Green Ports and Shipping Congress will identify and prioritise the areas that ports-based organisations and shipping companies need to collaborate on to reduce emissions.

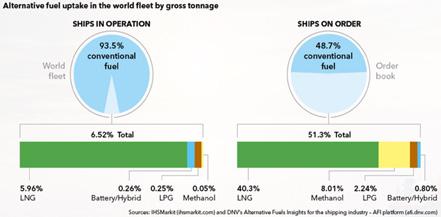

Green Ports & Shipping Congress will cover a range of topics addressing the aspects of energy transition plans and implementation as they affect port operations and ships.

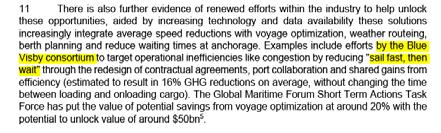

Media Partners: PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES GREENPORT INSIGHT FOR PORT EXECUTIVES MOTORSHIP MARINE TECHNOLOGY THE Media Supporters: Visit www.greenseascongress.com

Handbook Programme For further information contact the Events team on +44 1329 825335 or email info@greenseascongress.com Marina Bay Sands, Singapore Sponsors Supporters: International Windship Associatio

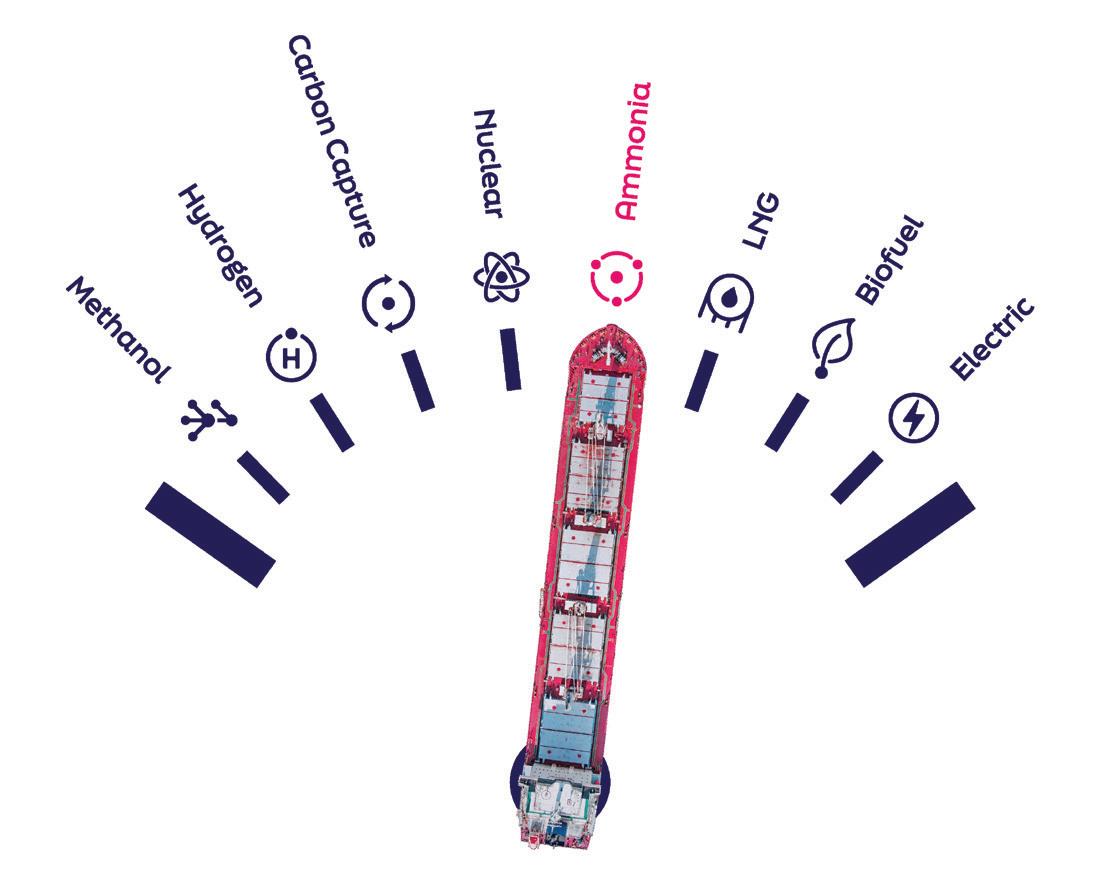

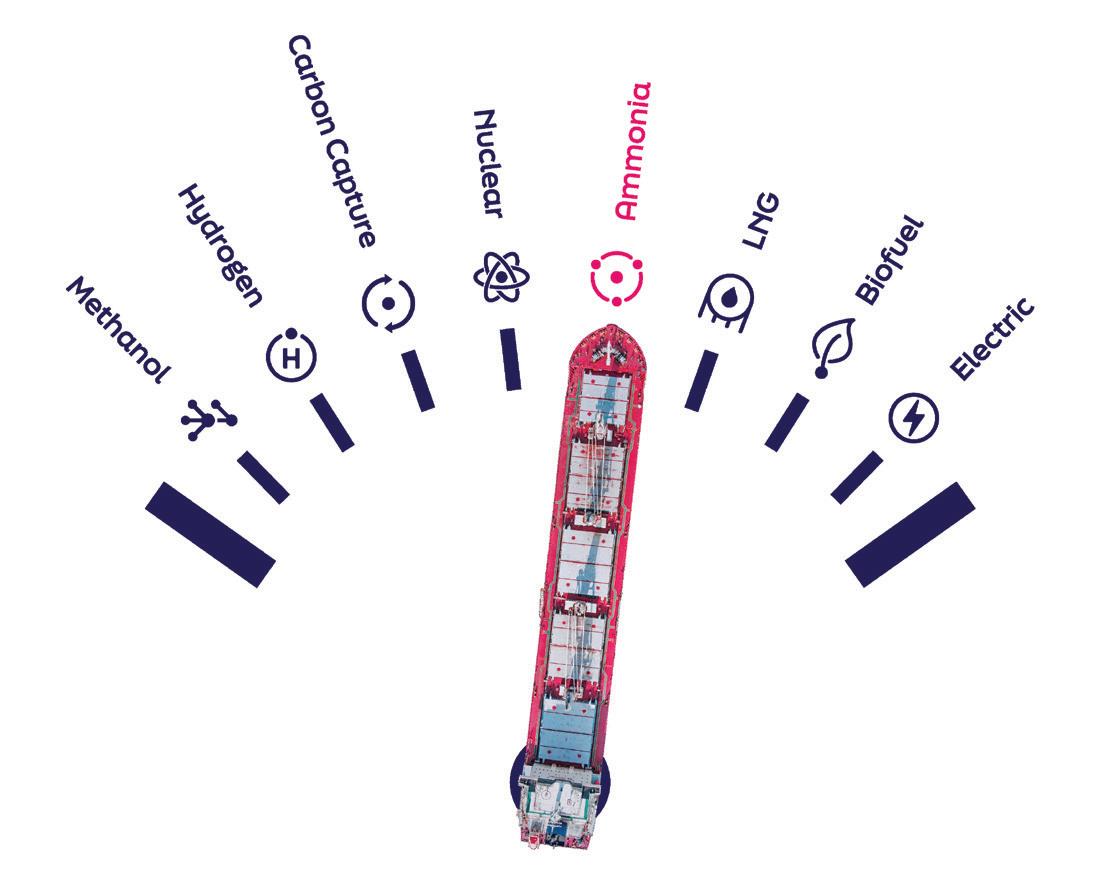

FUEL FOR THOUGHT

Ammonia

Exper t insights into the future of alternative fuel s

ANDREW WEBSTER Chief Executive Officer, Mercator Media Ltd

ANDREW WEBSTER Chief Executive Officer, Mercator Media Ltd

Welcome to Green Ports and Shipping Congress.

This event builds on the success of GreenPort Oceania, which evolved from the market leading conference, Propulsion & Future Fuels, now in its 45th year. Combined with GreenPort Congress and Cruise, in its 19th year we now offer a unique platform for ports and shipping; uniting these integral sectors to meet the 2050 net zero decarbonization targets.

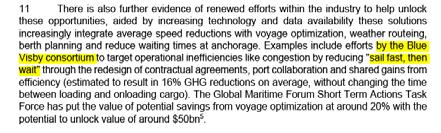

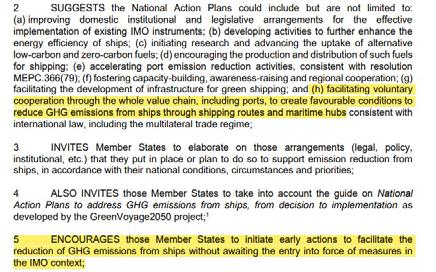

As the first conference of its kind, we are encouraged that this event is underpinned by IAPH, BIMCO, Global Centre for Maritime Decarbonisation, Singapore Shipping Association, Blue Visby, ICS, IBIA and IWSA.

We are also pleased to be holding the conference at the iconic Marina Bay Sands, Singapore. The venue is Asia’s leading destination for business, leisure and entertainment and Singapore’s first carbon neutral business event venue.

Our speaker line-up promises a wealth of learning and updates, commencing with the Keynote Panel, “Ports and Shipping - collaboration to achieve 2050 goals”. Moderated by James Forsdyke from Lloyd’s Register this panel features eminent speakers, Er Tham Wai Wah, Chief Sustainability Officer, MPA; Dr Sanjay C Kuttan, Chief Technology Officer, Global Centre for Maritime Decarbonisation; Lars Robert Pedersen, Deputy Secretary General, BIMCO; Captain K. Subramaniam, General Manager, Port Klang Authority and Past President, IAPH; Antonis Michail, Technical Director, International Association of Ports and Harbors / World Ports Sustainability Program and Evelyn Tang, Head of Contract Pricing, Maersk Southeast Asia Ocean. This will be followed by the full programme of targeted and innovative sessions, over the two days.

I am delighted that Lars Robert Pedersen, Deputy Secretary General, BIMCO will be your Chairman. I know that Lars Robert and our moderators will promote active debate and discussion throughout the event and introduce you to our schedule of expert speakers. Finally, a thank you to our sponsors Lloyd’s Register, Bureau Veritas and The Methanol Institute for sponsoring the Conference; and to all the supporters and speakers who have helped to make the first Green Ports and Shipping Congress possible. Last, but not least, to you, our delegates for being here.

On behalf of the Green Ports and Shipping team do enjoy the Conference and business networking opportunities.

We look forward to meeting you all.

Best,

Andrew Webster, Chief Executive, Mercator Media Limited

Welcome Letter 3

LARS ROBERT PEDERSEN Deputy Secretary General, BIMCO

LARS ROBERT PEDERSEN Deputy Secretary General, BIMCO

Dear delegates,

The Green Ports and Shipping conference comes as we move into an important phase in the decarbonisation of emissions. Whilst the process itself will stretch for decades, now is the time ports and shipping must come together to agree on where we decarbonise first and how we can do it.

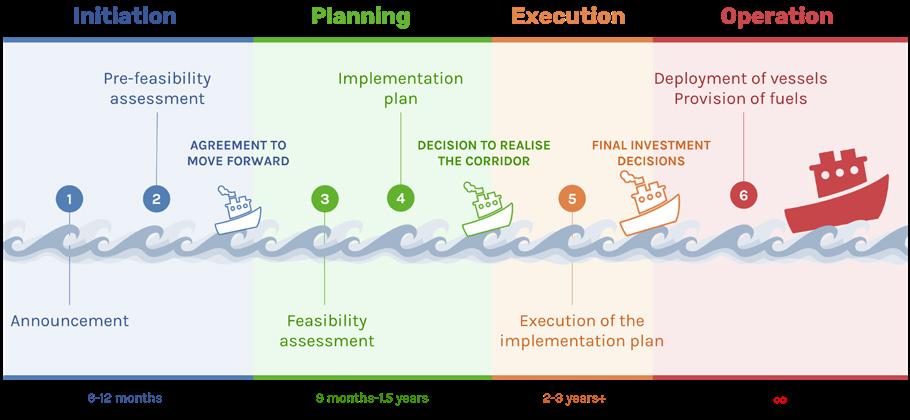

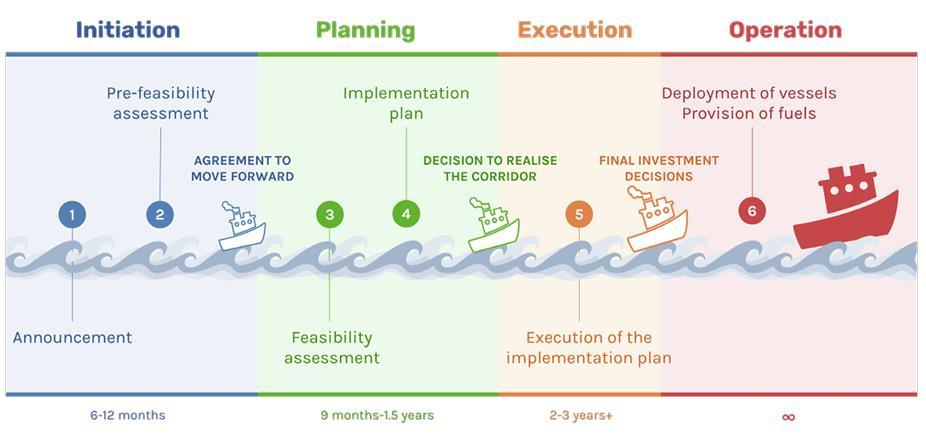

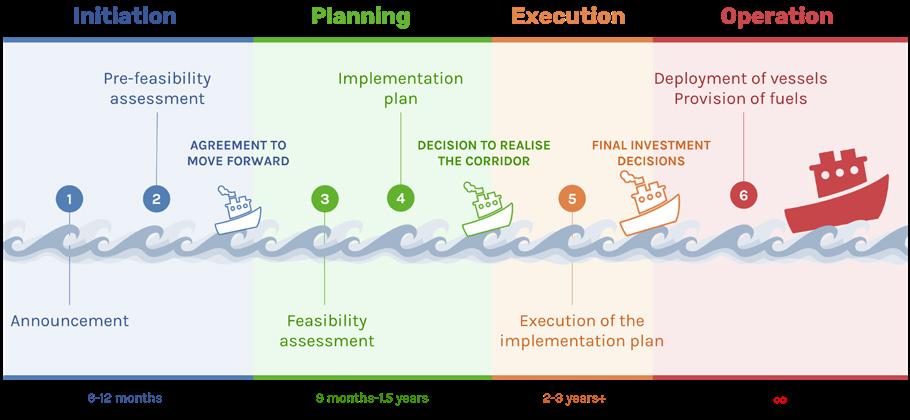

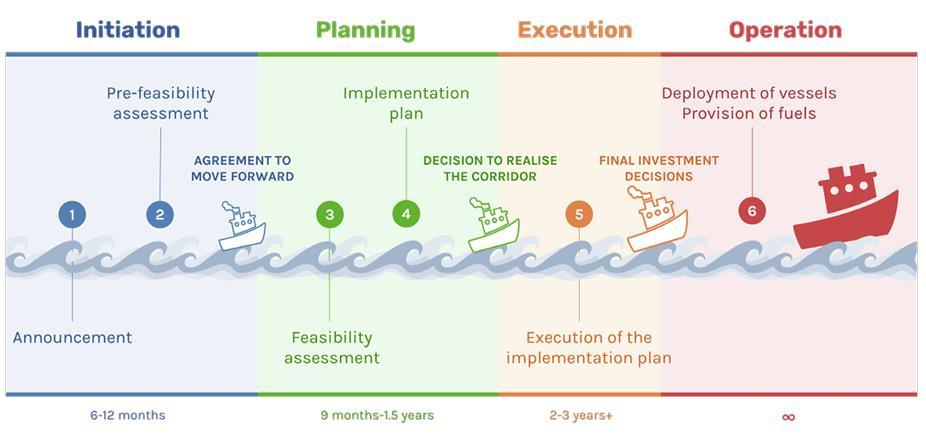

We are already seeing collaboration through the Green Corridor initiatives which aims to facilitate decarbonisation in discreet trading lanes of the world, but this will need to continue to expand so that eventually there will be one global green shipping industry. We will be talking more about Green Corridors on Day Two, Session 4.

It is a complicated puzzle, with ports and shipping needing to understand the others’ requirements and for those expectations to be calibrated across the sectors and indeed the world.

There has been much talk, can I say wishful thinking, but it is clear that large investments are now needed, and decarbonisation will need to pull through into every company’s business model. The Green Finance session on Day one will address initiatives in this area. The entire conference will give us all the opportunity to discuss, learn and progress. It will also give us the opportunity to network, exchange ideas and hear about experiences and practices. This, I believe, will contribute to the need to continually lift the knowledge level across both ports and shipping.

I encourage everyone to pay close attention to the next two days as it will all matter for each of you, one way or another.

Lars Robert Pedersen Conference chairperson

Welcome by Chairman

4

Contents Day 1

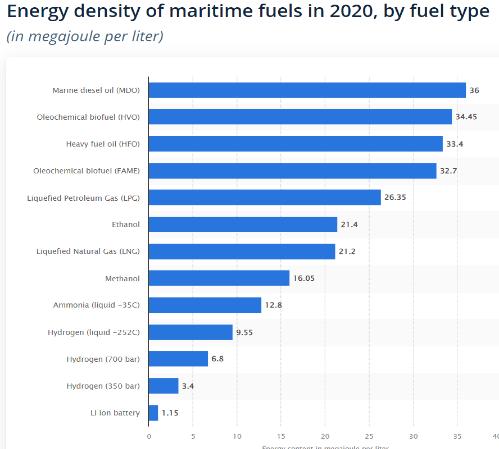

Future marine low and zero-carbon fuels including biofuels, methanol, ammonia, and potentially hydrogen. Alternative fuels hold the key to decarbonising the maritime industry, through both emission-free powering of vessels and port operations.

Session 2 - Infrastructure Development

Session will touch upon different bunkering techniques from class societies, fuel providers and terminals. As well as developing harmonised standards and regulations for ships and ports to safely bunker alternative fuels.

Session 3: Green Finance

The session will be a discussion between banks regarding sustainable loans and how they will help. As well as a classification society, a shipper, and a pork as to how they have utilised green finance.

Contents Day 1 5

Day 1 04 Welcome by Chairman Keynote Panel ...................................................................................................................................................08 Ports and Shipping - collaboration to achieve 2050 goals Session

fuels 18

1 - Future marine low and zero-carbon

....................................................................................... 23

.......................................................................................................................... 31

Contents Day 2

Session 4: Green Shipping Corridors

Ports and shippers are signing deals which establish shipping corridors, allowing shipping routes to respond quickly to policy and make rapid decisions to create more sustainable container movement. Hearing from different green corridor projects and partners as to their involvement and collaboration for sustainability.

Session 5: Maritime Digitalisation

This session will feature case studies showcasing the digitalisation solutions and tools supporting ports and shipping in their journey to become more efficient and sustainable.

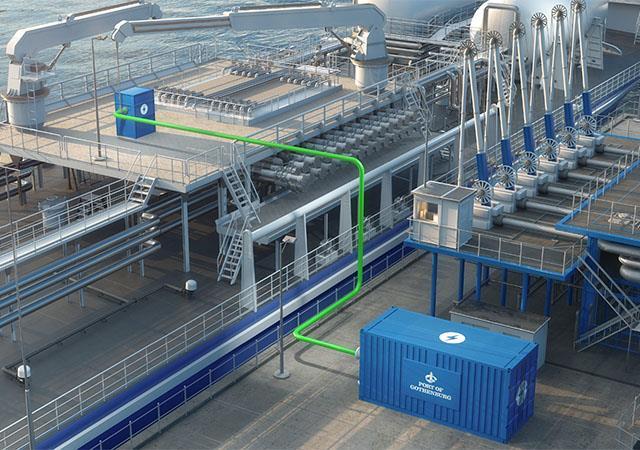

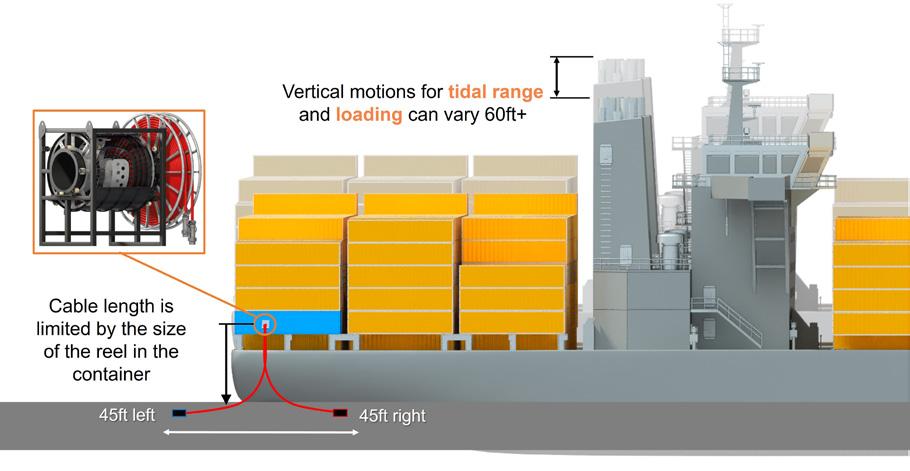

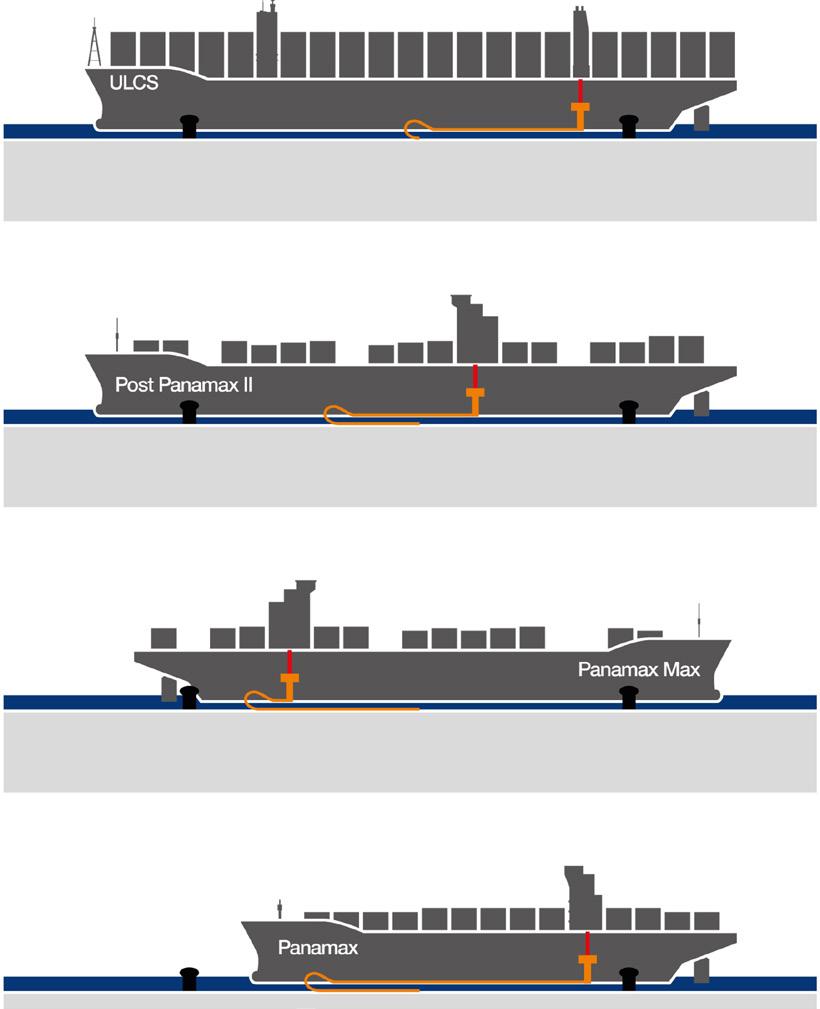

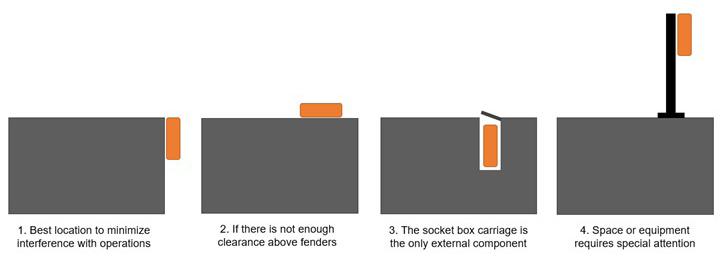

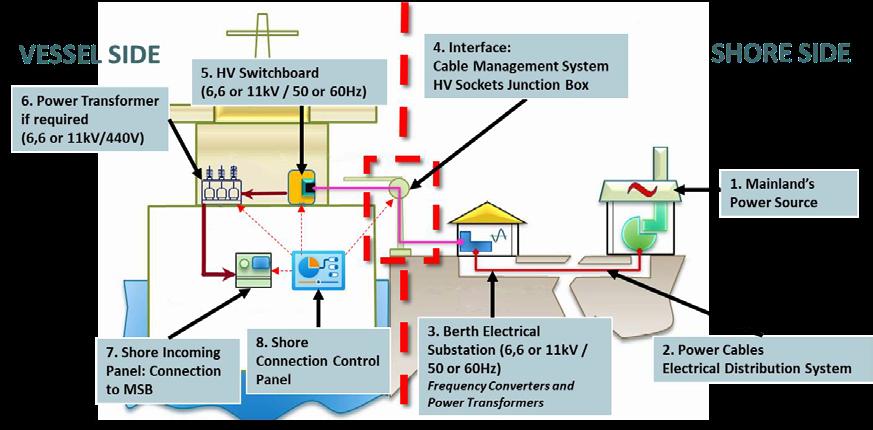

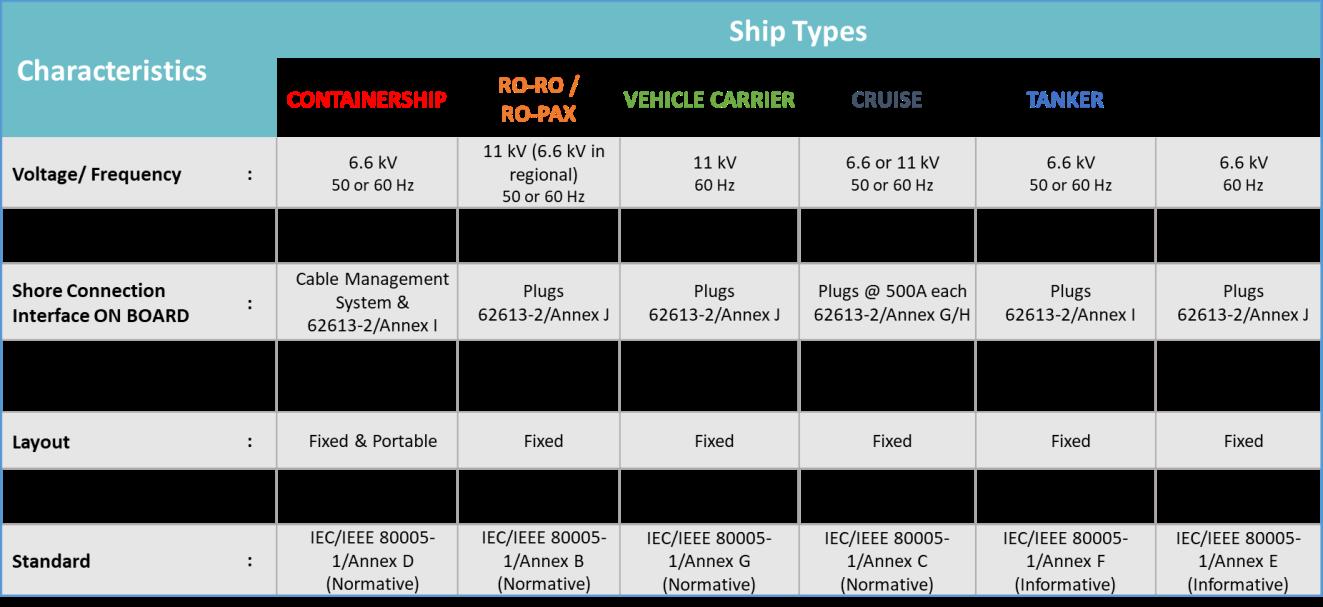

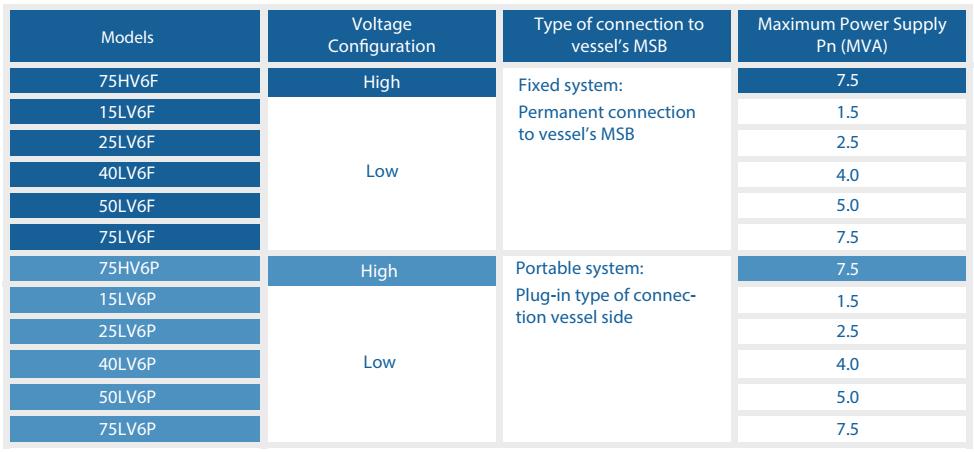

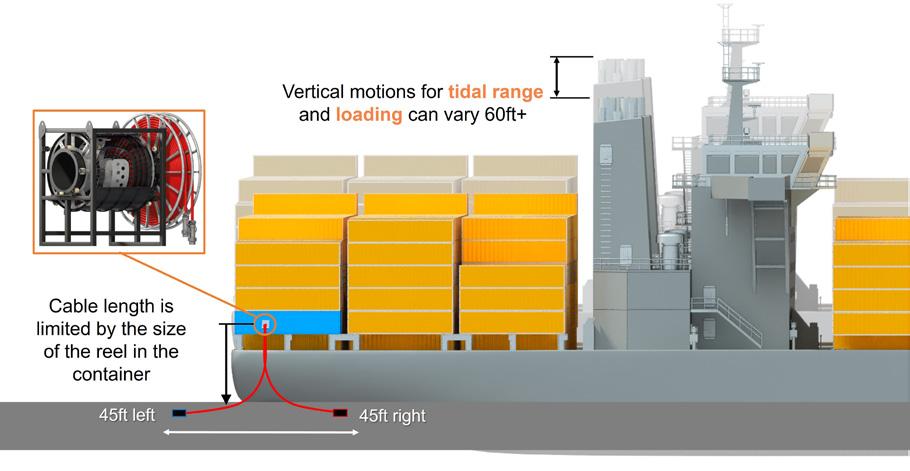

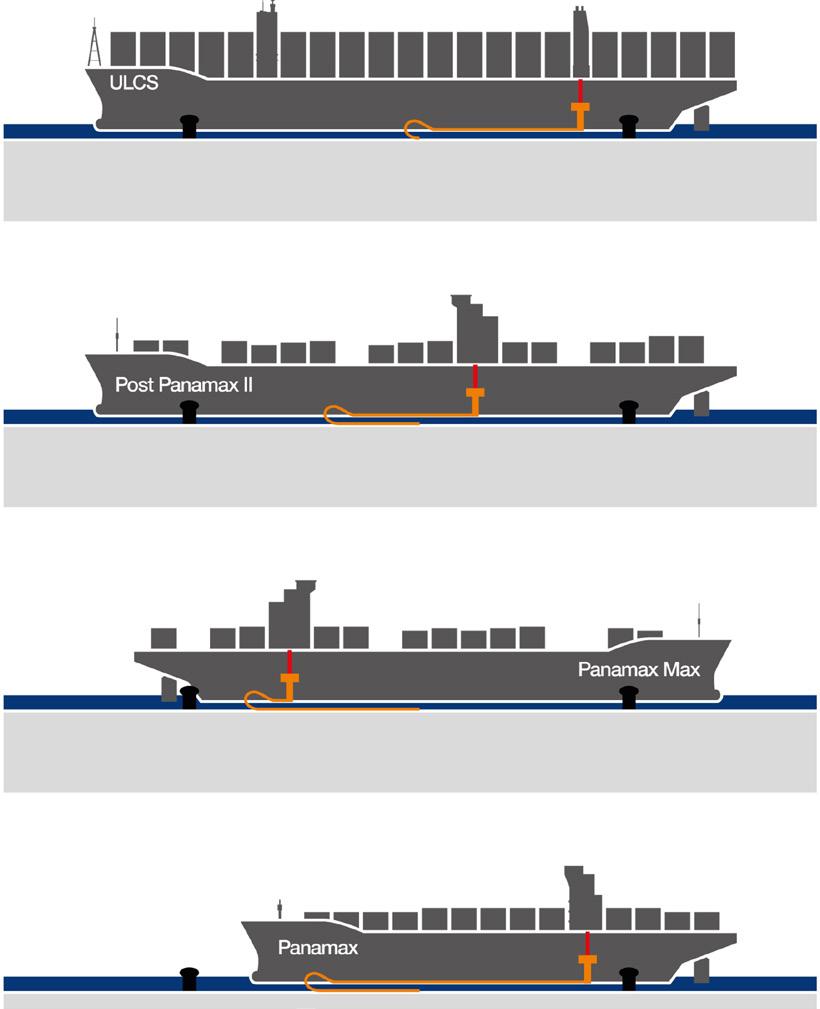

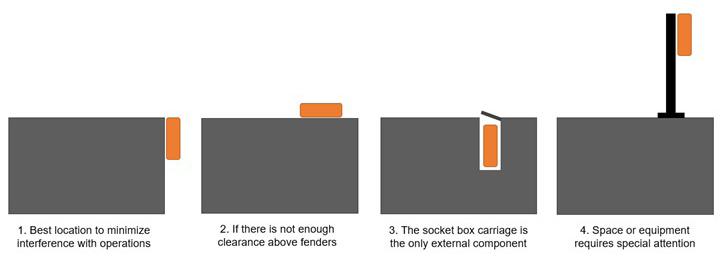

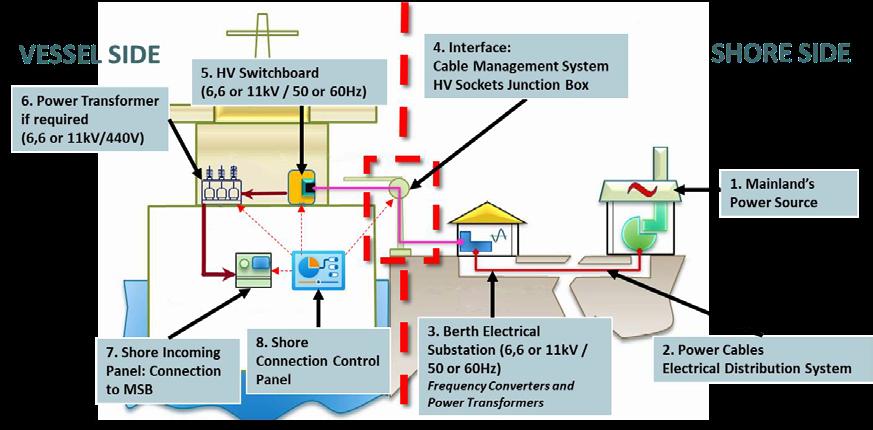

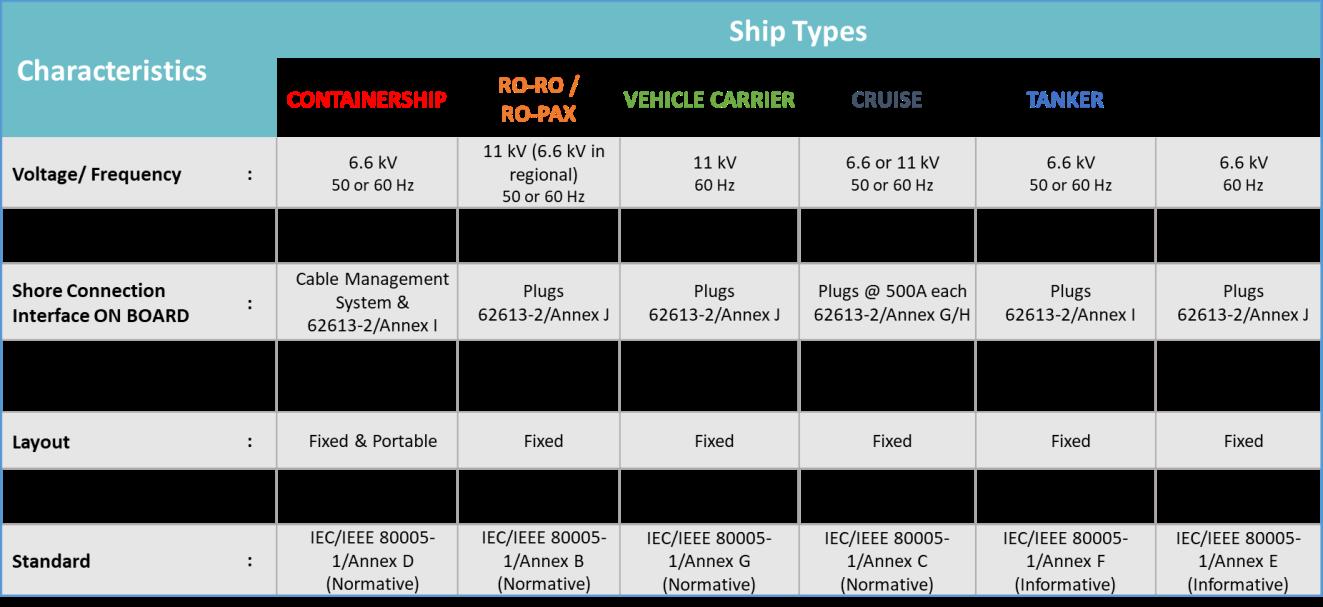

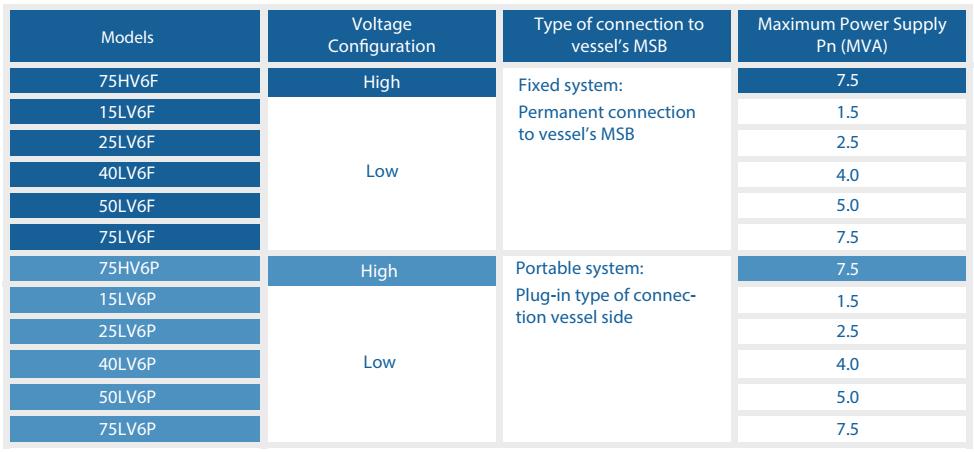

Session 6.1: Onshore Power Supply

Onshore Power Supply and what is needed for ports and shippers to be able to utilise this evolving technology.

Session 6.2: Green Technologies

Ports and shippers are introducing green technology, enhancing sustainability, and reducing their carbon footprint. This session will detail these technologies and how it affects both the portside and seaside.

Session 7: Collaborative projects

Collaborative projects to advance the deployment of zero/low-carbon solutions in the maritime industry. Detailing different projects that utilise different stages of the logistics chain.

Contents Day 2 6

Day 2 48 Opening by Chairman/Moderator

................................................................................................ 49

71

93

120

136

PIONEERING THE SAFETY AND PERFORMANCE OF THE FUELS OF THE FUTURE From biofuels to methanol, and ethanol to hydrogen, we are at the forefront of the energy transition, working with industry to develop clean energy solutions, now and in the future. Learn more at marine-offshore.bureauveritas.com Shaping a better maritime world.

KEYNOTE PANEL

Ports and Shippingcollaboration to achieve 2050 goals

Shipping already has regulations to follow from the IMO but what do they need from Ports to achieve these goals?

8

LARS ROBERT PEDERSEN

Deputy Secretary General, BIMCO

LARS ROBERT PEDERSEN

Deputy Secretary General, BIMCO

BIOGRAPHY

Deputy Secretary General Lars Robert Pedersen is responsible for BIMCO’s technical and operational activities involving all technical and nautical issues within the area of marine, environment, ship safety and maritime security. Lars Robert is furthermore responsible BIMCO’s activity related to regulatory developments relevant to shipping at international, regional and national levels.

In the past decade, he has served on IMO expert groups on market-based measures and on the steering group for the IMO 2020 fuel oil availability study. Lars Robert has also chaired the Motorship Propulsion & Future Fuels Conference for the past 6 years.

He joined BIMCO in early 2010 after a long career at A.P. Moller-Maersk (APMM).

For more than 25 years he was involved in regulatory affairs at IMO level, technical management of the Maersk fleet of container ships and prior to that as a seagoing engineer officer. Lars Robert holds an unlimited Chief Engineers license.

Chairman & Moderator 9

JAMES FORSDYKE

Managing Director, Lloyd’s Register Maritime

Decarbonisation Hub

BIOGRAPHY

James is the Managing Director of the Lloyd’s Register Maritime Decarbonisation Hub. He joined Lloyd’s Register in 2006, after graduating with a Masters of Engineering as a Naval Architect from the University of Southampton. He has worked in a variety of technical, commercial and leadership roles across the organization and globally, from various marine surveyor positions in Italy, Dubai and China to commercial and general management in Hong Kong and leadership positions from LR’s headquarters in the United Kingdom and now Singapore.

About the Lloyd’s Register (LR) Maritime Decarbonisation Hub

The LR Maritime Decarbonisation Hub, a joint initiative between Lloyd’s Register Group and Lloyd’s Register Foundation, is a non-profit research and action unit with a mission to accelerate the safe and sustainable decarbonisation of the maritime industry. Our core team of thought leaders and subject matter experts in engineering, economics and risk provide independent, fuel-agnostic and quantitative evidence-based research on future fuels and the shipping energy supply chain, with a strong focus on safety and risk mitigation.

Through initiatives that facilitate change across the maritime supply chain to remove obstacles to shipping’s energy transition, our vision is to enable a decarbonised shipping industry that leads the way in sustainability and benefits everyone. For more information, go to www. maritimedecarbonisationhub.org

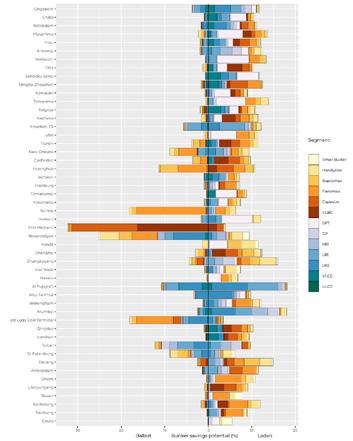

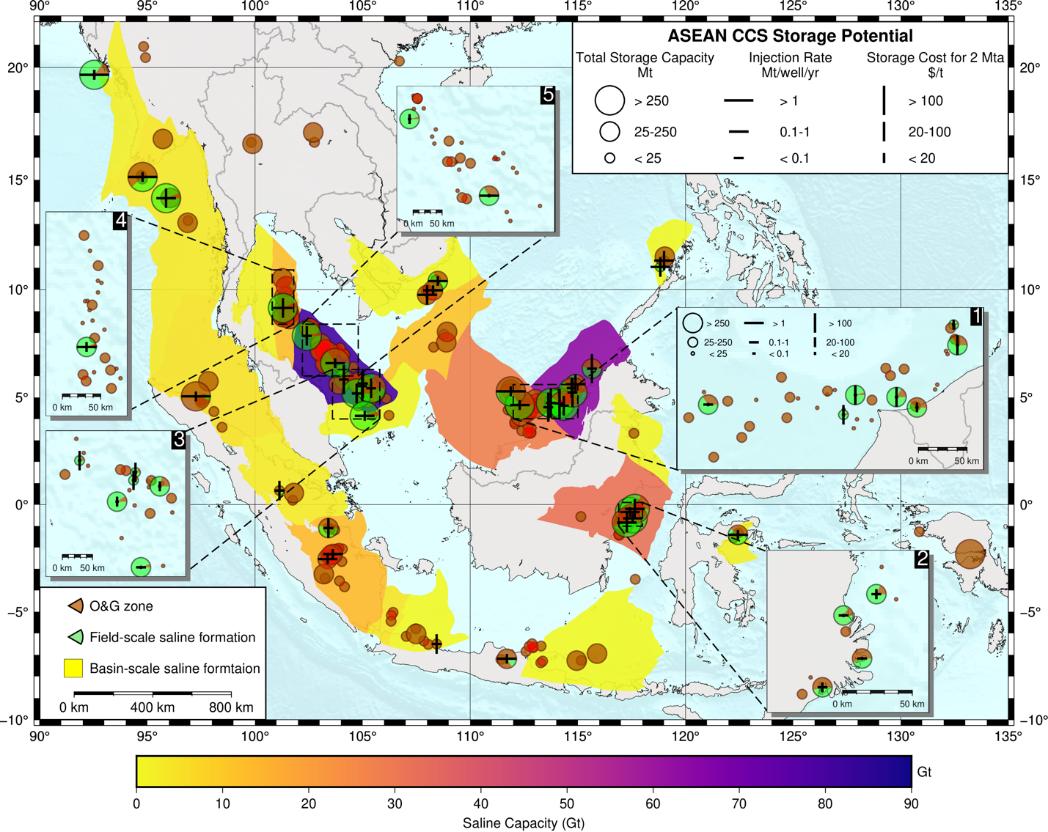

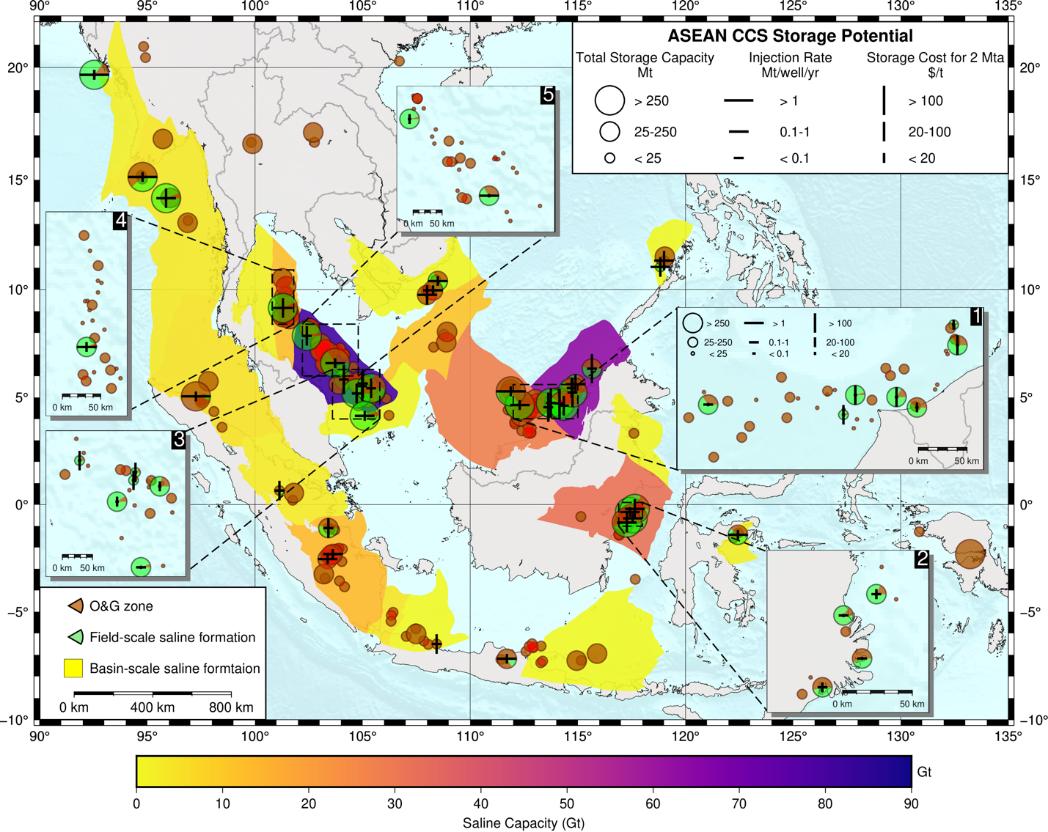

At COP28, the LR Maritime Decarbonisation Hub collaborated with the Environmental Defence Fund to introduce the Sustainable First Mover Initiatives (SFMIs) identification tool that offers shipping stakeholders a way to assess a port’s potential to produce and/or bunker electrofuels, while ensuring that local clean energy access, land suitability, and decarbonisation efforts are not undermined. The tool was used to examine the Indo-Pacific region as a case study, and the ports in the study were then ranked to determine which had ‘high’ or ‘promising’ potential.

In addition, the Hub works closely with port operator, PSA Singapore, and the Maritime and Port Authority of Singapore (MPA) on the cross-supply chain partnership, The Silk Alliance, a Green Corridor and first-mover initiative which aims to enable zero-emissions shipping across the Indian and Pacific oceans and foster partnerships with stakeholders across the maritime supply chain.

Keynote Panel Moderator

10

ER. THAM WAI WAH

Senior Director/Chief Engineer (Engrg & Project Mgt)

Chief Sustainability Officer (CSO)

Maritime and Port Authority of Singapore

BIOGRAPHY

Er. Tham Wai Wah is the Senior Director and Chief Engineer for Engineering & Project Management Division and concurrently holds the appointment of Chief Sustainability Officer (CSO) in the Maritime and Port Authority of Singapore (MPA).

As the Senior Director / Chief Engineer, Er. Tham leads the overall strategy & development planning, engineering and execution of all construction related projects within MPA. He is also the Superintending Officer overseeing the development of the Next Generation Tuas Mega Port.

As the CSO, Er. Tham spearheaded the initiative to formulate the Singapore Maritime Decarbonisation Blueprint, to drive the reduction of GHG emissions to meet the IMO targets for international shipping and Singapore’s emission set targets. As part of this framework, he formulated the adoption strategy of low and zero carbon fuels, encouraged pilot trials and fostered the development of industry collaborations across the value chain and ecosystem in the maritime sector.

Keynote Panel Speaker

11

BIOGRAPHY

DR SANJAY C KUTTAN Chief Strategy Officer, Global Centre for Maritime Decarbonisation

Sanjay is Chief Technology Officer at the Global Centre for Maritime Decarbonisation (GCMD). Established by six founding partners from the maritime industry and supported by the Maritime and Port Authority of Singapore, GCMD’s mission is to help the sector accelerate its decarbonisation efforts through shaping standards, deploying solutions, financing projects, and fostering collaboration across sectors. At GCMD, he oversees four project initiatives: ammonia as a marine fuel, assurance framework for drop-in green fuels, unlocking the carbon value chain, and energy efficiency technologies to improve fuel efficiency of ships.

Prior to joining GCMD, he was the Executive Director of the Singapore Maritime Institute which is responsible for funding maritime research projects with industry and building local capabilities in the maritime sector.

Keynote Panel Speaker

12

LARS ROBERT PEDERSEN

Deputy Secretary General, BIMCO

LARS ROBERT PEDERSEN

Deputy Secretary General, BIMCO

BIOGRAPHY

Deputy Secretary General Lars Robert Pedersen is responsible for BIMCO’s technical and operational activities involving all technical and nautical issues within the area of marine, environment, ship safety and maritime security. Lars Robert is furthermore responsible BIMCO’s activity related to regulatory developments relevant to shipping at international, regional and national levels.

In the past decade, he has served on IMO expert groups on market-based measures and on the steering group for the IMO 2020 fuel oil availability study. Lars Robert has also chaired the Motorship Propulsion & Future Fuels Conference for the past 6 years. He joined BIMCO in early 2010 after a long career at A.P. Moller-Maersk (APMM). For more than 25 years he was involved in regulatory affairs at IMO level, technical management of the Maersk fleet of container ships and prior to that as a seagoing engineer officer. Lars Robert holds an unlimited Chief Engineers license.

Keynote

Panel Speaker

13

ANTONIS MICHAIL

Technical Director, International Association of Ports and Harbors / World Ports Sustainability Program

BIOGRAPHY

Dr Antonis Michail is an engineer in background with specialisation on the environmental management of ports and freight transport systems at Master and PhD level, and with more than 15 years of professional experience in these fields. Since February 2018, Antonis joined the World Ports Sustainability Program (WPSP) of the International Association of Ports and Harbours (IAPH) as the person responsible for the technical developments and projects under the umbrella of the program. Before that, Antonis was holding the position of Senior Policy Advisor on sustainability and safety matters at the European Sea Ports Organisation (ESPO) from 2009 to 2017. Since back in 2003, Antonis was involved in the EcoPorts network of ports from various posts, including managing projects and coordinating the network’s activities and development until 2017.

Keynote Panel Speaker

14

EVELYN TENG Head of Contract Pricing, Maersk Southeast Asia Ocean

EVELYN TENG Head of Contract Pricing, Maersk Southeast Asia Ocean

BIOGRAPHY

Evelyn Teng is the Head of Contract Pricing for Maersk Southeast Asia Ocean business. She has over 20 years of working experience within Maersk, spanning across various commercial roles such as capacity & trade management, sales & marketing and tender management. She started the Singapore branch office for Safmarine in 2007 and led the country sales and customer service. Her key passions are on customer engagement and transformation within the shipping and logistics industry.

She graduated with a bachelor’s degree in economics and psychology from National University of Singapore.

She believes that “we are here to put a dent in the universe. Otherwise, why else even be here?”

Keynote

Speaker

Panel

15

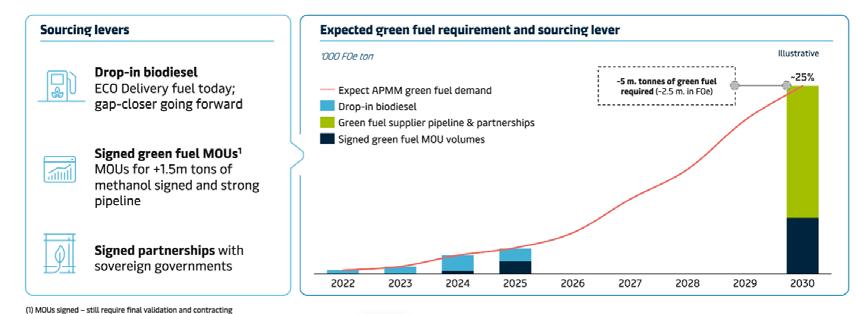

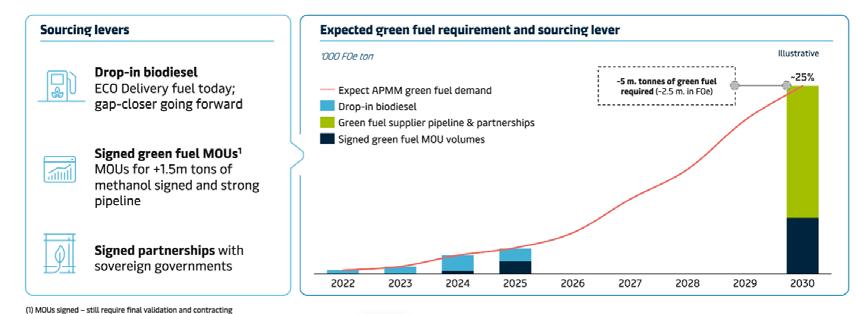

Net Zero by 2040

Our ambition is to transition to climate-neutral energy by 2040 across our entire business.

Decarbonizing Ocean

Securing large quantity of green fuel supply is imperative to enable our decarbonization strategy, as we require 5m tones of green fuel in 2030 to operate 25% of our fleet on green fuels.

Conference Paper 16

A.P. MollerMaersk

A.P. Moller - Maersk

www.methanol.org A safe, sustainable, available, and affordable marine fuel; 2020-compliant, reducing maritime emissions today; and providing a low carbon pathway.

SESSION 1

Future marine low and zero-carbon fuels

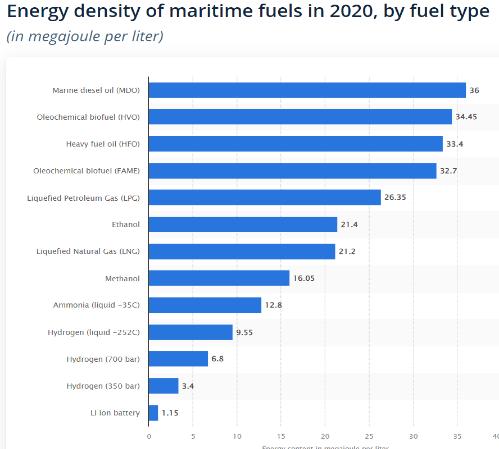

Future marine low and zero-carbon fuels including biofuels, methanol, ammonia, and potentially hydrogen. Alternative fuels hold the key to decarbonising the maritime industry, through both emission-free powering of vessels and port operations.

18

LARS ROBERT PEDERSEN

Deputy Secretary General, BIMCO

LARS ROBERT PEDERSEN

Deputy Secretary General, BIMCO

BIOGRAPHY

Deputy Secretary General Lars Robert Pedersen is responsible for BIMCO’s technical and operational activities involving all technical and nautical issues within the area of marine, environment, ship safety and maritime security. Lars Robert is furthermore responsible BIMCO’s activity related to regulatory developments relevant to shipping at international, regional and national levels.

In the past decade, he has served on IMO expert groups on market-based measures and on the steering group for the IMO 2020 fuel oil availability study. Lars Robert has also chaired the Motorship Propulsion & Future Fuels Conference for the past 6 years. He joined BIMCO in early 2010 after a long career at A.P. Moller-Maersk (APMM). For more than 25 years he was involved in regulatory affairs at IMO level, technical management of the Maersk fleet of container ships and prior to that as a seagoing engineer officer. Lars Robert holds an unlimited Chief Engineers license.

Moderator

19

GIRISH SREERAMAN

Area Business Development Manager, Maritime, DNV

BIOGRAPHY

Girish Sreeraman is responsible for DNV’s area business development in South East Asia and Indian Subcontinent since Sep 2017. Having joined DNV in Jan 2003, Girish started as a surveyor in DNV Mumbai and has worked various roles including new building and CMC manager, project manager for various ship related feasibility studies and new ship constructions. He has managed one of the biggest advisory projects of DNV-NB Project Management consultancy. Prior to his current role, as an ISO 9001 management systems auditor, he conducted assessments for Shipping companies, crew training centers, and shipyards. He has also led multiple due diligence and MPQA assessments for major shipyards on behalf of banks and shipowners. Recognized by DNV, he attended the DNV Global Leadership Management Program at IMD Lausanne in 2010. Girish holds a Bachelor’s degree in Technology, Marine Engineering from DMET Calcutta in 1994.

Speaker

20

MORTEN JACOBSEN, CEO, Green Marine,

MORTEN JACOBSEN, CEO, Green Marine,

Denmark

BIOGRAPHY

Morten Jacobsen is the founder and President of GREEN MARINE GROUP. He has over thirtyfive years of experience in the international shipping industry, primarily within ship owning and trading.

Green Marine, Denmark brings world-leading expertise in the design, construction and operations of methanol-powered ships, assisting shipowners, operators and shipyards in accelerating the transition to a methanol-powered maritime future.

Speaker

21

STANLEY TEO

STANLEY TEO

Vice President of Business Development for Southeast Asia, Advario

BIOGRAPHY

Stanley graduated from National University of Singapore in 1997, holding a Bachelor Degree of Mechanical and Production Engineering (Honors).

He has extensive experience in the petrochemical sector, having worked 27 years including various portfolios in ExxonMobil across prior to joining Oiltanking in 2006.

Since then, Stanley has contributed to the growth of Oiltanking, holding positions ranging from commercial to operations in both the petroleum and chemical sectors at the Singapore terminals.

From February 2015, he served as the General Manager China responsible for the business operations and strategic business planning for Oiltanking’s endeavours in the China market. Currently, he holds the position of the VP Business Development for Advario (carve-out of Oiltanking) in APAC, overseeing opportunities in the gas, chemicals and new energy sector.

Speaker

22

SESSION 2

Infrastructure Development

Session will touch upon different bunkering techniques from class societies, fuel providers and terminals. As well as developing harmonised standards and regulations for ships and ports to safely bunker alternative fuels.

23

ASHISH ANILAN

Assistant Director iCARE, Sustainability Lead, Bureau Veritas

BIOGRAPHY

Ashish brings over 15 years of experience in developing technology-driven marine projects across Southeast Asia and the Pacific. Currently, as Assistant Director and Sustainability Leader at Bureau Veritas Marine & Offshore, he spearheads strategic initiatives for the region’s sustainability and energy transition for maritime and adjoining sectors.

Ashish leads projects and partnerships through BV’s iCARE Center of Excellence (COE) and Future Shipping Team. He is a passionate and results-oriented leader, combining his expertise in business development, technical leadership, and project management. Ashish actively represents the organization in various trade associations and industry coalitions. He is also convening the Work Group developing Singapore’s National Standard for LNG bunkering, a testament to his commitment to shaping a sustainable maritime industry.

Ashish holds a master’s degree in technology management from the National University of Singapore and a bachelor’s degree in mechanical engineering from Nanyang Technological University.

Moderator

24

ANDREAS

KALAMIDAS,

Business Advisory Consultant, Lloyd’s Register

BIOGRAPHY

Andreas Kalamidas is a Business Advisory Consultant based in Singapore. He holds a BSc in Finance and a MSc in Maritime Technology and Management.

Prior to joining Lloyd’s Register he worked as Sustainability Analyst at another leading classification society where he led the environmental compliance projects and generated decarbonisation pathways for major shipowners. In his current role, Andreas works closely with both internal and external stakeholders to identify potential solutions and guide clients in decarbonization strategies, environmental compliance and exposure to emission related taxes.

Speaker

25

Key Opportunities for Ports in Maritime’s Energy Transition

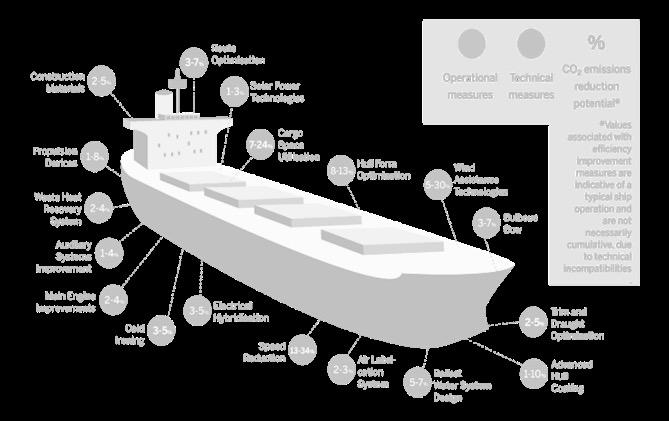

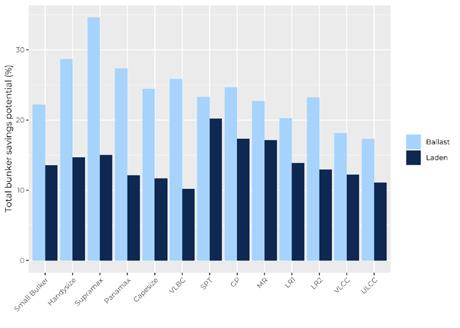

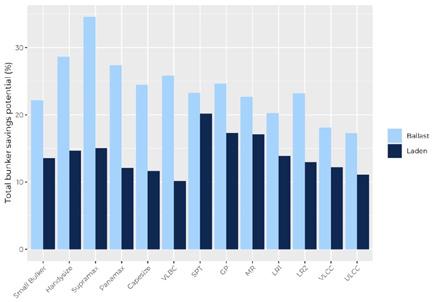

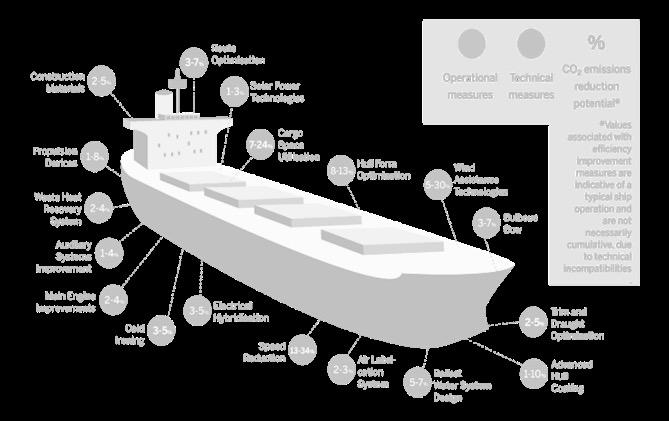

Ship Owners have 4 Energy Transition Levers at their disposal

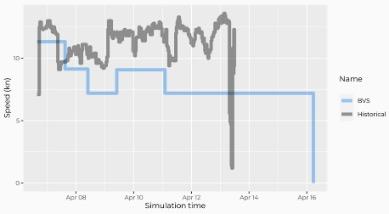

Speed reduction, waiting time optimisation, ESDs, fuel transition and newbuild planning are currently the foundation to build Energy Transition Strategies for major owners and charterers

CHALLENGES

CHALLENGES

Requires significant collaboration with charterers to agree to reduce speeds to optimise speed profiles and reduce waiting times through Just-In-Time model.

OPPORTUNITIES

Significant CII improvement potential both for the existing fleet and for newbuilds.

Close business alignment with charterers provides owners with a unique opportunity for collaboration.

The emissions improvement potential of ESDs is relatively limited given the operational profile and technology applied on typical modern fleets.

OPPORTUNITIES

CII improvements can be gained for existing vessels to ensure compliance until they can be replaced.

Fuel saving sharing models with charterers could generate a commercial upside for owners.

CHALLENGES

The supply of low or zero-carbon fuels is not currently mature enough to enable a short-term fuel change in the and the price of alt fuels will be comparatively high.

OPPORTUNITIES

Significant CII improvement potential through drop-in biofuels for the existing fleet.

Long-term emission reduction can only be achieved through a fuel change, allowing owners to meet emissions reduction targets.

Ship Owners have 4 Energy Transition Levers

CHALLENGES

Requires robust fleet planning and alignment with charterers. It is also a CAPEX intensive option with reasonable uncertainty around engine technology.

OPPORTUNITIES

Long-term emissions reductions can be achieved through energy efficient, alt fuelled vessels.

Improvement of owner’s competitive position in the market for both current and future charterers.

at their disposal

Speed reduction, waiting time optimisation, ESDs, fuel transition and newbuild planning are currently the foundation to build Energy Transition Strategies for major owners and charterers

CHALLENGES

CHALLENGES

Requires significant collaboration with charterers to agree to reduce speeds to optimise speed profiles and reduce waiting times through Just-In-Time model.

OPPORTUNITIES

Significant CII improvement potential both for the existing fleet and for newbuilds.

Close business alignment with charterers provides owners with a unique opportunity for collaboration.

The emissions improvement potential of ESDs is relatively limited given the operational profile and technology applied on typical modern fleets.

OPPORTUNITIES

CII improvements can be gained for existing vessels to ensure compliance until they can be replaced.

Fuel saving sharing models with charterers could generate a commercial upside for owners.

CHALLENGES

The supply of low or zero-carbon fuels is not currently mature enough to enable a short-term fuel change in the and the price of alt fuels will be comparatively high.

OPPORTUNITIES

Significant CII improvement potential through drop-in biofuels for the existing fleet.

Long-term emission reduction can only be achieved through a fuel change, allowing owners to meet emissions reduction targets.

CHALLENGES

Requires robust fleet planning and alignment with charterers. It is also a CAPEX intensive option with reasonable uncertainty around engine technology.

OPPORTUNITIES

Long-term emissions reductions can be achieved through energy efficient, alt fuelled vessels.

Improvement of owner’s competitive position in the market for both current and future charterers.

2

Conference Paper 26

SPEED OPTIMISATION ENERGY SAVING DEVICES FUEL TRANSITION NEWBUILDS

3

Andreas Kalamidas, Lloyd’s Register - Green Ports and Shipping Congress 2024

SPEED OPTIMISATION ENERGY SAVING DEVICES FUEL TRANSITION NEWBUILDS

Andreas Kalamidas, Lloyd’s Register - Green Ports and Shipping Congress 2024

Techno-economic Modelling Case Study: Vessel Transition Pathway

LR’s Case studies validate that alternative fuelled newbuildings will unlock significant decarbonisation potential that could bridge the gap of current baseline and long-term goals

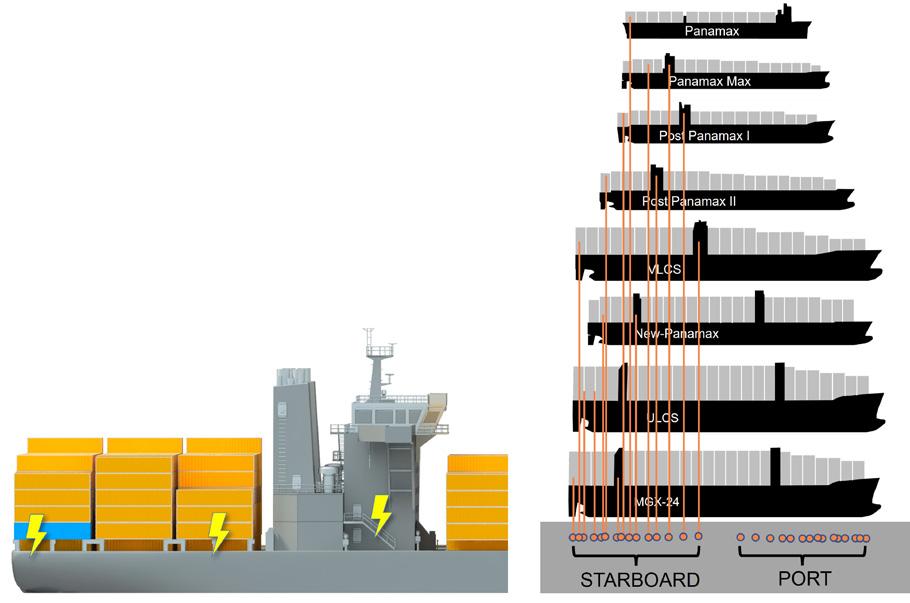

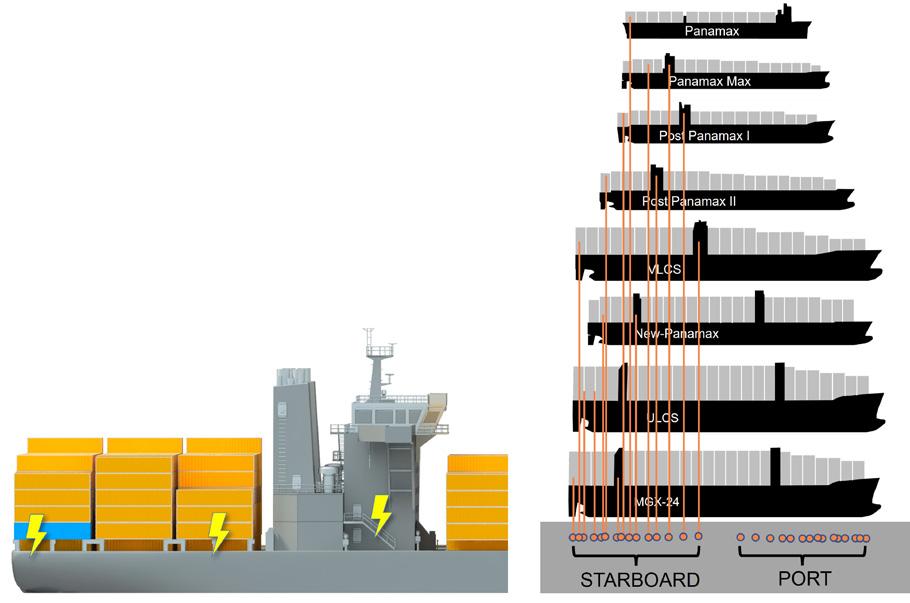

New Centres of Fuel Demand will emerge: Newcastlemax Case Study

Due to a combination of factors, we expect to see new pockets of fuel demand emerge that will be aligned with trade flows therefore the question of whether dual fuel newbuilds will require alternative fuels in new locations emerges.

Conference Paper 27 4

12.8 13.4 13.0 12.5 12.0 12.0 12.0 12.0 12.0 12.0 12.0 15.0 15.3 15.5 15.5 15.5 15.5 15.5 15.5 15.5 15.5 15.5 15.5 15.5 15.5 15.5 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 1.9 2.0 2.1 5.0 10.0 0.0 15.0 20.0 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 AER [gCO2/ t.Nm ] 2044 2045 2046 2047 2043 2049 2050 15.5 15.5 2048 Average Vessel Speed [ knts ] Vessel would fall off trajectory in 2027 even with speed reduction & ESDs, therefore drop-in biofuel is required. 2033: final full year of operation Replacement vessel moves significantly below emissions reduction trajectory ZERO CARBON FUELLED VESSEL SPEED OPTIMISATION 2024: ESDs fitted at drydock Target Trajectory Speed Optimisation ESDs & Speed Optimisation Drop-in Biofuel Newbuild Vessel Existing Avg. Speed Newbuild Avg. Speed DROP-IN BIOFUEL ESDS & SPEED OPTIMISATION SPEED OPTIMISATION Andreas Kalamidas, Lloyd’s Register - Green Ports and Shipping Congress 2024 5

Current Major Bunkering Hubs ARA Panama Fujairah Hong Kong Singapore Newcastlemax 2022 Trade (draught delineated) Potential Trade-linked Fuel Demand? Tubarão? Qingdao? Japan? Pilbara?

Register

Shipping Congress 2024

Andreas

Kalamidas, Lloyd’s

- Green Ports and

Key Considerations when developing Strategies to support first movers

Various critical factors that are central to the successful development of a robust and accurate bunker strategy exist

MARKET SIZING

In order for the project to succeed, a robust market sizing methodology is required to be followed. The methodology must follow diligent data analysis principles and consider historical bunkering estimates, the target vessel segments and their corresponding bunkering requirements

INFRASTRUCTURE REQUIREMENTS

Questions around the technical requirements for the bunkering infrastructure must be addressed. Storage facilities, Transportation, Scalability and flexibility due to the emerging diverse fuel mix as well as integration with current port operations for cases where ports didn’t serve as bunkering hubs are some of the concerns around infrastructure requirements.

MARKET AND SAFETY RISKS

The development of a risk register is key in understanding and overcoming the associated risks of alternative fuel bunkering. New Engine technologies, fuel hazards, alternative fuel supply reliability are some of the technical and commercial risks that arise for ports that consider alternative fuel availability.

REGULATORY LANDSCAPE

Having a detailed understanding of the global and regional regulations as well as the potential incentives to increase alternative fuel adoption is key to the success of the project as it will ultimately determine the accuracy of the demand estimate outputs.

Navigating Decision Gates for Port Authorities

How Market Assessments and Infrastructure studies can provide clarity in the decision-making process of Ports

Conference Paper 28 6

KEY PORT

MARKET SIZING MARKET RISKS INFRASTRUCTURE

REGULATORY LANDSCAPE

FACTORS

REQUIREMENTS

7

Andreas Kalamidas, Lloyd’s Register - Green Ports and Shipping Congress 2024

OUTPUTS FOR PORTS BUNKER PARCEL

MARKET STUDY MODALITY & INFRASTRUCTURE STUDY ANNUAL FUEL DEMAND BUNKER CONCEPT & VESSEL SIZE INFRASTRUCTURE WORKS REQUIRED Fleet breakdown by ship segment, size & ownership Demand Estimate Annual Fuel Demand Estimates Bunker Parcel Distributions Bunker Parcel Distributions Bunker Vessel / Fleet Definition Metocean / StS Limits Anchorage utilisation Limits • Process losses • Modality Definition • Infrastructure Required

DISTRIBUTIONS

Andreas Kalamidas, Lloyd’s Register - Green Ports and Shipping Congress 2024

ANDREW HOARE

Head of Fortescue Marine Systems and Green Shipping, Fortescue

BIOGRAPHY

Fortescue is an integrated green technology, energy, and metals company, recognised for its culture, innovation; and industry leading development of infrastructure, mining assets and green energy initiatives.

Andrew has 30 years’ experience in the maritime and energy sectors holding leadership positions at BW including CCO of BW LPG, COO of Navig8 Group and various senior positions at Pacific Carriers and Clarksons.

Andrew holds a Master of Arts (Honors) in Management with International Relations from the University of St Andrews, Scotland and a Master of Business Administration from Hult Ashridge, UK. He is also a Fellow of the Institute of Chartered Shipbrokers; an accredited CEDR meditator and sits on the Board of the Singapore Chamber of Maritime Arbitration (SCMA).

ABOUT FORTESCUE

Fortescue is focused on becoming the number 1 integrated green energy, metals and technology company, recognised for its culture, innovation and industry-leading development of infrastructure, mining assets and green energy initiatives. It operates with two divisions –Metals and Energy.

Fortescue is committed to producing green hydrogen, containing zero carbon, from renewable electricity. Green hydrogen is a zero-carbon fuel that, when used, produces primarily water. It is a practical and implementable solution that can help revolutionise the way we power our planet: helping to decarbonise heavy industry and create jobs globally.

Fortescue is leading the green industrial revolution, building a global portfolio of renewable green hydrogen and green ammonia projects, while also leading the global effort to help decarbonise hard-to-abate sectors. This includes developing and acquiring the technology and energy supply to help decarbonise the Australian iron ore operations of one of the world’s largest producers of iron ore, Fortescue Metals, by 2030 (Scope 1 and 2 terrestrial emissions).

Speaker

29

HAN NING

Head Port Business, Drewry Maritime Advisors

BIOGRAPHY

She joined Drewry Shipping Consultant in 2011. During 2016-2022, she has been overseeing Drewry China in all sectors including maritime research, shipping and port projects, as well as logistics projects. She moved to Singapore in 2022 and heads Drewry port business in Southeast Asia now. Her clients include IFC, Sinosure, China Harbor, SIPG, China Merchant, Cosco Energy Shipping, Jinjiang Shipping, TSL, CU Line, etc.

Prior to joining Drewry, she has worked in PSA China investment department for 5 years. With PSA, she has participated in three greenfield port projects as well as a few M&A projects.

She jointly translated a book of Professor Usher from Columbia University “Investing in the Era of Climate Change”(Columbia University Press), which has been published by CITIC press in China in 2023.

Speaker

30

SESSION 3

Green Finance

The session will be a discussion between banks regarding sustainable loans and how they will help. As well as a classification society, a shipper, and a pork as to how they have utilised green finance.

31

JACKIE SPITERI

Managing Director, Sustainable ESG

JACKIE SPITERI

Managing Director, Sustainable ESG

BIOGRAPHY

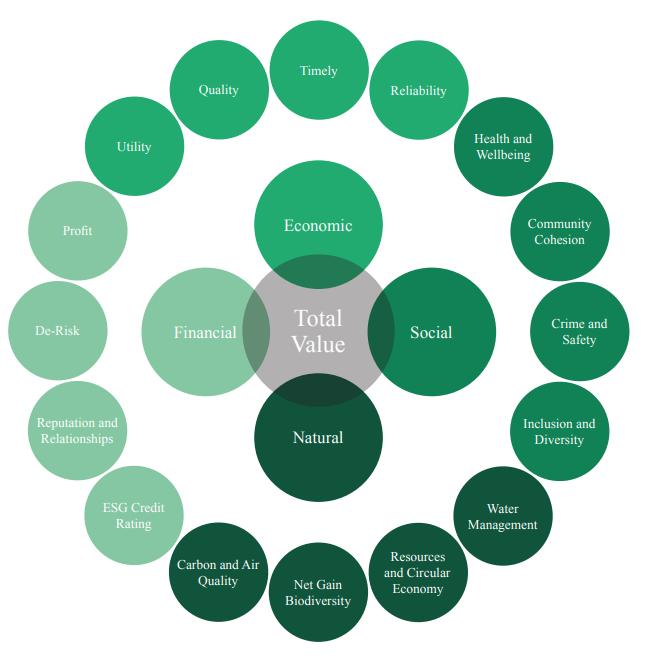

Jackie is an experienced Environmental, Social, Governance (ESG) professional with a history of working in the maritime and infrastructure sector bringing a wealth of knowledge on sustainable development and operations.

With over 15 years’ experience and a gift for creating collaborative partnerships, alongside a strong ability to recognise and cultivate the potential in others, Jackie has a proven track record of accelerating organisational sustainability through strategy development, implementation, communication, and education.

In 2022, Jackie became the founder and Managing Director of ESG advisory company Sustainable ESG (SESG). SESG are focused on supporting organisations navigate the evolving ESG imperative. Helping organisations to understand their current state and develop relevant and tailored strategies that build upon existing foundations.

Jackie has sat on the Board for PIANC ANZ, a global not-for-profit body that brings together experts on technical, economic, environmental and planning issues pertaining to waterborne transport and infrastructure and is a former Chair of the Ports Australia Environment Planning and Sustainability Working Group and sits on the Mayor of Newcastle’s Sustainable Development Collaborative, an active group focused on localising the United Nations SDGs to the region.

During her career Jackie has been responsible for the development of a number of Sustainability Financing Frameworks in the export/import infrastructure sector, enabling over $750million of sustainability linked debt to be realised through a series of innovative sustainability financing transactions. More recently Jackie has been deeply involved in the development of the ASEAN Taxonomy V3, that has seen the introduction of the Transport & Storage and Construction & Real Estate sectors.

Moderator

32

PANG TOH WEE

Senior Consultant - Maritime Advisory, DNV

BIOGRAPHY

Toh Wee is a Senior Consultant with the Maritime Advisory team at DNV, focused on ESG and Sustainability. With over 12 years of experience in the maritime industry, Toh Wee has expertise in shipbuilding and repair, alternative fuels, and sustainability consulting. Toh Wee has successfully delivered several sustainability projects for maritime customers in the value chain, such as GHG emission calculation, ESG reporting framework development, and Sustainability financing framework.

Prior to joining DNV, he held various roles as an engineer overseeing project management and research in the oil and gas industry. He is well experienced in sustainable finance-related services, providing solutions for sustainability-linked transactions and strategy development for financiers in the region.

Toh Wee holds a Bachelors’ degree in Offshore Engineering from the University of Newcastle and a certificate in Corporate and Environmental Sustainability from the Nanyang Technological University of Singapore.

Speaker

33

Raising Money for Maritime Decarbonization: A Green and Sustainable Finance Perspective

Abstract

The maritime sector is a major contributor to global greenhouse gas emissions and faces significant challenges in achieving the decarbonisation targets set by the International Maritime Organization. This paper explores the available green finance instruments, such as green, sustainability-linked and transition loans and bonds, to mobilise capital for low-carbon and zero-carbon technologies and practices in the shipping industry. It reviews the current state of the green finance market, the existing frameworks and standards for defining and reporting on green finance activities, and the opportunities and challenges for applying them to the maritime sector. It also provides some tools for green finance initiatives in the shipping industry and discusses the implications for policymakers, regulators, investors and stakeholders.

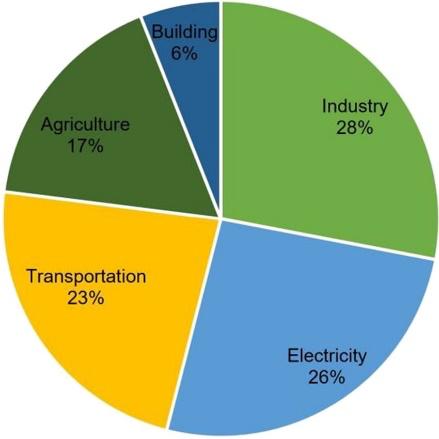

Introduction

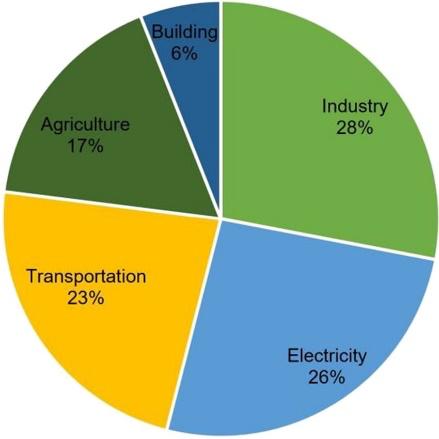

The maritime sector is responsible for about 2.8% of global carbon dioxide emissions according to the United Nations Conference on Trade and Development (UNCTAD, 2023). The IMO has adopted a strategy to meet net zero by 2050, which is in line with the goals of the Paris Agreement on climate change (IMO, 2023). However, achieving these ambitious targets will require significant investments in low-carbon and zero-carbon technologies and practices, such as alternative fuels, energy efficiency measures, carbon capture and storage, and operational optimisation. The Getting to Zero Coalition estimates that the annual investment needed to decarbonise the shipping industry by 2050 ranges from $1.4 trillion to $1.9 trillion, depending on the scenario (Coalition, 2020)

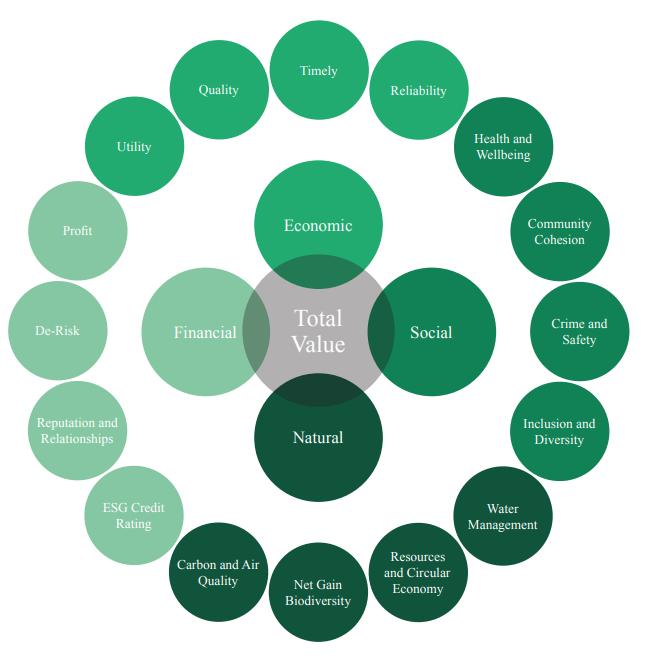

Green finance is a broad term that refers to the financing of activities that have positive environmental and social impacts, such as mitigating or adapting to climate change, enhancing biodiversity, reducing pollution, and improving resource efficiency. Green finance instruments, such as green, sustainability-linked and transition loans and bonds, are designed to channel capital from investors and lenders to borrowers and issuers that undertake green projects or commit to sustainability performance targets. Green finance can play a key role in supporting the decarbonisation of the maritime sector by providing access to lower-cost and longer-term funding, enhancing the reputation and credibility of the borrowers and issuers, and creating incentives and accountability for environmental and social performance. However, green finance also faces some challenges, such as the lack of a standard and consistent definition of what constitutes a green project or activity, the need for reliable and transparent reporting and verification of the environmental and social impacts, and the potential for greenwashing or misrepresentation of the green credentials of the borrowers and issuers.

This paper aims to provide an overview of the green finance market, the existing frameworks and standards for defining and reporting on green finance activities, and the opportunities and barriers for applying them to the maritime sector.

Current Status and Trends

Green finance has grown rapidly in recent years, driven by the increasing awareness and demand for environmental and social responsibility from investors, lenders, borrowers, issuers, regulators and policymakers. According to the Global Sustainable Investment Alliance, the global sustainable investment assets reached $35.3 trillion in 2020, a 34% increase from 2016

Conference Paper

34

trillion in 2020, a 34% increase from 2016 trillion in 2020, a 34% increase from 2016 (GSIA, 2023). Sustainable investment encompasses various strategies, such as negative or exclusionary screening, positive or best-in-class screening, thematic or impact investing, integration of environmental, social and governance (ESG) factors, engagement and voting, and norms-based screening. Among these strategies, green finance instruments, such as green, sustainabilitylinked and transition loans and bonds, have gained popularity and recognition as a way to link the financing of projects or activities to their environmental and social impacts.

Green loans and bonds are debt instruments that are exclusively used to finance or refinance green projects or activities that have clear environmental benefits, such as renewable energy, energy efficiency, clean transportation and pollution prevention for the maritime industry. The use of proceeds, the selection and evaluation of the green projects or activities, the management of the proceeds, and the reporting of the environmental impacts are the key elements of green loans and bonds and are guided by the Green Loan Principles (GLP) and the Green Bond Principles (GBP), respectively.

The GLP and the GBP are voluntary frameworks that were developed by the Loan Market Association (LMA), the Asia Pacific Loan Market Association (APLMA), the Loan Syndications and Trading Association (LSTA), and the International Capital Market Association (ICMA), with the input from various stakeholders, such as banks, investors, issuers, rating agencies, consultants, and non-governmental organizations (NGOs). The GLP and the GBP are aligned with the four components of the Green Bond Standard (GBS) of the European Union (EU), which is a legislative initiative that aims to establish a common and consistent framework for green bonds in the EU market (EU, 2020).

Sustainability-linked loans and bonds are debt instruments that are linked to the borrower’s or issuer’s performance on predefined sustainability objectives or key performance indicators (KPIs), such as reducing greenhouse gas emissions, improving energy efficiency, increasing the share of renewable energy, or enhancing social inclusion and diversity. The sustainability objectives or KPIs, the sustainability performance targets (SPTs), the loan or bond characteristics, the reporting of the sustainability performance, and the verification of the sustainability performance are the key elements of sustainability-linked loans and bonds, and are guided by the Sustainability-Linked Loan Principles (SLLP) and the Sustainability-Linked Bond Principles (SLBP), respectively.

Similarly, the SLLP and the SLBP are voluntary frameworks that were developed by the LMA, the APLMA, the LSTA, and the ICMA, with the input from various stakeholders, such as banks, investors, issuers, rating agencies, consultants, and NGOs. The SLLP and the SLBP are aligned with the EU Taxonomy Regulation, which is a legislative initiative that aims to establish a common and consistent classification system for sustainable economic activities in the EU market (EU, 2020).

Transition loans and bonds are debt instruments that are used to finance or refinance the transition of the borrower or issuer from a high-carbon to a low-carbon business model, sector, or activity, in line with the long-term goals of the Paris Agreement on climate change.

The transition loans and bonds are a relatively new and emerging concept in the green finance market, and unlike SLL and SLB, there is no universally agreed definition, framework or KPI requirements for them. However, some guidance and best practices have been developed by various stakeholders, such as the Climate Transition Finance Handbook (CTFH) of the ICMA, the Transition Bond Guidelines (TBG) of the Climate Bonds Initiative (CBI), and the Transition Finance Case Studies (TFCS) of the International Finance Corporation (IFC). The CTFH, the TBG, and the TFCS provide some common elements for transition loans and bonds, such as the identification of the transition strategy, the alignment with the science-based targets, the disclosure of the transition pathway, the reporting of the transition performance, and the verification of the transition impacts.

Conference Paper 35

taxonomies, transparency initiatives, and efforts to speed

as well as an increase in issuance from emerging markets. However, there are also macroeconomic factors that could hinder its growth, such as high-interest rates and the potential for an economic slowdown in key regions like Europe and Asia-Pacific (S&P, 2024).

Trafigura, commodity

The green finance market has witnessed remarkable growth in terms of volume and diversity in the past decade.

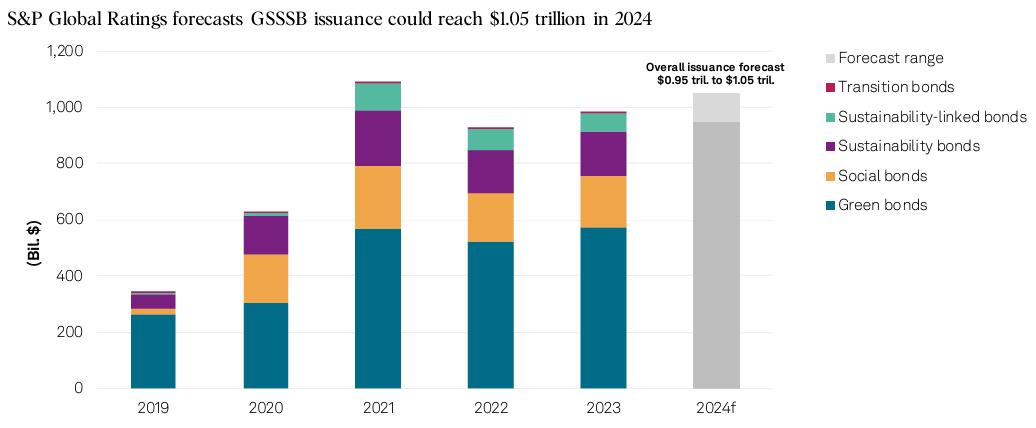

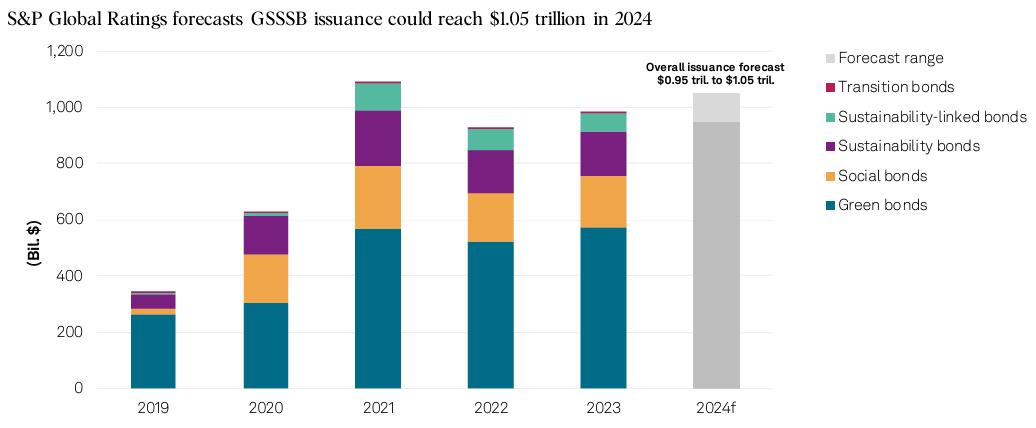

According to S&P Global Ratings’ research, the green, social, sustainability, and sustainabilitylinked bond (GSSSB) issuance in 2023 is at $0.98 trillion in 2023 and is expected to increase mostly to $0.95 trillion to $1.05 trillion in 2024 despite a number of factors which could underpin growth in GSSSB issuance as shown in Figure 1. There are several factors that could drive the growth of the green finance market, including the adoption of sustainable taxonomies, transparency initiatives, and efforts to speed up the energy transition, as well as an increase in issuance from emerging markets. However, there are also macroeconomic factors that could hinder its growth, such as high-interest rates and the potential for an economic slowdown in key regions like Europe and Asia-Pacific (S&P, 2024).

According to Bloomberg NEF, the global sustainability-linked loan issuance reached $119.5 billion in 2020, a 5% increase from 2019, despite the challenges posed by the COVID-19 pandemic. The cumulative sustainability-linked loan issuance since 2017 amounted to $323.9 billion by the end of 2020, with the US, France, Italy, Spain and the UK being the top five borrowers. The sustainability-linked loan market has also diversified in terms of sectors, regions, currencies, and types of borrowers, with the participation of corporates, financial institutions, and municipalities. The sustainability-linked loan market is expected to continue its growth momentum in 2021, with some estimates projecting a global issuance of $150-$200 billion (BNEF, 2021).

billion sustainability group of Bookrunners linked to greenhouse including Trafigura’s starting in These interest sustainable as well as borrowers

According to Bloomberg NEF, the global sustainability-linked loan issuance reached $119.5 billion in 2020, a 5% increase from 2019, despite the challenges posed by the COVID-19 pandemic. The cumulative sustainability-linked loan issuance since 2017 amounted to $323.9 billion by the end of 2020, with the US, France, Italy, Spain and

An example of a sustainable financing is that in October 2020, Maersk, the world’s largest container shipping company, secured a $5 billion revolving credit facility with a syndicate of 26 banks, with the interest margin linked to its progress in reducing carbon dioxide emissions per cargo moved by 60% by 2030, compared to 2008 levels. The facility also incorporated a mechanism that allows Maersk to reward its strategic sustainability partners in the syndicate with improved pricing terms (A.P. Moller – Maersk, 2020).

A more recent example is that in March 2024, Trafigura, one of the world’s largest commodity trading companies, signed a $56 billion sustainability-linked loan facility with a group of seven Mandated Lead Arrangers & Bookrunners (MLAB), with the interest rate linked to its KPI on cutting operational greenhouse gas emissions (Scope 1 & 2), including a new intensity reduction target on Trafigura’s shipping business (Scope 1 & 3) starting in 2026 (Trafigura, 2024). These examples illustrate the growing interest and innovation in green and sustainable financing for the shipping industry, as well as the potential benefits for both the borrowers and the lenders.

However, and limitations such as accepted defining the risk the ESG borrowers' independent ESG performance

Conference Paper 36

Figure 1: Global rating of GSSSB (Source: S&P Global)

up the energy transition,

Figure 1: Global rating of GSSSB (Source: S&P Global)

However, there are also some challenges and limitations that need to be addressed, such as the lack of standardised and widely accepted frameworks and standards for defining and reporting on the criteria and KPIs, the risk of greenwashing or misalignment of the ESG goals with the actual impact of the borrowers’ activities, and the need for independent verification and assurance of the ESG performance and data.

Frameworks and Standards

As the green finance market has expanded and diversified, there has been a growing need for common and consistent frameworks and standards for defining and reporting on green finance activities. Frameworks and standards would ensure the credibility, transparency, and accountability of green finance instruments and avoid the risk of greenwashing or misrepresenting the green credentials of the borrowers and issuers.

Unlike sustainability reporting, where clear frameworks such as ISSB and CSRD, which Singapore and EU have mandated as a reporting requirement with clear KPIs, there are no frameworks or regulations with KPIs that are widely accepted for green and sustainable financing, as they are either outdated, inaccurate, or incomplete today. However, the following sections provide a brief overview of the main frameworks and standards for green, sustainability-linked and transition loans and bonds, and their applicability to the maritime sector.

Green Loan Principles and Green Bond Principles

The Green Loan Principles (GLP) and the Green Bond Principles (GBP) are voluntary frameworks that provide guidance and best practices for the origination and issuance of green loans and bonds, respectively. The GLP and the GBP are based on four core components: use of proceeds, process for project evaluation and selection, management of proceeds, and reporting. The GLP and the GBP also provide a list of indicative categories of green projects or activities that are eligible for green loans and bonds, such as renewable energy, energy efficiency, clean transportation, pollution prevention and control, climate change adaptation, etc. The GLP and the GBP are aligned with the Green Bond Standard (GBS) of the EU, which is a legislative initiative that aims to establish a common and consistent framework for green bonds in the EU market. The GBS is based on the same four core components as the GLP and the GBP, but also introduces a mandatory verification by an external reviewer and a mandatory accreditation of the external reviewer by the EU.

Green loans and bonds can be used for the maritime sector if they finance or refinance green projects or activities that improve the environment in the shipping industry. These include lowcarbon or zero-carbon vessels that use alternative fuels, such as hydrogen, ammonia, biofuels, or electricity; or have energy efficiency measures, such as hull design, propeller optimisation, waste heat recovery, or wind-assisted propulsion. They also include green infrastructure and facilities in the maritime sector, such as ports, terminals, shipyards, or logistics centres, that meet high environmental standards, and green technologies and practices in the maritime sector, such as digitalization, automation, blockchain, or circular economy, that increase the environmental performance and efficiency of the shipping industry.

Sustainability Linked-Loan Principles and Sustainability

Linked-Bond Principles

Sustainability-linked loans and bonds (SLL and SLB) are another way to finance green and sustainable activities in the maritime sector. These are instruments that tie the financing terms, such as the interest rate or the coupon rate, to the borrower’s or the issuer’s progress in meeting predefined sustainability performance targets (SPTs). The SPTs should be ambitious, measurable, relevant, and verifiable and reflect the borrower’s or the issuer’s sustainability strategy and goals.

Conference Paper 37

The SLL and SLB follow the Sustainability-Linked Loan Principles (SLLP) and the SustainabilityLinked Bond Principles (SLBP), which are voluntary guidelines developed by the Loan Market Association, the Asia Pacific Loan Market Association, the Loan Syndications and Trading Association, and the International Capital Market Association, respectively encourage the borrower or the issuer to enhance their sustainability performance and impact over time and allow for more flexibility and innovation in how they use the proceeds, as they can be used for general corporate purposes instead of specific green projects or activities. The SLLP and the SLBP outline the main elements and best practices for structuring and issuing sustainabilitylinked loans and bonds, such as the selection and calibration of the SPTs, the calculation and adjustment of the financing terms, the reporting and verification of the SPTs and the financing terms, and the role and responsibilities of the external reviewers and the sustainability coordinators (Loan Market Association et al., 2019; International Capital Market Association, 2020). The SLLP and the SLBP are suitable for the maritime sector, as long as the SPTs are relevant and significant to the sustainability performance and impact of the borrower or the issuer in the shipping industry, and are consistent with the internationally recognised standards and frameworks, such as the IMO regulations, the Poseidon Principles, or the EU Taxonomy. For example, the SPTs can be related to the reduction of greenhouse gas emissions, the improvement of energy efficiency, the increase of renewable energy use, or the enhancement of biodiversity protection in the maritime sector.

The SLLP and SLBP also need regular reporting and verification of the SPTs and the financing terms, to ensure transparency and accountability for the stakeholders involved.

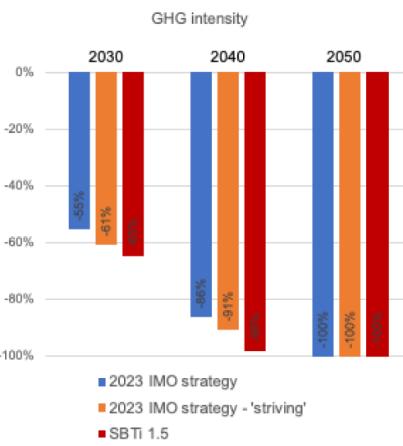

Maritime Regulations

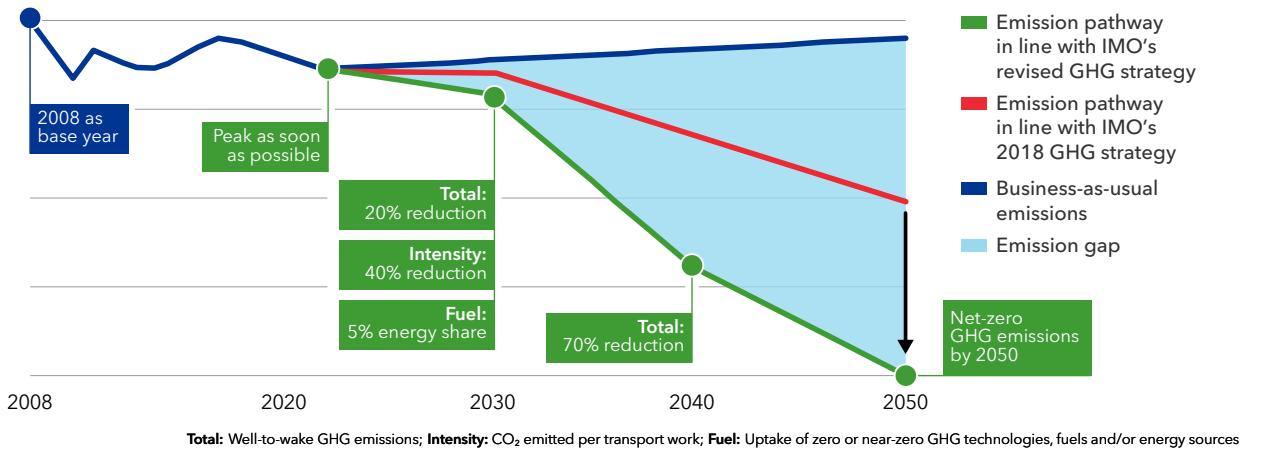

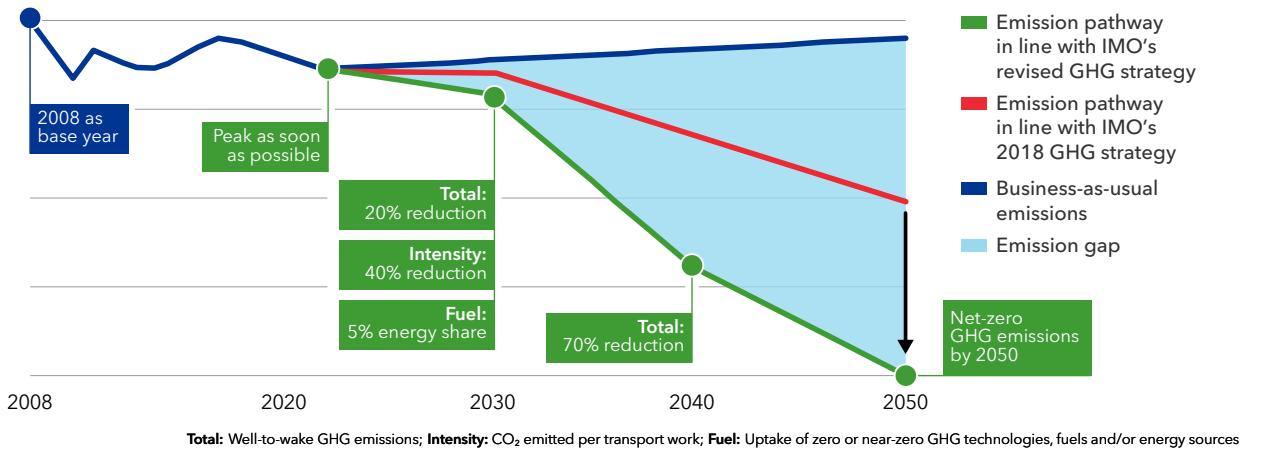

Figure 2: IMO strengthened targets (Source: DNV) allow how they used for instead of SLLP elements and issuing such SPTs, of the verification and the external coordinators 2019; Association, suitable SPTs the

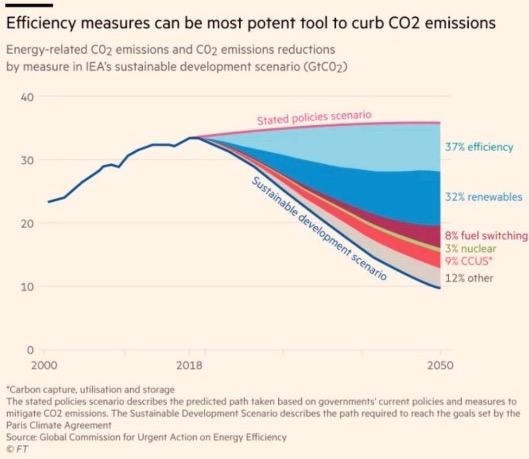

The maritime sector must comply with the regulations and standards established by the International Maritime Organization (IMO), the United Nations agency responsible for the safety, security, and environmental protection of international shipping. The IMO has set several ambitious targets and indicators for reducing greenhouse gas emissions and improving the maritime sector’s energy efficiency.

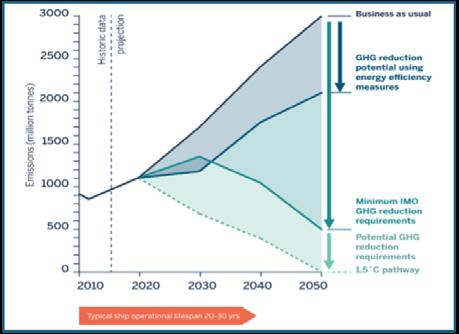

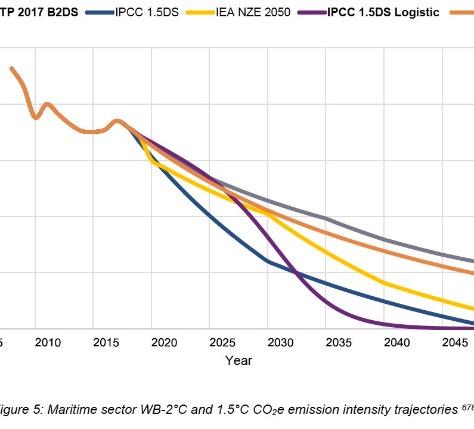

During MEPC80 last year, IMO has set targets to reduce the carbon intensity of international shipping by at least 40% by 2030 and by 70% by 2050, compared to the 2008 baseline, and to achieve the complete decarbonisation of the sector as soon as possible within this century as shown in Figure 2 (IMO, 2023).

international shipping by at least 40% by 2030 and by 70% by 2050, compared to the 2008 baseline, and to achieve the complete decarbonisation of the sector as soon as possible within this century as shown in Figure 2 (IMO, 2023).

Figure 2: IMO strengthened targets (Source: DNV)

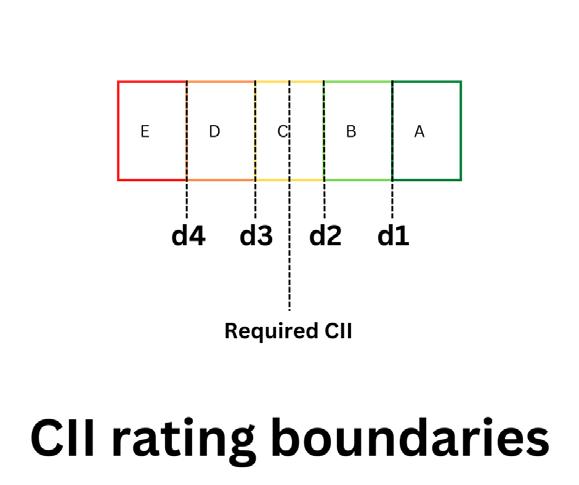

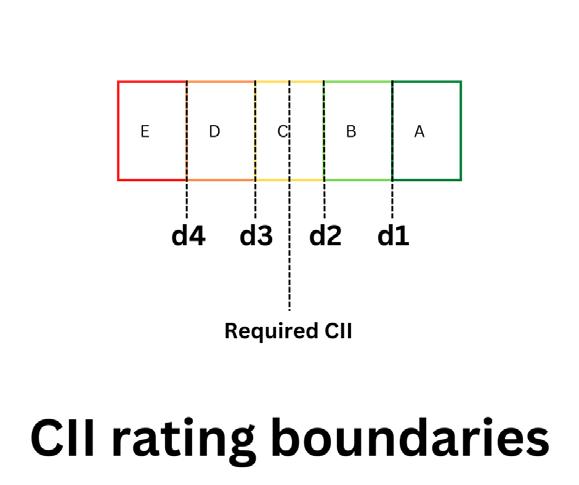

There are a few indicators which ship owners or managers would need to comply such as the Carbon Intensity Indicator (CII), Energy Efficiency Design Index (EEDI), Energy

Conference Paper 38

industry, internationally frameworks, such Poseidon example, reduction of improvement increase of enhancement aritime regular and the transparency and involved. with the by the (IMO), for the protection has set indicators for emissions and energy has set

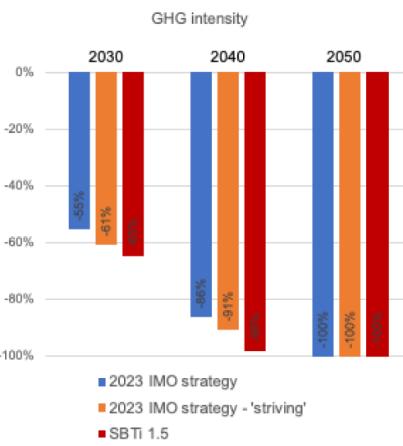

Design Index (EEDI), Energy Efficiency Existing Index (EEXI) and Energy Efficiency Operational Index (EEOI) as shown in Figure 3.

There are a few indicators which ship owners or managers would need to comply such as the Carbon Intensity Indicator (CII), Energy Efficiency Design Index (EEDI), Energy Efficiency Existing Index (EEXI) and Energy Efficiency Operational Index (EEOI) as shown in Figure 3.

CII and EEOI are indicators of the CO2 emissions per transport work and are used to assess the operational efficiency and performance of the ship. Like EEDI and EEXI, they also measure the CO2 emissions per transport work, but the difference is that they are based on the design of the ship of new and existing vessels, respectively. The EEDI regulations is required for new ships built after 2013. Whereas CII and EEXI are for existing ships, which owners have to comply with starting in 2023. EEOI is voluntary at the moment.

These regulations and standards reflect the high level of ambition and commitment of the IMO and the maritime sector to achieve environmental objectives and to align with the Paris Agreement and the UN Sustainable Development Goals.

Taxonomy

Taxonomy is a key concept and tool for green and sustainable financing, as it provides a common and consistent language and framework for defining and classifying economic activities and assets based on their environmental performance and impact. A taxonomy can help to identify and promote the activities and assets that contribute to environmental objectives, such as climate change mitigation and adaptation, biodiversity conservation, pollution prevention, and resource efficiency, and to exclude or discourage the activities and assets that harm or undermine these objectives. A taxonomy can also help to enhance the transparency and disclosure of the environmental performance and impact of the activities and assets, and to reduce the information asymmetry and uncertainty between the providers and users of green and sustainable financing.

However, there is no universally accepted and applied taxonomy for the maritime sector, as different countries and regions have developed or are developing their own taxonomies for green and sustainable financing, which may have different scopes, criteria, and thresholds for the maritime sector. For example, the European Union (EU) adopted a taxonomy regulation in

CII and EEOI are indicators of the CO2 emissions per transport work and are used to assess the operational efficiency and performance of the ship. Like EEDI and EEXI, they also measure the CO2 emissions per transport work, but the difference is that they are based on the design of the ship of new and existing vessels, respectively. The EEDI regulations is required for new ships built after 2013. Whereas CII and EEXI are for existing ships, which owners have to comply with starting in 2023. EEOI is voluntary at the moment. These regulations and standards reflect the high level of ambition and commitment of the

Conference Paper 39

Figure 3: EEDI, EEXI and CII (Source: IMO)

SPTs the of the

Efficiency

Figure 3: EEDI, EEXI and CII (Source: IMO)

2020, which establishes a framework for identifying and reporting the economic activities that are environmentally sustainable in the EU, and sets out six environmental objectives and four conditions for the activities to be considered as environmentally sustainable (EU Commission, 2023).

Other countries and regions, such as the UK, Canada, Japan, and ASEAN, are also developing or exploring their own taxonomies for green and sustainable financing, which may have different or similar approaches and criteria for the maritime sector.

Paris Agreement Alignment (PAA)

The MDBs have adopted a common framework to align their activities with the Paris Agreement. This framework consists of six core principles and four building blocks for operationalizing the alignment. The principles include alignment with mitigation goals, adaptation and climateresilient operations, accelerated contribution to the transition through climate finance, engagement and policy development support, reporting, and supporting transformational change. The building blocks include strategic alignment, operational alignment, alignment of internal activities, and alignment through reporting (Joint MDBs, 2023).

The MDBs’ Alignment Approach aims to enhance consistency and comparability of practices and standards for climate action, foster collaboration and coordination among stakeholders, support the implementation of National Determined Contributions (NDCs) and Long-term Climate Strategies (LTS), and contribute to the global stocktake and ratchet mechanism of the Paris Agreement. It is a dynamic and evolving process that responds to the latest scientific findings and policy developments and incorporates feedback from stakeholders. There is no specific PAA requirements for the maritime sector, but MDB’s can develop a sector specific PAA based on the same approach.

Poseidon Principles

Poseidon Principles are a set of principles and standards that guide the responsible lending and investment practices of financial institutions in the maritime sector and align their portfolios and practices with the IMO’s GHG emissions reduction targets and pathways for the sector. The Poseidon Principles are the first sector-specific application of the Paris Agreement for financial institutions and aim to enhance the role and responsibility of the financial sector in supporting the low-carbon and resilient transition of the maritime sector (Poseidon Principles, 2024).

The Poseidon Principles are a voluntary and self-governing initiative. They are open to any financial institution that provides finance to the maritime sector, such as banks, export credit agencies, insurers, and leasing companies. As of February 2024, there are 35 signatories to the Poseidon Principles, representing about 80% of the global ship finance portfolio, and covering various ship types and segments. The signatories of the Poseidon Principles have committed to align their ship finance portfolios with the IMO’s GHG emissions reduction strategy, which aims to reach net-zero of the sector by 2050 (Poseidon Principles, 2024).

The Poseidon Principles are a pioneering and innovative initiative that demonstrates the leadership and commitment of the financial sector in supporting the low-carbon and resilient transition of the maritime sector, and in aligning their portfolios and practices with the Paris Agreement and the IMO’s GHG emissions reduction targets and pathways.

The Poseidon Principles can provide several benefits and opportunities for the maritime sector and its stakeholders, such as the enhancement of the environmental and social performance and impact of the sector, the improvement of the access and cost of capital for the sector, the facilitation of the innovation and deployment of low-carbon and resilient technologies and fuels for the sector, and the promotion of the transparency and disclosure of the sector’s emissions and alignment.

Conference Paper 40

Discussions and Summary

There are regulatory requirements and also frameworks and initiatives that aim to develop or harmonise the taxonomies for the maritime sector. These initiatives provide some guidance and recommendations for the definition and classification of green and sustainable projects and assets in the maritime sector, such as the use of alternative fuels, the installation of emissionreduction technologies, and the adoption of energy management systems.

However, it is evident that there is a diversity and complexity of taxonomies for the maritime sector, which may create some challenges such as whether VLCC owners who want to get funding as a commitment to run on low-carbon fuel as well as be ready to be re-purposed to carry low or carbon fuel in future or the fact that OSVs owners, who are constantly being considered serving the oil and gas even if they are being used in the offshore wind farms are allowed to take up SLL or transitional loan due. Moreover, the diversity and complexity of taxonomies may increase the costs and difficulties of compliance and reporting for the sector and create some confusion and inconsistency for investors and lenders.

On the other hand, the diversity and complexity of taxonomies may also reflect the sector’s dynamism and innovation and create some flexibility and choice for investors and lenders. Therefore, it is important to foster dialogue and collaboration among the different stakeholders, such as the regulators, the industry, the financial institutions, and the civil society, to develop and implement a robust and reliable taxonomy for the maritime sector, that can balance the tradeoffs between the environmental and economic objectives, and between the harmonization and differentiation of the criteria and standards.

References

A.P. Moller – Maersk. (2020, February 25). A.P. Moller - Maersk links new $5.0bn revolving credit facility to its CO2 performance. Retrieved from htps://www.maersk.com/news/ar.cles/2020/02/25/ap-moller-maersklinks-new-5bn-revolving-credit-facility-to-its-co2-performance

Coali.on, G. t. (2020). The scale of investment needed to decarbonize international shipping.

EU Commission. (2023). COMMISSION DELEGATED REGULATION (EU).

GSIA. (2023). Global Sustainable Investment Review 2022 .

IMO. (2023). 2023 IMO STRATEGY ON REDUCTION OF GHG EMISSIONS FROM SHIPS.

Joint MDBs. (2023). Joint MDB Methodological Principles for Assessment of Paris Agreement Alignment of New operations Version 1.o.

Poseidon Principles. (2024). A global framework for responsible ship finance.

S&P, G. R. (2024). Sustainable Bond Issuance To Approach $1 Trillion In 2024.

Trafigura. (2024, March 14). Retrieved from Trafigura Group Pte Ltd closes the refinancing and extension of its USD5.6 billion European Syndicated Revolving Credit Facili.es: htps://www.trafigura.com/newsand-insights/press-releases/2024/trafigura-closes-the-refinancing-and-extension-of-its-usd56-billioneuropean-syndicated-revolving-credit-facili.es/

UNCTAD. (2023). REVIEW OF MARITIME TRANSPORT 2023. UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT.

Conference Paper 41

EUGENE WONG

Chief Executive Officer, Sustainable Finance

EUGENE WONG

Chief Executive Officer, Sustainable Finance

Institute Asia

BIOGRAPHY

Eugene Wong is the Chief Executive Officer of SFIA, an independent institute established to catalyse ideas on Sustainable Finance at the policy level in Asia, particularly in ASEAN, as well as propel action in support of those policy ideas.

Eugene was previously the Managing Director, Corporate Finance & Investments of the Securities Commission Malaysia (“SC”). He oversaw the SC’s ASEAN related initiatives and was a Chair of the Deputies of the ASEAN Capital Markets Forum (“ACMF”), the Co-Chair of its Sustainable Finance Working Group (“SFWG”) and a Co-Chair of the ASEAN Working Committee on Capital Market Development. At the SC, he also oversaw matters related to accounting for capital markets and served as a member of the Audit Oversight Board and an Adviser to the Malaysian Accounting Standards Board.

Eugene represents SFIA as an observer to the International Capital Market Association’s Green Bond Principles, Social Bond Principles, Sustainability Bond Guidelines and Sustainabilitylinked Loans Guidelines Group. He is also a member of Climate Bonds Initiative’s International Advisory Panel and an Independent Non-Executive Director of the Asia School of Business.

Prior to joining the SC, Eugene held positions in a merchant bank, a stockbroking company and in the corporate finance division of an international accounting firm.

Eugene is a Fellow of CPA Australia, Fellow of Chartered Accountants Australia and New Zealand and a Chartered Accountant of the Malaysian Institute of Accountants. He has an Advanced Diploma in Corporate Finance from The Institute of Chartered Accountants in England & Wales (ICAEW) and holds a B. Comm. from the University of Melbourne.

Speaker

42

BIOGRAPHY

JENS VAN YPERZEELE

Director, Sector Coverage Transport & LogisticsShipping, ING

Jens joined the Transport & Logistics team for ING in APAC in late 2016. In this position he is responsible for developing ING’s growing shipping customer base in the Asia Pacific and South Asia regions. He has over 15 years of experience in structuring and arranging financings in the natural resources, transportation and infrastructure sectors. During this time he has worked on corporate, leveraged and project financings to suit the needs of a broad range of clients. Jens started as a management trainee with ING and has worked in various structured finance roles since. He spent his formative years in oil&gas financing and also completed a stint in ING’s restructuring department. Prior to his current position Jens was part of the Offshore Oil&Gas team in New York. Jens holds an MSc in Management Science from Solvay Business School (Vrije Universiteit Brussel), Belgium.

Speaker

43

DAVID ALBERTANI Chief Executive Officer, Catalytic Finance Foundation

DAVID ALBERTANI Chief Executive Officer, Catalytic Finance Foundation

BIOGRAPHY

David Albertani is the CEO of the Catalytic Finance Foundation (‘Catalytic’). At Catalytic he leads the efforts in setting up new blended financial vehicles dedicated to sustainable infrastructure and oversees Technical Assistance implementation.

Among other Catalytic programs, Mr. Albertani has been leading the setup of the Subnational Climate Fund (SCF), targeting the implementation of a 750 MUSD blended finance vehicle for subnational sustainable infrastructure. Mr. Albertani also successfully managed a waste management program in Oran, Algeria which got him official recognition from the Algerian authorities. With sponsorship from Bloomberg Philanthropies, Mr. Albertani is currently leading efforts to design new blended finance vehicles, including on Port Decarbonization at a global level.

Mr. Albertani is an expert in waste and energy infrastructure project preparation and uses his project financing skills to bring projects to bankability.

Previously, he was a scientific associate in the mathematics department at the University of Geneva. He specialized in the field of probabilities and mechanical statistics where he published scientific articles on correlation estimates. He has been member of the council of the Swiss Doctoral Program of Mathematics.

Speaker

44

Port Decarbonization SolutionCatalytic Finance Foundation

1. Summary

The Catalytic Finance Foundation (‘Catalytic’) is a non-profit foundation based in Switzerland with a mission to accelerate the deployment of catalytic finance solutions for sustainable infrastructure. It incubates catalytic finance initiatives, such as blended finance investment funds, and supports the development of impactful projects in the form of technical assistance. Catalytic leads the implementation of the Catalytic Cities programme, sponsored by Bloomberg Philanthropies.

Shipping and ports are significant sources of Greenhouse gas (GHG) emissions and air pollution. While the industry has committed to reducing its environmental impact, progress towards a 1.5°C scenario by 2050 has been slow due to various barriers. A blended-finance solution can help overcome these barriers, provided it is structured to address key stakeholders’ interests and concerns. In this context, Catalytic is leading the design and structuring of a Port Decarbonization funding solution (the ‘Solution’) under its Catalytic Cities programme.

2. Context

The maritime shipping industry emits as much CO2 as Germany, which means that if it were its own country, it would be the sixth largest emitter in the world. Moreover, air pollution from ships contributes to an estimated 250,000 premature deaths and 6.4 million cases of childhood asthma worldwide each year. The impact is global, with critical impact zones in China, Singapore, Panama, and Brazil as well as along the coastlines of Asia, Africa, and South America.

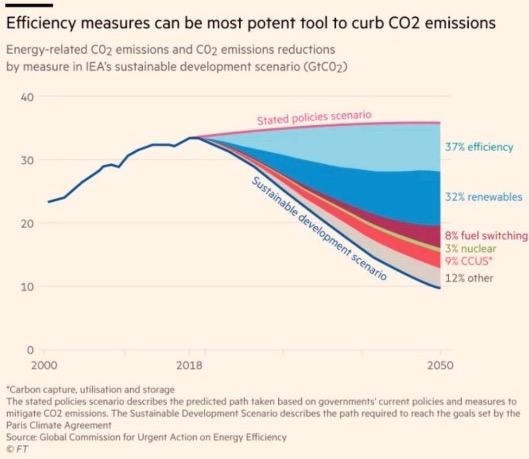

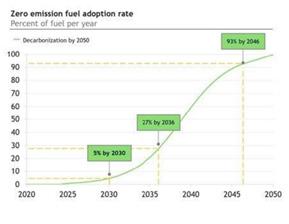

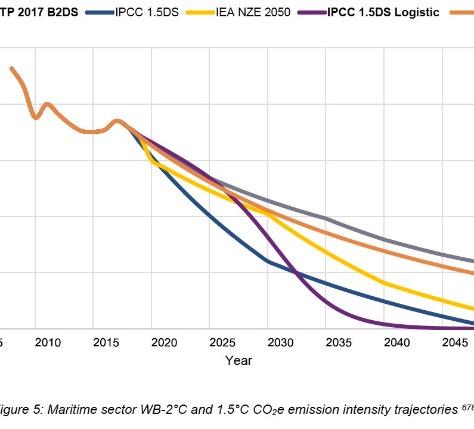

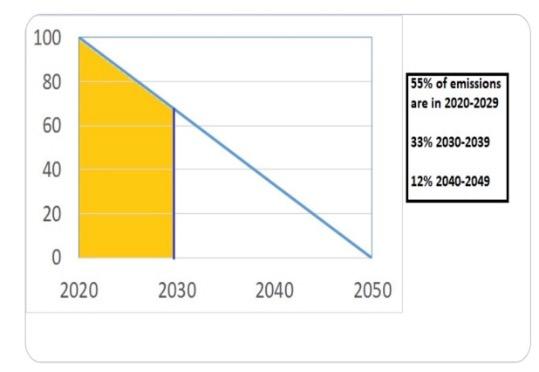

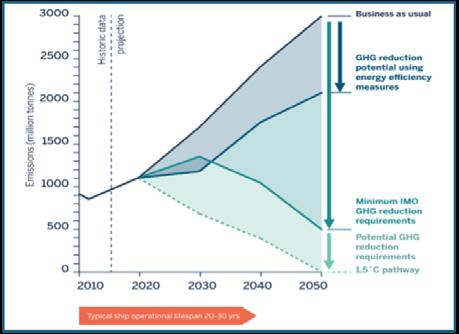

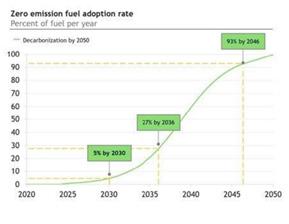

While industry efforts are underway, they are insufficient to ensure a global warming below 1.5°C. Based on the International Maritime Organization’s GHG strategy, the goal is to reach netzero close to 2050.However, as the volume of maritime trade is expected to triple by 2050, the industry would need to achieve zero GHG emissions by 2040 for a 1.5°C scenario or by 2050 for a 2.0°C scenario. To achieve this, no single individual measure will deliver decarbonization on its own and there is a need to take a multi-faceted approach.

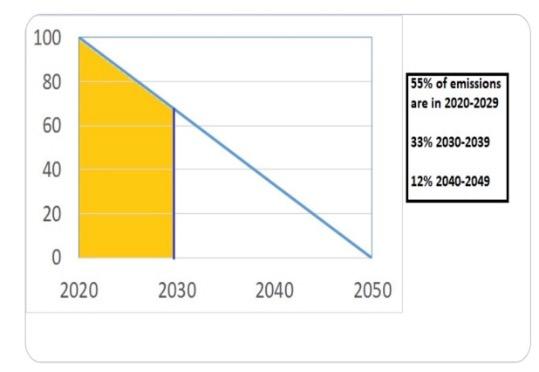

Source: UMAS (2019)

Source: UNCTAD (2022)

Conference Paper

45

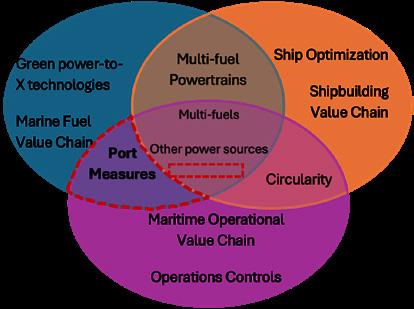

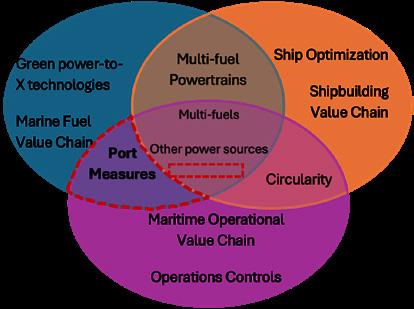

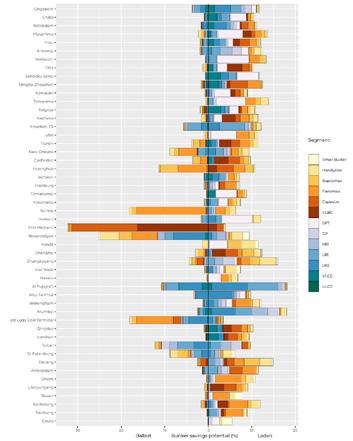

Graph 1: Energy efficiency measures will not be enough to reach IMO’s GHG

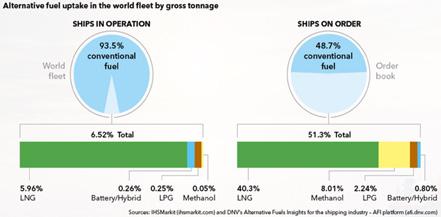

Graph 2: Multiple pathways to decarbonization

3. Investable Solutions

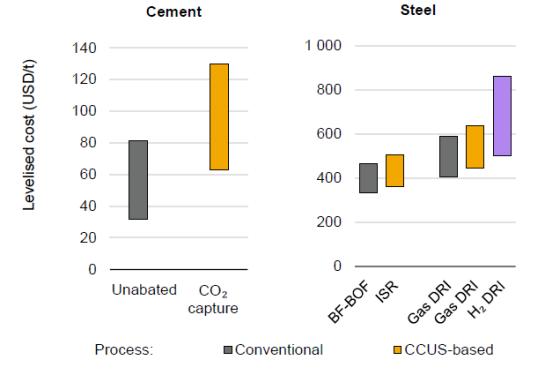

Various solutions offer strong opportunities for the multifaceted decarbonization of ports but there remain financing barriers to scale them. Catalytic identified the following available solutions to accelerate decarbonization of ports:

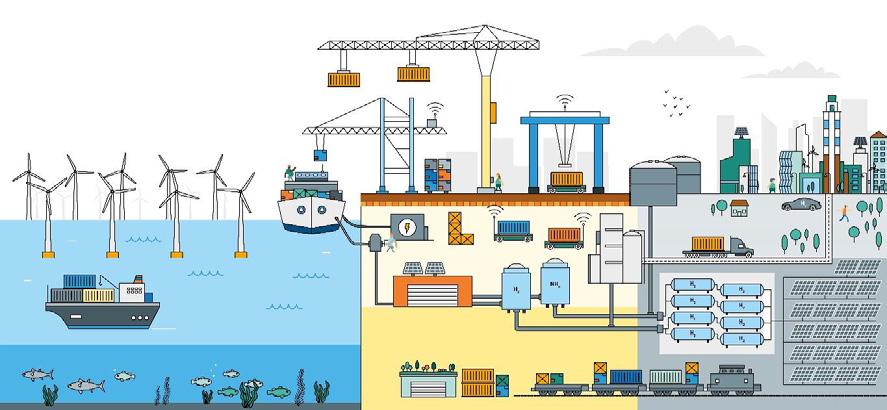

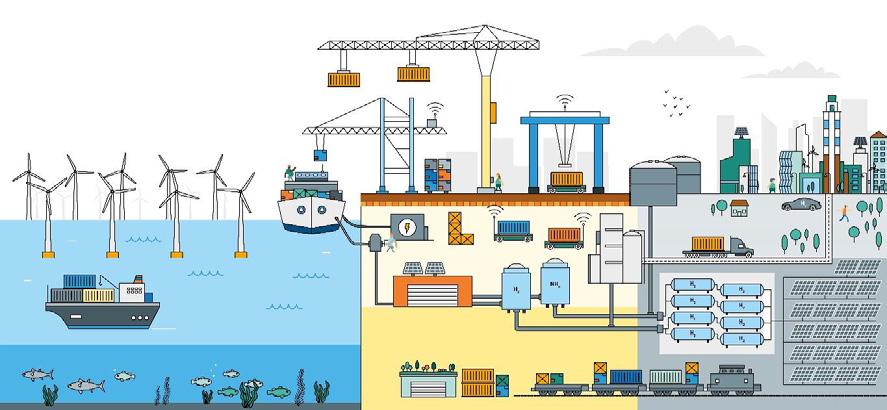

n Renewable Energy and Decentralised Generation: Investments in renewable energy generation and distribution at port will play a pivotal role in the deployment of other technologies for port decarbonization. Large land area of ports, vast warehouse roof space, and large open areas for parking and storage, offer opportunities for renewable energy generation on-site that could be used to power operations. Moreover, microgrids can aid ports in achieving self-sufficiency by guaranteeing the continuous independent supply of electricity.

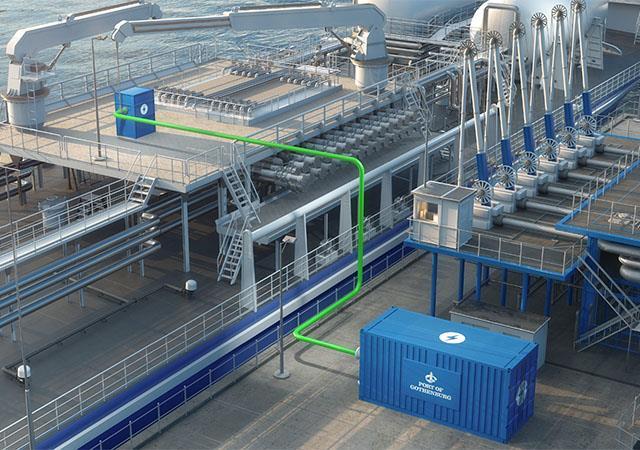

n Shore Power and Alternative Fuel Infrastructure: The deployment of multiple energy sources will ensure power reliability in different contexts. Cold ironing, also known as shore power, provides electrical power to ships while at port, allowing them to shut down their engines and reduce emissions. Infrastructure for Alternative Fuels such as green ammonia or green hydrogen would complement this. Deployment is limited by high upfront costs, absence of appropriate infrastructure such as grid capacity to support the high electricity output, and lack of incentives through policies and regulation.

n Cargo Handling Decarbonization: Substituting diesel-powered machinery will reduce ports’ carbon footprint and enhance local air quality. While the mix of cargo handling equipment will vary by port, they are typically powered by diesel fuel and could be switched to lower-emission propane, zero-emission battery, or hydrogen electric. Wider deployment is hindered by high upfront costs and commercial viability, lack of infrastructure, such as chargers and alternative fuel availability, and grid capacity constraints.

n Operational Efficiencies: Operational efficiencies at port are relatively accessible in terms of technology and costs. Enhancing operational efficiency (such as through LED retrofitting, Heat, Ventilation, Air Conditioning (HVAC) upgrades, and smart technologies) can help ports to reduce their carbon footprint, while simultaneously yielding gains in energy efficiency that can offset implementation costs in the short term. LED retrofits are particularly attractive in ports with high electricity costs, such as small island nations. Operational efficiency measures are easily replicable across other ports. Barriers to wider deployment include high upfront costs and absence of energy and waste management systems at port.

The main barriers to making investments into these solutions revolve around: upfront costs, ii) unclear benefits, iii) lack of supporting infrastructure, iv) lack of knowledge, v) lack of available long-term capital, vi) absence of policy and regulatory incentives.

Conference Paper 46

4. Catalytic’s Offer

To address the remaining barriers to accelerate investments into decarbonizing solutions, the solution that Catalytic is pursuing will have the following characteristics:

n Global coverage to reflect the interconnectedness of ports and support their various needs.

n A ‘packaged’ offer offering various solutions in parallel, as they are interdependent.

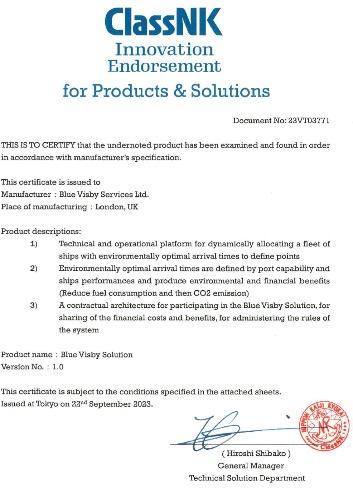

n A technical assistance component to help port authorities and other stakeholders to better access and plan their projects.