DIGITAL: TALKING THE SAME LANGUAGE

OVERCOMING DIGITAL FRAGMENTATION

SHAPE OF THINGS TO COME

PLOTTING GREEN CORRIDORS

DIGITAL: TALKING THE SAME LANGUAGE

OVERCOMING DIGITAL FRAGMENTATION

SHAPE OF THINGS TO COME

PLOTTING GREEN CORRIDORS

As our story Port and Terminal Investors CrowdIn, on p11, makes clear there is a lot of activity at the moment directed at buying into terminal sector opportunities with much of this coming from shipping lines. As PS goes to press there is more of this news with Hapag Lloyd signing a binding agreement via which it will acquire 35 per cent of JM Baxi Port & Logistics Limited from a Bain Capital Private Equity Affiliate. Furthermore, Hapag Lloyd is to subscribe to a capital increase by the company and raise its shareholding to 40 per cent.

The deals keep coming, with much evidence of the shipping line penetration into the terminal sector – sometimes as part of an overall effort to diversify along the supply chain and in other instances just to build a position in the terminal world.

Many of the deals, or combination of deals, are of such a scale that it is hard to imagine shipping lines repeating the actions of the past and disposing of port assets when the ‘hard rain falls.’ The theory seems to be, if you get involved on a large enough scale you move out of the arena of a niche investment and add another pillar to your business which represents a healthy and complementary area of diversification that will play a significant part in sustaining you through tough times and boosting overall performance in the good times.

Will it work? Watch this space…

There are those that believe that down the track the disposal of certain terminal assets by lines is a distinct possibility. Coupled with this there is expected to be more involvement by private equity, infrastructure and pension funds in the port sector – the high profile of the logistics sector during Covid has helped to build this interest.

As we enter 2023 there certainly promise to be interesting times ahead, with many commentators forecasting a challenging period of contraction, suggesting, in turn, as The Economist puts it on p19 that its “Time to batten down the hatches.” The Analyst and The New Yorker columns, on p18, subscribe to a similar point of view, highlighting how a new planning canvas is in prospect and an era that presents a difficult decision-making environment.

If you haven’t had enough to think about after you have read these pieces, then dive into Andy Penfold’s Shape of Things to Come article on p24. This sees a tighter business climate having a far-reaching impact on the terminal sector.

There is plenty of food for thought.

Happy New Year!

The international magazine for senior port & terminal executives

EDITORIAL & CONTENT

Editorial Director: Mike Mundy mmundy@portstrategy.com

Features Editor: A J Keyes keyesj186@gmail.com

Consultant Editor: AndrewPenfold andypenfold@yahoo.com

Regular Correspondents: Felicity Landon; Stevie Knight; John Bensalhia; Ben Hackett; Peter de Langen; Barry Parker; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING t +44 1329 825335 f +44 1329 550192

Media Sales Manager: Arrate Landera alandera@mercatormedia.com

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

PS magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com

Register and subscribe at www.portstrategy.com

1 year’s print subscription £295.00

1 year’s digital subscription with online access £228.50

For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com

©Mercator Media Limited 2023. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

Another year and plenty of challenges in the offing. There have been significant structural changes in the terminal sector –notably the increased penetration of liner operators. Will this stand the test of time? Financial entities are also forecast to have a larger role to play, encouraged by some recent healthy “cash-outs” by certain of these parties from early deals and by the generally higher profile of the sector generated in the covid era

The

Talking the Same Language highlights the innovative work of the iTerminals4.0 project to develop and test – in real operations – a standard digital language that allows for twoway communication between port equipment and terminal operations management systems. Equally, the article Overcoming Digital Fragmentation underlines how the removal of digital fragmentation will provide a major catalyst to digital transformation

(Picture: Port of Singapore Authority)

These are trying times, but we are resilient, responsive.

Despite the many challenges in this unprecedented time, we continue to quickly and safely deliver basic goods, food, medicine and supplies. With tireless, selfless men and women at the forefront, we are able to deliver essentials needed by societies and economies to heal and recover.

WE ARE STRONGER THAN EVER.

Hutchison Ports has exited the Dar es Salaam container terminal concession after failure to reach agreement with the Tanzania Port Authority (TPA) on the extension of its tenure there. Negotiations reportedly took place right up to December 2022 but the TPA formally took over the facility on 1 January 2023 with Adani Ports & SEZ appointed as what TPA describes as a service contractor on a monthly fee basis.

Hutchison’s exit took place against a background of a strained relationship with the TPA. There had been financial tensions a few years back – in September 2017, the late President John Magufuli instructed the TPA to review its contract with Tanzania International Container Terminal Services Inc (TICTS), Hutchison’s Tanzania business unit, with this resulting in a doubling of annual fees to the port authority, from US$7 million to US$14 million. The agreement between the two parties was also cited by Prof. Musa Assad, Controller & Auditor General, National Audit Office of Tanzania, 2014 – 19, as having major defects.

At a performance level there have also been regular problems relating to vessel berth waiting and container dwell times. Typically, in February 2020 waiting time for a berth at TICTS was reported by Hapag Lloyd as between 16 to 19 days and as recently as December 2022 as 8 to 10 days by Maersk. Not all of the congestion generating problems can be sourced to TICTS – there have been negative impacts from diverse sources:

Customs’ requirements, inland depot operations, truckers, container scanning requirements etc. but, as often happens to terminals, TICTS ended up ‘in the eye of the hurricane.’

External agencies such as the World Bank have in the past also criticised the port’s performance – suggesting that it can do better both in the context of serving Tanzania and the surrounding landlocked countries via the Central Corridor - Malawi, Zambia, Burundi, Rwanda, Uganda, and Eastern DRC.

Looking to the future, Plasduce Mbossa, Director General, TPA, has made it clear that the port will endeavour to find a new investor for Dar es Salaam’s container terminal. Equally, he emphasised when he took up his post, in mid-2022, that working with private sector companies to deliver a high level of efficiency is a priority and as such this goal is expected to figure large in the operator selection process for the container terminal. There is no word yet on the precise process that will be employed to achieve this but the logical path,

The governments of the UK and Scotland have announced plans to develop two new Green Freeports at Inverness and Cromarty Firth and Firth of Forth. The UK government is providing up to £52 million (US$63.3 million) in funding, with the initiative expected to generate an estimated £10.8 billion (US$13 billion) of private and public investment and create more than 75,000 new jobs. Sites in North East Scotland, Orkney and Clyde were not approved.

8 Offering a concession for the Dar es Salaam container berths via an international tender is in prospect with the port’s desire to boost efficiency levels central to this

especially given the desire to improve efficiency, is an international tender based on a multi-criteria bid – technical and financial aspects.

There have also been reports that the TPA is considering offering a concession for berths 5 to 7, in addition to berths 8 to 11 for the container terminal.

TPA currently operates berths 5 to 7, where approximately one third of the port’s annual container volume is handled as well as a variety of other cargoes. One option could be for the TPA to consider offering all these berths as one concession which would provide economies of scale and could offer advantages in pursuit of higher levels of efficiency. It would also give more flexibility to TPA in conjunction with its planned berth upgrade works at berths 8 to 11. Berths 1 to 7 have recently been reconstructed and provided with a depth alongside of 14.5m.

UK-based PD ports has raised a total debt facility of GBP710 million to refinance existing debt and provide for future business growth.

The 5-year arrangement, organised in conjunction with a syndicate of international banks involved in the infrastructure

sector, comprises a term facility, capex facility and RCF.

CIBC acted as coordinator, lawyers Hogan Lovells advised PD Ports – Linklaters acted for the lenders.

PD Ports continues to facilitate the growth of industry around its key port facilities, a notable recent

project being the establishment of the UK’s first large-scale lithium refinery at Teesport. The GBP500 million project will be used to provide battery materials for electric vehicles, renewable energy and consumer technology supply chains. Commissioning is scheduled for 2025.

The International Association of Ports & Harbours (IAPH) has released a new publication focussing on newly-created risk and resilience guidelines for ports as well as established a new risk inventory portal aimed at sharing best practices on risk mitigation and management for ports. IAPH aims to support ports in establishing a structured approach towards risk management and delivering business continuity and organisational preparedness.

The Swedish Government has given approval for Ports of Stockholm to apply for EU grant funding for pilot studies to develop onshore power infrastructure. The process will be undertaken in conjunction with eight other Baltic Sea ports seeking funding from the EU Connecting Europe Facility (CEF) that aim to gain support for facilities enabling more sustainable shipping with low air pollutant emissions. The application is called ‘Baltic Ports for Climate’ and partners are Aarhus, Klaipeda, Ventspils, Helsinki, Riga, Tallinn, Gdynia, and Hamburg.

Although Brazil’s Mario Franca, Brazil’s new Ports and Airports Minister, has strongly hinted that the urgently needed STS10 new container terminal concession for Santos will go ahead there could be a spanner thrown into the works as another port terminal, Ecoporto, lays claims to a sizeable chunk of land designated for STS10.

Outgoing Santos Port Authority (SPA) president Fernando Biral has said that some of the cash from recent years’ profits made from port operations – a record Reais416 million (US$80m) for

A leading Chilean logistics association has joined in with the country’s Maritime and Port Chamber (Camport) in calling for increased “public-private co-ordination” to combat violent criminal gangs stealing from container operators.

Colsa (the Logistics Association for San Antonio) has thrown its weight behind other Chilean agencies and companies involved in security - both private and public – to face up to the increasing “multi-million dollar thefts” from port areas in San Antonio.

The extra push for cooperation comes in the wake of a massive heist on January 11 which saw a well-organised criminal gang steal 13 containers stuffed with copper, valued at Pesos3,600M (US$4.414 million), belonging to state-owned Codelco. According to San Antonio police, 10 heavily armed

The International Container Terminal Services Inc. (ICTSI) subsidiary in Mexico, Contecon Manzanillo (CMSA), has commenced the third phase of its expansion project. This development will see capacity increase from 1.4 million TEU per annum to more than two million TEU per annum within the next fi ve years. Investment, which will span terminal infrastructure and quay and landside equipment,will total more than US$230million.

the first nine months of 2022 (see p31) - will go to a fund to pay “outstanding debts” to some operators, including Ecoporto. And a source very close to Ecoporto, a container and breakbulk terminal, notes that its area, of 126,000 sq m, is destined, according to SPA’s PDZ Master Plan, to be part of the 570,000 sq m that will form STS10, but if a “compensation agreement” is not reached with SPS and/or the Ports Ministry, then it will go through the courts and that could delay the process for up to five years.

In a nutshell Ecoporto, according to the reliable source, is saying the SPA must provide Reais300M (US$60M) compensation for the terminal handling equipment (including three virtually unused ZPMC STSGCs) it will hand over to the winning STS10 bidder plus another Reais1bn ($196M) for a “contract discrepancy.” Ecoporto’s operational area should have been 40,000 sq m larger when it began its concession some 20-years ago. While the concession has now ended, aside from a short short-term extension

to July, Ecoporto still has an active claim for compensation.

The way Ecoporto sees it, SPA has two choices; either they pay up most of the Reais1.3bn compensation claim or allow it to continue to operate with a renewed concession for another 20 or 25 years, which Antaq originally gave them permission to do. If not legal proceedings will be issued and that will be very time consuming.

Indeed, a source at Ecoporto reports that preliminary legal actions have already been initiated.

8 Colsa (the Logistics Association for San Antonio) is the latest organisation to call for increased “public-private co-ordination” to combat violent criminal gangs stealing from container operators

united effort from all parties.”

men entered the compound during the early hours, threatening staff before driving off with the containers.

This heist follows a series of attacks on container train and railroad facilities in northern Chile last October which forced the Chilean government to tighten security on all trains carrying copper.

“Companies associated with

Porto Itapoá, the rapidly growing container terminal in southern Brazil, in which Maersk has a 30 per cent stake, has just dded another 50,000m2 to its operational area increasing it by around 20 per cent and further expansion is in the pipeline of up to 150,000m2

Five ZPMC Mobile Harbour Cranes have been added to 17 of the same units already operating in Itapoa, which competes for cargo with the ports of Itajai and Paranagua.

Colsa request support from the national agencies in charge of security to face the increasingly frequent theft of millions of dollars of goods, which is seriously affecting the extra-port area of San Antonio,” Colsa emphasised in a statement. “It is beyond the resources of individual companies to deal with the sophisticated nature of these attacks so we are requesting a

December’s World Cup in Qatar gave a massive boost to Tecon Rio Grande (TRG), the box terminal owned and operated by Wilson, Sons in Brazil’s southernmost state. Between January and the end of November 2022, TRG doubled its boxed exports to the Middle East country, compared to the same period in 2021, with frozen chicken accounting for around 85 per cent of the total. For processed chicken, 495 reefers were shipped.

Three long-standing logistics companies, SAAM Logistics, Ultramar San Antonio and Agunsa Extraportuarios SA, also threw their weight behind moves to present a united front to fight the frequent heists.

“This type of situation exposes people who carry out their daily, operational tasks and safeguard our logistics centres, and these violent robberies do tremendous damage…” underlined Jorge Guajardo, Manager, Ultramar.

Dynamar has recently launched the 12th version of its annual perishable cargo publication, the Dynamar Reefer Analysis 2022. The publication comprises three main sections: two sections on container reefer trades and one section analysing the structure of the conventional reefer market. Forecasts for perishable trade volumes for full year 2022 and 2023 as well as for vessel fleet development are included.

15 17 TO FEB Newcastle Australia

Book your place now to join 150 ports

•Options for ports to combat climate change

•Net Zero Carbon Cruising

•Green Financing for Sustainable Port Development

•Pathways to Sustainable Ports

•Green Ports - What components are needed?

Host port:

Gold sponsor:

Silver sponsor:

Sponsors:

•Two day conference

•Full documentation in electronic form

•Lunch & refreshments throughout

•Welcome Reception

•Conference Dinner

•Port Tour

tel: +44 1329 825335

email: congress@greenport.com

visit: portstrategy.com/greenport-congress-oceania

Supported by:

There is an array of news this month from around the globe regarding investment in port and terminal businesses.

MSC confirms that it has completed the acquisition of Bollore Logistics which includes 16 African container terminal concessions and seven ro-ro terminals. It has similarly reported completion of the acquisition of Terminal Darsena Toscana (TDT), a container terminal facility in the Port of Livorno, Italy.

Hapag Lloyd, following on from an agreement to acquire a stake in the terminal business of Chile-based SM SAAM. has closed the purchase of a 49 per cent stake in the terminal operating company Spinelli active in the port of Genoa, Italy.

The Turkey-based terminal operator Yilport has announced a US$700 million investment in the port of Takoradi in Ghana targeted at building and operating a port complex. The project includes developing the existing container terminal to offer a capacity of 2.25m TEU and multipurpose berths for liquid, bulk, and general cargo operations offering a combined

capacity of around 20m tons per annum.

Ocean Network Express (ONE) reports it is to acquire a 51 per cent stake in each of TraPac LLC (TraPac) and Yusen Terminals LLC (YTI), currently held by Mitsui OSK Lines and Nippon Yusen Kabushiki Kaisha, respectively. TraPac operates in Los Angeles and Oakland and YTI in Los Angeles.

DP World (DPW) has appointed engineering consultants AECOM to assess the feasibility of establishing a second container terminal at the Port of Prince Rupert on Canada’s Pacific Coast. DPW operates the existing container terminal and the second terminal project is intended to meet anticipated demand over the longer term.

Vitoria, the first Brazilian port authority to be privatised has just announced its first concession, a contract with TechnipFMC, a global Franco-American oil and gas company.

State-owned port authority Companhias Docas do Espirito Santo (Codesa, located in the state of Espirito Santo, north of Rio de Janeiro) went private in the first half of 2022 when Quadra

The California Transportation Commission (CTC) approved US$175 million in funding for the 7th Street Grade Separation East Project, which will realign and reconstruct a primary trucking and access gateway into the Port of Oakland. The project is expected to commence during 2023, with the Alameda County Transportation Commission managing the process, with financial and engineering support from the Port of Oakland.

Capital investment fund paid Reais106million (US$22.6 million) for a 35-year concession.

TechnipFMC, which has wide interests in Brazil, has signed a five-and-a-half-year contract to operate a facility in Vitoria to support its offshore activities.

Quadra says it will invest Reais850m over its concession period, covering infrastructure, equipment and various expansion

The European Sea Ports Organisation (ESPO) has confirmed that the Aqaba Container Terminal, Jordan has been awarded the EcoPorts’ environmental management standard (PERS) for the third time. Aqaba first joined the EcoPorts’ network in 2013 and its latest PERS-certified status again acknowledges the efforts of the port in conjunction with protecting the marine ecosystems of the Jordanian coast and the Gulf of Aqaba.

projects, and predicts throughput will jump from seven million to 14 million tons per annum.

“Our contract with TechnipFMC is a historical contract as it is the first private contract made within the scope of a private port authority,” said Ilson Hulle, President, Vitoria Port Authority. “It’s a small step but we hope it will be the first of many, especially in the growing oil and gas industries.”

AD Ports Group (ADP) has signed two new agreements with the governments of Kyrgyzstan and the Republic of Sudan. The Ministry of Economy and Commerce of Kyrgyzstan has secured more than 300,000m² of land within the Khalifa Economic Zone Abu Dhabi (KEZAD) to develop and operate a logistics hub and customs area. In Sudan, ADP (and Invictus Investment) is supporting the development of Abu Amama port.

The Jawaharlal Nehru Port Authority (JNPA) has agreed a 30-year contract with JM Baxi Ports and Logistics to develop, operate and maintain two terminals – a shallow water berth and the coastal berth which was developed in in 2020 and is designed to handle 2.80 million tonnes/yr. The shallow water berth when fully developed will offer an annual throughput capacity of four million tonnes and will posses a 445m quay line with 145m of this for ro-ro operations.

This project follows on from JM Baxi partnering with CMA CGM in the winning bid for acquisition of JNPCT – a 680m quay and 54ha yard container handling facility. The result of this PPP project was announced in mid-2022.

Cepsa – the Spain-based multinational oil and gas company – is to invest €3 billion to establish the Andalusia Green Hydrogen Valley, a development that is claimed to create Europe’s largest green hydrogen hub in southern Spain. The company will set up two plants, each with a total capacity of 1 GW of green hydrogen, with one located in Huelva, adjacent to Cepsa’s La Rabida Energy Park and the other at its San Roque Energy Park in Cadiz.

Nippon Yusen Kabushiki Kaisha (NYK) has undertaken a trial of SpaceX’s satellite service, Starlink, on one of its ships. SpaceX is an Elon Musk company and in July 2022 it announced its satellite connectivity service to the maritime industry as soon as it received authorisation from the US Federal Communications Commission. Starlink uses low-orbit satellites to offer faster communication feedback, whereas the traditional process for ship-to-shore links are reliant on high orbit satellites, thereby leading to slower speeds.

Qinzhou Automated Container Terminal, China, operated by Beibu Gulf Port, has successfully implemented OPUS Terminal and is now developing advanced features such as Artificial Intelligence (AI)based intelligent forecast and operations plans, designed to achieve higher productivity and lower cost operations across-the-board.

The Port of London Container Terminal, located at the port of Tilbury in the UK, has signed a new SaaS (Software-as-aService) agreement with Portchain Quay. This new arrangement, effective January 19, 2023, will see Portchain Quay create reliable berth plans in the port supported by intelligent predictions, thereby improving the planning process for both the terminal and its customers by providing digital, real-time updates to the terminal’s planners and more accurate berthing predictions.

The Port of Rotterdam is now using an integrated planning approach to manage inland container shipping and allied activities. After what it describes as a “rigorous test period” the Port Authority of Rotterdam has deployed Nextlogic to help ensure faster processing of inland vessels at ports and terminals in order to improve efficiencies and use of quay space.

For each inland vessel, barge operators submit port calls, rotation, and cargo information to Nextlogic in advance of the sailing and each cargo terminal provides the details for its available quay capacity.

Nextlogic then compares this data, optimises the planning schedule for vessel calls on an automatic and continuous basis, before then generating the best timetable for all parties involved.

Allard Castelein, CEO Port of Rotterdam Authority, notes: “Nextlogic’s integrated planning for inland container shipping is a perfect example of innovative digital chain cooperation. This cooperation enables us to create a better balance between the coast and the hinterland and establish a more balanced

logistics system. It makes the port of Rotterdam smarter, more sustainable and, therefore, more attractive for clients.”

Rotterdam has confirmed that approximately 60 per cent of its entire inland shipping volume is already covered via the Nextlogic system, with four deep-sea facilities and 15 different barge operators also participating. Additional deep-sea handling centres, empty container depots and more barge operators are expected to link to Nextlogic in the near future.

Sijbrand Pot, Interim Director of Nextlogic, endorsed the strategy

and highlighted the plans moving forward: “I’m delighted that barge operators, terminals, and we, as Nextlogic, have jointly managed to progress this integrated planning to a standard service. It is an important milestone in this port-wide innovation project. Together with all parties involved, the ultimate goal is to achieve a more transparent, efficient port that benefits everyone.”

The Maritime and Port Authority of Singapore (MPA) has signed an agreement that will see a 5G mobile network offered at the Port of Singapore.

MPA has agreed a Memorandum of Understanding (MOU) with Infocomm Media Development Authority (IMDA) for delivery of full maritime 5G coverage across all major anchorage points, terminals, fairways and boarding areas. Delivery is expected to be by mid-2025.

Quah Ley Hoon, Chief Executive, MPA, notes: “Digitalisation continues to shape and transform the maritime industry, acting as a key driver for global trends such as logistics, supply chain efficiency and decarbonisation. MPA is taking the lead to help build a robust digital maritime ecosystem for Maritime Singapore, with fast, secure and high capacity 5G connectivity as one of the cornerstones to support

New features have been confirmed by the Port of Los Angeles to its Port Optimizer portal. First launched in 2017, in collaboration with Wabtec Corporation, this dynamic cloud-based information portal specialises in digitalising maritime shipping data for the port’s supply chain stakeholders..

Now the port authority and Wabtec, in partnership with GeoStamp, is allowing users a single view that offers real-time and historical truck turn-times for all 12 container terminals in the San Pedro Bay port complex. In addition, for container terminals

The Port of Duisberg has created a sustainable solution that digitally records the identification of a container and then compares it with the loading list in just a few seconds, while maintaining a recognition rate of almost 100 per cent for the discharge and loading of vessels. Working with industrial image processing specialist, VITRONIC, highresolution 12K cameras have been successfully tested on two cranes in this German port.

8 Maritime Singapore will soon see 5G coverage, the phasing in of the Integrated Port Operations C3 system and the launch of its Active Anchorage Management System

running through to 2026 as MPA upgrades its systems. It will enhance situational awareness and improve the efficiency and effectiveness of incident responses.

real-time data exchanges in the maritime domain.”

MPA has also confirmed the development of the Integrated Port Operations C3 (Command, Control and Communications)

system (IPOC system) in collaboration with the Defence Science and Technology Agency (DSTA). The IPOC system will be progressively phased into operation, starting in 2023 and

Singapore is additionally launching its Active Anchorage Management System (AAMS) in Q3 2023, which will utilise data to optimise allocation of limited anchorage space for vessels. The key benefit here is that it ensures that a vessel is anchored safely while taking into consideration various conditions including the wind, tide, depth and proximity to hazards.

in Los Angeles, the average dwell times for both trucks and on-dock rail are also an option.

“With these enhancements, the Port Optimizer will now provide visibility for 70 per cent of the import data for the San Pedro Bay port complex,” said Gene Seroka, Executive Director, Port of Los Angeles, adding: “Based on industry feedback, we have made additions that give stakeholders more planning and performance capabilities.”

Nalin Jain, President, Digital Electronics Business, Wabtec,

The Port of Ashdod, Israel, has confirmed the signing of new agreements with five start-up companies at an investment cost of around US$1 million. The move is part of the port’s technology incubator that has been established as it targets a new innovation strategy. Different companies supporting crane monitoring, port cameras and protection against cyber-attacks are all benefitting from the new spending.

outlined the tangible benefits to users: “Port Optimizer’s enhancements will help port stakeholders optimise their operations, relieve congestion stemming from increased global shipping traffic, and get products to people faster.”

The range of data available to users is now comprehensive. It includes a daily assessment of projected volumes due into Los Angeles up to three weeks in the future, while an estimate of the movement of containers by imports, exports and empties for

Zim Integrated Shipping Services Ltd is supporting a new platform for cross-border trade financing to support the activities of small-tomedium enterprises (SMEs). The product, being developed by 40Seas, is targeting ways of closing trade finance gaps by offering a solution that enables digital B2B payment functionality, as part of the cross-border trade process. Zim has provided 40Seas with US$11 in new million funding.

the next six months is also provided.

Historical containerised volumes by terminal, shipping line and vessel are given, along with current trends, while practical planning details of truck turn times, vessel discharge information in relation to remaining boxes on berths and when and where to return empty units are other key components.

The Port Authority of Gijón (PAG), Spain, has awarded a new contract to Prodevelop to digitalise its rail-port system in order to provide better monitoring and coordination of rail traffic at the port. This new solution will be integrated into the current port management platform at the port and will improve the exchange of information involving European rail freight services and cargo movements to/from the port.

Submissions are now open for the 44th Propulsion & Future Fuels Conference, the leading international conference on powering shipping’s emissioncutting ambitions. Present to a 150 strong maritime audience including operators representing

Abstracts of 250 words should be sent by February 24th, with a biography of the speaker, headshot photo and logo to conferences@ propulsionconference.com

Visit: motorship.com/PFFBOOK

Contact: +44 1329 825335

Email: conferences@propulsionconference.com

#MotorshipPFF

International Container Terminal Services, Inc. (ICTSI) has had two brand new ship-to-shore (STS) container cranes delivered to its South Pacific International Container Terminal (SPICT), located at the Port of Lae.

The significance of this investment is that it marks the first arrival of STS cranes in the region, while also representing the largest port machinery in Papua New Guinea (PNG) and therefore enabling larger container ships to be more efficiently handled.

The new Post-Panamax units will replace mobile harbour cranes and have been manufactured by Shanghai Zhenhua Heavy Industry Co. Ltd. (ZPMC) of China. Each crane offers

Robert Maxwell, CEO of ICTSI

South Pacific, confirmed the importance of the new cranes and noted that: “With improved

The Europa Container Terminal, Antwerp is to raise its annual capacity by 40 per cent by Q2 2025. Operator of the facility, PSA Antwerp, has signed an agreement with Stadsbader/ DSG for the first phase works, spanning civil and electrical infrastructure, designed to prepare the yard for the introduction of new automatic stacking cranes (ASCs).

Works will also be undertaken to accommodate new ship-toshore cranes as well as facilitate improved trucking flows.

The project represents a key part of the major overhaul of this facility by PSA Antwerp and the

Nokian Tyres, of Finland, has launched a new tyre for the front axles of reachstackers and other heavy duty cargo handling plant that is said to offer up to 35 per cent longer use. “Attention has been paid to the tire flexing area, which benefits from our special shock-absorbing rubber compound used in the tyre carcass. Thicker tyre results in longer service life,” explains Kimmo Kekki, Product Manager, Nokian Tyres.

Port of Antwerp-Bruges. It will also see a new, deeper, quay wall and generally greater automation and enhanced sustainability.

A contract has already been agreed with Austrian crane manufacturer Kuenz and the electrification and automation specialist ABB, for an order for 14 new ASCs. After delivery, the Europa Terminal will operate 48 units in its upgraded yard.

With the introduction of the end-load ASCs, all yard operations and truck handling will be done by ASCs. This will significantly increase capacity, which will largely be achieved by containers being stacked six high compared

Nidec ASI, part of the Energy & Infrastructure Division of the Nidec Group, has secured the tender for implementing a “shore-to-ship” electric power project for the Port of Sète, in the south of France. The €2.5 million contract is designed to facilitate compliance with EU directives that state European ports must adopt specific electrification systems for port quays by 2025 with the objective of decarbonisation in mind.

to the existing arrangement of just three high. It will also have the benefit of reducing total carbon emissions at the terminal by more than 50 per cent with each container handled.

Kuenz is designing and producing the ASCs, with ABB taking care of all matters relating to systems integration, for what represents PSA’s first order for end-load ASCs across its portfolio.

Parts for the first six cranes are scheduled for delivery in early 2024 and will be assembled on site, with testing then expected to start Q3 2024. The construction process of building the next eight units will commence in Q3 2024.

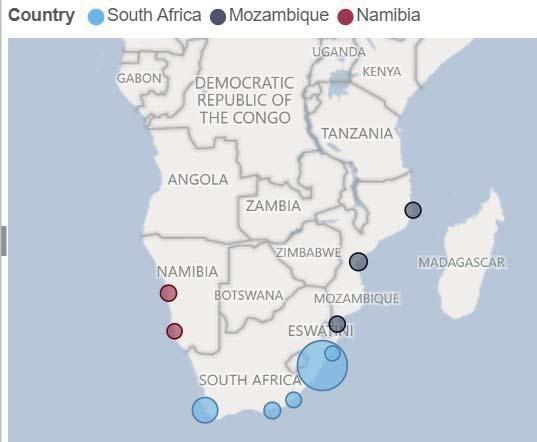

Maputo Port Development Company (MPDC), Mozambique, has placed an order with Kalmar, a Cargotec company, for 14 T2i terminal tractors and three forklift trucks, including two heavyduty units and one medium range model. Booked in Cargotec’s Q4 2022 order intake, all machines are scheduled to be delivered before the end of Q2 2023. MPDC has been using Kalmar equipment since 2008.

8 Ongoing investment by ICTSI at the Port of Lae, PNG has seen two STS gantry cranes arrive to offer greater efficiency in quayside handling and facilitate handling larger size vessels

productivity, the Port of Lae will soon become an important transshipment hub for the Pacific islands region.”

He added that as a result of this investment the port’s shipping line customers will see increases in quayside productivity and shorter port stays, while the ability to handle larger container ships will help to drive lower prices for both importers and exporters in the region.

“As we plant the seeds to create sustainable port cities and communities, it is our hope that this new equipment will further sustain Papua New Guinea’s economic growth and expanding international trade over the coming years,” Maxwell stated.

In order to ensure sufficient power supply is maintained for the new cranes, ICTSI South Pacific invested in two 2.5-Megawatt Cummins power generators in advance of the cranes arrival, although this is only part of the company’s investment plans which also include procurement of three new truck trailers for Lae as well as two rubber tyred gantries (RTGs) due for delivery in 2023.

Nassau Container Port (NCP), which undertakes container handling at the facility at Arawak Cay, Nassau, Bahamas, has placed an order for an eco-efficient Generation 6 Konecranes Gottwald Mobile Harbour Crane. The crane is slated for delivery in July 2023. NCP has also selected TRUCONNECT® remote monitoring that sends its data via a secure mobile connection to the Konecranes cloud service.

Join the world’s leading conference on balancing environmental challenges with economic demands

Host Port:

To help celebrate the 135th anniversary of the Port of Lisbon, GreenPort Congress and Cruise returns to showcase this vital and vibrant Atlantic gateway to Europe from 18-20 October.

Meet and network with over 200 attendees representing port authorities, terminal operators and shipping lines. For more information on attending, sponsoring or speaking, contact the events team: visit: greenport.com/congress

tel: +44 1329 825 335 email: congress@greenport.com

Sponsored by:

Media Partners: PORTSTRATEGY

Bothra Shipping Services has ordered three allelectric Generation 6 Konecranes Gottwald Mobile Harbour Cranes, with delivery scheduled for Q2 2023. The units are for the company’s bulk terminals at the Port of Kakinada, India, and offer a lift capacity of up to 125 tonnes and working radius of 51m. Bothra owns and operates an eight million tonnes per annum coal terminal and a six million tonnes per annum fertiliser facility.

The shore-based supply of electricity to power vessels when in port is steadily gaining traction – as recent developments indicate.

Leading global shipping line, CMA CGM has signed a long-term strategic collaboration with Shanghai International Port Group (SIPG) to develop, on a mass scale, the use of onshore power supply at the Port of Shanghai. The arrangement will see all CMA CGM ships, either constructed with the appropriate systems or retrofitted to take advantage of cold-ironing technology. By mid-2023, the partnership is expecting to see up to 50 vessels connecting at the port

The Port of Narvik and Norwegian company Plug Nord have secured funding of NOK 10.7

million (€1.02 million) to develop shore power for cruise ships. The plan is to build both a highvoltage facility for the larger cruise ships and a smaller low-voltage facility for smaller cruise vessels, although only one vessel at a time can be accommodated. Operations are planned by end 2024.

Elsewhere, Montrose Port Authority is partnering with Norway-based Plug Shore Power Ltd, in a 50/50 joint venture that will see the port become Scotland’s first facility able to provide shore power to offshore energy vessels. Dubbed Plug Montrose Ltd, the installation process will take up to 12 months to complete.

The Port of Québec, Canada is also now conducting a feasibility

8 Shored-based power is only available at two per cent of ports globally, but traction is growing, including at Shanghai

study for provision of shore power supply for cruise ships, following use, in 2022, of a greenhouse gas (GHG) rating tool from maritime risk management agency RightShip. The process assessed emissions from ships entering the port’s jurisdictional waters and facilitated the offer of discounts on port fees to vessels, dependent on their GHG rating and emission efficiency. However, the port is going one step further and moving towards shore-based power which is required as the Cruise Lines International Association has committed to all ships berthing at an electrified dock by 2035.

Liebherr Container Cranes Ltd. has completed its first ship to shore lift height increase using the company’s new patented jacking system.

The operation was completed at Patrick Terminals – Brisbane Autostrad, located on the east coast of Australia, as part of the crane manufacturer’s LiebherrTransform business package.

Although the actual lift height amendment has not been disclosed, Liebherr has said that

the operation was carried out on a crane supplied in 2015 that offered an existing lift height of 37.5m, but “with larger vessels calling at the port, a lift height extension was required.”

Although Liebherr has been carrying out lift height extensions for a number of years, this new jacking system was only patented in 2022, with the Brisbane terminal seeing its first use.

However, there is already another project confirmed. GCT

New York operates four Liebherr ship to shore container cranes. Supplied in 2004, these units have a lift height of 36.57 m and an outreach of 50m, but a LiebherrTransform project is going to upgrade the lift height of the cranes by 8.6m and the outreach of the cranes by 5.0m to facilitate the working of larger ships.

GCT New York is one of two facilities in the Port of New York/ New Jersey recently acquired by CMA CGM.

Hamburger Hafen und Logistik AG (HHLA) is commissioning the construction of a hydrogen filling station as part of the test centre for hydrogen powered port logistics at the Container Terminal Tollerort (CTT) in the Port of Hamburg. The facility is due to commence operations before the end of 2023 and will allow straddle carriers, forklift trucks, reach stackers and tractor units to be run on hydrogen throughout the terminal.

The Port of Valencia has confirmed its first load of hydrogen (H2) has arrived to supply its new refuelling station located on the Xità quay. This makes the Spanish port the first facility in Europe to offer a hydrogen installation in real operating conditions. The hydrogen supply station (HRS) can receive, store and deliver compressed hydrogen via dispenser to refuel port machinery. Prototype new handling equipment – a reach stacker and 4 x 4 tractor unit - that will use the station is set for delivery in the first quarter of 2023.

It is a new year, with a new Congress, and new sets of battles to be fought. Looking ahead, with my always cloudy and cracked crystal ball, I see that “supply chains” have smoothed out. Ports, perhaps, will be retreating from the media landscape - with pictures of anchored vessels making “top of the fold” front pages (web or print) and even network TV hiring harbour launches in order to bring the situation to their primetime newscasts.

The past three years were unprecedented - with 2020’s pandemic putting a damper on cargo flows, the overheated trade recovery in 2021 into early 2022, and the subsequent easing as things returned to “normal” (however you define it).

The Biden administration, whether you support it or oppose it (in my case- I stay mum), needs to congratulated for bringing “infrastructure” (the “I-word”) to the fore; something the previous administration talked about,

but failed to pull the trigger on. It goes without saying that seaports are central to the “I-word” and, for the coming year, I see new forms of cooperation between the ports and all manner of stakeholders - though the infrastructure development picture holds significant potential to look different from how it has historically.

In the maritime world, two big “D-words” have been digitalisation and decarbonization. We are in the

midst of a freight tech boom funded, in part, by private equity which was attracted at least partially by those aforementioned TV views of ships and boxes stacked up at drayage yards. At the same time, the push for ESG (Environmental, Social Governance) continues; my particular focus has been on

the “E” aspects - fuel saving and reduced emissions of carbon (and other substances, as well). Regulations concerning carbon intensity that are now beginning to impact international shipping will reward some players and penalise others. The new ratings for shipowners are influenced by trading patterns , things like the length of voyages, numbers of port calls - it’s inherently complicated. Of course, ship designs and naval architecture (efficient engines, smooth hull forms, etc.) will continue to evolve.

To a growing extent, the new regulations will drive the flows of cargo - and infrastructure investment for cargo (and for passengers). They will be influenced, more and more, by environmental considerations. With the increased ability to measure operational elements (to get a better measurement angle on actual emissions), planners will be operating with a much different canvas.

UNCTAD, in its yearly flagship publication, the review of Maritime Transport, has highlighted the considerable uncertainty facing shipping and ports. UNCTAD has developed four scenarios, based on key uncertainties in the geopolitical context and the COVID recovery.

Broadly, based on these four scenarios, we could see a sustained recovery of international trade, an interrupted recovery (either due to an intensifying war or due to the continued effects of COVID-19 as a result of high infection levels and new variants) or a ‘derailed’ recovery, if both of the above play out. In these scenarios, the uncertainties related to fighting climate

change, are not even included – though UNCTAD is very much aware of these.

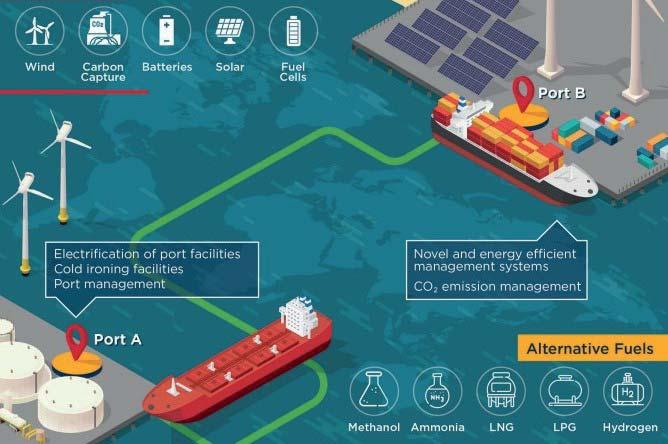

The DNV Maritime Forecast for 2022 is focused on these uncertainties and counts 24 different ‘future fuel mix scenarios’ with huge differences in the shares of fuels such as LNG, biofuels, methanol and ammonia. In the 2022 publication, DNV focuses on this uncertainty and does not add uncertainties regarding trade volumes to the analysis - though it is very aware of these.

Both reports show ports and shipping are in a period of ‘deep uncertainty’ in which there is no clarity on the direction, speed and

interrelations between key drivers of change (like initiatives to curtail climate change, or geopolitical tensions) in the long-term. Decision-making on infrastructure systems is very difficult when faced with deep uncertainty. The ‘traditional approach’ of predicting and acting upon such a prediction is not effective. Instead there is a need to acknowledge uncertainty, focus on robustness of (investment) decisions in different scenarios and ‘monitor and adapt’ as external events unfold.

However, this is easier said than done, especially for port development projects, because

such projects generally are ‘contested projects’ in the sense that some stakeholders are highly in favour while other stakeholders are fiercely opposed. Given the deep uncertainty, the often advocated stakeholder involvement approach of seeking to create agreement regarding assumptions (like for instance demand growth or energy needs) is increasingly problematic. That may imply that contested projects can only be executed if stakeholders can reach an agreement on decisions (i.e. whether and how to expand a port and with which kind of policies to mitigate societal impacts).

2022 ended bleakly as the global economy headed towards a recession. 2023 does not look optimistic for the coming six months at least. Time to batten down the hatches.

As 2022 came to an end it became increasingly clear that the good old days were gone with the collapse of sea freight rates, cargo demand and the accompanying economic pressures that will ensure that the next six to nine months will not bring any renewed joy.

In the container industry, carriers are reverting to old practices of trying for market share to fill their ships which, in turn, puts further downward pressures on freight rates. Rather than facing the issue of the collapse of demand and putting ships into lay-up, the current preferred option is to blank sailings and let ships sit at anchor. A short-term solution to a longer-term problem. The bulk sectors, dry and liquid are also under pressure as commodity demand declines due to reductions in industrial production which results in less need for coal, steel, crude oil and

petroleum products. The exception is the LNG sector as Europe has changed from pipeline gas to imports by ship from further afield.

The biggest disruptor is the war in the Ukraine which has caused economic problems in Europe, North America and Africa. The rush to find alternative sources of oil and gas allowed producers to push up prices and require long term contracts which in turn pushes up inflation in the energy market even as spot prices decline. Inflation that

At Port Strategy we focus a lot on the larger port and terminal facilities – we are very mindful, however, that the larger ports and facilities in them are not the whole story. Smaller or secondary ports, whatever you prefer to call them, also make up a very interesting sector of the port world. There is nothing like a niche business and we would like to hear more about yours, if you have a story to tell.

What sort of story?

Essentially any subject that will prove of interest to your peers. How as a small port you identified and captured a new stream of

began with oil and gas has by now filtered into the foodstuffs and consumer markets as wholesalers, retailers and producers push up prices either to cover additional costs or simply for profits sake.

Inflation triggered rising interest rates across the globe as central banks had no other tools to reduce inflation, which of course hit demand as expected and there we come full circle. The IMF warns that fully one third of the global economies are in recession but if we consider

that this includes most of the major economies then it becomes more serious.

The U.S. narrowly avoided a “formal” recession in 2022 but can it hold on to growth as demand declines? Probably not. Europe is for all intents and purposes in recession. With the Ukraine conflict stretching into year two things can only get worse.

Definitely not a bright outlook for this year.

business and what were the drivers behind this? What advantages did you capitalise on that your larger competitors may not have been able to offer? What challenges do you face? Does a low cargo throughput present problems in generating sufficient funds for asset replacement –pilot boats, tugs, terminal hardware etc? Would you say that you are disadvantaged in terms of attracting and retaining quality staff or do you consider your organisation is in the opposite position? Is it a struggle to implement tariff increases due to

a limited client base? What progress have you made on the road to decarbonisation – is this challenging? Do you have investment opportunities, what are they?

During Covid, in Europe and elsewhere, we saw a lot of secondary ports provide solutions to congestion problems in particular. This was a coming of age that provided an opportunity for a number of smaller ports to show what they can do and frequently with good results ensuing. So, what happens now? Do things go back the way they

were or can certain business streams be retained?

We ask these questions against a background of recognising the inherent assets of many smaller ports and facilities – less congestion, the ability to be more cost effective, offer a personalised service, move freight quickly and present great flexibility.

In this column and elsewhere in PS we would like to hear more about the world of smaller or secondary ports – don’t hesitate to get in touch. mike@ mikemundyassociates.co.uk

The final conference of the iTerminals4.0, drawing on case studies, highlighted that a standard digital language employed in terminal operations can deliver significant benefits.

Felicity Landon reports

8 The standards of TIC4.0 work and via a common language offer significant potential to achieve new levels of efficiency – Malta Freeport identified data visualisation as a huge breakthrough

The main objective of the iTerminals4.0 project was to develop and test – in real operations – a standard digital language that allows for two-way communication between port equipment and the operations management systems of container terminals participating in the project.

While it would be easy to get entangled in the technicalities, the message that emerged loud and clear from the project’s final conference was that of tangible results in real places. Case studies were presented by Terminal Link’s Malta Freeport and Thessaloniki container terminal and by PSA Antwerp, with the focus on the application of standardised equipment telemetry and digitalisation of port terminal operations.

The overall project, co-funded by the Connecting Europe Facility (CEF), provided the opportunity to demonstrate that the standards of TIC4.0 work and are useful as expected, said Boris Wenzel, Chairman of Terminal Industry Committee (TIC) 4.0. “The iTerminals project demonstrated that TIC4.0 is not just theory, but it actually works,” he underlined.

Francisco Blanquer, Senior Innovation and Development Senior Manager at Terminal Link (CMA CGM), said: “Thanks to iTerminals4.0, we were able to really move forward with standards with a very high speed.”

He noted that operational processes in the container terminal sector can be very inefficient. “Capex has to be kept

low because the time the equipment is working is really low. We don’t have a continuous process where we are operating 24/7 – we only work when we have cargo. And even when the machine is working, it is also idling, so the percentage [of utilisation] is very low. How do you improve this number?”

The options to optimise equipment utilisation included a disruptive new process and automation, or the use of data to optimise the process, he said.

“It is not easy to get data – in the past we have failed, using only a small percentage of data. The reality is that it could be machine, process, person, terminal; whatever the process you want to express, it is complex, with a lot of actions happening every millisecond.”

Meanwhile, information about what happens ‘between events’ has been missing. “We need the high-resolution data between events – now, thanks to the data, we can do this. We can have the events and the time in between.”

Why is this important? The main goal is to represent the reality, which means being able, via an IoT and Big Data platform, to compare TOS events and the status of every single process with CHE (Container Handling Equipment) reality, said Blanquer. “You can detect when something doesn’t go as it should; you can compare ‘What should be versus What it is’.”

For example, he said, you could pinpoint when a terminal

tractor should be going to the yard to collect a container, but in reality it is idling. “Thanks to the IoT and Big Data, we can identify non-conformities in the last week, month or year.”

However, he emphasised, this is dependent on a language which can represent any reality – present, past or future, performed, actual or scheduled, planned, requested, proposed or estimated.

The iTerminals4.0 project showed that TIC4.0 ‘can express any reality in a digital format’, including subject, concept, observed property, point of measurement and value.

MALTA FREEPORT: A CLEAR PICTURE

“In theory, there is no difference between practice and theory – but as all of us know, in reality there is,” said Angel Martinez, Head of Projects, Maritime and Terminal Solutions at Prodevelop.

He outlined the project in which numerous IoT devices were installed in the Malta Freeport yard to give a clear picture of what was happening in the terminal, pinpointing idling and providing a live view tool for process improvement and data analysis.

Hein Chetcuti, Operations Development Manager at Malta Freeport Terminals, said: “There is quite a learning curve and learning process for us to absorb this information and these technologies and start using them at a technical level. After all the infrastructure, which was a huge challenge, we sat down and started to digest all the wealth of information that was presented to us from the Big Data platform.”

Data visualisation gives you the power, a different perspective, he said. He described the pilot project at Malta, a system demonstrating in real time all the operations and all the assets that are working together on one screen, as a huge breakthrough that could not be done before with other technologies.

“Then we started looking at how to add operational value to this information and we started with horizontal transport –terminal tractors manually driven. We wanted to understand where the weak points of operations are.”

Data can be used to detect anomalies; in this instance, human supervisors might have a feeling there were deviations but it was difficult for them to understand the reasons for this and/or visualise what was going on, said Chetcuti.

“With the strength of all this data, we can also try to understand a number of operational issues we used to have, for example, drivers driving too slow, stopping in areas where they shouldn’t be stopping, taking wrong directions.”

He concluded: “For us, this is only the tip of the iceberg. You start deploying the technology and when you start using it in the mainstream process, there is no going back, only the way forward.”

Terminal Link and RBS (Realtime Business Solutions) worked together to develop a pilot supporting the project, with digital twin/3D visualisation.

The PSA Antwerp project focused on application of TIC4.0 standards for telemetry data exchange with yard operations equipment – in this case, straddle carriers.

Dany Akkary, Digital Transformation Manager at the PSA Antwerp container terminal, said: “This was like an opportunity to take a leap into the future and apply a new industry standard. We found that data is key and that standardisation is crucial. Standards such as 4.0 unlock actionable data with ease.”

One of the biggest challenges continues to be harnessing and processing data, said Akkary. At Antwerp, straddle carriers were chosen for testing software, with initial datasets

such as spreader hoist and power source monitored. This was later expanded to include other datasets, to cover operational efficiency, safety and maintenance. The platform allows real-time information on equipment status, he said.

The iTerminals4.0 project at Thessaloniki focused on the application of TIC4.0 standards for operational interoperability with the TOS. The terminal worked with software specialist TBA (Konecranes). The data value chain starts with collection, moving on to development and usage – but it cannot be utilised without proper data management, said Ida Lundmark, Business Line Director at TBA. “There is a need for a digital platform that uses standardised messages. In this iTerminal4.0 project, we demonstrated the value of data.”

In a round table discussion, the question was asked: what lessons have you learned from the pilots?

From PSA Antwerp’s point of view, there was the huge security operation required. Patrick Snelders, Enterprise Architect at PSA Antwerp, noted that data has value, so it matters who can make connections to which devices. “That is something in general in the industry – you have the Internet of Things and throwing it to the Cloud is one idea, but that is something my company will never do. So, we have to think further – to have it in a private environment to collect all that data.”

Francisco Blanquer highlighted the need for data quality: “A lot of the data from the TOS was wrong and no one realised until we did the analysis. You think everything is running fine – and absolutely not. And when the data is wrong, automatic decisions are also wrong,” he said.

While it was hard to discover that some data quality was a ‘disaster’, it was also positive in that the situation could be improved, said Blanquer. But there was also the potential for conflict; if the data informs you that your equipment is idling 60 per cent of the time when you thought it was doing a fantastic job, it is hard to tell a super professional operator the reality.

8 The PSA Antwerp project focused on application of TIC4.0 standards for telemetry data exchange with straddle carriers

Bruce Mills, Business Development Lead, Ports, Wärtsilä, highlights how overcoming digital fragmentation can optimise vessel arrivals and raise the bar across a broad spectrum of port activities

8 Tanger-Med confirms diverse benefits flowing from adopting Wärtsilä’s PMIS solution, which incorporates Vessel Traffic Services and JIT solutions, alongside business intelligence and data analytics tools

Ports are complex parts of the supply chain. Caught between the requirement to remain commercially successful in a competitive market and implement all the latest rules and regulations, whilst maintaining the safety and security of some of the world’s largest man-made objects, these hubs are the key interfaces between land and sea trade.

Despite the monumental role they play in the global supply chain, some of the world’s most advanced ports still rely on systems that were implemented in the 1990s and continue to run traditional, manual processes – both of which are no longer fit for purpose to tackle today’s challenges.

A number of global events over recent years – the challenges of the pandemic, the Ukraine conflict and the Ever Given grounding in the Suez Canal – have all contributed to major disruptions in the global supply chain and severely impacted port operations. This has caused ports around the world to strategically rethink how technology can be used to mitigate the consequences of such events and also improve port operations when not in times of crisis.

Many senior managers are now reflecting on how digital transformation can help them improve safety, reduce emissions, and increase efficiency, competitiveness and resilience. Technology can be used to break down ‘silos’ and ensure the supply chain can communicate more efficiently, as all stakeholders are operating from the same data. However, it is important that any solutions deployed are holistic and interoperable to avoid creating a fragmented digital ecosystem, which can lead to duplication and inefficiencies.

Ports are part of the maritime industry’s increasingly complex digital ecosystem. There is a plethora of solutions out there and a lack of standardisation, meaning different stakeholders

across the supply chain could each be using a different product – many of which are not interoperable or capable of sharing relevant voyage data with each other. Ports then attempt to overcome this fragmentation through costly manual processing, which is open to human error and often results in duplicated, incorrect or incomplete data being shared.

Data must be seen as a strategic asset and key component of port digitisation, so that all actors in the supply chain benefit from information sharing. Investing in a holistic data and digitalisation strategy is key, as is harnessing digital solutions that can be integrated across the entire port ecosystem.

With dismantled data silos, if a vessel is set to be delayed for any reason, information can be shared with the port at which the ship is set to dock and changes can be made to ensure everything is ready for the vessel to be loaded or unloaded at the right time.

Taking a holistic approach can be transformational from a supply chain perspective. With greater supply chain connectivity and data-sharing comes the potential for JustIn-Time (JIT) operations and the associated benefits. So, what are the benefits to JIT arrivals?

Looking at the maritime industry as a whole, saving fuel is critical to achieving emission reduction targets. Fuel consumption is the biggest contributor to the maritime industry’s 940 million tonnes of annual CO2 emissions. Therefore, anything ports can do to improve fuel efficiency is hugely valuable to the wider maritime supply chain. A study conducted by MarineTraffic and Energy and Environmental Research Associates (EERA) found JIT arrivals can lower fuel

consumption and carbon dioxide emissions by 14 per cent in conjunction with every journey. In turn, port workers and coastal residents benefit from these reduced local emissions and better air quality overall.

Looking beyond carbon to costs, the Wärtsilä team has identified that fuel comprises 43 per cent of total voyage costs and about 40 percent of a ship’s annual operating expenditure (OPEX). Therefore, ports that work with ship operators on JIT arrivals and help them improve the efficiency of their operations will certainly see more business and benefit from an improved reputation.

JIT arrivals can also reduce congestion and delays in ports – improving the safety, competitiveness and resilience of maritime operations. Congestion and confusion in busy port areas can significantly increase the risk of collisions; so clearly and effectively planning port calls ensures that both workers and valuable port assets are protected.

Increased efficiency and punctuality underpins competitiveness, not only compared to other ports, but also compared to other forms of transport such as air freight –which has been known to take business from ports in highly congested periods. In times when resilient and punctual supply chains are challenging to achieve, yet as important as ever, trying to achieve consistent JIT arrivals is a ‘no brainer.’

While the concept of JIT arrivals has been around for decades, the reality is that they have not yet been consistently achieved across the maritime industry and there has been no established procedure to share the benefits of JIT operations among all the stakeholders involved in a voyage – until now.

From the ports’ perspective, an advanced Port Management Information System (PMIS) is a key piece of the optimisation puzzle. It is used for planning, managing, monitoring and reporting all operations and related business processes. It is fundamentally a single source of information and data that can be made available, with the necessary security permissions, to any of the port’s stakeholders – whether internal staff, other organisations or even service providers (such as tugboat operators and marine pilots) and their customers.

autonomy, it’s important to remember that it enhances people’s roles and augments their day-to-day work. It can provide support with laborious and repetitive tasks to free up staff to focus on more complex challenges.

Digitalisation will expand further to support autonomy with those who adopt PMIS and enable JIT arrivals today, establishing the foundations for even more impactful future technologies. While the benefits ports are currently gaining from AI, machine learning and effective data use are substantial, this is only the tip of the digital iceberg.

In the future, a smart port’s systems could proactively and pre-emptively identify collision risks and prevent ships from getting into such situations, enhancing safety standards even further. Using the anticipated advancements in AI, machine learning, data and even more ground-breaking technologies, smart ports will be able to manage all of their resources optimally, making true efficiency and resilience a reality across their operations and for the wider supply chain.

To summarise, the digital journey is already underway at sea and onshore, and it can bring about much coveted safety improvements, efficient operations and enhanced resilience. To achieve this, it is critical that digital solutions are holistic and that data silos are broken down. When interoperable

and that data silos are broken down When solutions, such as advanced PMIS, are used, ports – and the maritime industry more broadly – remain ahead of the curve and ready to embrace supply chain modernisation with operations that are future-proofed and underpinned by data

Take TangerMed port in Morocco, for example. It is the largest port in Africa in terms of containerised cargo transiting through its facilities. It shares many of the same challenges as any modern port, but in addition it had lots of legacy solutions that wouldn’t talk to each other. In 2018 the owners of TangerMed set the Board of Directors the goal of becoming one of the top 10 most efficient ports in the world.

To achieve this, they adopted Wärtsilä’s PMIS solution, which incorporates Vessel Traffic Services and JIT solutions, alongside business intelligence and data analytics tools. As a result, TangerMed Port Authority succeeded in its goal earlier this year and was ranked sixth in a key global container port performance index.

The future of optimised port operations involves the uptake of more autonomous functions, which promises even greater supply chain safety and efficiency. When talking about

tion and It is can s, to ther boat the ting ges acy ners ming tion, ons, As a rlier take ater bout

8 Bruce Mills, Business Development Lead, Ports, Wärtsilä: “it is important that digital solutions deployed are holistic and interoperable”

While the benefits ports are currently gaining from AI, machine learning and effective data use are substantial, this is only the tip of the digital iceberg8 Digital fragmentation is the biggest obstacle to digital transformation

Shipping profits are being squeezed and the outlook is grim. This will have a far-reaching impact on the terminal sector. Andrew Penfold forecasts what happens next

8 The boom years are over with diverse shipping lines now owning much enlarged terminal portfolios –will they be able to sustain this position in the more difficult times ahead?

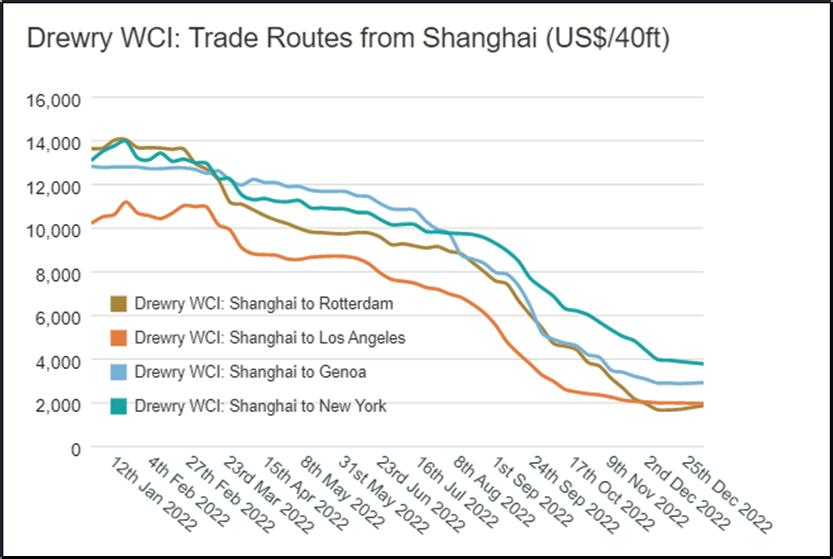

Following the Covid-led supply chain chaos of 2021 and 2022, container freight rates have collapsed and are pretty much at the same level as they reached in 2019. At the beginning of the year Drewry’s World Container Index was running at a level of around US$2,100 per 40’ container. At the peak of the market in January 2022 the corresponding rate was around US$9,700. The pattern of decline spread across the market, but the sharpest proportional drops were noted on the key Transpacific and Asia to Europe trades. This trend was also reflected in the other key indicator – the Shanghai Containerized Freight Index.

The massive profits recorded by the lines over the period represent a one-off gain. The ripples of this will spread out across the port market.

The resulting windfall profits have distorted the market and the impact has yet to be fully realised. The responses of the lines to these unprecedented profits have been interesting and will have far reaching effects on the port and terminal sector. Their responses have focused either on rapid expansion of capacity by means of a surge in newbuildings or an upturn in the pace of related infrastructure and other supply line supporting investments.

The former seems likely to have far-reaching negative impacts, whilst the latter will shift the structure of the market. Both responses will impact sharply on the port sector.

The orderbook for cellular container vessels is now very high and, according to Maersk Broker stands at over 30 per cent of existing fleet capacity. This is a higher proportion than noted in the late 2000s when the first round of the size-based revolution in the sector was in full swing. This ordering is concentrated on the largest vessel classes, with around 2.9m TEU of capacity in the 15,000TEU+ size range slated to be

delivered by 2025. Even with some cancellations and delays it looks like a case of ‘déjà vu all over again’.

Even with optimistic trade forecasts it seems certain that this capacity can’t be absorbed – and certainly not on the major east-west trades. Also, such optimism is thin on the ground. Despite some recovery in 2021, total container trade volumes remain marginally below 2019 totals and this weakness is most focused on the headhaul transpacific eastbound and westbound Asian to Europe trades. The world is currently heading into recession, with the World Bank reducing its global growth forecasts for 2023 from 3 per cent to 1.7 per cent in early January. The outlook for Europe is particularly poor, with most risks clearly on the downside.

So, we have a massive increase in supply and – at best – a stagnation in demand. The implications are clear, the shipping lines face a collapse in rates and profitability. The collapse in rates is well underway and the natural follow-on from this is a significant downturn in profitability. Short term moves to manage capacity – blank sailings, slow-steaming and rerouting – will not solve the problem.

The other approach to the windfall results of 2021 and 2022 has been to invest downstream in supporting infrastructure. This seems a more sensible strategy but will also cause some upheavals. Recent examples include MSC subsidiary TIL’s acquisition of Bolloré Africa Logistics, CMA CGM’s investment in the GCT terminals in New York and Evergreen’s completion of its 100 per cent stake in Colon Container Terminal. The logic of these purchases is clear: the integration of suppliers into the core shipping business. This has been a long-term trend, but it has accelerated sharply in the past two years with the sudden availability of cash.

The acceleration in this activity has also seen a new twist to it – the willingness on the part of key lines to bid very high numbers to secure terminal assets. The underlying thinking

is that the terminal asset can be leveraged to generate greater volume for the core shipping business and allied other services as well. A good case in point is the recent 30year concession for Jawaharlal Nehru Port Container Terminal, won by CMA CGM’s subsidiary CMA Terminals in partnership with J M Baxi Ports & Logistics with both parties taking a 50 per cent stake. Taking control of this facility, now known as Nhava Sheva Freeport Terminal, is integral to CMA CGM’s core stated objective of consolidating its end-to-end service offering and establishing greater control over the logistics chain to offer its customers “…higher quality, integrated, digital and more environmentally friendly services in a context that requires a comprehensive approach to the supply chain.”

It will be interesting to see if this approach – in a highly competitive climate - is one that ultimately pays off?

Quantifying the level of future freight rates and liner profitability is always very difficult but past experience shows that the link between supply and demand cannot be overcome. The container shipping market is heading for the rocks and there is little that can be done to steer away. Freight rates will fall to levels seen in the period 2016 to 2018, orders will be delayed, and scrapping will accelerate. Its also possible that lay-up of modern tonnage may be enforced.

Demand seems certain to remain weak in western Europe, although the outlook for the USA is somewhat more positive. With political and macro-economic uncertainties running high and the conflict in the Ukraine and Covid ongoing, it is unlikely that demand will remain stable this year and in 2024 and there are considerable downside risks.

Faced with these conditions the following pressures will be manifested on the port and terminal sector:

5 There will be pressures to deploy very large vessels onto secondary trades for which they were not really designed. The ‘cascading’ process that has been a feature of the container market can only continue and accelerate. The limitation here will be the capacities of container terminals in the secondary ports in Latin America, Africa, Australasia and the Indian sub-continent. The issue will not just be one of draught. In diverse cases, vessels will be lightly loaded – but with handling longer vessels at the berth, turning circles and the availability of gantries with sufficient outreach there will be challenges. Managing these requirements will require investment and, as has been mentioned, investments from lines in the anticipated market will be scarce.

5 There will be renewed downward pressure on stevedoring pricing. With lines increasingly focused on protecting profitability (or minimising losses?) all suppliers will come under pressure to ‘contribute’. In previous market cycles common-user terminal operators have been able to resist these pressures as often there were limited alternative deepwater facilities available. This position has changed. As has been noted in northern Europe most major ports have been able to handle the largest vessels and some port switching was possible during the congestion period. These lessons will not be quickly unlearnt.

5 The competitive nexus between line-owned and commonuser terminals will also be changed. Major shipping lines have increasingly focused on the provision of equity based dedicated capacity in major ports. The motive was initially to benefit from some of the perceived profitability in this sector with line-owned terminals seeking to market to third party

customers. This was a largely unsuccessful effort. With lines under pressure the motive for focusing operations at owned/controlled terminals will intensify. This will place pressure on the common-user sector where there is direct competition between the two types of operation. This is not a healthy situation – even in the short term.