S E ASIA BOX PORT

RANKING & TERMINALS

GLOBAL CONTAINER PROSPECTS

PORT MASTER CONCESSIONS

SIMULATION: REPRODUCING REALITY

JUNE 2023 VOL 1023 ISSUE 5 portstrategy.com Coastlink Conference Review | Pacific North Plans | STS Remote Control | Era of the eRTG

VIEWPOINT

MIKE MUNDY

Growth Prospects –Technical Advances –See PS on Stand J42 at TOC

Drewry Maritime Research has provided an updated perspective on Southeast Asia containerport and terminal performance in 2022. The terminal focus is new and serves to provide a wider view of one of the world’s most dynamic container environments. Further, both the port and terminal data are looked at in the context of a/ all traffic and b/ traffic excluding transshipment and domestic container movements. Breaking down the data in this way will undoubtedly prove of service to port planners and a competitive reference point when the various ports and terminals compare themselves to their peers, not just in the context of total volume but also the annual increase in volume, where the port of Manila has excelled in 2022 – p21.

Global container market prospects are assessed going forward in the article Brace for a Rough Ride - p25. Written by analyst Andrew Penfold, the article, as the title suggests, sees ongoing problems in the shipping market which will have negative consequences for ports and terminals. The nub of the problem foreseen is a collapse in shipping line revenues in turn generating problems regarding investment at the port and terminal level, notably to facilitate the entrance into service of a greater number of Ultra Large Container Vessels as well as the cascading down of higher capacity vessels into secondary trade lanes. The possibility of a greater emphasis on the use of line-owned terminals is also raised – p25.

This edition also sees the discussion Port Strategy has been pioneering on Port Master Concessions extended. As the title suggests, Frameworks for Analysis, the article, authored by Neil Davidson and Erik Wehl of the WAPPP Port Chapter, provides two simple frameworks that can help evaluate a Port Master Concession opportunity – p29.

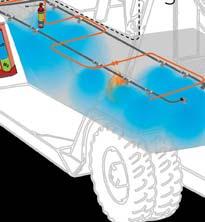

The technical content of this issue is additionally worthy of note. The technology behind the remote operation of ship-to-shore container cranes is examined in-depth along with recent market activity – p45. We also take a look at simulation systems for cargo handling where there are a number of notable advances – the roll out of systems for training operators on a wider range of cargo handling plant, the adoption of virtual reality and simulation training for new cargo types such as wind turbines in tandem lift mode – p51. The latest developments with eRTGs are similarly examined -p55.

If you are attending the Terminal Operations Conference in Amsterdam then please come and see us on Stand J42 in the Exhibition area.

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: AndrewPenfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s print subscription £295.00

1 year’s digital subscription with online access £228.50

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

©Mercator Media Limited 2023. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 3

Port Strategy will be at the Terminal Operations Conference – Stand J42, do take the opportunity to come and see us – old friends and colleagues and new, do drop by. Mike Mundy, PS’s Editorial Director, will be in attendance so if you have news then please take the opportunity to relay it. Look forward to seeing you! If your not attending, then don’t worry there is plenty of food for thought in this issue spanning news, views, market sector analysis, technical advances and more

PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 5 Weekly E-News Sign up for FREEat: www.portstrategy.com/enews CONTENTS JUNE 2023 is a proud support of Greenport and GreenPort Congress GreenPort magazine is a business information resource on how best to meet the environmental and CSR demands in marine ports and terminals. Sign up at greenport.com The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operational environmental challenges. Stay in touch at greenport.com Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Social Media links LinkedIn PortStrategy portstrategy YouTube On the cover The growth in vessel size and the need to provide a solution which maintains cargo handling efficiency was the driver behind Siemens’ development of its Simocrane Remote Control Operation System (RCOS). Siemens released an updated version - Remote Control Solution Version 6.1 – at the end of last month which includes diverse new features. NEWS FEATURE ARTICLES REGULARS 18 The New Yorker Jones Act, Infrastructure Links? 18 The Analyst World Bank Performance Index 19 The Economist The Elusive Recession 19 The Strategist Two Reports not to be Missed 21 S E Asia Box Port Ranking Not just ports but also a terminal ranking – who are the winners and losers? 25 Brace for a Rough Ride Container Market Prospects 29 Port Master Concessions Assessing an Opportunity 32 The ‘New Normal’ Coastlink Conference Review 37 Russia’s Dredge Capacity Ambitious Newbuilding Programme 38 Who is Making Hay? Pacific North Plans 41 MPV Demand & Supply Prospects Assessed 45 Geing More Remote STS Remote Control Activity 51 Reproducing Reality Simulation Options Build 55 Era of the eRTG Widening Appeal 58 ESG Goals Assessed New Thinking 61 Digital Twin & 5G in Hungary Driving Intermodal Eiciency 66 Postscript Boxes for car transport JUNE 2023 VOL1023ISSUEportstrategy.com CoastlinkConferenceReviewPacificNorthPlansSTSRemoteControlEraoftheeRTG GLOBAL CONTAINER PROSPECTS S E ASIA BOX PORT RANKING & TERMINALS PORT MASTER CONCESSIONS SIMULATION: REPRODUCING REALITY 17 Controversy Building? Time for a rethink in Tanzania 17 New Green Corridor Singapore-San Pedro Link 19 Roberts Bank 2 Finally Approved 19 Malta freeport Expansion Agreed 10 New Development Approach Bagamoyo Moves Again 10 Cambodia Box Terminal Construction Commences 13 Cross Channel Corridor Preparations Commence 13 Shared Data Deal California’s Ports Link-Up 15 VPA North Berth Konecranes Ramp-Up 15 Valencia Hydrogen Power Ro-ro Tractor Trials 17 NASH Scopes Out VTS Port of London Upgrade 17 New RTGs in Panama PSA Terminal Equipment

MOVING MORE

SANY PORT MACHINERY –FIRST-CLASS PERFORMANCE, EFFICIENCY AND DURABILITY

+ More than 5,000 port machines sold in 13 years

+ Innovative manufacturing processes incorporating trusted European components

+ Continuous development of alternative drive systems to reduce fuel consumption

+ Intuitive and comfortable to operate, enhanced concentration for more safety

REACH STACKER FUEL-SAVING AND STABLE

MATERIAL HANDLER STRONG AND EFFICIENT

HEAVY-DUTY FORKLIFT ROBUST AND DURABLE

EMPTY CONTAINER HANDLER FAST AND COMFORTABLE HARBOUR CRANE CUSTOMISED AND AUTOMATIC

PORT MACHINERY FROM SANY www.sanyeurope.com

VISIT US AT TOC EUROPE ROTTERDAM AHOY STAND F12 13. - 15.06. 2023

TPA TIME FOR A RETHINK ON DAR CONCESSION?

Singapore-San Pedro Green Corridor

The San Pedro ports of Los Angeles and Long Beach and Maritime and Port Authority of Singapore (MPA) are establishing a green and digital shipping corridor between the US West Coast and Singapore.

The Tanzania Port Authority (TPA) has stated repeatedly that it wants a terminal operator that can deliver an improved performance compared to its previous experience at its Tanzania International Container Terminal (TICTS), but the question is will it get this via a selective bidding process?

Africa Intelligence reports that the TPA has embarked upon what amounts to a selective bidding process for the Dar es Salaam Container Terminal concession with just three companies in the frame for the opportunity as opposed to all eligible bidders worldwide which can be accessed via a full international tender. The latter course of action is seen as the preferred course of action by such eminent institutions as the World Bank. International Finance Corp and European Bank for Reconstruction and

Gothenburg Deal

The Port of Gothenburg, Sweden has confirmed it is acquiring shares in the new Västvind wind farm located in the municipalities of Kungälv and Öckerö. If approved, construction will commence in 2027 and be completed in 2029, with installed capacity of 1 GW and the potential to generate up to 4.5 TWh of renewable electricity every year. Project developer, Eolus, will retain the remaining 95 per cent shares.

Development. It is also the most employed path to offer such a concession – by a distance.

Further, a restricted bidding process, particularly in the African environment, enlarges the scope for accusations of corruption. Anything that stands outside the norm – a bespoke process or specification – is invariably identified as suspicious activity with a commensurate increase regarding the potential for corruption, particulary if any of the parties involved have ‘previous’ in this respect.

Bottom line, a fully transparent international tender process open to all eligible parties, experts agree, is the best path to securing the most efficient operator that will deliver the best result for the terminal’s customers and the country as a whole. Matched against this a more restricted process represents a poor and

Jaxport Lease Offer

The Jacksonville Port Authority (JAXPORT) is seeking proposals for a long-term lease at the Talleyrand Marine Terminal. The site is currently occupied by Southeast Toyota Distributors and JAXPORT has confirmed it will be available in 2025. The area covers 79 acres of paved land, comprising four adjacent parcels at the marine terminal. It has vessel berthing access and on-dock intermodal rail facilities, with links to the CSX andNorfolk Southern networks.

questionable choice as witnessed by the fact that it is a process that is rarely employed.

The three parties known to currently be engaging with the TPA are Adani Ports and Special Economic Zone Limited (APSEZ), the AD Ports Group and DP World.

APSEZ is currently operating the terminal, under a management contract, while long-term operator selection is underway. AD ports Group, via its subsidiary Abu Dhabi Ports PSJC, has recently signed an agreement with Adani to jointly seek out opportunities in Africa. DP World has, according to Africa Intelligence, previously offered to finance the renovation of the port and is well known to be particularly keen on this opportunity.

Four for Xiamen

Xiamen Port in China is building four new container berths to increase capacity by 4.26 million TEU per annum. The investment of US$1.71 billion is part of the State Council’s 14th Five-Year Plan. In 2022, the port handled 12.99 million TEU, a sizeable increase on the 2021 total of 9.9 million TEU. Located opposite Taiwan, this port is crucial to supporting crossStrait trade and is part of the Maritime Silk Route.

The three ports have signed a Memorandum of Understanding (MoU) as part of the C40 Cities network and other stakeholders in the maritime and energy value chains with the objective of accelerating decarbonisation within the maritime industry. These goals are consistent with the objectives of the International Maritime Organization (IMO), and relevant authorities in both the US and Singapore.

This green and digital shipping corridor is specifically seeking to help support a transition to low and, eventually, zero-emission fuels by all ships calling in the San Pedro complex and at Singapore. The ports will work collectively in facilitating the supply and adoption of these fuels.

Ports agreeing these types of green corridor arrangements are gathering pace. In the UK, Dover is looking to adopt a link with ports in France, while the Port of Halifax, Canada has signed an MoU with the Port of Hamburg to assess a decarbonised shipping corridor between North America and Europe.

BRIEFS

Adani Offloads

Adani Ports and Special Economic Zone Ltd (APSEZ) has confirmed that it has now fully exited the Myanmar market. India’s largest integrated ports and logistics company has reached a deal for its port facility in Yangon, Myanmar. The Adani Yangon International Terminal has an annual handling capacity of 800,000 TEU and 3.5 million tonnes of bulk cargo. The buyer is Solar Energy and the agreed sale price has been confirmed as US$30 million.

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 7 PORT & TERMINAL NEWS

8 Controversy is building around the concession process for Tanzania International Container Terminal Services

Passion for our planet.

Now more than ever, finding sustainable solutions to keep your business moving is critical to your long-term survival. It’s no surprise then that we are passionate about moving towards a range of fully electric spreaders and performance optimisation tools can help you lower your carbon footprint, while improving your overall performance, which is surely something to celebrate.

As we know that our business can only survive, if your business thrives. Bromma, leading through innovation.

bromma.com

This is an original artwork inspired by Keith Haring’s collective works

The Government of Canada has finally approved the Roberts Bank 2 project, following an in-depth and rigorous environmental assessment process that started in 2013.

As a result, the Vancouver Fraser Port Authority (VFPA) will be able to develop a new three-berth container terminal delivering 2.4 million TEU of additional, annual container capacity.

According to a statement from VFPA, this project will bring substantial economic benefits, including more than 18,000 jobs during construction, more than 17,300 subsequent, ongoing jobs, an estimated US$2.2 billion in GDP annually once built, and around US$465 million in tax revenues related to support services.

Judy Rogers, Chair, VFPA Board explains the focus for the project: “Roberts Bank Terminal 2 has been designed in a way that ensures it aligns with our work toward our vision to make the Port of Vancouver the world’s most sustainable port, including protecting and enhancing the natural environment and

8 Malta Freeport

Terminals has concluded a deal with the government for an expansion of Malta Freeport. The project will see the north quay at Terminal Two increased by 175m and the west quay by 195m, to ensure that the largest container ships, including those with LNG-power, can be accommodated. The port currently handles around three million TEU annually.

Mannheim Link

The two ports of Mannheim and Rotterdam are expanding their collaboration to increase the digitalisation and sustainability of the logistics supply chain between the two facilities. Mannheim port in Germany is located on the Rhine corridor and within a largescale industrial sector, where bulk and container traffic is regularly transported to and from Rotterdam. Changing the logistics chain to a zero emission transport corridor is a key target.

ROBERTS BANK 2 FINALLY APPROVED

reflecting Indigenous priorities.”

The new marine terminal will be located in subtidal waters to minimize environmental effects and will be built in accordance with the port authority’s commitment to supporting local communities. The Roberts Bank

Terminal 2 community investment programme will provide $6 million to Delta organisations and students as part of the project process.

Adding around 30 per cent more capacity will be welcomed by port users. Dean Davison,

8 With Federal Government approval gained, the new Roberts Bank 2 terminal can finally move forward

Head of Maritime Advisory, Infrata, confirms that the new capacity is definitely needed. “Container volume demand through Vancouver, and the Pacific Gateway, continues to warrant the additional capacity, with existing terminals expecting to be fully utilised before the end of the current decade, even allowing for recent investment by DP World at its terminals in the port.”

The implications of this development are considered further in the Pacific North West feature in this issue.

BRIEFS

Success for CGSA

Contecon Guayaquil S.A. (CGSA), in Ecuador, has handled its largest ever vessel. The ICTSIoperated terminal successfully received the maiden call of the MV Maersk Camden, a container ships that is almost 366m in length and with a total capacity of 15,413 TEU. This vessel is currently deployed on Maersk Line’s AC2 service, which connects Asia with Latin America through the ports of Lazaro Cardenas, Guayaquil, Balboa, Manzanillo, Shanghai, Ningbo and Busan.

Polluting Truck Grant

The first round of a new US$400 million grant programme targeting port electrification and efficiency improvements for trucking has opened. The scheme falls under the US Department of Transportation’s Federal Highway Administration. The funding will focus on projects that reduce emissions from idling trucks which negatively impacts air quality for surrounding communities, truck drivers, and port workers.

Supplies by Drone

The Port of Singapore is planning to issue a call for proposals (CFP) before the end of 2023 to establish a drone port for the delivery of ship supplies. Chee Hong Tat, Senior Minister of State for Finance and Transport notes: “The CFP will act as a pathfinder for public agencies and private companies to develop a concept of operations for drones that is suited to Singapore’s operating environment as a busy hub.

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 9 PORT & TERMINAL NEWS

Ceres For Sale

BAGAMOYO PORT PROJECT: NEW DEVELOPMENT APPROACH BRIEFS

Ceres Terminals, the North American portfolio owned by Australia’s Macquarie Group Ltd, is up for sale. The current owners are reportedly hoping to raise US$1bn from the process. Ceres has 18 different operations in North America, currently handling 4.3 million TEU, 13.4 million cruise passengers and 580,000 ro-ro units. Macquarie acquired the portfolio from NYK Line in 2019 but the fund managing the portfolio, Macquarie Infrastructure Partners III, is due to close in the next 12-18 months.

Montreal Help Call

The Montreal Port Authority (MPA) is calling for more cash from the Federal government. Martin Imbleau, CEO, MPA, has said that costs to develop the new Contrecoeur container terminal have increased by nearly 50 per cent and as a result “urgent” financial help is needed. Current reports are indicating that the original project cost of C$950 million has now risen to C$1.4bn. The federal government has acknowledged the need to help but is yet to clarify any specific details.

Aberdeen Invests

The Port of Aberdeen in Scotland is investing £55 million over the next 10 years as part of its commitment to become the UK’s first net-zero port by 2040. Shore-power is being introduced by 2024, which follows the recent roll-out of electric vehicles and installation of LED lighting on the quaysides. Trials of hydrotreated vegetable oil for portowned vessels and equipment are underway, while onsite energy generation for the port estate is under assessment.

Over nine years in the making, Tanzania’s Bagamoyo port project has hit yet another new phase in the efforts to bring the project to market.

This latest phase, according to informed sources, is to seek multiple investors for different

components of the project as opposed to one major investor. In the latter respect, China Merchants Holdings held extensive discussions with the Tanzanian authorities about the project but these ultimately have come to nothing, although it is

not known whether China will seek reengagement under this new format. The discussions with China Merchants Holdings concluded in mid-2022 – it is not yet known how the project will be marketed to an array of investors.

CAMBODIA BOX TERMINAL CONSTRUCTION COMMENCES

Construction has commenced on a new container terminal at Sihanoukville Autonomous Port, Cambodia.

As a result of the project, annual capacity at the port is expected to increase from 700,000TEU per annum to 2.58 million TEU per annum upon completion in 2029, according to Sun Chanthol, Cambodia’s Minister of Public

Works and Transport. The new terminal will be built in three phases, with the first phase scheduled to be completed by 2026 and expected to cost US$275 million, delivering a 350m quay and a water depth of 14.5m.

Chanthol also confirmed that the second phase will commence in 2025 and finish in 2028, with the final phase starting in 2026

and concluding in 2029, with a total cost of US$698 million.

“The expansion project will allow large container ships to dock at the port and significantly reduce ocean freight costs for Cambodia,” explained Hun Sen, Prime Minister, Cambodia. Currently, ships considerably less than 4000TEU in size are able to call to the port.

PORT & TERMINAL NEWS

10 | JUNE 2023For the latest news and analysis go to www.portstrategy.com

The Kalmar ELECTRIC REACHSTACKER

The time is now to go electric.

Kalmar’s electrically powered reachstacker can help improve the eco-efficiency of your operations while maintaining the highest levels of productivity and safety. With a range of modular battery options and charging solutions, we can work with you to design a solution that will deliver for your business. What are you waiting for?

kalmarglobal.com

MEET OUR NEW HERO www.elme.com AT TOC EUROPE 13-15 JUNE IN ROTTERDAM WELCOME TO STAND H62 857 INNOVATION SPRING 2023 VOLUME ONE

CROSS CHANNEL GREEN SHIPPING CORRIDOR

California shared data system

Funding of US$30 million is being given to ports in California to develop a new shared data system. The ports of Los Angeles, Long Beach, Oakland, San Diego, and Hueneme are collectively working to develop the new shared system, to be known as the California Port Data Partnership.

The aim of the project is to advance: computerised and cloud-based data interoperability in order to support improved freight system resilience, emissions reduction, goods movement efficiencies and improved economic competitiveness.

The UK’s first green shipping corridor has taken a step forward. Schneider Electric, a specialist in digital transformation of energy management and automation, has confirmed an eight-month consultancy process to assess the opportunity to link the UK Port of Dover with both Calais and Dunkirk in France, as part of the UK’s Clean Maritime Demonstration Competition (CMDC).

Schneider Electric is assessing green energy pathway options for marine vessels and land vehicles to facilitate zero-emission movement of goods freight and passengers, with the process also including how to introduce cold-ironing capabilities to ships while berthed.

The Port of Dover is an integral

Collaboration

CrimsonLogic of Singapore and Shanghai Data Group (SDG) of China are collaborating to develop digital trade facilitation solutions. The new partnership is planning to support greater international outreach of Chinese enterprises by connecting them to over 60 global Customs nodes via CrimsonLogic’s CALISTA platform. This streamlines trade compliance and supply chain processes by optimising data reuse.

part of the process and Schneider Electric is going to be developing a “digital twin” model of the port’s electrical infrastructure to allow a new shore power system to be designed and tested on a virtual basis, including how to efficiently integrate the system into the existing port with minimal disruption.

Peter Selway, Segment Marketing Manager at Schneider Electric, explains further: “Port operators are facing pressure to transition to more sustainable business models that meet with the net-zero ambitions of the Clean Maritime Plan. UK ports are also becoming energy producers, providing the shore power needed to charge electric and hybrid vessels. By partnering in

Fleet Charging

The Port of Virginia in the US has signed a deal with ElectroTempo to enhance vehicle electrification initiatives. The port is targeting carbon neutrality by 2040 and expects the new arrangement to better optimise electric opportunities to help improve energy efficiency, reduce emissions, and help see operating cost decreases. ElectroTempo is a specialist software company for electric-powered fleet charging networks.

this consultancy project, we’re able to advise the Port of Dover on how to strategically invest in the shore power capabilities and infrastructure needed to support a green shipping corridor…. decarbonising this critical shipping channel will reduce maritime greenhouse gas emissions and provide a blueprint for other ports to follow.”

Schneider Electric has already assisted the Port of Dover with the Clean Maritime Demonstration Competition phase 1 to support the technological development necessary to reduce carbon emissions as part of the Port of Dover Air Quality Action Plan.

NYK Green Spend

NYK is investing in the Marunouchi Climate Tech Growth Fund, a new investment vehicle looking to participate in fi nance and climate tech startups that specialise in decarbonisation. All fi nancing is being provided through Marunouchi Innovation Partners Co. Ltd. (MIP), which is owned by Mitsubishi Corporation (MC), MUFG Bank, Ltd. (MUBK), and Pavilion Private Equity Co. Ltd. (PPE). The new deal supports NYK’s net-zero goal.

Increased visibility in freight movements across the supply chain, from arrival at a port through to the final delivery of the cargo, Mario Cordero, Executive Director, Port of Long Beach highlights: “By working together, California’s ports can enable end-to-end visibility and connectivity across the supply chain.”

Gene Seroka, Executive Director, Port of Los Angeles adds: “Analytics from that data allows us to see around corners, which is not just a competitive advantage, it’s now a public necessity. I commend our state leaders for having the foresight to invest in data infrastructure to create a more predictable and efficient supply chain.”

BRIEFS

AD Ports buys TTEK

The digital arm of AD Ports Group, Maqta Gateway, has acquired TTEK Inc. for US$26.7 million, with an upfront payment of US$17.1 million. TTEK Inc. specialises in the development of border control solutions and customs systems and the deal extends Maqta Gateway’s existing digital trade systems portfolio. The company is planning to leverage TTEK Inc’s experience across Africa, Australia, the Mid-East, and North America.

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 13 DIGITAL NEWS

8 The Port of Dover is hoping to be at the heart of a new green shipping corridor between the UK and France

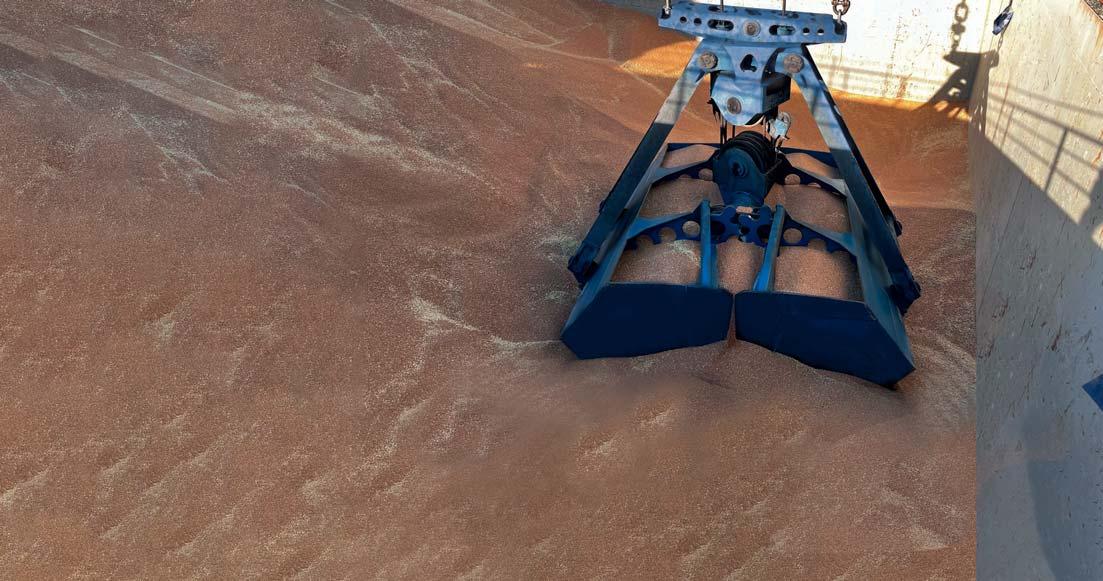

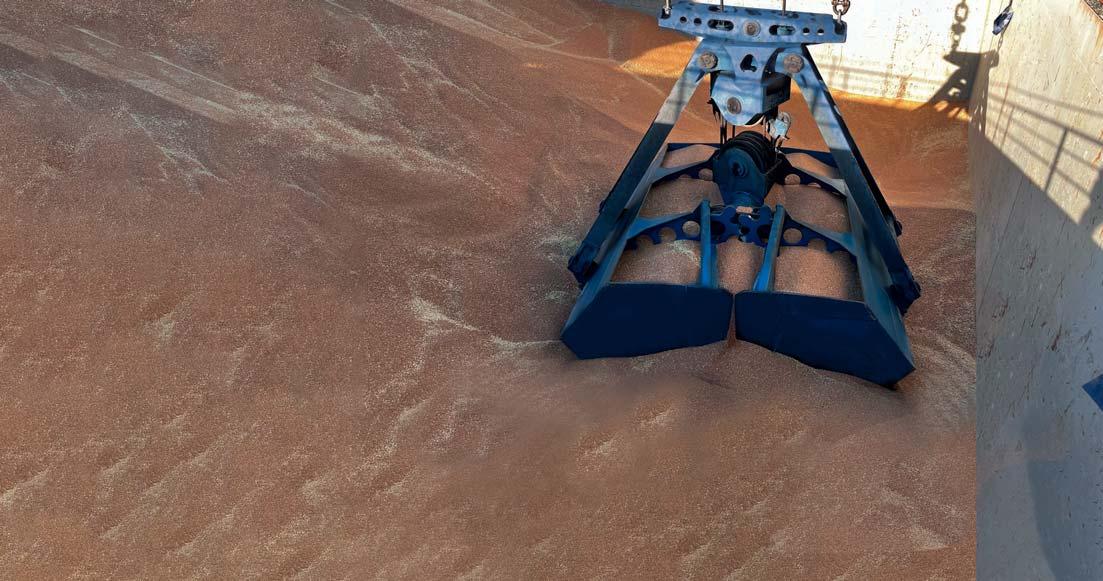

Deltastraat 15 • 4301 RC Zierikzee • T +31 (0)111 418 948 • E sales@nemag.com nemag.com Nemag grabs give dry bulk terminals throughout the world that competitive edge they need in today’s demanding market. ! Contact \ THE POWER OF GREAT DRY BULK HANDLING Scan the QRcode Take a peek

Stand H84

VIRGINIA RAMPS UP NORTH BERTH WITH KONECRANES ASCs

The US East Coast Port of Virginia is purchasing 36 new automated stacking cranes (ASCs) as part of its new modernisation plan for the North Berth at Norfolk International Terminals (NIT).

This order is worth almost US$150 million and will see the new cranes delivered in two batches by Konecranes of Finland. The first 18 units are scheduled to arrive in mid-2025, with the second set due in mid-2027, which is in accordance with the construction phases.

The North Berth project is modernising and expanding the current infrastructure so that 1.4 million TEU per annum can be handled, leading to a total capacity of 3.6 million TEU per annum at the combined North and South berths.

Key components of the North Berth project include installation of new ship-to-shore cranes and a new container yard, which is being configured around the use of ASCs, and a new operating system. As a result, the port is expecting to be able to operate a greater density of container stacking and improved productivity.

Stephen A. Edwards, CEO and Executive Director, Virginia Port Authority, notes: “We are nearing the start of construction on the North Berth project, and it is important that we get our equipment orders coordinated with the completion of construction. The North Berth

FLOW-SV Launched

Damen Shipyards Group recently reached out to industry stakeholders for input relating to vessel specifications for supporting offshore projects. The Netherlands-based company asked vessel operators, wind farm developers and equipment manufacturers to assist in the development process and has now released its new concept - the Damen Floating Offshore Wind Support Vessel (FLOW-SV).

project is the last piece in the overall modernisation of our primary container terminals and the timing of how we proceed will be critical to the success of this project.”

The timing of this project is also critical because it must finish on schedule so that other ongoing work, such as the completion of NIT’s Central Rail Yard expansion and the 55ft channel deepening process, can complement the extra capacity.

“Cargo owners, ocean carriers and logistics providers are going to closely following our progress. Many of the ocean carriers that call Virginia today are putting new, larger vessels into service during the next few years. We are telling them that they can bring

Drones Away

The Port of Antwerp covers more than 120km2 and it is now being monitored by six autonomous drones. The port authority has launched its ‘D-Hive drone-in-a-box’ network to enhance security by providing an airborne perspective to provide better berth management, infrastructure inspections, oil spill and floating waste detection activities, and to enhance security. There will be 18 daily Beyond Visual Line of Sight (BVLOS) drone flights.

8 The US Port of Virginia has placed an order with Konecranes for 36 new ASC units as part of its largescale modernisation project at NIT

those vessels to Virginia without concern for channel depth and width, rail capacity or modern terminals that can process large amounts of cargo with consistent efficiency,” Edwards adds, before confirming that construction work on the North Berth project will commence in Summer 2023.

In 2022, the port handled 3.7 million TEU, an increase of 5.1 per cent over the 2021 total of 3.5 million TEU. For the year through April 2023, total container volumes are down by 12.2 per cent due to weaker loaded import activity.

STS for APMT Tangier

The first of four batches of new dual ship-to-shore (STS) cranes have arrived at APM Terminals (APMT) MedPort Tangier in Morocco. With an outreach of 82m, these high spec, dual STS cranes can handle container ships of up to 24,000TEU featuring up to 26 rows of containers on-deck. The terminal has recently added 23 hybrid shuttle carriers to its existing fleet of 42 and implemented a shore power initiative with the Tangier Port Authority.

Hydrogen-Powered Tractor in Service at Valencia

The Port of Valencia, Spain, has received its first hydrogenpowered terminal tractor. The 4x4 unit is the first of its kind in the world and is being developed within the framework of the European H2PORTS project. This unit has a fuel cell/ battery hybrid powertrain and a storage system made of four Type 3 cylinders, guaranteeing continuous operations of at least six hours before refuelling.

The electric motor is powered by a high-performance LiFePO4 battery, with 25 kWh energy capacity, and a 70 kW Ballard fuel cell module. In particular, the electric motor can receive power for traction from the fuel cell and battery simultaneously or charge the battery during braking or decelerations. The fuel cell is also able to power both the electric motor and the battery, if needed.

This hybrid powertrain is able to successfully take advantage of a significant share of kinetic energy recovery, of up to 25 per cent, thereby making it a much more efficient unit to use for the intensive activities of roll-on/ roll-off operations.

Electric Cabooter

Kalmar has confirmed it has officially handed over its first completely electric reachstacker to its long-term partner Cabooter Group, following a six-month testing process. This new unit will continue to work at Cabooter Group’s Greenport Venlo intermodal terminal in the Netherlands. The unit has a 45-tonne lifting capacity and is equipped with a range of modular batteries and charging options.

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 15 EQUIPMENT NEWS

BRIEFS

NASH SCOPES OUT VTS FOR PORT OF LONDON AUTHORITY

BRIEFS

Zero-Emissions SSA

SSA Marine is now operating large-capacity, lithium forklifts at the US West Coast ports of Stockton and West Sacramento, California. The units were supplied by Wiggins eBull, who maintains it is offering the industry’s first commercialised largecapacity, zero-emissions forklift manufactured in the US. Joe Carrillo, Regional Vice President, SSA Pacific highlights:

“The Wiggins Yard eBulls are significantly reducing greenhouse gas emissions and sound pollution, while enabling us to effectively service our customers.”

The Port of London Authority (PLA) is upgrading its Vessel Traffic Services (VTS), with the help of shipping, navigation and maritime risk consultancy, NASH Maritime.

NASH Maritime, supported by Halcro Electronics and AFS Consultants, has completed an in-depth assessment to generate a clear understanding of user needs and requirements when it comes to an optimum VTS system.

According to the International Maritime Organisation (IMO), a VTS is a shore-side system which can range from the provision of simple information messages to ships, such as position of other traffic or meteorological hazard warnings, to extensive management of traffic within a port or waterway.

As custodian of the River Thames in London, the PLA requires the most modern, and efficient software system to enable safe management and co-ordination of vessel traffic and marine operations. Consequently, NASH Maritime’s research has helped to define new software specification, across both mandatory and desirable system requirements, while also ensuring that the strategic and operational needs of the PLA are fully included.

Dr Ed Rogers, Co-Founder, NASH Maritime, comments: “We brought to this project our understanding of the challenges that come with being a VTS system operator, our experience in defining VTS systems (both here in the UK and internationally)

and also our deep knowledge of IALA standards, EU Network and Information Systems Directive and GDPR requirements.”

With around 70 independently owned terminals and ports within the PLA’s jurisdiction, which includes largescale operations at DP World’s London Gateway and the Port of Tilbury, annual cargo of more than 50 million tonnes moves via this key waterway.

The PLA has also recently commenced a major master planning exercise to realise the growth opportunities along the River Thames as it starts implementing its Thames Vision 2050 initiative.

RTGs ARRIVE AT PSA PANAMA

PSA Panama has received three new rubber-tyred gantry (RTG) cranes from Konecranes. It represents the first order from this terminal for the Finlandbased equipment manufacturer.

The new units are powered by diesel-electric motors and each machine will incorporate Konecranes’ Diesel Fuel Saver

technology, as well as AutoSteering and Stack Collision Prevention. Remote monitoring from American mobile virtual network operator, TruConnect, is also included in the deal.

Each RTG is able to stack boxes up to five containers high and operate over six container rows wide plus a truck lane.

Hyster Dynamic Stability

Hyster has launched its Dynamic Stability System (DSS) for forklift trucks. The system, which is standard on all H40-70A models in the company’s recently launched Hyster A Series, provides automated performance controls and alerts for safer operations. When the DSS sensors detect the fork truck is exceeding designated stability limits, it automatically intervenes to ensure stable travel is maintained, in terms of speed, lift height, mast tilt and hydraulic load.

Amsterdam Fenders

Located at the former Rodman Cocoli Naval Base, Arraiján, PSA Panama recently increased its annual capacity to two million TEU per annum. The facility continues to act as a key transshipment hub on the Pacific Coast of Panama, located at the entrance to the Panama Canal.

ShibataFenderTeam (SFT) has completed the supply and installation of 21 sets of Cell Fender Systems to the Ijmuiden Sea lock, at the Port of Amsterdam. As part of the process, SFT designed and supplied a continuous fender-wall with delivery of 40 SPC Cone Fender Systems. This lock system was originally designed, in 2016, by SFT to support safe and smooth access of larger vessels.

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 17 EQUIPMENT NEWS

8 The Port of Tilbury is one of around 70 independently owned facilities on the River Thames that the PLA will continue to support with its VTS upgrade

BARRY PARKER

We are living in a partisan political age; regardless of what side you are on, most shipping and port executives would agree on that. One issue of concern to me has been the relentless attacks on the Jones Act, a set of laws which reserve trade between US ports (on the mainland, and also Alaska, Hawaii, and US territories including Puerto Rico) for vessels built in the States, and registered/crewed by US “citizens.”

It is complicated and the debates quickly degenerate from the factual into the world of opinions, “what if’s”, and sometimes featuring heated emotions and raised tempers. While the ports are welcoming vessels of all flags, with varied international cargo origins and destinations, they also benefit greatly from shipbuilding, maintenance/ repair and other

JONES ACT – EMERGING INFRASTRUCTURE LINKS?

activities tied to Jones Act vessels.

In looking at history, it is evident that such activity has been greatly reduced compared to the 1970s and 1980s (mirroring a decline, as well, in military vessels).

Yet increasingly, geopolitical concerns have been causing policymakers to take a fresh look at US security, and maritime readiness/capabilities are a part of that conversation. Potentially, after years of waning, local shipbuilding and related services could increase. Importantly, this comes at a time that trade flows may be easing- after a multiyear boom (brought about the pandemic, and subsequent shifts in cargo flows).

Yes, there are a lot of politics here. As these debates heat up and get vociferous, port

PETER DE LANGEN THEANALYST

Last month, the World Bank published a new version of the Logistics Performance Index. New in this edition are the results of a ‘big data’ analysis of the performance of international shipments, using data from, amongst others, MDS Transmodal, Marine Traffic and Tradelens. The data from MDS Transmodal and Marine Traffic have previously been used in publications of the United Nations (the Liner Shipping Connectivity Index/the Review of Maritime Transport).

The Tradelens data is new – and relevant. Data was collected regarding the total door-to-door transport time of maritime shipments. There is a huge variation between shipments. As was to be expected, the major ‘source’ of the variation of total transport

planners (even those with calm demeanors) should keep a weather eye on such developments. Whether one supports the Jones Act or not, there are emerging tie-ins with “infrastructure” here, with maritime transportation seeing benefits in recent legislation.

Traditional funding sources, like the long-standing grants programme benefiting ports, have gained. Yet additional funding outlets are emerging, as well. As decarbonisation continues to be infused into conversations (a different theme than national security) - and allocations of funding - a group of new initiatives concerning “Hydrogen Hubs” sees the US Department of Energy (USDOE) set to spend roughly US$7bn

on their development. If the concept advances, the hubs would promote new supply chains for movements of greener fuels including methanol and ammonia. It’s early days for such programs, but the ports (notably in the US Gulf Coast, but also, potentially, around the US East Coast) would see substantial benefits if the USDOE is looking in their direction when the final choices for hubs are made.

In terms of financial structuring, long-term contracts would likely be put in place for all aspects of the new energy infrastructures. And yes, that would also bring about incremental maritime activity (including newbuilds that would likely be trading domestically) right on our waterfronts.

WORLD BANK LOGISTICS PERFORMANCE

INDEX 2023: OBSERVATIONS

time is related to ports and dry ports; some containers have very high dwell times in ports, while others do not. This is especially the case on the ‘import journey’ (i.e., from port to final destination).

A comparison of dwell times reveals huge differences between countries, and not always as would intuitively be expected: the average import dwell time is much higher in western advanced economies (8.3 days in Belgium, 7.6 in Germany, 7.2 in The Netherlands and the US) than in emerging economies such as China (5.5) India (2.6) and Cambodia (2.1). Plus, aside from small island states (with low numbers of observations), the lowest import dwell time is found in Japan, where the average dwell time is as low as 1.0 days.

While in general, I definitely agree with the World Bank that lower dwell times are better, a deeper understanding is required to assess whether that holds in all cases. Probably, the most important issue for shippers is the ability to freely decide when to pick up their goods/ containers. Thus, if a high dwell time is caused by unproductive port operations or timeconsuming customs processes (as it may be in many countries) and containers were not available for shippers then this can build costs for shippers, not least because the dwell times are unpredictable.

However, on the other hand, when shippers can freely decide when and how to pick up their containers, they

may opt for long stays at the terminal, as well as slow, but sustainable and cheap onward transport modes in case stock levels are high enough. Such a scenario would not imply higher generalised transport costs for shippers.

Another caveat to keep in mind is that modern large, semiautomated terminals are designed for an average dwell time of around seven days, while container operations at older terminals with a limited yard space may have to adjust their pricing policies to secure low dwell times and reach an acceptable terminal efficiency.

In short, a more granular approach can extend the important new insights developed by the World Bank.

18 | JUNE 2023 For the latest news and analysis go to www.portstrategy.com

THENEWYORKER

Expectations of a recession are receding, despite declining demand, as economies remain in growth territory.

All the signs in late 2022 suggested that the largest economies of the EU and the US would enter into a mild recession sometime in the second half of 2023 with this driven by stubbornly high inflation, rising interest rates intended to choke off demand, and grain and energy price rises resulting from the on-going war in the Ukraine. Add to this, the financial sector in the US is a real cause for concern, evidenced by banks coming under pressure. So far, we have seen three banks being taken over, including Credit Suisse in Europe.

Also on the negative front, we have seen a very sharp drop in demand for consumer goods moving in containers with, for example, North American imports down by 24 per cent in the first quarter, year on year and Europe by nearly 30 per cent.

THE ELUSIVE RECESSION, NOT AS PER DEFINITION YET

Furthermore, with weak demand in the dry bulk sector global trade looks anemic.

This suggests that a recession is on the way in Europe and North America, but lo and behold, it appears to be elusive with GDP growth rates stubbornly staying out of the “traditional” definition of a recession with two quarters of negative growth.

Despite the above indicators China, the US and the EU continue to see their economies growing, albeit slowly in some

MIKE MUNDY THE

STRATEGIST

Let’s backtrack a bit and reference two interesting reports that came out a few months ago.

The first is the Annual Progress Report on Green Shipping Corridors from the Global Maritime Forum, which documents developments up to November 2022. The report describes itself as “a checkpoint for what has already become a movement.” Specifically, it evaluates:

5 The size, nature, and performance of global green corridor initiatives;

5 The amount and nature of national policy and regulation emerging to support these initiatives; and

5 The overall momentum behind the movement.

It further states, “In the year since the signing of the

cases, as unemployment remains stable and investment in industries is holding up as energy prices have dropped and profit margins (perhaps fueling inflation) are healthy.

Forecasters are coming to the view that a recession may be avoided, and that consumer goods consumption will recover by the second half of the year. The shipping sector, usually the first to bemoan the collapse in trade volumes, has been somewhat sanguine so far despite some very

large drops in revenue and profits in the first quarter of this year. The reason for that is that despite the collapse of freight rates, the container sector has so far managed capacity and kept rates above pe-covid days and is still seeing solid returns. Less solid are the results of the major ports as they face declining throughput. We are all holding our breath.

TWO REPORTS WORTH CATCHING UP WITH

Clydebank Declaration, 21 initiatives have emerged around the world. More than 110 stakeholders from across the value chain are engaged in these initiatives, and a significant level of public-private collaboration can be seen.”

Quantifying this, it identifies over 20 corridor initiatives, 12 short-sea, seven deep-sea and two, at the time, which remained to be confirmed. The individual projects are identified with the qualification that: “The vast majority of these initiatives remain at an early stage. Only a handful have advanced far enough to begin feasibility assessments or implementation planning.”

Among other coverage, the report goes on to offer “…seven recommendations to support

accelerated and green corridors.”

In all, the report provides four main working chapters: “Where do we need to be; Where are we now, Overview of progress and Recommendations. It can be downloaded, free of charge at: https://www.globalmaritimeforum. org/content/2022/11/The-2022Annual-Progress-Report-onGreen-Shipping-Corridors.pdf

The second report worthy of note is the: Act Now or Pay Later: The Costs of Climate Inaction for Ports and Shipping from New York-based RTI International.

This report was actually published in March 2022 but I bring it to your attention now a/ as it has just crossed my path and b/ I think it provides a very good summary not only of the range of climate related

challenges ports can face but also of the practical steps that can be taken to mitigate these. It also provides some insight into potential costs and particularly related to what it calls “hard strategies; required structural changes which it defines in three categories, namely, “elevate, defend and retreat.”

Act Now or Pay Later: The Costs of Climate Inaction for Ports and Shipping is a comprehensive work comprising eight main chapters. Like the previous report discussed, it is a highly recommended read and can be downloaded free of charge at: https://www.c40knowledgehub. org/s/article/Act-now-or-paylater-The-costs-of-climateinaction-for-ports-andshipping?language=en_US

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 19

THEECONOMIST

BEN HACKETT

8 Capacity management is to the fore in container shipping providing some stability but major ports have to contend with declining throughput

AI

S E ASIA BOX PORT RANKING

Independent market consultancy Drewry has drilled down into Southeast Asia containerport and terminal performance. Mike Mundy reports that the findings provide a useful new perspective

Container traffic moving via the Top 15 Southeast Asia containerports (by volume) in 2022 was generally static compared to 2021 – with the exception of seventh-ranked Manila in the Philippines which achieved a 10 per cent increase, the only double-digit increase – Table 1.

Five ports in the region saw a decline in volumes compared to the previous year and the increases achieved elsewhere were only single digit. The eighth ranked port of Haiphong, Vietnam saw the second largest increase at 5.7 per cent with Tanjung Priok, Indonesia, ninth in the ranking, third with a 3.43 per cent increase. Manila’s performance can be seen as exceptional compared to its peers in the region.

By way of a further insight into Southeast Asia containerport performance, Drewry Maritime Research, the compiler of the data, has also calculated 2021 – 2022 activity based solely on gateway – import and export – traffic (excluding transshipment and domestic traffic). Table 2 summarises the situation – again Manila, sixth in the ranking, emerges as the exception to the rule with a 10.6 per cent increase. Second ranked Port Klang, Malaysia, is next with a 6.4 per cent increase and Tanjung Priok the next highest with a 3.1 per cent increase.

Five of the gateway ports registered a contraction in cargo volume in 2022 compared to 2021.

8 Table 1: International Gateway Ports Ranking - Southeast Asia (2021/2022), by TEU

(Includes all container cargo: Gateway. Transshipment, and Domestic)

Source: Base data from Drewry Maritime Research (Excludes Transhipment and Domestic Movements)

8 Table 2: Container Port RankingSoutheast Asia (2021/2022), by TEU

Source: Base data from Drewry Maritime Research

CONTAINERPORT PERFORMANCE

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 21 Ranking 2022Country PortRegion20212022Growth 1SingaporeSingaporeSouth East Asia37,467,61237,289,600-0.5% 2MalaysiaPort KlangSouth East Asia13,727,08513,218,693-3.7% 3VietnamCat Lai (Ho Chi Minh)South East Asia12,313,29612,436,4291.0% 4MalaysiaTanjung PelepasSouth East Asia11,200,24510,512,806-6.1% 5ThailandLaem Cha-bangSouth East Asia8,523,3528,741,0802.6% 6IndonesiaTanjung PriokSouth East Asia6,926,0907,164,0283.4% 7PhilippinesManilaSouth East Asia4,976,0145,474,48410.0% 8VietnamHaiphongSouth East Asia4,027,4004,259,3775.8% 9IndonesiaSurabayaSouth East Asia3,489,9263,493,6670.1% 10MalaysiaPenangSouth East Asia1,278,0061,319,1133.2% 11ThailandBangkokSouth East Asia1,387,7631,267,942-8.6% 12IndonesiaBelawanSouth East Asia1,197,380993,825-17.0% 13PhilippinesCebuSouth East Asia914,111937,0522.5% 14MalaysiaJohorSouth East Asia937,205918,579-2.0% 15PhilippinesDavaoSouth East Asia824,343824,8980.1% International gateway* (teu) Ranking 2022CountryPortRegion20212022Growth 1ThailandLaem ChabangSouth East Asia8,523,3528,741,0802.6% 2VietnamCat Lai (Ho Chi Minh)South East Asia8,286,8488,208,043-1.0% 3MalaysiaPort KlangSouth East Asia5,326,1095,670,8196.5% 4SingaporeSingaporeSouth East Asia5,133,0635,108,675-0.5% 5IndonesiaTanjung PriokSouth East Asia4,596,3814,741,7973.2% 6PhilippinesManilaSouth East Asia3,580,6423,962,11110.7% 7VietnamHaiphongSouth East Asia2,710,4402,811,1893.7% 8IndonesiaSurabayaSouth East Asia1,661,5751,640,758-1.3% 9ThailandBangkokSouth East Asia1,387,7631,267,942-8.6% 10MalaysiaPenangSouth East Asia1,214,1061,242,6042.3% 11IndonesiaBelawanSouth East Asia1,197,380993,825-17.0% 12PhilippinesCebuSouth East Asia914,111937,0522.5% 13MalaysiaJohorSouth East Asia909,089899,289-1.1% 14PhilippinesDavaoSouth East Asia824,343824,8980.1% 15CambodiaSihanoukvilleSouth East Asia732,387788,0607.6%

MOMENTUM WHERE IT MATTERS

Building from a one-country operation at the Port of Manila in the Philippines, ICTSI has pressed forward across 35 years. On six continents, currently in 20 countries, we continue developing ports that deliver transformative benefits.

All across our operations, we work closely with our business and government partners, with our clients and host communities: to keep building momentum where it matters, in and through ports that keep driving sustainable growth.

ARGENTINA•AUSTRALIA•BRAZIL•CAMEROON•CHINA•COLOMBIA•DR CONGO•CROATIA•ECUADOR•GEORGIA•HONDURAS•IRAQ INDONESIA•MADAGASCAR•MEXICO•NIGERIA•PAKISTAN•PAPUA NEW GUINEA•PHILIPPINES•POLAND

www.ictsi.com

TERMINAL VIEW

Further drilling down into Southeast Asia container traffic data, Drewry provides the interesting perspective of a Top 20 container terminal ranking – Table 3 for all container traffic and Table 4 for gateway cargo only based on 2021 performance*. As might be expected, Table 3 shows the two major transshipment hubs of Singapore (Pasir Panjang Terminal) and Tanjung Pelepas in first and second positions respectively. PSA terminals are actually ranked in first, fourth, sixth, seventh, eighth and seventeenth in the ranking. In third position is port Klang with the Westport Kelang Multi Terminal.

Manila is the only entity other than Singapore to be identified in the ranking more than once with the Manila International Container Terminal in eleventh position and

Manila North Harbor at nineteen. As with the ports ranking, Drewry again examines the position of Southeast Asia terminals on a pure gateway cargo basis – import and export cargo (excluding domestic volumes and transshipment) –Table 4. It does so recording those terminals that have handled over a million TEU in 2021 – the Top 12. It is a useful perspective from the point of view of understanding offtake infrastructure – road and rail – needs for example.

Wesport Kelang Multi Terminal (B07 – B10), Malaysia tops the ranking with 4,035,995TEU, Saigon NewPort – Cat Lai Terminal second with 3,623,036TEU and Manila International Container Terminal in third with 2,508,119TEU. From fourth position down to twelfth all the remaining terminals handle volumes in the range from one million TEU to just under two million TEU.

(Includes all container cargo: Gateway. Transshipment, and Domestic)

8 This informative containerport performance data breaks new ground. Moving forward, as post-Pandemic data is collected and further refined it will undoubtedly prove useful to the sector – for overall port planning and wider aspects such as tariffs and competitive pricing

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 23 International gateway* (teu) Ranking 2021Sub RegionCountryPortTerminal2021 1South East AsiaMalaysiaPort KlangWestport Kelang Multi Terminal ( B07-B10) 4,035,995 2South East AsiaVietnamCat Lai (Ho Chi Minh)Saigon NewPort - Cat Lai Terminal 3,623,036 3South East AsiaPhilippinesManilaManila International Container Terminal 2,508,119 4South East AsiaIndonesiaTanjung PriokJakarta International Container Terminal (JICT) 1,976,392 5South East AsiaThailandLaem ChabangHutchison Ports - Terminal C1-C2 1,923,989 6South East AsiaVietnamCai MepTan Cang-Cai Mep International Terminal (TCIT) 1,732,896 7South East AsiaSingaporeSingaporePSA - Pasir Panjang Terminal 1,712,500 8South East AsiaThailandLaem ChabangTerminal B5_C3 (LCIT) 1,489,142 9South East AsiaIndonesiaSurabayaTerminal Petikemas Surabaya 1,330,047 10South East AsiaMalaysiaPort KlangNorthport (prev. Klang Container Terminal) 1,290,114 11South East AsiaIndonesiaTanjung PriokNew Priok Container Terminal 1 (NPCT1) 1,142,593 12South East AsiaMalaysiaPenangNorth Butterworth Container Terminal 1,141,710

8 Table 4: International Gateway Terminal RankingSoutheast Asia (2021) (excluding Transhipment and Domestic Movements), by TEU

CONTAINERPORT PERFORMANCE

Total throughput (teu) Ranking 2021 Sub RegionCountryPortTerminal2021 1South East AsiaSingaporeSingaporePSA - Pasir Panjang Terminal 12,500,000 2South East AsiaMalaysiaTanjung PelepasPTP Container Terminal 11,200,245 3South East AsiaMalaysiaPort KlangWestport Kelang Multi Terminal ( B07-B10) 10,402,050 4South East AsiaSingaporeSingapore MSC-PSA Asia Terminal (MPAT – Located in Pasir Panjang) 6,710,000 5South East AsiaVietnamCat Lai (Ho Chi Minh) Saigon NewPort - Cat Lai Terminal 5,383,411 6South East AsiaSingaporeSingaporeCOSCO-PSA Terminal (CPT – Located in Pasir Panjang) 4,727,000 7South East AsiaSingaporeSingaporeCMA CGM-PSA Lion Terminal (CPLT – Located in Pasir Panjang) 4,651,000 8South East AsiaSingaporeSingaporePSA - Brani Terminal 4,293,113 9South East AsiaMalaysiaPort KlangNorthport (prev. Klang Container Terminal) 3,325,035 10South East AsiaVietnamCai MepTan Cang-Cai Mep International Terminal (TCIT) 2,574,883 11South East AsiaPhilippinesManilaManila International Container Terminal 2,508,119 12South East AsiaIndonesiaTanjung PriokJakarta International Container Terminal (JICT) 2,037,518 13South East AsiaThailandLaem ChabangTerminal C1-C2 1,923,989 14South East AsiaSingaporeSingaporeMagenta Singapore Terminal (MST) 1,636,704 15South East AsiaThailandLaem ChabangTerminal B5_C3 (LCIT) 1,489,142 16South East AsiaVietnamHaiphongChua Ve Container terminal 1,435,817 17South East AsiaSingaporeSingaporePSA - Keppel Terminal 1,434,240 18South East AsiaIndonesiaSurabayaTerminal Petikemas Surabaya 1,415,644 19South East AsiaPhilippinesManilaNorth Harbour - multipurpose berths 1,390,986 20South East AsiaThailandBangkokPAT berths (Klongtoey dolphins) 1,387,763

8 Table 3: Terminal Ranking - Southeast Asia (2021), by TEU

THIS IS

After nearly a century of innovation, Hyster ® Zero-Emissions Container Handlers powered by hydrogen fuel cells prove that the best is yet to come. Take a closer look at the future of ports. VISIT

US AT TOC Rotterdam from 13-15 June stand C11 HUGE.

BRACE FOR A ROUGH RIDE

Problems in the shipping market will have a far-reaching impact on container ports and terminals. Andrew Penfold considers the threats and opportunities

It’s time to look at the container markets again and try to assess what will be the impact of a downturn on the port sector. For any long-term observer of the container business, it looks like a case of ‘déjà vu all over again’. The basic position can be summarised as follows:

5 The supply side is set for a massive expansion – especially in the larger size vessel ranges. There are only limited opportunities to use these ULCS and Megamax vessels outside the Asia to Europe and Transpacific trades.

5 Demand is uncertain. At the global level economic uncertainty is at very high levels. The latest IMF forecasts for global economic growth (April 2023) is 2.8 per cent for 2023. This is much lower than long-term trends and, given political uncertainties, may well understate the actual outcome.

5 The impact on different container trades will vary sharply, but the established vessel ‘cascading’ in the market will spread any negative effects very broadly (and very rapidly).

5 The decline in the supply/demand balance has already hit the market – way ahead of the delivery of new tonnage. This suggests that problems will run over the next two years and beyond.

This outlook can only cause difficulties for the container port and terminal sector.

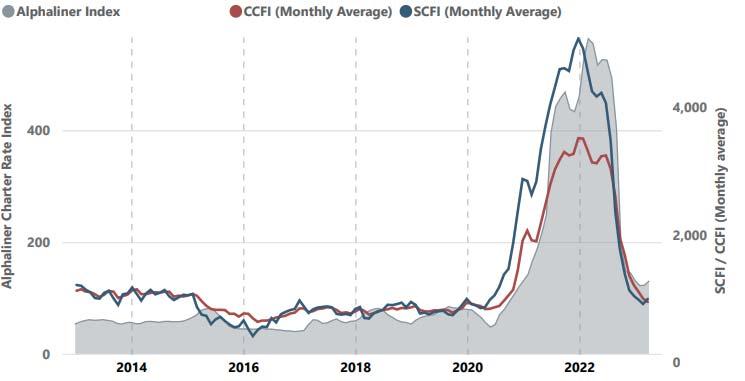

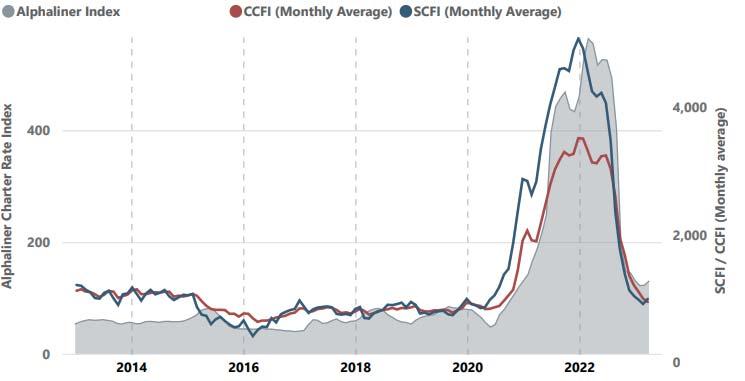

Nothing is really new in the shipping markets. Similar conditions have typified the markets over most of the period since 2014 and – indeed – real sustained profitability for container owners has been nebulous since the Financial Crisis.

Data collated by Alphaliner is germane here. Focusing on the market since 2014, it’s clear that the unprecedented surge in freight rates (SCFI/CCFI) and charter rates (Alphaliner Index) in 2021-2022 was by no means typical of any market upturn and was a true ‘Black Swan’ event if ever there was one. Rates peaked at hitherto unseen levels and have equally rapidly collapsed back to a much more typical position. It’s clear that this return to ‘normality’ will continue.

It’s all about supply and demand with the usual overlay of fear and greed. Shipping lines weren’t clever but lucky, with the freight sector probably the only real beneficiary of the epidemic. Supply chain disruption resulted in windfall gains for the industry. The question now is what did the lines do with all this cash? Have they deep enough pockets to survive

through a prolonged downturn? It’s worth taking a closer look at each side of the equation.

There are, of course, differences on each major route but past experience confirms that no individual trade can long be insulated from the broader balance of supply and demand. Rates remain higher than before the Pandemic but the outlook for supply and demand is not positive.

THE SUPPLY SIDE

The container fleet is now faced with a massive addition of new capacity for delivery over 2023 and 2024 and overall, a period of excess vessel capacity is certain. Despite the collapse in freight rates the level of ordering has remained very high, with this funded by additions of novel units utilising new fuelling methods such as methanol and – of course –LNG. It is estimated that around 730 new vessels will be added to the fleet by the end of 2024 – an increase of at least 10 per cent in total fleet capacity. The orderbook also includes some 150 vessels slated for delivery in 2025. Even with potential cancellations and delivery delays (yet to be noted) this represents a truly heroic commitment to the future container business.

These orders are focused on the largest size ranges with Neo-Panamax and Megamax vessels dominating the position. It is far from clear how the market can absorb this capacity. At the same time, the strongest demand has been noted in the intra-regional markets – especially in Asia –where much smaller vessels are optimum. These tranches of the fleet have been out of favour and there are concerns about capacity availability in some niches.

Superimposed on all of this is the uncertainty of the implications and deployment patterns as the alliance structure is reformed, as Maersk and MSC part company. The fallout from this is another variable.

WHAT ABOUT DEMAND?

The shipping lines have gambled on demand returning to (at least) historic levels. Will it?

The macro-economic outlook is not positive and the degree to which the current Chinese export recovery can be sustained remains unclear, with longer term shifts way from

CONTAINER PROSPECTS

8 The MSC Irina, recently introduced into service by MSC, offers a capacity of 24,346TEU and is representative of the flood of new high capacity tonnage underway which poses problems

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 25

this model already beginning to gather pace. Inflation remains high and the resulting impact on real wages in the major import zones will further limit the uptake of consumer goods. Retail sales in recent months have been disappointing and actual declines have been noted in the EU.

The stabilisation of rates in the past two months has been partially driven by wholesalers rebuilding stock after the supply chain disruptions. This is, by definition, a one-off factor.

These combined trends will hit demand for the largest classes of vessels, although putting a number on this remains very difficult at present. Any further upset at the geopolitical level can only push the market further into negative territory.

The following key factors with regard to demand need close monitoring:

5 Macro-economic growth and the risks associated with this – especially at the geopolitical level. The China/Taiwan situation is the key risk here.

5 The degree to which the Pandemic has shifted supply chains away from China. Will this accelerate and what does this mean for port investments?

5 The entire China strategy is in a state of flux with moves to boost local demand and shift away from export-orientated middle value goods. Emerging nations will take an increased market share, but correctly formatted port capacity is not there yet.

It doesn’t look like the pre-Covid pattern will emerge unaltered. The freight market is heading downhill, and the only uncertainty is how deep the hole will be.

WHAT CAN THE LINES DO?

Before considering the port implications it’s worth looking at the potential moves that lines will make to mitigate these issues. Scope for manoeuvre is quite limited:

5 Capacity can be absorbed by slow steaming and rerouting longhaul trades. This only indirectly impacts the level of freights, and in any case average liner speeds are at a ten year low already.

5 There is scope to cancel and delay orders as has been done in the past, but demand for other ship types is strong and yards are not likely to be cooperative. The costs will be high.

5 Scrapping is an option and seems certain to increase –especially for older tonnage in the mid-size ranges.

5 The degree to which shipping lines have embarked on alternative fuel strategies, often without a clear-cut cost

benefit analysis versus more conventional options, seems likely to slow. Making well intentioned ‘green’ moves will become less affordable.

5 They can squeeze their suppliers. The latter will be partly focused on the port sector.

IMPACT ON BOX PORTS

So, what happens when your customers’ revenues collapse?

The focus will be on spreading the pain. Bunker suppliers and other providers of consumables will be pressured, but what about the terminals? In the past, lines faced with a weakening bottom line have sought to pressure stevedores for lower rates and discounts. These moves have not gone down well given the level of investments made in terminals and continuing pressure to provide further, deeper, capabilities.

For established high volume terminals the response has been to resist by seeking to provide essential capabilities and to maintain margins by increased productivity. For major terminals this will continue, but it is important to note that in the major port ranges it is increasingly difficult to differentiate between terminals given the overall level of investment. Also, the supply/demand balance will weaken.

The degree to which this will focus demand on line-owned terminals at the expanse of common-user facilities will also undermine the latter facilities, although the alliance restructuring anticipated will provide some scope for negotiations here.

Elsewhere the emphasis will be on bringing new capacity on-line, in the emerging markets as they increase their role in the trades. This means additional handling capacities for much larger vessels. Close focusing of attention on these situations offers real potential for developers and investors. Demand will be strong here, and the major lines will be obliged to serve these markets or see their role decline rapidly. This is where the opportunities lie.

CONTAINER PROSPECTS For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 27

8 Figure 1: Container market indicators since 2014 (source Alphaliner)

The question now is what did the lines do with all this cash? Have they deep enough pockets to survive through a prolonged downturn?

‘‘

EXCLUSIVE DEALERSHIPS

WE ARE THE EXCLUSIVE DEALER FOR SEVERAL TRIPLE A BRANDS IN THE PORT EQUIPMENT INDUSTRY. OUR CLOSE CONNECTIONS WORK TO YOUR BENEFIT: YOU HAVE ACCESS TO SHORT SUPPLY LINES AND A WIDE RANGE OF PRODUCTS. WHETHER YOU’RE BUYING, LEASING OR RENTING, GPE OFFERS DIFFERENT FINANCING OPTIONS.

THANKS TO OUR NETWORK OF LOGISTICS EXPERTS, YOU’RE ALWAYS SURE YOUR MACHINE WILL ARRIVE PUNCTUALLY, NO MATTER WHERE IN THE WORLD YOU NEED IT.

WATCH ALL THE REEFERS, ALL OF THE TIME, WITHOUT TAKING A STEP

Energy monitoring. Not knowing is not an option.

IDENTECSOLUTIONS.COM

BETTER TOGETHER

FRAMEWORKS FOR ANALYSIS

Are you a government agency considering implementing a port master concession? The WAPPP* Port Chapter has developed two simple frameworks that can help evaluate the opportunity

FACTORKEY QUESTIONSNOTES

1Legislation/Port development policy

2Port governance/ Regulatory oversight

Have the national and local legislation and policies been up to the task?

Has the regulatory function been appropriate and effective?

3Strategic/Political issues Has the port ownership remained in the hands of the original concessionaire, and has their behaviour been acceptable?

4FinancingHave any issues been encountered in financing major port projects?

5Length of leaseWith hindsight, is the lease period considered to be the right length?

6Clawback provisionsHas it been necessary to invoke any clawbacks?

7Prices/Tariffs/RentsHave port prices and rents been maintained at acceptable levels?

8Level and suitability of investment in capacity Has the promised (and appropriate) investment in capacity and facilities been made?

9Level of inter-port competition Has there been sufficient inter-port competition in the market?

10Terminal operatorsHave there been any issues with major port tenants?

There are a number of examples of port master concessions where governments, mainly in developed nations, have chosen to grant concessions to the private sector for the role of a landlord port authority. Ports such as Geelong, Adelaide, Brisbane, Sydney (Botany), Melbourne and Newcastle in Australia, and Piraeus, Thessaloniki and most recently Igoumenitsa in Greece have seen control of their port authority companies, holding long-term leases, move to private sector investors in the main (Piraeus was sold to the Chinese state-owned entity Cosco).

Some emerging nations have also pursued this policy, such as Madagascar and more recently Nigeria. Other countries are considering it, for example, Brazil, although the policy direction seems to have recently changed with a new government.

Geneva, WAPPP is a global non-governmental organisation that promotes best practices in PPP to align with UN SDGs. This article is authored by Neil Davidson and Erik Wehl, of the WAPPP* Port Chapter. www.wappp.org

The legislative framework under which the master concession functions must be considered. Is there an overall national policy for the development of ports in national jurisdiction and has it worked?

Have the duty/guardianship priorities of a public port authority been reconciled with the natural profit maximising motive of a private master concession holder? Have some aspects of port regulation such as security and environmental matters been picked up by federal or national-wide regulators? Has the port master concession holder performed to required levels?

The question of foreign ownership/control of strategic assets is key, as is national security objectives. Has there been a change in the ultimate ownership of the master concession holder during the lease period?

Financing of major infrastructure projects at ports is often shared between state and local government/port authorities. Has the privatised landlord port authority made and met its commitments? Have the differing expectations of the level of return on investment between the public and private sectors been reconciled?

Given that one of the primary roles of a landlord port authority is investment in long-term infrastructure such as quay walls, a long lease period is usually called for (in Australia 99 years was used in some cases). There is also the issue of the wider asset base relative to revenue generating capability (real estate infrastructure, landside connection infrastructure etc.) and maintenance of same; some of these assets do not include revenue generating activities on their own. However, circumstances can change radically over such long periods and some parties feel lease periods are too long.

There should be protection built into the concession so that if the master concessionaire has sold off certain assets, the monies can be clawed back by the government. However, defining which assets should be subject to this provision can be complex.

Pricing powers of master concession holders is a thorny issue, given that their primary aim will be to maximise profits (the same as the private terminal operators in the port). Has regulation been necessary or not? If so, has it worked? Master concessions often result in the creation of local monopolies. There is also possible vertical integration across the supply chain by the master concession holder.

Linked to both the length of the master lease and the pricing controls, there is the need to ensure that the master concessionaire has invested in additional capacity at the port as and when required. Private companies take a different view to publicly-owned ones. Plus, there may be other types of important investment which may not directly generate a positive NPV but generate positive externalities etc for the neighbourhood (e.g. initiatives to reduce noise pollution) or when it comes to business development (e.g. energy transition), which may require a subsidy from municipality or region to make financial sense for the PA. Is the private partner committed to such type of investments?

Given the very long length of master concessions there may have been new competition and entirely new port entrants to the market. So even if a master concession has a natural monopoly to start with, this may not be the case decades down the line.

Relationships with existing terminal operators in the port (who may be competitors of the master concession holder) are relevant.

The value and risks of this approach – effectively monetising strategic assets that have previously functioned as public bodies, and which must retain a remit well beyond simply making profits – has been subject to a great deal of often heated discussion. Australia and Greece in particular have seen in-depth work carried out to assess the efficacy of the policy, and opinions vary widely. Politicians, financiers, academia, “neutral” observers and the industry itself often have different agendas.

In order to assist interested parties in analysing past deals, and consider possible future ones, the WAPPP Port Chapter has developed two simple frameworks – one to help look at those port master concessions that have already been granted, and the other to help weigh up whether a particular country or location has the necessary ingredients for the policy to stand a chance of being successful in a future master concession deal.

The frameworks take a deliberately straightforward

8 Table 1: Framework for Analysing Previous Port Master Concessions

PORT MASTER CONCESSIONS

For the latest news and analysis go to www.portstrategy.com JUNE 2023 | 29

*Based in

The leading terminal in the Mediterranean

cspspain.com

Member of

approach. This is not to say that the task of analysing port master concessions is simple – far from it in fact. Rather, the aim is to provide an “entry-level” foundation, highlighting the key factors commonly seen. These factors must be considered in the context of the stated goals, aims and reasons used to justify port master concession policies, for example generating income for the public sector from port assets, facilitating greater investment or increasing port efficiency (and note again the above comments about the varying opinions on the value or otherwise of the policy).

ANALYSING PREVIOUS MASTER CONCESSIONS

The following framework uses key questions for individual factors. The notes column provides some guidance on how to consider each of the key questions. A simple traffic light system could be applied to evaluate the result of the analysis by weighing up the success or otherwise of existing port master concessions. Red/amber/green colours may be used to illustrate whether any issues and obstacles encountered as a result of the master concession should be regarded as serious, manageable or limited/absent. The judgement in each case is of course ultimately subjective, but ought to be based on reviewing as extensively as possible the available objective evidence for each of the key questions.

There are ten key questions to be considered – Table 1ranging from high level policy, strategic and regulatory matters, to the finer detail of tariffs, rents, competition and port tenants, in particular terminal operators.