ISO9001:2015 SINCE 1994 AND AS9100D SINCE 1998

NIST SP 800-171 (COMPLIANCE UNDER DEVELOPMENT)

ISO9001:2015 SINCE 1994 AND AS9100D SINCE 1998

NIST SP 800-171 (COMPLIANCE UNDER DEVELOPMENT)

By now, most of us have heard from various Fortune Tellers (often called economists, analysts, think tanks, investment bankers, politicians, media pundits, and so on) about the 2023 economy, with prognostications ranging from dire warnings of an economic collapse to the soft landing recession scenario. No one really knows, but many try to forecast based on all the moving variables that comprise the U.S. economy. Our reading is a bit more optimistic. Although the crystal ball is cloudy, January and February are absolutely clear – the economy, for most sectors, was softer yet encouraging for March and April.

Looking forward, we see some bumpiness for manufacturing, possibly through the third quarter, followed by more favorable economic conditions – unless – the Fed pushes rates too high, or some black swan event occurs somewhere in the world that creates a global rogue wave, perhaps from Eastern Europe or Taiwan. As we move through March, the factors that typically signal a recession are not present. The most significant one would be rising unemployment, but while there have been some layoffs in the Tech sector, there are still over 700,000 open jobs in manufacturing and millions in the Services sectors. Manufacturing resists laying off skilled workers that were so hard to find.

U.S. consumers haven’t run out of spending steam yet, despite rising prices in food, and moderately higher fuel costs, both for home heating and gasoline. The harsh winter that would have created an advantage for Russia as Europe’s leading natural gas supplier wasn’t brutal, allowing European businesses and consumers to maintain solid import demand for U.S. goods and services. The closures of cities or provinces in China that disrupted supply chains created new demand for Made in the USA goods, resulting in capital expenditures for new U.S. factories, and updated equipment for greater capacity, with the vexing problem of staffing that is keeping wage rates high amid competitive demand for skilled workers. The pandemic, seemingly subsiding after spinning the world on its head, also seems to have thrown the usual variables forecasters use to predict economic twists and turns into the fan.

As a forward-looking, forward-thinking resource for the manufacturing industry, Manufacturing Outlook has remained a bit steadier, with less emphasis on the OMG scenarios and more focus on the facts. This is reflected in each of the Outlook sections within the publication. From our perspective, the cloudy crystal ball foretells fair skies ahead for 2023. Then, of course, the political season begins in 2024, which tends to upset the mood of the country as competing politicians attack each other to vie for higher office, but that is a story for later this year if it impacts manufacturing pro or con.

One exciting development to watch will be the supply of computer chips as more foundry and finish capacity come online. America, and much of the world, has adjusted to working remotely, so at the moment, there seems to be a bit of a glut of chips for personal computers and hand-held devices as demand wanes in a cooling market. That will move automotive back to the front of the line with their chip orders over the coming months, and the inventory of vehicles with all the digital bells and whistles will begin to expand on dealer lots.

Keep an eye on lithium, a key component for EV batteries. There will be worldwide competition for sources of supply, and EV manufacturing may hit some constraints as production demand eats into lithium availability. The black swan in this scenario? A technological development in battery storage and efficiency that diminishes or displaces the need for lithium, and possibly for some rare earths, as well. With China controlling 80% of rare earths, and operating as the biggest competitor and consumer of lithium, some technological innovation in batteries will be a good thing.

Get your FREE subscription to Manufacturing Outlook to stay ahead of the curve with the only publication focused on forward-looking, forward-thinking information for manufacturing. n

Lewis A. Weiss, PublisherContact laweiss@mfgtalkradio.com for comments, suggestions and ideas and guest requests for MFGTALKRADIO.COM podcast or any of our podcasts.

THE GLOBAL MANUFACTURING DOWNTURN CONTINUES BUT AT A SLOWER PACE. ENCOURAGING NEWS FROM EUROPE.

SERVICES OUTPERFORMING MANUFACTURING IN THE U.S.

By: Royce LoweFigures recently published by the Bureau of Economic Analysis, as its second estimate, show that the U.S. GDP for the last quarter of 2022 was at 2.7%. Recent International Monetary Fund (IMF) figures forecast growth in the U.S. for 2023 at 1.4%, and the Euro area at 0.7%. Emerging nations will grow by 4% in 2023, and 4.2% in 2024, (China at 5.2% in 2023). India, together with China, is forecast to account for half of global growth in 2023, versus a tenth for the U.S. and Euro area combined.

China and the U.S. are at or nearing zero population growth which often reveals a country in decline because it cannot grow its employment base for the foreseeable future. India’s population is expanding. There is some growing concern in nations with high COVID vaccination rates that the vaccine has interfered with male and female fertility, which may slow population growth globally and inhibit economic expansion in developed and developing nations.

The U.S. inflation rate is 6.4% for the 12 months ended January 2023 after rising 6.5% previously, according to February U.S. Labor Department data. Things are so “near the edge” that pinpointing the inflation rate stretches the capabilities of those who try to pinpoint it.

The future for manufacturing, based on data from ASIS, the Armada Strategic Intelligence System, suggests that primary metals and fabricated

metals are still looking at a slight downturn on the back of sluggish demand. This is somewhat reflected in recent drops in non-ferrous metal prices over the month of February. The following will serve to show what has been going on in the manufacturing world, hopefully, what the future might hold.

In the U.S., flash reports - representing data from 85% of respondents - composite index for February is at 50.2, versus 46.8 in January; the manufacturing PMI reading was at 47.8, versus 46.9 in January. The flash manufacturing production index for February came in at 48.4 versus 46.9 for January. The rate of decline of new orders was at its lowest since last October. The question is being asked, has inflation peaked, and have recession risks faded?

Light vehicle sales forecast for February, according to Cox Automotive, came in at 1.105 million, a 4% increase year-over-year, with a seasonally adjusted rate of 14.4 million. The J.D. Power and LMC Automotive forecast came in at 1,117,088 units or a 7.2% year-overyear increase.

The UK did a turnaround from January, with the flash composite index at 53.0, versus 48.5 in January, the manufacturing PMI for February at 49.2, versus January’s 47.0, and the manufacturing production index at 51.6, versus January’s 47.0.

Although Japan’s services PMI is on the rise, with a flash composite index of 50.7 versus January’s unchanged 50.7, its flash manufacturing output PMI for February is in decline, at 44.9 versus 47.2 for January. Its new orders and production fell to the greatest extent in just over two-and-ahalf-years.

China’s car sales for January 2023 showed registrations of 1.65 million, down 35% year-over-year, and the lowest figure for the month since 2012. There may be two major reasons for this drop. First, Chinese people celebrated a full week of the Lunar New Year holidays during January, making it a quieter month compared with the previous years. Second, the end of NEV subsidies at the end of 2022 made consumers choose to buy before the expiration date.

In December 2022, sales of NEVs surged by 90 percent. The seasonal decline in auto sales in China’s auto market should not be over-interpreted.

The seasonally adjusted Global Steel Users Purchasing Managers Index™ (PMI) – a composite indicator designed to give an accurate overview

of operating conditions at manufacturers identified as heavy users of steel – rose to 49.2 in January, from 48.8 in December, signaling a fifth successive deterioration in operating conditions but at a weaker rate. In fact, the sector moved closer to stability. There were slower falls in new orders in all three regions - North America, Europe, and Asia. New orders fell at the weakest rate since August 22nd, with only a fractional decline in Asia. Production fell at a slightly faster rate. Employment in the global steel-using sector rose very slightly for the first time in seven months in January.

The PMI for manufacturers who are heavy users of copper went to a 3-month high of 49.1 in January from 48.7 in December. Production grew

at European copper users in January. Production and new orders both fell at the slowest rates in three months, with production growth in Europe noted for the first time in ten months. Output and new orders both fell at the slowest rates in three months, with growth in production in Europe signaled for the first time in ten months. Demand remained weak in the U.S., where new orders fell at a rate little changed from December’s 31-month record, and also in Europe, although the rate of decline eased to an eight-month low. In Asia, outstanding business rose the most in nearly three years as demand showed signs of stabilizing. At the global level, supply chain pressures eased while input price inflation picked up since December but remained below the long-run

series average. Employment fell for the 12th time in the past 15 months in January, whereas the European workforce has fallen only once in the past two years.

The PMI for heavy users of aluminum increased from 48.4 in December to 48.8 in January. The downturn slowed further in January to the weakest since October 2022. There was a slower decline in new orders, and a slight increase in employment in January; in fact, the first since last June. Jobs growth in the U.S. and Europe more than offset a very slight fall in Asia, with production down for the sixth consecutive month.

The prices of non-ferrous metals through most of February were on the decline, effectively wiping out all the gains seen in January. Aluminum went from $1.29 to $1.17 per lb; copper from $4.22 to 4.01; nickel from $13.20 to $11.40, and zinc from $1.58. to $1.37. LME stocks are trending down.

Overall, the U.S. economy is showing some resilience, and Europe may not experience as deep a recession as predicted caused by natural gas prices. China will show growth, although numbers from China are always suspect. Countries in Oceania will benefit from supply chain shifts from Chinese companies to suppliers in Vietnam, Thailand, Indonesia, India, and Malaysia. Thus, previous dire recession forecasts have moderated to more neutral conditions.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook.

Throughout the industrial world and across every continent, businesses are making significant investments in robotics and automation. According to the McKinsey Global Industrial Robotics Survey, automated systems will account for 25% of capital spending over the next five years1. Many of these businesses believe that robotics-driven automation systems will drive major benefits in output quality, efficiency, and uptime.

That being said, there are challenges for these implementations to be successful, including the cost of investment, experience in deploying projects, and the belief that more robotics will mean companies can rely less on human capital.

The report illustrates several industries that are expected to see major growth in the use of robotics and automation, such as retail and consumer goods, where 23% of retail survey respondents plan to spend more than $500 million. That compares with 15% in food and beverage, and 8% in automotive1

However, logistics and fulfillment operations are expected to realize 30% or more of their overall capital investment over the next five years, which would place it as the number-one player in robotics. This most likely won’t surprise anyone, as companies like Amazon and Wal-Mart – and

their logistics partners – have been battling to leverage technology to increase competitive efficiencies over the last five years.

The fundamental benefits of robotics and automation cannot be ignored, and virtually every industrial deployment will result in more intelligent use of resources. In most cases, it frees the human employee from mundane, repetitive tasks, and empowers them to concentrate on core business objectives instead, bringing about numerous benefits to the workplace.

In the early days of robotics, there was plenty of chatter about robots fully replacing human workers The thinking was that robots would

eventually outsmart humans, and there would be less need for human capital. This has clearly not been the case, nor is it today’s path of robotics and automation. However, they are planning to represent a considerable amount of the average industrial company’s production strategy going forward.

According to a March 2017 report on automation in the workplace by PricewaterhouseCoopers, as many as 30 percent of jobs in the UK, 38 percent of jobs in the U.S., 35 percent of jobs in Germany, and 21 percent of jobs in Japan are at risk of being replaced by machine-based automation by the early 2030s2. Even more recently, 10.5 million jobs remained open, with roughly 1.7 jobs available per worker at the end of November 20223. While low headcounts of workers seem to be the new norm, robotics are not replacing anyone, but are filling the gaps that can’t be filled by human resources. Robotics tend to do the least desirable and most repetitive jobs in the supply chain.

There are a handful of documented reasons why humans and human labor will continue to play a significant role – despite the growth in robotics and automation.

Robots don’t understand emotional thoughts. Robots operate on rationally programmed logic. However, there will always be irrational variables that involve emotion-critical thinking in the decision-making process. This is why human labor will be important in supervising robotics so that changes can occur depending on any number of irrational or unpredictable changes to the environment.

Robots can’t understand the context. Especially for manufacturing jobs that require analysis, or the interpretation of slang from different countries and cultures, some robotics and automation may struggle in these types of warehouse production roles.

Lastly, robotics don’t understand customer service. Robotics and automation may continue to prove challenging as industrial companies try to implement these functions into remote customer site visits for service and repair, for example. AI-powered robotics will always be programmed to deliver the most pragmatic solution without any consideration of how that might affect future customer relationships.

In each of these scenarios, robotics can play a role, but not without human interaction. As a result, successful industrial companies today are finding the right balance and leveraging labor management technologies to better manage the relationship between human capital, automation, and robotics.

In a recent industrial-focused survey, 36% of executives said they currently leverage labor management system technology for their warehouse operations, and another 29% said they plan to make investments in this type of technology in 20234

What is Labor Management – Why is it Necessary for Robotics? Companies are relying on labor management technologies to inject more flexibility to quickly adapt to a rapidly evolving marketplace using robotics and automation. Fluid labor allows for greater productivity and efficiency from logistics and warehouse personnel to support everything from increasing customer demand to rapid shifts in the use of robotics and automation programs on the floor.

This strategy is helping to modernize legacy warehouse environments through real-time visibility into delivery, labor management, and operations to satisfy escalating customer expectations, save valuable resources, and reduce overhead costs even further. The ability to optimize any facet of the warehouse automation system enables a highly flexible and responsive supply chain operation. More importantly, today’s advanced labor management solutions can

leverage historical robotics data to create smarter performance tracking across the life of each automated system without complex and costly projects. In many cases, companies can leverage this technology to reduce data refresh from eight hours of programmed analysis down to just a couple of minutes for more real-time decision-making of labor needs.

Robotics and automation will continue to grow throughout the industrial commercial landscape. But without the use of intelligent labor management technology, these companies will not efficiently and effectively manage their robotics systems for optimum logistics and warehouse functions.

About the Author: Mike Babiak is the Director of Supply Chain Technology Strategy for Longbow Advantage, the industry-leading supply chain execution company behind The Rebus® Platform and the global leader in warehouse software and consulting. For more information, visit www.longbowadvantage. com.

1: https://www.mckinsey.com/industries/industrials-and-electronics/ our-insights/unlocking-the-industrial-potential-of-robotics-and-automation

2: https://www.pwc.co.uk/economic-services/ukeo/pwcukeo-section-4-automation-march-2017-v2.pdf

3: https://www.msn.com/en-us/ money/markets/employers-added-223000-jobs-in-december-unemployment-falls-to-35/ar-AA162Pew

4: Longbow Advantage online survey presented to more than 2,500 industry executives; December 2022.

Click here to listen to Mike Babiak on the Manufacturing Talk Radio podcast. n

by Bill Koenig Senior Editor, SME Media

by Bill Koenig Senior Editor, SME Media

Manufacturing lost 4,000 jobs last month, the Bureau of Labor Statistics said today.

Durable goods employment was little changed while non-durable goods absorbed the bulk of the job loss, according to a breakdown by sector issued by the bureau.

Job gainers included transportation equipment, up 1,300 jobs. That included a gain of 200 jobs in motor vehicles and parts. Non-metallic mineral products added 1,500 jobs and computer and electronic products added 2,800.

Industries posting job losses included furniture, down 2,800 jobs, and wood products, down 1,000.

Manufacturing employment took a hit in early 2020 with the COVID-19 pandemic. Jobs in the sector began to recover later that year and rose in 2021 and 2022. Manufacturing eventually recovered all the lost jobs.

However, the manufacturing economy began slowing down in late 2022.

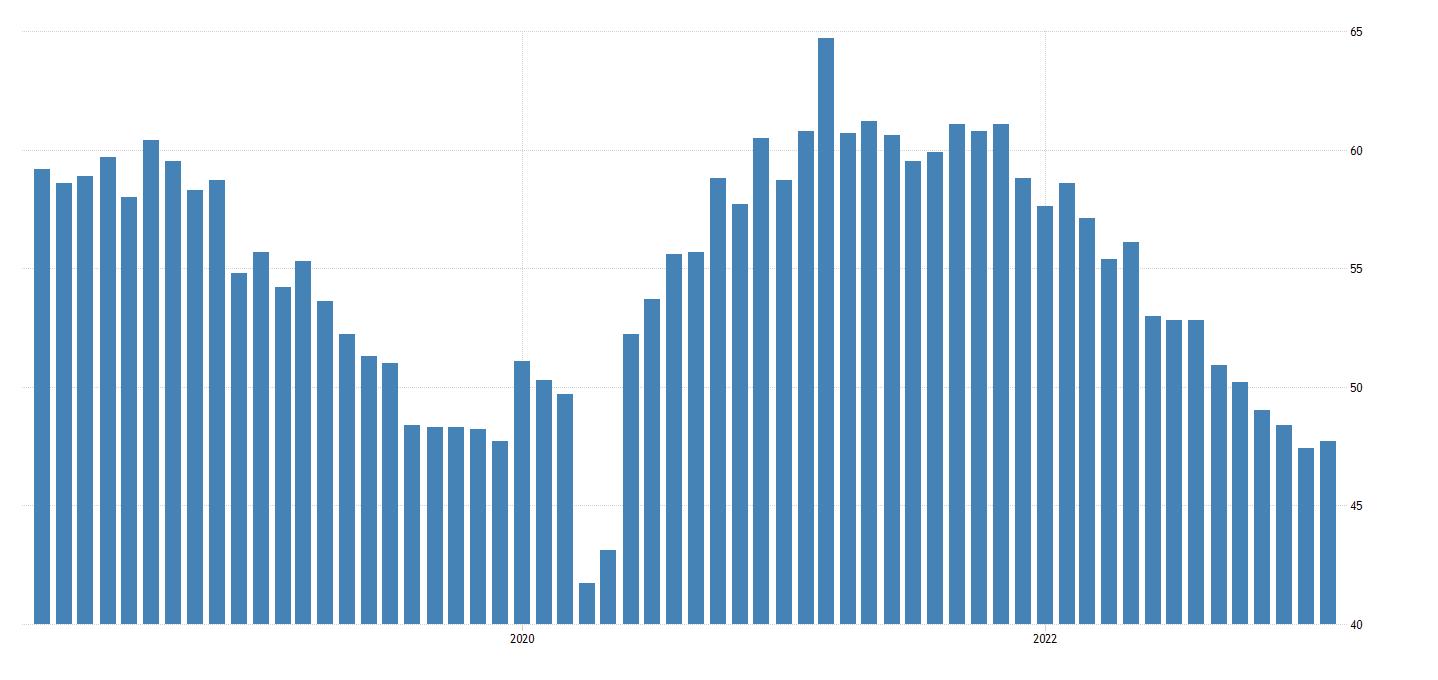

The Institute for Supply Management’s manufacturing index indicates the sector has been in economic contraction the past four months.

That index, known as the PMI, is considered a leading economic indicator and a barometer of where manufacturing is heading. The PMI is based on a survey of executives in 18 industries. The institute has said it expects sluggish results in this

year’s first half, with a recovery in the second half.

The Federal Reserve Board has been raising interest rates to cool the economy and reduce inflation.

Manufacturing totaled 12.983 million jobs on a seasonally adjusted basis in February, according to the bureau. That was down from an adjusted 12.987 million in January but better than the 12.654 million in February 2022.

Total non-farm employment increased by 311,000 jobs in February, the bureau said in a statement. That was better than the 205,000 estimate by economists surveyed by Reuters. The U.S. unemployment rate rose to 3.6 percent from 3.4 percent in January. n

INSTITUTE FOR SUPPLY MANAGEMENT®

Economic activity in the manufacturing sector contracted in February for the fourth consecutive month following a 28-month period of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®

The February Manufacturing PMI® registered 47.7 percent. In the last two months, the Manufacturing PMI® has been at its lowest levels since May 2020, when it registered 43.5 percent. The New Orders Index remained in contraction territory at 47 percent, 4.5 percentage points higher than the figure of 42.5 percent recorded in January. The Production Index reading of 47.3 percent is a 0.7-percentage point decrease compared to January’s figure of 48 percent. The Prices Index registered 51.3 percent, up 6.8 percentage points compared to the January figure of 44.5 percent. The Backlog of Orders Index registered 45.1 percent, 1.7 percentage points higher than the January reading of 43.4 percent. The Employment Index dropped into contraction territory, registering 49.1 percent, down 1.5 percentage points from January’s 50.6 percent. Of the six biggest manufacturing industries, two (Transportation Equipment; and Petroleum & Coal Products) registered growth in February. A reading above 50 percent indicates that the manufacturing sector is generally expanding; below 50 percent indicates that it is generally contracting.

The four manufacturing industries that reported growth in February are: Apparel, Leather & Allied Products; Transportation Equipment; Petroleum & Coal Products; and Electrical Equipment, Appliances & Components. ISM

Analysis by Timothy R. Fiore, CPSM, C.P.M. Chair of the Institute for Supply Management® Manufacturing Business Survey CommitteeThe U.S. manufacturing sector contracted in February, as the Manufacturing PMI® registered 47.7 percent, 0.3 percentage point higher than the reading of 47.4 percent recorded in January. This is the fourth month of slow contraction and continuation of a downward trend that began in June 2022. Of the five subindexes that directly factor into the Manufacturing PMI®, only one (the Inventories Index), was in growth territory, and just barely. Only three of the 10 subindexes were positive for the period.

Commodities Up in Price: Aluminum (2)*; Copper (3); Electrical Components (4); Electronic Components; Maintenance, Repair, and Operations (MRO) Materials; Polyethylene; Polypropylene; Solvents; Steel*; Steel — Stainless; and Steel Products* (2).

Commodities Down in Price: Aluminum (10)*; Corrugate (3); Corrugated Boxes (2); Freight (4); Lumber (2); Natural Gas (3); Ocean Freight (6); Pallets; Plastic Resins (9); Polyethylene; Steel* (10); Steel — Hot Rolled; and Steel Products* (8).

Commodities in Short Supply: Electrical Components (29); Electronic Components (27); Hydraulic Components (10); Packaging Materials; Plastic Resins; Semiconductors (27); and Steel Products (2).

February 2023

Analysis by Timothy R. Fiore, CPSM, C.P.M. , Chair of the Institute for Supply Management ® Manufacturing Business Survey CommitteeISM’s New Orders Index contracted for the sixth consecutive month in February, registering 47 percent. The three manufacturing industries that reported growth in new orders in February are: Petroleum & Coal Products; Transportation Equipment; and Miscellaneous Manufacturing‡

The Production Index registered 47.3 percent. The four industries reporting growth in production during the month of February are: Machinery; Transportation Equipment; Fabricated Metal Products; and Electrical Equipment, Appliances & Components.

ISM’s Employment Index registered 49.1 percent. Of 18 manufacturing industries, six reported employment growth in February, in the following order: Apparel, Leather & Allied Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Petroleum & Coal Products; Machinery; and Transportation Equipment.

The delivery performance of suppliers to manufacturing organizations was faster for a fifth straight month in February, as the Supplier Deliveries Index registered 45.2 percent. Four of 18 manufacturing industries reported slower supplier deliveries in February: Apparel, Leather & Allied Products; Textile Mills; Miscellaneous Manufacturing‡; and Food, Beverage & Tobacco Products.

The Inventories Index registered 50.1 percent. Of 18 manufacturing industries, the nine reporting higher inventories in February — in the following order — are: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Paper Products; Computer & Electronic Products; Plastics & Rubber Products; Fabricated Metal Products; Miscellaneous Manufacturing‡; and Transportation Equipment.

ISM’s Customers’ Inventories Index registered 46.9 percent. Six industries reported customers’ inventories as too high in February, in the following order: Paper Products; Nonmetallic Mineral Products; Printing & Related Support Activities; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; and Fabricated Metal Products.

The ISM Prices Index registered 51.3 percent. In February, eight industries — in the following order — reported paying increased prices for raw materials: Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Fabricated Metal Products; Nonmetallic Mineral Products; Petroleum & Coal Products; Computer & Electronic Products; Miscellaneous Manufacturing‡; and Machinery.

ISM’s Backlog of Orders Index registered 45.1 percent. Two industries reported growth in order backlogs in February: Computer & Electronic Products; and Transportation Equipment.

ISM’s New Export Orders Index registered 49.9 percent. Four industries reported growth in new export orders in February: Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Transportation Equipment; and Miscellaneous Manufacturing‡

ISM’s Imports Index registered 49.9 percent. The four industries reporting an increase in import volumes in February are: Transportation Equipment; Food, Beverage & Tobacco Products; Miscellaneous Manufacturing‡; and Electrical Equipment, Appliances & Components.

I suppose I have offered the same definition of an economist about a thousand times by now. “Somebody who explains tomorrow why the predictions they made yesterday didn’t come true today.” It is just that this is so very accurate. The problem is that the data shifts nearly constantly. At its heart, economics is a social science (despite our attempts to use numbers as if we were a “real” science). We study human behavior, and there is no creature on Earth less predictable and volatile than a human being. You remember your beloved Econ 101 class, where the professor valiantly tried to assert that people “maximize expected utility.” The reality is that people rarely do this – they react to everything they shouldn’t pay attention to and ignore what they really should be paying attention to. What does this mean when trying to puzzle out what to expect for this year’s economy?

Basically, there are two schools of thought competing with one another on the subject of recession. There are the true dismal scientists that are predicting a recession in 2023 and a fairly deep one. They point to a variety of factors ranging from a slowdown in industrial production to slumping retail and the retreat seen in measures such as the Purchasing Managers’ Index. They mostly assert that the central banks are still committed to dealing with persistent inflation, and that will propel them towards even higher interest rates. They cite the comments by Jerome Powell as he indicated that inflation, as measured by the PCE (Personal Consumption Expenditures), is still over twice as high as the Fed prefers. They want that rate at 2.0% or slightly below, and right now, it stands at 4.6%.

The other school asserts that 2023

will see nothing more dramatic than a minor downturn that starts to evaporate by the 2nd or 3rd quarter. They look at the fact that inflation has started to erode (probably peaked at the end of Q4 2022). They believe the Fed will slow down their rate hikes, and they point to the still solid jobless numbers. They look at the fall of commodity prices and the surge in industries such as automotive and aerospace.

If one looks at the data that comes from the Armada Strategic Intelligence System, one will observe that we are somewhere in the middle. In the latest issue of the CCAI report, we showed the latest ASIS model for industrial production as a whole. There was a substantial peak in 2022 – a holdover from the rapid growth that was seen in 2021. That started to ebb last year and is expected to keep dropping for a while this year before tracking back up

to what it was in the last decade. It is interesting how close the numbers are to the ten and twenty-year trend lines. In the more detailed breakdowns, we see some significant variations –booms in automotive and aerospace but declines in machinery. Less volatility in fabricated metal and more volatility as far as primary metal is concerned.

What is the conclusion one can draw from all this? The first is that there is a substantial degree of uncertainty to contend with, and that forces companies to develop a wide range of contingency plans. The outlook for the coming year depends on factors such as the Fed’s willingness to halt or even reverse rate hikes. There is a fear that political gamesmanship will lead to a default over the debt ceiling, and that could shove the economy into reverse. Global activity will play a huge role as well. Does China finally resume its production activity, or has the world moved on enough to blunt that impact? Commodities have been down, but there are still major disruptive threats to the oil supply as well as industrial metals. Leftist regimes in Latin America have already impacted copper, aluminum, and other metals. Europe asserts that it is no longer staring a recession in the face – at least not a severe one. Does that mean more market for U.S. goods or more competition from European producers? Probably both. The bottom line is that companies are facing a year of unknowns after a couple of years of predictability. We all knew 2020, and much of 2021 would be miserable, and we knew part of 2021 and 2022 would feature growth - we don’t quite know what to do with 2023 yet.

During the last recession (2020), the manufacturers did better than the service providers. The shutdown crushed those industries that relied on any kind of human interaction, and at the same time, there was a surge of stimulus designed to help get the economy out of the slide. Unfortunately, the majority of this cash never made it into the economy as everything was shut down. People turned to buying things rather than spending on travel, entertainment, and the like. This was a boon to some manufacturers despite the supply chain breakdown. Now there is the threat of a more “traditional” recession, and that would affect goods purchasing. The hike in inflation has already affected low and middle-income consumers as they cannot really afford much discretionary spending these days. Goods aimed at this income group will struggle to find markets, but the higher value goods are still in demand.

At the time of this writing, the markets were in turmoil again as they were back to expecting higher interest rates from the Fed. The news regarding the economy has been better than expected, and that is not a good thing from an interest rate perspective. The job market remains robust, business expansion is still in evidence, and confidence levels are recovering. All this adds up to the Fed assuming it has room to move rates higher as it struggles to control inflation. The pressure from factors such as commodity costs, logistics, and the like may have subsided, but the wage issue is taking the lead, and the worker shortage is making it extremely difficult to bring that wage inflation down.

The Bank of Canada hiked rates to 4.5% but then declared it would stop at this level for a while. The BoC has provided a fairly optimistic assessment for the year, although still asserting that inflation threats remain. The expectation is that inflation will fall to

3.0% by the end of the year and 2.0% by 2024. This is based on a couple of assumptions regarding employment, as there is a sense that reduced commodity prices will have an impact. There is also some expectation that worker shortage will not be as big an issue for Canada as in the U.S. This more optimistic assertion is based, to a degree, on the immigration approach taken. Canada is getting a significant influx of immigrants from Ukraine of late, and these are often skilled and trained workers. There is also an expectation that supply chain issues will continue to fade.

Mexico is seeing a level of foreign direct investment that is unprecedented. In the first nine months of 2022, it was up almost 30%. Of that FDI, over 45% was brand new investment, and 44% was reinvestment. The difference between 2021 and 2022 was dramatic. It went from $7.3 billion to $32.1 billion. This was part of what drove Q4 to grow by 3.7%, and that was much faster than either the U.S. or Canada for the same period. The sense is that 2023 will be somewhat slower, however, that pace will be slowing down somewhat. The Bank of Mexico sees a reduction in domestic demand and a reaction to a slowdown in the U.S., and predicts anemic growth of just 0.7% for the year. If there is a rebound, it will have to come from increased commodity pricing and a recovery in the tourism sector.

Author profile: Dr. Christopher Kuehl (Ph.D.) is a Managing Director of Armada Corporate Intelligence and one of the co-founders of the company in 1999. He has been Armada’s economic analyst and has worked with a wide variety of private clients and professional associations in the last ten years. He is the Chief Economist for the National Association for Credit Management and is on the Board of Advisors for their global division – Finance, Credit and International Business. n

by Royce Lowe

by Royce Lowe

Africa has a population of around 1.4 billion and a median age of around 20 years. It is a poor continent but rich in natural resources. It is lacking in infrastructure, but much less than it was since the arrival of numerous Chinese construction companies on the continent.

China’s forays into Africa began with Beijing’s support of liberation movements fighting colonial rule. Beginning in the late 1990s, China’s commercial engagement took off and was formalized in 2013 with the Belt and Road Initiative (BRI), a well-resourced effort to build political influence and grow commercial relationships throughout the developing world. The BRI’s major activities include lending for infrastructure development, engineered and constructed by Chinese companies, and resource extraction by Chinese mining and energy firms. While certain countries, including Ethiopia, Angola, and Zambia, have been a priority, China

has grown its presence in most African countries. Over the decades since the Cold War, Chinese influence in Africa has increased significantly, while U.S. influence has flatlined.

China is Africa’s largest two-way trading partner, at $254 billion in 2021, some four times greater than U.S.-Africa trade. China is the largest provider of foreign direct investment (FDI) that supports hundreds of thousands of African jobs. This is roughly double the level of U.S. foreign direct investment. While Chinese lending to African countries has fallen of late, China remains by far the largest lender to African countries. It is to be expected that China’s commercial activity in Africa would increase with the dramatic rise of its economy to become the second largest in the world, especially given China’s need for raw materials to support its very large manufacturing base. But this growth also represents a determined Chinese governmentdriven effort to make significant inroads in Africa.

African leaders recall with concern the Cold War, when the United States and Soviet Union fought proxy wars in Africa, making them wary of great power rivalry. Some Africans view China as a positive development model. This favorable impression is actively cultivated by Chinese diplomacy throughout Africa. Sometimes U.S. interests will require pressuring Africans to choose, such as when the United States pressed African states to vote to condemn Russia’s brazen invasion of Ukraine at the United Nations (China abstained). But in general, U.S. diplomacy in Africa will be more effective when it’s not framed as an “us-or-them” proposition, especially versus China. Early in the Biden administration, Secretary of State Antony Blinken told allies that the United States would not expect them to choose between Washington and Beijing. This approach, however, has come under increasing pressure as relations between the two major powers have further deteriorated.

The Flagship Reports with Dr. Chris Kuehl is both an “Officer of the Watch” briefing of economic conditions and an Executive Briefing on specific situations impacting those conditions. Written and presented by the officers of Armada Corporate Intelligence, Dr. Kuehl lightens up the mood of sometimes distressful geoeconomic news with a bit of humor. This monthly podcast includes information from the Flagship Reports issued 3 times and week, and AISI, the Armada Strategic Intelligence System, a tool for durable goods manufacturers that dives deep into the sector each month to provide more than 95% accurate near-term forecasts.

Africa is the poorest and fastestgrowing continent. It needs jobs to prevent social and political unrest. It needs trade and investment. Unfortunately, Africa represents just 3% of world trade. African leaders, in both government and business, recognize the importance of the U.S. market and the high standards of U.S. businesses, especially compared with the poor transparency and environmental records of many Chinese companies.

American businesses have not been too keen to get involved in Africa for many reasons, including a perception of high risk, poor infrastructure, and lack of government support. With more U.S. government tools now available, including the recently launched Development Finance Corporation, some businesses are looking to begin their involvement in Africa.

U.S. companies are not competitive against Chinese and other firms in certain industries, such as road and

bridge construction. Chinese firms have lower cost structures and benefit from decades of African experience. But some U.S. companies are competitive, including in the health, financial technology, and renewable energy sectors.

The United States has a great asset in its large and vibrant African diaspora, many of whom maintain commercial connections with Africa. The United States also remains a source of inspiration for the large majority of Africans, who aspire to democratic governance. Washington should continue to support African democrats, civil society, and media that are pressing for open and inclusive governance, often in the face of repression. China, on the other hand, opposes these values.

At a U.S. - Africa summit in Washington in December 2022, the United States announced plans to commit $55 billion to Africa over the next three years, including $15 billion

for trade and investment partnerships and deals, and $20 billion for health programs, of which $11.5 billion for HIV/AIDS. Just over a billion dollars will be allocated in support of African-led efforts in conservation, climate adaptation, and energy transitions.

Further statistics on exports and imports will only serve to illustrate the enormous difference between China’s performance and that of the U.S. Africa is a huge market, and it will continue to grow. One has only to go back to the nineties to see that China represented some 2% of global trade. Today it’s ten times that.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

Flash PMI data for February forecasts the Eurozone composite index at 52.3 versus 50.3 in January, the manufacturing PMI at 48.5 versus 48.8 for January, and the corresponding manufacturing production index at 50.4 versus 48.9 for January.

On the manufacturing side, chemical, plastics, and basic resources remained the main areas of weakness, while food and drink, household goods, and industrial goods manufacturing showed further signs of recovery. Automaking likewise continued to pull out of the slump seen last year. Within the Euro area, both France and Germany returned to growth for the first time since last October and last June, respectively. The composite PMI for France rose from 49.1 to 51.6, albeit with growth confined to the service sector. The composite PMI for Germany meanwhile edged up from 49.9 to 51.1, reflecting a second successive monthly rise in service sector activity and the first expansion of manufacturing output since last May. However, it was the rest of the Eurozone that reported the strongest performance with the composite index up from 51.4 to a nine-month high of 53.9, thanks to broad-based growth of manufacturing and services.

In manufacturing, the renewed growth of output was also often linked to improved supply chains, with average supplier delivery

times shortening for the first time since January 2020, and to the greatest degree since May 2009. An especially marked improvement in supplier performance was recorded in Germany, where a survey reported the shortening of lead times.

The acceleration of growth of output across the Eurozone was fueled by the first, yet modest rise in new orders since last May, which was driven by the steepest increase in demand for services for nine months and the shallowest – though still marked – drop in new orders for goods over the same period.

All is consistent with an expanding economy in the first quarter so far, with employment also on the rise.

• France, flash composite, 51.6 vs 49.1 January; 7-month high

• France, flash manufacturing output index, 45.9 vs 47.5 January; 3-month low

• France, flash manufacturing index, 47.9 vs 50.5 January; 4-month low

• Germany, flash composite, 51.1 vs 49.9 January; 8-month high

• Germany, flash manufacturing output index; 50.6 vs 48.4 January, 9-month high

• Germany, flash manufacturing index, 46.5 vs 47.3 January, 3-month low.

There is an air of optimism presently in the Eurozone manufacturing and services sector. The order books show reduced rates of contraction, while input cost inflation cooled further thanks to the alleviation of supply chain stress, but the average selling price inflation for both goods and services went slightly higher. It is boiling down to the first expansion in business activity since last June. Manufacturing production contracted modestly, showing the smallest drop in factory production since last June.

Meanwhile, France’s annual inflation rate reached a record high of 7.2% in February, up from 7% in January. Soaring food and service costs, in particular, pushed prices up. Spain’s inflation rate also ticked up, reaching 6.1% in February, up from 5.9% last month. The figures will put more pressure on the European Central Bank to further raise interest rates.

While all the data seem to be “teetering on the edge” the overall news is encouraging. A renewed slide into contraction should not be ruled out as borrowing costs rise, but the survey brings welcome good news to suggest that any downturn is likely to be far less severe than previously feared and that a recession may well be avoided altogether. n

China’s factories are launching a major worldwide “charm offensive” to regain lost buyers due to pandemic disruption and rising geopolitical tensions. (FT 2/27/23) Now that international travel from China is easier, they are sending delegates to

trade fairs and business conferences all over the U.S., Europe, even Saudi Arabia and Russia, bucking the trend, to try to reverse the damage caused by customers relocating their purchasing and supply chains outside of China. These represent-

atives are primarily exporters and factory directors sponsored by local governments which have been severely hit by shrinking tax revenues from both export manufacturing and property market chaos. The central government has made it clear to local continued

governments that they will not provide funds to bail them out beyond loosening credit, so provincial and municipal governments must do it themselves. Their initial efforts are to invest in travel and digital communications to regain lost customers. (It would help if the central government toned down their military saber-rattling.)

China’s export manufacturing companies in nearly every sector (except EVs and drones), including the food industry, packaging, eyewear, garments (think Disney, not just Target), appliances, and toolmaking (think Black & Decker), among others, have been shell-shocked by a confluence of rising export prices due to inflation, Covid-impacted delayed shipments, the fall-out from geopolitical conflict rhetoric and ongoing reduction in global demand. The post-Covid reopening purchasing boom is in decline. Consumers are spending, but product choices are changing. Warehouses in the U.S. are overflowing with unsold Chinese goods. The greatest impact is being felt in southeastern and southern China, especially in Fujian, Guangzhou, and Shenzhen, a region known as China’s “factory floor” for the rest of the world.

Will Chinese factory overtures succeed? Trade statistics for 2022 may give us a glimpse of the answer. Despite China’s falling exports in November (8.9% year on year) and further in December (9.9%), U.S.-China total trade volume in 2022 boomed, hitting a record $690.6bn. And China’s manufacturing sector is on the mend. February 2023 PMI for factories came in at 52.6 (Caixin 51.6), beating estimates and growing at the fastest pace in a decade. China has a deeply developed, efficient man-

ufacturing ecosystem that exporters like and which can be found in every region of the country. Logistics and shipping costs are dropping. Metals prices are stabilizing. Three years of rolling lockdowns may have simply lowered the temperature and pushed pause on an already overheating economy while laying the groundwork for a more diversified global supply chain landscape. China’s 2023 revised growth projection is now expected to exceed 5.5%.

China leads the world in EV battery development. One of the brightest spots in China’s Covid-era manufacturing is the growth of its EV and battery industries. China sees its speedy EV growth as a pathway for achieving more sustainable transportation with lower emissions and higher efficiency, and to deflect from its continued use of coal and shocking levels of increased investment in coal production to fuel the growth of other industries. China is by far the

largest EV manufacturer in the world, producing 3.5 million units in 2021, over 160% more than the year before, with projected production of battery (BEV) and plug-in hybrid (PHEV) vehicles to be several times more in 2023 than the combined global production of other developed markets, including Germany, The U.S., Japan, France, and South Korea. Domestically, China is only constrained by its electrification expansion and charging station installations. It also continues to provide subsidies and tax benefits for EV buyers. Globally it has enhanced its customer charm offensives with superb customer service, especially in Europe, where Chinese EV passenger cars are likely to dominate in years to come.

The global race for lithium is on. China has been searching worldwide for sources of lithium, the ultra-light metal used in electric vehicle batteries. Australia and Chile are the world’s largest lithium producers. continued

But Bolivia has huge undeveloped reserves which China has its eye on. China already has contracts to import over 90% of Australia’s exportable spodumene lithium and is waiting for Australia to develop the export of lithium hydroxide. With limited options and an insatiable appetite to expand its already globally dominant battery industry, it has recently clinched a very significant deal with Bolivia to develop its valuable lithium reserves called ”white gold” contained in its Potosi and Ururo salt flats, which are connected to Chile and Argentina.

In January, the giant Chinese battery company, CATL, won the bidding process to develop Bolivia’s reserves. It will take an investment of over $1 billion just to develop the first phase, a historic investment for Bolivia. Elsewhere, according to Reuters, Tesla, and other EV manufacturers routinely have discussions with mining companies, both large and small, scattered all over the world,

about lithium and other EV metals supplies but without signing contracts. But one big change to watch out for is future buyouts. Elon Musk has openly stated that he is considering the option of refining his own supply of lithium and other electric vehicle metals if it would “speed up the worldwide adoption of clean energy technologies.” He is currently considering a buyout of Canada-based battery metals miner Sigma Lithium Corp. (Bloomberg 2/24/23). Sigma is finishing up construction of a hard rock lithium mine in Brazil that could open as soon as April. It will produce spodumene concentrate, the same material that China imports from Australia, which can be used to make the type of lithium hydroxide preferred by Tesla and BMW. Such a development would follow his stated goal of taking leaps to “stay ahead of the competition” in the face of rivals clamoring to catch up while maintaining superior profitability in the EV price war he started.

On February 28, Tesla announced its decision to locate its next assembly plant in Northern Mexico’s industrial hub of Monterrey. Earlier in February, BMW announced its plan to invest $800 million to expand production in Mexico. Elsewhere Indonesia launched a new industrial policy to join the electric vehicle supply chain (The Diplomat, 2/7/23). And India recently announced that its electric-scooter leader Ola is on track to roll out its first car in 2024.

Author profile: Christine is cofounder and President of China Human Resources Group, Inc, a management consulting firm based in Princeton NJ. She has provided U.S. companies with strategic development and project implementation services for projects in China since 1986. n

MARCH 2023

As we noted in our January edition, Air India was on the verge of acquiring up to 500 new aircraft. It was recently announced that the company has placed orders with Airbus for 210 A320neos and 40 A350s, and with Boeing for 190 737Max, 20 787s and 10 of its largest 777X. This stands to be the largest purchase in commercial aviation history. Further to this, Air India has ordered a total of 880 engines from both CFM International and Rolls Royce to power the new fleet.

CFM International reported that this is the largest-ever order for its CFM LEAP engines, to power 210 Airbus A320/A321neo and 190 Boeing 737 MAX narrow-body aircraft. The order covers 420 LEAP-1A engines and 380 LEAP-1B engines, plus

spares. The airline also contracted for CFM services related to the new LEAP engines. A LEAP engine, short for Leading Edge Aviation Propulsion, is a high-bypass turbofan engine. Details of how the engine works may be found on YouTube or Wikipedia. The engine contains ceramic matrix composites, together with some of the first FAA-approved 3D-printed components. The order is said to be worth $80 billion, but Air India has not confirmed this figure. CFM International is a 50-50 venture of GE Aviation and Safran Aircraft Engines, and the developer of the LEAP engine family high-bypass turbofan engines. Each partner manufactures the LEAP engines in its own production operations.

Separately, Rolls-Royce announced

its own order from Air India for 68 Trent XWB-97 engines, plus options for 20 more engines. Rolls Royce also noted this represents the largestever order for the Trent XWB-97, the exclusive power plant for the Airbus A350-1000 widebody aircraft. Air India also ordered 12 Trent XWB-84 engines, the sole engine option for the Airbus A350-900.

Air India has “significant options” to increase its Airbus order, as the airline grows. Boeing said Air India may eventually add 50 more 737Max and 20 787s. Air India will begin receipt of the A350s before the end of 2023. The initial batch of six planes were being built for Russia’s Aeroflot PJSC, which is no longer able to take aircraft due to sanctions. It is also ordering 34 of the larger A350-1000

model that Airbus says will give it the ability to offer non-stop services “deep into all the continents of the world.”

Both Boeing and Airbus project that India will need on the order of 2,210 new planes over the next two decades. China, on the other hand, is projected to need 8,485 new aircraft through 2041. Boeing’s order from India contrasts with its recent performance in China. There the company has effectively missed out on new orders because of the grounding following two deadly accidents. China used to take a quarter of Boeing’s 737 output, and it’s been more than 3 1/2 years since a mainland Chinese airline took delivery of a new jet from the company’s bestselling line.

Air India is attempting to win back traffic from Emirates and Qatar

Airways, which have had a heyday carrying Indians to the U.S. and Europe via their huge hubs in Dubai and Doha. Indian Prime Minister Modi is proud of the deal, and sees it as part of a push to expand India’s aviation industry. The country wants to be a hub for maintenance and repair operations for the region as well.

Even the UK had something to say about this. Commenting on the deal, Prime Minister Rishi Sunak said Air India’s order bolstered Airbus’s decision last year to invest over £100 million at its wing assembly plant in Wales, as well as to add 450 jobs. It will also boost employment at Rolls Royce.

Singapore Airlines Ltd.’s low-cost carrier, Scoot Pte Ltd., signed a letter of intent to add Embraer SA regional jets to its fleet, aiming to

fly to smaller destinations in Asia’s emerging markets. Delivery of nine E190 E2 jets will start in 2024, according to the carrier. The aircraft will be sourced from the leasing company Azorra.

This agreement marks the first time Singapore’s main airline has ordered Embraer planes, and is a major boost for the Brazilian company. Embraer is seeking to secure the future for its flagship commercial aircraft. This order could grow to as many as 50 planes over time, as the carrier seeks to widen its reach in neighboring Indonesia, Malaysia, Vietnam, Thailand, and the Philippines.

Author profile:Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

MARCH 2023

Sustainable Aviation Fuel (SAF) is jet fuel produced from waste oils derived from biological sources (e.g., cooking oil, other non-palm waste oils from plants, agricultural residue, or non-fossil CO2), or solid waste from homes or businesses (e.g., packaging, paper, textiles, food waste). Commercial aircraft are currently certified to operate on a maximum of 50% SAF blended with conventional jet fuel, though aircraft and jet-

engine manufacturers have made commitments to increase the effective percentage of SAF.

SAF is a biofuel used to power aircraft that has similar properties to conventional jet fuel but with a smaller carbon footprint, depending on the feedstock and technologies used to produce it, SAF can reduce life cycle GHG (greenhouse gas) emissions dramatically compared to conventional jet fuel. Some emerging

SAF pathways even have a net-negative GHG footprint. SAF’s lower carbon intensity makes it an important solution for reducing aviation GHGs, which make up 9%–12% of U.S. transportation GHG emissions, according to the U.S. Environmental Protection Agency. An estimated 1 billion dry tons of biomass can be collected each year sustainably in the United States, enough to produce 50–60 billion gallons of low-carbon biofuels. These resources include:

corn grain, oil seeds, other fats, oils and greases, agricultural and forestry residues, and wet wastes (manures, wastewater treatment sludge.)

In the latest step by the commercial aerospace sector to reduce carbon emissions, Pratt & Whitney Canada agreed to work with regional aircraft builder ATR on an initiative to achieve 100% Sustainable Aviation Fuel (SAF) readiness for PW127 series engines by 2025. Their agreement will cover the new PW127XT engine that will power upcoming ATR aircraft. ATR is a Franco-Italian aircraft manufacturer headquartered near Toulouse. It is a 50-50 joint-venture of Airbus and Leonardo that supplies twin-engine turboprop aircraft for regional service, principally the ATR 42 and ATR 72 models – both of which are powered by PW127 engines.

“Our collaboration with ATR will be underway throughout 2023 and 2024, and builds on our recent 100% SAF test flight with Sweden’s Braathens Regional Airlines, which was an industry first for regional aviation,” said Anthony Rossi, Vice President of Sales and Marketing, Pratt & Whitney

Canada. He continued, “Alongside our efforts to continually enhance aircraft engine efficiency, SAF has a critical role to play on the journey to achieve the aviation industry’s goal of net-zero CO2 emissions by 2050. While all Pratt & Whitney Canada engines have already been certified for 50% SAF blends for more than a decade, ensuring readiness to operate with 100% SAF blends in the future will allow us to maximize their potential for decarbonization.”

Nathalie Tarnaud Laude, ATR’s Chief Executive Officer, added: “It is our collective responsibility as an industry to continue taking action to ensure that the vital connections provided by our aircraft across the globe are operated sustainably. We have recently demonstrated with our collaborators, Braathens Regional Airlines and Pratt & Whitney Canada, that ATR aircraft are SAF ready. Now, we need to continue to join forces to increase SAF availability as part of our common journey towards net-zero.”

GE Aviation reported the results of a successful test of its Passport turbofan

engine using 100% Sustainable Aviation Fuel (SAF). It’s the latest result among multiple efforts to lower carbon emissions in commercial and private aviation. The GE Passport engine is a smaller-scale version of the LEAP engine series developed by CFM International (a GE Aviation joint-venture with France’s Safran) developed for long-range business jets and introduced in 2018 for the Bombardier Global 7500 and 8000 series jets.

“As our testing shows, the Passport engine, like all GE engines, can operate on approved Sustainable Aviation Fuel today and in the future,” according to Melvyn Heard, President of the Passport engine program. “Our customers can be confident that the Passport engine can help meet their sustainability goals to reduce CO2 emissions in flight, thanks to the Passport’s more fuel-efficient technologies compared to previousgeneration business jet engines and its ability to operate on lower-carbon fuels.”

Other recent SAF tests of GE/CFM International engines include a United Airlines jet flight of a Boeing 737 MAX 8, with SAF powering one of two LEAP-1B engines : a Boeing ecoDemonstrator test flight using 100% SAF in CFM LEAP-1B engines; and a 100% SAF-fueled FedEx flight of a Boeing 777F, powered by two GE90 engines.

SAF is definitely in its infancy. Its future will depend on the willingness of those involved to produce gargantuan quantities of the stuff.

Author

profile: RoyceLowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook . n

MARCH 2023

General Motors has fallen behind in the EV race. It lags Ford, and of course Tesla, and is trying to speed ahead in the race for metals. GM is competing for a stake in Brazil’s Vale’s Base Metal Unit, according to those ubiquitous “people familiar with the matter.” Vale is splitting the base metal assets from its iron ore operations and wants to unveil a strategic partner for the new entity in the first half of 2023. Vale is making this move as a shift away from fossil fuels spurs demand for materials that are key to the manufacture of EV batteries. General Motors and Lithium Americas Corp. recently agreed a $650 million dollar deal to develop

the largest U.S. lithium deposit at the Thacker Pass mine in Nevada. This gives General Motors exclusive access to the first phase of production, which is expected to begin in 2026, and is forecast to supply as many as 1 million EVs per year.

GM’s CEO, Mary Barra, says “We’ll continue to work with many people in the industry, especially in lithium and the other critical minerals.” She continues “I think we’ll be positioned to have a competitive advantage.”

GM is pledging to sell nothing but plug-in models by the middle of the next decade. The company has opted

to build its own battery pack and dedicated EV platform rather than move quickly with converted internal combustion hardware, slowing its initial electric push. In any event, Barra says that output of EV models such as the Hummer pickup, electric Cadillac Lyriq, Chevrolet Silverado pickup and Blazer SUV will take off this year.

To say the prices of battery metals are volatile would be an understatement. Cobalt, nickel, and lithium soared to extraordinary heights last year, but lately came crashing down. Having stable supplies would be a real boon for GM. They are far from alone here,

as automakers, including Ford, have signed long-term mineral supply deals. Germany’s Volkswagen last year agreed to form a €3 billion jointventure with Belgium’s s Umicore for cathode materials. In 2021, Tesla struck a nickel deal with BHP, and a cobalt pact with Glencore, and in March that year got involved in a mining venture in New Caledonia.

The industry will surely be aware of the necessity to heed the warnings of Amnesty International, which has warned that mining is linked to environmental issues and claims of human rights abuses. In an era when environmental, social, and governance shortcomings carry severe reputational risks, GM could be exposing itself to criticism. Vale faced criticism after the collapse of the Brumadinho dam in Brazil, which killed 270 people

and released toxic sludge into the environment. The accident caused Vale to lose its position as the biggest iron-ore producer, and sparked a company-wide safety and governance overhaul. Reparations continued to adversely affect its financial results years after the incident.

Several companies are looking for ways to reduce the environmental footprint of mining to minimize those ESG concerns. GM has invested in Controlled Thermal Resources, a startup working to extract lithium using renewable energy, and is backing Lithion, a Canadian startup that recycles EV batteries to reuse materials.

Despite its move into mining, GM has some catching-up to do on EVs, selling just under 40,000 EVs last year,

finishing behind Ford and far short of market leader Tesla. Barra vows the company is just getting started, including with Chevrolet’s Equinox and Blazer models coming out this year, which start at around $30,000 and $40,000 to $45,000, respectively. Barra says that’s a very good deal.

U.S. steelmakers are bullish on 2023, with Cleveland-Cliffs forecasting an 8% growth in shipments to some 16 million tons, versus some 14.8 million tons in 2022. The 2023 selling price is forecast at some $115 per ton over that of 2022. Similar forecasts and price increases come from all the major U.S. steel companies.

Author profile: Royce Lowe, Manufacturing Talk Radio, UK and EU International Correspondent, Contributing Writer, Manufacturing Outlook. n

The total global annual spending on passenger EVs in 2022 was $388 billion, up 53% from the figure for 2021. So if we add this amount to the foregoing total for EVs, the global total has now passed $1 trillion. Is this a big number? Sounds like it. But it’s not that much more than the $918 million that GM will invest in four U.S. plants, mainly for the production launch of a new, small block ICE, as we reported last month.

But global auto sales are worth some $2.5 trillion a year. This means that since EVs effectively saw the real light of day, the value of total car sales has been around $25 trillion. Looked at this way, the cumulative value of EVs is quite modest. There again, it’s not that long ago that we were wondering if the EV would really take off. That they did can be illustrated by the following passenger EV sales from 2016 through 2022, transposed from a

BloombergNEF chart: 2016 - $25Bn; 2017 - $45Bn; 2018 - $80Bn; 2019$85Bn; 2020 - $125Bn; 2021 - $260Bn; 2022 - $388Bn.

So more than 50% of EV spending occurred in just the past 18 months. Bloomberg expects EV adoption to continue to rise in 2023, but at a slightly slower pace than the last two years, which saw sales jump from 3.2 million in 2020 to more than 10 million continued

in 2022. They expect 13.6 million plugin passenger vehicle sales in total for 2023, with around 75% of those being fully electric. But even so, 2023 global passenger EV sales could top 13.6 million.

China is set to be number one in EV sales again, with 8 million passenger EVs sold despite its phase-out of subsidies. The U.S. will do well, thanks to a combination of new EV manufacturing capacity and restored federal tax credits. At around 1.6 million plug-in vehicle sales in 2023, the U.S. will still be well behind Europe, but the gap is starting to narrow. Growth will be modest in Europe, but Chinese automakers are nipping at their heels and already account for over 10% of the region’s EV market.

There are now 27 million electric vehicles on the road globally, and this should exceed 40 million by the end of the year. That’s still only around 3% of the global vehicle fleet, but it’s a huge leap from less than 1% at the end of 2020. Plug-in vehicles now represent around 15% of global car sales, and their fortunes are increasingly tied to an overall global economy that is on shaky footing.

Sales of zero-emission vans and trucks will likely continue to rise quickly and should hit almost 600,000 globally in 2023, up over 80% from 2022. Since 2020, sales have jumped almost four-fold against the backdrop of a largely stagnant market for commercial vehicles. Commercial vehicles are used much more intensively than passenger cars, so electrifying them will lead to large reductions in both emissions and oil demand. China is the world’s largest commercial vehicle market, so what happens there determines the global picture. At 10% electric share, China is well ahead of almost all other

countries in this segment. Only South Korea has a higher adoption rate, with more than 20% of its light commercial vehicle sales electric in 2022.

So with all these EVs on the highways and many more to come, what’s happening with the charging situation? Industry Week fills us in on this. Federal agencies have agreed to standards for government-funded electric vehicle (EV) charging stations. This development should make it easier for manufacturers to develop systems to take advantage of nearly $5 billion in public funds. BidenHarris administration officials say this groundwork could lead to a made-in-America charging network that’s reliable and convenient. With the Department of Transportation and the Department of Energy partnership, the finalized standards support EV charging of any type of car in any state. To qualify for public funds, chargers must be made domestically.

White House officials state that “the plan requires that, effective immediately, final assembly and all manufacturing processes for any iron or steel charger enclosures or housing be carried out in the United States. By July 2024, at least 55% of the cost of all components will need to be manufactured domestically as well.”

U.S. manufacturing is poised to benefit from EV chargers purchased through the National Electric Vehicle Infrastructure program (NEVI), creating jobs and incentivizing companies to invest in U.S. production. Three years ago, there was little American footprint in the advanced EV charging industry. Now, producers are making investments to establish new headquarters, facilities, or production lines to build the next generation of EV chargers in the United States. These actions build on the previous commitment by Biden to put together a network of 500,000 EV chargers by 2030.n

One of the recent methods of attacking your systems is a “sleeper agent.” This is a malicious program that lays dormant in your computer, waiting to attack at a later date. These are very tricky because it means the attack or infection will also be on any backups that you make, so that when you restore from that back-up, it also restores the virus or ransomware you are trying to remove. It’s devilishly clever and very disruptive.

Hackers have become more patient as well. Some will even wait up to a year before attacking so that all of your back-ups have been compro -

mised, making you desperate and more willing to pay them to (hopefully) restore your data.

Imagine this: you’re hit with a cyber attack. You feel okay; you’ve always done your back-ups. You check them, manage them, and keep them safe, doing everything you’re supposed to do.

The cybercriminals have encrypted all your valuable data, followed by a demand for thousands of dollars to unlock it for you. You’re not worried; you’ve been performing proper back-ups and you’re confident that

everything is safe and secure. Your back-ups are off-site and have been protecting you for a year. You laugh in the face of the foolish attackers— hahaha!

The back-up restores your files and systems, and you’re ready to go. Unfortunately, the next morning, all your files are locked and unavailable to you again. Okay, no problem. You restore from a few days ago. Night comes and you sleep restfully, knowing everything will be restored back to normal, only for the process to repeat again, and your files are still compromised. What now?

We’ll begin by understanding what’s happening. In the past, hackers would attack immediately when you clicked on a bad email or a compromised link, then addressed it with new security protections. Good news for you and me, bad news for the hackers.

Sadly, more and more cyber attacks aren’t happening immediately. Instead, hackers are putting programs onto your computer that then go to “sleep.” When it’s initially installed, it doesn’t do anything harmful or noticeable, so it goes undetected until disaster strikes.

While the usual protocol for a cyber attack might call for something like the back-up situation we just explored, with sleeper agents, we have to pivot and be more proactive. The key to stopping a sleeper agent hacking attempt is to detect them as they come in.

Operating systems, like Windows and Mac OS, will assume that if you authorize the program, it should be allowed to install. The hackers take advantage of this and put their sleeper

agents into other install software that you may think is innocent. This way, when you give permission for something to be installed, it just comes along for the ride.

The counter to these sleeper agents is called an application control program. It reviews all the programs that regularly run on your computer and looks for those that do not appear to be doing anything or are acting out of the ordinary. It then flags these programs and sections them off, preventing them from making changes to your vital information.

The application control program does this by learning what you typically do on your device and how your device works. There is a learning period where it monitors the average uses of the device and remembers them. It then watches each program to see if it’s working in that same way as time goes on. If it is, then everything is good and can carry on its merry way. But, if an agent is being too quiet or starts asking to make changes to your files that are out of the ordinary, it is shut down, blocking access from any of your files.

The world is changing, and hackers are changing along with it. As our defenses change and grow, so do their attacks. Because new attacks are being developed every day, you should always have an adaptive approach to cyber security. Cyber security is never going to be a one-and-done situation, so you should always be adapting— the hackers are, and they’re lying in wait to strike. We have to be ready, too.

Author profile:

Ken Fanger, MBA has 30 years of industry experience in the fields of technology and cyber security, and is a sought-after CMMC Registered Professional, helping manufacturers and contractors to meet DoD requirements for CMMC compliance. He is passionate about technology deployment, and his MBA in Operations & Logistics has helped him to be an asset in the designing and deployment of networks to enhance the manufacturing experience. Over the past 5 years, he has focused on compliance and security, including working on the SCADA control system for the Cleveland Power Grid. Mr. Fanger works with each client to identify their unique needs, and develops a customized approach to meeting those needs in the most efficient and cost-effective ways, ensuring client success. n

Joe Biden told his audience during the State of the Union Address that when Americans work, when they do projects, they’re going to buy American: American lumber, glass, drywall and fiber-optic cables. He was talking about the 1933 Buy American Act. And he got a standing ovation for it.

In a recent New York Times Opinion article, Peter Coy, a long-time writer of opinion columns, reminded us that this act requires federal agencies to buy domestic products and materials except when such a purchase is not in the public interest, and when the cost is unreasonable. Biden told Congress that past administrations had found

ways to get around the Buy American Act. But those days were over, he stressed.

A law this old comes with interpretations and exemptions. Over the years, the government has issued many waivers in tacit recognition that certain purchases continued

in the U.S. would be prohibitively expensive. A new White House rule, dating from last October, states that to count as domestic, a product must have at least 60% domestic parts, up from the previous 55%, on its way to a 75% value. So why would the federal government buy products made domestically, even if they’re more expensive, even if they aren’t as good, and even if imported versions pose no national security concerns? If American-made parts were cheaper, better, or both, there would be no need to force their purchase since they’d be the obvious choice. So the requirement is either harmful to the government customers and hence the taxpayers, or it’s superfluous.

Some sometimes argue that imports aren’t safe, and sometimes this is true. Contaminated Chinese drywall, as used in the 2000s, caused a rotten egg smell and corroded metal in thousands of newly built homes, particularly in Florida. This is a case for testing and inspection; however, not a reason for blanket import restrictions.

Then there’s the question of jobs. Wouldn’t Buy American create more jobs in the U.S.? The unemployment rate in January was 3.4%, the lowest since 1969. In the short term, U.S. factories couldn’t handle the increased demand caused by suddenly ending waivers of the Buy American Act. There aren’t enough workers to spare. In the long run, people could be diverted into making products such as lumber and drywall, but these are not particularly attractive jobs. The Bureau of Labor Statistics says the median wage in production jobs in sawmills and wood preservation in 2021 was $17.76 per hour.

It doesn’t make sense for the U.S. to shelter relatively low-tech industries. America’s tariffs on apparel and footwear resulted in lower imports, and doubtless hurt the American consumer more than it hurt China. In any event, low-tech products were handed over to countries such as Vietnam and India.

On the other hand, the Biden Administration is also focused on high-wage, high-growth sectors that are vital to national security, reflected by the CHIPS and Science Act. Production of computing power depends upon tools, chemicals, and software that are often produced by a handful of companies and sometimes only one. This is from a new book by Chris Miller on the Chip War.

Miller notes that, for advanced manufacturing capabilities like chip making, components are normally sourced from many countries. Hence Buy American is often impossible. There is plenty of reason to question excessive reliance on trade with geopolitical rivals, but with allies such as Japan and Europe, where is the justification for Buy-American provisions? Good point!

In fact, there are no Buy American provisions in the CHIP and Science Act, due to the global nature of leading-edge semiconductor technology. The IRA (Inflation Reduction Act) relies on tax breaks rather than encouragement of domestic sourcing. The bipartisan infrastructure law has a waiver procedure that allows many foreign companies to supply U.S. customers. Trump’s tariffs on China are still in place, and now Biden is promising to be more aggressive in enforcing the 1933 law than were his predecessors.

Robert Atkinson is the president of the Information Technology and Innovation Foundation. A study by the organization concluded that insisting on American sourcing for technical products such as high-speed internet service to homes would raise prices by 20 to 25%.

Both Miller and Atkinson advocate friend-shoring of critical parts, i.e., switching to suppliers based in nations that are reliable allies. This goes back to Adam Smith, where everyone wins when countries specialize in what they do best rather than erecting protectionist barriers and trying to do everything alone.