OCR: The ‘Science Fiction’ Age | Offshore Opportunities Build | Drug Tsunami: Countermeasures

OCR: The ‘Science Fiction’ Age | Offshore Opportunities Build | Drug Tsunami: Countermeasures

MIKE MUNDY

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: Andrew Penfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production

David Blake, Paul Dunnington production@mercatormedia.com

The conference season is upon us and we look forward to engaging with you at the IAPH World Ports Conference in Hamburg. The event is a great stimulator of ideas, collaborations and a sure-fire way to get to know more influential contacts via the many networking opportunities

It is conference season again and Port Strategy will be available to delegates attending the IAPH World Ports Conference and also TOC Americas – two landmark industry events.

Let me interject a small commercial here, if you are attending the World Ports Conference – please do attend the session I will be moderating on the topic of Partnering with Investors to Optimise Concessions. This will run from 1500 to 1545 in Hall G on the second day of the conference, Wednesday 9 October. I expect it to be a thought-provoking session, there is an awful lot going on the area of concessions, both new awards and renewals. See you there!

Generally, there is much of interest in the World Ports Conference programme for port management and other stakeholders – resilience in supply chains, managing risk (including the use of AI to do this and cyber attack mitigation), innovative new technologies, combatting illicit trade and developing new business models for ports are all hot topics on Day 1 plus an array of technical visits to choose from.

Day 2 morning highlights include: creating a clean energy marine hub; towards a net zero maritime ecosystem, port leadership in climate action and green fuels and de-fossilised ports. The afternoon of Day 2 maintains an interesting focus on investment and a strong focus on the environment/sustainability including the opening afternoon session on Financing Energy and Climate Investments. Late afternoon there are also 2 x Port Endeavor Games – a unique IAPH crafted experience. Apply early, places are limited.

Day 3 sees the Conference formally close at lunchtime but prior to that I would highlight two papers I am particularly looking forward to hearing, the current risk landscape for shipping and ports, a presentation by Drewry Shipping Consultants, and global port markets in motion, a sector-by-sector analysis.

If all this hasn’t whetted your appetite, then the gala dinner on Wednesday evening might as well as good networking throughout the event.

Port Strategy looks forward to seeing you at the World Ports Conference and wishes to extend our very best wishes to TOC Americas for a great event.

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Daniel Spicer dspicer@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published bi-monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s digital subscription with online access £244.00

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

the Smart Port and there are more coming. The Smart Port concept promises to advance rapidly with the advent of powerful new technologies such as Spatial and Quantum Computing and Generative AI. The influence of these and other cutting-edge technologies will be felt at both the port management and terminal operations levels combining to have a transformative effect on the sector overall.

5

5

Converting a conventional RTG into an electrical one (E-RTG) means to shut down the diesel generator and to power the RTG with electrical power only – the emission saving, sustainable basis for automation. This is possible with electric power solutions, including E-RTG auto-steering and positioning systems, developed by Conductix-Wampfler: Plug-In Solution, Drive-In Solution, Hybrid Solution, Full-Battery Solution and Motor Driven Cable Reel Solution with CAP - Cable Auto Plug-In. We move your ports business!

www.conductix.com

After one of the longest courtships in port terminal history, involving many suitors, it looks like Santos Brasil will finally be taken over by French based liner company CMA CGM, for an initial outlay of around US$1.12BN and an eventual cost of approximately US$2.26BN.

The global carrier, which already has significant interests in Brazil (employing a workforce of more than 10,000 in eight offices) has signed an agreement offering to buy just under 48% of the shares of the Sao Paulo stock exchange (Bovespa) listed Santos Brasil, and reliable sources in Santos say the majority of shares will fall into their hands “in the near future”.

For nearly 10 years South America’s biggest container terminal outfit, which includes the largest terminal in Brazil (Tecon Santos, with 1.832M TEU handled in 2023, for a 38% share of all Santos), has been courted by the world’s leading terminal operating companies and shipping lines -including Maersk, MSC, Hutchison, and China Merchants Port Holdings, among others – and finally one of its suitors has stepped forward and made a concrete bid.

The French outfit has offered to buy (at Bovespa on September 23) 47.55% of the shares, all owned by chief shareholder Opportunity Group. At Reais15.30 a share (higher than the closing price of Reais12.71) the total cost to CMA CGM will be around Reais6.33BN (US$1.12BN) and more than double that if they buy the rest of the shares.

For its money it will get the 2.5M TEU per annum capacity Tecon Santos terminal, TEV, a car terminal in Santos, Tecon Imbituba

(for boxes and general cargo) in the south of Brazil, Tecon Vila do Conde (in the North region), a liquid bulk terminal in Itaqui (North region) and a growing logistics subsidiary, that will tie in with CEVA Logistics, which is also well established in Brazil, with a 7500 strong workforce.

In the first seven months of this year Tecon Santos increased its market share from 38% up to 41.3% of the 3.094M TEU handled up to end of July 31, 2024. This was at the expense of BTP (a joint venture between regional rivals MSC and Maersk), whose market share fell from 39% to 34.9% due to operational difficulties.

For the 12 months to June 30, 2024, Santos Brasil generated Reais2.55Bn in revenue and EBITDA was Reais1.28BN.

CMA CGM bought Mercosul Line, from Maersk, back in December of 2017, and has been ramping up its Brazilian operations even more since then. It is especially keen to continue improving and expanding its cabotage and Mercosur coastal services from the River Plate/

south of Brazil to Manaus, in the state of Amazonas. As the Santos Brasil group includes the Tecon Vila do Conde box terminal, on the outskirts of Belem (at the mouth of the Amazon River), it will tie in with Mercosul Line and CMA CGM’s growing business in Manaus (a city in the heart of the Amazon jungle with a 2.4M population). Last year and this year, severe droughts have hampered ship calls through the 1200 Km from the mouth of the Amazon to Manaus and Vila do Conde has been an important back-stop port for vessels to transship onto barges for the onward journey.

The CMA CGM offer for the Santos Brasil shares is subject to the usual Brazilian regulatory checks (from CADE, the monopolies watchdog and from Antaq, the Waterways and Ports regulator) but it is expected to pass those without hindrance or delay.

Maritime construction Group Jan De Nul has been awarded two major contracts in Georgia and Kazakhstan.

The first contract involves constructing a new deep-water port in Anaklia, Georgia, while the second project involves the

expansion of the Kuryk Port in Kazakhstan.

The company believes both projects will provide a significant boost to the “Middle Corridor,” (which is also known as the Trans-Caspian International Transport Route).

The construction of a new deep water port in Anaklia, Georgia, and the expansion of the Kuryk port in Kazakhstan, are being viewed as alternatives to the northern route through Russia, or the established southern route via the Suez Canal.

The Romanian government is reportedly in talks to buy Moldova’s only port. The Giurgiulești International Free Port is located at km 133 of the River Danube in the south of Moldova near the borders of Romania and Ukraine. Giurgiulești Port is the only facility in Moldova capable of servicing seagoing vessels, with its seven metre water depth.

AD Ports Group (AD Ports) has confirmed the acquisition process for Tbilisi Dry Port, making the Group the majority owner with a 60 per cent stake. This intermodal logistics hub is rail-linked and has customs bonded status. The deal further strengthens AD Ports’ plan to connect Asia and Europe via the Middle Trade Corridor, linking manufacturing centres in Western Asia to consumer markets in Eastern Europe. On-Dock is Go

A US$52 million infrastructure project to significantly improve on-dock rail capacity at the Pier 300 terminal in the Port of Los Angeles has been approved. Construction at the facility, operated by Fenix Marine Services, is expected to commence in early 2025 and will add five loading/ unloading tracks in the intermodal yard, enabling more cargo to be moved directly onto trains via the on-dock railyard.

The Port of Hodeida, Yemen, has been damaged by an airstrike from Israel according to port officials. This facility is reportedly controlled by Iranianbacked Houthi rebels and the strike was in response to an attack on Tel Aviv.

Our electric forklift experience spans decades, pushing the capabilities of material handling solutions and most importantly, powering real-world results for our customers. Hyster works as a trusted advisor to help operations confidently navigate the shift to electric and harness the financial, emissions and performance advantages of electrification – from busy ports and rail terminals to fast-paced logistics environments and everywhere in between.

That’s clean power that means business.

Good and bad news for Sri Lanka’s leading container port, Colombo. The facility ended the first half of 2024 with a 9.6% increase in transshipment cargo, due to double digit growth for the January to end of April period.

However, activity in June 2024 was down by five per cent, with July then seeing a further drop of six per cent, year-on-year.

The extent of the recent trends for this current year are more pronounced if the port’s vessel call data is noted, with containership visits falling by 18% for July 2024.

Keith Bernard, Chairman, Sri Lanka Ports Authority, put a positive spin on the situation: “The port is poised to become a key transshipment hub serving the Middle East, as many shipping lines are rerouting vessels to avoid prevailing risks in the Red Sea and Suez Canal,”

While the port has benefitted from Red-Sea ship diversions, capacity constraints at the port have challenged Colombo and resulted in reports of frequent congestion this year. As a consequence, both regular and ad-hoc shipping line customers have targeted alternate options – with some Indian ports benefitting.

For example, DP World Cochin, also known as Vallarpadam Terminal, more than doubled its container transshipments between April and July – the first four months of Indian fiscal year 2024/25 – to 70,701TEU, from 29,358TEU in the period a year ago, according to recently released port information.

Praveen Thomas Joseph, CEO, DP World Cochin, explains how

The African nation of Malawi looks set to lease a terminal at the port of Nacala in the north of Mozambique. The country is landlocked, so has no gateway port of its own. Similarly, Botswana has signed a deal with Zimbabwe and Mozambique for a new rail and port project, subject to financial closure, which includes a new US$1.5bn port at Technobanine, south of the Mozambique capital, Maputo.

the terminal was ready to take advantage of the congestion in Colombo: “In Q1 2024, we introduced new STS [ship-toshore] cranes, e-RTGs [rubbertyred gantry cranes] and expanded the yard space, boosting our capacity to approximately 1.4 million TEU a year, solidifying DP World Cochin as one of the largest terminals in South India.”

Elsewhere, Chennai Port saw its April-July transshipment movements jump to 35,417TEU, compared to just 6848TEU for the comparable previous period.

At the same time, Adani Group’s Vizhinjam Port in southern India is targeting a role as a potential “hub contender” by commencing a trial Maersk Line vessel call with 6900TEU moves. The new

PSA Baltics N.V., a subsidiary of PSA International (PSA), is acquiring an 85% majority stake in Loconi International S.A. (Loconi), one of Poland’s leading intermodal operators, from Polish freight forwarder ATC Cargo S.A. Established in 2011, Loconi provides logistics solutions integrating rail transport, last mile trucking and depot services across. It runs 220 trains monthly across five corridors and moves 250,000TEU p.a.

The Port of Portland in Oregon has confirmed that it hopes to have a new third-party operator in place by early 2025.

After two years of reported losses, the port had threatened to close the terminal, which would have removed direct access to transpacific container markets for shippers in Portland and Oregon.

■ Despite a good start to 2024, Sri Lanka’s Colombo port has seen recent transshipment volumes drop – at a time when India’s ports are targeting more subcontinent trade and bringing on new capacity

terminal is shortly to officially launch its phase-one operations. Clearly, Colombo will remain the focal point of transshipment activity for the subcontinent trade but port competition is intensifying. The attractive service rates reportedly on offer for transshipment calls at Vizhinjam, lower than the scale of vesselrelated charges at Colombo, are facilitating shipping lines considering their regional options. Pricing is said to be aggressive with part of the game plan aimed at building market share fast as per a high volume low-margin business.

The Emerald Duchess has arrived on the River Tees, in the UK. The £23m dredger is 71m long and will keep the 12 miles of the Tees to the North Sea and at Port of Hartlepool accessible for all vessels that enter its waters annually. Fitted with an innovative intelligent power management system, the vessel swaps between power from a battery pack equivalent to 10 Tesla cars and renewable diesel.

Submission of a business plan to Tina Kotek, Governor of Oregon, included the need for US$40 million of state funding to keep the facility open, which comprises US$5 million in stop-gap funding to help cover the current fiscal year’s loss and $35 million for dredging the Columbia River and long-term capital work at the T6 facility.

Portland is hopeful of following the landlord model that is commonplace to other West Coast ports. The port’s Board of Commissioners said it wants to negotiate an agreement with a private terminal operator to take over T6 and handle management and daily operations, along with marketing the facility to ocean carriers and cargo shippers.

“An agreement with a private operator would shield the port from the highly cyclical nature of the business and remove the current stevedore management structure for hiring labour and managing the terminal.”

The Port of Long Beach (POLB) has been awarded US$283 million from the federal government to support construction of “America’s Green Gateway.” This rail project will allow POLB to move more cargo by rail as part of easing supply chain congestion and reducing the environmental impact. This funding is for the port’s US$1.6bn Pier B On-Dock Rail Support Facility through the U.S. Department of Transportation’s Mega Grant Program.

CRUISE CAPITAL OF THE WORLD

GLOBAL GATEWAY OF THE AMERICAS

Global Spatial Technology Solutions (GSTS) has closed a C$11 million (US$8.2 million)

Series A funding round to accelerate the international commercialisation of its AI-powered maritime data platform. The company is specifically targeting near term expansion in the Asia Pacific and Europe, Middle East and Africa (EMEA) regions.

The OCIANA platform developed by GSTS provides operational optimisation, risk and compliance management support for the maritime industry, with ports, terminal operators and shipping lines as target customers.

The system offers dynamic route planning to support Just-In-Time Arrivals and delivers a platform for digital communication between ships, ports and terminal operators to allow vessel movements to be managed with real time

predictive visibility for better resource demand forecasting.

Richard Kolacz, CEO, GSTS, notes: “This funding is a strong endorsement from a highly recognised institutional investor upon completion of a detailed market assessment and an independent validation that OCIANA will be pivotal in facilitating upcoming maritime industry requirements. GSTS will

■ GSTS has secured additional funding to facilitate the expansion of its OCIANA platform into new regions

extend its presence and innovation in international regions and augment its development and delivery of novel solutions enabled by new data sources with AI-powered intelligence to solve the world’s most critical supply chain and climate challenges.”

■ Kumport Terminal Istanbul has joined the Portchain Connect network. The terminal is using the system to increase the quality and speed of its berth alignment with customers through digital handshakes and secure data sharing. Portchain will help Kumport Terminal Istanbul to simplify its communication channels and improve overall berth alignment by enabling receipt of real-time schedule and move count updates directly from carrier systems, This process allows immediate responses and serves to better synchronise vessel schedules with the terminal’s berth management.

Rotterdam-based Portbase has announced the launch of its new Portbase Marketplace. This central hub provides access to port logistics services, including to the Portbase services provided in Dutch ports, as well as a range of new offerings delivered through collaboration between Portbase and its ecosystem of community members to create products and services such as data storage and data conversion, identification, authorisation and authentication.

A new predictive software tool that analyses forecasts of port facility usage and resources is being developed to assist the Port of Milford Haven, UK in anticipating and adapting to changing demands on the Waterway. The project commenced in July 2024 and will run until March 2025 focusing on data analysis, programming and machine learning capability to support capacity planning via the development of a modelling tool for the strategic planning of port resources.

The Ministry of Electronics and Information Technology (MeitY) in India has launched the third phase of its capacitybuilding initiatives, as part of an ongoing commitment to the Digital India vision. Key focus areas are Digital Public Infrastructure, Contract and Procurement Management, Digital Governance, and Data Management. A series of related specialised training programmes are being conducted across the country.

ELME Spreader was born this year. So was the disco. Follow us in 2024 - we are celebrating it our way, by manufacturing world-leading spreaders.

Software solutions company, OneStop, has confirmed a new strategic partnership with the Port of Newcastle in New South Wales, Australia. The arrangement is targeting transformation of containerised freight operations, as part of three main goals covering supply chain ecosystem sustainability, efficiency, and economic growth.

OneStop Modal and Vehicle Booking System (VBS) solutions went live at the port in August 2024 with the mandate to enhance container handling coordination, improve turnaround times, and integrate seamlessly with existing logistics processes.

As part of the process, the VBS will function to minimise truck waiting times and reduce bottlenecks, ensuring smooth container flow and boosting productivity.

OneStop notes that its technology will efficiently manage and schedule vehicle movements, with the objective of alleviating congestion within the port and surrounding transport networks. This process will consequently result in faster and more reliable freight transit, as Sam Askin, CEO, OneStop, explains: “By leveraging our advanced OneStop Modal &

VBS solutions, and incorporating the latest technology capabilities, we are poised to transform containerised freight operations and drive significant economic and environmental benefits for the region,” he underlines.

Leading enterprise yard management systems provider, C3 Solutions, has announced a new partnership with EAIGLE, a premier vision AI platform renowned for its vision-based solutions tailored for the supply chain and logistics sectors.

This new collaboration will integrate C3’s yard management solution with EAIGLE’s advanced AI and computer vision technologies to deliver unparalleled automation and efficiency to yard operations at the gate, yard, and loading quay.

The Gambia Ports Authority (GPA) has awarded a contract to Prodevelop and Lasting Solutions to implement its Posidonia Management system. GPA is expecting this project to improve vessel and cargo handling processes, reduce ship response times and ensure full compliance with international maritime regulations and standards, while improving data management and reporting capabilities with all port facilities.

C3 Solutions offers dock scheduling and yard management systems, and when combined with EAIGLE’s Vision AI technology, provides:

● Reduced Gate Processing Times: Significantly faster processing for inbound and outbound vehicles, minimises delays and bottlenecks.

● Enhanced Security: Vision AI technology brings advanced security features, including automated vehicle identification and tracking.

● Optimised Labour Efficiency:

A new UK research hub will lead the use of digital twins in determining how transport systems, from road and rail to air and maritime, can be decarbonised as quickly, safely and cheaply as possible.

The TransiT Hub, led by Heriot-Watt and Glasgow universities, supported by a £46 million investment grant, will use digital replicas of the physical world to collect data in real time by sensors connected to infrastructure.

Kongsberg Digital and Smart Ship Hub are joining forces to integrate Kongsberg’s Vessel Insight with Smart Ship Hub’s digital platform.

The partnership plans to link data collected by Vessel Insight, that is processed in the cloud, to deliver enhanced performance management and machinery condition monitoring, with initiatives to reduce carbon emissions.

In addition, there is an aim to offer a tailored experience for both individual ships and entire fleets, with a focus on efficient data collection, standardisation, and intelligent management.

AI-driven automation and insights streamline tasks, maximising workforce productivity.

● Regulatory Compliance: Automated data logging and reporting ensures adherence to regulatory standards.

Nicholas Couture, CEO, C3 Solutions, highlights the value of the new partnership, with users benefitting from advancements and cost savings in yard management operations, processes, and overall productivity.

The POS SINGAPORE vessel is an integral part of the Korea Autonomous Surface Ship (KASS) project and is set to undergo a year of testing on trade routes between Korea and Southeast Asia. The tests will be aimed at targeting the effectiveness of the vessels automated systems, engine automation and also supporting cyber security systems. The POS SINGAPORE was built by the Hyundai Mipo Dockyard and delivered to operator Pan Ocean.

Kim Evanger, Director Ecosystem P&A at Kongsberg Digital, highlights: “This collaboration is an important advancement in our efforts to drive enhanced efficiency, sustainability, and innovation through the digitalisation of the maritime industry. Smart Ship Hub represents a fantastic hub of expertise and technological innovation, perfectly aligned with the capabilities of Vessel Insight. Together, we are perfectly positioned to deliver great value to our customers by transforming data into actionable insights for the crew and operators.”

INFORM has announced that it has successfully deployed its Syncrotess Optimization Plus solution at Norfolk Southern’s Austell terminal in Atlanta, Georgia enabling the terminal to have complete transparency of its stacked operations. The Yard Optimizer works in conjunction with the TOS to allocate storage locations for containers within the yard, to automatically determine the next operationally efficient move.

Kalmar Corporation, the specialist provider of material handling equipment and services, and CES Srl, an Italian manufacturer of super-sized heavy-duty material handling equipment, have confirmed a new partnership. The deal will see distribution and servicing of CES reachstacker units, which are over 125 tons capacity, on a global basis. As part of the agreement, Kalmar will also provide training and support to its customers on CES products.

Until now, Kalmar’s current offering of reachstackers was limited to a 125 ton capacity upper limit, but this new partnership will allow the Helsinki-headquartered company to provide its customers with even larger sized equipment.

“We are excited to partner with CES to offer our customers a comprehensive range of heavy-duty material handling solutions. This partnership will enable us to better serve our customers especially in heavy

logistics, such as wind energy, heavy bulk handling and heavy container handling industries,” confirmed Peter Olsson, Head of Global Sales of Counter Balanced Equipment at Kalmar.

“We are confident that our partnership with Kalmar will provide our customers with the best possible solutions for their heavy-duty material handling needs,” underlines Giovanni Bolcato, CEO of CES. “Kalmar’s global reach and expertise will enable us to reach new customers and markets, and we

are excited to work together to drive innovation in the heavyduty material handling industry.”

CES Srl, headquartered in Domegliara, Italy, specialises in the design and manufacture of traditional and super heavy reachstackers, which are unique on the market in lifting capacity and technology. Kalmar operates globally in over 120 countries offering a diverse product range.

Kalmar has concluded an agreement with longterm customer DP World Southampton to supply another 14 hybrid straddle carriers. The order was booked in Kalmar’s Q2 2024 intake, with delivery scheduled for Q2 2025.

The St. Vincent and Grenadines Port Authority (SVGPA) has ordered a new Konecranes Gottwald ESP.7 Mobile Harbor Crane to boost container and general cargo handling capacity in the Port of Kingstown.

This Generation 6 machine will join an existing Konecranes Gottwald mobile harbour Generation 5 crane in a new terminal, opening in Q1 2025, as Kingstown seeks to expand its service offering. The new crane will run on electricity from the harbour mains, reducing carbon emissions.

The Konecranes Gottwald ESP.7 Mobile Harbor Crane has a working radius of up to 51m and a maximum capacity of 125-tons to serve container ships up to post-Panamax class.

DP World Southampton has been operating Kalmar straddle carriers since 2007. This order will bring the total number of units at the terminal to 82. Being hybrid machines means a reduction of both fuel consumption and CO2 emissions during operations,

compared to traditional dieselpowered equipment, plus also generating less noise.

The units operated at Southampton are powered by hydrotreated vegetable oil (HVO), a biofuel made from 100% renewable raw material.

Brabo, specialist provider of pilot and port services in Antwerp, Belgium, has signed a deal with clean maritime technology company, Artemis Technologies, for an Artemis EF-12 Pilot boat. Scheduled for delivery in late summer 2025, the vessel is 100% electric, produces zero operational emissions and reduces operational costs by up to 80%. The Artemis eFoiler® electric propulsion system minimises wake and allows higher-speed transit to boost pilot hour utilisation.

India’s Ministry of Ports, Shipping and Waterways has unveiled the Green Tug Transition Program (GTTP). It is a key part of the government’s ‘Panch Karma Sankalp’ initiative, which intends to replace traditional fuel-powered harbour tugs with greener, more sustainable alternatives, playing an important part in decarbonizing India’s maritime activities. Phase 1 of GTTP runs from October 1, 2024 until December 31, 2027, with the four major ports of Jawaharlal Nehru, Deendayal, Paradip and V.O. Chidambaranar purchasing/chartering at least two green tugs each.

Hutchison Ports Felixstowe has taken delivery of five new automated electric rubber tyred gantries. These new units will initially operate in semi-automated mode but are capable of fully automated operation. They are able to lift a container 1 over 6 high and span up to seven container rows plus a roadway.

FOR PRODUCTIVE AND OUTSTANDING PORT OPERATORS

POWERFUL RANGE

To

+ READY FOR BIO FUEL (HVO –95% CO 2 ) + PREMIUM EUROPEAN SUPPLIERS + HIGH SAFETY STANDARDS + CONVENIENT ENHANCED FEATURES

A fleet of 20 terminal tractors has been fitted with an advanced multi-camera system to mitigate risk and improve safety at Rosslare Europort, the primary Irish port serving mainland Europe.

Port operator, Iarnród Éireann Irish Rail, is partnering with Camera Telematics to develop and roll-out the camera solution as part of a major IT project to create an integrated smart port system.

The multi-camera system introduced utilises a five-channel mobile digital video recorder (MDVR) to provide a four-camera solution that covers the front,

off-side and near-side of the terminal tractors, along with a wireless magnetic device that can be located at the rear of the trailer. The near-side camera is fitted lower, over the wheel arch, to provide added visibility underneath the trailer and the trailer leg, with footage available to the driver in real-time via an in-cab monitor.

A charging cradle is fitted in the terminal tractor for the wireless magnetic camera. When the device is removed from the cradle, it starts recording and displays a live view on a second monitor located in the cab. All footage

from each camera is automatically uploaded to Camera Telematics’ web-based Advanced Reporting and Viewing Software, so members of the Health & Safety and Operations teams can quickly access video and supporting data of any incident.

Rosslare Europort’s fleet of terminal tractors is used to load and unload both ro-ro (roll-on/ roll-off) and con-ro units between vessels and a storage terminal handling 200,000 freight units on an annual basis.

BEST container terminal at the Port of Barcelona, operated by Hutchison Ports, has taken delivery of 14 new automated stacking cranes (ASC) from Konecranes of Finland.

These new automated cranes have raised storage capacity by 25%, as the number of automated blocks rises from 27 to 34. The new blocks will be introduced in phases between September 2024 and Q1 2025, with the units acquired all electric and rail-mounted, like most of the terminal’s equipment.

Guillermo Belcastro, CEO, Hutchison Ports BEST, notes: “This new investment will result in an increase in the terminal’s operational and storage capacity and will contribute to the continuous improvement of the

quality of service in both maritime and inland operations.”

BEST currently has 13 Super Post-Panamax quay cranes, 54 automated cranes (ASC) and 40 Shuttle Carriers to operate the 80ha terminal, offering 1500m of berthing and a water depth alongside of 16.5m.

■ New Automated Stacking Cranes for the BEST Terminal, Barcelona

Hutchison Ports BEST is the first semi-automated terminal of the Hutchison Ports Group and is claimed to be the most technologically advanced port development project in Spain.

Washington state has awarded US$26.5 million to 11 ports to electrify operations, as part of the Port Electrification Grant Program, created in 2023 and funded by its Climate Commitment Act. Funding is provided for shore power projects introduced by the ports of Anacortes, Bellingham, Benton, Edmonds, Everett, Friday Harbor, and Seattle. The Northwest Seaport Alliance also received US$2.6 million for shore power planning.

Stockholm Norvik Port has introduced a new automated container loader that it says can place 30 tonnes of goods into a 40-foot container in just five minutes. The equipment will increase capacity and enhance services supporting the Swedish export industry.

“Unlike all other ports in Sweden, Ports of Stockholm has a surplus of empty containers, and there is a high demand for containers from the Swedish export industry,” reports Johan Wallén, CCO, Ports of Stockholm.

Cavotec has confirmed the successful commissioning of a MoorMaster automated vacuum mooring system at the APM Terminals (APMT) MedPort facility in Tangier, Morocco. The system was originally deployed on 400m of new quay wall developed during the terminal’s phase two expansion and it is designed to play a major part in reducing vessel turnaround times, increasing terminal productivity and lowering vessel fuel consumption.

Click here to read article on Port Strategy online

Click here to read article on Port Strategy online

Click here to read article on Port Strategy online

Click here to read article on Port Strategy online

Significant new capacity is due on stream at the port of Chancay, Peru. For this to succeed as an investment it will require the alignment of several key factors. Andrew Penfold takes a look. What are the lessons for other southern port developments?

The new port at Chancay in Peru is due on-stream by the end of the year for bulk handling and will expand to become a front-rank container handling terminal over 2025-2026. The new US$3.6bn terminal is being formatted to handle 18,000TEU vessels and clearly represents a major push to integrate the South American West Coat trades with China and other East Asian markets. The initial phase of development should provide around 1.5m TEU of capacity from 2025-2026. The driving force behind this is China’s Cosco Shipping and it clearly represents a major aspect of the – now somewhat uncertain – Belt and Road Initiative (BRI). Cosco’s share of the project is placed at 60%.

Although the terminal will be well formatted to meet current and future needs the entire project is controversial, both from geopolitical and container shipping perspectives. In the former category are US concerns about the influence of Chinese interests in South America, with the scale of the project raising concerns in Washington and being directly responsible for nascent US programmes to step up investment in the region. The degree to which these factors will shape the trade and port sector in coming years remains uncertain but attempts to raise real hard finance for such major projects on the open market would clearly prove much more difficult than under the soft financing available from the BRI.

The role of Chancay has been a matter of some dispute of late. The original idea was that the container facilities at the port were to be exclusively operated by Cosco. Recently, the Peruvian government sought to backtrack on this arrangement – possibly under US pressure – and to redefine the role of operation of the terminal on a non-exclusive basis. This did not last long, however, with political pressures from China (ahead of the Peruvian president’s visit to China) seeing this attempt to rewrite the position reversed.

The primary goal of the port is to operate as a hub offering services to multiple lines, not just Cosco.

Perhaps of more immediate (and readily quantifiable) interest is the degree to which such large-scale projects can be effective catalysts in the introduction of the largest vessels into the southern trades. Is the local demand there to justify regular (at least weekly) direct calls by Ultra Large Container Ships? Is the ship size advantage over currently deployed vessels sufficient to radically alter the structure of the trades and is it realistic to move from large scale feedering via northern ports In Mexico to/from East Asia to direct services? All these points need to be considered in order to adequately test the axiom ’build it and they will come’.

Total Peruvian container port demand has increased rapidly since 2018 by 14.8 per cent to reach a 2023 total of 3.1m TEUs – a CAGR of around 2.8 per cent. Trade and the Peruvian economy are dominated by the greater Lima region which is currently served by the two terminals at Callao operated by APM Terminals and DP World. Table 1 summarises demand development at Peruvian ports since 2018.

The focus of demand is generated by Lima, and this is also where national distribution centres are located. Only Paita enjoys a significant and different local hinterland primarily based on northern reefer commodities.

Total national demand, as noted above, reached 3,1m TEU last year, of which Callao accounted for around 87 per cent. This role has not and will not change. In addition, there is a limited role for transshipment at Callao with this reaching 0.7m TEU in 2023. This has increased marginally but remains a limited aspect of the national demand profile.

The current capacity of APM Norte is placed at 1.3m TEU and DP World offers 2.7m TEU of capacity. The combined capacity of the port is placed at some 4m TEU, which provides some significant headroom to accommodate anticipated growth. It should be noted that APM is fast filling up and the

■ The new port

proposed development at Chancay is a major factor in determining optimum development for the company regarding its expansion plans at Callao. With demand anticipated in the region of 2.5-3 per cent per annum there is a clear danger that the introduction of the first phase of Chancay (1.5m TEU from 2025-2026 with scope for rapid further expansion) will deliver overcapacity for the greater Lima area. There is no effective difference in the costs of current delivery of containers to the Callao terminals to/from the hinterland in contrast to Chancay – indeed, there are indications that trucking costs to the new terminal will be slightly higher from the major DCs. On this basis, only the ability of the new terminal to berth larger vessels will have a significant impact on transport cost structures. A review of current facilities confirms a water depth advantage of just one metre between Callao and Chancay –given tidal ranges and the level of part-loading on the trades this is a very limited advantage.

A review of the rationale for the terminal confirms only a limited water depth (ship size) advantage and inland costs are broadly comparable. The primary advantage stated by the promoters is that the new port will significantly reduce transit times Transpacific. How realistic is this? At present the link between Peru and the broader West Coast is provided by transshipment at northern terminals primarily in Mexico and to a much lesser extent at Posorja (Ecuador) and Buenaventura (Colombia). The concept is that direct services will be offered, thus reducing both costs and delivery time for Asian cargoes.

There are problems with this scenario. Firstly, the deployment of 18,000TEUs on a minimum weekly service would generate an annual capacity of up to 1.9m TEU. The penetration of such a new – presumably Cosco – service would account for over 70 per cent of the greater Lima market. This is an unrealistic level of demand to be secured and will require steady and rapid expansion of the national market over many years to be realistic and also exceeds the Phase 1 capacity of the port. The promoters emphasise that demand can be made up by increased transshipment from other West Coast ports via Chancay, and indeed such a policy is seen as essential if the largest vessels are to be regularly filled.

Similarly, the cost advantage of stepping up from 14,000TEU vessels that can currently be handled at Callao to the 18,000TEU class is not that great in the overall scheme of things – perhaps around US$50-65 per forty-foot container. With inland costs being higher and the existing terminals enjoying the potential to reduce stevedoring charges this could soon be negated.

The basic idea is to substitute direct services for containers feedered via northern ports. The problem is that this could also be delivered by the largest vessels that could in theory call at Callao. The advantage would be limited to the scale economies from the larger vessel. This represents an adjustment not a game changer.

It can also be asked why, if the position for direct services is as described, they have not already been established?

The position is further complicated by the position of the major lines at Callao. Given the investment of APMT at the port it seems certain that Maersk will maintain volumes at their own terminal – at least until capacity is reached. Hapag Lloyd’s volumes under the new Gemini alliance are also likely to go in this direction. Cosco will obviously be the anchor tenant for Chancay. There is little scope for redirection of other lines’ business away from DPW. Overall, the outlook is one of overcapacity (unless truly

heroic assumptions are made with regard to demand growth) and that there will be limited scope for Chancay to redirect business from other terminals on the basis of only marginal cost advantages.

Of course, the introduction of large-scale new capacity into a local port market is always disruptive, but the case of Chancay – and the risks identified – has a broader resonance. In southern trades there is great pressure to introduce (much) larger vessels into the trades with this being driven as much by anxiety on the part of the lines as to where they will actually deploy their ULCS investments as by any identified unit cost advantages. It is certainly clear that without the carrot of low cost of capital input under the Chinese BRI the development of such massive new capacity would have been difficult to bank. The long story of the development of the project, which was first mentioned in 2007, and the recent re-examination of fundamental contractual issues for the project underline that financial feasibility must be questionable. A much more limited approach – probably focused on the expansion of the existing Callao terminals – would have generated a stronger ROI.

Chancay is an example of the risk of out of scale port investment based on a hope of the emergence of required conditions. It tests the “build it and they will come” theory

Attempts to short circuit port development on the basis of superficially cheap development costs risk unsettling geopolitical ramifications and also very difficult financial implications. The concept of the ‘debt trap’ that has been associated with some BRI projects is not always the case, but it is certainly true that attempts at out of scale port development driven by not strictly commercial investments have the potential to severely prejudice existing well planned projects. It may be the case that demand increases at an extremely high rate in Peru and that this offers scope for Chancay’s projections to be realised. It may also be the case that these demand changes will be sufficient to catalyse the development of direct Asian services for the South American West Coast. Also, maybe the existing players will ‘sit on their hands’ while this change takes place – although why would they?

Chancay is an example of the risk of out of scale port investment based on a hope of the emergence of required conditions. Proper risk analysis is essential however superficially attractive an investment may be. This is always the case but in the southern trades the risks are much higher – these are fundamental questions for the next generation of port developments.

Click here to read article on Port Strategy online

Click here to read article on Port Strategy online

contact the events team: visit: greenport.com/congress tel: +44 1329 825 335 email: congress@greenport.com

Welcome Reception - Tuesday 22nd October 2024

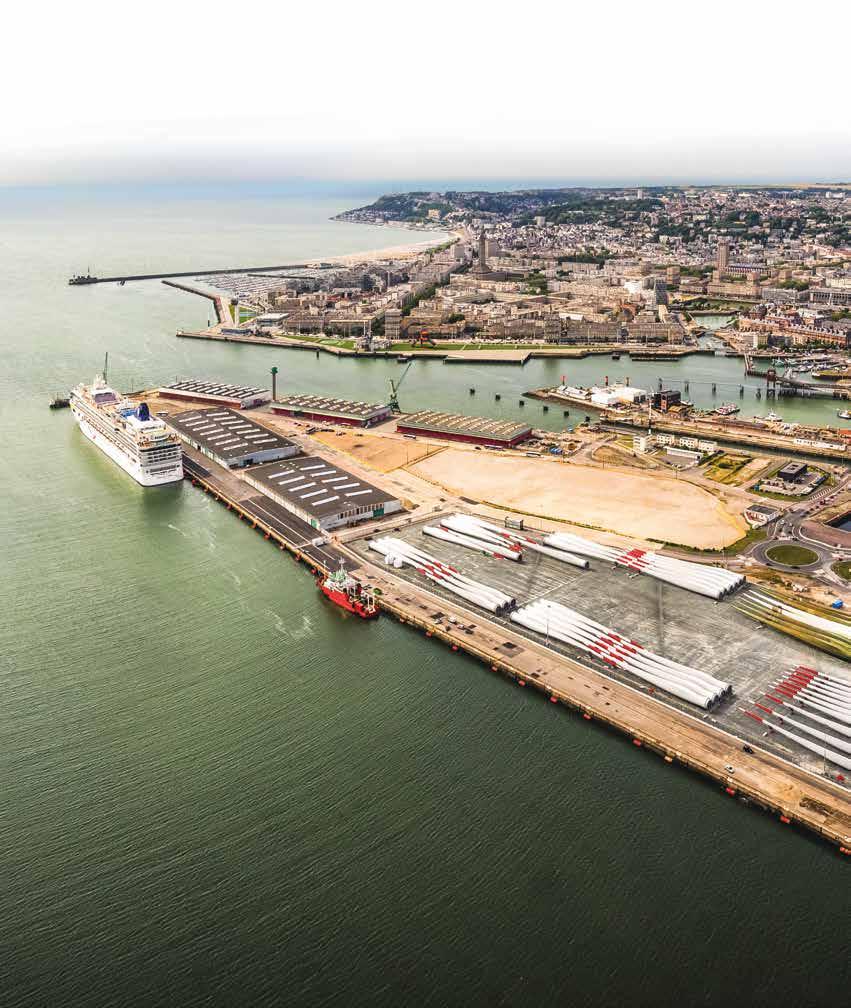

18:30 Welcome Reception - Hosted by City of LeHavre

DAY ONE - Wednesday 23rd October 2024

08:00 Coffee & Networking

09:30

Welcome by Chairman

Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC

09:40 Welcome Address by HAROPA Port

A representative of HAROPA Port

Session 1.1: Building a sustainable future

Priorities & challenges for meeting net-zero

10:00 Panel Moderator: Chris Wooldridge, Science Coordinator EcoPorts EcoSLC

Panellists include:

Isabelle Ryckbost, Secretary General, ESPO

Antonis Michail, Technical Director IAPH & WPSP, IAPH

Lamia Kerdjoudj. Secretary General, FEPORT

A representative of HAROPA Port

Nicolette van der Jagt, Director General, CLECAT

11:10 Coffee & Networking

Session 1.2: Electrification of Ports

Hear about the latest developments in the electrification of ports, cruise terminals and equipment.

Moderator: Dr. Mark van der Veen, Director of the Graduate School of Business, University of Amsterdam

11:30 Electrification of Ports, Cruise Terminals & Equipment Hervé Geraud, Onshore Power Supply Expert, HAROPA Port

11:45 Onshore Power Supply: The Business Case

Roland Teixeira, President, EOPSA

EOPSA’s 2024 strategy focuses on the business case and bankability of OPS, converging energy, maritime, and port experts to create a versatile, financially viable model, featuring the Cherbourg Port Microgrid.

12:00 Scaling customized shore power

Speaker to be confirmed, Powercon

Using standardized modules to create shore power solutions for ports world-wide

12:15 How to solve the “connection dilemma”?

Martin Tiling, Head of Shorepower, igus GmbH

Best practices from the Port of Hamburg becoming Europe’s shore power pioneer.

12:30 Question & Answer Session

12:45 Lunch & Networking

Book

2.1 Green Corridors

An update on recent projects and developments on creating green corridors.

A chance to hear from experts on the latest sustainability investments and the work being done to tackle the environmental, social and economic impacts of cruise operations.

Panel Moderator: Dr. Mark van der Veen, Director of the Graduate School of Business, University of Amsterdam

14:10 Green Corridors - update on recent developments and case studies

Megan Turner, Environment and Sustainability Manager, Port of Dover

In 2023, the Port of Dover led a feasibility study for a Green Corridor with Calais/Dunkirk, focusing on energy pathways, regulations, grid upgrades, and universal charging infrastructure.

14:25 Green Corridors – moving from promises to real action

Edvard Molitor, Head of International Public Affairs and Sustainability, Port of Gothenburg

A look into the rapid growth of global green corridor projects, highlighting the Port of Gothenburg’s pioneering biofuel and ammonia initiatives, emphasizing collaboration, challenges, and lessons in achieving sustainable shipping.

14:40 Validation of an Irish Sea Green Shipping Corridor

Richard Willis, Technical Director, Royal HaskoningDHV

This presentation outlines pilot projects for a green shipping corridor, detailing strategic steps, funding, and leadership needed for successful low-carbon shipping initiatives.

14:55 Speaker to be confirmed

15:10 Question & Answer Session

15:30 Coffee & Networking

14:10 The state of the art of technical environmental solutions in Mediterranean ports

Valeria Mangiarotti, Marketing Manager, Port System Authority of the Sardinian Sea European directive and regulations about the environment and the concrete solutions of the mediterranean ports.

14:25 Sustainability between challenges and opportunities in the port sector

Jamil Ouazzani, Director of Marketing & Strategic Intelligence, SGPTV SA (Tangier City Port Management Company)

14:40 Even Husby, Head of Environment, Port of Bergen

14:55 Cruise Europe

Tim Verhoeven, Projects & Policy Manager Sustainable Shipping, port of Antwerp-Bruges

15:10 Question & Answer Session

Book Online at

3.1 Resourcing the Transition to Sustainability

Are all ports equal? A look at seaports vs. inland enabling practicable implementation options for compliance, cost/risk reduction, environmental protection, and sustainability.

Panel Moderator: Chris Wooldridge, Science Coordinator EcoPorts EcoSLC

16:00 Resourcing the Transition to Sustainability

Cedric Virciglio, Strategic Planning Director, HAROPA Port

16:15 Port Readiness Level for Marine Fuels

Assessment Tool

Antonis Michail, Technical Director IAPH & WPSP, IAPH

16:30 The Role of Megaports in Climate Change

Marti Puig Duran, Chemical Engineer & University Lecturer, Polytechnic University of Catalonia EU mega ports prioritize climate change, adopting strategies like GHG reduction targets and On-shore Power Supply. The paper highlights implementation challenges, emphasizing stakeholder collaboration for sustainable port management and climate change adaptation.

16:45 Green Inland Ports – the way forward

Rob Leeuw van Weenen, Senior Project Manager, Panteia Nederland

Ioanna Kourouniotti, Freight Transport and Ports Consultant, Panteia

Developing an Environmental and Sustainable Management System for greening Inland Ports

17:00 Question & Answer Session

17:20 Day 1 Round Up with Chairman

17:30 Conference Close

3.2 Cruise Infrastructure & Development

An update on the latest projects in cruise infrastructure and development.

16:00 Malta’s Onshore Power Supply: A Groundbreaking Initiative for Cruise Liners

Norbert Grech, Senior Manager - Ports & Yachting Directorate, Transport Malta

Malta is making waves in the maritime industry with its initiative in onshore power supply (OPS), setting a new standard for environmental responsibility in Europe. As amongst the first countries in the continent to provide shoreto-ship electricity to multiple cruise liners simultaneously.

16:15

16:3

17:00 Question & Answer Session

19:30 Conference Dinner – Hosted by Haropa Port

DAY TWO - Thursday 24th October 2024

08:30 Coffee & Registration

09:20 Opening by Chairman

09:30 ESPO Environmental Report

Anaëlle Boudry, Senior Policy Advisor, ESPO

ESPO will present the 9th Annual Environmental Report. The ESPO Environmental Report is part of EcoPorts, which is the environmental flagship initiative of European Ports. The Environmental Report provides ESPO and European policymakers with insights on the environmental issues that European ports are working on, and informs the initiatives taken by ESPO.

09:55 ECO SLC Environmental Report

Marti Puig Duran, Chemical Engineer & University Lecturer, Polytechnic University of Catalonia

Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC

10:20 Question & Answer Session

10:30 Coffee & Networking

4.1 Infrastructure Development for Multimodal Services

A look into the adaptations needed to meet decarbonisation goals and address ecological transitions for logistics and supply chains.

Panel Moderator: Chris Wooldridge, Science Coordinator EcoPorts EcoSLC

10:50 Infrastructure Development for Multimodal Services

Pierre de Bellabre, Multimodality Project Director, HAROPA Port

11:05 Port of Moerdijk: multimodal hub for Europe

Kyra Lemmons, Commercial Manager –Logistics, Port of Moerdijk

11:20 Sergio Nardini, Head of Strategic Development, Port of Triest*

4.2 Investments in Decarbonisation

A look into the latest investment initiatives supporting sustainability of ports.

Panel Moderator: Dr. Mark van der Veen, Director of the Graduate School of Business, University of Amsterdam

10:50 Sustainable Finance

Lisa Hubert, Investment Director: Sustainable Ocean Fund, Mirova

11:05 Managing Subsidy Opportunities in a Coordinated Manner

Tim Verhoeven, Projects & Policy Manager

Sustainable Shipping, port of Antwerp-Bruges

Managing the variety of subsidy opportunities on a coordinated manner. How the Port of Antwerp-Bruges subsidy desk creates opportunities for the port and its community.

11:35 Decarbonizing Container Logistics on the River Siene

Ulrich Malchow, Managing Director, Port Feeder Barge

The latest developments at Port Feeder Barge to decarbonize intra port container logistics.

11:20 1:20

Paving the Way to a Sustainable Future with ABB’s Shore Connection Technology

Olivier Teramo, Sales Engineer & Account Manager Abb Marine & Ports , France

Port electrification is transforming the maritime industry, significantly contributing to the reduction of CO2 emissions and enhancing energy efficiency. ABB is at the forefront of this transformation, as demonstrated by the recent implementation of its shore connection solution at Portsmouth International Port.

11:20 How AI and the fourth industrial revolution will impact the Logistics Industry

Dawn Rasmussen, Managing Director, Problems Solved Ltd

A look at the types of AI technologies and their fit for logistics, technical infrastructure for AI integrations and leveraging machine learning for enhanced logistics efficiency.

11:50 Questions & Answers 11:50 Questions & Answers *invited

Book

(EU Regulation 2024/1679, Adopted on June 13, 2024) and EU Funding on the green transition of the maritime sector.

Moderator: Christopher Wooldridge, Science Coordinator EcoPorts EcoSLC

13:40 New European Maritime Space

Ms. Gesine Meissner, EU TEN-T Coordinator for the European Maritime Space

New TEN-T requirement to better connect the ports with their hinterland

Mr Pawel Wojciechowski, EU TEN-T Coordinator for the North Sea Rhine Mediterranean European Transport Corridor

EU funding support, with a focus on alternative fuels

Mr Carlo Secchi, EU TEN-T Coordinator for the Atlantic European Transport Corridor

14:15 Question & Answer Session

14:50 Coffee Break & Networking

6.1 Successful Port Integration for Meeting Net-Zero

Equitable, international collaboration to benefit communities and the environment.

Panel Moderator: Chris Wooldridge, Science Coordinator EcoPorts EcoSLC

15:20 Loss of Biodiversity –An Underestimated Risk

Malte Siegert, Chairman, NABU Hamburg

Biodiversity is often overlooked in public and political spheres, overshadowed by climate change measures. Ports face challenges balancing economic development and biodiversity, risking severe ecological and economic impacts if biodiversity is neglected.

15:35 Activating APM Terminal’s NetZero strategy through local decarbonization roadmaps

Andrea Wiholm, Director and Industrial PhD Researcher, Decarbonization Office APM Terminals.

The project developed local decarbonization roadmaps for APM Terminals’ global net zero strategy across eight terminals in nine countries. The presentation covers outcomes and lessons learned from these efforts.

6.2 Green Fuel Transition for Ports

A review of the progress being made to meet the 2050 goals for decarbonisation and current projects in place.

Panel Moderator: Dr. Mark van der Veen, Director of the Graduate School of Business, University of Amsterdam

15:20 Renewable energy – latest projects contributing to port growth

Kris Danaradjou, Deputy General Manager in Charge of Development, HAROPA Port

15:35 Climate Strategies in Baltic Ports

Bogdan Ołdakowski, Secretary General, BPO Baltic ports’ climate strategies, focusing on EU compliance, decarbonization, electrification, renewable energy, and ESG reporting, highlighting BPO’s role in multiport decarbonization projects and energy transitions.

6.1 Successful Port Integration for Meeting Net-Zero

Equitable, international collaboration to benefit communities and the environment.

Panel Moderator: Chris Wooldridge, Science Coordinator EcoPorts EcoSLC

15:50 Poole Harbour Decarbonisation Plan

Deanna Cornell, Green and Smart Ports Consultant, RoyalHaskonningDHV

This presentation outlines steps for ports and tenants to eliminate Scope 1, 2 and 3 emissions, addressing new regulations and compliance risks, and driving impactful change in the industry.

16:10 Confronting the Carbon Giant: Ports as Battlegrounds for Decarbonisation

Sjoerd de Jager, CEO & Co-Founder, PortXchange

Scope 3 emissions, transparency in emissions reporting, and community mobilization for environmental accountability, emphasizing ports’ roles in decarbonization and their impact on global supply chains and climate change efforts.

16:25 Question & Answer Session

16:50 Closing Remarks

17:00 End of Conference

DAY THREE - PORT TOUR Friday 25th October 2024

10:00 Port Tour of Le Havre

12:00 End of Conference

6.2 Green Fuel Transition for Ports

A review of the progress being made to meet the 2050 goals for decarbonisation and current projects in place.

Panel Moderator: Dr. Mark van der Veen, Director of the Graduate School of Business, University of Amsterdam

15:50 Hydrogen Fuel Cells as Onshore Power Supply Solution for Grid-Constrained Ports

Anis Ayoub, Stationary Power EMEA, PlugPower

Using hydrogen fuel cells for onshore power in ports, offering a sustainable alternative to overcome grid congestion and lack of infrastructure, aiding in decarbonization and sustainable practices.

16:10 Green fuel transition from a cross border perspective.

Sophie Delannoy, Program Manager –Sustainable Transport Fuels, North Sea Port Biofuels in transition

16:25 Question & Answer Session

GreenPort Congress & Cruise Combined

Delegate rate is EUR is €2,270.00

Price in GBP is £1,900.00 and includes:

n Choice of conference streams for GreenPort Cruise on day 1

n Two day conference attendance at GreenPort Congress

n Full documentation in electronic format

n Lunch and refreshments throughout

n Place at the Welcome Reception (22nd October 2024)

n Place at the Gala Dinner (23rd October 2024)

n Place at the Port Tour (25th October 2024)

Click here to buy

**Alternatively, you can call us on +44 1329 825335

**Currency will default to GBP - Enter your country name to change the currency.

GreenPort Cruise - One Day

Delegate Rate is EUR is €1155.00

Price or GBP is £970.00 and includes:

n One day conference attendance

n Full documentation in electronic format

n Lunch and refreshments

n Place at the Welcome Reception (22nd October 2024)

n Place at the Conference Dinner (23rd October 2024)

Click here to buy**

Alternatively, you can call us on +44 1329 825335

**Currency will default to GBP - Enter your country name to change the currency.

Booking Online: www.portstrategy.com/greenport-cruise-and-congress or complete form and return to sales@greenport.com. On receipt of your registration, you will be sent confirmation of your delegate place.

23 25

BOOK ONLINE OR COMPLETE THIS FORM AND RETURN TO SALES@GREENPORT.COM (Please copy this form for additional delegates)

Please tick all that apply :

Please register me for GreenPort Cruise 2024 (1 day) Please register me for GreenPort Congress 2024 (2 days) Welcome Reception (22nd Oct 2024) – No additional cost Conference Dinner (23rd Oct 2024) – No additional cost Port tour (25th Oct 2024) - No additional cost

Members of supporting associations will receive a discount I am a member of

Family Name

Country

First Name Telephone

Title Mr/Mrs/Ms/Dr/Other Fax

Company Email

Job Title Signature

Company Address

Company VAT No.

HOW TO PAY *UK registered companies will be charged the standard rate French VAT

Bank Transfer: Mercator Media Ltd, HSBC Bank plc, GBP account, Sort Code: 40-21-03, Account number: 91894919

SWIFT/BIC8: HBUKGB4B BRANCH BIC11: HBUKGB4131C, IBAN: GB61 HBUK 4021 0391 8949 19

Bank Transfer: Mercator Media Ltd, HSBC Bank plc, EUR account, Sort Code: 40-12-76, Account number: 70235247

SWIFT/BIC8: HBUKGB4B BRANCH BIC11: HBUKGB41CM1 IBAN: GB35HBUK40127670235247

NB: Prepayment is required in full for entry to the conference. Cancellations are not permitted, however substitutions are allowed. Le Havre OCT 2024 Le Havre France

Credit/Debit Card: Complete the form with your card details I have paid by bank transfer

Please charge my card (delete as appropriate) Mastercard/Visa/Amex

Card Number

Name on Card

Credit Card Billing Address

Expiry Date

Security Code Signature

Book online at www.portstrategy.com/greenport-cruise-and-congress

The Smart Port is seen by many as the fifth-generation port management model – a ‘new kid on the block’ that together with automated container handling holds the promise of much more to come as new technologies advance. Mike Mundy assesses the trend lines

Word is that the next big IT revolution is just round the corner – what precisely this will be is not entirely clear yet but there are some candidates: spatial computing, quantum computing and generative AI for example.

Spatial computing holds the power to alter how humans interact with technology by merging the virtual and physical worlds.

Quantum computing employs qubits, which can exist in multiple states at once, to deliver huge processing power. This can lead to positive step changes in diverse fields of application.

Generative AI is progressively coming of age this year and is expected to have a growing impact over the near term.

Advances in these fields and others will have implications for container terminal operations in both a front-line and back-up context.

The Smart Port and container terminal automation are in their infancy – there is much more to come. Yes, both concepts have now been around for a while but in terms of industry take-up they are still quite limited. A recent survey estimates that automated container terminals today only account for around five per cent of annual container handling capacity.

The adoption of the fully automated container terminal concept has to-date mainly been in developed economies –where the cost of container handling operations is high with the labour component being a major factor in this respect. The industry tends not to like to say it straight out, but it is nevertheless the case that ‘replacing man with machine’ can drive cost down. It is a positive economic equation, a higher initial system cost versus labour cost, which in the end delivers more economic operations. There are other bonuses – greater accuracy and overall efficiency which can contribute to raised value-added service levels and supply chain optimisation overall.

Traditional manual processes are, in high volume situations in particular, no longer fit for purpose against a background of emerging supply chain needs – real time tracking etc.

A leading example of a Smart Port is Singapore’s Tuas Port set to be the largest automated terminal in the world. The first phase of this interesting new terminal complex opened in September 2022 with development set to take place through to 2040.

The port has on its agenda some ambitious plans – the progressive application of artificial intelligence, data analytics, robotics and other cutting-edge technology. To facilitate this PSA has introduced what it describes as an event-driven architecture (EDA) platform – supported by Solace, the immensely powerful and flexible message broker platform. The EDA platform essentially masterminds the port’s operations and support activities such as maintenance. It processes data as events occur optimising inter-related operations and providing real-time data processing and live communication abilities. EDA is, in effect. ‘the glue’ that holds together and enables the seamless operation of the Smart Port and its interfaces with the supply chain.

Physical handling at Tuas Port is via high-spec ship-toshore cranes on the quayside offering a handling capability equivalent to an 18m water draught and the ability to reach across 24+ rows of containers on deck. Landside operations are fully electric with automated guided vehicles (AGVs) comprising the main handling units.

And, of course, as part of the terminal operation there are various key other smart/automated components –automatic gate operations, remote reefer monitoring, remote equipment monitoring and so on.

Bottom line, however, PSA cites the successful integration of EDA AT Tuas Port as a definitive step in the advancement of highly efficient container handling. A step that it considers sets a new industry standard for port automation and that

The impact of new cuttingedge technologies has the potential to deliver fundamental changes in the business of container port management and terminal operations

offers unparalleled connectivity with stakeholders along the supply chain.

Tuas Port stands as a top-of-the-range Smart Port, using automated instead of manual processes and featuring diverse sustainable characteristics. The fact that it is also a transshipment hub, as opposed to a gateway port, also adds another level of challenging complexity.

There is no uniform model for a smart port or an automated container terminal – as is normally the case with port or terminal design there are always bespoke elements, sometimes tailored to the circumstances of a given facility and/or the approach decided on by the developer. Some parties define a smart port quite simply as ‘a connected network’ or a logistics platform. A recent evolution of the original smart port concept is seen as ‘a port that not only places emphasis on its customers but also cares about the community.’ This, in turn, is seen as the fifth-generation port management model.

It is further interesting to note that a smart port is not necessarily one that has a cargo handling dimension, it can achieve this status purely in an overall port management context.

Whether there is a cargo handling element or not common denominators of a smart port are the use of technologies such as IoT, Big Data, blockchain, 5G and others.

A selection of smart port initiatives at a port management level are featured in Table 1.

According to an estimate made by Prof. Luis Pedrayes of the Autonomous University of Barcelona in June this year, there are now around 60 fully or semi-automated container terminals in operation with another 100 automation projects under implementation.

There is no doubt that in both a port management context and at the terminal operating level there is building interest in smart/automated technologies. As the powers of new generation technologies are unleashed, interest is growing and especially where labour costs are high and rising. There is resistance from unions of course – in locations such as the USA and Australia – but suffice it to say that over time it will be a hard job to resist the inevitable march of technological progress.

Experience in China, which now has significant know-how with established automated terminals and a large number under development, suggests that the overall productivity gain for an automated terminal is in the order of 20%, the reduction in personnel costs up to 70% and in energy consumption 20%. These figures maybe somewhat inflated for public relations purposes but the margins over a conventional terminal operation remain attractive even if scaled back.

The attraction of partial areas of automation – remote ship-to-shore crane operation, gate operations, remote reefer monitoring, automated maintenance systems, container tracking, enhanced communications etc – is also

Rotterdam, The Netherlands

● Employs a digital twin of the whole port and IoT sensors for measurement of water movement, turbidity and pressure to ensure compliance with environmental standards.

● The port is introducing renewable and green energy sources and electrification initiatives as well as optimising vessel call and departure management.

Los Angeles, USA

● Setting up a cyber résilience centre

● Together with GE developing a digital platform to “boost supply chain effectiveness.”

● A digital twin enabling management to monitor all processes in real-time.

● IoT sensors monitor water flow, turbidity and pressure.

Hamburg, Germany

● The Port of Hamburg utilises an IoT platform for managing traffic congestion, pollution, and road safety which consists of the three pillars, Smart Port infrastructure, intelligent traffic flows, and intelligent trade flows.

● Initiatives include: an IoT project to track different kinds of pollution, a focus on reducing water acoustics, the introduction of low emission vessels, weather sensors installed around the port, IT systems for all maintenance and intelligent solutions for real time navigation

Valencia, Spain

● The port of Valencia identifies connectivity, efficiency and responsibility as the foundation stones of its smart port concept. A lot of work has gone into maximising the connectivity of the logistics chain through cooperation, information AI, transparency and cyber security initiatives. At an operational level optimising intermodal in the logistics chain is a primary area of attention and generally maximising space availability.

● There is a commitment to zero emissions, the circular economy, community integration, the fight against climate change and the blue economy.

Port of Shanghai, China

● The Port of Shanghai has launched a fully automated and intelligent port in its new Yangshan Harbour zone, running 24 hours a day, seven days a week. The vision was to have a port intelligence system that could control all aspects of container handling, from ship traffic coordination and automated cranes to autonomous container vehicles. Human interaction is limited, monitoring video feeds of container traffic and ensuring the port intelligence software is operating correctly. For this a data centre was required to power the mission-critical software. The intelligence software simultaneously controls the cranes and vehicles, while also collecting and analysing data to make millions of decisions per second. Cisco HyperFlex was chosen to provide the necessary infrastructure for the data centre.

manifest, possibly accounting for the area of greatest activity.

The direction of travel is set – the digital revolution is fast establishing new rewarding methods of port management and terminal operations. The impact of new technology is potentially far reaching, generating fundamental changes in the business of port management and terminal operations.

■ China has 13 ports using autonomous container carrying trucks and estimates suggest in 2025 over 6000 Level-4 autonomous trucks will come into operation – a clear indicator of the rising interest in automation

WE ARE THE EXCLUSIVE DEALER FOR SEVERAL TRIPLE A BRANDS IN THE PORT EQUIPMENT INDUSTRY. OUR CLOSE CONNECTIONS WORK TO YOUR BENEFIT: YOU HAVE ACCESS TO SHORT SUPPLY LINES AND A WIDE RANGE OF PRODUCTS. WHETHER YOU’RE BUYING, LEASING OR RENTING, GPE OFFERS DIFFERENT FINANCING OPTIONS. THANKS TO OUR NETWORK OF LOGISTICS EXPERTS, YOU’RE ALWAYS SURE YOUR MACHINE WILL ARRIVE PUNCTUALLY, NO MATTER WHERE IN THE WORLD YOU NEED IT.

APMT’s lawyers are busy nowadays fighting offensive and defensive actions but is right on their side or is it ‘lawfare?’ The Editor assesses the situation

I had lunch with my legal eagle barrister friend the other day and we fell into talking about the law and its right and wrong use. I wasn’t entirely surprised to hear that my friend – who specialises in civil litigation – holds the belief that the law will deliver a result but not always justice. “Are you saying that the law is an ass,” I questioned him deploying the famous phrase. “Undoubtedly,” came back the rapid response, “time and time again.”

Interestingly, while he backed up this point of view with several lines of argument, the one that he was strongest on was the growing trend dubbed ‘lawfare’ – effectively the weaponisation of the legal system in the context of using it to gain a certain commercial or political advantage. Lawfare, he argues, distorts the positives on which the rule of law is based – justice, predictability, equality and so on. And worryingly, he adds, it is on the rise.

It was an interesting discussion and set me thinking about two legal interventions implemented recently in our sector by APM Terminals (APMT) – one in conjunction with the award of the concession for Durban Container Terminal Pier 2 (DC2) and another by way of an objection to Terminal Investment Limited (TIL), an affiliate of MSC, concluding a deal with the Aarhus Port Authority to set up a new terminal in its Omni Terminal port area..

APMT is, of course, an affiliate of Maersk Container Line and it is well known that APMT’s first priority is to support Maersk. In South Africa had APMT been successful in its bid for DC2 then it is clear that this would have leant significant support to Maersk building market share in the key European and Asian container trades. More control of the supply chain = more opportunity to leverage to its advantage. But it was not successful – reportedly US$100 million behind the winning bid from International Container Terminal Services Inc (ICTSI) and so it has resorted to legal action on a number of technicalities.

APMT’s main point is that ICTSI did not meet a requirement for bidders to meet a minimum solvency ratio via a specific formula. There is no real suggestion that ICTSI does not have the financial capacity to meet its obligations in terms of concession fees/investment etc, just that it does not conform with this specific ratio. Transnet used other means to satisfy itself regarding ICTSI’s financial solvency and was fully comfortable with the results.

In the real world, therefore, and speaking candidly, APMT appears to have sought and found an element in the bid process whereby it can try and get back in the game –leveraging a technicality or as my learned friend puts it employing ‘lawfare.’

As my learned friend also underlined, the trouble with lawfare is that it is by nature disruptive. Indeed, that is why many parties employ it!

In South Africa, APMT’s legal action against Transnet is basically holding up economic progress – the advancement of infrastructure to facilitate more efficient and cost competitive trade. One example, the upgrade of DCT2 would basically free up berthing space to facilitate the presence of

more competitive liner services. As it stands, Maersk is one of the dominant berth users, effectively barring other players from a new or stronger presence. With this in mind, the current legal challenge also works in Maersk’s favour just by maintaining the status quo.

Of course, technically speaking, APMT has the absolute right to launch a legal action but in the land of common sense is such an action well founded or more a case of sour grapes? There are many who believe the latter.

‘‘

…in the land of common sense is such an action well founded or more a case of sour grapes?

THE AARHUS QUESTION

It has been reported that APMT has filed an injunction in a local court to temporarily prevent the entrance of a second operator into the port of Aarhus, where it operates its own container terminal. It contends that it has an agreement with the port authority which gives it first right of refusal on any new development and that discussions with another party have taken place without due process.

This doesn’t sound like an entirely convincing argument if only on the basis that other operators have previously tried to defend a monopoly situation without too much success. Indeed, for example, I believe this was the case in Callao, Peru when DP World took on the port authority as a result of it awarding a concession to APM/Maersk! APM/Maersk prevailed!

The issue of ‘lawfare’ – the effective weaponisation of the legal system – is a serious one. As my friend suggests, it has a corrosive influence which needs to be taken account of properly in order to achieve fair and well balanced judgements.

■ Informed parties suggest that the minimum solvency ratio calculation method as set out in the DC2 bid process is impractical and cannot be met by some of the largest companies listed on the Johannesburg Stock Exchange including all but one of the big five banks

The adoption of Optical Character Recognition (OCR) technology in ports continues to grow – expanding way beyond basic, obvious applications such as container recognition at the gate. Increasingly being deployed as part of far more sophisticated solutions, across a far wider range of port equipment, and in

tandem with AI, machine learning and automation, OCR is playing a key role in the speed and efficiency of container handling operations, tracking and tracing of boxes, and damage detection and reporting. The companies referenced below all responded to a recent PS sector survey. Felicity Landon reports