MIKE MUNDY

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: Andrew Penfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production

David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Contracts between port authorities and terminal operators are steadily becoming more complex. One key area of challenge is the goal of maintaining a competitive environment

More traffic demands more cargo handling capacity and in turn this demands new terminals. Introducing a new terminal is not a straightforward matter it requires careful planning to ensure a good competitive balance is maintained – where market forces act as the main regulator.

Where terminals are introduced on a different footing – for example where one is concessioned via a fully international tender, another by a direct award and where privately-owned terminals exist side-by-side, achieving a level competitive playing field can be challenging. It may require government agency intervention via national port planning measures or some other instrument. There may also be attention required to wider areas such as tax breaks and funding measures.

Where the development sequence and/or approach is such that competitive inequalities are not addressed this can lead to diverse problems, which some parties argue is currently the case in Ecuador (see p9).

The source of such problems is multi-directional – in Ecuador it is the breaks given to certain terminals in terms of fees and service requirements but elsewhere it can be a port authority installing a new terminal operation that is encumbered by higher fees than existing competing terminals. This can be as a result of the port authority seeking to set the standard for rents under its jurisdiction at a higher level or some other goal that is seen to take precedence over maintaining a strong competitive environment. History tells us that this can lead to a chaotic situation with stronger than usual infighting between terminals and liner clients able to leverage the overall situation.

It is also not just the case that the competitive balance between like for like terminals needs to be addressed, for example container terminals. It can also be important to consider such an aspect between, for instance, container and multi-purpose terminals where the latter may offer a substantial container handling capacity targeted at the same categories of liner clients as the container terminal.

Unusual circumstance, you may say? Perhaps not! Without doubt there are many terminals that can flag up inequalities in this respect but elect not to do so for tactical or other reasons. It is also certain that many conversations on this and allied subjects take place behind closed doors. This is a problem area that promises to achieve increased prominence in the coming years as terminals continue to multiply and their respective experienced developers increase efforts to gain competitive advantage. It is thus an aspect of terminal development that port authorities and other public agencies need to be increasingly aware of as they offer new concession or other similar opportunities.

In short, it is a subject worthy of respect and one that the relevant agencies would do well to give serious attention to right from the outset of new terminal development.

Media Sales Manager: Daniel Spicer dspicer@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published bi-monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s digital subscription with online access £244.00

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

to enjoy a renaissance. Market conditions – influenced by factors such as continuity of supply and sustainability – are presenting new opportunities in the short-sea theatre of operations. But as our article on p22 highlights there are challenges and risk factors to navigate. The cover shows short-sea vessels in the Port of Dublin, Ireland

Bénin Terminal, a subsidiary of Africa Global Logistics, has secured €75 million in funding for the extension and modernisation of the Port of Cotonou.

The project will double the terminal quay to 1100m, add 15ha and increase quay and yard cranes as part of seeing capacity rise from 500,000 TEU per annum to one million TEU per annum. Completion of the construction worksis scheduled for 2026.

A banking consortium consisting of Societe Generale Benin, Vista Bank, Ecobank, CBAO Groupe Attijariwafa Bank and CBAO BENIN is providing the funding.

The expansion project expects to employ nearly 600 workers at the peak of construction, with an anticipated 200 direct and indirect jobs being generated as soon as the work is completed, including machine operators and technicians. Bénin Terminal said it is also keen to ensure that local companies are participating in the execution of the planned work.

Bénin Terminal has invested €216 million since 2013 at Cotonou as the port continues its role as a regional logistics hub serving Niger, Mali, Burkina Faso and Nigeria.

Canadian shipping company Canada Steam Ship Lines (CSL) has signed a new 21year strategic partnership with Australian resources company BCI Minerals Limited that will see a diesel-electric transshipment vessel assigned to support the development of the Mardie Salt and Potash Project on the Pilbara coast of Western Australia. Construction of the vessel is due to start in Spring 2026, with delivery due in mid-2027.

The Indian government has approved the development of a new port in Vadhavan, near Dahanu, Maharashtra, citing that this facility is potentially capable of “redefining India’s maritime trade.”

The total project cost, including land acquisition, is estimated at Rs762bn, and will fall under the remit of a new Special Purpose Vehicle (SPV) formed by the Jawaharlal Nehru Port Authority (JNPA) with 74% and the Maharashtra Maritime Board (MMB), which retains 26%.

This project will eventually develop an annual capacity of 298 million metric tons, including 23.2 million TEU, while being an integral part of the India-Middle East-Europe Corridor (IMEC). Cargo will be handled across nine container terminals, four

multipurpose berths, including a coastal berth, four liquid cargo areas, a roll-on-roll-off berth, and a coast guard operation.

■

project in India has been approved

In gaining approval, the project has overcome strong opposition from the local population and environmental groups, although support was gained from the influential Dahanu Taluka Environment Protection Authority (DTEPA).

The government has stated that the Vadhavan Port Project offers a “substantial opportunity for investors” although further details are awaited.

Kuwait is seeking to revive plans to develop a port to act as a major hub for the northern end of the Arabian Gulf.

This news follows a visit to the Gulf state by a Chinese delegation that has been reported by Kuwait’s state news agency as undertaking “in-depth technical and field discussions” relating to a number of infrastructure projects, which include the construction of the Mubarak Al-Kabeer port.

This project ceased building activity around 10 years ago despite being partially complete. The new process is also timely

US Customs and Border Protection (CBP) has approved a proposal from Ports of IndianaBurns Harbor to develop the first international container terminal on Lake Michigan. This facility, due to be operational before the end of 2025, will be the only water-based container route for shipping to directly serve the greater Chicago metropolitan area via the Great Lakes. Currently, serving the Chicago market is by rail or truck via major ports in North America.

with Turkey, Qatar and the United Arab Emirates known to be working to support the ambitious plan in Iraq to generate a US$17bn road and rail network – the interesting point there is that Kuwait is not involved with its fellow Gulf state partners (and Turkey).

Kristen Smith Diwan, Senior Resident Scholar, Arab Gulf States Institute in Washington DC points out: “It has become clear that if Kuwait doesn’t move forward it will be left behind. That is already happening.”

There are challenges to overcome before any resumption

The Australian and Western Australian governments are investing AUS$661.6 million (US$439 million) in the Lumsden Point project at Port Hedland. The facility aims is to export battery metals such as lithium and copper concentrates and to support the import of renewable energy equipment, notably wind turbines and blades. Infrastructure Australia has said more capacity in this location is a national infrastructure priority.

of construction activity, most notably existing container hubs in the region at both Abu Dhabi and Jebel Ali.

Moreover, Kuwait’s location at the northern end of the Gulf means it represents a significant deviation for shipping lines that is highly unappealing due to time and cost implications.

The project also has a political dimension. Kuwait is a longstanding ally of the US in the Mid East region, but any partnership involving China will likely cause concerns in Washington DC and potentially put pressure on the US relationship.

Grindrod has secured a new contract from Transnet National Ports Authority (TNPA) to develop and operate a container terminal at Richards Bay in South Africa. The aim is to increase annual container handling capacity at the port from the existing 50,000 TEU per annum to 200,000 TEU per annum. This is expected to help alleviate ongoing congestion issues commonplace throughout ports in the country.

A question was asked from the floor in the Africa focus session of the recent Terminal Operations Conference, held in Rotterdam, as to what are the root causes and the cure for the poor vessel turnround times and other performance related problems experienced over an extended period in the port of Dar es Salaam? The answer, given by a panellist from Drewry Shipping Consultants, centred on the relevant issue of capacity keeping pace with demand and generally the need to build a more productive operation.

There is truth in this latter point but in seeking an effective solution this is not the whole story and in this respect the Tanzania Port Authority (TPA) may have ‘shot itself in the foot.’

Hutchison Port Holdings, through its subsidiary Tanzania International Container Terminal Services Limited (TICTSL), was formerly the operator of what is now known as Container Terminal No 2 in Dar es Salaam, the port’s main container handling facility. The four-berth terminal has an annual handling capacity of one million TEU and in 2023 handled 820,000TEU, a figure said to represent 83% of Tanzania’s annual container volume.

TICTS was in residence from September 2000 until September 2022 at which point its’ concession was terminated by the TPA against a background of alleged poor performance highlighted by extended vessel times in port.

Adani Ports & Special Economic Zone Ltd (APSEZ) was subsequently appointed to operate the terminal on a management contract basis. The TPA billed this as an interim appointment with the message given out that a process would follow for a full international tender for the concession of the terminal. The process did happen but, in reality, it was a very poor relation to a properly assembled and managed concession process.

Take a step back in time – in August 2022, the month before TICTSL was effectively ousted at Container Terminal No2 – AD Ports Group signed an MOU with APSEZ for strategic joint investments in ports and other logistics activities in Tanzania.

Fast forward – at end May 2024 it was announced that Adani International Ports Holdings (AIPH) had signed a 30-year concession agreement with the TPA to operate and manage Container Terminal No 2. Further, East Africa Gateway Limited (EAGL) was incorporated as a joint venture of AIPH, AD Ports (30%) and East Harbour Terminals Limited. APSEZ is the controlling shareholder and will consolidate EAGL in its books.

concession award process can be seen to have major deficiencies – a fact underlined by the complaints of various participating bidders. The deficiencies, in turn, exhibit the tell-tale signs of a concession award result that had already been decided prior to the process beginning.

What are the signs? There are several but here are three examples:

■ Marketing of the Request for

The concession award process can be seen to have major deficiencies which can lead to problems ‘‘

EAGL signed a Share Purchase Agreement for the acquisition of a 95% stake in TICTS with the purchase price of US$39.5 million covering handling equipment, manpower acquisition and other essentials. Adani will operate Container Terminal No 2 through TICTS.

On the surface this looks like a simple progression from one terminal operator to another in Dar but if you look below the surface all is not well. The

Proposal (RFP) for concession of TICTS was only advertised in a local newspaper – no international coverage as is the norm and no mention of a road show which is also commonplace in conjunction with such opportunities.

■ The Expression of Interest (EOI)/ RFP process was slated by bidders as unclear – in particular the submission criteria was vague promoting the potential for expulsion from the process due to not adhering to the rules (whatever they were?).

■ The process was also criticised from a timing point of view – it was rushed – and there was strong criticism of queries being handled in a haphazard manner. As stated at the outset this process may yet prove not to be the TPA’s finest hour. A fullyfledged concession process, conducted objectively and immune to external influences, is the proven path to a very successful operation. A process that falls short in this respect, which is subject to undue influence and irregularities, is prone to containing structural flaws which history shows throw up obstacles that impede efficient and economic operations, i.e. achieving the full potential of the operating unit. It is also grossly unfair to all bidders who ‘entered the arena’ expecting to be taken seriously and who committed time and not insignificant funds to participate in the process.

Certainly, against this background Container Terminal No 2 in Dar es Salaam will be interesting to monitor going forward.

The Port of Oakland and a coalition of 20 community, business regulatory and workforce partners have collectively applied for a federal grant to enable the fast tracking of the port’s conversion to 100% zeroemission cargo handling operations. The grant is worth US$417 million and is being requested from the Environmental Protection Agency (EPA) Clean Ports Program: Zero-Emission Technology Deployment Competition.

HRADF, the privatisation agency for Greece, has confirmed that €24 million in funding from the European Union has been secured for the northern Aegean Sea Port of Alexandroupolis. These funds are for dredging and construction of road infrastructure. The port is seeking a primary role in the energy industry, with Gastrade developing a floating gas and regasification unit, along with supporting a pipeline linking Greece and Bulgaria.

The European Commission (EC) has approved a €570 million Italian scheme to incentivise ships to use shore-side electricity when berthing at ports in the country. The scheme takes the form of a reduction of up to 100% in electricity prices, which means that there can be lower electricity prices for ship operators when purchasing shore-side electricity. Achieving this position means electricity costs are at a competitive level with fossil-fuelled engines.

A new US$2bn cargo port is planned at Ba Ria in southern Vietnam. It is to be developed by a consortium consisting of Vietnamese State Capital Investment Corporation (SCIC), Hanoi-based Geleximco Group, and Ho Chi Minh City-based International Transportation and Trading (ITC).

According to the Ministry of Transport in Vietnam, the new port will be developed in two phases, with the first component due for completion in 2030 and offering two dock areas to accommodate ships up to 250,000dwt.

The existing Ba Ria-Vun port facilities comprise seven berths with a total container handling capacity of almost 7.7 million TEU per annum. However, with an average of 8.0 million TEU handled per annum across facilities in recent years, there are ongoing congestion issues impacting

performance and limiting future growth potential. Hence the requirement for major new capacity to meet demand over the longer term.

The Ministry believes that Phase 1 of the project is consistent with the country’s

The Government of Gambia has signed a 30-year concession with the Turkish port operator Albayrak which signposts future port development in the West African nation. Sell-side Transaction Advisor for the deal was Netherlands-based MTBS.

Speaking to Port Strategy, Robert Schot, Senior Manager, MTBS, explained: “Our role as Transaction Advisor was to support the Gambia Ports Authority during the negotiations process. This entailed strategic advice on the preferred contract set-up, financial advice related to the viability of the project, technical advice which included the required design specifications and legal advice in drafting the concession and shareholder agreements.”

Under the terms of the concession, Albayrak will rehabilitate the Port of Banjul

and develop a new deep-sea port in Sanyang. The latter requirement is essentially an acknowledgement that the port of Banjul, located in a dense urban area, has only limited potential for further expansion and faces difficulties with landside access – truck access - in times of heavy usage.

Sanyang is located just over 40km from Banjul and offers deep water as well as being located in close proximity to international road connections. The masterplan, as conceived by Albayrak, is to develop the new port on a phased basis with operations covering a wide range of cargo handling activities spanning container, general cargo, dry and liquid bulks etc.

■ The existing Ba Ria-Vun terminal facilities are operating beyond design capacities, hence major new capacity is on the agenda

overall aims for its marine facilities relating to keeping pace with future demand and ship sizes.

Two 500m container berths are envisaged. Overall, the port will be industrial in character and additionally feature a free zone, industrial zone and agricultural and fish processing zone. Albayrak will seek other investors to participate in the areas of planned activity and in conjunction with support activities in the logistics and other sectors.

The short-term development works at Banjul will have a strong focus on upgrading container capacity and overall terminal performance. This meshes with the Banjul Port 4th Expansion Project, now underway and financed by the African Development Bank, which comprises four key objectives: reduction of vessel waiting time; avoidance of congestion and costly associated payments, investment in new capacity, generally boosting efficiency via digitalisation, facilitating improved traffic flow around the port and the provision of cost-effective and reliable green and low emitting ferries.

Over the longer term there is the possibility of the relocation of the port of Banjul to Sanyang with the old port being developed on a real estate basis incorporating purpose-built marinas and facilities for cruise vessels.

The turbulence now prevailing in Ecuador –spanning economics, business agility, security and other issues - is mirrored in the country’s maritime port sector which in recent years has seen a significant injection of new capacity but left in its trail fundamental differences between the various terminals, particularly container terminals. The differences are said by some to amount to a corrosive competitive imbalance between the terminals and especially those clustered in or around Guayaquil.

This competitive imbalance has, in turn, generated its own problems and challenges which have had a notable impact on the fruit exporting sector, now more important than ever to Ecuador’s economy. With the oil sector in decline – maturation of wells, lack of investment, uncertainty over production in Yasuni National Park etc. – fruit exports, and notably bananas for which Ecuador holds the status of No 1 exporter in the world, take on much more importance in the economic equation.

Yet, just as this situation is in play, the logistics associated with fruit exports have become more challenging. The trigger point for this can be seen to be the recent decisions made independently by Maersk and MSC to relocate their terminal operations from ICTSI’s Contecon, Guayaquil facilities to DP World’s Posorja terminal and the Narportec terminal respectively.

Use of Posorja, the Banana Marketing and Export Association of Ecuador has calculated, entails an additional transport cost of US$130 per container.

MSC’s decision to move to the Narportec terminal, owned by Dole, has generated massive congestion especially on peak days - Wednesdays, Thursdays and Fridays. Access to Narportec is via urban areas of Guayaquil and very narrow streets. With large traffic volumes congestion is inevitable. This means not inconsiderable costs resulting from delays plus truckers being exposed to theft, extortion

The objective is always a level playing field which leads to the tried and tested situation of market forces acting as an effective competition regulator ‘‘

and safety issues due to the current troubled security situation. The neighbouring terminal of Terminal Portuario de Guayaquil (TPG) is similarly adversely affected.

Such challenges add to an already lengthy list of difficulties that banana exporters in particular face, ranging from biosecurity issues such as preventing Fusarium to delays at the Panama Canal. It is also ironic that both extended and congested supply lines contribute to a further exacerbation of an already troubled security situation and allied to this greater opportunity for drug trafficking, now a major problem for Ecuador.

Both Maersk and MSC moved their terminal operations with strengthening their margins in mind – an opportunity presented by the competitive imbalance between terminals. Compared to the original terminal facilities concessioned by the state to Contecon in 2007 other terminals such as Posorja and private terminals like the TPG and Narportec terminals operate under more favourable fee and tax regimes which give them more room for manoeuvre when it comes to attracting and retaining clients.

National port masterplans or single port region masterplans often contain elements which aim to iron out the inevitable competitive differences between terminals which spring from a multitude of sources – the different

■ Competitive imbalances have consequences. In Guayaquil following changes of terminal by liner operators, there is now frequent extreme landside congestion around the Narportec and TPG terminals in turn leading to truck driver safety and other security issues

timing of developments, a different legal basis for set-up, varying fees including some parties that do not have them relating to terminal occupation, different levels of applicability regarding rules and regulations that effect service delivery, differences in mandatory investment, insurance requirements and so on.

The combination of such factors can often result in big competitive differences between terminals. It is normal to address these through master-planning or other government-backed instruments. The objective is always a level playing field which leads to the tried and tested situation of market forces acting as an effective competition regulator.

The instruments used to build a healthy competitive climate should also be forward looking – if one party plans to add a major new slice of capacity what will the impact be? if it is a further development of an existing terminal, then is it appropriate to offer all the tax and other breaks given with the original terminal development?

Ecuador’s situation where it has diverse terminals that have come into service in different ways – for example Contecon via an international tender for the concession, DPW at Posorja via the direct award of a concession and TPG and Narportec as a privately-owned terminals – and which operate under different regimes is a classic one whereby intervention may be required to achieve the premier goal of a level playing field. This will ultimately strengthen supply chains and contribute to an improved economic and security situation, as well as a much-improved port sector investment climate underpinned by legal certainty – essential steps today in Ecuador.

The Government of Canada is investing up to C$51.2 million (US$37.5 million) in 19 digital infrastructure projects to help strengthen supply chains. Included are PSA Halifax’s container terminal’s digitalisation initiative and Vancouver Fraser Port Authority’s gateway optimisation and forecasting project.

European specialist in transport, mobility, logistics, environment and circular economy, Magellan Circle Italia, has confirmed a new strategic alliance with ESG specialist, EETRA. The aim of the partnership is to accelerate the transition towards more sustainable practices in the mobility and transport sectors by developing solutions for the digitalisation of the port and intermodal sectors, while also preparing for the future regulatory landscape.

The Maritime Administration (MARAD) has released a request for proposals to construct the first US Centre for Maritime Innovation. The project falls within the Maritime Environmental and Technical Assistance (META) programme and is expected to assist in the study, research, development, assessment, and implementation of innovative marine technologies and practices.

Work on the India-UAE leg of the strategic India-Middle East Europe Economic Corridor (IMEEEC) has reportedly commenced. As a result, the digital platform will be exchanging information between two ports in two countries.

Malaysia plans to build a new smart container port in the state of Negeri Sembilan on the western coast of the Malay Peninsula and facing the Malacca Strait.

The US$425 million port is expected to include berthing of 1.8km and an operational area of 809,300m2. It will also be the first box facility in the city of Port Dickson in Negri Sembilan state.

Anthony Loke, Transport Minister of the Government of Malaysia has stated that the border area between Negri Sembilan and Malacca had been decreed as a port area in 2017, before explaining further: “This smart container port, although located near the Kuala Linggi International Port in Melaka, will not be in direct competition as the latter will be more focused on the oil and gas sector. On our part, the government welcomes any private initiative and investment if it is to further improve our infrastructure such as port services.”

Interestingly this port project is planning to be the first facility in Malaysia to utilise artificial

intelligence (AI), meaning that it will potentially utilise a number of key AI functions. These include: automation and efficiency to gain faster turnaround times; increased throughput, and reduced labour costs, predictive maintenance to help minimise downtime, reduce repair costs, and extend the lifespan of port equipment plus optimised logistics through AI algorithms to streamline the routing and scheduling of container ships and trucks to reduce congestion and lower fuel consumption.

Other key AI-led functions involve enhanced security, which can safeguard against cyberattacks, data-driven decision making to support more informed decisions, optimisation of resource allocation, and improved strategic planning and environmental sustainability to contribute to more sustainable port operations and meet environmental goals.

Fundación Valenciaport has confirmed it is working on the development of an innovative 5G mobile communications laboratory (5G+ VLCPortLab) in partnership with the Institute of Telecommunications and Multimedia Applications (iTEAM) of the Polytechnic University of Valencia (UPV).

The aim of this initiative is to drive the development of mobile communications, advanced computing, digital twins, immersive applications and other next-generation technologies. The laboratory will consist of shared infrastructure, located at both the Port of Valencia and in the UPV, which will connect both entities by means of a dedicated high-capacity fibre optic connection.

■ Fundación Valenciaport is linking with iTeam to develop a CuttingEdge 5G Laboratory for innovative technological projects

Fundación Valenciaport underlines that this latest development is a “driving agent for future innovation projects.” The planned work programme certainly complements extensive other development work now underway in Valencia. Indeed, the 5G+ VLCPortLab

project represents a major step forward in the expansion of Fundación Valenciaport’s infrastructure by providing comprehensive support to ongoing projects within the port environment. For example, the European initiative IMAGINE B5G, in which emergency and security use cases will be tested and the national projects of the UNICO 5G R&D plan Advancing 5G Digital Twins, with which real-time digital twin pilots are carried out, or the 5GNACAR of the UNICO 5G Sectorial plan, focused on the intelligent management of the 5G network. The Valenciaport Foundation is a centre for Applied Research, Innovation and Training, at the service of the cluster port logistics at the Port of Valencia, Spain.

Intensive care for your assets is essential to secure safe mooring operations. BollardScan is a world leader in testing the structural integrity of bollards, as Quayconsult is specialized in assessing and monitoring quaysides, sheet piles, fenders, rail tracks and cranes. All in a unique, non-destructive way. Approved by Lloyd’s and executed in a rapidly growing number of main ports worldwide. So why shouldn’t you test us? Get in touch with the experts: 0044 785 327 1190. Or even better: visit our booth at the SMM, Hamburg (Hall A1.418).

www.bollardscan.com www.quayconsult.com

A new body has been launched to elevate standards and streamline provisioning of cybersecurity services across the maritime industry.

It is designated the International Maritime Cyber Security Organisation (IMCSO) and has devised a certification programme for security consultants and a professional register, helping shipping organisations to confidently select experienced personnel.

The IMCSO Maritime Standard cyber certification scheme offers training across four disciplines. Cyber professionals who take the examination can qualify as an Offensive Security Practitioner or Maritime Cyber Security Specialist in addition to specific fields including Secure by Design and Cloud Security.

Iraq is accelerating efforts to utilise digitalisation at the ports of Umm Qasr (North and South port zones). During the first week of July 2024, a team of specialists from the International Maritime Organization (IMO) conducted a mission in Basra to assess the support needed forIraq to achieve its goal of implementing a maritime single window. Currently, 80% of Iraq’s imports move via Umm Qasr located in the south of the country..

An authorised supplier registry will also be made available by the IMCSO and will act as a record of approved cyber security suppliers within the maritime cyber security speciality. Applicant organisations will need to meet certain certification and accreditation standards such as ISO 27001 and ISO 9001 as well as strict certification criteria.

A risk register database will

■ Newly established IMCSO is a not-for-profit organisation planning to elevate standards and streamline provisioning of cybersecurity services across the maritime industry

also be maintained by the IMCSO containing the results of ship assessments and audits enabling relevant parties to access the cyber risk profile of any given vessel.

Innovative provider of logistics visibility solutions, BlueBox Systems, has launched BlueBoxCargo, an advanced tracking solution that combines the features of BlueBoxAir and BlueBoxOcean.

The aim of this new platform is

Kerry Siam Seaport Limited (KSSP), a multi-purpose terminal operator in Laem Chabang, Thailand, is partnering with Kaleris to introduce optimisation improvements. The Navis N4 Terminal Operating System is helping to reduce truck driving distances by 20% and container rehandles by 10%, while improvements in vessel planning and yard strategies are targeting better productivity and lower carbon emissions. KSSP handles over one million TEU annually.

Fintraffic’s Vessel Traffic Services is expanding its digital port services with POLO Port Activity, through a business deal with Unikie.

The Port Activity service is built on an open ecosystem basis, which ensures that ports can develop the service according to their own needs. It offers real-time arrival and departure times for ships, emission calculations, berth planning, information on detachment and mooring and invoicing services, as well as water and waste management orders, tug and pilotage services.

Unikie states that POLO was created to help advance the digitalisation of ports and their services and it is clear that it will play a key role with Fintraffic.

designed to provide unparalleled real-time tracking capabilities for cargo shipments, giving companies the ultimate supply chain optimisation tool by advancing logistics technology to simplify ocean (and air) freight management.

Rajant Corporation, the developer of Kinetic Mesh® wireless networks, and Embotech, a leading provider of autonomous driving solutions for private grounds and smart factories, are partnering to advance port autonomy. The companies confirm that testing of Rajant’s networking with Embotech’s autonomous driving solution, implemented in a terminal tractor, demonstrated highly reliable connectivity.

Rami Metsäpelto, CEO, Fintraffic’s Vessel Traffic Services, notes: “Fintraffic’s Port Activity application is already in use in more than 20 ports in Finland and Sweden and in about a couple of hundred different organisations. The application helps maritime logistics actors and ports to develop their operations in a more efficient direction through real-time vessel and port information. Fintraffic will continue to develop Port Activity in a customeroriented and open manner, where port-specific service development will continue to play a key role.”

Class society ABS has published a new notation that can be integrated with weather routing software systems. As a result, containership operators can load an additional tier of containers on deck with reduced risk of loss due to parametric rolling. On a typical 15,000 TEU vessel this equates to an extra 640 containers, or 960 boxes on a 24,000 TEU ship – reflective of a 4.5% increase in both instances according to ABS.

Konecranes is expanding its electrified portfolio and redefining operations between ship and container stack technology through new Port Solutions developments. The company’s new launches cover innovations in straddle carriers, integrated automated solutions and port services:

● Konecranes Noell Straddle Carriers modular power options – Supporting the shift towards more sustainable practices, Konecranes has redesigned its Konecranes Noell Straddle Carriers to give the industry greater flexibility with interchangeable power modules including hybrid, battery and hydrogen options. The uniform design facilitates quicker delivery times and ensures the ready availability of spare parts. Maintenance demands are reduced, and each unit is pre-equipped for hydrogen use in addition to hybrid and battery power. The modular construction simplifies power system upgrades to meet the diverse energy needs of terminals now and in the future.

● Future Fields concept redefines the relationship between ship and stack

- Future Fields is an automation concept that incorporates an innovative multi-trolley ship-to-shore (STS) crane, an automated guided vehicle (AGV) and Automated High-Bay Container Storage to tackle challenges such as increasing vessel sizes and the limited availability of land. The outputs are improved productivity, greater consistency and higher capacity in container handling activities.

● Remote Support stops the

■ Konecranes ‘Future Fields’ is an automated handling and storage system designed with future needs in mind

downtime clock - Konecranes has renewed its Remote Support services for ports and terminals, which reduces the need for technicians to travel to site locations or wait on resources. Remote Support gives customers instant access to Konecranes experts through dedicated phone numbers, along with the Konecranes Support online platform and video calling for troubleshooting.

Konecranes has also introduced a heavy-duty version of its flagship E-VER electric forklift for lifting capacities of 18-25 tons. These units are now offered with increased capacity to meet the high-performance demands of industries such as steel and mining in addition to ports. The machine can lift 10% faster and accelerate up to 20% more quickly on slopes versus a diesel forklift, with reduced energy consumption and losses allowing the truck to use energy more efficiently, maintaining low energy consumption and zero tailpipe emissions.

Manufactured with clean energy, the powerful lithium-ion (Li-ion) battery pack fuels the

truck’s electric motors. Easily adaptable to the local power grid, it allows fast charging in under an hour and top-ups from braking energy during busy work shifts, and slower charging when not in use. A combination of high voltage and low current reduces energy consumption and losses, allowing the truck to use up to 90% of available energy. At the end of the forklift’s service life, the batteries can be used as emergency reserves at charging stations or as backup power.

With ever-growing industry demand for low-carbon solutions, this new range of lift trucks is part of the Konecranes commitment to power up for the future and

electrify its entire lift truck fleet by the end of 2026.

“Higher capacity on the E-VER is the next step on the road to zero tailpipe emissions across all of our lift trucks portfolio. As the global market transitions to carbon neutrality, an even broader environmental responsibility is clear. We have a product road map to deliver the right products at the right time, paving the way to a decarbonised and circular world by eliminating emissions in the entire value chain from production to usage and eventually enabling repurposing and efficient recycling,” explains Jeffrey Stokes, Director Product and Technology Management, Lift Trucks, Konecranes.

The construction division of HJ Shipbuilding & Construction (HJSC) has secured the Busan New Port West Container Terminal Phase 2-6 Transfer Crane Installation Project. The process involves building and installing 34 transfer cranes for a total construction cost of KRW187bn (US$134 million) over a 36-month period. These units stack containers in yards or load/unload them onto automated guided vehicles (AGVs) or trailers and this development follows Busan New Port Pier 7 (Phase 2-5), which became South Korea’s first completely automated terminal when it opened in April 2024.

Saudi Global Ports (SGP) has acquired three automated ship to shore quay cranes and three hybrid automated rubbertyred gantry units (RTGs) for King Abdulaziz Port Dammam. Adding this new equipment is expected to increase capacity from 2.5 million TEU to 3.2 million TEU and expands the existing fleet of 15 quay cranes and 47 RTGs. A further 15 hybrid RTGs are also on order for arrival in Summer 2024.

The Kalmar Collision Warning System has been installed on 36 straddles at the Maher Terminal in the Port of New York/New Jersey, with confirmation that a further 68 machines are to gain the same system throughout 2024 and 2025. By informing the driver of a potential collision, by visual and/or audible alarms, accident potential is significantly reduced.

ELME Spreader AB is investing for growth. Based in Älmhult, Sweden, the spreader manufacturer is currently celebrating its 50th anniversary and during Q3 of this year it is commencing construction of 1700m2 of additional space to facilitate increased manufacturing capacity in its existing product range and cater for new products for launch next year in the truck and crane segment across Europe, Asia and the US.

SeaPort Manatee has ordered two new Konecranes Gottwald ESP.7 Mobile Harbor Cranes. The port, based in Tampa Bay (FL), ordered the first unit in Q1 2024 and then decided to acquire a second crane at the start of Q2. Delivery of both machines is due before the end of 2024 and will complement the existing six cranes on site. The ability to run on electricity will help reduce emissions and increase capacity.

Konecranes has officially handed over eight hybrid one-over-three Konecranes Noell Straddle Carriers to Copenhagen Malmö Port (CMP). The equipment will be used at the new container terminal in Copenhagen. After arriving on site in Q4 2023, the straddle carriers have been fully assembled and tested on-site at the existing container facility. The new terminal is being developed several kilometres away at Ydre Nordhavn.

Sweden-based Hammer is marking 50 years of operations with the launch of two new models - Hammar 550, the world’s first Sideloader with 50 tonnes Safe Working Load, and the new flagship model, Hammar 500.

The Hammer 550 model offers a 50 tonnes Safe Working Load (CE-marked) and will be the world’s strongest Sideloader model. Initially developed for handling large cable drums, the design will offer flexible cargo handling operations.

Bengt-Olof Hammar, CEO, and owner, Hammar notes: “The Hammar 550 is a big step forward in broadening the Sideloader market and expanding what Sideloaders are used for. It has been developed for loads that are heavier and larger than any other Sideloader has previously been able to handle.” The first Hammar 550 was built in the second quarter of 2024.

The other major innovation is Hammar’s new flagship model, the Hammar 500. The company confirms that the Hammar 500 is based on a range of proven

technologies that have been merged and improved. For example, what is unique about the 500 model is its 6m crane reach and support legs that provide significantly increased stability.

These features allow a large handling area that, for example, enables the stacking of two containers two rows deep. The 500 model has support legs with three different operating positions providing great versatility, while offering a 36 or 45 tonne Safe Working Load levels.

Moving forward, Hammar

■ Hammar is celebrating its 50th anniversary with new products, including a new flagship model –the Hammer 500 sideloader

expects to continue to innovate and develop its service offering. “As long as the use of containers continues to increase, and companies are looking for more efficient and versatile logistics solutions, Hammar will continue to grow. We very much look forward to continuing to be the driving force in the industry, with a focus on service, innovation, quality, and sustainability,” says Bengt-Olof.

Kalmar, part of Cargotec, has launched a new electric empty container handler. This unit is based on the company’s proven electrical platform that uses the same electric drive system as the Kalmar electric reachstacker and Kalmar heavy electric forklift truck.

The Kalmar electric empty container handler is available in a single-stacker configuration

in 9 and 10 tonne capacities and lifting heights from five to eight units high. The doublestacker configuration is available in 10 and 11 tonne capacities, with stacking heights from 5+1 to 8+1 high.

Three different battery sizes are offered (163, 293 and 391 kWh) to support different load and operating-time requirements. The handler is designed to

minimise energy losses and optimise energy accumulation, thereby ensuring longer intervals between charges, improving battery lifetime and performance to save on battery size and cost.

A built-in thermal monitoring system ensures that the batteries remain within the optimal temperature range at all times during operations.

Kalmar has also confirmed a new deal to supply eight Kalmar Eco reachstackers to UK-based Maritime Transport.

This order, which also includes a seven-year Kalmar Complete Care entitlement, with Kalmar Insight as part of the package, was booked in Cargotec’s Q1 2024 order intake. The machines are

scheduled for delivery in two batches, with four units arriving in Q3 2024 and Q3 2025, respectively. Each reachstacker will utilise Kalmar’s Fleet Management Software, thereby enabling Maritime Transport to convert data into actionable and usable insights. This subsequently provides an effective way to

manage fleet operations and identify areas where efficiency can be improved.

Two of the new reachstackers will be deployed at Maritime Transport’s rail facility in Wakefield, northern England, with the remaining six at Hams Hall Rail Freight Terminal close to Birmingham, England.

The Port of Helsingborg has confirmed it is running a pilot test project for an autonomous terminal tractor.

Working in partnership with Terberg and EasyMile, the testing process will be undertaken outside of normal operations to assess the autonomous system’s capabilities and outline any technological issues, with the aim of live testing being completed during Autumn 2024.

The conclusions from the testing process are expected to underpin equipment selection for a new container facility that the Port of Helsingborg is planning to develop in 2030.

The pilot programme has a first phase that involves brake tests, load activities and mapping the tractor’s movements during cargo operations.

The port has stated that the vehicle’s path is initially restricted to container terminal Quay 906 and crane 20, with basic routes evaluated and approved before subsequent expansion to longer

distances and configurations to assess the total driving distance possible.

For the pilot programme, EasyMile’s safety driver will remain in the vehicle cabin so that the tractor’s on-board platform can be monitored,

ensuring safe driving behaviour and correct autonomous movements.

MOL and Volvo Penta are collaborating on trials for a pioneering new electric 4x4 ro-ro tractor, dubbed as the RME225.

This joint-venture is focusing on integrating a purpose-built electric driveline into the equipment, with the overall aim of helping customers remain competitive and profitable through the energy transition process.

The initiative aims to elevate and improve material handling operations for fleet owners such as terminal operators, and as part of the project, the trials will be

APM Terminals (APMT) has confirmed investment in 240 new pieces of equipment for five of its terminals in Latin America, Africa, and Europe. ZPMC is delivering 12 STS cranes to APMT Maasvlakte II in the Port of Rotterdam, four STS units for APMT MedPort Tangier in Morocco, two STS machines and nine RTG cranes for Côte d’Ivoire Terminal (CIT), with a further six automated RMGs and 14 oneover-one hybrid straddles for APMT Lazaro, Mexico.

utilising facilities used by DFDS at the Port of Ghent.

The RME225 features a Volvo Penta driveline consisting of three battery packs totalling 270 kWh of installed energy, an EPT802 gearbox, and two 200 kW propulsion motors. A separate 50 kW motor powers the hydraulic system and the fifth wheel. Designed for high productivity and performance, the RME225 aims to operate a full shift and provide a viable alternative to its diesel counterparts.

The trials are taking place at

SAAM Terminals has invested US$500,000 in a new state-of-the-art simulator from CM Labs Simulators of Canada. The machinery will allow training of new crane operators, while current drivers can enhance existing skills, by utilising controls that replicate actual equipment. This allows for exercises in varying environments and the simulation of common failures, thereby targeting enhancing operator safety and performance.

Two US ports have recently called for specialist crane services support.

The Virginia Port Authority (VPA) has issued a Request for Proposals (RFP) for the demolition and removal of up to four Ship-to-Shore (STS) Cranes at the Virginia International Gateway (VIG) terminal in Portsmouth, Virginia.

The selected contractor(s) will complete demolition and removal of the STS cranes with pricing specifically requested for a single mobilization to remove up to four cranes, as well as two mobilizations to remove two cranes at a time.

VIG currently has eight cranes across four berths, including six STS units that date back to 2007 when the facility opened under the management of former operator, APM Terminals.

the Port of Ghent, a strategic hub for largescale European shipping and logistics company, DFDS. The company is providing support for the trials through provision of a dedicated driver and a specially designated monitoring space at the terminal.

DFDS is hoping is involvement in the project will help reduce its environmental impact and aligns with its recent procurement of 100 electric trucks from Volvo, to complement the 125 heavy electric trucks previously acquired.

Aidrivers and ZF are collaborating to offer autonomous mobility solutions in port logistics, including the retrofitting of terminal tractors. Aidrivers will focus on the supply of the autonomous driving software ecosystem while ZF Mobility Solutions acts as the engineering partner for the integration, validation and deployment. The converted vehicles can operate independently in mixed traffic operations.

Also, Port of Miami Crane Management, Inc., (PMCM) has requested proposals from gantry crane contractors who are qualified and experienced in STS container crane refurbishment, upgrades, electronic upgrades, installation and repairs, with no less than 10 years experience.

The contract is to provide refurbishments and repairs for PortMiami Gantry Cranes 4-6 and 11-12.

Kalmar has introduced new branding to reflect its position as a fully independent company. It has debuted on the Nasdaq Helsinki following former parent company Cargotec choosing to separate its core businesses, Kalmar and Hiab. The partial demerger was completed on July 1, 2024 to enable Kalmar shares to begin trading on the Finnish stock exchange. Initial market capitalisation was set at €1.74bn (US$1.87bn).

WE ARE THE EXCLUSIVE DEALER FOR SEVERAL TRIPLE A BRANDS IN THE PORT EQUIPMENT INDUSTRY. OUR CLOSE CONNECTIONS WORK TO YOUR BENEFIT: YOU HAVE ACCESS TO SHORT SUPPLY LINES AND A WIDE RANGE OF PRODUCTS. WHETHER YOU’RE BUYING, LEASING OR RENTING, GPE OFFERS DIFFERENT FINANCING OPTIONS. THANKS TO OUR NETWORK OF LOGISTICS EXPERTS, YOU’RE ALWAYS SURE YOUR MACHINE WILL ARRIVE PUNCTUALLY, NO MATTER WHERE IN THE WORLD YOU NEED IT.

BARRY PARKER

While the ports, and business entities within them, are buttressed by the ideas underlying “free trade,” they are not immune from being caught up in political rip currents. So it is with the ship-to-shore (STS) container cranes that are used to work the behemoth container vessels along coasts in the States - with the Biden administration proposing hefty tariffs (in the order of 25%) on imports of cargo handling hardware from Chinaset to come into effect later this summer. The tariffs are part of a broader programme from the White House which also seeks to stem imports of electric vehicles, batteries, and computer chips from China, against the backdrop of frostier relations.

When looking at issues like this, I try to look past the political talking points and geopolitical fear-mongering, surely an impossibility in this election year (aforementioned “rip currents” says it all). The practicalities,

as presented by the American Association of Port Authorities (AAPA), and by a group of ports, in comments to the proposed tariffs, are that no manufacturing capabilities for producing equivalent cranes actually exist in the States. In its comments, responding to the U.S. Trade Representative proposals, the AAPA suggests allowing existing orders for Chinese manufactured

The USA’s Federal Maritime Commission (FMC) has requested additional information regarding the global operational alliance between Maersk and Hapag-Lloyd. This new proposed alliance, that would become operational in 2025, is something of an innovation in shipping networks because of its heavy reliance on transshipment in hub ports.

Gemini makes a distinction between a ‘mainline network’ and a ‘shuttle network’. The latter is used to serve important gateway ports such as Busan, Antwerp and Gdansk that receive direct calls from competing carriers. Thus, Gemini needs highly reliable terminal services and a strong on-time performance to be competitive in such ports. Gemini argues it is capable of

ship-to-shore cargo cranes to be exempted from tariffs (or tariff imposition delayed, if such measures on cranes are ultimately enacted following a proposed more detailed economic analysis).

To me, the exemption makes

a great deal of sense- though I would say that the port community (presumably through trade associations) needs to take the lead in actively prodding possible manufacturers in the States to climb aboard. Ports’ comments submitted re the proposed tariffs also highlight concerns about the role of cargo handling hardware in widening the supply pipelines and alleviating potential disruptions. If orders for cranes are delayed, or cancelled, disruptions in supply chains (albeit incremental) are more likely. As has been said before in PS, concerns over security coupled with tariff increases have the potential to slow the supply chain for new cranes which, in turn, raises the threat of congestion. Ultimately a balance between politics and practicalities has to be struck with the course of action suggested by the AAPA hitting a very sensible note in this respect.

delivering reliability because it operates the majority of the terminals in hub ports – through the sister companies APMT and the newly established ‘Hanseatic Global Terminals’ of Hapag-Lloyd.

The FMC has concluded that the submitted agreement is insufficiently detailed to assess its potential competitive impacts. The type of additional information requested is not published publicly as it is deemed commercially sensitive. I can only speculate about the concerns of FMC, but it is relevant to note FMC approved the current 2M cooperation as well as the once proposed P3 cooperation. The only area where Gemini is ‘bigger’ than those other cooperation agreements is in its inclusion of a

joint shuttle network and the joint selection of a terminal in a hub port. In other cooperation agreements, partners choose their terminal operator in a port individually.

This is not the case with Gemini, precisely because control over terminal operations in (hub) ports is critical for reliability. Likewise, shuttle (feeder) services are provided individually by the shipping lines in other alliances, but jointly in Gemini. While the current number of shuttle services is limited to services to large gateway ports, the cooperation agreement leaves the door open for potential additional joint shuttle services.

While there certainly will be

effects of Gemini for service providers in ports, like towage and terminal companies, the potential effects for end users are central for regulators. In my view it makes sense for the FMC (or any other regulator) to note that extending cooperation to shuttle networks in general poses a threat of reduced competition in ports served by such shuttles. Consequently, the regulator may only allow cooperation in the ‘shuttle network’ to services to ports in which sufficient alternative services are available. That is the case in the current Gemini network but would put a limit on extending cooperation in the shuttle network. In any case the FMC decisions will be critical for Gemini’s future.

BEN HACKETT

The Houthi entrance into the Gaza conflict changed the fundamentals of global trade and in turn economics. How easy it is to create chaos.

As we entered the final quarter of 2023, carriers were forecasting much reduced, even negative EBITDA for 2024 as excess capacity and a large order book was driving down freight rates. Cargo volumes were also flat with little growth on the horizon except possibly in the United States. The idea of port congestion around the world was not even on the horizon.

European countries were struggling to generate economic growth, with most either flatlining or slowly tipping into recession. Politically the issues surrounding populism and the voters feeling of being ignored and left out was pushing voters to support right wing, anti-immigrant parties in Sweden, The Netherlands, Belgium, Germany, Italy and the list goes on. The war in the Ukraine was trudging along with

no end in sight, only the arms industry was in expansion. Climatic conditions were also unpredictable with either too much or too little water in European canals and rivers. And then came October 7th and the ensuing war in Gaza which still drags on after nine months. And with the war came the Houthi’s in Yemen armed with top of the line weapons of war. As they decided to stop trade with Israel, they failed to discriminate vessel voyage origins and destinations thereby devasting the Suez Canal traffic by 60 per cent or more.

The consensus of opinion is that 2024 will not follow in the footsteps of 2023 and see a widespread continuation of growth in global dry bulk trades. The China factor is a big influence in this respect.

Analysts suggest that this year iron ore and coking coal imports into China will not match last year’s robust volumes. 2023 saw both Japan and the European Union record lower volumes of steel production – Japan down by three per cent to 87 million tonnes and the EU down by seven per cent to 126.3 million tonnes. China will not, however, field demand levels which will take up the slack generated by falling demand levels elsewhere.

With coal it is a similar story.

Immediate losers were Egypt and the Saudi Red Sea Ports. By November vessel owners with networks to and from Asia, began to use the Cape of Good Hope to reach Europe, the Mediterranean and the northern Red Sea ports. What should have been a relatively straightforward network realignment became difficult when trying to match required capacity with that actually available. Going into the 2nd quarter of 2024 we saw port congestion as vessels from

different routes were showing up and with equipment out of place.

As a result, freight rates soared to eye watering heights, beyond levels reached during the Pandemic for all types of vessels. The bonanza in freight earnings and panic reactions of shippers, looking for cargo space at any cost in order to keep their logistics supply chains intact, brought peak season cargoes forward thereby worsening the situation.

Carriers that had been projecting losses were suddenly flush with funds again.

Political uncertainty with chaos in France, the U.S. and a weak government in Germany are all adding to the uncertainty. Where are we going from here? Most likely the market volatilities and political uncertainties will continue, and this will certainly impact consumer demand, but this may take a while leaving the second half of 2024 unchanged from the first half. Good for some, bad for others.

Chinese demand is expected to be flat and not mirror last year’s healthy demand. There will be bright spots for example in India, Vietnam and Bangladesh but again these demand spikes will not serve to counter the drop in Chinese demand.

The US Department of Agriculture anticipates a different scenario with grain and soya. It sees a three per cent increase in volume up to 687 million tonnes.

In terms of development work impacting the longer-term prospects of the dry bulk trades, Africa is cited as a noteworthy area. There are positive signs of increasing mining activity spanning both core mainstream products and minor bulks uch as manganese.

A prime example in the former respect is the recent announcement by Rio Tinto that all conditions have now been met for the development of the world’s largest new iron ore mine – the Simandou mine project in Guinea, being implemented with Chinese and Guinean interests. Signalling its intent, Rio Tinto stated in its announcement that it will now press on with the development of 600+ kilometres of railway and port facilities that will facilitate the export of up to 120 million tonnes per year. First production is expected in short order – 2025.

Diverse parties also point to the uptick in smaller mining projects on the African continent. Some of these projects are responding to

specific requirements for instance in conjunction with EV/battery production but there are also other influential catalysts at work. Leading law firm White & Case notes:

“Mining & metals projects across Africa are benefiting from a sea change driven by the COVID-19 pandemic, acceleration of the energy transition and Russia’s invasion of Ukraine. Critical minerals and the mining sector more broadly have become part of energy security policies across developed markets. Industries buffeted by supply chain disruptions and ESG pressures also seek their own security, too, directly investing in or partnering with miners to secure supply.”

With uncertainties over the vector of deepsea container flows in the wake of political upheavals, the emphasis is increasingly focusing on shortsea shipping. How will this develop and what are the key issues for maximising demand? Andrew Penfold takes a look…

Shortsea shipping has been the poor relation of the container trades for many years but shifts at the macro level – political and environmental – are increasingly focusing attention on this sector. Of course, by definition, shortsea markets are local and factors impacting on the European trades may not be directly replicated in other major regions. Despite this, certain key trends are emerging that will shape the future markets. There are major barriers to maximising demand, however.

When analysing shortsea flows, it is vital to differentiate between feeder containers and direct intra-regional flows. Feeder operators are extensions of the deepsea players and will always wait for the arrival of the deepsea vessel if there is a service delay. This places pressure on schedules, with the feeder operator having little direct influence over schedule reliability. On the other hand, lines and shippers focusing on direct intra-regional flows will be primarily competing with efficient ro-ro ferry services where regularity of service and minimised journey times (along with costs) are the key drivers of market share.

Several operators have sought to combine these market sectors – a superficially attractive idea – but have repeatedly seen uncertain volumes and forced reliance on lower value commodities in the intra-regional container trades where time pressures are not so acute.

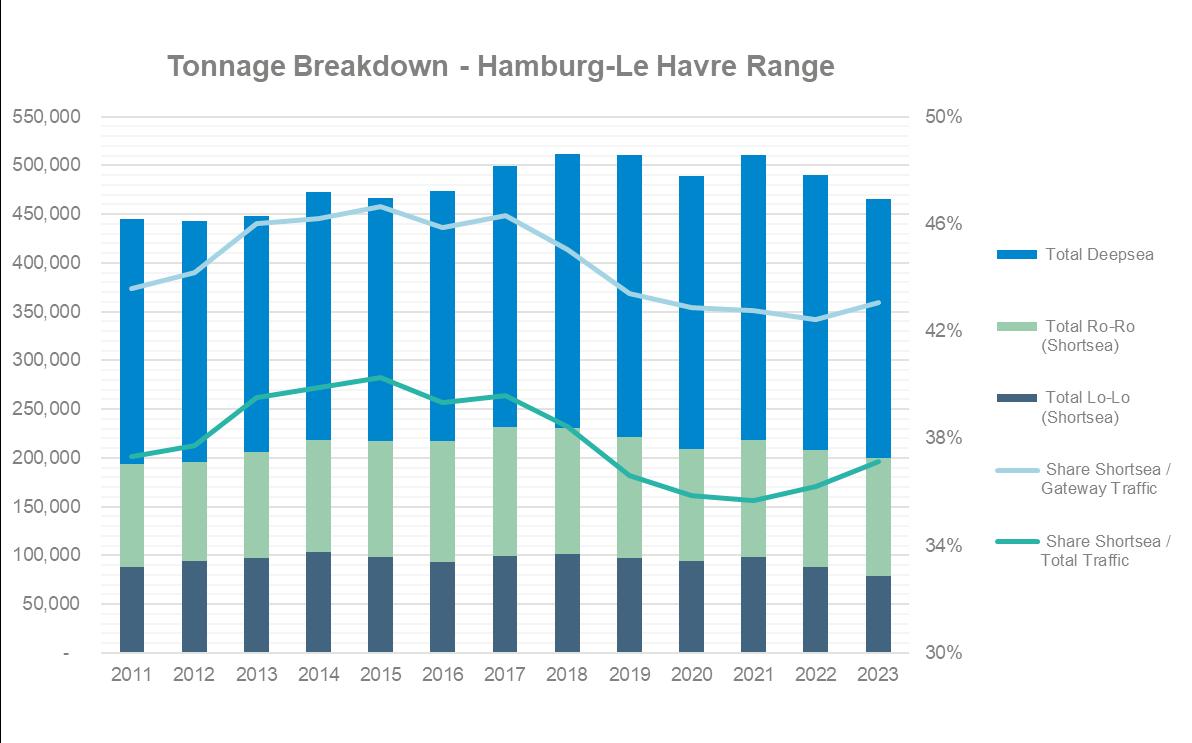

Figure 1 summarises the split in container traffic by type in the Hamburg-Le Havre range in the period between 2011 and 2023. Up to 2020 container demand growth was largely funded by transshipment, with shortsea traffic restricted by the pace of globalisation and (in the European market) by the post-Brexit slowdown. There is, however, currently renewed interest for shortsea demand. Generally, lo-lo suffered in 2022 and 2023 as a result of Russian volumes dropping out, macro-economic uncertainty and destocking.

The role of ro-ro is further summarised in Figure 2. Total shortsea volumes were squeezed as globalisation went from strength to strength prior to 2018 but this downward trend was reversed temporarily during the Pandemic. In 2022 and 2023 the share declined because of Russian lo-lo volumes dropping out, but ro-ro trades with the UK remained stable. The share of shortsea is, however, now picking up again and

this is expected to continue as a result of renewed interest in diversified and shorter supply chains as well as improving trade relations between the UK and Europe.

The last two years have seen surprisingly strong shortsea demand in NW Europe. For example, at Rotterdam the increase in ro-ro traffic has more than compensated for the loss of Russian trade.

So, the picture is complex but new trends are emerging. How can these be maximised?

At the centre of market positioning for successful shortsea development – be it for terminals, shipping lines or forwarders – is the acceptance that this is a highly competitive market. Shortsea container operations represent a single link in a supply chain where existing ro-ro operators already offer a very efficient and reliable service. A terminal operator developing in this sector must focus attention on key deliverables:

● Offering competitive facilities. It is vital to provide port and terminal facilities that are suitable for current and future needs. This means berthing the vessels that are currently required and that will be a feature in the coming years. Here, the focus will increasingly be on the size of feeder vessels deployed.

● Moving towards long term commitments from customers. The more that long-term contracts that are entered into –with both lines and cargo owners – will be a critical mark of success. The fixing of durable contracts in a highly structured market will add comfort for volumes and expansion investment.

● Effective transport costs. Of course, this is a critical test. For shortsea lo-lo operators the key competition will be with accompanied and unaccompanied ro-ro ferries. In contrast to deepsea/feeder shipping the margins are very tight in the shortsea markets, with the build-up of inland delivery, port/ shipping costs and final delivery often resulting in very limited differentials. When inventory costs are factored-into the equation then delivery time becomes a key competitive factor. Generally speaking, containerisation can offer a cheaper transport cost but usually loses out on delivery times and flexibility. The cost differential in the UK (for example) can be very limited at 15-20 per cent between

the

higher cost-ro-ro and shortsea containers. There is little that the terminal operator or line can do to overcome this situation, but it underlines the narrowness of the market, with some cargo owners preferring to pay more for ferry flexibility.

● Investment in supporting infrastructure. As a shortsea terminal operator there is a great temptation to invest in supporting infrastructure – for example, barge lines, trucking or other shortsea terminals. As part of a ‘one stop shop’ strategy this can make sense, with the terminal offering a single transport solution, for example, between the Ruhr and Manchester. However, margins can be very slim for these projects and the amount of potential management time required for marginal gains can be excessive. Detailed analysis of the synergies available from these options is essential.

● Focus on attracting industry related investment to (or near) the port estate. Successful shortsea terminal operators have focused on locking-in major customers by assisting with on, or near, dock investments. This ‘Port Centric’ approach is well suited to the shortsea container sector and serves to provide further certainties to volume projections – although there are always counter-party risks with such an approach. The attraction of Lidl’s UK supermarket business near to the Moerdijk terminal in Rotterdam is a good example of this strategy.

● Environmental perspective. In the current markets environmental issues are coming to the fore. The provision of environmentally friendly facilities for shortsea shipping are clearly consistent with policy developments. Shortsea terminals will offer clear advantages from this perspective versus ferry and other modes, and this will boost market share. Provision of ‘green’ bunkering facilities will further boost attractiveness.

The first half of 2024 has been positive for shortsea flows, but as the process of restocking goods slows there will be some lower growth over the rest of the year. In the narrow NW Europe market, the modality has shifted in favour of lo-lo in the UK markets as routes to/from the north of the UK open up. In the near-term, demand will be primarily dependent upon the pace of underlying growth in the economies, but the general trend is favourable.

As the world moves in the direction of shorter supply chains and intra-regional development there will be a clear need for expanded capacity in the shortsea sector ‘‘

In the longer run the stars are aligned for stronger and sustained growth. The shift in favour of nearshoring seems certain to continue as a result of macro-economic and political shifts and this will continue to favour both ro-ro and lo-lo shortsea volumes. Any reopening of the Russian markets would provide a further upside to demand. The situation is positive and will certainly require further investment in modern well formatted shortsea terminals. With a growth rate of 3.5-4 per cent per annum the existing (modern) shortsea terminals in NW Europe will come under capacity pressure in the medium term. This will require further investment (where space is available) and a strong focus on increasing productivity within existing port estates.

Figure 1 summarises the split in container traffic by type in the Hamburg-Le Havre range in the period between 2011 and 2023. Up to 2020 container demand growth was largely funded by transshipment, with shortsea traffic restricted by the pace of globalisation and (in the European market) by the post-Brexit slowdown. There is, however, currently renewed interest for shortsea demand. Generally, lo-lo suffered in 2022 and 2023 as a result of Russian volumes dropping out, macro-economic uncertainty and destocking.

Figure 1 summarises Le Havre range in the period between 2011 and 2023. Up to 2020 container demand growth was largely funded by transshipment, with shortsea traffic restricted by the pace of globalisation and (in the European market) by the post renewed interest for shortsea demand o suffered in 2022 and 2023 as a result of Russian volumes dropping out, macro

In contrast to many port investments around the world the downside for modernisation and expansion of shortsea capacity is limited. The key risk is at the macro-economic level. If the economies slow over a sustained period, then demand will fall back. At the same time, the formatting of the proposed investment must be very carefully considered. Any rapid increase in the size of vessels deployed on the shortsea trades could see a significant redeployment of capacity if terminals do not offer the required access capabilities.

The role of Ro-ro is further summarised in Figure 2. Total shortsea volumes were squeezed as globalisation went from strength to strength prior to 2018 but this downward trend was reversed temporarily during the Pandemic. In 2022 and 2023 the share declined because of Russian lovolumes dropping out, but ro -ro trades with the UK remained stable. The share of shortsea is,

In addition, the market is highly complex and subject to numerous policy requirements from the EU and national governments. Careful monitoring and anticipation of these issues will be vital.

The role of Ro-ro is further summarised in Figure 2. Total shortsea volumes were squeezed as globalisation went from strength to strength prior to 2018 but this downward trend was reversed temporarily during the Pandemic. In 2022 and 2023 the share declined because of Russian lo -lo volumes dropping out, but ro -ro trades with the UK remained stable. The share of shortsea is,

As the world moves in the direction of shorter supply chains and intra-regional development there will be a clear need for expanded capacity in the shortsea sector. The large deepsea terminals will not easily compete for this business and the feeder sector will remain distinct. This demand will be accelerated by modal shifts, with lo-lo and ro-ro fighting it out on the shorter haul (high volume) trades.

At the same time, it is clear that much of the shortsea fleet comprises older vessels. There will be a need not just for terminal investment but also for new vessels – optimum sizing of these units will be a major issue.

At the policy level subsidies and permitting will continue to feature, but the basic argument for this sector will remain competitive cost and service issues. Governments need to facilitate the growth in the shortsea sector to capture the benefits. This will also be essential to unlock environmental gains.

Considerable investment must be focused over the next five years, or so, to maximise the potential in this sector.

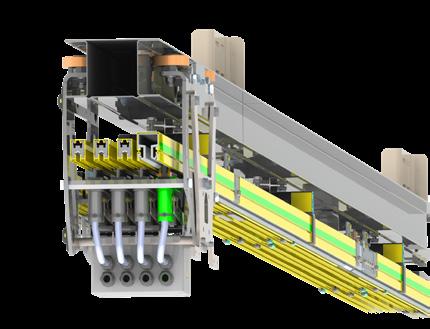

Converting a conventional RTG into an electrical one (E-RTG) means to shut down the diesel generator and to power the RTG with electrical power only – the emission saving, sustainable basis for automation. This is possible with electric power solutions, including E-RTG auto-steering and positioning systems, developed by Conductix-Wampfler: Plug-In Solution, Drive-In Solution, Hybrid Solution, Full-Battery Solution and Motor Driven Cable Reel Solution with CAP - Cable Auto Plug-In. We move your business!

www.conductix.com

Gdynia’s Baltic Container Terminal is the focus of a comprehensive terminal upgrade. Mike Mundy unveils the key steps which will deliver a significantly enhanced service offering

Gdynia’s Baltic Container Terminal (BCT), an operating unit of Manila-based International Container Terminal Services Inc., is the focus of a major investment programme designed to proactively meet user needs over the long term. Comprehensive investments are being undertaken by both the Port Authority of Gdynia and BCT with support from the European Union.

A key goal of the development programme is to provide access for higher capacity container vessels and with this in mind the Port Authority of Gdynia, at the end of 2022, commissioned Jan de Nul to implement a comprehensive dredging programme to deepen the Approach Track and Inner Basins of the Port of Gdynia. This has now been completed and following the completion of extensive terminal upgrade works at BCT, the terminal will be able to accept vessels with an LOA of up to 400m and draught of up to 14.7m. In particular, this is designed to complement BCT’s established role of handling direct deep-sea services as well as serving extensive short-sea/feeder lines.

The main construction work at BCT centres on the upgrade of the terminal’s Helskie Quay which is being re-developed to offer a depth alongside of 15.5m and draught of 14.7m over 730m, and the installation of a new third rail designed to facilitate the introduction of larger ship-to-shore (STS) cranes. These new generation cranes will provide a greater lift capacity, the ability to serve up to 25 rows of containers on deck and possess a span between the legs of 30.48m.

The final leg of the Helskie Quay, adjacent to the ro-ro ramp in the inner area of the dock, offers another 30m of quay with a draught alongside of 12.7m.

There are also supporting construction works underway which include a new intra-port road connecting the Helskie II Quay – which extends on from the main Helskie Quay for 176m – with a new logistics storage yard scheduled to come into operation in early 2026. The latter investment works are being undertaken by the Port Authority of Gdynia working together with BCT. There is also a new nine-hectare BCT staging area, again expected to come onstream early in 2026. Going forward, there is the prospect of additional terminal areas being added.

Wojciech Szymulewicz, CEO, BCT notes: “We are pleased to partner with the Port Authority of Gdynia to upgrade Gdynia’s container handling capacity and performance to

meet the new needs of shipping line and other clients. We recognise that the terminal development works have been challenging for liner clients but sincerely believe that the ‘prize will be worth the pain,’ notably our ability to serve higher capacity vessels and offer enhanced service levels on both the quayside and landside.

“We expect,” Szymulewicz elaborates, “diverse benefits to flow from the implementation of the latest Navis terminal operating system and our comprehensive equipment acquisition programme. In the pipeline, together with new generation STS cranes, are new rubber tyred gantries (RTGs), 15 tractor and semi-trailer container sets and other mobile equipment including reach stacker and heavy-duty forklift units.

Extensive dredging, quay redevelopment, equipment and IT systems acquisition position BCT to meet new client needs and fulfil strategic requirements ‘‘

“Once the overall development programme is fully bedded in, we anticipate an improved performance across the board, spanning all key areas: ship side operations; at the terminal gate, consolidating and expanding our already successful intermodal rail activities, yard operations and in conjunction with customer support functions.”

IMPORTANT STRATEGIC ROLE

The upgrade of the Port of Gdynia and BCT is also important in the context of TEN-T system development with Gdynia representing an important component of the Baltic SeaAdriatic Sea (BSAS) European Transport Corridor (ETC). This corridor is the subject of ongoing development with plans foreseeing the completion of the core network for BSAS by 2030 and 2040 for the extended core network.