New bank is born Berkshire Bank and Brookline Bank plan a $1.1 billion “merger of equals.”

What will the future hold? Pages 2-4

Paul Perrault PROVIDED PHOTO

New bank is born Berkshire Bank and Brookline Bank plan a $1.1 billion “merger of equals.”

What will the future hold? Pages 2-4

Paul Perrault PROVIDED PHOTO

JANUARY 2025 I VOL. 4, NO. 1

BY MATT MARTINEZ

The Berkshire Eagle

LENOX — They say lightning never strikes the same place twice.

At the Electric Power Research Institute’s Transmission and Distribution Laboratory, lightning strikes as many times as it likes — just not in bolts, per se.

For the electrical engineers working at EPRI, conjuring electric surges to rival a summer storm is a routine matter.

The 37-acre compound is home to three “impulse generators” — imposing structures that can generate high-voltage surges at will. The tallest is a massive green polygon similar in size to a grain elevator, housing 56 capacitors aligned on top of each other and capable of generating up to 5.3 megavolts. One megavolt — a unit of electric potential equal to 1 million volts — is enough to power 8,000 household outlets.

Researchers use that power to simulate a strike of lightning on a power transmission line or conductor, explained Andrew Phillips, vice president of transmission and distribution in-

frastructure for EPRI. The simulation comes in handy for utility companies when testing the durability of equipment against power surges in the field.

That’s one of more than 100 tests taking place at the facility, Phillips said. Many of the other tests have a similar goal: To maximize the safety and efficacy of our nation’s power grid and to gird it to withstand environmental threats.

The EPRI laboratory, located at 115 East New Lenox Road, can simulate a variety of situations. At one corner of the laboratory grounds, a levered pole is rigged strategically to bludgeon a set of power lines, simulating the impact of a fallen tree.

In another, a group of composite insulators — vital equipment for controlling the flow of current in an electric circuit — is battered with rain, salt and ultraviolet light in a “rapid aging chamber” that can simulate a decade’s worth of wear in a single year.

The goal there is to see how long the composite insulators hold up — some have lasted up to 70 years, Phillips said. The durability of composite insulators has increased thanks to improvements made by manufacturers based on the research. When such tests first started in the 1990s, most composite insulators didn’t last more than two years in the chamber.

That’s a fraction of the work that goes on at the Lenox laboratory, which is in a class of its own among its contemporaries, according to Phillips. He would know. In the same way devoted baseball fans make pilgrimages to baseball parks, Phillips visits the best high-voltage labs in the world.

“There’s no lab that does what this does in the U.S.,” Phillips said. “And there’s really maybe two other ones in the world that do what this does.”

EPRI, Page 9

BY JANE K AUFMAN

PITTSFIELD — The parent companies of Berkshire Bank and Brookline Bank have agreed to a “merger of equals” in the second half of 2025.

The all-stock transaction is valued at approximately $1.1 billion.

The merger of the two banking powerhouses — Berkshire Hills Bancorp and Brookline Bancorp — will create an institution with approximately $24 billion in assets, $18 billion in total deposits, $19 billion in total loans and more than 140 branches across five states.

The merger will allow both publicly held banks to increase their scale and enhance their performance under a new name — and at a $10.8 million cost to market that new brand.

The merged bank will be led by Brookline Bancorp president and CEO Paul Perrault, topping a six-man executive team, with three from Berkshire and three from Brookline.

Nitin J. Mhatre, Berkshire Bancorp’s CEO since January 2021, is not on the flow chart and will exit when the merger closes.

The two banks took five months to perform their due diligence prior to making the announcement.

Shareholder value was top of mind among the bank executives during a web call held jointly by the two banks.

Deposits held by rural customers, mostly customers of Berkshire Bank — at less competitive and lower interest rates than in more competitive urban markets, mostly held by Brookline — are paramount to bolstering shareholders’ earnings.

Mhatre said, “Stable funding that comes from some of these smaller rural markets ... [will] support the lending in the faster growing metro markets.”

He continued, “So I think there is a little bit of an advantage for us … compared to now similar sized banks that have maybe tighter footprints and maybe don’t have that advantage.”

Berkshire Bank has closed some of its branches in recent years, most notably the only bank in Otis in 2023 despite public outcry.

Will there be more or fewer branches under the merger?

“You’re always doing some pruning,” Perrault said. “Maybe you’re closing one. Maybe you’re opening one or moving one. And so I would expect that, that pattern would continue with the en-

BEN GARVER

Berkshire Bank’s parent company, Berkshire Hills Bancorp, has announced it is merging with Brookline Bancorp.

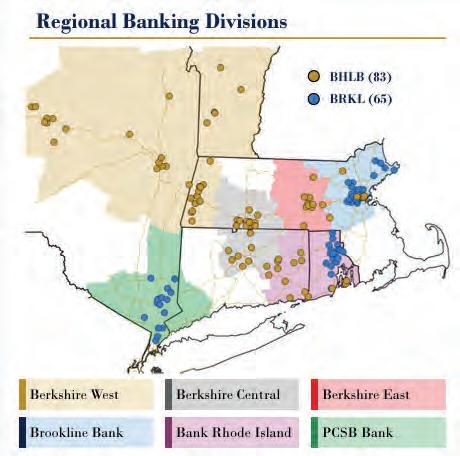

This screenshot shows the six regions that will be served by a merged Berkshire Hills Bancorp and Berkshire Bancorp if a merger is approved by the U.S. Securities and Exchange Commission.

BERKSHIRE HILLS BANCORP AND BROOKLINE BANCORP SCREENSHOT

larged footprint.”

The merged bank will be divided into six regions and led by three regional presidents from each company. Berkshire County would join a region that includes Vermont and much of Northern New York.

Chuck Leach, president and CEO of Lee Bank, listened to the conference call and said he heard “nothing Earth-shattering” on the call.

“To me, I think it just further defines the distinction between a community bank and a publicly traded bank,” he said. “We’re just focused on our own backyard, on our community, on our customers. We don’t have to be concerned with creating shareholder value year after year.”

John Bissell, president and CEO of Greylock Federal Credit Union, said there’s a place for large-scale banks in the North-

east as backers of major development. He contrasted that with the role of smaller financial institutions, which cycle money through the local economy.

“I’m grateful for the work of Berkshire Bank Foundation in

turning some of those profits into philanthropy here locally,” Bissell said. “It’s been very generous and provided a leadership role over the years, and I hope that continues to benefit our region in the years to come.”

Leadership team

Under the merger, the top leaders of a combined Berkshire Hills Bancorp and Brookline Bancorp will be:

David Brunelle, chair; Paul Perrault, president and CEO;

Carl Carlson, chief financial o cer; Sean Gray, chief operating o cer; Michael McCurdy, chief banking o cer; Mark Meikeljohn, chief credit o cer; Jacqueline Courtwright, chief human resources o cer; Ashlee Flores, chief risk o cer.

In addition, six people will serve as regional presidents. These are their names and current roles:

Darryl Fess, president and CEO of Brookline Bank; Michael Goldrick, president and CEO of PCSB Bank;

James Hickson, senior managing director – middle market and regional president of Berkshire Bank;

Elizabeth Mineo, managing director – private banking of Berkshire Bank; James Morris, market president of New York and managing director –commercial real estate of Berkshire Bank; William Tsonos, president and CEO of Bank Rhode Island.

Brookline Bancorp is a multibank holding company for Brookline Bank, Bank Rhode Island, PCSB Bank and their subsidiaries. Headquartered in Boston, it has $11 billion in assets and 65 branches throughout Massachusetts, Rhode Island and New York.

Berkshire Hills Bancorp Inc. is the parent company of Berkshire Bank, which operates in New England and New York. With $11.6 billion in assets and 83 financial centers, Berkshire is headquartered in Boston. Berkshire Bank was founded in Pittsfield Feb. 6, 1846.

The merger will be subject to SEC approval.

By Jane K aufman

A day after Berkshire Bank’s parent company announced a $1.1 billion “merger of equals” with Brookline Bancorp, the leader of the potential powerhouse spoke with The Berkshire Business Journal.

Paul Perrault is CEO and chairman of the board of Brookline Bancorp. He will serve as president and CEO of the new entity.

The deal is subject to SEC approval and is expected to close in the second half of 2025.

This account has been edited for clarity and brevity:

THE JOURNAL: What will the merger’s impact be on the Berkshires — including southern Vermont, northern Connecticut and eastern New York?

PERRAULT: I frankly don’t think it’s going to be very much, but one of the overriding reasons for this deal is that Berkshire Hills moved from Pittsfield headquarters to Boston headquarters a few years ago. We’re going to organize this new company into six regions, one of which will reestablish Pittsfield as one of the one of those six.

THE JOURNAL: Who will be the president of the Berkshire West region, which incorporates parts of eastern and northern New York as well as southern Vermont?

PERRAULT: We’re still sort of sorting that out. There are different candidates that we’re getting to know.

THE JOURNAL: Will the

name Berkshire Bank remain?

PERRAULT: The holding company and the bank will be getting a new name.

THE JOURNAL: Affordable housing is often listed as the top challenge facing the Berkshires. What role will the merged bank play?

PERRAULT: Brookline has a history of being very active in buying tax credits for affordable housing projects. So, we are likely to get involved both in purchasing the tax credits. But also, we have a very robust commercial real estate lending operation, and so we would have interest in doing the construction finance. So I think it bodes well for the Berkshires.

THE JOURNAL: Will anyone in the Berkshires lose their jobs as a result of this merger, particularly back office support, where there may be redundancies between the two entities?

PERRAULT: I don’t know enough about who does what, where, [in] what appears to us to be a pretty spread out kind of support in Berkshire for their operations. But I can’t say that there won’t be some impact.

THE JOURNAL: [Recently] you spoke of “pruning” bank branches as a strategy. Will that happen in the Berkshires?

PERRAULT: It is unlikely that there would be material changes in the branch structure in Berkshire County. Having said that, I do have a history of trying to modernize where our branches are because traffic patterns change. We are not there to close branches. There’s no over-

Paul Perrault, chairman and CEO of Brookline Bancorp, said a merger with Berkshire Hills Bancorp “bodes well for the Berkshires.”

laps. So I don’t think anything material will happen, certainly not for a long time.

THE JOURNAL: Can you talk about the importance of rural deposits to the strength of the merged entity?

PERRAULT: Our experience tells us that when you get away from the large urban areas, people’s behaviors seem to be a little less hyperactive about moving their money into the highest rate accounts, a little bit. It’s not massive, but somebody in a rural area seems to just handle their checking account and their savings account, whereas in a large urban area they might more aggressively try to move

that money into a CD.

THE JOURNAL: What will happen to Berkshire Bank Foundation? Does Brookline Bancorp have a similar foundation?

PERRAULT: I don’t know enough about the foundation to suggest that maybe we can do more, but we certainly have no plans to reduce. Brookline does not have a foundation, but Berkshire’s will survive the transaction.

THE JOURNAL: Will Nitin J. Mhatre, Berkshire Hills Bancorp CEO since January 2021, exit?

PERRAULT: This banking model is one that I have perfected over 30 years, this regional model. Their board and our board felt it’s appropriate that we lead the way to execute on it. Nitin will be well taken care of, and he’ll go on to some new adventure when the deal closes.

THE JOURNAL: What’s the history of this deal?

PERRAULT: Years ago, [in about 2019] I had talked to their then-Chairman [Bill Ryan], who was a friend of mine, about maybe putting it together. At that time, their board had no interest in looking at a combination because they were a bit troubled. Earlier this year, one of their newer directors asked the management if it was OK for them to approach me and talk about this merger of equals idea. She did, and I was interested, and we pursued it.

THE JOURNAL: How does merging help Brookline Bancorp?

PERRAULT: We are fortunate in that our banks and operating companies are prolific origination machines. I’m exaggerating a little bit. We’re very good at it in commercial banking. Funding those loans has become a bit of a challenge. We fund a lot of these loans with wholesale borrowings. It’s OK, but it’s expensive, and it’s something that the regulators keep an eye on.

We have a history of being expert in lending into commercial real estate — things like office buildings and apartment buildings. And in the current environment, that’s out of favor in the investor marketplace, and by the regulators. Both of those things get quite tempered when you put these two companies together. This has the effect of reducing the relative amount of real estate that the entire company has.

THE JOURNAL: And how will it help Berkshire Bancorp?

PERRAULT: In order to make money, banks need to make loans. We are very good at doing that. Them, less so.

THE JOURNAL: Would you back development in the Berkshires?

PERRAULT: We would certainly back the right sponsors of development. There’s a lot of tourism out that way. We’ve got nice niche businesses on Martha’s Vineyard, Nantucket. We do a lot in Newport, Rhode Island, and so we would look to bring that expertise there.

By Jane K aufman

PITTSFIELD — After Berkshire Bank’s parent company merges with Brookline Bancorp in 2025, one of the most notable changes might be the level of autonomy the six regional presidents will have.

“Each president will actually run a business unit,” said Matthew Emprimo, senior vice president at Berkshire Bank and commercial team leader for Berkshire County and Vermont regions. “So Berkshire West will be its own profit center, and that president will be responsible for the profitability of that region.”

Emprimo was one of three Berkshire County-based employees of Berkshire Bank who talked with The Journal about the $1.1 billion merger and what it will mean for Berkshire Hills Corp’s 1,200 employees and for Berkshire County customers.

The “merger of equals” is subject to SEC approval.

Decisions about branch closures and openings now made by a retail team leader at the corporate level will ride with the presidents, according to Lorelei Gazzillo Kiely, who is currently Berkshire Bank’s regional president in Pittsfield.

“That regional president will have a lot of authority to say, ‘I think we should have a branch here or there,’” Kiely said. “So it will be someone local that we’ll be working with.”

The newly envisioned Berkshire West region, the largest geographically of the six regions under the new entity, will encompass Berkshire County, southern Vermont and northern New York. Six names have been released as regional presidents — three from Berkshire and three from Brookline — but the decision as to who will lead each region hasn’t yet been finalized.

As to the Berkshire West region, “I think it’s going to be Jim Morris,” said Paul Perrault, who is chair and CEO of Brookline Bancorp and will be president

and CEO of the merged entity. Morris is now Berkshire Bank’s regional president for New York state.

In the meantime, Kiely said, “We feel we’re right-sized here in Berkshire County with our 12 branches.”

In fact, Berkshire Bank is investing in renovation projects at four Berkshire branches — in Lee, Lenox and at two Pittsfield branches on Cheshire Road and Elm Street.

“There are plans to renovate additional branches into the future, next year and the year after,” Kiely said.

Kiely will continue in her role as a key leader for Berkshire County employees as well as in her position as director of Berkshire Bank Foundation, running

philanthropy for the corporation.

“We provide over $2 million in funding each year to organizations throughout our footprint, and the large majority of that funding is provided right here in Berkshire County,” Kiely said.

Gary Levante, chief communication and sustainability officer, said Brookline also has a commitment to its communities.

He said in conducting the five-month due diligence, the two banks found they have complementary regions and cultures as well as operating philosophies.

“I think this merger is also going to bring together the best of both of those cultures, the best of those operating philosophies, so that we can tackle issues like affordable housing here, building

on the strengths that we already have at Berkshire Bank and their strengths to really tackle and address these issues,” Levante said.

From his standpoint as a commercial loan officer, Emprimo said the merged entity will allow more capital to flow into the Berkshires.

“It’s going to increase lending capacity,” he said, adding there will be “a broader breadth of loan products, of financial solutions than what we would have been able to offer just as Berkshire Bank alone.”

Employees at Berkshire Hills Bancorp were notified in a video meeting.

“This is a multi-month process where we’re getting now an even deeper understanding of each company’s operating environment, how they do business, and identifying all of the roles of the new company,” Levante said.

As for Berkshire Bank employees, “Really it’s business as usual.”

As a next step, a business integration team made up of people from both companies will ramp up over the next several months, Levante said.

“Ultimately, what impact that has on employees, it’s still really early to tell, because there will be opportunities for employees to step into new and expanded roles,” Levante said. “There will be more career mobility for employees at a much larger organization. So there’s also a lot of benefits that come along with a transaction like this for employees.”

Emprimo said Berkshire Bank employees are used to adjusting to new partnerships.

“This is not new to us,” he said. “We did 10 transactions in 10 years.”

Both Kiely and Levante said they sense excitement among employees.

“We are very strong here, and we look forward to continuing to be strong,” Kiely said. “I think people feel good about that, knowing that this is a very important market for the bank.”

PITTSFIELD

BIC appoints experts to board of directors

The Berkshire Innovation Center has appointed two new members to its board of directors: Tanja Srebotnjak, executive director of The Zilkha Center for the Environment at Williams College, and Garth Klimchuk, founder and managing partner at NorthRenew Energy.

Both are already actively involved in the mission of the BIC and bring a range of expertise that will be critical to the organization as it grows and evolves.

Srebotnjak has worked on sustainability strategy and operations and in a variety of settings. She obtained undergraduate and graduate degrees in statistics from Dortmund Technical University, Germany, and the University of Auckland, New Zealand, before joining the UN Statistics Division to work on environmental statistics and indicators. She later pursued doctoral research in environmental statistics and policy from the Yale School of the Environment and was the director of the Yale-Columbia Environmental Performance Index.

Since then, she has led research, education and strategic initiatives to address sustainability, climate and environmental health issues in academia and K-12 education as well as for environmental advocacy and think tank organizations in the U.S. and Europe.

Klimchuk has over 35 years of project development and financial advisory experience across the broad energy spectrum, with the last 15 years dedicated exclusively to renewable energy. As a developer, investment banker, CFO and consultant he has executed financial and strategic solutions representing over $10 billion in transaction value for companies ranging from startup to Fortune 100.

Prior to NorthRenew, he was founder and managing partner of NorthWinds Advisors, a financial advisory firm and broker-dealer. Through his broad responsibilities on behalf of his clients, he was engaged in deep due diligence and negotiation processes across a wide range of renewable energy projects and technologies.

Garth holds an MBA from The Wharton School, a master of arts degree in Energy Management and Policy from the University of Pennsylvania and a bachelor of science in geology from Brown University.

The American Bankers Association Foundation has honored Berkshire Bank for its dedication to economic inclusion with the foundation’s Community Commitment Award, which recognizes banks for extraordinary corporate social responsibility activities.

Specifically, the award recognized Berkshire’s Community Comeback program for providing $5 billion in lending, investment and technical assistance, an increase of approximately 70 percent over three years.

The Community Comeback focuses on four key areas: fueling small businesses; community financing and philanthropy; financial access and empowerment; and environmental sustainability. It has helped consumers realize the dream of homeownership, improve financial outcomes, create jobs, redevelop neighborhoods, and build a more equitable and sustainable future.

Community Commitment Award winners must embody banking at its best and demonstrate success in measurable terms. The awards selection committee, comprised of independent national experts, reviewed bank nominations from across the country and chose winners based on specific criteria, including the creativity and thoughtfulness of the program.

GREAT BARRINGTON

Flying

Flying Cloud Institute has received an $8,000 matching challenge gift from a summer camp family, which allowed donations received by Flying Cloud on Giving Tuesday, Dec. 3, to be doubled, up to $8,000.

All funds raised will enable Flying Cloud to run its innovative science and art programs at two local Berkshire County schools, offering in-school science residencies and after school workshops to area youth.

Flying Cloud educators will lead project-based investigations and model the Next Generation Science Strategies for inquiry-based learning. They will bring local STEM (Science, Technology, Engineering and Math) professionals as expert resources to the classroom, along with local artists who help students express their learning through original, creative work such as sculpture, dance, poetry, painting, or film.

GREAT BARRINGTON Berkshire Bounty awarded challenge grant

Berkshire Bounty, a nonprofit food rescue organization, has received a challenge grant from Warrior Trading, an online educational platform that offers a wide range of courses, training programs and software for individuals interested in day trading.

Donations up to $5,000 to Berkshire Bounty on Giving Tuesday were matched dollar for dollar by Warrior Trading.

Berkshire Bounty’s goal was to raise $100,000 by the end of 2024. Berkshire Bounty was to follow up Giving Tuesday fundraising with a crowdfunding campaign in which it will reach out to supporters to complete that goal.

For more information or to inquire about making an online or offline donation, contact Sara Haimowitz, Berkshire Bounty director of development, at sara@berkshirebounty.org.

STOCKBRIDGE Grinspoon funds access to

In a move to provide in-depth mental health care to emerging adults living in Massachusetts, philanthropist Harold Grinspoon has gifted $250,000 to the Austen Riggs Center to support the Riggs Online Intensive Outpatient Program. The funding, which Riggs is matching, will provide $500,000 for up to 13 weeks of treatment to 16 individuals over the course of the coming year.

The Online IOP serves individuals residing in Massachusetts between the ages of 18 and 30 and features nine hours of group meetings and two hours of individual psychotherapy with a doctoral-level clinician each week. In addition, it offers medication management, family therapy and coordination with other mental health resources, all of which are integrated in three times a week multidisciplinary team meetings.

The establishment of the Harold Grinspoon IOP Patient Aid Fund seeks to broaden access to the Online IOP by supporting prospective patients who lack either enough private funding or sufficient insurance coverage to pay for the program.

The Online IOP is accepting applications for admission and support via the Grinspoon fund. To find out more or to apply, call Jessi Nolet, Online IOP Program coordinator, between 8:30 a.m. and 5 p.m. weekdays at 833-921-5700 or via tinyurl.com/37b46yxn.

LEE

Canna Provisions wins awards for cannabis line

Canna Provisions has announced that its exclusive cannabis line, Smash Hits Cannabis, has achieved dual honors in the 2024 Leafly Budtenders’ Choice Awards for Massachusetts.

Chem D, an iconic strain cultivated by Smash Hits, was named by Massachusetts budtenders to be Strain of the Year, while Smash Hits itself was crowned Cannabis Flower Brand of the Year.

Previously, Chem D was chosen as the top strain in the 2023 Budtenders’ Choice Awards for Massachusetts as well, making this the latest in back-to-back wins for Canna Provisions and Smash Hits.

Greg “Chemdog” Krzanowski, director of cultivation for Canna Provisions, oversees the entire Smash Hits cannabis line from seeds to harvest and quality control of the final product.

Canna Provisions, an employee-owned, award-winning cannabis dispensary, operates retail stores in Lee and Holyoke.

GREAT BARRINGTON Center for Justice earns paralegal program grant

The Berkshire Center for Justice has been awarded a $5,000 grant from the Jewish Women’s Foundation of the Berkshires to support BCJ’s paralegal position.

The paralegal provides case assistance for center’s legal and wraparound community services for underrepresented low-income residents. The center offers six free legal clinics each month at Pittsfield and Great Barrington locations, and on the phone.

The Center for Justice is a nonprofit, charitable organization that provides legal, educational, social referrals and mentoring services that promote social and community justice. It was founded in 2006 by attorney Eve Schatz.

To support the organization’s justice programs, donations can be made at BerkshireCenterforJustice.org, or call 413-854-1955 for more information and volunteer opportunities.

Carr Hardware customers in Lenox and Pittsfield raised $1,856.35 through the company’s round-up initiative, directly benefiting the local Thanksgiving Angels program. The donation helped provide holiday meals for over 2,000 families in Berkshire County.

Throughout the month of October, Carr Hardware hosted a round-up campaign at its Lenox and Pittsfield locations, encouraging customers to round up their purchases to the nearest dollar.

The funds collected through this initiative were donated to the South Community Food Pantry’s Thanksgiving Angels program, which has been serving local families for years. The program works to ensure that families in need across Berkshire County can enjoy a full Thanksgiving meal, complete with all the traditional trimmings.

BHS is among Top 100 Women-Led Businesses

The Women’s Edge, together with its partner The Boston Globe, recently announced that Berkshire Health Systems was again named one of the annual Top 100 Women-Led Businesses in Massachusetts.

The 100 organizations honored generated over $124 billion in total revenue in 2023, demonstrating that women leaders continue to be key drivers of the state’s economy. This is the second year in a row that BHS has been recognized.

“On behalf of the more than 4,000 dedicated health care professionals that serve Berkshire County and the surrounding region, we are very grateful to The Women’s Edge and Boston Globe for this recognition,” said Darlene Rodowicz, president and CEO of Berkshire Health Systems.

This is the 24th year that The Women’s Edge — a Boston-based nonprofit organization devoted to advancing women in leadership positions created the list through a nomination process and reviewed both for-profit and not-forprofit organizations, and the 12th year that the list was created in collaboration with The Boston Globe.

In addition to revenue or operating

budget, factors considered in the evaluation included workplace and management diversity, board makeup and innovative projects.

PITTSFIELD

1Berkshire announces tech assistance cohorts

1Berkshire has announced its upcoming slate of technical assistance offerings through the Berkshire Economic Recovery Program.

The winter 2025 program includes three cohorts: “Building a Social Media Marketing Strategy” (full; waitlist open); “Let’s Jumpstart Your Crowdfunding Campaign”; and “Let Robots Do The Work: AI Tools for Small Business Success.”

These cohorts will each provide up to seven participating organizations/businesses support through a two-hour kickoff workshop and resources, followed by up to two additional hours of one-onone direct targeted technical assistance by a paid provider.

1Berkshire, through competitive grant funding from the U.S. Department of Agriculture, is able to provide this high-impact service at no cost to businesses, entrepreneurs and organizations located in any of the 32 cities and towns of Berkshire County, representing a more than $1,000 direct value per business in each cohort.

Through its series of cohorts spanning nearly four years, the Technical Assistance series has been able to support more than 200 businesses through targeted training and focused convenings, resulting in notable business improvements, and quantified by over $2,500,000 in funding collectively accessed by businesses through their participation.

For details and to register, bit.ly/ BERPTA. For more information or additional inquiries, email EconomicDev@1berkshire.com.

Afreemonthlypublicationby TheBerkshireEagle 75SouthChurchStreet, Pittsfield,MA01201

Visitberkshirebusinessjournal.comfor advertisinginformationandtosubscribe.

NEWSDEPARTMENT 413-447-7311 news@berkshireeagle.com

ADVERTISINGDEPARTMENT

AMYFILIAULT,AdvertisingManager 413-496-6322 afiliault@berkshireeagle.com

CHERYLGAJEWSKI,Directorof AdvertisingSales 413-841-6789,413-496-6330 cmcclusky@berkshireeagle.com

ShareyournewswiththeBerkshire BusinessJournal. Ifyouhaveacompany promotion,anewbusinessoranewventure,let theBerkshiresknowaboutit.Rememberthe 5Wsandthatbrieferisbetter.Emailtextand photostoBBJ@newenglandnewspapers.com. ProvideyourexpertiseintheBerkshire BusinessJournal. Doyouhavetheanswer toapersistentquestionaboutbusiness andtheBerkshires?Doyouhaveideasand suggestionsonhowourbusinesscommunity cangrow?Ifyouhaveacommenttomake aboutdoingbusinessintheBerkshiresor ifyou’relookingtoraiseanissuewiththe businesscommunity,thisisthevenuefor that.Wewelcomelettersupto300wordsand commentaryupto600words.Sendtheseto BBJ@newenglandnewspapers.com

BerkshireBusinessJournalispublished monthlybyNewEnglandNewspapersInc., 75S.ChurchSt.,Pittsfield,MA01201. PeriodicalspostagepaidatPittsfield,MA01201. BerkshireBusinessJournalisdeliveredfree tobusinessesinBerkshireCountyviathird classmail.Additionaldistributionismade viadrop-offatselectareanewsstands.The publisherreservestherighttoedit,rejector cancelanyadvertisementatanytime.Only publicationofanadvertisementshallconstitute finalacceptanceofanadvertiser’sorder.All contentsarecopyrightedbyNewEngland NewspapersInc.

By Jane Kaufman

LEE — Baja Charlie’s California Cuisine is closed, and a new restaurant will soon open in its place.

Last week, Baja Charlie’s owner Charles Hebler sold the furniture, fixtures and equipment at his restaurant at 62 West Center St. for an undisclosed price to Emre Semerci. The new restaurant, Lee Corner Kitchen, will offer American fare.

Hebler, who owned Baja Charlie’s for its 12-year run, said he began thinking about a change in his career as he approached the age of 65. The closing of the restaurant not only marks the end of the eclectic California Mexican cuisine in Lee, but also the beginning of a new cooking chapter for Hebler.

Hebler is planning to return to catering, where he launched his career in 1989 with the Rolling Stones Steel Wheels Tour. He’s looking at mobile kitchens and plans to launch his as-yet-unnamed catering business in the spring.

The restaurant has been “temporarily closed” since September when Hebler placed a classified ad in The Berkshire Eagle in for the “turnkey restaurant” with lease available.

In October 2021, Hebler had a life-threatening accident on his mountain-bike — flipping over a fence on Route 102 he didn’t notice.

He closed the restaurant for six months during his recovery. He said he’s particularly grateful to customers who returned when he reopened.

Since then, he hasn’t felt up to the daily grind and pressure that running a restaurant poses, and he looks forward to being able to pick his gigs.

While his first job, at his

grandparents’ business, The Cheshire Store, included making hot dogs, he didn’t discover a passion for food until his first year of college.

Born in Pittsfield, Hebler graduated from Pittsfield High School in 1977. After graduating, he enrolled at the University of California at Los Angeles, studying English. A course on Italian cooking lit him on fire. His father, Gordon Chestnut, had also studied at Cordon Bleu in Paris, influencing his decision to switch

from the classroom to the kitchen. Hebler left UCLA and graduated from Ma Cuisine Cooking School in Newport Beach, Calif., in 1987, then talked his way into a year-long apprenticeship at renown chef Michel Richard’s Citrus in Los Angeles. He was thrown onto the meat station of the Michelin-star-rated restaurant after Richard threw out a chef for ruining a steak.

Working with business part-

ner and neighbor, Terry Shapiro, he left that apprenticeship to cook for the Steel Wheels Tour.

Since then he’s cooked for dozens of bands, including the at Woodstock ‘94, Tanglewood and for Lollapalooza.

Once a 50-pound bag of ice split as he was carrying it into Billy Joel’s dressing room. The piano man took it in stride, breaking into a tap dance. He was moved when Elton John sent gifts of toys and teddy bears for his daughter after he sent

Owner Charles Hebler is planning to return to catering, where he launched his career in 1989 with the Rolling Stones Steel Wheels Tour.

John a letter and drawing she’d made for him.

Hebler met Shirley White on Laguna Beach and the two married in Lake Forest, Calif. When their daughter, Alex, was young, the two divorced. Hebler returned to the Berkshires, partly motivated by what he perceived to be better schools for her. He opened Napa California Cuisine in Lenox, which he ran as a restaurant for 12 years prior to opening Baja Charlie’s in 2012.

He later married Kelly Simmons, a retired teacher, and the two live in Lee. Would he live his life the same way if he had the chance to do it over again?

“There’s ups and downs to everything in everything in life,” he said. “I love music. I chose to cater bands because I loved the people who created the music, working for them, making them happy.”

He said he enjoyed particularly working with young talent, “who were just getting up there and getting behind them and giving them the best catering we could, give them more than they asked for.”

Having been through his neardeath experience, he feels certain of one thing.

“There’s purpose to life,” he said. “After my accident, life is about servitude.”

By Jane K aufman

BECKET — A year after opening the Becket Country Store, owner Ryan Eley is planning to expand the retail operation, add gas pumps and — eventually — a fastcharging station for electric vehicles.

Eley has helped out many drivers whose tanks are low and don’t want to risk making the drive from his store to Papa’s Healthy Food & Fuel 8.2 miles away. He’s planning to have three gasoline terminals and one diesel, with a total of six pumps for cars and trucks.

“I’ve topped people off with my own personal [gas] can probably a half dozen times,” he said. “All the time, people get stuck out here.”

Eley already has approval from Eversource to run the necessary three-phase power from Route 8 in order to power the fast-charging station, similar to those on the Massachusetts Turnpike. However, money has dried up to subsidize the project at a level of 75 percent to 90 percent, so he’ll wait for another round of government funding to pursue that part of the plan.

Eley said if he gets approval this winter from the town, he’ll get started in 2026 on the gas station.

In the meantime, he’s also planning to add floor space to the store from an office area at the back end, of the building, using most of the 3,100-square-foot building for retail.

He gutted the interior and did exterior and site work prior to opening Dec. 1, 2023.

He envisioned the space as a community hub and plans to add ice cream cones

JANE KAUFMAN

He’s hoping to get a list of all the necessary steps for approval before embarking. He wants to add space on the package store side of the business as well as provide more retail space.

While he doesn’t know exactly how much it will cost, he says he has a ballpark idea.

While Eley opened Dec. 1, 2023, he didn’t get a liquor license until April.

“It’s not been a full year of full operation but yeah, it was pretty good,” he said. “The summer was about what I thought it would be. We’ll see how this winter is having the liquor license. ... Good enough to keep going. But I think the gas station is really what would lock in the traffic.”

Getting up and running took more time than Eley expected.

“There’s a lot of regulation for a business like this,” said Eley, who found his initial efforts to open frustrated by the permitting process he wasn’t familiar with or prepared for. “It’s been tough to kind of square in on first, what is it that we’re required to do and how do we do it and then how do we finance doing it.”

Without a public water supply, the state Department of Environmental Protection and local Board of Health both have a role.

as a point of connection for Becket’s many summer camps.

“The deli’s been great,” Eley said. “We’ve had a really good lunch crowd through the week.”

He outsources baked goods from certified country kitchens and carries locally

produced goods.

The Becket Country Store hosted a farmers market during the summer, which also went well, Eley said.

He is now proposing a new site plan adding parking, with the gas station, EV charging stations and new entry ways.

“Now that we’re about a year in, we’ve kind of hashed everybody that is regulating us has at least sent me an email by now. We’re just trying to figure out how to get in the good graces of all those folks,” he said. “But that’s been really burdensome from my perspective. It’s probably a bit too overwhelming for a small business to have to keep up with that sort of compliance regime.”

Elm Court owner Linda Law and her business partner Richard Peiser, seen in October 2023, discuss the ongoing renovation and transformation of the historic property. “This is magnificent,” Law said, “however no one’s ever been able to make it successful.”

By C larenCe Fanto

STOCKBRIDGE — The historic Elm Court estate may soon emerge from a lengthy holding pattern, and with a new plan that doesn’t include a hotly debated annex.

Its current owners intend to submit changes to its existing development plan to Stockbridge and Lenox officials within the next several months.

Those changes include eliminating a planned three-anda-half-story, 96-room annex to the Gilded Age estate’s manor house, which raised eyebrows among some neighbors. They also include adding a yet-to-bedetermined number of guest cottages to the property and some custom lots.

Real estate entrepreneur Linda S. Law, who sold the highend Blantyre resort in 2017 after four years of ownership, and Richard Peiser, who holds an endowed chair at Harvard, bought Elm Court in December 2022 for $8 million.

The seller, real estate company Front Yard LLC of Denver, failed to develop Elm Court after a decade of ownership. In 2012, the company acquired the property from members of the Vanderbilt-Sloane family for $9.8 million.

Changes to the development plan would have to be approved by both towns, as 3 acres of the 89-acre property and its road frontage lie in Lenox.

In an interview with The Eagle earlier this week, Law said the cottages would be out of sight for neighbors and passers-by.

“From the street and the man-

The Elm Court estate in Stockbridge has been undergoing extensive renovations. A revised plan for a scaled-down resort, eliminating a massive 89-room annex in favor of 48 small guest cottages, is in the works for submission to town boards.

or house, you can see nothing,” she said. “We want to do this right, so it’s a win-win for everybody. I believe in this project and the jobs it will bring.”

Law projected the development would create $4.5 million in annual revenue for Stockbridge and Lenox from taxes and fees, as well as indirect positive financial impacts.

The manor house would offer 30 suites, as approved in the existing development plan.

Under a special permit previously approved for Front Yard LLC in Lenox, a sidewalk along

Old Stockbridge Road can be developed at the discretion of the town’s Select Board and ZBA along with significant sewer and water line enhancements along the roadway.

Under the banner of Amstar, a major real estate development company in Denver and its subsidiary, Travassa Destination Resorts and Spas, Front Yard had proposed a 112-room resort at Elm Court.

However, the plan was abandoned during the COVID-19 pandemic in the spring of 2020 following intense neighborhood opposition. The property

went on the market in October 2020 as a single-family residence for $12.5 million, but there were no takers.

“I know that even though the plan was approved, there were a lot of concerns about the massive 96-room addition from the neighbors,” Law said. “We have been developing and analyzing alternative site plans that would not utilize the addition.”

Front Yard’s original proposal carried a $50 million price tag.

The special permit granted by both towns, with extensions, allowed for 14 more rooms added to the 16 existing suites in the

Gilded Age manor house, as well as the 96-room annex linked to the main house. The plan included a 60-seat public restaurant and a 15,000-square-foot spa.

Law said she is also in talks with several clubs and envisions “dedicated space in the manor house for a small club room.”

Law sold the high-end Blantyre resort in Lenox for $15 million in November 2021. She and her investor-partners had purchased the property from the Fitzpatrick family for $8.7 million in June 2017, including the business, furnishings and equipment.

Blantyre remains closed pending additional investment to complete significant infrastructure repairs to its 1902 manor house.

Elm Court, listed on the National Register of Historic Places, was built in 1886 as the summer home of William Douglas Sloane, whose family owned a prominent furniture company, and Emily Thorn Vanderbilt, the granddaughter of Cornelius Vanderbilt. Its grounds were designed by Frederick Law Olmsted.

It was the last 19th century Berkshire Gilded Age Cottage still under original family ownership when it was sold in 2012 by Robert Berle and family members, descendants of the Vanderbilt-Sloane family.

Law resides in Lenox and the Silicon Valley region of California. Peiser is the Michael D. Spear Professor of Real Estate Development at the Harvard University Graduate School of Design.

Developer pays $14M for resort under repair

By C larenCe Fanto

LENOX — For the third time in eight years, the historic Blantyre resort has changed hands as the cost of repairs soared far beyond projections.

The 1902 Gilded Age mansion has been shuttered for extensive renovations and proposed expansion since November 2021. Now, as signaled at a November zoning board hearing, it has been purchased by hospitality industry investor and developer William “Liam” Krehbiel for $14 million.

He’s the founder and CEO of Chicago-based Topography Hospitality LLC, which specializes in renovating, developing and operating luxury country hotels. Krehbiel is also the co-managing partner of Ballyfin Demesne, a luxury hotel in Ireland that opened in 2011.

Krehbiel has described Blantyre as “a truly remarkable place that deserves to be restored in a very sensitive, thoughtful way to bring it back to its original splendor in a way that honors the history of that property.”

He predicted completion of the entire project and the reopening of the Blantyre resort would take two or three years.

According to Middle Berkshire Register of Deeds documents, Krehbiel’s recently formed Blantyre Property Co., a limited liability corporation based in Delaware and registered in Massachusetts, paid $14 million last month for the mansion and its surrounding 87 acres at 16 Blantyre Road, as well as its two adjoining lots, parcels and land on Patterson Road.

The seller, Blantyre LLC, was owned by Texas-based real estate investor

Clark Lyda and managing partner Ken Fulk, a noted interior designer.

They had paid previous owner Linda Law and her partners $15 million for the property in November 2021.

She had purchased it in June 2017 from the Fitzpatrick family of Red Lion Inn and Country Curtains fame for nearly $7 million and envisioned a $90 million buildout project. Law currently owns the Elm Court mansion on Old Stockbridge Road and is planning a scaled-down expansion there.

Since acquiring the 25-room Blantyre hotel, Lyda and Fulk had planned on investing at least $4 million on renovations before halting work more than a year ago

as costs outpaced available financing.

Last April, according to a Berkshire Superior Court judgment, with Krehbiel’s help they agreed a $3 million settlement with Bulley and Andrews LLC, a Chicago-based construction firm, for unpaid renovation work.

At a January 2023 zoning board meeting, Lyda had estimated that an extensive five-year renovation would cost well over $10 million. “It’s a big, ambitious project, there’s a lot of work to be done,” he said then.

A year later, all work had been halted and Lyda acknowledged that the mansion was in far worse shape than he and Fulk had realized. “We didn’t have a full

appreciation” of how much work was needed,” Lyda acknowledged.

Apart from renovations, an even more costly phased expansion had been outlined, first by Law and then by Lyda and Fulk.

The zoning board approved a special permit in 2020, revised in 2023, allowing a 45 guest-room annex, 20 condominium townhouses that would be privately owned (but available for hotel guest rentals when owners are not present) and 14 building lots for single-family homes to be held under separate ownership.

Last November, the ZBA confirmed that the special permit remained in effect because at least some of the necessary renovation had been completed.

Zoning Board Chair Robert Fuster said that, in 2023, the board already decided that substantial progress had been made on the renovation, meaning that the special permit would remain valid with no expiration date, based on Massachusetts case law.

Special permits do expire after two years if no work has begun, Fuster noted.

In a 5-0 vote, the ZBA members agreed that the existing special permit remains in effect and needs no extension since substantial construction work has been done.

At that November meeting, Fulk conceded that he had been “under-informed” about how much work and money was necessary.

“We didn’t understand the cost and the scale,” Fulk told the zoning board. “The quantity of work needed to protect the structure is staggering.”

The project includes an ongoing commitment to contribute to the town’s Affordable Housing Trust one existing house as well as four, 1-acre lots for development.

A series of hulking metal structures loom about the laboratory grounds and into the nearby woodlands. The structures appear like massive gates with tallest standing about 125 feet and a series of others about 100 feet tall, according to EPRI lab manager Steven Baker.

These are the remains of a threephase transformer constructed by General Electric in the 1960s, Phillips said, in an attempt to reach a 1 megavolt (1,000 kilovolts) capacity and usher in a new era for American-made transformers. In those days, most transformers could only transmit about 230 kilovolts, Phillips said.

GE was eager to increase the output of transformers, which “step up” voltage to high levels for efficient travel over long distances and also “step down” voltage when it reaches end users.

In its attempt, dubbed “Project EHV,” or “extra high voltage,” GE constructed a series of transformers traversing 4 miles of woodlands to a substation in Lenox Dale, and ran a high-voltage power line all the way through in the hopes that it would reach 1,000 kilovolts through a series of tests.

“If you go through the woods — which I have been, biking and hiking — you’ll find the foundations of these funny, big structures here,” Phillips said, pointing to the large metal structures near the lab.

The experiment resulted in a number of findings, Phillips said, but the most important was that the GE researchers didn’t reach their 1,000-kilovolt goal. Rather, the series of tests could only reach 765 kilovolts — a milestone for the development of 765-kilovolt

PAGE 1 EPRI, Page 10

Transmission and Distribution Laboratory in Lenox, the Electric Power Research Institute runs a variety of experiments that test the limitations, capabilities and safety

Inside EPRI’s multistress aging chamber, electrical insulators

temperatures, salt, fog and humidity.

FROM PAGE 9

transmission lines, now in use by major utilities including American Electric Power, New York Power Authority and the Chicago-based Commonwealth Edison Company.

The research done at the laboratory in Lenox allowed those high-voltage transmission lines to be created, Phillips said.

The GE lab was later purchased by EPRI, which was established in 1972 to “help power society toward a reliable, affordable and resilient energy future,” according to its website. EPRI also has laboratories in Charlotte, N.C., and Knoxville, Tenn.

Ever since, the transmission line has resulted in many electric industry “firsts.” In 1993, the line was used to develop methods for safe maintenance of live transmission lines via helicopter.

That feat has been enshrined in the laboratory’s main lobby through a series of photographs — some of which include electrical corona whirring through the rotors of the helicopter, in an image almost reminiscent of science fiction.

“We developed the methods on how

Workers reset a tree-strike simulation arm after a resiliency test of a new cement utility pole at

you would put a helicopter on an energized line, bond it so people could get on [to] fix things when it’s energized, and get off,” Phillips said.

In other words, the tests aimed to see how effective a helicopter would be in repairing live wires, depending on the aircraft’s position between the towers of a transmission line and whether or not the helicopter was “bonded” electrically.

In the EPRI tests, they used a “bonding wand” to achieve this, according to the 1993 final report on the tests. The lineman uses the wand to touch the electrified line to balance the voltage between the wire and the helicopter and lineman.

A mannequin named “Chicken Charlie,” so-called because of its chicken wire frame, was also placed on the helicopter’s work platform with a conductive suit to represent a live maintenance worker.

The tests helped develop best practices for helicopter maintenance, including safe work distances and bonding techniques. In recent years, the Lenox laboratory has continued along a similar trend by conducting testing for unmanned drones, which may be used by utilities in the coming years to perform visual inspections.

EPRI, Page 11

There are countless tests happening on a given day at the EPRI laboratory that would likely mystify the uninitiated — but only one gets the facility’s entire staff to drop what they’re doing and watch.

As Phillips describes it, the laboratory’s 14 full-time staffers gather amidst an array of high-speed cameras all pointed at the same thing: a manhole cover, affixed on top of a vent. What gets pumped through that vent varies from test to test — Baker said it could be methane, acetylene or carbon monoxide, among others.

Those are all gasses that have been found during field work in major sewer systems, Phillips said, which are known to cause explosions when pent up that can send manhole covers flying in populated areas.

At EPRI, researchers blow them up on purpose for the greater good.

The idea is to test out different sets of hinges and concrete bases to determine their durability against a simulated explosion.

The testing began in the 1990s, Phillips said, with the ultimate goal of reducing free-flying manhole covers that could potentially hurt people.

Most of the newly installed manhole covers are hinged, making them come up like “a dragon’s mouth” to let the gas out instead of flying off and endangering the public, Phillips said.

But testing still needs to be done to see how older manhole covers, and covers that are ensconced in older concrete, might hold up under the same pressure. At EPRI’s Charlotte lab, there’s an aging

chamber that can be used to rapidly weather manhole covers to see how older ones might hold up.

There are six underground vaults worth of manhole covers from scores of municipalities at the laboratory.

Improving safety and mitigating real-world harm are vital parts of the Lenox laboratory’s research — Phillips showcased an experiment to improve automatic shut-offs for downed power lines on nonconductive surfaces, such as asphalt, which could be instrumental in preventing wildfires that could start on the ground as a result.

Other tests are helping to strengthen utility poles from external force from felled trees and car collisions — a pole break can take a very long time to repair after a storm or hurricane, Phillips said, with an average time of between 16 and 24 hours for a fix.

The facility’s other major service is to give companies a place to innovate without fear of real-world consequences — utilities are very risk-averse, Phillips said, and can’t afford blackouts or problems that would affect real people in the name of technical progress.

The EPRI lab allows those utilities to “increase their confidence in new technologies, and identify risks” — giving companies the chance to work out the kinks and improve service with minimal, if any, disruption to customers.

But the laboratory is about far more than just the equipment — its researchers play a vital part in its success, Phillips said, and the success of the technologies that come from it.

“It’s not only about the test facility,” Phillips said. “It’s about the smart people who work here that think of all the things that could go wrong, and how we can test it.”

Matt Martinez can be reached at mmartinez@berkshireeagle.com.

By Sten Spinella

NORTH ADAMS — Chris Bonnivier’s patience has proved virtuous.

The multifaceted dining space is the brainchild of Bonnivier, a North County native who has appeared on Food Network’s “Beat Bobby Flay,” and runs Full Belly Food Truck. Segala opened Eagle Street Cafe, a breakfast and lunch spot, in November; Kelly was set to open Fewd, a bakery; and Radicci, a pop-up concept Bonnivier is helming, will feature different local chefs one or two weekends a month.

“I wanted to create a common space for everybody to have, where more people could be a part of something without having to pay expensive rent,” Bonnivier said. “I got with a couple other folks and collaborated with my landlord Yina Moore, and we said, ‘How can we better Eagle Street? What does this community need?’”

The newly minted proprietors are aware that staying in business in the Berkshires can be hard — Bonnivier referenced Firehouse Cafe’s recent closing in Adams. That’s a major reason why the three establishments will be housed together.

The business owners will each pay one-third of the $1,500-$2,000 rent, rather than the whole thing. Radicci will have different hours than Eagle Street Cafe, and Fewd will be connected to both as a dessert and pastry supplier.

Bonnivier said he was inspired by a month-long series of pop-ups at 90 Main, and recruited two chefs he respected in Segala and Kelly to make the rest of the vision come true.

There have been a lot of local inquiries to the businesses from people needing work, Bonnivier said, but they’re going to take time before ramping up hiring.

Years of traveling, and a desire to stay put, spending time with his grandkids and his wife, all played a role in Bonnivier’s commitment to the 23 Eagle Street property.

“I’ve been working on the road a

lot, so I’m excited to be home with my family now,” Bonnivier said. “This is about me coming home.”

Through it all, Bonnivier has remained a steadfast cheerleader for the city, noting its commitment, along with Moore’s, to success at the address.

Radicci, which is Italian for “roots,” is itself rooted in change — Italian one weekend, fried chicken

the next.

“One thing about the North Adams community, they like what they’re used to, but people at the same time like something new, and they venture to something when it’s new,” Bonnivier said. “I’ll throw my smoker out where they demolished the building next door, pop picnic tables over there, and we’ll have live music.”

By Jane K aufman

PITTSFIELD — As men accustomed to being outside and laboring for a living, Dave Mason and Jammie Sears decided they’d like to try something a little easier on their backs and knees.

In October, the two went to Florida to pick up the equipment to launch a business that will keep them outside, but won’t require nearly as much muscle power as, say, tree work, construction or landscaping — all ways they have earned their keep.

Now, they’re hoping that a propane-powered kettle, which pops oversized kernels of dried corn, will be a ticket to success.

Mason and Sears, operating as Patriot Pop, set up shop in front of Pittsfield’s Tractor Supply on Friday. Under a yellow canopy, the two were working with Alex Sears, Jammie Sears’ son.

The 180-quart propane-fired kettle pops mushroom corn in corn oil in less than five minutes. The popped corn is both fluffy and geometric, quite different from the home-popped type.

The entire setup, which they bought used in Florida, cost about $10,000, with entire business setup costing about $15,000 total. That doesn’t include the cost of a Chevy Silverado pickup truck with a 7-by-14-foot enclosed utility trailer they use to cart around the equipment. They already owned that.

They serve lemonade, locally sourced hot mulled cider and gourmet hot chocolate, for which they concocted their own recipe.

The business launched about a month ago at Cheshire Sporting Goods, which Sears owns. Since then, they’ve popped up

at a Cheshire craft fair, Canna Provisions in Lee, and this past Saturday at the North Adams American Legion. On Dec. 6, you can find them at the Lee Hop & Shop. They’ll be back at Tractor Supply Dec. 14 for a pet photo event.

How did this business come together?

“One, my wife loves kettle corn,” Mason said, referring to Jennifer Mason, whose name is also on the business.

He’s got a friend from high school who lives in South Carolina and has been at this business for 15 years or so. “He had been telling me to do it. It’s really good. It’s not as physically demanding as some of the work I’ve done.”

Mason joined the Army National Guard in 1992. He deployed to Tobyhanna Army Depot in Pennsylvania in 2002, and to Iraq in 2007 and 2008, providing personal security for VIPs throughout the city of Baghdad and beyond. For his service there, he earned the Combat Infantry Badge.

As a veteran-owned business, he hopes to help other veterans.

Another friend also told Mason it’s a solid business.

“There’s a whole community on Facebook that does this,” Mason said. “It’s just been awesome. Everyone’s so helpful. They’ll share recipes and some tricks.”

He said most of the recipes and quanti-

ties are tried and true.

“Some of it is a little bit of experimenting,” he said. “Some of the seasonings come from other veteran-owned companies that have well established seasonings and just playing with the amount and how strong we want it.”

On Friday, Patriot Pop rolled out an orangish cheddar jalapeno for the first time.

“It was perfect right off the bat, didn’t have to mess with anything,” Mason said. Patriot Pop sells exotic flavors in what they call kettle cups, quart containers with white chocolate and Oreos, for example.

“There are other people that do this,” he said. “We try to create different flavors to draw in more people.”

A pink-colored cherry apple isn’t selling as well.

“But everybody who’s bought it says, ‘Oh my goodness,’” Mason said. “My wife, that’s all she wants.”

While Mason and Sears produce kettle corn in batches on the spot, the popped corn will save — for two weeks on the shelf and for up to two months in the freezer, Mason said.

Mason said he expects the first year of this business will include smaller events and hopes to hit larger events in the second year.

Sears said working with Mason is going well.

“He’s a hard worker,” Sears said.

Alex Sears, who graduated from Westfield State University in 2023, said he enjoys working this business when he’s available.

“Funnily enough,” he said, “I have kind of an addiction to kettle corn.”

By Sten Spinella

ADAMS — Despite high hopes for Red’s Viking Pub when it opened early last year, the restaurant and bar says its run is over.

“Folks, Red’s is closing its doors effective immediately,” the business posted on its Facebook page. “Thank you to everyone that has become part of the regular crowd and for the support for the last few years.”

Just as there was a swell of support on social media for the establishment when it was opened by Bill Sweeney and Christin Fetterolf in late 2022, the disappointment, even devastation was palpable online after its closing.

Sweeney said that it ended up being too much work for them to shoulder, especially after he took a separate full-time job.

“We thought when I went back to work, Christin could do the payroll, ordering, and the place would be manageable,” Sweeney said. “But we went through 25 or more employees in less than three years. I’m not faulting anybody, but when people tell you running your own small business is a lot of work — it’s a lot of work.”

Fetterolf, nicknamed “Red” for her hair color, and her husband, Sweeney, bought the Viking Pub building at 83 Commercial St. on an October morning in 2022 and had it running under its new name by the afternoon: Red’s Viking Pub.

The couple originally opened the place because they wanted somewhere to play pool. It also became a way for Sweeney to put together a kitchen staff and flex

his culinary abilities. Fetterolf, who also had a hand in building the kitchen, ran the bar.

Sweeney said he and Fetterolf are grateful for the outpouring of well-wishes. The two transformed the space, cleaning and fixing everything up, redoing the kitchen and ceilings, bringing in

furniture and pool tables, and they still own the building and hope for someone to take over the bar or kitchen or both.

“We own the building, and have four apartments with nice tenants. We’re not leaving by any stretch,” Sweeney said. “I have a realtor who’s going to help us

look for someone to take it over, lease the kitchen, so we’re looking at all our options.”

Sweeney called it a turnkey operation, including pizza ovens, dishwashers, an extended bar, two taps.

True to the spirit of their opening, Red’s said on Facebook

that it will open the doors for local pool leagues to play for their current seasons.

“It’s not Adams,” Sweeney said of why Red’s is closing. “People bash on Adams a bit, but with the Glen and everything around that, there’s definitely something here.”

By Sten Spinella

NORTH ADAMS — Chef

and businessman

Matt Tatro has put Trés Niños Taqueria on the market and will soon move his other popular restaurant, Grazie, from its long-time home.

But don’t worry, Tatro says, it’s all good news.

“I’m really grateful and thankful for the time I had on Marshall Street, it holds a special spot in my heart,” Tatro said of where his Italian restaurant has been housed for nine years. “But things change; it’s simply business.”

Grazie will be moving to 310 State St. next year. Tatro is buying the building, currently an event space called The Venue, for $375,000. The restaurant will not be closing as the business slowly moves in to State Street; Tatro anticipates keeping Grazie running the first half of 2025 at Marshall Street.

Tatro’s other restaurant, Trés Niños, is officially for sale at $59,900.

Tatro caused a stir in March when he announced on Facebook that the Mexican restaurant was for sale. He later walked that sentiment back in an interview with The Eagle, but maintained that the possibility of a sale was “definitely something I’ve considered before.”

Marketed as a “turn-key taqueria,” Tatro says the eatery has been profitable for five years, has more than 20 seats inside and strong take-out sales.

He’s parting with Trés Niños largely because it’s cutting into time with his family, he said. He had initially started the business thinking he’d be mostly hands-off, but that hasn’t been the case.

As for Grazie, Tatro said it became apparent that buying property, rather than renting as he had been doing, and giving Grazie a “forever home,” as he put it, would be advantageous.

The restaurant’s new home on State Street was previously owned by Tom Rumbolt and Jason Nocher, who bought it last March for $255,000, according to city property records.

Rumbolt is Tatro’s former baseball coach and current lawyer. That connection ties into Tatro’s belief in the importance of “native investment” —

he credits local developer Dave Moresi for his work originally going in on and co-owning Grazie. And Tatro recalls how he, Rumbolt and Nocher were on the verge of buying the former Hot Dog Ranch building at 310 State St. a few years ago, before an employee’s personal circumstance forced Tatro to “pump the brakes.”

“Things have come back full circle,” Tatro said. “I’ve worked at a lot of restaurants, but I’ve never worked at a place with this camaraderie and family-type feel. That was reflected in the feedback from people online: We’re a local, family restaurant.”

Sten Spinella can be reached at sspinella@ berkshireeagle.com or 860-853-0085.

One of the oldest and most-trusted rules of investing is to get more conservative as you age. The thinking goes that the typical investor ought to reduce exposure to stocks, which are more volatile and therefore considered riskier, as they get older.

They would then allocate a greater percentage of the portfolio toward cash and bonds, which offer a lower historical return but have been less volatile and are considered less risky.

Age-based “target-date” funds follow this pattern. These funds typically offer investors a target retirement year. When you are younger and the target date is far in the future, these funds allocate primarily toward stocks. As the target date gets nearer, target date funds start to put more in bonds and less in stocks.

For example, the Vanguard Target Retirement 2055 Fund currently holds 90 percent in stocks versus just 10 percent in bonds, whereas the Vanguard Target 2025 Retirement Fund holds just 51 percent in stocks versus 49 percent in bonds. This is seemingly rational, and most people follow some version of this rule of thumb.

The problem is that our financial circumstances did

not come out of a mold. A cookie-cutter investment plan might work if you are financially “normal,” but what does that mean?

Everyone has a different situation, with various goals and capacity for risk-taking in a portfolio. What works in academic literature does not necessarily apply to you or me.

I explored this topic years ago when I was writing academic articles on spending in retirement. Every article I came across in my research used an example retiree with a $1 million portfolio. At the same time, I was preparing a financial plan for a single woman with a teacher’s pension from Vermont.

Her pension plus Social Security benefits were enough to cover her living expenses and then some. She had far less than $1 million saved in her 403(b) plan, but she also was not reliant on that nest egg for regular expenses. The academic starting point seemed irrelevant, and so did the standard investment rules of thumb.

For this retiree, we devised a portfolio strategy that set aside one sum of money for emergency expenses, another bucket for required minimum distributions, and the rest of

the portfolio was structured for longer-term growth. Even though she was in her late 60s, this meant that the portfolio ended up with more in stocks than the traditional rules of thumb would suggest.

Because she spends little from the portfolio each year, she has been growing the value over time. This gives her options. She has more money if she requires expensive long-term care. She also has the option to now increase her spending because her portfolio has grown.

Was this approach “risky”? In terms of potential volatility, the answer is yes. But in terms of planning for her needs and possible future outcomes, it may have reduced the risk that she depletes her portfolio with expensive long-term care. There are many kinds of risk in the world, and volatility is only one measure.

To be perfectly honest, it has taken many years of practice as a financial planner to realize when to avoid these kinds of rules of thumb. It’s easy as a financial advisor to plop anyone in their 60s into a moderate portfolio and nobody is likely to complain. As I have evolved, however, I try hard to understand the spending needs and long-term objectives before setting a default portfolio.

A preferable strategy, in my opinion, is to “bucket” investments into short and medium-term needs, and longer-term objectives. Keep spending needs in cash, money markets, CDs, and short-term bonds for safety. This could be anywhere from one to seven years’ worth of spending needs depending on your age and tolerance for risk. The rest of the portfolio might be better structured for growth with a higher allocation to stocks.

If you’re risk averse, this might still be a moderate portfolio. But for many people, this may mean a much higher allocation to stocks for this longer-term bucket. Many people in their 60s have become accustomed to the gyrations of the stock market and are willing to tolerate these fluctuations for long-term gain.

This bucketing strategy may end up resulting in a 60/40 portfolio, or it may not. It depends entirely on your spending needs, risk tolerance, and long-term goals. This kind of asset allocation requires more nuance and understanding of your financial plan than a simple model portfolio. You could do a lot worse than a simple 60/40 portfolio, but it may or may not be perfectly targeted to your circumstances.

In many cases, a bucketing

strategy may also result in a portfolio that gets more aggressive as you get older. If the portfolio value increases faster than spending, which has been happening for many people as the stock market rises, a larger relative share of the portfolio will be in the long-term bucket.

The overall portfolio may therefore get more aggressive. Several in the academic field of financial planning have argued for this so-called “rising equity” glide path, meaning that exposure to stock increases as you get older.

Regardless of what the academics say, there will never be a one-size-fits-all investment rule of thumb that is perfect for everyone. I believe the best way to approach your investment portfolio is to first have a solid grasp of your own short-term spending goals, longer-term financial objectives, and risk tolerance.

This solid foundation of a financial plan will help guide you toward a well-intentioned investment portfolio, not just the 60/40 portfolio or agebased strategies that too many people use as a default.

Luke Delorme is director of financial planning at Tableaux Wealth in Stockbridge.

By A my SoSne

When we think of education, we think of students sitting at desks beginning as early as first grade. Students attend elementary school, middle school, and go off to high school.

Outside of the classroom, students may be encouraged to join clubs, activities, sports, and to participate and be part of something, but this time is on top of academics.

Students feel pressured to be part of something, to be effective doers and motivators in a community for a variety of reasons; a resume for a college application, a topic for a personal essay, and just to feel a sense of self-efficacy, confidence and belonging within a community.

All too often, this pattern follows students to college. In colleges that are rooted in providing a diverse, liberal arts education, students enter as first years and immediately think about their next path. They often don’t feel capable or have the skills to immerse themselves in a profession.

Many apply for fellowships with their robust resumes of extracurriculars and strong transcripts, with the plan to attend a graduate school, which may finally land them in a profession. This pathway is long, arduous, expensive, and often not desired, practical or realistic for young individuals in today’s society.

Now, more than ever, it is imperative to respect the enormous changes in our economy, society, and within our communities as we educate our students from elementary school all the way up to high school and beyond. Learning answers in textbooks or on videos played on the smart board, taking obsolete standardized tests, and failing to lean into community resources surrounding us, may not be the best way to proceed in education. Of course, we all understand the challenges of trying to shift a whole curriculum and way of learning that has been embedded in our society since tiny little schoolhouses.

Let’s be honest, we spent nearly a year using technology to teach our students during the COVID-19 pandemic. We developed and were forced to innovate and navigate different platforms for learning and tools to engage our students from outside the classroom.

We cannot go back to the classrooms and pretend that this innovation and interconnectedness does not exist. Instead, we need to use these tools and lessons to provide more accessible resources, partnerships and innovative teaching methods into all our schools.

but students also need to practice their learned skills in the real world so that they leave college having learned how to interact, ask the right questions, and use collaborative resources.

Our local children need the same skills and need to start practicing them at an early age. Luckily, we live in a community ripe with intellect and opportunity, we just need to continue to find ways to connect all our resources.

How students think and perceive themselves as members of a community starts at a young age. In our rural community — struggling with an opioid crisis and staff shortages at schools and health care institutions — it is imperative that we use our resources to empower our youth to believe that they can impact the world they live in and that they can graduate from school and go into occupations of their choosing.

The program has been a perfect example of a collaboration that pools skills and resources to positively impact students across the board.

This fall, thanks to a grant from the Williams College TIDE Program (Toward Inclusion and Diversity and Equity) and funding from North Adams Public Schools’ 21st century program, along with support from the Berkshire Innovation Center, we — myself and some of my college students — initiated a new afterschool Robotics Club at Colegrove Elementary School.

The program has been a perfect example of a collaboration that pools skills and resources to positively impact students across the board. It also shows just how ripe Berkshire County is with opportunities to engage students in STEAM education, which is foundational to the future of education.