Clear route ahead

Two-stroke solutions for the future of shipping

Navigating new regulations, decarbonization, and complex fuel economics is easy with us as a partner. Our two-stroke

of millions of running hours and assistance that goes beyond installation and commissioning: Complete life-cycle support from our dedicated staff and the worldwide MAN PrimeServ after-sales network.

Clear route ahead – with MAN B&W two-stroke solutions.

HHI-EMD’s new H32DF-LM

been

landmark

China Classification Society (CCS) and Dalian COSCO Shipping Heavy Industry held an ignition ceremony for COSCO’s first ammonia powered duel-fuel test engine.

Onboard CCS trial

Sinotech CCS Co. Ltd., a Shanghai-based developer of carbon capture solutions, plans to install its first CCS unit onboard an Asian owned vessel by November 2022.

REGULARS

8

Regional Focus

While German maritime technology and shipping retains global influence, the country’s shipbuilding industry is at a crossroads, facing new uncertainties, writes David Tinsley.

14 Immutable laws

The laws of thermodynamics will limit battery-hybrid and fuel cell applications in deep-sea shipping, Duncan Duffy, Global Head of Technology, Electro Technical Systems, at LR tells The Motorship.

22 Hybrid propulsion concepts

MAN ES and ABB have teamed up to develop a dual-fuel, electric+ (DFE+) propulsion concept for LNG carriers.

28 One step beyond

Studies are pointing to the viability of onboard carbon capture and storage (CCS) technology for some ship types, but even in the best cases, CAPEX and OPEX are expected to be high.

Leader Briefing Georgios Plevrakis, ABS Vice President, Global Sustainability discusses carbon pricing and its effect on the maritime sector in an exclusive interview with The Motorship.

Ship Description

A new class of Chinesebuilt ships for the Baltic forestry products industry combine cargo carrying flexibility with a reduced carbon footprint, writes David Tinsley.

32 Boundary conditions

The IMO is considering how it can incorporate a well-to-wake (WtW) approach into the assessment of future fuels.

38 Hammer time

Ulstein has designed a ship built to house a thorium MSR reactor, Catherine Kristiseter Marti, Ulstein Group CEO tells The Motorship.

The Motorship’s Propulsion and Future Fuels Conference will take place this year in Hamburg, Germany. Stay in touch at propulsionconference.com

PROPELLER BLADE UPGRADE CUTS FUEL CONSUMPTION

VIEWPOINT

NICK EDSTROM | Editor nedstrom@motorship.comA hat tip

Writing ahead of our upcoming Propulsion and Future Fuels conference, which will be held in Hamburg in late November, I wanted to reflect on the alternative fuels space, as methanol and soon ammonia engines appear ready to change the face of the market.

It is worth reiterating how fortunate the shipping industry has been to have been so well served by forward thinking class societies, engine designers and of course ship owners over the last few years. Just because they have succeeded in making the remarkable appear routine should not blind us to the scale of the industry’s achievements in recent years.

No less remarkable is the ongoing expansion of the fuel mix to encompass methanol, and soon ammonia. These are significant achievements for an industry that has sometimes been unfairly characterised as resistant to change.

The Propulsion and Future Fuels event has been a long-term proponent of ammonia and methanol as alternative fuels, just as it championed LNG during the earliest stages of its commercialisation in the early 2000s.

The sheer range of fuel combustion solutions that are being developed is astonishing. In this issue alone, we cover the launch of Dalian COSCO Shipping Heavy Industry’s four-stroke dual-fuel ammonia-powered test engine in October; Hyundai Heavy Industries-Engine & Machinery Division’s successful test of an LNG and hydrogen fuel mix; and Volvo Penta’s decision to commercialise a hydrogen-injection solution on a small scale.

Early stage research into alternative fuel combustion is continuing, including a UK pure-hydrogen recuperated split cycle engine-based project involving Dolphin N2, Brighton University and Hiflux.

The fate of some of these solutions is likely to depend on the scope of regulations that are being discussed at the moment. We cover the argument about well-to-wake emissions, as well as the economics of carbon markets again this month.

The energy politics of different fuels, such as methanol, is another fascinating area. China’s position here is interesting: Sinopec has played a leading role in the development of domestic carbon capture use and storage (CCUS) schemes since China confirmed plans to introduce a domestic Emissions Trading Scheme (ETS), which came into force in July 2021.

Sinopec is also expressing an interest in recycling liquefied carbon dioxide from onboard CCS units, according to an interview with Sinotech CCS, featured in this month’s magazine.

Returning to the technological arena, delegates at this month’s PFF event should expect to see interesting technical developments in a range of areas. Just to pick one OEM, the steady expansion of FuelSave’s combustion optimisation solution across various 4-stroke engine solutions remains an example of a technological solution that we have followed closely since the late 2010s.

We have covered the development of battery-hybrid dual-fuel solutions for deep-sea commercial vessels previously. This issue sees the introduction of a new project: ABB is bringing its experience with DC grids to bear in a new collaboration with MAN Energy Solutions on a dual-fuel, electric+ (DFE+) propulsion concept for LNG carriers.

Berg Propulsion has secured a substantial reduction in fuel consumption and vibration for a long-serving Baltic ferry, after a propeller blade replacement.

Stena Danica entered service in 1983 and was fully renewed in 2005. It sails between Sweden and Denmark, connecting the ports of Gothenburg and Frederikshavn in just three hours and 30 minutes.

Last year, Stena Line asked Berg Propulsion to revise the 154.9m length ship’s twin propeller blades, with the aim of eliminating a persistent cavitation issue and enhancing fuel efficiency in a single project. In an additional technical challenge, Berg’s solution needed to be reverse engineered to fit with the existing propeller hub originally manufactured by another company.

“Stena continuously reviews the performance of its ships to evaluate whether machinery and systems on board are optimal for their actual operations,” said Per Wimby, Senior Naval Architect, STENA TEKNIK. “This is actually the third propeller blade replacement undertaken on Stena Danica over the years but this one is especially timely, given that it anticipates new regulatory requirements for all ships to demonstrate their energy efficiency.”

Stena Danica’s twin control pitch propellers are served by two Sulzer 12ZV40 medium speed engines per shaft. After several months of commercial operations in multiple sea states, Wimby confirmed that using the new propeller blades has reduced

average fuel consumption while neutralising a longstanding issue with vibrations. “It is a balance between efficiency and comfort onboard,” he said.

Victor Abrahamsson, After Market Business Development, Berg Propulsion, said that blade design had been optimized to reflect a planned reduction in operating speeds, in a compromise between one engine per shaft line running at full power or two engines running per shaft, without ‘overpitching’.

“Blade geometry has moved on quickly in recent years, based on more accurate calculations, 3D scanning and better modelling tools. Today, we make better use of materials so that the same or enhanced efficiencies are achieved using slimmer profiles and blades which cover less area. It’s also much easier to evaluate and predict the relative performance of different blade types.”

Magnus Thorén, Energy & Efficiency Account Manager, Berg Propulsion, said: “With fuel consumption so high on the agenda, we are putting all available tools at the disposal of our owner clients to secure the efficiencies they need. That means delivering tailor-made solutions for specific ship operating profiles, but this project also demonstrates what’s possible using the existing propeller hub: our designers and shipyard project teams could do this for any hub.”

Hyundai Heavy IndustriesEngine & Machinery Division’s new methanol dual fuel HiMSEN engine has completed type approval testing with seven class societies including KR, ABS and DNV.

The H32DF-LM, 4,000~6,000bhp was tested at the company’s Techno centre in Ulsan, South Korea.

The diesel/methanol genset significantly reduces GHG emissions, SOx and NOx. In addition, it prevents corrosion by using special materials and achieves stable high-power production by applying diesel cycle combustion and electronically controlled fuel injection (Common Rail) technology.

The first methanol HiMSEN engine will be delivered to the

HHI-EMD METHANOL ENGINE GAINS TYPE APPROVAL

2,100TEU container vessel that is built by Hyundai Mipo Dockyard in December. So far, 50 engines (13 vessels) have been ordered. HHI-EMD expects demand to increase.

Hyundai Heavy Industries has announced that its new engine factory can now produce 100 sets of HiMSEN engines per year.

Hyundai Engine Company has a plan to supply the dual-fuel engines to the domestic and foreign major shipbuilder such as Hyundai Samho Heavy Industries.

Ammonia development project

Svanehøj’s deepwell fuel pump has been chosen for a development project which aims to develop ammonia-fuelled vessels with 4-stroke auxiliary engines.

The company said that among the partners in this project is one of the world’s largest shipyards and one of the leading manufacturers of marine engines.

“A development project such as this is a great opportunity for us to show that Svanehøj is part of the solution to the climate challenge of shipping,” said Markus Tauriainen, sales director, fuel, Svanehøj.

a fuel pump solution for this project, we will contribute further to the ongoing fuel transition.”

Fully compatible According to leading companies in the shipbuilding industry, the most likely initial newbuild targets for ships utilising ammonia fuel will be container vessels and very large crude carriers. These vessels operate with 2-stroke main engines and 4-stroke auxiliary engines and Svanehøj has a strong ambition to become the preferred supplier of pump systems for these ships.

BRIEFS

SOFC trial on LNGC

Shell has signed a deal to power an LNG carrier with a HyAxiom-developed solid oxide fuel cell (SOFC). Under the agreement, Shell International Trading and Shipping Company, KSOE, DNV and Doosan Fuel Cell, agreed to launch a vessel powered by a SOFC in 2025. Doosan Fuel Cell says the low temperature SOFC it is currently developing has up to 65% efficiency, reduces noise and vibration and lowers maintenance costs.

”At Svanehøj, we have been working to develop solutions for future fuels for years. By supplying

BV AiP for GTT

Bureau Veritas has awarded an Approval in Principle to GTT for a new LNG carrier design based on a three cargo tanks arrangement. The new 174,000cbm design replaces a 4-tank configuration with a 3-tank design. The innovative new design is expected to reduce the boil-off gas (BOG) below 0.085% while reducing the operational costs for the gas carrier. The concept is designed to fit either with Mark III or NO96 technologies, developed by GTT.

Svanehøj’s fuel pump is a long-shafted cryogenic deepwell, multistage centrifugal pump, launched in 2016. It is

WinGD Qatar order

WinGD has received 25 orders for its dual-fuel X72DF-2.1 engine featuring its new onengine iCER , the company announced. The orders for 50 engines have been placed by multiple shipyards and shipowners in connection with QatarEnergy’s NFE project. The order includes a pair of LNGCs at Daewoo Shipbuilding & Marine Engineering (DSME), the first ships to be built by DSME featuring WinGD’s on-engine iCER.

described as a smaller version of Svanehøj’s well-proven deepwell cargo pump for gas, which has been installed on more than 1,100 gas carriers since the 1960s.

All the benefits of the larger cargo gas pump have been retained in the deepwell fuel pump, ensuring stability, optimised performance, high reliability and long service intervals.

The Svanehøj deepwell pump enables a ship to comply with both current and future requirements as the pump is fully compatible with all types of liquid gas fuels, including LNG, LPG, ammonia, methanol and hydrogen.

Damen eyes OPS

Mc Energy and Damen Services have signed a collaboration agreement to bring a shore power solution to market. Damen B-Shore can supply multiple voltages and switch between 50Hz and 60Hz networks. This means that every on-board network can be linked to a local network. B-Shore also absorbs any instability of the local grid and provides a safe separation between shore and ship, thus avoiding galvanic corrosion.

GERMAN YARDS ADJUST TO NEW REALITY

Bearing the scars of the Covid-19 onslaught, yards have maintained production continuity, albeit at lower levels than earlier, and delineated new business strategies aimed at conferring greater resilience and competitiveness in the years to come. But a large swathe of the sector, through the failure of Genting-owned MV Werften, has been taken out of the immediate reckoning as regards large-ship construction and export earnings. At the same time, recent changes in shipyard ownership together with fresh collaborative ventures, acting on new or unfolding opportunities, promise to re-energise some shipbuilding communities.

At a presentation held earlier this year, the Association of German Shipbuilders & Maritime Technology Suppliers(VSM) sounded a stark warning as to the future of the shipbuilding industry in Germany, and in Europe as a whole. Although global demand for newbuilds is robust, Asian yards not only attract the preponderance of contracts for all main categories of merchant shipping, with an increasing adeptness in newgeneration ‘green’ tonnage, but are also securing a growing proportion of the orders for more specialised vessels. Moreover, China’s domination now of the market for ro-ro and ro-pax tonnage is accompanied by its emergence as a cruiseship builder, a move that is in fact being technologically assisted by European organisations.

The VSM contends that China and South Korea are posing ‘unfair’ competition, engendered through both overt and covert support and financial mechanisms on the part of their

respective governments. The industry body suggested that shipbuilders in Europe could disappear altogether in just 10 years’ time if the European Commission and individual EU countries do not address the situation.

While EU action is still absent in response to the industry’s travails and its calls for a ‘level playing field’, the German Federal Government has displayed some acknowledgement of concerns through the announcement in August 2022 of a new package of financial support. This entails increased funding towards ‘green’ shipping, encompassing the development of environmentally-friendly maritime technology and construction of zero-emission ships. An additional EUR 30m ($29.2m) per year will be made available for such initiatives through to 2025.

Backing for investment by the shipbuilding industry in digital technology was contemporaneously expressed by clearance for a EUR 1.3m ($1.27m) state grant towards an ambitious research project to enhance shipbuilding production technology. The goal of the initiative, entitled “Digitisation of cold-plastic forming through continuous quality control”, is to provide a means of inspecting the surface of the sheet metal with the aid of sensors and to digitally record the forming process in 3D format so that manual intervention can be reduced. Downtime on pressing machines could be reduced by approximately 35%.

The Meyer Group, whose Papenburg fully-enclosed ‘ship factory’ is the jewel in the crown of the country’s commercial

8 P&O’s Arvia prior to float-out from the covered building dock at Papenburg

8 P&O’s Arvia prior to float-out from the covered building dock at Papenburg

While German maritime technology and shipping influence continues to show its mettle on the world stage, the country’s shipbuilding industry is at something of a crossroads, facing new uncertainties, writes David TinsleyCredit: Meyer Werft

shipbuilding sector, was in the process of implementing a plan to expand annual throughput and deliveries at all three of its yards in Germany and Finland prior to Covid-19. Moreover, a EUR260m ($253.2m) investment programme at the Finnish subsidiary, Meyer Turku, had been completed just before the outbreak of the pandemic. The expenditure at Turku has come to represent a cost burden on the group against the backcloth of the subsequent fall-off in orders.

While the pre-pandemic cruiseship newbuild workload at both Papenburg and Turku was retained, through renegotiations with clients leading to ‘stretched’ delivery times, this has been at the expense of a reduction in annual production volume and earnings.

Meyer Werft distinguished itself yet again last year by attracting two of the handful of contracts awarded worldwide for cruiseship tonnage, winning a medium-sized, 229m newbuild for Japan and a 289m apartment vessel for Norwegian-American interests. Nonetheless, the work inflow at Papenburg has not been enough to sustain pre-Covid utilisation rates, and shipyard utilisation will remain at a restrained level unless more orders can be attracted.

Since the minimum time from contract signing to delivery of a high-capacity cruise ship is approximately three to three and a half years, Meyer Werft needs to secure fresh contracts by early 2023 at the latest.

Although cruise ship construction will remain the core business of Meyer Werft and the Meyer Group as a whole, the family-controlled group has taken steps to expand and diversify its offering. As well as providing for more ‘one-off’ cruise vessels and also smaller sizes of ship, the revised strategy targets government vessels(such as research ships and naval auxiliaries) and mega yachts at the uppermost end of the scale. A dedicated division, Meyer Yachts, has been created to focus on newbuilds of more than 120 metres in length. Meyer has also entered into a joint venture addressing what is viewed as an emerging market for the production of floating real estate. The new entity, Meyer Floating Solutions, is headquartered in Turku.

Meyer and compatriot shipbuilder Fassmer strengthened their cooperation this year through the joint acquisition of Neptun Ship Design, previously part of MV Werften. The takeover signifies a strengthened focus by Meyer and Fassmer on the development of highly complex, specialised ships, which represent a key target market for both shipbuilders.

Cooperation between Meyer and Fassmer is already expressed in the contract for the new research ship Meteor IV, ordered by the Federal Ministry of Education and Research at the beginning of 2022. Due for handover by 2026, the newbuild is of some 10,000gt and has a length of approximately 125m, and will accommodate 35 scientists plus 36 crew.

To draw added value from its core business in the construction of cruise ships, the Meyer Group has created a new company, Meyer Re, which will offer service packages to maintain, refurbish and technologically update Meyer-built vessels throughout their operational life.

Both Genting Hong Kong and its German shipbuilding subsidiary MV Werften, with shipyards at Wismar, Stralsund and Rostock-Warnemuende, filed for bankruptcy in January 2022, leading to insolvency proceedings under an administrator appointed on March 1. The financial hiatus, compounded by the Covid pandemic, also hit the parent group’s cruise ship companies, and this had further impact on the German shipbuilding orderbook as various Genting entities and brands were the only customers of MV Werften.

However, the industrial fabric in Germany may to a large extent be saved through re-purposing of former MV Werften yards, with the accent on the naval market and on German

intent to raise defence spending in the light of Russia’s invasion of the Ukraine and aggressive stance towards the West. The purchase of the former MV Werften-owned Wismar shipyard by thyssenkrupp Marine Systems in June 2022 was quickly followed by the Federal Government’s acquisition – effectively nationalisation – of the Rostock-Warnemuende facilities.

Defence contractor thyssenkrupp Marine Systems considers that business opportunities in its key target sectors offer a long-term future for shipbuilding at Wismar, and holds out the prospect of submarine construction being implemented at the site in 2024. Meanwhile, revival of the Rostock yard under state control is expected to involve its transformation into a naval arsenal, with the possibility that portions of the yard may be leased out or dedicated to commercial and offshore-related activities.

Genting’s troubles also had an impact elsewhere in Germany. Shortly after MV Werften filed for bankruptcy, Lloyd Werft Bremerhaven – controlled by the Genting Group since 2015 – took the same step. Within the space of two months, new buyers were found, and the yard was reinstated as Lloyd Werft Yachts, with a primary role in mega-yacht newbuilding, refit and conversion. The purchasers are two German companies, the Heinrich Ronner Group and the Zech Group.

In the meantime, commercial shipbuilding has been revived in the northwest German town of Flensburg. The launching of a 4,000 lane-metre ro-ro freight vessel from Flensburger Schiffbau-Gesellschaft (FSG) in June this year was the first since the yard’s re-start, following its purchase out of insolvency by the Lars Windhorst-headed company Tennor Holding in 2020.

FSG is chasing the long-discussed plan for a large, new German icebreaking research ship, and sees benefit in the proposed creation of a shipyard consortium to attract the complex newbuild project. In line with the company’s plan to enter the luxury super-yacht sector and naval market, Tennor/ FSG purchased the insolvent Werft Nobiskrug during 2020.

The Nobiskrug yard at Rendsburg has now been brought under the management of FSG at Flensburg, to streamline operations and resources at the two yards.

A new project was announced in August 2022 with Canadian transport company Oceanex. This combined FSG’s expertise in ro-ro equipped vessels with another strand of the shipyard’s re-defined strategy, whereby newbuilds will incorporate comprehensive life-cycle analysis and planning. The agreement with Oceanex calls for the joint development of an innovative design of ice-classed, container/ro-ro(con-ro) vessel for eastern Canadian trade. This is designed to be ultra-efficient and “climate-neutral”.

The Flensburg yard delivered a tailor-made vessel to Oceanex in 2013, in the shape of the 210-metre, 19,460 dwt con-ro Oceanex Connaigra, which carries containers, trailers and motor vehicles between Montreal and Newfoundland.

ALLOW THE MARKET TO SUPPORT THE DECARB JOURNEY

8 Carbon economics at work: Sinopec completed the construction of China’s first large-scale carbon capture, utilization and storage (CCUS) project at Shengli Oilfield in January 2022, six months after China introduced a national Emissions Trading System (ETS) in July 2021

Georgios Plevrakis was keen to discuss the practicalities of carbon pricing when he was interviewed by The Motorship at SMM. Although many of the specific decisions around the scope of regional and international schemes, such as the EU’s Emissions Trading System (ETS) extension and the FuelEU Maritime proposal have not yet been finalised, Plevrakis noted that many of the specific issues had been identified and discussed.

“We’ve been discussing these issues for over two years,” he said, referring to specific issues that carbon pricing had to confront from a maritime perspective, including identifying where the ultimate responsibility for carbon emissions sits from a producer-pays perspective, as well as where the decision-making responsibility for operational decisions lies.

As editor of ABS’ latest publication in its Setting the Course to Low Carbon Shipping series, Plevrakis also noted carbon pricing would play an important role in creating the conditions for the emergence of hydrogen and carbon value chains.

Plevrakis looked beyond some of the short-term discussions to look at how the potential introduction of carbon pricing will affect the operation of shipping markets.

The appeal of carbon pricing for the industry is that it actually creates opportunities for ‘first movers’, and directly benefits operators who champion efficiency and adopt solutions earlier, Plevrakis noted. This will accelerate the adoption of clean technology solutions in the industry.

Plevrakis noted that the rules need to be predictable,

transparent and applicable, in order to encourage adoption by the maritime industry as well as the wider industrial complexes upon which the maritime sector will need to coordinate with it.

The success of the introduction of carbon capture use and storage (CCUS) supply chains will depend upon other hardto-abate sectors, such as cement manufacturing, steel making and other non-ferrous metallurgical sectors, adopting CCUS technology.

Clarity around these issues is vital in order to stimulate the development of technological solutions. “We need a standardised approach towards the sustainability aspects of [these] different areas.”

Taking a broader perspective, such schemes are expected to help to raise funds for both the development of solutions that are at pre-commercial stages of development, and help to support the cost of developing supply-side infrastructure.

Any assistance would be welcomed by the industry in the current economic environment. The annual cost of investing in the infrastructure required for the energy transition was likely to be between USD30 billion and USD60 billion over the next 30 years.

Returning to the issue of regulation, and taking the EU’s regulatory efforts as an example, Plevrakis cited the FuelEU Maritime scheme and the extension of the Emissions Trading System (ETS) to shipping as areas where a carbon price would be defined.

Georgios Plevrakis, ABS Vice President, Global Sustainability discusses carbon pricing and its effect on the maritime sector in an exclusive interview with The Motorship at SMM in September 2022

“The ETS creates a delta that can be traded, while the FuelEU Maritime scheme introduces a financial penalty, but both should help to support the transition,” Plevrakis noted.

The Motorship notes that the establishment of financial liabilities and an international pricing mechanism is also likely to accelerate the development of hedging tools to allow larger operators to manage their financial exposure to carbon prices, although the different bases of the ETS and FuelEU Maritime schemes will complicate basis risk calculations.

While the ETS and FuelEU Maritime schemes will help to establish financial liabilities for a carbon price for ship owners and operators in the EU, they will not be sufficient to offset the cost differential between alternative fuels and existing conventional fuels.

Taking into account the differences in energy density between alternative fuels such as methanol and ammonia and conventional fuels, and the higher production cost of producing alternative fuels, “the carbon neutral fuels that we will be producing will still be less cost efficient than the fossil fuels that we are using today,” he added.

Plevrakis concluded by calling for a carbon-based levy to be introduced on to fuels, in order to narrow the price differential between carbon-neutral fuels and conventional fuels.

Depending upon how the rules are framed, The Motorship notes that the effects of such a carbon levy alter the carbon economics of different fuels significantly. Scandinavian methanol suppliers believe that carbon-neutral methanol produced from renewable energy sources with the addition of recycled carbon dioxide from CCUS schemes could be carbon-positive.

8 Georgios Plevrakis, ABS Vice President, Global Sustainability

8 Georgios Plevrakis, ABS Vice President, Global Sustainability

METHANOL RETROFIT COSTS ADD UP FOR CONTAINER SHIPS

Back in August 2021, Maersk announced an order for eight new 16,000 TEU container ships powered by methanol, a move that brought the potential of the fuel to wide attention. Orders for another 10 are expected, and new projects are emerging across the sector, including retrofits

At SMM in September 2022, DNV signed on to a project to study the conversion of a container vessel into a methanol dual fuel vessel along with CSSC, MSC Mediterranean Shipping Company, WinGD – Winterthur Gas & Diesel, and Marine Design and Research Institute of China (MARIC). The project is still in its infancy, but DNV has previously studied the potential of methanol in the sector, noting that the additional CAPEX for installing a methanol system on board a vessel is roughly one third that of the additional costs associated with LNG systems. OPEX for methanol systems is expected to be comparable with that for oil-fuelled vessels without scrubber technology, but experience is limited.

According to DNV, methanol reduces GHG emissions by 8-9 % compared to MGO from a tank-to-wake perspective. It contains no sulphur, and some engine concepts could meet Tier III NOx requirements without after-treatment. Methanol can improve EEDI, EEXI and CII up to 8–9% compared to fuel oil, but in practice the improvement may be less if dwt is decreased or if auxiliary engines are not running on methanol.

Due to its density and lower heating value, methanol fuel tanks need to be approximately 2.5 times larger than oil tanks for the same energy content and 1.3 times larger than LNG tanks. An advantage over LNG, however, is that there’s no need for special materials to handle cryogenic temperatures, and methanol’s low corrosivity means that tanks can be stainless steel or coated carbon-manganese steels.

Risks

Øyvind Skåra, Principal Engineer, Piping Systems & Alternative Fuels, Maritime, at DNV, notes some risks associated with methanol including its low flashpoint which means it generates an explosive atmosphere in air at temperatures above 11oC. “Methanol flames are particularly hazardous, as they burn at low temperatures with a flame that is nearly invisible in daylight, with no smoke,” he said. “A methanol flame often goes undetected until it has spread to adjacent materials that burn in a wider range of light.”

A methanol-water mixture of at least 25% methanol is capable of burning, so fire extinguishing practices include the use of alcohol-resistant foams. A fixed fire detection and fire alarm system complying with Fire Safety System Code should be provided for all compartments containing a methanol fuel system. Additionally, the means to detection methanol fires in machinery spaces, such as portable heatdetection devices, should be installed.

Safety

While the IGF Code is mandatory under SOLAS, the IMO Interim Guidelines for the Safety of Ships Using Methyl/Ethyl Alcohol as Fuel (MSC.1/Circ. 1621), a supplement to the IGF Code, is non-mandatory and its use must be agreed with the vessel’s Flag Administration on a case-by-case basis. Skåra says that before signing a contract shipowners should seek confirmation from the Flag Administration that the Interim

Guidelines can be used in lieu of the IGF Code Alternative Design Approach or at least as a basis for approval.

According to the Interim Guidelines, cofferdams must have vapour and liquid leakage detection systems and the potential for water filling or inert gas purging upon detection of leakage. Water filling must be done via a system without permanent connections to water systems in non-hazardous areas. Emptying must be done with a separate system, and bilge ejectors serving hazardous spaces must not be permanently connected to the water system.

Nitrogen is needed for keeping an inert atmosphere in the fuel tanks at all times, and for purging bunkering lines and fuel lines. According to the Interim Guidelines, inert gas should be available permanently on board in order to achieve at least one trip from port to port considering maximum consumption of fuel expected and maximum length of trip expected and to keep tanks inerted during two weeks in harbour with minimum port consumption. The nitrogen required to gas-free tanks is in addition to these requirements.

Fuel tanks must not be located within machinery spaces of category A, accommodation spaces or spaces which are not defined and arranged as hazardous zone 1. The forepeak and afterpeak tanks cannot be used as fuel tanks either. Additional safety barriers required for both tank and ship are specified in the Interim Guidelines.

The fuel tank vent outlets are to be arranged at a distance of at least 15 metres from the nearest air intake or opening to accommodation and service spaces. The vapour discharge must be directed upwards in the form of unimpeded jets. Fuel tank vent outlets must be situated not less than three

8 MSC, WinGD, naval architects Marine Design and Research Institute of China (MARIC) and CSSC agreed to conduct a study project to examine the possibility of converting the main engine of a container vessel to a methanol-fuelled dual-fuel engine during SMM on 7 Septembermetres above the deck or gangway if located within four metres from such gangways. The vent system shall be sized, allowing for flame arrestors, if fitted, to permit filling at 125% of the design rate without over-pressurizing the tank.

Economics

A study just released by the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping examined the design of a methanolfuelled dual fuel 15,000 TEU vessel, estimating that methanol newbuilds would cost approximately 11% more than a standard newbuild and a conversion 10-16% more, depending on the level of preparation at newbuild.

The Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping’s report: Preparing Container Vessels for Conversion to Green Fuels was a collaboration between the Center and ABS, Maersk, MAN Energy Solutions, Mitsui, MHI, NYK Line, TotalEnergies, and Seaspan. It found that converting to methanol is less expensive than converting to ammonia partly because fuel tanks can be sized for methanol, installed at newbuilding, and then used for fuel oil before conversion. However, this is not possible for ammonia tanks, which are also more expensive than methanol tanks.

Tank volumes of 16,000 m3 were used for methanol, double the volume required for fuel oil, in the report’s analysis of a 15,000 TEU vessel converted to achieve equivalent range. This reduced cargo space by 240-610, with conversion of unprepared ships sacrificing most space. The vent mast is located at the front of the vessel, 10 metres away from the accommodation, service spaces, the funnel, air intakes, and ignition sources to meet the requirements of the Interim Guidelines.

An open or semi-enclosed bunker station is arranged on the port and starboard sides, so that the parallel body line is sufficiently contacted with a bunker barge. Finding space is challenging due to the limited space between side of the ship and the hatch cover. The space between the hatch covers may be used, but width is limited. As a result, it is recommended that bunker stations are prepared for at newbuild stage.

For unprepared vessels, the conversion only made financial sense after eight to 10 years of operation when the increased earning potential from using the full cargo space balanced out the increased cost and cargo loss of conversion.

These losses can be reduced if range is reduced. A tank capacity of 10,000 m3 led to the loss of around 400 TEU. In this case, the smaller methanol tank system only occupies a single cargo bay located close to the engine room and fuel preparation room. It is assumed that the auxiliary engines and boiler are not converted to methanol use. Conversion

CAPEX reduced to 9-12% of a standard newbuild cost, making it attractive after four years.

For conversion, the fuel tank would need to be cleaned and transfer pumps replaced. The tank coating may also need repair. A dedicated fuel supply system is needed for each fuel and must meet the requirements specified by the engine designer, typically supplying methanol at 13 bar. Fuel pipes outside the fuel preparation room in enclosed spaces must be double walled and will need to be routed in the existing ship structure and machinery space, a complicated undertaking.

The report states that conversion of the 2-stroke main engine requires new cylinder covers, installation of methanol injectors and a new, additional injection system with valve blocks and chain pipes. Other engine parts such as liners and exhaust valves may also need to be replaced, depending on the engine.

The report proposes installation of methanol tanks under the accommodation to reduce cargo losses and a combined fuel oil/methanol tank system that allows for initial use of fossil fuels. Additional tanks could be built between cargo holds according to the desired fuel oil range. “If a vessel is unprepared for conversion and the fuel tanks are not prepared for methanol, for a full range conversion we propose locating the additional tank next to the engine room. It is assumed that the tank will be built as a self-supporting double walled tank, that will be fixed in the cargo hold, and not fully integrated in the hull structure.”

Converting unprepared vessels only makes economic sense on longer timelines or where reduced range options reduce cargo loses, states the report. However, the different preparation levels analysed only had a small impact on newbuild and total costs and very little impact on the total lifetime cost. The desired range after conversion, on the other hand, had a much larger influence on conversion CAPEX and therefore the total lifetime cost.

8 Conversion pathways analyzed in this report

8 Conversion pathways analyzed in this report

Methanol flames are particularly hazardous, as they burn at low temperatures with a flame that is nearly invisible in daylight, with no smoke. A methanol flame often goes undetected until it has spread to adjacent materials that burn in a wider range of light

THERMODYNAMIC LAWS TO LIMIT

PURE-ELECTRIC APPLICATIONS

Duncan Duffy, Global Head of Technology, Electro Technical Systems, at Lloyd’s Register (LR) sees greater opportunity for battery-hybrid and fuel cell applications in deep-sea shipping

Duncan Duffy expects market economics to help pureelectric solutions to find a place among a range of options for ship owners operating in short-sea trades.

Leaving aside the potential impact of regulatory changes, it is a simple matter of thermodynamics. “Charging a batterypowered vessel directly with renewable electricity might result in conversion losses of 15% over the entire supply chain,” Duffy notes. This compares with the 63% efficiency of passing renewable electricity through an electrolyser to generate green hydrogen, and then converting it again to methanol.

This is before you even consider the efficiency of combustion engines, which are approaching their theoretical limits at 55% efficiencies. “For every penny you spend on renewable energy, you end up with significantly less value in terms of propulsion, when it gets to the propeller.”

But Duffy is clear that the technical challenges of scaling up pure-electric solutions to larger displacement vessels cannot be overcome by incentives. He cites the example of a pure-electric cruise vessel to illustrate his point.

“A passenger cruise vessel, operating a 14-hour route between overnight stays with a 10-hour recharging period, would require around 700 MWh,” Duffy noted.

Simply installing sufficient energy storage capacity onboard a vessel to store 700MMWh would introduce its own challenges from an energy storage system sizing perspective. “You would be looking at an ESS equivalent to around 140 teus, or 4,500 cubic metres”.

Duffy also noted that stepping up the electricity from 10kV to 54-55kV DC is likely to push the outer limits of what is technologically possible on vessels. “Bear in mind that the standards that are coming in from the IEC are increasing AC voltages to 36kV AC.”

For Duffy, the most convincing argument against building fully-electric larger displacement vessels is the scale of the renewable energy required to recharge them.

“You would need around 66MWh to recharge such a vessel. Or to put it another way, you’d be dedicating 5% of the output of Dogger Bank A simply to recharge a single vessel.”

LR projects

services is one of the outcomes we expect to get from that work.”

Nuclear power

Duffy noted that the sheer volume of renewable electricity required to produce hydrogen and then on to other hydrogenbased carriers, such as ammonia or methanol, was encouraging market participants to re-evaluate the potential for nuclearpowered propulsion to be used in the civilian market.

Interestingly, some of the work going into certifying swappable battery systems was likely to be applicable for nuclear designs. Potential suppliers of nuclear propulsion technology were also interested in supplying reactors on an Energy as a Service type (EaaS) contract.

“So as long as you have designed and built the ship to accommodate your specific reactor type, what you are effectively delivering is a plugin unit that comes with its own certification.” This would allow LR to leave avoid the challenge of becoming a nuclear regulator, and would also avoid leaving commercial ship operators with the challenge of disposing of nuclear waste at the end of life stage.

Fuel cells

In terms of other technologies, Duffy noted that LR had been involved in research involving fuel cell installations. “We've done studies looking at some fuel cell installations up to the 10MWh level in order to understand how that would integrate with other systems.”

While the technology offers advantages from an emissions perspective, there was little prospect of them replacing pure combustion engines as main movers for larger vessels in the short term.

“It is unlikely you would consider a fuel cell installation on its own without a supporting battery installation or another technology to store and release energy for those short-term transients.”

Battery chemistry

Duffy explained how LR is involved in Current Direct, an EU funded project to examine the potential for developing containerised swappable battery energy storage with a particular focus on the inland waterway market.

“We are using that research to understand the challenges of that technology, both from a security but also from a certi perspective... One of the challenges swappable equipment poses is that the equipment on the ship will change constantly. How we can accept that onto a classified ship as part of the essential

ber projects e n Current mine the inerised with a terway erstand th from tification wappable ent on the can accept he essential

Lloyd’s Register is active in a number of projects involving the electrification of maritime transport.

Duffy noted that lithium ion (Li-ion) was likely to remain the dominant chemistry for batteries for the maritime market for the remainder of the current decade. While other chemistries were under development, all had their own challenges: flow batteries have energy density constraints which are likely to limit their applicability in marine applications, for instance.

dominant for batteries fo cu other chemistries were un had their own challenge energy constr to limit their app applications, for inst

Advances in manufacturing were likely to lead to a doubling in Li-ion battery capacities from 2-3MWh in a teu to 5-6MWh/teu “over the medium to long term”, with university research suggesting that 15MWh/teu might be achievable. But y cautioned that real life operating experience suggested that batteries would rarely be fully charged.

Advances in man to lead to a doub from 2 “over term”, with migh Duffy cautioned that sugge

8 Duncan Duffy, Global Head of Technology, Electro Technical Systems, at Lloyd’s Register (LR)

STOPFORD: SHIP RETROFITS POSE HUGE DECARB CHALLENGE

The shipping industry faces a significant challenge in meeting the IMO’s decarbonisation targets and the task becomes the more difficult the better the economic climate and the stronger the growth of global trade, said Dr. Martin Stopford, the shipping economist

Dr Stopford notes that demand the World Bank forecasts the world’s population will grow by 24% by 2050 from 8 billion in 2021, which means a growing carbon emission burden. It is also likely to lead to growing demand for the services of the shipping industry.

Rather than forecasting the growth in global trade over the coming 30 years, Stopford presented four scenarios for global trade growth. In the first, trade would grow by 3.5% per year and emissions from shipping would reach 28.4 billion tonnes. This, however, he described as unlikely. At a 2.0% annual trade growth, emissions would reach 21.4 billion tonnes and if global trade only grew by 0.8%, the emissions would still amount to 15 billion tonnes in 2050. With lacklustre growth at first and gentle, sustained decline after that the emissions would amount to 11.3 billion tonnes in 2050, a slight reduction from 2021.

Retrofitting existing ships with fuel saving technologies will be one of the challenges that the industry will meet when it works its way towards decarbonisation. There are about 24,000 ship owning companies in the world at the moment and some 13,000 of them only have one vessel. Given the fact that freight markets are quite volatile, a major question is whether these owners will have the resources to make the necessary investments, Stopford noted in a presentation at Marintec in Shanghai in September.

Assuming that global trade will grow by 0.8% per year up to 2050, some ships built before the year 2020 would remain in service up to 2045. The propulsion system on these is based on diesel technology as is that one the first wave of vessels completed after 2020 that Stopford forecasts to trade up to the second half of the 2040s.

From the middle of this decade, wave 2 intermediate technology vessels will start entering service followed by zero carbon wave 3 vessels that will start to emerge soon after the second wave.

The fact that ships based on diesel technology are expected to remain in service for more than two decades from now highlights the need to upgrade existing vessels with energy saving technologies. However, the highly cyclical nature of shipping freight markets means that the main focus of ship owners lies in riding these cycles – it does not lie in technology or innovation.

This focus is quite distinct from the technological changes required to meet the IMO’s decarbonisation objectives. “You need entrepreneurs, people who make things work, young engineers who can work at home and at the office and who understand digital,” Stopford said. Although there is a lot of discussion about unmanned ships that may operate on the oceans in the future, the most crucial challenge that the shipping industry faces is not technology, but people.

While the industry needs entrepreneurial people, they should also be prepared to meet obstacles. “[When] Alfred Holt decided to use the type of boiler used in locomotives that worked at a pressure of 100 pounds per square inch on

his ships, rather than [the] ones working at 10 pounds that was the norm in shipping… the government tried to stop him,” Stopford said, referring to a British shipowner in the 1860s.

Shipowners should also be aware that there is likely to be a significant “green energy gap” as the production of green fuels is unlikely to keep up with demand growth from the second half of this decade onwards. As the demand for green energy is likely to outstrip supply in the near future and ultimately the production of fossil fuels will peak, nuclear power could be an option that the shipping industry needs to consider, Stopford concluded.

Investment needed in skilled staff and technology Stopford also notes that digital skills will be increasingly important in future, as ship owner seek to optimise the performance of systems onboard. Digital capabilities will be required to monitor the development of emissions from its ships and to reduce them. “Many owners do not have the staff to do this, they do not have the technical support anymore,” he told The Motorship.

Consequently, ship owners may well need to invest in hiring people with the right skills, at the same time as investing in energy saving technologies, to ensure that the investment in hardware produces the desired results.

8 Stopford: Digital technology and skilled employees will be required to achieve decarbonisation objectives

PARTNERS READY FOR DUAL-FUEL HYDROGEN ENGINE PROJECTS

The companies have worked together in pilot projects since 2017, successfully adapting Volvo Penta engines to run as a dual-fuel hydrogen and diesel solution via a conversion kit provided by CMB.TECH. Now, says Jakob Ursby, Director of Business Development at Volvo Penta, they are ready to start the dialogue with the market related to this increased cooperation on a project-to-project basis, with the aim of moving into small-scale industrialisation.

The aim is to establish dual-fuel hydrogen technology as a low-carbon interim solution before suitable zero-emissions alternatives become viable. It is an important step in Volvo Penta’s and CMB.TECH’s joint ambition to help accelerate their customers’ transition to net-zero emissions.

“From the initial dual-fuel technology projects we have seen reductions of CO2 emissions of up to 80%,” says Roy Campe, Chief Technology Officer at CMB.TECH. “It is clear that the energy transition is a major challenge in many types of applications. With the dual-fuel technology we have been developing over the last few years, we can provide a costeffective and robust solution for a variety of applications. We think there is huge potential in this solution for customers, both on land and at sea.”

The solution is expected to appeal to many shipowners due to its ease of installation, maintenance, and use. For the marine portfolio, the partners aim to start with pilots within the Volvo Penta commercial marine engine range. “Our dual fuel technology can be implemented on any diesel engine. The modification is minor and entails mainly the installation of a hydrogen injection manifold onto the air inlet collector. Also, the engine controller needs to be flashed with new software which allows for a switch over to the dual fuel mode,” says Campe.

large commercial sea going vessels. It uses two dual fuel combustion engines (H2ICED) with a total capacity of 441kW.

“The simplicity of the dual fuel technology allows a quick introduction into many applications. The potential to decarbonise with green hydrogen is huge, but many applications require a fallback scenario of traditional fuel to maintain a viable business. With the dual fuel technology, your asset is future proof, even without a full coverage of a reliable hydrogen infrastructure today,” says Campe.

He says: “The dual fuel technology is ideally suited to solve the chicken and egg story which is applicable if one wants to introduce a new fuel. It is a cost-effective and robust solution for emission reduction without compromising the operational performance. The transition can start today, even without a full coverage of a reliable hydrogen infrastructure. Using dual fuel engines, today's production capacity, experience and the widely spread service network can be applied to support energy transition, while getting acquainted with hydrogen as an alternative fuel.”

8 The design and testing of CMB. TECH’s hydrogeninjection system takes place at its Technology and Development Centre in Brentwood, in Essex, England

The co-combustion process involves hydrogen being injected and aspirated in the cylinder during the intake stroke. It mixes further to create a homogeneous mixture during the compression stroke, then a small amount of pilot diesel is injected into the chamber before top dead centre. The diesel auto-ignites due to the high temperature and pressure and co-combusts with the hydrogen, forcing the piston down during the power stroke. The cylinder is cleaned during the exhaust stroke with lower NOx and CO2 emissions in the exhaust gas.

CMB.TECH has its own passenger vessel, the Hydroville (in operation as from 2017), working on the dual-fuel technology implemented on the Volvo Penta engine. The 14-metre catamaran is a pilot project to test hydrogen technology for

Ursby says that a range of vessels across the commercial marine market are suitable for the dual-fuel solution. “Applications will go hand-in-hand with infrastructure development. For example, with the development of the ecosystem of vessels in the harbors, then we can imagine tugs and pilot boats as key targets. Another great potential is the crew transfer vessel market serving the offshore windfarms.

“This is a way to bridge over the gap to fully greenhouse gas free solutions which are under way. The dual-fuel solution will heavily reduce the emissions of greenhouse gases while at the same time provide a robust and reliable solution and thereby high productivity.”

Volvo Penta is investing heavily in exploring a wide range of sustainable and bridging technologies – such as hybridisation, electric drivelines, fuel cells and alternative fuels for combustion engines – giving customers the opportunity to find the technology that works best for their application.

Volvo Penta and CMB.TECH have agreed to accelerate the development of dual-fuel hydrogen-powered solutions

The dual fuel technology is ideally suited to solve the chicken and egg story which is applicable if one wants to introduce a new fuel

‘‘Credit: CMB.TECH

COSCO NH3 TEST ENGINE AMONG CHINESE AMMONIA LANDMARKS

China Classification Society (CCS) and Dalian COSCO Shipping Heavy Industry have held an ignition ceremony for COSCO’ first ammonia powered duel fuel test engine and an Approval in Principle (AiP) release ceremony for the design of ammonia-powered ships and ammonia supply system design

8 China Classi

cation Society (CCS) and Dalian COSCO Shipping Heavy Industry have held an ignition ceremony for COSCO’s

rst ammonia powered duel fuel test engine

The project is based on the 5000HP engine built by Dalian COSCO Shipping Heavy Industry and includes the design and manufacture of ammonia storage and gas supply systems, exhaust gas treatment, and the overall design and construction of ships.

CCS has set up a team of experts to participate in the R&D of the related sub-projects and the construction and inspection of the actual ship.

At the AIP release ceremony, Zhang Hui, general manager of CCS’s Dalian Branch, issued the world's first AiP certificate for an ammonia-fuelled tug design based on a construction project underway at Dalian COSCO Shipping Heavy Industry.

Ni Zhiyong, Director of the Product Division of CCS’s Shanghai Branch, issued an AiP certificate for the first domestic ammonia fuel supply system for marine four-stroke engines to Weihai Heavy Industry Technology.

HHI-EMD tests hydrogen blend on HiMSEN engine

Hyundai Heavy Industries Engine & Machinery Division (HHI-EMD) has tested an LNG and hydrogen fuel mix in a 1.5MW HiMSEN engine.

This engine performed with excellent performance and stability during the test, says HHI-EMD, which was conducted at HHI-EMD’s R&D centre. The mixing ratio of 25% hydrogen led to a 30% reduction in CO2 emissions compared to a diesel engine.

This LNG-hydrogen HiMSEN engine can be used for stationary power plants, or as a genset or propulsion engine on ships. The hydrogen evaporation gas (BOG) can be reused as fuel for the engine.

HHI-EMD has been developing the eco-friendly engine for LNG, methanol and ammonia, and additionally has a plan to develop the pure hydrogen combustion engine by 2025.

8 Weihai Heavy Industry Technology was awarded an AiP for an ammonia fuel supply system for marine four-stroke engines

8 HHI-EMD has successfully tested an LNG and hydrogen fuel mix in a 1.5MW HiMSEN engine at HHI-EMD’s R&D centre

ON THE CHARGE: VARD EXPECTS ELECTRIC SHIFT IN SOV MARKET

Busy with plans for new windfarm support vessels (SOVs), ship designers from around Norway’s west coast offshore cluster, and their corresponding yards, are proceeding on the understanding that windfarm operations will soon be powered entirely by battery-electric systems

A world-leader in shore power, and deriving over 95% of its energy needs from renewable hydropower, Norwegian companies are uniquely placed to consider how ship operations could become fully-electric with assistance from batteries. Already, Norway operates several allelectric vessels operating using large battery banks, including ferry Bastø Electric (4.3MWh) and the famous container feeder Yara Birkeland (6.7MWh).

Olympic Subsea, based in Fosnavåg, has subsea and offshore oil and gas vessels converted to work as SOVs. The company is also preparing its vessels to be able to plug in to wind turbines to charge. “We are a preparing a mooring system in the stern, which we can take on board a charger cable. It’s uncertain what standards are going to be in the industry, but we are preparing the vessel to have the route of the cables, the foundation for a mooring system. We have a battery pack on board, and we have dedicated additional rooms on deck, to facilitate up to four times the battery capacity.”

Designer Vard boasts that 87% of the vessels in its orderbook will either be delivered with batteries installed or be battery “ready”. Asked for clarification on what “ready” meant in this context, Henrik Burvang, Vard Design Manager, Research and Innovation explained: “Yes, to a large extent this boils down to providing that space. [But] if you actually have the intention of installing [batteries]… you need to be confident that it is manageable, and especially in regard of safety, and the approval process. So how much ventilation is needed, what kind of hazard do storms create on the ship.

“The more you prepare in the design phase, the more studies we are able to do, the easier the retrofit will eventually be.”

To this end, Vard is combining iterative computing with computational fluid dynamics, in a toolset it calls ‘parametric optimisation,’ to devise by machine-learning the best hull shape to allow its ship to move most efficiently through the waves, while also providing the optimum hull geometry to house large banks of batteries. “…we can do studies all night, on hundreds of different hull shapes,” Burvang said.

A design for a green SOV is part of Vard’s “Zero Class” line up which also includes a fishing vessel and a platform supply vessel (PSV). But Vard wants to take the concept of plugging ships into turbines even further, though, with its Plugin Electric PSV Project (PIEZO), which, confusingly, has nothing to do with piezoelectric minerals. It proposes to decarbonise offshore oil and gas, by capitalising on recent branching-out of some oil majors like project stakeholder Equinor, into renewable energy.

Norwind Offshore has only one vessel currently in its stable, Norwind Breeze, a former Vard PSV, now converted into an SOV. But the fledgling offshore company, which was formed by Volstad, Farstad and Kleven during the pandemic, has four more SOVs on order, of the Vard 4 19 design with hybrid diesel-electric propulsion. Each will have space underneath the working deck which can accommodate a large bank of batteries. “From our point of view, the

technology is there, it is just about scaling up,” said Roy Ove Standal, Norwind COO. “With a 25MW battery package, we can operate on electricity about 15 hours per day.”

But the batteries are not being fitted at the yard, and there is a tacit understanding that the spaces might be used for something else, like methanol tanks.

“In the US, Equinor tells us, they are obliged to offer a charging facility offshore,” explained Norwind Offshore CEO Svein Leon Aure, “So that will come, and we will deliver the vessel with the battery and a charger.”

He suggested the same might not pan out so neatly in Europe, without support from the right quarters. The vessels may instead be forced to bunker methanol or ammonia, from an offshore production facility powered by windfarm energy.

He acknowledged that charging onboard batteries with electricity would be cheaper and more efficient, “from our [an SOV operator] point of view.” However, he said: “I think there is a lot of politics involved. The energy the windmills are producing is very often sold already… so we cannot just tap from the production, which is one challenge.

“And, certain areas are requiring that all additional energy produced should be converted to hydrogen. So there is no defined way as to how this will develop.”

8 Vard SOVMONO FUEL HYDROGEN ENGINE PROJECT WINS UK FUNDING

The Department allocated over £14m to 31 projects supported by 121 organisations from across the UK to deliver feasibility studies and collaborative R&D projects in clean maritime solutions.

HydroMAR-E, a collaboration between Dolphin N2, Brighton University and Hiflux, supported by BMT, is developing a mono-fuel hydrogen version of the recuperated split cycle engine can be used in a range of heavy-duty applications for land and sea. It offers very high efficiency (competitive with a PEM fuel cell) very low emissions, and moderate capital cost increases compared to existing internal combustion engine manufacture.

Uniquely, and unlike a standard internal combustion engine, the new engine has demonstrated ability to use diesel, methane and hydrogen in the same core engine (and has potential for the same with ammonia or methanol) with the same high efficiency and low emissions, enabling a rapid transition as future fuels become more widely available.

The engine concept is covered by eight international patent families. A single cylinder proof of concept engine has been running at Brighton University since 2017.

Dolphin N2 says the recuperated split cycle is an internal combustion engine, with all that implies in terms of low cost and ease of manufacture, that aims to compete with zero emission drivetrains. It targets long haul trucks, 0.5-50MW distributed power generation, mixed-mode rail and marine applications. It can potentially do this with the efficiency of the largest power stations, and air quality somewhere between the toughest Californian passenger vehicle standard, and zero-impact (meaning emissions can’t be detected or are cleaner than the surrounding air).

There are two versions of the technology: ThermoPower® is a simplified system offering most of the air quality benefits and efficiency advantage versus advanced diesel engines and CryoPower® which delivers ultimate efficiency and air quality by the addition of liquid nitrogen or air to its internal processes.

“Split-cycle engines are known technology, and recuperation is commonplace in industrial gas turbines. It is the specific combination of these, plus the use of water or liquid nitrogen, that is innovative,” says Dolphin N2 on explaining the technology:

The distinctive feature of the engine is that the “cold” and “hot” parts of the traditional internal combustion engine are separated. A first set of cylinders draw in air and compress it – in the CryoPower® version, Liquid Nitrogen is injected to keep this process cool for maximum efficiency; the simpler ThermoPower® injects water. Then the compressed air passes through a recuperator, where the engine’s exhaust heats it up – saving fuel which normally has to do this. The air now passes to the second, hot cylinder set, which are thoroughly insulated – something that is not feasible in a normal internal combustion engine where the same cylinder handles hot and cold processes. These cylinders host the combustion and expansion events, which produce power;

they are bigger than the compressor cylinders (again impossible in a standard engine) because that is most efficient. The hot air passing into these combustion cylinders does so at the speed of sound, leading to extraordinary mixing with the fuel, and a unique “cool combustion” regime. The very low level of emissions, especially NOx and particulates, can be reduced using urea-based selective catalytic reduction after-treatment.

The cost for the ThermoPower® engine is estimated at around +20% compared to conventional diesel, with a fuel saving of 10-18% giving payback within a year. For CryoPower®, capital cost is estimated at around +50% of the cost of a commercial diesel engine, with fuel cost savings of up to 2025% per year giving a rapid payback on the extra cost.

HydroMAR-E will use a laboratory single cylinder engine, which has already demonstrated starting and running, to develop this spark-guided system to TRL4, then a multicylinder prototype to demonstrate TRL5 in readiness for future application demonstration in marine environments. Supporting work will develop an improved recuperator system, and review marinisation, installation, vessel systems and regulatory aspects.

Commenting on the award of the grant, Jake Rigby, Research and Development Lead at BMT said: “The UK is one of the global leaders in clean shipping, and, in an industry that is strongly focused on sustainability and zero emissions, it makes sense that the supply chain is also as decarbonised as practically possible, with retrofit and newbuild power generating solutions being considered for maritime applications. We look forward to moving this project forward, using the best in innovative green technology, complex engineering, and a partnership mindset to contribute to a more diversified and resilient energy economy.”

8 HydroMAR-E, a collaboration between Dolphin N2, Brighton University and Hiflux, is developing a mono-fuel hydrogen version of the recuperated split cycle engine, which can be used in a range of heavyduty applications for land and sea

project has been selected to develop is mono fuel hydrogen engine as part of the UK Department for Transport’s Clean Maritime Demonstration

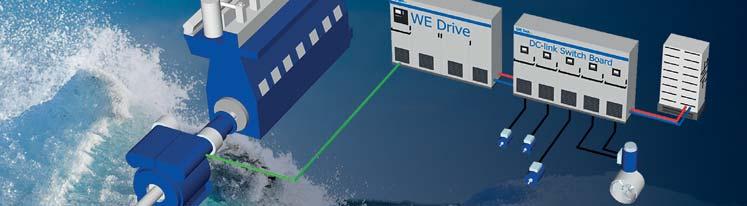

ABB’S DAC SYSTEM UNDERPINS MAN HYBRID DF LNGC DESIGN

The DFE+ concept features the MAN 49/60DF engine and ABB’s Dynamic AC (DAC) technology which aims to cut fuel consumption and reduce CO2 and methane emissions compared to conventional dual-fuel diesel electric (DFDE) propulsion systems. It also provides operational flexibility for different trades or retrofit from an LNG carrier to an FSU or FSRU.

A conventional DFDE concept is characterised by gensets operating at constant speed over the entire engine load, optimised for high load, typically 85%. At lower loads, the engines operate less efficiently, leading to higher fuel consumption and more methane slip.

In contrast, the new MAN/ABB DFE+ concept implements variable-speed operation, leading to better efficiency with significant reduction of methane slip over the entire engine load.

Variable speed power

Rune Lysebo, Head of Global Sales, ABB Marine & Ports, says the electric system can be optimised regardless of what fuel is used, and as a result, the concept is future-proof. “The same level of efficiency cannot be reached with fixed speed dual-fuel engines as the basis.”

The system also allows the use of future energy sources, such as fuel cells. “Shipowners who equip their vessels with an electric backbone and DAC will benefit from a fuelagnostic and 2050-ready ship.”

LNG carriers have two main operational modes: oceangoing and loading/ off-loading mode. Ocean-going mode represents the majority of the operational time, says Lysebo. DAC enables varying the frequency of the main power distribution system to match the vessel's power needs, providing significant energy savings. Loading / offloading mode is done with engines operating at nominal speed, hence standard cargo pumps can be used.

“This concept can be applied to Azipod® units, single and twin screws, as well as permanent magnet, synchronous or induction motors and gearboxes,” says Lysebo. “Based on the typical operational profile and sailing speed of LNG carriers, we see that the efficiency can be significantly improved from the current dominating propulsion concept used on LNG carriers. The new concept will give greater freedom in designing power and propulsion trains on LNG carriers. We expect to see more space available for payload or reduced length of the vessel, which again will contribute positively to lower fuel consumption and lower emissions.”

Energy storage is an optional extra benefit for the system. It can help to achieve more optimal load points for the engines, provide enhanced dynamic support of the distribution system and act as spinning reserve without causing additional emissions.”

Lysebo says that while variable-speed applications are well established for power distribution systems up to 10MWe, torque requirements and the low efficiency of first-generation dual-fuel engines – including limitations in the e-systems

design for diesel-electric propulsion systems over 10 MWe – made variable speed for propulsion systems over 10Me10MWe unworkable. The DAC technology overcomes this and is suited to a range of vessel types.

With DAC, the ship’s main power system is engineered for variable frequency, including component design and system integration. Power distribution for auxiliary loads is provided by frequency converters or directly from the variable frequency system. There are numerous small consumers in a vessel that are supplied by the engine room switchboards. This low voltage distribution is normally 400 – 690V with constant frequency, 50 or 60Hz. The DAC concept handles low voltage distribution and can be customised into different configurations to suit owners’ requirements.

The basic solution uses centralised frequency converters (island converters) to feed constant frequency at desired value to low voltage switchboards and distribution panels. and other loads requiring constant frequency. This is quite straightforward approach and allows the downstream distribution network to remain unchanged.

To achieve higher levels of integration, it is possible to combine the island converters with motor drives in multidrive configuration. This solution would reduce the size of island converters even more and in some cases make separate converters for single motors unnecessary.

8 Pictured at SMM, Stig Leira, Transformation Program Manager, ABB Marine & Ports; Rune Lysebo, Head of Global Sales, ABB Marine & Ports; Marita Krems, Vice President and Head of Four-Stroke Marine & License, MAN Energy Solutions; and Elvis Ettenhofer, Head of Marine FourStroke – Region Asia Pacific, MAN Energy Solutions

and

have teamed up on the

for LNG

Dual-fuel flexibility

With DFE+ shipowners will face less challenges in meeting the IMO’s Carbon Intensity Indicator (CII) requirements than would with existing LNG carrier propulsion technologies, says Elvis Ettenhofer, Head of Marine Four-Stroke – Region Asia Pacific, MAN Energy Solutions.

“In the last 15 years the shipping industry has made a continuous change for most of the ship applications from liquid fuels like MGO, MDO or HFO to cleaner and more environmentally friendly fuels like LNG. New emission regulations and geopolitical developments are accelerating the request for carbon neutral fuels like methanol, ammonia, hydrogen or synthetic fuels. Compared to LNG where the industry had a clearer picture and more time, today nobody can predict 100% when and what fuel will make the race. This creates uncertainty in respect of investment decisions to our customers and therefore the biggest value we can provide to our customers is flexibility.”

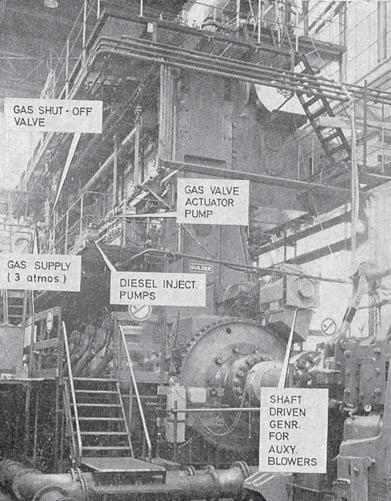

The newly launched MAN 49/60DF is available as an in-line engine with 6, 7, 8, 9 or 10 cylinders or as a V-type engine with 12 or 14 cylinders. Its output ranges from 7,800 to 18,200 kW, and it can run on LNG, diesel, biofuel blends and synthetic natural gas to provide fuel flexibility on the path to decarbonisation. “MAN 49/60 is our new 4-stroke flagship, and the engine platform is ready for all main alternative carbon neutral fuels. We still consider LNG as the main transition fuel and have therefore released the LNG version first. Next year the pure liquid version will follow for example diesel or synthetic fuel, and this version will be methanol ready.”

The 49/60DF features MAN’s latest technologies, including two-stage turbocharging, second-generation common-rail fuel injection, SaCoS5000 automation system and MAN’s next generation Adaptive Combustion Control ACC 2.0 that automatically sets combustion to optimum levels depending on ambient conditions, fuel quality and engine wear. The engine also retains existing MAN technologies such as the gas-injection system, pilot-fuel-oil system and MAN Selective Catalytic Reduction (SCR) system.

The 49/60DF can start in gas mode where it complies with IMO Tier III without secondary measures. In diesel mode, it complies with Tier III when combined with MAN’s SCR system. Soot emissions are halved in diesel mode due to MAN’s new common rail system 2.2, while the 49/60DF’s methane emissions are also drastically reduced in gas mode.

“One big benefit of a DFE+ System is that you can use the engines for the propulsion but also during LNG loading and unloading at the terminal,” says Ettenhofer. “This means you can reduce installed power to a minimum and still have enough redundancy in case of a technical issue or planned maintenance during regular ship operation. The exact number of engines or cylinder variants installed are very much dependant on the customers’ requirements for redundancy and ship speed. But considering as an example a required propulsion power of 22MW at design speed, 3 x 10L 49/60DF (1,300kW per cylinder) with a total installed power of 39MW, would be sufficient to have 2 x 10L 49/60DF online and one 10L 49/60DF standby for the operational load point with the highest power demand. Our customers benefit from the reduced numbers of installed engines and cylinders when it comes to maintenance costs and higher pay-load due to weight.”

Combined benefits

Regarding anticipated fuel savings, Ettenhofer says: “MAN and ABB are running simulations, and we will double-check our results with shipyards. This is a complex process and will take some time, but we see already now significant potential

in reduction of fuel costs and methane emissions. From a 49/60DF engine perspective only, we have around 4% in fuel savings compared to MAN’s first generation 51/60DF engine and around 40% in methane emissions reduction, with constant speed.”

“These improvements result from MAN’s two-stage turbocharging and improved combustion process based on MANs ACC2.0 (adaptive combustion control), smart sensors and enhanced pilot fuel injection that give us the possibility to perfectly control every individual cylinder and combustion cycle and reduce the methane emission and lift the efficiency of the engine to another level. Together with the integrated MAN/ABB DFE+ concept, additional savings in fuel and methane emissions will be generated.”

The DFE+ concept is able to be integrated with MAN’s ALSi (Air Lubrication System interface). Typically, conventional air lubrication systems use compressors to provide the air, and this means a lot of energy is required, says Ettenhofer. “MAN’s 49/60DF provides a smart interface that means no compressors are needed, and this improves vessel efficiency.”

MAN and ABB presented the DFE+ solution at the SMM trade show and have received a lot of positive feedback. The companies are expecting to announce their first customer soon.

8 The DFE+ concept aims to cut fuel consumption and reduce CO2 and methane emissions compared to conventional dualfuel diesel electric (DFDE) propulsion systems for LNG carriers

8 MAN 6L49/60DF engine

MODULARITY KEY TO DECATRIP BIO-LNG CORRIDOR PROJECT

A project called Decatrip aims to introduce carbon neutral ferry travel between Finland and Sweden in five years’ time but it also has a wider aim: to present modular architecture on which similar projects could be implemented elsewhere in Europe, which again could benefit a wide range of industries

In early September, Business Finland granted almost EUR1.6 million to a project called Decatrip set up by the shipbuilder Rauma Marine Constructions (RMC), Åbo Akademi University, charging solutions supplier Kempower and the ferry company Viking Line to set up a green corridor on the roughly 10 hour ferry crossing between Turku in South Western Finland and the Swedish capital Stockholm. Each ferry makes two crossings per day.

“The solutions developed in the project will enable fully carbon-neutral freight and passenger travel between Turku and Stockholm, but the project will also be scalable for other routes. This is important since all EU countries, Finland included, have signed on to build green maritime transport corridors,” said Mika Laurilehto, interim CEO of RMC in a statement.

Dr. Magnus Gustafsson, Research Director in Industrial Management at Åbo Akademi University, told The Motor Ship that the project’s roots go back to 2020 and discussions with RMC concerning the prospects for shipping in the region to use locally produced renewable fuels. It was clear from the start that these would be much more expensive than the ones that shipping uses today.

Håkan Enlund, SVP sales and marketing at RMC, had pointed out how the situation in shipping was akin to that with cars in the US before the oil crises of the 1970s. “Cars were fuel hungry, because fuel was cheap and fuel was cheap, because cars were fuel hungry,” Gustafsson cited Enlund’s words.