Vol. 104 Issue 1215

IMO 2023 GHG: Outside politics looms Subsea Mining: To boldly go PBST TCP: New radial generation Data silos: Port/voyage optimisation

ALSO IN THIS ISSUE: CCS feature | Sold State Batteries |

Index

By pairing our technical knowledge with the latest digital technologies, ABS leads the maritime industry in providing customers with innovative, tailored sustainability solutions that deliver results.

Learn more today at www.eagle.org/sustainability.

2023

KC-2 LNG debut | DNV’s VTI

JULY/AUGUST

Green Ports and Shipping Congress will identify and prioritise the areas that ports-based organisations and shipping companies need to collaborate on to reduce emissions.

Green Ports & Shipping Congress will cover a range of topics addressing the aspects of energy transition plans and

operations and ships.

Sessions and streams will focus on the required infrastructure, alternative fuel options/bunkering, technical solutions and how these align with the shipping lines and logistics chains.

It is a must-attend event for policy makers, ports and terminal operators, shipping companies, shippers and logistics companies, fuel & propulsion providers, decarbonisation clusters.

Media partners: PORTSTRATEGY INSIGHTFOR PORTEXECUTIVES GREENPORT INSIGHTFOR PORTEXECUTIVES MOTORSHIP MARINETECHNOLOGY THE Visit www.greenseascongress.com Supporters:

For further information about speaking, sponsoring or attending as a delegate,

the Events

Register your interest now!

contact

team on +44 1329 825335

FEATURES 4 6

14 New KC-2 debut

An upgraded version of South Korea’s home-grown LNG cargo containment solution has had its first application in a newly-delivered bunker tanker.

15 HiMSEN H2 engine reveal

South Korea’s first home-grown, mixed-fuel LNG/hydrogen engine has been demonstrated for the first time to potential buyers.

35

State of play

Toyota’s plans to introduce commercial solid-state production by 2027 is just one of several advances in battery chemistry aiming to boost power density, and increase longevity and C rates.

36 REGULARS

6 Regulation

The IMO has adopted a revised strategy to reduce greenhouse gas emissions from international shipping, targeting net zero emissions by 2050.

36 Design for Performance

Researchers in the SeaTech Consortium testing a dynamic wing and new engine control technology expect the project to lead to emissions reductions of 30% or more when running on LNG.

38

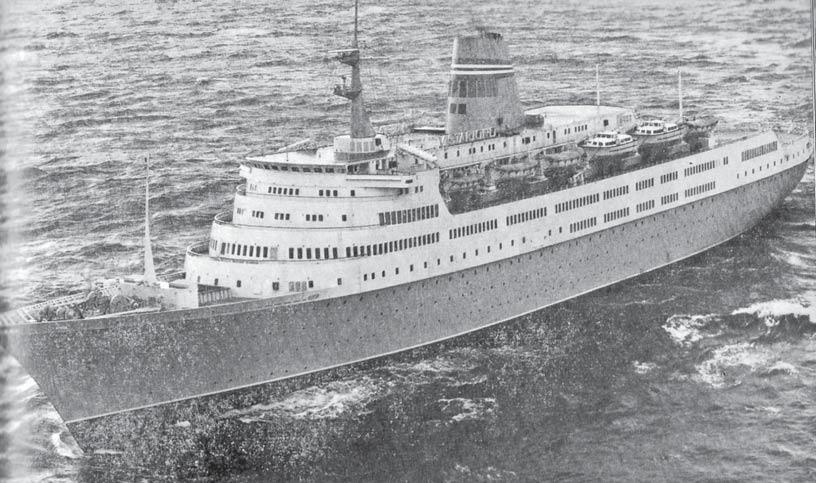

Ship Description

The NYK Group has taken delivery of the initial vessels in a major programme of LNG-fuelled pure car/ truck carrier (PCTC) construction, writes David Tinsley.

14 New combustion concept

Preliminary field tests of a new combustion concept being developed by the SeaTech Consortium support expectations of a 10% reduction in GHG emissions, and potential wider applicability.

18 New radial generation

PBST’s new generation of radial turbochargers are targeting single stage pressure ratios far above 6 and best-in-class specific mass flow rates, Wendy Laursen hears.

24 Measure for measure

DNV is launching a Recommended Practice (RP) offering to evaluate technical performance, which unlike the CII Index will not be swayed by the impact of weather, speed, and loading condition.

28 Purity key to containment

Designers of onboard CO2 capture technologies need to account for purity levels when designing containment systems, notes Rupert Hare, CEO of Houlder.

30 Lowest hanging data flows

A number of developers are ship’s propulsion system to the next port of call, and a growing number of companies are collaborating on making the most of it to reduce emissions.

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

Social Media Linkedin Facebook Twitter YouTube Online motorship.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREE at: www.motorship.com/enews For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 3 CONTENTS JULY/AUGUST 2023 NEWS

30 44TH

DEBUT FOR REVISED KOREAN LNG TANK SYSTEM

VIEWPOINT

NICK EDSTROM | Editor nedstrom@motorship.com

Barriers to implementation

While sceptics may quibble about the specific details, and there remain unresolved questions about what a net-zero decarbonised future for international shipping sector will look like, we should recognise what an outstanding achievement agreeing the IMO’s 2023 Greenhouse Gas Strategy was, given the extraordinary pressures under which the delegates were operating.

The agreement clearly sets a direction of travel for the industry, and the agreement of targets for the introduction of low and zero emission fuel by 2030 addresses some of the chicken and egg related concerns connected with big ticket investments to develop low and zero carbon fuel supplies.

The effects have been seen in the container market, where East Asian operators have begun to follow the lead of European container operators to invest in methanol-fuelled newbuilds. We can safely assume that demand for dual-fuel retrofit projects will pick up in the coming period.

However, large systemically important container line operators are responding to customer pressures (an area in which Scope 3 emissions outweighs youthful environmentalist consumers), and regional environmental regulation developments (the EU’s CBAM), as much as regulatory pressures.

Other sectors of the international shipping sector are lagging well behind in terms of adopting new fuels, both because of pervasive concerns about fuel availability and lingering hopes that advances in propulsion technology or emissions reduction technology (carbon capture!) will help to delay the inevitable.

I note that sector-specific concerns about the potential impact of higher decarbonisation fuel costs on logistics costs for existing trades (including Front Haul bulk trades to China) are likely to have influenced national attitudes towards adopting science-based targets at MEPC 80.

As such, the importance of developing a package of mid-term measures that will be able to incentivise the shipping industry to decarbonise will be the defining discussion in the coming period.

An interesting area that has not received adequate attention will be the need to incentivise efficiency improvements in existing vessels servicing trades that are likely to enter into long term decline well before 2050, such as the seaborne thermal coal market.

Fortunately, the incoming new IMO new secretary-general, Arsenio Antonio Dominguez Velasco, has a solid understanding of the decarbonisation brief, having served as chair of the MEPC committee. He will need all of his political experience, as outside interests are likely to intrude on maritime discussions related to decarbonisation to an ever greater extent.

The politicisation of the maritime decarbonisation agenda both within individual nations and regional blocs - the decarbonisation agenda is becoming increasingly politicised in Europe - and as a source of disagreement between the major trading nations (and the EU), is likely to intensify over the coming years.

It is a measure of the interconnected nature of the decarbonisation agenda that changes of government policy agendas can impact funding and the viability of low carbon and zero carbon fuel projects. Biofuel suppliers will be watching the formation of the next Dutch government with interest, for example.

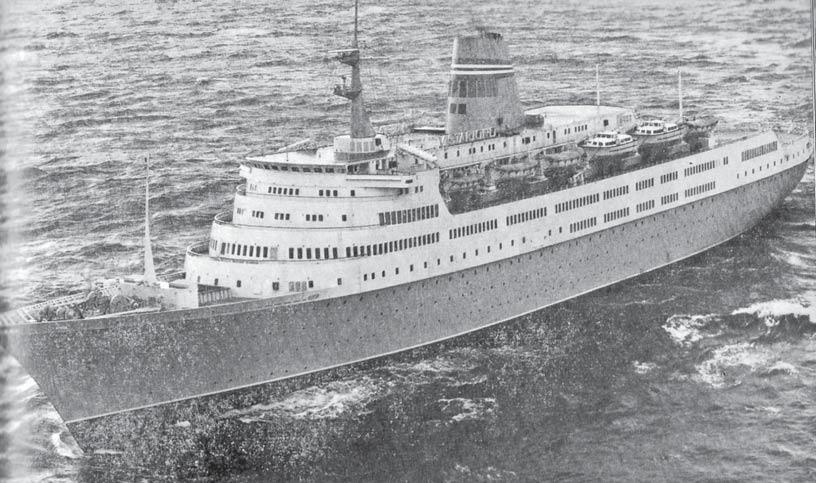

An upgraded version of South Korea’s home-grown LNG cargo containment solution has had its first application in a newlydelivered bunker tanker.

The technology initially developed between 2004 and 2014 that gave rise to the KC-1 membrane system has now been enhanced and introduced as the KC-2 design. Realising the further stage of R&D implemented in 2017, the KC-2 solution has made its debut in the 7,500m3-capacity LNG bunker tanker Blue Whale.

Built at the Ulsan complex of HD Hyundai Heavy Industries over a two-year period, the 97m Blue Whale was handed over last month to Korea LNG Bunkering (KOLB), a subsidiary of Korea Gas Corporation (KOGAS). KOLB has entrusted the vessel’s management and operation to Hyundai LNG Shipping.

KOLB had been selected by the Korean Ministry of Trade, Industry and Energy to front the national LNG Bunkering Vessel Construction Support Project in 2020, and the company ordered the ship with the benefit of a government subsidy of Won15bn ($11.5m). The overall contract price amounted to Won55.3b n($42m).

The nature and realisation of the newbuild scheme is regarded as a further achievement in the strategy of localising LNG cargo containment technology, given the Korean shipbuilding industry’s pre-eminent position in the global LNG carrier construction market and its reliance and expenditure on licensed foreign cargo system designs. Once the KC-2 solution has been verified in service in the Blue Whale, the commercialisation process will be extended to the LNGC sector.

The long-crafted, indigenous

KC-1 system came to fruition during 2018 through its embodiment in two 174,000m3 LNGCs completed by Samsung Heavy Industries for SK Shipping, the SK Serenity and SK Spica.

The KC-1 technology has subsequently been used to effect in two small-scale LNGCs of 7,500m3 capacity, which are chartered to KOGAS. Since respective handovers in September 2019 and January 2020, the vessels have been employed either shipping cargoes from the Tongyeong LNG terminal to Jeju Island in the Korea Strait, or undertaking direct bunker transfers.

While the efficiency benefits promised by the KC-1 membrane solution provided the technical foundation for its development and adoption, the motivation for the creation of the system was the financial benefit it would afford domestic shipbuilders in not having to pay licence fees for using foreign, core technologies. A few years ago, such payments were understood to equate to around 5% of ship price, and it was indicated that yards would be able to save around 60% of royalty costs by adopting KC-1.

Strengthening technological self-reliance in this sphere therefore has the potential to sharpen Korean shipbuilding competitiveness and consolidate its position as the world’s most prolific producer of LNG carriers. Currently, the preponderance of such vessels from Korean yards employ the membrane design series originated by Gaztransport & Technigaz(GTT).

NEWS REVIEW 4 | JULY/AUGUST 2023 For the latest news and analysis go to www.motorship.com

8 Blue Whale embodies South Korea’s newly-developed KC-2 cargo system

South Korea’s first home-grown, mixed-fuel LNG/hydrogen engine has been demonstrated for the first time to potential buyers. The versatile fourstroke design has been jointly developed by HD Hyundai Heavy Industries Engine & Machinery Division(HHI-EMD) and HD KSOE in keeping with decarbonisation goals, and will augment the group’s HiMSEN portfolio.

Based on HiMSEN LNG dual-fuel engine technology, the new model will provide users with the option to selectively use and switch between diesel oil, LNG and an LNG/hydrogen mixture. Operating in the latter mode will realise reductions in greenhouse gas emissions such as CO2 and unburnt methane.

The recent demonstration of the 1,500kW test engine at HD

KOREA PROMOTES HYDROGEN CO-FIRING ENGINE

engine offers first-rate loadfollowing behaviour, adjusting output precisely in accordance with changes in electrical load, be it as a marine auxiliary installation or in a landside power plant setting. Moreover, the multi-fuel combustion engine promises a faster start-up time and longer lifespan than fuel cells.

HHI’s

complex, in front of representatives from the shipping and power generation sectors, confirmed stable LNG/ hydrogen co-firing performance while satisfying IMO Tier III NOx

regulations without the need for aftertreatment solutions.

The manufacturer claims the

Following a test campaign last September, HD HHI obtained approval in principle(AiP) for its HiMSEN LNG/hydrogen mixed fuel engine safety concept. In the meantime, HHI is continuing research into a 100% hydrogen engine, with a view to an outcome by 2025.

New injection technology lowers NOx emissions of MAN 10.6 engines

MAN Energy Solutions has developed a new sequential fuel injection system to optimize the emissions performance of its new high efficiency 10.6 engines, and researchers shared details of its development at CIMAC 2023.

Currently the new large 2-stroke 10.6 engine types that have been developed by MAN are based on the S50ME-C9.7 and S60ME-C10.5 engine and include 50, 60, 80 and 95cm bore. The aim is to continue boosting the efficiency of MAN’s single-fuel engines which currently make up about half of its engine sales.

The high engine efficiency of the new engine necessitated a NOx solution to ensure the engine remained Tier II compliant. The production of NOx emissions

HiMSEN licence first

is related to fuel consumption and the mechanical and thermal load of the combustion chamber. Each of these parameters is inter-related, and the sequential fuel injection optimisation involves carefully timed sequencing of each injector. The concept is able to reduce NOx formation, and when combined with higher maximum cylinder pressures, fuel oil consumption is also reduced. The lower rate of injected energy achieved reduces NOx formation with only a small fuel oil consumption penalty.

The process is electronically controlled, with fuel booster injection valves hydraulically operated and controlled by window injection valve actuation. This ensures precise control for

First Panamanian SG

the system as fuel enters via pipes to a sleeve in the cylinder cover. A hydraulic cylinder unit sequential replaces the existing hydraulic cylinder unit as it no longer requires a booster. The new unit takes up half the space.

The exhaust valves and actuators are similar to those in existing hydraulic cylinder units and fuel injection valve actuators, but they are now located on the manoeuvring side of the cylinder cover rather than being placed on the baseplate.

The overall increased maximum combustion pressure of the 10.6 has led to reinforcement of both moving and structural engine parts, but this has been achieved with minimal change to engine room

Maersk feeder 1st

layout. The cylinder distance and height of interfaces are maintained. Main bearing size remains unchanged, as the main bearing zero is now introduced on the fore end of the engine to avoid having a bearing edge load that is too high. The crankpin bearing has increased diameter and width, and main bearing support side machining has now been introduced, along with crosshead bearing changed from white metal to tin-aluminium.

MAN says it is continuously pursuing the best possible efficiency and the lowest possible carbon footprint for its engines.

BRIEFS

Evergreen DF orders

A joint venture between HD Korea Shipbuilding & Offshore Engineering Co. and two Saudi Arabian partners have begun building a new plant in Ras Al-Khair. The new 150,000 m2 production plant is the first in Saudi Arabia capable of locally producing large-bore and medium speed diesel engines. The plant represents the first time that HD Hyundai will licence the manufacture of its HiMSEN 4-stroke, medium speed engines outside Korea.

Arsenio Antonio Dominguez

evasion

Velasco was elected as the next secretary-general of the IMO in mid July and will take up the post on 1 January 2024. He has been elected for a four-year period until 2027, with the possibility of a fouryear extension. The former Ambassador and Permanent Representative of Panama to the IMO and Chairman of the MEPC, will become the first Panamanian and Latin American to serve as secretary-general.

Maersk has taken delivery of the company’s first container vessel capable of operating on methanol. The 2,100 teu vessel was handed over by Hyundai Mipo Dockyard and Hyundai Heavy Industries on 10 July. The vessel is the first container vessel to be fuelled by methanol, and is expected to be the first methanol-powered vessel to be fuelled by green methanol in the world. The vessel is expected to arrive in Copenhagen in September.

An Evergreen Shipping subsidiary has ordered 16 16,000 teu container vessels from SHI, and 8 vessels from Nihon Shipyard for around US$180-210 million each. The vessels will be equipped with dual-fuel engines capable of operating on methanol. The Taiwanese based container line operator has previously noted that the vessels are expected to operate on routes between Asia and Europe.

‘‘ NEWS REVIEW

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions

8 LNG/hydrogen engine demonstration at Ulsan

Ulsan

For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 5

Credit: HD HHI).

2023 GHG STRATEGY LIFTS SHIPPING’S GREEN AMBITION

The International Maritime Organization (IMO) has adopted a revised strategy to reduce greenhouse gas emissions from international shipping.

The member States of the IMO, meeting at the Marine Environment Protection Committee (MEPC 80), have adopted the 2023 IMO Strategy on Reduction of GHG Emissions from Ships, with enhanced targets to tackle harmful emissions.

The revised IMO GHG Strategy includes an enhanced common ambition to reach net-zero GHG emissions from international shipping close to 2050, a commitment to ensure an uptake of alternative zero and near-zero GHG fuels by 2030, as well as indicative checkpoints for 2030 and 2040. The Strategy was adopted unanimously.

2023 IMO Strategy on Reduction of GHG Emissions from Ships

The 2023 IMO Strategy on Reduction of GHG Emissions from Ships (2023 IMO GHG Strategy) was adopted with improvements to the levels of ambition along with newly established indicative checkpoints towards GHG emission reduction from international shipping as shown in the following table. It is also noted that the reduction of the total annual GHG emissions by 2030 and 2040 were agreed as indicative checkpoints to reach net-zero GHG reduction target for 2050. The Strategy is subject to a review every five years.

The 2023 IMO GHG Strategy agreed a multi-faceted approach towards reducing environmental emissions from the international shipping sector.

It intends to review the EEDI requirements for ships with the aim of tightening the targets, in order to further reduce the carbon intensity of shipping.

While the existing CO2 emissions per transport work target of a 40% reduction by 2030 (against a 2008 baseline) was left unchanged, a new target of a 70% reduction (with an ambition to achieve an 80% reduction) was introduced for 2040.

One of the most potentially important innovations was the introduction of a requirement for at least 5% of energy used by international shipping to be supplied by zero or net-zero GHG emission technologies, fuels or energy sources by 2030. This ambition includes an ambition for up to 10% of energy used to be supplied by such sources.

Finally, the 2023 IMO GHG Strategy increases the level of ambition within the shipping sector, calling for GHG emissions from international shipping to peak as soon as possible and to reach net-zero GHG emissions by or close to 2050.

Well to wake LCA approach

As expected, the meeting recognised that GHG emissions produced during the manufacturing and distribution processes of low/zero-carbon fuels should be taken into account when comparing different fuels. The meeting also recognised that a fair comparison between fuels would also take into account other greenhouse gases apart from CO2,

MEPC80 6 | JULY/AUGUST 2023 For the latest news and analysis go to www.motorship.com

8 The IMO has adopted a revised strategy to reduce greenhouse gas emissions from international shipping

such as methane (CH4) and nitrous oxide (N2O), both of which have a high effect on global warming that NOx or SOx.

The meeting reviewed and adopted a set of draft Guidelines on Life Cycle GHG Intensity of Marine Fuels (LCA Guidelines) produced by a correspondence group to permit the assessment of GHG emission intensity from marine fuels, taking into account its manufacturing, distribution, and use onboard ships.

While the LCA Guidelines provide a general framework on the calculation method of GHG emission intensity including CO2, CH4 and N2O, there was no agreement on a number of technical issues, including the establishment of comprehensible regulations on GHG emission intensity calculation procedures and verification/certification procedures. The establishment of default emission factors, as well as some biomass related adjustments, will be addressed in an Expert Workshop.

Basket of candidate mid-term GHG reduction measures

As expected, discussion about the potential mid-term measures resulted in a number of shortlisted schemes that will be identified for further development.

A number of different schemes were put forward, including a universal greenhouse gas levy (or carbon levy), an annual ratchet for GHG emissions intensity, as well as a feebate mechanism.

A timeline for the mid-term measures specifying the adoption of specific measures by 2025 followed by entry into force by 2027 has been incorporated into the 2023 IMO GHG Strategy.

The candidate economic elements will undergo a comprehensive impact assessment (CIA) on the combination of technical and economical elements of respective basket of measures, with a view to facilitating the finalisation of the basket of measures.

The 2023 GHG Strategy states that a basket of candidate measure(s), delivering on the reduction targets, should be developed and finalized comprised of both:

– a technical element, namely a goal-based marine fuel standard regulating the phased reduction of the marine fuel’s GHG intensity; and

– an economic element, on the basis of a maritime GHG emissions pricing mechanism.

Next Steps

The 2023 Strategy sets out a timeline towards adoption of the basket of measures and adoption of the updated 2028 IMO GHG Strategy on reduction of GHG emissions from ships:

5 MEPC 81 (Spring 2024) - Interim report on Comprehensive impact assessment of the basket of candidate mid-term measures/Finalization of basket of measures

5 MEPC 82 (Autumn 2024) - Finalized report on Comprehensive impact assessment of the basket of candidate mid-term measures

5 MEPC 83 (Summer 2025) - Review of the short-term measure to be completed by 1 January 2026

5 MEPC 84 (Spring 2026) - Approval of measures / Review of the short-term measure (EEXI and CII) to be completed by 1 January 2026

5 Extraordinary one or two-day MEPC (six months after MEPC 83 in Autumn 2025) - Adoption of measures

Target dates:

5 MEPC 85 (Autumn 2026)

5 16 months after adoption of measures (2027) - Entry into force of measures

5 MEPC 86 (Summer 2027) - Initiate the review of the 2023 IMO GHG Strategy

Target year 2018 ambition2023 ambition

2030

6 To reduce CO2 emissions per transport work by at least 40%

6 To reduce CO2 emissions per transport work by at least 40%

6 To reduce total annual GHG emissions by at least 20% (striving for 30%)

6 Uptake of zero GHG emission fuels etc. to represent at least 5% of the energy used (striving for 10%)

2040

2050

6 To reduce CO2 emissions per transport work by at least 70%

6 To reduce total annual GHG emissions by at least 50%

6 To reduce total annual GHG emissions by at least 70% (striving for 80%)

6 To reach net-zero GHG emissions by or around 2050 at the latest

By

6 To reach zero GHG

5 MEPC 87 (Spring 2028)

5 MEPC 88 (Autumn 2028) - Finalization of the review of the 2023 IMO GHG Strategy with a view to adoption of the 2028 IMO Strategy on reduction of GHG emissions from ships.

Life cycle GHG assessment guidelines adopted

The MEPC adopted Guidelines on life cycle GHG intensity of marine fuels (LCA guidelines) for consideration and adoption. The LCA guidelines allow for a Well-to-Wake calculation, including Well-to-Tank and Tank-to-Wake emission factors, of total GHG emissions related to the production and use of marine fuels.

Interim guidance on the use of biofuels

The MEPC approved an MEPC circular on Interim guidance on the use of biofuels under regulations 26, 27 and 28 of MARPOL Annex VI (DCS and CII).

Marine Environment Protection Committee (MEPC 80)

The Marine Environment Protection Committee (MEPC) addresses environmental issues under IMO’s remit. This includes the control and prevention of ship-source pollution covered by the MARPOL treaty, including oil, chemicals carried in bulk, sewage, garbage and emissions from ships, including air pollutants and greenhouse gas emissions. Other matters covered include ballast water management, antifouling systems, ship recycling, pollution preparedness and response, and identification of special areas and particularly sensitive sea areas.

8 The introduction of zero GHG fuel targets by 2030 will incentivise the development of alternative fuel supplies

8 The introduction of milestone targets for 2030 and 2040, with higher ambitions, lifts the industry’s decarbonisation ambitions

MEPC80 For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 7

end-2099

emissions

TWO-STROKE ENGINES

1st ME-GA ENGINE WITH INDIVIDUAL CYLINDER CONTROL

The first low-pressure ME-GA engine to be equipped with a new engine control feature, ‘ME-GA-opti’, successfully completed LNG gas trials in South Korea in July, MAN ES has announced

The vessel’s engine-control system is the first to be equipped with a new control feature called ‘ME-GA opti’, which MAN ES states will allow optimal engine operation through individual cylinder control.

The MAN B&W ME-GA engine has been installed on an LNG carrier under construction by Samsung Heavy Industries (SHI) for an unspecified shipowner. The dual-fuel vessel, which was ordered in Q2 2021 and is scheduled for delivery in July 2023, is equipped with Exhaust Gas Recirculation (EGR) for emission reduction.

The introduction of individual cylinder control into the MEGA engine control system is expected to lead to improvements in the performance of the engine platform. The solution is expected to improve specific gas consumption during the average service life of an LNG carrier by “several percentage points”.

The algorithms used by the ‘ME-GA-opti’ ensure, in an unprecedented way, that the two-stroke Otto engines’ combustion process runs as close to its designed optimum as possible in service.

One of the ways in which the ME-GA-opti does this is by reducing the influences of ambient temperature, pressure and humidity, all of which can influence Otto-cycle engines’ operation. The MEGA-opti is able to adapt the engine’s running conditions as the combustion moves towards the pre-ignition limit, reducing fuel-ratio control activation.

The solution has the capacity to match ideal running conditions for the engine even in the toughest weather conditions and without oil activation.

First ME-GA gas trial

The announcement of the completion of sea trials by the first vessel equipped with a ME-GA-opti came a few days after the first vessel to be propelled by a MAN B&W MEGA engine completed its own sea and gas trials in Korea.

The MAN B&W engine was installed on an LNG carrier built by Hyundai Samho Heavy Industries (HSHI) for Norwegian shipping company, Knutsen OAS Shipping. The engine

In the adverse sea conditions that these vessels very often find themselves in, engines operate in far from ideal conditions. Prior to the development of ME-GA-opti, the engine would rely on oil operation to stabilise combustion in such rough weather.

Oil activation is a feature still found in the engine-control software, but its usage is expected to be significantly limited from now on, meeting charterers’ preference for maximised gas operation for LNG carriers.

itself was built by MAN licensee HHI-EMD.

Thomas S. Hansen, Head of Promotion and Customer Support, MAN Energy Solutions, said: “We have had more than 260 orders for the ME-GA since its launch in May 2021 and our orderbook contains ME-GA engine orders for ship deliveries stretching all the way into 2027. EGR as standard enables the ME-GA to significantly reduce emissions, while simultaneously improving fuel

8 An LNG carrier for Knutsen OAS Shipping has just successfully passed gas trials with a ME-GA engine (pictured)

fficiency and operation in both gas and fuel-oil operation.”

e

The Motorship notes that the volume of orders for the new MAN B&W ME-GA engine platform since MAN ES' latest addition was unveiled in March 2021 is testament to strong customer demand. It is significant that two of the first vessels to be powered by ME-GA engines were completed by major shipyards in Korea a few days apart.

8 | JULY/AUGUST 2023 For the latest news and analysis go to www.motorship.com

‘‘

The solution has the capacity to match ideal running conditions for the engine even in the toughest weather conditions and without oil activation

1st NH3-FUELLED X-DF-A ENGINE TO BE DELIVERED IN Q1 2025

WinGD has stated that it is on track to deliver the first X-DF-A dual fuel engine capable of operating on ammonia by Q1 2025, and expects the first vessel powered by X-DF-A engines to enter service by 2026

The company plans to begin engine tests on the unique, purpose built single-cylinder engine located at its Engine Research & Innovation Centre (ERIC) in Winterthur and a multi-cylinder test engine at WinGD’s Global Test Centre in Shanghai. The beginning of engine tests follows the successful conclusion of combustion tests at WinGD research facilities in December 2022.

WinGD notes that its Spray Combustion Chamber (SCC) at ERIC Winterthur has enabled the rapid development of 2-stroke combustion concepts and emission models. Since first ignition on the validation platform in 2022, the team has gained a wealth of insights into the combustion and emission characteristics which form the basis for a rapid deployment of the technology to the portfolio. WinGD can now provide accurate figures for ammonia consumption and relevant emissions.

Alongside the rapid development of WinGD’s X-DF-A engine platform, WinGD notes that commercial interest in its engines is also increasing, citing concrete orders for its engine concept.

WinGD has disclosed ammonia fuel technology developments involving two shipowners. Last month it signed an agreement with AET Tankers and sister company Akademi Laut Malaysia to develop crew training on ammonia engines. In January 2023 it announced a partnership with CMB.Tech, a sister company of Belgian shipowner CMB, to develop ammonia-fuelled engines for ten 210,000 DWT bulk carriers.

The developments are supported by strong collaborations with engine and ship builders in China, Japan and Korea, as well as by WinGD’s own extensive investment in research. Most recently, in June WinGD signed a memorandum of understanding with Mitsubishi Shipbuilding Co. Ltd to prepare X-DF-A for application across a range of vessel sizes and for integration with the engine builder’s ammonia fuel supply system. This follows a development project with Hyundai Heavy Industries initiated in June 2022.

WinGD CEO Dominik Schneiter said: “For the industry to be truly ready for alternative fuels, the engine concepts that use

Initial Engine Bore Targets

WinGD plans to extend the range of its methanol and ammonia engines to different bore sizes once the initial development of the alternative fuel engines is completed in 2025.

The expansion of the ammonia engine portfolio will likely be slower, focused on developing smaller bore engine following the development of the 52-bore engine, which would be the same as WinGD’s second test engine at Winterthur. “Once the

them – and the vessel designs, auxiliary systems, crew training and field support network - need to be ready before the fuels become widely available. Our development timeframe, as evidenced by these milestones in research and collaboration, shows that we are on track to give shipowners and operators the time they need to prepare for decarbonised ship power using ammonia as fuel.”

first research engine is running, you will also have the first commercial solution available,” Schneiter previously discussed with The Motorship in April 2023.

WinGD is also developing a second bore size for the ammonia engine, as part of a collaboration with CMB, the Belgian ship owner, on a series of ten ammonia-fuelled 210,000 dwt bulk carriers. The shop test of the first of the series 72-bore engines for the bulk carriers is expected to occur in mid 2025.

“Looking ahead, we will scale up from the 52-bore to the 72-bore following the same incremental approach that we used with LNG previously. It took us longer to scale up from 72 bore to 80 and 92 bore.” Schneiter emphasised that the engine designer was not planning to commit to the development of a 92 bore X-DF-A engine until it had gained operational experience from the 72-bore engine.

TWO-STROKE ENGINES For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 9

8 Dominik Schneiter, CEO of WinGD

Opinion: MEPC80 DEAL SENDS A CLEAR MESSAGE (about the IMO)

The agreement of a deal to achieve climate neutrality for global shipping by 2050 at the 80th meeting of the IMO’s Marine Environment Protection Committee (MEPC) marks a significant milestone for global shipping

The agreement also includes milestones for absolute reductions of greenhouse gas emissions from ships by 2030% in 2030 and 70-80% in 2040.

The agreement has agreed to begin a roadmap to develop a standard to define a green fuel, while the final shape of mid-term measures to improve the economics of operating on fuels with lower greenhouse gas emission (GHG) profiles have been delayed.

The agreement will have wide-ranging consequences for the shipping market, introducing a goal that at least 5% of fuels in global shipping should be green by 2030.

However, the agreement has fallen short of the maximalist objectives adopted by environmentalist activists and lobbyists, who note that no agreement was reached on absolute emission reduction targets for 2030 and 2040, and that the strategy also aims to reach only net-zero “by or around, i.e., close to 2050”, depending on “national circumstances”.

The phrasing of the latter objective appears to have been drafted with an eye on assuaging China’s concerns. China itself has a stated objective of achieving net zero by 2060.

Despite strenuous efforts, there was no agreement around introducing climate-science based emission reduction targets by 2030 and 2040. The discussions around introducing climate science based targets were dominated by entrenched differences between a group of states led by the Pacific Island states, the US, the UK, Canada and a smaller group of opponents led by China, Argentina and Brazil.

Limitations of the IMO

While the agreement has been criticised as lacking in ambition from environmentalist activists and lobbyists, it does represent a concrete step towards achieving full decarbonisation by 2050 for the IMO.

The delicate task of negotiating the agreement has been complicated by the intense international media attention focused on the IMO and its members.

The negotiating positions adopted by China and other member states were leaked to the media revealing concerns about the perceived introduction of mercantilist trade policies in Europe and North America. While European or American readers might not see any connection between President Biden’s IRA Act, or Europe’s moves to introduce a Carbon Border Adjustment Mechanism (CARB) regime (already subject to a formal complaint by India) and to de-risk supply chains with China, readers in East or southern Asia might have a different perspective.

National economic considerations also inevitably play a role. Exports of low value commodities such as soya, meat (and iron ore in Brazil’s case) to China and other Asian destinations occupy important roles in Brazil and Argentina’s export profiles.

Quite clearly, Brazil and Argentina, who were prominent opponents of 1.5°C-aligned action on shipping, fear the impact of higher transportation costs on key commodity

trades with East Asia, potentially exposing their exporters to competition from competitors located closer to China.

Political pressures

As I have previously noted, any fair-minded assessment of MEPC 80 must acknowledge that the delegates managed to reach an agreement that has given much needed certainty to the industry about the industry’s future direction of travel.

Shipowners will need to take into account the need to meet tighter GHG emission reduction targets when specifying fuel types for future newbuildings, and no less importantly, the decision has given fuel suppliers the confidence to develop projects to meet increases in future fuel demand.

However, the increasing politicisation of the decarbonisation debate in North America is likely to be reproduced in upcoming European elections in 2025. This is also affecting national governments, with both the Swedish and Finnish coalition governments now incorporating populist parties that explicitly oppose decarbonisation, and the issue contributing to the collapse of the Dutch government.

It is hard to avoid the conclusion that it is becoming harder and harder for the IMO to maintain its central role as the international forum for maritime regulation as conversations turn to subjects, such as decarbonisation, where many countries have vital strategic national interests at stake.

Reaching an agreement for the IMO to depoliticise the development of regulations should be a key objective for the organisation. This has wider implications for the organisation beyond climate change. We expect the looming introduction of semi-autonomous and autonomous systems at scale to require changes to IMO rules before the end of the decade. Student of English history will know the Luddites were an example of popular discontent towards the loss of skilled jobs during a previous economic downturn.

8 Reconciling the competing interests of hydrocarbon and hydrogen exporters (and importers) at the IMO will complicate decarbonisation negotiations once hydrogen production begins to ramp up towards the end of the decade

REGULATION 10 | JULY/AUGUST 2023 For the latest news and analysis go to www.motorship.com

Image: Courtesy of Government of Queensland

NEW ECA PROPOSALS TO BE SUBMITTED AT MEPC 81

Proposals to designate the Canadian Arctic, the North-East Atlantic Ocean and the remaining Norwegian coast not already covered by existing ECAs as Emissions Control Areas are likely to be submitted to the IMO’s next Maritime Environment Protection Committee meeting, MEPC 81

The ECAs could enter into force as soon as 2027, subject to approval within the IMO.

Canada and Norway confirmed plans to submit formal ECA proposals to the 81st session of the Marine Environment Protection Committee (MEPC 81), while work is underway on a North-East Atlantic Ocean ECA proposal which may also be ready for MEPC 81.

If these proposals are approved at MEPC 81, scheduled for April 2024, adoption could occur as soon as spring 2025. As MARPOL amendments enter into force 16 months after adoption, and ECAs take effect 12 months after entering into force, the ECA requirements could apply from as early as early 2027.

Canadian ECA

The intended Canadian Arctic ECA designation includes Canada’s Arctic waters and Arctic waters under Canada’s jurisdiction. The proposed Canadian Arctic ECA boundary begins near the Mackenzie River Delta in the Yukon and stretches to the northern tip of Newfoundland and Labrador. The eastern boundary meets the boundary of the existing North American ECA.

The proposal under development would cover both SOx and NOx and aim to reduce air pollution, including Black Carbon (BC).

North-East Atlantic ECA

The potential ECA in the North-East Atlantic would link the existing ECAs in the Baltic Sea, North Sea and English Channel with the upcoming Mediterranean ECA. The Mediterranean ECA, adopted at MEPC 79 in December 2022, will take effect on 1 May, 2025.

The proposal is expected to ensure consistent and uniform regulation across sea areas with high density traffic with a geographical scope covering parts of the North-East Atlantic Ocean, it said.

The new ECA proposals will need to be accompanied by analytical work to assess costs and benefit, in line with requirements and criteria set out in Appendix III of MARPOL Annex VI.

Depending on the outcome of this work, a joint coordinated proposal for the designation of an ECA in the North-East Atlantic Ocean could be submitted by the littoral States to MEPC 81.

Norwegian Plans

While the incoming Mediterranean ECA covers only SOx, Norway indicated that it intended to expand the existing ECA for both NOx and SOx currently established in the North Sea to cover the remainder of the Norwegian Sea.

The new North-East Atlantic ECA may also include the NOx element, meaning ships constructed on or after the date of adoption (or a later specified date) would also have to comply with NOx Tier III limits as specified in MARPOL Annex VI.

e-Bunker delivery notes confirmed as acceptable

The rules around bunker delivery notes have been amended to accept both paper and digital copies provided the requirements in MARPOL Annex VI are met.

It follows a proposal made to the 10th session of the sub-committee on Pollution Prevention and Response by the UK, International Association of Classification Societies and IBIA.

The 80th session of the Marine Environment Protection Committee (MEPC 80) approved the sub-committee’s interpretations and instructed the IMO

Secretariat to revise MEPC.1/Circ.795/Rev.7, for dissemination as MEPC.1/Circ.795/Rev.8

– Unified interpretations to Regulations 18.5 and 18.6 of MARPOL Annex VI.

The unified interpretation agreed is as follows: Applicability of the requirements for a bunker delivery note. Regulation 18

Fuel oil availability and quality

2 In the annex to circular MEPC.1/ Circ.795/Rev.7, it is proposed to add a new interpretation after paragraph 12.1 as follows:

“12.2 The Bunker Delivery Note (BDN)

8 Canada’s paper to MEPC 80 noted fuel consumption by all international and domestic ships transiting the Arctic increased by 116% between 2010 and 2019

required by regulation 18.5 is acceptable in either hard copy or electronic format provided it contains at least the information specified in appendix V to MARPOL Annex VI and is retained and made available on board in accordance with regulation 18.6.

In addition, an electronic BDN should be protected from edits, modifications or revisions and authentication be possible by a verification method such as a tracking number, watermark, date and time stamp, QR code, GPS coordinates or other verification methods.”

REGULATION For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 11

NEXT-GEN ENGINE CONTROL AT HEART OF MAN’s 49/60DF ENGINE

MAN Energy Solutions highlighted the development work that went into the 49/60DF engine at CIMAC 2023

MAN says the 49/60DF engine family’s automation system, SaCoS 5000, is prepared for the digital future and is a development that follows on from its cyber security, software-as-a-service and augmented reality support.

The SaCoS automation system was a design feature from the beginning. SaCoS 5000 builds on to existing functionality by adding the flexibility to adapt to different engines. It has higher and scalable CPU performance to handle increasingly sophisticated combustion control algorithms, and the hardware can be retrofitted to engines with SaCoSone automation.

A modular approach was taken to sensors and software, and the user interface is modernised. Cyber security is inherent in the design with control modules having the hardware to implement cryptographic protection. The IEC 62443 standard is met and functionality includes a newly developed data gateway to enable over-the-air software updates.

The system partitions the engine control from the engine room control automation to allow for individual optimisation such as high availability for the engine control. The engine room control system is used exclusively off-engine in the control cabinets and can be adapted to customer needs without the need for change in the core engine control and the subsequent re-testing this would otherwise require.

The high performance of the engine has been achieved through technology such as advanced two-stage turbocharging, Common Rail 2.2, three-point variable inlet valve timing, and Adaptive Combustion Control 2.0. The engine

also retains proven MAN technologies such as the gas-injection system, pilot-fuel-oil system and MAN SCR system.

MAN announced the launch of the 49/60DF at the 2022 SMM trade fair in Hamburg, and the engine is capable of running on LNG, diesel and HFO as well as a number of more sustainable fuels including biofuel blends and synthetic natural gas. The engine can operate and even start in gas mode where it complies with IMO Tier III without exhaust gas after-treatment. In diesel mode, it complies with Tier III when combined with MAN’s SCR system. The new engine is also methanol-ready.

Spark ignition optimisation for ammonia combustion

Mads Carsten Jespersen and a team of researchers from Technical University of Denmark (DTU) presented research into widening the operating limits of a sparkignited engine operating on pure ammonia and confirmed that combustion of 100% ammonia, pre-mixed with air but without an ignition improver is feasible.

While most previous studies have involved the addition of 5% hydrogen as an ignition improver for ammonia combustion, DTU researchers have shown that the safety and complexity challenges associated with this use of hydrogen can be avoided by optimising the spark ignition system.

Their research was undertaken on a single cylinder, spark ignition CFR engine and examined combustion system parameters given ammonia’s low auto-ignite and high latent heat properties. These properties enable a high compression ratio, and they found that using a high boost pressure

facilitates combustion quality and potentially increases power density.

The researchers achieved a combustion efficiency of over 95%, and the ammonia slip that occurred was believed to be the result of entrapment in crevices and ringpack. As ammonia has a much higher oxidation temperature than conventional hydrocarbon fuels, the trapped component did not post-oxidise as much as occurs with other fuels. The issue of crevices would be similar for all premixed ammonia engines regardless of ignition system, says Jespersen.

“The bowl configuration required for good diesel combustion in typical 4-stroke engines will be unsuited for premixed ammonia combustion because of the large squish volume that will be squeezed into the ring crevice.” This indicates that it would be difficult to develop an engine that performed well with diesel and ammonia, state the researchers.

Efficiency was relatively constant over a

range of tested intake pressures, indicating the potential to downsize the engine and minimise mechanical losses. The optimal air-fuel ratio was found to be 1.25. The researchers also found that advancing ignition time was an effective way of reducing this slip. While the ammonia slip does reduce, the NOx increases to a level corresponding to the ammonia. This this makes it possible to remove both the ammonia and NOx in a SCR catalyst. The researchers continue to investigate the influence of temperature and engine speed on the premixed ammonia fuel. “We are also investigating high pressure direct injection of ammonia,” says Jespersen. “We are still working on the injection system, but hope soon to inject into a constant volume combustion chamber. In another project, we are investigating the effect of mixing ammonia and DME for direct injection, and we are testing different pilot fuels and concepts.”

FOUR-STROKE ENGINES 12 | JULY/AUGUST 2023 For the latest news and analysis go to www.motorship.com

8 The MAN 49/60DF engine TAT was carried out at MAN ES’ Augsburg facility

YANMAR BEGINS DEVELOPMENT OF PURE GAS H2 ENGINE

Yanmar Power Technology has announced that it will begin development of a hydrogen-only, 4-stroke high-speed engine as part of the Nippon Foundation's “Technical Development Grant Program for Demonstration Experiments of Zero Emission Ships”

ofH2-fuelled

The engine will be designed for coastal vessels and developed as a propulsion (main) engine for small vessels. Yanmar will also develop a hybrid electric propulsion vessel compatible with the hydrogen engine by combining the hydrogen engine with a battery system.

A new vessel will be designed and equipped with a containerised hydrogen fuel engine and fuel supply system located on the upper deck. Ueno Transtech, part of the Ueno Group, will be responsible for the development and construction of the vessel.

Yanmar has already developed a pilot-ignited 6-cylinder hydrogen engine that uses biofuel as pilot fuel for ignition. Land demonstration tests will start in 2024, aiming for demonstration operation in 2026 and operation on the coastal vessel from around 2030.

Consortium members for the project include Yanmar, Ueno Transtech, Kyoto University, Fukuoka Shipbuilding, Mitsui E&S Shipbuilding and Mirai Shipbuilding.

Research vessel features Yanmar hybrid first

The newly-operational research vessel Geologen features a first for Yanmar – IMO Tier III engines in combination with a controllable pitch propeller and an electric motor PTI mounted on the gearbox.

The vessel was commissioned by the Geological Survey of Norway and built by Finnish boatbuilder, Kewatec Aluboat. The propulsion system was designed for low noise and vibration due to the scientific instruments onboard. The propeller tunnel design integrated in the hull is also unique to the vessel.

The drive train comprises two 670kW Yanmar 6AYEMGTWS marine diesel engines and a combined 200kW of

electric motors, propelling the vessel at a top speed of 20 knots. In electric-only mode, Geologen can cruise at five knots for up to four hours. The vessel uses the diesel system for transit to and from research sites, switching to electric drive during research operations to minimise vibration for more accurate survey work.

“We chose Yanmar because the company has such a good reputation, and we know these units have low vibrations, low emissions and the ability to deliver a complete IMO Tier III package,” says Gisle Johnsen, General Manager of Martec AS, Kewatec Aluboats Norwegian subsidiary. “This is a hybrid system of course, which does present challenges. For example, batteries are heavy which can affect fuel consumption in diesel-only mode, and the fire protection regulations mean we have to have a cooling system in place for the batteries. However, we consider this ship a great success, and we’re having a lot of interest in hybrid systems from our government clientele.”

FOUR-STROKE ENGINES For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 13

6-cylinder engine with pilot ignition

Yanmar Geologen research vessel. Inset: Rendering

8 The Geologen features Yanmar 6AYEM-GTWS marine diesel engines and a combined 200kW of electric motors

WÄRTSILÄ ADVANCES TESTING OF NEW COMBUSTION CONCEPT

Wärtsilä has put a considerable R&D effort in developing the next generation of its dual-fuel lean burn gas engine, with about 300 hours testing completed

The SeaTech project has involved the development of a set of engine technologies which enable a novel combustion concept that leads to a drastic reduction of CH4 and NOx emissions. Wärtsilä says its new technology results in an overall CO2 equivalent improvement of 10% compared to the best products currently on the market.

The development work started in 2017 on the W6L20CR 2sTC research engine and the initial promising results drove the decision to scale up the technology to medium bore. The proposal was included in the SeaTech project which set the aim of combining bow-mounted foils with new, sophisticated control systems for a Wärtsilä dual-fuel 31 engine to allow the engine to work in tandem optimally with the foils. Since June 2022, activities have been ramped up on three platforms including on the W10V31DF lab prototype for the full-scale validation.

During this process it was also decided to pilot the concept on the Aurora Botnia RoPax vessel, upgrading one of its four W8V31DF engines with the new technology package. The retrofit work took place in September 2022 and by end of the year the engine accumulated about 300 hours in gas mode. The first field measurements fully confirm the expectations from the R&D laboratory results showing the step change in the performance level of this novel concept, says Wärtsilä.

decided to lean on nearly 30 years of industry-leading experience with the GD technology. The base for the first newbuild implementation was the Wärtsilä 32 platform with an updated version of the GD system adapted for methanol use.

The main advancement to older designs includes an uprated injector to allow for a significant increase in injection pressure up to 600 bar as well as a re-designed accumulator and flow fuse system to ensure reliable and safe operation at high pressures. Special stand-alone pump units were designed to make the installation of the methanol equipment flexible and not be limited by the space available in the engine room.

Key benefits of this higher injection pressure are that it ensures the highest level of fuel efficiency and supports in achieving a good emissions profile for methanol combustion.

The newly developed combustion technology goes beyond just the LNG applications. The enhanced hardware flexibility of the fuel injection and valve train systems, combined with the advanced combustion closed-loop controls, will serve as a solid platform for building effective performance concepts largely based on hydrogen and ammonia in the future. Early laboratory tests indicate this potential.

Wärtsilä targets high injection pressure for methanol

Methanol has already proven to have the potential to become one of the key solutions for the marine industry to reach net carbon neutrality, and Wärtsilä has multiple newbuild and retrofit solutions available already.

Wärtsilä 32M has proven itself as a diesel engine for years and is now in deliveries for greener operation with methanol enabled by a robust gas diesel (GD) fuel system, says Wärtsilä.

When the demand in the marine market started to increase for a fast-to-market, reliable and efficient solution, Wärtsilä

In June 2023, Wärtsilä was contracted by Swedish ferry operator Stena Line to convert some of its vessels to operate with methanol fuel. The conversions will include the fuel supply system and engine modifications, as well as integrating the new installations with the ships’ existing systems.

The full scope of Wärtsilä’s supply package will include fuel tank instrumentation and valves, transfer pumps, low pressure pump skid, fuel valve trains, Methanol Fuel Pump Units and the automation of the system, engine conversions, and automation upgrade for the engine control room. The conversions are scheduled to take place in 2025.

On the newbuilding front, Wärtsilä will supply its hybrid propulsion system for four new heavy lift vessels being built at the Wuhu Shipyard for SAL Heavy Lift. Wärtsilä’s hybrid system will feature a variable-speed Wärtsilä 32 main engine capable of operating with methanol fuel. The hybrid system also includes energy storage, a PTO/PTI generator and motor, a multidrive converter, and the Wärtsilä Energy Management System for controlling and optimising the hybrid operations. The ships are scheduled for delivery in 2025.

FOUR-STROKE ENGINES 14 | JULY/AUGUST 2023For the latest news and analysis go to www.motorship.com

8 Wärtsilä methanol engine

‘‘

Methanol has already proven to have the potential to become one of the key solutions for the marine industry to reach net carbon neutrality, and Wärtsilä has multiple newbuild and retrofit solutions available already

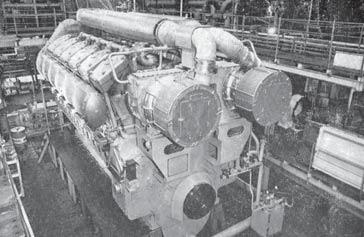

HANSHIN GAS ENGINE THERMAL EFFICIENCY EXCEEDS DIESEL

A team from Hanshin Diesel led by Satoru Higashikawa presented results at CIMAC 2023 demonstrating the thermal efficiency of the company’s low speed 4-stroke gas engine

Hanshin Diesel’s low speed 4-stroke engines are designed to provide power for main propulsion use, and they complete one cycle (intake, compression, combustion, and exhaust) for two crankshaft revolutions or four piston strokes.

Although larger in external dimension than medium or high speed engines, the low speed engine is easy to handle and reliable, says Hanshin Diesel, and the trend towards high efficiency propellers has enabled the advantages of having a longer stroke. And unlike medium speed engines, there is generally no need for a gearbox.

According to Hanshin Diesel, high thermal efficiency is achieved by the lower revolution speed which provides a sufficient combustion period, and the longer stroke which provides a larger combustion space. The engine has a low running cost which counters the higher initial CAPEX.

The six cylinder Hanshin Gas Engine G30 was completed in 2018, and the CIMAC presenters compared in-cylinder performance between it and the existing diesel engine. Maximum firing pressure is same but the gas engine has lower compressive pressure and earlier firing time. As the maximum temperature in cylinder of the gas engine is higher, they conclude that the thermal efficiency of the gas engine is greater.

Gas is pre-mixed with intake air and enters the combustion chamber through a gas injector nozzle. Ignition in the prechamber results from two spark plugs. A pressure sensor in each cylinder enables control of the ignition timing to avoid knocking.

“The most prominent feature of Hanshin Gas Engine is the stability,” says Satoru. “It has two plugs in one cylinder which supports redundancy. Other features are strong torch from prechamber and moderate swirl that assists flame propagation. Thanks to these, it has stable combustion from low load to high load. The engine can be loaded up solely by gas without misfire even from no load.”

Engine is the stability

Testing of the Hanshin Gas Engine G30 was done with the fuel gas whose methane number is about 66. Stable combustion was achieved under very lean conditions, and a thermal efficiency of 48.5% was achieved, which corresponds to the fuel consumption 151g/kWh with the assumption of fuel being 49200 kJ/kg.

The gas engine has the same size, configuration and shafting system as the original low speed diesel engine and can replace existing installations. Output and speed are also within the same layout range. Further tests have been carried out to improve the transient response of the gas engine to ensure easy operation during ship manoeuvring.

Hanshin Diesel plans to expand the engine lineup and is using the experience gained from the development of the gas engine to investigate future fuel solutions.

FOUR-STROKE ENGINES For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 15

8 Hanshin Diesel presented the results of in-cylinder performance tests on the G30 gas engine at CIMAC 2023

‘‘

The most prominent feature of Hanshin Gas

ABC DESIGN ADVANCE FOR EVOLVE ENGINE PLATFORM

A team from Anglo Belgian Corporation (ABC) worked together to ensure that, from the outset, the Evolve engine platform maximised modularity and commonality of parts and design

rporation

to ensure that, from the outset, aximised and of parts and

in

he transition d uding diesel, NG and CNG. stianen, R&D d behind the

ABC introduced the multifuel Evolve engine platform in November 2021. It is designed to facilitate the transition from conventional fuel to future fuel types including diesel, biodiesel, MDO, HFO, hydrogen, methanol, LNG and CNG. Speaking at CIMAC 2023 in Busan, Koen Christianen, R&D Manager at ABC, described what was achieved behind the panels that give the engine its modern look.

fficient, t also had to tions ranking go g als s of operation,

“Our new engine family had to be fuel flexible, fuel e and reduce harmful emissions to zero impact. It also had to be competitive in a broad number of applications ranking from 800kW to 8,000kW,” said Christianen. Key goals included ensuring high power density, simplicity of operation, durability and serviceability.

to simulate lso enableled of a range of ent commoon n c with a re duall-fuel fueel injection

FEV’s virtual engine software was used to simulate components and the entire engine. This also enabled vibration behaviour analysis and the testing of a range of options to reduce overall weight.

The engine platform features a highly efficient common rail system, variable valve timing and Miller cycle, with a micro pilot fuel injection system for future dual-fuel functionality or a mechanical pump-line-nozzle fuel injection system for liquid fuels.

The versatile cylinder head design makes it easy to convert from liquified fuel to other fuel types and makes for easy maintenance. The cylinder heads are adaptable to multi-fuel and different firing solutions, so the platform does not call for a commitment to any single fuel, enabling use of, or ready adaptation to, liquid fuel injection, dual-fuel and spark-ignited systems, such that the operational scope encompasses diesel, biodiesel, MDO, HFO, hydrogen, methanol, LNG, and CNG.

Evolve currently includes a 4-cylinder inline configuration and a 20-cylinder Vee configuration. Additionally, a full range of engine configurations will be launched gradually, filling the gap between these two options. While the V’s intake manifold segments are only common to the V-engines, the complete power unit (cylinder head with valvetrain, water jacket, liner, conrod, piston, intake and exhaust elbows) can be installed on all cylinder configurations. An important benefit for owners having both inline and V-engines.

The complete cylinder unit can be installed or removed to reduce assembly and overhaul time. All that needs to be done is unscrew the cylinder head studs and conrod bolts, and ABC claims a 20% reduction in overhaul time as a result.

“One major feature of modularity is the use of the same cylinder unit for all engine variants of the complete family,” says Christianen. “Within exactly the same cylinder head, a common rail or mechanical injector can be installed for diesel mode, a micro pilot injector can be added for dual fuel mode together with port injection, or the main injector can be swapped with a prechamber for spark ignited operation with prechamber. Thanks to this philosophy, virtually every future fuel can be used in the engine, even the ones we don’t know yet.”

The V-engine variants have a valve train driven by two outboard located camshafts; the inline engines have just one.

The modul d ar desesign means

are

o bot bo h withthe erent n cylylinder distance coveredbybearing ng

The modular design means that segments are common to both, with the different cylinder distance covered by bearing journals of different lengths. The engine types feature the same gears in their gear two trains (one for camshaft and high pressure fuel and one for oil and water pumps).

The two camshaft versions cover all combinations of common rail and mechanical injection, 720 to 1200rpm nominal speed, diesel, dual fuel and spark ignited version, says Christianen. Additionally, all versions can have 2-stage or 1-stage turbochargers. Both 1-stage and 2-stage turbochargers are possible on the same engine, and they can equally be installed at the front or rear of the engine, to facilitate integration.

The proprietary exhaust aftertreatment system provides for emission compliance for IMO Tier III, EU Stage V and EPA Tier 4. Modular components include a diesel particulate filter and selective catalytic reduction (SCR) unit with an integrated mixing pipe. Christianen says the aim was to minimise the space and cost of the system.

The first engine released as part of the EVOLVE range was the 4-cylinder 4EL23. Most recently, ABC announced the 20EV23 in December 2022, a 20-cylinder engine with an output range up to 7,200kW.

022, a an kW.

will with applications

C DZC xisting DZ

As the Evolve platform will overlap with many applications that have used the ABC DZC engine range, ABC has ensured that existing DZ engines can be retrofitted with the new Evolve engine without changes to the foundation.

to the foundation. of over the three at vides customers hoices

Koen Christianen: Evolve engine platform achieves commonality from four to 20 cylinders"

The modularity and commonality of components achieved over the three years of development that has gone into the Evolve platform provides customers with flexibility in fuel choices and quick retrofit/upgrade options when needed throughout the life of the engine, says Christianen.

ns when needed he

FOUR-STROKE ENGINES

16 | JULY/AUGUST 2023For the latest news and analysis go to www.motorship.com

t that segments ts

commont n to

8 Evolve-DF - the dual fuel cylinder head injection system

1MW SCALE SWRI TESTS REVEAL POSITIVE H2 RESULTS

Researchers from Texas-based Southwest Research Institute studied the effects of introducing hydrogen on a diesel engine that had not been optimised for its use and found no short-term noticeable change in engine operation

Christopher Stoos, Lead Engineer at the Locomotive Technology Center, Southwest Research Institute, presented the results of the testing of hydrogen fuel on a US EPA Tier 2 Caterpillar 3512 mine haul engine at CIMAC 2023. His research team found that, without optimising the control system or adjusting the diesel injection timing, the engine was able to use hydrogen as a supplemental fuel without noticeable change to engine operation.

Most hydrogen studies to date have been done on small engines or single cylinder test engines. This study differed as it was done at a 1MW scale. The particular CAT 3512 engine tested was not a marine engine, but the 3500 series engine is in service as a marine propulsion engine and a power generation engine in marine applications globally.

Fuel substitution ratios were made at 5%, 10%, 15%, 20%, 25% and 30% hydrogen, and all testing was done at steady state. The results showed that using supplemental hydrogen is possible on a heavy-duty offroad scale with very limited modifications to the existing engine. The work also gave insight into the changes of criteria pollutants and the greenhouse gas emissions reduction potential that hydrogen holds.

As hydrogen concentration increased, hydrocarbons, CO, CO2, NO, and particulate matter levels in the exhaust gas decreased. For hydrocarbons and CO, an initial increase in emissions was evident when the hydrogen was first introduced but this gradually decreased as the substitution ratio was increased. At 20% hydrogen, hydrocarbon emissions dropped below the diesel baseline.

higher engine out NO2 was demonstrated) and the unburned hydrogen in the exhaust.

The engine ran and responded as it would have on 100% diesel fuel, and no knocking was detected. The researchers conclude that short term use of the percentages of hydrogen tested presents few issues. For longer-term use, losses in engine energy efficiency could be overcome with intake and exhaust valve timing adjustments or timed port injection of the hydrogen, but engine optimisation would require significant effort, even at low hydrogen levels.

Southwest Research Institute, headquartered in San Antonio, Texas, is one of the oldest and largest independent, nonprofit, applied research and development organizations in the United States.

8

3512 engine revealed the engine was able to use hydrogen as a supplemental fuel without noticeable change to engine operation

NOx emissions overall remained relatively stable. NOx is formed at high temperatures during combustion from the nitrogen and oxygen in the air, so while supplemental hydrogen will reduce a lot of the criteria emissions that come from Diesel combustion, it doesn’t necessarily work with NOx.

The engine tested did not have Exhaust Gas Recirculation (EGR) or Selective Catalytic Reduction (SCR) to control NOx emissions, but the researchers believe this equipment could potentially benefit from the shift in NOx composition (a much

8 Southwest Research Institute launched an industry program to develop and build a unique hydrogen combustion engine demonstration vehicle in November 2022. The joint industry project will use current technology to create a “zeroemissions” heavyduty vehicle

FOUR-STROKE ENGINES For the latest news and analysis go to www.motorship.com JULY/AUGUST 2023 | 17

Combustion tests on a Caterpillar

‘‘

NOx emissions overall remained relatively stable. NOx is formed at high temperatures during combustion from the nitrogen and oxygen in the air, so while supplemental hydrogen will reduce a lot of the criteria emissions that come from Diesel combustion, it doesn’t necessarily work with NOx

Credit: Southwest Research Institute

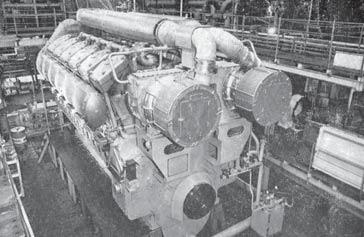

APPLIANCE OF DATA SCIENCE TO NEW PBST RADIAL TURBO

Researchers from MAN Energy Solutions explained the numerical simulation work behind the design of the new PBST TCP turbochargers at CIMAC 2023

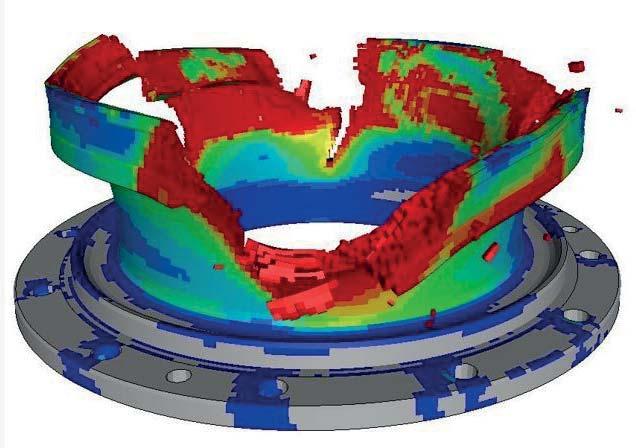

From first concepts to detailed design, testing and validation the tools help create a new radial turbocharger generation that pushes the limits towards single stage pressure ratios far above 6 and achieves best-in-class specific mass flow rates.

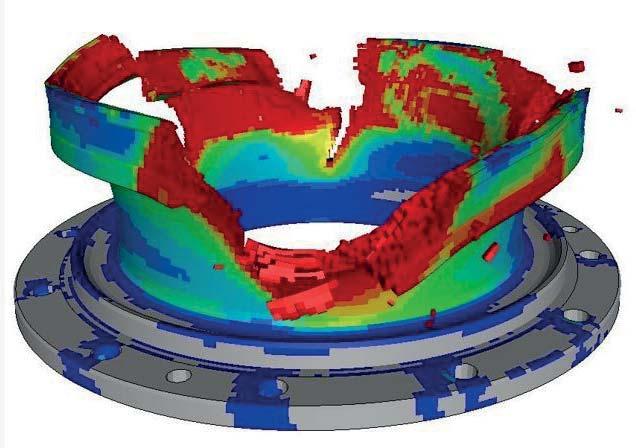

In PBST’s latest turbocharger containment test, the company’s specialists deliberately accelerated a brand new PBST TCP16 turbine outside of its safe operating zone until centrifugal forces ripped it to pieces. The turbine essentially disintegrated, but the high energy fragments were safely contained in the turbocharger housing. In the case of the TCP16, this means that burst protection can be implemented in the casings and no external cover is needed, which offers significant advantages in terms of installation space.

Dr. Mark Michael, one of the simulation specialists in the turbocharger engineering containment team based in Augsburg, noted that the turbine performed exactly as the numerical models predicted. “We can validate our simulation models via testing to make holistic observations about containment behaviour in different situations,” he said.

At CIMAC 2023, some of the simulation specialists discussed the numerical modelling behind tests such as this as well as the modelling of other key components of the series’ design.

TCP design

TCP (pressure) turbochargers are radial turbochargers suitable for high-speed and medium-speed engines and are designed with both conventional and future fuels in mind. PBST says they offer 1-stage efficiency levels > 70% and a reduction of rotor moment of inertia of 25% which results in a significant improvement in dynamic behaviour. The aim is to enable significantly higher engine power while maintaining engine size and weight.

Assessing the containment was particularly important due to the increased speed, newly developed rotor parts and casing design of the TCP series. Material properties were evaluated statistically and accounted for variation expected within the volume of individual parts. Impact areas from blade fragments led to optimization for specific load cases – even though such a catastrophic burst is extremely unlikely in practice.

A design loop using 3D FEM analysis led to a casing design with the structural integrity needed to counter thermomechanical fatigue and creep deformation at constant high temperature loading.

The compressor stage was developed from scratch to accommodate the targeted compressor pressure ratios. Again, numerical modelling played a key role - optimising flow and efficiency early in the design process. An early prototype was tested on a component test rig to ensure the modelling was on-track before the full design was developed. 3D CFD simulation was used in combination with verification tests to finalise the design.

The compressor wheel geometry was optimised for static

safety, low cycle fatigue and creep. The higher pressure ratios and circumferential speeds reached with the new design meant that fresh consideration had to be given to heat generation in the fluid cavity between the compressor wheel and other non-rotating parts.

The cooling system for the compressor backside cavity was developed using numerical modelling tools, including CFD. Even with the higher pressure ratios and speeds, the exchange intervals achieved were higher than those of PBST’s current TCR turbocharger series. The resulting channel design also ensured easy installation on the engine and is capable of managing the temperature of the bearing case, flange connections and the oil and sealing system.

CFD was used to maximise the aerodynamic performance of the turbine stage by optimising the blade speed ratio with the new compressor wheel. The result was a relatively small nozzle ring cross section compared to the turbine throat area. High cycle fatigue was a key design consideration, and every resonance crossing relating to stator excitation mechanisms was simulated and modelled. High rotor speeds, and therefore increased loading of the turbine wheel, led to static and dynamic load modelling as part of the development of the turbine geometry.

TCF design

TCF (flow) turbochargers are high performance solutions aimed at 2-stroke low-speed engines or for two-stage turbocharging on 4-stroke engines. With the introduction of the TCF, PBST’s ECOCHARGE (two-stage turbocharging) can achieve efficiency levels of up to 70%.

The compressor pressure ratio is relatively low, up to 5.0 (continuous operation), so the design effort was focused on achieving the highest specific flows to ensure optimal

TURBOCHARGERS 18 | JULY/AUGUST 2023 For the latest news and analysis go to www.motorship.com

8 Testing of the first TCP16 prototype has been underway since mid-2022

8 Physical tests validated the results of physical simulation models, allowing PBST researchers to make holistic observations about containment behaviour in different situations

dynamic response for a wide compressor map in a system suitable for the highly-compact ECOCHARGE units.

The high specific flow required meant the turbine stage development was independent from that done for the TCP turbine. CFD and FEM analysis balanced the aerodynamic, thermodynamic and mechanical constraints of casing weight and turbine efficiency to achieve a low solidity rotor concept. The design was optimised for greatest efficiency at medium and lower turbine pressure ratios, reflecting the TCF target applications.

High cycle fatigue

The rotating components of the TCP/TCF turbochargers operate at their mechanical and aerodynamic limits, and advanced numerical methods have played a role in pushing these limits by enabling a multi-disciplinary approach to the analysis of fluid structure interactions and their impact on high cycle fatigue. Early design work involved fully 3D solvers with moving meshes to simulate aerodynamic and structural mechanics for damping, excitation, and modal behaviour. This enabled highly accurate predictions of compressor and turbine blade amplitudes especially given that aerodynamic behaviour is non-linear.

It is important to have a valid temperature field, and this was defined using conjugate-heat-transfer calculations involving simulation of the fluid and structural parts. Cavity and cooling features can influence the elasticity and resonance speed, so these characteristics were included in the modelling.

Early prototypes were used to validate the calculations and modelling that went into the early design process. Digital twins of some components were also used to develop the required level of model and simulation accuracy. Ensuring a design suitable for series production also involved implementation of improvements for robustness based on choices between multiple variant designs that had similar thermodynamic, aerodynamic and structural features. This lead to the definition of the final geometry and the development of an appropriate test program.

The researchers conclude that making use of the validated models meant that unwanted loops late in the project were avoided. “There is a clear need for this huge high cycle fatigue evaluation effort, as modern turbocharger impellers are extremely highly loaded, while nevertheless a safe operation of the series product has to be guaranteed.”

Frame sizes

The TCP and TCF turbocharger series both consist of seven frame sizes, including the introduction of a new TCP/ TCF 19 size. The modular design of the turbochargers ensures that compressor and turbine sizings are suitable for various engine needs.

All TCP frame sizes can be operated at pressure ratios clearly about 6, says PBST, tending towards 6.6 for larger frame sizes. The wide TCP compressor map achieved means that, in comparison to the TCR-42, the charge air pressure can be increased by over 1 bar.

According to the PBST researchers, the TCP is a compact single-stage turbocharger series with a pressure ratio and efficiency level far beyond current single-stage turbochargers. It is a well-balanced compromise between operating cost, compactness and CAPEX.