Get your store ready for this big seasonal opportunity

Get your store ready for this big seasonal opportunity

Don’t get

caught

Alex Yau, editor

THIS month, I was given an inside look at what happens with the used disposable vapes taken for recycling from stores like yours.

A major UK waste company kindly invited me to one of its centres, where I saw step by step how used vapes are disposed of.

ALEX YAU

It was an eye-opening experience that exposed a lesserknown black market within the vaping industry (p3).

The next six months will be crucial for retailers in terms of managing their ranges while disposable vapes are still legal, and what to do a er the ban comes into e ect.

I’m excited to announce this issue’s cover story marks the start of Retail Express’s Countdown to the Disposable Vapes Ban campaign.

For the next six months, each issue will include news and features to help you prepare for the upcoming legislation.

Correction:

A Simply Doughnuts Ring Bakes story (Retail Express, 3 December) contained some inaccurate information. The actual lines available from Booker are Cocoa Glaze with Cocoa Cream Filling and Strawberry Glaze with Strawberry Jam Filling. They come in cases of 18, and Booker’s RRP is £1.19. We apologise for any confusion.

@retailexpress betterretailing.com facebook.com/betterretailing

020 7689 3358

Production editor

Ryan Cooper 020 7689 3354

Sub editors Jim Findlay 020 7689 3373

Robin Jarossi

Head of design

Anne-Claire Pickard

020 7689 3391

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Production coordinator Chris Gardner 020 7689 3368

– news Jack Courtez @JackCourtez 020 7689 3371

Features editor Charles Whitting @CharlieWhittin1 020 7689 3350

Features and advertorial writer Priya Khaira 020 7689 3379

Head of marketing Kate Daw 020 7689 3363

Head of commercial

Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205

Account director Lindsay Hudson 07749 416 544

Editor in chief Louise Banham @LouiseBanham

Features writer Jasper Hart @JasperAHHart 020 7689 3384

Specialist reporter Dia Stronach 020 7689 3375

Account managers Megan Byrne 07530 834 009

Lisa Martin 07951 461 146

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital Luthfa Begum 07909 254 949

EVRI retailers have lost out on the post-Christmas parcel rush following malfunctions with their printers.

Several store owners nationwide told Retail Express the kit had been “glitching” since December. Common issues included being unable to connect to the internet and paper rolls jamming.

Simon Grewal, of Premier Crabbs Cross in Redditch,

Worcestershire, said: “I’ve been told it’s a nationwide issue and the equipment is out of date.”

Maqsood Akhtar, of Blackthorn News & Food in Rotherham, said his parcel volumes rise from 600 to 1,000 transactions in January, but he has had to turn customers away.

He added: “The printer hasn’t been loading properly at all and fails to turn on. I spoke to Evri, which said it might take me two weeks to

receive a new working printer. I’m having to let a lot of customers down.”

Evri has since spoken to both retailers to send a replacement printer.

Other retailers experienced no issues, with some bene�iting from nearby failures.

Natalie Lightfoot, of Londis Solo Convenience in Glasgow, told Retail Express her store had received a major uplift in demand as she has the only working printer in the area.

network is an important part of our operation, providing pick-up and drop-off services to customers throughout the UK.

“Customers can use our locations to return parcels, with the option to either print their own label at home or in store.

NISA’S managing director, Peter Batt, and commercial director, Ayaz Alam, are to leave the business.

Co-op con�irmed the departures were to help it develop “signi�icant growth opportunities”.

An Evri spokesperson said: “Our 9,000-strong ParcelShop

“We work closely with all ParcelShops, providing a support line and direct point of contact for any issues, and we work hard to repair or replace any equipment as quickly as possible.”

FORMER Post Of�ice (PO) boss Paula Vennells has maintained her innocence, stating she was “devastated information was not shared with her” during the Horizon scandal.

Co-op managing director for B2B and growth Jerome Saint-Marc will oversee management in the interim.

The multiple’s commercial director, Sinead Bell, will look after Nisa’s commercial team during the transition.

STORES are to lose thousands of pounds following Imperial’s decision to pause incentives.

Several retailers told Retail Express the tobacco giant had temporarily stopped rewards for retailers who stock its brands under RRP. One retailer claimed their rep attributed the change to the high cost of the scheme and Imperial changing its focus to its new value-led Paramount brand.

In closing submissions for the Horizon inquiry last month, Vennells’ lawyers claimed no evidence had emerged to show she had acted in bad faith during the historic failures.

Meanwhile, Horizon IT provider Fujitsu said it “fully acknowledges and accepts its share of those failings”.

BESTWAY could lose 35 stores from its Bargain Booze and Wine Rack estate as part of lease negotiations with landlords.

According to Sky News, the �irm informed landlords about plans for a company voluntary arrangement for its retail arm. Sources claimed Bestway wanted to exit leases linked to vacant stores. The wholesaler intends to negotiate rent reductions with landlords across a further 10 sites.

14 -27 JANUARY 2025

DISPOSABLE vapes recycled from convenience stores are being illegally resold overseas, while some recycling bins are being used as dumping spots for hazardous drug paraphernalia.

According to a senior vaping-industry whistleblower, some retailers trying to comply with mandatory vape-recycling legislation were unknowingly supplying a recycling black market.

Exposing this hidden dark side to Retail Express, the industry insider said: “We found out recently there are various companies exporting disposables to Africa for reuse. It’s unbelievable, but some will happily consume a disposable vape that’s been used.

“We have it on very good authority that 20 tonnes of used vapes had been shipped out to Africa three months ago. They were all disposables, speci�ically targeted to be reused.

“Retailers are doing the right thing by having facilities for customers to recycle waste, but some of this stock is being sent abroad illegally.”

The source, who had access to industry-wide recycling data, added that only 5% of vapes taken from recycling bins were illicit. However, they claimed some bins were being used to dump dangerous materials.

They explained: “The vape-recycling companies sometimes get used drug needles, used drug bags and sex toys. If a retailer �inds a syringe or similarly dangerous material in their bin, we strongly advise them to leave it. Get in contact with your recycling provider, who can help sort it out.”

The source added there were fewer cases in retail because the bins mainly contained vapes and batteries, with public waste centres being the main hotspots for illegal materials.

The whistleblower also claimed some recycling companies were creating �ire hazards by sitting on used vapes, and not processing them for disposal.

They said: “I think one of them may be building them up to increase the fees they collect.”

Despite the issues around disposable-vape bins, the insider urged retailers not to ignore mandatory waste-recycling regulations ahead of increased efforts by trading standards to check compliance.

Retailers selling electrical equipment must offer recycling services for those goods under the Waste Electrical and Electronic Equipment (WEEE) regulation.

Those who have sales of less than £1,923 per week in electrical goods can qualify for the Distributor Takeback Scheme, where they help fund local-authority

recycling, instead of hosting a recycling point in store.

Non-compliance could result in maximum penalties of unlimited �ines.

Advising on what retailers can do to ensure they’re working with a legitimate vape recycler, the source explained there were several checks.

They told Retail Express:

“The illegal exports and hazards emphasise the importance of why retailers should ensure they’re using legitimate recyclers to get their waste sorted.

“Any recycling organisation must issue a quarterly return to show how much they’ve processed. This needs to be provided by law.

“The best entities for compliance advice are those

“WARRINGTON has recently been hit by severe flooding, which means some customers are unable to access vital services. We’ve gone to check on them. I have also worked with the local Sikh gurdwara to prepare hot meals for those in need. Nearly 300 meals have been cooked. A partnership with Nisa’s Making a Di erence Locally charity is also enabling us to raise and donate money to those most a ected.”

Mike Sohal, Dallam Stores, Warrington, Cheshire

that have well-established schemes such as Veolia, REPIC, Ecosurety and Valpak.

“They’ll have scheme managers who can give you all the advice you need for compliance, and can give you a proper timeline of any upcoming changes, whether small or big.

“They’ll have good relationships with trading standards. You want to avoid companies that have only recently been set up.”

Last month, a senior government source con�irmed to Retail Express that trading standards enforcement around WEEE is to increase.

They added small shops were mostly non-compliant due to concerns over cost, management and hygiene.

The whistleblower add-

ed: “Independent retailers are some of the worst for WEEE compliance.

“This goes from some franchises to one-man bands. I’ve never seen recycling bins in them, whereas the big chains such as BP, Co-op and Spar, do have them.

“We need to press upon retailers the importance of complying with WEEE.

“There was a company that had a �ire on premises caused by a vape. The loss adjuster refused to pay out on the damage because it didn’t show diligence in reducing the risk.”

COSTCUTTER: The symbol group has removed the £3.66 fuel levy charged on all deliveries to its mainland retailers. Costcutter said the decision implemented this month was to help its retailers overcome challenges associated with rising business costs such as the National Living Wage and National Insurance.

For the full story, go to betterretailing.com and search ‘Costcutter’

DSL GROUP: Convenience stores working with the general merchandise supplier have increased annual sales by £10,000 to £15,000, according to director Karanbir Landa. The company has more than 500 lines available, including imitation perfumes, hot-water bottles, heaters, air fryers, DIY tools, gifts and car-care products.

For the full story, go to betterretailing.com and search ‘DSL’

ROLLOVER: Retailers are still being a ected by availability issues from the food-to-go supplier, more than a month since they started. The company told retailers availability of its frozen baguettes was a ected by the closure of a major port on 7 December. Store owners were told to expect a backlog as the port reopens.

For the full story, go to betterretailing.com and search ‘Rollover’

KANTAR: Market share held by convenience stores for the nal three months of 2024 fell annually by 1.4% to a record low of 1.3%, according to newly released gures from the market analyst.

For the full story, go to betterretailing.com and search ‘Kantar’

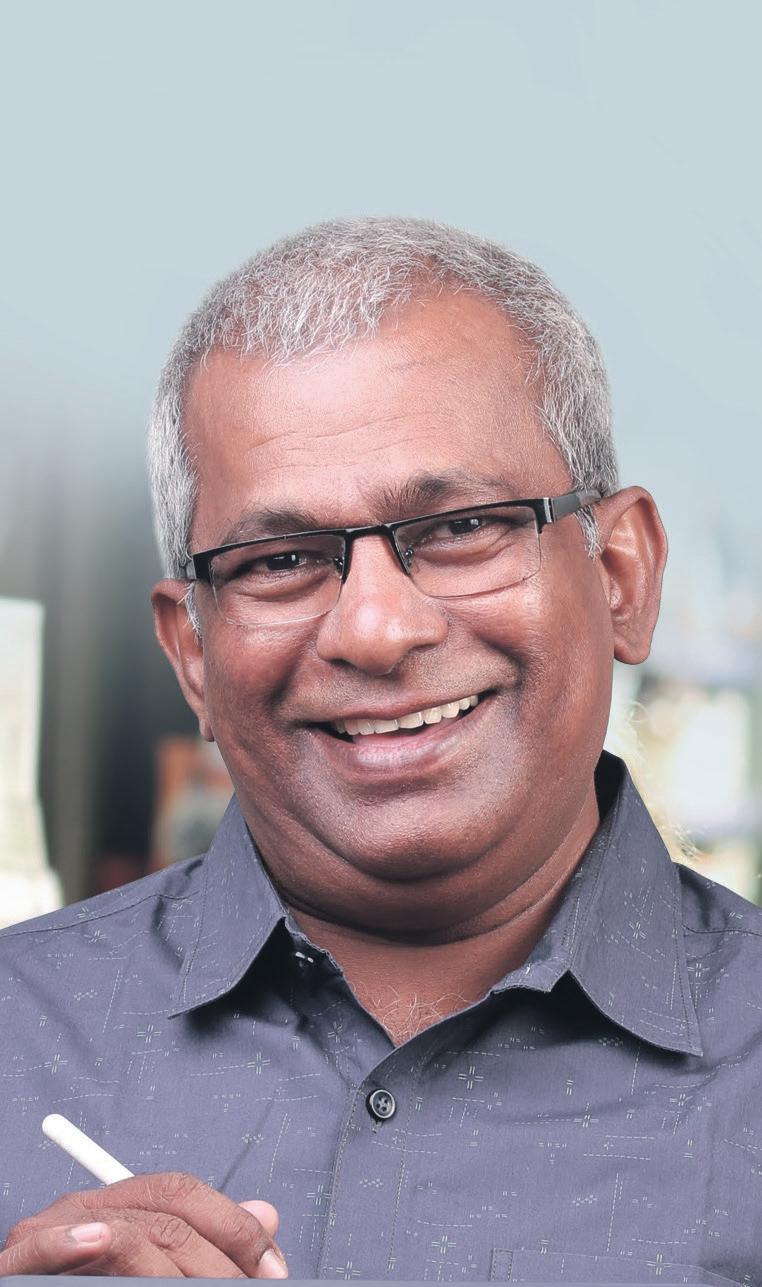

“WE started sponsoring the football team at my children’s school. Then, at a parents’ evening, we were approached by other parents telling us about events they had coming up, and asking whether we’d like to get involved. Your local schools are always good places to begin. It’s about being aware of what your community needs and building your contacts.”

Benedict Selvaratnam, Fresh elds Market, Croydon, south London

“WE have a ‘friends’ aisle speci cally for residents who want to have a chat. The nearby mental-health centre closes at 4pm, and lot of people might need someone to talk to after that time. Sometimes, going to social centres or friendship cafés has a stigma and people are scared of being labelled as a ‘loner’, but no one would second guess them coming to a store.”

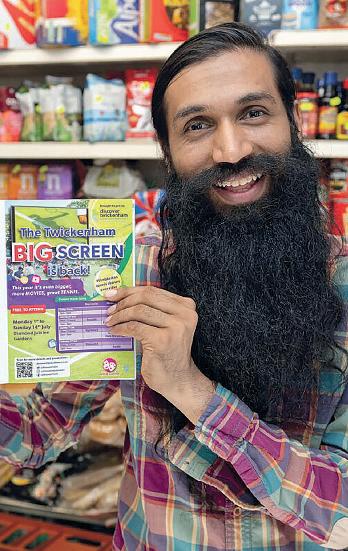

Deep Patel, Meet & Deep News, Twickenham, southwest London

ALEX YAU

SOME wholesalers are considering scrapping PMPs for plain packs following concerns suppliers are taking margin away from the format.

Several members of Unitas Wholesale have begun exploring plain packs in favour of PMPs, according to the buying group’s managing director,

represents many major convenience cash and carry and delivered wholesalers.

Kinney told Retail Express: “Are PMPs still bene�icial for retailers under mounting cost pressures? With businesses grappling to remain viable amid soaring costs, such as National Insurance contributions and the National Living Wage, these pressures are no longer short-term issues, but

operating costs for retailers.

“Many retailers are already pivoting towards straight packs, but this shift presents challenges. Wholesalers cannot stock both pack variants for every line, and there may not be an appropriately sized alternative product in the right case size.

“If margin issues remain unresolved, it may spell the end of support for PMPs by many

brand owners who value the independent retail channel as a pro�itable route to market, urgent action is needed.”

One of Unitas’s members, Parfetts, con�irmed to Retail Express it would not abandon PMPs. Parfetts joint managing director Guy Swindell said: “PMPs drive footfall in convenience. It’ll be a long road back to plain packs, which can reduce the rate of sale, so we’re

wholesaler Bobby’s is to improve tailored ranging for

�irm’s national sales manager, John Lucas, told Retail Express: “One of the key areas for improvement is new software we’re giving reps to use. The data inputted by reps will give us more knowledge on what retailers are buying and selling in different regions. It will tell us what the most popular products are. We’re using it to help the retailer grow sales and pro�it in their store.”

AN armed man suspected of causing fear of violence with a handgun at a Booker warehouse has been arrested.

O cers were called to the depot in Acton, London, in the early hours of 11 December, following reports a man was ring a handgun in the car park.

Cicerone Lichi, 51 years old, of no xed address in Ealing, was arrested and

charged with possession of an imitation rearm with intent to cause fear of violence. The investigation is ongoing.

star Alex Iwobi opened a convenience store to give free food to those in need.

Iwobi told BBC Africa:

“Here, we’re creating my own ‘Alexpress’, a little minimart to try and give out food to families that are not able to go and get food for their families at Christmas.”

The Fulham and Nigeria mid�ielder set up the “Alexpress” pop-up store in Canning Town, east London, last month, allowing residents to pick up food and drink for free.

PRIYA KHAIRA

MARS Chocolate Drinks & Treats (MCD&T) has expanded its ice cream range with the launch of the Snickers White Ice Cream bar.

This new addition combines roasted peanuts, nougat and caramel, all coated in white chocolate. It is available now in multipacks of four, with a £2.50 RRP.

The launch follows a strong performance by Mars in the ice cream category last year, with multipack unit sales up 5% and value sales increasing by 3%.

The Snickers White Ice Cream bar aims to attract both ice cream and white-

chocolate enthusiasts.

KP Nuts has partnered with darts sensation Luke Littler, recently crowned world champion and known as ‘The Nuke’, to strengthen its presence in the convenience sectors.

Littler sported the KP Nuts logo on his sleeve during the PDC World Championships at Alexandra Palace in December/January. Fans also had the opportunity to win signed merchandise through the collaboration.

Kevin McNair, marketing director at KP Snacks, highlighted Littler’s talent and energy as a perfect match for the brand’s spirit. Further partnership details will be revealed later this year.

According to Kerry Cavanaugh, general manager at MCD&T, the success of the company’s multipack offerings re�lects a growing trend for at-home ice cream consumption as a dessert or treat.

PARFETTS

PARFETTS has expanded its Go Local own-label range with three dried pasta varieties: Spaghetti, Fusilli and Penne.

2021–2022.

The Go Local pasta range is available at Parfetts depots and online.

“In the UK, 13% of all multipack ice cream sales are a white-chocolate variant.

Coupled with the popularity of the Snickers brand, we see a great opportunity to appeal to ice cream and whitechocolate fans alike with the launch in 2025,” he said.

ing at £1.19, with Spaghetti

The new products are available in 500g pricemarked packs (PMPs), retailing at £1.19, with Spaghetti offered in cases of 12 and Fusilli and Penne in cases of six.

UK retail data indicates that pasta remains a staple in household meal planning, with average consumption at 86g per person per week in

SANPELLEGRINO has introduced a refreshed can design across its UK range, emphasising the brand’s Italian heritage and use of sun-ripened Mediterranean fruits.

The updated design, available in individual and multipack formats, aligns with the upcoming nationwide rollout of its Zero Added Sugar range later this year.

The redesign is part of a broader campaign to strengthen Sanpellegrino’s UK presence.

Brand manager Aryna Yersak said the new look enhances the feel of a premium drinking experience while re�lecting the heritage of the brand.

ROCKSTAR Energy has rolled out a new ‘two for £2’ pricemarked pack (PMP) across its entire range. The multibuy offer aims to capitalise on the growth of stimulant energy drinks, which are up 5.8% year on year, adding £50.3m in value to convenience.

The offer includes popular �lavours such as Tropical Guava, Blueberry Pomegranate and several Zero Sugar options. The existing £1.29 individual PMP will remain available.

Ben Parker, Britvic’s commercial director, said the new PMP supports retailers by delivering value and meeting the strong demand for energy drinks.

HOOCH has introduced two new �lavours, Cherry Cola and Blue Raspberry, to its caffeinated RTD Soopa Hooch range, alongside a refreshed can design.

featuring in�luencer and experiential activations is planned for this year.

The new additions are now available across wholesalers following its initial launch in B&M.

SPANISH beer company

These �lavours join the existing lineup of Darkest Berry, Twisted Tropical and Electric Lemonade, bringing the range to �ive varieties.

Soopa Hooch has added over £800,000 in incremental value to the enhanced RTD category since its launch last year, driving an 18% increase in rate of sale.

A marketing campaign

Damm is now the exclusive UK distributor for Kirin Ichiban, following a long-term agreement with Japanese brewery Kirin Holdings.

The partnership sees Damm taking over distribution responsibilities from Carlsberg Marston’s Brewing Company (CMBC).

This move aligns with growing consumer demand for premium imported beer brands in the UK market.

By adding Kirin Ichiban to its portfolio, Damm aims to strengthen its presence in the premium beer segment while bringing a popular Japanese lager to a wider UK audience.

The collaboration comes after a year of strong growth for Wall’s, which saw a 40% increase in value sales and 36% in volume. The brand is also donating its products to food banks.

WALL’S Pastry has announced a charity partnership with Action Against Hunger, pledging to donate 5p from every pack sold of its 10x55g sausage rolls. Proceeds will fund initiatives addressing food insecurity in UK regions with high child poverty rates, supporting food distribution centres and essential supplies.

PRIYA KHAIRA

MARS Wrigley has expanded its Easter 2025 range with 10 new products across brands such as M&M’s and Galaxy.

The lineup caters to various occasions, including self-eat, sharing and a range of different egg sizes.

For self-eat treats, new additions include the M&M’s Crispy Bunny, which is �illed with M&M’s Minis, and the Maltesers Popcorn Bunny, featuring popcorn pieces.

The sharing-options range has expanded, with M&M’s Choco Mini Eggs, containing crispy pieces, and Galaxy Minstrels Mini Eggs being the latest additions.

Medium eggs include the M&M’s Minis Medium Egg and Maltesers White Mini Bunnies Medium Egg, designed to drive early season sales and repeat purchases.

Larger offerings include the M&M’s Crispy Bunny Large Egg and the Snickers Extra Large Egg.

The �inal launches are the Maltesers Truf�les Giant Egg, which includes Maltesers’ truf�les collection and the Galaxy Ripple Giant Egg.

Apart from these launches, there are 18 returning lines, which have had packaging or artwork changes.

In 2024, one in three shoppers bought Mars Wrigley products at Easter.

SPORTS-NUTRITION brand

Warrior has launched Creatine Protein Bars, which combine 20g of protein and 3g of creatine per serving to support strength, muscle growth and performance.

Available in Chocolate Orange, Chocolate Peanut, and Salted Caramel Brownie �lavours, the bars are low in sugar and fat, contain 237 calories and are suitable for

Additionally, last year saw the biggest spring season for chocolate confectionery yet, with value and unit growth outperforming total FMCG and confectionery.

vegetarians.

With the UK protein-bar market growing by 7.8% in 2023, the launch re�lects increasing demand for functional, health-focused snacks.

Priced at £2, the bars are available via Tropicana Wholesale.

ARIEL has partnered with former England striker Peter Crouch to launch The Big One pods, designed for tougher laundry loads.

The campaign spans TV, digital, social media and in-store promotions, with Crouch starring in an advert showing his humorous take on messy situations.

Available nationwide in Ariel’s original, colour range, and Fairy Non-Bio, the product promises to make laundry less of a “big deal”.

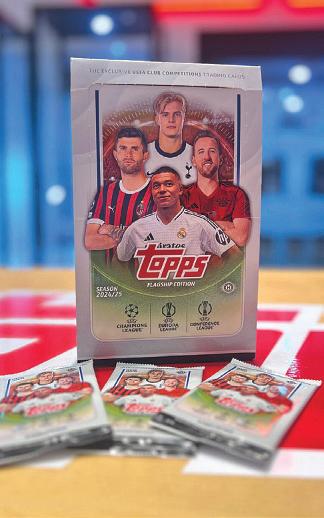

TOPPS has unveiled the UEFA Club Competitions (UCC) 2024/25 Flagship Collection. This features a lineup of autographed cards from football legends of the competition, such as Cristiano Ronaldo, Lionel Messi and Zinedine Zidane, alongside Erling Haaland and Jude Bellingham.

Highlights include a 1/1 autographed Endrick Rookie Arrival relic card and limited cards like Hype, showing Real Madrid’s rising stars.

The collection introduces new features, including Dual Autograph Teammates cards and Marks of Excellence cards, signed by Ronaldinho and Zlatan Ibrahimović.

Hancocks has launched its 2025 Mother’s Day range, featuring decorated confectionery, premium chocolate boxes and gift options such as the Bonds Pun Boxes, which retail at £2.

Popular choices include the Bonds Pick ’n’ Mix Set (£3.50), featuring Teeth & Lips, Mini Jelly Babies, Watermelon Slices and Pink and Blue Bottles, and the Chocolate Rose (£1).

Hancocks offers vegan options including Booja-Booja chocolates (£14.99).

Premium brands such as Lindt, Maltesers and Anthon Berg are also available.

Kathryn Hague, head of marketing, advises retailers

to create eye-catching displays to maximise sales for Mother’s Day in March.

MCGUIGAN Wines, part of Australian Vintage, will transition key ranges to a lightweight 300g glass bottle this year, saving an estimated 336,000kg of CO2 annually.

The bottles, made from 30% recycled glass, reduce emissions by 25% compared with traditional 400g bottles, aligning with Aus-

tralian Vintage’s Net Zero by 2040 goal.

Packed at Greencroft Bottling, a facility powered by wind and solar energy, the bottles retain their design while advancing sustainability.

McGuigan Wines aims to meet growing consumer demand for environmentally conscious products.

BOROUGH Broth, a UKbased producer of organic bone broths, is now accessible to independents via wholesalers including CLF, The Cress Co and CN Foods, following an initial launch in Sainsbury’s.

This expansion comes as the global bone broth market is projected to grow from

£860m in 2023 to £1.29bn by 2030, driven by rising demand for protein-enriched and health-focused foods. The Borough Broth range includes Chicken and Beef varieties.

BRISTOL-BASED kombucha brand Counter Culture has introduced Try Dry Kombucha, the of�icial kombucha of the Dry January Challenge.

This Citrus Yuzu �lavoured drink is available for purchase in cases of 12 for £23.95 (RRP) via Counter Culture, Amazon and Wise Bartender.

Wholesale options are also available through Suma, CLF, Essential Trading, Greencity Wholefoods and Inn Express.

The brand donates 5% of Try Dry sales to Alcohol Change UK. According to Alcohol Change, 28% of Brits are planning to have an alcoholfree January this year.

•

Premier Eldred Drive Stores, Orpington, southeast London, and a Women in Convenience ambassador

I GET invited to supplier events, which provide me with so many bene ts as a retailer. The reason I get invited to supplier events actually stems from doing a roundtable with RN and Lucozade, and that goes back years. Even if you put yourself out there once, it can lead to a lot of changes in your career. It’s all about engaging and communicating with the brands, so it opens up the opportunities of being invited to panels and events. These supplier events are a chance to meet other retailers you haven’t met before, and get to know the faces behind the brands.

Recently, I went up to Manchester with Suntory Beverage & Food GB&I (SBF GB&I) to discuss its upcoming products and how it’s doing as a company. It’s bene cial to see what’s being launched before others nd out and taste-test products – this was the case for Blucozade.

PRIYA KHAIRA

HANCOCKS has launched its 2025 Valentine’s Day range, featuring a selection of themed sweets, novelty items and premium gift options.

The collection aims to help retailers make the most of the season’s gift opportunities.

The pick and mix range includes heart-themed items such as Kingsway Gummy Hearts, Vidal Triple Hearts and Barratt Jelly Love Hearts. Hancocks’ award-winning Bonds Pun Boxes return with playful designs like ‘I Love You Berry Much’ and ‘You’re One in a Melon’.

For gifts, the Bonds Candy

Cups (£3.50 RRP) offer dessert-inspired sweets in �lavours like Berry Mess Mix and Sweet Vibes Freakshake, presented in recyclable and easy-to-merchandise packaging.

Premium additions include Anthon Berg’s Chocolate Liqueurs, featuring famous spirit brands, and the new Baileys Treats Box, combining milk chocolate and marzipan in dual-branded packaging.

Hancocks’ Chocolate Flavour Candy Roses remain a �irm favourite for Valentine’s and Galentine’s displays.

Kathryn Hague, head of marketing at Hancocks, highlighted Valentine’s Day

BLAZIN’ Fried Chicken �lavour has been added to Pringles’s Hot range, inspired by Nashville-style chicken.

Joining �lavours like Flamin’ Cheese, Mexican Chilli & Lime, Smokin’ BBQ Ribs, Kickin’ Sour Cream and Sweet Chilli, the new addition caters to the UK’s growing appetite for spicy snacks.

as a key sales opportunity, encouraging retailers to use bold in-store displays to attract customers.

The collection is available online and at Hancocks’ 14

nationwide cash-and-carry stores.

It’s great to have direct contact with these brands for charity purposes, too – like the recent Orangina drive with SBF GB&I. Another bene t of engaging with brands is being invited to some fun events. Recently, some WiC members were invited to Wembley to watch the Lionesses versus USA in a football match. Sometimes that can be useful for just stepping outside of retail with some likeminded people. There’s general socialising taking place, but we can’t help but chat about business sometimes. However, through this you nd out about others having similar problems and can share ideas. Collaborators

Available in 160g cans for £2.50 RRP, the non-HFSS �lavour builds on the Hot range’s success.

The spicy �lavour trend has grown by 23% across Europe over the past year.

PEPSICO has expanded its Extra Flamin’ Hot range with the launch of Walkers Extra Flamin’ Hot crisps.

The limited-edition launch is available for eight weeks from the beginning of January.

The new variety joins Walkers Max, Doritos and Wotsits Crunchy, tapping into the growing hotand-spicy �lavour trend, which saw 8.7% year-onyear growth.

Available in 150g sharing packs (£1.65 RRP), 70g price-marked packs (£1.25 RRP) and 45g grab bags (£1.10 RRP), the launch is being supported by a multimillion-pound TV and online campaign.

SURYA Foods has acquired a major stake in health snack brand Karma Bites, known for its naturally �lavoured, popped lotus seeds. This move aligns with Surya’s plans to expand its healthy-snacking range, with new product developments set for this year.

Karma Bites, available

through wholesalers including Dhamecha, Bestway and Parfetts, offers vegan, gluten-free snacks in �lavours like Himalayan Pink Salt and Wasabi, with an RRP of £1.79.

Surya’s continued investment in its Harwich site supports its mission to create ‘better for you’ snacks.

BRIOCHE Pasquier UK has announced a partnership with Roald Dahl’s Marvellous Children’s Charity, pledging to match donations from the charity’s Christmas Appeal with the Daily Express up to £20,000.

This initiative supports the charity’s work in providing specialist nurses for over 36,000 seriously ill children across the UK.

The funds will help establish more Roald Dahl Nurses, who deliver holistic care, reduce hospital visits and support affected families.

JTI recently teamed up with RETAIL EXPRESS to conduct test purchasing of illicit tobacco in Leeds. We examine the impact of the illicit trade on honest and legitimate retailers, alongside what you can do to help clamp down on the issue

IN September, Retail Express partnered up with JTI to go undercover across Leeds –named by the supplier as one of the UK’s illicit tobacco and vape capitals. Several stores were visited in the Leeds West and Pudsey constituency, including both una liated sites and symbol stores.

A total of 43 illegal tobacco and vape products had been bought from 18 stores during the operation. Nine of these sites had sold illicit stock during a similar exercise in 2023. Overall, 12 packs of cigarettes, 23 packs of rolling tobacco and eight vapes

were found to be illicit.

Commenting on the test purchasing, Retail Express editor Alex Yau said: “What stood out to me was how professionally illicit sellers were operating. Some stores had lookouts to see if Trading Standards or the police were on their way.

“Some of them also had stock stored in minivans. Not only were these used for stockholding, but they enabled the illicit sellers to drive o quickly if they suspected their illegal cigarettes were at any risk of seizure from the authorities.”

ACCORDING to HMRC, the total revenue lost from illicit tobacco in 2022/23 was £2.2bn. JTI’s own analysis suggests the illicit tobacco market is larger than this, with analysis of data from the O ce for National Statistics showing spending on illegal tobacco products in 2023/24

at £6.5bn1

Explaining the issue, JTI UK public a airs manager Ian Howell said: “Illicit tobacco is a problem that was big and is getting bigger. For example, 54% of rolling tobacco in the UK is made up of illegal or non-duty-paid sources. This gure is before the recent duty

To nd out more about

SATVINDER Singh, of the Local in Armley, has been running his store in Leeds West and Pudsey for 11 years. The illicit trade has caused his weekly tobacco sales to decline from £9,000 ve years ago to £4,000.

He said: “Three stores selling illicit tobacco have opened nearby and they’ve also introduced grocery products. Every day is a battle because our loyal customers are going to those shops. Customers come in every day asking for cheaper cigarettes or singles. When you hear of a customer buying cigarettes

for £5, you can’t say anything to them. You have to take it on the chin.”

increase, so we are anticipating further increases over the next 12 months. The government’s proposed generational smoking ban could also push more smokers towards the illicit market.

“Tackling illicit tobacco sales is one of our top priorities. We conduct test pur-

chase programmes, looking at what’s happening online and in stores. We provide the evidence we gather to law enforcement and encourage them to take action against those retailers, which in turn will help good retailers by bringing customers back into their stores.”

Ian Howell, public a airs manager, JTI UK

“OUR advice to anyone, whether you’re a retailer or a consumer who has seen illicit tobacco, is to report it by using the Citizens Advice consumer helpline, which will direct that information to Trading Standards. The number is 0808 223 1133.

“We know it’s frustrating. What everyone would like to see is enforcement action made within hours of a call being submitted. That doesn’t happen for various reasons. We do know Trading Standards is getting good at using closure orders and they’re easy to impose.

“However, sometimes the shop will change hands and be set up in the same premises or down the road. Last year, HMRC was given powers to issue ‘on the spot’ penalties of up to £10,000 on retailers selling illicit tobacco.

“Those powers can only be used directly by HMRC and they generally do not undertake enforcement at retail level. While Trading Standards can refer cases to HMRC in order for it to potentially issue a ne, we would like Trading Standards to be able to issue the nes itself and keep any money to reinvest in its services. We think that would be a gamechanger. There needs to be nancial penalties.”

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

INNOVATION: How are you setting yourself apart?

“AT the end of last year, I launched my own gin called Gin in a Tin. I made it in partnership with a local distillery. I had previously done something similar with a nearby brewery for my own craft-beer range. The gin was limited to a run of 200 units.”

Kaual Patel, Nisa Torridon Convenience, Lewisham, south London

“ THE idea behind Breaks was to better serve my customers with hot food and ensure they can be out within minutes of ordering. We make about 40% margin per product, but we’re focused on volume rather than profit. The majority of products are produced fresh on site.”

I made it in partnership with a local distillery

CHINESE NEW YEAR: Is your store ready for the occasion?

OYSTER CARD: Has the five-year decline in top-ups affected you?

“WE don’t really do many Oyster transactions now.

“WE’LL probably allocate a couple of shelves on a promotion end. We’ll have some PoS, and the rest of the shelves will be populated with Valentine’s Day and Easter. There’s no reason why you can’t have Chinese New Year and Valentine’s Day on your shelves at the same time.”

Avtar Sidhu, St John’s Budgens, Kenilworth, Warwickshire

“WE have meal kits. This year, we’re going to have a QR code that takes customers to Chinese recipes online. We’ll push for a two-for-£7 offer on main courses so customers will be able to choose ready meals, and if they wish to cook from scratch, they have that option, too.”

Vidur Pandya, Kislingbury Post Office, Northamptonshire

Shashi Patel, Meet & Deep News, Twickenham, southwest London

“OYSTER card top-ups declined noticeably during the pandemic, and we’re not even close to pre-pandemic levels now, more than three years since lockdown fully lifted. We issue around nine or 10 top-ups per day at £10 each. Occasionally, someone will buy a £250 monthly pass.”

Anonymous retailer

POST OFFICE: Will the firm’s new emergency support platform help? Oyster card top-ups have declined noticeably

“WE recently had an armed robbery in our branch, which was incredibly difficult for the person who experienced this violent threat. Having the immediate support was invaluable – it gave me and everyone in the branch the support to get back to doing what we do best.”

Tony Fleming, Thorne Post Office, Doncaster

“IT is an easily accessible resource that offers advice and facts, but it also says by implication that we care, that participants from different areas of the business recognised a need and worked together to make it the best it could be. It says you are not alone or the only one.”

Christine Donnelly, Great Milton Post Office, Oxfordshire

‘Ram

OUR Spar in Minster Lovell was ram-raided in December and the reality of what’s happened is still sinking in. Seeing the damage to our family business and knowing my parents were upstairs during the break-in is something I’ll never forget. The voicemail I received from my dad yesterday �illed me with fear

and distress. It will stay with me forever. This is the second time we’ve been targeted in just three months, and the damage this time is far more extensive. While we’re still processing the impact, one thing we are incredibly grateful for is the overwhelming support we’ve received. Messages, visits and of-

fers of help from our local community have meant the world to us. Knowing how much this shop means to all of them gives us the strength to keep going during what feels like an impossible time. A huge thank you must also go to AF Blakemore for its incredible support. Its guidance and assistance have been invaluable, reminding us that we’re not

alone in this.

While the road ahead feels uncertain, we’re determined to rebuild and continue serving our community. We’re currently seeking information to help with the police investigation. Together, we can make our community stronger.

Ian Lewis, Spar Minster Lovell, Oxfordshire

I WASTED a lot of time in 2024 thinking about how I could have handled the past four years di erently, so I can enter 2025 with all the experience, skill and energy I can muster because change is in the air. I detest rerunning over mistakes, but from this uncomfortable position of hindsight, I’m trying to learn the lessons and shi my mindset for 2025 to be our best year ever. We are going to be starting our 25th year of trading.

Each issue, one of seven top retailers shares advice to make your store magni cent

At Small Business Britain, I was on a roundtable discussion on #MakingWorkPay. I listened to all the fabulous business owners and their employment procedures and the di erence they could make to people’s lives through employment.

While my procedures have room for improvement, I have done some of my best work supporting colleagues this year. Some colleagues only stay for 18 months at the most, but many choose to stay as they value their work and the bene t they are to the area. One of my colleagues with a master’s in German literature is starting her 10th year. There have also been some unexpected positives that have come like buses at the end of the year.

First bus: a letter from the ACS asking me to be an ambassador. I’m now a retailer ambassador with over two decades of experience and, now my mum is semi-retired and I work in the post o ce, I’m a cross between Mrs Goggins and Dorcas Lane, with community at my heart.

Second bus: I was asked to speak at the House of Lords on behalf of the participants of the Small Business Britain BT Sustainability course I had undertaken.

These are the highlights in what has been a constant juggle to drag us back into pro t. I’m hoping the next two successes for the business are of a nancial nature and again not expected or planned, just a reflection of commitment and hard work for our community.

See you in 2025 and beyond.

LINDT & Sprüngli has partnered with Retail Express to o er ve retailers the chance to win £50-worth of Lindt Classic Recipe Milk and Lindt Excellence 70% Cocoa. You asked, Lindt listened. The number-one dark bar brand1 is now available in smaller cases of eight bars instead of 20. The Classic Recipe Milk range will also be available in cases of eight and price-marked to help drive convenience sales.

“SOMETHING we have been working towards for some time is making our NoteMachine ATM free for all our customers and those who live nearby. This is part of our commitment to providing the very best service for our loyal customers, we don’t want them to be disadvantaged because they can’t travel to the town centre. It also means that customers can save money on fuel or parking they would otherwise have to pay in town. We will have some big

to share later this year and recommend that everyone watches this space.”

With the disposables ban set to hit this year, PRIYA KHAIRA investigates how retailers can prepare for the upcoming changes

THE UK government’s decision to ban disposable vapes is set to come into place from 1 June.

For retailers, the forthcoming ban presents both challenges and opportunities, and will require them to adapt their operations to meet the new landscape.

The government announced the ban in October 2024, providing retailers with eight months to phase out disposable vapes and transition to alternative products, while

there will also be a six-month grace period from 1 June. But retailers would be wise to ensure their compliance well in advance as there will be signi cant penalties in place for non-compliance.

Retailers found in violation of the ban may face a xed penalty notice of £200, with additional enforcement actions for repeated breaches. This creates an urgent need for retailers to address their inventory and operational prac-

tices before the deadline.

Nishi Patel, from Londis Bexley Park in Dartford, Kent, has been busy preparing his stock ahead of the initial June deadline, clearing slowerselling disposables lines and replacing them with re llable alternatives.

“There are loads of innovations coming onto the market and we’ve been able to hit margins similar to what we were making on disposables,” he says.

FOR retailers, this period of change o ers an opportunity to explore alternative products that align with the new regulations. Retailers are encouraged to work closely with suppliers to secure these alternatives early, ensuring a seamless transition for their customers. The focus should not only be on meeting regulatory requirements, but also on retaining customer loyalty by providing suitable replacements for banned products.

One signi cant concern is the potential rise of a black market for disposable vapes. More than 1.5 million illegal vapes were seized by Trading Standards and police in 2024, according to FOI data from To-

tally Wicked.

Industry experts have warned that the prohibition of these products could lead to the proliferation of unregulated and potentially unsafe vapes, undermining the very objectives the ban seeks to achieve. Retailers must remain vigilant and work closely with authorities to combat illicit trade and ensure that their operations remain compliant and above board.

Another challenge lies in managing the nancial impact of the ban. For many convenience retailers, disposable vapes have become a lucrative product category, generating signi cant revenue, with some retailers stating it con-

stitutes almost 50% of their takings. Diversifying product o erings and investing in compliant vaping products will be key strategies for mitigating the nancial repercussions of the ban.

With all of this to contend with, some retailers feel apprehensive about the transition. Atul Sodha, of Londis Hare eld in Hillingdon, London, notes that while the June extension is providing retailers with more time, many of the changes that retailers have to make by June are unclear.

“The legislation has put a lot of responsibility onto the hands of retailers, who have been left to gure things out,” he says.

THE transition will demand sta training to ensure that employees are well-informed about the changes and can con dently guide customers through the shift. Sta must understand the features of permissible products and be prepared to address customer concerns because customers

won’t have all the facts at their ngertips and will be looking for expertise from local shops. To best educate their sta and customers, retailers should familiarise themselves with the new regulations, which stipulate that only chargeable and re llable vaping devices will be permis-

sible for sale from June 2025. The Association of Convenience Store’s (ACS) guide outlines how to safely dispose of unsold disposable vape stock and o ers strategies for communicating these changes to customers e ectively.

Clear communication strategies will be crucial in this

regard. Retailers should consider using in-store signage, brochures and one-on-one interactions to explain the ban’s implications and the reasons behind it. Proactive engagement with customers will help mitigate any potential backlash and foster a sense of trust and transparency.

To adapt to this regulatory change, consider the following steps:

Inventory assessment

Conduct a thorough review of your current vape product inventory. Identify disposable vape stocks and plan for their phased removal ahead of the 1 June deadline.

Explore alternatives

Investigate alternative products to meet customer demand, such as reusable vape kits, pouches, heated tobacco or nicotine replacement therapies. Retailers might also want to think about introducing other categories into the vacated disposable space, such as food to go or alcohol.

Engaging with sta training

Ensure that all sta members are informed about the new regulations and the features of permissible products. This knowledge is essential for guiding customer purchases and maintaining compliance.

Customer education

Develop clear communication strategies to inform customers about the upcoming changes. This can include in-store signage, informative brochures and sta readiness to answer queries, ensuring customers are aware of the reasons behind the ban and the available alternatives.

Set up

Introduce a recycling incentive programme and recycling bins to encourage customers to dispose of their vapes in store. This should be clearly displayed and signposted.

‘What should I do before 1 June?’

Clear your stock

Ensure that you have sold or cleared out all existing disposable vape products. Keep any leftover stock away from the shop floor.

Set up a takeback service

Retailers must provide a way for customers to recycle used or unwanted vapes. This could be a bin or container in store.

Get alternatives front and centre

Slowly introduce re llable open and closed vape lines in store.

Talk to customers

Engage with customers about the ban, making them aware of the changes and potentially encourage them to try out re llable options ahead of the ban.

AS the ban looms closer, retailers must consider the practicalities of stock management.

Conduct a thorough review of current inventory to identify disposable vape products that need to be sold or disposed of before the deadline. This might mean working with local waste management services or recycling services to remove left-

over stock leading up to June. Conduct a range review and rethink the way that vapes are being positioned and merchandised to accommodate to the new display regulations. Consider placing in-store signage or signs detailing the changes clearly to customers who might be unaware of the ban. Some retailers will be re-

quired to o er dedicated disposal bins for electronic cigarette waste. This means installing clearly labelled recycling bins for customers to return used vapes in store for proper disposal. Bins will need to be in compliance with WEEE regulations and o er clear signage to guide customers. Additionally, retailers should

work with certi ed waste management services to ensure responsible disposal.

Retailers should also consult their suppliers for guidance on alternative products and the logistics of transitioning to a new product range. Proper planning and early action will be critical in ensuring a smooth and successful transition.

Ban implementation date

The sale of disposable vapes will be prohibited in the UK from 1 June 2025.

Grace period

Retailers will be granted a six-month grace period following the June implementation, allowing them time to phase out disposables.

Where it will cover

The ban will apply to England, Wales and Scotland, with Northern Ireland expected to follow.

Penalty for non-compliance

Retailers face xed penalty notices, with further enforcement measures for repeated breaches. Retailers can be ned £5,000 for not having a disposable vape ‘take-back’ scheme.

Why is it happening?

An estimated eight million disposable vapes are discarded weekly in the UK, contributing to battery res and plastic pollution, which the ban aims to remove. Additionally, the government hopes this ban will help to tackle the rising underage consumption of disposable vapes, with their bright packaging and flavours cited as contributing to increased nicotine addiction.

Replacement products

Only re llable and rechargeable vaping devices will remain legal for sale post-ban. Retailers are encouraged to switch to these alternatives.

Support for retailers

The ACS has released an updated Selling Vapes Responsibly guide to help retailers comply with the ban and transition smoothly.

RALPH JONES nds out how retailers are preparing for a successful St Patrick’s Day this year

AMONG the many celebrations in spring, St Patrick’s Day on 17 March is one of the best for revellers to cast o their winter blues and for retailers to draw in additional sales.

Spending in UK pubs, bars and restaurants rose again from £78.9m in 2023 to £81.3m in 2024 on St Patrick’s Day, so the potential for increased revenue is there.

A problem for stores this year will be the day falling on a Monday. Ferhan Ashiq, of Levenhall Village Store in Mus-

selburgh, East Lothian, says:

“It will be a challenge. It’s traditionally the quietest day of the week for alcohol sales, which don’t really begin until Wednesdays. The weekend before will be more important than the day, so starting early will be best.”

St Patrick’s Day also o ers the opportunity for cross-promotion as it coincides with the Six Nations rugby tournament (the nal round takes place on 15 March), which usually sees an increase in alcohol sales,

especially Guinness. As the tournament’s o cial sponsor, Guinness will already be rmly in the spotlight for the duration of the tournament.

Hussan Lal, of St Mirren Food Store in Paisley, says:

“Guinness sells incredibly well for us all year round, but St Patrick’s Day isn’t something I’ve focused on before.

“We’ll give it a try this year. Guinness and rugby also go together – with the Six Nations being on as well there’s an opportunity there.”

WHEN asked for its core recommended lines for St Patrick’s Day, a spokesperson for Booker says: “Must-stock products for St Patrick’s Day are Jameson, Guinness, Guinness 0.0, Baileys and Magners. These products perform well around St Patrick’s Day.”

In recent years, low- and no-alcohol drinks have found a growing market of consumers.

With St Patrick’s Day falling on a Monday, Guinness 0.0 could help shoppers not in the habit of Monday drinking to mark the occasion.

“Two- fths of adults say they want to moderate their drinking,” says Lauren Priestley, head of category development, o -trade at Diageo, as she highlights the sales opportunity for noalcohol options.

Booker’s spokesperson adds that pushing shoppers beyond single cans is an important way to bolster basket spend from every shopper looking to mark the occasion.

“Multipacks are a great way to upsell on a variety of

di erent products – eightand four-packs are good performers,” they say.

Beyond alcohol, David Robertson, of Pozzie’s in Buckie, Moray, and Judith Mercer, of Hamilton’s Newsagents, Cregagh Road in Belfast, reported success in selling St Patrick’s Day cards.

“We do a smattering of St Patrick’s Day cards, it’s normally Celtic fans and the Irish diaspora that buy them,” says Robertson.

“They’re not the strongest sellers, but they could be in the right area for either of these two groups, such as Glasgow, for example.”

Lauren Priestley, head of category development, o -trade, Diageo

“ST PATRICK’S Day provides a golden opportunity for retailers to provide options and solutions for at-home celebrations.

“When it comes to merchandising, visibility is key. Retailers would bene t from merchandising Guinness with new, exciting and clear PoS, which will put the brand front and centre of customers’ minds. Crossmerchandising the products with popular crisps and high-quality snacks can also encourage increased basket spend during key calendar moments.

“Where space allows, including a few options in a chiller will enable retailers to maximise impulse purchases by providing products that are ready for immediate consumption.

Store location is crucial in knowing whether Ireland’s patron saint’s day is an opportunity worth focusing on.

I about it on social media, whiskey range, giving Irish

“When I had a neighbourhood store, we’d follow the associated promotions available, put posters up and talk about it on social media, but we’d also rearrange our whiskey range, giving Irish whiskies really prominent locations for the week, and it worked,” says Ashiq.

“We recommend stocking a few high-quality low- and no-alcohol options. And the demand for premium spirit options has surged over the past year, with consumers increasingly willing to invest in high-quality spirits such as vodka, whiskey, gin and tequila. Despite economic pressures, the shi towards premiumisation shows no signs of slowing.”

ALL retailers should lean on suppliers and symbols to get PoS material to create instore theatre, but there are some stores looking to create an even bigger impression on customers.

Julie Kaur, of Jules Convenience in Telford, Shropshire, usually makes the most of the occasion by stocking up on Guinness and Jameson,

putting on green jumpers and using the promotions provided by Booker, but she has ideas to go further.

“We’d like to make it make more of an event by doing tastings in store,” she says. “It would be brilliant to o er people the 0.0 Guinness and the normal one and see if they can guess which is which.

“There are so many di erent

Guinness formats now – bottles, cans and other crossover products. You could make a nice hamper and hold a charity ra le like we do at Christmas.

“Events like St Patrick’s Day may be smaller than others on your shop calendar, but when done well, they are about more than the sales. It’s the community recognition and enjoyment it creates in visiting.”

Mercer says stores with a large student customer base are an especially good match for St Patrick’s Day events.

“It’s more about exciting your customers,” she adds.

“Having themed events, even if they last just a week, means that there’s always something new when the customer walks into store, the impact isn’t just measured in associated sales.”

TAMARA BIRCH talks to retailers on their fresh and chilled ranges, their top products and their 2025 plans to boost category sales

HEALTH and value are the leading customer trends in fresh and chilled, according to suppliers.

Georgina Thomas, head of marketing for butters, spreads & oils at Saputo Dairy UK, says this is because shoppers are more aware of a product’s nutritional pro le. Therefore, she recommends including products that contain less saturated fat, as well as plant-based and dairy-free items.

She adds: “While the number of consumers opting for a plant-based diet is no longer

in growth, retailers would be unwise to ignore the category. While a relatively small 4.7% of the adult population in the UK is vegan, more than a third (38%) say they are open to substituting animal-based foods. It’s important, therefore, that retailers also stock dairy-free options to cater to these needs.”

Philip Rayner, founder and CEO of Glebe Farm Foods, echoes this, saying: “Sales of free-from products are on the rise in both value and volume, with the category val-

ued at £329.2m as of 2023, an increase of 10.3%. Plantbased milks are now rmly mainstream throughout the UK, with 32% of people using alternatives alongside traditional dairy milks. Total dairy alternative milk UK sales rose by £21.5m from 2022 to 2023, with oat milk rising by 48% in consumer sales over the same period.”

Retailers, however, such as Goran Raven, owner of Raven’s Budgens in Abridge, Essex, say local produce is driving sales currently. “We’re push-

ing our own agenda with local produce and customers are responding well,” he says. “It’s something we have good control over and it’s also not something they’re price sensitive to, either.”

Joshua James, owner of Fresh & Proper Fordham in Cambridgeshire, echoes this trend and adds: “We’ve been pushing local produce, but have found that scratch cooking is also on the rise. Shoppers are eating at home more and buying bulk meals. It’s all about adapting to customers.”

Shaun Whelan, convenience/ wholesale controller, Link Snacks International

“IT continues to be important for convenience retailers to demonstrate value across the store. One way to do this is to stock price-marked packs (PMPs). PMPs o er shoppers price con dence and reassure them they are not being overcharged. This is important when shoppers are watching what they spend.

“PMPs make life easier for convenience retailers, reassuring them they are charging the right price. Price-marked labels stand out on shelf and are a good way to draw the shopper’s eye to a particular product. They also o er a point of di erence for independent retailers. Convenience retailers can use PMPs to bolster their margins and increase footfall, as it shows how a store is o ering shoppers good value.”

Müller converts Corner yoghurt pots to clear packaging

In November, Müller Yoghurt & Desserts announced a shift from white to clear plastic for its Corner yoghurt pots.

The move aimed to help meet the manufacturer’s sustainability goals to halve the environmental impact of its packaging by 2030. The fully recyclable clear pots support a ‘closed loop’ system, which allows the material to be reused within the food sector.

By converting nearly 50% of Müller’s branded yoghurts to clear PET, the move is expected to boost the availability of rPET in the UK by more than 3,000 tonnes annually.

Wall’s reveals Deep Dish Pizza Pies range

The new Deep Dish Pizza Pies range from Wall’s is available in two flavours: Three Cheese and Pepperoni, each with an RRP of £2. The Three Cheese option blends extra mature cheddar, mozzarella and red Leicester, while the Pepperoni flavour includes tomato, cheddar and pepperoni.

It is designed as a quick meal solution, aimed at younger consumers and families, and can be oven baked or air fried.

Pukka’s World Flavours parcel range

Pukka’s new grab-and-go parcels, inspired by international cuisines, are available in three varieties: Jamaican Jerk Chicken, Mexican Beef and Indian Spiced Vegetable, all with a £1.50 RRP. Each recipe contains a blend of herbs and spices to deliver rich, authentic flavours.

The launch followed the manufacturer’s recent Pepperoni Pizza, Doner Kebab and All Day Breakfast innovations.

Kepak Group acquires Summit Foods

Kepak Group, the supplier of Rustlers, has acquired Summit Foods, which produces the Snacksters, East St Deli and Snax on the Go chilled and frozen brands. Kepak CEO Brian Farrell said the acquisition was driven by the strength of Summit’s “portfolio of fresh-for-longer sandwiches, and chilled and frozen meals and snacks”.

FRESH and chilled can be a challenging category, so it’s important to know whether a large range will work for you.

James recommends looking at your data. “If you’re not good at data analysis, I would steer clear from the category,” he says. “You’ve got to be constantly on it, adding in new lines, delisting ones that no longer work for you. We’ve been clever in that with a few

of our chillers, we switch between fresh products and ambient products.”

James stores soft drinks or alcohol in his chillers on occasion to create a strong meal solution, and follows closely what supermarkets do.

Raven decided fresh and chilled was the right category for him by putting himself in the eyes of a consumer. “Forecourts are in the posi-

tion of convenience and we take advantage of that on site. We’re in a small village on a busy road, so it works for us,” he says.

If you’re unsure, talk to other retailers or start by o ering a meal solution range of fresh and chilled products over a 12week period. This way, you’ll have the tangible data to see if it’s working. If it isn’t, you can try something else.

WASTE is inevitable with fresh and chilled, thanks to their short shelf lives. So, how are retailers lowering their waste?

James utilises food reduction apps Too Good to Go and Gander, as well as being strategic with reductions in store.

“We start a bit earlier than usual after we analysed our data and realised there was a dip in reductions during certain times, so we changed it up,” he says.

James says his food apps have been a huge success, and the store has generated a 4.9-star rating on average. “It helps with value and really helped local families bolster their Christmas meals, too,” he adds.

Raven, on the other hand, has stopped reductions entirely and instead focuses on tighter ordering and good rotations.

He says: “We used to reduce stock when we rst started and found that customers would only come in at the time when we reduced stock. This meant we were losing money and our waste was around 13-15%.

“Now, we don’t, and have customers buying it at full price. On a bad week, waste sits at 2-3%. It goes down to 1-1.5% on a good week.”

The retailer has also teamed up with a local charity that collects any waste and hands it out to homeless individuals that night, preventing it from going to land ll.

Retailers also recommend reviewing sales data to determine if every fresh and chilled line being stocked is selling. Similarly, if a product has slowed, but still has multiple facings, the facings should be reduced and its success monitored before delisting.

Georgina Thomas, head of marketing for butters, spreads & oils, Saputo Dairy UK

“CONSUMERS have shi ed towards more frequent, smaller shopping trips. They rely on convenience stores for quick and easy access to fresh and chilled staples such as butters, spreads, milk, and ready-togo options – they want to grab what they need without the commitment of a large weekly shop.

“By providing a well-rounded fresh and chilled range that meets these expectations, stores can drive footfall and foster loyalty. Customers know they can rely on their local shop for quality, convenience and consistency, encouraging repeat visits and increasing overall basket spend.”

THE biggest challenge when it comes to expanding fresh and chilled is space, but retailers do have strategies in place to keep their fresh and chilled ranges looking sharp. Raven, for example, took on an additional chiller speci cally for local produce in the

summer. He says: “We work with a lot of farmers, who grow a lot of soft fruit, so we decided to start stocking it. This included strawberries, plums and cherries, and we sold huge volumes of it.”

With regards to space, Raven is slowly working around

it and has recently purchased a second shop. He plans to focus on fresh and chilled to offer a point of di erence. “It’s a small convenience store, but we plan to mirror what we’ve done with the forecourt and go from there,” he adds.

Another challenge is waste and handling reduction.

“We have the room to expand, but it can be challenging with high waste,” he explains. “So, instead, we’re adding lines rather than investing in more chillers, and focusing on availability as out-of-stocks can harm your store.”

The RETAIL EXPRESS team nds out how retailers are encouraging customers to spend more in store

Getting customers to spend £1 more is easier than getting more customers. How are retailers increasing basket spend? – Harj Dhasee, Village Store, Mickleton, Gloucestershire

Benedict Selvaratnam, Fresh elds Market Store, Croydon, south London

“THERE are so many stats to prove that it’s cheaper and easier to get existing customers to buy more by looking after them, �inding out what they want and stocking it, than seeking out new customers. It’s more ef�icient. Our basket spend was £6.80, but we’ve bumped it up to £8 by tweaking some things and getting people to trade up.

“We position complementary items like pasta and sauces or beer and ready meals together. It reminds people that they go well together, which they often don’t think of or forget. We have a post of�ice and we encourage our cashiers to suggest items we have by the till area. You need to put high-margin items near the checkout and premium products at your gondola ends.

“Bundle deals are always very popular and help to increase basket spend, as do loyalty schemes. We teamed up with MyDD Point, which is used by a number of local retailers.”

Gary Hunt, CT & Baker Budgens of Holt, Norfolk 2

3

Chetan Patel, Felbridge Village Store, West Sussex

“WE’VE got a loyalty scheme with Azpiral and we really want to maximise that this year. We’ve got ideas for how we can do speci�ic promotions that are unique for loyal customers. It’s all about enhancing the promotions you’ve got.

“We’re working with suppliers such as The Cress Company and Suma to see what deals we can get, and then rather than pushing that enhanced margin, we pass it onto the customers. We had a promotion running over the summer months with Beaver cordials and we saw a 22% increase in sales just for that set of products.

“Don’t be greedy. Try to reward customers, especially the ones who are shopping with you on a weekly basis. That can also come in the form of putting in a special order for a speci�ic customer. It’s all about enhancing the offer to make the whole thing a more attractive proposition for your customers.”

“HAVINGthat complete range is important. If you want to create a meal from scratch, you want to be able to get everything you need in one store. So, if it’s missing one item, you might just go elsewhere for everything else as well. We need to tie up all the categories together.

“Growing basket for us has meant adding to our fruit and veg range, our fresh meat range, our wine offer and our afterdinner dessert range. That means our customers can get everything they need in one place. We’ve also added more organic and more premium options, which boost basket spend as well. But make sure they don’t have to go anywhere else for what they need.

“Offers and deals are also important, of course, and it’s always worth having some PMPs. It’s a bit of a cliché, but people will just pick up another pack just because it’s cheaper.”

In the next issue, the Retail Express team nds out how retailers are cutting costs in store. If you have any problems you’d like us to explore, please email