BUILDING A SUCCESSFUL BUSINESS

Consulting experts give their advice on how to create the best advisory business and provide the information every adviser needs.

Page 14 – 15

EMPLOYEE BENEFITS

The new ways of working means employees have different requirements. Employers need to understand and advise them to ensure they are still properly covered.

Page 16 – 17

SHARI’AH INVESTING

Forget the misconceptions around Shari’ah investing. Here’s everything you need to know about the rise of an investment practice that’s offering the world an ethical option.

Page 18 - 19

29 February 2024

First for the professional personal financial adviser

The erosion of medical scheme benefits and out-of-control specialist fees

BY MARTIN RIMMER CEO of Sirago Underwriting Managers

An analysis of three massive gap insurance claims amounting to R440k paid by Sirago Underwriting Managers during 2023 highlights an alarming reality of just how financially devastating the shortfalls are for in-hospital treatment that medical schemes are not paying for, and secondly, how specialist fees have rocketed in the absence of any price regulation in healthcare provisioning, meaning providers charge any rate they wish, often many more times the medical scheme rates.

Martin Rimmer, CEO of Sirago Underwriting Managers, explains that average gap claims values continue to rise exponentially, and mega gap claims are increasing in frequency, with massive shortfalls ranging anywhere between R50 000 and R191 000 (the regulated overall annual limit for 2023 per beneficiary per annum that gap insurers cover) for in-hospital treatments not paid by medical schemes. Gap insurance covers the difference that arises from the rate that healthcare

specialists charge for in-hospital procedures versus what a medical scheme pays.

“Of the thousands of claims processed in 2023, Sirago paid over 100 mega claims – internally classified as upwards of R40k per claim – in shortfalls not covered by medical scheme benefits on these mega claims alone. Total gap insurance claims paid between January and November 2023 by Sirago amounted to over R106m that policyholders would have to foot from their own pockets had they not had gap insurance in place,” explains Rimmer.

The three biggest gap insurance claims Sirago paid in 2023

Below is a breakdown of the three biggest gap insurance claims paid by Sirago during 2023.

“Of the R958k in specialist charges for these three claims alone, medical schemes only paid out 46% of the total specialist bills, while gap cover stepped in to pick up the 54% shortfall. The standout for anyone analysing these stats is that being on a comprehensive medical scheme option is no guarantee that your bills for in-hospital treatment will be paid for in full

by your medical scheme – in fact, in these three case studies, two members were on the top-end comprehensive medical scheme options, but less than half of the bills from their specialists were paid by the medical scheme.

Continued on next page

@MMMagza @MoneyMarketingSA

www.moneymarketing.co.za

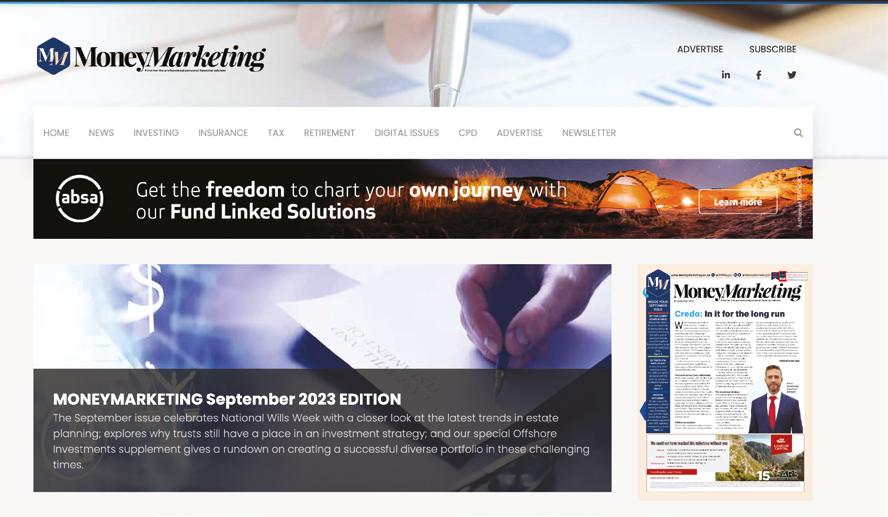

INSIDE YOUR FEBRUARY ISSUE

1 CONTINUOUS PROFESSIONAL DEVELOPMENT Condition Patient Doctor’s fees Medical Scheme paid % of bill paid by medical scheme Sirago Gap Cover paid Muscolo-skeletal/connective tissue, spinal stenosis (irreversible degeneration of the spinal discs) 58-year-old female, on a comprehensive medical scheme option R361 386 R185 677 51% R175 709 Circulatory System - Unstable Angina, coronary artery disease treated with stent implantation 69-year-old male, on a core hospital plan option R322 057 R140 681 43% R181 376 Acute Ischaemic Heart Disease - blood flow to the heart muscle obstructed by blockage of a coronary artery 61-year-old male, on a comprehensive medical scheme option R274 573 R110 933 40% R163 640 Martin Rimmer Follow @MMMagza on X and @MoneyMarketingSA on Facebook and LinkedIn. FIRST FOR THE PROFESSIONAL PERSONAL FINANCIAL ADVISER

We are seeing more frequently that gap cover is paying more than what the medical schemes are paying to doctors for in-hospital treatment. It’s a perverse situation where specialist doctor and hospital fees are now running levels that are many times more than the rate at which medical schemes reimburse. The reality is that even if you’re on a medical scheme benefit option that pays at 200% of tariff, it may very well not be enough, given that healthcare providers are free to charge whatever they want in the absence of any pricing regulation,” he adds.

The main drivers behind escalating costs in private healthcare

High demand for scarce specialist services, emigration and insufficient medical graduates are the most serious contributing factors in this private healthcare cost spiral, with a skills shortage that is guaranteed to remain problematic for many years as the NHI Bill drives uncertainty, disinvestment, and an exodus of healthcare professionals. Gaming of the system by unscrupulous healthcare providers (and in many instances aided by patients) is also a contributing factor, but one that medical schemes are clamping down heavily on, investigating and prosecuting.

“Average gap claims values continue to rise exponentially, and mega gap claims are increasing in frequency, with massive shortfalls”

“In the absence of any legislative overhaul to better protect users and funders (medical schemes), and balance this against proper price regulation for service providers, consumers are left between a rock and hard place, as any alternatives in the public healthcare space all but collapse. In an effort to manage the massive increase and risks related to healthcare costs, medical schemes are left without many alternatives, other than to continue to remove, reduce or even limit benefits related to certain procedures, leaving this burden on members and gap cover providers. The erosion of medical scheme benefits is very real and accelerating, with many of the drivers entirely outside of the control of healthcare funders and their members,” explains Rimmer.

Rimmer adds that if you consider that when gap cover was first introduced as a financial solution to medical scheme shortfalls, gap claims averaged

between R6 000 to R12 000. However, in the last three years or so, large claims of R50k+ are increasingly almost a daily occurrence. The bottom line is that gap cover is a critical part of your healthcare-funding strategy, and that medical scheme membership, whether on a comprehensive or core benefit, simply isn’t enough. For total peace of mind, no medical scheme member should be without gap cover if they want a hand-in-glove solution to protect themselves against the risk of onerous financial shortfalls on inhospital treatment and procedures.

“Consider at an average of just over R50 000 per mega claim, and measured against an average premium of R498/pm per policy on an individual basis, or R566/pm for a family (*Sirago Ultimate Gap, 2023 rates), it means policyholders have claimed approximately eight years’ worth of premiums paid or still to be collected. If you take one of the three massive gap claims paid at an average of R174k –that’s 29 years of premiums, which demonstrates the crucial role that gap insurance plays in your healthcare financial planning, protecting you from large and unexpected costs that you would need to self-fund if you do not have gap cover in place. Very few people, if any, have that sort of money available, unless they go into serious debt.”

Protect yourself from unexpected costs and unethical practices

Sirago provides the following advice to consumers to protect themselves when it comes to unexpected costs and unethical billing practices:

Always negotiate the pricing of any planned surgery with healthcare providers before and ask for a formal quote from all the medical role players – from the surgeon to the anaesthetist. That way there are no surprises or unexpected costs creeping in after the fact, unless there were specific complications during the procedure.

Your gap cover should be of no interest to your doctor, whatsoever. Be wary of doctors asking you upfront whether you have gap cover or not – overbilling based on a client’s insurance portfolio is a growing practice by some unscrupulous medical specialists looking to capitalise on the patient’s insurance cover by overcharging, and in some of the worst cases, scheduling unnecessary procedures, knowing that the patient has the insurance to cover the inflated price. You are not obliged to tell your specialist that you have gap cover, and it should be of no consequence whatsoever to your doctor whether you have gap cover in place.

WEDITOR’S NOTE

e’ve chosen to lead this month’s issue with a story about gap cover because there is no doubt all eyes are going to be on the medical industry this year. Elections are looming and the government is on a path to push through the NHI Bill as quickly as possible, with what could be devastating consequences for the private medical insurance industry. As Andre Jacobs, Marketing Manager at The People Company and Vice Chair of the FIA Health Exco, says: “It will completely disrupt the medical sector in the country and would inevitably reshape the role of medical schemes as well as gap cover.”

But it’s also time now for the industry to take a long, hard look at itself. As our cover story indicates, what happens when the gap cover is no longer covering ‘the gap’, but becomes insurance on insurance? At what point do consumers push back? While inflation in general may have stabilised (for now), food inflation is hurting the middle and poorer classes. Coffee, for example, costs about 20% more than last year, while white rice has gone up 32% year-on-year. And let’s not talk about eggs or canned products. These are the things that affect your clients’ pockets, and having to pay large increases for medical cover is sometimes not an option. They will be looking around for cheaper offerings or cancelling entirely, which makes the NHI look like a viable proposition for them.

In addition, medical aids need to consider their service. You may remember I was hospitalised toward the end of last year and was happy in the knowledge my insurance would cover me. Instead, I spent three long months fighting to prove it was an emergency admission. Luckily, sense eventually prevailed but it didn’t leave me feeling good about my provider. The industry needs to do better to keep consumers onside.

We’ve got more about the industry’s pushback against the NHI and gap cover news towards the back of the magazine. It’s an issue we’re going to be keeping a close eye on throughout the year, and we’ll be keeping you informed.

Happy reading!

SANDY WELCH Acting Editor, MoneyMarketing

SECTION 29 February 2024 www.moneymarketing.co.za IMAGES Shutterstock .com Continued from page 1

GET THE LATEST INDUSTRY NEWS STRAIGHT TO YOUR INBOX Scan the QR code to subscribe to the MoneyMarketing newsletter Don’t forget to follow us on Facebook,

LinkedIn and Twitter.

Sirago Underwriting Managers (Pty) Ltd is an Authorised Financial Services Provider (FSP: 4710) underwritten by GENRIC Insurance Company Limited (FSP: 43638). GENRIC is an authorised Financial Services Provider and licensed nonlife Insurer and a member of the Old Mutual Group. NEWS & OPINION

WARREN MCLEOD PORTFOLIO MANAGER, OLD MUTUAL INVESTMENT GROUP

How did you get involved in financial services –was it something you always wanted to do?

When speaking informally to friends and people I meet outside of the workspace, upon hearing my profession, a frequent question is, “When and how did you get involved in financial services?” My answer relates to my interest in mathematics at school. I was guided to investigate the field of financial services, particularly life assurance. The suggestions were very broad. Looking at life assurance products, I understood the objective, but I also wished to understand how to use the financial markets to achieve the suggestive guarantees of the products. My subsequent studies at university were in the field of statistics and finance – together they tied the two pieces together.

What was your first investment – and do you still have it?

I knew that being a student, I was likely to start my career in debt. I convinced my father to loan me a small sum of money. I knew the investment would need to cover the money I owed him, but simultaneously I needed it to grow to cover some of the debt I would accumulate.

Consequently, I invested in an Old Mutual endowment policy. The endowment policy matured soon after I began working, which I then used to make a payment on a bond I had taken out to purchase a townhouse and to return the money I owed my father. That was one of my best financial moments!

What have been your best – and worst –financial moments?

I have learned the importance of understanding one’s investment. A highlight has been managing a global equity portfolio based on a quantitative strategy, the Old Mutual Global Managed Alpha Fund. Less so now, but in the past, many people associated a quantitative strategy to a ‘black box’ strategy in which they believed there is little understanding of the reasons for holding a particular stock. My view is that the strategy is a glass box. Many of the measures used by fundamental managers to determine a fair value to pay for a share are the same or similar to measures used in our global quantitative

strategy. The characteristics considered include the quality of a company, the value, the earnings growth of a company, as well as other common measures of a company. Our strategy is a systematic process that enables us to explain the reason for holding the positions in the portfolio. It is a glass box, not a black box. This strategy enables us to manage a global fund locally, with our quantitative systems easily managing the huge quantity of data related to companies that are the shares in international indices that often consist of more than 3 000 shares.

What are some of the biggest lessons you have learnt in and about the finance industry?

I have participated in financial investments for 25 years. There have been difficult times; the most difficult is managing a fund which, at times, is behind expectations. But I have made it through low times by having patience, not being overconfident, and adhering to the investment strategy and not making irrational decisions. Markets are volatile, which results in the ups and the downs in performance. Perfection does not exist in financial markets.

What makes a good investment in today’s economic environment?

In line with our investment strategy, currently, a portfolio that displays the characteristics of value, a strong relationship with the direction of a positive global equity market, and risk diversification is an attractive portfolio. The economy is not static and, accordingly, the characteristics of our portfolio change through time. In February 2022, Finance Minister Enoch Godongwana amended the maximum offshore

investment limit for Regulation 28 retirement fund from 30% of assets to 45%. This gives an investor a greater opportunity to gain returns, since effectively the market has ‘expanded’. Our global managed alpha equity portfolio is a means of expanding an investor’s exposure to the global equity market.

What finance/investment trends and macroeconomic realities are currently on your watchlist?

Expanding one’s understanding of the market and investment strategies requires keeping up to speed with the research and ideas of others, which can be gained from published books and articles. As mentioned, the strategy I employ is based on the relationship between shares’ returns to the measures of value, earnings growth, and further financial characteristics of shares. Many will take the relationship for granted, but is there evidence that such a relationship does exist?

What are some of the best books on finance/ investing that you’ve ever read — and why would you recommend them to others?

Reading Malcolm Gladwell’s book Outliers emphasises the need for evidence and not simply accepting what we believe is logical and obvious. An example he gives, which highlights the need of evidence, is that most Nobel Prize winners in physics have an IQ above a certain level, but from that level, “additional” intelligence does not enhance the probability of obtaining a Nobel Prize in physics, which many of us assume.

What advice would you give to investors?

The financial realm is expanding and, due to technology, it is open to virtually all. We can gain from this opportunity, but we can also be burned. This emphasises the need for understanding our investment decisions.

29 February 2024 NEWS & OPINION 4 www.moneymarketing.co.za IMAGES Shutterstock .com Earn your CPD points The FPI recognises the quality of the content of Money Marketing ’s February 2024 issue and would like to reward its professional members with 1 verifiable CPD points/hours for reading the publication and gaining knowledge on relevant topics. For more information, visit our website at www.moneymarketing.co.za

1 CONTINUOUS PROFESSIONAL DEVELOPMENT

Ashburton Investments, the FirstRand group’s asset manager, is bolstering its team of investment professionals with key new hires under its CEO Duzi Ndlovu who joined in 2022, and Chief Investment Officer (CIO) Patrice Rassou who joined in 2020. Ashburton currently has R140bn of Assets Under Management (AUM) and plans to grow exponentially in the next three years by scaling its equity, multi-asset, fixed income and global capabilities, while widening its distribution footprint. “The first step in achieving its growth goal was to cement the investment team under Rassou’s leadership. This included the key appointment of Charl de Villiers as Head of Equities in 2021.” De Villiers has a stellar portfolio management track record, and his addition has added significant industry experience to the team,” says Ndlovu, who was previously CIO of Argon.

Vanessa Pillay was appointed as Ashburton Investments’ Head of Corporate and Commercial Distribution in October 2023. She has more than 25 years of financial markets and asset management experience across the corporate and institutional segments of the industry, and is highly regarded for her treasury, global markets and asset management expertise.

Vuyo

Mvulane was appointed as the Head of Institutional Distribution eight months ago. His experience spans manager research, portfolio management, business development and client service. Prior to joining Ashburton Investments, Mvulane was the Head of Business Development and Client Service at Mazi Asset Management.

Investments at the start of 2023. He gained his asset management, asset consulting, short-term insurance, healthcare and financial planning expertise fulfilling senior roles at Discovery Invest, Sasfin, Ninety One and Glacier. With more than 22 years of distribution experience, Amey holds an MCom in Tax and is a Certified Financial Planner (CFP).

These appointments follow the appointment of Kashif Noor to the position of Head of Retail Distribution at Ashburton a year ago. Noor was previously Nedbank’s Head of Wealth Management for the Cape and coastal regions. He also previously worked for ABSA Wealth, Coronation and Lloyds TSB.

Focusing on financial intermediaries, specifically independent financial advisers, Linked Investment Service

Provider (LISP) platforms, as well as discretionary fund managers (DFMs), Steven Amey was appointed as the Head of Intermediated Distribution at Ashburton

Sumendren Naidoo has been appointed Head: Distribution at Sanlam Corporate: Corporate Solutions with a clear vision to steer the company’s growth strategy while delivering holistic solutions for employee benefits. His appointment aligns with the Sanlam Group’s focus on innovation and growth to fuel its purpose of empowering generations to be financially confident, secure and prosperous. “My overarching goal is to fundamentally enhance how we approach employee benefits and financial planning, aligning closely with our client’s evolving needs in the broader South African context,” he says.

Nancy Hossack has been appointed Multiplecounsellor Portfolio Manager on Foord’s medium and high-equity South African multi-asset portfolios, including Foord Conservative and Foord

Balanced unit trust funds. Hossack joined Foord as an equity analyst from Investec Asset Management in 2015. Over her career, she has covered a wide range of JSE sectors as analyst. She was appointed as a portfolio manager on South African equity mandates at the start of 2021 and has built a compelling performance track record in this asset class. Hossack has been running internal multi-asset model portfolios since 2019.

Alexforbes has appointed Mpho Molopyane as chief economist. Molopyane is responsible for formulating the macroeconomic strategy for the business, identifying significant economic opportunities to positively influence the business, benefit our clients, and enhance our investment processes. Molopyane will also play a pivotal role in executing strategic objectives that align with the group’s vision and intent to impact.

She joins Alexforbes from Absa, where she held the position of senior economist, overseeing economic research for multiple African economies.

ensure

29 February 2024 www.moneymarketing.co.za 5 IMAGES Shutterstock .com

People

Business to the power of people Unlock business success by hiring the right people. Access SA’s largest jobseeker database with over 6 million candidates, ensuring effortless recruitment. Visit pnet.co.za to learn more.

Calculators don’t

financial well-being.

do.

What we’ve learned from 2023

BY MIKE TOWNSHEND Foord Portfolio Manager

BY MIKE TOWNSHEND Foord Portfolio Manager

Despite the very negative market outcomes of 2022, fears of a US-led global recession topped our list of worries at the beginning of last year. We also expected corporate earnings to start to decline and the global consumer to come under increasing pressure due to higher interest rates and the cost-of-living crisis.

Meanwhile, the Russian/Ukrainian war ground on and – in the first damning signs of the toll of higher interest rates – a regional banking crisis developed in America. By the end of March, two US bank failures (Silicon Valley Bank and Signature Bank) and the collapse of Swiss banking icon Credit Suisse spooked markets before central banks intervened with unlimited liquidity lifelines.

Global interest rates continued to rise in 2023 as central banks struggled to bring inflation down towards target levels. Tight monetary policy eventually paid off as inflation rates declined steadily throughout the year. By year end, the US Federal Reserve had turned decidedly dovish, signalling that the next interest rate move would likely be down.

In the event, we have not yet seen a US recession despite the fastest pace of interest rate rises in 40 years. In fact, US growth accelerated even as growth in other markets – such as Germany – slowed or reversed. An analysis of all US economic recessions going back 70 years shows that rapidly rising interest rates almost always lead to recession – but often with a lag of almost two years, on average. Economic growth is also always fastest during the interest rate hiking cycle. This makes sense: interest rates are rising because the economy is overheating. We therefore remain concerned about prospects for a US slowdown in 2024.

The final quarter of the year started horrifyingly as Hamas gunmen launched a surprise assault on Israel from the Gaza Strip that led to fierce reprisals from the Israeli Defence Forces. Fraught geopolitical tensions in the Middle East mean this conflict could still escalate into the wider region, with possible implications for commodity and share markets. Oil prices were nevertheless lower for the year on cracks in the OPEC+ cartel and greater US output. Precious metals, including gold, rose on the prospects of lower rates and greater geopolitical stress.

ChatGPT and other Artificial Intelligence (AI) products took the world by storm in 2023. Investors flooded

into stocks with any oblique exposure to AI themes. The tech-heavy Nasdaq Composite Index recovered from its 2022 pummelling to deliver an eye-popping 44.7%. Seven of the largest US tech stocks – dubbed the Magnificent Seven – rose by an astonishing 111%, pulling American and global markets up with them. Incredibly, the Magnificent Seven now have a higher weighting in the MSCI World Index than all UK, Chinese, French and Japanese stocks combined.

Most asset classes comfortably beat inflation in the year and 2023 proved – unexpectedly for us – to be a year of exceptional returns on equity markets. The MSCI World Index returned 24.4% in US dollars, with most regions delivering decent double-digit returns (North America 26.6%, Europe 20.7% and the Pacific region 15.6%).

Emerging markets lagged with a return of 10.3%, but this performance was dragged down by China – which at -11.0% was the worst performing of the world’s bourses.

“The Foord funds in South Africa performed credibly. The multi-asset class funds all delivered meaningful, inflation-beating returns”

In South Africa, performance across all asset classes was broadly similar. Listed property at 10.1% did slightly better than bonds at 9.7% and equities at 9.3%. Cash was the laggard with a still decent 8.0% when inflation averaged 5.6%. Anaemic economic growth of just 1.0% (using latest numbers) constrained the performance of domestic companies. The FTSE/JSE All Share Index return of 1.4% in US dollars was lower than most global markets after the rand weakened by 7.2% against the US dollar over the year.

This tepid overall domestic equity performance masks significant variations between the different sectors. The financials and industrials sectors delivered decent rand returns of 21.5% and 16.6% respectively. However, the resources sector suffered an 11.9% decline as most commodity prices came under pressure. Gold proved its resilience in difficult geopolitical circumstances and returned a solid 13.1% in rand.

Against this backdrop, the Foord funds in South Africa performed credibly. The multi-asset class funds all delivered meaningful, inflation-beating returns. The low weighting to the underperforming resources sector, moderate bond exposure, preference for global assets and a healthy weighting to gold bullion aided this outcome. The Foord Equity Fund was nearly 5% ahead of its benchmark last year and is also showing outperformance for up to three years. The Foord fixed income suite was in line or ahead of their benchmarks for the year.

The Foord global funds performed disappointingly last year amid the market’s AI exuberance. The conservative Foord International Fund was cautiously positioned with a low weight to the expensive US markets and preference for quality Chinese consumer and tech shares trading on very attractive levels. Its hedges against US market declines cost the fund, while its Chinese stocks traded even lower. The managers did well to avoid the bond market rout and then add to its fixed income portfolio as the bond market recovered. In the event, the fund sustained a small negative return – a sobering outcome after the fund’s stellar 2022 outperformance. The Foord Global Equity Fund lagged world equity indices owing to its 25% weight in ultra-cheap Chinese shares.

Looking ahead, we again enter a new year with caution and aware of potential downside risks. Geopolitical tension and high market valuations –especially in the US where bourses are just shy of all-time highs – remain a concern. Well-diversified investors, however, can still anticipate inflation-beating performances from their investments with Foord.

Although equity returns should moderate off a high base, there is opportunity within different geographies, and certain sectors that underperformed in 2023 are now looking particularly cheap. Multi-asset class funds should also benefit from lower risk, inflation-beating returns now available in fixed income markets.

29 February 2024 NEWS & OPINION 6 www.moneymarketing.co.za IMAGES Shutterstock .com

What’s the skinny on ‘miracle drugs’?

BY ROSS YAMMIN Business Development, Distribution and Global Research Analyst at Laurium Capital UK

During the last 18 months, global equity markets have been abuzz with the term ‘GLP-1’. The ‘miracle drugs’ have affected various industries and the debate between the drugs’ current high cost and longer-term benefit is one which continues to rage on in boardrooms and around dining room tables all over the globe. So, what exactly is a GLP-1? And is this money-making opportunity worth all the fuss?

GLP-1 stands for Glucagon Like Peptide-1, a hormone that the human body releases after an individual eats food. The drugs mimic the effects of this hormone, thereby giving an individual the feeling of being full. Initially the drugs were developed to treat diabetes, and what drug producers noticed in testing with their diabetes patients is that they were losing weight, and a lot of it. It didn’t take long for the drugs to be tested and clinically approved for the treatment of obesity, and suddenly the Western world had a

medicinal treatment for its overweight population (it is estimated that more than 40% of the US population is obese). These developments really got the market excited as the pharmaceutical majors who make GLP-1 ’s had an enormous addressable market to treat and saw their share prices soar as a result. Novo Nordisk, the Danish drugmaker who makes one of these GLP-1 drugs , eclipsed luxury goods stalwart LVMH to become Europe’s most valuable company and Eli Lilly, the diabetes leader in the US, soon had a market capitalisation of over half a trillion dollars.

But it isn’t all positive for the drugmakers, who have a major hurdle to overcome if they are to see their share

prices extend their already impressive gains. The major obstacle is price, with list prices in the US standing at around $1 000 per month for the GLP-1s produced by Novo Nordisk and Eli Lilly. To address this, pharmaceutical majors need insurers to come to the party. They are trying to force them to do so by proving that a thinner population is a healthier one, and that overall, the drugs will be a net saver for the European and American economies as they will have a healthier and therefore more productive population. This tussle between insurers and drug producers is one of the key catalysts for Lilly and Novo alike, as if they can make the drugs affordable for end users, it will go a long

“Pharmaceutical majors need insurers to come to the party. They are trying to force them to do so by proving that a thinner population is a healthier one”

SMEs play a crucial role in most economies, and South Africa is no exception. They are also important contributors to job creation and global economic development. According to the World Bank Group, SMEs represent about 90% of businesses worldwide, while the International Finance Corporation revealed that roughly 50% to 60% of South Africa’s workforce finds employment within SMEs.

“A key challenge SMEs face is finding employees who are a good fit for their business and who have the skills required to increase efficiency and business growth,” says Paul Byrne, Head of Data Insights & Customer Success at Pnet.

“Pnet researched the recruitment needs of SMEs over 12 months (Q2:2022 to Q2:2023) and the findings revealed that Finance skills fall within the top five most in-demand skills, alongside skills in Business & Management, Sales, Admin, Office & Support and IT for SMEs.”

Pnet’s research also revealed the top three in-demand roles in the SME sector during the same period, namely Sales Representatives, Accountants and Software Developers. Within the Finance Sector specifically, the most in-demand professionals over the 12-month period were Financial Accountants.

“When comparing hiring activity between September, October and November 2023 with the previous three

way towards them achieving their goals and meeting the market’s lofty profitability expectations.

In our view, the hype around GLP-1s certainly is worth all the fuss, and we believe the opportunity that exists for Novo Nordisk and Eli Lilly is compelling, and one we want to be involved in. Laurium Capital holds positions in Novo Nordisk in its global mandates and some of its multiasset funds.

Should you wish to learn more about the companies’ funds, please visit www.lauriumcapital.com

All Laurium UCITS funds are Section 65 approved, daily dealt and daily priced. Please contact your preferred International LISP to access the funds. Yammin serves a dual role at Laurium Capital and is based in London. His primary focus is on business development, and he also supports the research function of the business focussing on global equities.

Spotlight on SME employment trends in South Africa

BY PAUL BYRNE Head of Data Insights & Customer Success at Pnet

months (June, July, August 2023), Pnet’s findings revealed that hiring activity for Finance professionals (Bookkeeping, Payroll & Wages and Financial/Project Accounting) had increased by 3%,” says Byrne.

A study on “Factors Affecting Small and Medium Enterprises’ Financial Sustainability in South Africa” published in December 2021 emphasised the importance of accounting skills within SMEs: “It was found that financial awareness, budgeting and accounting skills have positive and significant effects on the financial sustainability of SMEs.”

Despite the need to attract and retain skilled talent, SMEs often face various recruitment challenges, such as time-to-hire and the hefty price tag often associated with sourcing suitable candidates.

How SMEs can become more efficient in their recruiting processes

Specialised online recruitment platforms offer SMEs a range of benefits to help them save both time and money during the hiring process, and to find the right candidates for their vacancies – ultimately driving business success.

Reducing time-to-hire

Sourcing candidates directly using job-matching technology streamlines the hiring process so that SMEs can quickly and directly reach more jobseekers.

SMEs can advertise their vacancies directly to active jobseekers, or tap into a database of professional candidates. Sophisticated platforms like Pnet’s online recruitment portal offer a host of easy-to-use tools and features to easily filter and shortlist suitable Finance candidates from their database of over six million jobseekers. What’s more, recruiters’ job ads get further reach from the 100 million Job Alerts that Pnet sends directly to jobseekers’ inboxes every month.

Reducing recruitment costs

By going directly to the source of suitable candidates using specialised recruitment platforms like Pnet, SMEs can save up to 60% on their recruitment costs. Pnet’s online recruitment platform uses advanced algorithms and analytics to target job advertisements to the most relevant candidates. This enables recruiters to find quality candidates using locally relevant filters, and even creates a talent pool to access when they need to hire for similar roles in the future.

Built-for-purpose online recruitment platforms are emerging as powerful tools to help SMEs find the right candidates for their vacant roles, thereby boosting their competitiveness in the market. In fact, these platforms have become a gamechanger for companies of all sizes, allowing them to flourish by attracting and retaining their most important asset – people.

NEWS & OPINION 29 February 2024 www.moneymarketing.co.za 7

2023: Surprising and unpredictable

BY RORY KUTISKER-JACOBSON Fund Manager at Allan Gray

Global markets continue to be dominated by the announcements and actions of central banks, and expectations around those actions, rather than fundamentals. In 2022, as global inflation spiked and central banks responded by hiking interest rates, we saw a considerable sell-off in speculative, longduration and leveraged assets, as the era of “easy money” appeared to be over. As inflation tapered during 2023, and central banks have begun to signal an end to rate hiking and possible rate cuts, many of these assets have rebounded sharply: After selling off in 2022, global equity markets were once again dominated by US stocks, and in particular large-cap US technology stocks. The largest US stocks (Apple, Alphabet, Meta, Microsoft, Tesla, Nvidia and Amazon) have come to be known as the “magnificent seven”, and in 2023, magnificent they were. The “worst” performing of the group was Apple, up 49%, while the best, Nvidia, buoyed by the excitement around artificial

intelligence and the related demand for their chips, was up over 200%. In absolute terms, the market value of Nvidia increased by over $800bn.

• Cryptocurrencies have also seen a resurgence Bitcoin bounced more than 160% to end the year at $42 085. Remarkably, that is still below where it began in 2022. This mathematical fact highlights how important avoiding large losses is to successful long-term investing. If you buy something that subsequently halves in value, you need it to increase by 100% to get your money back. Bitcoin speculators who bought on 31 December 2021 need to see a price recovery of 178% from 31 December 2022 to get their money back in nominal terms.

One asset class that hasn’t seen as strong a recovery is the bond market.

The JP Morgan Global Government Bond Index fell by 6.5% in 2021 and a further 17.2% in 2022. It failed to recover meaningfully in 2023, returning 4.0%.

Those who held long-duration “safe-

haven” developed market bonds have fared much worse. In 2022, investors in US and UK 30-year bonds lost a third and half of their investments, respectively – only to see further declines in prices during 2023, with a marginal recovery by year end.

Domestically, the economic environment remains challenging, dominated by poor sentiment and record levels of loadshedding. It is not surprising that we have not seen the same resurgence in asset prices:

In rands, the FTSE/JSE Capped SWIX

All Share Index generated a return of 7.9% in 2023, which equates to a decline of 1.1% in US dollars. Within that, though, there was a large divergence in individual sector and stock performance. Within the precious metals sector, for example, Harmony Gold returned 105% for the year, while Impala Platinum fell by 55%, including dividends.

• The FTSE/JSE All Bond Index fared

slightly better, generating a return of 9.7% in rands and 0.6% in US dollars.

Somewhat surprisingly, given the economic landscape, the yield on 10year bonds strengthened marginally from 11.1% at the start of 2023 to 10.9% at the end of the year.

As we consider 2024 and beyond, what should we expect of inflation and how may this impact central banks’ behaviour, interest rates and market returns?

In short: We don’t know. Our only expectation is that events are likely to surprise us, and surprise us in how the market reacts. We navigate this uncertainty by being patient and disciplined, and striving to buy only those assets where the risk-to-reward opportunity is skewed heavily in our favour, with a large margin of safety and the knowledge that we won’t always get it right.

A year in review: South Africa’s ongoing journey after greylisting by the FATF

BY JAMES GEORGE Compliance Manager, Compli-Serve SA

February 2024 marks one year of greylisting by the Financial Action Task Force (FATF) for South Africa, and it continues to grapple with the fallout. As we reflect on the past 12 months, there has been progress, but the path ahead remains challenging.

South African entities, including businesses and government agencies, have struggled to access international finance at competitive or feasible interest rates during this period. The country’s ability to secure favourable international loans and financing for critical infrastructure projects has been compromised to a certain extent.

Reduced access to international markets and finance has hindered development and job creation, while increased scrutiny of cross-border transactions and financial activities affects the smooth flow of goods and services. This has an impact on the competitiveness of South African exports and imports on the global stage.

South Africa has also seen the potential loss of financial business to neighbouring countries or other financial centres that are not facing the same scrutiny. The tarnishing of South Africa’s reputation as a global financial and business centre remains a significant challenge. Rebuilding trust and confidence in our financial system and regulatory framework is an ongoing process, far from an overnight solution.

This extended period of greylisting has deterred investors, both domestic and foreign, from engaging with the South African market. Investors typically seek stability and confidence in the regulatory environment, and South Africa’s status has not been conducive to attracting capital.

To address FATF recommendations and deficiencies, South Africa has had to enact stricter regulations and enforcement measures. While necessary to enhance the anti-money-laundering and combating-funding-ofterrorism framework, these measures have added to the regulatory burden on businesses and financial institutions.

Compliance costs have increased, as local businesses and financial institutions have invested in enhanced antimoney laundering and combating funding of terrorism

“South African regulatory authorities have faced mounting pressure to address deficiencies and work towards international compliance during this year”

compliance measures. This includes implementing advanced technologies for monitoring and reporting suspicious activities. The associated costs have strained corporate budgets and operational efficiency, increasing the cost of doing business in South Africa.

South African regulatory authorities have faced mounting pressure to address deficiencies and work towards international compliance during this year. This has led to more rigorous oversight and enforcement, potentially affecting the operational autonomy of financial institutions.

While progress has been made during this year, there is still much to be done to address and restore the nation’s financial integrity and international standing. Investigating and prosecuting complex money laundering and terrorism financing cases, identifying informal channels for global money remittance, and recovering assets lost to crime and corruption are ongoing challenges.

The financial services industry plays a pivotal role in identifying and reporting suspicious activities, necessitating ongoing capacity building and knowledge sharing. Adopting innovative technologies and data analytics enhances the detection and prevention of illicit financial flows. Continuous education, training, and awareness-raising are essential.

Through ongoing collaboration and commitment, South Africa aims to emerge from the greylist by early 2025, showcasing its dedication to a strong and transparent financial system, and reclaiming its position as a respected and reliable player in the global financial arena.

29 February 2024 NEWS & OPINION 8 www.moneymarketing.co.za

Citadel’s forex risk trends for 2024

BY BIANCA BOTES Director at Foreign Exchange Experts Citadel Global

With substantial foreign exchange market growth predicted for 2024 and over the next five years, and the world facing another tumultuous year, risks are mounting for forex clients. These are Citadel’s four predictions for forex risk trends in 2024, from elections and geopolitical risks to investment declines and more ups and downs for the rand.

Recently released research indicates that the global forex market size, for North America, Europe, UK, Switzerland, Middle East, Africa, Asia-Pacific, South America, China and Japan combined, is projected to grow by $516.48bn, accelerating at a compound annual growth rate from 2023 to 2028.

Geopolitical and environmental risks are mounting in 2024

The local forex market will certainly be affected by the geopolitical events we’ll be seeing in 2024. South Africa’s shifting position within international affairs is a concern. South Africa’s geopolitical ties have become more relevant considering its trade and political relationships with Russia, China, the United Arab Emirates, the US, Israel and its allies, and its standing in international bodies such as BRICS and the UN. Our financial markets are affected when we engage with sanctioned countries.

“We are likely to see an election-friendly Budget speech delivered on 21 February 2024, rather than the prioritisation of fiscal certainty needed to build investor confidence”

The past four years have taught us that one needs to remain fully aware of how dynamic and unpredictable the global environment is, and how swiftly and dramatically things can change. At the World Economic Forum this week, a lot of attention is being drawn to how the world needs to be ready and prepared for Disease X, the next unknown super-spreader pathogen we are likely to face in our lifetime. Scientists are also warning of accelerated climate change risks. All these global threats could impact our financial and forex markets.

It’s election year in South Africa and 70 other countries

This year the world will see in the region of 70 elections play out, including in the US and South Africa. Election periods typically bring political uncertainty, which can impact the forex markets.

In the local context, we are likely to see an electionfriendly Budget speech delivered on 21 February 2024, rather than the prioritisation of fiscal certainty needed to build investor confidence and implementation plans required to drive economic growth.

The challenges in South Africa are not only numerous but also complex. Ranging from collapsing state-owned enterprises such as Transnet and Eskom, a pressing debt burden, political and policy uncertainty, to South Africa’s geopolitical positioning, which can all contribute to volatile market conditions.

Foreign direct investments are likely to waver

Attracting foreign investment in the current political and economic environment has become harder, with many multinationals withdrawing from South Africa, while foreign investors are no longer the main holders of our bonds. The upcoming election will be closely monitored by foreign investors and will set the tone for the next four years of investment spend, economic growth and policy certainty.

Over the past year we have seen a sustained weak rand, and while it was not solely driven by local factors, additional risk premiums were built into the rand due to various risk factors facing the country.

The rand continues to face headwinds

The rand is displaying sustained weakness as it faces both global and local headwinds, making South Africa one of the worst-performing emerging market currencies in 2023.

We shouldn’t be surprised to see the rand devaluating further this year. A decrease in US interest rates, and the subsequent decline in the USD will assist the rand in gaining back some ground; however, we also need to focus on unwinding the risk premia in the rand, caused by the factors mentioned above.

The best way forward for businesses and individuals who rely on forex is “to prepare for uncertainty and volatility, and to hedge when markets provide opportunities”.

In the interconnected and volatile world of 2024, many ripple effects may be hard to navigate without professional treasury, cash management and risk-hedging solutions and advice.

About Citadel Global

Citadel Global is a holistic treasury solutions company that specialises in optimising, moving, and protecting money across the global marketplace. Citadel Global’s services include foreign exchange, treasury solutions and advice, as well as cash management, risk management and hedging strategies. Disclaimer

NEWS & OPINION 29 February 2024 www.moneymarketing.co.za 9 IMAGES Shutterstock .com

This article does not constitute financial advice. All information and opinions provided are of a general nature and are not intended to address the circumstances of any individual. Citadel Global Proprietary Limited is licensed as a financial services provider in terms of the Financial Advisory and Intermediary Services Act, 2002, operating under the approval of the South African Reserve Bank. Citadel Global is member of the South African Association of Treasury Advisors (SAATA) and fully complies with the FX Global Code.

Risk and resilience: Unpacking the effects of South Africa’s prolonged hard insurance market

BY CEDRIC MASONDO Chief Executive Officer, PSG Insure

Reinsurers and insurers in the South African market have shouldered massive losses over the past five years. COVID-19 was the first in a series of unexpected disasters, volatile market forces and social instabilities that contributed to the development of a hard market. At the beginning of 2022, conditions in the local insurance markets tightened further –resulting in arguably the most persistent hard market in recent history.

The insurance market in retrospect

Prior to the pandemic years, South Africa’s insurance market was characterised by softer conditions.

A moderately stable climate, both in macro- and microeconomic terms, gave rise to an abundance of capital relative to the size of the market. This, in turn, translated as lower insurance rates and broader policy terms and conditions. This status quo persisted for at least a decade before the arrival of COVID-19 on South African shores, which was a tipping point for the insurance sector.

No one could have predicted the sheer impact the pandemic would have on industries across the board, or foreseen what would come next. 2021 saw a spate of riots break out in parts of the country. This was followed in close succession by torrential flooding in KwaZulu-Natal. For South Africans, these untimely events played out within the broader context of the ongoing and then deteriorating energy crisis, which caused large-scale damage due to power surges, equipment failure and inventory losses.

Things weren’t looking up on the global front either. During this time, Europe saw an increase in natural disasters, and the Russia-Ukraine conflict put further pressure on supply chains. These events triggered

an upsurge in claims – many of which were related to business interruption and property damage. As a result, countless insurers and reinsurers realised that some exposures had not been adequately priced in.

An unavoidable chain reaction

Outside of these hurdles, the local insurance industry also suffered a knock caused by rapidly increasing inflation and a series of steep interest rate hikes. At the level of the state, slow GDP growth and a lack of infrastructure spending has exacerbated this situation.

On the ground, issues such as poverty and the country’s record-high unemployment rate undermined any meaningful progress towards post-pandemic recovery. The culmination of these factors has meant that less disposable income has fallen into the hands of everyday customers. With less income comes reduced buying power and, ultimately, less spend on insurable assets such as property and cars.

Loadshedding, as a single event, has changed the local risk landscape indelibly, with many insurers removing certain kinds of cover, imposing restrictive clauses and increasing exclusions. A greater level of responsibility has fallen on the shoulders of insured parties, who now have to implement tighter, more thorough risk management strategies.

The emergence of the hard market for insurance

For reinsurers, it has been time to batten down the hatches – to increase rates and tighten terms. In an attempt to consolidate and brace for the impact of the hard market, underwriters deemed certain disruptions such as grid failure to be uninsurable. These changes trickled down to insurers, and ultimately, clients, who have contended with getting less comprehensive cover for the same or a higher premium.

Some insurers have seen higher policy cancellation rates as clients look to optimise their disposable income. However, while the emergence of the hard market may have left industry stakeholders reeling, it may be safe to say that the sector has weathered the worst of the storm. Investor appetite, client expectations and the repricing strategies implemented by insurers to manage the impending risks, have reached a plateau. This does not mean that the hard market is a thing of the past. To the contrary, the hard market is likely to persist well into 2024, especially considering the country’s uncertain political outlook.

A more stable foundation

The long-term effects of hard market pricing and the general tightening of policy has reflected positively on the balance sheets of insurers and reinsurers, which is good news for the sector. In fact, many insurers have reported that they have maintained optimal levels of profitability and are now better equipped and prepared to tackle emerging risks with a greater level of foresight and experience.

Green shoots of growth can be seen in several of the country’s largest short-term insurers, many of which have appointed new C-suite executive and leadership teams who are eager to build on the foundation left by their predecessors. A new leadership system may bring a promising change in direction and a refreshed perspective on how to rebuild trust.

For clients, the hard market does mean higher premiums and more stringent underwriting conditions, but there’s another, more positive side to the coin too. The hard market has increased competition sector-wide. Insurers who have reinforced their operational policies and taken swift and decisive action to navigate the prevailing adversities, are now better capitalised and equipped to handle claims and deliver service excellence to their clients. Within this environment, these robust insurers are eager for good business and are poised to meet the needs and demands of the existing customer base. In light of this, clients can expect to negotiate competitive premiums and get real value for their money.

These shifts have also brought the critical nature of insurer-adviser and adviser-client relationships to the fore. Clients can expect to lean on the industry experience and specialist knowledge of their advisers, who are ready to stand alongside their clients every step of the way.

Equipped with better knowledge on market trends and consumer behaviour, advisers need to go beyond service delivery and become partners of their clients and their businesses. In their advisory capacity, they can offer clients invaluable insights and the tools they need to thrive, even in times of turbulence.

“The long-term effects of hard market pricing and the general tightening of policy has reflected positively on the balance sheets of insurers and reinsurers, which is good news for the sector”

29 February 2024 10 www.moneymarketing.co.za NEWS & OPINION IMAGES Shutterstock .com

The true value of education policies

BY KRESANTHA PILLAY Liberty Chief Specialist for Risk Products and Lifestyle Protector

As scores of South Africa’s 2023 matriculants embark on their tertiary education this year, thousands do so with the benefit of the education policies taken out by their parents to prepare for a time such as this.

Having achieved an impressive 82.9% National Senior Certificate pass rate as announced by Basic Education Minister Angie Motshekga, the 2023 class has been hailed for its resilience in coping with Covid-19’s extremely difficult academic and psycho-emotionally draining years. Many students dealt not only with the loss of their teachers due to the ‘Covid-19 storm’, but also the tragic loss of their parents.

In 2022 alone, Liberty paid over R33m for 732 claims on its EduCator benefit –an increase from the previous year which saw R25m paid out for 569 claims.

“Raising children involves significant costs, particularly when it comes to education. We have seen a good increase in EduCator claims year-on-year as more parents become aware of the available risk cover benefits. More parents are also aware that failing to plan can jeopardise their children’s future,” Kresantha Pillay, Liberty Chief Specialist for Risk Products and Lifestyle Protector says.

According to Pillay, the evolution of education as we know it has also affected the cost thereof and parents have started financially planning for education. Parents start saving for their children’s education sometimes as soon as they learn they are pregnant. “This forward-looking

approach is essentially presenting bigger opportunities and security for the parent and the child’s future,” says Pillay.

This is the kind of life-changing difference Lethabo Molefi*, 32, says she had in mind when she took out an education policy for her 18-month-old daughter this year. Molefi has joined the ranks of many South African parents who are thinking and planning ahead for their children’s education. “When my marriage ended this year, I realised that the weight of the responsibility of parenting is going to be on me,” Molefi, a Senior Social Media Manager based in Johannesburg, says.

“In 2022 alone, Liberty paid over R33m for 732 claims on its EduCator benefit”

She continues, “I thought about what I want her future to look like, and the opportunities I wanted to be able to afford her as she is growing up. Looking at how much daycare costs right now, I compared it to what I thought high school and varsity would cost in future. Because of that, I knew that I don’t ever want to find myself in a situation where she is done with school and can’t go to varsity should she wish to.”

“Education career is no longer linear, predictable, or defined. Though born

in South Africa, a child could end up studying abroad or, as we have now seen, your child is most likely going into a career path that does not exist today, possibly to be formed in the next five or ten years. As a parent, you will need to consider this and ensure you have an education policy that can provide for these possibilities,” elaborates Pillay.

Liberty EduCator has adapted to the growing trend of international communities and emigration by extending its current list of international universities to include more universities in Europe, North America, Australasia, and the Middle East for those looking abroad.

South Africa is notorious as being among ‘ the world’s toughest education systems as listed by MastersDegree.net, which considers factors like the education system’s structure, the country’s most challenging exam, tertiary education attainment, and the prevalence of stress among students – among others.

According to insights from Liberty, for a child who started Grade R in 2023, a complete education – including early childhood development, pre-primary, primary, high school, and three years of university – varies from costing a total of R3m for public school or more than R8m for private school tuition.

Pillay explains that in the past, people would take out additional life, disability, and critical illness insurance to ensure their child can still obtain an education in case of a major life event or change.

“However, if you pass away, there is no

guarantee that the money will be used for your child’s education. In the event of a disability, or critical illness, your coverage will likely focus on paying for rising medical expenses, not your child’s education,” Pillay clarifies.

“ You need to be intentional and know that the money will go towards your child’s education. If it is an education policy, it would then go towards education costs, or even pay the educational institution directly, eliminating the administrative burden and risk of the money being misused,” she states.

Molefi says, “I’ve picked up that my daughter is quite sharp, and I want to get her in the right hands so that it can unlock as many opportunities as possible. I don’t know what that looks like, but I just want her to feel like she’s got options.”

“Education policies are influencing financial products for parents, as more and more people want to secure their children’s educational future. We are also seeing a trend in investment in future planning, especially for young parents who are witnessing the changing educational landscape – one that provides greater choice to learners. As always, it is advised to make these informed decisions with the help of a financial adviser who will be able to assist you to put together a plan to ensure your life goals are achieved,” Pillay concludes.

NEWS & OPINION 29 February 2024 www.moneymarketing.co.za 11

IMAGES pexels.com

What financial advisory firms should focus on in 2024

BY JASON BERNIC AND DAVID KOP CFP® Co-founders and Directors of FI Consult (PTY) Ltd

It’s more important now than ever that financial advisory firms stay abreast of local and global changes in the financial world, as these can have severe impacts on their clients. In this article, we follow several trends that are affecting FAs globally, including regulatory changes, shifting consumer behaviour, technology, the environment and adviser demographics, as well as the rise of advice over product sales.

1. Regulation – We have been in a state of change since 2017 with the release of the RDR discussion document. Many of the proposals have been implemented and yet some of the important ones are still outstanding.

2. Consumer behaviour – Consumer behaviour is changing not just in financial services, but in general. They want deeper holistic services. They don’t want to be sold a product, but experience advice. This has led to advisory businesses needing to update their charging methodologies and service models.

3. Technology – The major benefit of technology is that it allows us to free up time and spend that time with the client. It also allows us to broaden the area in which we deliver services. Clients no longer need to find a planner next door to them, but can find the best in the country.

4. The environment – With pandemics, wars and a cost-of-living increases, our jobs have become harder, but also more important. These environmental factors have helped consumers recognise the importance of advice and are actively seeking planners and advisers who can help them with these matters.

5. Adviser demographics – We have both an ageing adviser base and client base. Globally, generational transfer of wealth is one of the biggest risks identified by financial planning firms. The focus should be on a plan for serving a younger and more diverse client base.

6. Importance on advice – Financial advice is expanding from just the financial products we sell. Financial management issues for young professionals, debt burdens and retirement reforms are creating opportunities for advisers and planners

“One thing that financial planning and advisory business owners should focus on in 2024 is to be intentional about their business strategy”

to engage with their clients on these issues. While all these trends impact financial planning businesses differently, there is one thing that financial planning and advisory business owners should focus on in 2024, and that is to be intentional about their business strategy.

Even if you think you do not have a strategy, you do, even if it is unintended. The best thing you can do for your business is to get intentional. Go through an exercise of defining and documenting your strategy to ensure that you can take advantage of the opportunity created by these trends.

Key strategies to build and grow your practice

1. Embrace technology.

2. Systemise your back office and focus on the client experience. Financial planning has moved from a telling and selling industry to a collaborative profession. You need to ensure that non-clientfacing activities are systemised to free up time to do an adviser’s most important role – focus on client interactions.

3. Change your mindset about regulations. The legislation is not something to be blindly complied with; in fact, blind compliance is what can hurt a business. If you rather try and understand why the regulations are in place, and then focus on how this can help you develop the client experience, you will naturally be compliant and be more client-centric.

4. Build a niche – there is a saying that you cannot make all the people happy all the time. If you look at your existing client base, you may find that many of them share a common trait. This is what attracted them to you and you to them. A client exercise where you examine the traits of your most loyal clients will help you in creating a niche.

Staying competitive in the digital space Technology has completely changed the financial planning landscape over the past 25 years and generously lent itself to improving both the client experience and the administrative function. Highspeed computing power and cloud-based solutions have sped up processes and created previously unimaginable convenience. This means:

• Advisers can work from many different devices from anywhere in the world, at any time Advisors can manage and process information at scale

• Advisors can communicate in many ways, maintaining professional distance or creating intimate connection Advisors have moved from manual calculations and spreadsheets to world-class scenariomodelling software that can be used in real time, in-person and online.

Neither advisor nor client needs to travel anywhere anymore; however, one thing that will always remain is the power of connection. Robo-advice services many clients, to a point, but where bigger clients have more complicated problems, the personal touch continues to be essential. Where in-person meetings are possible, especially with higher-value clients, it is important to create such a touchpoint at least once, if not every so often.

For advisers to remain competitive, they need to embrace technology, both on the front end (financial planning and client engagement) and the back end (administration and processing).

Advisers need to...

• Keep up with and be able to talk about technology with clients, business associates or anyone involved in and with your business.

Failing to ‘be in the know’ around technology unfortunately represents a disconnection with the world. Imagine not knowing what Chat GPT is. Own and use relatively up-to-date technology. It helps with business functions and processes,, takes a lot of administrative pain away, and lends itself to improved client experiences. There’s also the perception factor, e.g. iPhone 15 versus Sony Ericsson flip phone from 2003.

Bring technology into your business and financial planning processes, from CRMs to financial planning software, online applications and straight-through processing.

Go digital in terms of meetings and general communications. Create beautiful digital experiences, especially with virtual meetings, the most important factors being quality of video, clarity of sound, position of camera, lighting and background. Exactly as you would prepare a room for an in-person meeting.

How to acquire new clients

From a business’s point of view...

Financial planning businesses should spearhead the marketing and communications process to create opportunities for their advisers to benefit from. The business is responsible for branding, reputation management and the opening of markets. The marketing activity of the business is more general than that of the respective advisors, but puts the advisors in a position to either create, or respond to, potential new clients more easily.

There are three tiers to a business’s approach:

1. Foundational: website, socials, blogs, articles

2. Beneficial: public relations, paid media, Google ads, partnerships, funnels and retargeting, events webinars, podcast

3. Optional: community work, exhibitions, sponsorship, charities, endorsements, collaborations

29 February 2024 BUILDING A SUCCESSFUL BUSINESS 12 www.moneymarketing.co.za

From an adviser’s point of view...

If the business has a strategy, and any lead sources, advisers need to lean heavily into everything that is on offer. We came up with at least 171 different ways to get in front of potential new clients. These approaches span across 15 categories, some of which are: digital, thought leadership, social, community, networking and existing clients.

Advisers would do well to consider what they have done in the past, whether it worked or not, and what they have considered doing, whether done or not. This is a starting point to explore the number of potential prospecting strategies. Add to this any new ideas, and anything else that has been seen or done. Advisers should then consider which of these ideas they could enjoy, shortlist them to one or two, and create a plan, which should include targets, activity and milestones, placed on a timeline, with a pipeline and an accountability function.

Differentiating a business in a crowded market

Focus on your clients’ goals, needs and circumstances. Most of the industry is still selling product for commission, so when a professional financial planner places a client at the centre of his planning process, value unravels.

• Lead reviews with goals and circumstances –products, costs and performances are secondary.

• Create a differentiating experience through:

› How you show up. Who you are, how you communicate, commitments, promises and follow-ups

› Upskilling technically and also keeping up with markets and what’s happening in the world

› Thinking like an economist and having economics-based conversations

› Communicating with clients regularly and on special occasions

› Having support staff that are client-centric and service-driven

› Be a thought leader – write, post, blog, get on radio and podcasts.

FI Consult provides information to financial institutions on strategy, operations and human engagement. Its mission is to help advice businesses unlock potential and lock in value. Visit www.ficonsult.co.za

› Your financial planning philosophy –what you do, how you do it and why you do it

› Your financial planning process – following the sixstep financial planning process and standardising it throughout the business

› Using financial planning software for modelling and scenario planning

How a DFM can help build a successful financial advisory firm

BY FLORBELA YATES Head of Equilibrium

It is becoming increasingly difficult and costly for financial advisers to keep abreast of all the changes to legislation that affect their practices. Compliance and reporting are taking up a significant portion of an adviser’s time. Add to that the average age of the industry of 57 years –with younger advisers not yet experienced enough to take over their practices – and you soon realise why so many experienced advisers are choosing to partner with a discretionary fund manager (DFM).

The relationship between an adviser and a DFM should essentially lead to a longterm partnership. However, not all DFMs offer the same services, and selecting the right one is a process. Advisers should make a list of the issues they want solved and then ensure that the DFM has the skills and capacity to solve them.

At Equilibrium, we spend time getting to know our adviser partners and to understand the challenges facing their practices. For those who are looking for assistance with their portfolio

management, we build portfolios that align to their advice process, ensuring that the outcomes (or benchmarks) solve for what they are trying to achieve for their clients over the time horizon they have agreed with clients. By understanding the risk tolerance of their clients, we can allocate our risk budget appropriately to ensure that clients remain invested and don’t opt out at the first sign of market volatility.

“Many experienced advisers are choosing to partner with a discretionary fund manager (DFM)”

Advisers who partner with us receive monthly consolidated investment reports showing the look-through into percentages in all their underlying funds, the combined asset allocation at the portfolio level, and the overall performance of the portfolio

David Kop and Jason Bernic are co-founders of FI Consult, a Business Management Consultancy that works with financial planning businesses to help them grow and scale.

Kop has two and a half decades experience in financial planning, including roles in para planning, advising (independent and tied), owning his own business and working at FPI, the professional body for financial planners.

Bernic is a Certified Financial Planner professional and has over two decades of experience in financial services, from financial planning and international wealth management to coaching and consulting.

versus the benchmark over regular periods. They also participate in quarterly report backs, and those advisers with bespoke portfolios participate in quarterly investment committees where they have input into their portfolio construction and manager selection. With the proposed licensing changes for Category I and II financial services providers, this is one of the biggest reasons we now see so many advisers appointing DFMs to ensure they maintain these licenses.

Advisers looking to sell or merge their books with other advisers, looking to join a network, planning for succession, or wanting to grow assets can also benefit from appointing a DFM to ensure the offering across various books or their underlying clients is streamlined. By having fewer underlying funds and more overlap between clients, advisers can segment their clients more easily, get access to preferential fees (both with underlying fund managers and platform providers), better reporting and reduced compliance

burden on the practice, allowing them to spend more time with their clients.

Other benefits of partnering with a DFM include bulk switching capability across all clients simultaneously, and access to institutional and segregated mandates, as well as alternative asset classes, which are not usually available to retail advisers.

At Equilibrium, we partner with advisers throughout their journey. We’ve also seen a recent increase in advisers applying for their Category II licences. If you find yourself at this junction, we also offer supervisory services to help you achieve the goals you have set for your business.

BUILDING A SUCCESSFUL BUSINESS 29 February 2024 www.moneymarketing.co.za 13 IMAGES Shutterstock .com

Equilibrium Investment Management (Pty) Ltd (Equilibrium) is an authorised financial services provider (FSP32726) and part of Momentum Metropolitan Holdings Limited and rated B-BBEE level 1. While we make all reasonable attempts to ensure the accuracy of the information in this article, neither Equilibrium, Momentum Metropolitan Life Limited nor any of their respective subsidiaries or affiliates make any express or implied warranty about the accuracy of the information in this document.

The next step on your career ladder

GERRIE VAN DER MERWE HOD: Financial Planning –School of Financial Services

There are many ways to start a career in the financial services industry: in telesales, as part of a learnership programme, as an administrator, or by joining an internship programme hosted by a financial planning practice. Regardless of how you begin, you will reach a point in your career when you become aware of a deep void that cannot be filled by earning more money.

This innate human need for fulfilment can be satisfied in various ways, such as becoming involved in a charity, pursuing a personal goal like running a marathon, or simply by spending more time with your children. But to achieve a sense of fulfilment and greater happiness, you also need to develop professionally. For someone in the financial services industry, this will most likely mean wanting to become a financial planner.

The Financial Planning Institute (FPI) has set rigorous academic, experience and ethical standards that must be met before qualifying for the prestigious Certified Financial Planner® (CFP®) designation. Although it is fulfilling to achieve CFP professional status, its main benefit lies in an individual’s metamorphosis into a true professional with a wide set of skills that are used to meet the needs of others. The role of experience and ethical standards in an individual’s transformation is apparent, but the academic component is less easily understood. Its usefulness is sometimes questioned, as the naysayers

claim that it does not prepare you for industry work and that software does most of the analysis for you. Such sentiment ignores the continuous development of the academic learning process by tertiary institutions and standard-setting bodies to remain relevant and practical.

Besides that, academic study is also a faster way of gaining competence, and it protects clients from the errors inherent in a purely experiential learning process. Imagine if Christiaan Barnard, the South African cardiologist who performed the first heart transplant, had to develop his technique through trial and error. Many people would have suffered and died until he found the optimal way to carry out the operation. Academic (not practical) study informed his learning, until he could carry out the operation without loss of life. Similarly, by studying financial planning, you can transform into a professional with the ability to safely treat your clients well, without putting them at risk of financial ruin.

The often-overlooked fact about academic study is that deep insight into the nature of the financial process is gained by wrestling with the underlying knowledge base, like a complex calculation. It helps the financial planner to develop an instinct and feel for what to expect in the analysis process. Anomalies, such as capturing

errors, stand out to someone with the right academic background. And this deep understanding of financial planning also enables a financial planner to develop bespoke solutions to meet the unique needs and circumstances of their clients.