TREATY OF THE HIGH SEAS ADOPTED

The Treaty of the High Seas was adopted by consensus and standing ovation during the United Nations meeting in New York on 19 June 2023. According to the UN, this treaty –also known as “BBNJ” (biodiversity beyond national jurisdiction) – is key to protecting the ocean, promoting equity and fairness, tackling environmental degradation, fighting climate change, and preventing biodiversity loss in the high seas.

Adoption marks a successful end to more than a decade of multilateral work. The treaty will enter into force when 60 parties ratify it.

The European Union has committed to support the treaty’s ratification and early implementation through the EU Global Ocean Programme of €40 million and has invited members of the High Ambition Coalition to do the same within their capabilities.

“This is a major win for biodiversity – a game changer for the protection of the ocean and the sustainable use of its marine resources. The European Union and its member states are committed to signing and ratifying the BBNJ agreement as soon as possible. We urge others to do so too, as we hope the BBNJ Treaty will receive universal ratification and swiftly enter into force,” EU Commissioner for Environment, Oceans and

Fisheries Virginijus Sinkevičius said.

The treaty sets up a procedure to establish large-scale marine protected areas in the high seas, which will facilitate achieving the target of effectively conserving and managing 30% of land and sea by 2030. It also establishes the sharing of benefits from marine genetic resources, the transfer of marine technology between parties and contains rules to conduct environmental impact assessments.

Global negotiations on the Treaty of the High Seas concluded in March 2023.

PERU GIVES CRUCIAL SUPPORT TO ARTISANAL FISHERS

Peruvian government has issued a historic decree to enable fisher registration by cooperatives in the mahi-mahi and jumbo flying squid fisheries – two of the most significant artisanal fisheries in the world.

The decision removes the barriers for more than 900 mahi-mahi and squid artisanal vessels in major fisher organisations to be able to operate legally in Peruvian waters.

Peru’s mahi-mahi fishery generates more than 40% of world production by volume. Jumbo flying squid is the world’s largest invertebrate fishery, and Peru’s squid fishery comprises nearly half of global landings. These fisheries experienced uncontrolled fleet growth between 2000 and 2015 due to lack of fisheries research, management and political will. The fisheries were left operating under inadequate, out-of-date laws.

SPECIAL REPORT

Land-based aquaculture technology page 19

INSIGHT

Benelux in troubled waters page 12

NEWBUILDS

High-tech Stødig reaches Norwegian owners page 17

AQUACULTURE

Optimising restorative production page 46

JULY/AUGUST 2023 l VOL 72 ISSUE 7 worldfishing.net

Viewpoint 3 | Analysis 10 | New Horizons 14 | Fishing Technology 40 | Processing 44

Photo Credit: European Commission

n The EU wants the treaty ratified as soon as possible

n Peru’s mahi-mahi fishery is responsible for over 40% of the total global volume

VIEWPOINT

JASON HOLLAND | Editor | jholland@worldfishing.net

TAKING BLUE GROWTH ON LAND

There’s phenomenal global interest and equally unprecedented levels of investment being made in the land-based production of seafood, and the latest Special Report from World Fishing & Aquaculture, starting on page 19, explores that exciting landscape. The commercial farming of fish and other aquatic species in intensive, closed containment facilities is a concept that’s been around for many years, but what’s different today is the ventures in the spotlight are sophisticated, high-tech food production systems. Underpinning this considerable momentum is the soaring global demand for these products and the sector’s ability to align with consumer expectations.

With the plateauing of wild-capture fisheries in recent decades, the aquaculture industry has ramped up its output dramatically to meet demand. It now produces a harvest volume in excess of 80 million tonnes and accounts for more than half the seafood eaten worldwide. But while it’s accepted that traditional forms of production will continue to grow over the next decade or two, it has also been identified that this expansion could become hindered by a lack of additional coastline and watershed space in which to farm. Consequently, a lot of eyes have become firmly focused on these new farming technologies and the many services and solutions that surround the space. As such, the number of land-based projects coming onstream and joining the waiting wings is increasing on an almost daily basis, with the latest production methods being applied to an ever-widening number of commercially important species and geographies.

I would like to take this opportunity to thank all those individuals and companies that explained their operations and strategies to us. These discussions reaffirmed our belief that this is a space with a huge future and is on course to be a central component of future sustainable food systems. Later in the year, we will focus on the topic of greener fishing – looking at the technologies that are reshaping the catching sector. Once again, our hope is that many more of you will share your stories and visions with us and our readers.

The international fishing & aquaculture industry magazine

EDITORIAL & CONTENT

Editor: Jason Holland jholland@worldfishing.net

News Reporter: Rebecca Strong rstrong@mercatormedia.com

Regular Correspondents: Please contact our Correspondents at editor@worldfishing.net

Tim Oliver, Bonnie Waycott, Vladislav Vorotnikov Quentin Bates, Terje Engø Eduardo Campos Lima, Eugene Gerden

Production

David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING

t +44 1329 825335

f +44 1329 550192

Media Sales Manager: Hannah Bolland hbolland@worldfishing.net

Marketing marketing@mercatormedia.com

EXECUTIVE Events Director: Marianne Rasmussen-Coulling

Chief Executive: Andrew Webster awebster@mercatormedia.com

WF magazine is published monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hampshire PO16 8SD UK t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions

Subscriptions@mercatormedia.com Register and subscribe at www.worldfishing.net

1 year’s digital subscription with online access £204.50 For Memberships and Corporate/multi-user subscriptions: corporatesubs@mercatormedia.com

About World Fishing & Aquaculture

Launched in 1952, World Fishing & Aquaculture is published by Mercator Media, a B2B media and events company specialising in international maritime industries, including marine business and technology, ports and terminals, and environmental strategies.

Through its monthly publication and free access website (www. worldfishing.net), World Fishing & Aquaculture provides expert-written, in-depth coverage of the fisheries, aquaculture and processing sectors, with a strong focus on the emerging solutions, technologies and innovations that are shaping the broader seafood economy’s landscape.

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 3

Media Limited

is a trade mark of

Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hampshire PO16 8SD UK.

©Mercator

2023. ISSN 2044-1908 (online). World Fishing

Mercator

‘‘

Underpinning this considerable momentum is the soaring global demand for these products and the sector’s ability to align with consumer expectations

BRIEFS NORWEGIAN SALMON FARMING TAX SET AT 25%

Scotland scraps HPMA plans

The proposal to implement highly protected marine areas across 10% of Scotland’s seas by 2026 will not be progressed, Scottish government has confirmed. Instead, it will work with stakeholders to enhance marine protection, while supporting groups that wish to pursue community-led activities in their local area on a quicker timescale.

Australian marine park warning

The addition of more marine parks in Southeast Australia will reduce the fish supply and impact jobs in rural towns, according to the South East Trawl Fishing Industry Association and the Southern Shark Industry Alliance. Their warning follows the Department of the Environment’s announcement that it will look at potentially expanding fishing lock-outs in the region’s marine park network.

McDonald’s China menus eco-label

Filet-o-Fish sandwiches, Double Fish burgers and Kids Fish Fillet burgers served in more than 5,000 McDonald’s restaurants in China will now include the Marine Stewardship Council blue eco-label. Nearly 3,500 tonnes of MSCcertified whitefish are sold in McDonald’s China every year.

US aquaculture bill reintroduced

A bipartisan bill to establish national standards for sustainable offshore aquaculture has been reintroduced in the US Senate. The AQUAA act, which aims to designate NOAA as the lead for marine aquaculture, will seek to harmonise the permit system for offshore farms in federal waters and impel an R&D programme to drive innovation in the industry.

The government of Norway has had its resource rent tax on aquaculture passed by the country’s parliament (Storting), but the controversial proposal’s rate of 35% was lowered to 25%.

Including corporate tax, the new rate will be 47%, rising to about 65% when including Norwegian wealth tax. The additional tax only applies to the value added to fish during the final at-sea grow-out stage.

The initial proposal,

announced in September 2022 by the Labour Party and Centre Party coalition government, was for a 40% tax. There has been considerable opposition to this rate and a revised 35% was put forward in March this year, with salmon farmers putting investments on hold and warning of further economic impacts.

The new rate secured the support of the Liberal Party and Patient Focus, giving the government sufficient votes to

pass the tax.

In a statement, producer Grieg Seafood ASA said the new resource tax is “significantly better” than the original proposal of 40%.

“Grieg Seafood will study the details of the final tax when they have been made public and evaluate all investments that are put on hold in light of the final tax,” it said.

EU FISH STOCKS IMPROVING

Overfishing in the European Union has decreased, according to the latest figures from the European Commission.

The Commission’s ‘Sustainable fishing in the EU: state of play and orientations for 2024’ is based on independent scientific research and reports how overall sustainability has improved with fewer overfished stocks. However, it warns that more effort is needed to ensure progress continues.

It finds that stocks in the Northeast Atlantic are generally within healthy ranges, with the latest assessment pointing to the

best so far sustainability results. In the Mediterranean and the Black Seas, while stocks are slowly becoming healthier, fishing mortality continues to pose difficulties. The rate for 2020, the latest available data, is the lowest so far, but is still 71% above the recommended sustainability rate.

Moreover, climate change is causing some species to decline, leading to uncertainty for the communities which depend on them. Illegal, unreported and unregulated fishing is also a threat to fishing communities, as is the state of ecosystems within the Baltic

Sea and the impact of the Ukraine war on fisheries in the Black Sea.

The Commission proposed a package of measures last February to improve the sustainability and resilience of the EU’s fisheries and aquaculture sectors and is now encouraging member states, industry and NGOs to share their views as part of an online public consultation. Following the consultation, the Commission will table three proposals for consideration by the Council of the European Union to help inform fish quota decisions for 2024.

4 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net NEWS

C M Y CM MY CY CMY K

n The additional tax only applies to the value added to the fish during the final at-sea grow-out stage

FURUNO IS RESHAPING THE FUTURE OF FISHING WITH ITS 3D VISUALIZATION TOOL

Discover the 3D Sonar Visualizer™ F3D-S - a revolutionary product that displays sh and sonar data in 3D. Compatible with FSV-25/FSV-25S, it uses your existing sonar's hull unit to display sh, peaks, and sea oor details in a 3 dimensional “real world” view. Remove the seabed and adjust the depth line control to clearly visualize midwater marks and optimize your shing strategy. Experience a completely new way of shing with the revolutionary 3D Sonar Visualizer™ F3D-S.

More information at www.furuno.com

FISHING VESSEL WINS SHIP OF THE YEAR

Bluewild AS, Ulstein Design & Solutions AS and Westcon Yards have been awarded Ship of the Year 2023 for the environmentally-friendly factory trawler Ecofive.

This is the first time a fishing vessel has received the award, which was given at an award ceremony held on 6 June 2023 at the Nor-Shipping exhibition, with Norway’s Minister of Fisheries and Ocean Policy, Bjørnar Skjæran, announcing the winners.

The awards jury stated that Ecofive offers ground-breaking technology with several innovations for a greener fishing fleet.

Ecofive is 73.2 metres long, has a cargo space of approximately 2,000 cubic metres and is equipped with a triple trawl and a pelagic trawl. The equipment suppliers are mainly from the Norwegian maritime cluster.

It is fitted with a hybrid

propulsion system where the battery system has a capacity of 1,130 kWh. In addition to several energy efficiency measures, this will collectively provide at least a 25% reduction in fuel consumption and emissions compared to a corresponding modern vessel of this type. The savings can be up to 40% for some operations.

The twin propulsion system with rudder nozzles is the most significant single area for energy efficiency.

This alone reduces energy consumption by 15% compared to conventional vessels of the same type. Ecofive was also delivered with electrical winches, comprehensive heat recovery, and further energy efficiency measures.

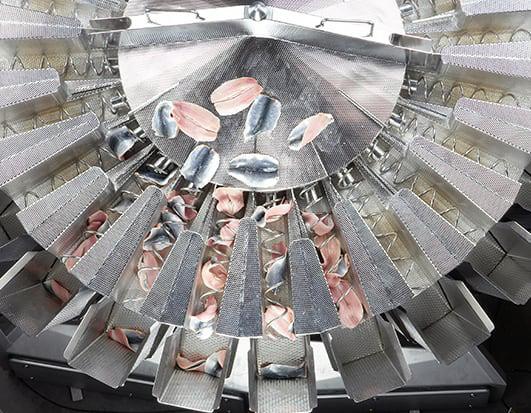

It features catch technology designed to take care of raw materials from catch to finished product. This includes a gentle trawling and boarding process where the catch flows in below

the waterline.

Live storage of the catch takes place in water-filled tanks at the reception system, while CO2 is used as a refrigerant to provide a lower temperature during freezing and endproduct higher quality.

Ecofive is also capable of processing multiple products,

and all residual raw materials are recovered for use.

Shipowner Bluewild and ship designer Ulstein Design & Solutions said the technology used was taken from fish carriers and land-based facilities and merged into a complete design package for onboard production.

ALASKA AQUACULTURE OPPORTUNITIES PROJECT

Plans to identify Aquaculture Opportunity Areas (AOAs) in Alaska state waters have been announced by the National Oceanic and Atmospheric Administration (NOAA) and partners in the US state.

Areas will be selected through engagement with tribes and the public, which NOAA said is a process that allows constituents to share their community, tribal and stewardship goals for sustainable aquaculture development in Alaska’s coastal and marine waters.

Alaska will join Southern California and the Gulf of Mexico as the third region in which NOAA is working with partners to identify AOAs.

The multi-year process to identify AOAs will be conducted in partnership with the State of Alaska and follows a comment period during which NOAA

received public support for aquaculture from Alaska Native organisations, the Alaska Department of Fish and Game, Alaska Governor Mike Dunleavy, members of Alaska’s legislature as well as industry and research institutions.

“With more coastline than all of the Lower 48 states combined, Alaska is uniquely

positioned to benefit from a growing marine aquaculture industry,” NOAA Fisheries Assistant Administrator Janet Coit said. “Aquaculture Opportunity Area identification efforts use the best available science, Indigenous Knowledge and collaboration with local communities to foster shellfish and seaweed aquaculture

– benefiting Alaska’s blue economy.”

In 2022, aquaculture production sales in Alaska totalled US$1.9 million, and the state is experiencing an increase in aquaculture permit applications.

The identification process for AOAs will not include federal waters, and NOAA will only consider marine invertebrates like shellfish and sea cucumbers and seaweed farming when identifying AOAs in Alaska.

Finfish farming in Alaska state waters is prohibited by law.

Identifying AOAs does not serve as a preapproval in the process. Prospective aquaculture growers will still have to go through state and federal permitting processes.

6 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net NEWS

n The name Ecofive comes from the working title of the project “ecofriendly-fishing-vessel”

n Seaweed farming in Doyle Bay, Alaska

Har vesting Oceans of Possibilities .

The Damen Landing Utility Vessel 2208 is designed to perform diverse tasks in the aquaculture industry. Its scope includes the transportation of people, cargo and feed, with multiple loading and unloading options. Once on location, the vessel supports a wide range of activities including pen maintenance and net cleaning.

Find out more on Damen.com

P ic t u re d he re : LUV 2 2 0 8

BRIEFS

Sunken Spanish trawler found

The wreck of Spanish fishing trawler Villa de Pitanxo that sunk off the Canadian coast in February 2022 claiming 21 lives has been found. Described as Spain’s worst fishing tragedy in nearly 40 years, Villa de Pitanxo went down in waters off Newfoundland with 24 people going overboard.

Faroes extends ban on Russia

The Government of the Faroe Islands has imposed further restrictive measures against Russia by only allowing entry to vessels conducting fisheries under the bilateral agreement between the Faroes and Russia. Also, the activities of those vessels in port are limited to crew changes, bunkering, provisioning, landing and transhipment.

Washington issues Mexico warning

The US Fish and Wildlife Service has advised that Mexico has failed to halt the illegal wildlife trade threatening the critically endangered vaquita porpoise, thereby diminishing the effectiveness of an international wildlife treaty. Under US law, President Biden must decide by mid-August whether to take action against Mexico, including imposing a trade embargo.

Seafish unveils new corporate plan

Responding to priorities identified by the UK’s seafood industry and government, public body Seafish has launched its new Corporate Plan 20232028. This strategy aims to provide the support industry needs to address current challenges, such as labour shortages, the climate emergency, postBrexit trade as well as reputational issues.

FISHING JOBS ADDED TO UK OCCUPATION SHORTAGE LIST

From this summer, share fishermen, trawler skippers and experienced deckhands on large fishing vessels are to benefit from lower fees and salary requirements. This will ensure that the fishing sector can continue to access the talent it needs at a reduced cost.

“We are backing the UK fishing industry with a comprehensive package of support to ensure that they are able to fully benefit from the fish in UK waters. We strongly encourage the sector to engage with this to ensure they can attract the workers they need,” UK Immigration Minister Robert Jenrick said.

Inclusion on the SOL means jobs qualify at a 20% lower salary threshold (GBP 20,960 instead of GBP 26,200). Applicants also pay lower fees (GBP 479 for a 3-year visa instead of GBP 625). The broader English language requirements of the Skilled Worker route also apply on the SOL.

The new roles added to the SOL follow the inclusion of

five construction-related roles added at the Spring Budget, after the government accepted the independent, evidencebased recommendations of the Migration Advisory Committee (MAC).

To be included on the SOL, a role must not only be skilled and in shortage, it must also be sensible to include it on the list in the context of alternative solutions to tackling the shortage, other than through immigration. It is not the purpose of the immigration system to provide a source of workers at pay and conditions which are not attractive to resident workers.

The changes ensure the points-based system delivers for the UK and works in the best interests of the economy, by prioritising the skills and talent needed and encouraging long-term investment in the domestic workforce. The SOL will remain under review to ensure it reflects the current labour market.

This new support forms part of the GBP 100 million UK Seafood Fund, to help modernise facilities, train and upskill fishermen, and invest in better scientific research on key fish stocks. The changes were set to be implemented ahead of the summer fishing season.

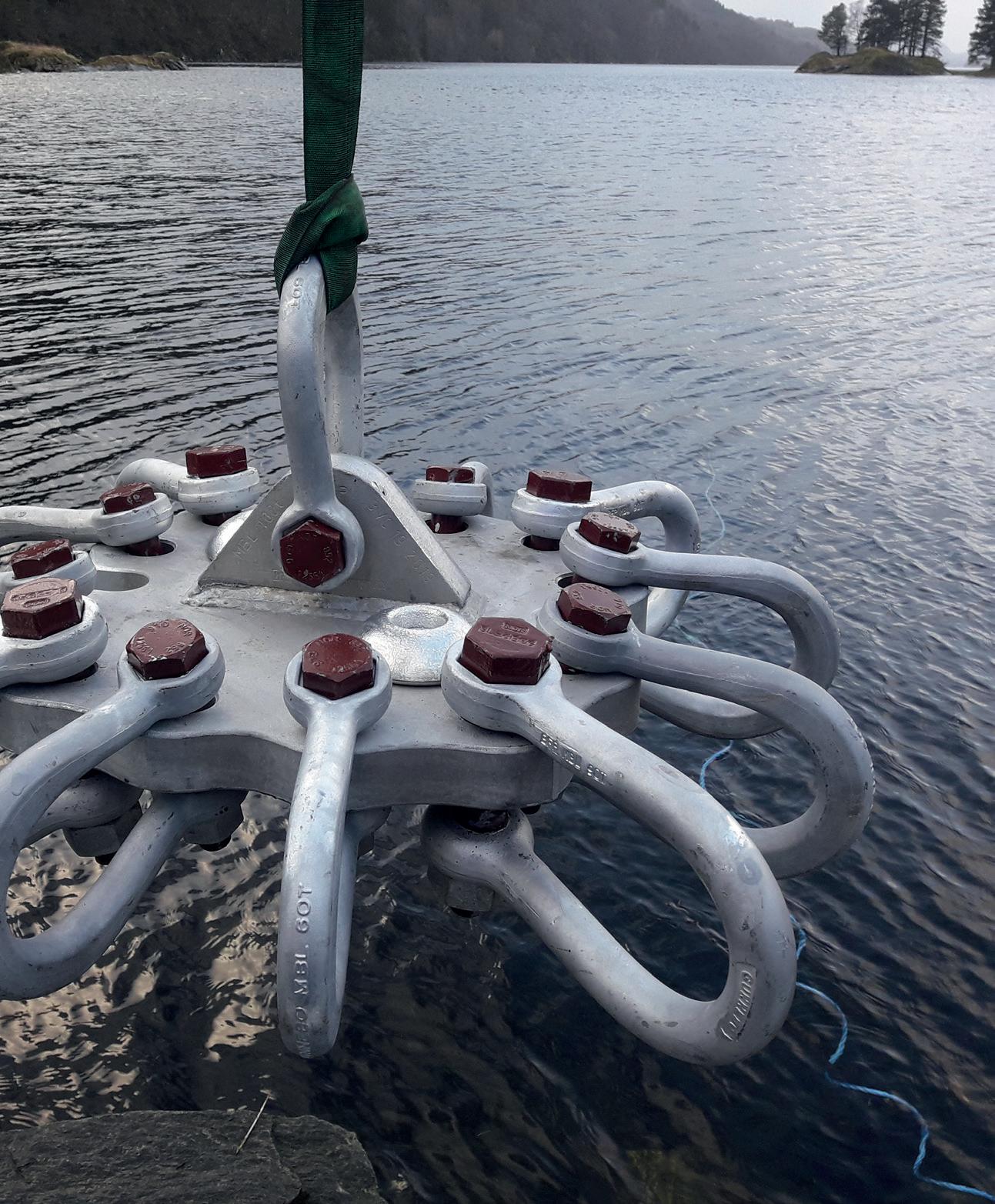

REPORT: CLIMATE CHANGE CAUSING FISH DISPLACEMENT

The majority of fish populations in the sea are responding to global warming by relocating towards colder waters nearer the north and south poles, according to new research on the impact of climate change on oceans.

Analysing current worldwide data on marine fish changes in recent years, researchers from the University of Glasgow have found that in response to ocean warming many marine fish populations are shifting toward the earth’s poles or are moving to deeper waters to stay cool.

According to the paper “Temperature change effects on marine fish range shifts: a meta-analysis of ecological and methodological predictors”, Over

the last century,global warming has had substantial impacts on marine ecosystems, with fish species disappearing from some locations altogether. In some cases, they may have adapted or changed aspects of their biology in order to adapt to warmer conditions. But in many cases, a change in the geographical range may be the only means of coping with rapid warming.

As the current effects of global warming on marine ecosystems are predicted to increase – and with sea temperatures forecasted to continue rising – the study advises that the ability to predict fish relocations will be vital to protect global ecosystems and maintain food security.

The latest study examined data on 115 species spanning all major oceanic regions, totalling 595 marine fish population responses to rising sea temperatures.

“We observed a striking trend wherewith species living in areas that are warming faster are also showing the most rapid shifts in their geographical distributions,” said Carolin Dahms, lead author on the study. “It’s possible that rate of warming in some regions may be too fast for fish to adapt, and so relocating may be their best coping strategy. At the same time, we see that their ability to do so is also impacted by other factors such as fishing, with commercially-exploited species moving more slowly.”

8 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net NEWS

n Inclusion on the SOL means jobs qualify at a 20% lower salary threshold

APPETITE FOR SEAFOOD SOARS STATESIDE

The US population is eating more seafood, with the consumption of both fresh and frozen products up nearly 8% in a single year.

In 2021, Americans consumed a record 20.5 pounds (9.3 kg) per head of seafood, an increase of 1.5 pounds (0.68 kg) from the previous year, according to figures released by trade body National Fisheries Institute (NFI).

“The 2021 Top 10 List bears out some long-held consumption predictions,” said NFI Programmes Director Richard Barry.

“For years, industry experts have reported a big overall increase in pandemic-era seafood consumption. There’s

no doubt we’ll continue to see pandemic-related market forces influence these numbers in different ways over the next few years.

“But this snapshot in time is evidence of a big consumption win.”

Shrimp grew its number by nearly a pound per person, solidifying its place as

America’s favourite seafood. Salmon also saw big gains whilst staples like canned tuna, tilapia and Alaska pollock held their ground. Meanwhile, pangasius jumped three spots to number six and clam made its way back onto the list.

In previous years, the Top 10 list has made up an outsized portion of US seafood consumption at nearly 90%. This time the familiar names on the list make up only 76%, evidence, said the NFI, that Americans are slowly trying new things.

FLOTTWEG CENTRIFUGES FOR MANUFACTURING AND PROCESSING OF FISH OIL, FISH MEAL, FISH BY-PRODUCTS AND SURIMI

Your advantages

More than 60 years of experience in separation technology

· Highest performance and separation efficiency

· Highest reliability and availability of machines and systems explicitly adapted to customers’ requirements

Highest possible cost efficiency due to continuous and automatic operation

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 9 NEWS

n Shrimp continues to be America’s favourite seafood

BLUE FOOD THINKING

Aquatic foods are central to a healthy, sustainable and equitable food system, but innovative endeavours are needed on all fronts, writes Jason

Blue foods – those products we consume that are derived from aquatic animals and plants which are caught or cultivated in marine and freshwater environments – are ideally placed to solve many of our future food system challenges, but it’s critical they are supported through action and innovation from all stakeholders across the entire value chain, according to Jim Leape, Co-founder and leader of the Blue Food Assessment, William and Eva Price Senior Fellow and Co-director of the Center for Ocean Solutions in the Stanford Woods Institute for the Environment.

Delivering the Blue Food Innovation Summit 2023’s keynote presentation entitled “Bridging Silos: Raising the profile of blue food in climate, sustainability and food conversations”, Leape acknowledged that “blue food is an odd phrase” and in certain situations “a challenging term”, but he also maintained it’s been important innovation in the way we talk about these food sources.

“The ‘blue food frame’ has helped us realise the fish, crustaceans and plants we harvest are not just natural and economic resources, they are food, and we need to be increasingly thinking about what roles they can play in achieving the array of goals we have for food systems. That recognition should open our lens to thinking about what we are doing with this resource and what we could be doing with this resource, and how can we develop it to meet the urgent needs that we will have in the future.”

The food systems that are in place are in trouble, Leape told the London conference. They are, he said, by far the principal driver of biodiversity loss, the principal use of water and cause of deforestation, as well as being the main contributor to climate change – all coming from producing so much of our food on land through agriculture, and in particular, through livestock farming.

Holland

“If we are going to build a food system that provides better diets than we have today for maybe 9 or 10 billion people, then it’s clear we can’t just continue to expand the production of food on land; we have to find ways to take better opportunities from the water. That’s what prompted the Blue Food Assessment four years ago, and that’s what brings us into this conversation – thinking much more broadly about the roles blue foods can play and building the systems we need.”

Through diversity comes possibility

While just four species of terrestrial animals provide more than 90% of the animal-source protein that we eat, there are 2,500 species of blue foods in production, including 600 species that are already cultivated in aquaculture, and most of these foods are also rich in vital micronutrients, Leape said.

“With diversity comes possibilities: Possibilities for

resilience, but also possibilities for meeting the many needs that we have in creating the food system of the future.”

To this end, there are some important considerations to be made, he said. Not least, that small-scale producers are at the heart of the blue food system and that most of the food consumed worldwide comes from smallscale production. And yet these producers are generally neglected in both management and market terms.

“Finding a way to support small-scale producers is an essential part of building the food system of the future,” Leape said. He also stressed that blue food is not just about more seafood, instead and to “serve our multiple needs” it’s about having more kinds of seafood and finding ways to expand the diversity of production to take better advantage of the huge array of species available.

There’s also a need think more expansively about what “sustainable” should mean in the context of blue foods, he told the summit. “The existing sustainable seafood movement has been crucially important: It’s taken a sector that was in many ways heedlessly destructive in terms of both capture fisheries and early industrial aquaculture and really raised the bar to show what good production looks like…If you look over the last 20 years, there’s been many gains on many fronts,” Leape said.

However, he insists the sustainability horizons now need to be broadened. On the environmental side, advantage needs to be taken of opportunities to develop and produce or shift to species that are intrinsically better in footprint, while from a social perspective, food systems need to be built that recognise the hugely important roles that women (as an estimated half the workforce) and also small-scale producers have.

“There are multiple dimensions to sustainability, and this is true of every walk of life – not just in blue food. But as we get a better understanding of what it’s going to take to live on this planet in a way that it can sustain, we need to be thinking much more broadly about what the elements of sustainability are and how we bring those into developing blue food resources. We need a lot of innovation on a lot of fronts – there’s plenty for all of us to do.

“Like most sustainability challenges, it’s all hands-ondeck, but the blue food frame has helped us understand this is a central part of meeting the challenges of the future and that it’s an agenda that’s full of opportunity,” Leape said.

10 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net ANALYSIS

We need a lot of innovation on a lot of fronts – there’s plenty for all of us to do

‘‘

Jim Leape, Blue Food Assessment

n Blue food systems need to recognise the critical roles played by women and small-scale producers

Self-spreading technology is patent protected

Longer ow route over the rope More speed = lower pressure

Longer ow route over the rope More speed = lower pressure

Shorter ow route under the rope Less speed = more pressure

INSIGHT

The future of fishing

BENELUX IN TROUBLED WATERS

Ever-tightening EU standards and steadily rising costs are forcing many of the states’ fishers to leave the industry whilst also driving up the price of seafood, writes Eugene

Gerden

The Benelux states of Belgium, Netherlands and Luxembourg have never been amongst Europe’s elite band of fish-producing nations, despite the first two having North Sea coastlines. Consequently, a significant proportion of their fish and seafood needs have been traditionally met by imports.

As has been the case with many other EU states in recent months, Belgian and Dutch fishers have faced significant cost increases. This has compounded problems that they were already facing as a result of increasingly tighter national and EU fishing regulations.

Many close to Benelux’s fishing industry feel problems have been accumulating for years. More recently, the Brexit deal has changed fishing rights, while the introduction of a ban on highly efficient pulse fishing in Netherlands, and the war in Ukraine has exacerbated the situation.

Some fishers have been saying that while authorities provide some support for them, in this current climate, it’s not sufficient for them to stay afloat. Indeed, amid these economic challenges, many Benelux fisherman have been forced to turn to buy-out schemes and will likely not return to commercial catching.

Royal support

In the case of the Netherlands, complexities facing the country’s fisheries sector have even forced local fishers to seek the support of King Willem-Alexander. In a letter sent to the king, Dutch fishers voiced concerns about the future of their industry. They explained that restrictive rules from the government would “kill the fishing industry in the Netherlands”.

Signed by 400 skippers and fishing companies, the letter also warned of what could happen should the plans

proceed for the introduction of nitrogen standards for trawlers and cutters that fish in so-called Natura 2000 areas. To comply with the standards, all these vessels must be converted to cleaner engines before 1 October 2023.

This, they have calculated, will cost an average €10,000 per vessel, with subsidies only available for half that amount.

Another area of serious concern for Dutch fishers is the ever-increasing area in which bottom fishing is not allowed. This is worrying shrimp catchers and also fishers working on larger cutters that specialise in sole and plaice – two of the most important species caught by the sector.

Plans are being drawn up to increase these protected areas. At the same time, the construction of new offshore windfarms is posing a serious threat to the Dutch shrimp catch.

According to Wageningen University & Research (WUR), the Netherlands has 283 active fishing cutters, with 120 targeting fish, the rest focus on shrimp, lobsters and other seafood products.

Socio-economic concerns

The biggest concern for Belgian fishers also centres on the regular reduction of quotas for sole and plaice catches by the European Commission.

While there has been increases made for haddock and cod quotas for the current year, Flemish Fisheries Minister Hilde Crevits explained these species are not a priority for Belgium fishers.

“Our Belgian fishermen are disappointed,” Crevits said. “The fishing rights for sole are very important to us. I am concerned about the socio-economic consequences of limiting the large catches of sole and plaice.”

Again, the situation has been further complicated by

n Dutch fishers are growing increasingly concerned by the expanding area in which bottom fishing is not allowed

12 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net

Brexit, with the UK’s departure from the EU ending the Belgian fleet’s access to certain waters. Added to this, the country’s fishers are unhappy with plans to make the fisheries sector more sustainable through the use of cleaner energy sources and phasing out fossil fuels.

“We have serious concerns about the feasibility and workability of European plans for the fisheries sector,” Crevits said. “We impose unfeasible or unworkable obligations on our own fishermen. Our fishermen already make a lot of effort today and are prepared to do so in the future, but on the basis of workable proposals.”

In addition to fuel, the European Commission also wants fishing methods and gear to become more sustainable. This includes phasing out bottom fishing with towed gear by 2030 in all marine protected areas (MPAs).

Farming interest

If there is a positive, it’s that Benelux’s aquaculture sector is in generally better shape than its fisheries. Head of research at Belgium-based Inagro Stefan Teerlinck told WF that Belgium has a very diverse and well-developed aquaculture sector, with the most popular fish species including pikeperch, sturgeon, rainbow trout and white shrimp.

He explained that fish farming is carried out both in the Flemish region (north) and Walloon region (south) and has strong research base. In addition, the aquaculture sector traditionally receives strong support from authorities.

“In our North Sea, we see an expansion of our mussel production. Also, foreign investors in aquaculture are interested in our region, while Asian businessmen want to invest in multitrophic shrimp production on land – in closed system with minimal water replacement.”

In terms of local consumption, Belgium’s total annual consumption of farmed fish and seafood sold via retail

channels is estimated at 17,333 tonnes, with the main species including salmon, shrimp and pangasius – most of which is imported. Local production and consumption is in the region of 300 tonnes, with trout accounting for 80%.

Salmon’s rising importance

Meanwhile, analysts have confirmed that the high level of inflation in the Benelux region is continuing to put pressure on its fish and seafood sector, and this is negatively affecting sales in the market.

Luc Van Bellegem, Senior Market Advisor of the Flanders’ Agricultural Marketing Board, an agency specialising on the promotion of Belgium fish products in domestic and foreign markets confirmed this trend.

“The demand for fish in Belgium is price-driven. The fish from aquaculture, such as salmon, will become more important in the future. Salmon represents already 30% of the home consumption of fish and will grow. Wild fish will become [more] expensive and demand will decline. Concerning exports, as we see from statistics, the export of both fish and fish products from Belgium is growing,” he said.

Cod remains the most popular fish in the Belgium market, closely followed by salmon.

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 13 INSIGHT

We have serious concerns about the feasibility and workability of European plans for the fisheries sector

‘‘

Hilde Crevits, Flemish Fisheries Minister

n Pikeperch farming in Belgium land-based systems

n North Sea mussel production

NEWHORIZONS Focusing

on Fisheries Development

RAISING THE BAR WITH BARRAMUNDI IN SRI LANKA

Oceanpick – the country’s first oceanic fish farm – offers a tantalising glimpse into the importance and value of barramundi farming, writes Bonnie

n Oceanpick harvested 1,200 tonnes and is expected to produce 1,800 tonnes in 2023

Over the past century, seafood consumption has grown significantly, and the vast majority of us are thinking differently about how we use natural resources like the ocean. As we reach ever closer to a tipping point, sustainability has become a more prominent topic in conversations, not only with consumers but also among industry, including aquaculture.

In 2012, Irfan Thassim, Founder and Director of barramundi farm Oceanpick, realised that change was needed, with more than 90% of Sri Lanka’s fish coming from wild capture with many stocks at risk of depletion. With a vision of establishing the first oceanic farm in Sri Lanka, Thassim turned to Kames Fish Farming Ltd in Scotland for help. The result was Oceanpick, Sri Lanka’s first and only commercial producer of barramundi (Lates calcarifer), a versatile and highly sought-after species that is known for its delicate flavour, firm texture and excellent nutritional profile.

Thassim said the significance of sustainable aquaculture is gaining prominence across the globe, and Sri Lanka recognises this as a valuable economic and environmental opportunity.

“Oceanpick is a pioneer in barramundi farming and it’s South Asia’s largest fin-fish farm, playing an important role in promoting the innovative aquaculture industry,” he told WF

“Barramundi farming in Sri Lanka is a huge opportunity for the country. It positively impacts economic, environmental and health aspects, and develops and fosters local communities. Oceanpick’s commitment to responsible farming practices ensures the production of

high-quality barramundi while minimising environmental impact. It provides a natural and spacious environment for the fish to grow, resulting in healthier and tastier barramundi and helping to meet the growing demand for fish protein while reducing pressure on wild fish stocks.”

Production increases

Oceanpick’s farms are located off the coast of Trincomalee on the north-eastern seaboard of Sri Lanka. Trincomalee is an ideal location for aquaculture as it’s free of the largescale industrial activities that are typical to other farming sites in the region. At the heart of its operations is the Alain Michel Hatchery, where carefully selected broodstock produce eggs that hatch into fry. The fry are then nurtured in controlled environments until they reach a suitable size for transfer to sea.

14 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net

Waycott

Barramundi farming in Sri Lanka is a huge opportunity for the country. It positively impacts economic, environmental and health aspects, and develops and fosters local communities.

Irfan Thassim, Oceanpick

‘‘

Photo

Credit: Oceanpick

Oceanpick operates three distinct sites that are dedicated to the pre-grow-out and grow-out phases. Selected for their pristine water conditions and ideal temperature ranges, the fish have ample space in which to swim and thrive, benefitting from the nutrient-rich waters and natural conditions. They are also closely monitored with regular health checks. Their diet consists of highquality, sustainable feed that is formulated to support their growth and enhance their flavour.

As they approach harvest size, they are carefully selected and transported to the processing plants, where they are handled with precision to preserve freshness and flavour and ensure optimal quality. After thorough cleaning, scaling and filleting, the barramundi are ready to be packaged and shipped to customers worldwide.

In 2022, Oceanpick harvested 1,200 tonnes and is expected to produce 1,800 tonnes this year. Its main export markets are Australia, the United States, the Maldives and more recently the EU.

CSR focus

Barramundi farming has had some key impacts on Sri Lanka, said Thassim, for example by stimulating economic growth in rural areas and contributing to the country’s overall economic development. It also provides an affordable source of fish to local populations, reducing the reliance on wild fish stocks, and has helped to facilitate the transfer of technology, expertise and best practices among different stakeholders. This can contribute to the development of local aquaculture knowledge and skills, empowering communities to engage in sustainable farming practices.

As well as its farm operations, Oceanpick also runs corporate social responsibility (CSR) programmes that focus on community welfare, education and environmental conservation. Through these, it promotes sustainable practices, empowers local communities and strengthens social harmony.

“Barramundi farming plays a crucial role in social impact and community development initiatives,” said Thassim. “Oceanpick actively engages with local communities. By empowering individuals through job creation, it contributes to poverty alleviation and social mobility. It also actively seeks partnerships with local fishermen, recognising their expertise and contribution to the fishing industry.

“Fishermen can work on the farm, leveraging their knowledge of fishing techniques and fish handling, and receive a source of income, especially during periods of low fishing activity or when fish stocks are depleted. This reduces their dependence solely on wild catches. They can also be involved in decision-making processes and provide feedback and insights, something which strengthens the social fabric of fishing communities.”

International standards

Recognising that sustainability is an important factor to the discerning global customer, Oceanpick ensures it conforms to strict industry standards, one of which is Best Aquaculture Practices (BAP).

“This certification demonstrates Oceanpick’s dedication to sustainable practices such as responsible sourcing, environmental stewardship and social accountability,” said Thassim. “By adhering to BAP guidelines, Oceanpick ensures that its barramundi are produced in a manner that prioritises the well-being of both the marine environment and local communities.”

Oceanpick also holds the Sedex Members Ethical Trade Audit (SMETA) certification, which verifies that Oceanpick maintains ethical and socially responsible practices and establishes itself as a company that values fairness, transparency and integrity in all aspects of its business. Plans are also underway to obtain the Aquaculture Stewardship Council (ASC) certification. Certifications

have been a huge boost to Oceanpick’s brand value and resulted in greater interest from customers.

“They have compelled Oceanpick to enhance practices such as fish welfare, feed management, water quality and disease prevention, ensuring that the farm operates in an environmentally sustainable and socially responsible manner, minimising any negative impacts on the ecosystem,” said Thassim.

“Barramundi products have gained increased credibility and value in the market, opening up opportunities for Oceanpick to access premium markets and command higher prices. Certification also provides a platform to educate consumers about the positive environmental and social impacts of responsible fish farming practices, and sets Oceanpick apart from competitors, helping it differentiate itself in crowded marketplaces and attract environmentally conscious consumers. Oceanpick also assumes a position of industry leadership in sustainable barramundi farming, inspiring other producers to adopt similar responsible practices.”

New species

Oceanpick has put Sri Lanka firmly on the global aquaculture map. The demand for barramundi is rising with greater interest from the US, Europe and Australia where the species originated, said Thassim.

Future plans include exploring the potential of other species such as grouper and snapper.

Oceanpick is currently engaged in research and evaluation processes to understand the suitability of different species for aquaculture, with growth characteristics, nutritional requirements, disease resistance and market demand studied extensively. A trial production of snapper has already been successful and provided valuable insights and practical knowledge that allow Oceanpick to refine its farming methods for successful production.

“The decision to develop other fish species is driven by market demand and feasibility assessments,” said Thassim. “Careful analysis of market trends, consumer preferences and commercial viability of each species are under consideration. Oceanpick’s research-driven approach, successful trial of snapper, collaboration efforts, consideration of market demand and environmental sustainability, and focus on continuous learning, enables the diversification of its species portfolio, while its commitment to delivering high-quality, sustainable seafood and contributing to aquaculture’s growth and development remains firm. It’s an exciting time and we are looking forward to seeing what the future holds.”

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 15 NEW HORIZONS

Photo Credit: Oceanpick

n Oceanpick’s farm team

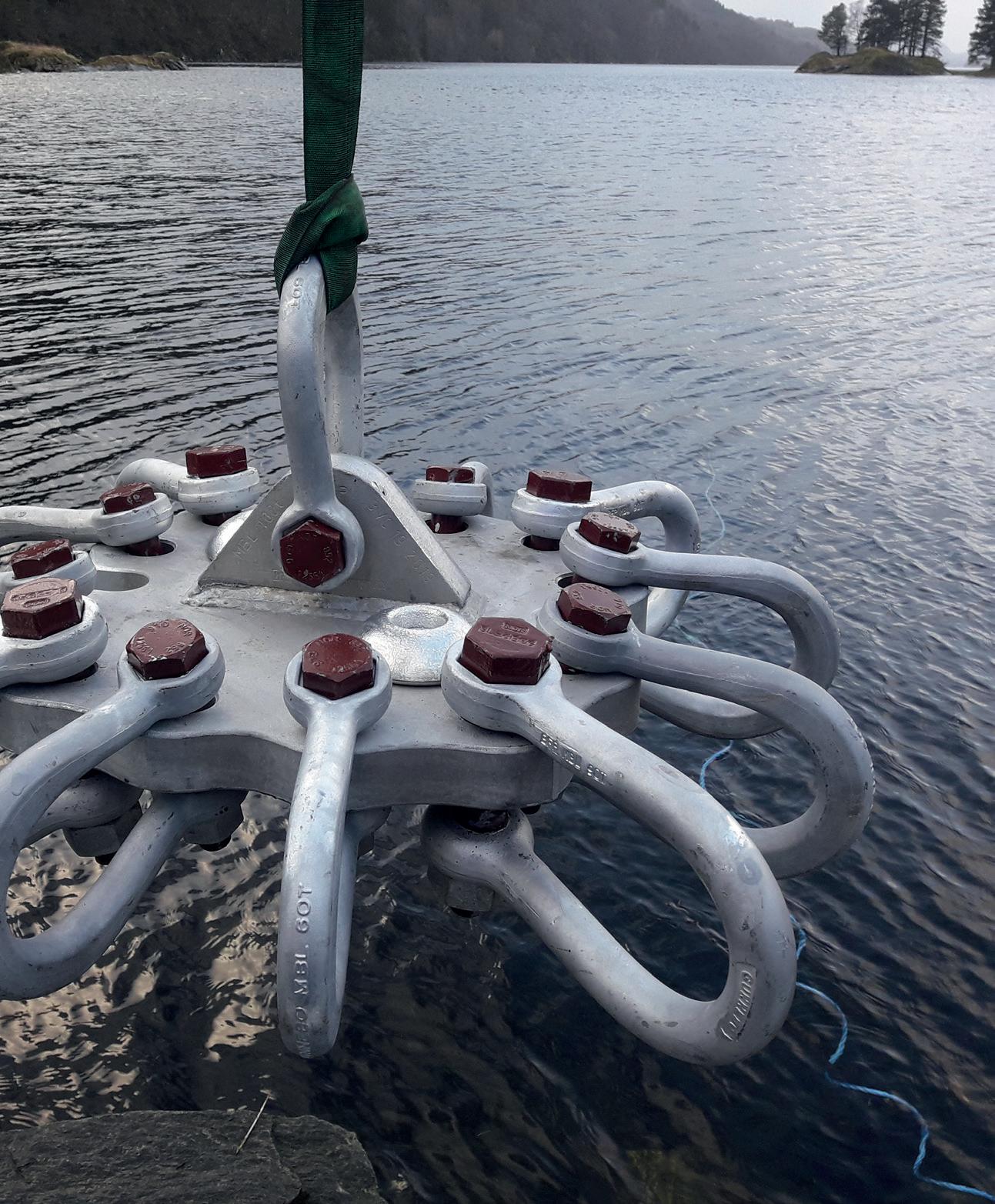

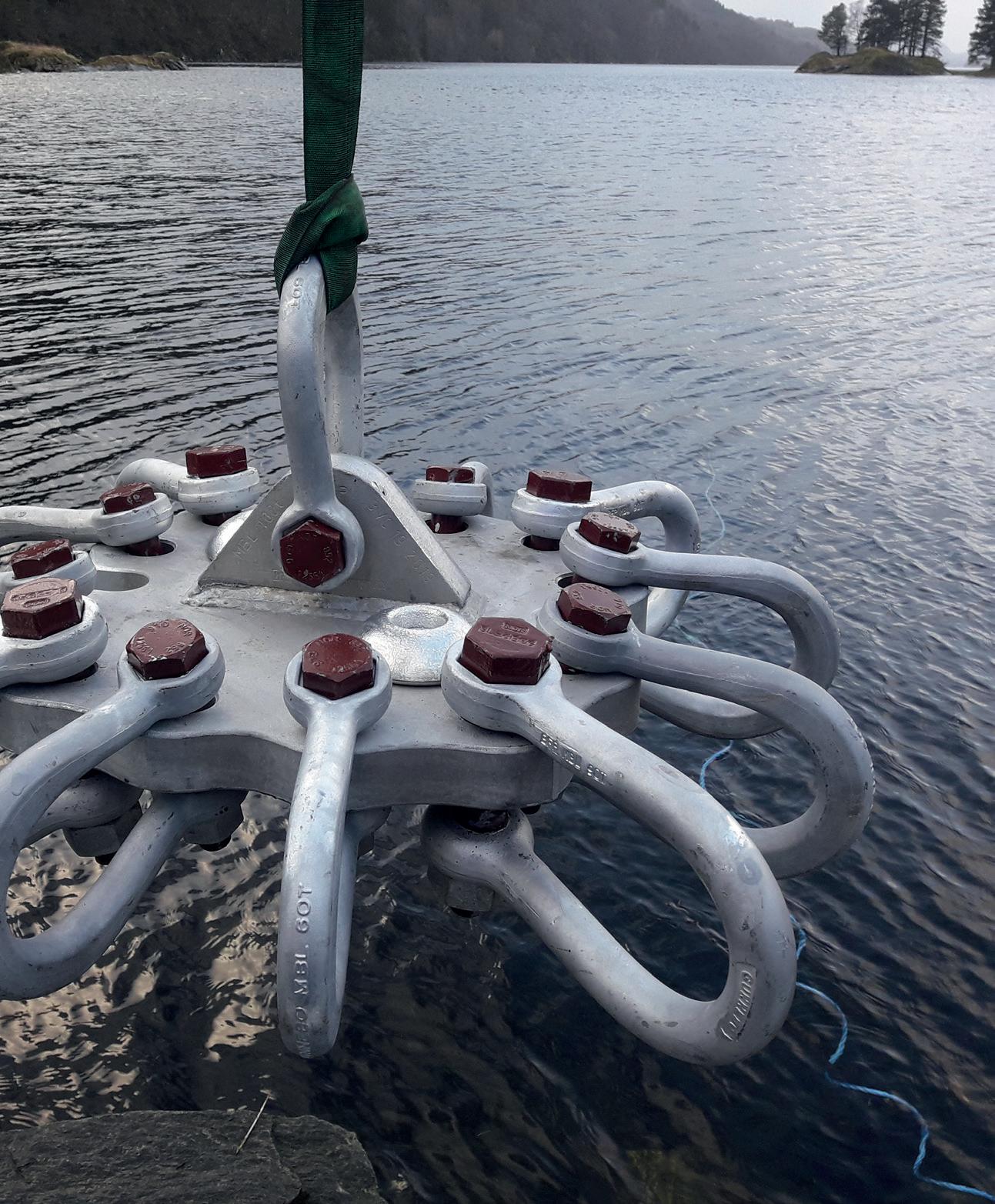

SAFER SOLUTIONS THAT WITHSTAND THE TOUGHEST ENVIRONMENTS

thecrosbygroup.com/aquaculture

our

of products, including connection

hot dip galvanized chain, mooring bolts, welded chain slings, and shackles. Watch videos and download the new brochure at

Increase the safety and efficiency of your operations with

wide range

plates,

Plenty of options for new Stødig

There’s a remarkable amount of technology packed into the 39.3-metre length of the new Norwegian fishing vessel, delivered to its owners Asbjørn Selsbane by the Karstensen yard in Denmark

Stødig steamed from the yard northward to Ålesund to pick up gear before heading to fishing grounds to start on shrimp that are frozen onboard. The new vessel is fishing with a pair of Vónin’s Storm trawl doors and Kodiak trawls. Later in the year there will be a switch to working on fresh whitefish with seine net gear. Next winter there’ll be another switch, this time to fishing for snow crab – also processed onboard.

To handle three very different fisheries, PE Bjørdal supplied Stødig with a three lane-factory deck. Catches of whitefish pass through Baader and KM Fish Machinery gutting and heading systems and the expectation is that whitefish catches will be landed fresh in tubs. The option is also there for landing live whitefish, and Stødig has a C-Flow vacuum pump system and 450 cubic metres of RSW tank capacity with a PTG FrioNordica RSW system to make this possible.

Shrimp and snow crab catches are destined for frozen production, with separate processing lines for both, and refrigeration system has four DSI V3 32/100B plate freezers capable of handling 40 tonnes per 24 hours.

Stødig is laid out with Evotec MultiSoft winches, with a Scantrol management system. There are three 22-tonne trawl winches mounted in a space below the wheelhouse, alongside a pair of 24-tonne fly-shooting winches. A set of three 15-tonne double net drums is mounted over the deck. Evotec also supplied the 5-tonne unloading and anchor winches.

The forward deck crane is a TMP 750K and the gallowsmounted deck crane serving the working deck aft is a 4-tonne/11-metre SeaQuest PKB.

For the snow crab fishery, Stødig is outfitted with an ice plough that can be dropped into place to keep ice clear of the hauling hatch on the starboard side while working along lines of traps.

Well powered

Stødig has a 1370kW Yanmar 6EY22AW main engine, powering a 3900mm K850/4 propeller via a HG7, 900/99rpm reduction gear, both from Nogva Heimdal. A PTO is mounted on the main gear, provides the primary power supply via a 800kW shaft generator. Additional power is derived from the pair of 400kWe Nogva Scania DI13 gensets. The electrical system is provided with a Power Management System (PMS) which has automatic start-up of the generator system.

During fishing, with the winch system largely in continuous use, the shaft generator is engaged, and when full power is needed on the winches, the main engine can consequently be used as a power source partly for propulsion and partly for the power supply. As a result, there’s no need to run the auxiliary engines.

If there’s a demand for additional power for the propulsion system, the auxiliary engines have the capacity to run the vessel’s normal power supply, including load on the electrical winch system. The energy configuration has been envisaged as providing fuel and operating economy,

with optimal yield from the main engine, plus delivering a high level of operational reliability.

Steering is a Kongsberg Tenfjord SR622 installation and there is a KSP design rudder with flap. The bow thruster is a 260hp Hundested SFT5 unit.

The wheelhouse is outfitted with three main screens facing the two control positions, with the key fishfinding and navigation data feeds channelled through these, while five overhead screens provide additional feeds. The fishfinders are a Simrad ES80 echo sounder and an EK80 broadband sounder, plus a Furuno DFF3 sounder. A Marport array of gear-mounted is used to monitor the doors and trawls.

Navigation systems are a pair of Tecdis T-2138A ECDIS sets, a MaxSea Time Zero plotter and an Olex 3D system.

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 17 NEWBUILDS

n Stødig was designed and built by Karstensen for Norwegian fishing company Asbjørn Selsbane n Stødig has started fishing with Vónin Kodiak shrimp trawls and Storm trawl doors

CLEOPATRAS POPULAR WITH NORWEGIAN COASTAL FLEET

Icelandic boatbuilder Trefjar built its reputation supplying its robust Cleopatra fast fishing vessels to its home market, but these days a substantial part of its activity is in exports –notably in Norway where these designs have proved themselves in coastal fisheries

Icelandic boatbuilder Trefjar built its reputation supplying its robust Cleopatra fast fishing vessels to its home market, but these days a substantial part of its activity is in exports – notably in Norway where these designs have proved themselves in coastal fisheries

Brothers Tom-Kenneth and Kurth-Anders Slettvoll fish from Kabelvåg in the Lofoten islands went to Trefjar for a pair of Cleopatras to replace an older boat they have been working since 2019. They are now fishing with new Ørsvåg II and Ørsvåg III: identical 9.99-metre boats outfitted for longlining.

The brothers’ boats have 410hp FPT C90 main engines driving a ZF286IV reduction gear. Electronic systems are from Furuno, Simrad and Olex, and include autopilots linked to the hydraulic bow and aft thrusters to activate automatically when required.

The longline systems onboard both boats have been delivered by Beitir. Ørsvåg II and Ørsvåg III each has fishroom capacity for twelve 380-litre tubs.

Their layout places the skipper’s control position on the starboard side of the wheelhouse, with a galley/mess area on the port side and there is a bunkroom with three berths below.

However, the most recent Trefjar delivery is Barents Gadus, a 10.99-metre, 3.8-metre breadth Cleopatra 36 for Piera Gaup, fishing from Tana in the far north of Norway. This is a standard Cleopatra 36 outfitted for longlining and netting.

Barents Gadus’ main engine is a 520hp FPT C13 coupled to a ZF325IV transmission and auxiliary power is supplied by a 9kW Nanni generator.

Its electronics package is a combination of instruments supplied by JRC, Olex and Simrad, and the hydraulic bow and stern trusters are interfaced to the autopilot to be activated automatically.

Catches are stored in the midships fishroom which has space for fifteen 380 litre tubs.

The forward section is laid out with bunks for three below, and with a toilet and shower in the cabin. The wheelhouse has the skipper’s control position on the starboard side and a galley/mess area to port.

DOWNSCALING FOR NEW PELAGIC CATCHER

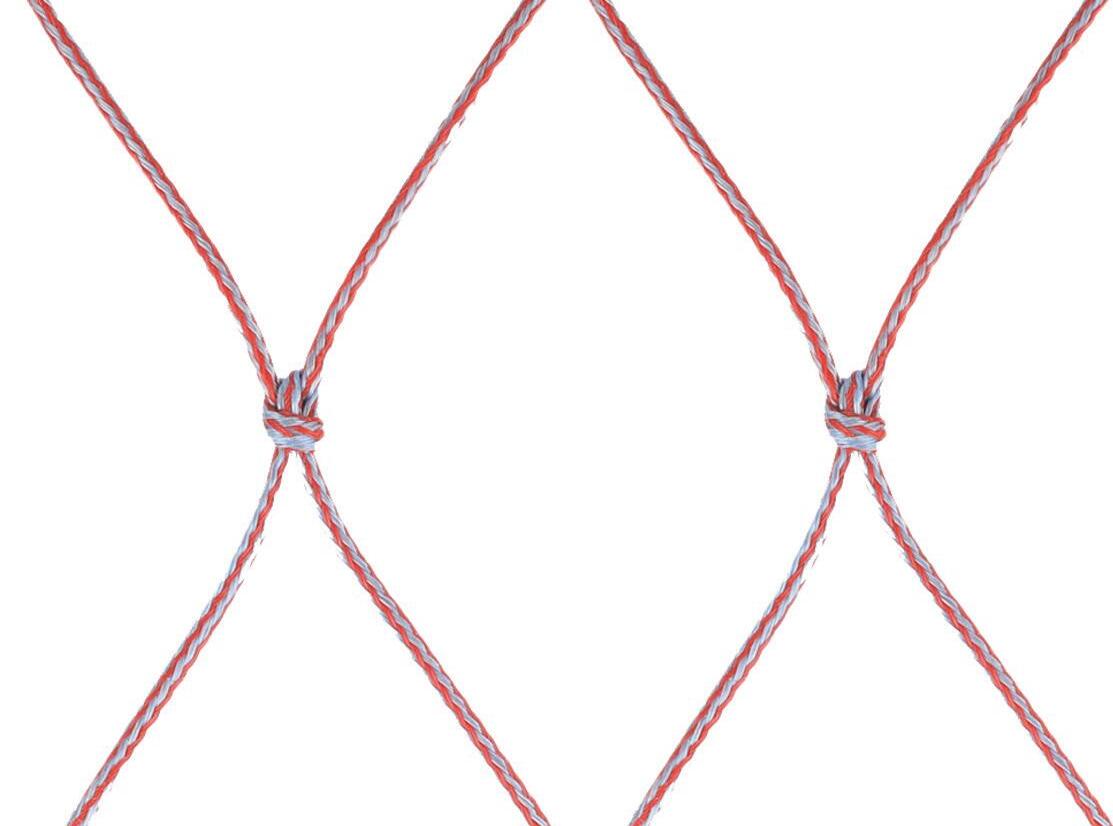

Parlevliet & van der Plas’ new pelagic freezer trawler already under construction at the Tersan yard in Turkey is going to be significantly more modest in size than the vessel it replaces P&P’s Skipsteknisk-designed newbuild at 111.5 metres and with a 21.2-metre beam is a long way from the sheer bulk of the Annelies Ilena (ex-Atlantic Dawn) that it will replace when it comes into service in 2025. The focus in the design has been on efficient operation, with a Wärtsilä 32 main engine and twin-screw propulsion, contributing to optimised fuel consumption, lower emissions and reduced noise levels. The new vessel will be equipped with scrubber technology and selective catalytic reactors, reducing effluents of particles and greenhouse gases to the environment to the lowest standards possible.

Accommodation will be for a crew of up to 60 and the new vessel will be capable of worldwide operation. It is expected to operate on similar lines to the company’s existing vessels – targeting herring, sardine, mackerel, horse mackerel and blue whiting, with all catches frozen at sea and destined for human consumption.

The refrigeration systems for the fishroom and the factory deck will use natural, environmentally friendly refrigerants for cold storage and for the 44 Dantech DSI Type V8 26/100 B SS vertical plate freezers, designed for CO2. Its Naust Marine deck equipment package extends

to 23 winches, as well as the Automatic Trawl Winch (ATW) control system and other critical deck equipment in a system that has been custom-designed to meet the P&P’s requirements.

The package as a whole includes three trawl winches managed by the Naust ATW system, four net drums and two net sounder winches. In addition, the new vessel will be outfitted with 10 auxiliary winches of various sizes, an anchor winch, two stoppers and three mooring winches, as well as additional deck equipment.

18 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net NEWBUILDS

n Ørsvåg II and Ørsvåg III, are identical Cleopatras now fishing from Kabelvåg in the Lofoten Islands

n P&P’s new pelagic catcher has been designed by Skipsteknisk and is expected to be operational in early 2025

SPECIALREPORT

LAND-BASED AQUACULTURE TECHNOLOGY

Expanding the horizon for RAS

Rapid growth brings focused investment

New systems look to overcome industry challenges

Where flow-through is capitalising on natural advantage

Plans progress for UK’s first land-based salmon farm

New shrimp feed focuses on farm performance

Fish farming firsts for South Korea

World Fishing & Aquaculture

DON’T GET CAUGHT WITH A FAILED PUMP ON THE JOB.

Bring confidence to your net cleaning job, with the most reliable pump on the market.

NLB’s high-pressure water jet pumps are proven reliable for offshore and onshore net cleaning. Engineered specifically for the aquaculture market, they withstand the harsh conditions of open seas, foul weather, and salt corrosion, all while delivering the same performance and durability NLB has been recognized for since 1971. Our units also offer a compatible interface with the industry’s leading head cleaning systems.

NLB will go the extra mile to make the switch easy for you. Let’s discuss your options at AquaNor!

NLBCORP.COM +44 7391 745 119 © Copyright 2023 NLB Corp. | PSaleAqua_23_005_v1 SEE THIS UNIT IN PERSON BOOTH G-730

NLB’s 205 Series aquaculture unit will be on display at our booth at the AquaNor show in Trondheim, Norway from August 22-25th. Be sure to stop by!

ANDFJORD SALMON LOOKS TO CAPITALISE ON ITS NATURAL ADVANTAGE

The land-based flow-through producer has a roadmap in place to produce 90,000 tonnes of fish by 2032 from its sites on the Norwegian island of Andøya. Jason Holland reports

At the time of writing, Atlantic salmon farmer Andfjord Salmon AS had just confirmed that it is to progress with plans that will increase the total production volume at it Kvalnes site to 40,000 tonnes of head-on gutted (HOG) fish in the next seven years. To deliver this growth, the company has secured a NOK 700 million bank loan to expand the Kvalnes’ operations.

The very first commercial harvest from the facility’s first/pilot pool – an expected 800 tonnes of 4kg fish – is only a matter of weeks away, but the company is looking further ahead, having now proven its concept – a farming system based on flow-through technology that capitalises on Andøya’s close proximity to the oxygen-rich Gulf Stream.

For those unfamiliar with the location, Andøya is the northernmost island in the Vesterålen archipelago, situated about 300km inside the Arctic circle. It’s also where Andfjord Salmon has a licence in place for 10,000 tonnes maximum allowed biomass (MAB) of land-based production. This will allow the Kvalnes’ facility to produce around 19,000 tonnes of HOG salmon.

Its new capacity will gradually be added over five phases between 2025 and 2030, with the next 8,000 tonnes of production scheduled to be added in 2025 via four new pools. From then, the company’s plan is to build four new pools every year to reach the 40,000-tonne target in 2030.

Reaching the 90,000-tonne total will be achieved through Andfjord Salmon’s two other locations on Andøya: Breivik and Fiskenes, which are expected to deliver a combined 50,000 tonnes. Preparatory work on these sites

is already underway, with construction anticipated to begin in 2026/27.

‘Simple but ingenious’

At 30,000 cubic metres each, Andfjord Salmon’s pools are huge. They are also square in shape. The reason for this, explains company CEO Martin Rasmussen is to create enough space for the 200,000 fast-growing salmon in each pool to behave naturally.

Through the company’s own patented technology, it has introduced a laminar waterflow, whereby a parallel current moves from one side of the pool to the other. Not only does this establish an even distribution of water in the system, it means there’s no turbulence.

“The fish can swim where they want to; they can have a schooling behaviour. We are simply housing a crosssection of the Gulf Stream on land,” Rasmussen told WF. “We have endless access to new, clean, clear seawater with the perfect temperature, salinity and oxygen levels for salmon production.”

All the pools will be built at sea level to enable the farm to move 5 tonnes of water per second (or 20,000 cubic metres per hour) without the need of additional energy to lift it. With a water intake at approximately 40 metres water depth, this water is also coming from below the upper columns where sea lice and harmful algae tend to be much more prevalent.

“The concept is protecting the fish and protecting the environment,” Rasmussen said. “It’s very simple but it’s also

SPECIAL REPORT

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 21

Photo Credit: Andfjord Salmon

n Andfjord Salmon plans to produce 40,000 tonnes of fish at Kvalnes by 2030

ingenious. It allows us to have a land-based model but with very low operational costs.”

He said the first production cycle has been very successful, with the first Kvalnes’ pool achieving good fish health and welfare, strong growth, low energy consumption whereby one kilogram of salmon can be produced at under 1 kilowatt per hour, and a survival rate of 97.8%, alongside an accumulated feed conversion ratio (FCR) of 0.96.

“When it comes to energy consumption, it’s very important to be below the surface level. We’re not lifting the water, but just pushing it through the pool, and this is

why our energy consumption is so low.”

Meanwhile, to achieve its FCR, the producer has put tight biological and feed controls in place, while the feeds themselves contain special ingredients and have properties that slow the rate at which they sink in the pool.

“This allows us to have much better control over the feeding process, which in turn reduces waste. Our feeding can be done with much greater precision than traditional at-sea salmon farmers,” Rasmussen said.

“And where flow-through really differs from RAS [recirculating aquaculture systems] is it’s merely borrowing the water to create a salmon habitat on land with the water passing back into the ocean without negative impacts. However, if you’re in a place where you don’t have these same natural advantages, you must have many processes in place just to change the water parameters. We’re able to avoid all that – there’s much less complexity in our methods compared to models where you don’t have these natural advantages.

“Also, there’s a lot of land-based aquaculture concepts being launched around the world, but we have chosen to be where Atlantic salmon swim naturally. On my way to work every day, I drive over nine salmon rivers. It’s part of the nature here.”

Traditional farming limitations

The Andfjord Salmon concept has been more than 20 years in development, with a great deal of time taken to properly research and develop its location, said Rasmussen. The company was therefore delighted to release its first 120gram smolt into the pilot pool at the end of June 2022.

By the start of May 2023, these fish had grown to an average weight of 3kg, which

demonstrated very stable production during the oftentricky winter period.

“The growth was about 40% better compared to our initial production plan so we have been very satisfied with the salmon production. We tend to compare our operations with those of traditional salmon farmers because its more similar to that sector than to RAS, and compared to traditional at-sea farming, we have very good numbers,” Rasmussen said.

He added that lot of biological performance seen in the first production cycle can be attributed to the emphasis it has placed on having high-quality smolt.

“We have quite a conservative approach when it comes to how fast we want to grow our smolt. I see many producers pushing the biological growth of smolt to levels that are perhaps too fast. They may achieve good growth but lose out when it comes to the maturation of the fish and their organs. This could also have a negative impact in the sea grow-out phase. So, for us it was important that the smolt producer had a similar profile as we have when it comes to temperature profiles. I didn’t want them to push the biology too fast, I wanted a conservative production cycle.

“So far, we have achieved a survival rate of around 98%, so having just 2% mortality in our first commercial production cycle is very, very good.”

As for the potential of land-based salmon farming in general, Rasmussen said it’s “a very interesting time” to be part of the developments in an “industry that’s growing up”, with a number of different models are coming into play.

“When it comes to the sustainable production of food, there are many upsides to land-based aquaculture. But in general, the industry needs more time to get experience so that it can solve many of the early, initial issues that it’s had.

“Ours is a unique concept; it’s quite different from the other landbased production methods because it’s so close to sea-based salmon farming. Therefore, I see us growing and developing alongside traditional production, which has of course become limited in terms of its growth possibilities.”

22 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net SPECIAL REPORT

It’s very simple but it’s also ingenious. It allows us to have a land-based model but with very low operational costs

‘‘

Martin Rasmussen

Photo Credit: Andfjord Salmon

Photo Credit: Andfjord Salmon

n Cross section of Andfjord Salmon’s flow-through system

n Andfjord Salmon CEO Martin Rasmussen

Immediate potential focus

Once its first harvest is complete, and with “everything already on the upside when it comes to growth, mortality and feed conversion rates” Andfjord Salmon will immediately get to work to have the next batch of pools in place, Rasmussen confirmed, adding that any adjustments to the next pools will only be very minor, as a lot has already been learned getting to this stage.

“We see different things being achieved in the future but they’re more likely to be optimisations,” he said. “We’re extremely proud the concept is working as it should be. But we’ve still seen some ways we can optimise things within our teams and with our equipment, so there’s more we can and shall do to improve the numbers further still.” The new pools will also be part of a substantial construction stage that will also include the delivery of new infrastructure such as waterways and a port area to support the increased salmon volumes that Kvalnes will produce. This is where a lot of the new financing will be diverted.

Asked whether Andfjord Salmon has any plans to extend its operations beyond Andøya and Norway, Rasmussen insisted that while it’s always tempting to look at additional possibilities, the current focus is very much on the significant plans that are now in place.

“We consider Andøya to be the perfect location for this concept, but of course there are other locations in the world that are suitable for this kind of salmon farming. But we are thinking one step at a time and want to build up our location and the opportunity that we have here before going out further into the world,” he said.

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 23 SPECIAL REPORT

So far, we have achieved a survival rate of around 98%, so having just 2% mortality in our first commercial production cycle is very, very good

‘‘

Martin Rasmussen

Photo Credit: Andfjord Salmon

n Kvalnes’ first pool ahead of smolt transfer

MULTI-STOREY RAS FOR HIGH-VALUE PRODUCTION

Can a new farming system for olive flounder reignite aquaculture in South Korea? Bonnie Waycott reports

While working in Norway between 1998 and 2014, Dr Woo-Jai Lee, CEO and founder of genomics and precision-breeding aquaculture firm BluGen, gained a deeper insight into the South Korean fish farming industry. But he was shocked by what he saw.

“At that time, South Korea was a leading country in many industrial sectors such as cars, electronics and shipbuilding,” he told WF. “However, fish farming was far behind major leading countries with extremely segmented value chains, poor sustainability practices and high inefficiencies. And yet, I saw that there was huge potential for the industry, and that the main reason behind the lagging development was the market situation. Fish farmers didn’t need to invest in R&D and new facilities for better production because they enjoyed a still-profitable market in which demand far outweighed supply.”

Lee founded BluGen in 2013 to introduce more sophisticated genomics and breeding technology, as well as recirculating aquaculture systems (RAS), to South Korea.

Hoping to change the country’s underdeveloped fish farming industry into a more modern and efficient one, Lee, who has over 20 years’ experience in genomics and breeding projects in Norway, is developing a system that can attract sound investments and offers new opportunities for younger workers – South Korea’s first RAS for olive flounder (Paralychthys olivaceus).

Located in Goheung, Jeollanam-do Province, one of the southernmost areas of the Korean peninsula, the 2,000-tonnes per year facility will include a hatchery of 2,000 breeder fish that are made up of 300 families. These will produce around 40 million units of juveniles each year.

There will also be shallow grow-out raceways of around 45cm in depth, built by Norwegian fish farm innovator SIFT Group (SIFT Group has developed a new concept for raceways and efficient water treatment technology, which makes an intensive farming density possible). Because the raceways can be stacked, shallow raceway designs will optimise footprint and increase production volume. For dwelling species like olive flounder, the density can be kept as high as 70kg/m2.

Woo-Jai Lee,

The aerobic and anaerobic phases have been separated and water treatment capacity and energy consumption rate both improved, while the concepts of sustainable and healthy (no antibiotics) production will be introduced for the first time. Construction is around 80% complete, and production is expected to begin by the end of 2023 pending no delays.

Industry firsts

The facility will house and vertically-integrate components

24 | JULY/AUGUST 2023 For the latest news and analysis go to www.worldfishing.net SPECIAL REPORT

We have the strongest olive flounder broodstock in the world and hope to pioneer a successful RAS deployment strategy

‘‘

Dr

BluGen

n BluGen hopes to produce 2,000 tonnes of olive flounder at the new facility

Photo Credit: BluGen

of the value chain that currently do not exist in South Korea – from R&D to broodstock management to grow-out –in an environmentally sustainable way and bring a new standard and approach to aquaculture in the country.

The olive flounder will be fed extruded pellets based on BluGen’s own proprietary formula (insect meal and other alternative formulations and combinations are currently being investigated) and grow at an FCR of 1.1. Although the vast majority of farmed olive flounder is around 1kg or less in size, BluGen is planning to grow the fish to the 2-3kg mark to fulfil a rarer market segment and fetch premium farm gate prices.

From stocking, it usually takes 10 months to reach 1kg, 14 months to 2kg and 18 months to 3kg.

According to Lee, olive flounder is native to South Korea and arguably the most important fish domestically in terms of consumption, seafood identity and representation. Current domestic production sits at around 45,000MT/ year, of which nearly the entire supply is consumed domestically.

Olive flounder is also important in Japan, and consumption is assumed to be around the same as that of South Korea. It is also widely consumed in China. Demand for the species in South Korea, Japan and China has been on the rise, but supply has been decreasing due to production challenges from disease and climate change, while there is still a significant dependency on wild catch and flow-through systems.

Pivotal project

The average Korean flow-through farmer experiences 65-70% mortality rates between the points of stocking juveniles to harvest, said Lee, who is also aiming to demonstrate the economic viability of his new RAS facility. These types of facilities should be conceived with a strong species-market match, a biologically RAS-friendly species and excellent value chain support, he said, and these are all elements that make BluGen a compelling project from an investors’ point of view.

“BluGen may be one of the most pivotal projects in South Korea’s aquaculture history,” said Lee. “Our inception was in genomics R&D, and we have selectively bred nine generations of olive flounder to produce what we consider a genetically superior fish. We are the only company in the world that has mapped the whole flounder genome, with a proprietary selective breeding programme that integrates and implements the entire value chain from disease challenges and vaccine development programs to feed development.

“This is the first time that we’re introducing genomics-level selective breeding and other value-chain technologies to commercial-level operations, and we are building the country’s first RAS project. We have the strongest olive flounder broodstock in the world and hope to pioneer a successful RAS deployment strategy for the domestic and international aquaculture community in areas including production, sustainability and investability.”

Lee is confident BluGen’s combination of selective breeding and RAS facility means its olive flounder will have better survivability and grow to a larger, more attractive size. The species is also particularly sensitive to water quality and disease and doesn’t require deep tanks,

he said, which makes it suitable for shallow raceways that offer controlled and stable growth conditions while maximising production.

Olive flounder also grow optimally within a certain temperature range, which RAS can provide, while the new facility should also be able to reduce mortality dramatically by treating the intake water and switching the feed from moisturised pellets to extruded pellets. Both steps can also block most of the pathogen introduction to the farm.

International potential

The National Institute of Fisheries Science (NIFS) and the South Korean government have recognised the commercial and symbolic importance of BluGen’s work. Both support the initiatives for implementing new technology to improve production efficiency and ultimately give farmers a strong position in the markets.

So far, BluGen has received support for actual farming practices, and for this particular project, a US$3.2 million non-dilutive grant from the South Korean government to begin construction.

“There are a lot of eyes on BluGen, since with a proof of concept, it will transform the South Korean way of farming olive flounder,” said Lee. “The domestic farming industry is waiting for BluGen to begin production. Their intent is to partner and cooperate with us throughout the whole value chain of the olive flounder farming sector. There are already several entities and regional governments within Korea that are interested in partnering with BluGen to accelerate this new way of farming.”

“We are also seeing a lot of focus on RAS projects, and we know that olive flounder is an uncommon species – at least to Western markets – that we can put on the map, with the successful implementation of RAS,” continued Lee. “Although yet to be discovered internationally, olive flounder is known for its texture and mild but delicious flavour, and we believe that it will continue to do well, for example in high-end Japanese restaurants.

“It’s an appealing and versatile species that can be successfully marketed and propagated worldwide. Right now, the current BluGen project won’t be able to supply much to export markets, so in future we plan to seek opportunities to farm the species near the export markets, together with ambitious investors.”

For the latest news and analysis go to www.worldfishing.net JULY/AUGUST 2023 | 25 SPECIAL REPORT

n The multi-story facility will feature shallow grow-out raceways

n BluGen CEO and Founder Dr Woo-Jai Lee

Photo Credit: BluGen

BIOFISHENCY ELX: NEW APPROACHES FOR RAS FARMS

Work is underway in Israel to ensure even better RAS-farmed fish, writes Bonnie Waycott

As projections continue for the expansion of global seafood demand and concerns rise over the effects of offshore farming, recirculating aquaculture systems (RAS) and the potential of seafood production on land are more in focus than ever. But although their advantages have been documented extensively, some limiting factors restrict their wider application, such as the inefficient removal of nitrogen and phosphorus compounds, the possible increase in pathogens within biofilters and the generation of off-flavour in fish. These can result in increased production costs and fish health issues that affect growth and survival.