CAN

DC2:

MEXICO:

CAN

DC2:

MEXICO:

India has been aggressively marketing itself as an Asian alternative to Chinese manufacturing from as far back as 2014 when it launched the “Make in India” campaign, to raise the profile of India as a global manufacturing hub. Similarly, the Atmanirbhar Bharat campaign was launched in 2020, backed by a US$277 billion stimulus package, equivalent to around 10 per cent of India’s GDP. This was partly aimed at providing some relief to the sectors of population worst hit by COVID-19 but is additionally designed to open up new avenues of trade, investment and employment in the economy. The underlying thinking is, improved liberalisation, policy amendments, relaxed regulations, infrastructure investment, skill development etc, will build “a future-ready India.”

The International Monetary Fund’s forecast for India’s GDP growth in 2023 is 6.1%, far outpacing China’s estimated 4.4% rise. Further, India is projected to leapfrog Germany and Japan to become the world’s third-largest economy over the next decade, and achieve the status of a US$10 trillion economy by 2035, according to a recent Centre for Economics and Business Research report.

The potential is there and clearly India is enjoying some success in presenting itself as an alternative to China – assisted by factors such as the concerns of business regarding growing tensions between China and the USA and China’s authoritarianism as witnessed by its severe lockdown policy.

The fact remains, however, that India’s vision of becoming the new “factory of the world” still has to overcome longstanding hurdles. Extensive bureaucracy, red tape, lack of skilled labour and lagging infrastructure are all problems that continue to prevail. They stand in the way of India establishing the sophisticated and seamless supply chains that China now boasts and which, when unimpeded, work exceptionally well.

As the articles on p18 and p20 document, India’s port infrastructure still faces challenges, although great progress has been made. There is the issue of formatting port capacity to accept the world’s largest vessels but arguably more crucial is putting in place modern road and rail links – a factor that has great influence over the location of manufacturing businesses. Action on this latter front will play a major part in giving industry the confidence to seriously consider relocation to India or to a locate a start-up in the country.

“Building investor confidence” is also a theme that South Africa’s government needs to address in conjunction with finding an investor for Durban Container Container Terminal – Pier 2, p7.

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: AndrewPenfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; John Bensalhia; Ben Hackett; Peter de Langen; Barry Parker; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s print subscription £295.00

1 year’s digital subscription with online access £228.50

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

©Mercator Media Limited 2023. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

India is in the ascendancy as an alternative manufacturing location to China, but there remains work to be done to build investor confidence. At a micro level, the same point applies in conjunction with South Africa’s Durban Container Terminal –pier 2 – the fundamental issue is will theory go into practice?

The colours of India’s national flag are prominent on our cover. India is coming – the seeds of opportunity are there to take up a more prominent position in world trade. The opportunity is at hand to compete with China to become a major manufacturing centre for retail and other products. The infrastructure, however, has to be right and in the articles on p20 and 22 we assess the country’s state of readiness to assume this status. Container trade prospects are detailed and the positives and negatives of port and inland infrastructure reviewed in-depth.

There are uncertainties surrounding the bid process for Durban Container Terminal 2 (DCT2) and the Ngqura Container Terminal. Government should do more to build investor confidence

The technical component of the bids for Durban Container Terminal – Pier 2 (DCT2) have now been submitted and the bidders –10 companies – await results, basically a pass or fail. After this the second bid component submitted by those bidders that have “passed,” the financial envelope, will be opened and if conforming to normal practice it is expected that the bidder with the highest financial offer will enter into detailed negotiations regarding its participation as a 49 per cent stakeholder in DC2. Straightforward? Seemingly so, but in reality there are many considerations around the process that present cause for concern.

A seemingly innocuous but nevertheless key point is the use of the word privatisation in conjunction with the DCT2 opportunity. This is a factor that has led to the increasing politicisation of the bid process, both for DCT2 and the Ngqura Container Terminal, a specialist transshipment hub at Port Elizabeth for which an investor is also being sought.

There has recently been criticism from the South Africa Transport and Allied Workers Union (Satawu) - one of the biggest unions active within Transnet, the government owned operator of the two facilities and the party that implemented and is overseeing the bid process – that the port of Durban is being privatised by stealth. Not a positive, but also not an entirely surprising reaction from the union side of the fence. More concerning are some of the ‘noises’ coming out of the ruling African National Congress (ANC) party, which of course, has substantial union support.

In mid-February, South African media reported what amounted to an attack on Portia Derby, CEO of the Transnet Group, by ANC and Economic Freedom Fighters (EFF) MPs participating in the Public Enterprises Portfolio Committee, they accused her of “doing nothing” to stop the company’s slide into disarray and reprimanded her for privatising parts of its operations which they said was not government policy.

The word “privatisation” is, to use an English expression, something of a “red rag to a bull.” The route Transnet appears to be taking with DCT2 could perhaps more accurately be described as a commercialisation – with just 49 per cent of the equity of DCT2 on offer it is by no means a complete transfer of the business from the public to private sector. Seasoned observers suggest that the word privatisation is essentially a weapon deployed by those in government, and others, who, bottom line, are fundamentally opposed to private sector participation in Transnet’s port

business. Certainly, it has to be acknowledged that strong resistance to the idea does exist – as has in fact been the case ever since the ANC came to power.

It also true to say that as key public sector businesses have experienced more and more problems – South African Airways, Eskom the power provider and Transnet Rail – more proposals about introducing private sector expertise, to a greater or lesser extent, have been forthcoming, in turn stimulating greater opposition to the idea. The net result is what amounts to a for and against camp in government and at a wider level. This has also reached the stage where it is becoming manifestly visible to potential investors which is raising cause for concern.

While nobody cares to admit it publicly, the initial launch of the DCT2 process raised some eyebrows and notably in terms of the demanding performance criteria that had to be achieved to qualify to participate in the process – much higher than is normally the case. It gave rise to the suspicion that setting the bar high was, in part or totally, a tactic that could be used to make the process fail.

The fact that this latter scenario has in fact

been seen recently in conjunction with Transnet Freight Rail further fans the flames of unease among investors. Transnet announced last year that 16 slots would be opened for auction to give third party access to South Africa’s rail freight infrastructure. Only one bidder, Traxtion Sheltham, successfully completed the first phase of the bid process and out of the 18 companies that showed interest in bidding only two participated because of the nature of the bid conditions. As stated by Mesela Nhlapo, CEO, African Rail Industry Association, Transnet’s onerous terms and conditions are not appealing to private sector investors.

The DCT2 bid process is underway and there are interested parties. It is very clear that the port sector would benefit immensely from private sector input. Government should make every effort to keep the process on track, to get behind it and not allow negative interests to pervade it. A key fundamental of a healthy bid process is investor confidence and this will ultimately deliver the best return for the country as a whole.

There is also the reality that given the deteriorating state of the South African economy greater participation by the private sector in what have hitherto been public sector enterprises is not an option but an absolute must.

Government should make every effort to keep the process on track, to get behind it and not allow negative interests to pervade it

‘‘

Santos Port Authority (SPA) achieved the best monthly performance in its history in March 2023, when it handled 15.3 million tons of cargo. At the same time, a total of 484 ships berthed at the port’s facilities, reflecting an increase of eight per cent over the comparable period of 2022. Marcus Mingoni, Interim CEO, SPA, underlines that the results are an indication of the port’s “increasing efficiency and productivity, consolidating its position as the largest port complex in Latin America.”

The Northwest Seaport Alliance (NWSA) partnership of the ports of Seattle and Tacoma has launched its 2023 Rail Cargo Incentive Program. The initiative offers a US$50 incentive per rail move for eligible rail volumes moving through the port gateway from May 1, 2023, with the hope that it could generate up to 60,000 additional rail lifts –a total that equals almost 15 per cent of the total international intermodal rail lifts passing through Seattle-Tacoma in 2022.

China’s twelve largest container ports handled 44.1 million TEU over the January and February 2023 period, confirming an increase of just 1.3 per cent compared to the same period in 2022. Shanghai was the leading facility with 7.46 million TEU, although activity was down by 8.6 per cent, with Ningbo & Zhoushan second with 5.31 million TEU, a rise of 9.1 per cent. Next is the port of Qingdao with 4.18 million TEU, reflecting a strong year-on-year increase of 12.3 per cent.

Two PSA subsidiaries are uniting to form a new single brand with the aim of combining complementary strengths and capabilities. The new entity, named PSA BDP, comprises PSA Cargo Solutions and BDP International, which PSA International acquired in April 2022.

PSA International states that Cargo Solutions and BDP have already been working closely to deliver expanded terminal value-added services, developing digital applications to streamline compliance

processes, and offering multimodal transportation solutions that focus on reducing carbon emissions.

In addition, PSA BDP is expected to leverage and support strategic hub port assets in the company and support an expansive global asset portfolio providing greater agility to shippers in what it terms as a “complex global environment.”

Further, PSA BDP is planning to enhance the delivery of innovative and sustainable solutions supported by industry-leading digitalisation and data capabilities

to empower connectivity across supply chain ecosystems.

PSA Group has been reorganised into two different business lines, Ports and Cargo Solutions. The new PSA BDP brand is going to represent the PSA Group’s Cargo Solutions business activity.

Tan Chong Meng, Group CEO, PSA International, said the reorganisation will sharpen the company’s “ability to innovate and deliver future solutions.”

APM Terminals (APMT) has confirmed a new project to develop two new deep-water berths at Lach Huyen port in Haiphong City, Vietnam, in conjunction with the Vietnamese HATECO group.

The new strategic partnership will see APMT focus on financial, operational, and technical support to HATECO as part of the partnership.

The port project itself entails developing two berths offering a

total length of 900m (based on 450m each), with the aim of accommodating container vessels of up to 18,000TEU in size.

The initial phase will see the new facility operating with five ship-to-shore (STS) cranes and 14 rubber-tyred gantry (RTG) cranes.

HATECO has stated that it intends to complete all construction works and deploy equipment by the end of 2024, with operations to commence at the new terminal by Q1 2025.

Martijn van Dongen, Head of Investment, APM Terminals, notes: “We are very pleased to partner with HATECO on this important project, further unlocking one of the rapidly growing and high-potential markets in South-East Asia.

“We also believe in the win-win partnership with HATECO, which will create synergies between local expertise and our global capabilities.”

APM Terminals (APMT) is expanding its Maasvlakte II terminal in Rotterdam, in a deal worth in excess of €1 billion ($1.1 billion).

The Port of Rotterdam

Authority is already constructing new quay walls of 1000m at the 47.5ha site, with completion of the work planned for mid-2024.

This expansion will result in the terminal’s capacity increasing by

approximately two million TEU per annum when the additional infrastructure becomes operational in Q2 2026. APMT opened the fully-automated Maasvlakte II terminal in 2015.

For the first two months of 2023, the Port of New York/New Jersey (NY/NJ) was the busiest container port in North America.

Handing a total of 1.216 million TEU in this period put this US East Coast port ahead of the two US West Coast ports of Los Angeles and Long Beach, which recorded 1.214 million TEU and 1.117 million TEU, respectively.

By comparison, for the comparable periods of 2022, Los Angeles led the way with 1.723 million TEU, followed by Long Beach recording 1.598 million TEU and NY/NJ in third place with a total of 1.524 million TEU.

Confidence in US West Coast ports, especially in Southern California, has been further undermined when operations ground to a halt across the San Pedro complex for 24 hours during the second week of April 2023. No work commenced at the start of a Thursday late shift because insufficient dock workers reported in and the same thing occurred the following Friday morning. As a result, four terminals across Long Beach were closed and all seven box facilities at Los Angeles did not work.

The relationship between employers and worker unions remains acrimonious, at best. On this occasion, and according to local media outlets, the PMA (employers association) accused the ILWU (stevedores union) of “with-holding” labour deliberately to shut-down both San Pedro ports. The union countered these

Neo-Panamax ships can now be handled at the Mariel Container Terminal (TCM) in Cuba. This follows TCM completing dredging of the access channel to be able to receive ships up to 366m LOA, 52m wide and 15m deep. The Port of Mariel is located 45km from Havana and TCM wants to use this project to help promote the sustainable economic development of Cuba, through the attraction of foreign investment.

The Economic Ministry in Germany is currently reassessing its previous decision to allow COSCO Shipping Ports (CSP) to acquire a stake in one of three terminals at the Port of Hamburg operated by Hamburg Hafen und Logostik AG (HHLA).

claims by explaining that its members were attending a monthly membership meeting on the Thursday and a low turnout the following morning was due to workers “observing” the Good Friday holiday.

The contract talks on the US West Coast continue to drag on, with little progress seemingly being made since the old deal finished at the end of July 2022. In March 2023, operations in the Port of Los Angeles stopped for one hour as stevedores and workers all took their lunch break simultaneously instead of the usual practice of staggering mealtimes.

While these specific events resulted in little loss of cargo activity at the ports, clear concerns remain on a wider basis. The PMA continues to warn the ILWU that the West Coast will lose traffic if reaching a settlement continues to drag on. “These actions undermine confidence in

The Port Authority of Valencia (PAV) has announced its first monthly increase in container traffic since May 2022. For March 2023, the port handled a total of 322,137TEU, representing a rise of 16.7 per cent over March 2022. At the same time, rail traffic is also rising. In Q1 2023, an average of 99 weekly trains were scheduled, up on the weekly averages for 2022 (90 trains) and 2021 (80 per week). Valencia is currently building a new 5 million TEU per annum container facility.

is benefitting from contentious labour contract talks on the US West Coast

west coast ports and threaten to further accelerate the diversion of discretionary cargo to Atlantic and Gulf coast ports,” it has been reported as saying.

This is just a snapshot of the first two months of 2023, and Los Angeles has just released its March 2023 data that shows loaded imports were up by 28 per cent over February 2023, although the total for Q1 2023 (of 1.84 million TEU) was still down on Q1 2022 by 32 per cent.

Yes, the difference between the three ports so far in this current year is very small, but it remains reflective of an ongoing trend in which beneficial cargo owners are continuing to shift from the West Coast to East Coast gateway ports of entry, primarily for Asiansourced cargo.

The Port of Melbourne is progressing its Port Rail Transformation Project (PRTP) through the launch of a new single-lane, two-way road connecting Mullaly Close/ Coode Road with the Dock Link Road. The new routing has been dubbed the “Intermodal Way.” The aim of this new initiative at Melbourne is to ensure a continuous flow of cargo activities linking marine, rail, and road freight activities that converge in the port.

Back in October 2022, German Chancellor Olaf Scholz gave approval for the deal in which CSP would gain a minority stake of 24.9 per cent, despite strong oppositiion from across the governing coalition.

Now, however, that the facility has been classified as “critical infrastructure” the terms by which the deal will allow CSP to acquire the shareholding are under further review.

Yet some confusion remains. According to local reports Scholz’s stance on the matter “has not changed” and a spokesperson for HHLA stated that the critical infrastructure tag was in place under “pre-existing criteria” which basically means there is no “significant change” in the process.

Chinese investment in German infrastructure remains a contentious issue amongst politicians in the country, with critics citing a concerning rise in influence and risks in national security.

For the fiscal year period April 2022 to March 2023, Adani Ports and Special Economic Zone Ltd (APSEZ) confirms that it handled a total of 8.6 million TEU across its portfolio. This activity reflected a five per cent year-on-year increase for the company, with Mundra Port by far the most dominant container facility, handling 77 per cent (6.6 million TEU) alone. APSEZ is India’s largest private port operator with a network of 12 ports and terminals.

Solutions

solutions that eliminate pollution, harmful emissions, vibrations, and noise.

Shore power solutions for:

5 Cruise ships

5 RoRo and RoPax vessels

5 Container ships

5 LNG carriers

5 Tank ships

5 Other vessel types

8 Hutchison Port Holdings (HPH) Trust has rolled out 5G technology at its Hong Kong container terminals – a first for the country. In conjunction with 3HK, reported to offer the strongest 5G network in Hong Kong, HPH Trust has established five 5g base stations in its terminals facilitating ultra-highspeed, low latency and large-scale machine-type communications. Ensuing benefits are reported as greater remote execution abilities, more connected devices and the option to implement virtual private real-time networks. HPH Trust further reports three pilot projects underway at its terminals: structuring a communications channel via 5G to remotely control rubber tyred gantries; introducing a CCTV system employing Artificial Intelligence with intrusion detection features for gatehouse application to maximise terminal security and the adoption of CCTV on quay cranes in order to better monitor berth traffic and vessel operations.

DP World Antwerp Gateway is improving container collection security through the introduction of fingerprint scanning technology. The new software to support container collections at the terminal complex is called Certified Pick up (CPu) and has been successfully tested in conjunction with NxtPort, and Belgium logistics specialists, Katoen Natie and Van More.

The CPu software enhances operational security because it enables truck drivers to be pre-registered with the system and upon arrival at the terminal their fingerprints can be matched to a specific container.

The existing system used involves gaining access via inputting a pin code, which opens up risks of multi-party handling and exposing containers to misuse.

The first containers collected using CPu were successfully

The Port of Cork Company (PoCC) is working with Innovez One, a specialist provider of port management systems, to accelerate the digitalisation of all port calls and operations processes. Under the new agreement, Innovez One will implement its marine software to automate the scheduling of port, tug, and pilotage using artificial intelligence (AI) and machine learning algorithms to manage schedules and dispatch resources.

collected in mid-March 2023 and DP World is now planning implementation for all truck collections, while further adaptation to the system will enable container collections involving both barge and rail.

DP World says that around 2000 companies have registered interest in obtaining the CPu

Transnet National Ports Authority (TNPA) is relaunching its Integrated Port Management System (IPMS) at eight commercial ports, with the aim of completing a digital transformation strategy to deliver a smart port system by 2028. Developed by Indiabased Navayuga Infotech in conjunction with Nambiti Technologies of South Africa, the IPMS aims to support the key objectives of the Transnet Market Demand Strategy.

system it has developed with its partners: “The success of our pilot project with Van Moer and Katoen Natie is the first step towards further rolling out CPu with all stakeholders and for all modes of transport in 2023. We are hopeful that the industry will see the benefits of increased security at container terminals and introduce

Itapoá Port in Brazil has introduced an HCVM XT cargo inspection system from Smiths Detection, a UK-based specialist in threat detection and security screening technologies. The new equipment meets the latest Brazilian image quality requirements and is focused on screening export cargo for security threats and undeclared goods. The HCVM XT is the first unit of its kind to be deployed in Latin America.

this technology throughout the entire logistics chain,” explains Dirk Van den Bosch, Chief Executive Officer, DP World, Antwerp.

Tanker shipping operator, Hafnia, has launched a new digital venture studio with partners Microsoft, Wilhelmsen, IMC Ventures and DNV. Dubbed project Studio 30 50, the studio’s objective is to identify new solutions which cover a broad range of maritime sector ESG issues and target significant emissions reductions by 2030. It will also function to fund proposals (from start-ups) which aim to improve supply chain efficiency.

Port Policy

Port Sector Reform

Value & Business Strategy

Public Private Partnerships

(National) Port Master planning

Institutional & Regulatory Change

Organisational Reform & Alignment

VALUATION

Feasibility

Business Case

Value Creation & Protection

Financial Modelling & Analysis

Project Structuring & Packaging

Risk Valuation, Allocation, Mitigation

TRANSACTION

Financial Solutions

Transaction Strategy

Transaction Management

Documentation & Contracts

Tendering & Negotiated Solutions

FINANCE

Due Diligence

Project Financing

Financial Structuring

Procurement of Finances

Investment/Divestment

Merger & Acquisition

CONTAINER SCANNER

CUSTOMS INSPECTION POST

BORDER CONTROL HEALTH FACILTIES

EMPTY DEPOT

CROSS-DOCKING FACILITY

CONTAINER STUFFING

STORING IMDG CONTAINERS

your intermodal port in the MedITERRANEAN _

REFERING AND HEATING CONTAINERS

7 × 750M RAIlTRACKS

RAIL CONNECTION WITH EUROPE

NO CONGESTION PORT

LOGISTICS ACTIVITY ZONE WITH 1M M2

Bruks Siwertell has confirmed a new order from Senegal Minergy Port SA (SMP) for a high-capacity grain handling Siwertell ship unloader. The equipment is for the new Bargny-Sendou port development, located near Dakar, Senegal, in West Africa. SMP selected this dry bulk handling solution on the basis of three important factors, namely, unloading capacity, unloading efficiency, and environmental impact. This unloader is fully enclosed and offers a continuous rated grain

handling capacity of 1200 tph, maintaining a spillage-free operation and generating minimal dust emissions.

In addition to minimising any material degradation in grain handling, the low weight of Siwertell technology also ensures specific advantages to this new port development. The Siwertell 640 M-type ship unloader will be installed on a jetty 1500m from the shore, and so minimising infrastructure weight, reduces the cost of jetty construction.

It will be assembled on site under Bruks Siwertell supervision, with operations scheduled to commence in mid-2024.

SMP is targeting this new port facility to be both a gateway to Senegal and its neighbouring countries, but also a hub for the wider west African region. An initial capacity of 20 million tonnes is being developed, with around 15 million tonnes expected to be handled in its first full year of operations.

Bruks Siwertell has also completed the commissioning of two large scale Siwertell ST 790-D-type ship-unloaders for a newly developed coal-handling power station in southern China. These new rail-mounted units offer a continuous coal-handling capacity of 1800 tph, with a peak capacity of 2000 tph, discharging vessels of up to 100,000 DWT.

These two ship-unloaders are designed to handle coal and other dry bulk materials via fully enclosed conveying lines from start to finish, ensuring an operation free from spillage and keeping dust emissions to a minimum to ensure operations are completed in the most environmentallyfriendly way possible.

Björn Ohlsson, Contract Manager, Bruks Siwertell notes:

The Port of Rotterdam Authority has placed six “smart bollards” on the quay of the Hutchison Ports ECT Delta port on the Maasvlakte, following the successful testing of one smart bollard. The six bollards, designed in cooperation with Straatman BV, Zwijndrecht, have been installed along a single berth to cater for large container ships and can measure the strength of the mooring lines on a continual basis.

“The COVID pandemic presented a number of challenges for the commissioning process

Elcome International is supplying and installing Saab’s next generation Vessel Traffic Management Information System (VTMIS) to the AD Ports Group. VTMIS is Saab’s stateof-the-art system and is being introduced at Khalifa Port, Zayed Port & Free Port, Musaffah Port and Al Dhafra region ports, as part of an initiative to provide remote, local, and centralised monitoring and control of vessel movements in and around the Emirate.

as it was impossible to send personnel from Sweden. We had to get creative, developing a unique set-up that saw our local personnel carry out the commissioning and performance tests with remote support.”

Konecranes has confirmed it has acquired the industrial and nuclear crane and crane service operations of North American-focused, Whiting Corporation. The privately-owned company has a 130-strong workforce across seven locations, and Konecranes is using the deal to target access to new customers and growth opportunities for its Industrial Service and Equipment business unit in a strategically important market.

The Georgia Ports Authority (GPA) has confirmed it is investing US$170 million on 55 new hybridengine rubber-tyred gantries (RTGs) to support the Ocean Terminal at the Port of Savannah.

The decision behind the spend is two-fold. First, it is a key part of redeveloping the 200-acre terminal into an all-container facility, while secondly, the new units reduce emissions by 50 per cent in comparison to conventional diesel machines.

GPA explains that on the basis of each RTG working an average of 4000 operating hours per annum, the hybrid engine will reduce emissions by 127 tonnes per unit per annum, or the equivalent of almost 7000 tonnes across the entire 55-RTG fleet.

These hybrid RTGs operate exclusively from electric battery power, with diesel generators only in use to recharge the batteries. As a result, GPA is expecting to see a reduction in fuel consumption by an estimated 47 per cent compared to the all-diesel machines, which translates to a reduction of 8800 gallons of diesel per crane per annum, or almost 500,000 gallons across the Ocean Terminal fleet on a yearly basis.

Consequently, on the basis of current fuel prices, GPA is expecting a reduction in fuel operating expenses by circa US$1.6 million/pa.

Napier Port in New Zealand has taken possession of four new Kalmar machines. The equipment includes two Eco Reach Stackers and two Empty Container Handlers with all units acquired as part of the port’s emissions redu ction strategy and wider sustainability objectives. The machines reportedly use up to 40 per cent less fuel than conventional units and will help lower Napier’s reliance on diesel fuels.

Doyle Shipping Group (DSG) at Dublin Port is acquiring a new hybrid Rubber Tyred Gantry (RTG) from Liebherr. The LES 200 unit features a capacitor system that captures and preserves the energy produced during hoist lowering and braking. This captured energy is then redeployed during peak demand to reduce the overall energy consumption and emissions of a RTG, plus lower operating and maintenance costs.

ISG (Intermodal Solutions Group) of Australia is combining dry bulk containers and the company’s patented revolver (tippler) system. Shipping containers are lifted into the ship’s hold, upon which a lid is automatically lifted off the container allowing the tippler to rotate the container 360 degrees in less than 60 seconds, emptying the cargo into the ships hold, before the lid is replaced and the containers are taken back to the processing plant to start the loop again.

The Port of Trelleborg has introduced a new Konecranes intermodal reach stacker at its intermodal terminal, located on the southern coast of Sweden. The new unit is the SMV 4538 CCX4 model that can stack 45 tonnes in the first row, up to four containers high. In addition to a wheelbase of 7500 mm, it utilises a unique combi spreader that can manage laden containers from the top and trailers from the bottom across multiple tracks.

8 Antwerp Terminal Services (ATS), a joint-venture between MSC PSA Europe Terminal (MPET) and PSA Antwerp (PSAA), has launched the world’s first hydrogen dual fuel straddle carrier, in conjunction with clean tech specialist, CMB.TECH. The machine is fuelled through a mix of hydrogen and diesel, with hydrogen injected into the diesel combustion engine, therefore helping to play an important role in reducing terminal greenhouse gas emissions. The dual fuel technology can replace 70 per cent of diesel consumption with hydrogen on new straddle carriers, with the ultimate goal of 100 per cent hydrogen injection, ATS reports. This first unit will now undergo extensive testing at PSAA’s Noordzee Terminal with allied ongoing development efforts focusing on how to improve the design in order to scale it up and consideration given to arrangements for the supply and storage of hydrogen for the entire straddle carrier fleet. Funding for the next phase is supported by PIONEERS, a scheme funded by the EU and coordinated by the Port of Antwerp-Bruges. Overall, the project is part of the Horizon 2020 programme which backs the development of solutions to reduce carbon emissions in the port sector, with the goal of transforming ports into green infrastructures by 2050.

Winning Logistics in Guinea, West Africa, has placed an order for two Konecranes Gottwald Model 8 G HPK 8200 B Cranes on Barge.

Konecranes Gottwald Cranes on Barge are specially designed to maintain an uninterrupted material flow on water, even during demanding marine conditions. The units can operate in winds of up to 24 m/s and at maximum wave heights of 2.5m, with a working radius of 43m, a 63-tonne grab curve and lifting speeds of up to 140m per minute. These parameters enable the cranes to generate handling rates of 30,000 tonnes per day, which matches the existing cranes in operation.

The new cranes will incorporate additional features to assist performance and contribute to enhanced safety. These include a fire suppression system, TRUCONNECT® remote monitoring and a spare parts package that will help to optimise maintenance and minimise downtime.

Sun Zhijun, Vice President of Winning International Group outlines the decision-making rationale: “Winning International Group takes Environmental, Social, Governance (ESG) compliance seriously in terms of sourcing products and services that are safe, reliable and efficient. We know that Konecranes Gottwald mobile harbour cranes are reliable

products for harsh environments. Their high productivity backed by quality service consistently creates added value for us. These cranes play a critical role in our unique offshore transshipment operation that has proven to be efficient, costeffective and environmentally friendly. We are happy to be able to partner with suppliers, like Konecranes, who share our belief

in sustainability beyond shipping and mining.”

On-site commissioning is planned for Q3 2024 and means Winning Logistics will be operating a fleet of 10 units, each loading ships with bauxite.

13 15 TO JUNE 202 Southampton United Kingdom

Marine Civils is open for business all year Marine Civils is Europe’s leading event dedicated to showcasing the latest equipment and solutions for marine, coastal and other challenging civil engineering projects with unique landscape features.

Reach a larger audience than ever before Reserve now for 2023 and make the most of year round marketing support from Marine Civils, Seawork and our eNews and social media channels.

Marine Civils attracts representatives from:

• Civil engineering

• UK port authorities

• Energy companies

• Conservation organisations, amongst others

With a big overlap in content and business for companies involved in marine construction, the event is uniquely positioned to provide invaluable opportunities to access wider relevant audiences via Seawork and Maritime Journal.

Unfortunately, this may not be the case in the US.

Well, in writing these opinion pieces, I’ve avoided the touchy issues of labour. After all, ports are fueled by people, and, as the saying goes, “if it ain’t brokedon’t fix it.” But the problem with that is maybe it is “broken,” however you define it!

Consider that US West Coast ports, which have been in the midst of “labour negotiations” (another phrase with a vague definition) for nearly a year, are now slowing down. Yes, the post-pandemic stats are good, but recent reports suggest that manpower shortages/ not enough workers, have contributed to actual shutdowns at Los Angeles/Long Beach (LA/ LB) in early April. The backdrop, evidenced in statistics put together by John McCown and other analysts, has confirmed what was visible to observers – a significant portion of cargo has shifted to the East Coast. While that is closer to my geography, I am not standing up and cheering. The repositioning of cargo gives

a hint as to the nature of the above-mentioned breakage.

To some degree, the West Coast ports have struggled with productivity. Maybe it is time now for further exploration of the dreaded “A” word, which is “A” for automation (a feature in some, though not all, of the East Coast terminals). The move to “A” need not connote a whole elimination of jobs. It does, however, suggest that a middle ground, that of re-skilling the workforce, might be part of the solutions. Just

In March 2023, the European Court of Auditors (ECA) published a report in which it argued that the EU’s ambitions regarding the growth of intermodal transport are not realistic. More specifically, the European Green Deal calls for a substantial part of the 75 per cent of inland freight carried today by road to shift to rail and inland waterways.

The ECA points out that the ‘modal shift’ ambitions are not new, but were already included in the 2011 whitepaper setting out the freight transport policies. However, since 2011, the share of intermodal (rail and inland waterways) transport has not grown at all; in fact, it even

8 Traditionally longshoremen have objected to the comprehensive adoption of automation, notably on the USWC, but increasingly this appears to be an impediment to optimising supply chain performance

like “seafarers” aboard ships are increasingly schooled with capabilities for operating in a more digitalised realm, the shore-side must come to grips with the bigger picture of how commerce can flow.

Though the ports are not operating the terminals in many

cases, and are performing the landlord function, they can play an important role in prodding both terminals and labour to explore moves towards this middle ground.

Supply chain data initiatives abound at this point, hoping to bring some fluidity to what’s been a very fragmented market structure. Individual ports (including those mentioned above) have well designed “data” displays reflecting their activities. Yet they are all in silos, not really purposed for interfacing with broader solutions that could be developed.

Automation at ports would enhance the ability to integrate into supply chain optimisation efforts. Not surprisingly (and, again I am not applauding), the productivity of US ports has ranked in the lower portions of the leaderboard when port performance is measured. But moves towards a more digitalised future (with the labour increasingly taking on supervisory roles) could be an important step towards enhanced productivity.

declined somewhat. In addition, the total volume transported by rail & inland waterways also grew only very moderately (rail volumes grew 8 per cent in the decade 2010-2020).

In spite of these developments, the EU targets a growth of rail freight of 100 per c ent by 2050, and a growth of inland waterways transport by 50 per cent in 2050.

The European Commission foresees a substantial growth of freight transport overall, and strives for a significant (but unspecified) shift from road to rail and inland waterways.

In my view, both of these drivers of rail volume growth are

highly uncertain. The overall freight transport volumes do not necessarily grow as the economy grows; an increasing decoupling can be observed. The aspired ‘modal shift’ is also uncertain. In addition, the environmental performance of road transport is bound to increase, as it will increasingly use electricity (and in addition hydrogen).

As with passenger cars, the shift to electricity may go fast once the tipping point, at which e-trucks become cheaper than diesel trucks, is reached. Even with e-trucks, there may be societal benefits of using intermodal transport, as a shift to

intermodal may alleviate highway congestion. However, this congestion is mostly driven by commuting in rush hours, so the effect is probably not very large.

All in all, aspirational goals for the growth of intermodal transport are fine, as long as policy makers do not become so invested in achieving these goals that they agree on massive investments in rail infrastructure and intermodal terminals. There is a serious risk that the costs of such investments will turn out to be higher than initially estimated, while the benefits will turn out to be lower than initially estimated.

It will take decades before we see the end of marine oil-based fuels and the alternative fuels, particularly LNG, may not bring the benefits touted.

Much has been written and even more discussed about the international shipping industry moving from the traditional polluting bunker fuels known as heavy fuel oil (HFO) to marine gas oil (MGO), a distillate to very low sulfur oil (VLSO) and now followed by the “greener” varieties of engine fuels such as ammonia, hydrogen, LNG, LPG, methanol some with support of batteries and scrubbers and, in some minor cases, a return to sail assistance.

Let’s put this into some perspective. There are +/- 58,000 internationally trading merchant ships plying the oceans. Today, over 99 .6 per cent of these, according to the DNV, operate using conventional fuel oils leaving less than half a per cent using the alternative cleaner and greener fuels, and these ships are

modifications, which lead to increased costs for the carriers. It will be interesting to see how the chosen fuel price differentials work out and whether they can provide greater stability than crude oil-based fuel has done in the past.

primarily containerships. It is estimated that by 2025/2027 the non-conventional fuel burning ships will reach somewhere near 20 per cent of the total fleet made up primarily of containerships which by then will number in the region of 5700.

The majority of the alternative fuel ships will be powered by LNG based on the current order book. It is interesting to note that Maersk Line has opted to invest in ships burning methanol whilst

The US Government Accountability Office (GAO) has conducted an assessment of the US Coast Guard’s Foreign Port Security Programme and concluded, in a 50+ page report, that it could:

- More consistently assess security in countries that don’t allow port visits.

- Share assessment information with other agencies working on supply chain security, and

- Coordinate with the State Department on strengthening foreign port security.

The report notes that the Coast Guard has assessed the security of foreign maritime ports since 2014 but due to the pandemic it had to suspend its country assessment visits during fy 2020 and 2021 with

CMA CGM and Hapag Lloyd have opted for LNG.

The availability of production and distribution facilities as well as an adequate bunkering infrastructure will be a challenge for the main global bunkering ports in order to service their clients. New fuels in many cases require extensive on-board

The other challenge facing the ship owning industry that is investing in alternative fuels is to prove that their new choice of propulsion is in reality, not just in theory, greener and more environmentally sustainable. There are already groups protesting the emissions from LNG in particular and methanol as well. Two highly active ones are “Say No To LNG’s” and the ClimateWorks Foundation. The contention is that LNG ships will produce methane emissions replacing CO2, neither of which is desirable. The financial impact on ports and ship owners is yet to be determined.

the programme resuming in May 2021.

This new GAO assessment has implications for the ports involved – including those countries that resist port visits - and as such its principal findings are worth noting.

On the issue of countries that don’t allow port visits, the GAO notes that the Coast Guard had started using alternative approaches to assess these countries but that this tactic has lacked consistency. GAO contends that by fully documenting procedures for using alternative approaches consistency can be improved with a commensurate boost to security.

On the point of sharing information with other agencies the report states:

“The program documents the results of its foreign port assessments in various reports. However, as of September 2022, it had not disseminated its most comprehensive report (known as its annual report) to Customs and Border Protection (CBP) and other federal agencies that may have a vested interest in receiving it. For example, it had not shared them with CBP, even though it is required to assess the information in its supply chain security efforts. By sharing its annual reports with CBP and other federal agencies, the Coast Guard could better support its

“whole of government” approach for securing the U.S. supply chain.”

In the final analysis, GAO comes up with six main recommendations for executive action which can be viewed at https://www.gao.gov/products/ gao-23-105385. Combined they are expected to lead to a more rigorous approach to foreign port security assessment.

The spirit of these recommendations is basically to use with greater positive effect internal resources and to achieve a higher level of coordination and capacity building resulting in a better overall assessment of maritime security in the context of the US supply chain.

Many of the drivers for rapid container trade growth are found in India. Are the planets finally aligned to deliver this? Andrew Penfold takes a look at the pros and the cons

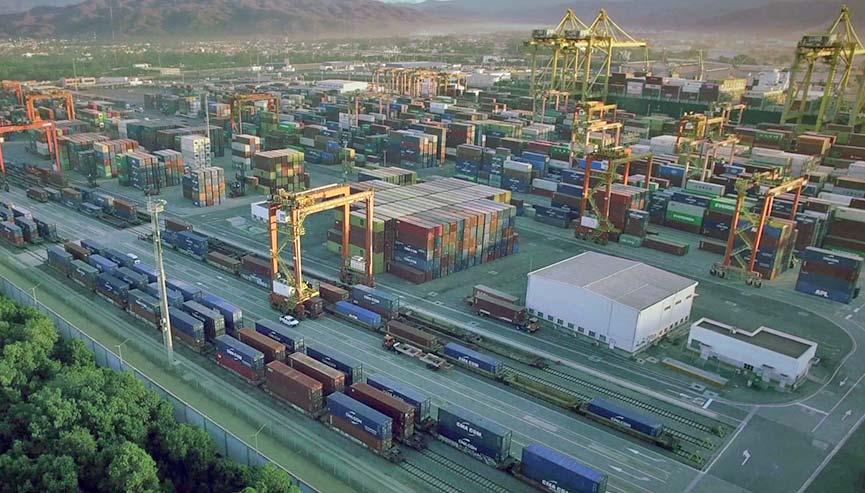

8 JNPT is one of the West Coast ports that has seen significant investment but container system investment needs to take place on a broader basis to unlock the full trade potential

The outlook for India as a major global manufacturing hub should be positive. The economy is expanding rapidly, there is increased openness and scepticism towards China has increased sharply post-Covid. The IMF is currently estimating GDP growth of 6.8 per cent this year with this broadly maintained in the short term. Labour costs are low, and this will continue, and exports are on the up, reaching more than USD422bn this financial year.

S&P Global and Morgan Stanley have recently reported that India will overtake Japan and Germany to become the world’s third-largest economy, with a forecast annual GDP annual GDP growth of 6.3 per cent through to 2030 and beyond.

Given geopolitical uncertainties regarding China, and a much higher perceived risk for placing all eggs in the Chinese basket, it would (at least superficially) seem that India offers a good alternative source for global manufacturers. The real question is whether this potential will be derailed by infrastructure issues? Can the port sector deliver what is required to catalyse the Indian economy?

Of course, its not just the ports that have held back India’s development. There are well-entrenched social issues in India and a generally bureaucratic structure has constrained innovation for many years, with protectionist policies undermining scope for export-led expansion and a notable lack of international trade partnerships. However, this final point may well be changing with the establishment of the USled Indo-Pacific Economic Framework from May of last year. This potential opening and reorientation of global demand away from China are already being reflected in container trade vectors.

If India is to capitalise on this new found relative opportunity it will be the container port sector that will have to lead the way.

Overall development of containers handled at Indian ports, as collated by the Indian Government, is summarised in the

accompanying graph. The pre-Covid trend was clearly one of sustained expansion with total volumes reaching a peak of over 17.1m TEU in 2019. The situation since then – in common with other markets – has been uncertain, with total volumes having contracted and remaining below the 2019 peak. It is fair to say that the lack of efficient port handling capacity is now actively constraining the level of Indian containerised trade. The rush to invest in Indian ports that was noted a few years ago has taken some time to be reanimated.

The difficulties and expense of inland container delivery in India has long been a major issue for trade development. The need to transit internal borders and the lack of a truly integrated transport policy (aside from the rapidly developing Mumbai/Gujarat to New Delhi axis) has resulted in a high level of dependency on smaller volume (feeder) ports serving immediate and localised hinterlands.

Within the overall national picture, it is apparent that there is a sharp difference between the situation facing west coast ports and those in the south and on the Bay of Bengal. In the former ports, investment has proceeded fairly rapidly with a series of projects permitting larger vessels to enter the trades. As a result, these west coast markets are far less dependent upon feedering from regional hub ports. It is estimated that within the total west coast demand feedering (from Dubai and Colombo) accounted for around 8 per cent of all containers handled.

The situation on the east coast is different. Here, the role of feedered containers is far greater with around 45 per cent of all containers handled at these ports being feedered either from Port Klang, Dubai or – most significantly – Colombo. It is estimated that around 2.5m TEU of Sri Lankan port demand is currently feedered to/from Indian east coast ports. This equates to around 38 per cent of demand at Colombo.

The additional costs of this cargo diversion are sizeable and can be estimated at around USD450-500 per 40ft container. Although significant it should be noted that in relation to the value of the goods this represents a limited

cost penalty. There has been significant and continuing pressure to develop a transshipment hub within a regional Indian port, but this has been driven as much by national reasons as from compelling cost assessments. The simple replacement of Sri Lanka with a domestic hub port would have little overall benefit except insofar as the revenue from handling would be in the hands of Indian companies –probably themselves subsidiaries of international stevedores.

Until east coast ports are developed to handle the size and type of vessels required for direct services (and until the required critical mass in demand is secured) the feedering model will remain dominant.

It should be noted that the major shipping lines are actively reviewing their strategies with regard to the Indian market. The push to deploy larger vessels on the trades – even where port access is highly problematic – has been accelerated by the cascading effect noted from the Far East to Europe trades. The introduction of ‘Megamax’ (20,000TEU+) vessels onto the major trades has seen a displacement of previous generation 13,000-15,000TEU units onto some of the Indian trades. This push – together with the development of increased direct services between India and North America – is rapidly changing the outlook.

According to Alphaliner, the biggest global container tonnage shift in 2022 was the rapid expansion of capacity deployed on the Middle East/Indian Subcontinent markets where around 320,000TEU of fleet capacity was added over the year. This compares with a stagnation in the established arterial trades. Indian demand was the driving force in these developments.

Typical of these developments was the decision by COSCO and OOCL to offer a dedicated southeast Asia to US East Coast service via India. The vessels are in the small category at around 4500TEU but are indicative of the underlying demand picture. The AWES service calls at Mundra where Adani will concentrate local and domestic feedered demand. There are currently five direct weekly services between India and the US East Coast. Garments are the major commodities

within these trades as US demand diversifies away from China to lower cost Indian and Bangladeshi suppliers.

The relative strength of demand here is confirmed by the recent US$500 per 40ft rate increase applied on these trades – this running counter to the broader trend of rate collapses noted on the larger deepsea trades.

The direction of travel is clear, with lines stepping-up investment in the Indian markets in anticipation of strong demand growth. Hapag-Lloyd’s decision to invest in India’s leading inland transport/terminal operator J M Baxi Ports & Logistics is another indicator of this trend.

The potential is clearly there, and the level of inward investment is increasing (see following article). At present, there is a lack of three things: overall container handling capacity, handling capacity correctly formatted to the needs of the largest vessels and limited inland container delivery restricting establishment of critical mass away from Mumbai and Gujarat. Each of these presents real difficulties but the profitability is there if carefully managed. In the meantime, reliance on smaller vessels and transshipment will continue.

Investment is recognising this potential and the level of projects coming forward is high. In the past the pace of growth has been constrained by both bureaucracy and India’s well-established vested interests. Developments on the global stage present an unprecedented opportunity for Indian exports – these markets remain the great underdeveloped opportunity for fast-track containerisation.

8 The difficulties associated with and expense of inland container delivery in India represent significant challenges that have to be addressed to optimise supply chain efficiency

India - these markets remain the great underdeveloped opportunity for fast-track containerisation

The UN reports India has overtaken China as the world’s most populous country. With its potential to be a tiger economy, are India’s ports purring? AJ Keyes looks at current developments

According to the Ministry of Ports, Shipping and Waterways in India, the country has 12 major ports (and 200 non-major facilities) and over 95 per cent of its trade (and 65 per cent of value) needs maritime transport access to serve its 1.43bn inhabitants.

The need for container ports to be efficient and for capacity to keep pace with cargo demand is undeniable, but as Andrew Penfold confirms (see preceding article), the country lacks three things: overall container handling capacity, handling capacity correctly formatted to the needs of the largest vessels and effective inland container delivery, restricting establishment of critical mass, away from Mumbai and Gujarat.

So, what is the current state of play across Indian ports? Roaring like a lion or meowing like a kitten?

Figure 1 provides an overview of the location of the main Indian container ports spread along the east and west coasts. There are a number of confirmed or known projects in India set to increase container capacity on both coasts.

Table 1 provides a listing of the main East Coast container ports and a summary of terminal operator(s), current annual throughput capacity, and investment plans.

The following represents a summary of the investment and capacity plans at selected East Coast ports:

5 Chennai: According to the Chennai Masterplan, 2022, the combined berth capacity at the first and second container terminals “may barely be sufficient for the expected container volume in 2035.” As a result, the Port Authority is planning to augment infrastructure and points out that the “existing concession agreements have a provision for the upgradation and renewal of container handling equipment by the operator in 15 to 20 years of operation.” A total of 3.7 million TEU per annum capacity by 2025 is cited in the masterplan, although this currently looks an optimistic build date.

5 Gangararam: The port handled 30 million tonnes in FY 2022 and forecasts a rise to 66 million tonnes by FY 2025. A new container terminal of 800,000 TEU per annum is part of the port’s ongoing development plans, with more than 400,000 TEU handled by FY 2025.

5 Karaikal: APSEZ has completed the acquisition of Karaikal Port Private Limited (KPPL), located around 300 kilometres south of Chennai. It is the only major port between Chennai and Tuticorin, and its strategic location allows access to the hinterland of Central Tamil Nadu. APSEZ has stated it intends to double the capacity of the port within the next five years and to add a container terminal.

5 VO Chidambaranar (Tuticorin): Confirmed plans to develop a transshipment hub by expanding container handling capacity to four million TEU per annum. The project includes construction of a breakwater, supporting yard, rail line and dredging in the Outer Harbour basin. A port official confirms: “This will be basically India’s answer to Colombo port. It will be a major container port, competing with Colombo, Singapore etc., the likes of which India has never seen before.” Big claims indeed.

5 Visakhapatnam: COVID-19 delayed capacity expansion but at the end of 2022 the port said the project to develop 1.2 million TEU of new capacity was completed, as part of targeting traffic currently moving over Colombo. The project entailed berth length expansion from 450m to 850m, supported by Super Post-Panamax cranes so ships up to 20,000 TEU in size can be handled. Local reports indicate that cargo from Kolkata port has been using Colombo and India’s west coast due to a lack of adequate infrastructure on the east coast.

Table 2 presents a summary of select container ports on the West Coast of India and their respective plans:

5 Cochin: Current capacity is one million TEU per annum and although there has been a Phase II development mooted, it remains unconfirmed. Doubts over the viability of the expansion were recently highlighted with the confirmation that for the fiscal year 2022-2023 period, the DP World facility saw transshipment activity fall by 30 per cent. As a result, only 104,666 TEU of transshipment cargo was handled, down on the 156,159 TEU in fiscal year 2021-22. The total volume of 695,230TEU in this recent year was down from 735,577TEU in the previous year..

5 Kandla: In Q4 2022, the government of India approved development of two new container terminals at Tuna-Tekra in Deendayal Port (Kandla Port) at an estimated cost of Rs5,963 crore (US$720 million). In a statement the Cabinet

Office said:: “From 2025, a net gap of 1.88 million TEU shall be available which can be catered for by a state-of-the-art container terminal at Tuna-Tekra, which will give it a strategic advantage as it will be the closest container terminal serving the vast hinterlands of northern India.”

5 Hazira: Very substantial plans are known for this facility, with as many as 19 new multi-purpose berths that will see cargo capacity rise from 150 million tonnes to 234 million tonnes. Space for containers has been confirmed within the project. This expansion is despite a further six berths being already undeveloped under the current concession terms. The exact timescales are not known, and the project is certainly ambitious.

5 Jawaharlal Nehru: CMA CGM Group subsidiary, CMA Terminals (CMAT), and J M Baxi Ports & Logistics Ltd., won the tender for privatisation of Jawaharlal Nehru Port Container Terminal (JNPCT), gaining a 30-year concession. The new Nhava Sheva Freeport Terminal has taken control of JNPCT’s 680m quay and 54ha yard and through equipment, yard and IT upgrades, intends to raise capacity to 1.8 million TEU per annum.

5 Mundra: APSEZ operates four container terminals and is expanding its infrastructure, due to ongoing double-digit throughput growth. In Summer 2022 the operator commenced the CT5 project that is targeting additional capacity of 1.3 million TEU per annum.

5 Pipavav: APM Terminals Pipavav is spending US$80 million, expanding its terminal to 1.6 million TEU capacity per annum to handle bigger ships and increased volumes from the implementation of its Western Dedicated Freight Corridor (DFC) initiative.

There are a number of ongoing and planned container port capacity projects on both the east and west coasts of India.

Collectively, these will add extra capacity to the country’s ports and with the involvement of both specialists in the Indian port market and leading global terminal operators, should enhance and improve container handling efficiency. Yet this investment may potentially see the weakest link in the supply chain moving inland, firmly placing the pressure on the quality and reliability of road and rail connectivity to support the country’s ports.

8 There are diverse capacity expansion plans for container ports in India but rail and road connectivity needs more attention

Karaikal Berth 5Government of Puducherry on Public Private Partnership

Kattupalli Kattupalli International Container Terminal (APSEZ)

Kolkata Bharat Kolkata Container Terminals (PSA)

Port authority & terminal operator

by 2025

Port expansion plan includes the development of a new container terminal with a handling capacity of 3.5 million TEUs and the creation of a multi-modal logistics park to enhance connectivity between the port and hinterland areas.

800,000 TEU terminal development

300,000Double capacity by 2028 and add a container terminal

1,200,000Expansion focused on coal and crude oil/gas

Wholly owned subsidiary850,000Capacity increase of 20% planned, noncontainer emphasis

Krishnapatnam Navayuga Container Terminal (APSEZ) Share of 75% in port company

1,200,000Phase 3 expansion, non-container VO Chidambaranar (Tuticorin) Tuticorin Container Terminal (PSA) PSA SICAL 57.5%450,000Outer Harbour project of 4 million TEU

Visakhapatnam Visakha Container Terminal (DPW) 30-year lease from 2002. DPW (26%) and United Liner Agencies of India (74%)

700,000Capacity up to 1.2 million TEU, longer-term could rise further

Notes: APSEZ = Adani Ports and Special Economic Zone. Primary focus on container activities Source: dataand.com

Host Port:

Sponsored by: Supported by:

Balancing Environmental Considerations with Economic Demands. The world’s leading conference on sustainable environmental practice comes to Lisbon.

Join us for two days of conference presentations and learn from the foremost experts in environmental technologies

Media Partners:

visit: https://www.portstrategy.com/greenport-cruise-and-congress

contact: +44 1329 825335

email: congress@greenport.com

Welcome Reception - Hosted by the Port of Lisbon

DAY ONE - Wednesday 18 October 2023

08:30 Coffee and registration

09:30 Opening by Chairman/Moderator

Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC, and Visiting Research Fellow, Cardiff University, UK

09:40 Welcome Address by Port of Lisbon

Keynote Panel

10:00 Climate Change: Energy efficiency, GHG emissions reduction & adaptation

-11:10 The risks to Ports, Shipping & the Logistics from climate change are increasing. This panel will discuss options available to combat these risks hearing from ports, shippers, and companies across the maritime industry. Confirmed panellists include Isabelle Ryckbost, Secretary General , ESPO; Nicolette van der Jagt, Director General, CLECAT; Isabel Moura Ramos, Executive Board Member, Port of Lisbon Authority

11:10 Coffee & Networking

11:30 Going Green: How can a Cruise Terminal be more sustainable

11:45 Opportunities, Risks & Threats regarding “Cold Ironing” in Ports - “The case of Heraklion Port”

Minas Papadakis, CEO, Heraklion Port Authority Cold ironing is the major way that ports can contribute to reducing shipping’s emissions. The administration of Heraklion Port has set the green transition as our top priority. The European program the “Electriport” was the result of our efforts towards a greener and sustainable port.

12:00 Shore-to-Ship Connection at Cruises and Cargo Terminals of the Lisbon Port

Armando Santos, Global Partner - Client Manager - Energy and Industry, Quadrante

11:30 Andreas Slotte, Head of Sustainable Development, Port of Helsinki

11.45 Miguel Matias, CEO, KEME Energy, Lda

12.00 Carbon Capture in the green transitionPorts as the entry to make CCUS/CCS & transport feasible

Ralph Guldberg Bjørndal, Senior Chief Project Manager, Ports, Marine & Coastal, Ramboll Ramboll is conducting a pre-feasibility study, outlining how carbon capture facilities can be implemented, and how port facilities shall be established to support the shipping of CO2 to the final storage destination. Various shipping options are considered, together with an assessment of how the expected CO2 Hub system might evolve.

12:30

Question & Answer Session

12:30

Question & Answer Session

12:45 Lunch & Networking

Duarte Morais Cabral, General Manager, Lisbon Cruise Port Session 1.1: Cruise Infrastructure Development Session 1.2: Carbon Neutral Ports14:10 Luca Imperiali di Francavilla, Global Product Manager, ABB Global Product Manager

The use of renewable energy sources at ports supports the Shore Connection when ships are connecting to it. We believe different shore connection applications will ultimately play a big role in decarbonizing the marine and ports industries. ABB will present to the audience a case example of Port of Toulon, one of ABB’s project deliveries, which is utilizing energy storage as part of shore connection.

14:25 What kind of options do ports have in their carbon neutrality journey?

Laurent Dupuis, VP Global Product Manager Ports & Maritime, Cavotec

In this presentation, Cavotec will compare the emissions reduction potential of different solutions for several ports and terminal types (cruise, ferries, container) to shed some light on how ports can create the best journey towards carbon neutrality.

14:40 Reliability and availability return of experience, from years of power conversion in Vessel Electrical Conversion systems, and Oil and Gas systems. Alex Lagarde. Conversion’s Energy Conversion Expert & Business Development Manager, GE Power

This presentation will explore reliability aspects of large power converter (range between 5MVA and 20MVA), based on more than 30 years of return of experience on critical electrical systems.

15:10 Questions & Answers

15:50 Faciliator: Antonis Michail, Technical Director, International Association of Ports and Harbors (IAPH)

Port Endeavor draws on real life examples from the 200+ strong IAPH World Ports Sustainability Program (WPSP) database of projects and best practices on how ports integrate the UN Sustainable Development Goals (UN SDGs) into their business models and operations. The aim of the game is to increase awareness among port management, staff and professionals working in port communities on how ports are already applying the UN Sustainable Development Goals to their business, to ultimately accelerate adoption of these measures in the port sector.

14:10 Bruno Vale, General Manager, YILPORT LISCONT

14:25 Energy Recovery & Storage for Ports –Where Energy Supply Meets Demand

Justin Hollingsworth, Business Development Manager, TMEIC

Energy storage systems (ESS) are a great asset when transitioning to renewable energy sources, and they also play a role in strengthening and managing demand on a local grid. This presentation will consider the benefits of ESS within a port and the use cases of distributed energy recovery and centralized energy storage.

14:40 - H2PORTS Project: A First Operational Experience

Using Hydrogen Powered Machinery at A Port Terminal

Aurelio Lazaro, R&D Engineer, Environmental Sustainability and Energy Transition, Fundación Valenciaport

This work will present the outcomes of the project that will include not only the feedback from this real operation experience but also the lessons learned during it development phase and the analysis of crosscutting aspects of the project such as legislation, replicability, market uptake and human awareness related with the use of hydrogen at ports.

15:10

15:50 Workshop facilitator: Christopher Wooldridge (Cardiff University - UK)

The workshop will investigate: What are the benefits and value of ESG approach, How do you initiate ESG into your port’s management framework, How do you identify key components, how does it enhance decision-making and what are the links with sustainability?

17:20- Day 1 Round up - Christopher Wooldridge

17:30 Conference Close

7-10PM CONFERENCE DINNER – HOSTED BY THE PORT OF LISBON

DAY TWO - Thursday 19th October 2023

08:30 Coffee and registration

09:00 Opening by Chairman/Moderator

Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC, and Visiting Research Fellow, Cardiff University, UK

09:10 EXCLUSIVE LAUNCH - ESPO Environmental Report

Valter Selén, Senior Policy Advisor Sustainable Development, Cruise and Ferry Network, EcoPorts Coordinator - ESPO

09:30 EXCLUSIVE LAUNCH - ECO SLC Environmental Report

Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC, and Visiting Research Fellow, Cardiff University, UK

09:50 Ms. Lamia Kerdjoudj, Secretary General, FEPORT

10:30 Coffee & Networking

10:50 Faciliator: Antonis Michail, Technical Director, International Association of Ports and Harbors (IAPH)

Port Endeavor draws on real life examples from the 200+ strong IAPH World Ports Sustainability Program (WPSP database of projects and best practices on how ports integrate the UN Sustainable Development Goals (UN SDGs) into their business models and operations. The aim of the exercise is to increase awareness among port management, staff and professionals working in port communities on how ports are already applying the UN Sustainable Development Goals to their business, to ultimately accelerate adoption of these measures in the port sector

10.50 Methanol as a Marine Fuel?

NABU study by Öko-Institut (Institute for Applied Ecology)

Malte Siegert, Head of Environmental Policy, Naturschutzbund Deutschland (NABU / Nature and Biodiversity Conservation Union)

NABU will present the major findings of the study “Methanol as a Marine Fuel” highlighting especially the environmental benefits of e-methanol.

11.05 EALING (European Flagship Action for Cold Ironing in Ports) Project

Rocío García Molina, Innovation & Port Cluster Development, Fundación Valenciaport

EALING (European Flagship Action for Cold Ironing in Ports) is a 42-month project, co-funded by the Connecting Europe Facility (CEF), which, in addition to carrying out all the technical, environmental, socio economic and financial studies necessary to prepare the works for the installation of shore-side electricity in 16 ports from 8 EU Member States, aims to work towards a harmonised and interoperable framework in the EU.

11:20

13:40 European Maritime Safety Agency

13:55 Generating hydrocarbon products from maritime waste: Ecoslops’ experience on profitable circular economy within ports.

Vincent Favier,CEO, Ecoslops

Ecoslops is an innovative cleantech that brings oil into circular economy. Our solutions have been developed to help ports manage their waste in a more efficient and environmentally friendly way. Our technology allows the recycling of oil residues from ships, as well as land-based hydrocarbon residues (yc used lub oil) that are often considered hazardous and difficult to dispose of

14:10 Target Zero: Zero Waste to Landfill at the Port of Dover Ben Crake, Environment Advisor, Port of Dover

14:40 Question & Answer Session

13:40 Ruben Eiras, Secretary-General, Fórum OceanoPortugal Blue Economy Cluster

13:55 Tiago Fernandes, Head of Logistics, Port of Lisbon Authority

14:10 Clean Ports, Clean Oceans: Improving Port Waste Management in the Philippines

Emeline Pluchon, WWF-Norway, Senior Advisor WWF will present the solutions conducted with the port and city authorities, such as the development of a materials recovery facility in the port of Cagayan de Oro, the collection and recycling of plastic waste in the ports of Manila North Port and Batangas, and will share how activities with other stakeholders in the port area have been developed collaboratively to ensure their sustainability.

14:40 Question & Answer Session

15:00 Coffee & Networking

Session 7: Digitalization and Technology

15:30 S5 Agency World

15:45 Moving on the Mersey – a localised approach for technology deployment to deliver emission reductions in leisure, freight, and passenger transport.

Richard Willis,Technical Director Port Operations & Technology, RoyalHaskoningDHV

Working together with local stakeholders across the maritime sector in the Liverpool City Region we studied where the use of river-centric transport modes blended with low-carbon technologies could transform both the under-used waterways in the city and reduce impact of air quality upon the residents.

16:00 Concrete use cases and experiences in utilising data analytics, AI and simulation to increase productivity, sustainability and safety

Miika Murremäki, Head of Digital Solutions, Kalmar

By leveraging analytics, AI, and simulation, cargo handling equipment experts can help ports to increase productivity, sustainability and safety. This can ultimately help ports to remain competitive in a rapidly changing industry. Kalmar will present on the main use cases

16:15 LSYM Port Simulators developed by the University of Valencia

Pablo Galán, Head of Business Development, e-nquest

Our mission is to accelerate the port industry’s transition to digitalized training. We develop training systems with simulators, capable of reproducing the working environment of real machinery used at the terminals like quay cranes, mobile harbor cranes and vehicles like heavy forklifts or reach stackers among others

16:30 Question & Answer Session

16:50 Conference Wrap up by Conference Chairman/Moderator – Christopher Wooldridge

17:00 Conference Close

Friday 20th October 2023 - PORT TOUR OF LISBON

Session 6.1: Waste Management and Circular Economy Session 6.2: Blue GrowthConference Fee

Cost per delegate (standard rate)

• Cruise – One Day event €1,100

• Cruise & Congress – €2,160

Booking Online greenport.com/congress or complete and fax the booking form below to +44 1329 550192. On receipt of your registration, you will be sent confirmation of your delegate place

Cruise Fee Includes

Attendance of Cruise conference streams on day 1, full documentation in electronic format, lunch and refreshments, place at the Welcome Reception and place at the Conference Dinner.

Cruise and Congress combined Fee Includes Choice of conference streams for GreenPort Cruise on day 1, two day conference attendance at GreenPort Congress, full documentation in electronic format, lunch and refreshments throughout, place at the Welcome Reception, place at the Conference Dinner, place at the Port Tour.

CONTACT US

For further information on exhibiting, sponsoring, or attending the conference, contact the Events team on: +44 1329 825335 or congress@greenport.com

OCT

BOOK ONLINE OR COMPLETE THIS FORM AND FAX TO +44 1329 550192

(Please copy this form for additional delegates)

Please tick all that apply :

Please register me for GreenPort Cruise 2022 (1 day)

Please register me for GreenPort Congress 2023 (2 days)

Welcome Reception (17th Oct 2023) – No additional cost

Conference Dinner (18th Oct 2023) – No additional cost

Port tour (20th Oct 2023) - No additional cost

Please register me for the virtual GreenPort Congress 2023

Members of supporting associations will receive a 10% discount

I am a member of

Family Name

First Name

HOW TO PAY *UK registered companies will be charged the standard rate UK VAT

Bank Transfer: Mercator Media Ltd, HSBC Bank plc, EUR account, Sort Code: 40-12-76, Account number: 70235247

SWIFT/BIC8: HBUKGB4B BRANCH BIC11: HBUKGB41CM1 IBAN: GB35HBUK40127670235247

NB: Prepayment is required in full for entry to the conference. Cancellations are not permitted, however substitutions are allowed.

Credit/Debit Card: Complete the form with your card details

I have paid by bank transfer

Please charge my card (delete as appropriate) Mastercard/Visa/Amex

Card Number

Name on Card

Credit Card Billing Address Expiry Date Security Code Signature

Secure your place now & Save 20%

environmental challenges with economic demands in

Host Port:

Sponsored by:

2023 Conference Sessions includes:

reduction & adaptation

Waste Management and Circular Economy

Infrastructure Development

Digitalization and Technology

Supported by: