X-DFA on track: WinGD’s Schneiter De-rating boxship: Wärtsilä Fit4Power

Modular LH2: Viking PEM FC project

4-stroke special: DF retrofit solutions

ALSO IN THIS ISSUE: MAN dual-fuel analysis | EU SRR consultation | Hydrogen FC special | Corvus PEM FC

MAY 2023 Vol. 104 Issue 1213 AN APPROACH TO GREEN SHIPPING CORRIDOR MODELING AND OPTIMIZATION www.eagle.org/GSCOutlook

Download your copy today

FEATURES 6

14 NH3 study for Angelicoussis

An Angelicoussis Group affiliate is conducting a joint study agreement (JSA) with Chevron into the transportation of ammonia in tankers.

16 MAN B&W ME-LGIM FAT

MAN Energy Solutions completed FAT tests for its first 95-bore ME-LGIM engine in March at HHI-EMD’s facility in Ulsan, South Korea.

60 Turkish Takeaway

The shipbuilding contracts for Torghattan Nord’s hydrogen-fuelled vessels are close to being awarded to a Turkish yard.

60 REGULARS

11 Leader Briefing Brett Hillis of Smith Reed explains how the extension of the EU’s Emissions Trading System (ETS) to shipping could create additional compliance risks for shipping companies.

13

Regulation

Will a consultation on revisions to the EU’s Ship Recycling Regulation accept more Asian yards or will the Commission cave in to circularity pressures to increase domestic EU scrapping?

60

Ship Description

Torghatten Nord’s 6.4MW PEM fuel cell powered double enders will herald the dawn of shipping’s zeroemissions era when they enter service in late 2025.

12 Its An Ill Wind

An April deal between Norway, the UK and seven EU states to lift offshore wind capacity in the North Sea to ‘at least’ 120GW by 2030 leaves questions about shipbuilding and recycling unanswered.

22 Four Stroke Advances

The latest developments in engine efficiency are being applied to the new generation of multi-fuel 4-stroke engines.

26 Engine de-rating solutions

Wärtsilä has developed a radical de-rating solution for customers operating larger container vessels that offers substantial reductions in fuel consumption and greenhouse gas emissions.

28 Laughing gas no more

WinGD’s programme to develop dual-fuel two-stroke engines capable of operating on ammonia and methanol is advancing apace, Dominik Schneiter, WinGD’s Vice President R&D, tells The Motorship

34 Ammonia bloom

MAN Energy Solutions expects ammonia (NH3) to surpass LNG and methanol as the dominant dual-fuel engine type before the end of the decade, according to forecasts seen by The Motorship

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

Social Media Linkedin Facebook Twitter YouTube Online motorship.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREE at: www.motorship.com/enews For the latest news and analysis go to www.motorship.com MAY 2023 | 3 CONTENTS MAY 2023 NEWS

12

26 44TH

VIEWPOINT

NICK EDSTROM | Editor nedstrom@motorship.com

Declaring An Interest

Since the April issue of The Motorship went to press, there has been no let up in the relentless pace of regulatory developments in the shipping sector.

The June meeting of the IMO’s MEPC committee looks set to be highly significant, with a number of market participants confidently expecting the IMO to raise its 2050 decarbonisation objective from 50% to full decarbonisation.

This is likely to be a somewhat easier decision for the IMO to make than more politically challenging decisions around the introduction of a potential global carbon levy, or a cap and trade scheme.

However, the extension of the EU’s Emissions Trading System (ETS) to shipping, which was finally approved by the European Parliament in mid April, will force many of the world’s largest operators to introduce systems to report and verify environmental emissions, as we hear in this month’s issue.

We would urge small and medium sized owners and operators who have not yet ensured that their existing DRS emissions reporting processes will be compliant when the new ETS reporting requirements come into force to do so as a matter of urgency.

Returning to the impact of higher environmental targets, it is uncontroversial to expect every higher environmental standards to impact newbuilding designs over the course of the current decade. Such expectations underpin the development strategies of developers like Corvus Energy, who openly admit that tighter environmental regulation is likely to be a key driver of the introduction of innovative technologies, such as fuel cells.

Even if higher decarbonisation targets are not agreed at MEPC80, or if those changes are ‘backloaded’ with the steepest reductions in emissions expected after 2033, many ship owners will need to improve the environmental profile of their existing tonnage.

It is no coincidence that the number of retrofit solutions to convert existing engines to operate on alternative fuels, or perhaps simply to improve their emissions profile until the early to mid 2030, are entering the market in increasing numbers.

As Nanda Sangram of Wartsila 2-stroke explains in an exclusive interview with The Motorship in this month’s issue, technological choices when commissioning retrofits are likely to be influenced by the remaining operational life of an asset.

More changes loom

However, such calculations are likely to be complicated by the emergence of tighter end-of-life regulations. The Motorship understands that the European Commission is considering introducing tighter rules to require EU-flagged vessels to be demolished and recycled in EU certified yards as part of the current EU Ship Recycling Regulation consultation. This will inevitably result in lower purchase prices for ship owners, and may well lead to pressure to extend the operational life of vessels.

The paradoxical effects of well meaning reforms to promote the development of domestic recycling based supply chains can be well imagined by looking at the impact of the United States’ own Jones Act on fleet age profiles.

We examine the prospects for a revival of ship recycling based supply chains in the EU in a number of features in this month’s issue. As a former (journalistic) steelhand, it is an intriguing idea.

CHEVRON IN NH3 JOINT STUDY PROJECT WITH ANGELICOUSSIS GROUP

Chevron has announced the agreement of a joint study agreement (JSA) with the Angelicoussis Group into the transportation of ammonia in tankers. The deal was announced between the Energy Transition focused division of the Angelicoussis Group, Green Ships, Chevron’s subsidiary Chevron Shipping Company LLC.

The initial study will evaluate the ammonia transportation market, existing infrastructure, the safety aspects of ammonia, potential next generation vessel requirements and a preliminary system to transport ammonia between the U.S. Gulf Coast and Europe. Future opportunities will focus on additional global markets.

Ammonia is a carrier of hydrogen and is believed to have potential to lower the carbon intensity of the marine industry. Through the JSA, the Angelicoussis Group and Chevron aim to advance ammonia’s technical and commercial feasibility at scale, particularly as an export for petrochemicals, power, and mobility markets.

Through the JSA, the Angelicoussis Group and Chevron aim to advance ammonia’s technical and commercial feasibility at scale, particularly as an export for petrochemicals, power, and mobility markets.

“We are pleased to collaborate with the Angelicoussis Group on this study, help advance lower carbon energy at scale and progress marine transportation of ammonia,” said Mark Ross, President of Chevron Shipping Company.

“Global value chain solutions are critical for growing the hydrogen market, and we believe shipping will play a crucial role. Chevron is leveraging its international functional marine expertise and collaborating with the Angelicoussis Group to pursue the delivery of lower carbon proof points to the market,” said Austin Knight, Vice President, Hydrogen, Chevron New Energies.

“Through collaborating with

Chevron Shipping Company on this study, we aim to make a meaningful contribution to prepare our industries for the transition towards lower carbon operations,” said Maria Angelicoussis, CEO of the Angelicoussis Group. “Combining our many years of experience in seaborne transport of liquid and gaseous energy sources with Chevron’s vast experience in the energy business provides a solid basis for this endeavor.”

“Ammonia has potential as a hydrogen vector and is considered one of the alternative fuel options to decarbonise shipping. We believe this study will contribute towards identifying the technical, operational and commercial challenges of carrying ammonia at scale and using it as a fuel in a safe and sustainable way,” said Stelios Troulis, Green Ships and Energy Transition Director for the Angelicoussis Group.

Chevron and the Angelicoussis Group have a long-standing relationship dating back to 2000. Since then, the partnership has grown from conventional vessels to include multiple LNG carriers, as well as joint work on energy transition initiatives.

The teaming of Chevron Shipping, Chevron New Energies and the Angelicoussis Group on this study supports and accelerates both organisations’ ambitions to become leading, global clean energy providers by focusing on all aspects of the hydrogen supply chain.

NEWS REVIEW 4 | MAY 2023 For the latest news and analysis go to www.motorship.com

■ Chevron New Energies and Chevron Shipping Company LLC have agreed a joint study agreement with Angelicoussis Group’s Green Ships to study the ammonia transportation market.

FAT TEST FOR FIRST 95-BORE ME-LGIM ENGINE

MAN Energy Solutions has announced the successful conclusion of Factory Acceptance Tests (FAT) tests for its first 95-bore ME-LGIM engine in the first half at HHI-EMD’s facility in Ulsan, South Korea.

The MAN B&W G95ME-LGIM type engine is the world’s largest methanol-powered two-stroke engine. The engine’s manufacture was also a milestone for HHI-EMD, as it became the first engine manufacturer to exceed 200 million brake-horsepower for low-speed, two-stroke engines when the engine was completed in March.

At a ceremony to commemorate the engine

Maran Dry Management Inc. (MDM), the dry bulk shipping arm of the Angelicoussis Group, recently took delivery of its first LNG-fuelled bulk carriers. The two DNV-classed Newcastlemax bulk carriers are the first dual-fuel bulkers in the Greek market.

The two Newcastlemax bulk carriers, Ubuntu Unity and Ubuntu Community, were delivered from Shanghai Waigaoqiao Ship Building Co., Ltd. (SWS) on 28 February and 18 April, respectively. The two DNV-classed vessels are the first LNG-fuelled bulk carriers to join the MDM fleet.

The 190,000-dwt vessels, registered with the Greek flag, will sail using LNG. The use of LNG will lead to significant

Anglo DF bulkers

Maran Dry Management Inc. (MDM), the dry bulk shipping arm of the Angelicoussis Group, recently took delivery of its first LNG-fuelled bulk carriers. The two DNV-classed Newcastlemax bulk carriers are the first dual-fuel bulkers in the Greek market. The two DNVclassed vessels are on charter to global mining company Anglo American. The vessels’ fuel tanks will allow the vessels to complete two round-trip routes from China to Australia or one round-trip route from China to Brazil on gas.

production milestone on 22 March, Bjarne Foldager, Head of Two-Stroke Business, congratulated Hyundai, on behalf of MAN Energy Solutions. In a speech at the event, he referred to the cooperation between the two companies that started in 1974, and noted that Hyundai was the first engine manufacturer to reach the 200 million bhp mark: “It took about 35 years for the first 100 million brake-horsepower, and only 13 years for the next 100 million – an unbelievable achievement!”

Regarding the engine itself, Foldager continued: “With its 95 cm cylinder bore-size, this is the world’s largest methanol engine. And maybe most importantly,

■ Bjarne

Head of

event

South Korea and flanked by an MAN B&W G95ME-

when this engine is in operation it will save 130,000 tons of CO2 annually when operating on carbon-neutral methanol. We have a great responsibility for the future to develop and produce

engine, the world’s largest. environmentally-friendly engines and ships. We are really proud of helping Hyundai on this important journey and hope to celebrate many new milestones together in the future.”

MARAN DRY TAKES DELIVERY OF FIRST LNG-FUELLED NEWCASTLEMAXES

reductions in CO2 and NOx, while almost eliminating SOx and particulate matter emissions. With a combination of dual-fuel, hull optimisations and energy efficiency measures, the vessels have a very advantageous and low EEDI rating, much lower than the baseline.

“Maran Dry Management, as part of the Angelicoussis Group, is committed to decarbonization and embraces sustainability initiatives to optimise its fleet environmental performance”, said Captain Babis Kouvakas, Managing Director at Maran Dry Management Inc. (MDM). “We are delighted to have collaborated

Korean CCS trial

South Korean container operator HMM has announced that it will conduct field tests on an onboard carbon capture and storage system on a multipurpose vessel in its fleet in the second half of 2023. HMM has selected onboard carbon capture technology developed by Korean cleantech developer Panasia, following the successful conclusion of a feasibility study. Unlike other onboard CCS developers, Panasia has developed a proprietary absorbent rather than relying on MEA.

with DNV and SWS on the design and development of these modern and environmentally friendly ships. Both vessels incorporate the latest technology, aiming to reduce carbon emissions.”

The vessels are 299.80 meters long, 47.5 meters wide and 24.70 meters deep, with a design draft of 18.25 meters and a design draft speed of 14 knots. They can use both LNG and conventional fuel and are equipped with two type-C LNG fuel tanks. The capacity of the LNG tanks means that the vessels could operate for 20,000 nautical miles powered by gas,

Ammonia reforming project

Wärtsilä is participating in a Norwegian state-funded project to develop ammonia reforming technology for installation on board ammonia (NH3) carriers. The project aims to develop a system to convert ammonia back to hydrogen at the receiving destination, which will then be installed onboard a Höegh LNG vessel. The project is intended to allow ammonia carriers to act as a floating receiving terminal.

allowing the vessels to complete two round-trip routes from China to Australia or one round-trip route from China to Brazil.

The Ubuntu vessels are on charter to global mining company Anglo American.

BRIEFS

MSC Cruise bunkering

TotalEnergies Marine Fuels and the Cruise Division of MSC Group have successfully completed the first LNG bunkering operation at the Port of Marseille Fos, on France’s Mediterranean coast, for MSC Cruises’ MSC World Europa. The MSC Cruises vessel was refuelled via a ship-to-ship transfer on April 22nd, while guest operations continued as normal. The bunkering was conducted by the Gas Vitality, an LNG bunker barge.

‘‘

Ports must be able to check the background of all vessels and show bodies such as OFAC that they have the technology to screen ships for suspected sanctions evasion

6 | MAY 2023 For the latest news and analysis go to www.motorship.com NEWS REVIEW

Foldager,

Two-Stroke Business, MAN Energy Solutions speaking at the

in

LGIM methanol-burning

Source: MAN Energy Solutions

The new MAN 49/60DF Best fuel costs and long-term compliance Today’s marine propulsion choices are 2 www.man-es.com/MAN-49-60 Future-proof in multiple ways

VIKING LH2 FUEL CELL PROJECT ADVANCES

Dr. Pierluigi Busetto of Trieste-based naval architects Navalprogetti s.r.l. discusses the progress of a retrofittable liquid hydrogen (LH2) container-based system in an interview with The Motorship

A pioneering project that is seeking to develop and commercialise a retrofittable liquid hydrogen (LH2) based solution within the next three years is continuing to progress.

The project is intended to result in a test installation of a hydrogen-fuelled PEM fuel cell system on board a cruise vessel owned by Viking as a replacement for a genset on board the cruise vessel before the end of the four-year project, Pierluigi Busetto, the CEO of Navalprogetti, tells The Motorship.

The consortium includes Navalprogetti S.r.l., Viking Hydrogen AS, Chart, Cenergy, Università Degli Studi di Trieste, Plug Power, Jeumont Electric, The Port of Bergen, PNO Consultants, Ricardo plc and Lloyd’s Register EMEA IPS

among its members.

Dr. Pierluigi Busetto of Navalprogetti S.r.l is currently acting as the Coordinator of an EU-funded project to develop a liquid hydrogen containment system.

While the project involves the development of a number of different objectives, it is expected to advance the development of LH2 based solutions for the merchant and passenger sectors. “We are obliged to find new solutions to meet the challenge of decarbonising the fleet, and this project offers interesting possibilities for reducing environmental emissions from existing tonnage. We know that there will be strong demand for retrofittable solutions that can lower emissions from existing vessels towards the end of the decade,” Busetto said. The development of

Approval in Principle awarded in April 2023 to Navalprogetti

Busetto noted that a project developed by Navalprogetti for Viking had received an Approval in Principle from Lloyd’s Register for the development and basic design of the LH2/FC power generation system for propulsion and hotel loads.

The project had led to a consortium of ship owners, SMEs and original equipment manufacturers collaborating in a project into the use of liquid hydrogen (LH2) as a marine fuel. Lloyd’s Register led a hazard identification workshop (HAZID) to understand the risks involved with using liquid hydrogen as a marine fuel in Southampton in October 2022.

Lloyd’s Register adopted a risk-based approach to review the novel design and facilitated a high-level hazard identification (HAZID) workshop for the liquid hydrogen fuel supply system (and associated ancillaries) in accordance with the LR ShipRight Procedure for Risk Based Designs.

The workshop participants included Lloyd’s Register and Norway’s NMA (as observers), both of whom have extensive experience of issues around hydrogen safety gained from their involvement in other passenger vessel projects featuring PEM fuel cells in Norway.

The Motorship notes that there are

specific safety considerations relating to the use of liquid hydrogen, as opposed to gaseous hydrogen, that require careful handling. Busetto noted that as a byproduct of work conducted during the Basic Design phase, Navalprogetti and Viking are developing some specialized technology necessary for the running of the system and are working to patent these inventions.

The Motorship notes that the use of hydrogen as a fuel is not fully covered by the existing regulatory framework, such as the IMO’s IGF Code (International Code of Safety for Ship Using Gases or Other Lowflashpoint Fuels).

DESIGN FOR PERFORMANCE 8 | MAY 2023 For the latest news and analysis go to www.motorship.com

■ The Viking Neptune was delivered to Viking at Fincantieri’s shipyard in Ancona on 10 September 2022

Source: Fincantieri

simplified hydrogen bunkering solutions would also be highly relevant for ports outside North America and Europe during the early stages of the green transition.

Navalprogetti is already studying and working on bunkering of LH2 as it is believed that, once the technical and regulatory challenges are solved, the bunkering of LH2 will become as straightforward as LNG bunkering is today.

sHYpS project

The EU funded Sustainable Hydrogen Powered Shipping Project (sHYpS) project was initiated in June 2022, and includes a consortium of partners from six different countries.

The Motorship reported on an initial development of a 100 kW PEM fuel cell trial installation on board the Viking Neptune, a vessel delivered for Viking in November 2022.

The consortium recently received a boost when Navalprogetti’s S.r.l basic design for a LH2 powered fuel cell system received an Approval in Principle from Lloyd’s Register.

Project objectives

The project intends to deliver an engine room configuration, defining spaces and arrangements for the PEM fuel cell systems as well as the relevant fuel supply and safety systems, in addition to the containerised LH2 storage system.

This system would then be subject to complete physical tests by CENERGY, a spinoff from the University of Trieste, before the system is installed and tested on board a Viking vessel before the conclusion of the project in June 2026.

Viking exercised an option with Fincantieri for four further cruise vessels in September 2022, and has an option for

a further two cruise vessels. The latest orders are due to be delivered between 2026 and 2028 and include provisions for the installation of 6 MW hydrogen-fuelled PEM fuel cell systems.

The 6 MW installation would allow Viking cruise vessels to eliminate during normal conditions the conventional genset use during port operations and sailing in Norway’s World Heritage Fjords. The Motorship understands that both the shipowner and the yard are closely following the project.

The largescale 6MW PEM fuel cell solution could be potentially applied to a number of commercial vessels operating in Europe.

Retrofittable solution for merchant fleet

Busetto noted that the fourth year of the project was likely to be focused on developing a study into the applicability of the installation of 6MW PEM fuel cell system on board merchant vessels.

While the system might not be applicable for the largest vessels operating in the EU, he had calculated that the installation would be sufficient for 75% of the fleet.

Busetto became animated when he began to discuss the wider commercial opportunities represented by the concept.

“If we can solve the technical challenges of retrofitting a 6MW PEM fuel cell system inside a cruise vessel, there is no question that the solution will not be applicable to other types of commercial shipping.”

For some of the commercial vessel classes, it may be possible to install the ISO containers on the deck of the vessel.

■ A four year EU-funded project to develop and commercialise liquid hydrogen fuelled PEM fuel cell units for the maritime sector was initiated in June 2022

Swappable container system as interim LH2 bunkering solution

One of the objectives of the project is to demonstrate the feasibility of introducing liquid hydrogen as a potential fuel for PEM fuel cells.

The project is seeking to develop a liquid hydrogen swappable storage solution, in which special 45’ foot ISO containers will be equipped with double wall stainless steel storage tanks capable of storing liquid hydrogen. The tanks are being designed to be interchangeable once the vessel is at berth and will also integrate technology to manage boil off gas from the LH2 containment units generated during transit.

Chart, the US gaseous fuels specialist, is contributing to the production of the LH2 containment tanks.

The Motorship notes that this will allow the LH2 containers to be replaced in the port of Bergen, which is envisaged to be the main refuelling spot for the Norwegian heritage fjords. The concept is expected to avoid many of the techno-economic challenges about installing expensive cryogenic LH2 bunkering equipment at the port before demand is assured. This interim approach will contribute to the development of local LH2 supply chain before shoreside

bunkering infrastructure matures, Busetto claims.

Plug Power is involved in the logistical and regulatory aspects of establishing a liquid hydrogen supply chain taking into account storage capacity and safety regulations at the port of Bergen.

“The containerised LH2 fuel supply aspect is one of the reasons that the concept is also attracting interest from other vessel segments,” Busetto commented, adding that the refilling and recycling of the cryogenic container tanks is expected to be the first application of its kind in the maritime sector.

DESIGN FOR PERFORMANCE For the latest news and analysis go to www.motorship.com MAY 2023 | 9

Source: sHYpS

POSITIONING NOR-SHIPPING AT THE HEART OF THE MARITIME ECONOMY

One of the enduring paradoxes of Nor-Shipping is that it offers visitors access to the latest developments in a wide range of maritime sectors, while maintaining its welcoming collegiate atmosphere.

Sidsel Norvik, Director of Nor-Shipping, explained that recreating Nor-Shipping’s warm and welcoming environment was easier in June “when Oslo is at her best” after last year’s exceptional spring event.

Socialising at Aker Brygge on Oslo’s waterfront in the evening or at one of the many evening receptions was an important part of what makes Nor-Shipping special. “Everyone appreciates the opportunity to meet up with old friends, but making new friends and contacts is very part of the Nor-Shipping experience.”

But creating the appearance of effortlessness requires significant preparation, and Nor-Shipping is preparing to do that for over 50,000 visitors at this year’s event.

The event is expected to break the previous record for delegates and exhibitors set in 2013, with over 1,000 exhibitors expected to attend the event. Part of the increase reflects the return of exhibitors and delegates from Asia.

Part of the increase reflects the increasing importance of the maritime economy as part of the broader environmental transition, as well as Norway’s own role in pioneering developments in a number of areas, ranging from marine aquaculture, offshore wind generation, autonomous shipping developments through to the hydrogen sector.

Nor-Shipping is continuing to expand its series of dedicated thematic conferences looking at specific marine economy sub-sectors, adding an offshore aquaculture event and an offshore wind seminar to its existing Marine Hydrogen Conference and Ship Autonomy and Sustainability events.

The offshore wind sector was likely to be boosted by Norway’s recent participation in the Ostend Declaration with EU partners and the UK, which targets over 300GW of offshore wind generation from the North Sea and Atlantic by 2050 in April.

The prominent role of Norway-based projects, such as the commissioning of the Yara Birkeland and the upcoming orders for a number of hydrogenfuelled or hydrogen-ready vessels, such as Torghattan Nord’s passenger vessels, made Nor-Shipping a natural venue for companies to share experiences.

One of the strengths of Nor-Shipping is its ability to bring together highlevel representatives from the maritime sector and from outside it, Sidsel

noted. “We are seeing more and more interest in the maritime economy from sectors who might not have been traditional attendees in years gone by,” Norvik added.

These topics will be explored in the Blue Talks series, which will look at a number of topical issues, including future fuels, carbon capture and ship recycling.

Ocean Campus

But Nor-Shipping is not just about networking, fun and upcoming opportunities in the maritime economy. It is also meant to offer practical solutions to some of the recruitment and training challenges that are confronting the maritime sector.

“We want to meet this issue head-on; building bridges between companies, education establishments and a new breed of potential industry talent.” Norvik said.

This is the inspiration behind Ocean Campus, debuting at this year’s Nor-Shipping, taking place in Oslo and Lillestrøm between 6 and 9 June.

Ocean Campus is a dedicated island of exhibition booths showcasing some of the world's leading maritime universities and colleges, including the World Maritime University (WMU), as well as the Norwegian University of Science and Technology (NTNU), BI Norwegian Business School, UiT Arctic University of Norway, MLA College, Oslo MET, and SINTEF Ocean.

The space will embody Nor-Shipping 2023’s main theme of #PartnerShip by encouraging these establishments to collaborate to support the development of a more sustainable shipping industry.

The participating schools' representatives will form an Ocean Campus Committee, working together with industry experts to tailor a program for the main Ocean Campus day, which sees thousands of students and young people visiting Nor-Shipping to discover how they can chart a future in the ocean space.

“We need a robust talent pipeline if we’re to not only meet the demands of an industry in transition, but also capitalise on the huge commercial potential offered in sustainable ocean development,” Norvik concluded.

■ Sidsel Norvik, Director of Nor-Shipping

LEADER 10 | MAY 2023 For the latest news and analysis go to www.motorship.com

Source: Nor-Shipping

TRADING EU EMISSIONS ALLOWANCES COULD CREATE COMPLIANCE RISKS FOR SHIPPERS

The extension of the EU’s Emissions Trading System (ETS) to cover EU shipping from April 2023 will create additional compliance for shipping companies, as Smith Reed’s Brett Hillis explains.

While shippers have focused on the practical implications of the recently approved extension of the EU’s Emissions Trading System to cover some vessels operating in the waters of the bloc’s member states from April 2024, ETS experts at legal practice Reed Smith explain that shipping companies considering bidding for, trading in or providing services relating to EU emissions allowances runs the risk of falling within the scope of regulations governing financial instruments under EU/EEA and UK laws.

Brett Hillis, a partner at Reed Smith who has specialised in financial regulatory advice, energy, carbon and commodities trading and derivatives, outlines some of the issues that shipping companies should be aware of.

Hillis cautions that ship owners and managers who seek to pass on some of or all of the costs of surrendering EUAs to charterers, or who trade in EUAs to turn a profit, may fall within the scope of the EU’s financial regulations.

Specialist advice may be needed to ascertain a company’s regulatory position under EU MiFID 2.

MiFID 2 and the ETS

ETS

A list of the key investment activities and services covered by EU MiFID 2 is provided in Section A of Annex 1 of the EU MiFID 2 regulation but includes the receipt and transmission of orders, as well as dealing on your own account, and portfolio management.

There are a number of exemptions for market participants, including an exemption for operators with compliance obligations under the EU ETS who when dealing in EUAs do not execute client orders, provide investment services or perform investment activities other than dealing on own account.

Hillis notes that this does not provide a solution to entities looking to provide services relating to EUAs or to those active in derivatives relating to EUAs. (This would include those using derivatives contracts to pass on the costs of compliance to charterers).

Hillis notes that there are additional exemptions for the provision of services exclusively for companies within a larger group, and an ancillary activities exemption. Shipping companies that wish to trade in emissions may need to consider other exemptions and in particular the ancillary activities and groups exemptions.

EU MiFID 2 is a cornerstone of EU/EEA financial regulation, and stipulates that the provision of investment services and/or the performance of investment activities as a regular occupation or business be subject to prior authorisation. Unless they can rely on an exemption under EU MiFID 2, a person acting from the EEA will need authorisation if they carry on an investment service or activity in relation to a “financial instrument” as a regular occupation or business.

Under EU MiFID 2, EUAs in and of themselves are “financial instruments.” Therefore, the spot sale or purchase of an EUA is a trade in a financial instrument.

In addition, options, futures, swaps and other derivatives relating to EUAs, whether they may be settled physically or in cash, are also “financial instruments.”

While both EUAs themselves and related derivatives are “financial instruments”, whether a particular transaction constitutes a “derivative” may have important regulatory consequences.

For example, if a transaction relating to EUAs is a derivative then it will fall within the scope of the European Market Infrastructure Regulation (EMIR) and its UK equivalent. EMIR sets obligations relating to the reporting of derivatives contracts as well as obligations relating to the risk mitigation and (where certain conditions are met) clearing or margining of OTC derivatives.

LEADER For the latest news and analysis go to www.motorship.com MAY 2023 | 11

■ Brett Hillis, a partner at Reed Smith

NORTH SEA PARTNERS COMMIT TO RAPID EXPANSION OF OFFSHORE WIND CAPACITY

Seven members of the European Union along with Norway and the UK announced ambitious plans at the Belgian port of Ostend to increase offshore wind capacity in the North Sea to ‘at least’ 120GW by 2030 on 24 April 2023

The announcement almost doubled the ambition of a 2022 announcement in Esbjerg, Denmark between four EU member states (Denmark, Belgium, the Netherlands and Germany) that established a target of 65GW.

UK has also increased its own ambitions for offshore wind generation since 2022, most recently targeting 50GW by 2030, including 5GW of floating offshore wind capacity. To put the targets into context, the UK currently accounts for almost half (14GW) of the 30GW of offshore wind capacity installed in the North Sea.

The announcement follows after the European Union raised its own target for renewable energy generation from 32% in 2030 to 42.5% in 2030 at the end of March 2023, following an agreement between the European Parliament and the governments of EU member states.

The Motorship notes that a number of Baltic and central European EU member states increased their ambitions for offshore wind production in the Baltic Sea to 20GW by 2030 in August 2022.

The announcement lifted the long-term target for offshore wind generation from the North Sea from 150GW to 300GW in 2050.

The announcement’s immediate impact upon wind turbine installation vessel capacity and the offshore service vessel sector is likely to attract the most attention. A UK technology accelerator, ORE Catapult, estimated in March that around 150 Surface Operation Vessels (SOVs) will be needed to serve rapidly expanding offshore wind developments in Europe by 2030, and 310 by 2050.

Hydrogen and CCUS

The announcement is expected to contribute to an expansion of renewable hydrogen production “at massive scale” as well as a significant expansion in electricity and hydrogen interconnectors.

Given existing renewable hydrogen production targets of 30GW by 2030 by Germany, Denmark, the Netherlands and the UK, the announcement expects the expansion of offshore wind energy to support higher renewable hydrogen production by 2050.

Interestingly, the agreement also notes that there is a need for greater coordination of storage and offshore infrastructure planning between signatories around the North Sea’s carbon capture, utilisation and storage (CCUS) potential.

Circularity and recycling

By comparison with detailed references to bilateral and multilateral agreements to govern the development of cross-border electricity interconnectors, and energy islands, there was no explicit reference to end of life recycling commitments for the wind turbines and components themselves.

Given the scope and scale of the ramp up of offshore wind capacity, as well as the need for regular replacements of turbines every 20-25 years, it is likely that the expansion will create a permanent sector installing, servicing and decommissioning offshore wind turbines.

Circular economy considerations (as well as concerns to reduce overdependence upon suppliers outside Europe) is likely to lead to the expansion of domestic European supply chains supplying offshore wind turbines and their associated supply equipment.

The announcement’s coded references to “safeguarding the supply of relevant critical raw materials” and “the enhanced circularity of offshore renewable energy and grid infrastructure” can be understood as indicating that the initiative will seek to stimulate local manufacturing and recycling chains.

Unlike Europe’s emerging cleantech sector, there was no explicit reference in the Ostend Declaration to the potential for an expansion of European specialist shipbuilding to meet the growth in demand for vessels installing, servicing and ultimately dismantling the expansion in offshore wind generation capacity.

Country20232050

Belgium6GW8GW

Denmark5.3GW8GW

Source: O ffi ce of the Prime Minister of Belgium

■ An ill wind: the premiers of seven EU states, the UK and Norway agreed to collaborate on the expansion of offshore wind and renewable hydrogen production on 24 April at the Belgian port of Ostend.

France 2.1GW (North Sea and Eastern Channel) 4.6-17GW (North Sea and Eastern Channel)

Germany26.4GW (North Sea)66GW (North Sea)

Ireland4.5GW20GW

Luxembourg--

Norway3GW (inc. 1.5GW floating)30GW (by 2040)

Netherlands21GW50GW (by 2040), 72GW (2050)

UK50GW (inc. 5GW floating) 100GW (ambition in March 2023 Offshore Wind Plan)

REGULATION 12 | MAY 2023 For the latest news and analysis go to www.motorship.com

EU SRR: JUST ONE SMALL PROBLEM…

In the run-up to new IMO carbon efficiency regulations in January, many experts had predicted an upturn in recycling volumes through the early months of 2023, including a significant number of older container feeders. In January, Alphaliner predicted that some 350,000teu of container tonnage would be scrapped this year. However, according to that analyst’s own data, what began as a fairly buoyant recycling market has dipped to almost nothing, and barely 50,000teu has been sold for breaking as May approaches.

■ The EU is currently consulting on a revision to the Ship Recycling Regulation: critics argue that non-EU scrapyards are being excluded from the list

There are a number of reasons for this. Owners of ships affected by the IMO’s carbon intensity indicator (CII) must now collect emissions data and file it with their chosen verifiers, but even so, no action will be needed until the middle of 2024, prompting the possibility of squeezing a few months’ extra revenue out of those vessels, giving owners the opportunity to make the most of freight rates which, for whatever reason, are not cratering as they were expected to

Meanwhile in India, Bangladesh and Pakistan, the main scrapping nations and biggest in the world by volume, weak currencies and financial issues have prevented many purchases– Pakistan, in particular, is battling inflation of 35% -- with central banks holding back on issuing credit to scrap buyers. Ships with heavy lightweights have been out of the question. This has led to cash intermediaries, such as GMS, being forced to hold onto vessels at the end of their lives for much longer than they normally would.

These bottlenecks in India, Bangladesh and Pakistan do not augur well for the medium-term profitability of the container fleet, which will soon take delivery of a deluge of vast new ships. It may, however, be an early taste of a longerterm problem that is to come.

From Brussels with love

Many of the world’s largest and most profitable ships are operated by European owners, and at the end of their lives, scrapped on beaches in the Indian subcontinent. The history of practices at these facilities has not been a proud one. Run up the beaches, vessels have been effectively dismantled from underneath, by workers who earned in a day what Europeans are paid in half an hour. Recycling of steel and other materials is extraordinarily efficient, based not on high-

minded ‘green’ ideals, but on the inexorable logic of necessity and desperation. Deaths and maimings have been a matter of routine.

In recent times, positive moves have been made to address these problems. Advocates of the IMO Hong Kong Convention, global maritime regulation’s answer to lax and dangerous conditions in the vessel scrapping industry, insist that it is driving progress, despite the fact that it is yet to be ratified. But as it often has, the European Commission has prefigured IMO with its own ruling, the EU Ship Recycling Regulation (SRR). Citing such treacherous working conditions as these, the EC has sought to prevent European shipowners from selling their tonnage for scrapping in the East, which operates “under conditions that are often harmful to workers' health and the environment.”

In fact, the EU SRR does not recognise any shipyard in India, Pakistan, or Bangladesh -- limiting itself to 38 yards across Europe, six in Turkey, and one in the US. Europe’s guidelines vary somewhat in their implementation but there are several constants. Hulls should be dismantled from alongside on quays or in drydocks, not clambered onto from underneath and hacked up with welding torches and explosives as they are on the beaches in Bangladesh; each ship should have an inventory of hazardous wastes including asbestos and heavy metals, which should be disposed of with due care; cranes and other equipment should be on hand to haul scrap metal around.

Rakesh Bhargava, chief executive of Singapore-based Sea Sentinels, said in March last year that offering South Asian recycling yards the opportunity to join the EU SRR scheme would be important “…to incentivise continued improvements in health, safety and environmental standards at these yards… in the absence of a globally enforced recycling regulation.”

REGULATION For the latest news and analysis go to www.motorship.com MAY 2023 | 13

Credit: ClassNK

But EU SRR’s critics argue that a deliberate attempt is being made to exclude non-EU scrapyards which the IMO’s own regulation would otherwise approve. Scrapyards in India, in particular, have invested some resources in cleaning up their act, improving on-site emergency medical provision, as well as making positive changes to hazardous waste disposal methods, and many feel they have earned EU SRR approval. A significant number of these yards have been inspected by international classification societies and certified as IMO Hong Kong Convention compliant.

John Stawpert, ICS Senior Manager of Environment and Trade, told The Motorship: “In order to meet demand going forward, it is essential that the EU recognises the huge improvements made in the recycling industry in the Indian subcontinent, and admits compliant facilities outside the OECD onto the EU list.”

European countries are not messing around, either. In 2020, shipowner Georg Eide was given a prison term, and NOK2m confiscated from his company Eide Marine Eidendom AS, after selling LASH carrier Eide Carrier to Wirana, a cash buyer. His intention was to scrap the ship at Pakistan’s Gadani beach, in contravention of the Basel Convention, which bans exports of hazardous waste from OECD to non-OECD nations.

"Eide has been charged with complicity in violation of international waste law,” said Ingvild Jenssen, Executive Director and Founder of the NGO Shipbreaking Platform, at the time. “The judgement acts as a stark warning that dodgy deals with cash buyers aimed at scrapping vessels on South Asian beaches, where there is no capacity and infrastructure to recycle and dispose of hazardous waste in a safe and environmentally sound manner, are a serious crime. It also cautions that due diligence is a must for not only shipowners, but also insurers and Marine Warranty Surveyors, to avoid any business relationship with companies that have terrible track records."

Hostile to shipowners’ attempts to circumvent EU rules on scrapping, NGO Shipbreaking Platform wants to end the practice of re-flagging ships that are about to be scrapped,

noting that the flags of St Kitts and Nevis, Comoros, Palau and Tuvalu, in particular, are “…hardly used during the operational life of ships, but are particularly popular for the last voyages to the scrap yards.” The decision of where to scrap ships should be based on the location of shipping company head offices alone, Shipbreaking Platform argues, sidestepping the flags of convenience debate entirely.

Too big to sail

But another minor snag with the EU SRR is that none of the yards on its list, including those in Turkey, have sufficient capacity to dismantle even the current fleet of very large ships. VLCCs are out, as well as capesize and panamax bulk carriers, and ultra-large container vessels, of which there are now a great many – and rather a lot more on the way, too.

“The EU list of Ship Recycling Facilities remains insufficient to meet the needs of the European fleet,” ICS’ Stawpert said. “This inadequacy will only get worse in the coming years as shipping moves towards a greener fleet to meet decarbonisation targets, with older tonnage getting taken out of service.”

In mid-March, the European Commission launched a consultation period of the SRR, due to come to an end in June.

Stawpert also added that there will be no ignoring the preferential scrap prices that south Asian yards can offer compared with yards in the west. Indeed, southeast Asian yards have typically held a strong hand in this regard, combining cheap labour and overheads, an abundance of space, and close proximity to busy scrap steel markets eager to receive recycled materials and resilient enough to receive periodic influxes of scrap metal – in stark contrast to steel markets in the EU.

“A Financial Incentive Mechanism will not improve compliance with the EU Ship Recycling Regulation,” Stawpert warned, “…as it will not be able to account for differentials in the price of steel between the European and Asian recycling markets, and will penalise certain types of shipping unfairly.”

■ The IMO’s Hong Kong Convention has not yet been ratified by enough members for the convention to come into force

REGULATION 14 | MAY 2023 For the latest news and analysis go to www.motorship.com

Source:

IMO

NorShipping 2023 Your Arena for Ocean Solutions Buy tickets Nor-Shipping2023 Oslo,6-9June Andmakea new#PartnerShip Discover new ocean opportunities. MainPartnersLeadingPartnersLeadingMediaPartners

EFFECTIVE SAFETY MANAGEMENT AND IMPROVED EFFICIENCY THROUGH REMOTE MONITORING OF INERT GAS SYSTEMS

As energy-consuming nations increasingly rely on LNG by sea rather than pipeline, LNG order books are breaking new records, and almost all newbuilding berths are booked until the end of 2026. Experts predict that with large volumes of new liquefaction capacity coming on stream in the months ahead, existing LNG fleet will run at full stretch in the coming years. Finding ways to reduce vessel downtime and support LNG tanker crews – especially when it comes to safety - are now more critical than ever, explains Bernt

at Survitec.

In the year since Russia invaded Ukraine, European LNG supplies have taken a significant hit, and gas-consuming nations have turned to suppliers around the world, including the US and Norway, for replacement gas. Liquefied gas from across the Atlantic or Middle East comes from LNG tankers, and this unexpected demand for ships drove day rates to new highs during the second half of 2022.

Rates have eased over the early weeks of this year, but sector experts predict this is only temporary. LNG carrier demand is set to climb further as new liquefaction capacity comes on stream in the US, Qatar and Australia. It is anticipated that with today’s fleet of approximately 640 ocean-going LNG carriers soon operating at total capacity, the 300+ new ships joining the fleet are likely to be snapped up as soon as they hit the water.

Optimising operations whilst protecting safety

In the face of unprecedented demand, it is no surprise that ship owners and operators are embracing new solutions and technologies to help manage resources and optimise operations. This is especially important when it comes to safety: effective and efficient management of safety critical systems such as inert gas (IG) systems is crucial.

When dealing with flammable cargo, an IG system is essential. It prevents explosion in the cargo tank by maintaining a non-explosive atmosphere. Most operators use inert gas with an oxygen content of less than 5%. Ensuring the inert gas used in cargo tanks complies with oxygen content requirements has traditionally been a complex technical process for LNG tanker crews.

IG systems are live systems that are operated every time a vessel comes into port to verify that the oxygen content is within the prescribed limits. The penalties for non-compliance are significant. Ships may be prevented from entering terminals and forced to

Öhrn, General Manager of Maritime Protection

wait on the anchorage. They may also be delayed for essential maintenance if the inert gas produced on board fails to meet specific criteria.

A problem or a technical hitch that stops the system from working is effectively treated as an emergency, requiring urgent support from specialised technicians. The Covid pandemic exacerbated this problem, with travel restrictions preventing service engineers from boarding ships to conduct inspections and diagnose faults locally. A solution had to be found.

Leveraging digital technology

At Maritime Protection, leading Inert Gas specialists and a Survitec brand, we worked in close collaboration with a customer, a globally-trading LNG company with a fleet in excess of 100 tankers, to develop a solution.

From the outset, it was clear that ship owners and operators would not want yet another IT software system on board that would require regular updates, maintenance or repairs. Also, any solution would need to be easy to install and capable of being retrofitted.

A solution was developed with this in mind, based on providing a simple programmable logic controller supplied in the mail, with clear instructions, ready for installation by a crew member. An annual feebased leasing model would supply parts and service, including maintenance and repair.

A pilot project commenced early in 2022 and operated like an IT help desk. At the critical end of operations, in the event of a tool-down situation, system experts could dial in virtually, connect to the system and take control if necessary. In the event of a

LNG 16 | MAY 2023 For the latest news and analysis go to www.motorship.com

■ Bernt Öhrn, General Manager of Maritime Protection at Survitec.

Somas valves for Cargo handling and Exhaust gas applications

Somas exhaust valves have been used for long time to control exhaust fuel engines.

Valves from Somas

Optimized for high temperature

Slim body design and low weight

In the shipping and shipbuilding industry a reliable valve is required to ensure that media

Somas triple excentric butterfly valve is an excellent choice for pipelines used for both ondue to minimal wear on the shaft and seat.

Triple excentric design

Excellent choice for

Flow optimized disc

Easy maintenance

Bi-directional

Reliable valve

Minimal wear

DIRECT DRIVE PERMANENT MAGNET SHAFT GENERATOR SOLUTION

www.somas.se

WE TECH SOLUTIONS WEB.: WWW.WETECH.FI TEL.: +358 20 786 1680 MEET WE TECH AT NOR-SHIPPING HALL D D01-40

technical glitch, the IG system could be monitored remotely, allowing shore-based experts to oversee IG operations and ensure that the gas met safety requirements regarding gas volume and composition.

There are many typical use cases. For example, there are instances where

LNG carriers have been preparing to dock and unload cargo, but the terminal authority has forbidden entry because the ship needs to prove that its systems comply with the safety requirements of the terminal. Also, incidents where ships have been delayed while safety systems are independently verified. With a remote support solution, shore-based experts can help shipboard personnel easily and quickly verify the system, whether it is a port authority, a repair yard, or a floating storage and regasification unit.

In a shipboard context, in a tool-down situation, experts can identify whether it is due to a faulty component and, if so, whether the component can be adjusted or bypassed. If a replacement part is needed, it can then be supplied at the next convenient port.

Another example is an LNG carrier on its way to drydock. In this case, cargo tanks must be dry and empty with zero risk of flammable gas, as only then will repair yard managers approve the ship to dock. Occasionally, IG systems have failed on the voyage to the repair yard. Ships have then been delayed, and penalties have built up because ships have not docked on time. A remote support solution can help ship operators avoid such a situation through timely, expert intervention.

Looking to the future

Before the advent of remote monitoring technology, Maritime Protection would typically receive a call from an asset owner asking technicians to attend ship as soon as possible. With more than 1,800 systems in operation, this could be a challenge: engineers might already be tied up travelling to and from other jobs. However, with a remote monitoring solution, engineers can access the system, diagnose the problem – and potentially resolve it – on the same day.

Remote monitoring can support routine operations too, such as tuning the system to improve fuel consumption and

reduce emissions. On one tanker, we found that fuel optimisation alone helped to make savings of several thousands of dollars per day.

There is also potential to alleviate and improve working conditions for crew and support ship managers – for example, if seagoing personnel are suffering from fatigue and need to rest or have reached the limit of their maximum working hours, shoreside experts can provide timely support.

After a successful pilot project, the Maritime Protection remote support solution was installed and operates on a fleet of 32 vessels. Other owners recognise the value of this service and ordering systems for ships on order and for existing tonnage.

Physical rapid response is still available if and when required, but remote monitoring solutions offer customers an alternative digital solution that is immediate, convenient, and cost-effective.

LNG 18 | MAY 2023 For the latest news and analysis go to www.motorship.com

SIGN UP TODAY

The 24th edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks.

Seawork delivers an international audience of visitors supported by our trusted partners.

Seawork is the meeting place for the commercial marine and workboat sector.

12,000m2 of undercover halls feature 500 and equipment on the quayside and pontoons.

Speed@Seawork on Monday 12 June at the Royal event for fast vessels operating at high speed for security interventions and Search & Rescue.

Speed@Seawork Sea Trials & Conference

The European Commercial Marine Awards (ECMAs) and Innovations Showcase.

For more information visit: seawork.com contact: +44 1329 825 335 or email: info@seawork.com

experts, helps visitors to keep up to date with the latest challenges and emerging opportunities.

The Careers & Training Day on Thursday 15 June 2023 delivers a programme focused on careers in the commercial marine industry.

JUNE 2023 Southampton United Kingdom 13 15 TO

Media partners MARITIMEJOURNAL COMMERCIAL MARINE BUSINESS BOATINGBUSINESS THE UK LEISURE MARINE BUSINESS

#Seawork

CUMMINS BUILDS NEW MARINE PARTNER NETWORK

In its latest marine partnership, Cummins has teamed up with Danfoss Power Solutions’ Editron division to bring hybrid marine solutions to the global maritime market.

The partners will develop a set of standard solutions for marine propulsion including both engines and fuel cells along with variable-speed diesel gensets and energy storage packages.

In Dec Cummins signed a framework agreement with Energys, an Australia-based hydrogen and fuel cell company, to work together on fuel cell powerhouse packages for marine and power generation, and it has now also signed an MoU with energy storage solutions provider Leclanché. This MOU enables Cummins and Leclanché to offer customers a wide range of hybrid, battery-only and fuel cell package solutions in marine and rail applications using a variety of power sources such as engines, hydrogen fuel cells, battery packs and racks, as well as other components.

The three relationships are helping Cummins achieve its Destination Zero strategy – the company’s plan to reach net zero emissions across its products by 2050. To support that goal in the marine industry, the company recently renamed its New Power segment Accelera.

Scott Malindzak, Cummins Director Global Marine Product Management, says that Danfoss’s power electronics, inverters and traction motors work well with Energys’s DNVapproved fuel cells and Leclanché’s energy storage systems. The standardisation the companies are aiming for will overcome the industry’s current challenge of bringing together componentry from different suppliers. Instead, the companies will work together and build systems ahead of time to ensure all the right pieces are in place and work well together. Although each vessel is unique, the commonality of the building blocks will ensure that their teams will have the knowledge they need ahead of time.

Malindzak says the partnerships will also satisfy the industry’s need for a global sales and service footprint. “We are able to pull these things together, not just for the upfront integration but also for back-end market support.”

Most demand, at present, is coming from Europe and the US, but Malindzak says they are ready to support other regions as well. “The industry is moving fast and potentially at scale towards decarbonisation, and these technologies are ways to get there. It’s either short-term, for bridging technologies, or longer-term decarbonisation. We see fuel cells taking more time to hit scale due to the cost of hydrogen and the cost of the fuel cells themselves. This could slow down adoption, at least initially, but we recognise we have to be on that journey now. There’s a lot of leaning to come with these systems once they get into the real world and operating.”

Both Cummins and Danfoss have

already active in the hybrid marine power sector. Cummins has provided the power system for DCV Driftmaster for the US Army Corps of Engineers. A 3,000hp (2,388 kWe) main propulsion system has been combined with a 3.4 MWh energy storage system and a Danfoss generator (EMPMI540-T4000).

In 2024, the short-sea ferry operator Molslinjen will introduce two 100% electric ferries, and Danfoss power converters feature on both vessels, powering battery power conversion on board as well as the vessel charging systems onshore. In addition, Danfoss drives will deliver precision control to the electric propulsion motors.

“This partnership is another step forward in Cummins’ Destination Zero strategy – our plan to reach net zero emissions across our products by 2050,” said Rachel Bridges, Global Marine Director, Cummins. “The respective products of Cummins and Danfoss’ are an ideal match, because both companies are focused on energy optimization, efficiency, and clean solutions. By providing a joint solution, we will be able to multiply our impact by bringing products and solutions to the market that are fully optimised for the marine industry. Our customers are looking for streamlined ways to meet complex regulations and decarbonisation goals, and together with Danfoss’ Editron division, we can help the marine industry.”

Looking further into the future, Malindzak sees Cummins targeting methanol for combustion. “Getting methanol as a fuel in our engines, it’s no big secret, is that when you start changing fuels, the performance of the engine changes. One way to mitigate this is hybridisation, add in battery power to make up for what you have potentially lost when you switch to fuels like methanol. That's not in our portfolio right now, but it’s part of our forward thinking.”

FOUR-STROKE ENGINES 20 | MAY 2023 For the latest news and analysis go to www.motorship.com

■ Cummins Danfoss Power Driftmaster

■ Scott Malindzak, Cummins Director Global Marine Product Management

NEW FUEL TECHNOLOGIES PAIRED WITH EFFICIENCY DEVELOPMENTS FOR 4-STROKES

The latest developments in engine efficiency are being applied to the new generation of multi-fuel 4-stroke engines.

MAN Energy Solutions’ MAN 49/60DF engine has received its Type Approval after a five-day test program witnessed by inspectors representing the class societies ABS, BV, CCS, DNV, LR and RINA. This most recent addition to its 4-stroke engine portfolio is capable of running on LNG, diesel and HFO as well as a number of more sustainable fuels including biofuel blends and synthetic natural gas.

The new 49/60DF engine platform features MAN’s latest engine technologies, including two-stage turbocharging, second-generation common-rail fuel injection, the SaCoS5000 automation system, and MAN’s next-generation Adaptive Combustion Control (ACC 2.0) that automatically optimises combustion with the support of an additional on-engine sensor.

“The second-generation ACC makes use of the new safety and control system, so it has much more computational power behind it. You can see the results in the fuel consumption and also in the dynamic capabilities of the engine in gas mode,” says Thomas Huchatz, Sales Manager Four-Stroke Marine.

He cites the example of a ropax ferry manoeuvring away from a quay on a windy day. “An engine can experience very high load fluctuations, particularly coming from the bow thrusters which are often powered by the main engines via gearbox PTOs. They can ramp up and down very quickly, and engines running in gas mode are typically slower reacting to these changes than in

diesel mode, such that DF engines may switch from gas to diesel mode. If you’re an operator and you’ve purchased a dual-fuel ship, you want to operate on gas all the time. You really want to avoid this switching.”

The two-stage turbocharger reduces fuel consumption, but it can also slow response time. MAN has overcome that with the upgraded ACC as well. “The software can really make up for the more complex, two-stage technology such that we are achieving the same dynamic capabilities as the 51/60DF,” says Huchatz.

MAN states that the new engine sets a benchmark in fuel efficiency within 4-stroke engines – both in gas and diesel mode – and therefore minimises fuel costs and potential costs for CO2-emission certificates. SFC in gas mode is 6,990 kJ/kWh @ 85% load, and SFOC in diesel mode is 171.0 g/kWh at 85% load, without attached pumps.

The engine’s efficient and fuel-flexible design offers

FOUR-STROKE ENGINES 22 | MAY 2023 For the latest news and analysis go to www.motorship.com

■ Rolls-Royce, Woodward L’Orange and WTZ Roßlau plan to develop a high-speed marine engine concept that can run on green methanol by the end of 2025.

‘‘

The second-generation ACC makes use of the new safety and control system, so it has much more computational power behind it.

Thomas Huchatz, Sales Manager Four-Stroke Marine

Source: Rolls-Royce

multiple paths to emission compliancy leading up to 2050, as per the current Fuel EU draft, says Huchatz. It complies with IMO Tier III without exhaust gas aftertreatment, and in diesel mode, it complies with Tier III when combined with MAN’s SCR system. Huchatz said the aim from the outset was to offer a future platform that can easily go from one fuel to the next and to make that platform as efficient and low on emissions as possible.

The engine retains well-proven MAN technologies such as the gas-injection system, the pilot-fuel-oil system and the MAN SCR system. Soot emissions in diesel mode are halved due to the second-generation common-rail system 2.2.

The 49/60DF’s methane emissions are significantly reduced in gas mode. Huchatz says a 50% reduction in methane slip has been achieved by further reducing cylinder crevices and by introducing closed crankcase ventilation where the escaping gas is redirected to the turbocharger rather than venting to the atmosphere.

The MAN 49/60DF can start in gas mode using an engine purging system that was introduced earlier in the 51/62DF. Additionally, the pump in the pilot fuel system is electrically powered, so it can deliver the full pressure required at zero rpm. This means no visible smoke during engine start-up in gas mode.

The new engine is also methanol-ready. Conversions are straight-forward as all engine variants originate from an initial, modular engine design. Huchatz

anticipates the full operation capability on methanol being taken up later this decade.

MAN is also introducing a pure diesel engine based on the 49/60 platform that will be methanol and LNG-ready and features the same technology upgrades as its dualfuel sibling; the engine can also operate on bio-fuels. This pure-diesel version allows MAN’s new common-rail system to fully play to its strengths of low-emission and low-vibration operation, paired with the maximum flexibility to design the combustion process to minimise fuel costs. Furthermore, its high powerdensity extends the power range of inline engines into applications traditionally equipped with V-type engines.

Methanol-ready 32/44CR engine

RINA has granted Approval in Principle (AiP) to MAN for its methanol-ready MAN L/V 32/44CR engine. The AiP includes an upgrade concept for the 4-stroke engine’s conversion to dualfuel running on methanol.

Methanol has several, physical advantages as a fuel, including a liquid state at ambient temperatures and its accordingly easy handling aboard vessels compared to gaseous fuels. Under combustion, methanol also emits fewer NOx emissions and no SOx or soot emissions.

Methanol is also much less hazardous to marine life compared with conventional marine fuels. However, Elvis Ettenhofer, Head of New Marine

■ The MAN 49/60DF engine passed its Type Approval Test after a five-day test program

■ MAN ES also plans to introduce a pure diesel variant based on the 49/60 platform that will be methanol and LNG-ready

Source: MAN ES

FOUR-STROKE ENGINES For the latest news and analysis go to www.motorship.com MAY 2023 | 23

Source: MAN ES

Solutions, MAN Energy Solutions, says methanol presents challenges for engine makers because much bigger injectors are required than for diesel to make up for the lower energy density of the fuel. Different combustion control is required, and additionally, says Ettenhofer, methanol acts as a solvent rather than a lubricant.

“This approval by RINA is significant as we move towards net zero. A major advantage of our 4-stroke portfolio is its inherent retrofit potential, which enables us to provide shipowners with cost-effective solutions and flexibility regarding future fuels. In this latter respect, there is no doubt but that interest in methanol is growing and that it will have a prominent role to play within shipping.”

Ettenhofer cites Clarksons research last year that showed many shipowners moved from favouring hydrogen to favouring methanol as a desirable 2030 fuel. “At present, it’s a bit like having a look in a crystal ball,” he says, so MAN is going to considerable lengths to ensure all options are covered. MAN’s motivation for providing shipowners with support for all potential new fuels is underpinned by its aim to “move big things to zero.”

possible power density of the propulsion system are the particular focus of the development.

Mathias Müller, project manager at Rolls-Royce Power Systems and MeOHmare’s project coordinator, says: “The focus of development activities is on redesigning the combustion process with fuel system, turbocharging and engine control as well as all fuel-interacting engine subsystems.”

Woodward L’Orange will completely redevelop the high-performance injection systems in the project. Dr. Michael Willmann, Director Technology at Woodward L’Orange, said: “So far, there are no production-ready injection systems for high-speed methanol marine engines. Methanol is a challenging fuel due to its properties. That’s why new materials and injector concepts have to be introduced.”

Wärtsilä upgrades 31 diesel engine

Wärtsilä has upgraded its 31 diesel engine for higher power output within the same physical footprint. The Wärtsilä 31 was originally introduced in 2015, and the OEM says it has the highest power per cylinder for engines of this bore size. The power upgrade will result in the current output range of 4.9 to 9.8 MW, being increased to a range of 5.2 to 10.4MW with 650kW per cylinder. The power increase gives customers the option to select fewer cylinders, thereby reducing the required engine room space, as well as lessening maintenance requirements.

Rolls-Royce progresses new fuel engine development Rolls-Royce, Woodward L’Orange and WTZ Roßlau have been working since the beginning of 2023 on the new joint project MeOHmare. By the end of 2025, the three partners will develop a concept for a high-speed internal combustion engine for ships that can run on green methanol in a CO2-neutral manner.

Rolls-Royce’s business unit Power Systems will develop an engine concept based on the mtu Series 4000 that will be designed for low-emission, CO2-neutral and economical operation of ships with methanol. Climate and environmental friendliness as well as the highest

The Wärtsilä 31 has proven to be extremely popular for installation on a broad range of vessel types, including among others, fishing vessels, ice breakers, ferries, cruise vessels, cable layers, and catamarans. Lars Anderson, Director of Product Management at Wärtsilä says: “The Wärtsilä 31 is already the best engine in its class, and this development widens its market advantage even further. By extending its performance, we are making a real contribution to greater sustainability and supporting our commitment to a decarbonised future.”

The first deliveries of the upgraded engine are taking place during the first half of 2023. Already, seven higher power output Wärtsilä 31 engines have been contracted.

■ Wärtsilä has upgraded its 31 diesel engine for higher power output within the same physical footprint

FOUR-STROKE ENGINES 24 | MAY 2023 For the latest news and analysis go to www.motorship.com

‘‘

This approval by RINA is significant as we move towards net zero

Elvis Ettenhofer, Head of New Marine Solutions, MAN Energy Solutions

Source: Wärtsilä

ALWAYS INNOVATING FOR A BETTER FUTUREWWW.WOODWARD.COM/WLO

DECARBONIZED WORLD The future is now! We are working on tomorrow’s solutions today –and delivering large engine components for the fuels of the future. HYDROGEN AMMONIA E-METHANE METHANOL ETHANOL … WOODWARD L’ORANGE GMBH PORSCHESTRASSE 8 70435 STUTTGART, GERMANY Visit us at the CIMAC Congress June 12-16, 2023 Busan, South Korea

LARGE ENGINE SYSTEM SOLUTIONS FOR A CLEANER,

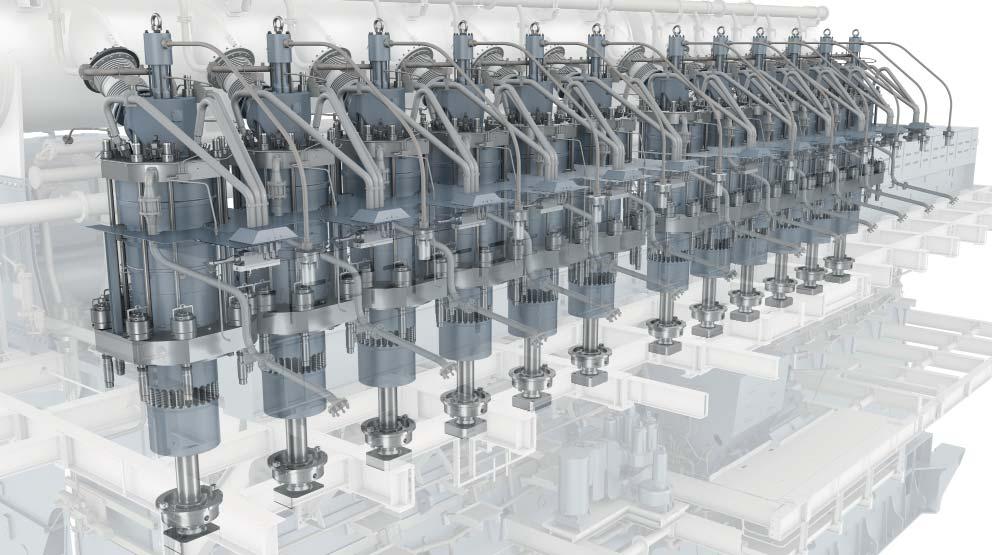

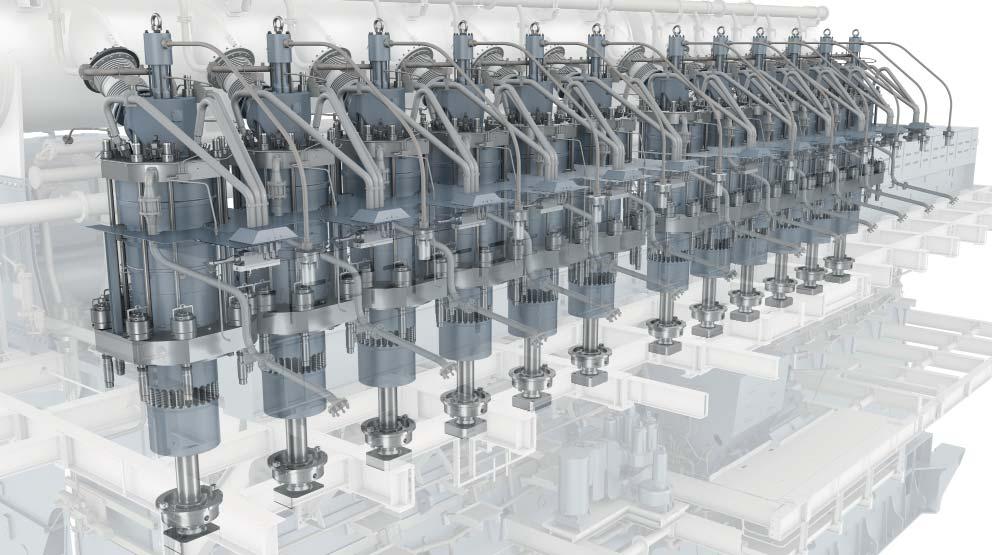

WÄRTSILÄ DEVELOPS ENGINE DE-RATING SOLUTION

FOR 96-BORE POWERED BOXSHIPS

Wärtsilä has developed a radical de-rating solution for customers operating larger container vessels that offers substantial reductions in fuel consumption and greenhouse gas emissions.

The solution has initially been developed for RT-flex96C-B engines, and will see the engine converted to a 72-bore engine.

Sangram Nanda, General Manager of Technology Development at Wärtsilä 2-Stroke Services in Switzerland, explained that the Fit4Power solution had been developed in record time in response to specific customer requests to improve the CII profile of larger container vessels.

The solution had been pioneered for vessels powered by RT-flex96C-B main movers, which were installed on large container vessels between 2004 and 2012 or so. “The majority of the vessels were ordered before container vessel operating speeds slowed around 2010 or so, and have oversized engines for their current operating speeds,” Nanda explained.

While improving the efficiency of the engines is an important objective, most of the vessels are approaching mid-life and maintaining CII ratings for the vessels is an equally important objective for ship owners and operators.

The Motorship notes that rebuilding the engine with a 45% smaller engine capacity was likely to boost a vessel’s annual CII rating.

By improving efficiency in line with CII requirements, radical derating extends the CII compliant lifetime of the vessel by three to five years.

“It would be realistic to target fuel efficiency savings of between 10-15%,” Nanda told The Motorship, adding that there were opportunities to gain a few additional percentage points of fuel savings If you took the opportunity to upgrade and economise on the number of turbochargers.

Interestingly, Nanda noted that there were particular opex costs connected with maintaining engines approaching midlife that would partially offset some of the costs of rebuilding the RT-flex72R engines.

“Typically an engine requires significant scheduled maintenance once it approaches midlife, on the pistons, on the rings, on the liners and so on. A proportion of the cost of the Fit4Power upgrade simply replaces scheduled maintenance costs that you are saving. When you look at it from an upgrade perspective, you

are partially offsetting maintenance costs that you would spend anyway.”

From an ongoing opex perspective, Nanda noted that the radical derating solution reduces ongoing maintenance costs, particular if the components are downsized and might even lead to reduced feed-in rates for lube oil, for example.

By comparison, wider discussions around hydrodynamic optimisation, including the potential replacement of propellers optimised for slower operational speeds, or the reduced weight of the propulsion system following the engine retrofit, would increase GHG emissions reductions and fuel efficiencies, but would require cost-benefit analysis over the remaining operational life of the vessel. Such decisions needed to be taken in line with broader customer decisions about extending a vessel’s operational life.

Higher compression ratio

During the engine conversion process, the engine design team increased the firing pressure from 145 to 200 bar, while the layout of the engine was also optimised.

The combustion chamber was also replaced with an optimised chamber design, which was expected to result in more efficient combustion than in the original RT-flex96C-B design. As a result of the enhancements, Nanda reiterated that he expected the derated engine to achieve a 10-15% improvement in SFOC rates.

“Finally, towards the end of the process, we agree with the customer about the optimal tuning for the engine. The interesting thing is that this decision is the result of an active discussion with the customer, which allows us to offer the spec based on their operational requirements, and how they plan to operate the vessel.”

Alt fuel conversion compatibility

For shipowners concerned about ensuring CII compliance beyond the end of the decade, the upgrade solution is intended to be compatible with future conversions to operate on alternative fuels. It is designed to be compatible with Wärtsilä Fit4Fuels future fuels conversion platform, which will enable vessels to use LNG, methanol and ammonia fuels.

Groundbreaking floating FAT

Nanda also explained that the project was noteworthy as it resulted in the world’s first factory acceptance test (FAT) at sea.

“We had to discuss how to carry out the FAT with class and the flag state because

the rulebook is based on engines being tested on a test bed, rather than out at sea.”

In this case, the engine also required a product design assessment at sea. Wärtsilä Fit4Power received a certificate of product

design assessment from ABS in 2022.

Nanda noted that the Wärtsilä Fit4Power project was also the world’s first 22 Bar MEP two stroke engine.

RETROFIT/CONVERSION 26 | MAY 2023 For the latest news and analysis go to www.motorship.com

■ Sangram Nanda, General Manager of Technology Development at Wärtsilä 2-Stroke Services in Switzerland,

■ The solution has initially been developed for RTflex96C-B engines, and will see the engine converted to a 72-bore engine

“When we are modifying the engine for the Wärtsilä Fit4Power solution, we prepare the engine for a potential future Wärtsilä Fit4Fuels conversion... rather than requiring unnecessary replacement of engine parts. For example, when we replace the cylinder cover we include two additional unused sealed holes, which can be simply used for the installation of two alternative fuel injectors by changing the plugs in a future methanol retrofit.”

Commercial opportunities

The Wärtsilä Fit4Power radical de-rating solution has been focused on delivering solutions for larger container vessels, and a number of ship owners have placed orders for the engine conversion solution.

“We have a full order book for our engineers for the remainder of 2023,” Nanda told The Motorship. Because of the number of container vessels that are approaching midlife, Nanda noted that Wärtsilä 2-Stroke Services engineers could be busy for the next 4 years carrying out engine conversions simply on these vessels at a rate of 1-2 vessels per month.