Sponsor: Supporters:

A neutral pan-European network dedicated to the promotion of short sea and feeder shipping and the intermodal transport networks that support the sector.

Chairman: Nick Lambert, Co-Founder & Director, NLA International Ltd

visit: coastlink.co.uk

contact: +44 1329 825335

email: info@coastlink.co.uk

Media partners:

GREENPORT INSIGHT FOR PORT EXECUTIVES

SHIP MARINE TECHNOLOGY THE

MOTOR

by: Growing Sustainable Supply Chains: Short Sea Shipping & Intermodal Networks Conference Handbook Royal Liver Building, Liverpool, UK

#Coastlink Hosted

BG Freight Rotterdam Port of Liverpool Glasgow Belfast Dublin Peel Ports More than Ports Join us at peelports.com In Liverpool, we’re better connected Together with BG Freight and Peel Port Logistics, the Port of Liverpool offers a more efficient route to access the industrial heartland and major consumer UK and Irish markets. With the advantage of our rail services, we bring goods closer to the end destination reducing road miles and lowering carbon emissions.

Welcome to the Coastlink 2023 Conference

Firstly, I would like to extend our sincere thanks to Peel Ports - Liverpool for hosting this year’s event including aspects of the conference and the Technical Visit on Day 2. The City of Liverpool is steeped in maritime history and is a major hub for shipping and port operations.

The conference event in 2023 will be held at the iconic Royal Liver Building venue, located in the heart of Liverpool with views overlooking the waterfront. The Royal Liver Building forms one third of the world famous ‘Three Graces’, alongside the Port of Liverpool Building and the Cunard Building. I am sure that this prestigious venue will add to your Coastlink experience and overall enjoyment of the event.

Offering sustainable, port centric solutions, Peel Ports have made a commitment to be a net zero port operator by 2040 - aligning with this year’s over-arching theme of ‘Growing Sustainable Supply Chains: Short Sea Shipping and Intermodal Networks’. I am delighted to confirm that Claudio Veritiero, CEO of Peel Ports Group, will provide you with the Port’s Welcome Address.

Thank you also to Peel Ports for introducing Coastlink’s first workshop in the afternoon of Day 2, enabling us to continue the discussion around sustainability - before we commence the tour of the Port of Liverpool. I am sure that you will find the tour insightful.

As the second largest port group in the UK, Peel Ports Group safely handle over 70 million tonnes of cargo from across the globe. With direct deep-sea and short sea connections to a range of countries, state of the art facilities, and future-proofed equipment, the port’s strategic location on both sides of the River Mersey and the Manchester Ship Canal means that it is also one of the country’s best connected.

I am delighted that Nick Lambert, Co-Founder and Director at NLA International, will be returning to be your Chairman for Coastlink 2023. I know that Nick and our moderators will promote active debate and discussion throughout the event, whilst introducing you to our schedule of expert speakers. I hope that you enjoy the sessions and the networking opportunities on offer.

Finally, once again a thank you to Peel Ports - Liverpool for hosting us this year; to the Port of Antwerp-Bruges for sponsoring the Conference; and to all the supporters and speakers who have helped to make Coastlink 2023 possible. Last, but not least, to you our delegates for joining this year’s conference in what will be an exciting and busy month for the City of Liverpool!

On behalf of the Coastlink team I hope that you enjoy the Conference. We look forward to meeting you all throughout the 2 days.

MARIANNE RASMUSSEN COULLING Events Director

Welcome Letter

3

CLAUDIO VERITIERO CEO, Peel Ports Group

BIOGRAPHY

Claudio joined Peel Ports in 2021. He has over 25 years of experience working in infrastructure, logistics, property development and financing markets.

He was previously Chief Operating Officer of Kier Group Plc, the UK’s largest construction and infrastructure services contractor and Chief Operating Officer of Speedy Hire Plc, the UK’s largest provider of construction equipment rental services.

Prior to his time in industry, Claudio spent 8 years in the investment banking advisory division of Rothschild & Co.

Welcome Address

4

Welcome to Liverpool

I’d like to extend a warm welcome to delegates and speakers joining the Coastlink Conference this week. We at Peel Ports Group are honoured to be hosting this event, which brings together some of the most influential and forward-thinking minds in the ports and logistics industry.

Steeped in maritime history, the city and Port of Liverpool offer a formidable backdrop for this key industry event. A stroll on the famous Liverpool waterfront provides a fascinating glimpse into its heritage as a hub for global trade; from the iconic and majestic buildings gracing the pier head to the docks, and the waterways and warehouse buildings of the Royal Albert Dock, I would like to encourage everyone to enjoy the sights and sounds of this great city. But for all the maritime heritage the city has to offer, the Port of Liverpool has certainly not stood still. Some may remember Liverpool hosting this conference ten years ago and, for us at Peel Ports, it offers an excellent opportunity to showcase the transformational changes we have made to what is now one of the UK’s leading ports.

In our case, here in Liverpool, much of the attention is given to the investment we made into developing Liverpool2, and this can often hide the significant investments we also make into our short-sea operations.

From future innovation, and economic and environmental topics, this year’s conference theme rightly focuses on growing sustainable supply chains, which has never been more critical than it is today. With an urgent need to reduce carbon emissions and tackle global warming, our industry must play its part in developing greater cooperation for greener, more efficient and sustainable supply chains.

My team and I look forward to meeting with you all for an engaging and enjoyable event, discussing and learning about the different opportunities and challenges ahead and further enhancing our networks across Europe.

Welcome Address

5

CLAUDIO VERITIERO CEO, Peel Ports Group

NICK LAMBERT Co-Founder & Director, NLA International Ltd

BIOGRAPHY

A master mariner and a committed proponent of the maritime users’ perspective, Rear Admiral Nick Lambert concluded a long naval operational career as the UK National Hydrographer in December 2012. He advises on a wide range of maritime issues including the growing potential of the blue economy concept, the importance of spatial data infrastructures and hydrography for maritime economies, the evolution of eNavigation and GNSS vulnerability, near or real time situational awareness (especially that derived from space based assets and applications), maritime connectivity and cyber security, human factors, and training and education in the maritime sector.

He has a particular interest in the Polar Regions and is also engaged in a variety of situational awareness, fisheries and aquaculture management, marine autonomous systems and vessel efficiency projects.

Chairman

6

Welcome to the Coastlink Conference 2023

Dear Delegate

Amazingly May is nearly upon us and it’s time to pen a welcome address for Coastlink 2023, the second in-person gathering of ‘the Coastlink debating chamber’ since the COVID pandemic. The agenda for Liverpool is most certainly in the spirit of our debating chamber with a welldesigned array of sessions, topics, speakers and panels building on the themes and outcomes of Coastlink 2022 in Antwerp and the Coastlink Live webinar last November.

Post Brexit and post pandemic are, unsurprisingly, key strategic contexts underpinned by market forces such as the ever-increasing drive towards digitisation of processes and data coupled with the need for sustainable supply chains that, in turn, reveal opportunities for innovation in ports and intermodal transport solutions such as freeports and short sea shipping services.

More broadly, at the grand strategic level, the fragile but simultaneously adaptable nature of our totally interconnected JEJIT global logistics networks continues to be highlighted by the fallout of the Russian invasion of Ukraine alongside the compelling international emphasis on the need to achieve net zero as more evidence of climate changes emerges.

Hosted by Peel Ports - Liverpool and sponsored by the Port of Antwerp-Bruges, Coastlink 2023 Day One addresses those intermodal aspects whilst Day Two majors on sustainable supply chains and the transition to decarbonised energy solutions. Case studies of early adopters in these fields will inform what I’m sure will be a vigorous debate about the role of governments, regulation, and risk management as we wrestle with the future function of hub ports, alternative fuels and who should jump first.

The Mercator Media team has done a great job in creating this agenda and I am in particular, looking forward to the workshop in the afternoon of 4 May when we will formally seek delegate feedback on the issues emerging from the conference. The workshop is a new element of the Coastlink series with the purpose of articulating, scoring, and prioritising our deliberations; information that will be used to shape future events and to inform international, EU and UK governments, agencies, and institutions.

Thank you to our hosts, our sponsors, our speakers and delegates, and Mercator Media. I’m in no doubt that Coastlink 2023 will be stimulating and rewarding, and much look forward to seeing you all.

Best wishes

NICK LAMBERT Director, NLA International Ltd

Chairman Welcome Address

7

Contents 8 Contents Welcome Letter 3 from Marianne Rasmussen-Coulling, Events Director Welcome Address 5 Claudio Veritiero, CEO, Peel Ports Group Chairman’s Welcome 7 Nick Lambert Director, NLA International Ltd Session 1 9 Market Sector Overview: the new normal in an adapting market Session 1 - Panel topic 23 Post-Brexit & Post-Pandemic: Are we where we need to be? Session 2 ............................................................................................................................................................. 31 How to promote growth and deliver resilient end to end supply chains Session 2 - Panel Topic ............................................................................................................................. 49 Freeports: Driving change for coastal shipping and the supply chain? Session 3 ............................................................................................................................................................. 56 Sustainability & the Energy transition – A route to shipping freight sustainably Session 3 - Panel Topic ............................................................................................................................. 69 Driving Efficiency through Data & Port Collaboration

Market Sector Overview - the new normal in an adapting market SESSION 1 9

ROBERT MEGANN Managing Director, W.E.C. Lines UK Limited

BIOGRAPHY

Roger has been involved in the shipping & logistics industry for over 30 years beginning his professional career in Freight Forwarding before moving into the container liner sector with ACL, Yang Ming and CSAV. Roger then took a senior role with the Port of Liverpool in 2015. Over 4 years he successfully led the commercialisation of Liverpool2 a £500 million investment by Peel and reinvigorated Royal Seaforth with new short sea services. In 2019 Roger joined W.E.C. Lines and opened W.E.C. UK in Felixstowe. To date, the UK business has quadrupled its throughput following the development of several new and transformative services in the short sea markets between the UK, Spain, Portugal, Morocco, and the Canary Islands. W.E.C. UK now has offices in Liverpool and Felixstowe and services connecting to Liverpool, Tilbury, Thamesport, Immingham and Teesport.

Session 1 - Keynote

10

- Connecting North and South Spain with Morocco and Canary Islands

- Inland connection within Spain with own block trains - Equipment available:

Oslo Moss Gothenburg Hamburg Aarhus Helsinki Kotka Tallinn Riga Helsingborg Klaipeda Bilbao Gijon Vigo Leixoes Lisbon Setubal Sines Casablanca Sc de Tenerife Las Palmas Pto. del Rosario Figueira Da Foz Stockholm Tilbury Bremerhaven Liverpool Dublin Belfast Greenock Rauma Gaevle Cork Le Havre Montoir Kaliningrad Gdynia Kutno Katy Wrocławskie Kristiansand Bergen Haugesund Tananger Copenhagen Nador Grangemouth Blyth Immingham Thamesport Germersheim Duisburg Mossend Moerdijk Rotterdam Teesport Sevilla Barcelona Valencia Zaragoza Burgos Antwerp Madrid

FURTHER INFORMATION CALL

OFFICE

VISIT

WECLINES.COM W.E.C. LINES UK LTD Unit 1 | Suite 3 Orwell House | Ferry Ln | Felixstowe IP11 3QL | United Kingdom Telephone +44 (0)13 947 630 30 | E-mail: sales@uk.weclines.com Outports Railway Direct ports of call - 15 dedicated WEC Lines vessels

FOR

OUR

OR

OUR WEBSITE

- Connecting United Kingdom and Northern Europe with Spain, Portugal, Morocco and Canary Islands

20ft DV, 40ft DV, 40ft HC, 40ft HCPW, 45ft HCPW, flat

tops

racks and open

MIKE GARRATT Chairman, MDS Transmodal

BIOGRAPHY

Mike has a first degree in economics and a masters degree in Transport Design. He worked initially as a local government transport planner, and subsequently as a researcher and then lecturer at the Universities of Leicester and Liverpool.

Mike co-founded the transport consultancy MDS Transmodal, which has now been trading since 1983. He specialises in rail freight, ports and maritime economics. Mike has conducted numerous studies for government, local authorities and the private sector. In the UK, he is a board member of the UK Rail Freight Group. Mike has been and continues to be involved with freight forecasting for amongst others: Department for Transport and Network Rail. He was instrumental in the concept and early design of the GB Freight Model and is heavily involved in freight modelling and freight transport economics consultancy in the UK and overseas. Mike Garratt is regarded as one of the most informed observers of the rail, shipping and ports industries in the UK and is regularly called upon to speak at conferences and private seminars. He has developed global databases and models describing the supply, demand and performance in the global container industry and is currently or recently been working on studies for UNCTAD, the World Bank, national transport models in the Middle East, several freight models within Europe and in the UK ports industry.

More recently, with his colleague Antonella Teodoro and in collaboration with the Global Shippers Forum, he has used these resources to develop a Quarterly Review of the Container Industry and engaged in the debate on market concentration.

Session 1 – Speaker

12

The Great Britain freight market: making the case for infrastructure investment to support short-sea shipping

Introduction

This short paper is intended to outline arguments and evidence that will be included in a presentation at the Coastlink conference in Liverpool in May 2023. The case that will be presented is that, because around 25% of freight lifted within Britain has also passed through a port, that shifts in the port of entry will have a significant impact on the case for investments in port, road and rail infrastructure designed to accommodate freight. However, current appraisal techniques that deal with the public interest case for such investments tend not to take into account the entire journey; only that part that takes place within Britain and not including the maritime leg. However, the techniques and data that would also take into account that maritime leg are available.

The most footloose market with respect to ports, and therefore of most interest in considering the opportunity to take into account the maritime leg, is short sea unitised shipping. This is because the port of entry does not generally depend upon other calls on a rotation (as with deep-sea container shipping) or the presence of industrial plant and storage facilities within a given port (as in the case for most bulk traffics). At a time when there is an increased interest in freight within Government and when both the road and rail network managers are considering how to deal with a growing interest in how their networks contribute to economic growth and dealing with the climate change agenda there is a case for examining how short sea shipping can enter this debate.

Change over the last decade

Based upon combining a range of data sources, the overall GB inland domestic freight market may have grown by as much as a quarter over the decade from 2011 to 2021 while total tonnes through all UK ports fell by around 14%. Bulk traffics through the ports have declined by around 25% through deindustrialization and a gradual shift away from carbon. By contrast, unitised freight through the ports has continued to grow, by around 3% between 2011 and 2021. Specifically for that sector which offers the most interest for short sea shipping, import traffic to GB ports from EU ports, that growth in unitised tonnage has been around 8.5% over the last decade (sources UK Ports traffic, DfT). It is reasonable to expect this market to gradually recover following the different economic shocks of the last 15 years.

Leaving aside coal to power stations, over the same period rail freight tonnages grew by around a quarter while road freight vehicle kilometres grew by around 9%. At the same time, DfT surveys show that tonnes carried per truck grew by 15%. Put simply, based upon road traffic counts, unitised goods traffic, in trucks, trailers and containers, moving through consumer based supply chains, has continued to grow.

The maritime opportunity

This growth all adds to congestion and emissions; the question is whether the maritime sector can make a contribution to reducing that impact and identify for itself new commercial opportunities.

Session 1 - Conference Paper

13

Because unit load traffics involve long and expensive overland hauls their transfer to the sea mode represents the best opportunity for the expansion of maritime traffics, which in turn can stimulate the development of regional distribution hubs based on ports. For Britain, this particularly applies to the short sea sector because, unlike the deep-sea container sector where the capacity of the ships employed are shared between all the Western European economies, the relevant short sea services are generally dedicated to Great Britain.

A generation ago, the case for such a switch was based mainly on cutting road network congestion. The grant system that has applied for some 50 years in Britain to encourage intermodal freight traffic to switch to rail was mainly justified on non-user congestion costs to other road users and a similar policy narrative applied to short-sea shipping, albeit that access to that grant system has not in practice been available. An increased interest in considering user benefits, and therefore reducing transport costs to thereby raise economic productivity, should favour short-sea shipping. This benefit is not generally ‘scored’.

The most obvious opportunity to develop a switch towards short sea shipping lies in extending the proportion of the distance that freight is at sea so as to reduce the distance covered overland; for Great Britain this implies switching traffic that has entered Britain via the Short Straits from EU countries and carried in accompanied trucks onto longer short sea shipping routes where drop trailers and containers are employed. Any freight entering Britain will have in any case to face the cost of a mode switch at a port of entry (even if using the Channel Tunnel and transferring onto shuttle trains). For some cargo, the congested south-east of Britain can be by-passed by short sea shipping.

The case for such a transition has been made for half a century. For most of that period it was frustrated by a highly cost competitive road haulage industry with access to relatively low cost labour and the development of supply chains that could deliver ‘next day’ from Continental mainland distribution centres.

Drivers for change

However, various drivers are now impacting on this market that are informing supply chain behaviour and strengthen the case for policy interventions to accelerate this switch from long distance road haulage to short sea shipping that is already happening.

These factors include:

n BREXIT, which has increased trade friction in crossing borders (i.e. at the ports) and therefore particularly the cost of using accompanied trucks because of the threat of delays caused. Unaccompanied trailer or container traffic does not suffer the same level of additional cost and the great advantage accompanied trucks offer of speed, reliability and therefore the ability to make direct deliveries from the Continent to cut stockholding is reduced.

n The impact of COVID, which further encouraged stockholding as supply chains became disrupted.

n The increased SCALE in the capacity of individual deep-sea ships, which further encourages transhipment and the development of short sea feeder lo-lo services. The pressure to identify interventions to address CLIMATE CHANGE, which will lead to low carbon solutions being developed for road (batteries or fuel cells), rail (further electrification) and deep-sea shipping (methanol). The pressure to find deep-sea solutions provide the basis for adopting similar solutions in the short-sea sector.

The quite rapid adoption of fuel fuelled methanol/diesel ships in their new building programmes by several of the leading deep-sea container lines is also significant (68 ships

Session 1 - Conference Paper 14

at the time of writing on 22/3/23), because it demonstrates that there will also be low carbon solutions available to short sea shipping. It is claimed that bunkering on methanol can reduce CO2 emissions by up to 95%.

Without such ‘green’ prospects, short sea shipping would struggle to make a public interest case against electrified railways and battery powered HGVs. In particular, it would otherwise be possible to argue that longer distance rail freight routeing across the Continent to serve short maritime crossings would be a ‘greener’ solution because most of these routes are already electrified. It will be important for the maritime sector to itself demonstrate that such solutions can be offered within the medium term if individual States are to facilitate the requisite conditions for short sea shipping to achieve its potential. The maritime sector needs buy-in from policy makers.

The statistical evidence

The above drivers of BREXIT, COVID and CLIMATE CHANGE are already encouraging a shift in behaviour.

Over the period 2011 to 2021, an analysis of GB port and Eurotunnel statistics of international unit load import traffic and tonnages from ports in EU countries (including the Republic of Ireland) to GB ports indicates an overall 8.5% growth. Within that overall growth there is evidence that the market is shifting to towards longer crossings using ‘non-accompanied’ modes, behavioural evidence that this saves money; otherwise why would companies do it? The evidence includes:

n a 16% fall in the tonnes of cargo arriving in accompanied trucks, with the lowest fall being through ports in the north-east (Humber to Forth range) and the highest fall of 26% being in the north-west (Holyhead – Clyde range)

n a 2% increase in the tonnes of cargo arriving by unaccompanied ro-ro modes (drop trailers or containers on slave trailers) with the highest increase of 37% being in the north-west.

n a 103% increase in the tonnes of cargo arriving in lo-lo containers, with both the north-west and the north-east ranges achieving 125-127% increases.

That is, there has been a significant switch towards unaccompanied modes, and particularly containers, which (unlike trailers) can be readily forwarded within Britain by rail.

Most dramatically, the growth of imports through ‘northern’ ports (i.e. north of Birmingham) was 25% while there was no net aggregate growth through ‘southern’ ports; this is evidence that irrespective of policy drivers such as climate change that the freight industry is increasingly choosing longer sea routes from EU cargo sources. By 2021, southern ports (Felixstowe to Fishguard range) captured only 61% of the overall import market via EU ports. These trends clearly pre-date policy initiatives to de-carbonise road freight.

The Dover Straits will continue to play a major role in this market; the port of Dover and Eurotunnel together have a one third market share of tonnes moved and represent a major investment in terms of port infrastructure and supporting networks. Shipping companies continue to invest in the Short Straits. The question for policy makers and investors will be on which routes to facilitate and anticipate further growth.

This trend, to seek lower cost solutions through using longer sea routes to reduce inland haulage and to make increasing use of containers, has gone hand in hand with a gradual ‘drift’ northwards of where the major distribution centres (warehouses) are located (a consequence also of rising property and labour costs), which further generates a cumulative driver ‘northwards’.

The case for infrastructure development

These trends have important implications for the development of infrastructure.

Session 1 - Conference Paper 15

For the ports themselves, a switch towards unaccompanied modes implies a need for more storage space within the ports. The physical cost of handling drop trailers and trailers can also be significantly mitigated if the port estate itself is the first destination for the cargo (i.e. the site of the first distribution centre in the supply chain), which itself implies not only large areas allocated for port and distribution activities in just a handful of key locations but also the road and rail capacity to use the sites as distribution hubs as well as to move those goods onwards into the hinterland. The fact some relevant ports are generally close to major concentrations of population helps to support the case for near dock-estate distribution centres. Within Britain these are mainly matters for the ports themselves because they lie within the private sector. However, such investment decisions will be heavily influenced by planning policies and the investments made in public sector road and rail networks.

That is, if longer sea crossings are to reach their full potential then planning regimes need to facilitate port estate expansion and highway and rail network managers (in Britain, National Highways and Network Rail) need to provide the requisite capacity for capacity.

Making that case

The challenge may therefore be to demonstrate the public interest case in terms that the public sector can recognise.

How might this be done?

In most western countries, the case for transport infrastructure investment is made using well established cost-benefit procedures based on established values and costs of fuel, equipment, labour and time. They are generally applied to the case for passenger based investment but can also be applied to the case for freight investment. MDST’s GB Freight Model has been used to this effect and incorporates freight based cost models (that reflect user costs) as well as non-user costs that reflect wider public interest values (congestion and emission impacts etc.). Other economists may be able to provide similar models.

Modelling savings in user costs through the use of longer maritime crossing to reach regional ports is crucial, because such reduced costs translate directly into productivity gains and raise gross domestic product. Such modelling techniques that have been used to appraise the case for internal transport infrastructure investment can be equally well used to test the value of short sea shipping services and therefore the value of road and rail infrastructure to support port gateways. They have not yet been applied to the short-sea case to re-route existing cargo flows onto longer maritime routes. That is, ‘public interest’ appraisal techniques have not been applied that take into account the whole of the international journey so that the value that port gateways can offer has not been fully taken into account.

Session 1 - Conference Paper 16

Conclusion

The evidence is now available that demonstrates that the freight market is switching to longer sea crossings to serve the GB short sea market, based on reducing costs and reflecting how accompanied truck solutions entering the UK across the Short Straits are losing market share. The switch itself is not currently being driven by public sector intervention; it is happening because of a number of commercial drivers within the transport market, although some companies maybe concerned about future proofing in the light of possible Government policy interventions. However, if this trend is to be further fostered and accelerated then the relevant ports will require a planning regime that allows them to expand and the case to be made for road and rail network support and capacity to accommodate the cargo volumes that will be generated.

It would be in the interest of the maritime sector to work with the network providers to develop the public interest case for such development.

Session 1 - Conference Paper 17

MICHAEL ROSENKILDE LIND Senior Commercial Manager, Port of Aalborg

BIOGRAPHY

With a background from Shipping agency and forwarding, Michael have been working as a Senior Commercial Manager at the Port of Aalborg for 7 years, working on developing new business for the port, the municipality, and the northern region of Denmark.

Session 1 – Speaker

18

Understanding cargo flows and local attitudes towards short-sea-shipping

Introduction

The European maritime transport policy recognizes the importance of the waterborne transport systems as key elements for sustainable growth in Europe. A major goal is to transfer more than 50% of road transport to rail or waterways within 2050. To meet this challenge waterway transport needs to get more attractive and overcome its disadvantages. Therefore, it is necessary to develop new knowledge and technology and find a completely new approach to short-sea and inland waterways shipping.

Port of Aalborg participates in the EU H2020-funded AEGIS (Advanced, Efficient and Green Intermodal Systems) Project, where the key element is to shift road transport to waterborne transport by developing environmentally friendly and economically sustainable transport solutions resulting in reduced road congestions and pollution. This topic is being examined through a multitude of dimensions, including renewal of ports, automation of cargo handling, enhanced digital connectivity, identification of regulatory challenges, developing green advanced vessels, etc.

The AEGIS Project will provide a proposal for construction of a new, fully automated terminal, able to handle RoRo, container and bulk transport via short-sea services and the rail network for Port of Aalborg.

A key element in developing and introducing short-sea-logistics is to understand local cargo flows and local attitudes towards new technologies and solutions. A shortlist of these is presented in this paper.

Background

Port of Aalborg is a multimodal, medium sized port situated in the northern part of Denmark and the biggest inland port in Denmark measured in size and annual throughput. The port connects the North Atlantic and Scandinavia with mainland Europe by sea, rail, and road. The Port is connected by weekly feeder routes to Hamburg and Bremerhaven and the railways are directly linked to the European rail Network.

International Cargo flow in and out of the Port of Aalborg region

A large proportion of both national- and international goods in Denmark is transported by truck. In 2018, approximately 28% of total international goods transport (in tonnage) were transported by truck, and approximately 91% of domestic goods were transported by truck (Vejdirektoratet, 2020). Numbers for 2019 account for approximately 162,5 million tonnes nationally and 26,5 million tonnes internationally by truck (Statistikbanken, Statistics Denmark, 2021). The AEGIS project is aimed to directly impact the transport mode of goods on shorter distances, looking to potentially shift transportation of goods from road to short-sea-shipping solutions.

The AEGIS project has examined the potential gross volume of goods that can be shifted from road transport to short-sea-shipping in Denmark, categorized by different goods types. It also includes analyses of the price structure for transportation of the goods by both road transport and short-sea-shipping, including an analysis of last mile / final destination delivery.

The total number of goods that is estimated to be shiftable from road to short-sea-shipping in Denmark are (based on 2019 data):

Session 1 - Conference Paper

19

It is estimated that the potential gross volume of goods that can be shifted from road transport to Short-sea-shipping in Denmark is approximately 5 million tonnes yearly, or about 18% of the relevant goods by truck. It is important to note that this is provided that any short-sea-shipping solution would be on par or cheaper than a competing direct road solution.

In the period from October 2020 – September 2021, the AEGIS research team has carefully analyzed: a) the total gross volume of goods that can potentially be shifted from road transport to include short-sea-shipping solutions within Europe; b) the cost-economics of road transport (i.e. door-to-door competing solutions); and c) the combined cost economics of short-seashipping solutions (i.e. last-mile road transport, port operations and handling as well as vessel shipping cost in different scenarios).

In more detail, the analyses have been carried out using the following data:

n A comprehensive Eurostat dataset showing inter-regional transport between every region in Europe (based on goods type).

n A dozen interviews with production companies to inquire about their needs as well as cost-points to address the potential attractiveness of short-sea-shipping solutions.

n Expert interviews with ports, shippers as well as terminal operators to gain insight into business models and cost-economics in operations.

n Quantitative analyses of costing for each segment of the transport journey.

Conference Paper 20

Session 1 -

2019 International/Denmark (yearly) Tonnes Movements Total - International/Denmark (yearly) 26.471.732 1.576.052 Relevant Scenario of relevant goods 4.864.392 274.755 National (yearly) Tonnes Movements Total - International/Denmark (yearly) 1.003.000 57.000 Relevant Scenario of relevant goods 177.540 9.899 GRAND TOTAL 5.041.932 284.654 /day 13.814 780 % of relevant regions 18,4% % of all trucking goods (162,5+26,471732 mill.) 2,7%

Table 1 - Conclusions from AEGIS on potential gross volume of goods that can be shifted from trucks to short-sea-shipping

• Quantitative analyses of costing for each segment of the transport journey.

International Cargo flows in and out of the Port of Aalborg region

International Cargo flows in and out of the Port of Aalborg region

In 2019, Port of Aalborgs region had a total of 1.212.423 tonnes inbound and 1.276.434 tonnes outbound by road. This was transported by 72.297 trips inbound and 71.532 trips outbound.

In 2019, Port of Aalborgs region had a total of 1.212.423 tonnes inbound and 1.276.434 tonnes outbound by road. This was transported by 72.297 trips inbound and 71.532 trips outbound. Figure 1 above gives an illustration of the number of yearly movements of trucks to/from the region in 2019 (not all countries are included).

Findings from interviews with local stakeholders

From the time-value analyses, as well as interviews with companies – both in relation with the AEGIS project, the core findings related to the relevant goods and also conversion potential were:

Findings from interviews with local stakeholders

n The overall price for the transport solution is important when deciding on a transport solution. A more expensive solution would hinder shifting from road to short-sea-shipping.

From the time-value analyses, as well as interviews with companies – both in relation with the AEGIS project, the core findings related to the relevant goods and also conversion potential were:

n For low-time-value goods, longer transport times are acceptable, and can be planned. Many customers are merely accustomed to very fast and flexible shipments.

n For high-time-value goods (e.g. machinery, machine equipment), longer transport times are not acceptable. Similarly, the transport cost is low compared to both the risk of any damages with short-sea-shipping solutions as well as lost-opportunity costs due to delays.

n Companies were sceptical that short-sea-solutions could become cheaper, or be on par, with the price of road transports.

n Most production companies said that their freight forwarders were in charge of a solution, and that this was not in the interest of the company to change, as long as the previous solution worked.

1 - Conference Paper 21

Session

business models and cost-economics in operations.

Figure 1 displays the international cargo moved by truck in and out of the Port of Aalborg region based on 2019 data (Eurostat).

Figure 1: Displaying interna:onal truck movents in and out of the Port of Aalborg region.

Figure 1 displays the international cargo moved by truck in and out of the Port of Aalborg region based on 2019 data (Eurostat).

Figure 1: Displaying interna:onal truck movents in and out of the Port of Aalborg region.

n Companies were not keen on extending the dialogue with freight forwarders.

n Companies mentioned that ports and partners should develop the solutions, then freight forwarders and companies would choose accordingly (a hen-andthe-egg discussion).

Conclusions

This Paper has introduced some of the findings regarding truck cargo traffic in Denmark and the local region surrounding Port of Aalborg.

Rail and waterborne transport are important business areas and Port of Aalborg want to promote green logistics such as short-sea-shipping and rail. In AEGIS Port of Aalborg serve as use case for the developed knowledge and technology.

The AEGIS Project presents an opportunity for Port of Aalborg to better understand the national and international cargo flows by truck coming in and out of the region. Port of Aalborg wish to attract local cargo moved by truck to rail or short-sea-shipping solutions.

The AEGIS Project has provided Port of Aalborg with data on local cargo flows proving, that there is great potential to convert from truck to a short-sea-shipping alternative.

Locally, stakeholders are not yet convinced about the positive advantages of short-seashipping and have not yet made significant commitments towards any short-sea-shipping solution.

References

1. Statistics Denmark (2021). “Statistikbanken: Business Sectors” https://www.statistikbanken.dk/ statbank5a/default.asp?w=1920 , retrieved between January 2 – May 23, 2021.

2. Vejdirektoratet (2020). “Udvikling i national og international lastbiltrafik i Danmark - En statistisk belysning”. Report no.: 601. https://www.vejdirektoratet.dk/api/drupal/sites/default/ files/2020-02/National%20og%20international%20lastbiltrafik%20i%20DK_WEB.pdf , retrieved on March 24, 2021.

Acknowledgements

The AEGIS project has received funding from the European Union’s Horizon 2020 research and innovation program (Grant Agreement N°859992).

Partners in AEGIS are Port of Aalborg (DK), Aalborg University (DK), Kalmar (FI), DFDS (DK), DTU (DK), Grieg Connect (NO), Institut für Strukturleichtbau und Energieeffizienz (DE), MacGregor (FI), NCL (NO), SINTEF Ocean (NO), Port of Trondheim (NO) and Port of Vordingborg (DK).

Session 1 - Conference Paper 22

Post-Brexit & Post-PandemicAre we where we need to be? SESSION 1 PANEL 23

RICHARD BALLANTYNE OBE Chief Executive, British Ports Association

BIOGRAPHY

Richard Ballantyne joined the British Ports Association in 2007 and became the Chief Executive in 2016.

Richard has in-depth expertise in ports, transport, trade, and environmental policy matters as well as a wide experience of the legislative process around the UK. He is a champion of sustainable development and is also a passionate advocate of the value of the UK ports industry both to the regions in which they are based but also as national gateways.

He is a Director of Maritime UK, a Trustee of the Merchant Navy Welfare Board charity and was previously a Director of Port Skills and Safety Ltd.

Before joining the BPA Richard spent five years at a Westminster political consultancy and was previously an MP’s researcher in the House of Commons.

Richard was also awarded an OBE in the 2022 New Year’s Honours for his services to the maritime sector.

The British Ports Association is the national body for ports. We represent the interests of operators that handle 86% of all UK port traffic, to Westminster and devolved Governments, and other national and international bodies. Membership is a sign of responsible port management and those outside the association remain firmly on the margins of the industry.

We are an inclusive and progressive association, open to all and committed to supporting Government to deliver a policy framework that enables all ports to thrive. Our membership comprises many ports, terminal operators, and port facilities, all of varying size, location and nature, many of whom have had to consider how new post Brexit borders rules will impact their operations and, of course, their customers. That said the industry has responded well and the ports sector continues to keep the UK supplied.

As the UK looks forward, following sustained lobbying from the BPA and others, a new generation of Freeports have been designated. It is exciting that government sees ports as being key economic enablers and part of the ‘Levelling Up’ agenda. However the limits on the numbers of Freeports has threatened competition issues in the sector and we are pushing for a more inclusive and ambitious policy.

Session 1 - Moderator

24

Coastlink Supporting Association

DOUG BANNISTER CEO, Port of Dover

BIOGRAPHY

Appointed in January 2019, Doug is the CEO of the Port of Dover, the busiest port in Europe. Prior to joining the Port of Dover, Doug was Group CEO for Ports of Jersey which operated the island’s harbours, coastguard, marinas, and airport.

In addition to Ports of Jersey, Doug has had over 30 years’ experience in leading international businesses. This experience included Managing Director of Maersk Line UK, as well as various executive roles managing shipping businesses in North America, Europe, Asia, India, Australia and New Zealand. Doug is skilled at turnaround, restructuring and transformation of capital intensive transportation businesses.

He holds an MBA in International Marketing (Seton Hall University, New Jersey 1997) and a B.A in Economics (St Lawrence University, New York 1988). In 2016 Doug was awarded the Institute of Directors Jersey Director of the Year for large businesses.

Born in Summit, New Jersey, USA, Doug holds dual British and American citizenship.

The Port of Dover empowers £144 billion of exchange each year and processes 33% of all trade in goods between the EU and UK. This vital gateway, which welcomes 10,000 trucks per day via 130 crossings, is critical for post-Brexit and Covid success, connecting trade, travel, visitors, and communities locally-globally.

The Port is a leader in sustainability, collaborating with local and international partners to create a more seamless, sustainable, and tech-enabled port. The “Targeting Our Sustainable Future” project aims to achieve net-zero carbon emissions (Scope 1 and 2) by 2025, with an ambition to become the world’s first high volume green shipping corridor.

Session 1 - Panellist

25

HOWARD KNOTT Logistics & Supply Chain Consultant Irish Exporters Association

BIOGRAPHY

Graduate of Dublin University and Fellow of Chartered Institute of Logistics and Transport.

Currently Logistics and Supply Chain Consultant to the Irish Exporters Association as well as columnist and Maritime Transport writer for Fleet Transport.

Previous experience as Irish representative on a number of EU Supply Chain related projects building on the experience of managing the Irish operations of a number of International Shipping and Forwarding Operations.

Post-Brexit and Post-Pandemic: Are we where we need to be?

Unlike the global Covid-19 outbreak and the Russian invasion of Ukraine, both of which came as a sudden shock to traders, Brexit was long forecast enabling preparations to handle it to be commenced well in advance.

The Irish Exporters Association (IEA) is a membership organization, representing, training, and otherwise assisting Irish manufacturers and export service companies to meet the challenges in developing and holding markets abroad.

Since the UK Brexit Referendum decision minimizing the damage and exploiting new opportunities have been key priorities for Irish Government, it’s Agencies and the IEA, along with Manufacturing and service firms. The switch from trading with and through the UK to doing so directly with EU member states has been quick and very successful.

The Shipping Industry has played a major role in facilitating this change in focus: Ferry Companies, DFDS and Finnlines have entered the market, while established Lines including, Stena, CLdN, Grimaldi, Brittany Ferries have added significant capacity and routes facilitating a doubling of traffic on direct continental routes. On the lo-lo side, since 2019 traffic volumes increased by 12%.

Session 1 - Panellist

26

But the Brexit disruption is not yet done! The UK Government has long-fingered many import control measures that will impact the import of many key products from Ireland and elsewhere in EU. The Windsor Framework will take some time to fully come into force.

While the COVID-19 induced Deep-Sea supply chain issues have cooled, uncertainty remains as to whether or not the near-shoring, prompted by these and climate change concerns, will stick.

Global product price and interest rate inflation has to be the prime concern for all of those engaged in international trade throughout 2023 and into 2024. These may impact particularly strongly on Carriers, Terminals, Freight Forwarders and Airlines as trade volumes on all markets retreat.

The title of this discussion asks, Are we where we need to be? We never can be, there are too many moving parts, but after the last five years everybody involved in any Supply Chain is much better prepared to face the challenges.

Session 1 - Panellist 27

AMAIA SARASOLA Marketing & Commercial Manager Port of Bilbao Authority

BIOGRAPHY

As the Port of Bilbao Marketing and Commercial Manager, her role is to drive growth and profitability of the port through developing and implementing marketing strategies that align with the Bilbao Port’s strategic pillars: environmental sustainability, competitive services and generation of economic growth.

She works to build strong relationships with stakeholders, promote the value of the port’s services and capabilities and ensure that the port is able to meet evolving needs of customers and the region.

The development of greener and digital shipping corridors is a priority for the Port of Bilbao. Since 2005 the Port of Bilbao has been leading actions in these areas which will now be boosted with the investment in the electrification of the port terminals and the Basque Hydrogen Corridor. Bilbao as the leader in shipping services to the Atlantic Arc, and to the United Kingdom in particular, has been further strengthened with the introduction of more environmentallyfriendly vessels in the last two years.

The Port of Bilbao is the leading Spanish port in terms of traffic with the United Kingdom.

Brexit forced us all to modify trade and transport practices with the UK.

Amaia Sarasola will explain the experience of the Port of Bilbao in continuing to provide the best possible service to its main market.

Session 1 - Panellist

28

BIOGRAPHY

A Highly motivated and driven individual with over 35 years of experience in the Shipping & Logistics industry including 20 years of senior executive management roles, leading operational, commercial teams with business change and growth development.

With 30 years at DFDS previous roles have included:

n Managing Director DFDS Seaways UK Immingham, Ferry Division for 7 years

n Digital & IT Officer Ferry Division, Cph for 3yrs

Currently engaged in commercial activities for the past 3yrs as Commercial Director Client & Engagement Business Unit, focusing on the growth and business development in the Forestry, Metals, Renewables sector(s) across Europe, Scandinavia, Baltics & Mediterranean regions.

Session 1 - Panellist

29

SEAN POTTER, FCILT, PSPO 1 Commercial Director, DFDS A/S, Industries & Client Engagement Business Unit

Promote your business to the right audience in the right place at the right time. Engage with our international audience of decision makers and buyers. The Port Strategy multi-media platforms offer our commercial partners a wide range of opportunities for campaign delivery. We provide bespoke marketing packages with quantifiable ROI.

Port Strategy’s valued content is dedicated to the international ports and terminals business and is delivered through multiple channels.

Arrate Landera, Brand Manager t: (+44) 1329 825 335 e: sales@portstrategy.com www.portstrategy.com Contact us today

INSIGHT

EXECUTIVES MAGAZINE RECIPIENTS DECISION MAKERS PAGEVIEWS PER MONTH 17,800 72% 36,240 Reach industry professionals with Port Strategy

PORTSTRATEGY

FOR PORT

How to promote growth and deliver resilient end to end supply chains

SESSION

31

2

MICHELLE GARDNER Deputy Director of Policy, Logistics UK

BIOGRAPHY

Michelle Gardner was appointed Deputy Director of Policy for Logistics UK in October 2022, having previously joined as Head of Public Policy in February 2021. Michelle oversees the development and engagement of Logistics UK policy, including on topics such as road regulation, infrastructure, trade and decarbonisation.

Michelle has a background in both policy and public affairs and prior to joining Logistics UK, she was Environmental Manager at the Society of Motor Manufacturers and Traders. Previously she worked for the British Retail Consortium, first leading on public affairs and then on employment and health and safety policy.

Session 2 - Speaker

32

Coastlink Supporting Association

STEPHEN CARR Group Commercial Director , Peel Ports - Liverpool

BIOGRAPHY

Stephen joined Peel Ports in 2009 as Head of Business Development for the Mersey Division before moving to his current group role, Commercial Director in 2017. He started his career with BP, working across a variety of sales and marketing roles for the best part of 12 years, before becoming Sales Director for Manchester based chemicals firm TGD.

Based in at the Port of Liverpool, Stephen is responsible for driving the businesses forward with new and existing commercial opportunities across the group’s diverse portfolio. During his time with Peel Ports, he has played a leading role in strategic projects including the development of container terminal Liverpool2, the growth in the use of the Manchester Ship Canal (as a multimodal logistics hub), and the development of port-centric warehousing throughout North-west England.

Host Port

What mode of transport uses Ports?

We explore why the true answer to that question defines why both industry and consumers need to think differently about the role and the functions of modern ports.

Session 2 - Speaker

33

GEOFF LIPPITT Group Commercial and Strategy Director, PD Ports

BIOGRAPHY

Geoff joined PD Ports in 2011 and, as Chief Commercial Officer, oversees the commercial developments of the Company’s UK-wide port and logistics operations.

A marketing graduate from Salford University, Geoff started his career as Transport Controller for Overseas Containers Limited (OCL).

Geoff has over 40 years’ experience in the logistics and transport industry with a background in operational and general management, as well as in business development. His experience includes senior appointments in the shipping and ports logistics sectors, and more recently with Kuehne + Nagel, where he held the position of Vice President, Global Business Development. During his career, Geoff has also worked at ABP, BOC and a number of other major logistics businesses in senior roles.

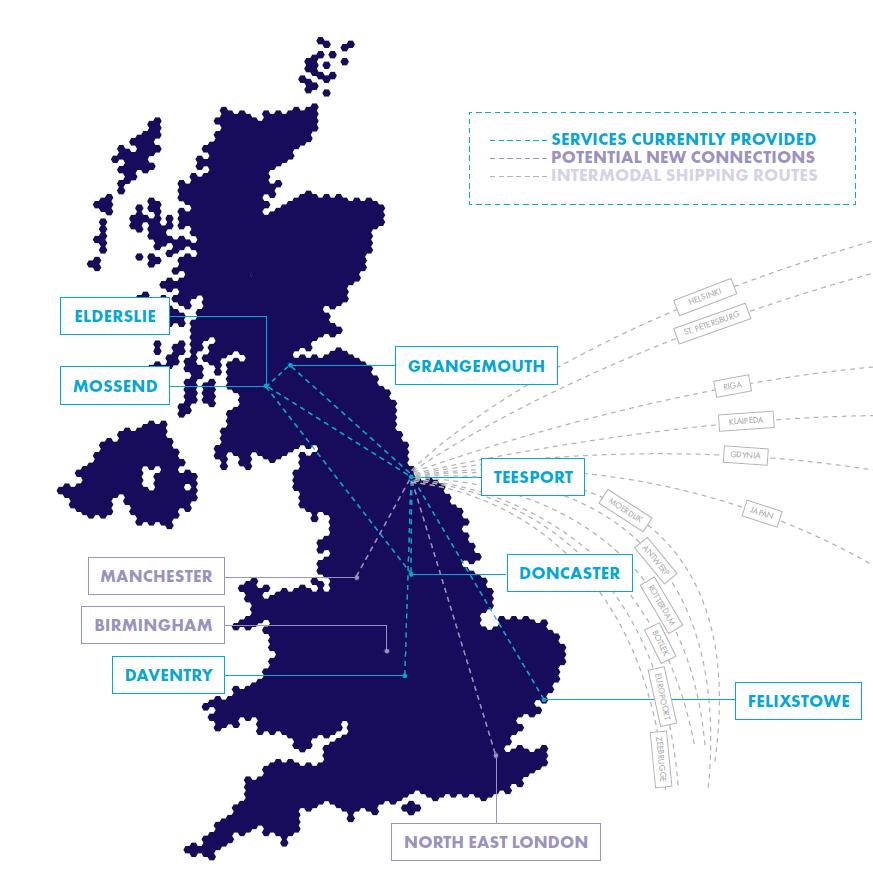

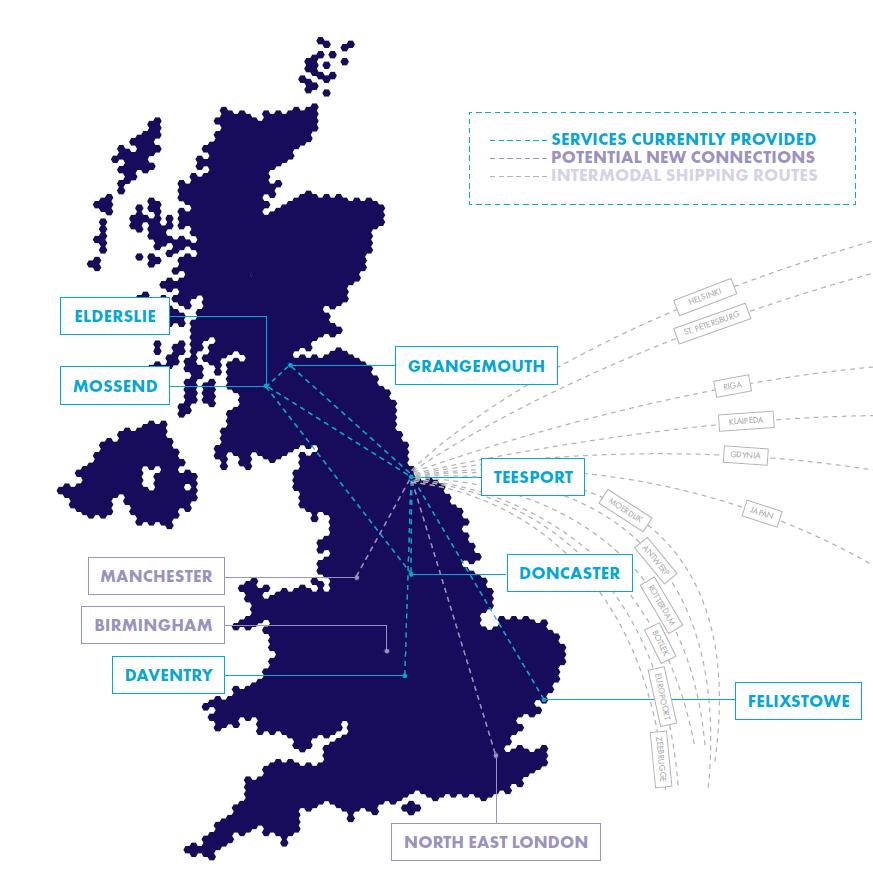

In his role at PD Ports, Geoff is responsible for driving the commercial business development activities across the Company. In recent years, Geoff has led the transformational development of PD Ports’ green rail agenda, positioning Teesport’s Intermodal Rail Terminal as a critical component in UK infrastructure for northern bound freight.

Geoff has been instrumental in driving forward relationships with Transport for North and as the recently elected Vice Chair of the Rail Freight Group, continues to advocate moving freight by rail to create more resilient supply chains, reduce carbon emissions and deliver on the levelling up agenda for the North.

Session 2 - Speaker

34

“How intermodal, short sea shipping, RoRo, LoLo and last mile delivery road haulage can interlink to provide resilience and enhance capacity for ports and operators”

“How intermodal, short sea shipping, RoRo, LoLo and last mile delivery road haulage can interlink to provide resilience and enhance capacity for ports and operators”

Geoff’s presentation will focus on five key themes that underpin his presentation; how intermodal, short sea shipping, RoRo, LoLo and last mile deliver road haulage can interlink to provide resilience and enhance capacity for ports and operators.

1. Rail Intermodality

Geoff’s presentation will focus on five key themes that underpin his presentation; how intermodal, short sea shipping, RoRo, LoLo and last mile deliver road haulage can interlink to provide resilience and enhance capacity for ports and operators.

The use of rail to replace road trunking and provide enhanced resilience and reliability for trade flows.

Rail Intermodality

At PD Ports, our intermodal services have the capacity to remove around 85,000 trucks from the UK road network each year. This not only provides a significant carbon emissions saving throughout the supply chain, but also provides a more flexible and reliable means for onward distribution.

The use of rail to replace road trunking and provide enhanced resilience and reliability for trade flows.

At PD Ports, our intermodal services have the capacity to remove around 85,000 trucks from the UK road network each year. This not only provides a significant carbon emissions saving throughout the supply chain, but also provides a more flexible and reliable means for onward distribution.

2. Short Sea Shipping and Rail Links

Short Sea Shipping and Rail Links

Geoff will then cover the creation of land bridges between the UK and Northern Europe using rail and short sea LoLo connections.

Geoff will then cover the creation of land bridges between the UK and Northern Europe using rail and short sea LoLo connections.

Session 2 - Conference Paper

35 RESTRICTED 14:30-14:15 3rd May

3. Warehousing Links

Warehousing Links

Connecting inland warehousing to ports with short sea connections using rail to allow for local deliveries to be affected in a greener supply chain.

Connecting inland warehousing to ports with short sea connections using rail to allow for local deliveries to be affected in a greener supply chain.

4. Resilience Using Rail and Feeder Services

Resilience Using Rail and Feeder Services

Explaining the strategies to protect the resilience of coastal shipping and rail services using the Teesport to Felixstowe service as an example.

Explaining the strategies to protect the resilience of coastal shipping and rail services using the Teesport to Felixstowe service as an example.

5. Infrastructure Challenges

Infrastructure Challenges

Specifically, Geoff will look at the challenges to develop W10 and W12 cleared routes including restraints put upon the rail network by funding and other programme challenges using the TransPennine route as an example.

Specifically, Geoff will look at the challenges to develop W10 and W12 cleared routes including restraints put upon the rail network by funding and other programme challenges using the TransPennine route as an example.

Session 2 - Conference Paper 36

RESTRICTED

Coastlink Sponsor

JUSTIN ATKIN

UK & Ireland Representative, Port of Antwerp-Bruges

BIOGRAPHY

Justin has more than 25 years’ experience in the ports and shipping sector including working in senior operational and commercial roles for Associated British Ports.

He has worked as a logistics consultant since 2016 and joined the international team of Port of Antwerp-Bruges in 2018, for whom he is Representative for the UK and Ireland. With many years’ experience with dry bulk and break bulk cargoes, Justin has extended his knowledge to include the unitised (containers and trailers), chemical, cool logistics and e-commerce sectors.

Based in Northern Lincolnshire, Justin is a life-long supporter of Liverpool Football Club; and is a committed road cyclist, completing the ‘Coast to Coast’ challenge in 2022.

Session 2 - Speaker

37

Port of Antwerp-Bruges:an integrated supply chain offer

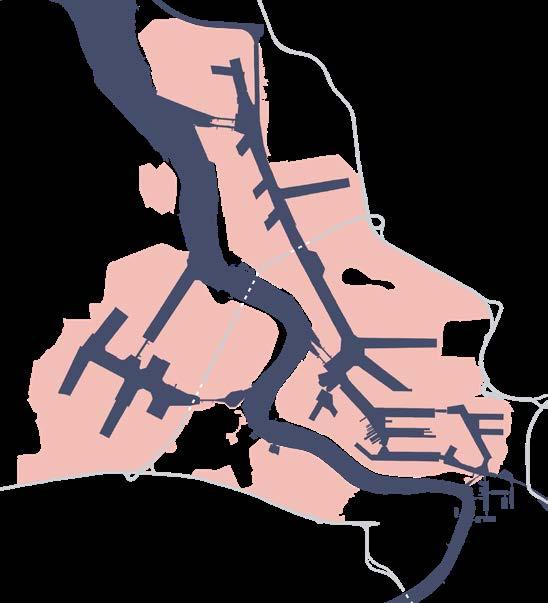

Port of Antwerp-Bruges combines the best of both worlds. The port of Antwerp is strong in the traffic and storage of containers, breakbulk and chemical products. Bruges is the biggest port in the world for ro-ro traffic. It also handles containers and the transhipment of liquefied natural gas.

Session 2 - Conference Paper

1. Faster connections

n Widely connected to overseas destinations

n In the top league of container ports

n Double gateway: inland location and direct sea access

n Smooth port transit

n Flexible transport solutions for the European hinterland

n Focus on interconnection

3. Future-oriented processes

n Cargo-generating port

n Safe, fast, high-quality cargo handling

n Integrated logistics service offer

n Can-do mentality

4. Integrated logistics

n Private and public efforts

n Sustainable Development Goals (SDGs

Session 2 - Conference Paper

2. Smoother customs

n Antwerp-Bruges, European external border

n Paperless procedures

n Authorised Economic Operators (AEO)

39

North andCentralAmerica thAmerica Near East Sou Middl e East/ isc Far East Africa Pacific Region 517 Port of Antwerp Bruges 175 106 34 89 102 32 165

1. Faster connections

Widely connected to overseas destinations

Port of Antwerp-Bruges is the leading European port for regular breakbulk, ro-ro and automotive sailings to all areas. Our container services go as far as the Americas, Africa, the Near, Middle and Far East and the Indian Subcontinent. For closer destinations, Port of Antwerp-Bruges offers numerous shortsea and feeder services.

In the top league of container ports

The new container shipping alliances have added several calls at Port of AntwerpBruges. The reasons are the port’s optimal nautical accessibility, the presence of cargo-generating industry and excellent connectivity with European economic centres.

Double gateway: inland location and direct sea access

Thanks to its maritime location, Bruges is easily accessible for the largest container vessels, which guaranteeing short transit times for overseas destinations. Combined with Antwerp’s inland location near the heart of the European manufacturing and consumer base, Port of Antwerp-Bruges offers a perfect double gateway to the rest of the world.

Focus on interconnection

To tap into the added value of our port, Port of Antwerp-Bruges is going all out for interconnection. We will bundle freight rail transport between the two sites and optimise estuary navigation (by inland vessels on the North Sea). A pipeline connection is also on the priority list. There will also be an efficient exchange of data between the two sites, too.

Flexible transport solutions for the European hinterland

Port of Antwerp-Bruges continues to create the

William

1. Faster connections

Session 2 - Conference Paper

With over 200 regular maritime breakbulk liner services, we can reach the whole world from Port of AntwerpBruges

Moyersoen CEOArcelor Mittal Logistics

Widely connected overseas destinations Port of Antwerp-Bruges the leading regular breakbulk, automotive Our container far as the the Near, and the Indian For closer of Antwerp-Bruges numerous feeder services. In the top container The new alliances calls at Port Bruges. The the port’s accessibility, cargo-generating excellent European Double inland location direct sea Thanks to Bruges is the largest which guaranteeing times for Combined inland location of the European and consumer Antwerp-Bruges double gateway the world.

Session 2 - Conference Paper

Save on cost, time and carbon footprint

Moscow RUSSIA Madrid Las Palmas Bucharest Strasbourg Athus Co urtray Mannheim Frankfurt Duisburg Cuxhaven Rotterdam & Amsterdam Neuss Rome Athens Piraeus Derince Borusan Milan Basel Leipz g Lovosice Schwarzheide Kutno Wroclaw Katowice Budapest Curtici Zagreb Par s Tyne Hull Tilbury Lübeck Malmö Gdynia Gdansk Lyon 250 km FR ANCE N ET H E R L AN DS G E RMANY Dublin Riga Paldiski Kotka SW EDE N Helsinki Hanko Uusikaupunki Pietasaari Oulu Kerni St.Petersburg Frederikstad Södertälje Husum Hirtshals Drammen Halden Göteborg Esb erg Marseille Gijon Munich Linz 500 km 750 km 1000 km NORWAY RUSSIA BEL ARUS UKR AINE BOSNIA AND HERZEGOW NA SERBIA KOSOVO MONTENEGRO MACEDONIA ALBANIA TURKEY SWITZERL AND ANDORR A LICHTENSTEIN MOLDOVA SPAI N I RE L AN D AUST R IA Vijo B E LG I U M PORTUGAL DE N MARK POL AN D L AT VIA ESTON IA CZEC H RE PU BLIC H U N GA RY G RE ECE SLOV AKIA ITALY CROAT IA FI N L AN D U N IT E D KI NG DOM Middlesbrough Sheerness Southhampton Cork Le Havre BU L GA R IA RO MAN IA SLOVE N IA LUX MALTA CYPRUS Killingholme Purfleet Grimsby Rosslare Saint-Nazaire Tarragona Sagunto Pasajes Bilbao Santander L vorno Ant werp Bruges Port of Tenerife

The inland location of the Antwerpplatform is an important plus. Seagoing ships can deliver their cargo close to the westEuropean consumer

41

Ivan De Donder Plant Manager, Lumipaper

Barge

Port of Antwerp-Bruges is, through its central location in the Scheldt-Maas-Rhine delta, linked to the panEuropean inland waterway network.

Estuary navigation

Estuary ships can reach major terminals on the Rhine and other ports via the Western Scheldt and the North Sea. This is a fast and sustainable mode of transport.

A reliable supplychain thanks to a modal shift

Port of Antwerp-Bruges offers excellent hinterland connections with the transport

Rail

Port of Antwerp-Bruges lies at the junction of Europe’s three main rail corridors and every single one of its terminals has rail access.

Shortsea

A large variety of regular shortsea and feeder services connect both the dedicated shortsea and the deep sea container terminals in Port of Antwerp-Bruges with key economic centres in both Northern and Northeastern Europe, as well as North Africa and the Mediterranean. For the UK, our port platform has become a real turntable with more than 70 liner services offering daily connections.

Road

The port offers direct access to a dense international network of motorways to France, the Netherlands, Germany and beyond. The port’s container terminals are open 24/5 in order to allow night logistics and avoid truck traffic during the day.

Pipelines

Major pipelines guarantee the safe and reliable transport of petrochemicals in the port and from Antwerp-Bruges, the hub of the European pipeline network, to other industrial centres in the Netherlands, France and Germany. Port of Antwerp- Bruges also has an extensive infrastructure for the storage and transhipment of LNG. Moreover, it’s one of the main entry points for LNG supplies in Northwest Europe.

Session 2 - Conference Paper 42 G E R MA NY Liege Aachen RUSSIA N ET H E RL AN DS B E LG I U M F R AN CE Eindhoven Duisburg Düsseldorf Brussels Vlissingen Rotterdam Europe A nt werp Europe Bruge s Europe

Do you want to import goods into the EU of which you don’t know the final destination yet?

The Port of AntwerpBruges has the largest concentration of bonded warehouses in Europe, allowing customs duties and tax deferral. Thanks to our bonded warehousing system you can store the goods for an unlimited period; and you don’t have to pay VAT and customs dues until the goods have been delivered to your customer in the EU. In the meantime you are allowed to provide value-added services, processing the goods according to your customer’s requirements or you can use the bonded warehouses as global distribution centers.

Do foreign companies need to have a Belgian VAT number to import goods via the Port of Antwerp-Bruges?

No, Antwerp-Bruges port logistics service providers act as fiscal representatives, which means that they have a global VAT number enabling them to complete all customs formalities for companies that are not registered in Belgium. All advantages, such as deferral of VAT at import, apply here as well.

Are you deterred by the high deposit that must be paid on excise goods?

No need: there is a cap on the excise deposit payable on goods imported into the EU.

2. Smoother customs

Antwerp-Bruges, European external border

This means that all customs formalities can be done in Antwerp or Bruges for destinations in any of the 27 member states of the European Customs Union. The same customs regulations, customs duties, rules of origin, quotas, etc. apply throughout this area.

Paperless procedures

The electronic data exchange with customs administrations can be started two to three days before the vessel’s arrival at the port. This –in combination with the paperless export and flexible transit procedures for containers and ro-ro, and 24/7 customs supervision in the port – helps smooth your cargo’s transit via the Port of Antwerp-Bruges.

Authorised Economic Operators (AEO)

Most service providers in the port have the Authorised Economic Operator (AEO) certificate, which translates into fewer inspections, simpler customs procedures and fewer warranties.

Session 2 - Conference Paper 43

Port of Antwerp-Bruges

The entire customs territoryof the European Unioncan be served via the Port of Antwerp-Bruges.

The Port of AntwerpBruges as the ideal distribution hub for Europe and beyond

Port of Antwerp-Bruges combines a large offer of tailor-made logistics services with a strategic location, excellent connectivity, and many ways to avoid direct import duties and taxes. Indeed, most of the storage facilities are bonded, meaning Port of AntwerpBruges is a virtual free trade zone.

3. Integrated logistics

Cargo-generating port

Port of Antwerp-Bruges’ maritime, logistical and industrial activities are strongly linked and complement each other. Antwerp-Bruges is home to the largest integrated (petro) chemical cluster in Europe, and the most diverse in the world. This creates strong demand for freight transport.

Safe, fast and highquality cargo handling

Port of Antwerp-Bruges has more storage space than any other European port. In combination with its stateof-the-art infrastructure and equipment and the great expertise of its personnel, it can handle any cargo efficiently and safely, including hazardous and refrigerated cargo.

Our Terminals

Our storage capacity

Session 2 - Conference Paper 44

Large distribution centre capacity

Professional service providers

Third party tanks

Covered Silo storage storage space

Liquid Deepsea Breakbulk Dry bulk bulk container & ro-ro

Integrated logistics

Integrated logistics service offer

Most of the logistics service providers in Port of AntwerpBruges operate as a onestopshop, offering complete solutions including freight forwarding, storage, valueadded logistics (VAL), customs administration, fiscal representation and distribution services.

Can-do mindset

With their ‘getting things done’ mindset, the AntwerpBruges logistics service providers always respond swiftly and flexibly to both customer demands and unexpected events.

Session 2 - Conference Paper 45

Cargo handling Logistics

Industry

4. Leading sustainable port

When it comes to sustainability, we set the bar high

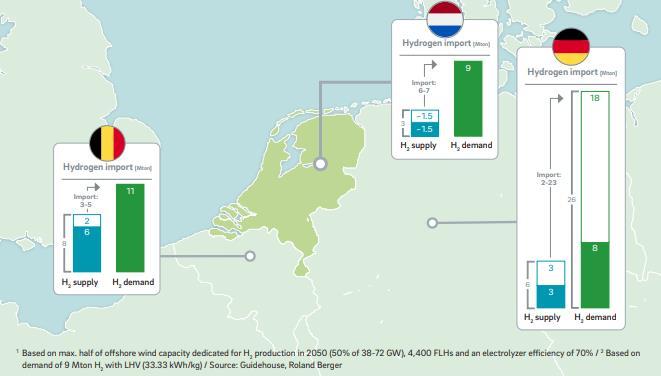

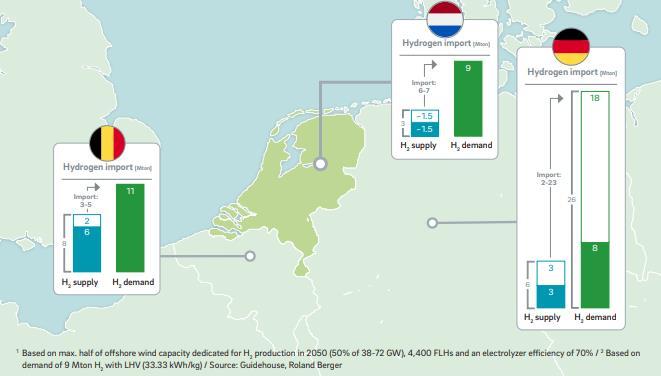

By combining the industrial cluster of Antwerp with Bruges’ location on the coast, we have all the tools to address the future energy challenges in Flanders and the wider region. As such, Port of Antwerp-Bruges will take up a leading position as an import hub for green hydrogen and will play an active and pioneering role in the hydrogen economy. In addition, together with our industrial and maritime customers, we will continue our efforts to reduce our carbon footprint. For instance, we’ve installed wind turbines and solar mirrors as a source of green energy. We are also examining methods of applying CCUS (Carbon Capture, Utilisation & Storage) to contribute to foster the transition towards a low-carbon port.

Private and public efforts

We aim to be a carbonneutral port by 2030. To achieve this goal, we are continuously pushing the boundaries with innovations that make the port greener, keep it accessible and lead the way in our digital world. Therefore, we have joined the Belgian Alliance for Climate Action, a conglomerate of private and academic institutions that encourage their business partners to make sustainability a priority by setting science-based targets.

Sustainable Development Goals

Sustainability and the UN’s development goals are the touchstone for everything we do. Our sustainability policy and business plan are built around five core SDGs: health & welfare, work & economic growth, innovation, sustainable cities & communities, and climate action. They form a guideline for the further development of the port.

Session 2 - Conference Paper

46

Session 2 - Conference Paper 47

Port of Antwerp-Bruges 19

Platform Bruges

Platform Antwerp

Change starts here.

The port that gets your green energy flowing

As the world evolves, we evolve too.

With maritime connections to more than 1000 ports, Port of Antwerp-Bruges is at the heart of international world trade. It’s our ambition to become a major import hub of the hydrogen supply chain to Europe’s industrial hinterland, and help drive change towards a greener, more sustainable future.

Join us in building the world of tomorrow. Discover our plans on portofantwerpbruges.com.

Freeports: Driving change for coastal shipping and the supply chain?

A discussion on the impacts and benefits of Freeports. How will supply chains adjust?

49

PANEL DISCUSSION

RICHARD BALLANTYNE OBE Chief Executive, British Ports Association

BIOGRAPHY

Richard Ballantyne joined the British Ports Association in 2007 and became the Chief Executive in 2016.

Richard has in-depth expertise in ports, transport, trade, and environmental policy matters as well as a wide experience of the legislative process around the UK. He is a champion of sustainable development and is also a passionate advocate of the value of the UK ports industry both to the regions in which they are based but also as national gateways.

He is a Director of Maritime UK, a Trustee of the Merchant Navy Welfare Board charity and was previously a Director of Port Skills and Safety Ltd.

Before joining the BPA Richard spent five years at a Westminster political consultancy and was previously an MP’s researcher in the House of Commons.

Richard was also awarded an OBE in the 2022 New Year’s Honours for his services to the maritime sector.

The British Ports Association is the national body for ports. We represent the interests of operators that handle 86% of all UK port traffic, to Westminster and devolved Governments, and other national and international bodies. Membership is a sign of responsible port management and those outside the association remain firmly on the margins of the industry.

We are an inclusive and progressive association, open to all and committed to supporting Government to deliver a policy framework that enables all ports to thrive. Our membership comprises many ports, terminal operators, and port facilities, all of varying size, location and nature, many of whom have had to consider how new post Brexit borders rules will impact their operations and, of course, their customers. That said the industry has responded well and the ports sector continues to keep the UK supplied.

As the UK looks forward, following sustained lobbying from the BPA and others, a new generation of Freeports have been designated. It is exciting that government sees ports as being key economic enablers and part of the ‘Levelling Up’ agenda. However the limits on the numbers of Freeports has threatened competition issues in the sector and we are pushing for a more inclusive and ambitious policy.

Session 2 - Moderator

50

Coastlink Supporting Association

BIOGRAPHY

Giles Jones is Project Manager at Liverpool City Region Freeport.

LCR Freeport is a multi-modal special economic zone driving growth in the UK’s advanced manufacturing, biomanufacturing, logistics, and low carbon industries. In this role Giles is responsible for liaising with public and private sector partners to drive delivery of the Freeport.

Prior to assuming this role Giles was employed by the UK’s Department for International Trade for four years.

Session 2 - Panellist

51

GILES JONES Project Manager, Liverpool City Region Freeport

BENJAMIN HARRAWAY General Manager, Portico Shipping Ltd

BIOGRAPHY

Benjamin Harraway is General Manager at Portico Shipping Ltd, based at Portsmouth International Port. Ben has a wealth of experience in the maritime industry. Driving Portico’s vision for the future, Ben has developed the business’ masterplan for the next 20 years and has been heavily involved in the port’s successful freeport bid, working closely with stakeholders to establish a Customs Site at Portico.

Located at Portsmouth International Port, the UK’s most successful municipal port, Portico is ideally positioned to handle cargo from ship to shore and beyond. As a deep-water port, close to main shipping channels and with direct access to the national motorway network, Portico is the first choice for customers looking for an efficient and cost-effective cargo handling and stevedore service on the south coast.

Stretching across 66 acres, our site is equipped to handle all types of cargo, including fresh produce, container, break bulk, general bulk, and project cargo, as well as the provision of extensive logistics services.

“Freeports provide a really exciting opportunity for customers to reimagine their short-sea supply chain, taking advantage of the fantastic package of benefits available. But it is up to freight forwarders, freeport operators and the government to help attract and guide the right customers to maximise the levelling-up potential – this is where I think the message is struggling to create an impact.

Freeports will help customers to simplify their customs processes, streamline their supply chain and reduce costs for both UK and overseas operations. Freeports also have to potential to really attract new industry to the UK’s Freeport locations, including the Solent Freeport region, bringing new innovation, employment and supply chain networks to these areas.

However, there is still a lot of work to be done by all parties involved, from a Government level to the end user, to ensure that the Freeport model is right, that it fits the existing infrastructure and technology available to freeport operators, and that the benefits, restrictions and processes are communicated out to potential freeport customers. This is where Portico Shipping, as a freeport operator and freight forwarder located in the Solent Freeport region, is focusing its efforts – working with potential customers, helping them to understand the freeport offering and adapt their supply chain to realise the freeport benefits.”

Session 2 - Panellist

52

NOLAN GRAY Freeport Director, Tees Valley Combined Authority

BIOGRAPHY

He is responsible for delivering the first and largest Freeport in the UK. The 4,500-acre Teesside Freeport covers sites across the entire Tees Valley including Teesworks, Teesside International Airport, PD Teesport, Wilton International, Port of Middlesbrough, the Port of Hartlepool, Able Seaton Port, Redcar Bulk Terminal and LV Shipping.

“Teesside Freeport offers one of the largest regeneration opportunities in Europe, with wellconnected infrastructure, a strong innovation eco-system, access to a highly skilled local population and miles and miles of opportunity”.