AS an independent retailer, you would’ve been urged to get out there and speak to other business owners before, to help you meet new people and learn.

I appreciate this is a lot harder to do in practice than in theory, and can be even more challenging when you are in the minority. As a female working in a predominantly male retail space, I’m not afraid to admit that I’ve felt intimidated and undermined at times. It’s also not easy to be honest about this, but I know I’m not alone, especially among other female retailers.

This is not to say this industry isn’t welcoming, because it is, but unfair gender representation exists, and I’m pleased to say we are working to bring this issue to the forefront.

On 8 November, the inaugural Women in Convenience event will take place in Birmingham, aimed to create a support network to empower and inspire women across the industry. In the lead up to the event, I sat in on a focus group hearing retailers share their experiences of gender discrimination, and how lonely being a female retailer can truly be.

Although this gave me the confidence that we are taking the right action, it saddened me that women today are still feeling judged, and assumed not the decision-makers in their own businesses.

Spaces are still available to attend our event, and it would be great to have anyone there working in retail, no matter their job title. Just simply scan the QR code and register.

THE Scottish government is set to outline a plan to enable more independent stores to secure an exemption from the upcoming deposit

scheme (DRS), sources claim.

The move comes after store owners expressed the current handling fees aren’t enough

to cover the costs involved in participating in the scheme, which rolls out next August, and could lead to store closures as a result.

Fears have since been accelerated due to the ongoing energy crisis. However, an industry source told Retail Express last week, the Scottish government are expected to unveil a plan to enable

more exemptions to protect the survivability of convenience stores.

When asked to outline the details, a spokesperson for the Scottish government didn’t deny the claims, but responded: “We are keen to ensure this process is as straightforward as possible and we are working with Zero Waste Scotland (ZWS) to

deliver additional guidance to support retailers through the exemptions process.”

The exemptions process is managed by ZWS, and has been open for applications since 2021. Any retailer can apply if they meet certain criteria.

Scheme administrator Circularity Scotland Limited declined to comment.

FUJITSU has admitted to being aware of “numerous

the

it gave evidence to

inquiry for the �irst time last month.

Barrister Richard Whittam KC, representing the Japanese technology �irm, reiterated

its apology for involvement, and con�irmed “warehouses have been searched, databases have been processed and electronic documents from approximately 120 Fujitsu individuals have been collected”, amounting to more than 30 million records.

INDEPENDENT retailers have been told to prepare their stores for “hugely disruptive” blackouts this winter.

Last month, National Grid boss John Pettigrew warned blackouts may be imposed between 4pm to 7pm on the coldest days in January

and February if Europe cuts gas exports due to the Ukrainian crisis.

These would have a major impact on independent retailers who rely on electricity to operate EPoS, chillers, lighting and many other vital areas of their stores.

RISHI

“She was not wrong to want to improve growth in this

but some mistakes were made.”

edged

It is yet unclear whether Sunak will announce further support to businesses to mitigate the impact of the cost-ofliving crisis and rising bills.

INDEPENDENT convenience stores are set to face increased competition after Asda unveiled its upcoming ‘Express’ format.

The model is being targeted to local communities, and the supermarket intends to open 30 sites in total, with the �irst

opening in Sutton Cold�ield on 8 November, and a second in Tottenham Hale on 6 December.

Each store will stock 3,000 products, including fresh, ambient and chilled, alongside Asda’s Extra Special own-label and parcel collection services.

A MULTI-SITE Bedford retailer has been left “devastated” after an ATM ram-raid attack on his store left him with £50,000-worth of damage, and “no faith” in the police.

Seelan Thambirajah became a victim of the crime last month, after an ATM was ripped from his Premier Gostwick Road store at 3am.

He told Retail Express: “The impact of this is huge, and my livelihood has pretty much been destroyed. Our CCTV shows the criminals managed to complete the theft in just six minutes. They’d clearly done their homework because they knew exactly where everything was.

“The police turned up immediately and I had to shut the store temporarily for a few days while they carried out the investigation. Since, we’ve had to put up a wooden door to make it workable until the full building recovery can be carried out.

“My store is getting cold and the whole thing is costing me so much money, which is made even worse during these dif�icult times.”

Thambirajah revealed this isn’t going to be a “quick �ix”, and he feels unsupported by the police and government. “We didn’t make any money

from the ATM, and we had it installed to help the community residents have access to cash. Everyone is really upset.

“But I wouldn’t recommend anyone has one in this current climate. The police haven’t returned since to check in, and I feel completely helpless. I’m just in a complete limbo.”

When asked how the investigation was progressing, a spokesperson for Bedfordshire Police told Retail Express: “We were called at around 3.40am on 7 October to reports of a ram raid at a convenience store in Gostwick Road, Bedford.

“Anyone with information is asked to call 101 quoting reference number 28 of 7 October. You can also report information online via the Bedfordshire Police website, or call Crimestoppers, anonymously, on 0800 555 111.”

Jeet Bansi, owner of Londis Meon Vale in Stratfordupon-Avon, experienced a ram raid at his rural store six years ago, and still deals with the trauma that followed.

“I don’t like reliving it because it was a really dif�icult time,” he said. “It had a detrimental impact on our community, and made everyone working at the store feel vulnerable.”

Since, Bansi has invested in a fog machine and exterior lights to deter another attack. “We have learnt

from it and tried to educate staff on what to look out for as these aren’t opportunistic criminals,” he explained.

However, Thambirajah stressed more needs to be done to protect retailers.

“Sometimes it feels like no body cares about the work that independent retailers carry out, especially the government,” he said. “We need more support in so many ways.”

Collating data on the number of recorded ram raids is challenging due to the varying nature of the crime. However, �igures from the ACS’ 2021 crime report revealed 800 attacks took place within a year, averaging 67 a month.

Chief executive James

Lowman added: “Crime is one of the biggest challenges faced by local shops, and incidents of serious and organised crime such as ATM ram raids are extremely costly for convenience retailers and can be incredibly traumatic.

“Retailers are committed to ensuring the safety of their colleagues and customers and have continued to invest in crime prevention measures in their stores, including installing

CCTV, intruder alarms and external security. It’s vital that all of these incidents are reported, and having CCTV with a good view of your ATM can help with the police investigation in the event of a ram raid.”

Retailers are reminded GroceryAid has a range of services available to provide colleagues with emotional, practical and �inancial support, and can be accessed at groceryaid. org.uk.

NISA: The symbol group has confirmed it’s reduced its fuel levy by nearly 10% to £10.99 per drop. The reduction, which retailers pay on every delivery, was implemented on 17 October. Nisa reviews the charge every quarter, basing the rate on the cost of fuel. Despite the decrease, the levy is still higher than the £4.88 rate introduced in February.

For the full story, go to betterRetailing.com and search ‘fuel’

NEWSPAPERS: Royal coverage in September helped most newspapers achieve month-on-month sales growth, according to ABC figures. Analysis revealed stores made an extra £76,000 in profit every week from the category compared with the previous month.

For the full story, go to betterRetailing.com and search ‘newspapers’

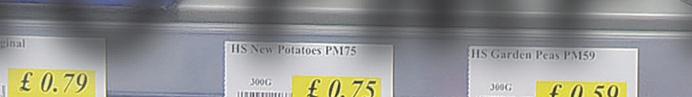

PRICES: Grocery prices are rising faster than the overall rate of inflation. The September figures from the Office for National Statistics showed a 10.1% overall rate of inflation, but prices in categories such as dairy products rose by nearly a quarter year on year. Fruit and confectionery were the only grocery categories to rise by less than 10% year on year.

For the full story, go to betterRetailing.com and search ‘inflation’

PAYPOINT: More than 200 PayPoint stores have been accused of refusing to process the government’s Energy Bill Support Scheme vouchers. Complaints from customers online said they tried as many as seven PayPointissued £66 vouchers, only to be refused service in all.

For the full story, go to betterRetailing.com and search ‘PayPoint’

“The expansion has been a long time coming. If you have Spar above your door, it’s crucial to have an own label to match. The clear message is that Spar wants a really great own-label range. I’m particularly excited about the pet food products. People might not move entirely away from major brands, but I expect an expanded own-label range will still work really well for us, especially with the cost-of-living crisis.”

“I

has quite a good own-label range, which customers really like. I understand that it is going to be quite expansive, with 125 lines over a phased rollout. They’re also going to receive support from Spar International to help with the expansion, which will apply to products across a wide range of categories.”

Anonymous retailer

CONVENIENCE stores provide “vital” services to help shoppers battle the cost-ofliving crisis, experts have claimed.

Speaking at the ACS’s Heart of the Community event last week, communications director Chris Noice said convenience stores are ranked top for having the most positive impact on

their local areas (47%), with 57% of consumers voting them as the most essential service.

When asked how money should be invested in their communities, 53% selected ‘more support for existing local businesses’, followed by 50% for ‘community policing’, 45% for ‘new/emerging local businesses’ and 41% for ‘more CCTV on streets’.

In addition, the trade body revealed that despite the cost-of-living crisis, local shops continue to help customers manage their money.

Sixty-�ive per cent agreed that walking to their local shop saves money on fuel, 61% agreed that their local shop allows them to use a range of services in one place and 57% agreed local shops are a convenient alternative to

delivery apps such as Deliveroo or Uber Eats.

Deputy editor of The Spectator Katy Balls described small businesses as “forces of good”.

She explained: “The health of a community is often judged by how the high street looks. Shops are important to the government, not just for the economy, but what they are trying to achieve with political messages.”

SALES of own-label products grew by 8.1% last month, while branded items declined by 0.7%.

Figures from Kantar also reported the average annual grocery bill is expected to rise by £643 to £5,265.

Head of retail and consumer insight Fraser McKevitt said “consumers are looking for ways to manage budgets and avoid paying more”, and “this is about stocking the food we know and love while hunting for cheaper alternatives”.

For the full story go to betterRetailing.com and search ’Kantar’

CHARITY NewstrAid is offering up to £250 per household to anyone who is working or has worked in the distribution of newspapers and magazines.

The move is aimed at providing support during the costof-living crisis. CEO Neil Jagger said: “We felt it was vital to launch a fund that can provide some financial assistance to anyone in the industry who is finding it difficult to

make ends meet.” To apply and see if you meet the eligibility criteria, visit newstraid.org.uk.

BESTWAY has permanently closed the �irst store opened under its premium Tippl format, after nearly two years.

The site in Garforth, Leeds, was listed as “permanently closed” on the Bargain

Booze website.

Bestway con�irmed the closure, but said more Tippl stores could follow. It said the trial was “enormously useful”, but heavily impacted by the pandemic.

For the full story, go to betterRetailing.com and search ’Bestway’

The Independent Achievers Academy (IAA) joined ENYA MCATEER , of Mulkerns Spar Jonesborough in Newry, County Armagh, to discuss how she is managing the costof-living crisis, as well as how she uses props, involves her staff and adapts planograms to create impactful displays

Shoppers are budgeting, due to rising costs. So customers can plan ahead and spread costs, Enya started stocking Christmas lines in September. Enya also has a loyalty card where customers can load funds to spend at Christmas.

Enya encourages her team to create their displays in the sections they manage, providing feedback and working with them to make improvements. They then check sales reports to see how successful a display has been.

3

Enya and her team find inspiration for displays via social media platforms, such as Pinterest, or by visiting other stores. Enya takes photos and notes any added smells and props she can easily replicate in store.

“Having strong displays has a good impact on the store and it helps sales, too. We use a mixture of wholesaler and supplier planograms that are available online, and we tweak them to suit our shop.”

TAMARA BIRCH

TAMARA BIRCH

SUNTORY Beverage & Food GB&I (SBF GB&I) has launched a new website for retailers, Simply Soft Drinks, which is free to use.

The website contains information, advice and tools to help independent retailers drive soft drinks sales in store. It also contains channel-speci�ic planograms for convenience stores, forecourts, foodservice and health & �itness operators.

Some of the advice includes a category insight guide, which includes the macro trends helping the soft drinks category grow within the industry.

No login details are required, and the supplier has promised regular updates to the website to offer retailers the latest insight, so they are always kept up to date.

Matt Gouldsmith, channel director of wholesale at SBF GB&I, said: “With more than a third of retailers saying they want better impartial advice, we have listened and created this free website to help them drive sales and open up new occasions in store.

“If you are an independent or symbol retailer in any channel, refreshing your chiller and maximising your sales is now quite literally at your �ingertips, with the launch of Simply Soft Drinks.”

PEPSICO has launched a campaign for Quaker, ‘Heat it to release it’, to highlight the brand’s range of hot breakfast varieties and encourage shoppers to choose Quaker satchets and pots for hot breakfasts.

The campaign will span TV, on-demand, outdoor, YouTube and social media to advertise the different �lavours across Quaker’s full lineup. This includes Oat So Simple, Simply No Added Sugar sachets and Heavenly Oats pots.

The supplier is hoping to attract new customers looking for a hot breakfast option in the colder months and follows on from the brand’s ‘The �ire inside campaign’ last year.

PLANT-BASED chocolate brand Butterm!lk has launched two products ahead of the festive season.

The new �lavours, Orange Choccy Segments and Choccy Truf�les with Spiced Caramel, are available now and are dairy-free and vegan, helping retailers to meet the rise in demand for more freefrom lines.

The products are also gluten-free, palm-oil-free and are packaged in recyclable material. The new products follow the supplier’s successful launches of 17 new lines in the past 12 months.

Orange Choccy Segments have an RRP of £3, while Choccy Truf�les with Spiced Caramel have an RRP of £4.

JTI UK has marked Mayfair’s 30th birthday by offering retailers the chance to win £50 or £100 of Amazon vouchers.

Retailers can enter on JTI’s trade website, JTI Advance, and they can gain an additional entry by submitting a short quote on how Mayfair has brought them success in the past 30 years.

Mark McGuiness, marketing director at JTI UK, said:

“Since it was launched, the brand has gone from strength-to-strength and we’re continually looking to innovate to make sure it remains a success.

“We’re launching the competition on JTI Advance as a thank you to retailers for the support they’ve given the brand over the past 30 years and look forward to the next 30.”

FERRERO UK has expanded its Tic Tac range with Tic Tac Fresh, available now to grocery and convenience stores.

Tic Tac Fresh has three �lavours – Strong Mint, Cool Cherry and Grapefruit Mint –each in a 16.4g box at an RRP of £1. The products are sugarfree and HFSS-compliant, and are intended to add a ‘cooling freshness’ to Ferrero’s confectionery range.

Jason Sutherland, UK & Ireland’s sales director at Ferrero, said: “With Tic Tac, we are always aiming to provide shoppers with exciting and fresh taste sensations, and have recruited more than 380,000 consumers as a result of our �lavour innovation.

“As a brand, the total Tic

Tac range continues to outperform the category – 19% increase versus total sugar at 10% – and the introduction of the new Tic Tac Fresh �lavours will further strengthen this growth.”

PRIYANKA JETHWA

PRIYANKA JETHWA

JTI UK has launched the next-generation model of its heated tobacco device with Ploom X, as it plans to phase out its predecessor, Ploom S.

It will be available to selected convenience retailers in the Greater London area from November. The device will be offered as a bundle deal in most stores, including one device and two packs of 20 Evo Tobacco Sticks at an RRP of £29.

The device can be used exclusively with Evo sticks (RRP £4.50), which are available to all London retailers within the M25. Ploom X’s upgrades include

a redesigned heat �low system and a higher heating temperature to ensure a more consistent nicotine delivery; one heating mode; adjustments to the air�low system, enabling a more consistent vapour delivery and increased vapour volume; longer session times of up to �ive minutes and the ability to use more Evo Tobacco Sticks per charge, with up to 22 sessions with just one charge; and a smaller and more compact device.

The front panel is also customisable for personalisation, which will be available online at ploom. co.uk.

Mark McGuinness,

LAMBRINI is kicking off the party season with its ‘Ultimate brini party’ competition to inspire consumers to make Lambrini cocktails.

Entrants can win a range of prizes, with 10 bespoke parties worth £2,000 up for grabs, plus 500 £250 custom neon sign vouchers. To be in with a chance to win,

consumers must purchase a bottle of Lambrini with a promotional neck �lag and enter a code on lambriniparty.co.uk.

The brand currently holds a 60% value share of total perry category, and has a 29% volume share of the combined perry and �lavoured wine market.

marketing director at JTI UK, said: “We estimate the category will be worth

£250m by 2025, with 66% of consumers buying through traditional retail.”

YAKULT is running an onpack competition offering shoppers the chance to win luxury breaks worth £2,600, as well as thousands of ‘feelgood’ prizes.

UK and Ireland.

For every pack purchased, shoppers will have the chance to win by visiting the on-pack URL and scanning their receipt.

To support the campaign, Yakult is working with experts to advise consumers on how they can ‘feel good’ and look after their well-being.

FRUBES has launched its �irst augmented reality (AR) mini-game on-pack.

The packaging displays six new characters and features a QR code that allows children to explore the brand’s bespoke AR world.

While playing, they will be able to interact with friends, share high scores and take sel�ies with Frubes �ilters.

The launch of the minigame will be supported by TV, video-on-demand, online and in-store activity.

Ewa Moxham, head of marketing for Yoplait, said: “We know children are exposed to digital in�luences from a young age and love being involved in shared experiences. Our new game

brings this together to create the ultimate activity to keeps kids entertained.”

ACCOLADE Wines is adding to its Echo Falls Fruit Fusions range with an Orchard Fruits variety.

With an RRP of £5.50, the supplier said the wine is aimed at the brand’s younger (aged 18-30), female audience, who enjoy fruitier, higher-ABV options. It added there is high crossover be-

tween purchasers of Echo Falls and fruit ciders, aiming to give shoppers a reason to continue to select Echo Falls when looking for orchard fruit �lavours in store.

Branded PoS and merchandising will support the launch within wholesale to increase purchase, alongside an in�luencer campaign.

WHITLEY Neill has announced it is expanding into the low- and no-alcohol category for the �irst time with four new 0% varieties.

The range plays off the brand’s core range, and comes in 0% Rhubarb & Ginger, Raspberry, Blood Orange and Spiced Dry varieties. The range has an RRP of £22.

Rachel Adams, marketing director at Halewood Artisanal Spirits, said: “Over the past couple of years we’ve seen more consumers seeking to moderate their overall alcohol consumption. We know these consumers are looking for well-known, trusted brands. Therefore, Whitley Neill is in a prime place to ful�il this demand

by offering an alcohol-free alternative to some of our most popular varieties.”

RED Bull’s new on-pack promotion will give shoppers a chance to nominate their favourite rising UK streaming star, where both the streamer and customer get the chance to win a streaming prize.

The campaign speci�ically targets 18-to-34-year-olds, who the suppliers said log in to watch their favourite players live-streaming.

The on-pack promotion will run across original 4x250ml and 8x250ml cans, and Sugarfree 4x250ml and 8x250ml formats.

The supplier said its Red Bull Energy Drink 250ml four-pack is the bestselling multipack in the sports and energy category in the total market.

NOMO is back with its freefrom Christmas range and is urging retailers to stock up on sweet festive treats that cater for a range of diets.

Available to Nisa retailers is a Cookie Dough Reindeer (RRP 80p), Classic Advent Calendar (RRP £5) and Premium Advent Calendar

(RRP £10).

The brand said it has driven 25% of growth in the free-from chocolate category since 2020, and sales of its Christmas range grew by 90.4% in 2021, compared to the market growth in freefrom chocolate at Christmas of 38.4%.

Lucozade Alert has added more than £2.5m to the stimulation segment since its launch in September 2021 and is also HFSScompliant. RETAIL EXPRESS explores the opportunity it presents for convenience stores

LUCOZADE Alert is a distinctive stimulation drink range from the Lucozade brand. It contains naturallysourced caffeine and vitamin B3, which helps reduce tiredness without compromising on the Lucozade taste, and comes in three flavours: Tropical Burst, Cherry Blast and Original.

Research has shown that 75%1 of adults report concerns about tiredness, yet many shoppers still don’t think stimulant drinks are for them. This ‘white space’ is why Suntory Beverage & Food GB&I launched Lucozade Alert last year. The range responds to a clear consumer need for a stimulation drink which tastes great, is lowcalorie and more relevant to a wider audience, giving retailers a stimulation drink that responds to these clear shopper needs.

Lucozade Alert is also exempt from all HFSS restrictions, which means retailers can site and sell the brand anywhere in store.

“THE stimulation market is worth more than £1bn2 and is experiencing strong growth, increasing by 57% in the past five years, with a predicted growth3 in the next few years. This makes it the fastest-growing soft drinks segment1. However, even with all this growth there is still a real opportunity for retailers to increase their sales even further, as we know that stimulation drinks are only currently bought by 12%4 of shoppers.”

MORE than a third of shoppers would choose a big night in (BNI) over going to a pub, bar or restaurant to save money over the next six months, according to new research commissioned by Häagen-Dazs.

Moreover, the BNI occasion is an opportunity for retailers to drive bigger basket spend, with one in two shoppers spending more than £15 per person. Overall, 64% of retailers feel that the BNI contributes to the success of their store.

The supplier encourages retailers to widen their dessert offerings to maximise sales based on the occasion. Currently,

43% of consumers think the dessert options in their local stores are limited, while 48% say they can’t �ind what they’re craving.

This contrasts with retailers’ perceptions of their ranges: one in four rate their current range of desserts for BNI as “excellent”, with a further 38% rating it as “good”.

Sixty per cent of shoppers would choose ice cream for a movie night at home, while 44% would buy a premium ice cream brand speci�ically for a BNI. This continues into the winter months, with 35% of shoppers purchasing the same amount of ice cream for a BNI in the winter compared to the summer.

Jose Alves, marketing

manager at Häagen-Dazs UK, said: “Providing a range of �lavours and formats to suit different tastes will treat stores to maximum success. Häagen-Dazs gives consumers premium ice cream experiences without compromise, in pint tubs and mini cups for mindful indulgence in portioncontrolled sizes.”

CONFECTIONERY distributor World of Sweets is now stocking new Gummi Pop Surprise novelty sweets.

The sweets are available in Unicorn Pets and Motorz varieties, each at an RRP of £3.

They include toys and candies inside a sphereshaped unit that consumers can peel to reveal the toy and candy compartments.

Overall, there are up to 12 Unicorn Pets and 24 Motorz cars to collect. The sweets are also available in branded display cases to further highlight them.

Chris Smith, marketing communications manager at World of Sweets, said: “Children’s novelty prod-

ucts are becoming more and more popular. Their collectability element means they’ll be a repeat purchase,

element children.”

so they’re de�initely worth stocking up on and their unboxing experience will be a fun element for children.”

FREE-from snack brand Livia’s has launched a selection of its products into select healthy lifestyle wholesalers.

The supplier’s Nugglets in Choc Brownie and Cookie Dough �lavours (RRP £1.79), and Million Squares in Salted Caramel and Orange Chocolate �lavours (RRP £1.79), are now available from Epicurium, AF Blakemore’s Vegan Store, Faire and Ankorstore. They are also available from the brand’s website.

These snacks are vegan, and gluten- and dairy-free. They also include non-arti�icial plant-based ingredients and are free from re�ined sugar, palm oil and preservatives.

PERNOD Ricard UK is launching a Malibu campaign aimed at university students having a safe night out called #Good VibesOnly.

The campaign will see the brand provide thousands of discounted Uber rides as well as branded tuk-tuks across Newcastle, Sheffield, Cardiff and Liverpool to help fresh ers travel home safely.

It comes as research com missioned by Malibu reveals that staying safe on a night out is a key priority for 73% of 18-to-25-year-olds, with nine in 10 of the young wom en polled claiming they’d been made to feel vulnerable.

There are 11,000 £10 Uber discount vouchers for students, while the branded

tuk-tuks will take freshers home from Revolution bars in the cities they appear in. The campaign is supported by

a social media awards push fronted by reality TV celebri ties Joey Essex and Olivia Attwood.

SHAKEN Udder has reformulated its Dairy Free shakes to make them HFSS-compliant, meaning their entire range now complies with the regulations.

Available in Strawberry and Chocolate, the Dairy-Free shakes come in 330ml graband-go bottles. They contain no artificial colours, flavours or preservatives, and are vegan and vegetarian. They have less than 5% added sugar and contain fewer than 200 calories.

The brand uses ethically sourced coconut milk, and the cap, label and bottle are fully recyclable.

Andy Howie, co-founder of Shaken Udder, said: “It has a been a top priority of ours

at Shaken Udder to ensure our shakes comply with HFSS regulations. Our dairy milkshakes were already compliant with HFSS regulations and we have recently

reformulated the recipe of our Dairy Free shakes to make them HFSS-compliant, without sacrificing the deli cious taste and flavour that we are known for.”

WESTONS Cider is urging retailers to capitalise on what it predicts will be a “historic” winter for cider sales.

The supplier forecasts record cider sales due to the first winter World Cup fall ing in between Halloween and Christmas, combined with the increasing yearround sales of cider.

“With the FIFA World Cup taking place in the winter for the first time this year, an exciting opportunity has opened up for cider. If retail ers can stock up in advance, and communicate the events to customers, they will be able to reap the benefits,” said Darryl Hinksman, head

of business development at Westons Cider.

The supplier recommends stocking its leading sellers, including six- and eight-

packs of Henry Westons Vintage and the Stowford Press 10-pack, which has had a 292% annual sales increase.

“I

“I CAN’T survive with these margins. The formula suppliers use to decide PMPs is not �it for purpose. If I can’t get margins of 25% on crisps, 30% on confectionery, 25% on alcohol and 35% on soft drinks, I’m going to struggle.”

“THE changes are adding to the fears of small businesses.

When we need stability and reassurances that we will be helped to survive the costof-living crisis, all we hear is

messages

empty

Jason Birks, Moscis Convenience Store, Peterlee, County Durham

“SOME people are embarrassed to ask for help, but retailers need help. If you don’t ask for help, you don’t get it. Trade press and other retailers need to let them know who to go to for advice on cash �low or mental health. GroceryAid is one, and I’m sure The Fed offers the same.”

Arif Ahmed, Ahmed’s Newsagent, Coventry

because

“THEY are a good thing. With Booker, the margins are pretty good. However, retailers have got to be careful because sometimes prices will be put up and your margin is slashed. Because they’re price-marked, there’s nothing you can do.”

“WE’LL be putting dinner packages together and building value-for-money bundle deals for our customers. We’re talking to wholesalers, brand leaders and local suppliers, telling them that it’s a hard time for everyone. We’re trying to support our community.”

Bobby Singh, BB Nevison Store, Pontefract, West Yorkshire

EVRI owe me underpaid commission on parcels yet again. I operate a small store, so its easy for me to track the parcels coming in and out manually.

It was during this process that I came to realise they’d underpaid me on two consecutive months.

I contacted my rep about

this, and they admitted there was a glitch causing issues. I was told to provide my own breakdown as apparently Evri don’t have this information. I did so and heard nothing back since. This is continuing to happen, and it is so frustrating. It must be a lot harder for bigger stores to keep

on top of.

I have also been experiencing issues with the handheld scanner. I notice that despite scanning parcels when they get delivered, when the customer comes in to collect a package, it no longer exists on the system.

I have to rescan it, which takes extra time when

I’ve already done it. This shouldn’t be happening.

Hardik Patel, Svarn News & Off Licence, Stafford

A spokesperson for Evri responded: “We can con�irm we were already in contact with Mr Patel and are investigating his concerns.”

IT was really nice to be recognised for our efforts by winning this year’s Raj Aggarwal trophy. Not just for me, but my wife, Charlotte, and all the staff that participate in our community events. We don’t do it to win awards, we do it because we enjoy what we do. I knew Raj personally, and applauded him for all the work he did. We’ve managed to raise a phenomenal amount of money over the years, and I want to say thank you to everyone who’s helped. I’m in the middle of preparing for our next event on Bonfire Night – there’s a real buzz in the shop.

WE have put a new sign up outside the shop advertising our community jigsaw swap shop. We’ve been running this for a while, but wanted to shout about it a little more and let passers-by know about it who might not be aware. We encourage people to donate a puzzle they already own, and take one themselves from the shelf to do at home, completely free of charge. It’s so popular and just another reason why it’s so important to do things for the community, especially when it’s appreciated.

I was talking with my RDM the other day and, as someone with a very small store, the incoming deposit return scheme (DRS) in Scotland is very worrying.

When the change in licensing laws came into effect, the onus was placed on the retailer from the start. It was the same with curbing drinking. It fell on us, and at the time we needed the support from the police. We still don’t have that support and the same is now true with DRS elsewhere. It comes into play next August and that’s not as far away as you might think.

For a small store such as mine, I don’t know where I’m going to be able to fit a reverse vending machine, let alone think about the price of the extra electricity it will require to run. The fees for all of this haven’t been calculated correctly and neither have the logistics. I get my rubbish collected twice a week, my recycling even more regularly. The exact frequency of bottle collections hasn’t yet been decided, but I’m worried that there is going to be a backlog. If there is, I’m going to have nowhere to store the containers.

There will also have to be two types of barcode printed in the UK – one for Scotland and one for the rest of the UK – to stop people crossing back and forth across the border, buying bottles and then trying to redeem credit from Scotland. But this will also mean that there will be occasions when people won’t be able to return bottles because of the barcode.

The arrival date of the DRS has been pushed back more than a few times, but it doesn’t seem like they’ve used that extra time to find any more solutions or write any more explanatory information for retailers. They’ve just changed the date and left us to ask ourselves how it’s going to work logistically. It will cause extra stress for independents and their workforce. Everything will end up falling on us, at a time when people expect us to have even more services –whether it’s cash facilities or parcel services.

I plan to apply for an exemption, but I will have to be fast. If too many people have already put in for an exemption in your area, then I’ll be told I can’t have one.

Trudy Davies, Woosnam & Davies News, Llanidloes –@trudydavies1964

‘It was an honour to be recognised’

Dean Holborn, director of Surrey-based Holborns Convenience Stores – @DeanHolbornLondis

JTI UK has partnered with RETAIL EXPRESS to help educate retailers on the importance of responsible retailing. In part three of four, we explore illicit tobacco penalties, the process of reporting illicit tobacco and how JTI UK is supporting retailers to tackle illegal sales

HMRC estimates that 9% of cigarettes and 34% of roll-yourown (RYO) tobacco smoked in 2020/21 was illegal, losing tax revenue of £2.5bn. This brings the total of lost tax through tobacco smuggling since 2000 to more than £51bn.

Great efforts continue to be made against illegal trade, with 1.14 billion cigarettes

and 149.6 tonnes of RYO seized by Border Force and HMRC in 2020/21, protecting revenue of £487.8m. But more help is needed. Independent retailers are at the heart of their communities and are in a strong position to uncover any nearby sellers of illicit tobacco products. By reporting any known illicit tobacco products, retail-

ers can help suppliers tackle the issue.

Sales of illegal tobacco products can result in the suspension or revocation of a premises licence, fines and prison sentences.

“In short, it could mean the loss of a business, financial ruin and loss of liberty,” says Ian Howell, fiscal and

regulatory affairs manager at JTI UK.

Legislation introduced this year provided HMRC officers with powers to apply on-thespot fines of up to £10,000 against those dealing in illegal tobacco products, as well as the ability to revoke the registrations required under trackand-trace legislation.

REPORTING illicit tobacco products and stockists is vital to combat issues faced by retailers. Contact the HM Revenue & Customs’ fraud hotline on 0800 788 887, trading standards via the Citizens Advice consumer helpline on 0808 223 1133, or Crimestoppers on 0800 555 111. Retailers can also visit jtiadvance.co.uk/ dontbecomplicit and use

the Don’t Be Complicit in Illicit microsite’s easy ‘report’ function.

“Educating and training staff on illicit tobacco is also vital, as the more staff who are aware of the warning signs to look out for, the better,” says JTI UK’s Ian Howell.

“It’s also important to obtain your stock from reputable wholesalers, cash and carry depots, or company

salesforces. In the case of cigarettes and RYO, retailers will always be asked for their EOID and FID as part of the tobacco track-andtrace regime.”

Law-enforcement agencies depend on retailer support to take action and Howell says doing this is crucial to tackling the problem head on.

“By encouraging more people, both retailers and

customers alike, to report suspicious activity to the relevant authorities, retailers can help protect their local communities,” says Howell.

“Illegal tobacco is not a victimless crime – it not only takes footfall and revenue away from legitimate retailers, but it also facilitates the supply of illegal tobacco to communities and supports organised criminal networks.”

“ILLICIT tobacco is a challenge for us and while we report each incidence, resources aren’t always available.

“The work JTI UK is doing to tackle illicit tobacco is great and is making a difference. There is more that can be done and we’re confident this can be achieved.

“JTI UK has clearly noticed the issue and have thought ‘how can we change it?’ and ‘what information can we pass on to the relevant channels?’.

“There is a lot more that needs to be done, like working with more suppliers to increase influence with the government or finding a way to share information across the UK so those selling illicit tobacco can’t move elsewhere. It’s all about communication. That’s how we’ll tackle illicit tobacco.”

“AT JTI UK, we don’t take the issue of illicit tobacco lightly. We’re committed to supporting retailers and providing them with the tools they need to join the fight against illicit tobacco.

“Retailers play a vital role in combatting the illicit trade, and our job at JTI UK is to ensure they are knowledgeable and confident in communicating the dangers of the illicit tobacco trade to their customers and steering them away from directly or indirectly supporting organised criminal enterprises.

“We know many retailers feel these reports fall on ‘deaf ears’ and that nothing ever seems to happen. However, everyday enforcement action is taking place and the criminals depriving honest retailers from legitimate sales are being brought to justice.”

SINCE the start of 2020, just one of JTI UK’s investigation projects has conducted more than 830 test purchases and gathered evidence on more than 480 retailers selling illegal tobacco products.

JTI UK is committed to supporting law-abiding independent retailers to tackle illicit tobacco sales. It operates its Don’t Be Complicit in Illicit campaign and

dedicated microsite, jtiadvance.co.uk/dontbecomplicit, to do so.

“We assist law enforcement to stamp out illicit trade through a variety of nononsense measures,” says Howell.

“We regularly conduct test purchasing to identify retailers selling illegal tobacco and, since the start of 2020, have gathered evidence on

480 of them.”

JTI UK shares any evidence of illegal sales collected during these visits with HMRC and trading standards, in the anticipation they will undertake further investigations and mount prosecutions.

The manufacturer has also long advocated for the new powers in the Finance Act 2022, which is an encouraging step for combatting

the illicit trade.

“But to stamp out a resurgence of illicit trade, these powers must be extended to trading standards officers, who currently undertake a significant portion of enforcement action in the UK,” says Howell.

Independent retailers can get further advice on tackling illicit tobacco products from JTI UK’s business advisers.

Join the fight in combatting online illicit tobacco

Know who you should report illicit tobacco traders to Retailers can contact HM Revenue & Customs’ fraud hotline on 0800 788 887, trading standards via the Citizens Advice consumer helpline on 0808 223 1133 or Crimestoppers on 0800 555 111. Retailers can also visit jtiadvance.co.uk/dontbecomplicit.

Double-check your stock

Only obtain your stock from reputable wholesalers, cash and carry depots or company salesforces. Make sure you have your EOID and FID with you, as this will always be checked as part of the tobacco track-and-trace system.

Illicit tobacco will only be tackled if everyone reports it to the relevant authorities. Encourage other retailers and your teams to report suspicious activity to the relevant authorities, which will help you to protect your local communities.

THE contention around the margins offered to convenience retailers by price-marked packs (PMPs) has intensified in recent weeks.

Unitas Wholesale is currently refusing to stock certain Mars Wrigley lines after the supplier increased its wholesale prices, without adjusting PMPs accordingly, meaning retailers were faced with reduced margins.

Some stores are facing a conundrum, as customer preference for PMPs continues to grow. “Eden Farm Hulleys is

monitoring the sales of PMP/ non-PMP volumes, by brand and line,” says Ben Lawrence, sales director at the supplier.

“The past few months have had an increase in demand for more ‘value-priced’ goods, replacing premium branded lines, and PMPs are leading the way here.

“If anything, the demand for PMPs is intensifying and will continue to do so as customers manage their budgets more closely and want to know the cost of their products. It is just about whether this works for the retailer.”

PMPs make up a high portion ofsales in key convenience categories: they account for more than 69% of total soft drinks sales, while KP Snacks’ £1 PMP range now consists of 35 lines and is worth £74.7m, growing by 22% annually.

“Ultimately, the decision to stock plain or PMP is up to the retailer, but in most branded products where we offer both, the rate of sale is almost always heavily in favour of the PMP across every category,” says Kenton Burchell, trading director at Bestway Wholesale.

THE central debate around PMPs centres on whether their volume sales can justify the margins they offer. This can depend on the wholesaler, leaving different retailers with different outcomes.

Muhammad Rashid, of Attock Superstore in Oldham, Cheshire, is a vocal proponent of PMPs, and generally gets margins ranging from 25% to 30% across the categories in which he stocks them.

“For example, a Dreamies

Cat Treats £1.25 PMP outer costs me £5.99, I make 28% margin on it. The same-sized plain pack outer costs me £8.99 – I’d have to sell boxes at £1.75 each and I make 25%,” he says. “The PMP costs me and the customer less.”

Even when it comes to categories where he could make more margin, the risk of lost volume is too great, he says “I’d rather shift two boxes of something in the same amount of time I sell one box that has a

bit more margin,” he adds.

While he has seen PMP prices increase across crisps and chocolates from £1 to £1.25, he says customers are happier to absorb that price as they know he’s not responsible for it.

“If I charged that for a plain pack, the customer would remember the old PMP and think I’m putting prices up artificially, but if it’s on pack, they recognise it’s out of my control and I’m not trying to pinch a few more pennies,” he says.

Muhammad Rashid, Attock Superstore, Oldham, Cheshire

“I LOVE PMPs, as long as the margins are decent. Customers like to complain about the prices, so when it’s price-marked, they can’t complain to me. I’m also not a petrol station, so I don’t have to make my prices more expensive. In Parfetts, £1 Haribo packs get me 30% margin. I’m always quite annoyed when I can’t find products that are normally price-marked because the wholesaler charges more for plain packs and then I have to charge the customer more.

“A 500ml Coca-Cola bottle PMP is £1.39, but if it’s a plain pack I have to sell it for at least £1.69, which is a huge difference when a 2l bottle isn’t that much more, so in situations like that it’s beneficial for me to offer PMPs. I also don’t have an EPoS system, so it’s easier for my employees to look for a price-mark than it is to remember the prices of thousands of items we sell.”

SEVERAL factors are influencing the extent of retailers’ PMP ranges, such as location, competition and customer base. James Stead, who runs White’s Calver in rural Derbyshire, tries to avoid them where possible.

“We’re in an affluent area, and we’re the local shop for five or six villages,” he says. “It’s important to have a few in to show a sense of value, but otherwise we try to steer clear. We would do more if we had more competition.”

Meanwhile, the customer base of Rachael Hockmeyer’s Spar Sleaford forecourt in Lincolnshire is split between residents of a nearby estate and transient customers stopping for fuel or a break, which has impacted her PMP range.

“There are certain departments where you have to have them, and for us it’s cereal,” she says. “With cereals, you don’t lose the margin greatly with a PMP, where you do is products price-marked at £1.

Apart from cereal, we made the decision to price-mark selected lines in a department. In soft drinks, we have budget pricemarked lines like Boost and own-label lines. You’re letting the customer know you have a PMP for them if they want a budget-friendly option, but if they want something more premium, they will have to pay a premium price for it.”

This sort of approach is manageable for the on-the-go customers who are happy to nip in

for a soft drink, snack or sweet treat, while regular customers can rely on their groceries being more appealingly priced. However, Hockmeyer stresses it’s important to make sure your strong PMP sellers remain available, as customers don’t take plain alternatives well.

“We have found from time to time only the plain packs available, then the customer is used to the PMP and you get complaints. That’s why we’re so department-specific,” she says.

“PMPS could be considered one of the grocery category’s greatest promotional tools, so it is no surprise they have grown in popularity across other categories such as beers and impulse lines. Consumers are big fans of PMPs, and in the top sellers lists across the Bestway range, each category includes PMP lines.

“While branded PMPs profit on return (PoR) can be lower than own-brand PMPs, they can absolutely offer very good margins for local retailers. At Bestway, we price-mark the vast majority of our own-brand products and work to a minimum of 30% PoR on certain categories, such as ambient grocery. We also run regular promotions at 40% PoR, which demonstrates that PMPs are well worth investing in.

“While almost all categories operate PMPs, retailers must strike a balance between high-value lines such as spirits, and everyday essentials such as toilet paper, tea bags and multipacks.”

WHERE PMPs are important sellers, particularly as part of a ‘good, better, best’ range accompanying plain-packed premium lines, helping them stand out in the right place on shelf is important.

Visibility is a strong starting point, especially for categories behind the counter such as spirits, or for large multipacks of beer which can be cross-merchandised with food categories.

“The best thing about PMPs

is they essentially include an advert on the products, and therefore sell themselves wherever merchandised,” says Bestway’s Burchell.

“However, retailers should always look at smart merchandising, such as ensuring that associated products are placed near each other in the store.”

Clearly delineating where a category’s value selection starts and ends is also key to spotlighting PMPs – as well

as highlighting where shoppers may want to consider premiumisation. “Alongside offering PMPs, tiering is essential to highlight value propositions,” says Monisha Singh, shopper marketing manager at Kepak.

“Blocking products in good and better ordering from left to right makes the category easier and quicker to shop while offering obvious tradeup options from value to premium options.”

Kenton Burchell, trading director, Bestway Wholesale

BISCUITS and cakes are a firm customer favourite, and while buying habits have changed in recent months for a variety of reasons, retailers and suppliers agree that stocking a core range of established favourites is essential to building strong sales.

Aslı Özen Turhan, chief marketing officer at Pladis UK & Ireland, recommends prioritising the bestselling lines.

“Biscuits are integral to a convenience store’s offer, as the category is worth £273m in the channel. Within this,

core biscuit ranges from established brands, such as McVitie’s, are driving the greatest growth,” she says.

“When shopping for sweet biscuits, the top three purchasing motivators for consumers are quality, price and range. Taking this into account, it’s clear the core favourite biscuit lines should be every retailers’ biggest priority.”

However, while these mainstream products will form the cornerstone of sales, customers are now also looking for a wider range of biscuit and cake

products to choose from. New products – either launches from mainstream brands or different options entirely – can keep an offer fresh.

Susan Nash, trade communications manager at Mondelez International, notes the customer demand for innovation and excitement in this category, as well the increasing levels of on-the-go purchases, which have seen the sales of brands like BelVita grow recently.

Nash also highlights recent research that suggests healthier and more nutritious

food options are important to customers, so retailers

think about stocking healthier alternatives, particularly as HFSS restrictions will impact stores – even smaller ones

as customer and supplier behaviour changes.

“We recognise the importance

snacking

proud

support

new HFSS-compliant

as well as

ranges that are made

packaged with mindful

mind,” she says.

THE cost-of-living crisis has been the dominating theme for the past few months. How can suppliers respond and adapt in kind, while maximising sales?

Pladis’ Özen Turhan highlighted the so-called ‘lipstick effect’ when it comes to biscuits, preferring to either buy higher-quality products less often or to lean into bulk buying to make savings.

“With economic uncertainty manifesting itself once more, shoppers are opting for the bestselling, everyday biscuits

which consumers perceive as a permissible treat or ‘affordable indulgence’. Products in larger formats are representative of a lower cost per kilogram, meaning sharing pouches are a great stocking choice, in order to showcase value,” Özen Turhan says. “Similarly, products in larger formats represent a lower cost per kg, so snacks in sharing pouches – such as McVitie’s Blissfuls – are a great stocking choice when it comes to showcasing value.”

With

tailers showcasing more choice than usual, giving customers the chance to trade up or trade down, to stock up or to just top up. This is also of particular relevance as Christmas approaches. The festive season brings a greater opportunity for sharing cakes and biscuits, for example, as well as the premiumisation and indulgence.

Özen Turhan says: “When embracing an evening in, consumers are more willing to spend on premium propositions from heritage brands, such as

McVitie’s. Stocking premium lines is a retailer’s ticket to generating higher-value sales.”

Mondelez’s Susan Nash is expecting an increase in nights-in sharing occasions, regardless of Christmas, as the weather gets worse and people look to socialise at home rather than in more expensive on-trade.

“Families can turn to our well-loved shareable biscuits, such as the Cadbury biscuits range, including Cadbury Cookies, Cadbury Crunchy Melts and Cadbury Roundies,” she says.

“THE ‘better-for-you’ snacks category has definitely bounced back since Covid-19, totalling £667.3m, value sales and a 5.4% uplift versus last year. Nature Valley is participating in this growth, growing by 3.1% versus last year at £59.4m, while Fibre One is still leading within the diet management segment. Snackers are also looking for options that offer the taste of a traditionally more indulgent product.

“We know many people have a hard time satisfying a broad range of sweet cravings without feeling guilt for indulging. Doughnuts in particular are seen as a tasty and often nostalgic treat, loved since childhood, but now only to be enjoyed on rare occasions due to the level of indulgence. We therefore identified an opportunity to expand our consumers’ ‘better-for-you’ repertoire with the permissible version of the ultimate snacking treat: Fibre One 90 Calorie Doughnuts, which launched this summer.”

maximise sales

Prioritise bestselling lines to maximise the values of any potential sales.

Highlight premium and value options to give customers the choice to save money or treat themselves to an indulgence.

As we go towards the colder months, think about the sales opportunity for nights in and sharing occasions.

Tap into brand campaigns. Cadbury Fingers has recently launched a campaign based around the importance of sharing. ‘Sign with fingers big and small’ is encouraging individuals to learn British Sign Language – this taps into a potential new customer base.

Stocking healthier or HFSS-compliant ranges can add a point of difference to your range and attract different sales, particularly as more suppliers have launched compliant options.

OWING to the new HFSS regulations that have come into force in the past month, there are remaining questions as how to stock sugary snacks like biscuits and cakes, as well as how to promote them,

all the while still attaining a level of reasonable sales.

“Businesses with stores under 2,000sq ft or fewer than 50 staff members can continue to encourage shoppers to purchase on impulse – and

generate strong sales growth – by positioning the bestselling biscuits and cakes, along with exciting launches, at end-of-aisle, front-of-store or right by the checkout,” says Pladis’ Özen Turhan.

JP Del Carmen, head of snacks at General Mills

SUPPLIER VIEW

THE cigars and cigarillos category may not be as large as other nicotine categories, but it is still enjoying decent growth within the industry and offering retailers sales opportunities from a variety of different avenues.

One of the most relevant is the Christmas treat opportunity, with people either looking to get themselves, a friend or relative something special for Christmas. Cigars fit into this category nicely, with options

ranging from well-known and popular brands such as Sterling, Signature and Hamlet all the way to super-premium hand-rolled cigars from Cuba and other countries.

“A trend we continue to see from year to year is that cigars and cigarillos are most popular around particular seasons – with a volume uplift trend in the run-up to December,” says Gemma Bateson, sales director at JTI UK. “It is therefore important for retailers to

stock up ahead of Christmas to make the most of their popularity.

“Aside from cigarillos, retailers should also consider brands in both the small and the medium/large segments to ensure they are covering their bases, so think about including the top-selling brands from each segment as a minimum,” says Alastair Williams, country director at Scandinavian Tobacco Group UK (STG UK).

CHARLES WHITTING finds out how retailers can use cigars and cigarillos to drive sales this winter

WHEN it comes to any tobacco or nicotine products, the lack of visibility they have because of legislation means retailers have to use their own knowledge to promote and recommend them to customers. They also need to know what their customers are after and ensure they are stocking up on anything that is requested. If customers get the idea they can’t get certain cigars at a store, they are likely to think that is always the case.

“Customers will have their

own preference of brand and what they will purchase. Retailers should be aware of their customers’ needs and on which products will be profitable for their margins,” says Kenton Burchell, trading director at Bestway Wholesale. “Customers know what brands they like to purchase, and retailers should be aware of the brands they need to stock to drive sales and keep margins afloat.”

John Foy, from Mam’s Convenience Store in Maghull, Liverpool, enjoys strong ciga-

rillo sales throughout the year because he has brand-loyal customers who know they can get what they’re after from his store.

“We have people coming in the same time every week for their cigars. The Sterling 10-packs are the most popular. Our customers are very brandloyal,” he says.

Brand loyalty certainly exists within the cigar category, particularly when it comes to higher-end, premium products. But retailers would do

well to have trade-down as well as trade-up options in their store and ensure they are letting customers know about this, even in the run-up to Christmas.

“Customers who buy cigars and cigarillos are usually pretty brand-loyal, however it’s certainly possible the current cost-of-living crisis will encourage some adult smokers to look to search for more ‘value’ brands, like Moments, to save some money,” says STG UK’s Williams.

AS well as knowing what customers want, retailers should also know more about the products they have on offer in order to make informed and helpful recommendations to their customers.

Bhavin Patel runs Tylers Green Stores in North Weald, Essex. It’s a specialised store with around 200 hand-rolled cigar options, most of which his customers can’t get anywhere else in the county. That

is a major selling point for his store, but requires enormous knowledge about cigars from himself and his team.

“You need that knowledge with these products. It’s a passion for me,” he says. “I have people come a long distance – from south London, even – to buy our products.”

However, even below the highest end of the cigar market, staff knowledge and understanding remain crucial.

Bestway’s Burchell recommends retailers keep to up to date with the latest products on offer to ensure they are stocking and can talk confidently about the products their customers are after.

“Retailers should use our category advice and marketing insights to give them an insight on the products and the popular brands that they will need to sell in the store,” he says.

Knowledge is key

Having up-to-date knowledge on the latest cigar and cigarillo products is key to offering a good level of customer service. To confidently talk about new products, retailers and their staff should use all the platforms available to them – including JTI’s trade retailer website, jtiadvance.co.uk.

Availability and range

Through stocking a full range and maintaining good availability of products, such as Sterling Dual Capsule Leaf Wrapped, retailers and their staff can provide a successful offering and service to their customers without them having to shop around.

Display it right

JTI’s larger category solution includes backlighting where cigar, vaping, next-gen and tobacco products can all be stored in the same gantry. The solution incorporates the entire category and is available in a variety of widths.

Keep up to date

JTI recently announced the transition of its sales force to business advisers, who are allocated smaller, dedicated catchment areas where they will be responsible for every trading channel within it. This means they can provide a more bespoke, personal service so they can identify commercial opportunities.

The RETAIL

Catherine Johnson, Premier St Dogmael, Pembrokeshire

Catherine Johnson, Premier St Dogmael, Pembrokeshire

“I USE a couple of stockists outside our main wholesaler. They have a minimum order, so I try to meet, but not exceed, it. I’ve put Christmas stock out already in anticipation of people budgeting and needing to stagger their purchases. I wouldn’t be surprised if there was a drop in demand. I’m certainly anticipating a lower level of card sales. The move towards not sending ‘unnecessary’ materials is de�initely happening. If people normally treat themselves to four things, this year they’ll be more inclined to treat themselves to three because of rising costs

“But I do think it’s going to be very similar to the past few Christmases. We’ll keep a range of value and high-end items. In biscuits, for example, I have two packs for £2 and I also have a box of Borders biscuits for sharing or gifting priced at £16. It’s about giving the customer a choice. I’ve kept the choice, but I’ve reduced the volume I’ll be buying.”

“WE’RE going to take things day by day this Christmas. The costof-living crisis is the main issue we’re facing this year, and we’ve already noticed people cutting down heavily on unnecessary spending in the shop. They’re looking for value for money much more now, and if they don’t have to spend their money on something, then they won’t.

“We’ll be stocking the same products mostly this year compared with previous Christmases, but we’ll be cutting down the amount of stock that we’ll have in store because a lot of people will be cutting down their Christmas purchases this year. If needs be, we’ll go to the cash and carry on a daily basis rather than a weekly basis to keep things topped up or if we run short. We’ll still be stocking premium products, but just on a more limited basis. Most of the retailers in the area are doing the same things as us.”

“WE’RE a traditional CTN business that’s part of the community. We gained customers during the pandemic and we’ve largely retained them. But this year, we’re seeing people watch their spending even more now than they’ve ever done before. People are just after value options at the moment and we stick to what sells.

“Everything keeps going up in price and, for the most part, customers don’t feel they can do much about it. We’re still selling price-marked packs in the store. The chocolate has gone up from £1 to £1.25, but I think it’s better to see that increase coming from the manufacturer rather than from me. There’s always that suspicion otherwise. I think people are happy with the manufacturers plastering price increases via PMPs rather than retailers doing it themselves. We have to concentrate on doing the basics right. It’s going to be very challenging.”