Baltic Containerport Review | Reefer Monitoring: Data Driven | Spreaders: Electric & Green Goals

DAR SWIMS AGAINST THE TIDE

TAPPING DRY BULK TRANSSHIPMENT

SANTOS: RETHINK UNDERWAY?

ASSET VALUATION: SMALL PORTS

JULY/AUGUST 2023 VOL 1023 ISSUE 6 portstrategy.com

From initial concept through to design, construction, operation, and eventually decommissioning, we provide a one-stop solution supporting customers at every stage of the lifecycle for marine, ports and coastal projects.

www.bmt.org

MIKE MUNDY

Integrity Has Its Place

The Black Sea Grain Initiative has folded and the Kremlin has launched a series of missile attacks on the port city of Odessa in Ukraine. The reason? Allegedly because the West has impeded Russia’s own grain and fertilizer export operations. Those of us that are properly informed, however, know that there will be little truth in this – its just more bull….from the deranged centre of power in Moscow! A lashing out as Ukraine dared to create an explosion on the bridge to Crimea where Russia is in illegal occupancy.

I have visited Odessa a couple of times and it is without doubt a jewel in the crown of Ukraine’s cities and has the same status in global terms as a port city. It is a city with stunning architecture that has been subject to diverse influences over the years – for example, French and Italian much more so than Russian. UNESCO underlines, for example:

“The historic centre of Odessa represents an important interchange of human values within Eastern Europe through its heterogeneous architectural styles, developed during its rapid growth in the 19th century, that reflect the coexistence of many cultures and the combination of influences characteristic of the border area of Europe and Asia.”

So, to hear in the last few days of Russian missiles hitting a cathedral and other non-military buildings is really just deplorable, as (of course) is the loss of civilian lives.

History will be the judge of this, and I doubt very much if President Putin and Russia will come out of this well. Putin’s propaganda machine may have the Russian people fooled for now but history will definitely be a more objective judge.

The application of sanctions against Russia and the withdrawal of business from engagement in Russian deals and commerce generally is also a way for business to make a statement against the wrongs being implemented by Russia. The sale by APM Terminals of its stake in Global Ports was the right thing to do as was the termination of calls in Russia by its sister company Maersk as well as similar actions by other liner operators.

But there is still a way to go with this withdrawal. According to data from the Kyiv School of Economics less than 300 of over 3350 large foreign companies that owned assets in Russia have already left and about 500 are in the process of withdrawing.

There are also others that need to ‘get on the programme’ – the operators of the dark ships and others who may even be considering stronger engagement with Moscow, for example DP World whose name has recently been added to a list of international sponsors of war by Ukraine’s National Agency on Corruption Prevention. The agency contends DP World is strengthening its cooperation with Russia and specifically that it has recently signed an agreement with the Russian state corporation Rosatom on the development of the Northern Sea Route.

Generally, it is perhaps appropriate to reflect on the words of Dwight D. Eisenhower who said: “The supreme quality for leadership is unquestionably integrity.”

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: AndrewPenfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

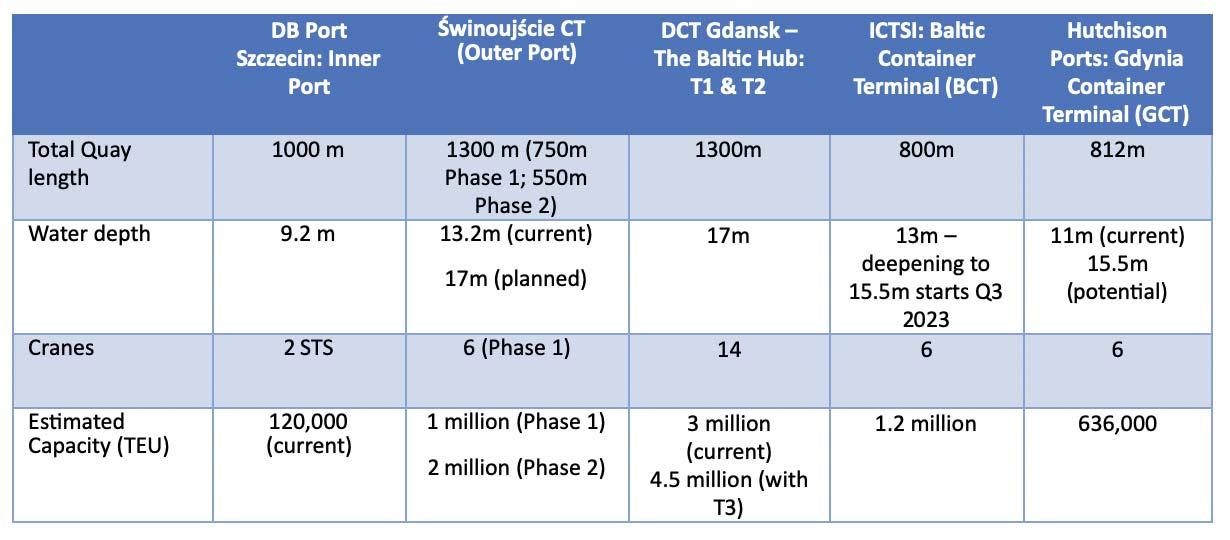

PS magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s print subscription £295.00

1 year’s digital subscription with online access £228.50

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

©Mercator Media Limited 2023. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 3

The war in Ukraine –and it is a war not a so-called ‘Special Operation’ – has a long shadow which extends well into the maritime sector. Who knows when this unnecessary, heinous conflict will end but when it does, if not before, there will, in all probability, be a reckoning with regard to how companies and indeed countries have behaved during it. Integrity has its place!

PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES

VIEWPOINT

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 5 Weekly E-News Sign up for FREEat: www.portstrategy.com/enews CONTENTS JULY/AUGUST 2023 is a proud support of Greenport and GreenPort Congress GreenPort magazine is a business information resource on how best to meet the environmental and CSR demands in marine ports and terminals. Sign up at greenport.com The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operational environmental challenges. Stay in touch at greenport.com Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Social Media links LinkedIn PortStrategy portstrategy YouTube On the cover The award of the container terminal concession in Dar es Salaam effects not just Tanzanian importers and exporters but those in the landlocked countries around Tanzania that depend on the Dar gateway. The fundamental goal behind the award is improved efficiency and as such the Tanzania Port Authority’s seeming intention to depart from best practice in making the award is hard to understand - (p23). NEWS FEATURE ARTICLES REGULARS 19 The New Yorker Linking Up the Data Silos 19 The Analyst Sustainability and Digitalisation to the Fore 21 The Economist No Cause for Optimism 21 The Strategist Clean Energy Maritime Hubs 23 Swimming Against the Tide Taking the Wrong Road in Dar es Salaam? 24 Tapping Transshipment Dry Bulk Transshipment to Reduce Costs 26 Santos Rethink? Concession Policy Rejig 29 New Lease of Life DP World Santos, Improved Prospects 30 In Pole Position Poland Leads in the Baltic 32 Cranking Up Capacity Baltic Port Plans 34 Bidding for the Big Time Klaipeda Seeks Scale 35 Big Ambitions but Challenges Russia turns to Northeast passage 36 Maximising Value Asset Valuation for Small Ports 38 Data Drives Development Automated Reefer Monitoring 40 Electric and Green Goals Telescopic Spreader Trends 46 Postscript China Revs up Auto Activities JULY/AUGUST 2023 VOL 1023 ISSUE 6 portstrategy.com Baltic Containerport Review Reefer Monitoring: Data Driven Spreaders: Electric & Green Goals TAPPING DRY BULK TRANSSHIPMENT DAR SWIMS AGAINST THE TIDE SANTOS: RETHINK UNDERWAY? ASSET VALUATION: SMALL PORTS 17 ICTSI Selected… …for Durban Pier 2 17 CPKC Alternative Serving the US via Mexico 18 Valencia Deal CMA CGM Buys In 19 Mega Trends Focus Hamburg Plan 10 MSC Link to Wilson, Sons Acquisition Interest? 11 Predicting Truck Flows Valencia Taps AI 11 Costa Scans Two new scanners 13 Double Oering from CM Labs New STS Pack and MasterCab 14 Double-Stack in Brisbane Truck trials with Qube 15 Autonomous Trucksy Roerdam Plans 17 Busy Times Kalmar & Liebherr

ICTSI SELECTED FOR FLAGSHIP DURBAN CONTAINER TERMINAL

After an extensive selection process, Transnet, the government agency responsible for the development, management and operation of South Africa’s key terminals, has selected Manila headquartered International Container Terminal Services Inc (ICTSI) as the equity partner for its flagship Durban Container Terminal (DCT) Pier 2.

DCT Pier 2 is Transnet’s biggest container terminal, handling 72 per cent of the Port of Durban’s throughput and 46 per cent of South Africa’s container traffic. The 25-year joint venture will have a major focus on the development and upgrade of the terminal with the objective of delivering superior standards of operation to waterside and landside-based customers.

The general intention is to reposition the terminal for best practice performance, in turn delivering growth in throughput volume. ICTSI will support the terminal in an operational context as well as commercially in conjunction with liner operators.

Transnet points out the combined planned initiatives will play a significant part in stimulating exports and imports with this notably facilitated by lifting DCT Pier 2’s annual throughput capacity from two million to 2.8 million TEU/yr.

“The partnership in Pier 2 is a major step forward for our programme to bring in global expertise to improve efficiencies

Barcelona Re-Tender

The Port of Barcelona is resuming its tender for the construction and operation of the 54,000m2 future cruise terminal G on Adossat wharf. The original tender was approved in November 2022, but then cancelled in March 2023. To date, two companies have shown an interest, Catalonia Cruise Terminal C, S.L. (Royal Caribbean) and a joint venture of Norwegian Cruise Line, Viking Ocean Cruises and Virgin Cruises.

CPKC Targets Safe Mexican Alternative

Shortly after confirming itself as a newly merged entity, Canadian Pacific Kansas City Railroad (CPKC), outlined a “safe alternative route that is considerably faster” from Asia to key locations in the US via Mexico.

at our terminals, and bodes well for our ongoing plans to crowd in the private sector in areas identified for growth,” underlines Portia Derby, Transnet Group Chief Executive.

There was stiff competition to secure the opportunity. Transnet confirms it received 18 responses to its initial call for Expressions of Interest, in August 2021, nine of them from global terminal operators. Ten parties were subsequently shortlisted in response to a request for qualifications and of the shortlisted respondents, six bidders submitted proposals, before ICTSI was selected.

Key elements of the transaction include:

5 A new company will be formed to manage the operations at DCT Pier 2, in which Transnet will have majority ownership of 50 per cent plus one share.

5 The term of the transaction is 25 years, with an option to extend to a maximum of 30

Long An is Live

Long An International Port in Vietnam has officially launched container handling services across seven berths. Dongtam Group commenced construction in 2015. The total berth length from Berth 1 to Berth 7 is 1670m. In the next phase of development the Port will expand to 10 berths, including one berth for liquid/ liquefied petroleum gas and one berth for large cruise ships. The facility is located in Can Giuoc District, Vietnam.

years in the event that berth deepening of the North Quay at Pier 2 is delayed.

5 Non-current assets will be transferred into the new company, together with customer and supplier contracts. The new company is required to achieve a minimum level 4 BBEE contribution status.

5 The terminal operating licence and lease will be subcontracted to the new company, after seeking approval from Transnet National Ports Authority.

5 DCT Pier 2 employees will be seconded to the new entity. There will be no retrenchments, and employees will retain the same terms and conditions before and after the introduction of the private sector partner.

Transnet is now working with ICTSI to finalise arrangements.

No Hutch Sale

International press reports are indicating that PSA International is no longer planning to sell its 20 per cent stake in Hutchison Ports due to limited interest in the deal. Singapore-based operator, PSA, acquired the stake in Hutchison Ports in 2006 for US$4.4bn and was rumoured to be seeking US$4bn from this proposed sale. Both Cosco and China Merchants had been noted as possible names looking into the opportunity.

According to Cory Heinz, MD Asia Pacific, CPKC, the company already offers highly competitive access from Vancouver (BC) to the US Midwest, with a four- day transit to Chicago and direct access to Kansas City and Minneapolis.

The option of access to US markets via Mexico and avoiding US West Coast terminals and the Panama Canal is regarded by CKPC as a potential “game-changer.”

Lázaro Cárdenas is Mexico’s second-largest port and has two container terminals with a combined capacity of 3.2 million TEU per annum, with on-dock rail access and expansion space, with terminal utilisation only in the order of 50 per cent.

CPKC adds that moving container traffic from Asia to Dallas over this Mexican Pacific gateway takes sixteen days on the water and four on the rail, equivalent to 7-10 days faster than using the Panama Canal and calling at Houston (based on rail to Kansas City and Chicago being seven and eight days, respectively).

BRIEFS

Norvik Seeking CO2

The Swedish Energy Agency is funding a feasibility study to assess the viability of establishing the infrastructure to support captured carbon dioxide (CO2) at Stockholm Norvik Port. The initiative aims to establish overall proof of concept to develop a regional, sustainable, and cost-efficient infrastructure for carbon dioxide capture, interim storage, and transportation in eastern Sweden.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 7 PORT & TERMINAL NEWS

8 Transnet has selected ICTSI as its equity partner for its flagship Pier 2 terminal at Durban

CMA CGM ENTERS PORT OF VALENCIA BRIEFS

Onne for Safety

Onne Multipurpose Terminal (OMT), the Nigerian cargo-handling operation of International Container Terminal Services, Inc. has recorded an impressive safety milestone after achieving two million man-hours with zero lost time injury (LTI). Moreover, OMT has been able to reach this significant position just two years after it commenced commercial operations in 2021. OMT is one of four current ICTSI terminals in Africa, although this total is expected to increase.

PSA Venice Gets 25 More Years

PSA Venice has signed an agreement with the North Adriatic Sea Port Authority (AdSP) to extend its existing concession by 25 years. This new contract commences on October 1, 2024, and will run until October 1, 2049. The operator confirms it will be implementing terminal improvements, including expanding capacity to 500,000TEU per annum.

The original 25-year concession began in 1997.

Ceres Sold

Carrix has agreed to purchase the Ceres Terminals portfolio from Macquarie Asset Management. The deal includes 18 port locations in North America, but excludes assets in Jacksonville, which remain under the ownership of Macquarie. No financial terms have been revealed, although Macquarie was reportedly seeking US$1bn. The Ceres facilities will become part of Carrix’s subsidiary, SSA Marine, which operates at over 250 port and rail locations worldwide. The transaction remains subject to the approval of relevant regulatory authorities.

CMA CGM has closed a deal to acquire 49 per cent of Cosco Shipping Ports (CSP) Valencia Iberian Terminal, located at the Muelle Príncipe Felipe in the Port of Valencia.

The CSP Iberian Valencia Terminal consists of 2300m of berth, 145ha of yard, an automatic gate system solely to support local cargo flows and direct connectivity to the dry ports of Madrid, Zaragoza and Bilbao, as well as an automatic gate system for the flow of local cargo.

A combination of this infrastructure and geographic location make both this terminal, and Valenciaport, a key container gateway for the Iberian peninsula, in addition to the leading port for serving Madrid. The terminal serves a market extending

APM Terminals (APMT) Valencia is investing €3.6 million (US$3.9 million) to expand capacity, increase equipment efficiency and improve the flow of trucks entering its terminal.

According to this operator, sister company to Maersk Line within the AP Moller Maersk Group, a total of 11 new Terberg YT223 terminal tractors, each equipped with Cummins Stage 5

350km, which comprises an estimated 55-60 per cent of Spanish GDP activity, according to information specialist Data&.

The commitment from the French line further consolidates the port’s key strategic role in the Western Mediterranean. In addition to CMA CGM,

8 CMA CGM has acquired a 49 per cent stake in Cosco Shipping Ports (CSP) Valencia Iberian Terminal

Mediterranean Shipping Co (MSC), Maersk Line and Cosco all have made major commitments to high capacity operations in the port of Valencia.

…AS APMT ALSO INVESTS

engines to comply with current European Union emissions regulations, have arrived at the facility.

The new tractors are one part of a more extensive investment plan by APMT Valencia, which includes the commissioning of four Rubber-Tyred Gantry (RTG) cranes, with a 50-tonne lifting capacity.

Further, the terminal has commenced the construction of new gates for trucks, which will see the number of access lanes to the terminal increased from five to six, while also being able to automatically read container and truck details through use of Optical Character Recognition and License Plate Recognition.

PLUS SAGUNTO RAIL INVESTMENT CONFIRMED

The Port of Sagunto, a satellite port to Valenica and also under the management of the Port Authority of Valencia, is to see investment of €17.5 million (US19.3 million) from the Spanish Government for construction of its inner rail network. The

8 Rotterdam World Gateway (RWG) has reached agreement with its shareholders DP World, CMACGM/ Terminal Link, HMM, MOL and the Port of Rotterdam Authority regarding a phased expansion of the RWG terminal. In the first phase, an extra berth for the deep-sea operations will be developed and alongside this capacity expansion the focus will be on future oriented facilities in which automation, sustainability and connectivity are central. The total investment is approximately €500 million and initially includes civil works, quay cranes, storage modules with automatic stacking cranes and electrical automatic guided vehicles. Commerical roll-out will be 2026.

recently released tender cites a completion period of 11 months after the award.

The project is being financed with European CEF funds and includes an Intermodal Goods Facility, with the terminal capable of accommodating trains of 750m

in length. This project is part of the Port Authority of Valencia (PAV) development strategy which earmarks more than US$260 million for the rail sector and forms part of comprehensive efforts to decarbonise port operations.

PORT & TERMINAL NEWS

8 | JULY/AUGUST 2023 For the latest news and analysis go to www.portstrategy.com

HAMBURG TARGETING “GLOBAL MEGA TRENDS”…

The Hamburg Senate has endorsed a new port development plan. As a result, the strategic guidelines for future port policy and availability of land for port development are more visible.

Dr. Melanie Leonhard, Senator of Economics and Innovation explains: “Hamburg is and will remain Germany’s largest seaport. This is of fundamental importance for the economic strength of Germany as an exporting economy and for supply chain security at national

and European level. Going forward, we shall continue to operate a large, efficient universal seaport that serves these aims. Cargo handling is not an end in itself and container numbers may be an indicator but are not the only relevant factor. Unlike other ports, Hamburg is itself a significant market and industrial base. Goods on arrival are not only transhipped, but also consumed or further processed.“

The Senate also confirms that the port will focus on “global mega-trends” including

digitalization, climate protection, and e-commerce, to extend its competitive position. Other key areas of focus include special attention given to the port railway network and the rail infrastructure with the hinterland, noting that from 2040 the Port should be climateneutral in its operations. Moreover, expansion of shore power-supply for vessels to reduce emissions of harmful pollutants, contributing directly towards keeping the atmosphere clean are also key points of note.

...AS MEGA-SHIP ARRIVES

Takoradi Sees Biggest Bulk Ship – and Record Activity

The “ONE Innovation”, the largest container ship of the shipping company ONE - Ocean Network Express - has called at the port of Hamburg. This vessel is the first 24,000TEU vessel of the ONE shipping company. It has a 400m LOA and an exact capacity of 24,136TEU.

“The shipping company’s

Indiana Interest?

Ports of Indiana has issued a Request for Qualifications (RFQ) to identify potential operators for the general cargo terminal at Ports of Indiana-Mount Vernon.

The 11-acre facility includes three warehouses (totalling 90,000ft2) and potential connectivity to five Class I railroads. A 60-ton dual lift crane capable of transloading cargoes between warehouse, barge, truck, and rail is also available. Investment of US$2.5 million has been made since 2020.

decision to call at the Port of Hamburg with its most modern ship shows that we have done our homework. For example, the terminal operators have state-of-the-art container gantry cranes to efficiently unload and load a ship of this size. In addition, shore power systems are currently being installed at the

Rotterdam Rail

Modal 3 Logistik has commenced a new rail shuttle running twice a week back and forth between Rotterdam and Magdeburg in central Germany. This service represents the first time this German logistics service provider has offered a direct train shuttle to Rotterdam. Each Sunday and Wednesday the container shuttle departs from Rotterdam and arrives in Magdeburg on Mondays and Thursdays, respectively. Modal 3 also provides first and last mile trucking..

container terminals in the Port of Hamburg to make the ships’ laytime more environmentally friendly,” says Axel Mattern, CEO of Port of Hamburg Marketing. The ship is deployed on the Asia-Europe service, FE3, by THE Alliance (THEA). It is the first of six new Megamax vessels to join ONE’s core fleet.

VICT on Schedule

International Container Terminal Services (ICTSI) has confirmed that its Victoria International Container Terminal (VICT) at the Port of Melbourne, Australia is on schedule to simultaneously accommodate two ships up to 14,000TEU by 2024. The A$235 million ($159 million) expansion includes adding three new quay cranes (to eight units), 10 new automatic stacking cranes (ASC) and raising yard capacity by 50 per cent.

Takoradi Port has received the biggest bulk ship ever to call the port since its construction in 1928.

The bauxite vessel, mv Baby Hercules, is a Capesize bulker with a 240m LOA and a draught of 16 meters, the first ever with these dimensions. Bedeschi S.p.a. supplied all the conveyor lines of the terminal, the two shiploaders and one eco-hopper, which enabled the vessel to load a record of 106,530 metric tons of Bauxite in just five days, which compares favourably to needing between 12 and 15 days to load the same volumes without the equipment from Bedeschi S.p.a.

BRIEFS

BNCT to Double

Belawan New Container Terminal (BNCT) is doubling its throughput capacity to 1.4 million TEU per annum. Operator of the facility, DP World, confi rms it has signed an agreement with the Indonesia Investment Authority (INA) and government-owned port operator Pelindo. The global operator also announced that it plans to support links to other terminals and minor ports on the island of Sumatra, faciliating lower cost box transport.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 9 PORT & TERMINAL NEWS

MSC AND WILSON, SONS LINK BRIEFS

Truck Rule Change

The Peruvian Association of Port Operators (ASPPOR) is calling for new regulations that would allow for two 20ft containers to be transported by truck instead of the current maximum of one, as this would save 100,000 heavy vehicle trips per year between Lima and the port of Callao. Favio León Lecca, President of ASPPOR, is pressing for rules to be changed to reduce pollution and traffic congestion: “It is important that transport companies, regulators and port terminals work together to find solutions that allow greater efficiency in the flow of cargo, and, for sure, allowing two x 20 footers is one of them,” underlines Lecca.

News…94 so far… Uruguay

The Administracion Nacional de Puertos de Uruguay (ANP, or National Uruguayan Ports Authority) has opened up a tender process to improve the infrastructure at the port of Nueva Palmira, in the Colonia province, at the strategic confluence of the Rivers Uruguay and Parana, some 220 km west of Montevideo. Four companies have already shown an interest, states ANP, without disclosing the names of the companies involved. Nueva Palmira is Uruguay’s largest port for dry bulk shipments, and most of the improvements will be made to the Ultramar Sur and Union piers.

FIG floating dock

The Falkland Islands Government (FIG) has launched a tender to build a new floating dock system to replace the moribund FIPASS dock. Potential developers have two months to present their plans.

MSC is reportedly keen to buy a majority shareholding in Wilson, Sons, the Brazilian based diversified shipping, terminal operating and logistics company.

An article published in the Globo newspaper stirred up the “Chat and Gossip channels” in Brazilian port and maritime circles as Wilson, Sons declared that it was carrying out one of its occasional “strategic reviews” but that “nothing was on the table”.

Wilson, Sons, owns and operates two port terminals (Tecon Salvador in the northeast of Brazil, and Tecon Rio Grande, TRG, in the far south) and also owns a shipyard (in Guaruja, across the channel from Santos), and two fleets (88 tugboats and 22 Offshore Support Vessels), as well as an inland terminal (at Santo Andre, near Sao Paulo), two offshore support bases and various other offices and ship agencies.

Taking over Tecon Salvador and TRG – two deepwater terminals – could greatly assist MSC’s transshipment options along East Coast of South America, several analysts advised PS.

According to Bloomberg the share price of parent company Ocean Wilsons Holdings Limited shot up by 14.07 per cent in the wake of the news that MSC was looking to buy the company. However, although contact between the two parties has been made, reliable sources do

not believe any formal offers have been put forward by the Swiss headquartered company, which has a 50 per cent share in the BTP Terminal Operating Company in Santos. The share price of Santos Brasil, still Brazil’s biggest TOC, also rose (also by 14 per cent) on the Wilson’s news with the Bovespa (Sao Paulo stock exchange) reflecting the fact that MSC, and its partner Maersk, had also shown an interest in buying them, not so long ago. The current valuation of Wilson, Sons on the Bovespa is around Reais8.8BN (US$1.8BN)

Arnaldo Calbucci, the CEO for Wilson, Sons in Brazil, told PS that

the “main shareholders of the company are studying strategic possibilities as they regularly do and have done in the past” and that there is “nothing on the table” right now.

A statement from Wilson, Sons to both the London Stock Exchange and Bovespa, reflects the same sentiment as Calbucci, stating that “no formal proposals had been made from third parties”.

“Whenever news of these discussions is leaked or released the share price shoots up, so I am not sure how credible the MSC bid is, but it possibly has more substance than the Maersk one of two years ago and there would be more synergies in an MSC buy than a Maersk one,” said one market analyst based in Sao Paulo.

DP WORLD CALLAO BUILDS GREEN CREDENTIALS

DP World Callao, in Peru, has received the first LNG powered vessel to berth along the West Coast of South America and is promising the container terminal will be carbon neutral by the year 2030.

The Liberty, owned and operated by CMA CGM is, at 366 meters and with 14,800TEU capacity, one of the largest ships currently operated in WCSA trade.

“DP World is reducing its carbon footprint throughout the world and we hope to achieve carbonneutrality in the South Pier in Callao by 2030,” states the terminal operator.

In 2021, DP World began a

US$350M expansion plan – taking capacity from 1.5m TEU up to 2.7m TEU – with all new equipment bought for the upgrade helping it carry out a gradual change of the energy matrix from fossil fuels to electricity, especially from

renewable sources. Eventually the company will halt emissions of 4320 tons of CO2 gases per year from its Callao facility.

LATIN AMERICA NEWS

10 | JULY/AUGUST 2023For the latest news and analysis go to www.portstrategy.com

8 Wilson, Sons Tecon Salvador facility – reportedly part of the company’s assets attracting interest from MSC

8 DP World reducing its carbon footprint in Callao with this goal at the heart of expansion plans

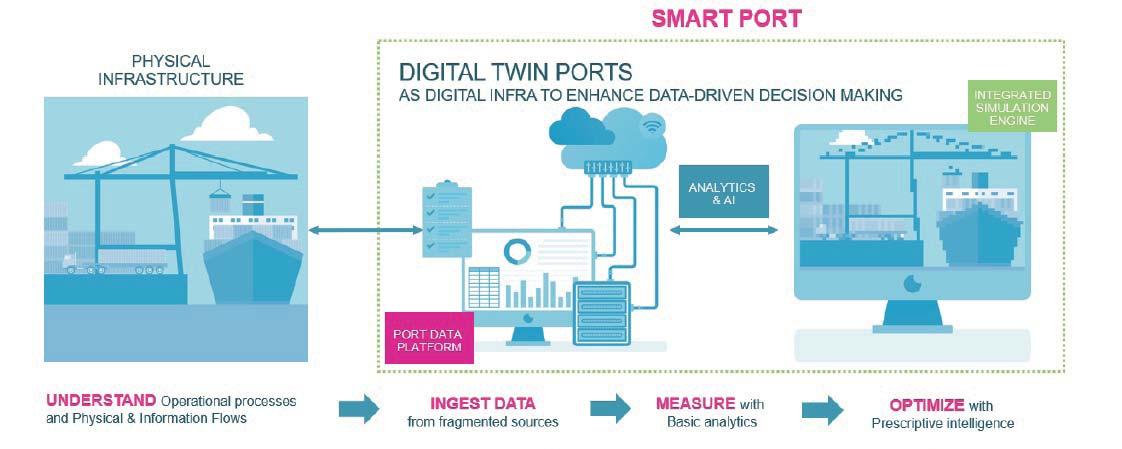

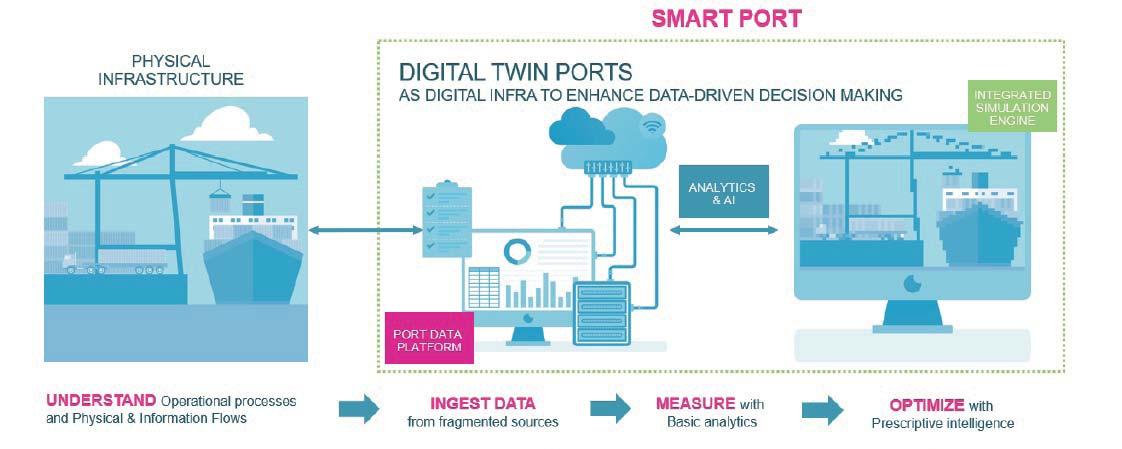

Valenciaport and Nextport have developed a pilot programme using Artificial Intelligence (AI) that aims to predict: the number of trucks that will pass through the port; which terminal will be accessed and whether the truck will be loaded or unloaded.

The new Artificial Intelligence system combines Valenciaport’s data, both landside and marinerelated, with other relevant information to understand the behaviour of a ship on arrival at the port and its impact on landside traffic flow.

The size of the ships, the type of services and routes, the terminal timetables, the weather, the calendars of festivities in third countries (the Chinese New Year, for example, has a strong influence on port traffic) or even a history of world GDP are considered to adjust this predictive machine learning model; assisted and supervised by specialists in the system.

Using this specialist software, Valenciaport states it can know days in advance what is going to happen in the Valencian docks, both in terms of loading and unloading of ships, as well as the movements that will take place at the terminal gates and the number of truck entries.

This means that when Valenciaport enters in the new system that a ship is going to arrive on a specific day, it will be able to forecast from this point in time the workload for both import and export activities.

Valenciaport points out that this predictive, AI-assisted model represents a competitive advantage for terminals and carriers operating within its

Next-Gen Westwell

Westwell has released its “Next-Gen Digital & Intelligent Port Operating Platform” and launched the new Large Language Model (LLM) product TerminalGPT for port operations. Using the LLM technology and combined with experience of large logistics scenarios, the new product can become an expert in smart port operations through continuous pre-trainings by transforming from a manual operation to an intelligent mode.

VALENCIA PORT USING AI TO PREDICT TRUCK FLOWS

8 Valenciaport is using AI technology to offer predictive solutions to landside port traffic flow

facilities as improvements in planning and managing needs and working times can be undertaken far more efficiently.

Jose García de la Guía, Senior Product Manager at Nextport (a division of US-headquartered Moffatt & Nichol) underlines:

“With this tool, which combines

Big Data technology, Digital Twin, Simulation and Artificial Intelligence, a more dynamic, real-time and prescriptive decision-making process is promoted.”

Moving forward, Valenciaport is confident that this AI software can assist beyond the port’s boundaries.

It states that the information forecast can be utilised to

improve traffic management on the roads near the port’s access points as well as internally in the port area.

As a result, by knowing the volume of trucking that is expected to be using the port’s road connections, on an hourly basis, it will be possible to warn truck and other drivers about the latest position who, if necessary, can seek alternate routes.

REPUTATION MATTERS IN COSTA RICA

The Government of Costa Rica in partnership with APM Terminals (APMT) Moin has confirmed the inauguration of two new container scanners.

The two new units have been added to one existing scanner that has been in service at the facility since 2020. The government states it is implementing this new

ImpalaID App is Go

Hamburg-based software provider, DAKOSY, has created ImpalaID, a new universal identification tool for logistics at the Port of Hamburg. It is a central Identity Provider System (IDP-System) for logistics and generates secure legitimisation through a secure QR code for users. Nicolai Port, Head of the Intermodal Transport Solutions Department, DAKOSY, notes: “Our new app fills a significant gap for authentication at barriers or gate systems in the port.”

investment in order to provide better surveillance and security to combat the typical day-to-day challenges that any port or terminal faces regarding the detection of unlawful goods and container contamination.

Ensuring that the port is more efficient, modern and safe are all key objectives of this investment. Leo Huisman,

SMITCO is Live

Tideworks Technology has confirmed that its Mainsail 10 terminal operating system (TOS) is live at Santa Marta International Terminal Company (SMITCO). SMITCO successfully upgraded from Tideworks’ legacy Mainsail solution to the advanced Mainsail 10, offering the terminal operator more flexibility through a highly configurable user experience and intelligent third-party integration capabilities

Regional Director, APM Terminals Americas, emphasises: “The inauguration of these scanners will allow our customers and international markets to see Costa Rica as a safer country and improve the country’s reputation.”

Integrated Platform

SEDNA will integrate its email management platform with OrbitMI’s maritime software products. This represents an extension of a partnership established in 2021. The primary purpose of this new unified product is to help centralise vessel data by providing a seamless flow of maritime data across the two platforms, digitally. It is already in use in the tanker industry with Stena Bulk and will now be rolled out at a wider level.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 11 DIGITAL NEWS

BRIEFS

CM Labs Simulations, has launched two new products for the port industry.

The first is an enhanced Ship-To-Shore (STS) Crane Simulator Training Pack. Taking on board feedback from a range of customers and industry experts, the Montreal, Canada-based company is offering a range of new features in this package including an enhanced graphics engine and the following:

5 Multiple STS Size application – expanded offering of cranes from Post-Panamax to MegaMax

5 Support for various delivery methods - training to move cargo to transfer vehicles or straddle carriers on the dock

5 Dual Cycle Support (load/ unload) - move cargo off and on the ship in the same exercise

5 Ship orientation (port/starboard) - choose and train for loading and unloading from port or starboard sides of the ship

5 Exercise builder capabilities - instructors can make their own load plans – choose vessel, orientation, and cycle type Devon Van de Kletersteeg, Product Manager, Ports, CM Labs explains why the update delivers a more absorbing experience for the user:

“Every port operates slightly differently. With this update to the STS, we wanted to make sure that the training addresses the operations needs of various port environments. With the enhancements, trainees will have a much deeper immersive experience and instructors will be able to more closely replicate the existing port environment. Combining the new features with

ABP Digital Drive

Major UK ports group, Associated British Ports (ABP), has launched a new company-wide initiative to digitalise asset management across its network of 21 ports. The GBP£1.5 million (US$1.8 million) investment follows a successful pilot trial of the new technology. Working in conjunction with Mainsaver and Spidex, in-depth tests confirmed the practicalities of implementing and allocating work in a digital manner.

CM LABS UPGRADES STS TRAINING PACK AND INTRODUCES MASTERCAB

system expandable to six Degrees of Freedom (DOF). This means that the MasterCab can reproduce the sensory cues experienced by operators on the real equipment, ensuring a more fluid transition from training to real operations.

Van de Kletersteeg notes:: “We are delivering on the promise to release a fully immersive simulation training experience with the MasterCab. With the MasterCab, port and terminal managers and operators can experience more effective training and skills development, and ultimately realize a faster return on their investment.”

the power of the physics-based CM Labs’ Smart Training Technology, the STS is the most accurate and realistic offering on the market today.”

The second product released is CM Labs’ MasterCab, a fullimmersion training simulator. This product is powered by what CM Labs describes as the most “realistic port equipment simulation” offering available.

MasterCab is a comprehensive training solution that develops operational skills, muscle memory, and spatial intelligence. As a result,

ZIM’s Spinframe Lead

ZIM, has confirmed the closing of an US$8 million financing round in Spinframe. Spinframe develops vehicle-inspection systems based on artificial intelligence (AI), computer vision, and machine-learning technologies, that create “Digital Twins” for vehicles throughout the supply chain, while detecting anomalies during the process. This project is a key part of ZIM’s strategy is to invest in earlystage digital supply chain companies.

it allows terminals to safely and effectively assess and train new operators, while at the same time preparing personnel for new equipment and processes.

MasterCab features 10 high-definition displays, providing full field-of-view perspective, driven by what CM Labs describes as industryleading simulation of operating conditions, machine response and the port environment.

Further aspects of the product offering that enable the trainee operator to gain a more realistic understanding include professional-grade seating, controls and pedals as well as high-fidelity audio and a motion

Russian Cyberattack

The port of Rotterdam website has been targeted in a cyberattack that is being blamed on pro-Russian supporters, according to Dutch news sources. A hacker group called “NoName057(16)” said the attacks were a response to plans by the government of the Netherlands to buy Swiss tanks for Ukraine. Amsterdam and Groningen faced distributeddenial-of-service attacks (DDoS), according to the Dutch National Cyber Security Centre.

The MasterCab provides training that is available 24/7, and runs a complete catalogue of quay-side and yard-side equipment training packs and custom simulations, thereby giving instructors real-time training data so that all sessions can be monitored and assessed

CM Labs clients include the Port of Tilbury, Flinders Adelaide Container Terminal, Indonesian Port Corporation, Napier Port, Ports of Auckland, multiple DP World sites, the Pacific Maritime Association (USA) and over 100 other companies and equipment operators.

BRIEFS

CLEVR Kongsberg

Kongsberg Maritime and CLEVR have confi rmed a new partnership. This collaboration has the primary aim of accelerating Kongsberg Maritime’s internal digital transformation journey. CLEVR, a provider of low code and software solutions, will support development of an internal tool for digital workfl ow processes to unlock new levels of operational efficiency, streamline processes, and enhance collaboration across the value chain.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 13 DIGITAL NEWS

8 CM Labs has released two new products, including MasterCab, which the company describes as a full-immersion training simulator

Vietnam Venture

Trelleborg Marine and Infrastructure, is to open a new state-of-theart manufacturing facility in Vietnam. With production to commence in 2026. This new facility will complement the company’s existing operations at its Qingdao based site, which serves the Chinese market. The new Vietnam factory is located in the Phu My 3 Specialised Industrial Park (SIP) of Ba Ria Vung Tau province, one of eight provinces in the southern key economic zones of Vietnam.

Zero Emissions Tug

A new consortium of UK shipbuilder Harland & Wolff, Macduff Ship Designers, Kongsberg Maritime and Echandia, are aiming to develop and build a zero emissions harbour and coastal tug. The unit will be 25.5m in length and have a bollard pull of 50 tonnes, with electric propulsion gained from stored battery power for day-to-day operations. The tug’s engine is also backed up by generators driven by biofuel when shore charging support is unavailable.

Felixstowe Order

The UK Port of Felixstowe has placed a new order for 100 batterypowered autonomous trucks, in a deal with Shanghai Westwell Technology. Felixstowe owner, Hutchison Ports, introduced the same Q-Trucks model at its Terminal D facility in Laem Chabang, Thailand in 2020. The port has also taken delivery of six new semi-automated remote-controlled electric rubber-tired gantry cranes (RCeRTGs) from Konecranes of Finland, the first part of an order for 17 new cranes.

NEW DOUBLE-STACK VEHICLE TRIALS IN BRISBANE…

Working under stringent operating and safety conditions, the new Super B Double Stacked vehicle, which was designed by specialist The Drake Group, carried eight empty containers on a pre-defined route that covered both Qube’s port area and some public port roads. The ability to double-stack containers is fully compliant with load restraint requirements in Australia

Qube said that this activity was the first time any double stacked container vehicle had been tested on any public roads in Australia. The Drake Group simultaneously launched the 32m Super B-double trailer at the Brisbane Truck Show in June 2023.

Neil Stephens, CEO, PBPL (Port of Brisbane) offered congratulations on the trial being completed successfully, while highlighting the importance of the process: “This is a fantastic outcome for Qube and all parties involved…. as Port Manager one of our key priorities is investing in infrastructure to support supply chain efficiency.”

Stephens stressed that this test represented a clear demonstration of the potential for enhancements in operational efficiency in Brisbane, based on collaboration and innovation being achieved by Qube Logistics customers and partners, which include PBPL. “We were pleased to deliver road improvement works and upgrade the access/ egress to a number of facilities to support this new vehicle and Qube’s innovation,” he added.

Sam Drake, Director, The Drake Group, endorsed these comments: “We’ve worked with the customer, the Port of Brisbane, the National Heavy Vehicle Regulator (NHVR) and other relevant authorities to come up with an approved Double Stack Container Super B-double Skel trailer combination that can be operated on the port precinct,” he said. “The purpose is to shift as many empty containers as possible in the most efficient way on the port precinct. So, we’re hoping that it’s something people see as a viable solution and get excited.”

…AS AARHUS TRIALS AUTOMATED ‘BLUE BOT’ STRADS

APM Terminals (APMT) Aarhus has received two further automated straddle carriers from Shanghai Zhenhua Heavy Industries Co. Ltd. (ZPMC).

These latest two carriers will complement a first prototype that has been tested at a real-world operating terminal since the start of 2022.

The automated straddle carriers are known as “Blue Bots” and ZPMC confirms that they have been specifically built for APM Terminals Aarhus. APMT states that the straddles are

equipped with hybrid diesel generators and lithium battery to meet the demand for intelligent environmental protection.

A range of tests has been conducted with the first straddle carrier, including navigating in the reefer area and picking and placing containers to and from a test quay crane lane.

APMT notes that the first “Blue Bot” has successfully completed more than 6000 lifts and navigated 800km in a testing area.

Mikael Gutman, Nordic Managing Director, APMT,

elaborates: “We are proud to be part of the development of these highly-advanced GPS operated automated straddle carriers. We have been testing the first straddle carrier in a small, enclosed area which has provided valuable learnings and insights for the development of the next models. With the new Blue Bots, we are now ready to expand our test area to 65,000 square metres in order to further analyse and optimise the technology to fit our operations and enhance safety.”

EQUIPMENT NEWS

A new double stacked container vehicle has been tested at the Port of Brisbane, Australia, by logistics specialist, Qube Logistics.

BRIEFS

14 | JULY/AUGUST 2023 For the latest news and analysis go to www.portstrategy.com

8 Qube Logistics, in conjunction with vehicle designer, The Drake Group, has successfully trialled its new Super B Double Stacked vehicle at the Port of Brisbane, the first time such a vehicle has been tested in Australia

8 The Port of Seattle has acquired a third shore power system for its Pier 66, claiming this makes it the world’s first port with three systems for cruise ships. The Port of Seattle will use Watts Marine’s innovative, cost-effective Mobile Cable Positioning Device (CPD), which facilitates shore power connections by moving the cabling strategically to the ideal location. The mobile design simplifies moving the system to accommodate docked vessels of all sizes and configurations, making shore power available almost immediately. The new shore power connection is expected to be fully operational by the 2024 Alaska cruise season. The port serves a large and fast-growing cruise market, with more than 200 vessels in a typical season between April and October.

HYSTER® TO USE ROCSYS

Autonomous Yard Trucks in Rotterdam

Autonomous yard trucks are to be used across multiple locations in the Port of Rotterdam, as a result of a new partnership.

Kramer Group, a major Rotterdam depot and container terminal operator and StreetDrone, a leading provider of autonomous yard truck technology, and Terberg, Europe’s largest manufacturer of yard trucks, have joined forces on the project.

Over the course of the next two years, the programme will see the introduction of six autonomous yard trucks. First delivery will be by the end of 2023 to the Kramer City Terminal, followed by supporting the Maasvlakte Container Exchange Route in 2024.

Zero-emission Hyster Terminal

Tractors are planning to use the ROC-1 autonomous charging system developed by Rocsys. This new deal means that by using the robotic ROC-1 solution, parked machines can be both plugged in and charged automatically, while taking advantage of the system’s ability

Virtual MIT

Manzanillo International Terminal (MIT), Panama is introducing a new virtual training tool for its terminal yard tractor drivers from Tideworks. The DriverSIM solution incorporates virtual reality technology in order to provide terminal operatives with simulated activities as part of the equipment training process. Tideworks highlights that moving training to a virtual environment can reduce training costs by 50 per cent.

to work with any type of charger, notably a standard CCS (Common Charging System) inlet.

Crijn Bouman, CEO and Co-founder of Rocsys, explains: “Rocsys is thrilled to introduce the first autonomous charger for Hyster. By harnessing cuttingedge soft robotics, AI technology, and continuous data-driven

ABB & HHLA Project

ABB Ltd and Hamburger terminal operator Hafen und Logistik AG (HHLA) have announced a new partnership with the aim of increasing efficiency in the longterm operation of big, automated stacking crane (ASC) systems. The two companies report that the deal, due to run until the end of 2025, is seeking to unlock potential for further development of systems for ASCs as well as their use, maintenance, and servicing, through exploiting their combined knowledge.

monitoring, we offer a reliable and secure charging solution. The high power requirements of electric vehicles can result in heavy and inflexible charging cables, which may be challenging to handle. Our innovative system eliminates this issue, helping to support safety and efficiency without compromising performance.”

As well as being an option for selected Hyster equipment, the ROC-1 autonomous charging system will also be implemented at the Hyster test centre in Weeze, Germany. Rocsys will use the Hyster site to carry out autonomous charging demos.

Shore Investment

The Ministry of Infrastructure in the Netherlands is allocating €140 million (US$150 million) to boost shore power plants at ports, with a further €40 million (US$43 million) being added from its climate fund. By 2030, European ports will be required to supply ships over 5000 gross tonnes with shore power under the Alternative Fuels Infrastructure Regulation (AFIR). Ports involved include: Amsterdam, North Sea Port and Rotterdam.

The partners in the venture expect the new technology of StreetDrone’s autonomous driving and remote teleoperation solutions to help Kramer’s workforce to move containers with heightened precision, efficiency, and safety, while using Terberg’s high-end autonomous vehicle platform.

Kramer Group is a major depot and container terminal service provider, with key locations in Waalhaven and at the Maasvlakte, managing 900,000 container movements annually. UK-based StreetDrone offers connected autonomous yard truck fleets, fleet management and automotive control systems.

BRIEFS

Electric Dreams

The marine unit of Volvo, Volvo Penta, and Italian heavy equipment manufacturer Fantuzzi Team Material Handling (FTMH) are collaborating on the development of electric forklifts. The two companies are targeting a range of e-forklifts up to 52 tonnes, with the first model to be electrified being the 26-tonne capacity FTF 2612, which currently uses a Volvo Penta D8 engine. FTMH has been using Volvo Penta diesel engines for the past 10 years.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 15 EQUIPMENT NEWS

8 The robotic ROC-1 solution from Rocsys means parked Hyster units can be both plugged in and charged automatically, while taking advantage of the system’s ability to work with any type of charger

RTE rte-usa.com Reefer Monitoring for Terminals Discover what 80+ locations worldwide already have. Refrigerated Transport Electronics | New York - Panama | Since 1981 IT’S YOUR MOVE. www.tideworks.com +1.206.382.4470

BUSY TIME FOR KALMAR AND LIEBHERR

BRIEFS

Autonomous Estonia

HHLA TK Estonia, a subsidiary of Hamburger Hafen und Logistik AG (HHLA), and Munichbased FERNRIDE have successfully completed their phase one jointventure relating to development of selfdriving vehicles. FERNRIDE had equipped a yard truck with sensors and cameras to transport containers between the quayside and the yard via remote control at the terminal in Estonia. Phase two will see autonomous driving incorporated into operational procedures.

A round-up of recent activities from major equipment manufacturers and suppliers, Kalmar (part of Cargotec) and Liebherr Container Cranes Ltd, outlines a range of deliveries and orders across different ports and geographic locations.

The following is a summary of key Kalmar activities:

5 Supply of the world’s first all-electric fleet of straddle carriers for operation at the new fourth berth at DP World’s London Gateway Terminal. Order value GBP12m.

5 A deal to supply 15 medium electric forklifts to BJB Lift Trucks Ltd (BJB), a UK material handling equipment provider. The order was booked in Q2 2023, with delivery scheduled for Q4 2023. With its headquarters in Grimsby, BJB supports a UK-wide customer base and already has a fleet of 36 diesel-powered Kalmar trucks of this size.

Ian Roden, Director, BJB explains: “Electrically powered forklift trucks are becoming increasingly popular as a way to reduce emissions and fuel costs across a wide range of material-handling applications. Kalmar is a trusted partner for BJB and its medium electric forklift truck is a state-of-theart solution.”

5 Another larger order that involves supplying 13 forklift

trucks to a leading Italian logistics and equipment rental service provider. The deal was recorded in Q2 2023.

Although the ordering company has not been named, Kalmar said it is a “long-term partner of Kalmar and one of its longest-standing customers in Italy, already operating a fleet of Kalmar forklifts of varying models.”

5 Confirmed delivery of its first fully electric reachstacker to long-standing partner, Cabooter Group. The announcement follows a six-month testing phase at the Cabooter Group’s Greenport Venlo intermodal terminal, located in the southeast of the Netherlands.

Cabooter Group is already utilising five Kalmar Eco reachstackers at its Venlo and also Kaldenkirchen terminal in Germany, as part of a desire to lower fuel costs and ensure reduced emissions.

LIEBHERR INNOVATION

Liebherr confirms several recent notable developments:

5 A new cabinless ship-to-shore container crane at Patrick Terminals – Brisbane AutoStrad, Australia. The unit utilises Liebherr’s Remote Operator Station (ROS) for pick and place over the vessel and allows the same level of crane control as an on-board operator but from

an office-based environment

This new semi-automated crane is the first of its type for use by Patrick Terminals, as well as one of the first cabinless Liebherr ship to shore container cranes to enter service globally.

Brisbane Autostrad already has two Liebherr ship to shore container cranes, with the unit supplied in 2015 recently undergoing a lift height and outreach extension using Liebherr’s transform technology so as to now offer an outreach of 54m.

5 Three big dual trolley ship-toshore container cranes to Hamburger Hafen und Logistik AG (HHLA), for the Container Terminal Altenwerder (CTA) facility at the Port of Hamburg, Germany. These units have a safe working load of 75 tonnes twin lift, at an outreach of 61m. The cabinless cranes operate via automation and remote control, which includes the Liebherr Remote Operator Station (ROS), for pick and place on the vessel. The use of two trolleys operating on a single crane ensures a mix of operational flexibility and increased efficiencies.

Konecranes Win

A public tender from Copenhagen Malmö Port (CMP) to supply container handling equipment for a new container terminal in Copenhagen has been won by Konecranes. As a result, eight hybrid straddle carriers will be delivered in Q4 2023, and two Ship-To-Shore (STS) cranes are scheduled for delivery in Q1 2025. The existing container terminal in Copenhagen is being moved to a new location in Ydre Nordhavn, with completion due in 2025.

HIT Solar Power

Hongkong International Terminals (HIT), operated by Hutchison Ports has received two new quay cranes, the first in the port featuring 84 solar panels on top of the machinery house. HIT explains the HK$78 million (US$10 million) investment:

“Energy collected will be used to power auxiliary systems including air conditioning and lighting systems in the quay cranes. With estimated three hours of exposure to sunlight every day, the photovoltaic system on quay cranes will be able to generate roughly 42,000Wh of energy with a 98.75% system efficiency.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 17 EQUIPMENT NEWS

8 Kalmar has delivered its first fully electric reachstacker to longstanding partner, Cabooter Group, after a six-month testing phase at the Cabooter Group’s Greenport Venlo intermodal terminal

WATCH ALL THE REEFERS, ALL OF THE TIME, WITHOUT TAKING A STEP

With visibility comes insight – a proven solution for true reefer container management. MTBS

STRATEGY

Port Policy

Port Sector Reform

Value & Business Strategy

Public Private Partnerships

(National) Port Master planning

Institutional & Regulatory Change

Organisational Reform & Alignment

VALUATION

Feasibility

Business Case

Value Creation & Protection

Financial Modelling & Analysis

Project Structuring & Packaging

Risk Valuation, Allocation, Mitigation

TRANSACTION

Financial Solutions

Transaction Strategy

Transaction Management

Documentation & Contracts

Tendering & Negotiated Solutions

FINANCE

Due Diligence

Project Financing

Financial Structuring

Procurement of Finances

Investment/Divestment

Merger & Acquisition

value in the maritime

is the leading Unlocking

& transport industry MTBS.NL

BARRY PARKER

LINKING UP THE DATA SILOS

As readers are viewing this, the International Maritime Organization (IMO) meeting regarding the future path of shipping’s decarbonisation will have already occurred. The digitalisation sector, goes hand in hand with this objective; perhaps coincidently, but probably not - there has been an absolute explosion of data providers hoping to offer the shipping business (vessel owners, cargo interests, and everyone in between) products/ apps/platforms (take your pick!) to help “optimise”.

As I listened to a sudden burst of webinars just prior to the full -blown summer season, it occurs to me that something is missing from these vast “data lakes” (buzzwords loom large in the world of the shipping optimisers) meant to fine-tune vessel voyages. The missing element is data from the ports.

Some of the larger ports have trumpeted their databases, available to online viewers, of

things like vessel arrivals, number of vessels waiting, and the like. Yet these are all discrete systems; they don’t hook up to optimisation systems aimed at the shipping companies (who could reduce their carbon emissions if the ships did not “hurry up and wait” because berths are not ready.)

There are no real common standards for such systems, so a few of the ports have developed APIs (application programming interfaces, yes) which can make

PETER DE LANGEN THEANALYST

The government of the city state of Hamburg recently published Hamburg’s port vision until 2040. The vision clearly describes the changing environment and discusses the initiatives to succeed in this new environment, with a strong focus on sustainability and digitalisation. This approach clearly is the ‘new normal’ in the ports industry. The following five observations are especially noteworthy.

First, while other ports have also indicated that they are shifting away from a ‘volume focus’, in which the tons handled are central to a port’s success, Hamburg probably does so in the most explicit way. Most news items the German and international press published at the launch of the vision focus on

found that the beauty of APIs is that the industry need not adhere to a precise set of data architecture, but they do need to make certain bits of logistical data (I am thinking berth availability and scheduling) available via the interfaces that will then feed disparate systems. For the management of the ports, it’s important for them to make their carrier and terminal customers, along with their in-house number crunchers and data boffins, clearly aware of the broader purpose of opening up this type of data to other applications.

data available to developers of voyage optimizer apps. Indeed, the data can also be viewed, and input into programming efforts on the cargo side, as well.

The exact nuts and bolts of how to write the code for a port’s data availability are beyond my low-tech grasp. However, I’ve

A welcome development would be for organisers of conferences directed at the port sector, to check out what the optimisers are saying when they are speaking at conferences (or, these days, webinars) directed at ship operators. The port side and the vessel side (including vendors of products that pull together data from multiple sources) ought to be talking to each other.

HAMBURG PUTS SUSTAINABILITY AND DIGITALISATION TO THE FORE

this point. The vision document does not present scenarios for the evolution of volumes or an assessment of additional capacity needs. Mostly implicitly, the vision suggests Hamburg can cater for eventual growth of demand for cargo handling through improving the productivity of existing facilities and assets.

Second, the vision emphasises Hamburg’s strength and growth potential as a port industriallogistics ecosystem, with opportunities for attracting new activities in energy production, circular manufacturing and maritime technology. The vision also suggests that the port authority (HPA) aims to take new steps in ‘designing’ this

ecosystem, for instance through maximising the use of rail and barge by companies located in the port and by promoting intensive land use.

Third, the vision shows Hamburg aims to benefit from growth opportunities in the cruise segment. This contrasts with other attractive port-cities like Amsterdam, Valencia and Barcelona, that explicitly or implicitly take an approach focused on improving the sustainability (in the ecological as well as social perspective) rather than the growth of cruise tourism.

Fourth -though this was not a recent decision- the ‘Hafencity’ redevelopment of older port areas will cross the river Elbe with

the development of the Grasbrook Neighborhood. As initially with the development of Hafencity, sceptics may rightly point out the increasing pressure this puts on the adjacent port activities, but this redevelopment undoubtedly creates value for residents and visitors alike.

Fifth, perhaps the best way to understand how we look at the future is through looking at past vision documents. In 2012 Hamburg published its plan for 2025. Then, it handled more than 130 million tons (compared to 120 in 2022) and forecast a volume of 296 million ton in 2025. Even without volume growth Hamburg remained a thriving port industrial-logistics ecosystem.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 19

THENEWYORKER

8 The better interchange of data between ports and shipping lines can assist in meeting decarbonisation challenges

Green Ports and Shipping Congress will identify and prioritise the areas that ports-based organisations and shipping companies need to collaborate on to reduce emissions.

Green Ports & Shipping Congress will cover a range of topics addressing the aspects of energy transition plans and

operations and ships.

Sessions and streams will focus on the required infrastructure, alternative fuel options/bunkering, technical solutions and how these align with the shipping lines and logistics chains.

It is a must-attend event for policy makers, ports and terminal operators, shipping companies, shippers and logistics companies, fuel & propulsion providers, decarbonisation clusters.

Media partners: PORTSTRATEGY INSIGHTFOR PORTEXECUTIVES GREENPORT INSIGHTFOR PORTEXECUTIVES MOTORSHIP MARINETECHNOLOGY THE Visit www.greenseascongress.com Supporters:

For further information about speaking, sponsoring or attending as a delegate,

the Events

Register your interest now!

contact

team on +44 1329 825335

HACKETT

NO CAUSE FOR OPTIMISM

The lights are off on economic growth as the volume of trade continues to decline, we should not be overly optimistic about the 3rd quarter.

The world’s major economies are struggling to keep out of recession, according to the technical definition of two quarters of GDP decline. The U.S. has managed to avoid officially being designated as in recession, as has the struggling UK, but only just. The once mighty German economy is technically in a very mild recession which is causing much debate about how to bring the economy back to its once consistently strong growth. China also has issues with economic growth below five per cent.

Taking the old GDP measure as an indicator of the economy today has little to guide us in the near-term future and maybe not even over the longer term as economists are beginning to tell

us. I have always been critical of using GDP growth as a means of looking forward for 12 months. What we are seeing in the figures published by various countries’ economic institutions is that there is hardly a twinkle of growth underlying economic activity as consumers struggle with high inflation in foodstuffs and services leaving little room for expenditure on the nice things to have, consumer goods.

MIKE MUNDY THE

STRATEGIST

As we look at the volume of import trade on the three big head-haul routes it is very clear that there is a problem with growth. There isn’t any! It is virtually all negative except for the odd hiccup such as the Panama Canal water crisis which

is causing cargo to be off-loaded on the U.S. West Coast instead of on the East Coast. This is a leading indicator of bad things to come as retailers are still trying to get rid of high inventories of unwanted goods.

Carriers continue to introduce new capacity, particularly the larger vessel sizes over 20,000 TEU capacity, adding to their headaches of sharply declining revenue as freight rates have collapsed in line with declining import demand in North America and Europe.

Freight rates across the major trading lanes have continued their downward trend. Most carriers have managed to avoid losses, but the pressure is on to hold on to the little positive that is left. Ports and terminals are also feeling the pinch as a result.

Perhaps if you are on vacation, extend the time away!

Just before PS was about to go to press, I was sitting in the basement coffee shop of Waterstones bookshop in Piccadilly, London, chatting with a colleague/friend and among the various topics we covered was the remarkable lack of infrastructure and systems under development to support the global shipping industry’s greater use of low carbon fuels. Was there a spy in the sky, who was listening?

Well, it seems a number of countries – specifically Canada, Norway, Panama, Uruguay and the United Arab Emirates (UAE) –plus the International Chamber of Shipping (ICS) and the International Association of Ports & Harbors (IAPH), who, hot on the heels of this discussion, on the 20

CLEAN ENERGY MARINE HUBS INITIATIVE LAUNCHED

July, launched the Clean Energy Maritime Hubs Initiative (CEMHubs). Announced in Goa, India CEM-Hubs aims to bring together the private sector and governments across the energy-maritime value chain “to transform maritime transportation and production hubs for future low-carbon fuels.”

The founding partners in the initiative emphasise: “The energy maritime value chain is far from ready to transport the influx of low-carbon fuels that are expected between now and 2050. To accommodate demand,” they elaborate, “the shipping industry is expected to transport at least 50 per cent of all traded low carbon fuels by 2050, according

to the International Renewable Energy Agency (IRENA). But the production centres, vessels and port infrastructure required to accommodate expected demand do not currently exist at commercial scale.”

Further underlining the size of the challenge, they point out that to-date, “only one ship in the whole global fleet has been piloted to transport liquefied hydrogen – travelling from Australia to Japan.” And that: “For hydrogen derivatives such as ammonia and other low-carbon fuels moved by ships, the scale is far from what heavy industries, transport and other sectors would require. To support the global transition to

net-zero targets, shipping is expected to transport between two and up to five times the low carbon fuels it will consume by 2050.”

The initiative is clearly a much needed one with it adopted less than a year after it was first presented, in an unprecedented move by the Clean Energy Ministerial (CEM). This again underlines the immense scale of the problem and urgency to establish solutions.

Well done all those involved –let’s get cracking!

It is not just an area that must be addressed but also as Patrick Verhoeven, Managing Director, IAPH, points out, a significant area of business opportunity.

For the latest news and analysis go to www.portstrategy.com JULY/AUGUST 2023 | 21

BEN

THEECONOMIST

8 Typifying today’s difficult market – Cosco Shipping anticipates a 74 per cent fall in earnings with bargain basement container rates in-play

OCT 2023 Lisbon Portugal

Port of Lisbon, Lisbon • Portugal

Host Port:

Conference Programme

Balancing environmental challenges with economic demands

Sponsored by:

Supported by:

Balancing Environmental Considerations with Economic Demands. The world’s leading conference on sustainable environmental practice comes to Lisbon.

Join us for two days of conference presentations and learn from the foremost experts in environmental technologies

visit: greenport.com/congress contact: +44 1329 825335 email: congress@greenport.com

Media Partners:

#GPCongress

Tuesday 17th October 2023

Welcome Reception - Hosted by the Port of Lisbon

DAY ONE - Wednesday 18 October 2023

08:30 Coffee and registration

09:30 Opening by Chairman/Moderator

Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC, and Visiting Research Fellow, Cardiff University, UK

09:40 Welcome Address by Port of Lisbon

Keynote Panel

10:00 Climate Change: Energy efficiency, GHG emissions reduction & adaptation

-11:10 The risks to Ports, Shipping & the Logistics from climate change are increasing. This panel will discuss options available to combat these risks hearing from ports, shippers, and companies across the maritime industry. Confirmed panellists include Isabelle Ryckbost, Secretary General , ESPO; Nicolette van der Jagt, Director General, CLECAT; Isabel Moura Ramos, Executive Board Member, Port of Lisbon Authority

11:10 Coffee & Networking

11:30 Going Green: How can a Cruise Terminal be more sustainable

Duarte Morais Cabral, General Manager, Lisbon Cruise Port

11:45 Opportunities, Risks & Threats regarding “Cold Ironing” in Ports - “The case of Heraklion Port”

Minas Papadakis, CEO, Heraklion Port Authority

Cold ironing is the major way that ports can contribute to reducing shipping’s emissions. The administration of Heraklion Port has set the green transition as our top priority. The European program the “Electriport” was the result of our efforts towards a greener and sustainable port.

12:00

Shore-to-Ship Connection at Cruises and Cargo Terminals of the Lisbon Port

Armando Santos, Global Partner - Client Manager - Energy and Industry, Quadrante

11:30 The Port of Helsinki - A carbon-neutral port Andreas Slotte, Head of Sustainable Development, Port of Helsinki

11.45 Miguel Matias, CEO, KEME Energy, Lda

12.00 Carbon Capture in the green transitionPorts as the entry to make CCUS/CCS & transport feasible

Ralph Guldberg Bjørndal, Senior Chief Project Manager, Ports, Marine & Coastal, Ramboll Ramboll is conducting a pre-feasibility study, outlining how carbon capture facilities can be implemented, and how port facilities shall be established to support the shipping of CO2 to the final storage destination. Various shipping options are considered, together with an assessment of how the expected CO2 Hub system might evolve.

12:15

Transforming Cruise Infrastructure: Global Ports Holding’s Expansion while Developing Future-Ready CruisePorts

Stephen Xuereb, COO, Global Ports Holding

Discover Global Ports Holding’s (GPH) remarkable expansion in transforming cruise infrastructure and its commitment to developing future-ready ports. With a global network of 27 ports across 14 countries, GPH brings together years of experience, operational expertise, and collaboration to revolutionize the cruise industry. Join this session to gain valuable insights into GPH’s expansion and its strategies for developing future-ready cruise ports in shaping the cruise infrastructure of tomorrow.

12:30

Question & Answer Session

12:30

Question & Answer Session

12:45 Lunch & Networking

Session 1.1: Cruise Infrastructure Development

Session 1.2: Carbon Neutral Ports

Book Online at https://www.portstrategy.com/greenport-cruise-and-congress or fax form to +44 1329 550192 For further information please call +44 1329 825335 or email congress@greenport.com

Shore Power

14:10 Port of Toulon - utilizing energy storage

Luca Imperiali di Francavilla, Global Product Manager, ABB

The use of renewable energy sources at ports supports the Shore Connection when ships are connecting to it. We believe different shore connection applications will ultimately play a big role in decarbonizing the marine and ports industries. ABB will present to the audience a case example of Port of Toulon, one of ABB’s project deliveries, which is utilizing energy storage as part of shore connection.

14:25 What kind of options do ports have in their carbon neutrality journey?

Laurent Dupuis, VP Global Product Manager

Ports & Maritime, Cavotec

In this presentation, Cavotec will compare the emissions reduction potential of different solutions for several ports and terminal types (cruise, ferries, container) to shed some light on how ports can create the best journey towards carbon neutrality.

14:40 Reliability and availability return of experience, from years of power conversion in Vessel Electrical Conversion systems, and Oil and Gas systems.

Alex Lagarde. Conversion’s Energy Conversion Expert & Business Development Manager, GE Vernova

This presentation will explore reliability aspects of large power converter (range between 5MVA and 20MVA), based on more than 30 years of return of experience on critical electrical systems.

14:55 OPS and the strategic challenges for a port authority, the case of the sea cruise in Port of Amsterdam

Jan Egbertsen, Manager Innovation, Port of Amsterdam

OPS is in the clean shipping strategy of Port of Amsterdam one of the three pillars. The other pillars are the development of clean fuels in the shipping industry ad IT. Port of Amsterdam has already invested in OPS for barges and river cruises in the city area and is now building an OPS installation for the sea cruise terminal of Amsterdam. The development of OPS in a port asks for a close cooperation between the relevant terminals and the port authority.

15:10 Questions & Answers

15:30 Coffee & Networking

2.2 – Infrastructure Development for Ports

14:10 Bruno Vale, General Manager, YILPORT LISCONT

14:25 Energy Recovery & Storage for Ports –Where Energy Supply Meets Demand

Justin Hollingsworth, Business Development Manager, TMEIC

Energy storage systems (ESS) are a great asset when transitioning to renewable energy sources, and they also play a role in strengthening and managing demand on a local grid. This presentation will consider the benefits of ESS within a port and the use cases of distributed energy recovery and centralized energy storage.

14:40 H2PORTS Project: A First Operational Experience Using Hydrogen Powered Machinery at A Port Terminal

Aurelio Lazaro, R&D Engineer, Environmental Sustainability and Energy Transition, Fundación Valenciaport

This work will present the outcomes of the project that will include not only the feedback from this real operation experience but also the lessons learned during it development phase and the analysis of crosscutting aspects of the project such as legislation, replicability, market uptake and human awareness related with the use of hydrogen at ports.

14:55 Decarbonising terminal operations: Reaching a tipping point in battery-electric container handling equipment

Sahar Rashidbeigi, Head of Decarbonisation, APM Terminals

The global shipping industry needs to decarbonise container handling equipment (CHE) to meet emission reduction targets, address demand from customers, and deliver social benefits. Battery-electric CHE is the preferred option, but is still an early-stage market and needs action to reach a tipping point on affordability, attractiveness, and accessibility. This presentation will share which actions are needed for large-scale roll-out of decarbonised CHE.

15:10 - Question & Answers

Session 2.1

–

Session

Book Online at https://www.portstrategy.com/greenport-cruise-and-congress or fax form to +44 1329 550192 For further information please call +44 1329 825335 or email congress@greenport.com

Session

3.1 Port Endeavour Session 3.2 ESG - Environmental, Social and Corporate Governance Workshop

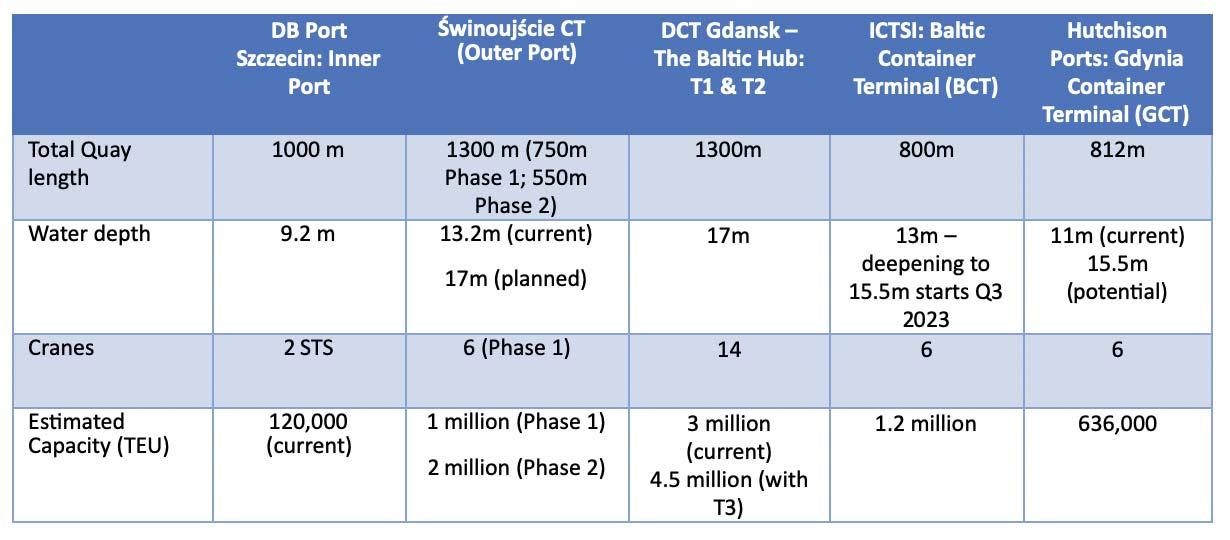

15:50 Faciliator: Antonis Michail, Technical Director, International Association of Ports and Harbors (IAPH)