Homes unveiled its first net-zero electricity home to the public at the 2022 Berkshire Hathaway Shareholders meeting in Omaha, Neb., in May.

The RV/MH Hall of Fame in Elkhart, Ind., is celebrating multiple historic achievements in August, inducting 10 new honorees in its 50th year, as well as unveiling the much-an ticipated Manufactured Housing Museum.

TThe awe-inspiring sight of our industry’s homes on the National Mall in June once again served as a poignant reminder of just how much progress has been made, and how much change manufactured housing professionals can affect in a relatively short period of time.

Local governments nationwide are coming to realize the need for fair treatment of factory-built homes. In Florida, the state association partnered and worked tirelessly to earn a 50 percent tax break on new manufactured homes, a measure that helps builders and operators keep homes affordable and flowing to the market for eager homebuyers.

Just in the last few years, manufactured homes and manufactured home communities have become an increasingly viable option for new buyers, including Millennials. Meanwhile, growth among builders has come via strategic investment, large acquisition, and thoughtful partnerships.

Brokers and lenders, as well as many other service providers, in recent years have examined and re-imagined how they deliver value, implementing new products and enhanced tech platforms.

Back in Washington, many policymakers, administration officials, and lawmakers are coming to truly see the need for added affordable housing, and a near consensus is forming that the answer is manufactured and modular homes.

There is a continued need for advocacy on many fronts, of course, and there always will be. But it should be lost on no one that the manufactured housing industry measured in home shipments has nearly doubled its productivity in 10 years.

And more so, the wide range of public and private stakeholders are coming to learn why.

Patrick Revere is associate vice president of MHVillage and publisher for the MHInsider magazine and blog for industry professionals. His background is in print news, language, and communication.

VOLUME 5 • EDITION 4 JULY / AUGUST 2022 MHInsider.com

Publisher Patrick Revere patrick@mhvillage.com

Merit Kathan merit@mhvillage.com

George Allen gfa7156@aol.com

Sean Vichinsky sean@mhvillage.com

Nick Bertino

Erik Edwards

Kevan Enger Mitch Gonzalez Matt Herskowitz Raymond Leech Tony Petosa Adarsh Rachmale

Advertising Sales (877) 406-0232 advertise@mhvillage.com

Patrick Revere

2600 Five Mile Road NE Grand Rapids, MI, 49525 (616) 888-6994 patrick@mhvillage.com

Although we make every effort to ensure that the information in this issue was correct before publication, MHVillage, Inc. and the publisher do not assume and hereby disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. Opinions expressed are those of the author or persons quoted and not necessarily those of MHInsider or the publisher MHVillage, Inc.

Copyright ©2022 MHVillage, Inc. All rights reserved. Reproduction of MHInsider content, MHI or other contributor content, in part or in whole, is prohibited without written authorization from MHVillage, Inc.

MHInsider™ is published by:

2600 Five Mile Road NE Grand Rapids, MI 49525 (800) 397 2158 www.MHVillage.com

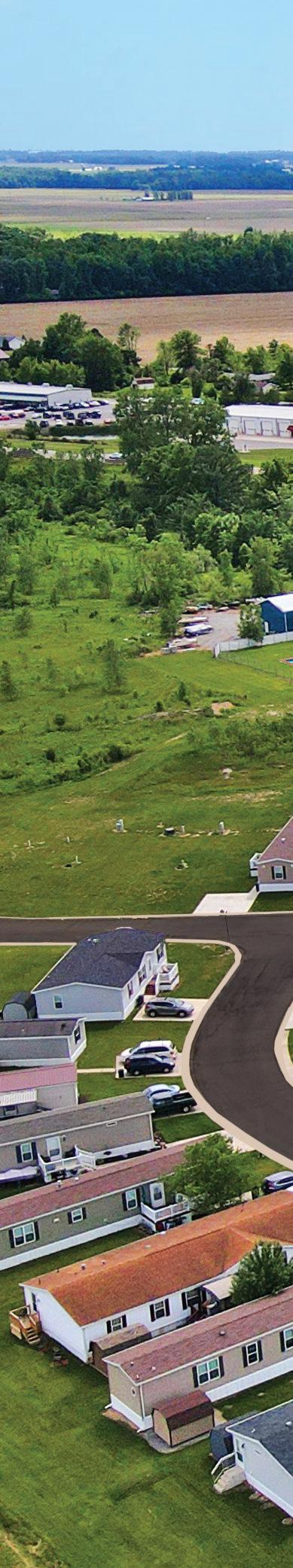

Westview Estates in Sandusky, Ohio, has been ac quired by Crown Communities and will be managed by Kodiak Property Management. "This is another great acquisition for Crown Communities and our eighth acquisition in 12 months," Alex Cabot, of Crown Communities, said. "Westview is one of the highest quality manufactured housing communi ties in Northwest Ohio and represents the type of property Crown Communities seeks to acquire and operate in the future."

Farmington Hills, Mich-based RHP Properties has acquired Valley View Estates in Shiloh, Ill., as well as three communities in Delaware, expanding the company’s portfolio to 15 communities in Illinois and 311 nationwide. Valley View Estates is on 57 acres and features more than 230 homes near local schools and large employers. The acquisition in Delaware consists of Colonial East, an all-ages community, and Sussex

East and Sussex West, a pair of 55+ communities. All of the properties are located in Rehoboth. RHP has seven communities in Delaware.

Yale Realty & Capital Advisors in the second quarter topped its best single sale in the St. Louis market with a $17.5 million closing, registering $75,300 per pad in the 200-plus homesite, 95% occupied community. Upper Midwest Regional Director Ken Schefler credits his record-breaking close to the buyer's longstanding relationship with Yale. In Florida, Yale National Di rector of Brokerage James Cook closed a $19 million, 175-homesite, senior community with spacious lots, abundant amenities, and below-market rents.

Hometown America has agreed to purchase Mary Manor Estates, a manufactured home community in Sunnyvale, Calif. The 116-site community is fully occupied, and sits about 12 miles from San Jose, and 40 miles south of San Francisco. Built in

1974, the Mary Manor Estates has a pool, clubhouse, and car washing station.

UMH Properties has acquired a manufactured home community in Monaca, Pa. for $5.8 million. The community has 96 developed homesites and is situated on about 18 acres. “We are happy to announce the acquisition of this well-located community,” UMH President and CEO Sam Landy said. “This community is located near some of our communities that are at or near full occupancy and it complements our existing portfolio. Landy said UMH will upgrade the commu nity to increase revenue and community value. He said the company continues to seek opportunistic acquisitions that meet their growth criteria. UMH Properties owns and operates 128 manufactured home communities with more than 24,100 homesites in New Jersey, New York, Ohio, Pennsylvania, Ten nessee, Indiana, Maryland, Michigan, Alabama, and South Carolina, and has one co-owned community in Florida. UMH also recently opened a pair of new

home retail locations, one in Carmel, Ind., and another in Catskill, N.Y.

RHP Properties, the nation's largest private owner and operator of manufactured home communities, is providing a $10,000 donation to support Mountain »

View High School in El Monte, Calif. The donation is in partnership with AdoptAClassroom.org. The funding is for pre-Kindergarten through 12th grade schools and teachers in the U.S. to purchase materials and tools for their students to learn and succeed. This is the fifth school RHP Properties has adopted through the program, with a total of $50,000 in donations. Mountain View has about 1,340 students in ninth through 12th grade, including about 200 students who reside in nearby Brookside Country Club, an RHP Properties community.

The Northwest Housing Association, which represents manufactured home retailers and builders in Washington, has hired Lance Clark as executive director of the organization.

Clark brings about 20 years of association management and building industry experience to the role left vacant by the recently retired longtime Executive Director Joan Brown. “I am excited to serve as NHA’s executive and sup port members during a time of dynamic growth in manufactured home sales,” Clark said.

Norman Pate, 78, of Woodway, Texas, passed away in March. Mr. Pate came to Texas from Alabama in 1973 to work with Winston Indus tries and Crimson Homes. He and his wife Susie worked at Brigadier Manufactured Plant and started Brigadier Homes of Waco. Mr. Pate loved being a small business owner, and developed many friendships from his associations in the industry; his employees, and clients. His passion was providing quality manufac tured housing to the community and developing his business. A visitation was held in early April at Grace Gardens Funeral Home Chapel. He is survived by his wife, children Lane and Ashley, sister-in-law Lola

Murphy Pate, nieces Vicki and Rhonda, nephews Scott, Chris, Ray, and Dave, as well as countless cousins and other family and friends. Memorial contributions may be made to the Alzheimer’s Association.

Joseph Adlore Chaudier, who built L’Anse Mobile Home Park in Michigan, died in March from brain cancer. He had been in the United States Air Force, and worked as a draftsman for Ford Motor Company before returning to his hometown. He served on the Michigan Manufactured Housing Commission. Mr. Chaudier is survived by his wife Doris, three daughters, eight grandchildren, and three brothers. He was preceded in death by his parents John and Gladys Chaudier and six siblings.

Wisconsin Retailer, Advocate Laid to Rest Eugene “Gene” Victor Remy, 84, of Remy’s Homes, passed away in April. Mr Remy was an entrepreneur from an early age, catching and selling minnows at his parents’ resort, and selling manufactured homes during his high school lunch breaks. What began as a business venture led him to the realization of his true passion of providing affordable housing for families. He served in the U.S. Navy and was a trained electrician. He and his wife Pat also owned and oper ated Thunderhill Estates and Gitche Gumee Resort. Mr. Remy served on the boards for the Wisconsin Manufactured Housing Association and Wisconsin Housing Alliance, and in 2001 earned the Elmer Fry Award for leadership and industry innovation.

GA

Atlanta Evergreen Marriott Conference Resort

By attending SECO22, you’ll get to experience a suite of new and most requested topics and speakers. Here’s just a sneak peek of what you’ll see and do at this year’s SECO:

Tour on-site manufactured homes to see the latest developments in industry manufacturing

Take part in SECO’s first-ever golf tournament and networking roundtables

Attend THREE receptions for entertainment and networking throughout SECO22

Experience SECO’s first-ever

BAND at the event

Attend all-time favorite SECO educational sessions to further your industry knowledge

Over 500 attendees are expected to attend SECO live and in-person this year. You can’t miss your chance to be among this exclusive group and stay ahead of the curve.

To learn about sponsorship, exhibiting, and advertising opportunities, call (404) 777-SECO

Monday, Aug. 15

Elkhart, Ind. | RV/MH Hall of Fame and Conference Center

The RV/MH Hall of Fame in its 50th year invites industry professionals, family, and friends to cele brate the milestone anniversary and honor the 2022 inductees. The event starts with a cocktail mixer, followed by dinner and the induction ceremonies. The hall in Elkhart details the careers of hundreds of RV and MH professionals, including a library, event center, and museums for each of the industries.

Tuesday, Aug. 16 — Wednesday, Aug. 17

Elkhart, Ind. | Northern Indiana Homebuilding

Texas Manufactured Housing Association Annual Convention Sunday, Sept. 18 — Tuesday, Sept. 20 San Antonio, Texas | Marriott Riverwalk

The annual meeting in Texas begins with a Sun day golf event and exhibit booths opening in the afternoon, followed by a mixer and welcome dinner. Monday will start with a sponsored breakfast, ed ucational sessions, and a luncheon with a keynote speaker to be announced. The evening includes a cocktail reception and the Chairman’s Dinner. The event wraps up Tuesday morning with a networking breakfast and the fourth quarter association board meeting.

2022 Arizona Manufactured Housing Conference Sunday, Sept. 25 — Tuesday, Sept. 27

If you have an event or gathering — virtual or in person — you would like to have listed with MHInsider, please contact us at: www.mhvillage.com/pro/manufactured-housing-industry-trade-shows/

TThree manufactured homes on the National Mall June 7-12 drew the attention and the praise of Washington D.C. lawmakers and policymakers, as well as passersby.

Cavco Industries teamed with UMH Properties to showcase a single-section manufactured home, and Skyline Champion Corporation brought out a pair of homes, one small-floorplan accessory dwelling unit, and a new CrossMod multi-section home with a pitched roof and attached garage.

“We made the decision to showcase our two homes because the country has a crisis and we have the solu tion,” Champion Homes Executive Vice President of Business Development Wade Lyall said. “Affordable, attainable housing is a crisis in our country and man ufactured housing is the solution. We need improved zoning acceptance and better access to attainable financing solutions, and by showcasing with MHI we get a chance to show members of Congress the industry’s newest products that can help solve the affordable housing issue.” »

New homes built in the factory dominated the event's first week. Then, in the second week of the showcase, manufactured homes were joined by panelized and modular homes. A 3D printer building homes and alternative building ma terials — such as container construction and system building — also were featured.

“When people come in the house, it speaks for itself,” MHI Chairman Leo Poggione said. “They walk in and they’re like, ‘I can’t believe how beautiful this home is.'”

Mark Sickles, from the Virginia House of Delegates, said he wished more people knew about the manufac tured housing industry and the homes it produces.

“I think if more boards of supervisors and city councils saw these homes they would be more willing

to change their codes to allow them to occur. It’s really beautiful,” Sickles said.

The Innovative Housing Showcase, hosted by the U.S. Department of Housing and Urban Development, is part of a push toward high-quality, affordable housing solutions, which is also is a White House priority. The Manufactured Housing Institute, the national advocacy group for factory-built housing, joined HUD early in the week to host Homes on the Hill, an opportunity for its members to appeal to lawmakers from their home states or states in which they operate.

“I don’t know anywhere in the country, and I travel almost every week, that I’ve seen something like this that is that affordable,” HUD Secretary Marcia Fudge said in an interview with MHI.

“It is going to be a major part of the solution,” Fudge said of manufactured homes.

Lesli Gooch is CEO of MHI.

“Our industry came together to ensure that federal lawmakers, policymakers, and the public could see first-hand how manufactured homes are delivering on the American dream of homeownership,” she said. “Thousands of people toured our homes on the National Mall during the Innovative Housing Showcase and we appreciate HUD Secretary Fudge

and her team for recognizing that our homes are making attainable homeownership a reality and for helping us share what we do with the nation.

“Manufactured homes are energy-efficient, designed with today’s families in mind, and at a price point that is attainable for millions of Americans who would otherwise be struggling to find a place to call home,” Gooch added. “The three homes will now head to their final destination, making three families’ American dreams come true. This has been a perfect way to recognize the 20th Anniversary of National Homeownership Month.”

In addition to HUD Secretary Marcia Fudge, members of Congress and administration leaders from across the federal government were impressed by the quality, design, and attainable price point of the homes.

In her opening remarks kicking off HUD’s Inno vative Showcase, Secretary Fudge said “today is the beginning of solving the country’s affordable

housing challenge" and recommitted her agency to utilizing innovative housing solutions to address the problem, including manufactured housing as part of the solution.

As part of this event, MHI members from across the country blanketed Capitol Hill to meet with their Sen ators and Representatives to advance the industry’s policy priorities and ensure manufactured housing remains an affordable homeownership option.

Manufactured housing professionals met with Congressional offices to talk about the need to update FHA’s Title I and Title II programs, to ensure DOE’s energy standards do not become effective until they are revised and adopted as part of the HUD Code, and to urge federal efforts to preserve and develop manufactured housing communities. MHV

To Advertise, call: 1-877-406-0232

Want MHInsider news in print and online, or just digital? Need to add or remove a colleague? Place a hold? Change an address?

Go to http://subscriber.mhinsider.com on your computer, tablet or phone.

When you subscribe, or link to your current subscription, you will be provided an individualized reader identification code to help facilitate any changes.

Thank you for reading!

Reach Over 30,000 Manufactured Housing Professionals in Print and Online

TThe SECO National Conference of Community Own ers announced recently the return to an in-person format for the annual SECO Conference.

This year’s event, taking place from October 3 - 6, 2022, will welcome community owners and managers from all over the country to Stone Mountain Park in Atlanta.

The event’s website bills itself as being for “anyone who owns or has an interest in the health and opera tion of manufactured home communities.”

SECO20 and SECO21 were the organization’s first two years operating as a virtual event. With two years of virtual success in their back pocket, SECO is returning to an in-person format to kindle networking relationships between community owners and other industry professionals.

“SECO has always been about making personal connections and fostering education with small to mid-size community owners and managers,” SECO Co-Founder and organizer Spencer Roane said.

“We are thrilled to be back in Atlanta this year to continue the tradition in-person and share industry knowledge among fellow professionals,” he added.

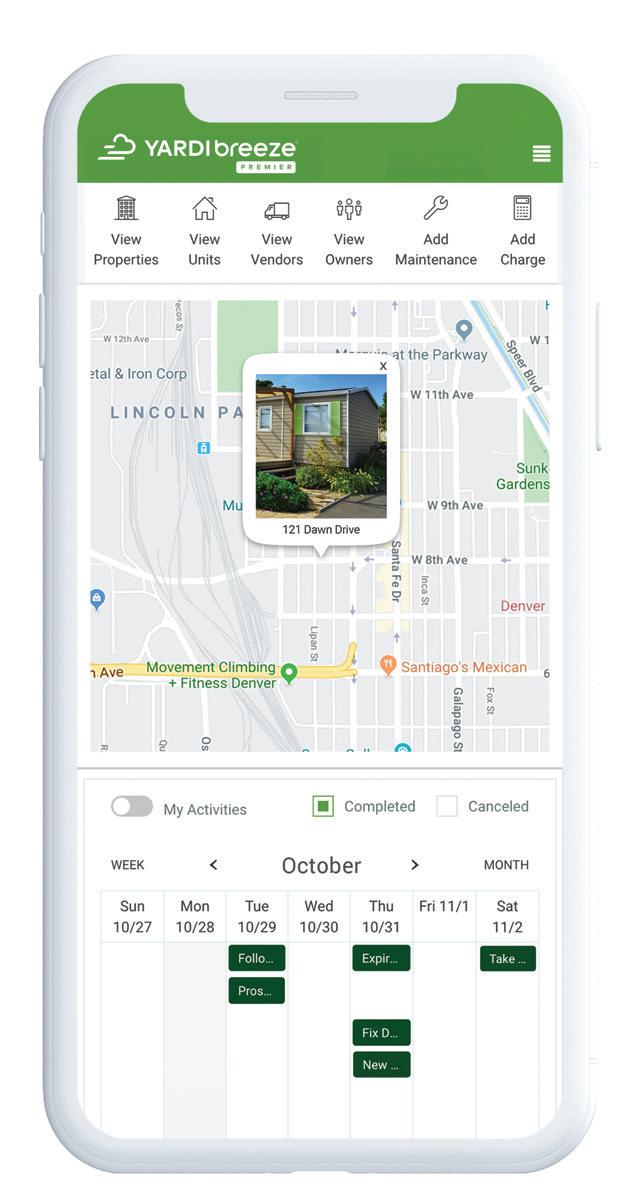

The 2022 event is set to host a number of new events and attractions while bringing back some all-time favorite sessions. This year’s educational programming is set to focus on management developments and challenges, community opera tions, management software and technology, and financing/valuation topics.

Notably, SECO22 will mark the return of on-site manufactured homes to the event for attendees to view.

Additionally, this year, attendees can take part in SECO’s first-ever golf tournament, attend three recep tions for entertainment and networking, experience SECO’s first-ever live band at the event, and see the latest developments in industry manufacturing.

On the programming side of things, attendees will also welcome the return of Manager Monday, a day of programming dedicated to community management topics, as well as the networking roundtables.

For more information on SECO22 and to register today, visit secoconference.com. MHV

TThe RV/MH Hall of Fame in Elkhart, Ind., is celebrating multiple historic achievements in August, inducting 10 new honorees in its 50th year, as well as unveiling the much-anticipated Manufactured Housing Museum.

“This year's induction dinner guests will get a special treat as the grand opening of the 21,000 square foot Manufactured Housing Museum will be taking place on the same day,” RV/MH Hall of Fame President Darryl Searer said. “This museum winds through time from the industry's origins, through the present day, and finishing with tomorrow.”

The museum, Searer said, is highly educational on every thing the industry has to offer and features an immersive and interactive experience that takes the Hall of Fame's new museum from being an attraction to a destination. »

The RV/MH Hall of Fame was formed in 1972 by a group of industry magazine publishers, and during the ensuing years has been able to grow from a small library to a 40-acre campus featuring an RV Museum with 60 one-of-a-kind recreational vehicles, the new interactive manufactured housing museum, the world's largest industry library, a hall dedicated to Go-RVING, an exhibitor's hall, and the Hall of Fame. A 36,000 square foot convention hall is underway for the Northern Indiana Event Center, which already has a pair of halls providing 24,000 square feet of space, and a 250-unit multi-purpose rally/show site that also is a one million square foot parking lot with a 20,000 square foot climate-controlled pavilion at the center.

In 1986, Dave Carter sold a lumber yard and an

electrical supply business to concentrate on Dave Carter & Associates, supplying the electrical and building product needs of the manufactured housing industry. In three years he took DCA from a regional provider to a national supplier with a dozen distribu tion centers. In 1993 the business added plumbing products, diversified into RV in 2008, and helped rebuild the manufactured housing industry during its 15+ year recent era of growth. DCA was named MHI Supplier of the Year in 2011, and Dave Carter continues to advocate for affordable housing on the local, regional, and national levels.

Harry Karsten built The Karsten Co. and Karsten Homes into a West Coast powerhouse. It was founded in 1995 and built its workforce to more than 700 people, including a couple hundred at the homebuilding facil ity at its plant near Mather Airport in Sacramento. »

The company expanded from California to other homebuilding sites in Albuquerque, N.M., Stayton, Ore., and Breckinridge, Texas. At the time it was purchased by Clayton in 2005, the facilities were putting out better than 1,700 homes a year in 14 states in the West and central United States.

Ray Gritton has been in the manufactured housing industry for more than 40 years. He started his first dealership in Modesto in the 1970s and has worked for large corporations in charge of hundreds of deal erships. He currently owns 13 locations in five states. Gritton has won multiple awards and has served on boards for state and national industry associations.

Tim Williams had a long, productive, and diverse career in manufactured housing even prior to co-founding 21st Mortgage in 1995. As CEO of the organization, he has been instrumental in providing improved financing for affordable homes across the country as well as growing 21st into one of Knox ville's largest employers. In addition to his efforts in Tennessee, Williams has been a tireless advocate for manufactured housing in Washington, D.C., and nationwide.

Eugene Landy is a founder and current chairman of the board for UMH Properties, Inc., a publicly-owned REIT in the ownership and operation of manufac tured home communities. He is a graduate of the U.S. Merchant Marine Academy as well as Yale Law School, where he served for many years on the board of advisors. UMH, now operated by Eugene’s son, Sam, has a portfolio of 127 manufactured home communi ties with about 24,000 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan, Maryland, Alabama, and South Carolina. UMH also owns and operates one community in Florida through its joint venture with Nuveen Real Estate.

Jim Scoular donated generously to the museum in honor of his father Ralph, a 1998 RV/MH Hall of Fame inductee.A small group of industry professionals was able to get a sneak peek of the new Manufactured Housing Museum, an experience made possible by many individuals, most notably the museum’s namesake Jim Scoular, who donated to the effort in honor of his father, Ralph, who preceded him in the industry and as a member of the Hall of Fame.

The museum is a linear historical journey through time and into the future of manufactured housing, beginning with covered wagons on the American frontier and viewing the future of housing from a rather surprising vantage point.

The journey includes an appeal to all of the human senses, from crickets in the night to the aroma of fresh-cut grass, and a gentle breeze at your back. Veteran museum, zoo, and theme park designer Thomas Landgrebe left not a single trick on the table in the effort to create a remarkable experience in time and place.

“I appreciate so much what everyone who works here has done,” Jim Scoular, a South Dakota industry professional, said of the efforts in Elkhart, Ind. “It’s a dream come true for the industry, and it all comes back to the leadership here. It’s tremendous.”

With the addition of the new museum to comple ment its existing offerings, Searer said he anticipates annual visits to exceed 100,000. In the last 10 years the venue has matured from a hall, meeting space, and library valued at $500,000 to a much larger event space with two museums, a large outdoor rally site and pavilion, and the two museums now worth about $22 million.

“We’ve come a long way in a short period of time,” Searer said.

Among those who toured the hall in advance of its Aug. 15 opening was Joe Viglione, of Fairmont Homes, which donated the first modern home to the museum,

jump starting subsequent donations and partnerships that have made the effort a success.

“This addition to the hall is a great thing for our industry,” said Kim Schultz-Rainford, who owns communities in Texas.

George Allen, a former community owner and consultant in manufactured housing, continues to write about industry advances and is a longtime supporter of the hall of fame.

“I have waited 44 years , the sum of my career, to see what I saw today,” Allen said following the sneak peek museum tour. “I am very impressed.” MHV

If you are thinking of purchasing or selling a community, or have questions running your community, please make us your first call.

We are here to help you and we look forward to assisting you.

ATTORNEYS AT LAW www.BMBde.com

Wilmington | Dover | Lewes | Georgetown 302-327-1100

by Raymond Leech maybe

by Raymond Leech maybe

AAs we all know, manufactured housing is one of the best sources of affordable housing avail able today and makes up to 10 percent of all of the nation’s housing stock. With the severe housing shortage in this country, estimated to be close to four million units by Freddie Mac, manufactured homes are valuable in closing this gap. But a large percentage of loans used to purchase these homes are chattel loans or personal property loans, and the convention al mortgage marketplace does not support chattel loans. This results in financing that has higher interest rates over shorter terms, and fewer consumer protections.

While Cascade Financial has been successful in creating a few securitizations in recent years, there are currently no other major investors that purchase or securitize chattel loans for MH. And the two Government-Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac, do not have policies or products in place to purchase them either.

But that could be changing. »

In April of this year, the Federal Housing Finance Agency (FHFA) released the Duty To Serve (DTS) plans of Fannie Mae and Freddie Mac. Duty To Serve is a commitment by FHFA through Fannie Mae and Fred die Mac to provide financing in three key underserved mar kets: manufactured housing, rural housing, and affordable housing preservation.

DTS commenced in 2016 and the first plans were an nounced in 2018. A new plan is announced every three years. The one released in April is for 2022 through 2024.

But the 2022 plans got off to a rocky start, and one of the reasons is both GSEs had nothing to address support for chattel loans.

In a stunning development, the original DTS proposals to FHFA in May of 2021 were soundly rejected by many housing advocates such as the Lincoln Institute, the National Housing Conference, and National Commu nity Stabilization Act. They told FHFA to hit “pause” as they did not believe the proposals met the spirit of the DTS commitment.

The advocates were upset that both GSEs were ending their plans to explore purchasing chattel loans, and disappointed in the goal levels set for rural, affordable housing preservation, and manufactured housing. FHFA listened and told Fannie Mae and Freddie Mac in January of this year to go back to the drawing board. And they did, and the new proposals were accepted in April.

But even with the improved proposals and more robust goals, do not expect significant changes regarding chattel financing in the next few years. However, there are some things happening.

In their April DTS plan, Freddie Mac announced

a definite focus and goals for chattel loans in the next few years.

Freddie Mac committed to purchasing from 1500 to 2500 chattel loans as part of their DTS goals in 2024. Over the next two years, their plan is to complete a feasibility assessment of the requirements and processes needed to support chattel loan purchase, including un derwriting, pricing, consumer protection, valuation and risk management.

And if they are successful, they want to obtain FHFA approval to move forward with a loan option that could be introduced in 2024. The big challenges they point out are a lack of lender standardization, no standard underwriting practices, and no consistent approach to assessing property values.

Freddie Mac announced a focus on MH homes in Na tive American and Alaskan American communities, which have complicated land ownership rules due to trust or tribal issues. They also are working on efforts with nonprofit developers to expand the availability of manufac tured housing. Additionally, they are focusing on expanding their outreach and loan purchases in resident-owned communities (ROCs) and nonprofit developer communities.

Fannie Mae’s plan does not include any specific goals for chattel financing by 2024. But they are still interested in exploring this area.

“We continue to work with our regulator (FHFA) to understand safety and soundness considerations and the viability of a chattel loan pilot program,” Fannie Mae said in a published statement.

So based on this, Fannie Mae may offer the chattel loan product via a pilot. Typically, pilots are done with selected lenders in specific markets. And pilots can be up to one or two years in length. So do not expect

Freddie Mac is taking the lead on chattel financing efforts, and typically, once one GSE adopts a program or product, the other one will follow.

-Raymond Leech

a chattel loan product available nationwide to lenders from Fannie Mae for several years at least.

Fannie Mae’s plan also includes efforts to develop products and strategies to purchase more loans in manufactured home communities. These communities feature homes built in factories and delivered to the community where residents own homes and lease the land from a community owner. They also announced that all loans in these communities must have 100 percent tenant site lease protections in place.

In addition, Fannie Mae an nounced that they are exploring how to purchase more loans from MHCs to finance rental units, and also allow residents who rent MH units to report their rental

payment data to credit bureaus to help build up their credit profiles.

The good news for the man ufactured housing industry is that both Fannie and Freddie are increasingly committed to the purchase of more conventional loans related to MH titled as real property, with Freddie planning to purchase from 5,800 to 7,500 loans each in the next three years and Fannie planning to purchase at least 9,300 loans annually in the next three years.

So, in summary, housing advocates were able to steer both Fannie Mae and Freddie Mac toward more robust efforts and goals in the manufactured housing marketplace. Freddie

Mac is taking the lead on chattel financing efforts, and typically, once one GSE adopts a program or product, the other one will follow. This will be an interesting effort to examine during the next few years, and hopefully we will see progress down the road. MHV Raymond Leech has worked in the mortgage industry for 30 years, first with Fannie Mae and more recently with Fairway Independent Mortgage Corporation. He has developed and managed construction and renovation mortgage products, but also worked on FHFA Duty To Serve efforts involving manufactured housing, as well as rural affordable housing efforts.

HHistorically low unemployment, growing payrolls, and rising con sumer spending have combined with continuing supply chain challenges in what is being called The Great Supply Chain Disrup tion. Add the war in Ukraine to the mix and we now have a historically unique combination of forces that has pushed inflation to a 41-year high of 8.5 percent in March of this year.

Inflation happens when prices go up as a result of an increase in production costs, raw materials, and labor. Over the past year, this cost-push inflation has been exacerbated by an increase in demand for goods and services that has exceeded supply and the ability to produce goods at a rate that meets that demand.

This skyrocketing inflation has led the Fed, whose job it is to promote the health of the U.S. economy and the stability of the financial system, to increase its benchmark interest rate. The first hike came in March of this year marked by a quarter of a

percentage point, followed by a second boost of half a percentage point in May, and three quarters hike in June.

The moves prompted the prime rate to increase to 4.25 percent. The prime rate is what banks charge their best and most cred itworthy customers and is used as a basis for other loans such as mortgages, home equity loans and lines of credit, small business loans, and personal loans.

What most mobile home com munity owners don’t realize, however, is that rising interest rates also have an impact on their park’s property value.

And the impact can cost you millions of dollars.

The Fed raised the rate by three-quarters of a percentage at the July meeting, and is expected to raise it by at least a quarter-percentage point two more times this year.

The current prime rate of 4.25 percent is up from 4 and 3.50

percent in March but still below 2019's 5.25 percent (8/1/19) or 2018's high of 5.5 percent (12/20/2018). However, it will go back up as a result of the upcoming Fed hikes.

The majority of mobile home parks are acquired using lever age, mostly agency financing via Fannie Mae and Freddie Mac, but other types of loans as well. Although Fannie and Freddie loan rates are typically lower than stan dard loans, their rates will also increase. This means that buyers will be paying more for the capi tal they use to acquire a mobile home community.

This is significant because if the cost of capital goes up for borrowers, it follows that buyer’s returns will be impacted, and as a result, so will cap rates.

While there is still a lot of de mand for manufactured home communities as an asset class, acquisitions must have positive leverage otherwise they just won’t make sense.

And this is why sellers must pay attention. »

At the moment, the hikes hav en’t impacted deal flow but there is more trepidation in the market from buyers and more urgency from sellers.

This urgency is not unwarrant ed. Here’s why.

Let’s assume you have a park that is currently valued at $20 million. In a primary market, your community may be at a high 3 percent cap rate. If the property is located in a tertiary market you may be looking at a low 5 percent or high 4 percent cap rate.

If the park has a $700,000 NOI, and cap rates move up by 100 basis points or just 1 percent from 3.5 percent to 4.5 percent, for exam ple — it will erode your property’s value by about $4.4 million.

Instead of $20 million your property is now worth $15.56 million. I don’t know about you but I would rather keep that $4.4 million instead of seeing it simply vanish.

If the cap rate increases by just a half-percentage point, you are still down $2.5 million. That is better than the $4.4 million but still $2.5 million more than what I am willing to give up.

This amount of money alone can have a generational impact on a family, fund a worthy cause for years, or be the beginning of a new portfolio of properties or investments.

Now imagine the impact if you have multiple properties.

Aside from interest rates, buyers will also have to weigh

the increasing cost of repairs, labor, and materials — all components that will impact a community’s NOI.

With at least three more interest rate hikes forecasted this year, timing has never been more important.

Mobile home park owners who have been thinking about selling or think they may want to sell in the next three to five years should consider their timing and the repercussions of the changing economic conditions on the value of their property.

The first step toward mak ing the best decision for your property is to request a broker opinion of value from a repu table seller-focused broker that specializes in selling mobile home communities and understands the current landscape.

With an estimate of your prop erty’s on-market value in hand, you can then decide if selling now makes the most sense for you, or if you rather hold for the next three to five years. MHV

Kevan Enger is a partner and man ufactured housing director for Capstone MH. He specializes in helping mobile and manufactured home park property owners across the country successfully position, market, and sell their properties to maximize their returns. Capstone has seven offices in five states throughout Florida, the Southeast, Midwest, and Mid-Atlantic.

by Patrick Revere

by Patrick Revere

OOne of the nation’s largest own er-operators of manufactured new home communities is expanding its presence in the Houston area with two new projects, including the re-de velopment of an existing bayfront setting, for individuals, families, and empty nesters seeking an affordable homeownership solution.

Inspire Communities is based in Phoenix and owns and operates 130 all-age and active-adult manufactured home communities and RV resorts. It recently completed a multi-million dollar re-development of its Oceanway community, a 17-acre enclave, in gulf coast Texas that has 150 homesites, including 32 waterfront and bayview homes on the shores of Trinity Bay.

Ten miles from Baytown, the newlook, gated community of affordable, well-built, high-style manufactured homes offers the charm of bayside living while appealing to those seeking a nearby second home for weekend getaways.

The community features homes in a variety of settings with stainless steel appliances, vaulted ceilings, upgraded cabinetry, and crown molding. Stylish, open-concept floor plans range from approximately 1,200 to 2,000 square feet. Waterfront Smart Cottages include a deck overlooking Trinity Bay. »

“It’s the look, feel and quality of a traditional new home, but at a more affordable price,” Senior Vice President of Sales and Marketing Heidi Loftin said. “It’s truly luxury living within reach.

“This was a unique opportunity to create a com munity of affordable new homes with the bay right outside your door… It’s really a hidden gem,” she said.

The community has two-, three- and four-bedroom options including farmhouse designs and waterfront cottages. Features include an island kitchen, oversized breakfast bar, great room, primary bedroom with walk-in shower, flex space, and a two-car driveway.

Several waterfront “Smart Cottages” feature low-e double pane windows and upgraded exterior paneling with a 50-year warranty, Loftin said.

The re-development of Oceanway includes the addition of a charming main boulevard lined with white picket fences and tall palm trees, newly paved streets, a fenced sports court, and a playground.

Loftin said other amenities include a 650-foot com mercially engineered fishing pier and an expansive boardwalk sundeck with lounge chairs.

Aaron Simon, a 41-year-old accountant, recently purchased a new home in Oceanway.

“Everything they’ve done is really nice and it’s a great location right on the water,” Simon said. “I love stepping onto my patio where I can enjoy a nice breeze and a beautiful view of the water.

“Plus, I like to fish so having the fishing pier here was a big selling point for me too,” he said. “And of course, you can’t beat the price.”

North of Houston in Willis, Inspire Communities is developing Rockrose Ranch at Lake Conroe, new construction on 170 acres for both an all-age and a gated, active-adult village.

Located two miles from Lake Conroe, the ground-up development will feature a sprawling amenity island with two swimming pools, pickleball courts, children’s playground, fire pits, miles of walking trails, lakes, and a fenced dog park. MHV

SSun Communities, the Michigan-based real estate investment trust, has released its annual environ mental, social, and governance report, unveiling the implementation of new initiatives, policies, and procedures within the company.

“As we grow, we view our responsibility and stew ardship to the environment, as well as to our team members, communities, and all stakeholders, with a stronger resolve than ever,” Sun Communities Chair man and CEO Gary Shiffman said. “We recognize that our team members and culture are the foundation to our success, and we demonstrate our value for their contributions by investing in various programs and benefits.”

In the last year, Sun engaged executive leadership to develop a corporate sustainability strategy that is integrated with the larger corporate vision and framework. In 2021, the ESG Steering Committee was established to align initiatives and actions addressing

and managing material issues. The committee meets quarterly to establish strategies related to these is sues, discuss the progress of initiatives, and ensure cross-functional collaboration.

Advancements made by the company in its ESG efforts during 2021 and 2022 occurred largely at corporate headquarters in Southfield, Mich., as well as in its manufactured home communities, RV resorts, and marinas located throughout the United States, Canada, and Puerto Rico.

The highlights of Sun Communities’ progress includes the following measures:

• The IDEA Council was launched to create a focus on inclusion, diversity, equity, and accessibility

• More than 5,600 volunteer hours were provided by Sun team members

• A company-wide commitment to formalize the reduction of greenhouse gas emissions and »

In 2021, Sun undertook a comprehensive assess ment of its supplier partnerships and procurement processes to identify opportunities and risks within the supply chain.

The assessment would have been a valuable effort at any time, and proved particularly insightful in the face of industry challenges with the cost and availability of goods and services. It creates better leverage for the company and provides an improved supply base, product standards, and reliability of processes.

“This information allowed the team to develop supplier and sourcing strategies, maximizing the size and purchasing capabilities of Sun,” the report stated. “The team was also creating a sustainable supply chain to accommodate our needs and geographic spread at the same time.”

An initial step was to issue the Supplier Code of Conduct, which established the baseline expectations

of what suppliers must meet to work with Sun. The company will continue these efforts and expand to include a comprehensive supplier management program, with supplier audits and business reviews throughout 2022 and beyond.

In addition, and as a complement to its ESG efforts, Sun has dedicated itself as a member of the United Nations Global Compact initiative, a voluntary leader ship platform for the development, implementation, and, disclosure of responsible business practices. The initiative was launched in 2000, and has be come the largest corporate sustainability initiative in the world, with more than 15,000 companies and 3,800 non-business signatories based in more than 160 countries. MHV

RRent Butter wants its clients to rent better, streamlining internal leasing operations and enhancing the renter’s and community owner’s screening experience.

Company founders Chris Rankin, a developer, and Tom Raleigh, an attorney, had been working in multi-family housing, largely serving the middle market on Chicago’s west and south side. They were

part of a real estate firm that grew from 100 to 10,000 apartments in five years and learned pretty quickly that they needed a more efficient way to screen and communicate with prospects and renters.

Truthfully, they had become somewhat accustomed to application acceptance on little more than a credit score, as well as a high volume of turnover and evic tion. They were certain there was a better way.

“What are your biggest pain points? We interviewed 50 landlords and they all said the same thing,” Raleigh said. “How do I assess risk when the applicant’s credit score is really low? It made sense for us to tackle that issue.

“If they make stable income and make their rent payment on time, what does the credit score matter?” Raleigh asked.

A great majority of the people who apply have the ability to pay their rent, Raleigh said, but what Rent Butter customers are looking for is the willingness to pay.

“We call that the ‘Grit Factor’,” Raleigh said.

Rent Butter’s digital applica tion runs on a smartphone and gets approval from the applicant to share banking information with the owner looking to rent. It looks at instances

of non-sufficient funds and overdrafts, measures income stability, timely rent payments, and positive or negative trends in revenue and account balance.

“We give every landlord two reports,” Rankin said. “We give them the banking report, and credit behavior report. The real question is how they’re trending, not whether they have a 670 credit score but are they trending up to 720 or down to 550?

“The interface is easy to understand, and it really draws your eye to what’s important.”

The app pulls in info on defaults or late accounts that have yet to hit the credit score — 634 credit score six months later can be below 600 with a bad couple of months. All of the information flows into Rent Manager and other large property management software solutions.

“The decades of hard work our industry has put into place has been very rewarding,” Raleigh said, for the property owner and management team, as well as the renter.

“We make it really easy to apply,” Raleigh said. “Go on your phone and apply in five minutes.” The easier it is for someone to apply, the more applications the property owner will receive.

The more common rental application is five or six pages to look over. With Rent Butter the appli cant uploads an image of their ID card or driver’s license and completes the rest on their smartphone in just minutes.

“Our ID verification tool is like airport technology at your property,” Raleigh said. “Their ID can be scanned and validated in real time.”

Pay stubs can be shared easily, and if no pay stubs are available, the user can provide secure access to their bank account.

“Connect your bank, and once permission is granted Rent Butter goes in to extract the needed data for the property owner,” Raleigh said. “It asks the applicant ‘Of all of these deposits, which ones are income?’ You click a box to confirm deposits that are earned income.

“Gig work and side hustles are included, so the applicant finally has a way to show their true income,” he said. MHV

MMortgageFlex knows that the best way to make your customer happy is to be first, be flexible, and be responsive.

It’s a suite of loan and originating software solutions that brings the relationship between lender, dealer, and customer to a new place, far beyond long-held approaches that reach back to fax machines and call lists.

“Everything is tied in together and everything is bilingual and mobile,” MortgageFlex’s John McCrae said. “The way to get to that potential borrower is to react quicker. That customer’s cell phone is going off within 10 minutes to offer them a conversation in Spanish or English.”

The company has about 40 employees and is based in Jacksonville, Fla., though its employees work remotely from many different locations. The offering is 100% Microsoft hosted and is used by 40 regular customers as well as about 35 credit union service organizations.

MortgageFlex had been working with Credit Human at the time it realized the opportunity for its services in manufactured housing. »

Ice, formerly Ellie Mae, bought Black Night, which merged the two main competitors in the loan origination and servicing technology space

“We spent almost a year working with them on use cases just to figure out how they operate, and then we spent about eight months developing the product,” McCrae said. “We thought it was going to be a one-off and come to learn there are not a lot of active players with lending and servicing technology like this in the manufactured housing space.”

In any form of lending, McCrae said, origination is the easier place to gain a foothold, but servicing is where you gain loyalty and grow your business. These are conversations that apply to all forms of products in the marketplace, including in technology.

“We set it up to where the user only sees what they need,” McCrae said. “If a client is only doing chattel loans, then they’re not going to have to look at any of the rules associated solely with conventional loans."

Integrations are made simple. For instance, Docu prep is a document provider that can seamlessly identify property and loan type, and will automati cally grab and share a complete document package

that aligns with state standards for the transaction.

“We’re putting tools into the hands of lenders to put them on the same playing field,” McCrae said.

The product was designed for conventional mort gage lending, and that remains a major part of the business. The company has dipped into commercial lending, and also handles the chattel process easily, even when dealers and in-community lenders are keeping those loans on the books.

“Servicing of chattel loans is pretty easy compara tively,” McCrae said. “Escrows are minimal and we’ve gained expertise in the whole customer service side, letting people do everything online.”

MortgageFlex continues to develop its set of services, including through artificial intelligence and optical character recognition, a tool to scan and digitize whole text for immediate readability for machine editing, computing, and analysis. MHV

Early in 2022, the Fed disclosed in their minutes that they believed the low workforce participation was due to Americans having too much equity in their real estate. To counteract this behavior, they stated their goal was to create a mini recession around real estate. They then proceeded to tell the market they would implement 5-7 rate hikes this year, including the largest increase in over 22 years of 50 basis points.

In total, we have seen all-in rates go from the low-mid 3%’s to 5-6%’s in the span of four months. Thus far, buyers have continued to focus on price per pad and rent growth due to a severe lack of housing and ignored the materially higher rates. Depending on how high rates go and how long they stay there, more and more buyers will start being priced out of the market and the Fed might eventually achieve its goal of creating a real estate correction. If your timeline or hold period is more than 5 years, we believe rent growth and inflation will eventually offset the potential coming correction. But if you have planned changes, like retirement or family planning that are motivating you to sell in the next 5 years, there is a high probability that commercial real estate will be worth less in the next few years than it is today.

BELL Mid-Atlantic 985-373-3472

D“Deploy the bots!” sounds like the dramatic high point to a summer blockbuster, but here in the real world of big business operations the notion of hiring robots can be a lot more surprising than any Hollywood script.

Bots already are performing many essential tasks in the life of the average American, but all we see are the results — curated content on a web page, chat conversation made to mimic human mannerisms, or moment-to-moment health moni toring — usually without a blink of consideration for how the job got done.

Jason Cook, vice president of sales for Plena.io, said in many cases the bots they deploy, and others like them, can get the job completed 90% faster than a human worker.

“Bots don’t quit, they don’t get COVID, and they do their job,” Cook said.

Bots aren’t for every job, but they do really well with repetitive tasks that humans often refer to as “mind-numbing,” tasks that are critical to the vitality of a business but tend to be put off, or divided up among several team members in what can be a rather error-prone, inefficient process.

One bot, programmed to complete a task through a series of interrelating algorithms, doesn’t get bored, distracted, or burnt out — they work 24/7 if needed. And they’re particularly helpful in highly regulated areas, because of how they relentlessly stay on task within strictly defined parameters.

“It’s a very difficult time to hire a staff accountant,” Plena Account Executive Ted Gundersen said. “A lot of CFOs are jumping in to do some nitty-gritty stuff, like bank reconciliation, accounts payable… that’s what we alleviate.

“As a human, I need to go to the bank or bank website, pull in all the payments, open property

management software and match up every trans action in both places,” he said. “We need to match this $1.05 against that $1.05. It’s thousands of clicks, and then report back. That’s hours sitting at a desk clicking over and over.”

Bots can perform manual tasks on a computer in the same way a human would, but with much more accuracy and speed. And the bots can work with any system because they login with a username and password just like a full time employee.

“In theory, robotic process automation can abate any manual process,” Gundersen said. “We focus on finance at Plena, but we can do stuff in HR, sales, operations. It’s a digital worker, the employee you don’t see… Some people think of it as an excel macro, but on steroids.”

The company has about 50 human employees with a centralized management team in Utah, and tech developers all over the place.

CEO Dave Aditya worked at Adobe before starting Plena in 2017. Cofounder and Chief Revenue Officer Jackson Ostler was driving to dental school when Aditya called and asked him to join the venture. Last year alone the company raised $10 million in venture capital.

The Plena bots, Cook said, in one year cost less than an employee with $50,000 in salary and benefits.

Many large organizations worldwide are employing bots, and the real estate space industry is one of the main verticals Plena.io is focused on.

“It’s not a matter of if real estate organizations will adopt this type of product; it’s a matter of when. If it’s not in six months, it will be in two years,” Cook said.

Plena already is working with big names like Vineyards Management, Colliers International, D.R. Horton, Stellar senior living, Roots Management, and Rangewater. MHV

by Adarsh Rachmale

by Adarsh Rachmale

DDuring the past few decades, the world has wit nessed technology advance at breathtaking speeds.

Look at the first Apple Macintosh computer from 1984, and then look at the newest iPhones in Amer ican’s pockets. An iPhone 13 has enough processing power to guide over 1 million Apollo spacecraft to the moon, simultaneously. Technology is advancing at an almost incomprehensible speed, and while it can be challenging to keep up, it’s facilitating innovation in every industry nationwide.

The manufactured housing industry is no different. Modern manufactured homes are full of smart tech nology to help homeowners save energy, time, and money. Lenders can take applications online and issue approvals in minutes. Home manufacturers engineer the home building process to keep quality high and prices low for American home buyers. Did you know that the amount of waste from the construction of a single section home can fit into one trash can? Com pare that to the typical site-built home, and you’ll »

see how well engineered a manufactured home is. Just the concept alone, building a home in a factory on an assembly line, is more advanced than building a home on a building site, out in the elements. And though it may not be as glamorous as a new home rolling off the assembly line, property insurance has its share of technological advances as well.

The key components to a great insurance product are ease, simplicity, and value - all three of which can be improved with modern technology.

With any financial product (insurance, lending, or otherwise), the hardest step for the consumers is the first step, the application. A financial appli cation is long, requires lots of information, asks for uncomfortable details, and when finished, offers no reward because there is still the very real possibility of denial. Though it cannot eliminate the negative aspects of the process completely, technology can help insurance companies alleviate much of the pain of the application process and keep home buyers happy during their new home purchase.

Have you ever seen a home buyer look at a paper insurance application? Their eyes get wide as they stare at endless boxes (usually not large enough for the answer), long questions, tiny print, and seem ingly hundreds of"initial here" and "sign here" boxes. Technology in the smart phone insurance application all but eliminates that initial negative experience. Conditional logic technology allows the application to ask for only the information it needs to make a decision based on that customer — this means no extraneous questions. The application also has fewer questions per page. Studies show that there is a do pamine release from the sense of completion every time a user moves to another page on an application, which keeps them happy and moving forward.

The digital application also allows for much easier follow up from the insurance company. If a customer took a paper application home and never finished it, no one would ever know, and no one would be able to check on the status of the incomplete paper application. In the case of digital application, how ever, follow up opportunities are endless. Because the application gives their contact information at

the onset, insurance companies can follow up with incomplete applications, and pro-actively reach out to the applicant to help them complete their application. According to a study by Brevet, it takes five follow ups with a customer before a sale is made. Technology allows the insurance companies to do this more effectively, thus allowing for more sales.

Once the applicant has submitted their application, underwriting begins. This is the process by which the insurance company determines the amount of risk in the policy, and how to price the premium to account for that risk. Traditionally, this is very labor-intensive process that involves looking at various actuarial tables, going back and forth with the customer, performing many calculations, submitting data to supervisors, and finally submitting a decision to the applicant. This process can take anywhere from a few days to many weeks. Because of the length of underwriting, many customers are lost, either to other companies or they simply lose interest and move on.

To help convert more applicants to customers, insurance companies use technology to significantly speed up the underwriting process. Data is instantly taken from the application, analyzed, and sent to the underwriter. There are no manual calculations or need for various actuarial tables. The computer takes care of all of that. Advanced algorithms look at hundreds, if not thousands, of variables and determine risk with much more detail and accuracy than a human ever could. This is especially beneficial for manufactured housing because the underwriting algorithm can account for the unique profile of manufactured housing risk, which a human oftentimes cannot. The technology in insurance underwriting allows for a better insurance product for manufactured homeowners. Modern insurance companies, like CoverTree out of Michigan, are working tirelessly to create technologically advanced insurance products specifically tailored manufactured homeowners, giving the manufactured housing industry a qual ity insurance product to go with its high quality, high value, homes.

And finally, there is the technology in the claims process. Most insurance customers will never reach this stage. But if they do, there is technology available to make filing a claim much less difficult than it has been traditionally. Modern insurance companies all have smart phone apps that allow the customer to file a claim, upload photos/video, even do virtual inspections with a claim adjuster. Technology also allows for much faster funds disbursement. Experi encing any sort of loss or damage to a home can be one of the most stressful times in someone’s life, and technology in the claims process makes that time less stressful for homeowners.

What’s next? Like every other industry, artificial intelligence, (AI), also known as machine learning, is set to make a huge impact in the insurance space. Insurance AI will be able to analyze millions of data points in real time and adjust policies and premiums for constantly changing variables. Smart insurance

companies can learn from their customers losses and benefit from data-network-effects to improve pricing and experience moving forward. This will be a huge win for the manufactured housing industry. While human underwriters may come with biases toward manufactured homes, a machine will be able to see the material benefits without the inaccurate, outdated stigma associated with a manufactured home. The future of housing is a manufactured home, and we look forward to seeing insurance technology play a key role in the growth of the manufactured housing industry. MHV

Adarsh Rachmale is the co-founder and CEO at CoverTree, the first and only insur-tech focused on middle America and manufactured homes. CoverTree offers state-of-the-art rating, data-driven pricing, and first-time residents can go online and purchase a policy in three minutes without having to talk to anyone.

TThe U.S. Department of Housing and Urban De velopment on July 19 posted to the Federal Register another slate of changes for manufactured housing, the most robust update to the HUD Code in decades.

The changes include 88 new and updated standards, bringing the HUD Code in line with more recent man ufactured housing industry standards, and further improving the quality and safety of manufactured home construction.

“Manufactured homes are an important element of the nation’s affordable housing supply,” HUD Assistant Secretary for Housing Julia Gordon said. “These proposed updates, when final, will help to expand the availability of safe and affordable homes that align with current design trends and construction methods.”

Proposed changes in the rule will facilitate innova tion and greater production of manufactured homes with features that are sought-after by consumers and that are common consumer needs for modern living, HUD stated in a press release on the updates.

When final, the updates contained in the proposed rule will enact a significant number of recommenda tions made by the federally-mandated Manufactured Housing Consensus Committee.

Further, the updates will eliminate the need for manufacturers to obtain alternative construction approvals for frequently requested features and materials that already meet or exceed HUD stan dards. The proposed updates are available for public comment for 60 days.

Overview of Proposed Rule Changes for Manufactured Housing Materials that facilitate modern design ap proaches and improve quality: Updates to reference standards for materials (wood, steel, piping) and products will align with other building standards, will allow the use of more modern design approaches and installation of alternative materials.

Ridge roof designs: Revising definitions and regu latory language will allow certain specified roof ridge designs without a requirement for specific on-site inspections by a HUD-approved agency.

Open floor plans, truss designs, and specifications for attics: The updated requirements for exterior door separation and structural design requirements will improve allowances for open floorplans while maintaining fire safety, clarify unclear provisions, and allow the potential for optimization of truss design.

Accessibility improvements: Modifications to standards for accessible showers will comply with nationally-recognized disability standards for rollin showers. This will eliminate the need for HUD alternative construction approval.

Modern and energy-saving appliances: Updating and adding new standards will allow for the use of more modern and energy-efficient appliances, includ ing gas-fired tankless water heaters, eliminating the need for HUD alternative construction approvals for use of such appliances.

In January, HUD published proposed rule changes for manufactured homes, that were given an added grace period before going into effect. Those changes, which went into effect July 12, address data plates, interior passages, stairways, safety alarms, garages, and carports, among other considerations. MHV

CClayton Homes unveiled its first net-zero electricity home to the public at the 2022 Berkshire Hathaway Shareholders meeting in Omaha, Neb., in May.

The home showcases energy-efficient features available to Clayton customers today, as well as new technologies Clayton is exploring for future innovation, including solar power.

With all of these upgrades combined, the home produces enough electricity to power itself.

“Clayton is committed to building sustainable and attainable homes," CEO Kevin Clayton said. "Whether it's building this net-zero home or through our volunteer program, Clayton Impact, our team members aim to leave a lasting, positive impact on our communities and the planet."

The net-zero electricity home showcased at the Berkshire Hathaway’s annual meeting is The Pulse floor plan, paired with several energy efficiency upgrades and a solar roofing system.

Features on the home currently available to custom ers include Energy Star® appliances, LED lights, Lux windows with argon, a 22-21-50 insulation package and an ecobee® smart thermostat.

Additional upgrades being explored include Certain Teed® Solar shingles and Benjamin Moore® low-VOC paint. The Pulse home costs just under $230,000 before the cost of land and solar panels.

Megan Foster, the interior design manager for Clayton, said the team’s dedication to creating homes with features their customers desire is the guiding vision for their work.

“Across all aspects of the building process, from materials to innovative design, Clayton Built® homes are built efficiently and thoughtfully to serve as an attainable home solution for a growing number of people,” Foster said.

In addition to the home display, Clayton set up a rather unusual offering for a home show: A 64-gal lon bin of waste, which represents all that was collected during the off-site building process of the net-zero electricity home.

William Jenkins, director of environment and sus tainability for the company, said the inclusion of the waste bin while showing the home helped attendees conceptualize the extraordinarily minimal amount of waste from the building process.

“While we are continuing to improve the energy efficiency of our homes, our sustainability efforts also include improving the energy and fuel efficiency of our operations, increasing our reliance on renewable energy, and setting ongoing reduction targets for waste and water consumption,” Jenkins said.

He said Clayton’s building innovations are part of a larger commitment to social responsibility that spans across the entire enterprise.

A newly launched Clayton Social Responsibility website features stories across the company demon strating Clayton’s growing commitment to be a “force for good” in Clayton’s communities, and with its customers, team members, and partners.

The site highlights a new partnership between Clayton and The Arbor Day Foundation to plant 2.33 million trees in forests around the country in 2022, helping restore vital ecosystems in an effort to foster a long-term, sustainable impact. MHV

BY:

BY:

started as a

version of

sector has quickly

where you can download the

over the years into the tremendous industry we are proud to be a part of today. To learn more, please visit

look forward to connecting with many of you again very soon.

AAccessory dwelling units, or ADUs, are the diminutive housing market juggernaut tiny homes were intended to be, if not quite the media darling.

While design shows and travel and lifestyle shows featured myriad variety of tiny homes, ADUs have found the financial and legal pathways to gain the attention of city and village halls nationwide.

In just a few weeks in May and June, headlines in diverse markets hailed ADUs as the best way to solve the housing crisis in densely populated and expensive areas.

On May 25, Forbes contributor Jeffrey Steele’s headline declared “Affordable Housing Crisis Demands ADUs, DADUs”.

“If there are solutions to the crisis, one may be found in the concept of the Detached Accessory Dwelling Unit, or DADU. Known in some places as granny flats or coach houses, these compact dwellings are legally permitted on parcels of existing homes… They provide additional housing options to those who otherwise likely wouldn’t have hope of finding one. And for that reason, many municipalities are making way for them,” the article stated.

Neal Collins at the San Jose Spotlight said revised regulations for ADUs in California since they were approved in 2016 have spurred growth. The state eliminated the owner-occupancy rule, so now owners can rent both the primary residence and the ADU. Additional revisions addressed cumbersome set-back and lot size requirements.

In its initial year, California issued fewer than 5,000 ADU permits, but between 2018 and 2020 more than 33,800 such permits were issued.

In early June, Madison.com let its readers in Mad ison, Wisc., know that there are new opportunities for homeowners who want an adjacent residence. The city had allowed ADUs for nearly 10 years but recently dropped the application and approval process that slowed development. Now ADUs are allowed in all areas where single-family homes are allowed. It also allowed for attached units, so garage lofts and other underused sections of the existing home can be used. It also increased the allowable floor space to 900 square feet.

Other such headlines during the same time frame ring from Salt Lake City, Utah, Austin, Texas, St. Pe tersburg, Fla., and the islands of Hawaii. Each locale has big business, high land cost, and robust service and hospitality sectors that require a labor force to be able to live where they work.

Manufactured housing professionals have said ADUs represent the welcome entry of factory-built affordable housing into urban areas. While not all ADUs are built off site, many are, including by some of the largest manufactured home builders in the country.

Skyline Champion, for instance, brought a new ADU to the National Mall in early June as part of MHI’s Homes on the Hill and HUD’s Innovative Housing Showcase during National Homeownership Month.

ADUs can be many things, from a granny flat to student housing. Moreover, small, affordable, energy-efficient homes located in city centers have been shown to stabilize local rental markets in availability and price.

Each ADU discussion and meeting with local officials is an opportunity to demon strate to the right people what factory-built housing can do for a community, its retirees, students, and service industries. MHV

IImpact Housing has completed 29 homes in 2022 that will go to victims of hurricanes Irma and Michael participating in the Rebuild Florida Housing Repair and Replacement Program. Florida builders and contractors invited the Georgia-based builder to participate in the program to produce more than 40 quality-built homes as permanent replacements for homes lost during the storms.

Modular housing offers the ability to meet the varied building code requirements throughout Florida’s coastal regions from its single construction facility. For instance, Impact Housing uses windows that are installed to meet code-mandated missile testing requirements where storm winds can exceed 150 miles per hour.

“One of the biggest benefits of modular construction is that we can design homes to any wind speed required. Most of our units are designed to withstand up to 150 mph wind speed,” Impact Housing Managing Director Matt Calamari said. “That covers every area of Florida other than south Florida. But we can plan and build for wind speeds to 180 mph to meet south Florida’s needs as well. Our plan sets are pre-approved by the state of Florida and can be customized for home replacement throughout the entire state.

“It’s a huge benefit when build ing to meet these requirements,” Calamari added. “Otherwise, Re build Florida would have to go to each local contractor and say ‘will you build this house’ and then go through permitting one-off. Modular construction can address permitting across the board. It’s effective, scalable, and expedites the process.”

Homes are shipped “substan tially complete,” and include all appliances, flooring, plumbing,

and exterior siding. The homes are being delivered to areas still recovering from hurricane damage, including Marco Island, the Florida panhandle, and the Florida Keys.

While it has taken Rebuild Florida years to qualify families, secure funding, identify builders and contractors, and begin con struction, modular housing has proven to be one of the fastest solutions for replacing the homes lost to hurricanes. The average modular home is produced in fewer than ten days and ready to

ship to displaced homeowners. Built with modular construction methods, these are then perma nently sited homes.

HRRP is a housing rehabilitation, reconstruction and replacement program that prioritizes the el derly, people with disabilities, and low-income families impacted by hurricane destruction.

The program is a partnership between the Florida Department of Economic Opportunity and the U.S. Department of Housing and Urban Development. MHV

AAfter an extended period of declining rates, many borrowers are experiencing for the first time an envi ronment of dramatically increasing interest rates against a backdrop of runaway inflation. The 10-year Treasury yield, after hitting an all-time low of 0.52 percent in August 2020, has since increased seven-fold, hovering recently above 4 percent, with most of that increase hitting this year. Inflation is running at its highest level in four de cades, and the word “transitory” has been stricken from Fed speak. The graph on the following page outlines the 10-year Treasury yield since 1962, reflecting an all-time high yield of 15.84 percent in September 1981. The lowest yield recorded was in August 2020 during the easing of monetary policy following the COVID-19 shutdown. »

Chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of July 05, 2022 is 2.82%.

-

With inflation running at its highest level in forty years, many are wondering how high Treasury yields will climb before peaking. In the coming months, inflation will be the key determinate of where interest rates level off, but most are expecting rates to continue to trend higher. In order to be prepared to face a higher interest rate environment, this article will address a few considerations commercial real estate owners should take into account when assessing financing alternatives and structures.

Over the past two decades, a large number of com mercial real estate owners, finding interest rates to be attractive by historical standards, elected to finance their properties with long-term fixed rate loans. While these loans offer the advantage of locking in a borrow

trading purposes or advice. Neither macrotrends llc nor any of

provided. Data courtesy of www.Macrotrends.Net.

er’s interest rate for an extended period of time (often 10 years or longer), they also are typically structured with prepayment penalties in order to obtain the lowest rate, making it difficult to pay these loans off early. Borrowers who are now in the final years of their fixed rate loans are faced with a dilemma: Should they refinance their properties now and pay the penalties in order to lock in new long-term fixed rates or wait until loan maturity to avoid pre-payment penalties and settle for potentially higher interest rates when they do refinance their properties.

If you find yourself faced with this challenge, it is worth noting that while yield maintenance and defeasance prepayment penalties can be large, generally speaking the penalties decrease as Trea

sury yields increase and the loan term approaches maturity. If you are nearing the end of your loan term, but not yet in the open window (when the loan can be prepaid without penalty), it may still be a smart move to pay off your current loan early, particularly if you, like many, believe interest rates will continue to rise or if you are accessing additional loan proceeds above your current loan balance. Fur thermore, depending on the individual situation, there may be a tax benefit to take advantage of when incurring a prepayment penalty.

However, we would recommend that you consult with your accountant or tax adviser before pursuing this course of action.