Mountain View, CA

Mountain View, CA

Mountain View, California Annual Comprehensive Financial Report

For the Fiscal Year Ended June 30, 2024

Prepared by: Finance and Administrative Services Department

This page intentionally left blank

November 22, 2024

OFFICE OF THE CITY MANAGER

500 Castro Street, P.O. Box 7540

Mountain View, CA 94039‐7540

650‐903‐6301 | MountainView.gov

Honorable Mayor, City Council, and Members of the Mountain View Community:

I submit for your information and consideration the Annual Comprehensive Financial Report (ACFR) of the City of Mountain View (City) for the fiscal year ended June 30, 2024.

The local economy has fully recovered to COVID‐19 prepandemic levels. The City’s major revenues have generally remained strong and have benefited from inflation as well as the increase in interest rates but are not increasing at the same rate as prior fiscal years. Thanks to the leadership of the City Council and through the support and hard work of the Executive Leadership team and our outstanding City employees, we have provided an exceptional level of service to our community while maintaining fiscal stability during the fiscal year.

While revenues have recovered, expenditures are outpacing revenue growth. As a result, we are cautiously optimistic about the future fiscal health of the City. However, continued uncertainty surrounding inflationary pressures, elevated interest rates, transitioning national economic policies, and geopolitical conflicts cloud the economic picture. These all contribute to the likelihood of slower‐paced growth in the future.

The current General Operating Fund Forecast indicates sufficient financial resources to maintain the Mountain View of today, but building the Mountain View of tomorrow will require that we continue to enhance and diversify the City’s revenue streams to maintain ongoing fiscal stability and accomplish bold initiatives the City is advancing.

On November 5, 2024, Mountain View residents overwhelmingly supported the vision for the Mountain View of tomorrow and passed a proposed ballot measure, Measure G, by 72% to create an additional tier to the existing property transfer tax for transactions over $6.0 million. Per City Council direction, this additional source of revenue will be dedicated to the following funding priorities for the next 10 years:

• Public Safety Facilities;

• Parks, Open Space, and Biodiversity;

• Affordable Housing; and

• Other general governmental services, including road maintenance, active transportation, small business support, and homeless support services, among others.

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 2 of 14

As we move ahead, it is my pleasure to present the City’s Annual Comprehensive Financial Report (ACFR) for the fiscal year ended June 30, 2024. The ACFR has been prepared in conformity with the principles and standards for financial reporting set forth by the Governmental Accounting Standards Board (GASB) and in compliance with the City Charter, Section 1106.

Though the audit is conducted by an independent certified public accounting firm, City management assumes full responsibility for both the accuracy of the data and the completeness and fairness of the presentation, including all disclosures. We believe the data, as presented, is accurate in all material respects, that its presentation fairly shows the financial position and the results of the City’s operations as measured by the financial activity of the City’s various funds, and, in conjunction with the included notes, will provide the reader with an understanding of the City’s financial activities and status.

To provide a basis for making these representations, City management has established a comprehensive internal control framework that is designed to protect the government’s assets from loss, theft, or misuse and to compile sufficiently reliable information for the preparation of the City’s financial statements in accordance with accounting principles generally accepted in the United States of America (GAAP). Because the cost of internal controls should not outweigh its benefits, the City’s comprehensive framework of internal controls has been designed to provide reasonable, rather than absolute, assurance that the financial statements will be free from material misstatement.

The City’s books, financial records, and financial statements have been audited by Badawi & Associates, a firm of independent licensed certified public accountants, selected by and reporting to the City Council. The objective of the independent audit is to provide reasonable assurance that the financial statements of the City and related entities are free of material misstatement. The independent auditor concluded, based upon their audit, that there was a reasonable basis for rendering an unmodified “clean” opinion on the City’s basic financial statements as of, and for, the fiscal year ended June 30, 2024, and they are fairly presented in conformity with GAAP. The independent auditor’s report is presented at the beginning of the financial section of this report, on Page 1.

GAAP requires that management provide a narrative introduction, overview, and analysis to accompany the basic financial statements in a section entitled Management’s Discussion and Analysis (MD&A). This letter of transmittal is designed to complement the MD&A and should be read in conjunction with it. The City’s MD&A can be found immediately following the report of the independent auditors. The notes to the financial statements are provided in the financial section and are considered essential to fair presentation and adequate disclosure.

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 3 of 14

The ACFR is divided into the following sections:

The Introductory Section includes this letter of transmittal, an overview of the organizational structure of the City, and prior awards received.

The Financial Section includes the following:

• Independent Auditor’s Report.

• Management’s Discussion and Analysis.

• Basic Financial Statements—Includes the government‐wide financial statements that present an overview of the City’s entire financial operations and the fund financial statements that present financial information for each of the City’s major funds as well as other governmental, proprietary, and custodial funds

• Notes to Basic Financial Statements—The notes provide additional information that is essential to a full understanding of the data provided in the government‐wide and fund financial statements.

• Required Supplementary Information—Includes schedules required to be presented, showing information related to the City’s pension plans and other postemployment benefits plan.

• Other Supplementary Information—Includes the Budgetary Schedule of the Park Land Dedication Capital Projects Fund, Combining Statements and Schedules of the nonmajor governmental funds, internal service funds, and custodial funds.

The Statistical Section includes tables containing historical financial data, debt statistics, and miscellaneous social and economic data of the City that may be of interest to potential investors in the City’s bonds and to other readers. The data includes 10‐year revenue and expenditure information as well as 10 years of net position/fund balance information.

This ACFR includes the results of financial activities of the primary government, which encompasses several enterprise activities as well as all of its component units: the Mountain View Shoreline Regional Park Community (Shoreline Community) and the City of Mountain View Capital Improvements Financing Authority (Financing Authority). Separate financial statements for the Shoreline Community are included following the Statistical Section. There is no legal requirement for a separate component unit report for the Financing Authority.

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 4 of 14

The City was incorporated on November 7, 1902. The City Charter was originally approved by voters in 1952 and requires the City to operate under a Council‐Manager form of government. Seven Councilmembers are elected at‐large for four‐year terms that are staggered, so three or four seats are filled at the general municipal election in November of every even‐numbered year. Continuous service on the City Council is limited to two consecutive terms. Each year, in January, Council elects one of its members as Mayor and another as Vice Mayor.

With a population of approximately 86,535 and occupying just over 12 square miles, Mountain View is situated in Silicon Valley, about 36 miles southeast of the City of San Francisco and 15 miles northwest of the City of San Jose.

The City provides the following full range of municipal services, which are reflected in this report:

•General government (city management, legal, human resources, information technology, and financial activities);

• Public safety (police and fire services);

• Public works (engineering, design, and utility maintenance);

• Community development (land use, development review, inspections, and affordable housing); and

• Culture and recreation (library, parks, recreation, performing arts, and golf course)

The City also provides water, wastewater, and solid waste utility enterprise activities, and the financial information regarding these activities is included in this report.

The financial reporting entity includes all funds of the primary government (i.e., the City) as well as its component units. The seven‐member City Council serves as the governing body of the Mountain View Shoreline Regional Park Community and the City of Mountain View Capital Improvements Financing Authority, although these agencies are legal entities separate from the City. These two agencies are considered component units of the City and are blended in the reporting entity. However, this does not mean the City assumes the obligations or liabilities of these entities, and they are budgeted and accounted for separately from the City.

No other agencies or activities associated with the City, or utilizing a name similar to the City, meet the established criteria for inclusion in the reporting entity and, accordingly, are excluded from this report

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 5 of 14

The City Council is required by the City Charter to adopt a budget by June 30 to be in effect for the ensuing fiscal year, which begins July 1. Budgets are approved at the fund and department level (legal level of control) and may not be exceeded without City Council approval. Transfers and adjustments between funds and capital projects must be submitted to the City Council for approval. The City Charter requires approval by five votes of the seven‐member City Council to amend the budget.

The City is centrally located in Silicon Valley and is serviced by several major freeways (U.S. 101, Interstate 280, State Route 85, and State Route 237) connecting the City to three international airports, shipping, and rail lines in the Bay Area. Mountain View is also a regional transportation hub and has transit stops for the Caltrain commuter train and Santa Clara Valley Transportation Authority (VTA) light rail system.

Even though the local economy has fully recovered to COVID‐19 prepandemic levels, the City is not experiencing revenue growth at the same level as the prior fiscal year. The only General Fund revenues that are significantly higher than expected are property taxes and use of money and property (investment and rental income). Overall, total General Fund revenue decreased from $234.0 million in Fiscal Year 2022‐23 to $221.1 million in Fiscal Year 2023‐24, a decrease of $12.9 million, or 5.5%. Except for property taxes and use of money and property, all major General Fund revenues experienced a decline in Fiscal Year 2023‐24, when compared to Fiscal Year 2022‐23.

Even though the City finances have fully recovered, the local business community continues to see lingering impacts from the COVID‐19 pandemic. As businesses grapple with hybrid and remote workforce strategies, commercial real estate vacancy rates continue to remain elevated and corporate layoffs persist. Office vacancy rates in Silicon Valley were estimated to be 16.8% between July and September 2024, with Mountain View estimated to be 21.6% for the same time period, according to Colliers, a commercial real estate firm.

Another indicator of the local economy’s health is unemployment. The unemployment rate in Mountain View in September 2024 was estimated to be 3.3% compared to the prior‐year rate of 2.8% for the same month, reflecting the relative continued strength of employment in the local region, especially when compared to the unemployment rate of the State of California as a whole. Unemploym ent rates in the area are expected to continue to increase as corporate layoffs continue to occur. In addition, a tight labor market could also push the unemployment rate up. Per the UCLA Anderson forecast, the “labor force decline is attributable to retirements, migration out‐of‐state, and individuals choosing to spend their time in nonmarket activities, such as child‐raising.”

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 6 of 14

Unemployment Rates

Despite various financial challenges that have arisen in the past, the City has a history of maintaining prudent fiscal practices and budget discipline that has enabled the City to consistently maintain its AAA credit rating. The rating reflects the City’s sizeable property tax base, substantial revenue generated annually by the numerous commercial and residential leases in which the City is the lessor, and a positive financial position supported by strong reserve levels and a very modest debt burden.

The economic vitality of the City relies upon a strong and diversified business community that is flexible enough to withstand economic challenges. As part of the City’s economic development efforts, the City works to attract and retain companies with growth potential and make the City a desirable location for the corporate community. As a result, Mountain View continues to be recognized as a prime location in Silicon Valley in which to live and work. Mountain View’s innovation economy includes major technology companies, including Google, Intuit, LinkedIn, Microsoft, Samsung, Siemens Medical Solutions, and Synopsys. Downtown Mountain View is a key location for businesses, especially start‐up companies, because of the diverse number of retailers, restaurants, and convenient access to public transportation.

The City is also committ ed to preserving its existing services and programs while investing in the future through prudent budgeting and infrastructure development. During the past decade, the City experienced a strong economy that, together with sound fiscal planning, has allowed the City to increase resources where needed and to pay down pension and other postemployment benefit obligations. It has also allowed for the maintenance of adequate reserves for times of economic downturn.

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 7 of 14

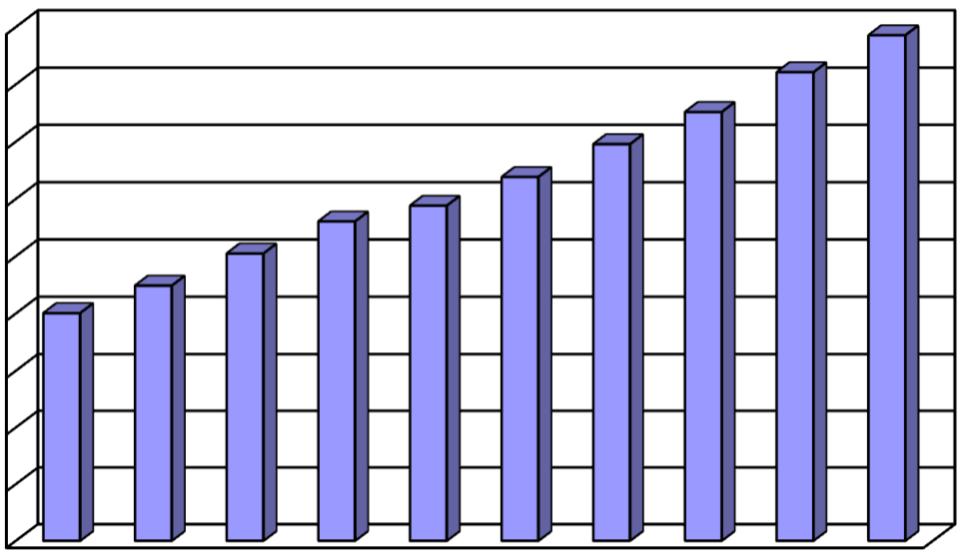

Property tax accounts for 36.7% of total General Fund revenues and is a key indicator of the City’s economic outlook. For reference, property tax revenue accounted for 33.8% of total General Fund revenues in Fiscal Year 2022‐23. Property tax revenue in the General Fund totaled $81.1 million in Fiscal Year 2023‐24 compared to $79.0 million in Fiscal Year 2022‐23, an increase of $2.1 million, or 2.6%. Even though property tax revenue has experienced significant growth over the past five years, future growth is expected to be nominal.

Property Tax Revenue ‐ General Fund (in millions)

$10.0 $20.0

$0.0

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 8 of 14

The median sales price of single‐family residences was $2.5 million for the quarter ended September 30, 2024. As can be seen in the chart below, this price has remained relatively stable since decreasing from a high of $2.9 million for the quarter ended March 31, 2022.

$3,000,000

$2,500,000

$2,000,000

$1,500,000

$1,000,000

$500,000

$0

3/31/20219/30/20213/31/20229/30/20223/31/20239/30/20233/31/20249/30/2024

Source: HdL Coren & Cone

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 9 of 14

Even though median sales prices continue to hover around $2.5 million and 30‐year fixed mortgage rates hit a high of nearly 8% in October 2023, the number of home sales in the local housing market have rebounded, after experiencing a decrease in Fiscal Year 2022‐23. There were 262 single‐family home sales in Fiscal Year 2022‐23, compared to 227 in Fiscal Year 2021‐22, an increase of 35, or 15.4%.

Number of Mountain View Detached Single‐Family Residential Full Value Sales

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 10 of 14

Use of money and property, which consists primarily of lease revenue and investment earnings, is an important source of General Fund revenue and accounts for 23.3% of total General Fund revenues. For reference, use of money and property revenue accounted for 20.3% of total General Fund revenues in Fiscal Year 2022‐23. This revenue source generated $51.4 million in Fiscal Year 2023‐24, an increase of $3.9 million, or 8.2%, when compared to Fiscal Year 2022‐23. Use of Money and Property revenue is projected to experience a nominal increase in Fiscal Year 2024‐25 as the City’s investment portfolio continues to earn higher investment returns.

$60.0

$50.0

$40.0

$30.0

$20.0

$10.0

$0.0

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 11 of 14

Tax

Sales tax is another important source of General Fund revenue as it accounts for 11.1% of total General Fund revenues. For reference, sales tax revenue accounted for 10.9% of total General Fund revenues in Fiscal Year 2022‐23. Sales tax revenue in the General Fund totaled $24.5 million in Fiscal Year 2023‐24 compared to $25.4 million in Fiscal Year 2022‐23, a decrease of $0.9 million, or 3.5%. Sales tax revenue is projected to stay relatively flat for Fiscal Year 2024‐25.

Sales Tax Revenue ‐ General Fund (in millions)

$30.0

$25.0

$20.0

$15.0

$10.0

$5.0

$0.0

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 12 of 14

The City annually prepares a five‐year forecast for its General Operating Fund and, periodically, a Long‐Range Financial Forecast to project revenue and expenditure trends for the next 10 years. As part of the Fiscal Year 2024‐25 Adopted Budget, a Five‐Year Financial Forecast (Forecast) was developed for Fiscal Years 2024‐25 through 2028‐29. A financial forecast, even with fluctuating economic variables, can assist with the identification of long‐term financial trends, causes of fiscal imbalances, future fiscal challenges, opportunities, and potential requirements; all of which may assist in keeping the City on a continuing path of fiscal sustainability. While it is challenging to accurately forecast revenues due to the variable nature of the revenue sources and their connection to regional, state, national, and international economic conditions, it is possible to identify reasonable financial trends and provide a conceptual financial picture that will be useful to the City’s decision‐making. The Forecast guides the City as it continues to confront the need to balance expenditures and revenues.

The General Fund Forecast projects a modest positive‐ending operating balance for Fiscal Year 2024‐25. However, subsequent fiscal years are projected to result in modest operating deficits. Should the projected deficits come to fruition, maintaining operating and emergency reserves during the period will help the City withstand possible future economic downturns.

Estimated General Operating Fund Operating Balance (in millions)

$1.0

$0.0

($1.0)

($2.0)

($3.0)

($4.0)

($5.0)

$2.0 FY 2024‐25FY 2025‐26FY 2026‐27FY 2027‐28FY 2028‐29

In summary, the City weathered a challenging fiscal environment and has emerged stronger as key City revenues have surpassed prepandemic levels. However, local economic indicators are projecting a flattening of revenues with slower‐paced growth anticipated in Fiscal Year 2024‐25, following strong revenue growth in the past several fiscal years. Uncertainty with inflation, interest rates, national and state economic policies, and geopolitical conflicts all contribute to the projected slower‐paced growth. In contrast, expenditures are expected to grow at a faster pace than revenues for the foreseeable future due in large part to anticipated increases in operational costs.

Honorable Mayor, City Council, and Members of the Mountain View Community

November 22, 2024

Page 13 of 14

The City Council has established a financial and budgetary policy framework which is reviewed and updated as necessary by the City Council. A comprehensive and consistent set of financial and budgetary policies provides a basis for sound financial planning, identifies appropriate directions for service‐level developments, aids budgetary decision‐making, and serves as an overall framework to guide financial management and operations of the City.

The City’s adoption of financial policies also promotes public confidence and increases the City’s credibility in the eyes of bond‐rating agencies and potential investors. Such policies also provide the resources to react to potential financial emergencies in a prudent manner.

Article XIIIB of the California State Constitution, which became effective in Fiscal Year 1979‐80, and which was modified (by Proposition 111) in November 1989, establishes, by formula, an appropriation limit for governmental agencies. Using the appropriations of Fiscal Year 1978‐79 as the base year, the limit is modified by the growth in inflation and population during each fiscal year. Inflation is measured as the year‐over‐year growth in per‐capita personal income while population growth is based on a weighted growth measure that blends growth in the civilian population with growth in K‐12 and community college average daily attendance. Article XIIIB also sets the guidelines as to what is to be included in the appropriation limits.

The City’s appropriation limit for Fiscal Year 2023‐24 was $356,727,282; the City’s actual appropriations subject to the limit were $133,942,950, far below the limit. The Fiscal Year 2023‐24 appropriation limit increased from $342,417,977 in Fiscal Year 2022‐23 due primarily to the increase of 4.44% in California’s per‐capita personal income over the prior year, one of the factors used in calculating the change in the appropriation limit.

Honorable Mayor, City Council, and Members of the Mountain View Community November 22, 2024

Page 14 of 14

The Government Finance Officers Association (GFOA) awarded a Certificate of Achievement for Excellence in Financial Reporting to the City for its Annual Comprehensive Financial Report for the fiscal year ended June 30, 2023. This was the 34th consecutive year the City has received this prestigious award. In order to be awarded a Certificate of Achievement, the City had to publish an easily readable and efficiently organized ACFR that satisfied both GAAP and applicable legal requirements. The GFOA award is valid for a one‐year period only. I believe our current ACFR continues to meet the program’s requirements, and we are submitting it to the GFOA to determine its eligibility for another certificate.

In addition, the City also received the GFOA’s Distinguished Budget Presentation Award for the City’s annual budget document for Fiscal Year 2023‐24. In order to qualify for this Distinguished Budget Presentation Award, the government’s budget document had to be judged proficient as a policy document, a financial plan, an operations guide, and a communication device.

Special recognition is extended to Arn Andrews, Assistant City Manager; Derek Rampone, Finance and Administrative Services Director; Grace Zheng, Assistant Finance and Administrative Services Director; and the entire staff of the Finance and Administrative Services Department for their dedication to all City departments, residents, and customers on a daily basis. The preparation of this report could not have been achieved without the skillful, dedicated, and efficient services of the entire staff of the Finance and Administrative Services Department. In particular, Helen He, Accounting Manager; Janet Shum, Senior Accountant; and Marichi Valle, Accountant, were instrumental in preparing the ACFR accurately and in a timely manner. Every member of the department deserves recognition and thanks for their commitment to the City and their profession. I would also like to thank the members of the City Council and Council Finance Committee for their leadership and policy guidance in managing the financial operations of the City in a fiscally responsible manner that continues to serve in the best interests of the residents of the City.

Respectfully submitted,

Kimbra McCarthy City Manager

Patricia Showalter Mayor

Lisa Matichak Vice Mayor

Margaret Abe-Koga Councilmember

Alison Hicks Councilmember

Ellen Kamei

Councilmember

Lucas Ramirez Councilmember

Emily Ann Ramos

Councilmember

Kimbra McCarthy City Manager

Jennifer Logue City Attorney

Heather Glaser City Clerk

Audrey Seymour Ramberg

Arn Andrews

Assistant City Manager

Assistant City Manager

Lenka Wright Chief Communications Officer

Danielle Lee Chief Sustainability and Resiliency Officer

Christian Murdock Community Development Director

Roger Jensen CIO/Information Technology Director

John Marchant Community Services Director

Kimberly Thomas Deputy City Manager

Derek Rampone Finance and Administrative Services Director

Juan Diaz Fire Chief

Wayne Chen Housing Director

Maxine Gullo Human Resources Director

Tracy Gray Library Director

Michael Canfield Police Chief

Dawn Cameron Public Works Director

Mountain View Residents Mountain View City Council CityManager CityClerk CityAttorney City Manager’s Office

City Boards, Commissions & Committees

Environmental Planning Commission

Board of Library Trustees

Parks and Recreation Commission

Rental

Human

Performing

For its Annual Comprehensive Financial Report For the Fiscal Year Ended June 30, 2023

Executive Director/CEO

This page intentionally left blank

To the Honorable Mayor and Members of the City Council of the City of Mountain View Mountain View, California

Opinions

We have audited the financial statements of the governmental activities, the business-type activities, each major fund, and the aggregate remaining fund information of the City of Mountain View (City), as of and for the year ended June 30, 2024, and the related notes to the financial statements, which collectively comprise City’s basic financial statements as listed in the table of contents.

In our opinion, the accompanying financial statements present fairly, in all material respects, the respective financial position of the governmental activities, the business-type activities, each major fund, and the aggregate remaining fund information of the City, as of June 30, 2024, and the respective changes in financial position and, where applicable, cash flows thereof and the respective budgetary comparison for the General Fund, Shoreline Regional Park Community Fund, and the Housing Fund, for the year then ended in accordance with accounting principles generally accepted in the United States of America.

We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS) and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the City and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinions.

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

To the Honorable Mayor and Members of the City Council of the City of Mountain View

Mountain View, California

Page 2

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the City’s ability to continue as a going concern for twelve months beyond the financial statement date, including any currently known information that may raise substantial doubt shortly thereafter.

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinions. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the City’s internal control. Accordingly, no such opinion is expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the City’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control–related matters that we identified during the audit.

To the Honorable Mayor and Members

of the City Council of the City of Mountain View

Mountain View, California

Page 3

Accounting principles generally accepted in the United States of America require that the management’s discussion and analysis, and the required pension and OPEB information schedules, be presented to supplement the basic financial statements. Such information is the responsibility of management and, although not a part of the basic financial statements, is required by the Governmental Accounting Standards Board who considers it to be an essential part of financial reporting for placing the basic financial statements in an appropriate operational, economic, or historical context. We have applied certain limited procedures to the required supplementary information in accordance with auditing standards generally accepted in the United States of America, which consisted of inquiries of management about the methods of preparing the information and comparing the information for consistency with management’s responses to our inquiries, the basic financial statements, and other knowledge we obtained during our audit of the basic financial statements. We do not express an opinion or provide any assurance on the information because the limited procedures do not provide us with sufficient evidence to express an opinion or provide any assurance.

Our audit was conducted for the purpose of forming opinions on the financial statements that collectively comprise the City’s basic financial statements. The individual and combining fund financial statements and schedules are presented for purposes of additional analysis and are not a required part of the basic financial statements.

The individual and combining fund financial statements and schedules are the responsibility of management and were derived from and relates directly to the underlying accounting and other records used to prepare the basic financial statements. Such information has been subjected to the auditing procedures applied in the audit of the basic financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the basic financial statements or to the basic financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the individual and combining fund financial statements and schedules are fairly stated, in all material respects, in relation to the basic financial statements as a whole.

Management is responsible for the other information annual financial report. The other information comprises the introductory section, statistical section, and component unit financial statements section but does not include the basic financial statements and our auditor's report thereon. Our opinions on the basic financial statements do not cover the other information, and we do not express an opinion or any form of assurance thereon. In connection with our audit of the basic financial statements, our responsibility is to read the other information and consider whether a material inconsistency exists between the other information and the basic financial statements, or the other information otherwise appears to be materially misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the other information exists, we are required to describe it in our report.

To the Honorable Mayor and Members of the City Council of the City of Mountain View

Mountain View, California

Page 4

In accordance with Government Auditing Standards, we have also issued our report dated November 22, 2024 on our consideration of the City’s internal control over financial reporting and on our tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters. The purpose of that report is solely to describe the scope of our testing of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinion on the effectiveness of internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordance with Government Auditing Standards in considering the City’s internal control over financial reporting and compliance.

Badawi & Associates, CPAs Berkeley, California November 22, 2024

Management’s Discussion and Analysis (MD&A) (Unaudited)

For the Fiscal Year Ended June 30, 2024

This section of the City of Mountain View’s (City) Annual Comprehensive Financial Report (ACFR) presents a narrative overview and analysis of the financial activities of the City for the fiscal year ended June 30, 2024. We encourage readers to consider the information presented here in conjunction with additional information that has been furnished in our Letter of Transmittal and Basic Financial Statements and to recognize that the financial statements focus on past results compared to the City’s operating budget, which focuses on future goals and allocation of resources.

Key financial highlights for the fiscal year are outlined below. Details can be found in the Government‐Wide Financial Analysis the Financial Analysis of the City’s Funds sections of this MD&A.

• The assets and deferred outflows of resources of the City exceeded its liabilities and deferred inflows of resources at the close of the fiscal year ended June 30, 2024 by $1.6 billion (net position). Of this amount, $229.3 million represents unrestricted net position, which may be used to meet the City’s ongoing obligations.

• The City’s total net position increased by $98.8 million compared to the increase of $112.0 million in the prior fiscal year, a decrease of 11.8% in the current fiscal year when compared to the prior fiscal year. Of this amount, $85.2 million was generated by governmental activities and $13.6 million by business‐type activities. Overall, citywide expenses were up $31.1 million, while revenues were only up $17.2 million.

• The City’s total outstanding long‐term debt decreased modestly by $1.5 million in the current fiscal year, primarily due to scheduled debt service payments, offset by increases in landfill containment and claims liabilities.

• The City’s net pension liabilities increased by $12.9 million, a relatively small increase compared to last year’s increase of $128.8 million. This is primarily attributed to positive investment earnings experienced in FY 2022‐23 and realized in Fiscal Year 2023‐24. In the prior fiscal year, CalPERS experienced a negative 6.1% return on investments, which was the main driver of the large increase in the pension liability last year. Net other post‐employment benefit (OPEB) liabilities decreased by $2.2 million due to the same reason.

• The City’s governmental funds reported total fund balances of $1.0 billion, an increase of $70.0 million, or 7.2% from the prior fiscal year. The increase is mainly in the General Capital

Project Funds due to funding of projects that haven't started yet or are in the early stages of construction.

• The total fund balance of the General Fund was $238.7 million, an increase of $2.1 million, or 0.9% from the prior fiscal year. Approximately $133.3 million of this amount, or 55.9%, represents unassigned fund balance which is available to meet the City’s current and future needs. This unassigned fund balance has been designated for future one‐time expenditures, one‐time payments toward unfunded liabilities, and emergency funds and is 70.6% of total General Fund expenditures for the fiscal year ended June 30, 2024. This is an increase from 69.2% of total General Fund expenditures in the prior fiscal year.

This Discussion and Analysis document is intended to serve as an introduction to the City’s basic financial statements. The City’s basic financial statements are comprised of three components: (1) government‐wide financial statements; (2) fund financial statements; and (3) notes to the basic financial statements. This report also contains required and other supplementary information in addition to the basic financial statements themselves.

The government‐wide financial statements are designed to provide readers with a broad overview of the City’s finances in a manner similar to a private‐sector business.

The Statement of Net Position presents information on all of the City’s assets, deferred outflows of resources, liabilities, and deferred inflows of resources, with the difference between them reported as net position. Over time, increases or decreases in net position may serve as a useful indicator of whether the overall financial position of the City is improving or deteriorating.

The Statement of Activities presents information showing how the City’s net position changed during the most recent fiscal year. All changes in net position are reported as soon as the underlying event giving rise to the change occurs, regardless of the timing of related cash flows. Thus, revenues and expenses are reported in this statement for some items that will only result in cash flows in future fiscal periods, such as revenues pertaining to uncollected taxes and expenses pertaining to earned, but unused, vacation and sick leave.

Both of the government‐wide financial statements distinguish functions of the City that are principally supported by taxes and intergovernmental revenues (governmental activities) from other functions that are intended to recover all or a significant portion of their costs through user fees and charges (business‐type activities). The governmental activities of the City include general government, public safety, public works, community development, and culture and recreation. The business‐type activities of the City include water, wastewater, and solid waste operations (enterprise funds).

The government‐wide financial statements include not only the City itself (known as the primary government) but also two legally separate entities for which the City is financially accountable: (1) Mountain View Shoreline Regional Park Community (Shoreline Community or SRPC); and (2) City of Mountain View Capital Improvements Financing Authority (Financing Authority). Although legally separate from the City, these component units are blended with the primary government because they have the same governing board as the City and because of their financial relationship with the City. In addition, separate financial statements for the Shoreline Community component unit are included within the City’s ACFR.

The fund financial statements are designed to report information about groupings of related accounts, which are used to maintain control over resources that have been segregated for specific activities or objectives. The City, like other State and local governments, uses fund accounting to ensure and demonstrate compliance with finance‐related legal requirements. All of the funds of the City can be divided into the following three categories: governmental funds, proprietary funds, and fiduciary funds.

Governmental funds are used to account for essentially the same functions reported as governmental activities in the government‐wide financial statements. However, unlike the government‐wide financial statements, governmental fund financial statements focus on near‐term inflows and outflows of spendable resources as well as on balances of spendable resources available at the end of the fiscal year. Such information may be useful in determining what financial resources are available in the near future to finance the City’s programs.

Because the focus of governmental funds is narrower than that of the government‐wide financial statements, it is useful to compare the information presented for governmental funds with similar information presented for governmental activities in the government‐wide financial statements. By doing so, readers may better understand the long‐term impact of the government’s near‐term financing decisions. Both the governmental funds Balance Sheet and the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances provide a reconciliation to facilitate this comparison between governmental funds and governmental activities.

The City maintains several individual governmental funds organized according to their type (special revenue, debt service, and capital projects funds). Information is presented separately in the governmental funds Balance Sheet and in the governmental funds Statement of Revenues, Expenditures, and Changes in Fund Balances for the General Fund, Shoreline Regional Park Community Fund, Housing Fund, General Capital Projects Fund, and Park Land Dedication Capital Projects Fund, all of which are considered to be major funds. Data from the remaining governmental funds are combined into a single, aggregated presentation. Individual fund data for each of these nonmajor governmental funds is provided in the form of combining statements elsewhere in this report.

The City adopts an annual appropriated budget for most of its funds except the General Capital Projects Fund, which is budgeted on a project basis. Budgetary comparison statements and schedules have been provided for these funds to demonstrate compliance with budgets.

Proprietary funds are generally used to account for services for which the City charges customers, either external customers or internal customers or departments of the City. Proprietary funds provide the same type of information as shown in the government‐wide financial statements, only in more detail. The City maintains two different types of proprietary funds.

Enterprise funds are used to report the same functions presented as business‐type activities in the government‐wide financial statements. The City uses enterprise funds to account for its water, wastewater, and solid waste operations, all of which are considered to be major funds of the City.

Internal service funds are used to accumulate and allocate costs internally among the City’s various functions. The City uses internal service funds to account for its equipment maintenance and replacement, Retirees’ Health Plan, Employee Benefits Plan, and various other self‐insurance liability programs. Because these services predominantly benefit governmental rather than business‐type functions, they have been included within governmental activities in the government‐wide financial statements. The internal service funds are combined into a single, aggregated presentation in the proprietary funds financial statements. Individual fund data for the internal service funds is provided in the form of combining statements elsewhere in this report.

Fiduciary funds are used to account for fiduciary activities and resources held for the benefit of individuals, organizations, or other governments that are not part of the City. These are comprised of custodial funds, which are not required to be reported in pension (and other employee benefit) trust funds, investment trust funds, or private‐purpose trust funds and include custodial balances and activities of the City’s labor unions, flexible benefits, and Center for Performing Arts. Since the resources of these funds are not available to support the City’s own programs, they are not reflected in the government‐wide financial statements.

The notes provide additional information that is essential to a full understanding of the data provided in the government‐wide and fund financial statements.

Required Supplementary Information includes schedules required to be presented showing information related to the City’s pension plans and other post‐employment benefits plan.

Other Supplementary Information includes the combining statements and schedules of the nonmajor governmental funds, internal service funds, and custodial funds.

A condensed summary of the City’s net position for governmental and business‐type activities is as follows:

Condensed Statement of Net Position (Dollars in Thousands)

42.2% of the City’s net position, amounting to $682.2 million, reflects its investment in capital assets (e.g., land, buildings, other improvements, etc.) less any related outstanding debt used to acquire or construct those assets. The City uses these capital assets to provide services to its residents and community members. Therefore, these assets are not available for future spending. Although the City’s investment in its capital assets is reported net of related debt, it should be noted the resources needed to repay this debt must be provided from other sources since the capital assets themselves cannot be liquidated for these liabilities. The largest portion (43.6%) of the City’s net position, or $703.9 million, represents resources that are subject to external restrictions on how they may be used. The last portion of the City’s net position, $229.3 million (14.2%), represents unrestricted net position and may be used to meet the City’s ongoing obligations.

The City’s total noncurrent liabilities increased by $9.3 million, compared with the prior fiscal year, primarily due to an increase of net pension liability of $12.9 million, which is a moderate increase compared to the prior year’s increase of $128.8 million.

The changes in net position for governmental and business‐type activities are as follows:

Condensed Statement of Activities (Dollars in Thousands)

2024202320242023 20242023 Revenues:

Program revenues such as charges for services, operating grants and contributions, and capital grants and contributions are generated from or restricted to each activity. General revenues are composed of taxes and other revenues not specifically generated by, or restricted to, individual activities. All tax revenues and investment earnings are included in general revenues

The following charts are graphical comparisons of governmental revenues by source for Fiscal Years 2023‐24 and 2022‐23:

Fiscal Year 2023‐24 Governmental Activities

Revenues by Source

Fiscal Year 2022‐23 Governmental Activities

Revenues by Source

Total Governmental Revenues increased to $366.4 million, a $12.9 million increase when compared to the prior fiscal year.

Revenue Highlights:

• Revenues from charges for services of $75.1 million, property taxes of $153.6 million, and investment income of $57.6 million were the three largest revenue sources for gonvermental activities. Together, these accounted for $286.3 million, or 78.1% of total revenue.

• Capital grants and contributions decreased by $13.8 million, primarily related to a one‐time park land dedication fee of $16.1 million received for the 777 West Middlefield Road project in Fiscal Year 2022‐23.

• Property taxes increased by $10.4 million over the prior fiscal year as the residential and commercial real estate markets continued to experience strong growth in assessed values.

• The investment income increased by $34.0 million over the prior fiscal year, mainly due to the unrealized gains on investments and the higher interest earnings resulting from the elevated interest rates being earned on investments.

The following charts are graphical comparison of the City’s governmental expenses by function for Fiscal Years 2023‐24 and 2022‐23. Please note the expenses do not include capital outlays as those are added to the City’s capital assets.

Fiscal Year 2023‐24

Governmental Activities

Expenses by Function

Fiscal Year 2022‐23

Governmental Activities

Expenses by Function

Total expenses increased to $279.7 million in the current fiscal year, an increase of $17.0 million, or by 6.5% compared to the prior fiscal year. The increase is mainly due to increases in salaries and benefits that include pension and OPEB expenses related to adjustments required by GASB Statement Nos. 68 and 75. Salaries and benefits are higher in the current fiscal year as a result of an increase in authorized positions, Council‐approved cost‐of‐living adjustments, an increase in benefit costs and higher additional pension UAL (unfunded Accrued Liability) payments.

Business‐type activities increased the City’s net position by $13.6 million compared to an increase of $22.3 million from the prior fiscal year. The significant key factors are as follows:

• Water net position increased by $3.2 million, primarily due to capital contributions of $1.9 million and investment income of $1.3 million.

• Wastewater net position increased by $8.6 million, primarily due to net operating income of $5.3 million, investment income of $1.5 million, and developer capital contributions of $1.0 million.

• Solid waste net position increased by $1.8 million, primarily due to net operating income of $1.4 million.

As noted earlier, the City uses fund accounting to ensure and demonstrate compliance with finance‐related legal requirements.

Governmental Funds—The focus of the City’s governmental funds is to account for the near‐term inflows, outflows, and balances of resources that are available for spending. This information is useful in assessing the City’s financing requirements. In particular, unassigned fund balance may serve as a useful measure of a government’s net resources available for spending at the end of the fiscal year. Types of governmental funds reported by the City include the General Fund, Special Revenue Funds, Debt Service Funds, and Capital Project Funds.

At June 30, 2024, the City’s governmental funds reported combined ending fund balances of $1.0 billion, an increase of $70.0 million compared to the prior fiscal year. The components for the change are increases of $2.1 million in the General Fund, $22.8 million in the Shoreline Regional Park Community Fund, $8.5 million in the Housing Fund, and $39.8 million in the Capital Projects fund, offset by a decrease of $3.1 million in the Park Land Dedication Capital Projects Fund.

Total fund balance is comprised of an unassigned fund balance of $133.3 million that is available for spending at the City’s discretion. The remainder of the fund balance is nonspendable ($7.2 million), restricted ($776.0 million), committed ($115.6 million), and assigned ($5.3 million), none of which are available for new discretionary spending.

Total revenues for governmental funds were $364.8 million while expenditures were $290.6 million. The revenues were $74.2 million more than total expenditures.

The General Fund is used to account for all revenues and expenditures necessary to carry out basic government activities of the City that are not accounted for through other funds. At June 30, 2024, the unassigned fund balance of $133.3 million was $6.2 million higher than the prior fiscal year.

As a measure of the General Fund’s liquidity, it may be useful to compare both unassigned fund balance and total fund balance to total fund expenditures. Unassigned fund balance of $133.3 million represents 55.9% of total fund balance, 70.6% of fund expenditures of $189.0 million, while total fund balance represents 126.3% of that same amount.

The fund balance of the City’s General Fund increased by $2.1 million during the current fiscal year. Total General Fund revenues decreased to $221.0 million, a decrease of $13.0 million over the prior fiscal year. The decrease is primarily due to decreases in intergovernmental revenues ($9.5 million) and charges for services ($3.5 million). Intergovernmental revenue decreased, primarily due to the receipt of $9.7 million in the ARPA (American Rescue Plan Act) grant fund in Fiscal Year 2022‐23, with no comparable large grants received in Fiscal Year 2023‐24. Charges for Services decreased, primarily due to a $1.3 million decrease in plan check fees revenue, resulting from reduced project activities, and the receipt of $1.1 million under an agreement with Google to reimburse the costs of two planners and two engineer limited‐term positions in the prior fiscal year.

General Fund expenditures increased by $5.4 million over the prior fiscal year, primarily due to the increase of $12.0 million in salaries and benefits costs, offset by a decrease in capital outlay of $6.5 million. The increase in salaries and benefits is due to positions added in Fiscal Year 2023‐24, merit and market salary rate adjustments, and pension contributions. The capital outlay decreased primarily due to the City’s $3.1 million contribution to residential development project at 777 West Middlefield Road and the addition of $3.8 million in leased assets in the prior fiscal year.

The following charts are graphical comparison between June 30, 2024 and 2023, for General Fund revenues by sources and expenditures by function:

Fiscal Year 2023‐24 General Fund Revenues by Source

Fiscal Year 2022‐23

Fiscal Year 2023‐24

Fiscal Year 2022‐23 General Fund

The Shoreline Regional Park Community Fund receives property taxes on properties within the Shoreline Community. The fund accounts for the revenues and expenditures of the Shoreline Community.

Revenues were $78.6 million for the fiscal year ended June 30, 2024, an increase of $14.2 million over the prior fiscal year. Revenues increased, primarily due to an $8.2 million increase in property tax revenues and a $6.1 million increase in investment earnings, driven by higher interest rates and unrealized gains during Fiscal Year 2023‐24.

Expenditures were $31.2 million compared to $28.5 million in the prior fiscal year. Of this amount, $25.4 million was expended on general government, which is $2.8 million higher when compared to the prior fiscal year.

In addition, $33.7 million was transferred out for capital improvement projects and debt service payments compared to $27.7 million in the prior fiscal year. The fund balance of $109.1 million as of June 30, 2024 is restricted for expenditures of the Shoreline Community.

The Housing Fund accounts for fees paid by developers to provide for increasing and improving the supply of extremely low‐, very low‐, low‐, and moderate‐income housing (affordable housing).

Revenues were $9.6 million for the fiscal year ended June 30, 2024, a decrease of $1.0 million from the prior fiscal year. The fund balance of $185.9 million is restricted for future affordable housing projects.

The General Capital Projects Fund accounts for all general capital improvements not funded from proprietary funds.

Revenues were $22.2 million for the fiscal year ended June 30, 2024, an increase of $19.2 million from the prior year, primarily due to $14.6 million increase in investment earnings and $5.0 million increase in intergovernmental revenue. Investment earnings increased as a result of higher interest rates and unrealized gains on investments during this fiscal year. The increase in Intergovernmental revenue was attributed to $1.7 million grants from Santa Clara County for the Magical Bridge Playground project and $2.3 million from Silicon Valley Transportation Measure B grants.

Expenditures were $54.9 million, which was $30.8 million less than the prior fiscal year. These funds were expended on capital outlay projects, including: Rengstorff Park Aquatics Center Replacement Design and Construction, All‐Inclusive Playground, and Rengstorff Park Maintenance and Tennis Buildings Replacement Design and Construction. The fund balance of $318.8 million is available to fund approved capital projects. The decrease in expenditures is attributed to the acquisition of 909 and 917 San Rafael Avenue property and the 87 East Evelyn Avenue lot, which took place in the prior fiscal year.

The Park Land Dedication Capital Projects Fund accounts for revenues derived from fees on residential subdivisions used for park and recreation projects.

Revenues were $3.8 million for the fiscal year ended June 30, 2024, a decrease of $13.9 million from the prior fiscal year. The decrease was primarily due to decreased developer contributions, which was partially offset by increased investment earnings. The developer contributions decreased due to the $16.1 million contribution received for the 777 West Middlefield Road project in the prior fiscal year. There was no expenditure incurred in the current year. The fund balance of $65.3 million is available for park and recreation projects.

Proprietary Funds—The City’s proprietary funds statements provide the same type of information found in the government‐wide financial statements but in more detail.

At the end of the fiscal year, the unrestricted net positions for the Water, Wastewater, and Solid Waste Funds are $61.6 million, $69.4 million, and $17.1 million, respectively. The total increase in net position for the enterprise funds from the prior fiscal year is $13.6 million. The net operating income of the Water Fund (negative $365,000) and Wastewater Fund ($5.3 million) decreased by $2.3 million and $2.4 million, respectively, when compared to the prior fiscal year. The decrease in the Water Fund is primarily due to the $4.0 million minimum water obligation payment, while the reduction in the Wastewater Fund is attributed to the higher usage at the Treatment plant. The Solid Waste Fund’s net operating income ($1.4 million) increased by $915,000 over the prior year. Factors concerning the finances of the enterprise funds have also been addressed previously in the discussion of the City’s business‐type activities. The internal service funds have an unrestricted net position of $38.9 million at June 30, 2024.

Fiduciary Funds—The City maintains fiduciary funds for fiduciary activities and assets held by the City in custodial capacity for the benefit of agencies outside of the City or employees. As of June 30, 2024, the assets of the custodial funds totaled $670,000, comparable to the prior fiscal year.

General Fund differences between the original Fiscal Year 2023‐24 budget and the final amended budget resulted in an increase of $651,000 in budgeted revenue (primarily related to Other Revenues) and a $13.4 million increase in expenditure appropriations. Approximately $7.7 million of the adjustment in expenditure appropriations is related to prior‐year encumbrances that carry forward at the beginning of the fiscal year as specified in the City Charter. An additional $1.5 million of appropriations was established for payment for building inspection and fire plan checking contract services related to development activity, which are cost‐recovered by fees paid by developers. An additional $1.7 million of appropriations was established for the payment of compensated absences. The balance of adjustments was made midyear for various operational needs not anticipated at budget adoption and grants or reimbursements received during the fiscal year.

General Fund actual revenues are $20.5 million or 10.2% higher than the final amended budget for the fiscal year. The variance is primarily due to the following revenues coming in higher‐than‐expected:

•Investment and lease interest income—$20.2 million higher (primarily noncash mark‐to‐market accounting adjustments for unrealized portfolio gains).

• Property tax revenues—$6.6 million higher.

•Other revenues—$1.0 million higher.

The above increases were partially offset by decreases in Other Taxes, Licenses, Permits and Fees, and Charges for Services.

Also contributing to the large variance is the City’s practice of analyzing and projecting revenues throughout the fiscal year but not typically adjusting the original revenue budget to match projections. In addition, the City does not generally budget for uncertain or one‐time revenues, such as Excess Educational Revenue Augmentation Funds (ERAF) and reimbursements, including adjusting the budget after receiving the revenue. Both of these practices can result in budgeted amounts that are much lower than actual amounts.

Actual expenditures for the General Fund are $34.4 million lower than the final amended budget for the fiscal year. The variance is primarily due to continued salary and benefit savings incurred from vacant positions and budgeted amounts for limited‐period funding, one‐time programs, and nondepartment costs being included in the final amended budget amounts, yet these types of costs are not typically fully expended within one year. It is anticipated that as the City ramps up recruitment of newly authorized positions and recently vacated existing positions, actual costs of salary and benefits will be more in line with budget amounts.

As a result of the higher than expected or budgeted revenues and expenditure budgets not being fully expended, the General Fund has experienced a positive budget versus actual variance.

Capital Assets

The City’s capital assets for its governmental and business‐type activities as of June 30, 2024 was $713.2 million (net of accumulated depreciation and amortization). Capital assets include land, leased assets, construction in progress, buildings, improvements other than buildings, machinery and equipment, subscription‐based IT arrangement (SBITA) assets, and infrastructure. The total net increase in the City’s capital assets as of June 30, 2024 is $30.3 million or 4.4%.

The change in capital assets, net of depreciation, for the governmental and business‐type activities are as follows:

Major capital asset activities during the current fiscal year included the following:

• Total capital assets increased by $30.3 million due to a net increase in assets of $67.6 million, offset by a $37.3 million net increases in accumulated depreciation and amortization.

• Construction in progress increased by $30.7 million. Some of the major projects worked on and/or completed during the year included: Rengstorff Park Aquatics Center Replacement Design and Construction, All Inclusive Playground, and Water and Sewer Replacement 101 at Two Locations Construction.

Additional information about the City’s capital assets is discussed in Note 6 to the financial statements.

As of June 30, 2024, the City had $163.6 million of outstanding noncurrent liabilities related to governmental activities and $12.5 million related to business‐type activities, for a total of $176.1 million. Noncurrent liabilities outstanding as of June 30, 2024, with a comparison to prior year and the net change, are as follows:

The decreases to noncurrent liabilities were primarily due to the reduction of SBITA liabilities and scheduled debt service payments offset partially by the increase in Landfill Containment and Compensated Absences.

The City Charter limits bonded indebtedness for General Obligation bonds to 15.0% of the total assessed valuation of all real and personal property within the City. The City has no general obligation debt outstanding as of June 30, 2024 and has maintained its underlying “AAA” issuer credit rating from Standard & Poor’s since July 2014.

Additional information regarding the City’s noncurrent liabilities is discussed in Note 7 to the financial statements.

• The local economy has fully recovered to prepandemic levels. However, local economic indicators are projecting stable revenues with slower‐paced growth anticipated in Fiscal Year 2024‐25. Uncertainty with inflation, interest rates, national and state economic policies, and geopolitical conflicts all contribute to the projected slower‐paced growth.

• Overall, property taxes for the City are expected to increase in the upcoming fiscal year based on increases in property taxes from new development, change in ownership, and the 2.0% increase in assessed value due to the positive California Consumer Price Index.

• Sales tax revenue is expected to be about the same as the current fiscal year. However, a moderate increase is projected for future years.

•Business License revenue is projected to experience a 7.4% decline compared to the current fiscal year due to known and potential layoffs. Utility Users Tax (UUT) is projected to be 29.9% higher than the current fiscal year, mainly because of a potential refund claim that City has recorded as payable in Fiscal Year 2023‐24, which significantly lowered the current year revenue. Transient Occupancy Tax (TOT) is projected to increase by 7.7% compared to the current year. This increase is primarily due to one hotel’s failure to remit taxes in the current fiscal year for three quarters, which the City did not record as TOT revenue in the current fiscal year. Business travel has stabilized and is expected to remain stable in the near future, leading us to anticipate a moderate increase in TOT revenue.

• Cost‐of‐service studies were conducted for all three utility funds during the past year. As such, rates were adjusted to reflect the cost of services rather than across‐the‐board rate increases. The Fiscal Year 2024‐25 adopted rates for the Water, Wastewater, and Solid Waste Management Funds varied due to rate structure adjustments being phased in over multiple years, with impacts differing based on account type and billed usage.

All of these factors were considered in preparing the City’s budget for Fiscal Year 2024‐25.

These financial statements are intended to provide residents, taxpayers, investors, and creditors with a general overview of the City’s finances. Questions concerning any of the information provided in this report or requests for additional financial information should be directed to the Finance and Administrative Services Department, 500 Castro Street, P.O. Box 7540, Mountain View, California, 94039‐7540, or financeadmin@mountainview.gov.

This page intentionally left blank

This page intentionally left blank

June 30, 2024

(Dollars in Thousands)

For the year ended June 30, 2024 (Dollars in Thousands)

Program Revenues

General Revenues:

Taxes:

Property taxes

Sales taxes

Transient occupancy taxes

Utility users tax

Nonregulatory franchise and business, unrestricted

Intergovernmental ‐ not restricted to specific programs

Investment income

Total taxes

Transfers

Total general revenues and transfers

Change in net position

Net position ‐ beginning of year

Net position ‐ end of year

GovernmentalBusiness‐Type

This page intentionally left blank

June 30, 2024 (Dollars in Thousands)

GovernmentalGovernmental FundsFunds

This page intentionally left blank

Reconciliation of the Governmental Funds Balance Sheet to the Government‐Wide Statement of Net Position

June 30, 2024

(Dollars in Thousands)

Amounts reported for governmental activities in the statement of net position are different because:

Capitalassetsusedingovernmentalactivitieswerenotcurrentfinancialresources. Therefore,theywerenotreportedintheGovernmentalFundsBalanceSheet. Exceptfortheinternalservicefundsreportedbelow,thecapitalassetswere adjusted as follows:

Internalservicefundswereusedbymanagementtochargethecostsofcertain activities,suchasinsurance,toindividualfunds.Theassetsandliabilitiesofthe InternalservicefundswereincludedingovernmentalactivitiesintheGovernment‐Wide Statement of Net

IntheGovernment‐WideFinancialStatements,deferredemployercontributionsfor pensionandOPEB,certaindifferencesbetweenactuarialestimatesandactual results,andotheradjustmentsresultingfromchangesinassumptionsandbenefits are deferred in the current year.

Long‐termliabilitieswerenotdueandpayableinthecurrentperiod.Therefore, they were not reported in the Governmental Funds Balance Sheet.

For the year ended June 30, 2024 (Dollars in Thousands)

FINANCING SOURCES (USES):

This page intentionally left blank

For the year ended June 30, 2024 (Dollars in Thousands)

Amounts reported for governmental activities in the Government‐Wide Statement of Activities were different because:

Governmentalfundsreportedcapitaloutlay asexpenditures.However,intheGovernment‐WideStatementof Activities, thecostofthoseassetswasallocatedovertheirestimatedlivesasdepreciationexpense.Thiswastheamountofcapital assets recorded in the current period, net of the amount related to internal service funds.

DepreciationexpenseoncapitalassetswasreportedintheGovernment‐WideStatementofActivities,butdidnotrequire theuseofcurrentfinancialresources.Therefore,depreciationexpensewasnotreportedasexpendituresinthe governmental funds, net of the amount related to internal service funds. (29,607)

Accrued compensated leave payments were reported as expenditures in the governmental funds, however expense is recognized in the Government‐Wide Statement of Activities based on earned leave accruals. (656)

Repaymentsoflong‐termdebtarerecognizedasexpendituresinthegovernmentalfunds.Inthegovernment‐wide statements,repaymentsoflong‐termliabilitiesarereportedasreductionsofliabilities.Expendituresforrepaymentof principal portion of long‐term debt were.

Currentyearemployer pensioncontributions arerecordedasexpenditures inthegovernmentalfunds,however,these amounts are reported as a deferred outflow of resources in the Government‐Wide Statement of Net Position.

PensionexpenseisreportedintheGovernment‐WideStatementof Activities doesnotrequiretheuseof current financial resources, and therefore is not reported as expenditures in governmental funds. (46,860)

OPEBexpenseisreportedintheGovernment‐WideStatementof Activities doesnotrequiretheuseof current financial resources, and therefore is not reported as expenditures in governmental funds. 1,359

Someexpensesreportedinthestatementof activities donotrequiretheuseof current financialresourcesandtherefore are not reported as expenditures in governmental funds

Internalservicefundswereusedbymanagementtochargethecostsofcertainactivities,suchasinsuranceandfleet management,toindividualfunds.Thenetrevenueoftheinternalservicefundswasreportedwithgovernmental activities. 2,535 Change in Net Position of Governmental Activities 85,177 $

For the year ended June 30, 2024 (Dollars in Thousands)

Amounts

Statement of Revenues, Expenditures and Changes in Fund Balances

Shoreline Regional Park Community

For the year ended June 30, 2024 (Dollars in Thousands)

Statement of Revenues, Expenditures and Changes in Fund Balances

For the year ended June 30, 2024 (Dollars in Thousands)

June 30, 2024 (Dollars in Thousands)

Business-Type Activities

Statement of Revenues, Expenses and Changes in Net Position

Proprietary Funds

For the year ended June 30, 2024 (Dollars in Thousands)

AND TRANSFERS:

For the year ended June 30, 2024 (Dollars in Thousands)

For the year ended June 30, 2024 (Dollars in Thousands)

For the year ended June 30, 2024 (Dollars in Thousands)

This page intentionally left blank

This page intentionally left blank

Notes to Basic Financial Statements

For the Year Ended June 30, 2024

The City of Mountain View (City) was incorporated in 1902 and is a charter city, having had its charter granted by the State of California in 1952. The City operates under the Council‐Manager form of government and provides the following services: public safety (police, fire, and paramedic), public works, utilities (water, wastewater, and solid waste), community development, cultural and recreation services and administration and support services.

The accompanying basic financial statements present the financial activities of the City, which is the primary government presented, along with the financial activities of its component units, which are entities for which the City is financially accountable. Although they are separate legal entities, blended component units are in substance part of the City's operations and are reported as an integral part of the City's financial statements. The City's component units, which are described below, are all blended.

The Mountain View Shoreline Regional Park Community (Shoreline Community) ‐ is a separate government entity created for the purpose of developing approximately 1,550 acres of bayfront lands. The Shoreline Community’s governing board is the same as the City and the City’s management has operational responsibility for the Shoreline Community. Its financial activities have been blended in the accompanying financial statements in the Shoreline Regional Park Community Special Revenue Fund and the nonmajor debt service funds. Separate financial statements for the Shoreline Community are also included as a component of the City’s Annual Comprehensive Financial Report.

The City of Mountain View Capital Improvements Financing Authority (Financing Authority) ‐ is a separate government entity whose purpose is to assist with the financing or refinancing of certain public capital improvements within the City. The Financing Authority’s governing board is the same as the City, the Financing Authority provides services solely to the City, and a financial benefit/burden relationship exists between the City and the Financing Authority. Its financial activities have been blended in the accompanying financial statements in the nonmajor debt service funds. Separate financial statements for the Financing Authority are not required and therefore, not issued.

The City’s basic financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. The Governmental Accounting Standards Board (GASB) is the acknowledged standard setting body for establishing accounting and financial reporting standards followed by governmental entities. These standards require that the financial statements described below be presented.

The Statement of Net Position and the Statement of Activities display information about the primary government (the City and its component units). These statements include the financial activities of the overall City government, except for fiduciary activities. Eliminations have been made to minimize the double counting of internal activities. These statements distinguish between the governmental and business‐type activities of the City. Governmental activities generally are financed through taxes, intergovernmental revenues and other nonexchange transactions. Business‐type activities are financed in whole or in part by fees charged to external parties.