MARCH/APRIL 2024 VOL 1024 ISSUE 2 portstrategy.com IFRS-S2 Game Changer | AI in TOS: Unlocking Benefits | Berthing System Innovation

TERMINAL RESALES?

IN TRANSSHIPMENT

AT THE GATE

MOORING SCRUTINISED

BRAZIL

INVESTING

REVOLUTION

SAFE

EUROPEAN RENTAL FLEET • Short Term Rental • Long Term Rental • Directly Available From Stock Keep on moving! Call us on +31 (0)20 4974101 or visit our site forkliftcenter.com Reach Stackers 10 to 85 tons capacity Tow Tractors GCW: 70 to 375 tons Forklift Trucks 10 to 60 tons capacity

VIEWPOINT

MIKE MUNDY

A challenging but interesting start to 2024. Negatives and positives in play and among the latter the subject that stands out as offering considerable scope to maximise vessel and personnel safety, as well as boost efficiency, is optimising the berthing process. This came under the microscope recently in London with diverse stakeholders opening the doors on an area worthy of ongoing attention – p42

A Mixed Picture So Far…

Three months into 2024 and the story of geo-political instability continues. The latest element of this being Iran’s missile attack on Israel, cited as a defensive measure but clearly with a lot of potential to escalate into something larger.

Ironically, to a certain extent these exceptional events, due to vessel diversion etc, are providing some revenue relief to container liner operators who are struggling against the harsh realities of self-induced over-capacity versus demand. How quickly, the thought springs to mind, the old normal has become the new normal – cycles repeat themselves!

The economic picture is mixed, as highlighted by The Economist column on p21. This said, decreasing inflation and the end of interest rate hiking cycles in most economies are positives to hang on to. Hopefully, further stability will follow once the current spate of pending elections is over, although, looking at the USA in particular, it could go the other way!

Exceptional events are of course not all geo-political, as highlighted by the most unfortunate collision between the M/S Dali, on charter to Maersk, and Baltimore’s Francis Scott Key Bridge. While this appears to have resulted from a propulsion issue (although yet to be officially confirmed) the incident has no doubt given a lot of food for thought to the many ports like New Orleans and Melbourne which operate with bridges with air draft limits, which can present fine margins with some of the larger vessels deployed today.

I would also suggest that the USA’s determination that it might be at risk in a security context from Chinese made cranes is something of an exceptional event. We look at this in Postscript, p50, and question whether the idea of replacing existing cranes with home built/ assembled units will stack-up? Practicalities suggest otherwise.

In a more heartening context, I would also draw your attention to the articles focusing on Southeast Asia, Investing in Transshipment, p22 and the Indonesia story on p22 – both underline a commitment to serious ongoing investment.

Last but by no means least, do read the review of the Safe Mooring Seminar organised jointly by Through Transport Club and Port Strategy and held in London at the end of March. This threw a much-needed spotlight on a subject area where there is considerable scope to maximise safety and efficiency. It is certainly an aspect of port and terminal operations that will benefit from greater dialogue between all interested parties.

The international magazine for senior port & terminal executives EDITORIAL & CONTENT Editorial Director: Mike Mundy mmundy@portstrategy.com Features Editor: A J Keyes keyesj186@gmail.com Consultant Editor: Andrew Penfold andypenfold@yahoo.com Regular Correspondents: Felicity Landon; Stevie Knight; Ben Hackett; Peter de Langen; Charles Haine; AJ Keyes; Andrew Penfold; Oleksandr Gavrylyuk Johan-Paul Verschuure; Phoebe Davison Production David Blake, Paul Dunnington production@mercatormedia.com SALES & MARKETING t +44 1329 825335 f +44 1329 550192 Media Sales Manager: Arrate Landera alandera@mercatormedia.com Marketing marketing@mercatormedia.com Chief Executive: Andrew Webster awebster@mercatormedia.com PS magazine is published bi-monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com Subscriptions Subscriptions@mercatormedia.com Register and subscribe at www.portstrategy.com 1 year’s digital subscription with online access £244.00 For Memberships and Corporate/ multi-user subscriptions: corporatesubs@mercatormedia.com ©Mercator Media Limited 2024. ISSN 1740-2638 (print) ISSN 2633-4232 (online). Port Strategy is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 3

PORTSTRATEGY INSIGHT FOR PORT EXECUTIVES

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 5

Media links LinkedIn PortStrategy portstrategy YouTube

Congress is a

meet

operationalenvironmental

Stay in

at greenport.com

leading

Greece

14-16 October 2019 www.greenport.com/congress Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREEat: www.portstrategy.com/enews

is a proud support of Greenport and GreenPort Congress GreenPort magazine is a business information resource on how best to meet the environmental and CSR demands in marine ports and terminals. Sign up at greenport.com The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operational environmental challenges. Stay in touch at greenport.com

Media links LinkedIn PortStrategy portstrategy YouTube The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operationalenvironmental challenges. Stay in touch at greenport.com

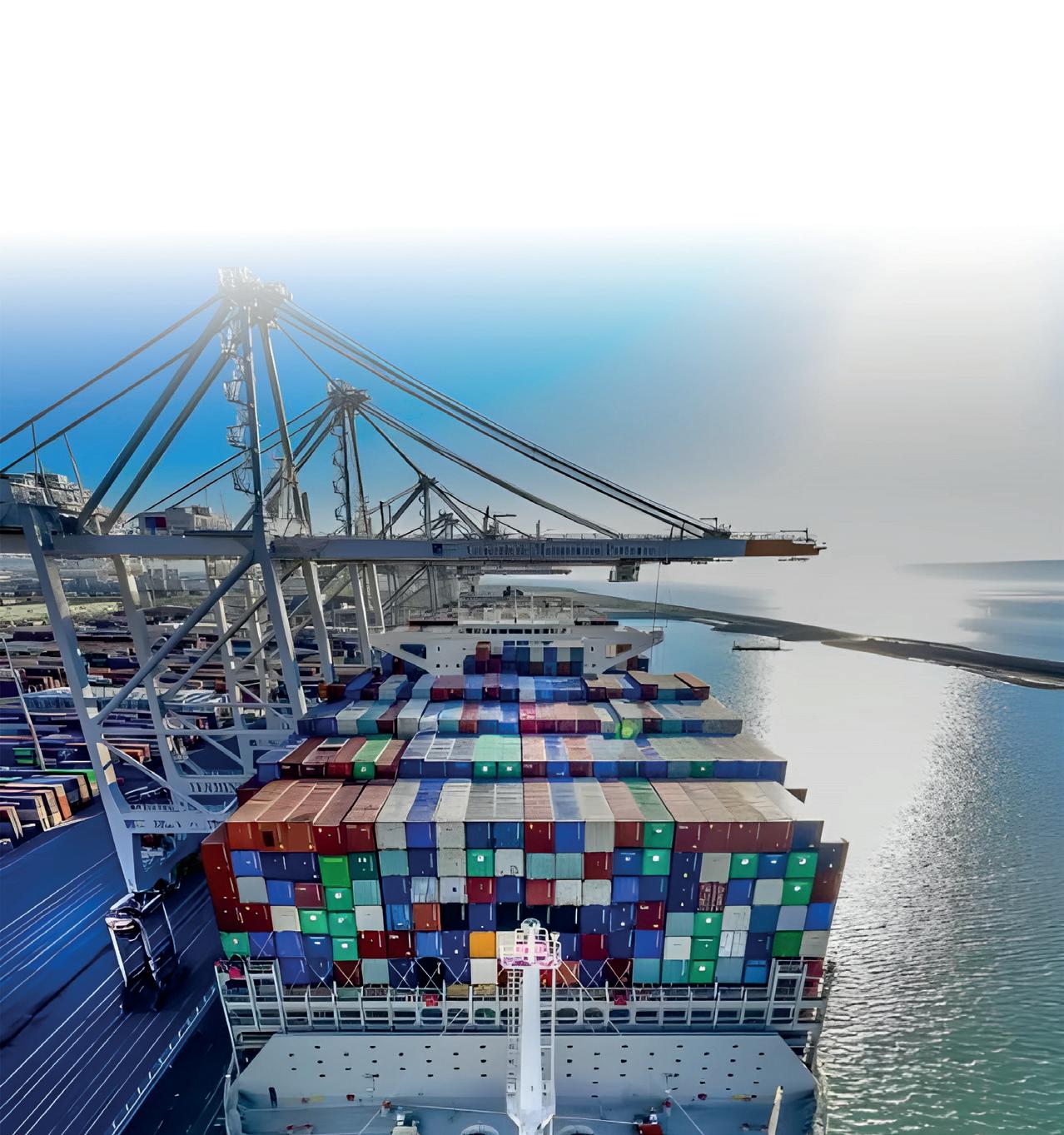

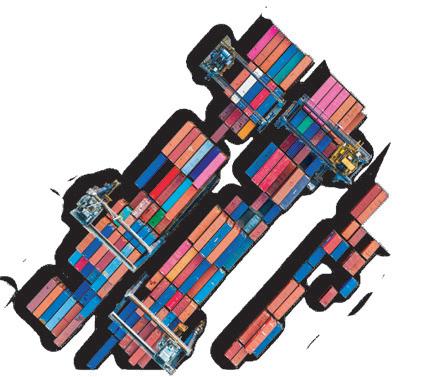

leading port executives in Athens, Greece from 14-16 October 2019 www.greenport.com/congress Online portstrategy.com 5 Latest news 5 Comment & analysis 5 Industry database 5 Events Weekly E-News Sign up for FREEat: www.portstrategy.com/enews Social Media links LinkedIn PortStrategy portstrategy YouTube The Congress is a meeting point that provides senior executives with the solutions they require to meet regulatory and operationalenvironmental challenges. Stay in touch at greenport.com Join leading port executives in Athens, Greece from 14-16 October 2019 www.greenport.com/congress analysis www.portstrategy.com/enews On the cover Pictured, PSA Singapore’s Pasir Panjang Terminal. Singapore is the focal point for approximately 200 shipping services offering links to around 600 ports worldwide. The port is renowned as a world leader in transshipment – see p20 NEWS FEATURE ARTICLES

18 The New Yorker Political Play 18 The Analyst Port Islands? 19 The Economist Global Economy Remains Under Stress 19 The Strategist DDigitalization & Decarbonisation 50 Postscript Let’s Talk Sense 20 Investing in Transshipment Southeast Asia Challenges 22 Regional Role Affirmed Indonesia – Status Quo for Now 24 Alternative Fuels Catalyst? EU ETS, a Driver for Clean Fuels? 27 Combatting Illicit Cargo Adopting Preventative Measures 28 Intermodal South America Big Hitters Talk Big Numbers 29 Terminal Resales in Brazil Fact or Fiction? 31 Competition Builds in Peru APMT Callao a Canny Path 32 Revolution at the Gate AI Redefines Possibilities 36 IFRS-S2 Game Changer A New Governance Framework 38 AI in TOS Unlocking the Benefits 41 The Green Connection Sustainable Port Agents 42 Safe Mooring Scrutinised Key Issues Raised 44 Berthing System Innovation The Latest Product & Service Advances MARCH/APRIL 2024 VOL 1024 ISSUE 2 portstrategy.com IFRS-S2 Game Changer AI in TOS: Unlocking Benefits Berthing System Innovation BRAZIL TERMINAL RESALES? INVESTING IN TRANSSHIPMENT REVOLUTION AT THE GATE SAFE MOORING SCRUTINISED 16 Chidambaranar Outer Harbour Interest 16 PLA Emphasis Environmental Agenda 18 Santos Brasil Sweeps up New Business 18 DPW Santos Investment Package 19 APMT Durban Motivation Questioned 19 Ukraine Grain Exports Surge 11 Digital Networking Tests Port and Inland Connectivity 11 AI Arrives INFORM Solutions 13 Portsmouth Powers On ABB Shore Connection 13 Digital Bunkering Successful Trials 15 Electric Pier 400 Kalmar APMT Deal 17 Record Maasvlakte II Order Capacity to Double 17 Bieste Bulk Bucket New Handling Solution

Social

The

meeting point that provides senior executives with the solutions they require to

regulatory and

challenges.

touch

Join

port executives in Athens,

from

CONTENTS MARCH/APRIL 2024

Social

Join

REGULARS

BRIEFS

Solar Peel in Liverpool

UK-based Peel Ports Group is working with E.ON to install the UK’s largest roof-mounted solar energy system at the Port of Liverpool. This is the first stage of a 25-year agreement between the two companies to help Peel Ports Group reach its goal of net zero emissions by 2040 and could see as many as 63,000 solar panels installed on 26 buildings. The panels could generate up to 31MW of renewable electricity and meet the yearly power needs of more than 10,000 average UK homes.

Kaohsiung Expansion

Taiwan International Ports Corporation, Ltd. (TIPC) is upgrading Kaohsiung Port’s 3rd and 5th Container Terminals and adjacent yards, with a budget of NT$4.4bn (US$138 million) allocated. This latest project follows the 7th Container Terminal opening in May 2023. Water depth increases and new equipment will enable ships up to 24,000 TEU to call. Construction work commenced in February 2024 and completion is scheduled for Summer 2027.

ICTSI go in Iloilo

International Container Terminal Services, Inc. (ICTSI) has gained regulatory authority to manage and expand Visayas Container Terminal (VCT). VCT is located in Iloilo City, central Philippines, and is a critical gateway for the province of Iloilo, Panay Island, and the Western Visayas area. With ICTSI’s investment in terminal infrastructure, the facility is expected to see improved capacity and operating efficiencies and become a catalyst for Iloilo’s economic and social growth.

CHIDAMBARANAR OUTER HARBOUR TERMINAL PRE-BID MEETING

A diverse range of interested parties are showing an interest in the proposed four million TEU capacity container terminal in the outer harbour of V O Chidambaranar (VOC) Port.

In an official “pre-bid” meeting, reports in India confirm that potential operators, Adani Ports and Special Economic Zone Ltd (APSEZ), PSA International Pte Ltd of Singapore, JSW Infrastructure Ltd and J M Baxi Ports and Logistics Ltd, were among the participants.

Also in attendance were Dutch dredging contractor Van Oord India Pvt Ltd and International Seaport Dredging Pvt Ltd, a part of Belgium’s DEME Group,

presumably because of a large, phased requirement for dredging to support the project.

Mohan Muthu, a local rock supplier also participated, no doubt interested in the 5.5km breakwater construction component.

A previous roadshow for this project was held by VOC Port Authority in mid-March 2024, but feedback at the time from potential bidders suggested that the project cost estimates from the state-owned port authority needed to be reviewed. Bidders urged the port authority to re-visit the cost estimates or else to raise the viability gap funding to 50 per

n A range of interested parties attended a “pre-bid” meeting at V O Chidambaranar Port and the port authority is now seeking bids based on a lowest viability gap funding process

cent of the project cost to make it attractive.

As a result, the port authority is requesting interest based on the lowest viability gap funding (VGF) quoted by bidders for developing the project. This makes it different from the model followed previously for unionised and government-owned major ports in which cargo handling contracts are finalised on the basis of the highest royalty per TEU or per ton of cargo quoted by the bidders.

PLA CHAIR PUTS EMPHASIS ON THE ENVIRONMENT

The Port of London is expanding, increasing its cargo volumes, investing and recruiting – but its work is also all about the environment, said Jonson Cox, Chair, Port of London Authority. Reflecting on the past year, he told guests at the PLA’s annual reception onboard the Silver Sturgeon: “We have launched the Clean Thames Manifesto and were able to persuade three water companies, which discharge through 118 points in the river, that they will bring forward their targets for a clean river ten years ahead of the government target.

“We have also published our Net Zero River Plan [a three-year action plan for 2024-2027] for 2040.”

During 2023, the PLA also launched its masterplan for

the river, “to get a really coherent view of how we develop the river, particularly downstream”, said Cox.

He also described the PLA’s work with the Company of Watermen and Lightermen and other parties to focus on training and career-long learning, and his pride in the expansion of apprenticeships on the river.

In 2024, the PLA will invest in new pilot cutters, an upgrade of the pilots’ simulator, the replacement of its Vessel Traffic Services (VTS) equipment and the replacement of 17 radar stations along the river, among other projects.

A particular highlight in 2023 was the launch of the UCL Tamesis, a remote-control survey vessel ‘packed with technology’.

Formally named by the UK Maritime Minister, Baroness Vere, the vessel is jointly operated by the PLA and the University of London (UCL). It is the first fully electric, remotely operated survey vessel in a UK port.

The PLA is also working with SEA-KIT, which won government funding to build the world’s first hydrogen-fuelled remote surveying vessel (RSV), to be operated on the Thames.

Cox emphasised the unique benefits of the PLA’s Trust Port status, noting: “We have no shareholders to bail us out, no government to bail us out. We have to succeed – it is down to us.

But also, we have no shareholders that we have to pay dividends to. We invest everything we make into the port.”

PORT & TERMINAL NEWS 6 | MARCH/APRIL 2024 For the latest news and analysis go to www.portstrategy.com

The Kalmar ELECTRIC REACHSTACKER

“With our focus firmly on improving the sustainability of our operations, reducing the noise and airborne emissions that our equipment generates is a must. The goal we set when we first signed the agreement to collaborate with Kalmar on this eco-efficient solution in 2019 has not changed: We want to become the industry leader in airborne emission and noise reduction, which is why we choose a Kalmar Electric Reachstacker.”

Hans

Cabooter, President and CEO, Cabooter Group.

The time is now to go electric.

Kalmar’s electrically powered reachstacker can help improve theeco-efficiency of your operations while maintaining the highest levels of productivity and safety. With a range of modular battery options and charging solutions, we can work with you to design a solution that will deliver for your business. What are you waiting for?

kalmarglobal.com

BRIEFS

Bangkok Relocation

Thailand’s prime minister, Srettha Thavisin, has confirmed an intention to relocate Bangkok Port. The current port area on the Chao Phraya River will be regenerated in a bid to benefit local citizens by the removal of pollution caused by shipping and road transport. The Ministry of Transport and the Port Authority of Thailand are working on a relocation study, although the Bangkok Metropolitan Administration (BMA), the city’s local government, favours shifting the port to Laem Chabang.

Cuxhaven Support

The government of Germany is extending help to Cuxhaven port and its energy hub plans. As part of a new strategy, the government will partly fund the construction of berths five to seven at the port. Total construction costs are around €300 million, with the state of Lower Saxony allocating €100 million and private port industry providing €100 million through concession fees. The remaining €100 million from the federal government means the project can now proceed.

Gopalpur Deal

Adani Ports & SEZ is acquiring a 95% share in Gopalpur Port Limited. The stake is being bought from SP Group (56 %) and from Orissa Stevedores (39 %). A reported enterprise value of INR 3,080 crore (US$369.6m) applies. Located on the east coast of India, Gopalpur port can handle up to 20 million tonnes per annum of dry bulk cargo, including iron ore, coal, limestone, ilmenite, and alumina.

SANTOS BRASIL SWEEPS UP NEW LINER BUSINESS

n Tecon Imbituba terminal has picked up the new Brazex service

Brazil’s leading box terminal operator, Santos Brasil (SB), has been boxing clever this year in tying carriers to long-term contracts as it mops up the mess caused by reduced berth capacity at two key terminals.

A badly damaged berth at BTP, in Santos, and quay refurbishment at the Portonave terminal in

Navegantes, Santa Catarina, has left shipping lines needing to find quick-fix alternatives. SB’s Tecon Santos facility has secured a Far East and a Mediterranean service and its Tecon Imbituba terminal, in the south, has picked up the New Brazex service to the US Gulf (operated by CMA CGM and Cosco).

Other terminal operators that have benefitted from the “overflow” caused by the two dislocations are Ecoporto and DP World in Santos, and two Wilson, Sons terminals in Salvador and Rio Grande.

Usually, carriers will divert for a few months and pay a premium price for that but the commercial department at Santos Brasil insists that they sign one to two year contracts, to guarantee windows.

“The unfortunate accident at BTP means that the Ipanema service [ECSA to Asia, by MSC] and one Mediterranean service have switched to us, and they are a boost to our volumes for sure,” says a veteran director for Santos Brasil. “It makes no sense for us to have 2-3 month contracts.”

Forecasts as to when BTP’s pier will be ready again vary from July to late September.

DP WORLD SANTOS IMPLEMENTS INVESTMENT PACKAGE

DP World Santos is to invest Reais250M (US$50 million) in new equipment for its box terminal, located on the left bank of the Port of Santos, South America’s biggest for containers.

The cash will be spent on two new Ship to Shore Gantry Cranes, five RTGs, 12 internal transfer vehicles and two Empty Container Handlers. This adds to the Reais175 million already being spent on an additional 190m of quay. Together these improvements will boost annual capacity to 1.7 million TEU and allow for two large box ships to be berthed simultaneously.

“The expansions being carried out by DP World in Brazil will meet growing demand in the container market in the postpandemic era and prepare the terminal to support Santos’ growth and strategic role as a key port in South America,”

says Fabio Siccherino, CEO, DPW Santos.

DPW Santos, the third biggest box terminal operator in the port after BTP and Santos Brasil,

n DP World Santos –undertaking a major investment in new quay and landside equipment

handled 1.077 million TEU in 2023, 22 per cent of the overall throughput of 4.783 million TEU for Santos as a whole; up from 21.1 per cent in 2022.

PORT & TERMINAL NEWS 8 | MARCH/APRIL 2024 For the latest news and analysis go to www.portstrategy.com

At the beginning of April local newspapers in Durban including Business Day carried a story announcing a legal challenge by APM Terminals (APMT), part of the Maersk group, to the confirmed award by Transnet of the Durban Container Terminal (DCT) Pier 2 concession to International Container Terminal Services Inc.

Interestingly, the story carried by Business Day, which features direct quotes from APMT, reflects the message from APMT that it is doing this for the good of the country overall, as part of its stated mission to, “Improve life for all by integrating the world.” It even says, “…we believe we would successfully deliver this in Durban.” Furthermore, Business Day quotes APMT as saying: “It is not our intention to delay the process unnecessarily or to cause any disruption.”

On top of these remarks that suggest APMT’s motives in bringing its legal challenge are quite altruistic it further states that it will “…ensure that the process is lawful.” Another statement pitched to occupy the higher ground.

There are, however, many that might take a rather different view of APMT’s motives.

The bid structure is understood to have been a two-part one with points awarded across both elements – the financial part and the technical submission. ICTSI won which clearly came as something of a shock to APMT. There was plainly an expectation that it had done enough to win. It had the motivation to bid high, getting a foot in the door with DCT pier 2, the jewel in the crown of Transnet’s container terminal portfolio handling over 70 per cent of Durban’s port traffic, would have enabled APMT,

Multimodal Hub

The Pecem Port Complex has signed a contract with Fracht Log to operate a multimodal cargo terminal for the storage and distribution of nonhazardous products in the Northeast region of Brazil. Fracht will invest Reais60M in the project and the facility, located in an area of 10.7 hectares, will open by the end of this year.

APMT DURBAN ACTION SPARKS MOTIVATION QUESTIONS

together with its sister liner company Maersk, to exercise a lot of influence over South Africa’s supply chains as a whole.

APMT might cite its latest branding as an integrator in this respect but there will certainly be others who see its objective in a different light, “control” being a key factor.

Looking back down the years it can be seen that Maersk, APMT’s sister company, has enjoyed a strong position in Durban accounting for over 25 per cent of throughput with its current operating partner MSC holding an even stronger position nearer to 40 per cent. Furthermore, when it comes to the important reefer trade it is well known that their respective market shares are higher, possibly accounting for up to 80 per cent on a combined basis.

One of the underlying reasons for Maersk being able to maintain a strong market position can be seen to be quay access. Together with MSC it accounts for the lion’s

APMT Vietnam Deal

APM Terminals and Hateco

Haiphong International Container Terminal (HHIT), a fully owned subsidiary of Hateco Group, have signed a memorandum of understanding (MOU) to further develop a terminal in Haiphong in North Vietnam. This new announcement follows a strategic partnership that commenced in 2023.

Drewry Identifies Flourishing Ukraine Grain Exports

Over the past few months, Ukraine has witnessed a remarkable surge in grain exports, signalling a robust agricultural industry, according to Drewry.

The company confirms that despite the expiration of the Black Sea Grain Initiative, which once governed the region’s trade dynamics, Ukraine’s grain shipments have surged, contributing approximately 25 billion tonne miles monthly.

n The Citrus Growers Association anticipates a bonanza season for exports but notes: “The CGA views the expeditious introduction of the appointed private operator of Durban’s container terminal Pier 2, ICTSI, as critical. Any delays,” it says, “will imperil the export economy.”

share of berthing capacity and the only route out of this situation is widely acknowledged to be productivity improvements –faster vessel turnaround offers more available capacity, in turn allowing more access by other liner operators. A more competitive situation, which has long been the objective of parties such as South Africa’s influential Citrus Growers Association. While not cited by APMT it is clear, given the presence of such a scenario, that there are very strong commercial reasons for APMT to attack the award to ICTSI of partnering with Transnet at DC pier 2. As one source put it: “even maintaining the status quo (nothing happening) will work well for them, loss of control is the fear factor.”

Gdansk Refurbs

The Port of Gdansk is reconstructing its Rudowe and Bytomskie Quays. The combined length of these quays is more than 450m and the project forms part of a initiative co-fi nanced by the Connecting Europe Facility 2021-2027 (CEF 2). The EU is contributing a total of US$108 million to the project.

During January and February 2024, Ukraine consistently exported an average of four million tonnes of grain per month, representing a “100 per cent” surge compared to the preceding months.

While these export figures are still beneath the levels seen before the conflict, they surpass the volumes recorded during the now concluded Black Sea Grain Initiative.

Drewry summarises by adding that the strategic establishment of alternative export routes and competitive pricing strategies demonstrates Ukraine’s commitment to maintaining its position in the global grain market.

However, as geopolitical challenges persist – notably Russian aggression – the nation’s ability to navigate these obstacles will be critical for sustaining its current success in the international grain trade.

BRIEFS

Lavrio Port Bidders

A majority share in the Greek port of Lavrio, located north of Athens, is being offered for sale by the country’s privatization agency, the Hellenic Republic Asset Development Fund (HRADF). A 60-year concession is on offer. Located near popular tourist destinations such as the Cycladic Islands and the airport, HRADF considers it attractive for tourism development.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 9 SPECIAL NEWS REPORT

Handle bulk with efficiency and reliability

Pneumatic and mechanical ship (un)loaders

Up to 2500 tph for loaders and up to 1200 tph for unloaders.

Low noise & dust emission machine within reach

Turnkey solutions for cereals, soy flour, fertilizer, pellets and more...

TESTS COMMENCE FOR DIGITAL SEA AND INLAND PORT NETWORKING

Platform operators Portbase and RheinPorts have launched a new joint initiative to digitally connect the maritime and inland port communities.

The aim of the project is to optimise the flow of data between the seaports in the Netherlands and the inland ports on the Rhine. The Port of Rotterdam, Duisport and Port of Switzerland are supporting this project, as both shareholders and ambassadors.

A principal objective is to reduce complexity in data exchange throughout logistics chains, which will be achieved through the seamless exchange of data to facilitate import and export process optimisation, improvements in planning and the simplification of the transfer of information to

the stakeholders involved.

The ultimate goal is to create a digital corridor. This facilitates hassle-free and secure data transmission, reduces complexity and increases efficiency for inland shipping and ports. Everyone involved stands to benefit – from importers and exporters and terminal operators to carriers, port and customs authorities.

A test phase is scheduled to be completed by the end of 2024 followed by a ramp-up phase commencing during 2025.

INFORM BRINGS AI TO DUISBURG GATEWAY TERMINAL

INFORM is poised to enhance the Duisburg Gateway Terminal (DGT) operations through its advanced AI-based solutions.

The project focuses on leveraging AI technologies to streamline intermodal logistics, in turn pioneering Europe’s first CO2-neutral intermodal terminal in the heart of Duisburg’s port as the facility initiates operations and scales up.

INFORM will implement its Intermodal TOS at DGT, leveraging a modular design that allows a high degree of automation and operational

All-In-One Port-IT

Port-IT, a leading provider of maritime Cyber Security & IT solutions, has announced the introduction of an all-inone fast and secure maritime connectivity solution. This service combines high-speed internet access with robust cybersecurity measures, offering vessel owners and operators a comprehensive and secure connectivity solution and complete IT management and seamless integration of services, all from one partner.

optimisation. Key features include:

Barge Handling – AI will streamline barge handling to enhance and minimise delays.

Crane Optimisation - Refine operations of six intermodal barge cranes by organising equipment jobs to decrease handling times.

Optimise Train Loading – Use advanced algorithms to plan and execute train loading operations for optimal use of resources and reducing turnaround times.

Stack Optimisation – AI will optimise container stacking to

IT-Security Hub

Marcybersec.com is offering a new web portal that provides a central directory for IT security, but which is specifically tailored to meet the needs of the maritime industry. This access ensures consolidated access to specific reports relating to cyberattacks, relevant regulations and recommendations for action and additional supporting information via direct links. The consolidation of reported attacks only refers to specifically-named companies, to ensure credibility.

Paradip Upgrades with ID Tech

India’s Paradip Port Authority (PPA) has confirmed it is working with ID Tech to modernise its cargo reception and despatch facilities. Specific focus will be placed on the use of new systems to upgrade gate management and optimise cargo movement.

The tracking of inward and outward cargo activity will be improved by the implementation, operation, and management of an RFID-based Access Control System, along with cloud-based Harbour Entry Permit application software. This will deliver real-time monitoring and recording of cargo movements while enabling efficient management and optimisation of port and terminal activities.

People movements will also be monitored to help improve port security.

New Simulation

improve space use and accessibility.

Billing Module Integration

- Facilitating the billing process with a tailored module that accurately captures services rendered, streamlining financial operations.

Booking Platform Interface

- Seamless platform integration to streamline combined transport bookings and enhance operational coordination.

The first construction phase of the terminal will open in Summer 2024, utilising INFORM’s Syncrotess Intermodal TOS.

FourKites & BuyCo

Real-time supply chain visibility platform, FourKites®, and BuyCo, a container shipping platform, have announced a strategic partnership to provide Fortune 500 shippers with comprehensive understanding and control throughout the entire container shipping process. This visibility spans both inland and ocean shipments, from initial planning and booking to realtime transportation visibility.

CM Labs Simulations has announced the launch of a new simulation training solution for double empty container handlers.

Designed in collaboration with port operator trainers, the Intellia Double Empty Container Handler Add-On Module instructs operators on using double empty container handler control functions and techniques for loading and unloading containers in a real port setting.

BRIEFS

AI Cleans Oceans

A new system using AI and smart robots is expected to revolutionise the cleaning of ocean seabeds. The ‘SeaClear’ system has been developed as part of a four-year European research project and has already passed a series of tests. A range of remotely operated underwater vehicles (ROVs) work in conjunction with drone monitors and sea-mapping technology, while AI-based algorithms accurately locate and detect litter.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 11 PORT & TERMINAL NEWS

n The Port of Rotterdam is supporting the development of tests that could lead to formation of a new digital corridor on the River Rhine

ELME Spreader was born this year. So was the disco. Follow us in 2024 - we are celebrating it our way, by manufacturing world-leading spreaders.

www.elme.com

www.elme.com

1974 - 2024

PORTSMOUTH POWERS ON

Portsmouth International Port, UK and leading electrification and automation technology provider, ABB, have agreed a deal that will see a shore connection solution installed for Q4 2024. Operational readiness is then expected from Q2 2025.

Portsmouth is currently implementing a shore power system across its three busiest berths as part of its Sea Change project. This new process will cater for two ferry berths, each equipped with five connection points, and an additional berth shared by ferries and cruise ships.

The shore connection solution

offered by ABB allows vessels to shut off their engines while waiting at the berth, thereby reducing annual carbon dioxide emissions. The port is expecting to see an estimated 20,000 tons of harmful emissions removed to enhance air quality.

ABB’s shore connection system includes a 16-MVA ACS6080 drive with a shunt filter, medium-voltage (MV) switchgear, power-factor compensation, transformers, e-houses, cable management systems, and automation. This equipment will be supplemented by installation, cabling, and

commissioning services, with a three-year maintenance agreement also in place.

In conjunction with this project, the port’s largest customer, Brittany Ferries, is introducing two new LNG-electric hybrid ferries from 2025.

The Sea Change project is part of the Zero Emissions Vessels and Infrastructure (ZEVI) competition funded by the UK Government in partnership with Innovate UK. The UK Department for Transport is supporting 10 major initiatives throughout the UK relating to clean maritime solutions.

DIGITAL BUNKERING DEBUTS IN SINGAPORE

After a number of successful trials, the Maritime and Port Authority (MPA) has confirmed that electronic bunker delivery notes to digitalise Singapore’s bunker industry are operational. .

As a result, the MPA is expecting the new process to save the bunker sector up to 40,000 hours per annum in helping to “boost efficiency and transparency.”

The maritime regulator explains that this new system uses mobile and cloud solutions to complete and issue digital bunkering documents, while also streamlining workflow and enhancing crew safety by eliminating the requirement to

transfer bunker documents on a physical basis between vessels.

During 2023, more than 100 trials were completed, involving over 20 companies regularly active in the bunkering industry.

The MPA states that it intends to make the process fully iterative: “Feedback from users will continue to be gathered to improve the solutions, with plans to make digital bunkering a mandatory requirement by the end of 2024.” Plus, the MPA will continue to explore and work with the industry on other enhancements, including automating the data flow from mass flow meters.

Japanese container shipping

n A number of successful trials for digital bunkering processes have been completed in Singapore, including by ONE. MPA is targeting a mandatory system by the end of 2024

partnership, Ocean Network Express (ONE) has been involved in the process by successfully completing an e-BDN adoption trial. It notes: “As part of the trial, the cargo officer, chief engineer, and bunker surveyor logged in to the platform via their unique link and one-time password to complete the electronic bunkering documentation for pre and post-delivery. Upon completion, the bunkering documents were transmitted to all parties before the vessels departed.”

BRIEFS

Eurogate picks Conroo

The Gate Pass solution from CONROO is being introduced at Eurogate Container Terminal Hamburg (CTH). This new app solution enables full digital verification of truck drivers, which will improve operating efficiencies and increase terminal security. It works on all common mobile devices and covers the entire process from registration and fully digital driver verification to DAKOSY route planning (TR02) and on-site instructions.

Oldendorf & Harbor Lab

Major dry bulk shipping company, Oldendorf Carriers, has signed a new deal with specialist in maritime technology for centralising and simplifying port disbursement costs, Harbor Lab. As a result, Harbor Lab’s software-as-a-service (SaaS) platform will provide realtime, accurate information on disbursements that will streamline processes, save money through accurate invoicing and bring transparency to shipping.

GSBN Reveals Savings

Global Shipping Business Network (GSBN) has published the study, “Impact of Digitalization in Driving Decarbonization in Shipping.” Key conclusions suggest that the absence of a universally adopted digital platform creates interoperability challenges, complicating eff orts to reduce carbon emissions. Also, shipping stakeholders are urged to recognise the environmental and operational benefi ts of digital solutions, such as waste reduction and streamlined processes, that are crucial to achieving the industry’s decarbonisation goals.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 13 DIGITAL NEWS

KALMAR SCORES ELECTRIC APMT PIER 400 DEAL….

Kalmar, part of Cargotec, has signed a new contract with APM Terminals’ Pier 400 Los Angeles to supply two new Kalmar electric AutoStrads™ and undertake a retrofit of two existing hybrid straddle carriers. These new and retrofitted units are part of APM Terminals’ US$60 million electrification pilot programme, an initiative also underway in Aqaba Container Terminal, APM Terminals Barcelona, APM Terminals

Mobile, and the Suez Canal Container Terminal.

This latest deal in Los Angeles was booked as part of Cargotec’s Q1 2024 order intake, with the equipment due to be delivered in Q4 2024. Jon Poelma, Managing Director, APM Terminals, Pier 400, explains: “With this pilot we look to gain greater understanding of how to convert our existing hybrid equipment fleet to fully electric with our on-site mechanic workforce. Electrifying straddle carriers is an essential task for us. We’re confident they will be able to meet the significant operational demands of the terminal. We have made the

commitment to our customers to decarbonise supply chains and are aiming for net-zero emissions at the terminal before 2030.”

Kalmar adds that the two Kalmar electric straddle carriers participating in the electrification pilot project will feature high-power batteries with an operation time of 45–50 minutes and a charging time of

approximately five to six minutes. Charging of the equipment will be performed at two Kalmar FastCharge™ charging stations strategically located on the machines’ working routes. All charging related decisions are performed automatically by Kalmar One Fleet Optimiser’s energy management module. Pier 400 covers an area of 507

n Kalmar is supplying APMT’s Pier 400 facility with two new electric straddle units, plus retrofitting two additional units as part of a wider electrification initiative

acres and is home to 19 Super Post-Panamax ship-to-shore (STS) cranes. The terminal currently operates a total of 132 Kalmar AutoStrads™, all of which have hybrid electric drivetrains.

….AND CONFIRMS A WIDE RANGE OF OTHER AGREEMENTS

Kalmar has also announced a raft of other deals across a wide geographical range of companies, including: Intermodal Terminal Company (ITC) has ordered six electric reachstackers and two electric empty container handlers, all powered by lithium-ion batteries, at the

RST Crane Plan

Rotterdam Shortsea Terminals (RST) is looking to source new cranes from Europe due to cost increases elsewhere. The operator has explained that it has seen the price of cranes manufactured in China rise by 40 per cent since 2018, meaning that quotes from Dutch and other Europeanbased manufacturers are being sought. RST provides feeder ship and inland waterway services from the Port of Rotterdam to European ports.

new A$400 million Somerton Intermodal Terminal (SIT) being developed in Melbourne, Australia, scheduled to arrive in Q1 2025 as the facility opens.

A deal for autonomous terminal tractor solutions with Forterra (formerly RRAI).

Kalmar will develop the

Van Oord Boosts Profit

Global marine construction and dredging specialist, Van Oord, has announced record high revenue and a doubling of profits for 2023. The Rotterdambased company confirmed a revenue increase of 42 per cent to €2.9bn from €2.0bn in 2022, with net profit rising from €6 million to €127 million. Growth across both the Dredging & Infra and Offshore Energy business units was achieved with EBITDA rising from €243 million in 2022 to €379 million for 2023.

automation-ready terminal tractor (including Kalmar

One fleet automation management system) with Forterra providing its AutoDrive platform for autonomous operations.

Supplying Hutchison Ports’ ECT Delta terminal with two fully electric straddle carriers by Q4

Liebherr in Italy

Liebherr Container Cranes Ltd. has confirmed the handover of four electric Rubber-Tyred Gantry cranes (ERTG) to facilities in Italy. One ERTG has been delivered to Salerno Container Terminal (SCT), operated by the Gallozzi Group, with the other three units passed to Consorzio Napoletano Terminal Containers, Naples (Conateco), an MSC company. Each machine has a hybrid powertrain employing both diesel and electricity.

2024, piloting the use of battery technologies.

Three diesel-electric straddle carriers for the Ile de la Reunion Terminal on Reunion Island, in the Indian Ocean, with delivery scheduled during Q4 2024.

BRIEFS

Digital Tyre App

Continental has launched a new ContiConnect Lite app, for digital tyre management. This new tool allows for professional tyre monitoring in tyres for port and terminal duty. Continental’s radial off-the-road (OTR) tyres are fitted with a Bluetoothenabled sensor ex-factory, ready for ContiConnect Lite. This tool supplies data on tyre pressure and temperature for optimised tyre management and ensures a free-of-charge gateway to key digital features.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 15 EQUIPMENT NEWS

Date for your diary in 2024

Join the world’s leading conference on balancing environmental challenges with economic demands

Meet and network with over 200 attendees representing port authorities, terminal operators and shipping lines. For more information on attending, sponsoring or speaking, contact the events team:

visit: greenport.com/congress

tel: +44 1329 825 335

email: congress@greenport.com

#GPCongress

Le Havre Media Partners:

RECORD ORDER FOR APM TERMINALS MAASVLAKTE II

APM Terminals Maasvlakte II has confirmed the signing of a contract for 62 Automated Rail Mounted Gantry Cranes (ARMGs) with Austrian crane builder Kuenz. The electric cranes will feature ABB control and information systems, automation solutions/ sensors, and software, alongside remote-control features aimed at optimising crane efficiency through remote management.

This is reportedly the largest ever crane order in Europe made by APM Terminals. The first ARMG unit is scheduled for delivery in April 2025.

The aerodynamic design and relatively low energy

consumption of Kuenz’s ARMGs made the choice the logical one according to Hans Jongejan, Project Director MVII-Expansion, who explains: “This is an important step in the expansion of APMT MVII. Kuenz and ABB once again proved to be the best solution for the handling of our containers. The combination between the reliable automatic handling provided by Kuenz and ABB’s aerodynamic cranes makes this a sustainable choice. This allows us to not only become the most modern gateway to Europe but also the most efficient and sustainable.”

“The Kuenz ARMG Concept 2.0,

introduced in the current facility of APMT MVII, was characterized by innovative new features, especially in the hoist unit. This groundbreaking development not only increased the performance of the cranes, but also significantly reduced operating costs. The positive effects of this pioneering innovation have been fully realised,” says David Moosbrugger, Managing Director of Kuenz.

Due to the projected technological development and efficiency of these ARMGs, the capacity of APMT MVII is expected to significantly increase, indeed almost double by end 2027.

ENTER THE BIESTE BUCKET BULK HANDLING SOLUTION

Latvia-based Bleste Sia has introduced its new ‘Bleste Bucket’ bulk handling solution. The company said that the Bleste Bucket is a modern iteration of the traditional bulk grab in container format (see picture) while also being an innovative yet simple product that improves dry bulk handling for companies looking for efficiency, cost and speed gains.

According to Dinis Hruscovs, Managing Director, Bleste Bucket, speeds up bulk cargo logistics, especially for terminals, and in a durable way. The bucket is reportedly manufactured to a very sturdy quality and with dimensions that suit terminals, trucks, vessels, and (mobile) cranes. “Dump trucks can drive right into the bucket, a unique feature. This means no spill-over onto the pier, reducing waste, dirt and dust as well as less time and cost spent on cleaning up afterwards. The crane operator then lifts the bucket from the pier onto the vessel to discharge, again with less dust than caused by, for example, orange-peel grabs.”

The company states that due to its smart design, there is no need for extra employees or equipment when using the Bleste Bucket -

only a crane operator and dump truck driver are needed, perfect for environments where infrastructure or port handling equipment is scarce. The Bleste Bucket is reported to provide savings on time spent on loading and discharging, clean-up time and cost, and use of personnel.

The Bleste Bucket is additionally said to be especially useful for scarcely or nonequipped piers, as the Bucket can be handled on a vessel that already has a boom crane which makes for easier handling in those circumstances. Multiple cranes can be used for parallel loading, reportedly making it even more

cost and time efficient. It also comes standard with links and chains for immediate hook-up with a crane, although as the bucket can actually take up to 30t of bulk, stronger links and chains can be installed if clients wish to use it at that capacity.

Bleste feels that Africa will be a key market for this new product – where many piers and quaysides are not equipped with a crane. As the crane and bucket are already on the vessel, all that is needed is for the crane to move the Bleste Bucket on the pier for loading.

BRIEFS

Contecon Guayaquil Tracker

ICTSI’s Contecon Guayaquil SA (CGSA) terminal has confirmed implementation of a new terminal tracker for its rubber tyred gantry (RTG) fleet. Delivered by RFID and wireless sensor network provider Identec Solutions, the tracker provides increased visibility and real-time awareness of yard activities to deliver accurate stow positions and container weights to the Terminal Operating System (TOS).

BEST Countdown Begins

The arrival of the Onshore Power Supply (OPS) system to supply electricity to container ships arriving at the BEST terminal marks the beginning of the countdown to connect the first container ships in July for the Port of Barcelona. The OPS substation comprises six modules assembled in Denmark by the PowerCon company and will allow two container ships to connect simultaneously. Barcelona is targeting becoming a carbon-neutral port by 2050.

Four LBS 800 for Chibatao

Liebherr has delivered four LBS 800 barge slewing cranes to Porto Chibato, Brazil, marking the entrance of these new generation cranes into service for the first time. The cranes basically employ the superstructure from its mobile harbour cranes, mounted on a barge, and are intended to provide a flexible handling capability. Liebherr states that the LBS 800 cranes are the largest such models available with a maximum capacity of 104 tonnes and slightly longer boom length than standard at 66 metres, facilitating a reach over 23 rows of containers.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 17 EQUIPMENT NEWS

n Bleste Buckets are produced on demand within one month

THENEWYORKER

BARRY PARKER

These days, politics is being infused into the transportation business more than ever before, now complemented by a fear-factor. It’s not clear to me whether protectionism, or maritime/port security, is piloting this boat.

The Republican half of the Congressional duo behind the Ocean Shipping Reform Act of 2022 (OSRA 2022), which brought a pro-cargo shipper regulatory bite to a Federal agency previously known for its deregulation of liner shipping, is now at it again.

In an increasingly partisan legislative environment, the House of Representatives passed a bill dubbed “Ocean Shipping Reform 2.0” (introduced into Congress in 2023), which takes aim at: “…Chinese state-sponsored LOGINK software and allows the Federal Maritime Commission (FMC) to investigate foreign shipping exchanges like the Shanghai Shipping Exchange

POLITICS PROGRESSIVELY A FACTOR IN THE SUPPY CHAIN

(SSE) to preempt improper business practices.”

The bill’s prospects in the Senate are unclear. The LOGINK platform has, at the time of writing, not been deployed directly in U.S. ports, but does figure in relation to digital platforms (some of which are cooperating with the SSE) used by logisticians handling cargo moved into the States.

Meantime, recent concerns about maritime cyber-security have put cargo cranes used in multiple U.S. ports into the spotlight; language in an end-February Biden administration Executive Order encouraging purchases of cranes to be manufactured in the States (a work-in-progress at this point), is aimed at “bringing domestic onshore manufacturing capacity back to America to provide safe, secure cranes to U.S. ports – thanks to an over

THEANALYST

PETER DE LANGEN

The energy and raw materials transition, critical for achieving a sustainable and (more) circular economy, creates a huge demand for new private investments in ports, in activities like production, assembly, storage and maintenance of offshore windmills, hydrogen plants to convert sustainable energy in hydrogen and ammonia, plants for biofuels and circular recycling and production activities.

Many ports struggle with land availability, especially in advanced economies, in which port expansion projects more or less by definition are ‘contested projects’. Relatively small expansion projects may be feasible, but I wonder whether there is a case for some well

US$20 billion investment in U.S. port infrastructure under President Biden’s Investing in America Agenda.”

While these battles are raging on Capitol Hill (which I point out is approximately 40 miles from the deep-sea docks at Baltimore and 150 miles from the terminals in the Norfolk area if you bypass the I-95 motorway). some realism is always a good thing. The recent monthly web-blast from a large media- savvy U.S. West Coast port featured an interview with a highly-informed top liner carrier executive handling trade into the Pacific region.

In referring specifically to the Chinese cranes, the interviewee (responding to a reporter’s question on cyber-matters) said: “The steel/assembly is Chinese, but the control systems - which communicate… are non-PRC. They are from countries like Germany, Japan

and Malaysia.” I do not claim to have seen these cranes up close and personally, but perhaps the House and Senate might organise a bus tour over to Baltimore and Norfolk to check out the relevant hardware.

Resources for readers:

5 https://homeland. house.gov/2024/03/12/ wtas-joint-investigationintoccp-backed-companysupplying-cranes-to-u-s-portsreveals-shocking-findings/

5 https://www.whitehouse. gov/briefing-room/statementsreleases/2024/02/21/ fact-sheet-biden-harrisadministration-announcesinitiative-to-bolstercybersecurity-of-u-s-ports/

5 https://dustyjohnson.house. gov/media/press-releases/ johnson-garamendis-oceanshipping-reform-20-passesus-house

SUSTAINABLE PORT INDUSTRIAL ISLANDS?

located new ‘port industrial islands’?

Such islands may take the same approach of real islands, where offshore wind is converted into hydrogen and ammonia and these are used in downstream production activities. But ‘islands’ can also be thought of in more metaphorical terms: areas created specifically for port-industrial

n The port of Huelva, Spain – is seen as port offering ‘industrial island capacity’ for energy and other products

activities without residents/urban areas in the vicinity.

Even though Rotterdam’s Maasvlakte 2 is not a true ‘island’ it can be regarded as an island in this sense. And while there was initially a lot of debate about

whether it was needed in the first place, in hindsight a larger Maasvlakte would have been instrumental in speeding up the sustainability transition. The surge of sustainable investments in (somewhat) remote ports such as Raahe, Groningen and Huelva can be explained because they can be considered as ‘port industrial islands’ where land for industrial activities is still available.

In some countries there may be an opportunity space to develop true new port industrial islands, that may also be of value in coastal protection given rising water levels. In other countries there may be a need to improve regulatory frameworks and policies to secure existing ports can operate as such ‘islands’ in an otherwise increasingly nuisance free service economy.

18 | MARCH/APRIL 2024 For the latest news and analysis go to www.portstrategy.com

THEECONOMIST

BEN HACKETT

THE GLOBAL ECONOMY REMAINS UNDER STRESS

2023 was not a good year and 2024 looks uncertain for the maritime industry.

2023 was a year of relatively low economic activity, with the exception of the U.S. In Asia China struggled to maintain economic growth at or near five per cent while Europe was mostly flatlining with growth hovering plus/minus zero per cent with the former economic growth engine, Germany, entering into a technical recession. In contrast, the U.S. Real GDP increased 2.5 per cent in 2023 compared with an increase of 1.9 percent in 2022.

This year does not look much different, with the World Bank and the international Monetary Fund remaining very cautious with global growth projected at 3.1 per cent in 2024, which is less than the 3.8 per cent average between 2000-2019. It would be lower were it not for the robust U.S. growth which continues to suck in

imports, primarily from Asia. Europe is expected to grow marginally while both China and the U.S. are expected to weaken. Overall, not a picture of health and expectations that we shall see a rebound in the maritime sector this year.

The panic over the Red Sea Houthi attacks on vessels is all

THESTRATEGIST

MIKE MUNDY

All hail the potential of digitalisation to positively impact shipping’s decarbonisation!

This is the message that comes across loud and clear in a new study published by Global Shipping Business Network (GSBN), a neutral, not for profit consortium.

GSBN commissioned SIA Partners to implement the study entitled, Impact of Digitalization in Driving Decarbonization in Shipping. At its heart the study addresses the positive impact of digitalised documentation processes including the adoption of electronic Bills of Lading (EbL) and the use of paperless solutions during the cargo release process.

The study contends that the absence of a universally adopted digital platform creates

their normal seven day services at the European ports of call. Freight rates have also declined following the initial panic surge which worked to the benefit of carriers. This reversed the financial losses that most lines suffered in 2023 with Quarter 4 earnings falling into negative territory for the first time since 2018 according to Alphaliner.

but over as ship operators are avoiding the route and opting for the round Africa voyage. The fears over the impact on the supply chain and inflation have subsided as container carriers, as expected, have brought in extra capacity, increased speed, and focused on west Mediterranean transshipment ports to return to

In general, ports are managing to survive the economic and political pressures although transshipment ports in the eastern Mediterranean are suffering with the shift of the large container ships to the western ports. North American ports are experiencing preemptive shifts of cargo from the East Coast to the West Coast against a background of the labour union negotiations on the East coming up imminently.

Looking forward, we remain in an uncertain environment with U.S. political chaos, the continuing war in the Ukraine and the populist political mood in Europe impacting consumer confidence and industrial expansion.

NEW STUDY HIGHLIGHTS THE DECARBONISING POWER OF DIGITALISATION

“interoperability challenges, complicating efforts to reduce carbon emissions.” And suggests that against this backdrop, GSBN’s comprehensive data infrastructure emerges as a good candidate to support interoperability and to generally facilitate the transition to a digital ecosystem.

Study highlights include:

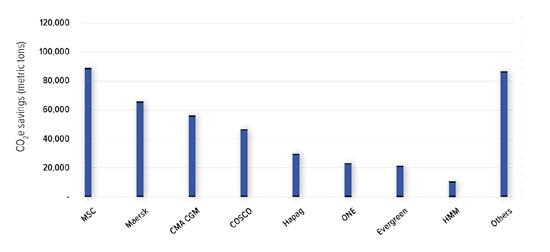

As carriers pledge to adopt eBLs by 2030, the transition of the estimated 16 million paper

bills issued annually could reduce CO2e emissions by up to 107,000 tonnes.

The potential CO2e reduction per electronic bill of lading is between 2.1 and 6.8kg and between 9.8 and 1.4 kg for an electronic delivery order.

In 2023, over 120,000 eBLs and more than one million shipments using GSBN’s Cargo Release solution contributed to an estimated CO2e

reduction of up to 14,972 tonnes.

The study concludes with actionable recommendations for the industry, emphasising the need for broad-based digital adoption, enhanced data integrity and interoperability, as well as the removal of legal barriers “to accelerate towards a greener future for global shipping.”

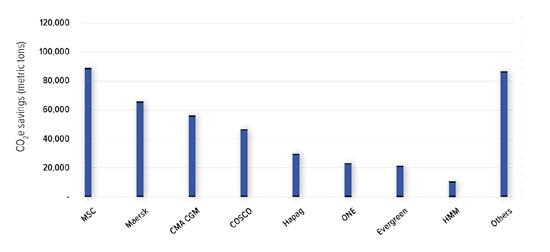

It is further interesting to note that the study proposes comprehensive models based on live cases to quantify the opportunities that digitalised documentation processes represent. Practically speaking, for example, it looks at a number of the leading container lines and scales up, based on specific scenarios, the potential impact of the adoption of eBLs – as per Figure 1.

For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 19

n Figure 1: Estimated CO2e savings per carrier, per year worldwide based on the study results

INVESTING IN TRANSSHIPMENT

Southeast Asia is a crucial region supporting container transshipment activity. But is it in danger of overdeveloping and generating too much capacity? A J Keyes assesses the position

Source: Ports, dataand.com

Source: Ports, dataand.com

“Though there was a concerted push for economic recovery in many developed countries, the global economy remained fraught with turbulence in 2023 and the world continued to experience inflation, rising interest rates, tight labour markets, geopolitical tensions and ongoing wars, all of which destabilised the outlook for recovery and disrupted supply chains,” announced Tan Chong Meng, Group CEO of PSA when recently confirming how Singapore’s total container volumes handled in 2023 recorded 38.8 million TEU.

So, what level of infrastructure is currently responsible for handling these substantial container transshipment volumes?

So, what level of infrastructure is currently responsible for handling these substan8al container transshipment volumes? Table 1 provides a summary of the overall facili8es at each of the three hub ports and, unsurprisingly, the numbers confirm the size and scale of the ports. There is a tremendous amount of quay, deep water, and a high number of large ship-to-ship cranes.

Table 1 provides a summary of the overall facilities at each of the three hub ports and, unsurprisingly, the numbers confirm the size and scale of the ports. There is a tremendous amount of quay, deep water, and a high number of large ship-to-ship cranes.

Generally, transshipment ports are able to operate at higher u8lisa8on ra8os than gateway (importexport) facili8es, so these hub facili8es regularly surpass the 85 per cent industry benchmark total aIer which terminal efficiency levels can be impacted. At an es8mated 70.5 per cent at Port Klang and 78.0 per cent for PSA Singapore (which excludes Tuas port), both of these facili8es have space and even Tanjung Pelepas at 84 per cent can rightly argue to have some exis8ng capacity to use.

Despite these comments being echoed throughout the container industry, Singapore still recorded an improvement in container volumes handled of 4.8 per cent over 2022. Yet this executive is clearly remaining cautious. “Looking ahead to 2024, the outlook for recovery of the global economy remains unclear, and the world braces itself for further potential geopolitical volatility.”

TOO MUCH TOO SOON?

Generally, transshipment ports are able to operate at higher utilisation ratios than gateway (import-export) facilities, so these hub facilities regularly surpass the 85 per cent industry benchmark total after which terminal efficiency levels can be impacted. At an estimated 70.5 per cent at Port Klang and 78.0 per cent for PSA Singapore (which excludes Tuas port), both of these facilities have space and even Tanjung Pelepas at 84 per cent can rightly argue to have some existing capacity to use.

Table 1: Summary of Container Port Infrastructure at Hub Ports in South East Asia, Start of 2024 Infrastructure Port Klang Port Tanjung Pelepas

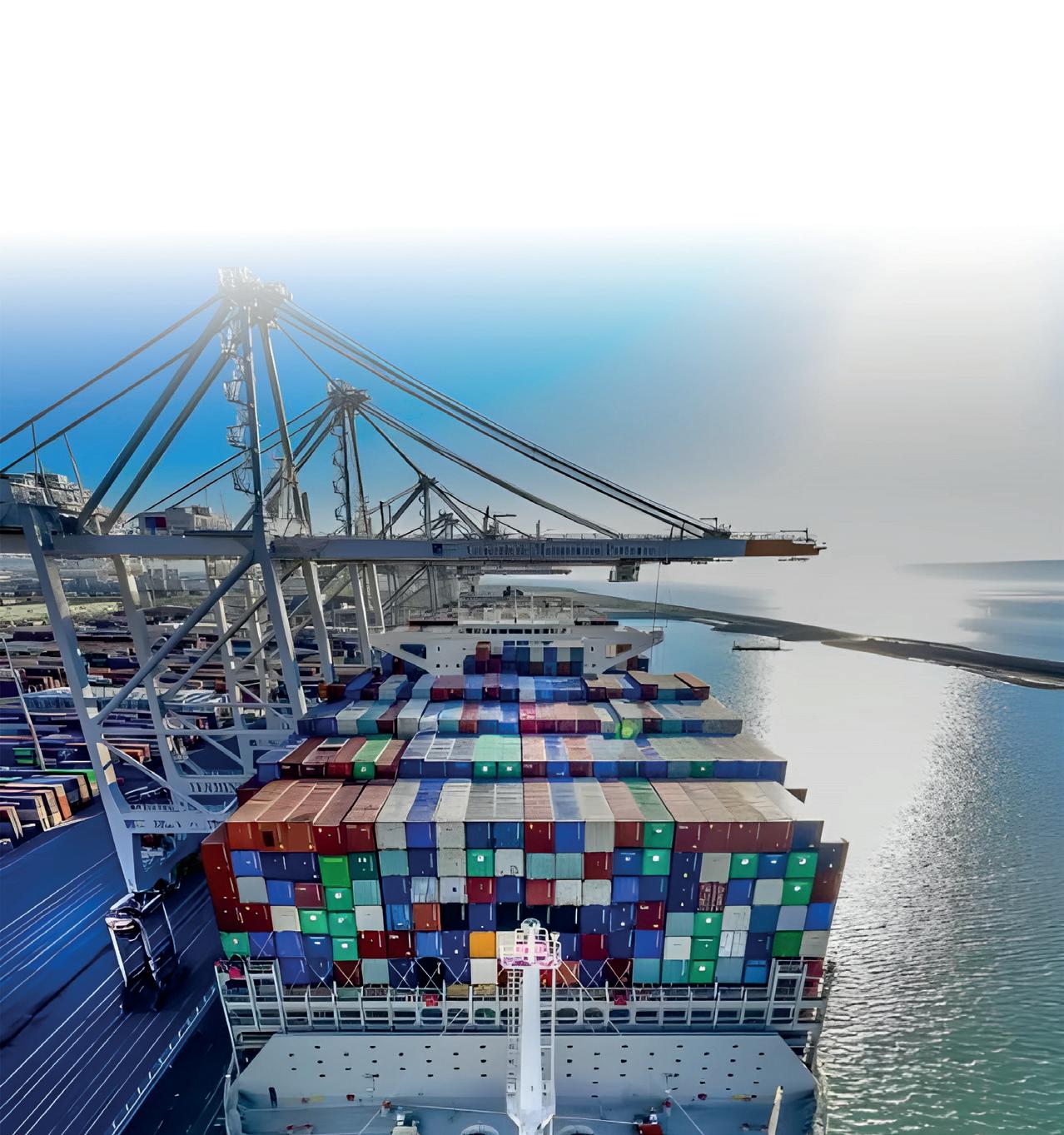

The Port of Singapore and the two Malaysian ports of Port Klang and Tanjung Pelepas are each adding to their existing substantial terminals, infrastructure and container handling capabilities. However, is there a danger of overcapacity?

The development of Singapore’s container volumes since 2010 is shown in Figure 1, where it can be seen that the port suffered some volatility in the middle of the past decade, but overall activity has increased from 28.6 million TEU at the start of the period up to 38.8 million TEU in 2023 (reflecting 2.4 per cent per annum).

Both Port Klang and Tanjung Pelepas have seen increases over the same period, with Port Klang rising from almost 8.9 million TEU to just over 14.0 million TEU (3.6 per cent per annum) and Tanjung Pelepas up from 6.3 million TEU to almost 14.8 million TEU (four per cent per annum). Although Singapore’s annual growth total is the lowest, the port’s volumes are more than 30 per cent higher than the combined throughput total of the two facilities in Malaysia in 2023.

Note: Includes es5mates. Phase 1 of Tuas opened in 2022

Source: Ports listed, port authori5es

A NEW CHAPTER

There are known, confirmed and ongoing expansion plans underway in each of these locations. In Singapore, the existing 55 berths at Tanjong Pagar, Keppel, Brani and Pasir Panjang container terminals generate a total handling capacity of 50 million twenty-foot equivalent units (TEU) per annum, although all of the PSA Singapore container terminals are being consolidated at a single location – on Singapore’s western seaboard at Tuas. When completed in the 2040s, Tuas Port will be the largest automated container terminal in the world, with an annual handling capacity of 65 million TEU. By comparison, Pasir Panjang Terminal has 37 berths with a handling capacity of 34 million TEU annually. Tuas Port will occupy about 1,337ha of land when completed, with 66 berths collectively offering 26km of quay. Port operations at Tuas Port Phase 1 commenced in Q3 2022 and will have 21 deep-water berths that can handle 20 million TEU annually when fully operational in 2027. PSA is expecting to move its operations at Tanjong Pagar, Keppel, and Brani

SOUTHEAST ASIA: TRANSSHIPMENT 20 | MARCH/APRIL 2024 For the latest news and analysis go to www.portstrategy.com

n Figure 1: Total Container Volumes Handled at Transshipment Hub Ports in Southeast Asia 2010-2023e, in TEU

Ports Northport (Malaysia) / Westports Malaysia APM Terminals Tanjong Pagar, Keppel, Brani and Pasir Panjang Tuas Port Number of berths 31 14 55 65 Amount of quay (m) 8403 5040 15500+ 26000 Water depth range (m) 13.0-17.5 15.0-19.0 18.0 18.0+ Number of cranes 99 66 SPPx 190+ TBC Reefer points 5332 4445 TBC Capacity in 2023 (million TEU) 20.0 12.5 50.0 Capacity of 65 million TEU p.a. when completed Volumes in 2023 (million TEU) 14.1 10.5 39.0 EsOmated uOlisaOon (%) 70.5% 84.0% 78.0%

PSA Singapore PSA Tuas Terminals /

5,000,000 10,000,000 15,000,000 20,000,000 25,000,000 30,000,000 35,000,000 40,000,000 45,000,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023e TANJUNG

SINGAPORE

PELEPAS PORT KLANG

Note: Includes estimates. Phase 1 of Tuas opened in 2022

Terminals to Tuas Port by 2027, with the Pasir Panjang Terminal activity fully consolidated at Tuas Port by the 2040s.

With a population of only 5.6 million, Singapore cannot rely on import-export activity, so its long history of being a primary hub for regional cargo, aggregating containers from ASEAN countries, such as Vietnam and Indonesia, will continue. This is proven by 85 per cent of the incoming cargo to the port being destined for other ports – a trend expected to continue.

EQUIPMENT & EXPANSION AT PTP

Tanjung Pelepas is planning to expand its current capacity, with investment in equipment and phased expansion. The current annual capacity of 12.5 million TEU will see a further 3.5 million TEU generated, as the port expands its footprint over five phases with more than 430ha added. In terms of the port’s development, Phase 3 of its expansion is expected to commence in 2025, with a target completion in 2028.

Investment in equipment is ongoing and constant. At the start of April 2024, PTP reached agreement with Shanghai Zhenhua Heavy Industries Co. Ltd (ZPMC) for the purchase of five Ultra Large Container Vessel (ULCV) Quay Cranes. This news followed a February 2024 agreement with Sany Marine Heavy Industry Co Ltd for six ultra large container vessel (ULCV) quay cranes.

Mark Hardiman, new CEO of PTP, notes that these purchases are within PTP’s broader equipment modernisation strategy, with the focus on efforts to expand capacity, upgrade, and add machinery and facilities, as well as improve terminal efficiency and port-related activities to consolidate PTP’s position as a trade and shipping hub in the region.

“Beyond boosting capacity, PTP also sees the purchase of these new ULCV quay cranes as an opportunity to advance its sustainability goals. These cranes are expected to contribute to a 45% emissions reduction by 2030, supporting PTP’s commitment to the Paris Agreement and efficient operations,” he states.

These two announcements followed news in December 2023 that 48 new electric rubber-tyre gantry units (RTGs) were on order, with delivery by Q3 2025. Another step in the port’s sustainability drive towards decarbonisation.

KLANG: “GAME CHANGER” PLANNED

Port Klang currently comprises Westport and Northport, which are its main international terminals, but despite confirmed expansion here, a massive “game changer” is on the horizon.

Development of a new 4.8km wharf at Westport in Port Klang is expected to be completed in 15 years, adding capacity for an extra 13 million TEU to be handled, according

Source: Ports listed, port authorities

to Ng Sze Han, Chairman of the Malaysian State Investment, Trade & Mobility Committee.

Furthermore, the government of Malaysia is also planning to develop a massive greenfield terminal on Carey Island, Port Klang. Originally considered in 2017 the project is expected to progress following a formal feasibility study, with Capt. K Subramaniam, General Manager of Port Klang Authority (PKA), referring to the development as a “game changer” and advising that the process had ticked “90 per cent of the boxes” necessary.

When completed in the 2040s, Tuas Port will be the largest automated container terminal in the world, with an annual handling capacity of 65 million TEU

The US$5.9bn project is expected to comprise both container and conventional berths, offering handling capacities of 30 million TEU and 20 million tonnes, respectively, when full build-out is achieved. To put the project into perspective, it could develop 15km of berthing, which is equivalent to the entire existing Port Klang port across all cargo activities.

The greenfield port plan is not dissimilar to Tuas Port, under development in rival Singapore, although unlike Tuas Port the Carey Island project is not designed to replace existing terminals. It does though face challenges. Its location further offshore means the wave heights may necessitate breakwaters plus around 90 per cent of Carey Island is a palm oil plantation owned by Malaysian company, Sime Darby –not to mention that the location is home to the indigenous Mah Mari tribe who cannot be displaced. As such, it clearly has some hurdles to overcome if it is to come to fruition.

n Table 1:

SOUTHEAST ASIA: TRANSSHIPMENT For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 21

Summary of Container Port Infrastructure at Hub Ports in South East Asia, Start of 2024

‘‘

Infrastructure Port Klang Port Tanjung Pelepas PSA Singapore PSA Tuas Terminals/Ports Northport (Malaysia)/ Westports Malaysia APM Terminals Tanjong Pagar, Keppel, Brani and Pasir Panjang Tuas Port Number of berths 31 14 55 65 Amount of quay (m) 8403 5040 15500+ 26000 Water depth range (m) 13.0-17.5 15.0-19.0 18.0 18.0+ Number of cranes 99 66 SPPx 190+ TBC Reefer points 5332 4445 TBC Capacity in 2023 (million TEU) 20.0 12.5 50.0 Volumes in 2023 (million TEU) 14.1 10.5 39.0 Estimated utilisation (%) 70.5% 84.0% 78.0% Capacity of 65 million TEU p.a. when completed

n Phase One of Tuas port is open for business with it destined to eventually offer 66 berths over 26km of quay

REGIONAL ROLE AFFIRMED

Indonesia is a key trading partner for Singapore, with this transshipment hub responsible for aggregating container traffic for the country, AJ Keyes asks how ports in Indonesia are developing to keep pace with future demand and whether current dynamics will change?

Indonesia is an island nation comprising more than 17,000 islands and collectively a very populous country. Despite an estimated 110 commercial ports able to accommodate larger cargo ships, container-handling facilities are limited. Port infrastructure in many places is old and obsolete, resulting in very high logistical costs and longer vessel turnaround times as some ports are operating beyond realistic capacity limits.

The government has been modernising and upgrading infrastructure in certain locations, most notably in Jakarta (Tanjung Priok), but even so challenges remain.

Jakarta, on the island of Java, is the capital, the largest Indonesian city and an important centre of commerce and education. Its port, Tanjung Priok, is the principal port of the country.

Jakarta is situated on the northern coast of Java Island. Its economy depends on manufacturing electricals, automobiles, mechanical engineering products and chemicals.

Established in 1999, Jakarta International Container Terminal (JICT), located at Tanjung Priok, is a joint venture between Hutchison Ports and Pelabuhan Indonesia (Persero). The facility is the largest container terminal in Indonesia and offers a capacity of 2.5 million TEU per annum. The 45.5ha facility has eight berths and 1640m of quay, with water depths ranging between 12m and 16m. There is also the Koja terminal, another Hutchison facility situated adjacent to JIT, which has a 620,000 TEU capacity.

EXPANSION AGENDA

The port has largescale expansion plans with these focused on the “Newpriok” area of the port. Newpriok Container Terminal 1 is already operational offering a 1.5 million TEU annual capacity and with a draught of 16.5m is reportedly

capable of handling Ultra Large Container Ships (ULCS). The four shareholders behind this project comprise: Pelindo II (IPC); Mitsui & Co., Ltd, PSA International PTE Ltd. and NYK Line.

According to Alphaliner, there are further planned facilities including: CT2 (1.5 million TEU per annum), CT3 (1.5 million TEU), plus CT4, CT5, CT6 and CT7 are each due to introduce a capacity of 1.75 million TEU per annum. There are no confirmed dates for the construction of these terminals at the present time.

Yet despite the desire to develop substantial additional capacity, with space to do so, the major users of this port confirm that ships calling are exclusively serving intra-Asian trade routes, supplemented by coastal services.

Based on Q1 2024, the biggest users of Jakarta Port, according to TEU capacity, are identified in Table 1. It can be seen that MSC’s weekly capacity of 4210 TEU (applicable in March 2024) includes the largest ships calling on the operator’s intra-Asia service linking Indonesia to Qingdao, Shenzhen, Singapore and ports in South Korea, Vietnam and Thailand.

SURABAYA SPLIT

Indonesia’s other major container facility is Tanjung Perak (Surabaya), but it is a port with a more uncertain future.

DP World (DPW) decided not to renew its operating contract and 49 per cent share in the PT Terminal Petikemas Surabaya (TPS) facility when its concession ended in 2019 –this resulted in TPS returning to being a 100 per cent subsidiary of Pelindo III.

DPW stated at the time that the new terms offered did not meet its requirements: “It is unfortunate that the significant positive contributions made by global terminal operators in Indonesia have not been fully recognised, despite our successful track record.”

n There is an expansion agenda at Newpriok with a continuing emphasis on serving vessels operating in intraAsian trade

SOUTHEAST ASIA: INDONESIA 22 | MARCH/APRIL 2024 For the latest news and analysis go to www.portstrategy.com

Instead, DPW, in quick order, signed a US$1.2bn agreement with the Indonesia-based Maspion Group to develop a new three million TEU capacity terminal in Eastern Java with an adjacent industrial facility. This new development is less than 10 miles from the company’s previous operation, TPS, and has more capacity (TPS was capped at a maximum of 2.5 million TEU per annum). DPW states that this project is the first of its kind in Indonesia that involves a partnership between a private foreign investor and a private-sector Indonesian company. In October 2023, ground was finally broken on the 110ha project site.

ENTER EJMT

However, DPW is not the only global operator developing facilities in Indonesia. Also in Q4 2023, International Container Terminal Services Inc. (ICTSI) confirmed development of a multipurpose terminal, with operations commencing in Q4 2024.

The government has been modernising and upgrading port infrastructure in certain locations, most notably in Jakarta (Tanjung Priok), but nevertheless challenges remain ‘‘

The project is being undertaken by the company’s business unit in East Java, East Java Multipurpose Terminal (EJMT). A 300m quay, breakwater and breakbulk area catering for super heavy lift cargoes are planned, along with dredging of the navigational channel to 13.5 meters. It will be supported by two post-Panamax mobile harbour cranes and other cargo handling equipment, with the aim of serving

hinterlands in Lamongan, Tuban and central Java.

Gerard Langes, Head of Business Development for Asia Pacific and the Philippines, ICTSI, explains the company’s approach: “By building positive relationships with stakeholders, ICTSI is contributing to the sustainable economic and social well-being of the local community.” Based on the company’s ongoing expansion on a global basis, this is a strategy that clearly works well.

There is substantial space and capacity potential at Jakarta, while DPW is developing a new largescale facility close to the original container terminal in Surabaya. These ports will clearly offer long-term potential for container handling, but sizes of ships calling will be a crucial factor. The ICTSI project will also be part of the competitive landscape with operations scheduled to commence in 2024 and the ability to serve container vessels of a size typical to the Indonesian market.

Vessels calling in the country are typically smaller in nature and are exclusively intra-regional and/or coastal, linking with major hubs like Singapore. Port container volumes continue to grow and support expansion of terminal capacity. It appears, however, that for the foreseeable future this will be in the context of regional port development linked to major established hub facilities.

n Table 1: Main Container

n ICTSI is pressing ahead with the development of its new East Java Multipurpose Terminal which will serve hinterlands in Lamongan, Tuban and central Java

INDONESIA For the latest news and analysis go to www.portstrategy.com MARCH/APRIL 2024 | 23

SOUTHEAST ASIA:

Shipping line Users of Port of Tanjung Priok (Jakarta)

Shipping Line/Operator Share of Ship Calls Share of TEU Capacity Vessel Information (TEU) Timo Intim Line 15.1% 7.1% 480 – 662 size range Temas Line 9.3% 5.0% 2607 & 2135 biggest tonnage Salam Pacific Indonesia Lines 10.6% 4.8% Largest vessel is 1744 MSC 4.8% 9.3% 4210 weekly capacity

Source: Alphaliner, dataand.com

Includes operating Newpriok terminals

ALTERNATIVE FUELS CATALYST?

Royal HaskoningDHV investigates to what extent the EU Emission Trading System (ETS) incentivises shipping companies to switch from traditional fuels towards low(er) carbon fuels

THE SET-UP OF EU ETS