Dear Guild Members,

As we look forward to our upcoming mee ng in September, I want to remind everyone to pay your dues to be eligible to a end. Please check this issue for hotel links and use the registra on link so we can get an accurate head count.

I am pleased to confirm that we will be mee ng with Serjon Youkhana from Mopar on Tuesday morning September 10th at 9:00am at our MMG Mee ng in Las Vegas. This is an exci ng opportunity to strengthen our partnership and collaborate on future ini a ves.

Our vendors play a crucial role in making the Guild happen. We have been working diligently on their schedule, and I encourage everyone to support our vendors. Their contribu ons are invaluable to the success of our mee ngs and the Guild as a whole.

I would like to extend my hear elt thanks to Don, Susan, Jill, and all the execu ve commi ee members for their tremendous help with the arrangements for the September mee ng. Their hard work and dedica on have been instrumental in ensuring that this event will be a success.

Thank you, and I look forward to seeing you all in September!

Thank you again for your support.

Sincerly,

Cody

Cody Eckhardt - President - Mopar Masters Guild Service Director - Ken Garff CDJRF - W. Valley City UT

“Plans are nothing; planning is everything” ~Dwight D. Eisenhower

32.5 Mopar Masters Mee ng Schedule & I nerary

Las Vegas 2024 (Tenta ve)

The Annual Mopar Masters Guild Meeting Will Now Be Held on September 8th - 10th, 2024 just before The Mopar Service & Parts Business Conference in Las Vegas, Nevada

New York-New York Hotel & Casino

3790 S Las Vegas Blvd

Las Vegas, NV 89109

Hotel Reserva on Link (Click Here)

Registra on Link to A end our MMG Mee ng (Click Here)

*You MUST be a qualified Stellan s Dealer with a PAID MMG Membership to a end

Saturday September 7th, 2024

Arrive in Las Vegas

No Formal Event Planned

We will no fy everyone where we will be if guests would like to stop by and catch up with each other Park Terrace Room for MMG Meetings

Gramercy A Room for Breakfast and Lunches

Sunday September 8th, 2024

7:00am – 7:45am Breakfast - Gramercy A Room

7:45am – 8:45am MMG Discussions Begin - Park Terrace Room

Opening Comments - MMG President Cody Eckhardt

Secretary’s Presenta on of Minutes - John Russo

Treasurers’ Report - Chris Hojnacki

Commi ee Reports

Guild Business Old/New

8:45am - 9:00am Break

Continued on Page 4

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 3

9:00am - 10:00am MMG Discussions Con nue

10:00am - 10:15am Break

10:15am - 12:00pm MMG Discussions Con nue

12:00pm - 12:45pm Lunch - Gramercy A Room

12:45pm - 1:15pm Vendor Presenta on - Endeavor Business Media (FenderBender/Ratchet+Wrench)

1:15pm - 1:45pm Vendor Presena on - Bow e Solu ons

1:45pm - 2:00pm Break

2:00pm - 2:30pm Vendor Presenta on - Petra Automo ve Products

2:30pm - 3:00pm Vendor Presenta on - Ac vator

3:00pm - 3:15pm Break

3:15pm - 3:45pm Vendor Presenta on - Be er Car People

3:45pm - 5:00pm MMG Discussions Con nue

5:00pm Adjourn Day 1 Mee ng

Monday September 9th, 2024

7:00am - 7:45am Breakfast - Gramercy A Room

7:45am - 8:00am MMG Discussions Con nue - Park Terrace Room

8:00am - 9:00am Vendor Presena on - AER Sales

9:00am - 10:00am Vendor Presena on - Reynolds & Reynolds

10:00am - 10:15am Break

10:15am - 11:15am Vendor Presena on - QB Business Solu ons

11:15am - 12:00pm MMG Discussions Con nue

12:00pm - 12:45pm Lunch - Gramercy A Room

1:00pm - 2:00pm Vendor Presenta on - OEConnec on

2:00pm - 2:15pm Break

2:15pm - 3:15pm Vendor Presena on - Snap-On Business Solu ons

3:15pm - 3:30pm Break

3:30pm - 4:30pm Vendor Presenta on - Elite Extra - Epicor

4:30pm - 5:00pm MMG Discussions Con nue

5:00pm Adjourn Day 2 Mee ng

Monday Evening September 9th ,2024 - Annual MMG Recep on

7:00pm - 10:00pm Beer Park - Las Vegas (Located Underneath The Paris Hotel’s Eiffle Tower!)

Tuesday September 10th, 2024

7:00am - 7:45am Breakfast

7:45am - 8:45am MMG Discussions Con nue

8:45am - 9:00am Break

9:00am Discussions With Mopar & Serjon Youkhana

11:00am Adjourn – End of Mopar Masters Guild’s 2024 Mee ng

See You Next Year at The MMG’s 33rd Annual Mee ng in Orlando

Date: 5-20-2024

Loca on: Cambria Hotel Riverview

SteveAusencioParts DirectorJack Powell CDJREscondidoCA

RobertChatwinParts ManagerLarry H. Miller CJDRSandyUT

ChristopherChivGeneral ManagerDallas CDJRDallasTX

KentCogswellParts ManagerJack Phelan CDJRCountrysideIL

IanGrohsParts ManagerStateline CJDRFFort MillSC

SeanHarrellService ManagerDeMontrond CDJRConroeTX

TedHawkinsParts ManagerCerritos DCJRCerritosCA

PaulHouseAsst. Parts ManagerDeMontrond CDJRConroeTX

JimJaegerParts DirectorBosak CDJRMerrillvilleIN

Ma JarvisS&P DirectorBald Hill DCJWarwickRI

DerekJohnsonService DirectorDallas CDJRDallasTX

TomKelloggParts ManagerZeigler CDJR of GrandvilleGrandvilleMI

DavidKiserParts DirectorSpartanburg CDJRSpartanburgSC

DavidLo onAsst. Parts ManagerSpartanburg CDJRSpartanburgSC

StephenLoreyService ManagerLeith CJRaleighNC

SteveMarrio Region Service DirectorTeam DRMyrtle BeachSC

AndrewQuadeParts ManagerLeith CJRaleighNC

MikeRenfroService DirectorDeMontrond CDJRConroeTX

BrentRichmondService ManagerZeigler CDJR of GrandvilleGrandvilleMI

RandyRogersParts ManagerHuffines CJDRPlanoTX

JohnRussoParts ManagerDallas DCJRDallasTX

Mark Beaton20 Group ModeratorMBA Dealer Services, LLCHudsonvilleMI

MichaeleBeatonCFOCrown CDJRHollandMI

JenShort20 Group AdminMBA Dealer Services, LLCHudsonvilleMI

Continued on Page 6

Continued from Page 5

Guild Members: 21

MBA Representa ves: Mark Beaton, Michaele Beaton, and Jen Short

Mee ng Overview

Chair: Mark Beaton

Start Time: 8:00 a.m.

Virtual A endees: None

Introduc ons

New Members:

o David Kiser, Parts Director, Spartanburg CDJR

o David Lo on, Parts Manager, Spartanburg CDJR

o Brent Richmond, Service Manager, Zeigler CDJR of Grandville

Key Discussions and Ac vi es

MBA Website Updates

Upcoming addi on of various pay plans to the resources tab.

Post-Lunch Break Topics

1. Composite Discussion: Detailed review of the composite.

2. Diagnos c Fee Jus fica on:

Continued on Page 7

Continued from Page 6

o Extensive factory training specific to manufacturers’ vehicles.

o Tech training, exper se, and knowledge.

o State-of-the-art facili es.

o Factory-specific diagnos c and repair tools.

3. Fun Segment:

o Iden fying vintage pictures of celebri es such as Bea Arthur, Be y White, Bob Segar, Bruce Springsteen, Bjorn Borg, and John McEnroe.

4. Announcement:

o MBA services terminated its Facebook Page.

Open Discussions

1. Mopar Issues:

o Pricing errors and me frame for correc ons.

o High turnover affec ng customer service quality at dealerships.

o Shipping issues causing delays and customer service problems:

Cross docking special handling orders.

NDA orders taking a couple of days to ship.

Daily orders from PDCs not delivered overnight, affec ng IRFs and shop customers.

2. Aging MRA Problems:

o Ongoing significant issue for many dealers.

3. Shortage Claim Window:

o Reduced back to 2 weeks from 1 month (during and a er the strike).

4. Parts Managers’ Needs:

o A method to order Star restricted parts for CP situa ons.

5. Order Restric ons:

o The impact of “1 in 7 days” order restric ons on customer service.

6. NADA Explana on:

Continued on Page 8

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 7

o Research and defini ons to promote a healthy balance for a ersales departments’ profitability compared to large corporate dealer groups’ profitability expecta ons.

Winners:

Ian Grohs with “Hiring Support Staff Process”

Tom Kellogg with “Capturing Merchant Fees”

Ma Jarvis with “Parts Dept Employee as PDI Tech

(L-R) Moderator Mark Beaton with Best Prac ce Winners: Tom Kellogg, Ma Jarvis and Ian Grohs

Continued on Page 9

Continued from Page 8

Facts about the Great Lakes.

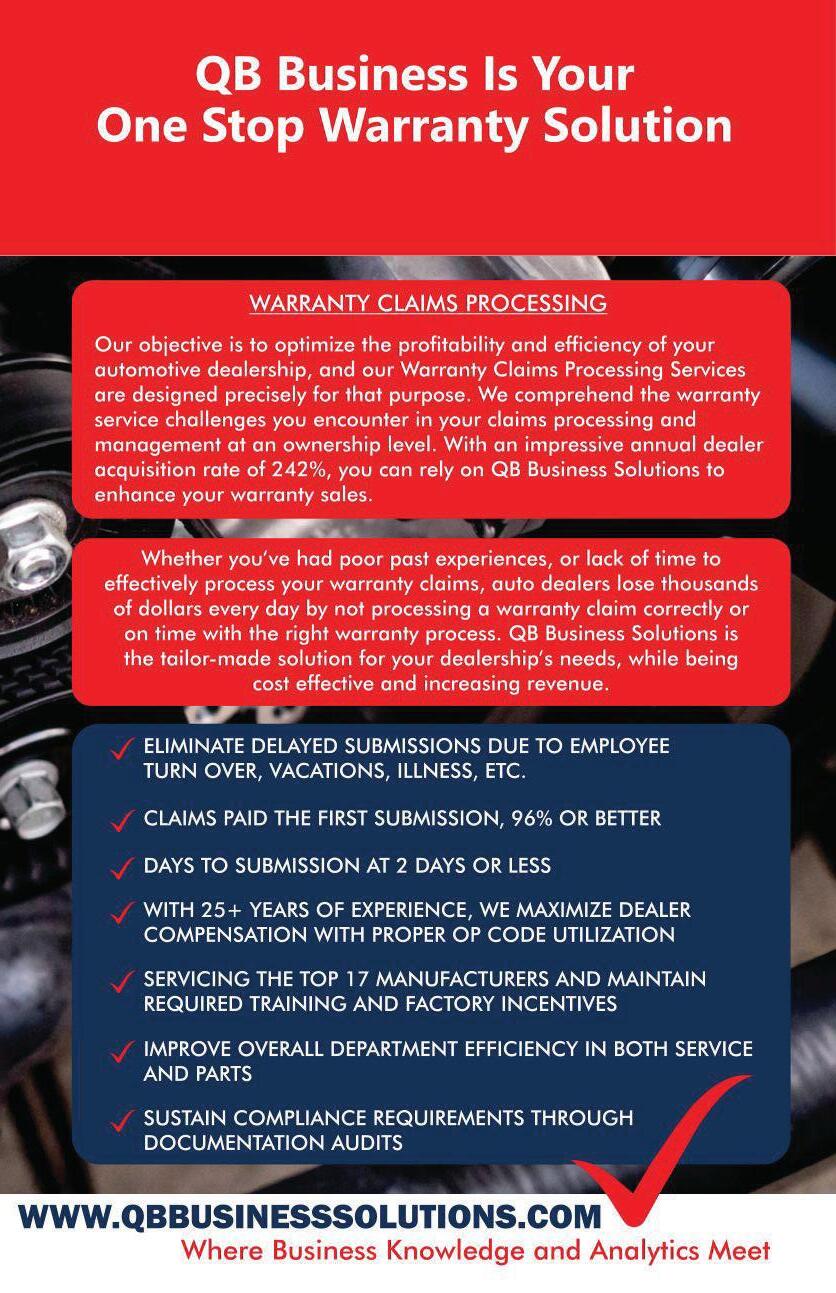

QB Business Solu ons:

o Detailed analy cs of business performance.

o Unique offerings:

No monthly fees.

No upfront costs.

No service fees.

No need to log into DMS.

Proven results with increases up to $500K for some dealers.

Continued on Page 10

Continued from Page 9

Continued on Page 11

Continued from Page 10

Date: November 14 & 15

Loca on: Sco sdale, Arizona

See y’all at our next 20 Group!

Submi ed by John Russo - MMG Secretary - Parts Manager - Dallas DCJR

The exchange of information by like sized dealers in a non-competitive environment.

With Kat Monteiro

My view today as I write this comes from home, looking out our sliding glass window onto the pool. The weather is warm, and it looks so invi ng. But I do not let the clear blue water fool me, it is s ll too cold to jump in! That being said Rick has already been jumping in, quickly, but I like it to reach at least 75 degrees before I go in. But that day is coming soon and then it will really feel like summer.

Rick is s ll working his part me gig for Jack Powell. He is s ll enjoying it and that makes it a good thing. When we are in town he goes into the store once a week in the morning and then he and Steve play a round of golf in the a ernoon. He usually sits in the same spot I am at now in the mornings to do his work - that is the beauty of it all and what makes it good work - being able to work from wherever we happen to be, at home or traveling. All I can say is that is a win-win for everyone - Rick is enjoying the work and the challenges, and Steve likes having him available to bounce things off of, and the Powells are s ll happy with what he brings in for the store.

Re rement is good! I just got home from Lincoln, Nebraska where I went to dog sit for our daughter Terra because her company sent her to Ba le Creek, Michigan for a week to work at their hub there. So, with 2 days’ no ce, we found a cheap flight on United economy, and I flew out for 10 days. It was so great to be able to do that, it makes me happy. If I was s ll working, I wouldn’t have these opportuni es. The weather was much nicer while I was there compared to when I was there in January and was pre y much snowed in for a week with temperatures below zero! I was able to get out for some nice walks and went out to the edge of her apartment complex to watch the sunset every night.

Our big adventure was spending a month at our house in Mazatlán, Mexico between April and May. It was a great me. We were fortunate enough to have guests come visit which makes it fun for us to show them around and take them to our favorite places and restaurants.

Continued on Page 13

Continued from Page 12

There were days by the pool, evenings were spent watching the sunset from our back pa o, the guys did several fishing trips and caught lots of fish! We take the fish to a local restaurant where they will cook it up any way you like it and add in all the fixings to go along with it. I think our favorite was the sashimi - it was so good! Nothing beats fresh tuna! We also had them fix the fish breaded, seared, and ceviche. It is kind of cool to walk in the restaurant with a bag of fish you caught that day! On one of the fishing days our friend Pam caught the Marlin. I really think it was one of the happiest days of her life! She was so excited!

We also spent a day out on a catamaran. Cruising along the coastline of Mazatlán and then catching the sunset. It was a wondrous day. And what makes it even more special is that we chartered the boat so there were just 5 of us on this catamaran, which is usually packed with people, you all know what I am talking about when you take those tourist tours, but we had the boat to ourselves. Very special.

Continued on Page 14

Continued from Page 13

And ea ng, we did so much ea ng! But the food down there is so good. We went to 26 different restaurants in the month we were there, and a couple we did twice! The food, especially the seafood, is so fresh, and delightful! There is nothing be er than having breakfast under an open air palapa on the beach.

While we are there we also enjoy hanging out in the historical district. It’s very interes ng to see all the old buildings and the Plaza Machado where there is always something happening. And it is so pre y at night with many streets lit up in lights. We even went to the Opera House and watched a dance troop do a show!

When we were there 2 years ago, we went to the aquarium and they were doing construc on on a big new building that was going to house a new aquarium, when we went back there this trip that building was finished. It is so nice! Big, beau ful exhibits, and the architecture is very unique. It really is world class now. A fun place to spend a day.

So, if you plan a trip to Mazatlán, reach out to me or Rick and we will steer you in the right direc on and send you to some great places!

I would like to end here by asking that all of you please send prayers and get well wishes to Marvin Windham. He unfortunately had a stroke. He was very well taken care of at the ICU and is now at the Spain Rehab center which is supposed to be top notch. He is improving daily but it is just going to take some me. But you all know Marvin, he is very mo vated, and in good spirits, bugging the doctor about when he can get back to his golf game! And he has never missed the daily Wordle on our li le group chat!! So, you go Marvin! You got this!

Continued on Page 15

Continued from Page 14

Un l next me, be sure to stop and smell the roses, (because they are in full bloom right now!) and be kind to a stranger today.

The exchange of information by like sized dealers in a non-competitive environment.

“RedCap now brings the magic of Uber to thousands of dealerships,” the head of Uber for Business US & Canada said.

RedCap, by Solera, now offers access to auto parts delivery through Uber Direct, according to a news release

This collabora on enhances transporta on solu ons at up to 5,500 dealerships na onwide, enhancing customer experience, op mizing opera onal efficiency, and se ng a new standard for comprehensive transporta on solu ons in the automo ve sector.

With a leading posi on in the US rideshare industry, the Uber pla orm provides a seamless integra on with RedCap, a preferred choice for enhancing and streamlining automo ve service processes in dealerships across the U.S.

“Our collabora on with Uber for Business marks a significant advancement in automo ve transporta on soluons,” said Stephen Kelley, VP of product strategy and UX at Solera. “By integra ng Uber’s extensive rideshare and delivery capabili es with RedCap, dealerships can greatly enhance the customer experience with expanded driver capacity and interna onal expansion opportuni es, op mize opera onal costs, and streamline their service processes. This empowers dealerships to offer seamless transporta on solu ons, ensuring customers remain sa sfied and loyal while driving opera onal efficiency and profitability.”

This integra on empowers dealerships to:

• Elevate customer experiences: 47% of car buyers think about changing their automotive brand after a company fails to deliver a relevant customer experience. This integration allows dealerships to offer seamless transportation solutions while customers are without a vehicle.

• Deliver and receive parts on-demand: Time is of the essence, and with on-demand delivery via Uber Direct, dealerships don’t need to e up their li s wai ng hours for parts to arrive or pull someone from the team to make a run. RedCap’s Parts OnDemand product modernizes parts delivery without requiring addi onal trucks or personnel.

• Op mize costs: Shu les can be costly to run and maintain —$4,000 to $5,000 a month, according to RedCap research. With Shu le OnDemand, dealerships will only pay for the rides and vouchers they use.

• Increase revenue: According to RedCap, in 2024 dealerships are experiencing a 63% increase in customer spend when the customer is transported from the dealership to their home or work.

• Opera onal process enhancement to Pickup & Delivery: Enhance your dealership’s Pickup & Delivery processes by u lizing RedCap’s Driver Return, powered by Uber for Business, func onality – a driver-app embedded workflow that supports one-way or no-loaner Pickup & Delivery experiences. This feature enables Pickup & Delivery drivers to request a ride from Uber directly within

Continued on Page 17

Continued from Page 16

RedCap’s DriverQ app, allowing the dealership to be er u lize their available resources by elimina ng chase drivers and the addi onal mileage, expense, and deprecia on on dealership vehicles.

• Control spending and simplify reimbursement: Dealership administrators have the op on to set parameters around spend and usage, and service advisors can a ach receipts to repair orders, which are o en reimbursed by original equipment manufacturers for warran ed vehicles.

• Leverage Uber’s scale: Rides with Uber are available on-demand in all 50 U.S. states, providing greater coverage than alterna ves.

• Lower liability: Uber maintains automo ve insurance with leading providers to help protect riders and drivers in the event of a covered accident.

• Receive dedicated support: The team offers hands-on support for automo ve dealerships that need help signing up or using the tool.

“Solera’s RedCap now brings the magic of Uber to thousands of dealerships across the country,” said Josh Butler, head of Uber for Business US & Canada. “Customer service in this industry is paramount. A big part of that is helping people get out of the shop and on with their day — off to family, work, or appointments — as fast as possible. Uber for Business’ solu ons add an addi onal layer of streamlined transporta on and delivery tools for dealerships, and we’re excited to be expanding our footprint in this space.”

The company invites dealerships and industry professionals to visit getredcap.com to learn more.

Source: h ps://www.fenderbender.com/news/latest-news/news/55088648/solera-and-uber-collaborate-forauto-parts-delivery

The FenderBender staff reporters have a combined two-plus decades of journalism and collision repair experience.

The exchange of information by like sized dealers in a non-competitive environment.

Our Supporting Vendors: Support those who support you .

Our Supporting Vendors: Support those who support you

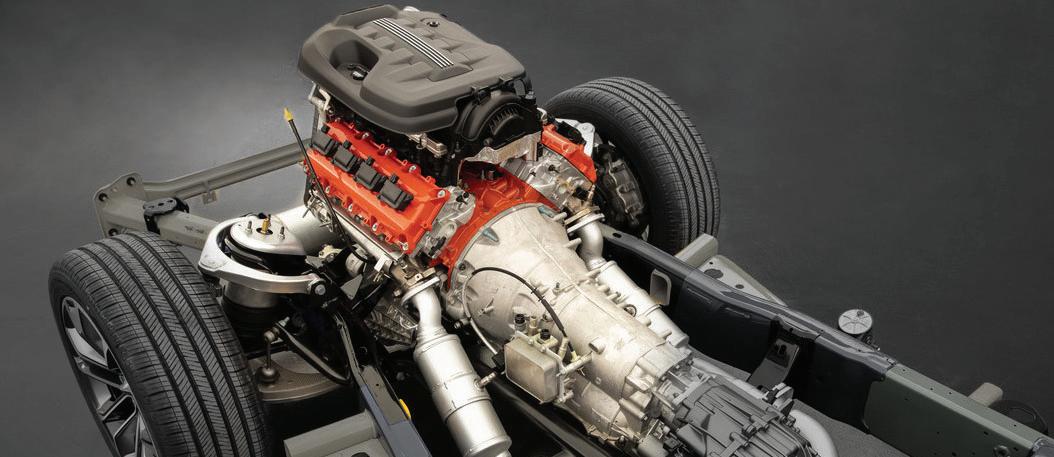

Rev up your parts sales and drive your parts department like a

*Upgrade coming soon!

Drive your collision parts business through fast, accurate parts order management with increased horsepower and a smooth ride that includes:

• Streamlined parts fulfillment process

• Manufacturer parts programs

• Reduced back-and-forth phone calls

Make sure your parts team stays in pole position! Leverage RepairLink to drive your mechanical part sales through:

• Enhanced order accuracy

• User-friendly tools to simplify the procurement process

• Streamlined interactions for increased productivity

PSXLink offers those precision gauges on your dashboard, increasing performance visibility and helping you take control of your parts sales business with:

• Actionable insights

• An easy way to manage transactional customer data

• Clear, interactive performance metrics

• Automated reports on sales activities & progress

Supercharge your wholesale engine and accelerate the speed of parts order transactions with OEC Payments. Run your parts business at peak performance and:

• Improve and automate ordering, payment, & reconciliation

• Support secure parts transactions

• Reduce time spent manually processing payments

rcharge your

That sleek, eye-catching paint job that keeps turning heads? That’s OEC eMarketing! Stand out in the crowd & keep customers engaged with:

• Smart, savvy, & professionally crafted messaging

• Increased customer retention & part sales

• Email campaigns that target your existing customers

Sponsored by AER

Shops who purchase a Mopar® Powertrain unit from a local Mopar dealer and submit an entry form will be entered in a drawing on January 1, 2025, to win a Zero1 Off-Road Odyssey tour. This epic multi-day, off-road adventure takes riders deep into some of the most scenic terrain of the desert Southwest. Get started now!

Order from your local Mopar Powertrain dealer and register your powertrain purchases at www.aergiveaway.com to enter. ALL UNITS PURCHASED

Trip date* will be April 2, 2025

*Trip date subject to change.

9 shop winners (1 per BC)

1 dealer with the most entries

• 3 days / 2 nights in Goldfield for a Zero1 Off-Road guided tour experience! AND

• 1 night in Las Vegas

• Over $3,500 value!

Our skilled agents are ready to take every inbound service call. Expect professional responses that elevate your customer's experience.

We manage your inbound calls and coordinate appointment setting, ensuring your team can prioritize personal customer engagement. Meet our core solutions that improves your customer service

INCREASE CLOSE RATE WITH CONNECTED RESPONSE™

Our mobile-friendly emails enable quick and increasing appointments.

Our system directly links with your scheduler for quick, hassle-free appointment setting. Service Advisors get instant updates, ensuring top-tier customer service.

FOCUS ON CUSTOMER SATISFACTION, THE REST OF THE SERVICE

Our Connected Response™ automates follow-ups on vehicle alerts, converting them into service appointments and improving customer retention.

CAMPAIGN CALLS™ RECOVER INACTIVE CUSTOMERS

Our live agents identify and reactivate key accounts from your inactive and loyalty lists to bring them back to your dealership.

Better Car People has been connecting dealerships with customers since 2010 and combines top-notch AI and to deliver the best customer engagement. Our success in generating appointments, leads, and custom follow-up processes proves why leading dealers, dealer groups, and OEMs trust us with their most valuable asset: their customers.

Our Virtual BDC skilled agents and tech drive your sales engagement, and 90-day email/SMS follow-ups while you concentrate on closing deals.

Sales BDCTM is your dealership boost.

We Call & Follow-Up Leads

We Prioritize & Engage Customers

We Set On-site Appointments

Better Car People provides solutions for Sales and Service BDCs, internet lead responses, and training to maximize every marketing dollar. We currently partner with 1200+ dealerships around the US and Canada and needs of the modern dealer.

www.bettercarpeople.com/market-center stellantis@bettercarpeople.com (855) 448.4219 DISCOVER

FIRST QUALITY RESPONSE™

customers using our 24/7/365 system that combines technology and dedicated live agents.

CAMPAIGN CALLS™

Our live agents identify and reactivate key accounts from your inactive and loyalty lists to bring them back to your dealership.

SERVICE TO SALES™

We connect with service customers on-site, setting sales and trade appointments to maximize conversion opportunities.

In the cutthroat world of automotive service, missing calls isn’t just a minor inconvenience – it’s a self-inflicted wound that’s bleeding your business dry.

This blog post is a reality check on why missed calls are downright disastrous for automo ve service centers – a disaster that Bow e Solu ons can prevent you from having altogether.

Down the Drain:

Miss a call, lose a customer. It’s as simple as that. In an industry where people need help fast, missing calls means handing over revenue to your competitors. Stop shooting yourself in the foot and make sure your calls are answered when your staff are busy serving the customers in your store.

Customer Loyalty? Forget About It:

Every missed call is a stab in the back of customer loyalty. They want to feel valued, not sidelined. Keep ignoring them, and they’ll gladly take their business to someone who will answer the phone. Loyalty is earned, not assumed.

A Circus or a Service Center?

Chaos ensues when calls go unanswered. Miscommunication, delayed appointments, and wasted resources become the norm, which also increases your expenses as a business. The money you spend on leads is wasted when you miss a call, and playing catchup and cleaning up messes is costly. A welloiled service center doesn’t let the phone go unanswered.

Quality? What Quality?

E

ffec ve communica on is the backbone of quality service. Missed calls mean missed details. You can’t provide top-notch service if you’re playing phone tag. Having to call customer service already gives customers anxiety. Add on an unanswered call, and you have yourself an annoyed customer.

Continued on Page 31

Continued from Page 30

When the phone rings and rings, you’re breeding frustration and anger. In a world where everyone expects instant responses, your indifference is a oneway ticket to customer dissatisfaction. Think nega ve reviews and a tarnished reputa on.

Did you know that 80% of your missed calls are calling your competors? While you miss out on calls, your competitors are cashing in. A service center that can’t pick up the call in time loses to one that’s always ready to answer. It’s a competitive world out there, and missed calls are handing over your customers to your competition.

In an industry where every call ma ers, it’s me for automo ve service centers to wake up and make sure every call is being answered. That’s where Bow e Solu ons steps in. When you sign up for our inbound call management service, our agents are ready to answer your phones, especially overflow calls. We can take care of your customers on the phone, while you’re taking care of your customers in your store – saving you me, money, and missed service opportuni es.

Stop standing in your own way and start being the service center that customers choose because you’re there when they need you. Learn more about how Bow e Solu ons can help you stop missing calls and contact us today.

info@activator.ai | www.activator.ai @GetActivatorPro

Built with the power of Salesforce, Activator's Hybrid CDP and Multichannel Journey Builder expands your dealership marketing beyond data from multiple sources, then automates and applies that data to create a custom journey driven the interactions and preferences of the individual customer.

With this foundational framework in place, Activator can now incorporate additional data, both 1st party and 3rd party data sources, creating a comprehensive customer solution facilitates the creation of personalized customer journeys that engage with individuals based on their interactions and preferences. Over time, the data collected during these interactions is channeled back into the CDP, creating a picture of the customer’s preferences and personalization of marketing outreach.

Seamlessly integrate data from multiple sources, including DMS, 1st-party, and 3rd-party data sources, using our hybrid CDP

Preserve the accuracy of your customer data through a Data Management Layer that malformed data.

Use Multichannel Journey Builder to deliver across multiple channels, including email, text, direct mail, and 1-to-1 communications.

For more information on Activator’s capabilities and how it can enhance your dealership’s performance, schedule a demo at www.activator.ai/demo

Can You Increase Your Bo om Line with More Efficient Warranty Reimbursement?

In the ever-evolving landscape of the automo ve industry, car dealerships are con nuously on the lookout for ways to enhance their bo om line. One avenue that presents a significant opportunity for improvement is warranty reimbursement on parts and labor. If you operate a dealership, you may o en wonder if you are receiving the maximum amount possible from manufacturers for warranty work. The good news is that with a strategic approach and expert guidance, your dealership can indeed become eligible for be er warranty reimbursement rates.

Warranty work can be a difficult aspect of dealership management. Tradi onally, manufacturers set standard reimbursement rates for warranty parts and labor. However, these rates o en do not match the retail rates that dealers charge their regular customers. The discrepancy means dealerships are some mes le with the short end of the s ck, accep ng lower compensa on for warranty work than they might otherwise earn – but it doesn’t have to be that way.

So, is your dealership eligible for be er warranty reimbursement on parts and labor? In short, yes. In most states, legisla on enables dealerships to apply for higher reimbursement rates based on what they charge their retail customers. These statutes have been enacted to ensure that dealers are fairly compensated for the warranty work that they perform, bringing the reimbursement rates closer to the actual retail rates. Yet, even with these laws in place, numerous dealerships are not taking full advantage of them. Why? Because the process can be complex, me-consuming, and laden with pi alls for the unini ated.

Continued on Page 41

Continued from Page 40

This is where outsourcing Warranty Reimbursement makes a world of difference. The level of exper se in naviga ng the warranty reimbursement landscape with precision takes skill and knowledge. Now, let’s unpack how QB Business Solu ons can empower your dealership to tap into be er warranty reimbursement for parts and labor, making comprehensive use of the statutes designed to support your profitability.

For Parts Warranty Reimbursement, most state laws permit dealerships to receive compensa on based not on the manufacturer’s suggested price but rather on the retail prices that the dealer customarily charges customers. The founda onal step is gathering and submi ng a request to the manufacturer with a list of parts and the prices you charged for them in retail repairs. This request is somewhat of a sta s cal exercise, requiring careful documenta on, and o en a specific number of part and labor entries.

At QB Business Solu ons, their experts deploy a me culous approach to this process. They understand that ge ng together all the necessary informa on can be daun ng for dealership team members who are already juggling mul ple responsibili es. That’s why they roll up their sleeves and take on the heavy li ing, ensuring every detail is accounted for.

Like parts, Labor Warranty Reimbursement also has room for improvement. The legisla ve framework in numerous states s pulates that dealerships can demand labor rates comparable to what they charge non-warranty customers. As with parts, a submission process entails providing proof of the labor rates. This proof involves compiling a list of labor jobs performed, the me taken, and the rates charged.

Again, precision is of the utmost importance, and that’s another area where QB Business Solu ons shines. Their team understands the ins and outs of the labor submission process. They analyze your labor reports, help iden fy the suitable labor jobs to include in your submission and work with you to make a compelling case for increased labor rates.

It’s essen al to understand that this is not a ‘submit and forget’ type of opera on. Manufacturers o en have guidelines and criteria for these submissions, and the process of reviewing reimbursement rate increase requests can be lengthy and fraught with poten al objec ons. With decades of experience, the QB Business Solu ons team an cipates these challenges and knows how to address them proac vely.

The objec ve for QB Business Solu ons is to get you the results YOU deserve, and they accomplish this by handling communica ons and any disputes that might arise.

Maintaining a harmonious rela onship with your manufacturer is key to running a successful dealership. Dealing with warranty reimbursements can, at mes seem like it puts a strain on this rela onship. It’s a delicate dance between asser ng your rights to fair compensa on and maintaining a good rapport with the manufacturer. That’s another area where QB Business Solu ons provides value. They serve as a buffer, ensuring that all interac ons with manufacturers are professional, respec ul, and grounded in the common goal of sustaining a beneficial partnership.

Continued on Page 42

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 41

QB Business Solu ons understands that while the bo om line is crucial, so too are the rela onships you’ve spent years building. Their mode of opera on is always to engage in a manner that upholds the mutual respect between your dealership and the manufacturer, and their long-standing rela onships in the industry allow them to navigate these waters smoothly.

Improving warranty reimbursements shouldn’t be seen as a one- me correc on but a con nual process of refinement and nego a on. Market condi ons change, your dealership evolves, and manufacturers update their policies. QB Business Solu ons advocates an approach of regular review and adjustment, ensuring that your dealership’s warranty reimbursements reflect the current state of your business and the market.

At QB Business Solu ons, they are not just looking to win a single ba le for increased warranty reimbursement; they are your partners in developing a long-term strategy that considers the en rety of your service and parts opera ons. QB Business Solu ons helps to establish processes that stand the test of me, providing a stable founda on for you to build upon and achieve sustained success.

TechForce Founda on has launched a “Techs Talk” survey to gain insight into the perspectives, values, and experiences of aspiring and newly employed technicians.

“Most technician surveys in the marketplace today are heavily skewed by responses from GenX and Boomers,” said Jennifer Maher, CEO of TechForce Founda on, in a news release. “TechForce Founda on wants to specifically gather insights from GenZ future techs and new working techs within their first two years of employment. This gives us be er data in building the workforce going forward, and knowledge to address the crippling technician shortage.”

In December 2023, the number of students gradua ng from technical schools in all segments, including collision, increased for the first time in a decade, according to TechForce Foundation’s 2023 Technician Supply & Demand report.

Overall, the number of auto collision technician graduates was up .5% in 2022, or 800 technicians. The rise followed a six-year-long downward slide.

TechForce noted that 795,000 new automo ve, diesel, collision repair, avia on, and avionics technicians are s ll needed to meet demand through 2027; 110,000 collision techs are needed.

Now, TechForce says na onal demand for top- er technicians has created three job openings for every tech school graduate today. However, many young people hesitate to commit to technician careers or quit a er two years of employment.

“We hear anecdotal reasons ranging from the cost of training and tools [and] a desire for certain compensa on or work/life balance to s gmas or lack of clarity involving the career path,” Maher said. “It’s me we have solid data as to what this aspiring workforce truly wants and needs.”

According to a survey of employed technicians conducted last year by the Society of Collision Repair Specialists (SCRS) and I-CAR, those least satisfied with their careers are refinish technicians with structural and nonstructural body technicians not far behind

The top three reasons technicians said they stayed at their jobs were compensa on, convenience, and their coworkers. Workplace culture and management style as well as good work/life balance were also high on the list with around 15% of respondents finding them to be important.

TechForce encourages all working technicians within their first two years of employment and all high school and post-secondary students enrolled in collision, automo ve, avia on, diesel, restora on, welding, and other related programs to take the survey. The survey is anonymous.

Source: www.RepairerDrivenNews - Ar cle by Lurah Lowery

The exchange of information by like sized dealers in a non-competitive environment.

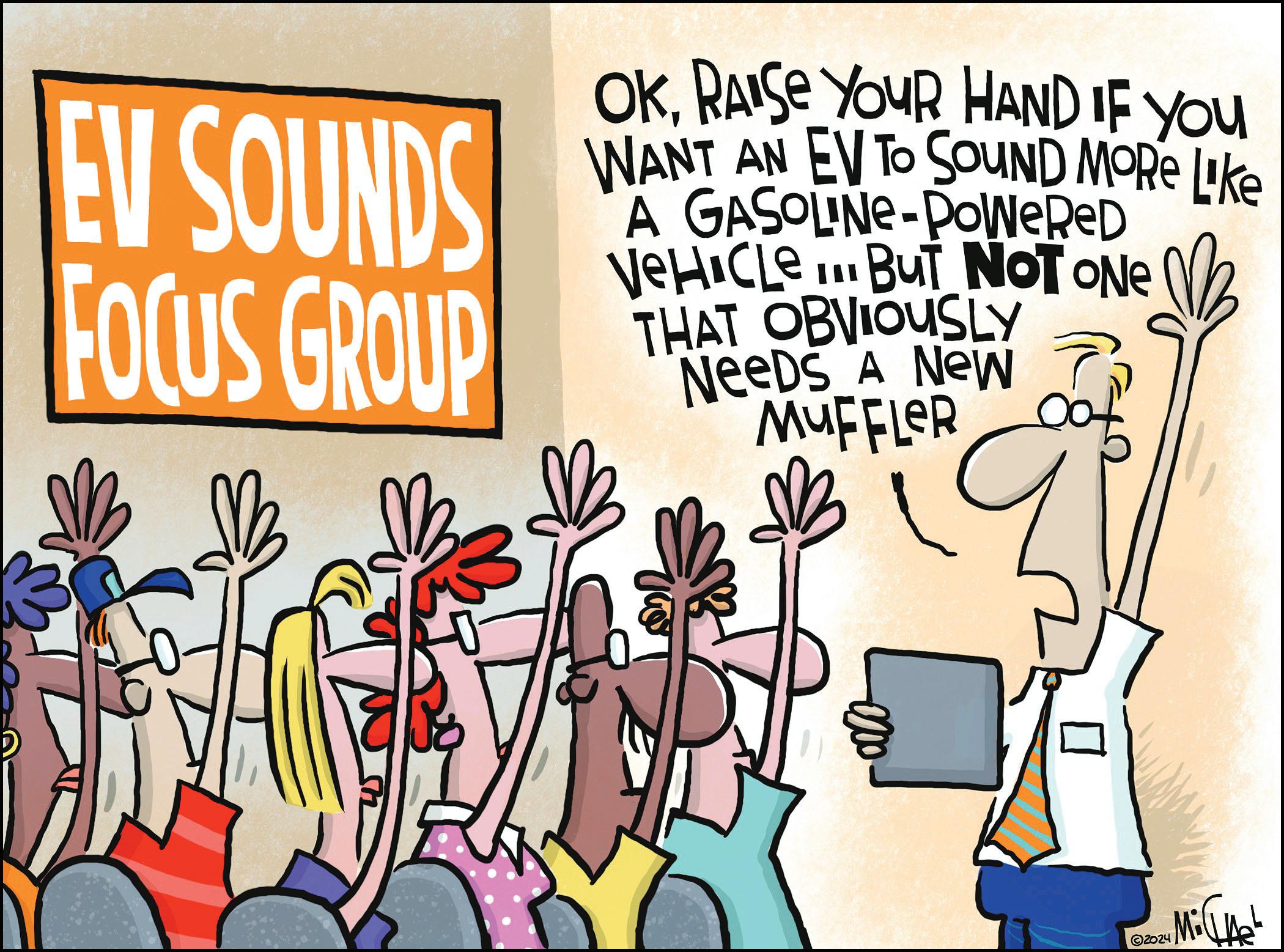

The electric vehicle market is steeped in uncertainty. EV sales growth has slowed; automakers are pulling back on EV produc on; poli cs around the subject is growing nasty, as the very idea of driving an EV has entered the culture wars.

But one analyst says don’t fret: “Our long-term outlook for EVs remains bright.”

That’s according to market researcher BloombergNEF, which released the 2024 version of its annual electric vehicle outlook report earlier this month.

In 2023, EVs made up 18% of global passenger-vehicle sales. By 2030, according to the report, 45% will be EVs. That number jumps to 73% by 2040 — s ll short of what the world needs to reach net zero emissions in transporta on, the firm says, but enough to achieve major reduc ons in climate-changing carbon emissions.

The long-term outlook adds a bit of glow to more recent news, especially in the U.S. and in California, where an EV sales slowdown, led by Tesla, has spanned two quarters, challenging the state’s climate goals.

A global survey conducted by consul ng firm McKinsey, also released Wednesday, included this shocker: 29% of EV owners told McKinsey they plan to replace the EV they bought with a gasoline or diesel car, a figure that jumps to 38% for U.S. EV owners.

Continued on Page 45

Continued from Page 44

Phillip Kampshoff, who leads McKinsey’s Center for Future Mobility in the Americas, said he’d seen EV sales as “a one-way street. Once you buy, you’re hooked on an EV. But that’s not what the data shows.”

Under a 2020 edict by Gov. Gavin Newsom, auto manufacturers must phase out California sales of new fossil fuel cars between now and 2035, when only what the state calls “zero-emission vehicles” will be allowed. (The mandate allows 20% of those vehicles to be plug-in hybrids, which can run on fossil fuels.)

Eleven other states are following California’s lead, although Virginia’s Republican governor plans to drop out by year’s end.

In the U.S., hard-knuckle poli cs are affec ng consumer a tudes toward electric vehicles, as presiden al candidate Donald Trump and his supporters in Congress have turned government regula ons on emissions technology into a red meat issue for MAGA conserva ves. Or, as BloombergNEF more gently puts it: “In the U.S., market ji ers inflamed by upcoming presiden al elec ons helped slow down adop on this year.”

Beyond poli cs, the road to EV growth is chock full of hazards, and different countries are moving at different speeds and with different levels of commitment.

Today, “China, India and France are s ll showing signs of healthy growth, but the latest data from Germany, Italy and the U.S. is more concerning,” BloombergNEF said. Global EV sales “are set to rise from 13.9 million in 2023 to over 30 million in 2027,” despite the lagging U.S.

Whatever the geography, consumer concerns about price, driving range, ba ery lifespan, and unreliable public charging con nue to dampen many buyers’ enthusiasm for EVs. BloombergNEF’s findings are echoed by consul ng firm McKinsey and the AAA motor club, in recent forecasts of their own.

But EV prices are coming down, range is improving, and large numbers of public chargers are being installed, all of which could revive sales growth.

Consumers around the planet are warming to the idea of buying an electric car, but they’re moving slowly. According to McKinsey, 14% of 30,000 global survey respondents in 2021 said their next vehicle would be an EV. This year, it’s 18%.

In the U.S. it’s a different story, where consumer interest in an EV purchase declined to 18% this year, according to AAA’s survey, down from 23% in 2023. And nearly two-thirds reported they were unlikely to buy an EV next me they buy a car.

Interest in hybrids is on the rise. One in three said they were likely to buy a hybrid, a vehicle that adds a small ba ery to an internal combus on engine to improve fuel efficiency.

That’s bad news for pure EV sales, at least in the immediate future, said Greg Brannon, head of automo ve research at AAA. Early adopters already have their EVs, he said, while mainstream buyers remain skep cal.

Continued on Page 46

The exchange of information by like sized dealers in a non-competitive environment.

Continued from Page 45

Tesla’s sales decline, overcapacity and price cuts, plus the an cs of Chief Execu ve Elon Musk, bode ill for the U.S. market as a whole. “Tesla is a leading indicator of what’s happening in the EV market,” Brannon said. “When we see so ening at Tesla, we see so ening across the board.”

Major automakers are losing billions of dollars in their EV divisions. Tesla, Mercedes-Benz, General Motors and Ford have all cut back their EV goals for the U.S., at least temporarily. Companies such as Hyundai and Kia, however, aren’t retrea ng. The market is moving from early adopters to “early majority customers,” Kia CEO Ho Sung Song told Automo ve News.

“Once we start going into early majority customers, the speed of transi oning to electrifica on will be fast,” Song said. “Our commitment remains resolute.”

Global markets

In China, India, and even in France, the picture’s different. China is the world’s largest seller of automobiles of any type, including EVs. The country has managed to make EVs far cheaper than carmakers in the U.S. and in Europe, and they’ve begun a big export push. (The Biden administra on is slapping a 100% tariff on Chinamade EVs to protect domes c manufacturing.)

For the first quarter in China, EV sales were up 37%, according to BloombergNEF. In India, it’s 39%, and in France, 20%. The U.S. was a laggard, up just 4%.

Gliding on the S curve?

Both BloombergNEF and McKinsey said that EV sales appear to be on the flat part of what’s known in business circles as the S curve. Sales of a popular new technology take off fast among early adopters, then glide along flat for awhile as mainstream customers mull their op ons, and then shoot up again if the mainstream buys in.

McKinsey’s Kampshoff said he personally believes the mainstream will get on board — but maybe not as aggressively as the industry once hoped. The consul ng firm has reduced its growth projec ons for 2030 by 15% to 20% he said.

S ll, “while we expect slower adop on, overall, we’re s ll pre y bullish.”

Source: www.OrlandoSen nel.com

Ar cle by Russ Mitchell - Los Angeles Times

Amy Klobuchar and Mike Lee sent out a le er to FTC this week seeking clarifica on on steps it’s taken to addressing unfair repair restric ons.

U.S. Senators Amy Klobuchar (D-MN) and Mike Lee (R-UT) sent out a le er to the Federal Trade Commission (FTC) this week seeking clarifica on on steps the agency has taken to addressing unfair repair restric ons.

Lee shared the le er penned by him and Klobuchar on social media earlier this week, in which they recognize the awareness raised by FTC surrounding the lack of protections for consumers seeking repairs for vehicles, smartphones, farm equipment, and other personal property

Part of this ac on taken by FTC includes the 2021 release of a Policy Statement on Repair Restric ons Imposed by Manufacturers and Sellers, in which FTC outlined inten ons to devote more resources toward dismantling unlawful repair restric ons.

In their le er, Klobuchar and Lee–who serve as chair and ranking member of the Senate Judiciary Subcommittee on An trust, Compe on Policy and Consumer Rights, respec vely–ask for further details on what steps FTC has taken since its Policy Statement to address repair restric ons.

Specifically, the le er asks for informa on on what the FTC has demonstrably done for right to repair, and what resulted from those ac ons, as well as whether it has determined if manufacturers should make parts, tools, manuals, and other data and equipment available to consumers and independent repair shops.

The Senators end with reques ng clarifica on on how FTC will hold manufacturers accountable, and what the agency requires from Congress to accomplish that.

Source: www.RatchetandWrench.com

Ratchet+Wrench Staff Reporters

The exchange of information by like sized dealers in a non-competitive environment.

UT

The exchange of information by like sized dealers in a non-competitive environment.

2 0 2 4 M o p a r M a s t e r s G u i l d

Officers:

O f f i c e r s & C o m m i t t e e s

President Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT

V. Pres - Jim Jaeger – Bosak Motors – Merrillville, IN

Secretary - John Russo - Dallas DCJ - Dallas, TX

Treasurer – Chris Hojnacki – Serra CDJR – Lake Orion, MI

Executive Committee - All Officers Including:

Dan Hutton - Tom O’Brien DCJR - Greenwood, IN

Alan Yancey - Hayes CDJ - Alto, GA

Rick Cutaia - Rick Hendrick DCJR – Charleston, SC

Steve Hofer – Park Chrysler Jeep – Burnsville, MN

Susan McDaniel – Bill Luke CJD – Phoenix, AZ

Joe McBeth - Dallas DCJ - Dallas, TX

Guild Committees

MMG Annual Meeting 2024

Jill Vance - Apogee Event Agency

Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT

Finance Committee

Chris Hojnacki - Serra CDJR – Lake Orion, MI

Susan McDaniel - Bill Luke CJD – Phoenix, AZ

Don Cushing – MMG Magazine

Newsletter/Website/Social Media

Don Cushing – MMG Magazine

Vendor Committees

Reynolds & Reynolds

Rick Cutaia - Rick Hendrick DCJR – Charleston, SC (Co-Chair)

Susan McDaniel – Bill Luke CJD – Phoenix, AZ (Co-Chair)

Joe Handzik - Bettenhausen Auto - Tinley Park, IL

Randy Rogers - Huffines CJDR - Plano, TX

Kent Cogswell - Jack Phelan CDJR - Countryside, IL

*David Kiser - Spartanburg CDJR - Spartanburg, SC

*Chris Hojnacki - Serra CDJR – Lake Orion, MI

CDK Global

Joe McBeth - Dallas DCJ – Dallas, TX (Chair)

Ian Grohs – Stateline CDJR – Fort Mill, SC

Mick Padgeon - Fred Beans Parts - Doylestown, PA

Robert Chatwin - Larry Miller DCJR - Sandy, UT

Dan Hutton - Tom O’Brien DCJR - Greenwood, IN

*Steve Hofer – Park Chrysler Jeep – Burnsville, MN

*Jim Jaeger - Bosak Auto Group - Merrillville, IN

OEConnection

Dan Hutton - Tom O’Brien CJD – Greenwood, IN (Chair)

Joe McBeth - Dallas DCJ – Dallas, TX

Jim Jaeger - Bosak Motors - Merrillville, IN

Chris Hojnacki - Serra CDJR – Lake Orion, MI

*Steve Hofer – Park Chrysler Jeep – Burnsville, MN

Snap On Business Solutions

Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT (Chair)

Randy Rogers - Huffines CJDR - Plano, TX

*Steve Hofer – Park Chrysler Jeep – Burnsville, MN

AER Manufacturing

Robert Chatwin - Larry Miller DCJR - Sandy, UT (Chair)

John Waltereit - Serra Palace CDJR - Lake Orion, MI

Ted Hawkins - Cerritos Dodge - Cerritos. CA

Chris Hojnacki - Serra CDJR – Lake Orion, MI

*Josh Gouldsmith - Gladstone CDJR - Gladstone, MO

*Joe Handzik - Bettenhausen Auto - Tinley Park, IL

Elite Extra - Epicore

Joe McBeth - Dallas DCJ - Dallas, TX

Alan Yancey - Hayes CDJ - Alto, GA

Chris Hojnacki – Serra CDJR – Lake Orion, MI

Steve Anderson - Tonkin Parts Center - Portland, OR

Steve Hofer – Park Chrysler Jeep – Burnsville, MN

Vendor Chairs

Susan McDaniel - Bill Luke CJD – Phoenix, AZ

Cody Eckhardt - Ken Garff CDJRF - W. Valley City UT *Alternate