ANASTASIA DONDE Senior Editor, Middle Market Growth adonde@acg.org

ANASTASIA DONDE Senior Editor, Middle Market Growth adonde@acg.org

ANASTASIA DONDE Senior Editor, Middle Market Growth adonde@acg.org

ANASTASIA DONDE Senior Editor, Middle Market Growth adonde@acg.org

For close to a year now, fears of a recession, rising interest rates, tightening credit and growing geopolitical risk have driven a lot of M&A to the sidelines. Deal flow has dipped and middle-market businesses have hunkered down and focused on mitigating losses and managing through a downturn instead of pursuing M&A.

Several sources in this edition, however, point to strategies designed to take advantage of economic uncertainty, such as improving employee retention or sales and marketing strategy during downtime, and focusing on fine-tuning companies’ workforces.

“You can’t save your way to success—you still have to spend on growth opportunities,” says Kunal Mehta, expert partner at Bain & Company, who is featured in this issue’s cover profile. Despite weakening market fundamentals, companies can still drive incremental value by focusing on talent acquisition and employee retention, growing market share, entering a new market or buying out a weaker competitor, Mehta says.

Employee retention is a topic that came up throughout this magazine, as sources note that keeping good employees has been difficult, especially in a post-COVID environment and after the Great Resignation wave. Hiring and training new employees is also difficult and costly, especially now.

But operating partners are also thinking about solutions to this problem. Both Mehta and Zorian Rotenberg, an operating partner focused on go-tomarket strategy at Charlesbank Capital Partners, suggest tailored retention strategies. These could be customized to individuals, depending on what’s important to them—compensation packages, bonuses, additional PTO, stock options or coaching programs.

In his guest column, Five Key Priorities for Operating Partners During Economic Uncertainty, Rotenberg also notes that a dislocation might present an opportunity to snap up quality sales talent. At a time of mass layoffs at tech companies and other industries, some quality candidates could be between jobs or working within unstable companies or sectors.

Rotenberg also says that an economic downturn is a good time to “slow down to speed up,” i.e., use the time to reassess a company’s approach to lead generation, client retention and new business opportunities.

We hope you find these tips and many more in this issue insightful during a weakened market climate. You can send us suggestions, story ideas and news at tips@acg.org. //

36

A profile of Bain & Company Expert Partner Kunal Mehta looks at his career path, insights into building an effective go-to-market strategy and ways companies can navigate market turmoil.

44

Despite recent bumps for technology businesses, tech investors, companies and advisors are finding ways to transact, focusing on due diligence and picking bright spots in the sector.

VICE PRESIDENT, ACG MEDIA

Jackie D’Antonio jdantonio@acg.org

CONTENT DIRECTOR

Kathryn Maloney kmaloney@acg.org

SENIOR EDITOR Anastasia Donde adonde@acg.org

DIGITAL EDITOR Carolyn Vallejo cvallejo@acg.org

ART DIRECTOR, ACG MEDIA

Michelle Bruno mbruno@acg.org

CHIEF REVENUE OFFICER

Harry Nikpour hnikpour@acg.org

SENIOR DIRECTOR, STRATEGIC DEVELOPMENT

Kaitlyn Gregorio kgregorio@acg.org

Association for Corporate Growth membership@acg.org www.acg.org

Copyright 2023 Middle Market Growth® and Association for Corporate Growth, Inc.®

All rights reserved.

Printed in the United States of America.

ISSN 2475-921X (print)

ISSN 2475-9228 (online)

It’s time to drop your online course on state-specific tax law. And stop worrying if your deal will close this millennium. Let the team who’s guided countless firms through acquisitions, mergers, spin-offs, roll-ups – you name it – live in the HR weeds while you focus on what matters: growth. Manage risks and finalize deals faster with Insperity, ACG’s preferred HR solution for middle market companies.

|

|

insperity.com/acg | capital.growth@insperity.com

10 14 16

ON TREND: MID-MARKET BUSINESSES REVIEW BANK RELATIONSHIPS IN THE WAKE OF BANKING TURMOIL

Following recent bank failures, small and midsize companies are closely watching cash deposits, diversifying relationships with banks and seeking alternative financing methods.

THE WORKPLACE: TRIALING THE FOUR-DAY WORKWEEK

A look at MiddleGround Capital’s experimental approach to improving work-life balance.

WATCH LIST: THE INVESTMENTS REQUIRED FOR A RESILIENT SUPPLY CHAIN

The CEO of Siemens Financial Services Inc. explains how to navigate a wide range of current and future challenges.

18

WATCH LIST: U.S. MIDDLE-MARKET DEALS DEFY ECONOMIC UNCERTAINTIES

Preqin data shows that high-quality mid-market firms are witnessing a surge in deal flow, buoyed by record levels of dry powder.

20 22

WATCH LIST: REVOLUTIONIZING MIDDLE-MARKET DEAL SOURCING: THE ROLE OF ARTIFICIAL INTELLIGENCE

The CEO of Cyndx explores the impact of artificial intelligence on deals.

WATCH LIST: SETTING UP MID-CAP PE FUNDS AND PORTFOLIO COMPANIES FOR DATA ANALYTICS SUCCESS

The vice chairman of Stax outlines steps for effectively harnessing data analytics.

The collapse of Silicon Valley Bank, Signature Bank and First Republic Bank this spring were some of the biggest hits to the banking ecosystem since the 2008 financial crisis. In the weeks following those failures and subsequent shocks to the banking system, middle-market companies and investors were monitoring exposure, watching out for potential aftershocks and discussing a way forward.

Now that the dust has settled, middle-market and small companies are keeping a close eye on cash deposits, building or diversifying relationships with banks and seeking alternative financing methods amid tightening bank credit.

George Elston, chief financial officer at EyePoint Pharmaceuticals, a client of SVB in Watertown, Massachusetts, says the bank’s collapse was a warning to small and mid-market companies. “SVB was a wake-up call to smaller firms and their management of cash in operating, savings or asset-management accounts,” he says. “Traditionally, a simple calculation of cost [versus] benefit for cash allocation was enough, but now liquidity risk needs to be a meaningful factor in where cash resides.”

The collapse of SVB came as a surprise to middle- market firms, says Brad Haller, a senior partner in Mergers

& Acquisitions at West Monroe in Chicago, who says he had not heard of companies expressing concerns previously about the stability of their deposits in regional banks.

As one of SVB’s clients, EyePoint has been weathering the storm. It holds $144 million in cash in U.S. bank accounts. All of its operating accounts were at SVB, and it has $40 million in debt with the bank. EyePoint’s debt agreement requires that the company use SVB for its commercial banking and asset-management services.

EyePoint’s reaction to the SVB collapse was to put “immediate focus on ensuring continuing our business operations uninterrupted and identifying/mitigating any cash at risk,” Elston says.

The collapse also changed the company’s cash strategy. For anticipated deposit/operating accounts, Elston says, “we have established a relationship with an alternative commercial bank while maintaining compliance with our loan covenants.”

Just as EyePoint has done, Haller believes it will be crucial for middle-market and small companies to forge new deposit and lending arrangements. “They will need to develop more relationships with banks, but it takes time and effort to build them,” he says.

The demise of several banks in the spring has led some smaller businesses to reassess risk, deposits and lending relationships

Jeffrey Stevenson, managing partner at VSS Capital Partners, a lower mid-market structured capital provider, calls the bank collapses a “significant disruption to lower middle-market lending.”

“Regional banks have pulled back and, in some cases, have put a hold on new customers or, at the very least, have lowered their leverage levels and tightened their covenants,” he says. “It’s a big dynamic in the marketplace right now because small companies have [traditionally] been financed through the regional banking system.”

U.S. regulators in March took control of SVB, which catered to technology, private equity and venture capital firms, and announced the federal government would guarantee deposits following the bank’s collapse, which was the largest bank failure since Washington Mutual in 2008.

Days later, state regulators in New York seized control of Signature Bank, which had counted private equity as a significant part of its lending business. In late April, federal regulators took control of First Republic Bank and made a deal to sell most of its operations to JPMorgan Chase.

As the fallout continues, Haller predicts that middle-market businesses will be warier of using small, regional banks for their financing needs. “They will be using private debt/credit facilities, which have seen a material increase in fundraising and capital deployment over the last 18 months,” Haller says.

VSS’ Stevenson also expects that regional banks will be more cautious about lending and that the costs will increase. “In general, there has been a tightening of credit across the board, particularly for some small regional banks that have pulled back as they’ve had flights of deposits,” Stevenson says. “Their credit committees have pulled back and become more conservative.”

A study by Biz2Credit Small Business Lending Index showed that loan approval rates at big banks dropped from 14.2% in February to 13.8% in March, which was the lowest figure for big banks since July 2021. Small business owners also found it challenging to find funding from small banks. Approval rates of business loan applications decreased from 21.3% in February to 19.1% in March.

“In many cases, we are finding that regional banks are focusing on existing relationships and not taking on new relationships,” Stevenson says. “It’s really having a widespread impact on lower middle-market firms in terms of their ways to finance acquisitions.”

To ensure that portfolio companies have solid banking relationships, Stevenson says his firm serves as a fiduciary on their boards and evaluates those connections. “We are interested in diversification and not having exposure to banks that are potentially at risk. We advise companies in that regard,” he says.

As an example of the recent difficulty of securing financing, he cites a lower mid-market healthcare services company VSS is working with that turned to other financing methods after it was unable to secure loans from a bank or direct lender to complete an acquisition.

“VSS was able to come up with a [structured capital] solution to enable the acquisition to go forward,” Stevenson says. “We are providing junior capital in the form of debt and equity.”

Stevenson foresees that an inability to arrange financing will have a chilling effect on deals. “In some cases, it will cause deals not to get done altogether,” Stevenson says. “It will require creative financing solutions and, in other cases, will require a change in valuations in order to fit into what’s available for financing.”

Haller agrees that companies will need to reconsider valuations. “Sellers are still expecting a valuation that someone told them they were worth in 2021, but that’s no longer the case,” he says.

Although Haller says marketplace participants “have tried to go back to normal with lessons learned,” he believes the biggest result of the regional banking crisis will be increased federal regulations.

The bottom line, according to Haller and Stevenson, is that the regional bank collapses have made credit harder to come by and more expensive. That dilemma is not helped by rising interest rates. Looking to the future, Haller hopes the dealmaking environment will improve with no more bank collapses and a stabilization of interest rates.

“I am cautiously optimistic for the future,” he says. “It has been a slow six months in the PE investment space. I am hoping for interest rate stabilization. They don’t need to fall. They just need to stop increasing.” //

Companies across the world have been running trials of the four-day workweek and finding positive results. Now there is percolating interest in finance and among middle-market businesses in the U.S.

A worldwide pilot was spearheaded last year by 4 Day Week Global, a nonprofit organization associated with U.K. and U.S. universities that consults companies on implementing the four-day workweek. Following a trial that ran at U.S. companies from last April through October, some businesses decided to permanently adopt the four-day workweek or phase it in over time.

Private equity firm MiddleGround Capital, based in Lexington, Kentucky, began its own experiment, separate from the 4 Day Week Global trial, earlier this year and is gradually transitioning to the shorter workweek. John Stewart, founding partner at MiddleGround, says his firm's pilot program is going well and generating inbound interest from other PE firms.

When Stewart first announced his plan to phase in the four-day workweek on LinkedIn at the beginning of the year, there wasn’t a lot of positive feedback. “Some people were calling me crazy,” he says. MiddleGround is the only private equity firm to have gone public with its four-day work week experiment. Stewart says that even employees resisted at first. He says some younger staff members, especially ones that came from investment banking, are used to 80- to 100hour workweeks. “They don’t value time off as much as others do. But I’ve got more experience and I know that eventually you burn out and become resentful,” Stewart says.

Stewart’s strategy was to start with making 20% of the year a four-day workweek and gradually apply that schedule to the full year over a five-year period. MiddleGround started by offering days off to align with

holidays, so that employees could enjoy a long weekend. “With a fourday weekend, you can actually go somewhere,” Stewart says, adding that some employees traveled to Europe or the Caribbean on one such extended weekend in April.

Stewart’s experiment followed many others that were conducted last year. At the end of the trial in conjunction with 4 Day Week Global, employees and managers reported positive results, including increased productivity and less burnout, according to CNBC. The pilot involved 33 companies in the U.S. and 61 companies in the United Kingdom. The trial had been implemented in multiple other countries, including Spain, South Africa, Belgium, Iceland and Japan.

After the 4 Day Week Globalfacilitated trial, many companies said they didn’t want to go back to the five-day week. The pilot used a “10080-100 model,” where workers would receive 100% of their pay for 80% of the time worked while maintaining 100% productivity. In the U.K., businesses that participated in the six-month trial “said switching to a four-day workweek improved productivity, morale and team culture,” according to CNBC.

Companies that participated in the trial in the U.S. included Kickstarter and Cisco. Bolt, a San Francisco-based e-commerce company, was an early adopter of the trial in the beginning of 2022, deciding to permanently implement the strategy later that year.

Bolt issued an announcement saying, “The Four-Day Workweek Is Here to Stay” last year, citing overwhelmingly positive results from the three-month trial. “94% of employees surveyed said they wanted the program to continue and 86% said they were more efficient with their time,” the announcement noted, adding that

87% of managers reported that their teams maintained productivity levels.

“We’ve seen the research on the four-day workweek and its benefits on mental health and productivity,” MiddleGround’s Stewart says of his decision to implement the shortened schedule. He adds that employee engagement and well-being is important and the four-day workweek is just one of many benefits MiddleGround offers

Unlike many businesses that went remote or hybrid post-COVID, Stewart doesn’t believe in permanent remote work: “One of my employees asked if he can go work from the beach for two weeks and I said, ‘Why don’t you go to the beach and don’t do work?’”

Stewart admits that there are times when employees must work even if it’s on a day off—if they’re in the middle of a transaction, for example. “When you have a live deal, you have to work, but then you can take time off once

staff. Some of the other perks include no employee co-pay on insurance, paid lunches at work, pets in the office and fitness centers. “We want to do anything we can to make work more fun for staff,” Stewart says. The approach also helps with retention, he adds.

Retention is important to Stewart, especially during recent trends of the Great Resignation and “quiet quitting.” Hiring and training new employees is costly, he notes, so keeping good team members is crucial. The approach seems to be working so far, as the firm has had low turnover: Only three people quit in the last three years. The firm currently employs 120 people.

Stewart says many of MiddleGround’s portfolio companies already have fourday workweeks, but the private equity firm doesn’t mandate it.

Even as it phases in the truncated schedule, MiddleGround requires its employees to come into a physical office on the days they’re working.

the deal closes,” he says. He imagines getting creative with the four-day workweek in the future and having one team take Fridays off and another take Mondays off, so there is always someone available to represent the firm.

Regardless of where the experiment leads, Stewart believes it’s worth trying.

“I don’t think there is any reason you can’t do it. Even if we get half of the way there and then stop, it’ll be good enough,” Stewart says. He also notes that the idea has to come from the top—not an HR manager or consultant, so employees know the head of the firm supports the idea.

“It’s good that it came from me, and I try to set a good example by not doing work on days off,” he continues. “And I can tell that others are doing it too by the e-mail traffic that I get.” //

We’ve seen the research on the four- day workweek and its benefits on mental health and productivity.

JOHN STEWART Founding Partner, MiddleGround CapitalANASTASIA DONDE is Middle Market Growth’s senior editor.

More than three years have passed since the COVID-19 pandemic forced the world into lockdown and triggered a massive test of our global supply chain. In this post-pandemic market, some experts indicate that supply chain disruption has eased to pre-pandemic levels with the reopening of China’s economy as well as shifts in supply and demand. Others suggest that the market is still struggling to move past those disruptors.

As a lender in the industrial space, I’m focused on how we can build a more resilient supply chain that can navigate current and future challenges by investing locally and focusing on digitalization and sustainability. The Biden administration’s monumental investments in climate and sustainability will lower energy costs, accelerate private investment in clean energy solutions, create jobs and economic opportunity, and strengthen supply chains across sectors.

They say history repeats itself, and while there are bound to be other disruptors in the future such as resource scarcity, climate change and congestion, I believe these investments and collective efforts will help ensure that our global supply chain can withstand future challenges.

ANTHONY CASCIANO President and CEO, Siemens Financial Services, Inc.

ANTHONY CASCIANO President and CEO, Siemens Financial Services, Inc.

For decades, the private sector focused narrowly on the cost of supply chains, creating a global network of suppliers to support global customers. The pandemic, however, revealed the inherent threats of the reliance on such long supply chains, which come under incredible pressure when disruption occurs.

Now, many manufacturers have shifted their focus to gain more control over their supply chain and be better prepared for future disruptors that challenge geographic proximity. This trend of “glocalization” helps tap into global networks of innovation but allows responsiveness to local customer

needs with more manufacturing and supply chain support nearby.

This shift will cause the Americas region to rely heavily on Latin America going forward. In 2020, Siemens Financial Services (SFS) launched a separate financing entity in Latin America called Siemens Servicios Comerciales to offer competitive financing solutions and invest in the region. Backed by our knowledge and experience across sectors, we’re ensuring that tapping into the region’s talent and opportunity is mutually beneficial and improves the quality of life of the region’s people.

In Colombia, SFS helped long-term Siemens customer Tecnoglass—a leading manufacturer of architectural glass and associated aluminum products for the global commercial and residential construction industries—with a refinancing solution. It allowed the company to update production equipment in existing plants as well as production and energy efficiency solutions for a new facility.

As manufacturing shifts back to the Americas, digitalization—the process of digitalizing information to draw insights used to identify new opportunities for product innovation— is important for ensuring efficiency and optimizing business operations. It helps businesses address manufacturing inefficiencies and identify market trends and supply chain disturbances and is being adopted rapidly across sectors.

Siemens Vice President and Head of Supply Chain Management in the Americas Patric Stadtfeld explained to me that data transparency is key in building a supply chain that is more resilient than our pre-pandemic one proved to be. “Manufacturers are focused on implementing digital solutions to better prepare for potential disruptions such as global conflict, decarbonization goals, glocalization, etc.,” he told me. “Those who aren’t investing in this space will find it harder to integrate themselves in the market going forward.”

Working with manufacturers toward the goal of digitalized facilities, Siemens’ “smart factory” technologies utilize data for predicting maintenance needs, increasing productivity and meeting sustainability goals.

Siemens is supporting Kore Power, Inc.—the leading U.S.based developer of battery cell technology for the clean energy and e-mobility industries—with its future lithium-ion battery cell production facility. Smart factory technology from Siemens and leading investment capital from SFS will help accelerate the build-out of the digitalized facility, which will address the rapidly growing demand for battery cells due in large part to electric vehicle (EV) and renewable energy applications.

Speaking of EV and renewable energy applications, digitalization plays an important role in the race to sustainability. “As the global population continues to grow and resource limitation becomes more prominent, digitalization allows

us to achieve more while using less,” Chief Procurement Officer for Siemens Digital Industries Jens Eckert explained to me. “For example, a digital simulation within a digital twin environment can replace physical prototypes, thus reducing the resources used in product development and creating a more sustainable business.”

In our modern market, companies are being held accountable for their Scope 3 emissions and, along with decarbonizing their own operations, they are expected to build a sustainable supply chain. Businesses of all sizes must implement a sustainability strategy to compete in the market going forward. Large corporations—Siemens included—now require a carbon assessment as part of their vendor-selection process. However, implementing a sustainability strategy requires knowledge and access to capital that many small and medium-size enterprises (SMEs) and minority-owned businesses lack.

Luckily, lenders are stepping up to support these businesses with innovative solutions in an effort to create a more equitable and sustainable market while recognizing that SMEs make up 99.9% of businesses in the U.S. At SFS, our Kickstarter Capital program—a $100 million commitment to the decarbonization of SMEs—allows businesses to work with finance and technology experts to design and implement a sustainability strategy with minimal disruption to operations and cash flow.

Additionally, innovative financing solutions like sustainability-linked loans can incentivize businesses to decarbonize. SFS and other lenders provided Crown Castle—a Texas-based communications infrastructure company—with a sustainability-linked loan with credit facility pricing subject to adjustment based on KPIs related to renewable energy and conversion to LED lights on cell towers. Solutions like this are mutually beneficial and incentivize the company to be greener.

Supply chain disruptors will come and go, but local investments, digitalization and sustainability are critical for ensuring that our supply chain can withstand disruptions in the future. Supporting SMEs and minority-owned businesses is critical in the transformation of our supply chain due to their huge share of the market. With a collective effort, including support from the government, we can build a stronger supply chain that can withstand future challenges. //

ANTHONY CASCIANO is president and CEO of Siemens Financial Services, Inc., the U.S. financing arm of Siemens Financial Services (SFS). He is also CEO of SFS’ Project & Structured Finance Americas business unit, providing debt financing—including corporate lending, project finance and structured finance solutions—to clients across the region.

Furthermore, leveraged buyouts in large caps are also becoming more expensive due to increased borrowing costs as rates rise and a valuation mismatch between buyers and sellers. Both factors have pushed private equity and venture firms toward the mid-market in search of deals that are easier to finance and execute. Although the number of deals has decreased, indicating dealmakers’ cautious stance, the significant aggregate transaction value suggests they remain prepared to pay for worthy deals.

After a historic run of U.S. middle-market deal activity in 2021, the market cooled considerably last year as dealmakers paused amid uncertainties brought about by rising inflation, aggressive rate hikes and valuation volatility. However, in the past two quarters, as a reflection of the growing quality of middle-market companies in the U.S., deal activity held up impressively.

The aggregate value of mid-market buyouts and venture deals in the U.S. experienced a surge of 237% in Q4 2022 compared to the previous quarter, reaching $74.1 billion and marking the second-best quarterly performance in the past decade. This momentum carried over into the first quarter of this year, with an aggregate deal value of $64.2 billion across 80 deals, the lowest deal volume in a decade. Still-high aggregate deal value across the smallest deal volume meant the average deal size hit a historic high of $1.4 billion, surpassing the previous quarter’s record of $1 billion.

Much of this is likely due to private equity and venture firms’ record levels of dry powder, which surpassed $2.5 trillion for the first time as of April 2023, according to Preqin Pro. This meant PE and VC firms had an unprecedented amount of cash to deploy. Of the 10 billion-dollar mid-market deals in the U.S. this year, eight were all-cash transactions. In the case of Qualtrics, for example—which tech-focused PE firm Silver Lake and Canada’s largest pension fund took private—less than 10% of the financing came from debt.

With improving business prospects alongside lower valuations, mid-market companies have become more attractive to investors. These smaller companies are typically seen as having promising growth potential in scale and operations.

According to the Golub Capital Altman Index, which monitors around 110-150 U.S. mid-market businesses backed by private equity, these companies had a year-on-year increase in earnings and revenue growth of 11% in the first two months of this year, surpassing expectations. The results suggest the tailwind of falling energy prices more than offset the headwind of rising interest rates, helping to boost consumer confidence and profit margins.

Mid-market deals have proven more resilient than larger transactions in today’s uncertain environment, in part due to their lower reliance on debt financing for leverage and wider and more fluid exit windows, given the current weak IPO market.

The exit environment in the U.S. mid-market sector has been robust over the past few years, hitting an all-time high exit multiple of 9.18x in 2021, the most active year for deals. Although the exit multiple has fallen to 7x in 2022, it is still above the 10-year average of 6.25x, indicating healthy returns for investors. //

Sourcing new deal opportunities has traditionally been a time-consuming process that relied heavily on personal networks or banker relationships. With a lack of available private market corporate data on a company’s financials, leadership team, capital raising history and comparable company valuations, investors are often required to spend a significant amount of time researching many different, and often unstructured, data sets to identify suitable opportunities to invest in.

This has been particularly true for private companies in the middle market. While efficiencies begin to exist for the largest players, many middle-market companies are too small or lack the resources to appropriately disclose the necessary information for an investor to find them. It’s in this middle market where the best opportunities are often found—yet sufficient information remains limited.

In recent years, artificial intelligence has been changing all that and creating efficiencies in deal sourcing on an exponential basis. Tools that utilize AI for finding and evaluating deals—such as what we’ve created at Cyndx—allow investors to search for potential companies and uncover insights about new investment opportunities at a size and scale never seen before. For example, Cyndx has over 22 million global public and private companies in our database,

which provide an unparalleled view into the private capital markets. This wouldn’t be possible without using AI and natural language processing (NLP). This scale allows Cyndx to create large cohorts around any company or concept to enhance the accuracy of our AI predictions.

So, what does this mean for middle-market bankers, venture capital and private equity firms, and companies seeking investment? How exactly is AI being used and how is it changing the way they think about deals?

Advances in AI and NLP technologies simplify investors’ deal sourcing and investment strategy with tools that help quickly identify and access the right companies. Consequently, the efficiency of the private market will increase, while the risks associated with it will decrease over time.

As digitization increases access to global corporate data, AI is being used to evaluate investment opportunities more efficiently. Access to unstructured corporate data is growing exponentially; market intelligence firm IDC projects it will make up more than 80% of global data by 2025. However, this poses a challenge for businesses as they try to glean insights and gain a competitive advantage from all the new and existing data. Having the data is no longer the problem—structuring it and knowing what to do with it is.

The use of AI and NLP is allowing companies and investors to quickly understand vast amounts of unstructured data and obtain unique insights. Properly trained AI can help investors identify or recognize patterns within data and adapt to changes in those data sets, while NLP enables systems to understand human language and the emotion behind the text. Combined, AI and NLP technologies allow investors to make more informed investing decisions or better identify and classify investment opportunities. For example, Cyndx’s Projected to Raise algorithm identifies with 86% precision when a company is likely to need capital, without having access to a company’s financial projections. This allows users or customers to identify transactions before they happen so that they can participate in that potential transaction.

Research that would normally take months of manual labor can now be done in seconds. Investors can look at multiple factors and understand the influence they have on one another when making a potential investment decision—i.e., bankers can look at where an executive worked historically, the number of patents filed (as well as who

owns competitive patents), acceleration of capital into a particular space, lines of business that are supported, education of the founding team and the experience of the investment partners, among other information.

As a result, investors can gain a 360-degree perspective on a company’s associations and its competitive landscape, and AI is bringing in new data sets that provide a deeper and instantaneous picture of a company or industry ecosystem. This approach goes beyond the standard classification and uncovers—through dynamic mapping—the most relevant concepts associated with any one company, even for an extremely niche sector. With this technology, investors now uncover unique opportunities in a record amount of time and can maintain a consistent deal flow.

AI is also changing the game for entrepreneurs and company owners who can reap the same benefits when looking for the right strategic partners for their company. Finding the best investor or the most attractive business opportunity and conducting the appropriate level of due diligence has traditionally been a highly manual and time-consuming process for entrepreneurs as well. Companies don’t always have access to the relevant information necessary to make the right decision as it is often opaque or unavailable. With AI’s ability to recognize patterns and adapt to changes within data sets and NLP’s ability to pull sentiment from the data, entrepreneurs can quickly use these innovative technologies to match them with the right investors.

AI and NLP tools significantly reduce the time and energy spent on private capital market research and due diligence by automating the research and analysis processes. Furthermore, with AI and NLP’s analytics and automation advantages, entrepreneurs can quickly identify the right funding opportunities, while investors can identify suitable private market investments. Neither will have to worry about missing out on potential funding or investment opportunities.

Today, AI and NLP tools provide greater visibility into the private market and improve the discovery of acquisition targets while reducing the time spent evaluating a business opportunity. As these tools become more widespread, the impact on middle-market deal sourcing will be undeniable. //

JIM M C VEIGH has more than 20 years of investment banking experience at Salomon Brothers, DLJ, Credit Suisse and most recently Bank of America/Merrill Lynch, where he ran the Internet and Cable Banking groups.

AI is also changing the game for entrepreneurs and company owners who can reap the same benefits when looking for the right strategic partners for their company.

of investment and disruption. It is an enticing vision that becomes a convenient excuse. How often do mid-market CEOs hear, “Yes, we’ll be able to look at that once we have the new system implemented, in eight months?”

Avalue-based, incremental approach to data analytics success has multiple advantages. It brings outcomes and insights forward in time, creating value for the business along the journey, not at the end. It creates organizational momentum and changes culture: Once leaders see relevant, useful data for their business, they want more. This approach provides guidance, definition and learning for technology initiatives (underway or contemplated). Most importantly, it realizes the promise of data analytics and properly positions it as a journey, not a one-time transformation.

Most senior leaders recognize the value of building additional data-driven insights into strategy and operations. Value has two dimensions: The first is running the business better, making strategic, tactical and operating decisions, using the full range of information and insights available. The second is creating value from the data itself: integrating value into existing products and services or creating new products.

While there is often agreement on the potential value to be created via data analytics, there is typically concern about potential obstacles, which range from a lack of shared vision around what is important and worth pursuing, to siloed, messy data and processes, and limitations of legacy systems and technology.

Unfortunately, many companies get trapped in an idealized vision of an all-encompassing technology solution that promises to eliminate obstacles and create significant business value, but to do so only after a prolonged period

The alternative is a value-based approach to data analytics: An evolutionary process that identifies a road map to an ideal end state but takes incremental steps to control risk and bring valuable insights forward. The approach allows for course correction as business reality changes, forces delivery of value in usable time frames and focuses on delivering value to discover limitations in systems, data and process. All of this is pursued in parallel with a larger technology transformation to increase the likelihood of success, or as an alternative path to the massive investment of time and resources of such a transformation.

Based on Stax’s experience working with mid-market private equity sponsors and management teams across industries and situations, here are common steps to success:

Clarify the business value first, rather than evaluating technology or systems. Outline a vision of the end point, remain flexible and approach the initiative in increments. Next, define outcomes for each increment along three dimensions: valuable insights for the business; enhanced understanding of process, data and systems; and capabilities built for the organization. Finally, encourage a test and learn, rapid-failure and learning culture.

Don’t accept existing systems as an excuse. In the worst case, data can be extracted and processed outside existing systems. Often, existing silos can be linked in the middle via light technology and process.

Compared to a systems transformation, for most midmarket companies the value-based incremental approach is more consistent with driving positive returns within PE time frames, while reducing risk and complexity. //

No Guessing.

No Extrapolation.

When it comes to valuing M&A transactions in the middle market, no other source provides the level of quality and granularity as GF Data.

GF Data provides the most reliable data on private-equity sponsored M&A transactions with enterprise values of $10 million – $500 million.

Uncover proprietary transactional information provided by an established pool of private equity groups on a blind and confidential basis. Obtain accurate and up-to-date information to value and assess middle-market businesses.

To learn more about subscribing or contributing, scan the code or contact bdunn@acg.org.

GFData.com

Euclid Transactional is a market-leading firm specializing in transactional insurance underwriting and claims handling. The firm provides underwriting services for representations and warranties, tax, contingent liability and other transactional insurance products. They seek to provide best-in-class service for clients, lawyers, and brokers on deal time and with the commercial priorities of their partners in mind.

Euclid Transactional has bound over 5,000 policies and insured more than $4 trillion in total deal value. The firm attracts and retains top talent and has built a team of over 135 professionals across North America and Europe that collectively have the most transactional experience in the industry.

Your deal is important to you, and we know it. Our firm’s professionals work in a dedicated, fast-paced manner to meet the needs and timeline of any deal. The team provides efficient service and well-reasoned decisions to provide the best commercial results for policies.

Jay Rittberg, Managing Principal jrittberg@euclidtransactional.com

(646) 517-8808

Phil Casper, Principal pcasper@euclidtransactional.com

(646) 517-8810

Albert Song, Principal asong@euclidtransactional.com

(646) 517-8809

Canada

Mike MacRory, Managing Director Head of Canada mmacrory@euclidtransactional.com

(647) 846-2261

Kit Westropp, Managing Principal kwestropp@euclidtransactional.com

+44 (20) 3950-6154

Mark Storrie, Principal mstorrie@euclidtransactional.com

+44 (20) 3950-9349

Carl Christian Rösiö, Principal ccrosio@euclidtransactional.com

+44 (20) 3950-6156

Tax

Justin Berutich, Managing Director Head of Tax jberutich@euclidtransactional.com

(646) 817-2919

Our claims team — the industry’s largest dedicated team — leverages extensive underwriting and claims experience to drive fair resolutions. Backed by the financial security of our highly-rated insurance carrier partners, we have paid losses over $530 million in claims payments.

With offices in New York, Chicago, Toronto, London, Frankfurt, Copenhagen, and Stockholm, they cover global risks for insureds in the US, Canada, Europe, the Middle East and Africa (EMEA) with leadership by industry veterans. Their global team has over 350 years of collective experience and deep legal, M&A, and tax knowledge.

Representations & Warranties Insurance — Protects against undisclosed matters and misrepresentations that would otherwise negatively impact your acquisition.

Tax Liability Insurance — Provides protection to any taxpayer should a tax position fail to qualify for its intended tax treatment (whether or not the tax treatment relates to an M&A deal).

Contingent Liability Insurance — Covers adverse judgments, balance sheet contingencies and other obligations, helping you limit the downside of potential liabilities.

•Reduced escrow requirements & more cash for sellers at closing

•Bidding advantages during the deal process

•Credit protection for buyers

•Safeguards companies against unlikely liabilities

•Protection against damage to relationship between buyer & seller due to unforeseen breach

Business leaders should tread carefully and humanely should they need to lay off staff. Here’s how.

Recent hires and promotions, including PE operating partners, advisors and C-suite executives.

As uncertainty looms in the marketplace and reductions in staff are required, organizations can work to make the process smoother and less painful.

ELAINE HUGAR President, DPG Management

During weakening economic conditions, employers might be thinking about reducing staff. We explore best practices.

As organizations follow the roller coaster imposed by market conditions and the economy, tough decisions related to human capital costs and staffing levels must be made and communicated. Business leaders have challenging decisions ahead, based on questions that include:

1. Who stays and who goes?

2. What are the best practices for protecting the organization from litigation?

3. What are the most effective communication and execution strategies?

4. How do we retain and engage the remaining staff while increasing their workload?

No one sets out to make bad decisions. But fast decisions later scrutinized by a federal or state agency can look circumspect under cold, stark lights. There must be an objective and well-documented process followed to reach the right decisions. First, look at departments and work teams as groups. Within those groups, follow this hierarchy of selection to identify the headcount to eliminate:

• POSITION —Can the role be eliminated? If certain functions are going away, a company may be able to eliminate the position completely. Be thoughtful in selecting the roles that can be eliminated. Now is not the time to change roles to select specific individuals for layoffs.

• PERF ORMANCE —If multiple people inhabit the same role or job title, use objective performance measures as the deciding factor. This is not about a supervisor’s opinion; clear metrics or robust performance reviews should be used to guide the decisions. It’s important to create a matrix of the specific performance criteria for each role, then evaluate each employee against the criteria. The matrix could become critical in the event of charges from the Equal Employment Opportunity Commission.

• TENURE —If you are not in a union environment, using length of service is usually the last objective measure to employ. This strategy may find organizations eliminating their strongest workers.

Prior to finalizing the list of those who will be terminated, compare the current EEOC statistics to the statistics after the reduction in

force. This is to identify possible discriminatory patterns. Avoiding this step could put the firm at significant risk in the event of EEOC charges.

Where allowable by law, employers should review the option of obtaining signed separation agreements from terminated employees in consideration for their severance package. It’s important to work with an attorney to ensure the employees over age 40 are provided a separation agreement that addresses age discrimination.

During the process of finalizing the list of impacted employees, organizations should take great care to maintain confidentiality. Some leadership teams struggle with keeping secrets. The list of names of those employees targeted for termination frequently changes during the process. Leaks about the upcoming staff reductions can become very problematic.

We’ve all heard about the “creative ways” some companies have communicated their downsizings. Some organizations have conducted group terminations in a conference room or, worse yet, on a Zoom call with large groups of people. These approaches tarnish the organization’s public image, break trust with their remaining staff and treat exiting employees as if they are no longer valuable.

In preparing to notify employees, it is best to create a script of talking points for the manager. The script should include a statement about why the organization is making staff changes. It should provide guidance for the manager and include information about separation agreements, severance, unemployment insurance and employee benefits. Managers should be reminded to avoid conversations about why and how certain employees were selected for termination.

The notification to the affected employee should take less than five minutes. It should be delivered in a respectful and professional manner. Most employees are stunned during the notification and won’t remember any of the specifics discussed. Providing them with a letter outlining the termination details is recommended.

After the employee has been notified, tell them to go home. If appropriate, let them come back and wrap things up for their clients and colleagues if they’d like. Give them dignity and space to finish well. Let them say goodbyes

if they’d like. All employees will notice the dignified way these impacted employees are treated.

Finally, organizations should consider offering outplacement services to terminated employees. These services help with writing resumes, preparing for interviews, networking and other tactics necessary to land their next job. These services can reduce unemployment costs, lower the risk of negative legal action and demonstrate concern for the terminated employees. Additionally, the remaining employees will be watching carefully to see how the firm is handling the terminations.

Immediately after the terminated employees have been notified, leaders should meet with their remaining staff. A script should be created to guide those leaders. The script should include a brief explanation of the workforce reduction with an acknowledgment related to the human impact. Leaders should briefly address the increase in workload for the remaining employees and expectations for the organization’s future. Staff reductions can result in decreased loyalty and productivity. It is important to encourage employees to discuss their concerns with their leaders directly and remind them of the open-door policy. There is risk of unwanted turnover if this step is missed.

As uncertainty looms in the marketplace and reductions in staff are required, organizations can work to make the process smoother and less painful by handling it with skill and care. //

Use an objective and well-documented process to make the right decisions.

New York-based One Rock Capital Partners appointed Monica Yavin as its chief people officer. Yavin is leading all aspects of human resources, driving talent management initiatives and spearheading recruitment programs and practices.

Before joining One Rock, Yavin served as senior HR business partner and head of learning and development at First Eagle Investments, where she advanced strategic human capital initiatives focused on the investment, sales and marketing teams.

At First Eagle, she led the learning and development function, designing and implementing performance management and talent strategy, as well as leadership development programs.

Before that, Yavin was head of learning, global functions, at American International Group and held various roles at Citigroup and Bank of America.

Tracy Rosser has been appointed the strategic advisor of NewRoad Capital Partners, a growth equity firm based in northwest Arkansas.

Prior to NewRoad, Rosser was the executive vice president of operations at Transplace/ Uber Freight, a logistics/transportation technology company.

Before that, he spent more than two decades at Walmart, where he served as senior vice president of transportation and supply chain, chief operating officer of Walmart Transportation and senior vice president of store operations for the Southeastern United States.

At NewRoad Capital Partners, he will be working with six operating partners and six strategic advisors to help refine and execute the firm’s investment thesis.

Vivify Specialty Ingredients, a provider of specialty colorants, additives and ingredients for various industries, has announced the appointment of Brian Leen as its new CEO. Vivify is backed by Gryphon Investors.

Leen, who has been a board member of Vivify since 2021, will succeed former CEO Devlin Riley.

Leen brings deep industry experience to the role, having held leadership positions in companies such as Gopher Resource and ADA Carbon Solutions.

As Vivify’s CEO, he will be responsible for diversifying the company’s product line and adding innovative services.

Pentec Health, a provider of patient-specific compounded sterile medications and complex in-home clinical services, has announced that Matthew Deans will lead the company as president and CEO. The company is backed by New York-based Wellspring Capital Management.

Deans has been Pentec’s chief strategy officer since January 2022. He previously worked as senior vice president of business development for Option Care Health, where he led product and service development across pharmaceutical manufacturers, health plans, healthcare systems and providers.

Corona, California-based Agile Sourcing Partners, a supply chain services company and a portfolio company of Post Capital Partners, appointed Jeff Giffen as CEO.

Before joining Agile, Giffen was the senior vice president of engineering and operations at Osmose Utilities Services in Georgia, where he led the firm’s Steel Structures Services business as well as its international business units.

Giffen was also a regional engineering manager for Hanson Pipe and Precast in Jacksonville, Florida, where he oversaw all engineering activities for the company’s Southeast region.

He also worked at Tindall Corp. and Caldwell Tanks, holding various engineering and management positions.

As Agile’s CEO, Giffen oversees the company’s mission to increase agility and efficiency in modernizing utility and energy infrastructure.

Deans was part of the management team that led the sale and carve-out of Walgreens

Infusion Services to Madison Dearborn Partners in 2015 to form Option Care and completed the merger with BioScrip in 2019 to form Option Care Health.

As Pentec Health’s new CEO, Deans will focus on strategic growth of patient care services and products to address complex care. He will also join Pentec’s board of directors. Deans succeeds Paul Mastrapa, who will continue as Pentec Health’s executive board chairman.

Bernd Leger has been named the chief marketing officer at Cornerstone OnDemand, a provider of learning and talent experience solutions.

Cornerstone OnDemand is part of the Clearlake Capital Group portfolio.

Leger will focus on the company’s global marketing function, including global field and digital marketing, product marketing, and brand and customer advocacy. He will also help drive customer value and brand success to scale demand and customer growth.

Leger previously served as the CMO of Mimecast, a cloud-based email management company, where he played a significant role in taking the company private and serving as the executive sponsor for the organization’s diversity, equity and inclusion initiatives.

Before Mimecast, he was CMO at Nexthink and held several marketing leadership positions at software and cybersecurity companies.

Capstreet, a Houston-based lower middle-market private equity firm, has appointed Alyssa Fox as senior vice president of marketing in the operating executive group.

Fox will work with the investment team and portfolio companies on brand and go-to-market strategies.

Before joining Capstreet, she was the vice president of channel marketing at Alert Logic, a managed detection and response provider, where she drove the channel pipeline, built innovative co-marketing campaigns with partners and managed the company’s partner program.

She has also held senior leadership positions in marketing and content development at multiple private and public software companies, including Graylog, Micro Focus and NetIQ.

Rohrer Corp., a North American packaging manufacturer headquartered in Wadsworth, Ohio, appointed Tim Swanson as its new CEO. Swanson will also serve on the Rohrer Corp. board.

Wellspring Capital Management purchased Rohrer in 2021.

Swanson previously worked at Bettcher Industries, a global protein processing platform, where he served as CEO.

He also served as president with Barnes Group, where he led its global force and motion systems platform. Prior to Barnes Group, he worked in various leadership positions at Illinois Tool Works and Whirlpool Corp.

At Rohrer, Swanson replaced Steve Wirrig, who had been president and CEO at the company since 2016.

Silver Creek Midstream, a private midstream company that operates crude oil gathering, transportation and storage assets in Wyoming, has announced the promotion of two senior leaders, Chris Storey and Aaron Hencke.

Storey, who previously served as senior vice president and CFO for Silver Creek, has been promoted to president and CFO, where he will assist in the overall management of the company.

Hencke, who previously served as senior vice president of operations, has been appointed executive vice president and COO, where he will continue to lead the daily operations of the company’s assets in Wyoming.

Silver Creek is backed by equity commitments from Tailwater Capital, The Energy & Minerals Group and Silver Creek Management.

Aspirion, a technology-enabled healthcare revenue-cycle management provider for complex claims and revenue integrity, has named Amy Amick as its new chief executive officer. Aspirion is backed by Linden Capital Partners and Aquiline Capital Partners.

Amick was most recently the president and CEO of SPH Analytics, a healthcare measurement and analytics platform company, where she achieved substantial top- and bottom-line growth, leading to its acquisition by Press Ganey in 2021. Before that, she worked at several healthcare tech companies including MedAssets, M*Modal, Microsoft’s Health Solutions Group and Allscripts/Misys.

At Aspirion, Amick will help the company deliver next-generation reimbursement solutions, capitalizing on its existing investments and rapid advancements in AI and machine learning.

A profile of Bain & Company Expert Partner Kunal Mehta looks at his career path, insights into building an effective go-to-market strategy and ways companies can navigate market turmoil.

Despite recent bumps for technology businesses, tech investors, companies and advisors are finding ways to transact, focusing on due diligence and picking bright spots in the sector.

I thought the industry of software and technology would largely be a snowflake, with problems unique to just that area. But what I’ve learned since is that many industries have similar issues, so experiences from operating partners can be applied across the board.

KUNAL MEHTA Expert Partner, Bain & Company

Kunal Mehta learned the hard way that he can’t handle seeing lots of blood—a discovery that changed the path of his life. As an undergraduate majoring in zoology at Washington, D.C.’s George Washington University, Mehta planned to go on to medical school and a career as a physician. But once the hands-on portion of his undergrad courses started, he began passing out at the sight of blood. Mehta quickly realized he was pursuing the wrong profession. Fortunately, he had double majored, with a second degree in economics.

“I was going down the wrong path right out of the gate. … When I saw it all firsthand, and I just couldn’t cope, I thought, ‘This is not going to work,’” says Mehta, who followed up his undergraduate degrees with a Master of Health Science in health policy and finance from the Johns Hopkins Bloomberg School of Public Health. During a brief stint in public health, exposure to the software industry once again changed the trajectory of his career. “I met a lot of really cool software people and I thought, ‘I think I want to spend the rest of my life in software,’” says Mehta.

He went on to earn an MBA with a computer science concentration from The George Washington University School of Business, which launched him into a career that has largely centered around revenue operations, marketing and sales management.

Having begun his career as a consultant at Peregrine Systems, Mehta went on to hold a variety of roles within the marketing and sales arena for companies including HP, cloud computing company VMware and Infoblox, among others.

Today, Mehta is a partner in B2B commercial excellence at Bain & Company. Working primarily with sponsor-backed companies, he focuses on their go-to-market (GTM) strategies. He analyzes companies’ approaches to reaching target customers and establishing an edge over competitors—largely by identifying and addressing

inefficiencies within their sales and marketing plans. He jokes that he is probably “the only person in software with a zoology degree.” Mehta has essentially built a career around dissection, replacing animal specimens with the GTM plans of burgeoning companies.

“Many companies spend a lot on sales and marketing, but they don’t get the impact that they should,” Mehta says.

One of the biggest mistakes that Mehta believes sales and marketing professionals make is failing to dig into the nitty-gritty of their pipelines. Beyond just looking at whether salespeople are hitting their targets, he says executives should focus on cross-selling opportunities, the value customers derive from products they buy, and whether sales and marketing teams are equipped with adequate resources.

He’s got an ability to look through all kinds of data, people, etc. and really suss out what needs to happen to incite growth within a company.

SUSAN SCUTT Managing Director, Partners Group

He likens his role to the monitoring devices that auto insurance companies install in people’s cars to rate their driving habits and reward good drivers with discounts. “What I do is equip sales teams in a way that drives outcomes,” he says. “We’re seeing patterns of what’s working and not working, so we can optimize and drive efficiencies.”

When it comes to driving outcomes, people who have worked with Mehta characterize him as one of the most skilled and competent individuals in the business. “He’s very strong at operationalizing. People come up with plans, ideas and roadmaps, and they know that he’s going to roll them

out, manage them and pull all the departments, people and bits together to make things start working,” says Catherine Schalk, president and self-proclaimed “chief thinking officer” of sales enablement agency Inkwazi Kommunications. She worked with Mehta in the mid-2000s at HewlettPackard, where the pair ran the technology company’s enablement operations.

Schalk adds that one of Mehta’s best attributes is his ability to perform well in stressful situations and to always remain calm. He has an amazing capacity to keep multiple balls in the air at once and still track the detailed minutiae of each one, she notes.

Nina McIntyre was the chief marketing officer of software company ETQ and was already leading a well-oiled, productive marketing team when her path first crossed with Mehta’s in late 2019. Despite her team’s success, after ETQ was acquired by TCV (Technology Crossover Ventures), she was asked to meet with Mehta to discuss areas for improvement—a request that felt disconcerting at the time. But McIntyre was pleasantly surprised by Mehta, whose sincerity almost immediately put her at ease. “He was a very good listener and built a lot of trust in me,” she recalls.

In early 2020, just months before the pandemic hit, McIntyre assumed the additional responsibility of ETQ’s inside sales. McIntyre went to Mehta for advice and he introduced her to The Pipeline Group, a provider of go-to-market services, which had a material impact on ETQ’s business.

Mehta’s collaborative approach and big-picture thinking is exactly what drove another former colleague, Susan Scutt, to recruit him to TCV when she was hired by the PE firm to help bolster its portfolio operations.

Having previously worked with Mehta when she was at Vista Equity Partners and he was in charge of enablement and education programs in the areas of sales, presales, professional services and customers at Infoblox, Scutt reached out to him for help with identifying the biggest needs and challenges of the companies her firm was looking at acquiring. “The deal team thought the problem was X. He came in and was like, ‘Yes, that’s an opportunity, but the biggest challenge is lack of marketing and that their marketing funnel isn’t fully functional,’” remembers Scutt, who is now a managing director at Partners Group. “He’s got an ability to look through all kinds of data, people, etc. and really suss out what needs to happen to incite growth within a company.”

Mehta’s keen eye for assessing challenges and devising solutions is especially relevant in today’s environment. While volatility and fears of a looming recession are forcing middle-market PE firms and portfolio companies to batten down the hatches by cutting costs and focusing on near-term goals, he is quick to note that growth remains a strong possibility even in a downturn. “During a recession it’s important for a company to invest strategically and get rid of all the ‘nice to haves,’” he says. Companies should focus on the two or three things that will help them grow market share, retain customers, enter a new market or buy out a weaker competitor. “There are lots of ways to skin a cat if you optimize your ability to do that,” he says. “You can’t save your way to success—you still have to spend on growth opportunities.”

He believes many organizations are struggling to adapt to the postCOVID environment and some of the long-term changes the pandemic brought about. “The tailwinds of COVID-led growth have ended, and that is visible in companies’ valuations right now,” says Mehta.

Despite lower valuations, Mehta thinks most companies are not looking to sell immediately and are instead hunkering down to avoid raising capital through a down market. Since belt-tightening won’t be enough to get through the downturn, there will come a point where organizations not growing fast enough will be forced to seek out partners or sell, although that hasn’t

Highlights CAREER

BAIN & COMPANY

Expert Partner

March 2022 – Present

TCV

Operating Principal

Sept. 2019 – March 2022

INFOBLOX

Vice President, Worldwide Sales Strategy & Operations

Aug. 2016 – Sept. 2018

VMWARE

Director, End User Computing Portfolio

Marketing

Jan. 2013 – June 2015

INFORMATICA

Director, Global Enablement

Aug. 2010 – Jan. 2013

HEWLETTPACKARD

Director, Head of Global Enablement

Feb. 2008 – Aug. 2010

happened yet. “As valuations went down, so did deals and deal flow,” says Mehta. “Right now, I find that deal teams are spending a lot more time with their portfolio companies and digging in there.”

Not surprisingly, after the recent collapses of Silicon Valley Bank and Signature Bank, diversifying banking relationships became a top priority for middle-market PE firms. “For a couple of weeks, it was the only thing people could think about, and it took up incredible mindshare for people to make sure they were mitigating any risks within banking relationships,” says Mehta.

But the biggest challenge he believes middlemarket organizations currently face is attracting talent, a problem that was exacerbated by the so-called Great Resignation, which saw many people leave the job market during the COVID-19 pandemic.

Middle-market companies seeking to recruit experienced candidates face an automatic disadvantage to larger peers that can pay more and provide better perks and benefits. And attracting talent is only half the challenge, with retention proving equally difficult for midsize organizations. To hold on to key employees, particularly star sales representatives, Mehta says PE firms should tailor retention strategies to individuals based on what’s valuable to them: bonuses, stock options, coaching programs or something else.

Although virtual work has been used by some companies as a perk and allows employers to cast a broader net in recruitment efforts, Mehta thinks remote arrangements have hurt go-to-market strategies by increasing the time needed to get new sales representatives up to speed. “You have a certain number of months in mind where you expect a new sales rep will ramp up. That number has gone way up in terms of getting a rep productive since COVID because they are not learning from their peers,” he says.

Affecting meaningful improvements for clients’ go-to-market strategies hinges not just on sharp analysis; it also requires the right bedside manner.

Cherif Sleiman, chief revenue officer at Property Finder Group, who worked with Mehta at Infoblox, says there are three main dimensions of his former colleague: conscientious leadership, a capacity for structured thinking and process orientation, and executive presence.

“He’s so humble that you wouldn’t think of him as this sort of power guy who is so structured and process oriented,” Sleiman says. “Then, all of a sudden, you see this out-of-the-box thinking with lots of analytical abilities, problem-solving skills and structured thinking, along with the ability to establish relationships and alliances with any kind of vendor to help problem-solve.” Mehta has the rare ability to maintain a calm composure in any executive setting and to give people the feeling that he is on their side, Sleiman adds.

Mehta’s affable nature is something that resonates with bosses and employees, too. Jagadeep HG, an instructor architect at Informatica, credits Mehta with helping him develop key skills in his own career. “He is quite compassionate and someone who allows you to work independently, and he believed in my capabilities,” says HG, noting that Mehta gave him the opportunity to run a couple of projects on his own. “When he believes in someone, they will deliver for him. A lot of managers don’t have that ability and will just take things on themselves.”

Mehta’s approach to people, analysis and problem-solving has worked out well for him throughout his career across a range of organizations.

“I thought the industry of software and technology would largely be a snowflake, with problems unique to just that area,” he says. “But what I’ve learned since is that many industries have similar issues, so experiences from operating partners can be applied across the board. This includes how you organize your teams and efforts, go to market and how to integrate activities so everyone is aligned around a common goal.” //

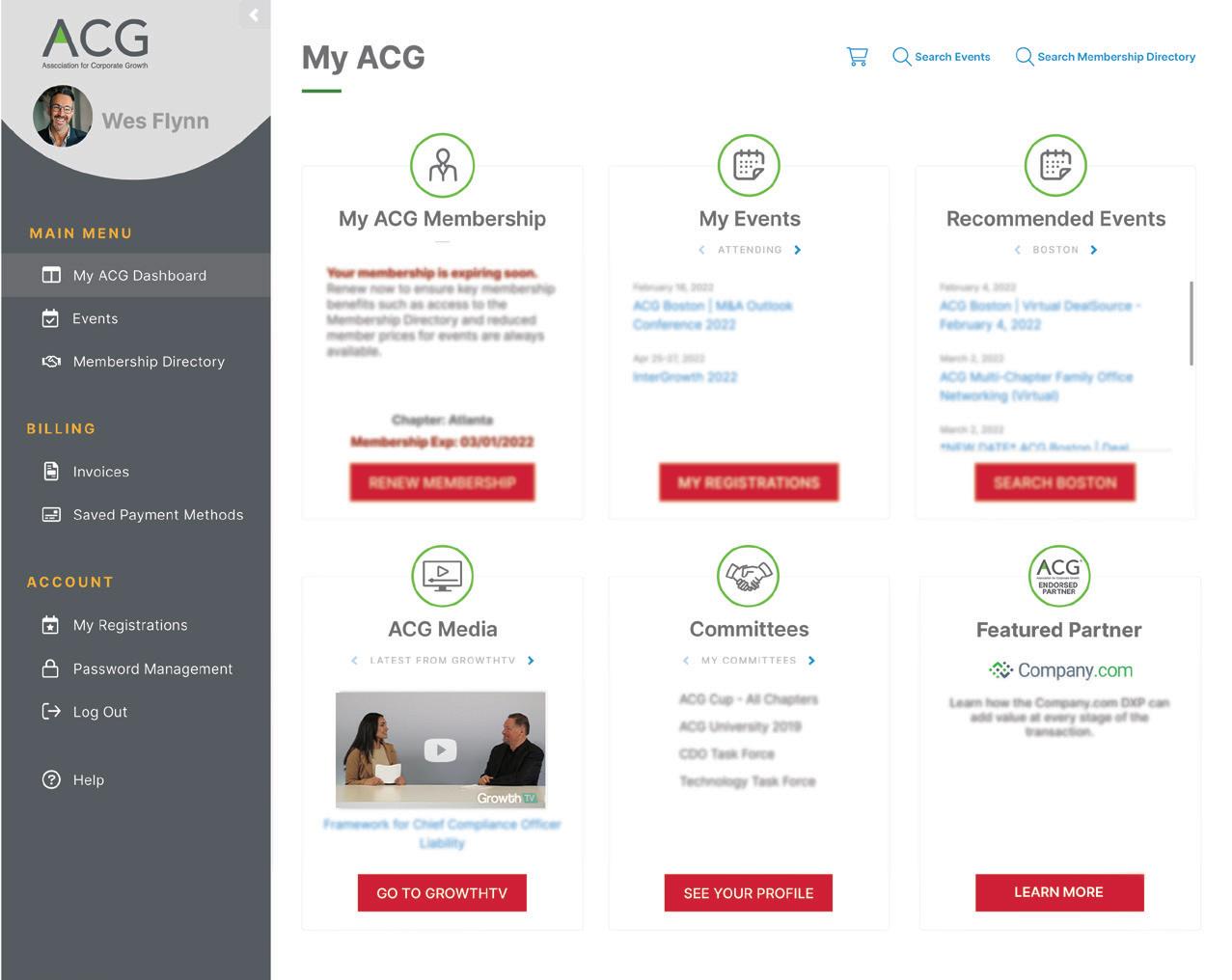

ACG Members represent the most active and engaged professionals within the middle market.

They embody ACG’s mission of driving middle-market growth by carrying out their own missions: to source and close deals, to grow their own organizations, to win business, and to continue developing their own careers.

And we help make it happen. When you join ACG as a member, you gain access to the exclusive network and benefit from the connections that ACG actively facilitates.

Does this sound like you? Are you among the middle-market’s foremost, deal-making, business-growing, investment-finding, ladder-climbing, acquisition-targeting, talent-sourcing, hand-shaking, professionals? Do you aspire to be?

If so, we encourage you to join ACG as a member and take advantage of the following benefits:

� Invitations to Member-Only Events - Collaborate with other ACG members and benefit from expert panels and industry insights. (Some events are just for fun.)

� Member-Only Discounts for just about all ACG-hosted events, including InterGrowth: the premier dealmaking conference in the middle market.

� Access to – and a presence – within the ACG Member Directory: Search for and connect with fellow ACG members with our exclusive directory of middle-market professionals.

� A Subscription to Middle Market Growth® Magazine: Keep up to date on news, trends, best practices and thought leadership in the middle market.

� ACG JobSource® - Post or search for a job on ACG’s job board.

� Earn your MMP via ACG’s Middle-Market Professional Certification Program at a discounted rate.

� Member-Only Offers courtesy of ACG’s Partners

75% of ACG Members do deals with other members

75% of ACG Members do deals with other members

In an uncertain climate, middle-market buyers and sellers begin to get back to business

While an economic slowdown has been weighing on M&A for close to a year now, several negative events in the tech sector in recent months have made the future even more uncertain for companies in this area.

Some big tech companies like Google, Amazon, Microsoft and Zoom have been laying off thousands of workers—due to a confluence of factors including higher interest rates, inflation and a perhaps inevitable reversal following pandemic hiring sprees. Meanwhile, the collapse of Silicon Valley Bank and a pullback by venture capitalist investors have made things more difficult for smaller companies and startups. Just like the rest of the market, the middle-market tech sector is reeling from the roller-coaster ride of the last few years.

Compared with early 2022, the beginning of 2023 has been quiet on the deal front. The number of middle-market tech deals in January 2023 was just 11, compared with 48 in January 2022, according to Refinitiv. While some industrywatchers say things are starting to pick up, few expect a return to 2021 and early 2022 levels. “It’s no surprise that dealmaking has slowed considerably,” says Justin Loeb, director at Clearsight Advisors, a subsidiary of Regions Financial Corporation. “Interest rates have increased and the cost of capital across the board is more expensive, which makes it more difficult to do a traditional leveraged buyout.”

Still, tech investors, companies and advisors are finding ways to transact, focusing on due diligence and picking bright spots in the sector. Strategic investors, in particular, are in a stronger position to do deals when they can finance them with cash and without debt financing, which is harder to come by in the current market environment.

Several sources say they’ve seen increased interest from strategic buyers in sale processes. “It’s true

that stock prices have been depressed and boards may be hesitant, but many companies still have plenty of cash on their balance sheet and want to buy growth,” says Pete Dalrymple, managing director and co-head of technology investment banking at William Blair. “Strategics are playing a much longer game than most PE investors—they think of the world in a 10- to 25-year time horizon and can make longer term bets.”

In June 2022, William Blair advised Brightly Software, a leader in cloud-based asset and maintenance management software, in its sale to Siemens, a publicly traded German engineering company. “Siemens was able to pay a market-clearing price for a highly strategic software company that will transform Siemens’ profile for the next 30 years,” says Dalrymple. Siemens purchased the company for $1.58 billion, according to a press release from Brightly Software.

“We’ve seen a resurgence in corporate acquirer M&A from large strategics,” notes Loeb. “Many of them are viewing uncertainty as a reason to find some ‘deals’ from a value perspective. Most of the strategics we work with in the knowledge economy can use cash on- hand or an existing debt facility to finance a deal. In 2021 and 2022, private equity platforms dominated the deal closures. Now it seems like many clients are getting the strongest looks from strategics or are being assessed as add- ons to existing PE platforms.”

In February 2023, Clearsight advised digital and data engineering company Hexacta in its sale to GlobalLogic, as well as life sciences consulting firm Bionest Partners in its sale to Accenture. In November 2022, Clearsight advised digital transformation consultancy AustinCSI in its sale to Cognizant.

For private equity investors, focusing on addons is a similarly reliable way to add value to their existing portfolio companies in the current environment. “In a climate with uncertainty, we’re trying to be thoughtful and intentional

about using the lever of M&A within our portfolio,” says EJ Whelan, managing director at private equity firm Berkshire Partners. “We’ve always been acquisitive, but today this is an even more prevalent approach. We can be opportunistic when valuation expectations align—if there are companies that have been burning money and hitting a wall, there may be opportunities to bring them into our platforms and really make 1+1=3 or 4.” For example, Berkshire invested in Tango, a leading provider of cloud-based store lifecycle management and integrated workplace management software, as a platform company in 2021. Within six weeks of that investment, in January 2022, Tango acquired AgilQuest, the leader in flexible and hybrid workplace scheduling.

In a riskier environment, due diligence takes on added importance for investors of all stripes. “Whether you’re a strategic or private equity buyer you want to make sure that if you get a deal done, you’ve done all the requisite diligence because this can be a tricky market environment and you don’t want to end up with surprises after the fact,” says Dalrymple.

Cybersecurity is one area of focus. “We are seeing a rapid rise in cybersecurity threats, resulting in an increased number of breaches that carry monumental costs for organizations. It has become critical for an acquirer to assess the target’s cybersecurity posture across multiple threat vectors and level of cybersecurity program maturity,” notes Vik Sharma, managing director at William Blair. Accordingly, there has been a greater emphasis on tech diligence as it relates to security and breaches.

“If there’s a hack or another problem, the whole company can go down. It’s important to be proactive rather than reactive when it comes to cybersecurity in today’s environment,” says Shawn

Flynn, principal at investment bank Global Capital Markets.

Investors are also spending more time digging into organizational charts during due diligence, says Flynn. “Who was hired pre-pandemic, who was hired during the pandemic, how many workers were and are remote? What does the culture look like and how cohesive are the employees?” he adds. “There’s a worry that emotional bonds are not as strong as they were pre-COVID and that employees won’t stay on after a transaction as a result.”

Sales pipelines are another area of focus for potential buyers in the tech space. “In an environment where no one is sure whether we’re in or possibly going into a recession, buyers are scrubbing sales pipelines far more rigorously than in the past,” says Dalrymple. “Buyers are saying, ‘If you want us to pay a market clearing price, that’s fine, but with headwinds we need to make sure the business is going to hit its numbers.’ That means looking at sales projections, lead quality, historical budget trends and the quality of the company’s sales management teams to ensure the numbers will be delivered on.”