► Target Asset Carrier of the Year 2023

► General Mills Gold Dry Carrier of the Year 2024

► Ecolab Breakthrough Carrier of the Year 2023

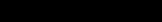

1200+ Power Units and 5000+ Trailers (Over 4:1 trailer ratio)

25% of total fleet is Hazmat Certified

• Specialized fleets for our customers’ unique or expedited needs

• Fleets dedicated regions and routes to service one-way lanes with efficiency

• 36% of total 2023 Legend miles were powered by biodiesel and renewable diesel

• EV fleet dedicated to servicing the Southern California area efficiency

Our goals in the Food and Retail markets are to provide services in all areas that meet the demands of our Customers.

Meet Aaron, logistics leader for Seneca Foods, a shelf-to-table food producer.

Aaron manages customer orders by effectively balancing warehouse space and transportation demand, trusting Ruan to provide dedicated capacity, cost savings, and continuous improvement.

Meet Kelli, operations leader for Ruan, a dedicated third-party logistics provider. Kelli’s team of professional drivers enable Seneca Foods to succeed in a fast-paced commodity market, serving as the physical link between and an extension of their plants to ensure production stays on track.

Delivering farm fresh goodness made great. Together.

From day one, we work as one. We become an extension of your business. Through our personal approach, we learn your values. Your goals. Your challenges. And we leverage our expertise and technology-driven processes to provide efficient day-to-day logistics operations, cost savings, reliability, and consistency. Just like we do for Aaron and Seneca Foods.

Get in touch with one of our tailored solution experts by scanning the QR code.

Your tailored solution awaits.

For 20 years and counting, our partners’ success is measured by implementing freight efficiencies while reducing emissions.

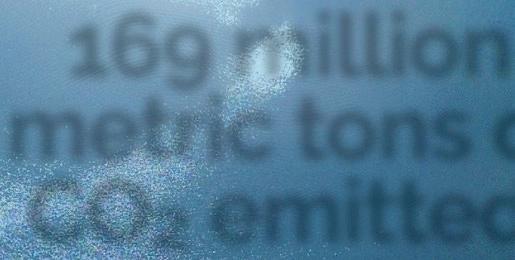

Since 2004, SmartWay has been helping our partners achieve more with market-based incentives and innovative technologies to save fuel and reduce emissions. SmartWay Partners have saved $55.4 billion on fuel costs and prevented the release of more than 169 million metric tons of carbon dioxide, the largest source of greenhouse gas. With the SmartWay Program, freight transport is becoming more efficient, as well as environmentally friendly and socially responsible. In the program’s 20th year, there are more than 4,000 SmartWay Partners, and more companies keep joining. Learn all the benefits of being a SmartWay Partner at epa.gov/smartway.

Any way you ship it, ship it the

Published three times a year for:

Food Shippers of America

1144 East State Street, Suite -288A Geneva, IL 60134

847-302-1496

executivedirector@foodshippers.org www.foodshippers.org

Published by:

MindShare Strategies, Inc.

Ponte Vedra Beach, FL 32004 USA

952-442-8850 www.MindShare.bz

Billing Address: MindShare Strategies, Inc. P.O. Box 843 Springfield, TN 37172 USA

Group Editorial Director and Publisher: Brian Everett, ABC 952-442-8850 x201 brian@mindshare.bz

Editorial Content This Edition: Faith Boone Courtney

Brian Everett Karen Kroll Conrad Winter

Advertising Sales: Cassidy Mullins

952-442-8850 ext. 215 cassidy@mindshare.bz

Alec Stifter 952-442-8850 x218 alec@mindshare.bz

Design/Production Manager: Todd Pernsteiner 952-841-1111 todd@pernsteiner.com

Accounting/Administration/Circulation: Karen Everett

952-442-8850 x203 karen@mindshare.bz

Marketing/Communications: Brynn Aiello 952-442-8850 x220 brynn@mindshare.bz

©2025

Brian Everett, Publisher Senior Partner, MindShare Strategies

952-442-8850 x201

brian@mindshare.bz

A significant portion of supply chain activities in the food industry relies on the ability to manufacture, store and transport temperature-sensitive food ingredients and products – and it’s rapidly growing.

In fact, according to recent research released by Custom Market Insights, the demand of global cold chain logistics market size and share was valued at over $321 billion in 2023 and is estimated to be over $368 billion in 2024. The market is expected to reach a value of over $1,245 billion by 2033, at a compound annual growth rate (CAGR) of about 14.5% during the forecast period 2024-2033. That’s some tremendous growth, to put it mildly. This cold chain logistics boom is presenting new opportunities (and requirements) for food shippers to cut costs, reduce waste, and help create a more sustainable future for temperaturesensitive products and materials.

According to this research, factors driving this dramatic growth underscores what many industry observers have been talking about over the last 24 months:

Expanding Global Food Trade. A significant increase in demand for perishable food products, coupled with globalization and shifting consumer preferences, is driving rapid growth of the cold chain logistics market. Expanding international trade involving fresh produce and seafood is necessitating efficient cold chain infrastructure to maintain product integrity and safety during transportation.

E-commerce & Online Grocery Retailing. The rapid explosion of e-commerce platforms and online grocery retailing is driving the demand for cold chain logistics services. More and more, consumers are purchasing fresh and frozen food items onlinerequiring reliable temperature-sensitive transportation and warehousing solutions to ensure product quality and freshness through delivery.

Advancements in Technology.

Innovations such as blockchain-based traceability solutions, temperature monitoring devices enabled by the Internet of Things (IoT), advanced refrigeration systems, and innovative packaging are transforming the cold chain. These emerging technologies enhance transparency, visibility and real-time tracking capabilities—enabling more effective cold chain management and risk of product spoilage or loss.

Emerging Markets & Rapid Urbanization. Urbanization, along with changing dietary preferences in emerging markets, are creating significant opportunities for

the cold chain logistics market. Rising disposable incomes, urbanization trends, and an increasing demand for convenience foods are having an impact on this market and the need to efficiently transport perishable goods from production hubs to urban centers.

Tightening Regulatory Requirements. Regulations such as the FDA’s Food Safety Modernization Act (FSMA) in the United States and quality standards imposed by regulatory authorities are changing practices by food shippers and their providers in cold chain logistics. So buckle up, food shippers, and continue to navigate through this rapid growth. You can do this through close collaboration with your logistics providers, carriers and technology innovators; and exploring emerging trends and new opportunities found in FSA’s communication and educational channels, as well as at the annual Food Shippers Conference. The cold chain logistics boom is happening – and much of it is managed and driven by you.

A fragmented market with many players

When describing what makes a shipper of choice, this saying applies: “Everything I’ve ever needed to know I learned in kindergarten.” The term “shipper of choice” refers to those who follow through on commitments and work collaboratively, respectfully, and professionally with their carriers and other logistics partners. Additionally, driver friendliness, flexibility, accommodations,

efficiency, and low detention times are common characteristics of shippers that providers want to work with.

Creating such a reputation is crucial because it signifies a company that providers actively prefer to work with due to their reliable practices, efficient operations, and positive treatment of drivers – which translates to better access to

capacity, potentially lower shipping costs, and smoother logistics operations, especially in lanes or situations with limited carrier availability or high demand.

Food Shippers of America (FSA) continuously features food companies that apply best practices that make their relationships, operations and expectations most appealing

THE TERM “SHIPPER OF CHOICE” REFERS TO THOSE WHO FOLLOW THROUGH ON COMMITMENTS AND WORK COLLABORATIVELY,

to their providers. In addition, many industry media outlets and organizations such as Supply Chain Brain, Logistics Management and Freightwaves actually highlight such best practices through awards programs. These recognition programs highlight some of the most critical characteristics that place a food company into the category of “shipper of choice.”

One way shippers of choice demonstrate respect is by paying their carriers promptly. This is especially critical for small carriers, who tend to operate with tighter margins. Approximately 96% of motor carriers operate fewer than 10 trucks, according to the American Trucking Associations.

Looking for ways to strengthen your status as a shipper of choice?

See page 10 for 10 Hallmarks of a Shipper of Choice

Shippers of choice plan ahead and try to provide their provider partners with the lead time they need to secure capacity at reasonable rates. At the same time, they remain flexible, understanding disruptions can impact even wellorganized supply and chain logistics operations.

They partner with providers to resolve any issues and keep open lines of communication. Especially when challenges arise, this helps both parties develop workable strategies for addressing them.

Shippers of choice also run their own operations as efficiently as they can. Many leverage technology to streamline processes and minimize delays. Along with benefiting the shippers themselves, this helps the providers with which

they partner, as it smooths their interactions.

Companies that earn the reputation as a shipper of choice benefit in several ways. Because doing business with them tends to be straightforward, logistics partners are more likely to go the extra mile to find capacity, even when the market tightens. Shippers of choice also tend to attract a wider universe of logistics partners, so they’re better able to find those that best fit their needs. Many shippers of choice provide consistent work to their partners, so providers are better able to capture favorable rates, which they can pass back through to the shippers.

Respect is key at BASF Corp., a major worldwide corporation that operates in numerous industry segments, including agriculture and nutrition. “BASF strives to create an environment where carriers enjoy working with us and delivering to our customers,” says Michael Vogt, Director of Logistics Procurement, North America.

To this end, BASF treats truck drivers with respect, he adds. Among other actions, BASF provides timely payments, access to on-site break rooms and it offers security fast passes and trailer drop yards to eliminate driver loading and unloading wait times.

“We have regular dialogues with carriers to exchange feedback and work toward continuous improvement and smooth logistics flow,” Vogt adds.

Costa Farms grows more than 1,500 varieties of plants, making it one of the largest horticultural growers in the world. Management understands that its trucking partners are a vital component of Costa Farms’ supply chain, playing an essential role in ensuring smooth movement and timely deliveriess, says Justin Hancock, Director, Research and Development and Horticultural Content. “They bridge the gap between our farms and our customers, making it possible to deliver our product to the consumer efficiently and reliably, crucial in maintaining our competitive advantage,” he adds.

To make their trucking partners’ hard work a little easier and their days more tolerable, Costa Farms has established numerous best practices. These include creating an on-site driver’s lounge, complete with private rooms, showers, kitchen, relaxation area, and office space with access to Wi-Fi. This lounge is available to the drivers throughout Costa Farms’ loading hours.

Costa Farms also has two truck/ trailer parking areas with capacity

AS EFFICIENTLY AS THEY CAN.

for more than 150 tractor trailers. This parking area is available for drivers who wish to either drop trailers for a load to be picked up at a later date, or to park if they arrive prior to their loading time, Hancock says. In addition, Hancock says Costa Farms has implemented a batch loading schedule to guarantee that drivers who arrive at their scheduled time get loaded in a timely manner.

Agri-Mark Inc., a dairy cooperative and certified B-Corp that is owned by hundreds of farm families throughout New England and upstate New York, approaches its logistics partnerships with a spirit of collaboration.

“Collaboration and strong relationships are key to us as a farmer-owned cooperative,” says Katie Dattilio, Transportation Supervisor for the company. “We

focus on being solution-driven, flexible, and efficient for our customers and logistics partners. Thanks to our hardworking warehouse team, freight is always ready when drivers arrive. We’re incredibly proud of our team and we are honored to be recognized as a shipper of choice.”

Other food companies that recently have been recognized as shippers of choice in industry-wide recognition programs such as Freightwaves’ Shipper of Choice awards program include Albertsons, Aldi, Certainteed, Dawn Food Products, General Mills, Niagara Bottling, PepsiCo, Schreiber Foods, Target, Coca-Cola, Kroger, Tyson Foods and Univar Solutions.

Continued on page 10

In today’s competitive market, it’s critical that food shippers strive to be a “shipper of choice.” This means to go the extra mile to make it easier for providers to do their jobs. Here’s how to strengthen your provider relationships and achieve this coveted status.

Focus on Partnerships. Collaborate with your providers to identify and solve problems that impact both parties.

Communicate Clearly. Providers often are frustrated when shippers provide incomplete instructions. Keep them informed about shipment changes and be readily available to answer questions. Make it easy for carriers to obtain scheduling and policy procedures on your website. Host regular provider conferences and solicit feedback on how you can improve as a shipper.

Be a Predictable Partner. Providers like to do business with predictable shippers. Strive to be reliable with your shipping volume and avoid last-minute changes. The more predictable you are, the easier it is for providers to integrate your shipments into their planning.

Pay Promptly. Ensure payments are made within the agreed-upon time, especially since on-time payment is the top request for becoming a preferred shipper.

Provide Sufficient Lead Time. This helps providers to schedule their operations more efficiently. Giving your provider weeks of notice—rather than days—greatly improves your ability to be accommodated, while firmly positioning you in the “easy to work with” category.

Be Flexible with Schedules. Offer flexible schedules, large delivery windows, and fast yard check-in and check-out. Providing flexible appointment times and accepting trucks during “off” hours, such as evenings and weekends, helps providers better utilize their assets and gives them the ability to pick up shipments at less busy times.

Provide Drop-and-Hook Capability. This allows drivers to drop off a load and hook up to a pre-loaded or empty container at the same facility. Truckers are more likely to accept such freight because it enables them to spend more time on the road, maximizing their earning potential.

Provide Driver Amenities. Drivers spend excessive amounts of time behind the wheel of their rigs. Providing restrooms, break areas, and available parking can go a long way in making your location more desirable.

Minimize Loading/Unloading Wait Times. Each minute a driver is stuck at your facility is time off the road—time that can’t be utilized for hauling new shipments. Provide convenient access for drivers with a yard that is easy to navigate when coming and going. Have your equipment and manpower ready to go when a driver arrives. Shippers associated with excessive wait times will have difficulty attracting providers. Leverage TMS Solutions. Transportation management system (TMS) technology solutions help providers increase the predictability of shipments, providing them with greater visibility further upstream. This will also help them to improve route planning and driver scheduling functions.

The Food Shippers Annual Conference has become renowned as an industry event that reflects the opportunities, challenges, and insights that are critical to modern supply chain success in the food industry. This year’s event takes a close look at emerging trends, best practices, and the current health of the food chain industry.

When it comes to the biggest challenges facing today’s modern food shipper, “the need to continue improving on-time performance while maintaining market relevant costs is top of the list,” says Steve Hart, Vice President, Transportation and Logistics Services with Sysco. Hart is a 2025 FSA Annual Conference Co-Chair, along with Clyde Coleman, Senior Director of Corporate Logistics with Performance Food Group and Jim Hamm, Director National Accounts with R.E. Garrison Trucking.

FSA’s 69th annual conference, which takes place March 2-4 in Palm Desert, CA, will cover some of the biggest opportunities in food chain

enhancement and productivity. Here are some of the primary topics to be covered.

Driving 11 hours a day to deliver freight is both demanding and sometimes uncertain, which is part of why the trucking industry faces tremendous difficulties attracting and retaining drivers. Amid everincreasing consumer demands, now more than ever there’s a heavy demand to move freight. Enter autonomous trucking.

The goal for this emerging trucking technology that is much less driver reliant is to speed the flow of goods, accelerate delivery times, and lower costs. Driverless trucks, once regarded as the stuff of science fiction, are gradually moving closer to viability in real-world freight operations after years of investment, development work, and on-road testing and validation. Autonomous trucks also can save on fuel because they don’t have to stop and will drive at more consistent speeds. The vehicles’ laser and radar sensors can “see” farther than human eyes can.

The trucks never tire or become distracted.

If you’re attending the conference you can experience this cuttingedge technology for yourself, according to Coleman. Two of the leading manufacturers, Aurora and Kodiak, will have their tractors on display, he says.

Torc Robotics also will have their Autonomous eCascadia Technology Demonstrator on site.

“You’ll also get a glimpse into trucking’s future with advanced sensors, cameras, and radar systems that allow trucks with different powertrain options to navigate roads without human intervention,” he continues. “This technology will improve safety, efficiency, and reliability in the logistics industry.”

In addition, the conference will feature a panel discussion on the future of autonomous trucking highlighting executives with DAT Freight and Analytics, Torc Robotics, Aurora and Kodiak.

As part of their research and exploration of the topic of autonomous trucking, 2025 Conference Co-Chairs Clyde Coleman of Performance Food Group and Steve Hart of Sysco Corp., recently visited Aurora and Kodiak Robotics to experience their autonomous truck technologies through ride-alongs.

The Aurora Drive, the company’s core autonomous driving technology, includes self-driving hardware, software, mapping, and data services.

“Words alone cannot describe the experience of being in the cab observing the ‘Aurora Driver’ autonomous solution navigating everyday driving conditions,” says Hart. “The technology can see things beyond the human eye with predictive abilities that mitigate risks.”

“As most people, I was skeptical about autonomous trucks before the ride and the experience,” says Coleman. “However, after experiencing Aurora Drive, I no longer have my reservations about safety and their ability to mitigate driving situations. I would feel comfortable with me and my family driving next to an autonomous truck. The technology behind Aurora provides visibility and

technology that has provided this level of comfort.”

Pictured above are Hart and Coleman next to autonomous truck technology by Kodiak Robotics, which is developing an industryleading artificial intelligence (AI) powered technology stack purpose-built for long-haul trucking applications. Kodiak’s unique modular hardware approach integrates sensors into a streamlined sensor-pod structure that optimizes perception, scalability and maintainability.

There’s a major shift in integrating

transformative technology into the operations of major enterprises in the food industry. Powerful solutions are significantly impacting supply chain networks through efficiency enhancement to growth acceleration – but with all these positive impacts, perhaps the most notable benefit is the ability for technology to guide and manage change. Interestingly, some of the biggest hurdles to overcome in technology involve complexities of implementation, gaining buy-in from key stakeholders, and ensuring a solid return on technology investments.

The conference will feature a panel discussion on how powerful technologies are helping with change management in supply chains. This panel will include executives from Optimal Dynamics, Rise Baking Co., Sunsweet Growers, Dollar General Corp. and Schwan’s Co.

Supply chain visibility is now paramount following the pandemic, and shippers, consumers and regulators are requiring a more holistic view into how food is produced and delivered. Many industry observers agree that the entire ecosystem changed with the ‘Uberization’ of the supply chain

because providers gained access to digital tools that enabled power at scale. Rate transparency also is enabled through additional tools that shippers can utilize, but that is ultimately driven by the carriers embracing the technology.

Such visibility tools become especially valuable during supply shortages and disruptive events.

“The conference will highlight a panel comprised of top-tier companies that provide shipment visibility, sharing their progress in the space with intelligence of where the development of new solutions in the future,” says Hart. Executives are from Lindt & Sprugli, FourKites, Descartes Systems Group and Shippeo. “Staying relevant of where these capabilities are headed is key to shippers and distributors alike,” Hart concludes.

Built by the Women In Trucking Association, the WITney® Educational Trailer features interactive kiosks that quiz visitors on their knowledge of trucking and educates them about potential careers in the industry. This mobile classroom offers hands-on learning experiences and showcases various aspects of trucking, including safety, vehicle operation, and careers for women in the industry. It also allows visitors to test their driving skills with a state-of-the-art driver simulator. The next edition of Food Chain Digest will dive deep into the perspectives, best practices, and challenges shared by supply chain executives at the conference.

No other company combines the knowledge and experience in cold storage construction and warehousing that Tippmann Group offers. As owners & operators of more than 130,000,000 cubic feet of temperature-controlled space, Tippmann Group is your single source for cold storage excellence.

Operating private fleets are a significant initiative by many food companies in management their supply chains. In fact, nine of the top 10 private fleets in North America are food companies, including Walmart, PepsiCo, Sysco Corp., Performance Food Group, U.S. Foods, Reyes Holdings, McLane Co., Tyson Foods, and Nutrien.

According to Tom Moore, CTP, Executive Vice President of the

National Private Truck Council (NPTC), there are several reasons why companies operate private fleets.

“Top reasons include improved customer service, control of transportation costs, and enhanced control over their supply chains,” he says. “Maintaining

your own fleet gives you the power to manage all aspects of your transportation operations, from scheduling and route planning to driver selection. Owning your fleet puts you in a position to adapt to changing market demands, customer needs, and the unexpected.”

Moore cites other reasons that include: hedging against outside carrier capacity; specializing in

products and/or equipment; mitigating liability, safety and risks; providing branding and marketing opportunities; and generating profits.

“Another advantage private fleets have is lower turnover,” he says. “Private fleet report a turnover of around 20% compared to a large for-hire fleet, which can run 85% to 100%.”

The volume of domestic tonnage has been significant in recent years and is growing significantly, says Moore: “To put it into perspective, overall trucks haul 72.4% of domestic tonnage and account for 80% of transportation revenue. Private fleets represent 46% of truck tonnage and 49% of revenue.”

The growth of private fleets is significant in recent years as shippers prioritize reliable capacity and costs, and attempt to avoid the service disruptions that plagued them leading up to and during the pandemic, according to Moore: “The pandemic years taught shippers many things about capacity and managing shipping costs. That has resulted in shippers doubling down on private fleets to safeguard against uncertain futures. Companies that historically were opposed to having in-house

transportation are now embracing the private fleet model. We’re now seeing companies with longstanding commitment to their private fleets adding drivers and equipment.”

He says that according to NPTC’s most recent Benchmarking Survey Report, which involved 122 private fleet respondents with data collected during the first part of 2024, the industry saw a 7.5% yearover-year increase in shipments handled by private fleets. Volumes and freight value also increased 8.6% and 7.2%, respectively. Private fleet growth is expected to continue, with 72% of respondents planning to increase drivers, equipment or shippers in the next five years.

The author of the report since 2007, Moore says that while private fleets handle 75% of outbound shipments, the inbound share of freight in the U.S. handled by private fleets has stabilized in the low to mid-30% range, after peaking at 43% during the pandemic. While private fleets continue to dominate outbound logistics, the inbound market is more mixed, with some segments being handled by third-party carriers or vendors.

Currently, of the more than 2 million registered carriers at the Federal Motor Carrier Safety Administration (FMCSA), 47% are private carriers.

The top four challenges for private fleets are driver-related issues, safety (accidents and injuries) and internal staffing, and costs, according to the report. Other challenges include volatile fuel costs, difficulties in backhauling, customer service, and managing capacity.

As with for-hire carriers, private fleet owners report their greatest challenge revolves around an aging workforce, difficulties in recruiting and hiring, high turnover rates, poor retention, and the overall driver shortages. “The average fleet reports that they review, screen, and interview 16 candidates to fill one driver’s position,” says Moore. “That’s up from 10 candidates reported last year.”

While safety on the road is one of the highest priority for any trucking operation, interestingly private fleets in the United States have had a lower record accident rate since 2011, which is three times better than the trucking industry overall. In 2023, private fleets reported 0.47 recordable accidents per million miles. Safety factors that impact accident rates in private fleet operations include driver behavior, technology such as telematics and GPS tracking, and being consistent with safety rules.

“MAINTAINING YOUR OWN FLEET GIVES YOU THE POWER TO MANAGE ALL ASPECTS OF YOUR TRANSPORTATION OPERATIONS, FROM SCHEDULING AND ROUTE PLANNING TO DRIVER SELECTION. OWNING YOUR FLEET PUTS YOU IN A POSITION TO ADAPT TO CHANGING MARKET DEMANDS, CUSTOMER NEEDS, AND THE UNEXPECTED.”

— TOM MOORE, CTP, EXECUTIVE VICE PRESIDENT OF THE NATIONAL PRIVATE TRUCK COUNCIL (NPTC)

In talking with food shippers, there sometimes can be a misunderstanding of how a private fleet works in contrast with a contract carrier or forhire carrier partner.

Typically a private fleet is a significant, long-term commitment with fixed costs. With a for-hire or 3PL relationship, the food shipper only engages for what is required, when it’s needed. For many food shippers that have some component of their supply chains reliant on a private fleet operation, it’s an ongoing assessment many complicated factors: changes in their business model, shifts in market demand, and “fixed cost” factors such as equipment purchases, setting up and staffing a fleet management team, dedicated technology resources, operating costs, fleet maintenance, insurance, regulatory costs and compliance, and more.

Food companies, especially large enterprises, often use a mix of private fleet, common carriage and dedicated fleet capacity for their supply chain operations. According to industry observers, this likely won’t change any time soon. But if recent trends continue, the use of private fleets will continue to increase as they support complex food chains.

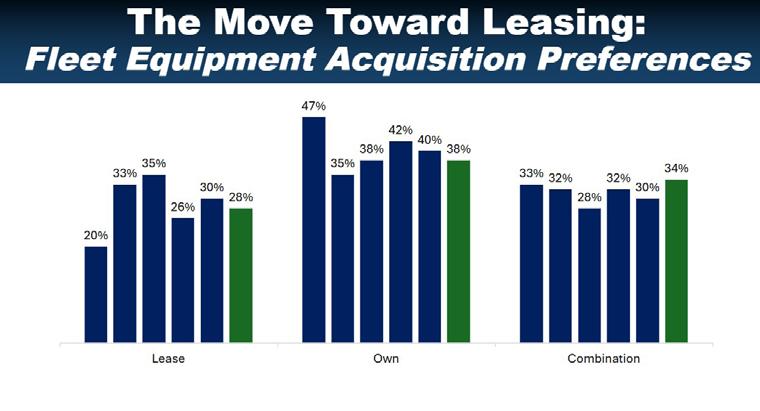

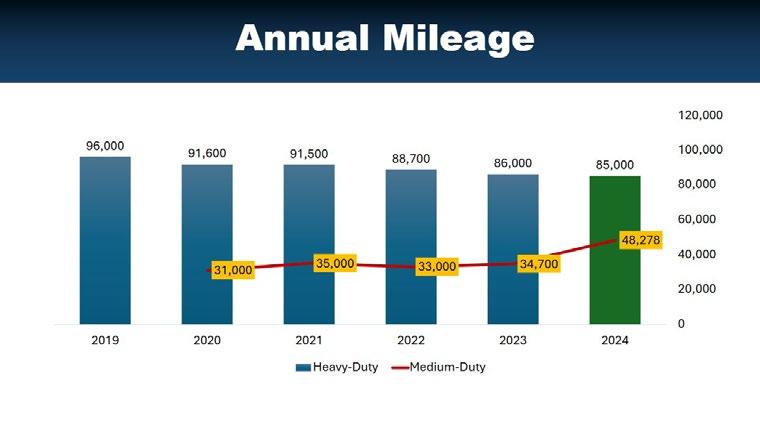

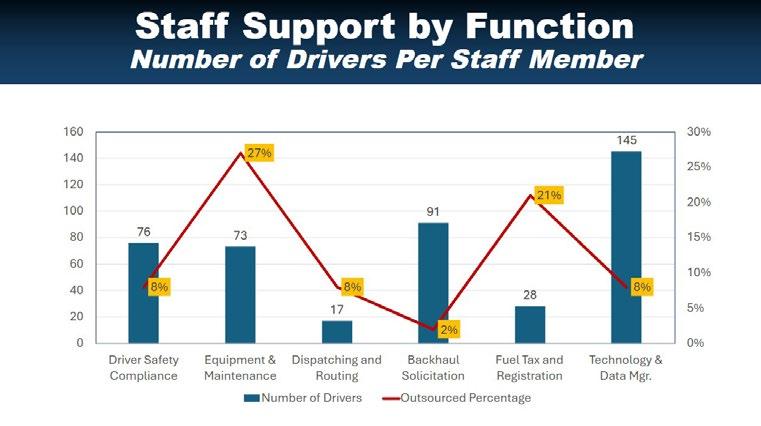

To the right are some key benchmark data points for the NPTC’s Benchmark Survey Report which may be of high interest to supply chain executives with food manufacturers, retailers and distributors.

Source: NPTC Benchmarking Survey Report

Tractors: 12,663

Trailers: 89,447

Trucks: 29

Annual Revenue: $648.1 billion

Tractors: 5,983

Tractors: 11,618

Trailers: 29,286

Trucks: 18,852

Annual Revenue: $91.5 billion

SYSCO CORP.

Tractors: 9,218

Trailers: 11,088

Trucks: 2,679

Annual Revenue: $76 billion

Trailers: 7,741

Trucks: 436

Annual Revenue: $35.6 billion

Tractors: 5,539

Trailers: 7,493

Trucks: 963

Annual Revenue: $35.6 billion

Tractors: 6,231

Trailers: 7,933

Trucks: 1,075

Annual Revenue:

$57.3 billion

MCLANE CO.

Tractors: 3,964

Trailers: 10,258

Trucks: 170 Annual Revenue: $5.4 billion

Many North American food enterprises are adopting generative Artificial Intelligence (gen AI), which is a type of AI that performs tasks like summarizing, answering questions, and classifying data. Such machine learning models can quickly identify and learn patterns and structures from large datasets. However, while many are adopting gen AI at some limited level there are signs of accelerated application in key areas such as supply chain strategy and operations.

In fact, there are four key areas in which leading food enterprises are leveraging gen AI to bring efficiencies, productivity and value to their supply chains:

Food companies are leveraging gen AI to analyze their historical data and stack it against other factors—such as inventory and supplier data, production patterns, and transportation and distribution networks—to create more accurate and resilient forecasts.

Because food suppliers oftentimes deal with unpredictable demand from consumers, Kraft Heinz uses its AI-powered software called Lighthouse to help anticipate and adjust to these demand shifts. Lighthouse uses proprietary algorithms and data from suppliers, factories, and distribution centers to plan product demand and recommend how to handle supply

chain disruptions along the way, according to a recent article in Business Insider. The goal is that with AI, Kraft Heinz associates can recognize patterns and precisely address these demand fluctuations, boosting sales.

Enhance Freight Management. AI is driving insights that help improve traceability and enable dynamic supply chain decisions. Route optimization and asset management can be leading use cases, with relatively high adoption, economic impact and success probability.

For example, Aldi International Buying Asia, the global hub for the major supermarket chain to source products from Asia, is turning to AI to strengthen its freight management. This major supermarket chain is implementing a technology platform to centralize its global shipping volume and increase visibility.

Earlier last year, Aldi went live on One Network’s NEO platform to digitize its supply chain, reduce costs, and enable end-to-end visibility and collaboration. One Network is the leader in supply chain control towers and provider of the Digital Supply Chain Network™. Its solution gives supply chain managers and executives end-toend visibility and control with one data model and one truth, from raw material to last-mile delivery.

“This will greatly improve effectiveness in collaborating with our suppliers and being more responsive to our customers,” says Fritz Walleczek, Managing Director of Aldi International Buying Asia.

“AI WON’T CHANGE FOOD CHAIN MANAGEMENT OVERNIGHT BUT WE SHOULD CONTINUE TO SEE STEADY TECHNOLOGICAL PROGRESS IN THE NEXT FEW YEARS.”

KEN GOLDBERG, DISTINGUISHED PROFESSOR OF ENGINEERING & CHIEF SCIENTIST, UC BERKELEY & AMBI ROBOTICS

From side to side.

And front to back.

From side to side. And front to back.

Automation Operations. AI allows robotics to handle tasks such as picking, offering support across sorting, and returns management. Modern AI software analyzes warehouse layouts and processes to reduce travel distances for robots and humans, optimize workforce planning, and facilitate interactions between workers and robots to improve warehouse and dock efficiencies. The opportunities to use AI to automate operations are limitless.

The Coca-Cola Company recently embarked on a five-year strategic partnership with Microsoft Corp. to align its core technology strategy systemwide, enable the adoption of leading-edge technology, and foster innovation and productivity globally. The companies have been jointly experimenting with groundbreaking new technology like Azure OpenAI Service to develop innovative generative AI use cases across its manufacturing and supply chain.

This includes testing how Copilot for Microsoft 365 could help improve workplace productivity.

Most major independent bottling partners also have followed suit in migrating applications to Microsoft Azure. The company currently is exploring the use of generative AI-powered digital assistants to help employees improve customer experiences, streamline operations, foster innovation, gain a competitive advantage, boost efficiency and uncover new growth opportunities.

Improved Risk Management.

Risk assessments help build basic seasonal or templated event models by allowing food chain practitioners to model specific events such as weather events, wildfires, recessions, and pandemics. Food companies now use AI to respond to crises and strengthen supply chains before they are strained. AI can recommend changes to a company’s supply chain

policies based on a multitude of factors, such as seasonality and macroeconomic trends. For instance, AI can identify the best supply chain configuration, the optimal number of suppliers (and their locations), and the most favorable terms of the supply chain contracts.

These are significant ways in which the food supply chain industry can leverage AI.

“However, AI won’t change food chain management overnight but we should continue to see steady technological progress in the next few years,” says Ken Goldberg, Distinguished Professor of Engineering & Chief Scientist, UC Berkeley & Ambi Robotics, and speaker at last year’s Food Shippers Annual Conference.

Since 1927, Hermann Services has provided warehouse, truck transportation, and 3PL solutions throughout the U.S.

v

p

c o m m i t t e d t o s a f e l y a n d e f f i c i e n t l y t r a n s p o r t i n g y o u r c a r g o o n

t i m e , s o l v i n g a l l o f y o u r f r e i g h t m a n a g e m e n t c h a l l e n g e s

W e p r o v i d e d e d i c a t e d , v a l u e - a d d e d w a r e h o u s i n g s e r v i c e s

t h r o u g h s t r a t e

AIB

W e ' r e p r o u d t o m a i n t a i n A I B S u p e r i o r R a t i n g s i n

o u r w a r e h o u s e s . T h i s e n s u r e s y o u r f o o d - g r a d e

p r o d u c t s a r e s t o r e d a n d h a n d l e d w i t h t h e

u t m o s t c a r e a n d q u a l i t y .

Hi-Tech WMS

W e p r o v i d e v a l u e - a d d e d w a r e h o u s i n g a n d

p r o g r a m s t a i l o r e d t o m e e t y o u r n e e d s w i t h

s t a t e - o f - t h e - a r t i n f o r m a t i o n t e c h n o l o g y a n d

s p e c i a l i z e d m a t e r i a l h a n d l i n g e q u i p m e n t

Energy-Efficient Warehouses

W i t h m o t i o n - a c t i v a t e d l i g h t i n g a n d p r i s t i n e

s p a c e s , w e a c t i v e l y l i m i t o u r e n e r g y u s a g e a n d

t h e a m o u n t o f p o l l u t i o n w e c r e a t e .

Warehousing W

3rd Party Logistics

A supply chain professional’s evolution in the food industry typically progresses from a primarily operational, cost-focused role managing individual logistics function to a strategic leader creates a digitized supply chain and data analytics to optimize the entire supply chain network. This individual usually transitions from a “mover of materials or goods” to a “value chain orchestrator.”

More and more, food companies that realize the competitive advantage of a supply chain have created an executive role in the C-suite that is the Chief Supply Chain Officer (CSCO).

Not that long ago, traditionally the role of a CSCO was to ensure

the effectiveness and efficiency of an enterprise’s day-to-day supply chain operations. Given current complexities in the business landscape such as changing economic and geopolitical headwinds, disruptive technologies, unexpected weather events, integrated supply chains and rising customer demands, the CSCO’s mandate has rapidly expended in magnitude and importance.

Today’s CSCOs must not only achieve their long-established operational responsibilities but they also must serve as strategic thought leaders who lead teams, champion critical large-scale transformations in the enterprise, and manage key relationships both internally and externally.

Food Chain Digest recently spoke with several CSCOs in the food industry and identified nine priorities that typically are priorities for food enterprises. These emerging and expanded responsibilities for CSCOs provide new opportunities to influence critical business decisions for their companies:

1. Incorporate best practices in supply chain management. Traditional CSCO responsibilities, such as balancing cost performance and quality, managing internal operations and making data-driven decisions, remain necessary for running the business day to day. However, today’s CSCOs also serve as strategic executives who must be capable of responding to a variety of business opportunities while driving long-term growth for the enterprise.

2. Optimize your supply chain footprint to create agility and navigate geopolitical realities. A food enterprise’s sourcing and manufacturing strategy and operations must align with its overall business goals and objectives. CSCOs play a critical role in managing emerging trends and shifts in supply and demand, complex geopolitical realities, and increased cost pressures that impact company operations.

3. Adopt best-in-class supply chain technologies. Advanced supply chain and manufacturing operations require complex technology infrastructure. CSCOs must embrace a new paradigm of digitized manufacturing to optimize operations.

4. Effectively manage data to support technology implementations. The exponential growth of technology and data has outpaced the ability of food companies to generate meaningful insights from data. CSCOs must drive efforts to

ultimately develop processes and systems that leverage data stored in traditionally siloed systems in order to transform them into critical insights and operational improvements.

5. Leverage artificial intelligence (AI) to stay ahead of the competition. As technological innovations continue to emerge, food companies need to stay ahead of the curve without rushing into potentially unscalable solutions. CSCOs must drive the adoption of process automation enabled by AI and GenAI, and work closely with Chief Information Officers to navigate data integrations and technical supply chain challenges.

6. Create operational flexibility focused on customer needs. The customer experience (CX) and engagement are critical to meet any food company’s business goals, and often require adjusting operations to meet evolving customer requirements. CSCOs must drive the optimization of product portfolios, manufacturing processes, and supply chain initiatives that adjust to changing research and development (R&D) initiatives and shifting markets.

7. Impact carbon footprint for maximum sustainability in operations. ESG initiatives can help decrease operating costs, boost margins and enhance brand value. CSCOs must embrace market opportunities generated by ESG, including new products, business models and customer engagement methods that

ultimately create value beyond regulatory compliance.

8. Recruit and maintain top talent to solve complex food chain problems. A forward-looking talent strategy that embraces diversity, fosters innovation, and promotes a culture of continuous improvement is critical to ensure workforce effectiveness. The role of the CSCO is key to implementing business approaches, policies and best practices in supply chains that attract young talent, retain skilled professionals, navigate unions to create win-wins, and ensure regulatory and safety compliance.

9. Establish best practices in supply chain agility to respond to disruptions. Responsive, flexible, integrated supply chains are required to adapt to complex market conditions and increasing demands by customers. CSCOs must build vision and expertise among their teams to identify risk events early and increase supply chain flexibility to ultimately respond proactively and minimize operational loss.

Traditional Priorities & Objectives

1. Incorporate best practices in supply chain management.

2. Optimize your supply chain footprint to create agility and navigate geopolitical realities.

Digitized Operations

3. Adopt best-in-class supply chain technologies

4. Effectively manage data to support technology implementations.

5. Leverage artificial intelligence (AI) to stay ahead of the competition

asi_halfpgFCD_E1_2025_final_• 12/30/24 8:37 AM Page 1

Building A Modernized Supply Chain

6. Create operational flexibility focused on customer needs.

7. Impact carbon footprint for maximum sustainability in operations

8. Recruit and maintain top talent to solve complex food chain problems

9. Establish best practices in supply chain agility to respond to disruptions

To find out more: www.alliance.com

Larry Elliott,

Executive Vice President & Chief Supply Chain Officer, Monogram Foods

Corporate Approach:

Elliott’s role is part of Monogram’s strategy to drive margin improvement and foster continued growth. His new appointment in 2024 will enable these objectives and strengthen the company’s supply chain initiatives through cost optimization, inventory management, supplier relationships, sustainability, and streamlined processes to deliver sustained growth.

Alexandre Eboli, Chief Supply Chain Officer, Conagra Brands

Corporate Approach:

“Our strategies focus on a digitally connected supply chain with end-to-end visibility – digitizing both our manufacturing operations as well as digitally connecting with our customers and our suppliers,” says Eboli. “At ConAgra, our supply chain efforts support a healthy planet and a healthy business, with focus on climate change, packaging, sustainable sourcing, water conservation, and waste reduction.”

Todd

Huetinck,

Chief Supply Chain Officer, Whataburger®

Corporate Approach: “At Whataburger, we are sticklers for quality, and Todd’s extensive background in developing quality systems across vast geographies was particularly valuable to us,” says Alexander Ivannikov, Chief Administrative Officer.

“While our growth plans are ambitious, we only expand if we can maintain the same high standards for both product and experience. Todd brings a unique and valuable perspective to the CSCO role to help ensure we uphold these commitments as we grow.”

Cesar Pina, Senior Vice President & Chief Supply Chain Officer, McDonald’s

North America

Corporate Approach:

As Senior Vice President and Chief Supply Chain Officer of North America, Pina leads a team that fosters and stewards supplier partnerships – an enduring competitive advantage for the McDonald’s System. The teams he oversees partner with all three legs of the stool to leverage the scale of our more than $16 billion spend to drive sustainable sourcing practices, scale efficiencies and innovation, and deliver value across more than 15,000 restaurants in the U.S. and Canada.

a wide spectrum of services, PalletTrader’s core focus is to optimize cost and bring efficiency to your pallet management process. Backed by the largest nationwide digital supplier network, PalletTrader is the premier choice to support all your pallet needs. To learn more check out pallettrader.com

Welcome to the 2025 Food Chain Providers Buyer’s Guide! This resource is published by Food Chain Digest to help supply chain professionals find potential providers of valuable services, including for-hire motor carriers, 3PLs, brokers, drayage, maritime, rail, intermodal, expedited, warehousing, air cargo, TMS, and last-mile/final mile. All companies listed in this Resource Guide are paid advertisers and are not in any way officially endorsed by Food Shippers of America (FSA).

Allen Lund Company LLC

www.allenlund.com

Allen Lund Company 800-404-5863

ALC Logistics/TMS 800-282-3246

lisa.grossnickle@allenlund.com

Allen Lund Company is a 3PL, working with shippers, growers and carriers across the nation to arrange the transport of dry, refrigerated and flatbed freight. Additionally, ALC has a logistics and software division, ALC Logistics and an International division licensed as an OTINVOCC.

Alliance Shippers Inc. www.alliance.com

One of North America’s top privately owned global logistics & transportation service corporations.

American Brokerage www.american-brokerage.com

Specializes in temperature-controlled LTL & truck load transportation of goods across the United States.

Aptean www.aptean.com/en-US

Creates hyper-niche software solutions that enhance operational efficiency and drive measurable results for businesses.

Bettaway www.bettaway.com

Leverages its experience, data & technology to deliver smart, comprehensive, supply chain solutions.

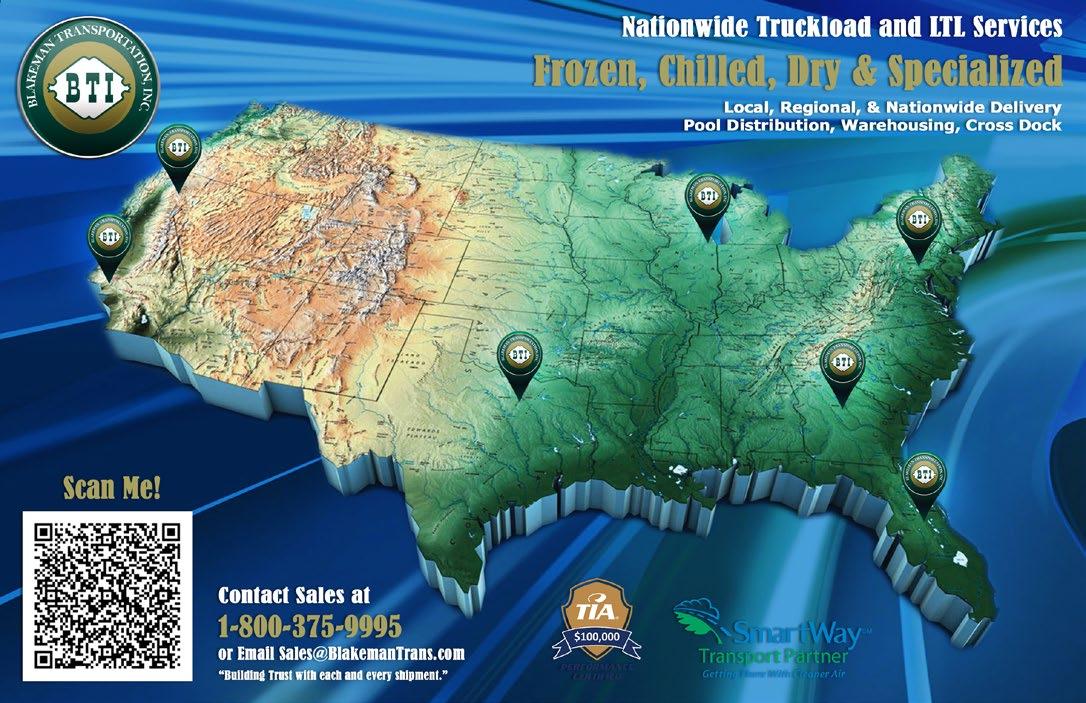

Blakeman Transportation www.blakemantrans.com

Offers quality, cost-effective transportation & distribution services to multiple industries throughout the U.S. & Canada.

Catch-Up Logistics www.catchuplogistics.com

Full service provider of ambient and temperature controlled food grade distribution and warehousing services.

Coastal Cold Storage, Inc.

www.coastalcarriers.com

636-528-8988 sales@coastalcarriers.com

Coastal Cold Storage is a premier cold chain provider specializing in frozen and refrigerated warehousing solutions. Located near St. Louis, MO, our state-of-theart Phase 1 facility offers 4.8 million cubic feet of storage space and advanced logistics capabilities. Centrally located, we can deliver to 70% of the U.S. population within a 10hour drive, ensuring unmatched speed to market. With a

>99% fill rate, rapid loading/unloading, cutting-edge WMS systems, and customizable programs, we deliver efficiency and accuracy. As a family-owned operation, we provide personalized service, SQF certification, and a 6S Lean Workplace. Choose Coastal for cost-effective, high-quality cold storage solutions.

Continental Express

www.continentalexpressinc.com

Specializes in the transport of temperature-controlled and dedicated-route freight.

Distribution Technology

www.distributiontechnology.com

Tailored warehouse and distribution solutions, designed to optimize your supply chain and drive success.

Doug Andrus Distributing LLC

www.dougandrus.com

Service types include regional, long haul, heavy haul, dedicated and third-party logistics.

DTS Logistics

www.dtslogistx.com

Takes care of the details in your supply chain so that you can focus on delivering value with quality products.

Dynamic Logistix

www.dynamiclogistix.com

913-274-3800

gfeese@shipdlx.com

Logistics is chaotic. That’s why at Dynamic Logistix, we build tailored solutions that combines powerful technology, a dedicated team of experts, and a carefully curated carrier network to help shippers turn supply chain chaos into clarity.

East Coast Warehouse

www.eastcoastwarehouse.com

443-771-2719

wnutter@eastcoastwarehouse.com

East Coast Warehouse has over 65 years of experience delivering trusted, temperature-controlled logistics solutions for the food and beverage industry. With stateof-the-art facilities strategically located near major ports, we provide seamless end-to-end services, including warehousing, port drayage, customs clearance, and specialized transportation. Our dedicated team, with an average tenure of nearly 20 years, operates as an extension of your business, ensuring efficient and reliable supply chain management. Built on a foundation of trust, strong corporate values, and a commitment to excellence, we make it easy to move your products into the marketplace with precision and care.

EPA SmartWay

www.epa.gov/smartway

Helps companies advance supply chain sustainability by measuring, benchmarking & improving freight transportation efficiency.

First Logistics Management Services

www.firstlogisticsllc.com

630-854-3598

kgalena@firstlogisticsllc.com

Since 2003, First Logistics has been a trusted 3PL provider, offering 1.8 million sq. ft. of food-grade warehousing across five Chicagoland facilities. Our comprehensive warehousing services are powered by cutting-edge technology, operational expertise, and a customer-focused culture, delivering efficient, tailored solutions that set us apart in the industry.

GSM Transport

www.gsmtransport.com

Leading intermodal drayage company specializing in hauling overweight intermodal containers.

Helix Logistics

www.helixlogistics.com

708-246-7000

aderlaga@helixlogistics.com

Since 2008, Helix Logistics has delivered reliable shipping solutions nationwide. Our services include flatbeds, dry vans, and refrigerated equipment, offering full truckload (FTL), partial load, and are one of the largest less-thantruckload (LTL) providers in the industry. Our refrigerated equipment ensures optimal conditions for transporting temperature-sensitive goods. From food-grade products to electronics and raw materials, we securely handle a wide range of items. Committed to flexibility, reliability, and customer satisfaction, Helix Logistics tailors its services to meet the unique needs of industries across the country, providing efficient and dependable deliveries every step of the way.

Hermann Total Distribution Service

www.hermanntds.com

Family-owned and operated business offering nationwide solutions for warehousing, transportation and logistics.

Hurricane Express, Inc.

www.hurricaneexpressinc.com

918-262-6025

thoyt@hurexp.com

Hurricane is a family-owned company providing exceptional customer service for over 32 years. With an asset fleet of more than 450 trucks and a trailer pool over 600, our professional drivers take pride in their on-time delivery performance with several customer achievement awards. We cover coast to coast year-round.

JT Logistics

www.jtlogistics.com

Provides state-of-the-art warehouse, transportation, and fulfillment services to worldwide clients.

Koch Companies

www.kochtrucking.com

Specializes in long-haul, regional, local and dedicated fleets tailored to customers’ transportation needs.

Kottke Trucking

www.kottke-trucking.com

Specializes in providing world class transportation needs with the best equipment in the industry.

Legend Transportation

www.newlegendinc.com

Western regional premier freight transportation company hauling goods to more than 30 cities in 12 western states.

Leonard’s Express

www.leonardsexpress.com

A family-owned asset-based transportation provider located in Farmington, New York.

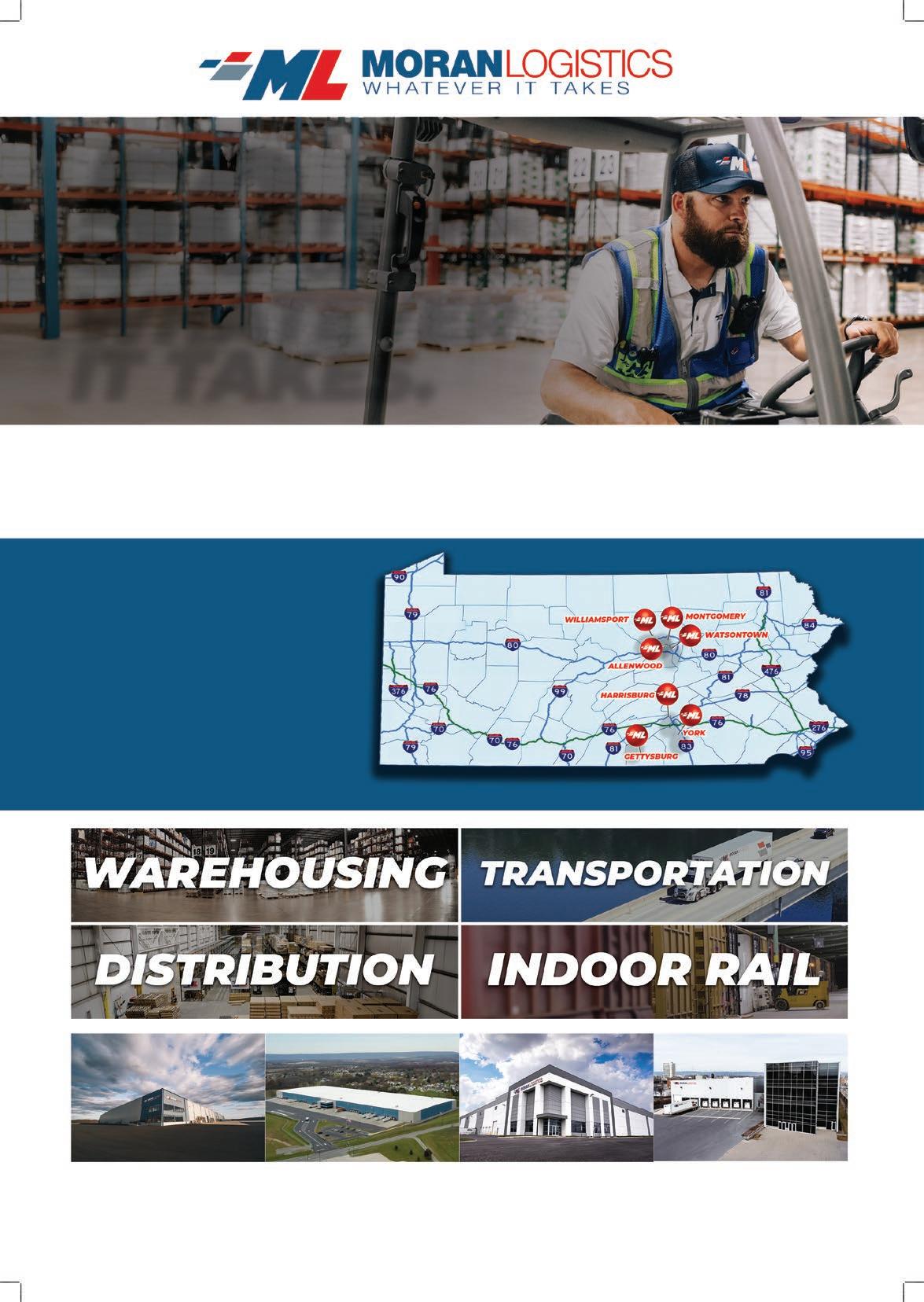

Moran Logistics

www.moranlogistics.com

A three-generation, family owned and operated asset based third-party logistics provider.

MW Logistics

www.mwlogistics.com

A privately held, non-asset 3PL that designs logistic and transportation solutions for businesses.

Norfolk Southern

www.norfolksouthern.com

Dedicated to advancing safety, serving communities, and driving innovation for tomorrow’s rail.

RLS Logistics

www.rlslogistics.com

Provides nationwide transportation, cold storage warehousing, cross docking & direct to consumer fulfillment solutions.

Ruan Transportation

www.ruan.com 515-208-6360 rvanpole@ruan.com

Ruan, one of the nation’s largest family-owned transportation management companies, delivers Integrated Supply Chain Solutions through Dedicated Contract Transportation, Managed Transportation, Value-Added Warehousing, and Brokerage Support Services. By combining asset-based and non-asset-based capabilities with advanced technology and industry expertise, we create tailored solutions that drive efficiency and value. At Ruan, personal connections form the foundation of everything we do. We deeply understand our customers’ operations, building trust through long-term relationships and a shared vision for success. Every day, we anticipate the needs of our customers and team members, ensuring our partnerships are defined by empathy, innovation, and reliability.

905368_Doug.indd 1

• Our locations: Chambersburg, PA Greensburg, PA Pittsburgh, PA Davenport, IA

• Dry, Refrigerated, and Frozen Temperature Zones

• Asset based with refer and Dry vans

• Rail/Truck Cross Dock Services

• Rework and Packaging Services

• Import/Export containers from Eastern Ports

• Licensed for Alcohol Storage

• USDA Room

• Customs Bonded

Phone: 412-441-9512

Fax: 412-441-9517

Email: sales@catchuplogistics.com www.catchuplogistics.com

MIKE C., ASSISTANT TRANSPORTATION DIRECTOR OF WHOLESOME FOODS INC.

We’re with you through every freight journey, solving food logistics challenges with real-world trucking expertise, a track record of success and relationships built on trust. Ship with Schulz Logistics.

SchulzLogistics.com/Food rnickeson@schulzlogistics.com 531-289-1951

RWB Trucking LLC

www.rwbtrucking.com

630-225-7631

craig@rwbtrucking.com

RWB Trucking is a family-owned logistics brokerage (3PL) based in Woodridge, IL, specializing in Full Truckload (FTL) shipments across the United States and Canada. With a commitment to delivering exceptional service, we offer comprehensive transportation solutions, including refrigerated, dry van, drayage, tanker, and flatbed services. Our meticulous carrier qualification process, real-time load tracking, and transparent communication ensure a seamless experience for every customer. Whether it’s coordinating complex shipments or providing 24/7 support, we pride ourselves on our attention to detail and dedication to meeting our clients’ needs—365 days a year.

Schulz Logistics, LLC

www.schulzlogistics.com

531-289-1951

rnickeson@schulzlogistics.com

Discover unparalleled logistics excellence with Schulz Logistics, where industry expertise meets innovative solutions. As a leading force in the freight brokerage realm, we pride ourselves on seamlessly connecting diverse industries with tailored logistics services. From expedited and team solutions to temperature-controlled transport, our comprehensive suite of offerings is designed to meet the demands of your business. We recognize the importance of personal connections and individualized attention. Our commitment to offering a personalized touch ensures our carriers and customers don’t feel like mere transactions. Explore our range of services, crafted to optimize efficiency, enhance reliability and propel your supply chain forward.

Spartan Logistics

www.spartanlogistics.com

614-497-1777

nharmon@spartanlogistics.com

Spartan Logistics is a third-party logistics company known for our expertise in food-grade warehousing. We own and operate high-quality warehouses, fleet, forklifts, and more, ensuring the highest safety and efficiency standards in handling food and beverage products. With decades of specialized experience, our team excels in managing fast-moving inventory, particularly in the food and beverage sector, while also working with many clients in the paper and packaging industries. Our workforce of over 350 skilled warehouse professionals manages more than 4 million square feet of strategically located warehouse space across Ohio, Indiana, South Carolina, Arkansas, Missouri, Kentucky, Texas, Tennessee, and Georgia.

Spoerl Trucking

www.spoerltrucking.com

Delivers freight including food services, promotional products & industrial supplies throughout the U.S. & Canada.

Stokes Trucking

stokestrucking.com

435-799-8538

mark@stokestrucking.com

Founded in 1979 with just one truck, our company has grown while keeping the same strong trucker spirit that started it all. Based in Tremonton, Utah, we specialize in regional transportation services, delivering dry goods and refrigerated items with reliability and care. Serving customers across the Western and Midwestern United States, we take pride in our decades of experience and commitment to exceptional service. Our dedication to quality has made us a trusted partner for businesses seeking dependable transportation solutions in these key regions.

Sun Transportation Systems Inc. ststrucks.com

877-874-0063

twhite@ststrucks.com

Founded in 2006, long standing mid-sized asset-based carrier that has since become a Tier 1 carrier within the food and beverage industry. Certified: CAMSC Diversity Supplier;C-TPAT;FAST;SmartWay and EcoVadis. With terminals located in USA and Canada, we offer both dry van and reefer service. Licensed to run Interstate USA, Cross Border CDA/USA/MX, Intra-Canada. Fleet is fully tracked through live GPS/Geofencing with EDI capabilities helping to achieve Four Kites Premier Carrier status. Our business has been built primarily on referrals. We are very selective with who we deal with and what we commit to, building trust through our service.

With one railcar having the same capacity as four trucks, rail is the most efficient, sustainable shipping for foods, beverages, and consumer products. It's only the beginning of what we deliver.

No rail access? We partner with hundreds of warehouse facilities.

The Greenbrier Companies www.gbrx.com

503-937-1522

tom.jackson@gbrx.com

Greenbrier Companies deliver reliable, best-in-class solutions for shipping temperature-sensitive food products. Our advanced refrigerated and insulated boxcars offer premium performance and exceptional safety throughout the supply chain. Features include temperature monitoring, door sensors, an R-Value above 39, a UA Factor of 207 and optional GPS tracking. Each boxcar has diesel-powered refrigeration units, insulated plug type doors and end of car cushioning for superior product protection. Greenbrier’s high-performance boxcars ensure safe, efficient and worry-free transportation for perishable food items. Trust Greenbrier for dependable shipping solutions. Learn more at www.gbrx.com

Tippmann Group www.tippmanngroup.com

260-490-3000

mwolf@tippmanngroup.com

Tippmann Group is a unique combination of two companies, Tippmann Construction and Interstate Warehousing, which are dedicated to safe and efficient design, construction and operation of multi-temperature food processing and distribution facilities for the food industry.

Interstate Warehousing is the 4th largest PRW company in the United States with SQF certified facilities in key markets around the U.S. and more than 130,000,000 cubic feet of cold storage space. As a design/build company, Tippmann Construction has been in business since 1968, and our refrigeration expertise and owner/ operator experience make Tippmann Group your single-source provider for all your temperature-controlled facility needs.

Uline

www.uline.com

The leading distributor of shipping, industrial and packaging materials to businesses throughout North America.

United Facilities

www.unitedfacilities.com

A family-run third-party logistics company (3PL) with nearly 70 years of logistics know-how.