5 minute read

OWNERS CAUTIOUS DESPITE RECENT FALL IN LNG PRICE

The volatility of LNG prices since the outbreak of the conflict in Ukraine means that sophisticated ship owners and operators are reassessing price indices the company has 12 23,660 teu container ships on order that will be delivered within the next two years.

If a week is a long time in politics, as a British prime minister famously said in the 1960s, the past year has seen the complete transformation of Europe’s energy imports. The volatility in energy markets following the Russian invasion of Ukraine has also affected the price of LNG.

For ship owners whose vessels use LNG as fuel, the recent rise in methane prices has meant tough decisions. Many operators were forced to revert to using MGO in their dualfuel engines.

More recently, the price of LNG has fallen back, but many companies have remained understandably wary about whether the recent fall means that the crisis is over.

“LNG is more attractive now of course as it reaches MGO parity, I am wary of declaring that we are ‘out of the woods’ as I do not believe that sufficient alternative supply has been achieved to replace the Russian molecules,” said Daniel Gent, Energy & Sustainability Manager at the short sea car carrier operator UECC in Norway. The company has recently introduced three dual fuel battery hybrid vessels with a capacity of 3,600 ceu each.

“The low prices are in part because of increased supply but largely down to demand collapse. While the short-term outlook remains unclear, over the longer term I think the investment case for LNG is still sound. What we are seeing now is the birth of a new era in terms of LNG supply in Europe and one that probably comes with lower geopolitical risk,” he continued.

Brussels Express has continued to use LNG on its route between East Asia and Europe, Haupt said, despite the recent turmoil on the market for the fuel. He said that the current expectations are that the newbuildings will also use LNG as they gradually enter service.

However, Gant sees a possibility that the price of LNG could stabilise at an attractive level in the future. “If the US can start exporting in the order of magnitude that we have talked about for years, then I see no reason that competitive LNG prices could not be here to stay,” he concluded.

Forecasting Price Development Is Difficult

Nils Haupt, Head of Corporate Communications at HapagLloyd Container Line told The Motorship that the Hamburg based deep sea container shipping operator has recently taken delivery of the 15,000 teu Brussels Express. In addition,

When LNG started to make inroads as marine fuel, some commentators said that its price would not be as volatile as that of oil, which would add to the attractiveness of the fuel. However, Haupt is careful not to jump into far-reaching conclusions about the recent developments on the market. He noted that theoretically these events have reduced the attractiveness of LNG as a fuel, but added that it would be necessary to see how its price would develop in the future before any significant conclusions could be made.

Northern Insights

Mathias Sundberg, Technical Manager at the Finnish ferry company Viking Line said that the price of LNG had started to climb already in the autumn of 2021, i.e. before the Russian attack on Ukraine, as debate emerged about whether or not the Nord Stream 2 pipeline from Russia to Germany should be commissioned. “Following the (Russian) invasion on

Ukraine and subsequent events have made the LNG market extremely volatile and hard to predict,” he told The Motorship

Two of the five vessels that the company operates are fitted with dual fuel engines, the 57,655 gross ton Viking Grace and the 65,211 gross ton Viking Glory that both serve on the 10 hour crossing between Turku in Finland, Mariehamn on the Aland Islands and the Swedish capital of Stockholm. They make two crossings each day.

Both of these vessels currently use LNG, Sandberg pointed out. However, in the autumn both ships used low sulphur MGO as the price of LNG was triple of that of the oil fuel, Johanna Boijer-Svahnstrom, Corporate Communications Head at the company said in October.

Forward pricing curves indicate that the price of LNG would start to rise again over the next six months, Sandberg continued, adding that the demand should increase again after the winter as European gas storage facilities would need to be refilled again. However, forecasting the future development of the price is difficult, he concluded.

Chief Captain and Head of Ship Management, Captain Tarvi-Carlos Tuulik at the Estonian ferry company Tallink said the company was ready to use LNG on its vessels again, once the needs for gas from industry and domestic households have been met and are covered. “We also want to make sure that the natural gas that we use does not originate from an aggressor state,” he told The Motorship

The company has two dual fuel powered ships in its fleet, the 2017 built MegaStar of 49,134 gross tons and the 50,622 gross ton MyStar that entered service at the end of last year. Both vessels serve the short crossing between the Estonian and Finnish capitals and have an unusually high service speed of 27 knots.

Tuulik said that when Tallink had first started using LNG on its vessels, it was possible to make agreements regarding the price of gas according to various pricing models. “We had high expectations for the TTF pricing model, but unfortunately the latest gas price fluctuations have shown that we need to also consider alternative gas pricing models and that’s what we are already doing right now. Our goal is to achieve security of LNG supply and a controllable price fluctuation,” he concluded.

Eu Should Extend Lower Lng Consumption Commitment

Bruegel, the Brussels based economic think tank, said in a report on 2 February that the European Union had so far weathered the energy crisis brought on by Russia’s invasion of Ukraine in February 2022 and that it would manage winter 2022/23 even if Russia abruptly halted all pipeline gas flows. “However, preparations must be made for winter 2023-24. In particular, gas storage facilities should be 90 percent full by 1 October 2023,” it said in the report.

LNG price pressures

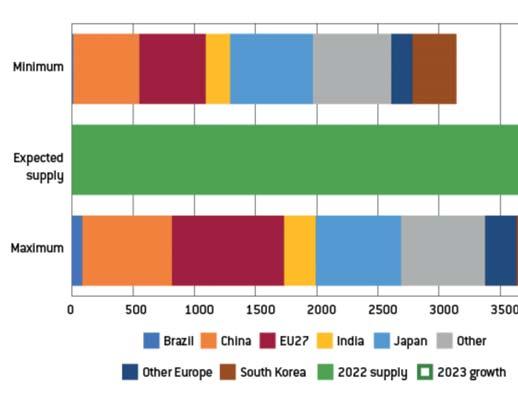

Shell’s LNG Outlook 2023 described why LNG prices rose sharply in 2022, as European countries increased imports of LNG by 60% year on year in 2022 to 121 million tonnes of LNG in 2022. Looking forward, the report expects European importers to become an important source of demand for LNG, while potential competition with Asia for limited new supply may see renewed price pressures in 2023.

“We assess the demand reduction needed if the 90 percent storage target is to be achieved. Our assessment takes into account EU imports, exports to refill gas storage facilities in Ukraine and Moldova, the weather and the situation in power markets, where gas demand is highly dependent on non-gas energy sources,” Bruegel said.

“Assuming limited Russian exports continue, and weather conditions are typical, demand up to 1 October 2023 must remain 13% lower than the previous five-year average. The EU should therefore extend its demand-reduction target, which is currently set to expire on 31 March 2023,” the think tank commented.

8 Global LNG, range of expected demand vs expected supply, 2023, TWh

Many market participants monitor futures settled against the Title Transfer Facility (TTF) in the Netherlands, which is the EU's most commonly used gas price benchmark for the settlement of gas contracts. The liquidity of the index facilitates the use of hedging instruments.

Some physically-based assessments of LNG bunker prices remain in the market. SEA\LNG, the trade body representing LNG suppliers, publishes monthly averages of S&P Platts Global daily assessments of LNG bunker prices for LNG stems delivered at the ports of Rotterdam and Singapore.

The average monthly premium for LNG bunkers on a marine LSFO equivalent basis over fuel oil bunkers has narrowed since peaking in September 2022, but remained close to the pre-Ukraine war high reached in September 2021.