THE ISM MANUFACTURING REPORT

MANUFACTURING TIDBITS: RESHORING AND FDI UP 53%, A NEW RECORD

CORNELL STUDY CONFIRMS: IMPORTING CHINESE SOLAR EXACERBATES

Brought to you by www.jacketmediaco.com The Manufacturing & Business Podcast Network LISTEN TO OUR PODCASTS AT: OUR PODCASTS: MARCH ISM PMI: 46.3% Released April 3rd -The Full Executive Summary Report On Business - Page 16 [ FROM IMPORT DEPENDENCE TO SOLAR POWER DOMINANCE: A LOOK AT THE FUTURE OF U.S. SOLAR PRODUCTION

PAGE 16

PAGE 10

CLIMATE

PAGE 12 PAGE 8

PAGE 38

PAGE 40

CHANGE

MATERIALS OUTLOOK

AUTOMOTIVE OUTLOOK

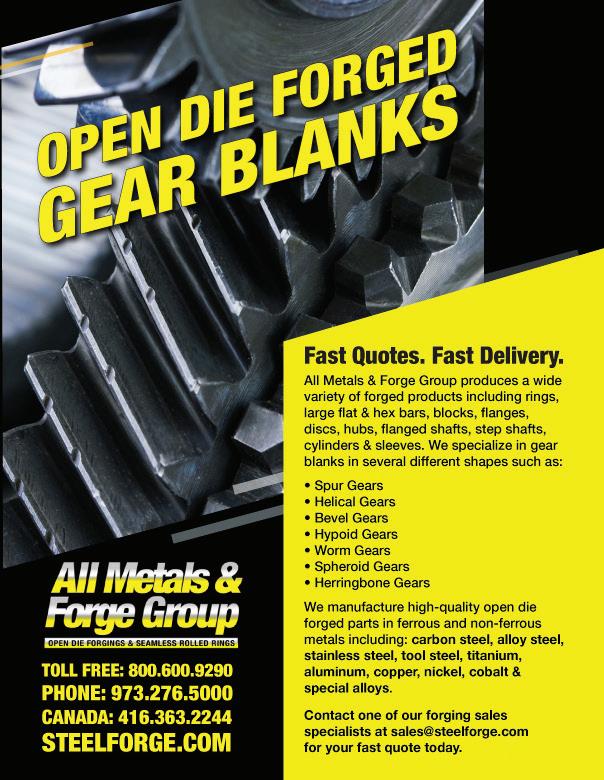

3 Manufacturing Outlook /April 2023 Forging Deliveries Got You Down? How About 8-10 Weeks? U.S. (973) 276-5000 Toll Free (800) 600-9290 Canada (416) 363-2244 STEELFORGE.COM • SALES@STEELFORGE.COM ISO 9001/AS 9100D Registered ALLOY • CARBON • STAINLESS • TOOL STEEL • NICKEL • ALUMINUM • TITANIUM

© 2023 Jacket Media Co. No part of this publication may be reproduced or used in any form without the prior written permission of the publisher. Manufacturing Outlook is a registered trademark of Jacket Media Co.

A Thousand Opinions… but No Answers by Lewis A. Weiss

Manufacturing In The US Takes A Leap In March by Royce Lowe

COVER STORY: FROM IMPORT DEPENDENCE TO SOLAR POWER DOMINANCE: A LOOK AT THE FUTURE OF U.S. SOLAR PRODUCTION by Jessica Baron

OUTLOOK 24

AFRICA

Blackouts; South Africa’s Huge Problem by Royce Lowe

27

EUROZONE OUTLOOK

Strength and Growth Continue by Chris Anderson

ASIA OUTLOOK

U.S. Solar Manufacturing Renaissance Needs China And Southeast Asia by Christine Casati

Boeing and Saudis and 787s by Royce Lowe

Reshoring and Foreign Direct Investment Up 53%, a New Record by The Reshoring Initiative

Cornell Study Confirms: Importing Chinese Solar Exacerbates Climate Change by The Coalition for a Prosperous America

The World and Russian Oil and Gas by Royce Lowe

MATERIALS OUTLOOK 16

MANUFACTURING TIDBITS 10 12 14 40

Grabbing for Africa’s Minerals by Royce Lowe

AUTOMOTIVE OUTLOOK

MANUFACTURING REPORT ON

The Manufacturing PMI is 46.3%

20

by Dr. Chris Kuehl The Elephant in the Room SOUTH AMERICAN OUTLOOK

Andreas and His Chinese EV by Royce Lowe

Learning the Language of Cybersecurity by Ken Fanger

4 Manufacturing Outlook /April 2023

Publisher

TIM

ROYCE

KEN

Advertising

JACKET

75

(973)

OF CONTENTS

PUBLISHER’S

5

LEWIS A WEISS Editor in Chief

GRADY Creative Director CRAIG ROVERE Contributing Writers

LOWE JESSICA BARON CHRIS KUEHL CHRIS ANDERSON CHRISTINE CASATI

FANGER Production Manager LINDA HOPLER

ADVERTISE@MFGTALKRADIO.COM Editorial Office

MEDIA CO.

LANE ROAD FAIRFIELD, NJ 07004

808-8300 TABLE

STATEMENT

28

AEROSPACE OUTLOOK 32

ENERGY

34

MANUFACTURING OUTLOOK 6

CYBER

42 ISSUES

44

OUTLOOK

SECURITY OUTLOOK

OUTLOOK

38

Open call for... Contributing Writers for new and existing content. Let’s start a conversation –Contact us at info@jacketmediaco.com ISM

Future Leaders by Royce Lowe BUSINESS

8

22

U.S. Domestic Market Share Index Slightly Increases by The Coalition for a Prosperous America

NORTH AMERICAN OUTLOOK

by Dr. Royce Lowe Bolivia’s Lithium Dilemma

A Thousand Opinions…but No Answers

Recession - to be or not to be, that is the question. While it is interesting to follow all the tea leaves floating in the tempest, no one has a crystal ball about whether a recession will occur. It seems that the Fed will remain on course to crush inflation, which usually also crushes economic expansion. The banks, at least some, have been caught in a bond yield problem and are having to sell their 2-year bonds at a discount to cover their short-term deposit withdrawals or loan losses.

When one leg of your stool is wobbly, it is annoying; when two are wobbly and the third is questionable, people tend to look for more solid ground without landing on it as the stool collapses. The next person won’t use that stool, and may feel wobbliness in theirs, whether real or imagined. They ask the person next to them seeking reassurance. Suddenly, everybody wants a nice, solid chair.

Recessions are often caused by fear factors, and the pundits are doing their very best to pump those into the conversation on mainstream media. But most of manufacturing isn’t feeling any serious wobble in their sector of the economy. They are becoming cautious, with more emphasis on invoice collection and less on extended payment terms, but their order books are still fairly solid. And they continue to hold onto employees, which flies in the face of the very thing that signals to the Fed that their strategy is becoming effective – rising unemployment. The target – about 5% unemployment.

That doesn’t seem like a far stretch from 3.4%, but it means millions of Americans will lose their jobs. They won’t have the funds to spend. Demand will fall. Order books will suddenly contract. More layoffs will begin, and before the Fed can stop the derailment, the economic train comes off the tracks. Getting it back up and running then becomes the Fed focus, but in the meantime, there is an economic mess that will have unpleasant impacts for everyday Americans for years to come, trying to recover from their personal downturn.

Inflation is cooling, albeit, slowly, and not fast enough for the Fed. The Fed is moderating its interest rate hikes, with the latest being just a quarter of a point, but the problem is knowing when you have gone a few basis points too far. Unfortunately, the Fed often doesn’t know when the train cars will begin jumping the rails. And when it happens, it is rapid-fire and too late to prevent. They don’t slow the train – it is crash or no crash.

Manufacturing Outlook continues to be encouraged by the resilience in the manufacturing sector. Keep in mind that the manufacturing industry has been the canary in the coal mine going into every recession, and the breath of fresh air coming out of every recession. We encourage our readers to observe it carefully and closely. At any moment in 2023, some action by the Federal Reserve Bank or the federal government could create the chain reaction of an economic derailment.

Tune in to the Manufacturing Talk Radio Podcast and listen to the ISM Report on Business® recorded on Monday, April 3rd with Manufacturing Committee Chair, Mr. Tim Fiore, and the episode recorded on Wednesday, April 5th with the Services Committee Chair, Mr. Anthony Nieves. These two discussions are the most in-depth analysis presented by the Institute for Supply Management on any media platform, and contain signals about economic conditions ahead. Keep a close eye on employment in this report, which showed its first reading below 50 in March, 2023, in the manufacturing sector. Will this become a trend, as the Fed wants, or was this an errant blip on the radar?

Be sure to listen to the Manufacturing Talk Radio episode with Dr. Chris Kuehl around the ASIS report, or Armada Strategic Intelligence System for manufacturing. It is showing an almost eerie 95%+ accuracy rate in its economic projections for the next several months. Dr. Kuehl joins hosts Lew Weiss and Tim Grady about mid-month to provide the latest strategic update in a tightly packed 23-minute discussion.

There is always more, including the development of solar power that we highlight in this issue, including the reshoring of this technology and manufacturing to U.S. shores and its heartland. n

Lewis A. Weiss, Publisher

Contact

laweiss@mfgtalkradio.com

for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

5 Manufacturing Outlook /April 2023

PUBLISHERS STATEMENT FOLLOW US: SUBSCRIBE

MANUFACTURING OUTLOOK

6 Manufacturing Outlook /April 2023 MANUFACTURING OUTLOOK

continued

MANUFACTURING IN U.S. TAKES A LEAP IN MARCH. EUROPE IMPROVES, BUT ALMOST ALL DUE TO SERVICES

By: Royce Lowe

The U.S. inflation rate is 6.0% for the 12 months ended February 2023. Data from Armada Strategic Intelligence System (ASIS) suggests that manufacturing industrial production will tend to stabilize in Q2, then improve through the year end. As for the primary metal sector, there will be a good improvement in Q2 and Q3, before a downturn in Q4. The fabricated metals sector will “blip” in Q3, before receding in Q4 and through the first half of 2024, when some recovery will be seen in the back end of the year.

People in the manufacture and distribution of goods moved into heavy inventory building in 2022, and 70% of those companies find themselves overstocked. At the same time, global inventories of non-ferrous metals are at multi-decade lows. The aerospace and miscellaneous transportation sector looks healthy through the rest of 2023. Computer and electronic products will pick up steam starting Q3 of this year. The machinery sector will suffer a lack of demand through mid-2024. Motor vehicles and parts will see good demand through 2023, with a downward trend for early 2024, and a correction in Q2 of that year.

In the U.S., the “flash” composite index for March is at 53.3 versus 50.2 in February; flash services at 53.8 versus 50.6; the manufacturing production index was at 51.0 versus 47.4 and the manufacturing PMI reading was at 49.3 versus 47.3.

Demand was up and new order growth returned. U.S. companies saw a renewed expansion in business activity in March. Production grew at a solid pace that was the fastest since May 2022, as demand conditions improved and new order growth returned. Both manufacturers and service providers registered upturns in output, with service sector firms driving the increase.

Total U.S. new vehicle sales for March 2023, including retail and non-retail transactions, are projected to reach 1,330,700 units, a 6.2% increase from March 2022, according to a joint forecast from J.D. Power and LMC Automotive. March 2023 has the same number of selling days as March 2022. New-vehicle total sales for Q1 2023 are projected to reach 3,526,700 units, a 7.3% increase from Q1 2022 when adjusted for selling days.

The UK slipped again, with the composite index back at 52.2 versus 53.1 in February; services at 52.8 versus 53.5, manufacturing production at 49.0 versus 50.9 and manufacturing at 48.0 versus 49.3.

Japan’s services PMI is still on the rise, with a flash composite index of 51.9 versus February’s 51.1; services at 54.2 versus 54.0, and manufacturing production at 47.4 versus 45.3.

According to the China Association of Automobile Manufacturers, auto sales in China surged by 13.5% from

a year earlier, to nearly 1.98 million units in February 2023, rebounding sharply from a 35% plunge in the previous month. Data from the China Association of Automobile Manufacturers (CAAM) showed it was the first increase in car sales in four months. Meanwhile, sales of NEVs jumped 55.9 percent year-on-year to 525,000 units in February. For the first two months of the year, car sales fell by 15.2 percent from a year earlier to 3.625 million units, reversing from a 7.5 percent growth in the same period of 2022.

Global inventories of non-ferrous metals are reported at multi-decade lows. The prices of non-ferrous metals through most of March were on the decline, but not to the same extent as during February. Aluminum went from $1.18 to $1.15 per lb during March, but 60 days ago was at $1.70; copper from $4.11 to $4.08, 60 days ago at 4.20; nickel from $11.70 to $10.10, 60 days ago at $12.8 and zinc from $1.40. to $1.32, 60 days ago at $1.32. LME stocks are trending up a little.

The global manufacturing situation is on a slow improvement path. Demand is not the best, but there are several bright patches, such as aerospace, motor vehicles, and computer and electronic products. Car sales are up. The words inflation and recession are still on front pages, and naturally impact manufacturing industries. The latest results from U.S. manufacturers are encouraging. With spring and lower energy consumption, the world is a little more optimistic.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

7 Manufacturing Outlook /April 2023 MANUFACTURING OUTLOOK

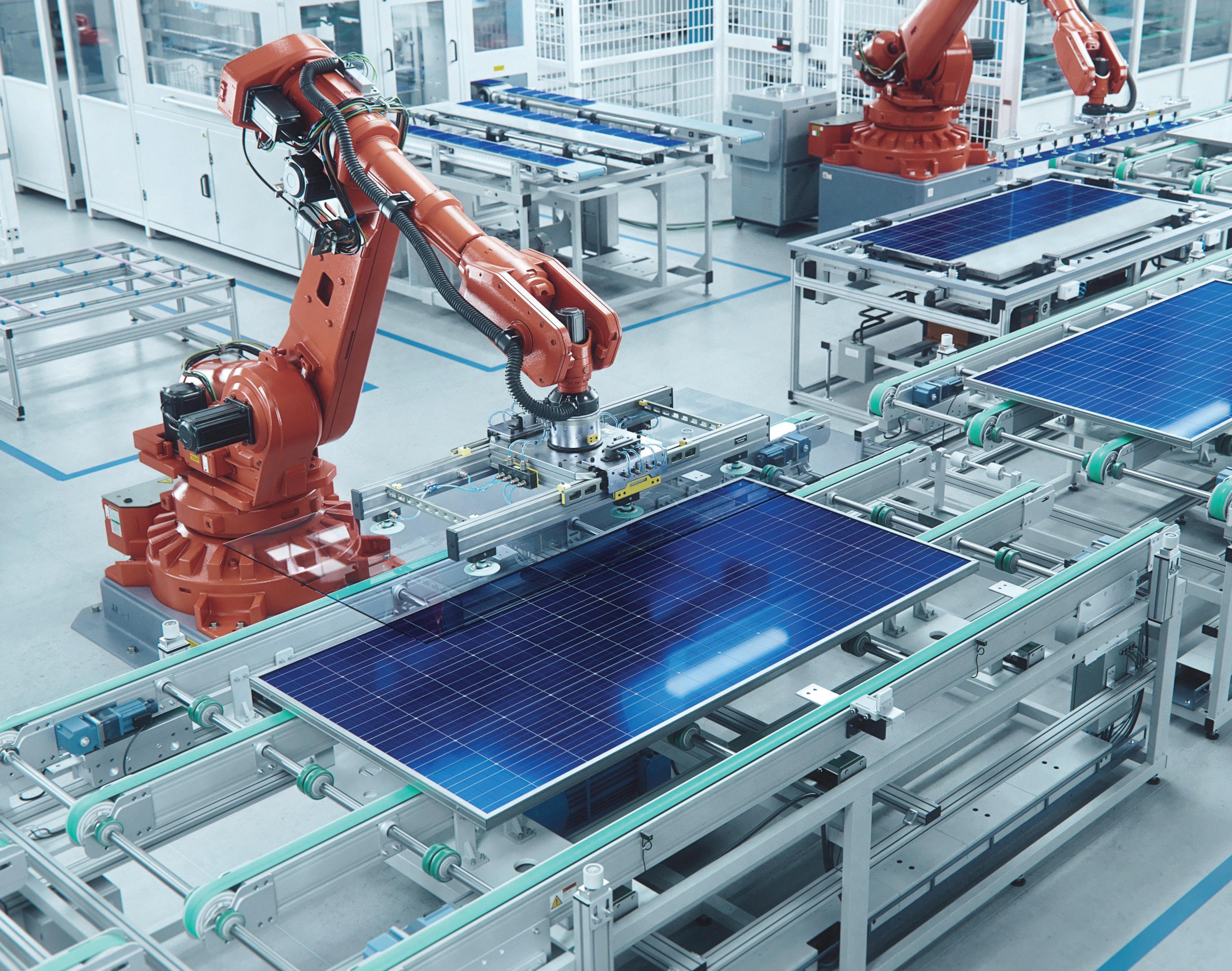

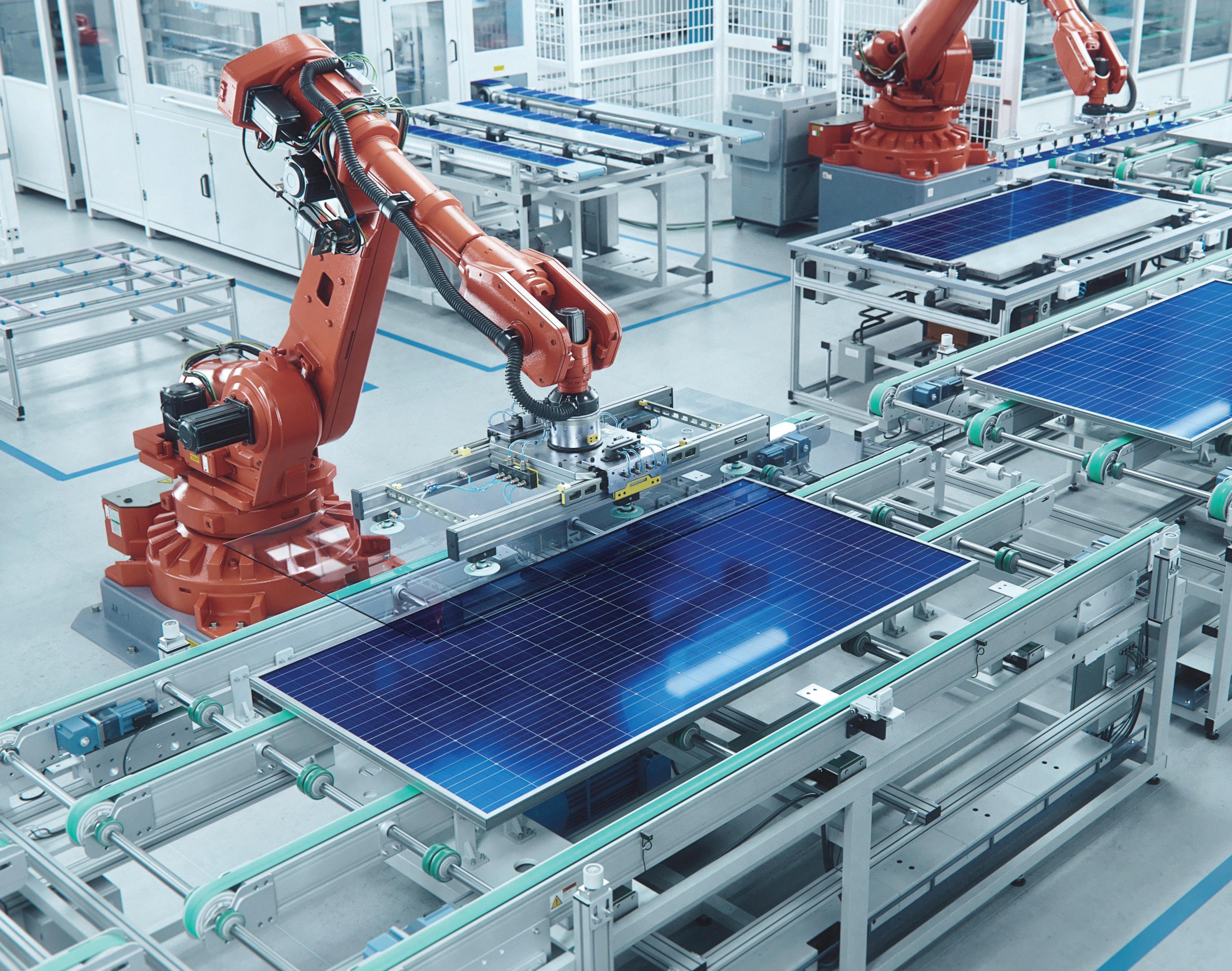

From Import Dependence to Solar Power Dominance: A Look at the Future of U.S. Solar Production

by Jessica Baron

by Jessica Baron

U.S. solar panel production has grown rapidly in recent years, with significant expansion expected in the near future. This is partly due to the $1.2 trillion U.S. Bipartisan Infrastructure Law (BIL) which has earmarked funds for raw materials mining, factory production, and utility-level adoption, as well as tax credits to encourage consumer adoption of photovoltaic (PV) solar systems.

However, the U.S. still faces challenges before it can become a dominant player in the solar energy market.

Trends in U.S. Consumer Adoption of Solar Panels

Solar panel adoption is growing steadily in the U.S. for small and residential installations, and there is currently enough solar equipment to power 25 million American homes.

Increasing U.S. consumer adoption of solar panels has been driven by the availability of government incentives and a growing awareness of solar’s environmental benefits. Although the price of residential photovoltaics (PV) and their installation has significantly decreased for residential consumers, uptake is still the highest among high-income Americans with high-value homes. However, the

8 Manufacturing Outlook /April 2023 continued

COVER STORY

incomes of solar adopters have been slowly moving toward the median in recent years.

Between 2020 and 2021, small-scale solar capacity for residential homes rose 35% from 2.9 to 3.9 gigawatts (GWdc). But 2022 set a record of 40% growth for residential homes, which added 6 GWdc of solar installations.

Yet, while the U.S. installed 20.2 GWdc of solar PV capacity in 2022 for a total of 142.3 GWdc and solar made up 50% of the new domestic electricity-generating capacity, that was actually a growth reduction of 16% compared to 2021. At the root of the problem were supply chain issues, which led to a 31% reduction in solar adoption at the utility level.

The History and Future of U.S. Solar Panel Production

In 1978, U.S. companies produced 95% of the global market share of solar panels. By 1984, that number was 55%; by 1990, it was 32%; by 2005, it was a mere 9%. The reasons behind the decline are complex but are partly due to the growth of Japanese consumer electronic companies and their investment in solar cell production to

complement new semiconductor investments. This foresight made them dominant in solar panel production at the turn of the century, even though much of the production has since shifted to China and Taiwan.

According to the Solar Energy Industries Association (SEIA), dozens of companies have made announcements about opening factories addressing all parts of the supply chain in the U.S., which could add 47 gigawatts (GW) of module manufacturing capacity, and well over 100 gigawatt-hours of battery manufacturing. But for the U.S. to develop capacity in all parts of the supply chain—silicon ingots, wafers, solar cells, and solar panels—it must first grapple with China’s dominance in polysilicon production, a critical component of solar panels.

Boosting U.S. Solar Production Along the Supply Chain

The U.S. currently has eight active polysilicon or silicon metal facilities, with the largest in Michigan and West Virginia. However, the Department of Energy reports no active domestic polysilicon ingot manufacturing. Furthermore, just one U.S. facility (run by CubicPV in Massachusetts) refines ingots into polysilicon wafers. There

is zero domestic solar cell manufacturing capacity. However, there are sixteen domestic polysilicon module manufacturers, and promise to add more from companies, including Qcells, Enel North America and 3Sun USA, Mission Solar, and Philadelphia Solar.

Crucial parts of the supply chain remain overseas, but this is set to change. In January 2023, Hanwha Qcells pledged $2.5 billion to manufacture solar ingots, wafers, cells, and finished modules in Cartersville and Dalton, Georgia. The South Korean solar manufacturer Hanwha Solutions plans to build a massive solar manufacturing facility in the United States to produce ingots, wafers, and solar panels by 2025.

Last year, SPI Energy signed a letter of intent to set up wafer production in the U.S., and Convalt Energy pledged to produce ingots, wafers, and cells in upstate New York by 2024. First Solar has not only invested over $1 billion in expanding its footprint in Ohio and plans to open new facilities in the Southeast, but they’ve found a workaround for mining and importing silicon by replacing it with thinfilm cadmium telluride (CdTe).

A Bright Future for U.S. Solar Power

In 2021, the U.S. imported 80% of its solar panel modules. But new production facilities have sparked predictions that the U.S. solar fleet will reach 700 GWdc by 2033 and 1,600 GWdc by 2050, in which case solar would account for half of U.S. electricity. Currently, only 3.4% of domestic electricity is generated from solar power.

If all goes well, the supply chain issues that interrupted the growth of U.S. solar energy in 2022 will become a thing of the past.

Author profile: Jessica Baron is a freelance writer covering the fields of science and technology. n

9 Manufacturing Outlook /April 2023 COVER STORY

Reshoring and FDI Up 53%, a New Record

by The Reshoring Initiative

Sarasota, FL, March 24th, 2023 — reshoring + Foreign Direct Investment (FDI) job announcements in 2022 were at the highest rate ever recorded. 4Q announcements accelerated even more than anticipated due to the Chips and Infrastructure Acts and deglobalization trends. Top takeaways:

• 364,000 reshoring + FDI jobs announced for 2022, up 53% from 2021’s record.

• 2022 brought the total number of job announcements since 2010 to nearly 1.6 million.

• EV batteries make Electrical Equipment the top industry.

With the IRA, Chips Act, and Infrastructure Bill, the U.S. Government is finally warming up to an industrial policy, though a more comprehensive plan could be achieved at a lower cost.

Supply chain gaps and the need for greater self-sufficiency set the stage for the current upward trend in reshoring. The risks of a Taiwan-China conflict or China voluntarily decoupling are focusing those concerns. Destabilizing geo-political and climate forces have brought to light our vulnerabilities and the need to address them. The White House responded with the Inflation Reduction Act, Chips Act and Infrastructure Bill, offering some direction and financial security to the companies and industries intent on filling the gaps. These government actions are necessary in the short run but are not sufficient since they do not improve the U.S.’ uncompetitive cost structure. A true industrial policy would level the cost playing field via comprehensive actions such as massive skilled workforce investments, a 25% lower USD and retention of immediate expensing of capital investments.

“The current actions and momentum are a great start. A true industrial policy would accelerate the trend and increase U.S. manufacturing by 40%, 5 million jobs. Reshoring will reduce the trade and budget deficits and make the U.S. safer, more self-reliant and resilient,” said Harry Moser, Founder and President of the Reshoring Initiative.

About the Report

The Reshoring Initiative’s 2022 Data Report contains data on U.S. reshoring and FDI by companies that have shifted production or sourcing from offshore to the United States.

“We publish this data quarterly to show companies that their peers are successfully reshoring and that they should reevaluate their sourcing and siting decisions,” said Harry Moser, Founder and President of the Re-

10 Manufacturing Outlook /April 2023

MANUFACTURING TIDBITS

shoring Initiative. “With 5 million manufacturing jobs still offshore, as measured by our $1.2 trillion/year goods trade deficit, there is potential for much more growth. We also call on the administration and Congress to enact policy changes to make the United States competitive again.”

About the Reshoring Initiative

A 55-year manufacturing industry veteran and retired President of GF Machining Solutions, Harry Moser founded the Reshoring Initiative to move lost jobs back to the U.S. He was named to the Industry Week and Association for Manufacturing Excellence (AME) Halls of Fame for his efforts with the Reshoring Initiative. Additional information on the Reshoring Initiative and its many sponsoring associations and companies is available at reshorenow.org.

The Reshoring Initiative provides the media with custom analyses of specific regions or industries. Contact Harry Moser to inquire.

MEDIA CONTACTS: Harry Moser, President

Reshoring Initiative 847.867.1144 Harry.Moser@reshorenow.org or dgs Marketing Engineers® Chuck Bates, Public Relations Director 317.813.2230

bates@dgsmarketing.com n

11 Manufacturing Outlook /April 2023

MANUFACTURING TIDBITS

Source: Reshoring Initiative Library data

Manufacturing Job Announcements per Year, Reshoring + FDI, 2010 thru 2022

Cornell Study Confirms: Importing Chinese Solar Exacerbates Climate Change

WASHINGTON — A recent study by Cornell University researchers confirms that reshoring the solar supply chain and boosting domestic solar manufacturing would significantly cut greenhouse gas emissions by 30%. “If reshored PV manufacturing is achieved by 2035, the estimated GHG emissions and energy consumption from panel production would

be 30% and 13% lower, respectively, than having relied on trading partners as in 2020,” the report states. “If the reshored manufacturing target is met by 2050, the climate impacts and energy use would then be reduced by 33% and 17%.”

As NBC recently reported, “research from the Center for Research on

Energy and Clean Air and GEM published late last month showed China approved the highest number of new coal-fired plants since 2015 last year.

“Incredibly, Beijing authorized 106 gigawatts of new coal power capacity in 2022, four times higher than a year earlier and the equivalent of 100 large-fired power plants, the research said.”

12 Manufacturing Outlook /April 2023

MANUFACTURING TIDBITS

Boosting Domestic Solar Manufacturing Would Gut Greenhouse Gas Emissions by 30%

“This study is yet another data point proving that importing Chinese solar—which is made from coalfired power plants and Uyghur forced labor—is bad for the environment, unethical, and harms American manufacturers that are forced to compete against China’s illegal trade violations,” said CPA Chair Zach Mottl. “If the Biden administration, and its Chinese apologists in the Climate Policy Office, are serious about addressing climate change, it would immediately revoke the Solar Emergency Declaration and take additional steps to support American solar manufacturers.”

The Coalition for a Prosperous America (CPA) has consistently called for reshoring the solar supply chain and boosting domestic solar manufacturing, and pointed out the dangers of continued reliance on Chinese solar imports.

Last year the Biden administration took unprecedented steps to protect Chinese solar manufacturers that are illegally violating U.S. trade law. Biden’s Solar Emergency Declaration effectively neutralizes the Department of Commerce’s investigation into whether Chinese solar manufacturers are illegally circumventing antidumping and countervailing duty (AD/CVD) orders. In December, Commerce issued a preliminary determination that found that Chinese companies operating in Malaysia, Thailand, Vietnam, and Cambodia are illegally circumventing existing antidumping and countervailing (AD/ CVD) duty orders on solar cells and modules from China.

Instead of supporting robust enforcement of U.S. trade laws, the emergency declaration gives Chinese manufacturers a free pass to illegally circumvent AD/CVD orders for

24 months and protects them from retroactive duties — regardless of what Commerce finds in its final investigation. This is not merely a 2-year tariff suspension, however. In fact, it is a complete “get out of jail free card” for China forever. It allows Chinese solar manufacturers to avoid tariffs forever by merely certifying that they produce wafers outside of China — something the Chinese will easily be able to do prior to the end of the two-year suspension.

Biden’s emergency declaration came after intense lobbying by the Solar Energy Industries Association (SEIA), a trade association that was exposed as a front for Chinese solar manufacturers and whose members have been implicated in the use of forced labor in Xinjiang. Last year, the Commerce Department announced it was investigating three of SEIA’s Chinese members for illegal trade activity.

In a scathing report released last year, The American Prospect exposed SEIA as failing to “disclose that among its leading members are the same Chinese-owned companies that are implicated not only in the investi-

gation of illegal tariff evasion, but in the use of slave labor to produce solar components and coal-fired energy to power the factories.” Additionally, The American Prospect unmasked that SEIA’s “main strategy for the past ten years has been to lament restrictions on Chinese solar production.”

The American Prospect reports, “SEIA’s membership includes U.S. subsidiaries of Chinese producers JinkoSolar, JA Solar, Trina Solar, BYD, and LONGi Solar, which are the dominant solar component manufacturers in the world.”

About CPA

CPA is the only national organization representing exclusively domestic producers across many sectors. We are a bipartisan coalition of manufacturers, farmers, ranchers, and labor organizations that make and grow things in the United States.

American jobs, strength, and well-being are built and sustained by growing America’s productive capacity. We value quality employment, national security, and domestic self- sufficiency over cheap consumption. n

13 Manufacturing Outlook /April 2023 MANUFACTURING TIDBITS

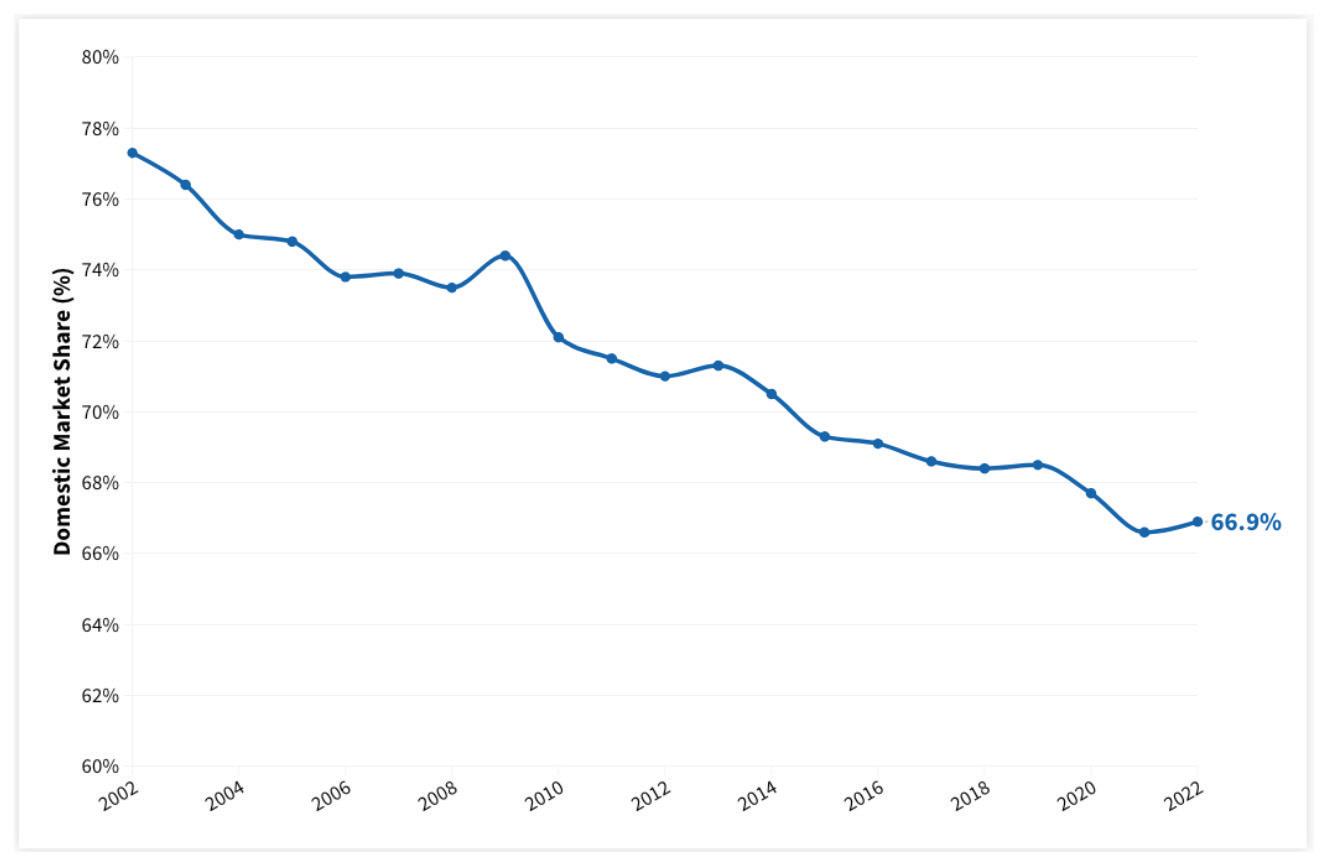

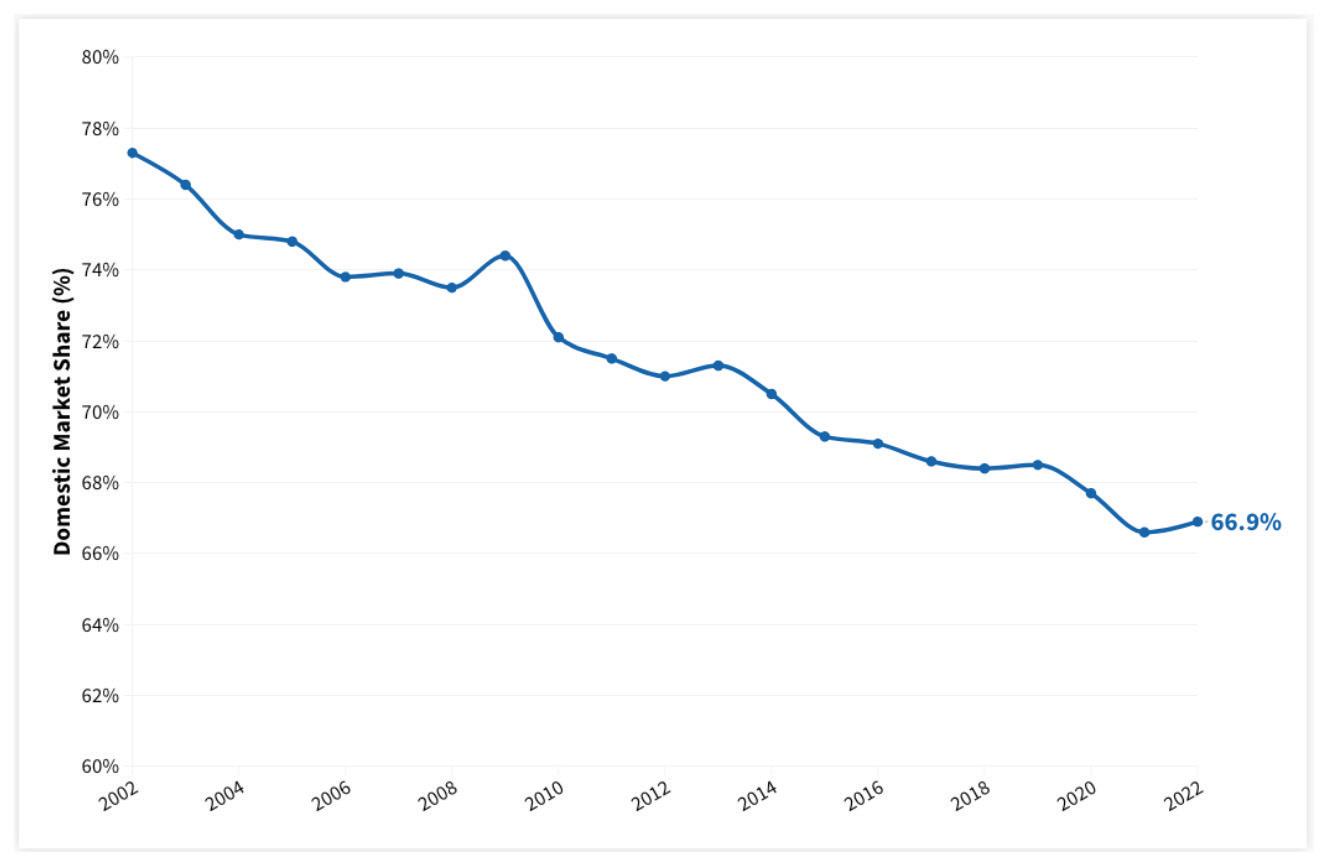

U.S. Domestic Market Share Index Slightly Increases

by The Coalition for a Prosperous America

The Coalition for a Prosperous America (CPA) today released a quarterly update to the Domestic Market Share Index (DMSI) which measures the market share of U.S. manufacturing producers in the U.S. home market. The DMSI increased slightly to 67.8 in the fourth quarter 2022, up 1.3 percentage points from the third quarter, reflecting a slowdown in imports at the end of the year. For the entire year, the index was 66.9 in 2022, an increase of 0.3 percentage points from the previous year. After imports surged in 2021 and the first three quarters of 2022, imports stabilized in the fourth quarter.

While policy makers often talk of access to foreign markets, the biggest market in the world is the U.S. consumer market where producers have lost market share in the last decades. The U.S. trade deficit in manufactured goods rose 13% to $1.199 trillion last year, an all-time record. The manufacturing trade deficit grew at a faster rate than the overall goods trade deficit in 2022, which increased by 9%.

“U.S. manufacturers continue to lose share in the U.S. market, and our trade deficit in manufactured goods set a new record in 2022,” said CPA

chief economist Jeff Ferry. “Rebuilding domestic production is the only way to create good jobs, boost economic growth, and address growing inequality in America.”

The DMSI measures the share that U.S. domestic producers hold of the U.S. market for manufactured goods. A DMSI of 66.9 means that foreign producers hold about one third of the U.S. market for manufactured goods in the form of imports. The U.S. market for manufactured goods, worth about $7.2 trillion, is the world’s largest market. Since 2002, U.S. manufacturers have lost more than

14 Manufacturing Outlook /April 2023

MANUFACTURING TIDBITS

ten percentage points of home market share, falling from 77.3% in 2002 to 66.9% for 2022. This represents a huge setback for U.S. producers, who have traditionally been strongest in the home market.

In Q4, gains were strongest among producers of primary metals and textiles, each gaining 4.4 percentage points of the domestic market. Producers of apparel also regained market share, increasing from 7.7% to 11.6%. Yet, all three of these industries remain below the average DMSI for the overall manufacturing industry. The apparel sector remains the sector in which domestic manufacturers hold the smallest percentage of the domestic market. Among sectors that lost the most market share over the quarter, U.S. motor vehicles manufacturers lost 1.1 percentage points of the domestic market falling to a 67.1% share of the domestic market.

By import source, the European Union gained 0.8 percentage points of the U.S. domestic market in

2022, increasing from 6.7% to 7.5%. Overtaking China, the 27-nation EU became the largest source of manufactured goods to the U.S. in the fourth quarter. Gains of market share by EU countries were most pronounced in Ireland and Germany. The two nations gained market share in chemical products by 2.1 percentage points combined. Motor vehicle imports from Germany also gained 0.6 percentage points.

China’s share of the market for manufactured goods in the U.S. fell by half a percentage point in 2022 to its lowest level since 2012. Since the implementation of Section 301 tariffs in 2018, China’s share of the U.S. domestic manufactured goods market has fallen from a record high of 8.1% to 6.8% in 2022. Textiles and computer & electronic products were the largest drivers of the decline, losing 2.4 and 2.1 percentage points of market share, respectively. For the year, China lost market share in 12 of the 19 subsectors. While China continues to hold the largest share of the U.S. market by a single foreign

country, policies aimed at decoupling the two economies have had an impact to decrease China’s share of the U.S. market.

Canada and Mexico’s combined share of the U.S. domestic market rose only 0.1 percentage point in 2022 despite the buzz about friendshoring. In 2022, the USMCA partners had a combined share of 9.1%. Mexico is the second largest source of manufactured goods in the U.S. with a 5.5% share and Canada is third with 3.6%.

About CPA

CPA is the only national organization representing exclusively domestic producers across many sectors. We are a bipartisan coalition of manufacturers, farmers, ranchers, and labor organizations that make and grow things in the United States. n

15 Manufacturing Outlook /April 2023 MANUFACTURING TIDBITS

Figure 1: Domestic Market Share Index (DMSI) (2002-2022)

THE INSTITUTE FOR SUPPLY MANAGEMENT’S MANUFACTURING REPORT ON BUSINESS®

16 Manufacturing Outlook /April 2023

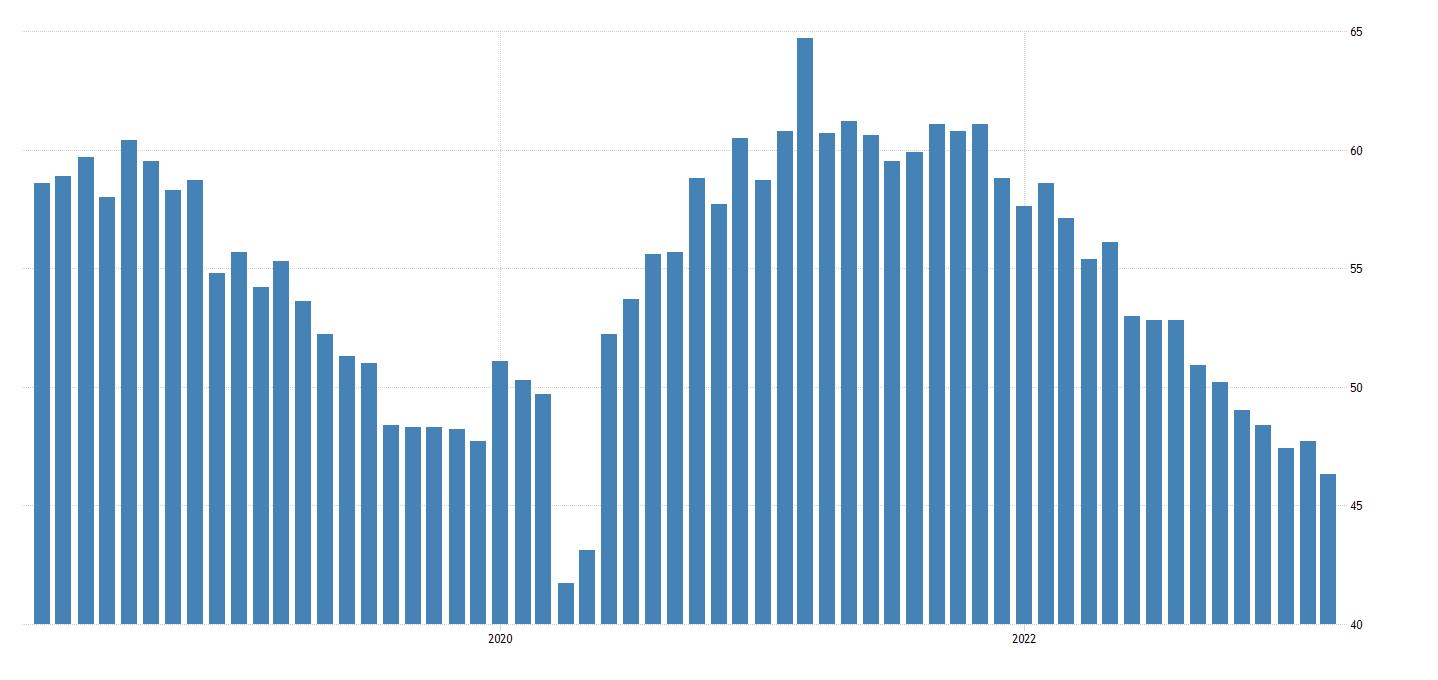

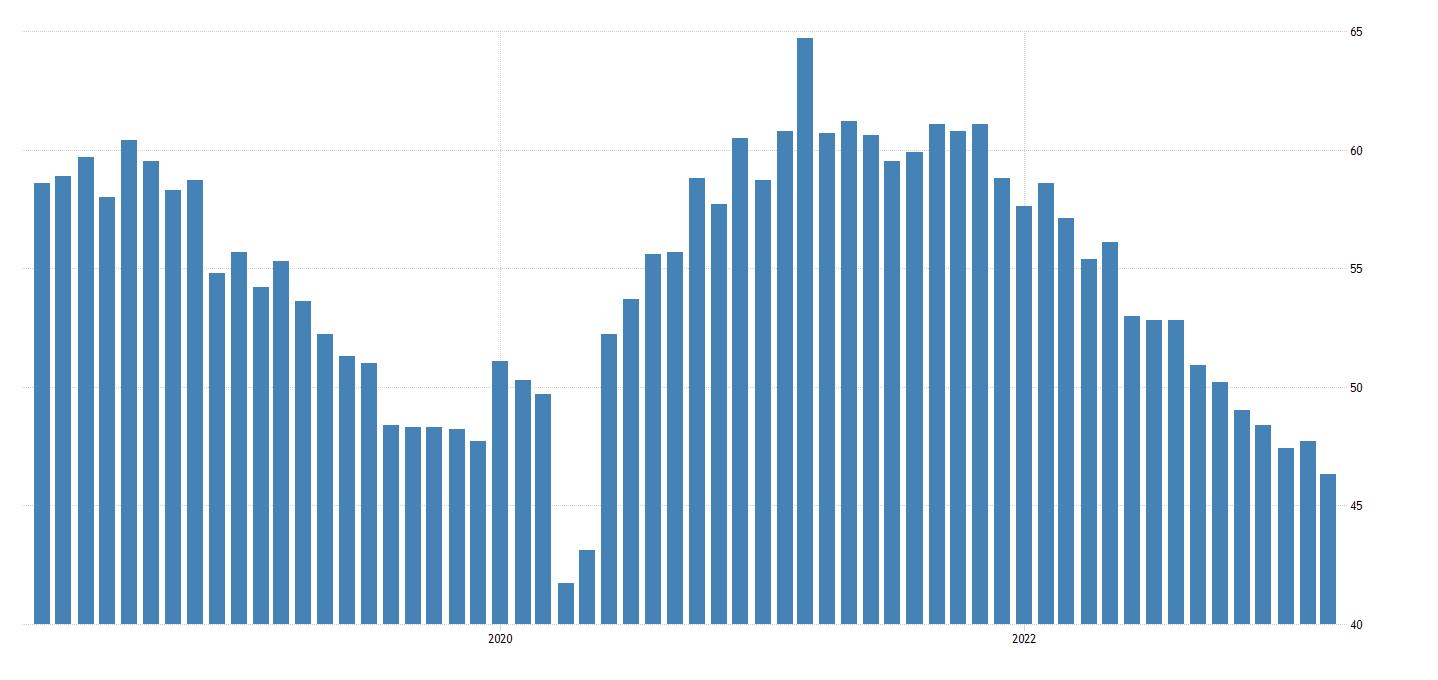

BREAKING NEWS ISM PMI at 46.3% for March 2023 ISM REPORT OUTLOOK MARCH 2023 46.3% Released April 3rd ISM PMI for the past 5 years Expanding Contracting continued

INSTITUTE FOR SUPPLY MANAGEMENT®

Economic activity in the manufacturing sector contracted in March for the fifth consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®

The March Manufacturing PMI® registered 46.3 percent. The New Orders Index remained in contraction territory at 44.3 percent, 2.7 percentage points lower than the figure of 47 percent recorded in February. The Production Index reading of 47.8 percent is a 0.5-percentage point increase compared to February’s figure of 47.3 percent. The Prices Index registered 49.2 percent, down 2.1 percentage points compared to the February figure of 51.3 percent.

The Backlog of Orders Index registered 43.9 percent, 1.2 percentage points lower than the February reading of 45.1 percent. The Employment Index continued in contraction territory, registering 46.9 percent, down 2.2 percentage points from February’s reading of 49.1 percent.

The Supplier Deliveries Index figure of 44.8 percent is 0.4 percentage point lower than the 45.2 percent recorded in February; this is the index’s lowest reading since March 2009 (43.2 percent). The Inventories Index dropped into contraction at 47.5 percent, 2.6 percentage points lower than the February reading of 50.1 percent.

The six manufacturing industries that reported growth in March — in the following order — are: Printing & Related Support Activities; Miscellaneous Manufacturing‡; Fabricated Metal Products; Petroleum & Coal Products; Primary Metals; and Machinery. ISM

Analysis by Timothy R. Fiore, CPSM, C.P.M. Chair of the Institute for Supply Management® Manufacturing Business Survey Committee

PMI® at 46.3% MANUFACTURING

The U.S. manufacturing sector contracted in March, as the Manufacturing PMI® registered 46.3 percent, 1.4 percentage points lower than the reading of 47.7 percent recorded in February. This is the fifth month of contraction and continuation of a downward trend that began in June 2022. Of the five subindexes that directly factor into the Manufacturing PMI®, none were in growth territory. This month, the PMI® registered its lowest reading since May 2020 (43.5 percent).

Manufacturing at a Glance

Commodities Reported

Commodities Up in Price: Copper (4); Electrical Components (5); Electronic Components (2); Plastic Resins*; Polypropylene (2); Propylenes; Steel (2); Steel — Cold Rolled; Steel — Fabrications; Steel — Hot Rolled; Steel — Scrap; Steel — Stainless (2); and Steel Products (3).

Commodities Down in Price: Caustic Soda; Corn; Corrugate (4); Corrugated Boxes (3); Crude Oil; Freight (5); Natural Gas (4); Ocean Freight (7); Plastic Resins* (10); Polyethylene; and Solvents. Commodities in Short Supply: Electrical Components (30); Electronic Components (28); Hydraulic Components (11); Integrated Circuits; and Semiconductors (28).

17 Manufacturing Outlook /April 2023 ISM REPORT OUTLOOK continued 12 ISM WORLD.ORG

PMI 48.7% = Overall Economy Breakeven Line 50% = Manufacturing Economy Breakeven Line 2023 2022 2021 46.3%

INDEX Mar Index Feb Index % Point Change Direction Rate of Change Trend* (months) Manufacturing PMI® 46.3 47.7 -1.4 Contracting Faster 5 New Orders 44.3 47.0 -2.7 Contracting Faster 7 Production 47.8 47.3 +0.5 Contracting Slower 4 Employment 46.9 49.1 -2.2 Contracting Faster 2 Supplier Deliveries 44.8 45.2 -0.4 Faster Faster 6 Inventories 47.5 50.1 -2.6 Contracting From Growing 1 Customers’ Inventories 48.9 46.9 +2.0 Too Low Slower 78 Prices 49.2 51.3 -2.1 Decreasing From Increasing 1 Backlog of Orders 43.9 45.1 -1.2 Contracting Faster 6 New Export Orders 47.6 49.9 -2.3 Contracting Faster 8 Imports 47.9 49.9 -2.0 Contracting Faster 5 Overall Economy Contracting Faster 4 Manufacturing Sector Contracting Faster 5

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies). *Number of months moving in current direction. Manufacturing ISM® Report On Business® data has been seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

Note: To view the full report, visit the ISM ® Report On Business® website at ismrob.org The number of consecutive months the commodity has been listed is indicated after each item. *Reported as both up and down in price.

reportonbusiness

ISM® Report On Business®

New Orders

March 2023

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s New Orders Index contracted for the seventh consecutive month in March, registering 44.3 percent. The five manufacturing industries that reported growth in new orders in March are: Printing & Related Support Activities; Miscellaneous Manufacturing‡; Primary Metals; Petroleum & Coal Products; and Fabricated Metal Products.

The Production Index registered 47.8 percent. The eight industries reporting growth in production during the month of March are, in order: Printing & Related Support Activities; Fabricated Metal Products; Miscellaneous Manufacturing‡; Electrical Equipment, Appliances & Components; Primary Metals; Food, Beverage & Tobacco Products; Transportation Equipment; and Machinery.

Employment

ISM’s Employment Index registered 46.9 percent. Of 18 manufacturing industries, six reported employment growth in March, in the following order: Printing & Related Support Activities; Primary Metals; Machinery; Fabricated Metal Products; Transportation Equipment; and Miscellaneous Manufacturing‡

Supplier Deliveries

The delivery performance of suppliers to manufacturing organizations was faster for a sixth straight month in March, as the Supplier Deliveries Index registered 44.8 percent. Two of 18 manufacturing industries reported slower supplier deliveries in March: Petroleum & Coal Products; and Miscellaneous Manufacturing‡.

Inventories

The Inventories Index registered 47.5 percent. Of 18 manufacturing industries, the seven reporting higher inventories in March — in the following order — are: Printing & Related Support Activities; Textile Mills; Nonmetallic Mineral Products; Paper Products; Electrical Equipment, Appliances & Components; Machinery; and Computer & Electronic Products.

18 Manufacturing Outlook /April 2023 ISM REPORT OUTLOOK continued

Manufacturing PMI®

New Orders (Manufacturing) 52.7% = Census Bureau Mfg. Breakeven Line 2023 20 2022 2021 44.3%

Employment (Manufacturing) 50.4% = B.L.S. Mfg. Employment Breakeven Line 2023 2022 2021 46.9% 20 Supplier Deliveries (Manufacturing) 2023 80 2022 2021 53.1% 44.8% Inventories (Manufacturing) 44.4% = B.E.A. Overall Mfg. Inventories Breakeven Line 2023 2022 2021 47.5% Production (Manufacturing) 52.2% = Federal Reserve Board Industrial Production Breakeven Line 2023 2022 2021 47.8% 70 Production

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

ISM® Report On Business®

Customers’ Inventories

March 2023

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey Committee

ISM’s Customers’ Inventories Index registered 48.9 percent in March, 2 percentage points higher than the 46.9 percent reported for February. Five industries reported customers’ inventories as too high in March: Paper Products; Electrical Equipment, Appliances & Components; Furniture & Related Products; Plastics & Rubber Products; and Computer & Electronic Products.

Prices (Manufacturing)

Prices

The ISM Prices Index registered 49.2 percent. In March, eight industries — in the following order — reported paying increased prices for raw materials: Machinery; Plastics & Rubber Products; Transportation Equipment; Fabricated Metal Products; Nonmetallic Mineral Products; Primary Metals; Electrical Equipment, Appliances & Components; and Miscellaneous Manufacturing‡

Backlog of Orders

ISM’s Backlog of Orders Index registered 43.9 percent in March, a 1.2-percentage point decrease compared to February’s reading of 45.1 percent, indicating order backlogs contracted for the sixth consecutive month after a 27-month period of expansion. Two industries reported growth in order backlogs in March: Textile Mills; and Food, Beverage & Tobacco Products.

New Export Orders

ISM’s New Export Orders Index registered 47.6 percent. Four industries reported growth in new export orders in March: Printing & Related Support Activities; Textile Mills; Paper Products; and Miscellaneous Manufacturing‡

Imports

ISM’s Imports Index registered 47.9 percent in March, a decrease of 2 percentage points compared to February’s figure of 49.9 percent. The four industries reporting an increase in import volumes in March are: Textile Mills; Petroleum & Coal Products; Miscellaneous Manufacturing‡; and Food, Beverage & Tobacco Products.

19 Manufacturing Outlook /April 2023 ISM REPORT OUTLOOK

Manufacturing PMI®

Customer Inventories (Manufacturing) 2023 2022 2021 48.9% Backlog of Orders (Manufacturing) 2023 2022 2021 43.9% New Export Orders (Manufacturing) 2023 2022 2021 47.6 % Imports (Manufacturing) 2023 2022 2021 47.9%

52.9% = B.L.S. Producer Prices Index for Intermediate Materials Breakeven Line 2023 2022 2021 49.2%

‡Miscellaneous Manufacturing (products such as medical equipment and supplies, jewelry, sporting goods, toys and office supplies).

n

NORTH AMERICA OUTLOOK

by Dr. Chris Kuehl

by Dr. Chris Kuehl

A few days ago, I might have written about some geopolitical shift or speculated on the rate of inflation, but then the banking system blew up, and suddenly people are competing to determine how panic-stricken they should be. There are pundits proclaiming the arrival of another “black swan” event and others comparing this to the 2008 meltdown.

What do we really know now?

Recognize that this piece is being written in the midst of all this, and the story will doubtless change.

This essentially started at the point the Federal Reserve began to hike rates. It is clear they had no choice if they wanted to have an impact on inflation numbers that reached twenty-year highs. But there was no doubt this set

of moves would reverberate through the economy. It essentially meant the era of easy money was at an end, and that had major implications for the bond market. Banks (and other institutions) had been using bonds as their anchor. Now they were sitting on bonds that would sell at a discount while they would have to buy bonds that would be more expensive, and that affected their stability. Silicon Valley Bank was particularly vulnerable, but as we have seen, they are certainly not alone.

failure rate and are often shunned by other banks. The tech sector has been getting hit lately, and that added to the problem. SVB loaded up on long term bonds when asset prices were high and interest rates were low. Then the Fed started aggressively hiking rates, and bond prices plunged. Banks were left with huge losses as there is no requirement for banks to cover these unrecognized losses. The fact is there is $620 billion in unrecognized losses in the system, and that is over a third of the total capital cushion of banks. Fortunately, the majority of banks are not as close to the edge as SVB and some others.

We have seen Signature Bank and Republic Bank in deep trouble, and the investment community has slammed most of the major banks out of concern over their bond position. SVB was troubled for years as it specialized in high-risk lending to tech start-ups. These are companies that have a 98% continued

The government has stepped in quickly to shore up these banks and protect depositors, but this carries a risk as well. The moves are designed to

20 Manufacturing Outlook /April 2023 NORTH AMERICA OUTLOOK

APRIL 2023

The Elephant in the Room

protect both the insured and uninsured depositors, and that begs the question –why bother with the distinction at all. There are major companies that are just assuming they will be covered and essentially abuse the system. Remember all that cash that was pumped into the system during the pandemic? There was at one time some 7 billion in excess savings and there is still $3.5 billion out there. Much of that became deposits at banks, and these banks bought a lot of “safe” longterm bonds and government-backed mortgage backed securities.

These unrecognised losses are not a big issue until and unless the banks need to handle depositor demands. This could be depositors deciding to bolt from the bank in a bank run, or it could simply be people seeking higher returns on their deposits. The big banks can offer more, and the smaller banks struggle to maintain the depositor base to cover their bond position.

It cascades fast and that is what prompted the quick series of bailouts. The financial system quickly started to stabilize, but long term risk just increased. The banks have basically become “wards of the state” as they will be rescued regardless of their

mistakes and miscalculations, and that rewards high-risk behavior as there are limited consequences. In the immediate future, there is very likely to be a shift in the position of the Fed and other central banks. The betting now is that interest rates could come down as early as this summer. Good news for some but it also means less pressure on inflation.

Does all of this mean a heightened risk for recession – especially in the manufacturing community? Not necessarily. As serious as this is, the crisis is restricted to the financial sector for the most part, and as the weeks have progressed, the bailout plans have indeed calmed the market to a degree. UBS purchased Credit Suisse with the support of the Swiss government; SVB eventually found a buyer in First Citizen’s Bank, and the other troubled banks are getting support from the heavyweights in the banking community. The impact on the rest of the economy will be felt as loan standards tighten. That process was already underway, and this accelerates it. That could be somewhat good news for manufacturers as banks are more enthusiastic about loans for the purchase of something tangible and expensive (like machinery).

The U.S. is still expected to see growth in the first quarter of around 2.0% to 2.5% - at least according to the GDP

Now projections from the Atlanta Fed. The major concerns as far as the year is concerned include the ongoing issue of labor shortage and the impact that has had on wages, as well as the issue of overstocking. In reaction to the supply chain crisis, there was an intense increase in inventory, and now 75% of companies are reporting they are overstocked. This will upset the usual replenishment cycle until at least the end of the second quarter and perhaps beyond.

Thus far, Canada and Mexico have been unaffected by the bank crisis, although both of the central banks in these nations have started to back down when it comes to advocating higher interest rates. Canada is still expected to see growth between 1.0% and 1.5% for the coming year and slightly higher in 2024. Mexico will likely see growth closer to 3.0% based on expansion of nearshoring. These investments are at the highest level on record, with 45% of them new projects. The FDI pace in Mexico has been driven by companies abandoning China but still in need of lower labor costs.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the co-founders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division – Finance, and Credit.

21 Manufacturing Outlook /April 2023 NORTH AMERICA OUTLOOK

APRIL

SOUTH AMERICA OUTLOOK

by Royce Lowe

by Royce Lowe

Bolivia’s Lithium Dilemma

Bolivia, a very poor country of some 12 million people in the high Andes, is currently in the midst of financial chaos, with its citizens lining up to try to exchange their currency for U.S. dollars. But maybe help is on the way, through exploitation of the country’s lithium reserves. Which, according to the U.S. Geological Survey, are, at 21 million tons, the world’s largest. In 2021, Yacimientos de Litios Boliviano (YLB), the state mining company, started soliciting proposals to mine Bolivia’s lithium using direct lithium extraction (DLE), a set of technologies that use sorbents, membranes, or other materials to chemically remove lithium from salty brines. It received submissions from companies in Argentina, China, Russia, and the U.S.

The so-called lithium triangle in South America, Argentina, Chile, and Bolivia, represents some two-thirds of global lithium resources as salt flats. To date, there has not been too much extraction from the Bolivian sector, but president Luis Arce is upbeat, and says there is no time to lose. YLB has announced that it will move forward with a Chinese group that includes the battery company Contemporary Amperex Technology Co. Ltd. (CATL), CATL’s recycling subsidiary BRUNP, and the mining company CMOC (CBC), Arce has no choice but to remain upbeat. The aim is to construct two DLE plants, each capable of producing 25,000 tons of lithium carbonate annually, mainly for use in electric vehicle batteries.

Bolivia first declared its intent to industrialize its lithium shortly after former president Evo Morales led the Movimiento al Socialismo (Mas) to power in 2006. The Mas has governed for all but one year since, including the current administration. Throughout, the Mas has insisted on sovereign control of Bolivia’s lithium, with the state trying to develop it alone, or with limited input from foreign companies.

The typical method to extract lithium involves pumping brine into ponds and processing the lithium salts that crystallize once the water has evaporated. The Bolivian state has invested roughly $800m in this method, with a grid of ponds and

22 Manufacturing Outlook /April 2023

SOUTH AMERICA OUTLOOK

2022

continued

an unfinished plant that it says will begin producing 15,000 tons of lithium carbonate per annum starting this year. But this method, which works well enough in the salt flats of neighboring Chile and Argentina, is less well suited to Bolivia, where the brine has high levels of impurities and the salt flats have a rainy season of several months. YLB has admitted to relatively poor results.

Hence the change in YLB’s strategy and their aforementioned call for proposals from foreign companies to develop the new “DLE” technologies that can pull lithium straight from brine, potentially without the need for solar evaporation. The deal further locks in Chinese dominance of the battery industry and its supply chains. Just two Chinese companies, CATL and BYD, produce more than half the world’s batteries. And some 60% of the world’s lithium is processed in China. There may yet be more deals to come. The Bolivian government said it was still negotiating with five other companies from China, Russia and the U.S.

The plan brings up questions about the nature of the investment, how the project will be managed and how the earnings will be divided between the consortium and the various levels of Bolivia’s government. Even those in favor of pressing on to battery production are skeptical about the 2025 deadline. Héctor Córdova, the former president of Bolivia’s state mining company, said that the reality of the country shows that this dream is impossible. He goes on to say that Bolivia lacks the basic industry, has insufficient qualified personnel, and has no plan for industrial development in such a short space of time. Maybe he’s just inviting China to provide the financing and the qualified personnel to make sure the plan succeeds.

What’s On Lula’s Plate?

Brazil’s recently elected president, Luiz Inacio Lula de Silva (known as Lula), is no stranger to the ups and downs of his country’s economy. This is his second shot, after nursing Brazil through good times from 2002 to 2010, when his term saw increases in Brazilian incomes, soaring demand for its commodities, and a hefty drop in unemployment, poverty, and government debt.

The second time around promises to be hard work. He finds the economy, and the country, in somewhat of a mess, sorely needing investment in its infrastructure, and spending on education to train Brazilian workers for better jobs, and to make up for lost learning from the recent pandemic. The pandemic brought almost a million deaths, and an increase in poverty.

Many economists are sending out warnings of a possible global recession. Weak global growth, falling commodity prices, and rising interest rates would not be good for Brazil. But the global economy is looking in better shape than it was just a few months ago, with inflation on the decrease. Commodity prices have fallen from the levels seen following Russia’s invasion of Ukraine, but are still well above pre-pandemic levels.

Brazil’s inflation rate has halved over the past few months, from 12% to 5.8% recently. But Brazil’s economy is forecast to grow by just 1% in 2023. And who knows what might happen to the global economy in the near future? And there are also Bolsonaro’s supporters waiting in the wings.

Lula recently visited President Biden, his first outside visit while in office. They discussed world affairs, jointly condemned Russia’s invasion of Ukraine, and also discussed their interest in intensifying bilateral cooperation in areas such as trade and investment, energy, health, science, technology and innovation, defense, education and culture, and consular affairs, through a results-oriented approach that benefits both societies. Biden was invited to visit Brazil, which he agreed to do.

China is, of course, actively involved in Brazil but as yet trails the U.S. in trade with the country. Brazil’s infrastructure requirements, however, will surely let China in for a big slice of the investment pie. It is most probable that we can look forward to an increased U.S. presence in Brazil, with an accompanying Chinese one.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

23 Manufacturing Outlook /April 2023

SOUTH AMERICA OUTLOOK

AFRICA OUTLOOK

by Royce Lowe Blackouts; South Africa’s Huge Problem

by Royce Lowe Blackouts; South Africa’s Huge Problem

South Africa has suffered for many years from what are known as rolling blackouts. This has been going on since 2008. The more prolonged power outages that have dogged South Africa for months on end have been hard to endure. The problem: Eskom Holdings SOC Ltd., the debt-stricken state utility that supplies more than 90% of the nation’s electricity, can’t keep pace with demand from its old and poorly maintained plants.

With the governing party in danger of losing its majority in 2024 elections, President Cyril Ramaphosa has declared a national “state of disaster,” allowing his administration to bypass bureaucratic hurdles so it can accelerate new energy projects. The government intends to give Eskom 254 billion rand ($13.9 billion) in debt relief to free up funds for repairs and improving the transmission and distribution system.

Eskom has a history of deep financial losses and poor planning. Allegations of mismanagement and corruption have plagued the utility. It ran into financial trouble in the early 1980s after committing to build plants that weren’t needed. Then, when White minority rule of South Africa ended in 1994, the company wasn’t prepared for the sharp increase in demand as previously neglected areas were connected to the grid. Over the following two decades, Eskom suffered from erratic government decision-making and political interference. A lack of generating capacity led to regular power supply disruptions.

The company has had 14 leaders since 2007, much of that turnover coming during the nine-year tenure of South African President Jacob Zuma. A judicial commission found the upheaval at Eskom was an

orchestrated attempt by Zuma’s allies to raid its coffers with his tacit consent. Zuma denies the charge. Eskom’s leaders have said the company hasn’t been permitted to charge adequate prices to meet its costs. Imagine the most economically prominent on the continent of Africa suffering frequent, devastating power outages, the result of a process known as loadshedding. In other words, forced power cuts.

Intentional outages imposed by Eskom to reduce demand, often lasting many hours, have affected water services (since pumps can’t run without power), food safety (since refrigerators can’t stay cold), and the ability of hospitals to provide care. The blackouts are sapping business confidence in a country whose biggest industries, such as mining, depend on reliable access to cheap electricity. The central bank estimated that the crisis was costing the economy as much as 899 million

24 Manufacturing Outlook /April 2023 AFRICA OUTLOOK continued

APRIL 2023

THE FLAGSHIP REPORTS

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to provide more than 95% accurate near-term forecasts.

rand, or approximately $48 million, a day. In addition to all this, four-fifths of South Africa’s power is generated by coal.

South Africa has an abundance of coal, and 90,000 people are employed at mines that feed Eskom power stations via conveyor belts. After its founding in 1923, Eskom rapidly built coal-fired plants, spurred by the needs of its gold mining industry, the world’s largest. In the 1970s, it began building a new fleet of power stations that operate to this day, along with the only nuclear plant on the African continent. Plans were announced in 2007 to build two giant new coal-fired plants, Medupi and Kusile, that were scheduled to be completed within eight years at a total cost of 163 billion rand. However,

construction has been plagued by labor unrest, mismanagement, and equipment defects. The likely final price tag is over 460 billion rand.

A plan was unveiled this past February, a relief package, conditional on Eskom bringing in private partners to help operate its plants and transmission network. The government is also making it easier for the utility’s rivals to build their own power stations by scrapping licensing requirements.

They’ll be allowed to sell their surplus output to the grid, while households and businesses that install their own solar panels will get tax breaks. Ramaphosa intends to appoint a new minister in his office who will focus solely on bolstering the electricity supply. One

challenge: The governing party, the African National Congress, is wary of disrupting the coal industry, not least because mineworkers are a key voting constituency.

South Africa’s National Treasury predicted the economy would expand by just 0.9% in 2023, down from 2.5% in 2022, and expects power rationing to persist until at least the end of 2024.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

25 Manufacturing Outlook /April 2023 AFRICA OUTLOOK

*Toll free within the U.S. * ISO9001:2015 SINCE 1994 AND AS9100D SINCE 1998 NIST SP 800-171 (COMPLIANCE UNDER DEVELOPMENT)

EUROZONE GLOBAL OUTLOOK

by Chris Anderson

by Chris Anderson

Strength and Growth Continue

Eurozone economic growth rose to a ten-month high in March, adding to signs that the economy is reviving after falling into decline late last year. Inflationary pressures have continued to moderate with input prices falling sharply in manufacturing. Jobs growth has also accelerated, and business confidence in the outlook has remained resilient. However, the overall rate of growth remains modest and is driven solely by the service sector, with manufacturing suffering a further loss of new orders, meaning current output is only being sustained via backlogs of previously placed orders.

Recession fears and energy market fears are fading. There are record improvements to supplier delivery times. Here are the Eurozone figures:

• Composite, 54.1 vs 52.0

February, 10-month high

• Services PMI, 55.6 vs 52.7

February, 10-month high

• Manufacturing output index, 49.9 vs 50.1 February, 2-month low

• Manufacturing PMI, 47.1 vs 48.5

February, 4-month low.

France and Germany both showed good performance on the services side, but Germany’s manufacturing performance was at an almost three-year low. Let it be said that expectations in the manufacturing sector remain low at the present time.

• France, flash composite, 54.0 vs 51.7 February; 10-month high

• France flash services PMI, 55.5 vs 53.1 February; 10-month high

• France, flash manufacturing output index, 46.9 vs 45.0 February; 2-month high

• France, flash manufacturing PMI, 47.9 vs 50.5 January; 4-month low

• Germany, flash composite, 52.6 vs 50.7 February; 10-month high

• Germany, flash services PMI, 53.9 vs 50.9 February; 10-month high

• Germany, flash manufacturing output index; 50.1 vs 50.2 February, 2-month low

• Germany, flash manufacturing PMI, 44.4 vs 46.3 February, 34-month low.

The rest of the major countries in the Eurozone performed better, and were, in large part responsible for the hikes in the indexes. The West European car market reached 797,330 units, while sales in the first two months exceeded 1.6 million units, some 10.5% ahead of last year’s pace.n

27 Manufacturing Outlook /April 2023

EUROZONE OUTLOOK

APRIL 2023

ASIA OUTLOOK

by Christine Casati

U.S. SOLAR MANUFACTURING RENAISSANCE NEEDS CHINA AND SOUTHEAST ASIA

THE GLOBAL BIG PICTURE: Solar power generation is on track to surpass all other energy sources by 2027, according to Myles McCormick of the Financial Times (2/27/23). Photovoltaic (PV) capacity is expected to ‘leapfrog’ hydropower by 2024.

Within three years, it will overtake combined gas-fired generation. And by 2027, solar energy is predicted to “push past coal” to provide the largest share of power generation capacity of any other energy source. (Side Note: In March, Governor Jim Justice of

West Virginia put his family coal mining business up for sale). The main drivers of this seismic shift in electricity generation over the next five years are renewable green energy policymaking and the lower lifetime cost of one megawatt-hour (MWh): continued

28 Manufacturing Outlook /April 2023

ASIA OUTLOOK

Solar: $36; Wind: $38; Combined Gas: $60; Coal: $108. (Source: International Energy Agency).

While government subsidies and long-term tax breaks are speeding up action for solar buildouts in Europe, India, Australia, and the U.S., among others, China is still the world leader in already commissioned solar power generation and in the production of supply line components and storage, not just modules and cells. The construction and installation of an entire solar power project, from ground-breaking to commissioning, is complex, whether for residential or utility power (on-grid, off-grid, hybrid, commercial, and ground-mounted solar plants). It involves a wide-ranging manufacturing supply chain of large volumes of diverse raw materials and components, with delivery required in a relatively short period of time. It will take the U.S. at least five years to build out its solar transformation bases and decrease reliance on imports.

Tackling The Solar Supply Chain Requirements

Buildouts for raw material processing and everything that goes into solar and storage manufacturing equipment are needed. A condensed list includes quarries, quartz crystal plants, silicon metal furnaces, wafers, ingots, polysilicon, modules, cells, glass, manufacturing equipment, inverters and microinverters, batteries, battery cells, battery packs, copper foil, cathode active materials, cathode and anode materials, and packaging materials. The passage of the Biden Administration’s Inflation Reduction Act (IRA) has provided billions in investment incentives and tax credits to support and accelerate the U.S. solar buildout. One example is Enphase, a California-based clean energy hardware pioneer which will produce millions of solar microin-

verters by late this year, thanks to tax credits under the IRA.

In large part, propelled by these incentives, there are currently 6100 projects throughout the supply chain in the works, according to SEIA (Solar Energy Industries Association, White Paper March 8, 2023). That includes those currently in operation and those in planning or already under construction. Generation capacity totals 185 GWdc. SEIA’s stated goal through these and more new projects is to achieve 30% of U.S. electricity generation by 2030 while building a resilient and equitable solar and storage manufacturing platform. They claim this would generate $100 billion in annual economic investment and over 1 million jobs while reducing carbon emissions by a whopping 700 million tons.

U.S. Solar and Storage Manufacturing Buildout Workforce

Manufacturing jobs are known for creating a multiplier effect in the economy. The SEIA has estimated that the ongoing solar transformation buildout will provide 115,000 family-sustaining jobs by 2030, with a multiplier effect throughout the economy of over 500,000 jobs. These jobs include sales and purchasing,

logistics, accounting, human sources, packaging, warehousing, etc., across the entire industry.

Reliance on Imports

While U.S. domestic cell manufacturers are being built and domestic sources of ingot and wafers are being developed, U.S. solar module manufacturers must rely on imported cells and imported ingot and wafers. The highest concentration of polysilicon is produced in China. We have to source there. There is a risk of price spikes due to occasional power shortages. There are many other components in the solar supply chain mentioned above that can be readily sourced in China at a low cost. The bottom line is we need China to fuel our solar renaissance in the near term.

Constraints on Solar Manufacturing Transformation

In spite of current renewable energy support in the IRA, policy-driven supply constraints and disruptions led to major reductions in solar installations in 2022. The U.S. added only 20.2 gigawatts (GW) of new solar capacity in 2022, down 16% from 2021. This was caused mainly by the investigation conducted by the Department of Commerce due to complaints by some U.S. solar panel manufacturers continued

29 Manufacturing Outlook /April 2023

ASIA OUTLOOK

that China was circumventing solar-related tariffs by locating factories in Malaysia, Vietnam, Cambodia, and Thailand, where many U.S. solar investors were sourcing components, as well as by U.S. Customs and Border Protection detaining equipment shipments for U.S. projects under the Uyghur Forced Labor Prevention Act.

The Biden administration stepped in and allowed the solar project materials already planned or ordered from Southeast Asian suppliers to be imported free of tariffs for another two years to allow projects to move forward. Yet many projects have been caught in the crosshairs, and some investors have delayed or withdrawn their investments entirely until the supply chain becomes more transparent. There is the additional concern that Republicans who now control the House of Representatives will try to use the CRA (Congressional Resolution Act) to reverse Biden’s renewable energy climate initiatives

and reinstate tariffs. This could be a further blow to urgently needed solar manufacturing acceleration provided for under the IRA.

There are also recent hiccups in the tech banking sector that may profoundly affect some scheduled solar power projects. The fallout from the receivership of SVB (Silicon Valley Bank) revealed that SVB had carved out a niche for lending to community clean energy projects to the tune of $1.2 billion in 2022. The Wall Street Journal reported on 3/15/23 that the solar clients of SVB included the residential solar company Sunrun, the battery storage buildout company STEM, and the fuel cell manufacturer Bloom Energy. At the time, their stocks plummeted 7-10%. Sunrun stated that their $40 million loan for drawdowns could easily be replaced, as they are well connected to other banking groups.

It is true that for U.S. economic security, we need to pivot away from overreliance on China as well as other less mature offshoot suppliers in Southeast Asia, which may pose a greater risk of supply chain disruptions due to nation-related infrastructure issues, lack of digital transformation, or geopolitics. But it will take years for the U.S. and our allies to develop both the workforce and the component and storage manufacturing capability required to complete our solar buildout transformation to the level we could achieve. We must be realistic about our near-term needs for collaboration with China and Southeast Asia. They are way ahead in the game. They can help us leapfrog.

Author profile: Christine is cofounder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986. n

30 Manufacturing Outlook /April 2023

ASIA OUTLOOK

31 Manufacturing Outlook /April 2023 ASIA OUTLOOK

AEROSPACE OUTLOOK

by Royce Lowe

Boeing and Saudis and 787s

Boeing said recently that it has reached a deal to sell 78 of its 787 Dreamliner planes to two Saudi airlines, the latest large order for the wide-body jets in the past few months. The jetliners will go to Saudi Arabian Airlines, or Saudia, and a new airline, Riyadh Air, recently announced by Crown Prince Mohammed bin Salman. Saudia ordered 39 of the planes, with options for 10 more, and Riyadh Air will get 39 of the two largest models of the planes, with options for 33 more.

The Saudi purchase caps sales of almost 200 Dreamliners over the past four months, giving Boeing major industrial and political wins in lucrative wide-body sales against European rival Airbus. Boeing did not disclose a delivery schedule for

the planes. The White House said the order is worth almost $37 billion, although that figure does not take into account the discounts that airlines usually receive for such large orders.

Riyadh Air is owned by the country’s sovereign wealth fund and will be led by Tony Douglas as CEO, a longtime industry veteran, and former CEO of Etihad Airways. Douglas spoke of the ambition in the Kingdom and of the certainty of the placing of further orders. He said the order will help Saudi Arabia connect to 100 destinations.

In December, United Airlines agreed to buy at least 100 Dreamliners from Boeing, and Air India recently placed an order for 460 Boeing and Airbus planes.

Boeing was recently set to resume deliveries of the Dreamliner after a weeks-long pause resulting from a data analysis issue it disclosed last month. CEO Dave Calhoun recently said that the delivery resumption was “imminent.” Following resumption of deliveries to fulfill existing orders, Boeing will now face the difficult task of producing and delivering those 787s in a time of unprecedented supply chain pressures, analysts said.

The recent orders fill out Boeing’s backlog at a time when the company aims to boost 787 production to 10 a month by 2026 – a target that would take “supersonic” growth given that Boeing is still working to increase production back to three a month, said highly-rated Vertical Research analyst Robert Stallard. He says it’s fine and

32 Manufacturing Outlook /April 2023 AEROSPACE OUTLOOK continued

2023

APRIL

dandy to have the orders, but it’s not a question of demand, but rather of supply. “They’ve got to go out and actually make the aircraft.”

The 787 faces multiple strains on its supply chain, several shared broadly across the aviation industry, such as forgings and castings for engines. Planemakers are also grappling with the after-effects of the pandemic, which forced waves of layoffs and retirements of skilled workers.

The Dreamliner, however, has faced several unique challenges, some of which slipped by Quality Control. There were also cases where materials supplied by sub-contractors were suspect. There was a year-long delivery pause due to production quality problems that were resolved last August.

In February, Boeing’s chief financial officer, Brian West, said the planemaker had to lower 787 production from three aircraft a month due to slower fuselage production at Spirit Aerosystems. The company also confirmed last month that it would need to replace a non-compliant component before delivering certain 787s.

The Saudi deal, in particular, was seen as a blow for Airbus, which just months ago had been expected to land part of the order. Negotiations ebbed back and forth over the past year, echoing a volatile period in U.S.-Saudi relations. Last October, sources said Airbus may win an order for 40 of its A350

jets after Washington said it was reviewing options for Saudi relations in a dispute over oil output levels. Since then, diplomats and regional experts have said the United States and Saudi Arabia are trying to move beyond last year’s low point in ties, as security concerns align over the threat from Iranian drones.

Both Washington and Paris weighed in with lobbying, with Riyadh’s final decision taken at the highest level, according to “two people familiar with the negotiations.” One European source called the outcome of the plane order “totally political,” but a U.S. official denied there had been any diplomatic trade-offs. “Saudi Airlines is a governmentowned airline, and so there are politics involved with this,” analyst Stallard said. “I wouldn’t rule out buying from Airbus if the Saudi government thinks it’s in their best interest to do some things with the Europeans in the future.”

The quality glitches that Boeing went through with the 787, plus the infamous 737 MAX saga, and Boeing’s relations with the FAA, means that the company will have to maintain a spotless quality standard on orders of this magnitude.

33 Manufacturing Outlook /April 2023 AEROSPACE OUTLOOK

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

APRIL 2023

ENERGY OUTLOOK

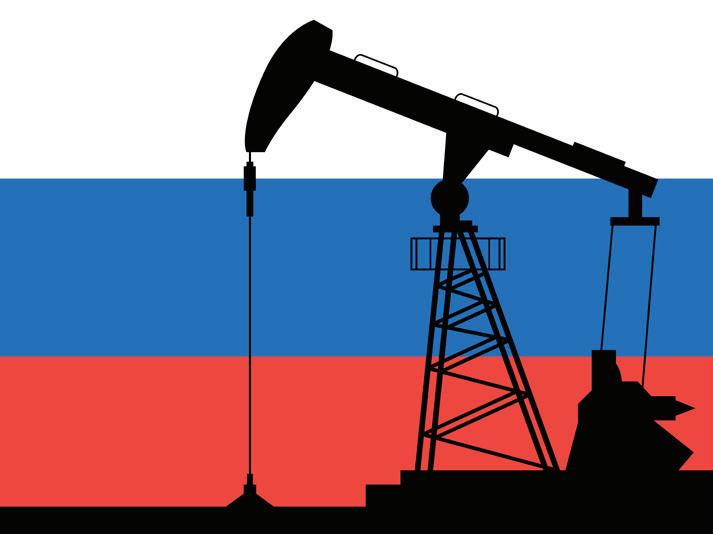

The World and Russian Oil and Gas

by Royce Lowe

by Royce Lowe

relationship evaporated in February 2022 as Russian troops entered eastern Donbas.

monopoly, crippling Gazprom’s ability to develop its fields. And the UK’s BP said it would pull out of a $14bn stake in Rosneft, Russia’s state oil giant.

Germany had nurtured the Nordstream 2 pipelines for 15 years against United States objections but said it was halting the process of certifying them for commercial use. Russia’s full invasion of Ukraine prompted Dutch oil major Shell to withdraw from joint projects worth $3bn with Gazprom, the Russian gas

The energy levers that Russian President Vladimir Putin would use to mute Europe’s response to his invasion were broken. “When Russia attacked Ukraine, one working hypothesis was that Europe would be divided by energy blackmail,” Greek Foreign Minister Nikos Dendias told reporters

Before its invasion of Ukraine, Russia was Europe’s chief energy source. Moscow has waged an energy war against the European Union over the past year, but the bloc appears to be holding firm. It supplied 29 percent of the European Union’s oil imports and 43 percent of its gas imports. Moscow was on the cusp of activating the twin Nordstream 2 pipelines, which would have increased its gas exports to the EU by a third, but this continued

34 Manufacturing Outlook /April 2023 ENERGY OUTLOOK

on the anniversary of the Donbas invasion. “This hypothesis was completely inaccurate. The EU gained a new unifying narrative, and the support to Ukraine is steady, lasting, and increasing,” Dendias said.

According to Sir Michael Leigh - the former director-general for enlargement at the European Commission, - on the European Union side, there is now a “real determination to reduce drastically dependence” on Russian oil and gas. In 2020, during the coronavirus pandemic recession, the EU raised 270 billion euros ($287bn) to fund renewable energy. After Russia’s invasion, it stiffened its ambition, setting a goal to generate 45 percent of total final energy consumption from renewables. Several EU governments set even more ambitious goals. Recent analysis by Ember, an energy think-tank, suggests Europeans have moved even faster than their governments. Ember estimates that electricity from solar photovoltaics and wind reached a record 22 percent of the mix in the EU last year, a one-fifth increase on 2021, with two-thirds of the increase in solar energy coming from rooftop photovoltaics, not power plants.

“The energy transition in Europe is not from the top down – what we’re seeing is it’s bottom up,” Dave Jones, head of electricity insights at Ember, stated. “Individuals are interested in producing their own energy and doing their bit for the energy crisis to defy Russia as an aggressor and a threat to Europe,” he said. “If people want to step up, they can act outside of policy,” said Jones, who believes solar and wind will leap ahead by another fifth this year, and possibly outperform EU 2030 targets. Renewable energy has obvious attractions for Europe, which is poor in hydrocarbons. Apart from being clean, it on-shores energy

production is at near-constant prices. An export tracker by the think tank Bruegel shows that Russian sales of mineral fuels to the 27 EU countries progressively fell last year from $18bn a month to $8bn in December 2022. They are set to fall further.