CONFERENCE

May 19, 2023

Desert Willow Conference Center

ARIZONA'S PREMIER EDUCATION EVENT FOR CHARITABLE GIFT PLANNING PROFESSIONALS

WELCOME FROM THE PRESIDENT AND CONFERENCE CHAIR

It’s our great privilege to welcome you to Arizona Charitable Gift Planners’ 29th Annual Conference!

We’re so glad you’re here and hope you have a wonderful day of learning and interacting with this year’s amazing line-up of conference speakers, with your fellow gift planners and professional advisors, and with our conference partners.

We are incredibly grateful to all who helped make today’s conference possible, and especially our very generous sponsors whose financial support helped underwrite today’s event. Please be sure to visit their information tables and learn how you and your organization can benefit from the resources they offer.

A very special thank you to AZCGP’s board and committees for your many hours of planning and hard work throughout the year to put on today’s event. This conference is only possible thanks to the efforts of dedicated volunteers serving on our Programs, Development, Marketing, and Conference Steering Committees, with support from our association management team at Premium Organization.

We hope you will come away from today feeling inspired, refreshed, and ready to apply what you learn to your work and career, and make the most of new and renewed connections with your fellow participants. And we invite you to stay active with AZCGP all year! There are countless opportunities – by becoming a member, volunteering for a committee, being a program partner, and of course attending our monthly programs and social activities.

Thanks again for being with us today. Enjoy the conference!

Brad Harris, CFRE, CAP® President

Beth Salazar, CAP® Vice President & Conference Committee Chair

Arizona Charitable Gift Planners Conference | 3

PRESIDENT S LETTER

2022/2023 Current Board of Directors

President

Brad Harris, CFRE, CAP®

A New Leaf

Vice President

Beth Salazar, CAP®

Southwest Autism Research & Resource Center

Secretary

Cindy Bozik, CTFA

Mariner Wealth Advisors

Treasurer

Alan Knobloch, CFRE

Synergy Philanthropy

Past President

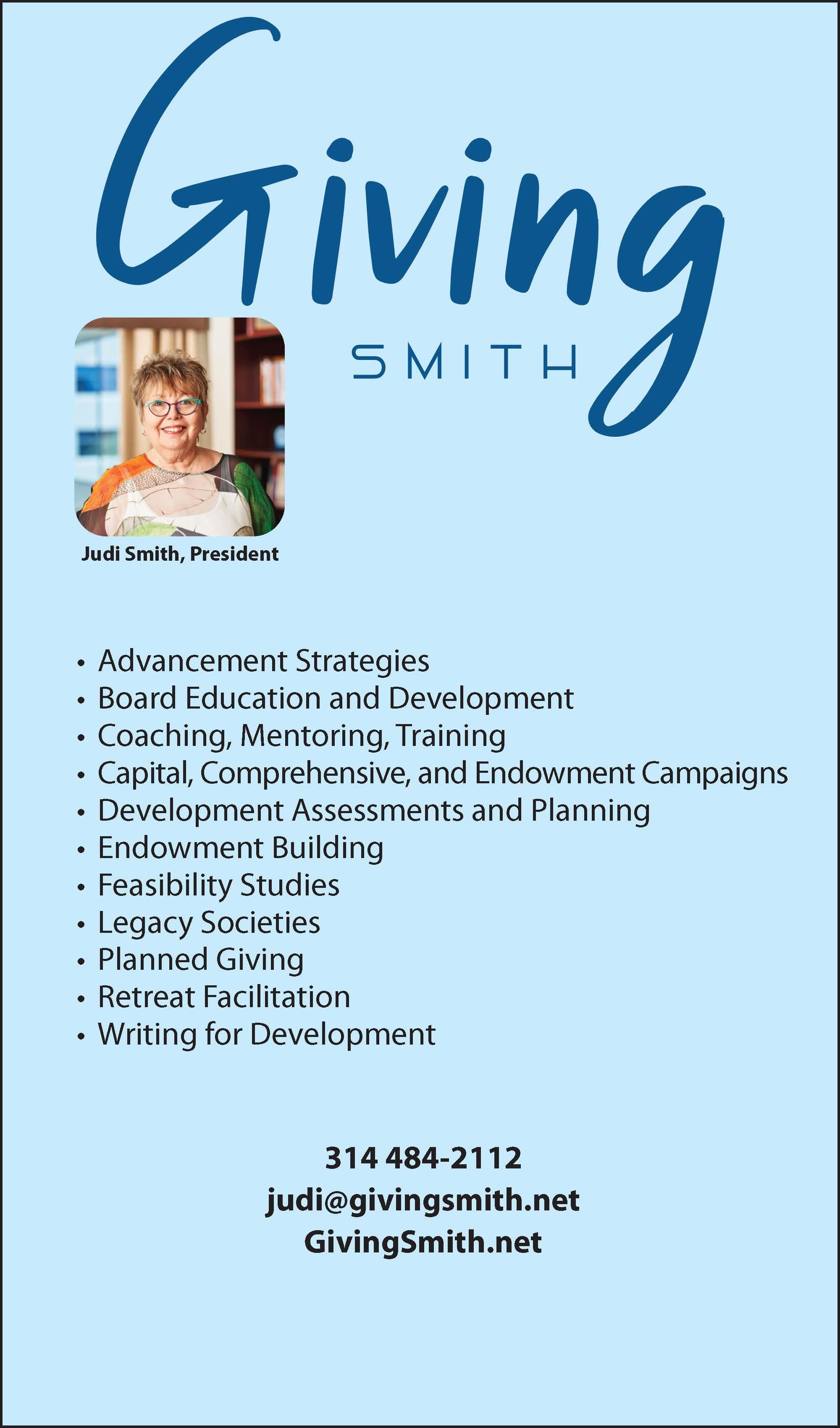

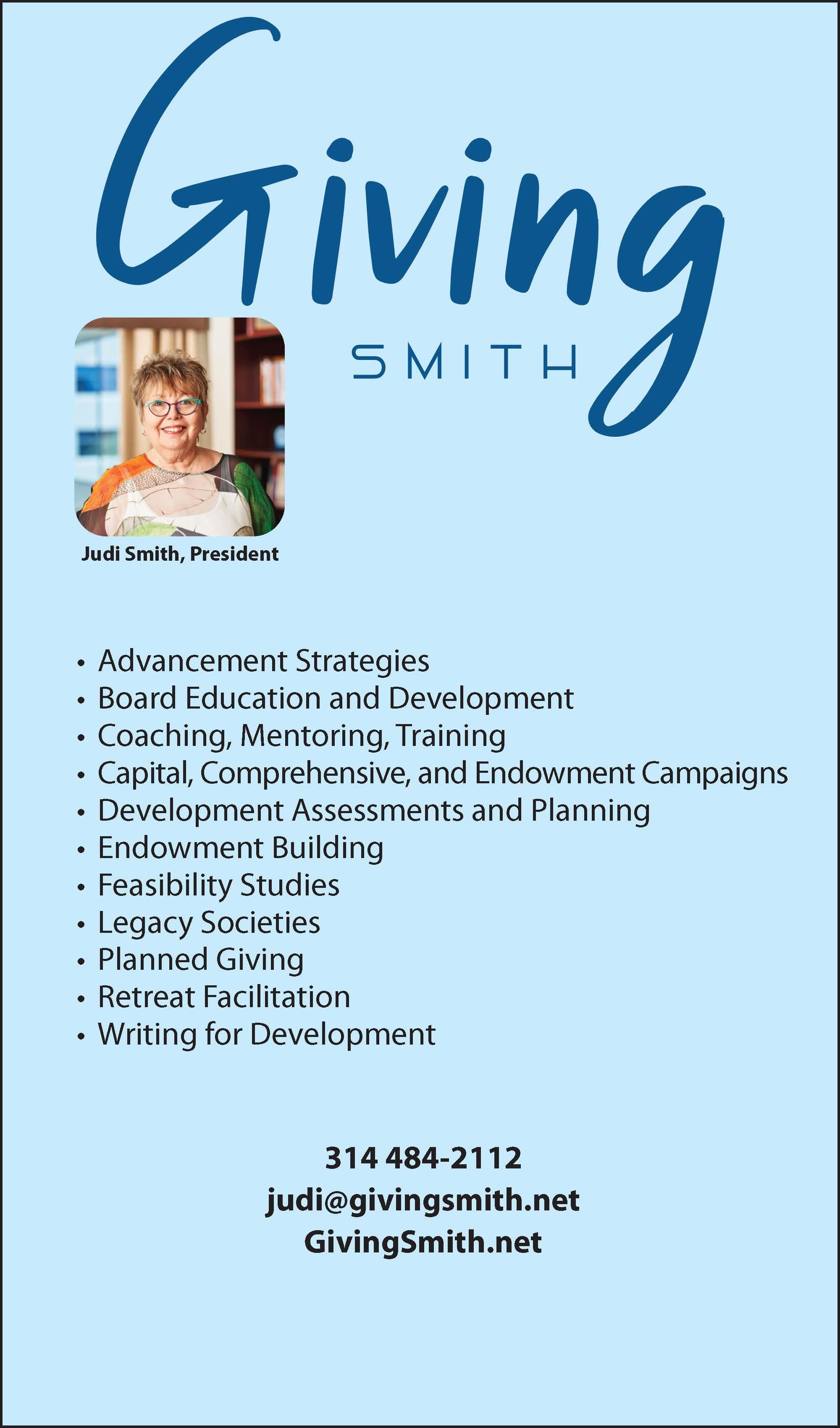

Judith Smith, CFRE

GivingSmith

Director

Margaret Stephens-Reed

VALLEYLIFE

Director

Bridget Costello

Free Arts for Abused Children of Arizona

Director

Adele Dietrich, CFRE, CAP®

Gift Planning Officers, LLC

Director

Susan Waschler, CFRE

Valley of the Sun YMCA

Director

Kristen Mihaljevic, CGPP, CAP®

Arizona Community Foundation

Director

Russell Bucklew, JD, CFP®, CAP®

ASU Foundation

Director

Andrea Claus

Morris Hall PLLC

Director

Darin Shebesta, CFP®, AIF, CAP®

Jackson | Roskelley Wealth Advisors

Director

John Moore, CKA, CIMA CAP®

Director

Vanessa Martin

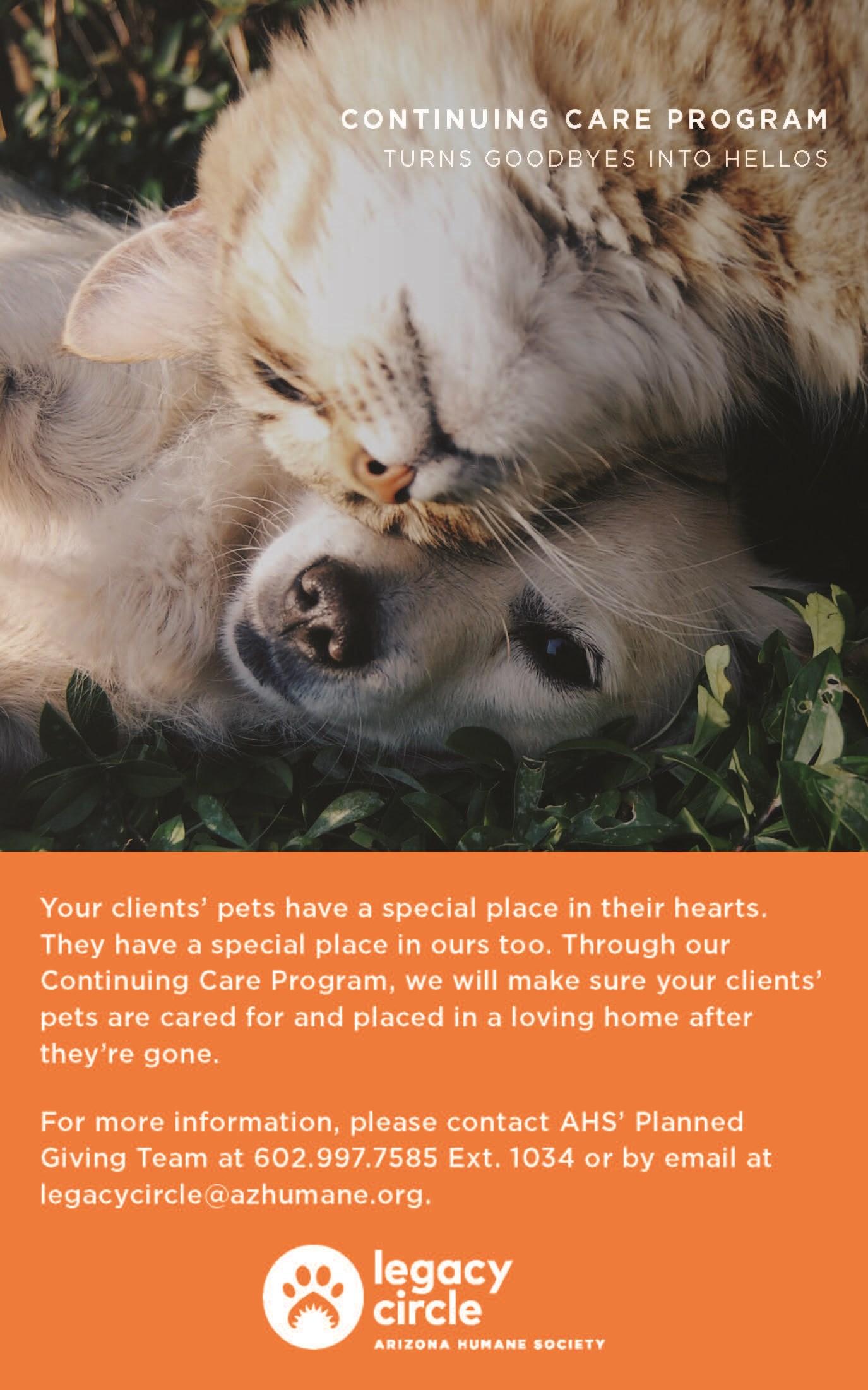

Arizona Humane Society

THANK YOU Arizona Charitable Gift Planners Conference | 5

2023/2024 Incoming

Board of Directors

President

Beth Salazar, CAP®

Southwest Autism Research & Resource Center

Vice President

Darin Shebesta, CFP®, AIF, CAP®

Jackson | Roskelley Wealth Advisors

Secretary

Cindy Bozik, CTFA

Mariner Wealth Advisors

Treasurer

Alan Knobloch, CFRE

Synergy Philanthropy

Past President

Brad Harris, CFRE, CAP®

A New Leaf Director

Bridget Costello

Free Arts for Abused Children of Arizona

Director

Susan Waschler, CFRE

Valley of the Sun YMCA

Director

Kristen Mihaljevic, CGPP, CAP®

Arizona Community Foundation

Director

Russell Bucklew, JD, CFP®, CAP®

ASU Foundation

Director

Andrea Claus

Morris Hall PLLC

Director

John Moore, CKA, CIMA CAP®

Director

Vanessa Martin

Arizona Humane Society Director

Thomesa Lydon, CRES, SRES, ASP

Lydon Senior Pathways/ReMax Excalibur

Director

Nicola Lawrence, CFRE, CAP®

Phoenix Children’s Hospital Foundation

Director

Beth Jo Zeitzer

R.O.I. Properties

8 | Arizona Charitable Gift Planners Conference WELCOME

8:10am - 9:00am

Seven Things Donors Wish We

Wayne Olson

Fundraiser, Author, Speaker | Aim Higher LUNCH

12:30pm - 1:20pm

Johni Hays, J.D., FCEP

Executive Vice President | Thompson & Associates PRESENTATION

KEYNOTE SESSIONS Arizona Charitable Gift Planners Conference | 10

BREAKFAST KEYNOTE

Knew

KEYNOTE

Mistakes

Stories of Ethical Dilemmas in Charitable Planning: Learn from the

of Others

Session is Approved for 1PT CE Credit Session is Approved for 1PT CE Credit No Slides Provided

SLIDES

AGENDA

FRIDAY MAY 19th

7:15am Check-in / Breakfast

8:00am Opening Announcements

8:10am Breakfast Keynote

Wayne Olson, Fundraiser, Author, Speaker | Aim Higher

Seven Things Donors Wish We Knew

9:15am Breakout Sessions

Getting Started: 72-Hour PG Program

Judi Smith, MA, CFRE, President | GivingSmith

Getting Inspired: How to Effectively Manage Bequests and Honor Your Donor’s Intent

Lindy Nash, Supervising Attorney | Chisholm Chisholm & Kilpatrick LTD

Getting Technical: The Five Key Financial Planning Trends That Will Impact Giving

Juan Ros, CFP®, AEP®, CEPA®, CVGA®, Financial Advisor | Forum

10:20am Break: Networking, Partner Connections

Ask the Experts: Lindy Nash

10:30am Breakout Sessions

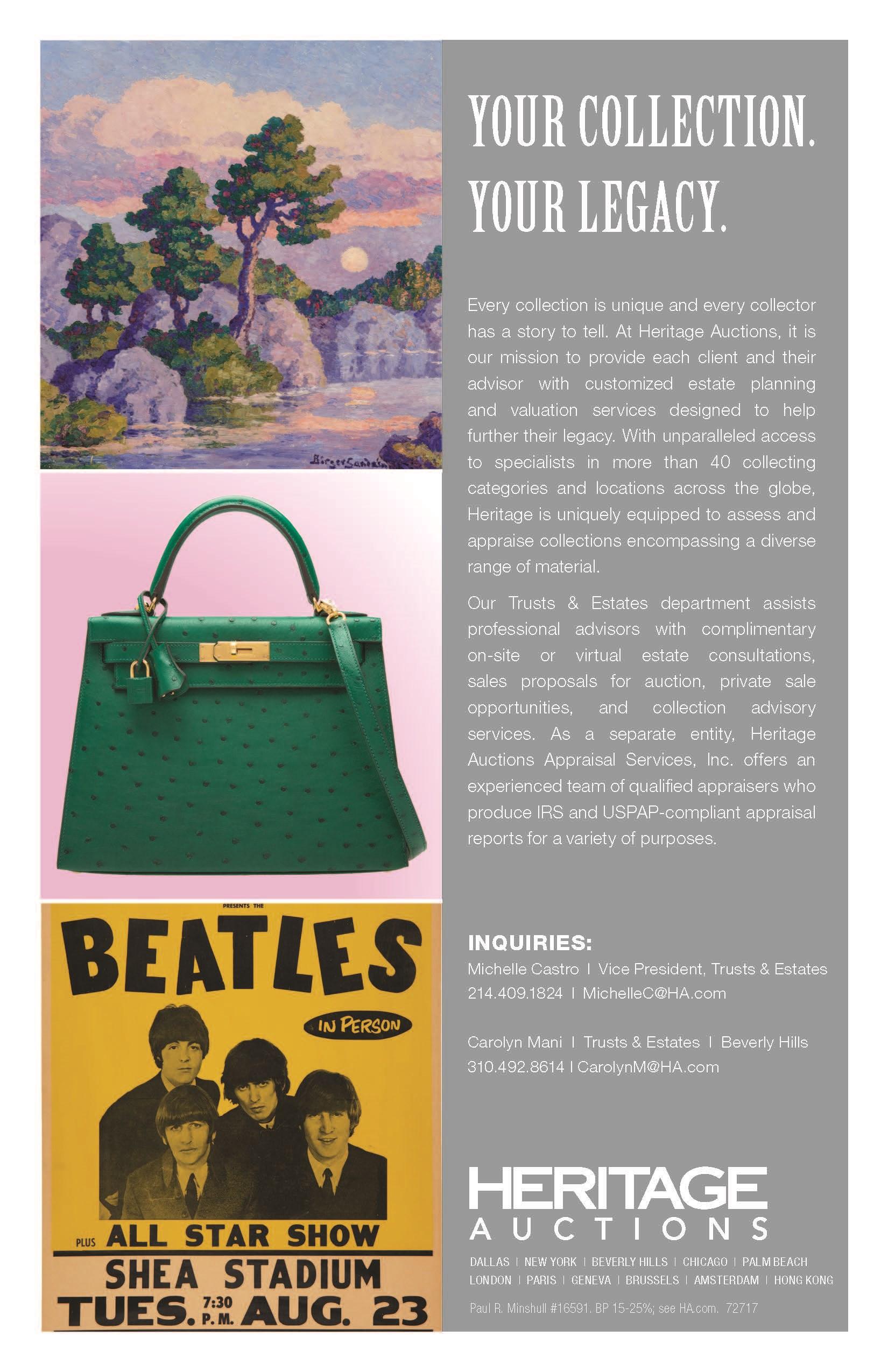

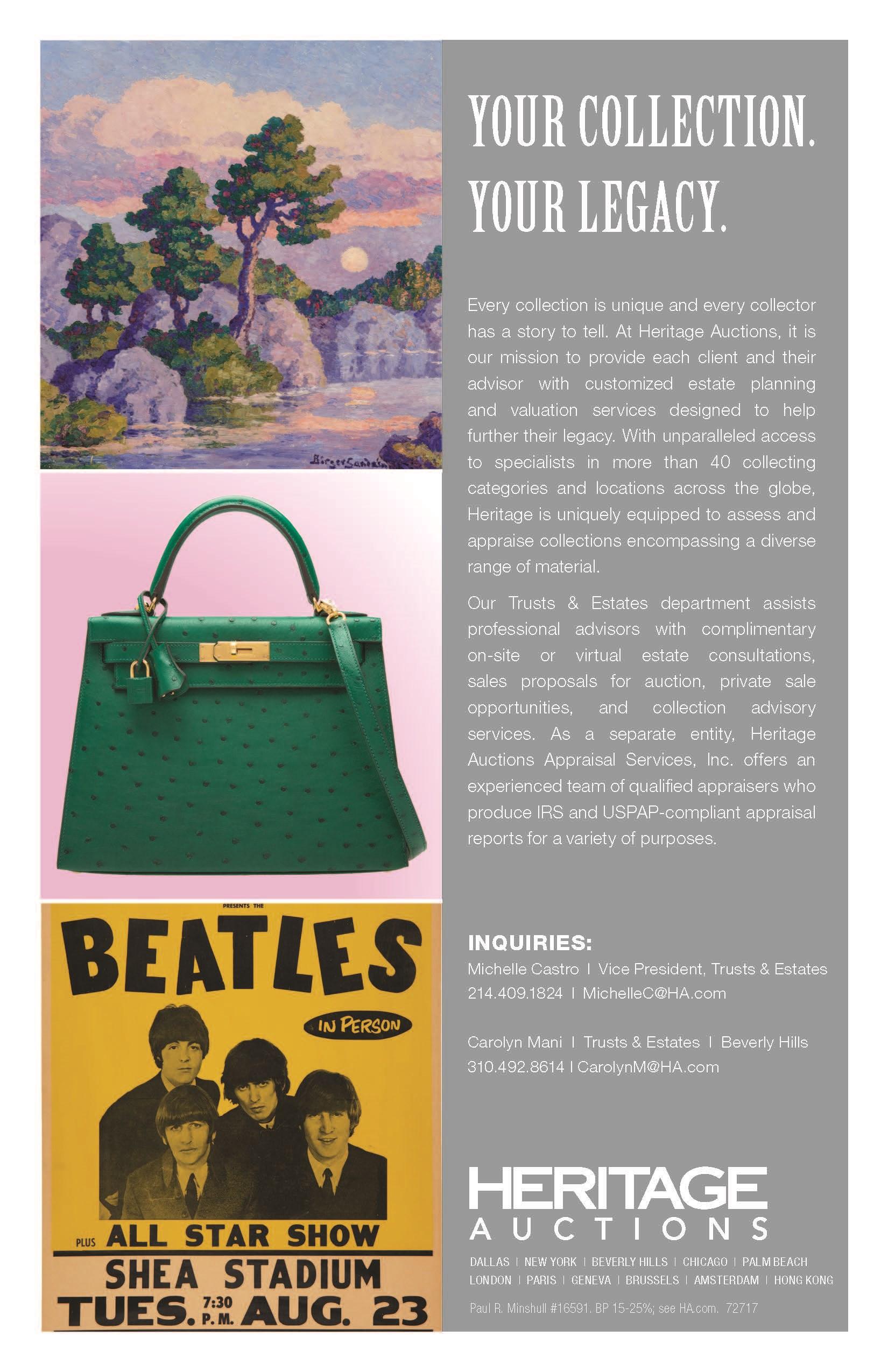

Getting Started: Do's and Don'ts for Art Donations

Carolyn Mani, West Coast Director Trust & Estates | Heritage Auctions

Getting Inspired: Jeopardy! Alex Trebeck, I'll Take Annuities for $1,000

Johni Hays, J.D., FCEP, Executive Vice President | Thompson & Associates

Getting Technical: The Generous Business: How Families Use Their Business as an Engine for Generosity

Michael King, Vice President | Charitable Wealth Strategist

14 | Arizona Charitable Gift Planners Conference

FRIDAY MAY 19th

11:40am Break: Networking, Partner Connections

Ask the Experts: Carolyn Mani & Juan Ros

11:55am Lunch

12:30pm Lunch Keynote

Johni Hays, J.D., FCEP, Exec Vice President | Thompson & Associates

Stories of Ethical Dilemmas in Charitable Planning: Learn from the Mistakes of Others

1:20pm Break: Networking, Partner Connections

1:35pm Breakout Sessions

Getting Started: Generosity and Legacy

Lucas Cooper, VP of Network Relations | National Christian Foundation

Getting Inspired: Tax Policy: Driver of Gifts or Restrictor of Gifts?

Amina Saeed, Attorney | River Valley Law Firm

Getting Technical: Life Insurance Settlements: An Additional Fundraising Opportunity

Lisa Rehburg, Life Insurance Settlements Broker | Rehburg Life Insurance Settlements

2:40pm Break: Networking, Partner Connections

2:55pm Closing End of the Day Giveaways

3:30pm Adjourn

Arizona Charitable Gift Planners Conference | 15

AGENDA

GETTING INSPIRED TRACK Arizona Charitable Gift Planners Conference | 17 9:15am - 10:20am How to Effectively Manage Bequests and Honor Your Donor’s Intent Lindy Nash Supervising Attorney | Chisholm Chisholm & Kilpatrick LTD 10:30am - 11:40am Jeopardy! Alex Trebeck, I'll Take Annuities for $1,000 Johni Hays, J.D., FCEP Executive Vice

| Thompson & Associates 1:35pm - 2:40pm Tax Policy: Driver of Gifts or Restrictor of Gifts? Amina Saeed Attorney | River Valley Law Firm PRESENTATION SLIDES PRESENTATION SLIDES Presentation Slides provided Post Event Session is Approved for 1PT CE Credit Approved for 1PT CE Credit / one (1) hour of CE credit Approved for 1PT CE Credit / one (1) hour of CE credit

President

GETTING TECHINCAL TRACK Arizona Charitable Gift Planners Conference | 19 9:15am - 10:20am The Five Key Financial Planning Trends That Will Impact Giving Juan Ros, CFP®, AEP®, CEPA®, CVGA® Financial Advisor | Forum 10:30am - 11:40am The Generous Business: How Families Use Their Business as an Engine for Generosity Michael King Vice 1:35pm - 2:40pm Life Insurance Settlements: An Additional Fundraising Opportunity Lisa Rehburg PRESENTATION SLIDES PRESENTATION SLIDES PRESENTATION SLIDES Approved for 1PT CE Credit / one (1) hour of CE credit Approved for 1PT CE Credit / one (1) hour of CE credit Approved for 1PT CE Credit / one (1) hour of CE credit

Chartered Advisor in Philanthropy

April 2023 - January 2024

JointheArizonaCommunityFoundationandtheArizona Charitable Gift PlannersforamoderatedCAPStudyGroup.Subjecttospaceavailability, youmayjointhegroupatthebeginningofanycoursemodule

Forthelatestupdates,visitazfoundation.org/CAP.

Allmeetingstakeplacefrom8:00to10:00a.m.

GS849: Charitable Strategies

April 24, May9, June 6,June 20, 2023

GS859: Gift Planning in a Nonprofit Context

Dates to be determined

CAP Program

The Chartered Advisor in Philanthropy® is a designation provided by The American College of Financial Services. The CAP® curriculum is designed to provide specialized education in philanthropic planning, giving students the knowledge and tools needed to help clients articulate and advance their highest aspirations for self, family and society.

CAP Study Group

Impactinthe Context

GS839: Planning forPhilanthropic

of FamilyWealth

Dates to be determined

Forpricing and enrollment information fortheAmerican College of Financial Services CAPprogramandtoreserve yourseatinthe ACF/AZCGP CAPStudyGroup,visit azfoundation.org/CAP

For more information, contact Jill McIlroy at jmcilroy@azfoundation.org or call 602.682.2077

The CAP Study Group provides enrolled students with an opportunity to elevate and deepen their study experience through discussions with other candidates in the disciplines of law, accounting, finance and gift planning. In addition to learning through collaborative discourse and real life case studies, study group participants will gain a supportive referral network of like-minded professionals with a broad range of perspectives.

ACF/AZCGP

CAPSTUDYGROUP

Arizona Charitable Gift Planners Conference | 22

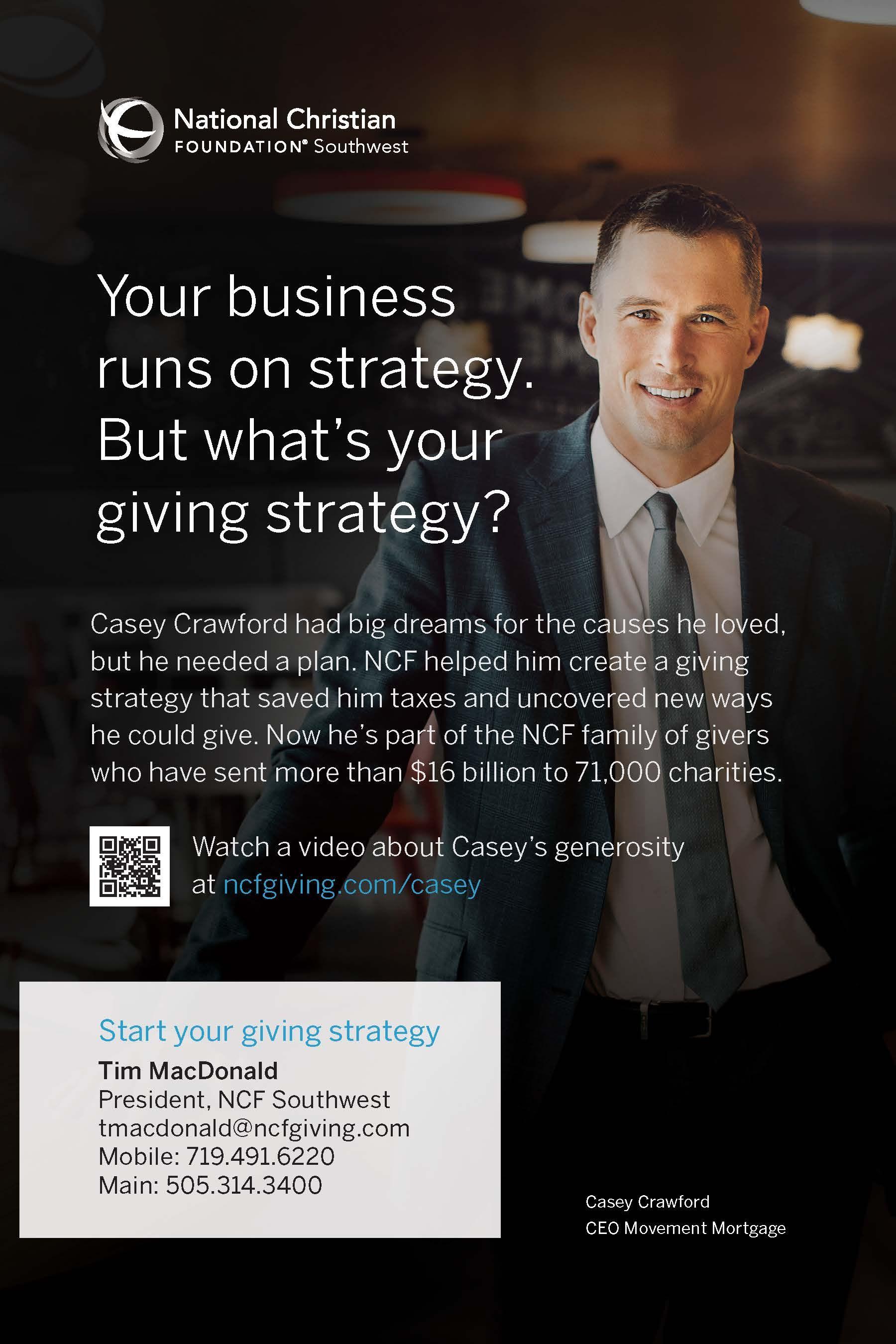

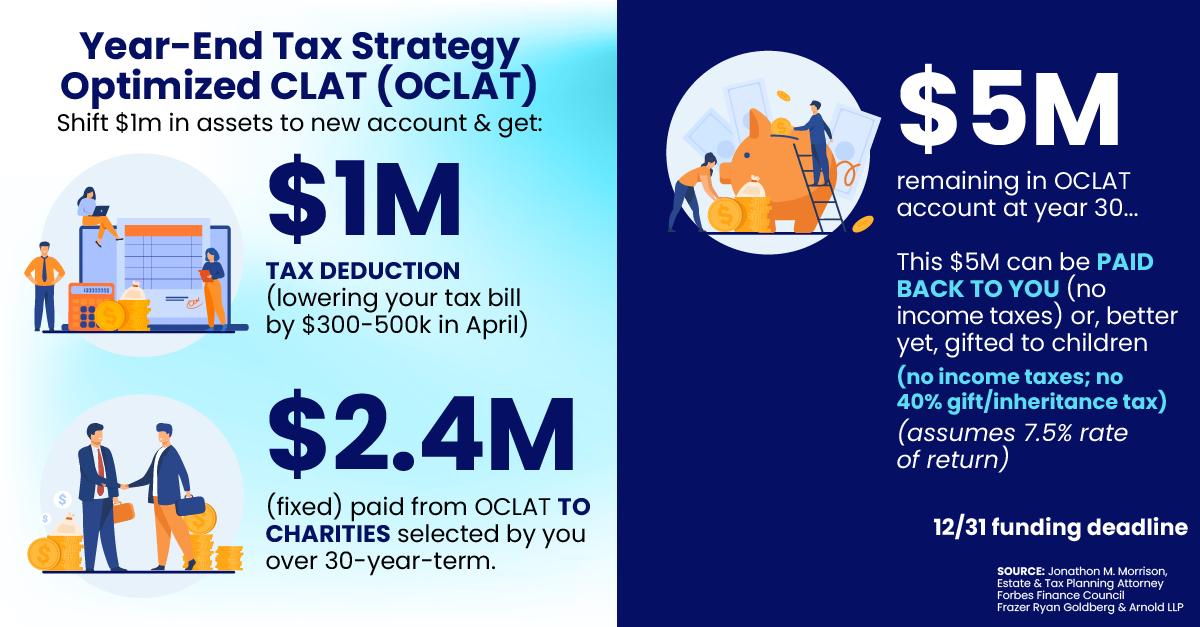

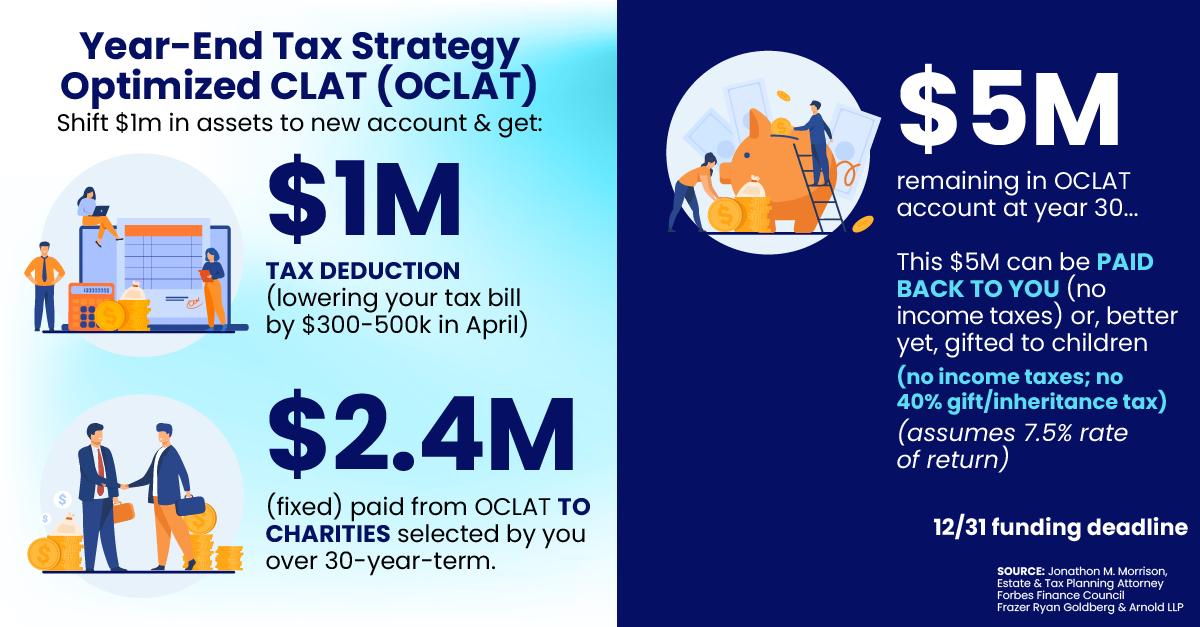

How to Give to Charity…Without It Costing You (Or Charity) Anything

Peer-Reviewed “Optimized CLAT” Returns Donation (Or Perhaps More) Back to Donor After Several Years…And Provides a Larger Gift to Charity

Donor A -$1M Cash Gift to Charity

Donor A makes a cash gift of $1M to charity (or a charitable donor advised fund).

Donor A receives a $1M tax deduction…but nothing else in return. Tax Deduction $ Paid to Charity

Donor B -$1M Gift to Optimized CLAT

DonorBtransfers$1MintotheOptimizedCLAT(whichoperatesmuchlikearegularinvestmentaccount setupwithhisinvestmentadvisor,butwitha“Lock-UpPeriod”wherethefundscan’tbewithdrawnfor sometime).DonorBreceivesanimmediate$1Mtaxdeduction(likeDonorAabove).However,DonorB doesn’tgiveanythingawaytocharityquiteyet;instead,heremainsincontrolofinvestingthefull$1M (whichwillbereturnedtohimlater).

Toenjoythetaxdeduction,theTaxCoderequiresDonorBtomakeannualpaymentsfromtheaccountto anynon-profitsorcharitiesselectedbyDonorB (includingadonoradvisedfund)…muchlikereceivingatax deductionforgivingcharityan“I.O.U.”

Thedonorselectsthenumberofyearstospreadouttheannualpayments;however,theTaxCoderequires thatthepaymentsmusttotal$1M…plusalittlebitmore(tocompensatecharitiesforhavingtowaitforthe donation)basedontheIRS-setinterestrateineffectwhentheaccountisfunded(whichiscurrentlynearan all-timelow).

Aftermakingallpayments,theremaininginvestmentsintheaccountarepaidbacktoDonorB.

Tomaximizethetimethatthe$1Mcanappreciateandgrow,DonorBselectsa20-yearcharitablepayment term(“Lock-UpPeriod”),butwithsmallpaymentstocharityintheearlieryears.

AsindicatedonthefollowingPaymentSchedule,DonorBenjoysthesame$1Mtaxdeductionas DonorA.However,DonorBreceivesback~$2Mandcharityreceives~$1.3M. BothDonorBand charitybenefittremendously.

AdditionalBenefits:(i)accountmaybefundedwithupto30%ofannualincome,everysingleyear,asa retirementstrategy,(ii)accountassetsareimmediatelyprotectedfromcreditors(&divorce,ifsinglewhen funded),(iii)remainingaccountassetsmaybegiftedtofamily,freeofgift/estatetaxes,and(iv)nolimiton lengthofLock-UpPeriod(thelonger,thegreaterthepotentialbenefits).

Considerations:(i)DonorBcannotwithdrawassetsfromaccountuntilendofLock-UpPeriod,(ii)DonorB paystaxesonincomegeneratedinsideaccount(liketypicalinvestmentaccount)

(602)

© May 2022 Frazer, Ryan, Goldberg

Arnold

Jonathon Morrison, Esq. Senior Partner, Tax and Family Wealth Planning jmorrison@frgalaw.com;

277-2010

&

$ Back to Donor $1M $1M -----

Tax Deduction $ Paid to Charity $ Back to Donor $1M $1.3M $2M