2 minute read

Unlocking African Mining Investment: Stability, Security, and Supply

Simon Ford, the Portfolio Director of Hyve Group, fields questions from Mining Business Africa (MBA) on the relevance of the 2023 Investing in African Mining Indaba’s theme to contemporary trends in African mining, as well as the in-person events.

MBA: After a two-year hiatus, the Investing in Mining Indaba returned in 2022. How is the mining industry’s response to this year’s event?

Advertisement

SF: Overall, the response has been extremely positive. We saw a record-breaking Indaba in May 2022 that set the tone for the industry and for post-pandemic events as we lead up to February 2023. We are seeing a lot of early commitment and we are encouraged by the interest we have already received. With commodity prices remaining strong, and demand for critical minerals, battery metals and rare earths accelerating we can expect this to translate to another bumper turnout and we are excited to be back to our regular dateline in February.

MBA: What changes have you introduced to ensure that the event meets delegates’ expectations and is more relevant to the current trends in the global mining sector?

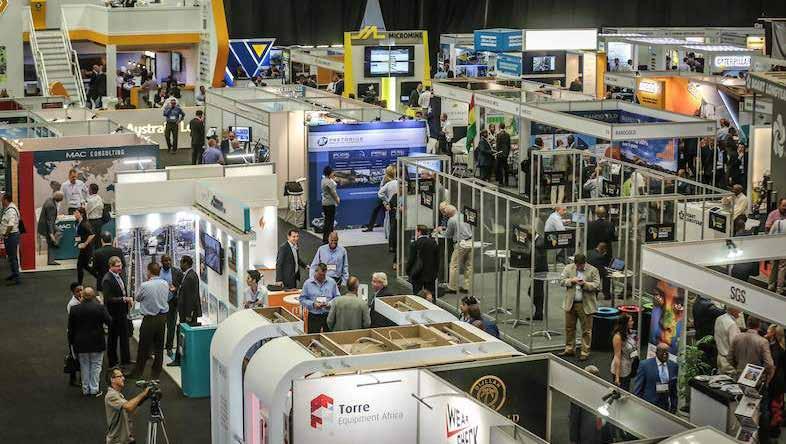

SF: It is wonderful to be able to gather, once more, in Cape Town for the world’s largest mining investment event and as always, we are hoping for a blockbuster lineup of speakers, including key government leaders and policymakers, corporate leadership, investors and thought leaders. With the Mining Indaba’s integration of 121 Group, we are in an even stronger position to serve our thousands of delegates with bespoke meeting programmes between investors and junior miners as part of their Mining Indaba experience.

One particular programme we are excited about for 2023 is the Explorers Showcase, where we hope to showcase early-stage explorers through presentations and core samples to help stimulate those much-needed conversations with investors. This ensures we can now claim to be driving investment into every stage of the mining production cycle through explorers, to juniors and on to mid-tiers and major mining companies.

It’s a great initiative, supported by the Department of Mineral Resources and Energy, South Africa, and will also help to support their exploration drive. To complement this, we will run the Junior ESG Forum as well as our ESG Awards. Please also look out for our new dedicated area for Junior Miners, aptly named the Junior MINE.

For the first time in 2022, we held our dedicated Infrastructure & Supply Chain Forum bringing together the vital mining supply chain companies with senior mining executives to discuss ESG-focused solutions to Africa’s growing mining operations. Such was the success of that programme, we have integrated it with our technology-focused Mining 2050 stream, to create the new three-day InfraTech

Delegates

Mining 2050, Sustainability Day, Young Leaders Forum and the General Counsel Forum.

MBA: You have chosen the theme of ‘Stability, Security and Supply for the 2023’ event. What is the rationale behind this?

SF: As the world cautiously emerged from the global pandemic in 2022, we rightly focused on getting Africa’s myriad economies back on track. Whilst ESG, from investment to operations and social licence to operate, will continue to underpin the values of Mining Indaba, we find ourselves entering a new chapter in both pan-African and global economies. Therefore, February’s official theme will be: “Unlocking African Mining Investment: Stability, Security, and Supply”. This captures the very real geopolitical shifts and economic disruptions we are experiencing, which are providing pressure points – as well as opportunities – within African mining. Due to this situation, global economies are seeking the security of supply, especially for their energy transitions, as well as the raw materials and precious metals to bolster their economic power.