FIGHTING CRIME FROM BEHIND THE COUNTER

• How ‘Safe Places’ in local shops are protecting vulnerable residents

• Shopkeeper’s groundbreaking initiative provides a di erent path for those facing a life of crime

• How ‘Safe Places’ in local shops are protecting vulnerable residents

• Shopkeeper’s groundbreaking initiative provides a di erent path for those facing a life of crime

LAST week, I was given the rst look at Eat 17’s revamped Walthamstow store in London. The multi-site Spar retailer had previously carved a niche for itself with a restaurant next to its convenience store, o ering customers a sit-down meal service.

However, the company hasn’t been immune to the cost pressures experienced by all independent retailers. At the end of last year, the restaurant was forced to close. Instead of removing the foodservice elements altogether, founders James Brundle and Chris O’Connor still maintained some fresh-food products and merged them into their expanded convenience o er.

For example, a local chef serves fresh pizza by the slice every day, with up to 400 slices being sold a week.

Alongside the fresh pizza, customers can also purchase prepacked versions to take home and prepare themselves. These are merchandised with cra beer and snacks to encourage customers to increase their basket spend.

The store stocks products from 30 local suppliers overall, with an extensive range of jarred chilli oil being a standout for me.

O’Connor highlighted a brand called Yok Chan’s Chilli Oil, a product created using a fusion of influences from its founders, who have roots in China, Malaysia and Sri Lanka. Customers are informed about its origins with potential recipe ideas.

Although most retailers won’t be able to imitate what Eat 17 has done, there are some elements that are simple and a ordable to apply to your store.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau

020 7689 3358

News editor Ciarán Donnelly @CiaranDNewtrade 07743 936703

Editor – news Jack Courtez @JackCourtez 020 7689 3371

Features editor Charles Whitting @CharlieWhittin1 020 7689 3350

Features and advertorial writer Priya Khaira 020 7689 3379

Production editor

Ryan Cooper 020 7689 3354

Sub editors Jim Findlay 020 7689 3373

Robin Jarossi

Head of design Anne-Claire Pickard

020 7689 3391

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Production coordinator

Chris Gardner 020 7689 3368

Head of marketing Kate Daw 020 7689 3363

Head of commercial Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205

Account director Lindsay Hudson 07749 416 544

Editor in chief Louise Banham @LouiseBanham

Features writer Jasper Hart @JasperAHHart 020 7689 3384

Specialist reporter Dia Stronach 020 7689 3375

Account managers Megan Byrne 07530 834 009

Lisa Martin 07951 461 146

Finance manager

Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital

Luthfa Begum 07909 254 949

ALEX YAU

THE number of Post Of�ice (PO) branches offering a full range of services is decreasing, with sites in rural locations also being cut.

According to a new House of Commons report released this month, the number of standard agency branches

offering full services at the end of March 2024 was 9,250, 14% fewer than in March 2009.

The report also stated that the number of branches serving rural communities was falling, with Northern Ireland, Wales and Scotland being hit heavily.

Centrally managed Crown

post of�ice sites also saw a dip. The report stated: “This suggests these Crown branches will be closed or be run by someone else.”

Conversely, the number of branches focusing on prepaid parcel and bill payments rose, representing the change in demand for services.

March 2024, bringing the total to 606.

Despite the declines, the total number of branches stood at 11,805, the highest since 2012.

New drop-and-collect services increased by 374 between March 2023 and

The PO network must have at least 11,500 branches to retain its government subsidy. Since 2019, the organisation has received £50m a year to help maintain its network in rural locations.

BOOKER is to roll out its Scoot rapid delivery service in April, claiming it can help retailers generate £2,500 in additional weekly sales.

Retail Express revealed this month the service was being trialled in Goran Raven’s

MONDELEZ has been undercut on its own supply of Creme Eggs, as wholesalers have rushed to buy cheaper stock from elsewhere.

Budgens in Romford before the wider rollout in April. It will be exclusive to the wholesaler’s symbol group retailers. The �irm �iled trademarks for Scoot last year.

AN outbreak of foot-andmouth disease in Germany has hit availability of some core frozen pepperoni-pizza lines in convenience stores.

Affected brands include Dr Oetker’s Ristorante frozen pizza, which has been com-

pletely blocked from entering the UK.

Commenting on the issue, the brand said: “While there have been some temporary supply interruptions, we are con�ident these will be resolved quickly.”

A Mondelez spokesperson did not con�irm or deny claims from industry sources.

It said: “We have valued relationships with retailers and wholesalers.”

According to industry sources, several major wholesalers have opted to buy imported stock instead of of�icially from Mondelez.

ALLWYN is trialling a scratchcard dispenser it claims will speed up service and provide improved sales data analysis. The unit is being tested out at an Asda in Ashton-underLyne. The National Lottery operator said it has “automated inventory management”, can display 20 scratchcards at once on a digital screen and limits the sale of games to 10 scratchcards.

Available stock is automatically updated as cards are loaded. For

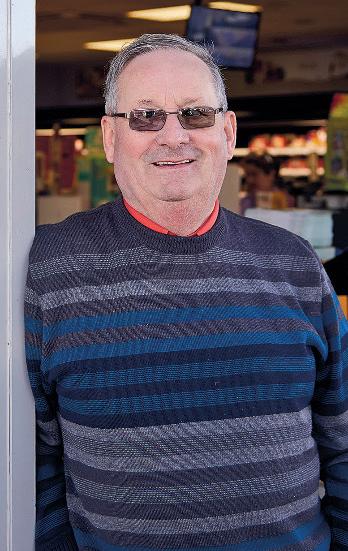

INDEPENDENT retailers across England have made their communities “a safer place” after stepping up to protect victims of bullying and steer youths away from crime.

Vas Vekaria, of Kegs N Blades in Bolton, has rallied several nearby businesses together to create ‘Safe Places’ in their stores.

Those passing by are noti�ied through window displays and the initiative started after Vekaria became aware of children from nearby schools being bullied.

He told Retail Express: “We have several schools nearby, and there have been recent incidents in which children have had their phones stolen.

“In other instances, it’s been kids in balaclavas chasing other children and causing havoc.

“The victims of the bullying have sometimes walked past the shop without realising we can look after them while they call their parents or the police.

“We offer them somewhere to sit and give them a snack and a drink. We have received thanks from parents.

“Similarly, if you’re an adult who’s feeling unsafe or vulnerable, then the store can be a safe place for you, too. We’ve always offered help to those who need it, but it’s the �irst time

we’ve really let the community know properly.”

Other businesses that have joined Vekaria in becoming ‘Safe Places’ include a bakery, a pub and a Go Local convenience store.

Explaining the support offered, Deepak Pindoria, of Go Local Morris Green in Bolton, added: “We’ve always been here to offer support to schoolchildren and residents, as these issues have happened over the 15 years we’ve been in business.

“As well as children who have been bullied, we’ve used the shop as a safe space for kids who have lost their parents or people who have had medical problems.

“Someone suffered a really serious medical emergency, and I let them stay in the shop for as long they needed until the ambulance came to help them.

“People might not realise they can walk into shops during emergencies.

“We’ve got a display in the window telling them they can. Vas [Vekaria] kickstarted all this.”

Elsewhere, Harjit Singh, of H & Jodie’s Nisa in Walsall, West Midlands, has moved onto the next phase of the Project Phoenix initiative.

Teaming up with Walsall council last year, he invest ed in providing communitysupport of�icers to protect convenience stores and businesses from antisocial behaviour.

These include a Co-op,

Spar, Costcutter and Savers.

The next stage of the scheme will provide investment and guidance for children and adolescents to nearby youth and sports clubs, such as knife-crimeprevention initiatives and a martial-arts club.

Singh told Retail Express:

“We’ve got the school near the shop to work closely with Project Phoenix, and there are other schools that want to meet up and get involved.

“The clubs, council and the police have jumped on Project Phoenix. We’re close

“THE

ruptcy to address the theft problem in a competitive market space.”

Dee Sedani, multi-site retailer, Derbyshire

to more than £100,000 in funding, which is partly supported by Nisa’s Making a Difference Locally fundraising initiative.

“The council previously didn’t have that relationship with the school and I helped build the bridge.

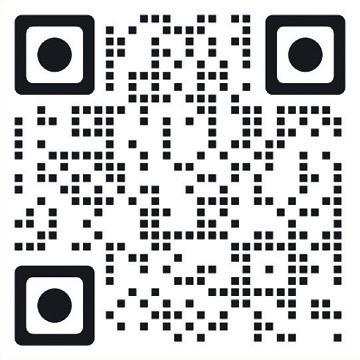

“The next phase will be to make a QR code available, so the school kids can scan it and get a timetable of all the events at participating clubs.

“We also want to raise wider awareness in the community as we have lots of positive stories.

“IT’S been a worrying time for myself and other independent retailers. The government needs to step up in o ering support, when cost pressures have increased substantially. My utility costs for gas and electricity have risen signi cantly, and we’re about to be hit by rises in wage costs, among other areas. If I look at my gures for the recent December-to-January period, sales are noticeably down compared with the previous year.” Anonymous retailer

MORRISONS: The supermarket is to make its More loyalty scheme available to Daily franchisees later this year. Plans for the rollout were revealed in recent promotional material for prospective Daily franchise partners last month. The scheme is already available in the supermarket’s centrallyoperated Daily sites.

“The manager at a nearby McDonald’s said antisocial behaviour has gone away, and more families are eating there because of the community-support of�icers provided by Project Phoenix.”

One nearby resident who has bene�ited from Project Phoenix said: “The small village I’ve lived in for most of my life has more problems than it should have.

“It does your heart good to see someone help the residents. The project has had a positive impact and made the area a safer place.”

For the full story, go to betterretailing.com and search ‘Morrisons’

SMITHS NEWS: The wholesaler has expanded its partnership with greetings-card company Hallmark to retailers across the UK. It said: “It is estimated that 8.2 million consumers a year buy greetings cards from convenience locations, and we are keen to help our independent retailers take advantage of this growing market.”

For the full story, go to betterretailing.com and search ‘Smiths News’

EMPLOYMENT: Retailers will not be exempt from a new Employment Rights Bill designed to end zero-hour contracts and strengthen statutory sick pay. Although the ACS said it welcomed any sick-pay consultation, it raised concerns that “in shops employing two or three people on shift at any one time, sta absence can see a business grind to a halt”.

ALCOHOL DUTY: Changes from 1 February added 2p to a 500ml 4% ABV beer and 1p to 500ml cider with 5% ABV. For wines with a strength of 11.5%-14.5%, the removal of a temporary flattax rate has added between 9p and 54p per bottle. Wines with an ABV of 11.5%-12.4% had duty cut by between 2p and 13p. In response, some wine suppliers have reduced the strength in their products.

“WE want a dedicated ombudsman to champion small businesses. The retail market in Ireland is worth approximately €40bn each year to the Irish economy. Independent retailers play a vital role in Irish society, with its strong tradition of independent retail, which provides focal points in villages, towns and cities. More e ective police and court action is also required.”

Martin Mulligan, Mulligans Londis Athlone, County Westmeath

YAU

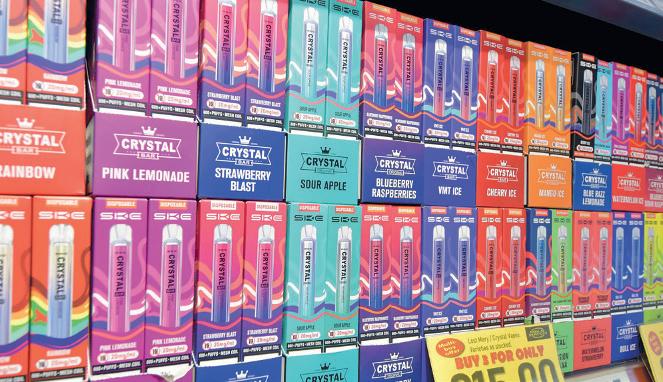

A LEADING retailer is pleading to the government to ensure upcoming vape regulations do not force independent convenience stores to shut for good.

Writing in The Telegraph this month, Coventry-based multi-site retailer Paul Cheema said shops would “pay the price” of the Tobacco and

pushed through Parliament

The Bill suggests anonymising vaping products through plain packaging, banning advertising of the products and forcing retailers to have licences to sell vapes.

Cheema said: “This Bill isn’t just about taking laudable action on child-friendly �lavours and packaging of vapes. This is about a government who bang the growth

there’s a PR job to be done with city fat cats and overseas investors.

“Being able to pop to the shop may soon become a thing of the past for many.

“This Bill will make it more dif�icult for smokers to �ind better alternatives while threatening the livelihood of the 400,000-plus people working in local shops.

“Stores will face even more

black market will continue to thrive and local stores will close, costing local jobs. Please, prime minister, help us community retailers to thrive, not disappear.”

Cheema’s warning comes as the disposable-vapes ban is due to come into force on 1 June. Several retailers said they are still waiting for advice from suppliers, despite the ban being less than four

PARFETTS is to serve more retailers in the south of England with a depot opening.

The Southampton site will serve retailers through cashand-carry and delivered wholesale when it opens later this year, bringing “access to a wide range of regular promotions”. Although Parfetts predominantly serves retailers in its heartland of the north of England, it began delivery to store owners in the Midlands and the south when its Birmingham depot launched in 2023.

IRELAND’S deposit return scheme (DRS) has processed one billion drink containers since its introduction a year ago.

Alan Dillon, minister of state for small business and retail & circular economy said: “DRS is already making a real di erence – recycling rates are improving, litter is reducing, the environment is cleaner, and community

groups, schools, charities and sports clubs are bene ting greatly from the refunds. I am looking forward to seeing more positive results this year.”

SPENDING in symbols and independents fell by nearly 6% in the 12 weeks to the end of January, according to the latest Kantar �igures. In comparison, the multiples saw an increase, with sales at Lidl rising by 7.4% during the period. Conveni-

ence retailer Co-op also returned to growth, with sales rising by 0.8%. January sales were, however, buoyed by fresh fruit, vegetables and salad, with low- and noalcohol drinks having a 7% upturn across multiples and independents.

PRIYA KHAIRA

COCA-COLA Europaci�ic Partners (CCEP) has added three new �lavours to its Fanta Zero lineup, catering to the growing demand for low-sugar soft drinks.

Fanta Zero Apple and Fanta Zero Raspberry are available now in 330ml cans, and 500ml and 2l bottles.

A limited-edition Fanta Tutti Frutti Zero Sugar will follow in mid-March, available exclusively in a slimline 250ml can.

The launches come as the low-calorie-�lavouredcarbonates segment has grown by 23.1% in value over the past year, with more than 80% of consumers

reducing their sugar intake.

Rob Yeomans, vice president of commercial development at CCEP GB, said: “We’re excited to expand our core Fanta zero-sugar range with the tangy Fanta Zero Apple and sweet Fanta Zero Raspberry, catering to consumers’ appetite for fruit �lavours.

“Our limitededition Tutti Frutti Zero Sugar is like a carnival in a can, with vibrant packaging and a nostalgic taste.

“Limited editions are a great way to engage new

shoppers, generate buzz and drive sales for our customers.”

All three varieties will be backed by a multimillionpound campaign, featuring in�luencer partnerships, outof-home ads and live events.

Retailers can access PoS kits via my.ccep.com.

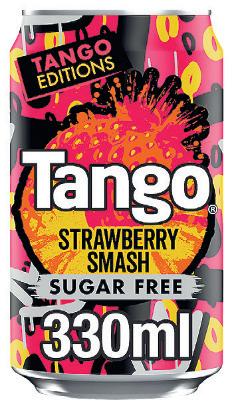

TANGO has introduced Strawberry Smash, a limitededition sugar-free �lavour that blends strawberry and pineapple.

Part of Tango’s annual Editions range, the launch follows the success of previous limited-time �lavours, such as Tango Mango, which generated £12.7m in 2024.

Strawberry Smash will be available until February 2026. It comes in 330ml cans (RRP 85p), 500ml bottles (£2.15 plain and £1.25 pricemarked packs), 2l bottles (£3.35) and multipacks (eight-pack: £5.29, 24-pack: £13.19). Multiple formats are aimed at tapping into at-home and on-the-go shopper missions.

FERRERO UK has introduced Tic Tac Two, a sugar-free range featuring dual-layered mints with contrasting �lavours, designed to enhance on-the-go refreshment.

Now available across grocery, convenience and wholesale channels, Tic Tac Two comes in Raspberry & Lemon, Strawberry & Lime and Fresh & Mild Spearmint �lavours, enabling consumers to mix and match tastes.

A Ferrero spokesperson said: “Tic Tac Two adds a playful twist to the brand while meeting growing demand for on-the-go confectionery.”

PHILIP Morris Limited (PML) has added Riviera Pearl and Provence Pearl to its Terea Pearls range for Iqos Iluma heated-tobacco devices.

CARLSBERG Britvic has expanded its soft drinks lineup with Pepsi Zero Sugar Strawberries ’N’ Cream and Pepsi Zero Sugar Cream Soda, tapping into the growing demand for �lavoured colas.

The launch is designed to appeal to Gen Z shoppers, with indulgent, treat-inspired �lavours set to boost category sales.

Retailers can receive PoS materials and free case promotions upon request to support the launch.

Available formats include

500ml bottles (price-marked and plain), 8x330ml can multipacks and a 1.5l bottle for Strawberries ’N’ Cream.

Terea Pearls, RRP £7, use capsule technology, enabling users to switch from a tobacco blend to a �lavoured option with a single click.

Riviera Pearl features a raspberry-and-rose

pro�ile, while Provence Pearl combines grape with menthol.

Suki Athwal, of Shop Around the Clock in Tenterden, Kent, said: “More customers have shown interest in heated tobacco innovation.”

CADBURY has launched Made to Share, a range of limited-edition pack designs for Dairy Milk 180g and 95g PMPs, encouraging playful sharing moments.

Each pack features one of 12 designs, posing fun questions like ‘Who cooked?’, ‘Who Pays the Subscription?’ or ‘Who drove?’ to decide

who gets the biggest share of chocolate.

Supported by out-ofhome advertising and social media, the launch aims to drive sales by making sharing more interactive and engaging.

POPWORKS is celebrating the release of Bridget Jones: Mad About The Boy with its �irst on-pack competition, running until 23 March on Sweet & Salty and Sweet BBQ 85g sharing bags.

Shoppers have the chance to win a luxury getaway, movie merchandise and gift vouchers by purchasing participating packs, scanning the QR code and registering online.

The partnership aims to tap into Bridget Jones’ fanbase, positioning PopWorks as the go-to snack for big nights in.

To further drive engagement, the campaign will be backed by PR, digital and in-store promotions.

Pocket confectionery remains a valuable opportunity within impulse, with Tic Tac contributing £8m to sales. The 38.5g packs have an RRP of £1.70.

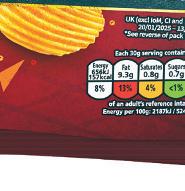

KP SNACKS has added Frisps Cheese & Onion to its £1.25 PMP range.

With KP’s PMP range now worth £122m, the launch taps into strong demand for value-driven snacking, contributing to the £368.8m crisps, snacks and nuts PMP segment.

According to Lumina data, PMPs represent 39% of crisp and snack purchases.

Stuart Graham, head of convenience and impulse at KP Snacks, noted that the addition aligns with KP’s strategy to bring popular

I JOINEDsocial media for the store in 2015 when I was about to do a re t.

What I’ve learned is you have to be brave and shout about the things you’re doing. We all do things we should be proud of.

I know there’s a fear of being trolled, but remember, you can edit and delete posts. And you can respond to any comments positively. What you’ll nd is that you build a local online community.

It’s important to post consistently and to make sure you put your personality into your posts. Once I did that, I started to gain momentum.

All sta members are trained to speak to customers about following us on Facebook. We have a Smiirl counter in the store to direct people to our Facebook page, but all you need is a small QR code at the till. Don’t let them walk out without scanning the QR code, or they’ll forget to do it.

Outside of social media, we’re always doing something with the local community that bene ts local causes and promotes the store at the same time. That includes ra les, litter picks, a Halloween walk and more.

The impact of our marketing has been massive. I’ve not got the biggest store, but people return. If you sit back and do nothing, you start to fall under the radar.

PRIYA KHAIRA

TERRY’S has unveiled its Easter 2025 range, introducing new products to capitalise on seasonal sales.

Leading the lineup is the brand’s �irst Chocolate Orange Cream Filled Egg (RRP 70p), alongside the Chocolate Orange Easter Egg with Exploding Candy Minis (RRP £1.35).

According to Kantar data, �illed eggs are the secondbiggest Easter segment.

The brand’s Chocolate Orange Milk Mini Eggs were among the top-10 bestselling Easter egg lines in 2024, growing 13% in value, outpacing market trends.

Returning favourites include the XL Terry’s Chocolate Orange Easter Egg and the Exploding Candy Egg, both of which performed strongly last year.

Additionally, the Chocolate Orange Truf�les Easter Egg has been given a refreshed look, featuring modernised packaging and an updated logo.

This follows 46% value growth and 35% volume growth in 2024, highlighting its growing popularity.

The launch aims to build on the success of Terry’s

MAGNUM has launched its Utopia range, featuring Double Cherry and Double Hazelnut.

Double Cherry combines marbled berry and cream ice cream, drizzled with sourcherry coulis and coated in Magnum milk chocolate with crunchy berry sugar pieces.

Meanwhile, the Double Hazelnut variety blends hazelnut and caramel almond ice creams with a salted hazelnut sauce, encased in white chocolate studded with caramelised hazelnut, almond and

pistachio pieces.

Following the success of Euphoria Pink Lemonade, 2024’s top ice cream launch, Utopia is now available in £2.30 (single) and £4.25 (three-pack) formats.

HÄAGEN-DAZS’S signature �lavours are now available in a stickbar format.

Stickbars, which combine premium ice cream with a Belgian-chocolate coating, come in Salted Caramel, Cookies & Cream and Macadamia Nut Brittle (Co-op exclusive) varieties.

Developed using input from consumer testing, the bars

aim to deliver luxury tastes in a convenient format.

Backed by a six-�igure marketing campaign, HäagenDazs’s Stickbars will be available to order from April, with an RRP of £2.65 per bar.

According to Nielsen data, chocolate sticks are growing by 32.6% year on year in the ice cream category.

Christmas range, which outperformed the market in volume and value, according to Nielsen Scantrack data.

MR KIPLING has added limited-edition Simnel Slices to its Easter range.

The expansion taps into growing demand for seasonal cake innovations, beyond traditional cake �lavours.

Simnel, which is a rich fruitcake, is the third most popular Easter cake, growing 7.4% year on year, yet rarely available in a

smaller, convenient format.

The slices feature a moist sponge with dried fruit, marzipan-�lavour �illing and soft marzipan-�lavour icing. The target audience is shoppers aged 45 and older. Launching alongside returning favourites from Mr Kipling and Cadbury Cakes, the six-pack Simnel Slices are now available at an RRP of £2.

WORLD of Sweets has introduced Bonds Trail Mix, a new range designed to offer a healthier snacking alternative while maintaining indulgent �lavours.

The 25g snack-sized packs (RRP 70p) come in three dessert-inspired �lavours – Chocolate Orange, Sticky Toffee and Banoffee Pie –each containing 114 or fewer calories.

Part of World of Sweets’ healthier-snacking initiative, the launch aligns with growing demand for better-for-you options.

A report conducted last year found that 50% of Brits are eating more healthily.

Shop+ is a brand-new free digital magazine for consumers, featuring: Join the Shop+ Club and earn money for your store!

New products in the convenience channel

Recipes using ingredients from your store

Money-saving ideas, well-being advice and lots more!

Join our exclusive Shop+ club and earn money every time one of your shoppers scans the Shop+ QR code. PLUS: The chance to win £500 cash with every issue.

Find out more and get your free in-store and digital point-of-sale at bit.ly/shop-plus25 or by scanning the QR code.

PRIYA KHAIRA

LYNX has introduced Sunset Fresh, a new aquatic-inspired fragrance designed to appeal to younger consumers.

The latest addition aims to reinforce Lynx’s position in the male grooming category while tapping into evolving fragrance trends.

£3.95 and £5, depending on the size.

The full range is available now across convenience and wholesale channels.

Monique Rossi, general manager of deodorants at Unilever UKI, said: “Fragrance remains the numberone con�idence driver among young males. Sunset Fresh has been developed to resonate with our core audience while helping retailers refresh their shelves.”

Sunset Fresh blends tropical mango and sweet mandarin scents, and is available in multiple formats, including body spray, antiperspirant, roll-on and shower gel.

Roll-on deodorants are priced at £2.25, shower gels range from £1.25 to £3.50, and body sprays and antiperspirants are priced between

Lynx will support the launch with a £2m marketing campaign from July to Sep-

PLANT-BASED chocolate brand Happi has launched two oat milk Easter eggs for 2025 – Salted Honeycomb and Cherry & Almond – expanding its seasonal lineup.

Made with 100% natural ingredients and sustainably sourced cacao, the eggs offer a healthier alternative, containing 35% less sugar than mass-market brands.

They also feature ecofriendly packaging, with a fully compostable inner bag and recyclable paper outer packaging.

The new eggs join Happi’s �ive-strong Easter range, alongside Plain Milk, Salted Caramel and Orange. The 155g eggs have an RRP of £11.99.

ORGANIC food brand Biona has released a new Ginger & Turmeric paste, set to be available next month with an RRP of £3.19.

Designed for wellnessconscious consumers, the ready-to-use paste eliminates the need for peeling or chopping, making it easier to prepare Indian and South-East Asianinspired dishes.

Carmen Ferguson, brand manager at Windmill Organics, highlighted the growing demand for organic ingredients and scratch cooking, predicting strong consumer interest.

With organic food sales outperforming non-organic, Biona’s latest launch taps into

ALPEN has revealed a new recipe and packaging refresh across its muesli range, designed to emphasise its new taste and nutritional bene�its.

The updated packs now feature 30% more fruit. As part of the refresh, Alpen Original Muesli and Alpen

No Added Sugar Muesli will be available in new 950g and 550g pack sizes.

tember, ensuring high visibility across key retail channels. The PETA-approved vegan range is also packaged in in�initely recyclable cans. Spar goes nuts

The relaunch is being backed by a £2m marketing investment, marking Alpen’s �irst major consumer campaign in four years.

Louise Vickers, head of brand at Alpen, said:

“Through a major investment into our product, our packaging and brand, we want to inspire consumers who are looking for a wholesome start to the day.”

SPAR has partnered with The Hershey Company and Euro Food Brands to launch Reese’s Peanut Butter White Bar, available exclusively in Spar stores across Scotland, Wales and England for six weeks since 20 February.

The 90g bar combines peanut butter with a white-

chocolate-�lavoured coating. During the limited-time launch, the bar will be available at a promotional price of £1.50. After that it will be available elsewhere with a £2.10 RRP.

Reese’s has seen 26% growth in UK convenience sales over the past year.

IFE, part of Food, Drink & Hospitality Week, returns to ExCel London on 17-19 March to connect retailers and hospitality professionals with innovative products. Event manager FEDERICO DELLAFIORE discusses some of the highlights of this year’s event

IFE is a must-attend event for professionals in food and drink retail to explore thousands of innovative products from the UK and around the world. With countless opportunities to sample products and hear directly from the passionate entrepreneurs behind the brands, IFE is an invaluable opportunity to fast track product sourcing.

Buyers looking to engage with smaller brands can head straight to the Startup Market, a bustling hub of emerg-

ing new-to-market food and drink businesses. Plus, the New Products Tasting Theatre is a must-visit to hear directly from brand owners, sample products and learn about the latest industry trends. In addition to exploring the wide range of products on display, IFE is also a chance for retailers to step out of the daily routine and hear from inspiring industry leaders as they discuss the food trends and consumer research on the Future Food Stage.

IFE 2025 will feature countless fresh initiatives that elevate its o ering for food and drink retailers. The Fresh Produce Section will be returning for its second year in partnership with the Fresh Produce Consortium, and retailers visiting the show should explore its Bakery, Snack & Confectionery, Chilled & Frozen and Grocery & Wholesale sections, all of which have seen huge growth and innovation for 2025.

The Future Food Stage and

Umri

RRP: £3.50 per can

Michelin-starred credentials.

the Trends & Innovation Platform will be o ering invaluable insights into the very latest trends in food and drink, from uncovering key consumer trends to analysing the UK’s national food strategy to opportunities in convenience and impulse.

International trade will also be at the top of the agenda, from a networking event hosted by the Department for Business & Trade to a packed programme of content on the Exporters Hub.

Acai Berry

RRP:

Umri is more than just a beverage – it’s a blend of natural ingredients for women naturally navigating the challenges of perimenopause and menopause.

1

Check out the exhibitor list on the IFE website to explore di erent categories and make sure you don’t miss out on innovative products from quality brands.

2

Don’t miss the Startup Market, a bustling hub of new product discovery at IFE and your chance to speak directly with the entrepreneurs behind the brands.

3

Suppliers from more than 45 countries including Greece, Italy, Vietnam, South Korea, Kenya, Poland and India will be exhibiting, showcasing international innovation and building closer relationships with UK retailers.

4

Check out the Future Food Stage seminar programme to keep on top of all the latest trends in the food and drink industry and hear from retailers including Planet Organic, Iceland and Ocado.

5

Visit IFE’s sister show, IFE Manufacturing, to meet with sustainable packaging brands, quality ingredients suppliers, product designers, labelling and compliance experts, and much more.

To nd out more and register for your complimentary trade ticket, visit ife.co.uk. IFE takes place alongside IFE Manufacturing, The Pub Show, HRC and International Salon Culinaire as part of Food, Drink & Hospitality Week

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

The sign looks better than

my old one

CARRIAGE CHARGES: How will InPost Newstrade’s decreases help you?

“THE Fed has been in discussion with InPost Newstrade. The fact that the news wholesaler has acted on our members’ concerns is a positive development and we are pleased to see it taking steps to protect smaller news stores.”

HOME DELIVERY: How are you meeting customer needs?

“MY partnership with Snappy Shopper enables me to offer in-store and competitive pricing, which customers value a lot. However, you can’t just survive alone on competitive price. I make sure it’s a convenient service and can deliver to customers in the promised time.”

Serge Notay, Notay’s Premier, Batley, West Yorkshire

“I’VE recently teamed up with Flash Delivery. I’m the only one in Rochdale with Flash. They don’t take lots of commission like Uber Eats or Deliveroo do. Money from deliveries is also in my bank account the next day. It allows me to pass on savings to customers.”

We have a lot of residents who rely on it

ELFBAR: Are the vape firm’s branded storefronts beneficial?

“AN Elfbar rep had come to the store twice before to give us some Elfbar and Lost Mary promotions and products. He said he was offering a new sign if we needed it, free of charge. It’s a good deal, considering new signs can cost you more than £2,000+VAT. It’s a two-year deal. We can change after.”

Anonymous retailer

“WE don’t mind having the signage, despite the disposable-vapes ban coming on 1 June, and the Tobacco and Vapes Bill later, because these companies are bringing out alternative products. The sign looks better than my old sign. My customers like it, and it is helping us to sell more vapes.”

Anonymous retailer

Prinal Patel, Raj’s Premier, Isle of Wight

Mo Razzaq, Mo’s Premier, Blantyre, and Fed national president

It’s all about the services that help people

It will help if it’s a small decrease

FOOTFALL: How are you offsetting a decline?

“WE have to change the narrative from doom and gloom to recognising that shopper habits are changing again, not collapsing. Convenience stores are the cornerstone of our communities. Adapting to changing habits will ensure our stores remain a vital part of the retail landscape.”

Susan Connolly, Spar Pennings Road, Tidworth, Wiltshire

“IT’S all about offering services that help people. I’m never going to be as cheap as the multiples, but I offer PayPoint and I’ve got Snappy Shopper, which I’ve done okay with. Delivery isn’t so huge in my area, but I have one eye on the big cities, and I think it’s coming our way.”

Ken Singh, BB Nevison Superstore, Pontefract

FOLLOWING the �irst meeting of our Retailers 4 Retailers support group this month, we have decided to set up scheduled meetings online to happen regularly on Zoom every second Monday. The next one will be happening on 3 March at 7pm and the meeting is for retailers.

As a group, we feel it’s important to offer consistent peer support and be there for other store owners at regular time slots that they know will be happening, especially while we get this off the ground.

I’ve set this group up in partnership with other independent retailers, including

COMMUNITY RETAILER OF THE WEEK

Sheraz Awan, Premier Westerhope Convenience, Newcastle

‘We’ve been giving away free bread’

“WE hand out free bread outside the shop every day from 7.45am to 9.45pm. This is bread we purchase ourselves to give away. We promote it on Facebook and TikTok, and some of our videos have gone viral. March 2025 will mark ve years of us doing this every day. That’s more than 1,800 days giving away free bread. I also donate bread to various food banks. Last week, I gave away more than 700 brioches. Whether it was two, three, four, ve or 20 brioches, anyone could take as many as they wanted.”

Atul Sodha, Neil Godhania and Sophie Towers.

We urge any retailer who is looking for support, seeking advice or willing to offer support to others to join our next call online.

We are aiming to create a safe space for retailers, created by other retailers.

Our hope is to develop

a support system so other store owners no longer need to feel alone because only other retailers understand what retailers have to deal with.

We hope other retailers can join us.

Natalie Lightfoot, Londis Solo Convenience, Glasgow

COMMUNITY RETAILER OF THE WEEK

‘We’re helping to support diversity’

“WE recently donated £1,000 to support this year’s Darlington Pride Festival through Nisa’s Making a Di erence Locally (MADL) charity initiative. It’s a key event in the town’s cultural calendar to promote diversity and inclusion. The donation was inspired by store team member Gavin Morrison, who performs as drag queen Georgina Sparx. Every time a customer buys one of our own-brand products, a penny from that sale is added to our MADL fund. We’re delighted to be supporting such a popular and inclusive event, right on our doorstep.”

JANUARY was a month in which I focused, as usual, on looking over my stores and giving them some TLC during the quiet time. I spend around £20,000£30,000 sprucing up my shops – putting in new counters at two of them, for example.

Now is the time when I start looking at ways I can save money in the shop, ahead of the National Minimum Wage increase on 1 April. There are tough times ahead, and it’s not going to get any better, so it’s about maximising where you can save money and cut back on any wastage that’s happening. Cut costs where you can.

We’ve moved from Lloyds Bank to Wellpay, and that is saving us £25,000 a year. I never thought we’d save that much over all the stores just by changing banks.

We’ve gone through all the sta hours to make sure they’re up to date and have already saved a couple of hours here and there.

Make sure you’re looking across all the shi s. We’re already on a bit of a skeleton crew here, but we’ve still found ways to cut costs further.

Do you need a two-hour crossover or can it just be an hour? Over the course of a week, that’s almost an entire day’s wage, so that’s £350 saved just by tightening up one hour a day. If we have two members of sta working, can we make the second person a younger employee because they cost less money?

We’re looking at more things like that – it doesn’t always work, but it’s important to look for them.

You have to make sure that everyone is working as e ciently and e ectively as possible. I don’t always understand the margins and charges, so I found someone who did and that has tightened things up there.

We’ve found other areas where we can make savings because the wage-bill increase will cost us all money, while the disposable-vapes ban looks set to hit our income.

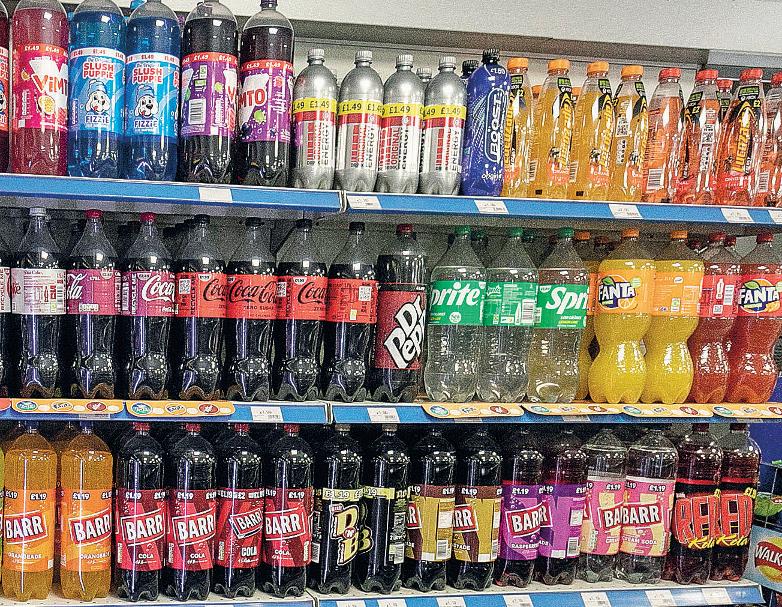

Price-marked packs are convenience store staples. PRIYA KHAIRA explores the bene ts, challenges and strategies for getting PMPs right

WITH the cost-of-living crisis, shoppers are more price-conscious than ever. Price-marked packs (PMP) play a crucial role in building con dence by providing clear and upfront pricing, eliminating concerns about overcharging.

PMPs o er a simple yet powerful value proposition: transparency, trust and a ordability. “PMPs o er shoppers price con dence. It is good to have PMPs available for budget-conscious shoppers and to provide a point of

di erence,” explains Shaun Whelan, convenience and wholesale OOH controller at Jack Link’s Protein Snacks. For independent retailers, competing with supermarkets and discounters is a challenge. PMPs o er a way to level the playing eld by giving customers the price signals they expect, particularly for everyday essentials and impulse purchases.

Lewis Woodward, of Nisa Local Colleygate in Halesowen, West Midlands, has experimented with PMPs and found

they make a measurable difference. “The rate of sale and customer con dence make PMPs worth it for us. It helps

get people through the door,” he explains. “I’ve tested my store both ways, and right now, PMPs are working best.”

Ben Parker, vice president of o -trade sales at Carlsberg Britvic, o ers retailers three top tips for maximising sales

Category merchandising is the key to success for chillers. Retailers should cover the following eight macro categories to help shoppers navigate chillers: carbs, sports & energy, water, juice drinks & iced tea, kids, health & wellness, dairy & protein and iced co ee. Including PMPs across these categories is key.

Consumers are looking for choice – ensure a wider range of flavours are available across flavoured carbs, colas and juice drinks, and in di erent formats.

Ensure you are stocking a range of well-known established brands in chillers. Brand loyalty is the most important factor when choosing a soft drink. This also anchors a consumer’s eye and is the key to successful navigation. Consider stocking well-known brands in PMP formats to maximise this opportunity.

WHILE PMPs can o er signicant bene ts, retailers need to be selective about where and when to use them. Not every category requires pricemarking, and strategic selection can help maintain strong margins while ensuring customer trust.

PMPs are most e ective in categories where products move quickly and are purchased frequently as these items are typically high-volume sellers where customers actively compare prices.

Imtiyaz Mamode, of Wych Lane Premier in Gosport, Hampshire, notes that PMPs are vital for sustaining growth in impulse categories. “We see a lot of passing trade during the after-school period, so it’s essential we o er pricemarked packs in crisps, snacks and confectionery,” he says.

Matt Stanton, head of insight at DCS Group, says: “Some retailers avoid PMPs so they can increase prices to capitalise on distress purchases. While this might seem a good

idea on the surface, only around one in 10 missions are distress, whereas one in ve are planned top-up missions, and these shoppers will be much less likely to over-pay.” Charging a competitive price, and using PMPs to do so, is an excellent way to drive shopper loyalty.

One of the biggest challenges is deciding whether price-mark. Understanding shopper behaviours is key to making the right PMP decisions.

A practical, at-a-glance checklist for retailers to ensure they are making the most of PMPs

Stock PMPs in high-turnover categories like soft drinks and confectionery.

Monitor PMP margins and buy in bulk when promotions are available at wholesalers.

Mix PMP and non-PMP options to balance trust with pro tability.

Use strategic merchandising to highlight PMP products in high-tra c areas.

Adjust PMP stock seasonally – i.e. soft drinks in summer, hot beverages in winter.

Soft drinks

Top categories for PMP success of shoppers say they tend to shop in places with lots of PMPs the stat 48%

Soft drinks remain one of the strongest-performing price-marked categories.

Confectionery and snacks

Smaller pack formats such as chocolate bars, sharing bags and crisps are impulse-driven and bene t from PMPs’ clear value proposition. According to KP Snacks, £1.25 PMPs account for 50% of crisps, snacks, nuts and popcorn sales, and are growing by 6.1% in value.

Everyday essentials

Biscuits, hot beverages and staple grocery items can bene t from PMPs, particularly for budgetconscious shoppers. However, retailers should consider stocking a mix of PMP and non-PMP products to cater to di erent spending preferences.

On-the-go missions

Price-marked single-serve or smaller pack options for breakfast and lunch cater to shoppers seeking quick, convenient meals while reinforcing value perception.

TIMING PMP promotions around seasonal demand can help retailers maximise sales and ensure products remain relevant throughout the year.

By price-marking bottled water, ice lollies and popular carbonated drinks in the summer, retailers can reinforce a store as a go-to destination for summer essentials,

encouraging impulse buys and multi-pack purchases.

As families prepare for the back-to-school season, the demand for convenient lunchbox options and snacksized products increases. PMPs on items such as multipack crisps, cereal bars and juice boxes can reassure parents they are getting good value

while stocking up for their children’s school meals.

Festive seasons such as Christmas, Easter and Halloween drive strong demand for seasonal confectionery, biscuits and gifting items.

Shoppers often buy in bulk during these celebrations, making PMPs an e ective way to increase volume sales while

promoting a ordability.

During colder months, the focus shifts toward comfort foods, hot beverages and warming essentials. PMPs on tea, co ee, instant soups and hot chocolate can help retailers capture sales from customers seeking a ordable winter warmers on grocery top-up missions.

Volume vs margin: nding the right balance PMPs encourage faster sales because customers perceive them as good value. While individual margins may be slightly lower, the increased turnover can lead to higher overall pro ts. Retailers should assess whether a high-volume, lower-margin strategy works for their store and whether PMP products generate more frequent purchases.

Multi-buy o ers: increasing basket spend Retailers can boost PMP pro tability by pairing them with multi-buy promotions. For example, offering ‘two for £2’ on PMP snacks or drinks encourages larger basket sizes while maintaining a strong sense of value for customers. This strategy ensures that PMP sales contribute to overall revenue growth rather than just driving single-item transactions.

of shoppers say a pricemarked pack reassures them they’re not being overcharged the stat

63%

Smart buying: timing purchases for maximum pro t Wholesalers regularly o er promotional pricing on PMP products. Savvy retailers buy in bulk during promotional periods to reduce their cost per unit while still selling at the standard PMP price. By planning ahead and stocking up when prices are lowest, retailers can protect their margins and improve their pro t per case.

Complementary sales: leverage PMPs to drive higher-margin purchases

PMPs don’t just sell themselves – they also bring customers into the store, where they are likely to pick up additional products. A price-marked energy drink, for instance, may encourage shoppers to grab a sandwich or protein bar, increasing the overall spend per visit. Retailers can strategically position high-margin products near PMP items to encourage these additional sales.

Supplier partnerships: maximising promotional support

Many brands provide in-store marketing support for PMP products, such as free point-of-sale materials, promotional posters and social media collaborations. Retailers should work with suppliers to take advantage of these, using them to highlight PMP value while drawing attention to complementary premium products in store.

Frisps

KP Snacks has expanded its PMP o ering with the addition of Frisps Cheese & Onion in a £1.25 format. The addition of the line comes as KP’s PMP range is worth £122m, within a total crisps, snacks and nuts PMP segment worth £368.8m.

Extra Refreshers

Mars Wrigley has launched two new Extra Refreshers PMPs, available in Tropical and Bubblemint varieties, each with an RRP of £2.50.

Doritos

PepsiCo has launched Doritos Dinamita exclusively to the convenience channel in a PMP format. It is available in a £1.25 PMP, following the popularity of PMPs in the crisps and snacks category over recent years. The new flavour adds to Doritos’ existing Extra Flamin’ Hot Portfolio.

Tango

Tango has launched its latest ‘Editions’ flavour, Strawberry Smash. Tango’s annual rotational series has seen considerable success. Previous ‘Editions’, including Tango Mango, Paradise Punch and Berry Peachy, have all been crowned numberone new product development in the fruit-flavoured carbonates category in their respective launch years. It is available in 330ml and 500ml pricemarked formats.

Pringles

Pringles has launched an exclusive price-marked convenience channel variety. Pringles Flame Grilled Steak is available now. PoS materials are also available upon request.

Monster

Monster has launched Monster Juiced Rio Punch in price-marked single 500ml cans and four-can multipacks. Rio Punch joins the Monster Juiced range, which includes Mango Loco, Pipeline Punch, Aussie Lemonade, Khaotic, Paci c Punch, Monarch, Ripper, Mixxd Punch and Bad Apple.

Ahead of the impending law changes, convenience retailers need to think about how to sell tobacco pro tably and keep customers coming back, writes TIM MURRAY

ACCORDING to the ACS 2024 Local Shop Report, tobacco and vaping products make up 20% of convenience retailers’ sales, but charity Action on Smoking and Health says tobacco generates just 10% of their profits. This highlights the tighter margins this category o ers, but also shows how important it remains to the bottom line of most stores.

The retailers who spoke to Retail Express said tobacco

remains an important driver of footfall, loyalty and related purchases.

But, at Londis BWS in Chesham, Buckinghamshire, Hitesh Modi says his tobacco sales went down last year. “People are buying 30g packs of tobacco instead of 50g,” he says. “In cigarettes, we’re stocking Paramount, which we source direct and sell for £12.50. There’s no loyalty, people buy whatever’s

cheapest.”

Sunny Patel, at Lutterworth News in Leicestershire, says the category has been a challenging one over the past six months, with an older clientele and a need to look for reward schemes to remain pro table. “This past year’s been a mix and match, with a lot of reshaping in suppliers’ and wholesalers’ reward schemes,” he says.

“Wholesalers such as

Bestway, Costco and Dhamecha have good incentives, and the tobacco reps are helpful. But with less presence on the gantry, tobacco is a highrisk category. For younger shoppers, it’s about vapes and roll-your-own (RYO), but older customers buy cigarettes.”

For a lot of retailers, the focus is on retaining their tobacco customers with either their preferred lines or the best possible value.

ACCORDING to tobaccoinsider.

com, two-thirds (64%) of UK tobacco sales are factorymade cigarettes (FMC), while RYO and loose tobacco make up 21%, and 15% is next-gen nicotine products.

Tobacco buyers have been trading down in the current economic climate. In FMC, the ultra-value segment continues to grow the fastest, with ultravalue now comprising 18% of the total tobacco market.

“The lowest pricing tiers, economy and value, now represent nearly three-quarters of

ready-made cigarette and RYO sales,” says Andrew Malm, Imperial Brands’ UK market manager.

JTI UK introduced its ultravalue Mayfair Gold Rolling Tobacco in September, and then followed that up in January when the company dropped the price of Mayfair Gold cigarettes’ RRP from £13.30 to £12.50, making this the supplier’s cheapest ready-made cigarette o ering.

However, within RYO, the premium price sector still holds the largest share, 36%,

and manufacturers have been responding.

Nitesh Patel, at Loscoe Post O ce & Stores in Derbyshire, says demand for RYO tobacco and accessories has increased by 40% in the past three years.

“The switch from FMC has been noticeable,” he adds.

The growth of RYO can also be seen from IRI Marketplace’s data, which shows convenience retailers take over half of all tobacco accessories sales, with cigarette papers and lter tips’ channel sales up 14% annually.

Ian Howell, public a airs manager, JTI UK

“THE illicit tobacco market continued to grow in 2024, and shows no sign of stopping. The gures are staggering – 30% of cigarette consumption and 54% of RYO now come from illegal and other non-duty-paid sources, avoiding UK taxes.

“This has serious rami cations for honest retailers’ incomes, as it not only impacts their legitimate tobacco sales, but also means they miss out on wider basket spend, with shoppers visiting other stores.

“The latest duty rises, coupled with the Tobacco and Vapes Bill, will likely see more smokers turn to the illicit market, meaning this challenge will only grow in the months ahead for retailers.

“A recent survey found 78% of retailers feel a generational ban would lead to more illicit tobacco in their local area. There’s no doubt that retailers are concerned about the generational ban, with 63% saying they would prefer raising the minimum legal age of purchase for tobacco to 21 as an alternative.”

Reflecting the value trend, Imperial’s latest valuetobacco launches, Paramount Superkings Original and King Size Original 20s, topped the 10 bestselling launches in convenience stores in December in Retail Express’ sister publication RN. Paramount Superkings Original generated the highest weekly sales, £48.30, or 4.2 packs per store.

Wessex Distribution is supplying independents direct with new cigarette brand Graysons, which has an RRP of £12.65 and provides a 10% margin. Retailers buy stock from Wessex’s reps, and reorder via drop shipments or further visits.

Republic Technologies is underlining its lters’ environmental credentials with the rollout of Just Paper plastic-free Swan lter tips, complementing its environmentally friendly OCB range.

In cigars, STG UK has expanded its Signature cigarillo range with the new Action Mix mint and berry cigarillo, which contains two capsules combining these flavours. They are available in packs of 10 sticks and have an RRP of £5.85. STG also updated its Henri Wintermans Half Corona packaging in October.

CIGARS and cigarillos are another area where retailers can do well, o ering typical margins three times higher than cigarettes. Cigars are a £342m market, but within this subcategory, it is cigarillos that are growing fastest, worth nearly £150m and contributing over 56% of volume.

Scandinavian Tobacco Group UK’s (STG UK) Signature Action’s sales have

increased more than 50% since last year, followed by miniatures such as their Signature Blue and Moments Blue. STG’s Henri Wintermans is the biggest medium/large cigar brand and the fth-biggest cigar by value. Retailers should train sta to talk to cigar buyers to exploit gifting, and occasions such as birthdays, Easter, Father’s Day and Christmas.

Sunny Patel, Lutterworth News, Leicestershire

“OFFERING variety is important, and so is a good price point. We sell about half cigarettes, a third RYO, 5% cigars, and the rest are vapes.

“Our biggest cigarette brands are low price, Benson & Hedges (B&H) Blue, Sterling and Mayfair. The range is becoming more concentrated. We sell fewer premium cigarettes like B&H Gold now, but mix it up with products featured in the suppliers’ schemes.

“We sell a lot of RYO because it’s cheaper than cigarettes, but prices have risen with recent duty increases, from £20 minimum for a pack to £30.”

IT’S tempting to charge more for cigarettes, with typical margins of 6% on RRPs, but as smokers’ budgets tighten, stores should keep prices competitive to keep regular customers coming back and capitalise on the ultra-value segment’s upward trend.

In Lumina’s September convenience tracking data, 70% of tobacco shoppers said good value was the main reason for visiting stores, with 53% saying price was important when

purchasing in store.

However, data in Retail Express’ sister publication RN showed 70% of stores charging above the most-common price for premium brands Benson & Hedges Gold King Size, Benson & Hedges Silver King Size and Marlboro Gold King Size, which might mean there is scope to reclaim some margin from premium options, although this could risk pushing regular customers – and their secondary spend – away.

“Focus tobacco ranges on ultra-value brands,” says Mark McGuinness, JTI UK’s marketing director, as smokers look for more a ordable options. “Use tools like the margin calculator on the JTI 360 retailer hub to set competitive prices without sacri cing pro tability.”

“Build cigar ranges around cigarillos in di erent flavours and the top-performing brands in the miniature, small and medium/large segments,” says Prianka Jhingan, STG UK’s head of marketing. “The top 10 brands account for more than 90% of sales.”

“Use tobacco accessory suppliers’ branding to highlight that you sell tobacco,” says Swan lters stockist Param Akilan, of Go Local Extra in Shefeld. “Site a counter-top display unit for lters and papers. Stores with limited space should make them as visible as possible, with an eye-catching display behind the cashiers.”

“We keep our cigarette prices at RRP or a little more, 10p or 20p,” says Patel, “If you put more on top, people notice.

“You’ve got to shop around.

If you buy £1,000 of cigarettes, Bestway often gives you a free case of Red Bull or other energy drinks, and Costco always has tobacco at a good price. There are a lot of costs involved in selling tobacco, and retailers obviously have to pass them on. Customers know that costs have gone up, but if you keep

the prices reasonable, they will come back.”

Retailers should make getting the range right and nding the best deals top priority.

Patel recommends checking wholesalers’ o ers and talking to supplier reps, as there’s plenty of help available.

“Some symbol wholesalers dictate their deals and don’t count stores’ tobacco spend towards the required monthly total, but independents have more freedom,” he says.

The arrival of warmer weather means it’s time for some spring cleaning in the beer-and-cider arena. TIM MURRAY looks at developments in the category and how tastes are changing

WITH an overall market value of more than £5bn, beer is hugely important – it delivers almost £4bn in value to the grocery market, a gure that, within convenience and independent stores, is worth £1.3bn.

In convenience stores and independents, cider delivers £819m.

Beer and cider are therefore crucial areas for retailers. Heineken’s category and commercial strategy director, Alexander Wilson, notes: “This is particularly important con-

sidering that volume sales in beer are critical for retailers in helping to increase footfall and penetration at key moments in the year.”

With the changing of the seasons, out go the winter beers – stouts and darker ales – and in come lighter beers, lagers, pale ales and cider, with the latter category including a variety of flavoured options.

“We try to reduce the range of ciders in the winter, and we increase it in the summer,” says Vidur Pandya, from Kis-

lingbury Village Store & Post O ce in Northamptonshire.

“Fruity flavours always work in the summer, especially during the barbecue season.

“The clocks going forward [30 March] is the point at which it kicks in and we change the range – it’s the easiest way to remember it, too. We’ll be doing the same again in March, and we create o ers once we change over.”

Devoted cider drinkers are year-round consumers. “They don’t disappear during the

colder months,” says Westons head of business development Darryl Hinksman.

Demand for cider does increase in the summer, however. Hinksman adds: “As temperatures climb, so does the demand for cider.

“Some of the peak ciderconsumption days coincide with the summer months.

“This, in hand with the long Easter weekend and bank holidays, gives retailers prime opportunities to boost trade-up and impulse purchases.”

Vidur Pandya, Kislingbury Village Store & Post O ce, Northamptonshire

“WE are seeing a shi away from spirits towards beers and ales. Multipacks are doing well in the current [economic] climate – everyone is looking for value. Customers who used to buy four-packs are now opting for 10-packs, which o er much better value.

“Cra beers and ales are still growing. We’re launching a section and are working with a wholesaler to supply us with local cra beers. We’re still in talks about the range – we don’t want to duplicate things, and don’t want too little or too much choice, but we’re almost ready.

“We’ll put in some wooden xtures to match the cra -beer feel. We’ll buy that ourselves. It’s from Ikea, but it creates an ‘artisan’ feel.”

TASTES continue to develop, and Pandya says that, following the craft-beer resurgence, customers are “looking to try something di erent”, so retailers who expand their ranges can boost their sales.

Customers are looking for new beers, with premium world beers becoming increasingly important.

Consider Birra Moretti, for example, or Cruzcampo, which has generated £88m in retail sales since its introduction.

“As tastes change and evolve, we have noticed more customers, across all demographics, are keen to explore

new styles of beer, including a growing interest in world lagers,” says Heineken’s Wilson.

Liam Fidler, head of otrade at Damm, adds: “World beer continues its consistent year-on-year share growth as more shoppers choose to trade up.

“World beer was once limited to a few super-premium lagers, but it is now a variety of di erent brands at di erent prices and in formats made for di erent occasions.”

Ethical concerns are also beginning to a ect purchasing decisions within beer and ci-

der, so retailers should talk to their customers and suppliers to see if there is a point of difference they can o er that will yield bene ts.

“In 2025, sustainability will continue to shape the beer industry,” explains Paul Brazier, head of marketing at Purity Brewing Co.

“With consumers becoming increasingly environmentally conscious, carbon-neutral products are seeing increased demand.

“One standout example is Black Sheep Brewery’s Respire, the brewery’s rst carbon-neutral beer.”

Fruit-cider brand Kopparberg is aiming to cater to the evolving tastes of cider drinkers with its 2025 launch of Crisp Apple. The 4% ABV drink o ers a taste of traditional apple cider coupled with the sweeter flavour pro le associated with Kopparberg.

Westons is celebrating a landmark 145th birthday this year, and will be commemorating the milestone with a new addition to its range. Head of business development Darryl Hinksman says: “To mark this milestone, we will be introducing a new permanent addition to the bestselling Henry Westons range that pays tribute to the generations of brand heritage.”

Purity Brewing Company

Eco-friendly brand Purity Brewing Company launched its rst premium-lager category last year. Pure Pilsner keeps to the company’s environmental commitments and is made entirely from locally sourced British hops and barley.

Damm

Damm, noting that larger multipacks are the “fastest growing pack size aggregation”, is launching the 10x440ml Estrella Damm can pack.

Nirvana Brewery Nirvana Brewery has launched its rst Nitro Stout. The 330ml can has a 0.5% ABV and features the brand’s refreshed branding.

NO- and low-alcohol beers and ciders (no & low) continue to draw in consumers, with suppliers’ e orts to improve the taste of their o erings in this area paying dividends and the category continuing to see growth in terms of sales and product variety.

BrewDog’s o -trade category development executive, Caitlin Brown, says almost 40% of 18-to-25-year-olds are

not drinking alcohol, a gure that has almost doubled since 2019.

“With the continued demand, we expect no & low to grow further and play a stronger role in shoppers’ repertoires as we move into the new year,” she adds.

“In fact, as more shoppers expand their search for alternatives into additional channels, this sub-segment of beer

is outperforming total beer in impulse.”

Julie Kaur, of Premier Jules Convenience Store in Telford, Sta ordshire, concurs, citing alcohol-free cider as particularly popular. “Alcohol-free Kopparberg is doing well, as is Thatchers Zero,” she says.

“People are picking these brands up, so we’ve started bringing in a few more zeroalcohol lines. It’s a good option

to give customers.

“I’m surprised by how many men are buying Guinness 0.0. There’s’ de nitely a trend towards zero alcohol.”

Moderation is also gaining in acceptance, too, as Gen Z drink less alcohol than previous generations.

Heineken’s Foster’s Shandy was launched a year ago, and already boasts 0.2% market share.

Darryl Hinksman, head of business development, Westons

“QUALITY and convenience are the ultimate goals for shoppers when they enter stores. To take advantage of this, independent retailers should consider seasonal in-store displays and incorporating bestsellers in cross-category promotions.

“For example, keeping spring and summer foods – such as chilled barbecue produce – or bagged snacks close to cider-and-beer xtures will encourage shoppers to stock up on all the items they need for an a ernoon of entertaining, spending more time instore and driving higher volume sales in the process.”

“Warmer weather is also a time to promote larger formats to drive value and volume sales.”

Caitlin Brown, o -trade category development executive, BrewDog PLC

“AS a result of the increased cost of living, 20% of shoppers are drinking less out of home, with 13% saying they are drinking more at home, which is great news for retail. Despite trying to save money by going out less, shoppers still like to treat themselves, so indulgence is a key trend at home.”

Liam Fidler, head of o -trade, Damm

“WE suggest retailers encourage their shoppers to elevate their occasions. Creating dedicated spaces that have all the products shoppers might want for a big night in with friends or family can help ensure they don’t forget anything, or that they feel inspired to add something to the basket they weren’t intending to buy. Choosing premium products for this space can also encourage a greater spend overall.

“When creating merchandising and promotional strategies, one consideration that instantly comes to mind is making shoppers’ journeys easier and more convenient.

“With that in mind, I suggest focusing on an ‘occasion-led’ marketing approach, where shoppers are inspired by PoS visuals.”

With lots of new laws coming into practice this year, the RETAIL EXPRESS team nds out how retailers are preparing

Sarj Patel, Pasture Lane Stores, Sutton Bonington, Nottinghamshire

“THE big one for people is the disposables ban. We need to start running them down now and get people buying alternatives, such as the rechargeable vapes.

“We’ve stopped buying disposables already because we don’t want to get lumbered with them after June. Lots of retailers still think that the ban is a long way away or think it’s not been con�irmed, but it has and there are a lot of slow lines out there already. People need to get their stock sold or they are going to end up with a lot of products they can’t sell.

“Speak to your wholesaler. There are so many alternatives out there and you don’t want to end up with the wrong one, especially if you’ve not got the space. Retailers should do some research to �ind out what the main brands are, what’s popular in their area and what they need to stock. The re�illable devices will cost around £12.99 for customers, so you need to have the right one.”

Imtiyaz Mamode, Wych Lane Premier, Gosford, Hampshire 2

Nathalie Fullerton, One Stop Partick, Glasgow 3

“THE wage increase and the disposables ban will affect retailers a lot. Normally if there’s a wage increase, it means we’re going to have to pass that extra cost onto the customers. But, at the moment, that’s not something we want to do, so we’ll try to get stock at a good price now so we can keep prices down.

“Our staff hours aren’t going to go down. Our shop is usually very busy, so, if anything, we want more staff nowadays because otherwise I’ll have to work those hours in the shop and my time is better spent working on growing the business. Hopefully, the increase in wages will encourage more people to seek jobs with us so we can get more staff.

“In terms of the disposable-vapes ban, we spoke to our supplier and it has said it’s our responsibility whether we buy from them, so we’re going to stop getting any in the second week of March and then we’ll sell through.”

“FOR me, the biggest legislative change of the year is the disposable-vapes ban. We’ve already got a small selection of re�illables and pods, and we will be upping that all the way to June. Initially, I think we’ll have the same amount of space dedicated to the non-disposables as we had for the disposables range. There are products launching all the time, with El�bar and Lost Mary both coming up with their own re�illable devices. And people are buying them.

“It depends on whether these new products become the norm. We’ll have to play it by ear because we’ll dedicate the same space if they do, but if things start to trail off, we’ll have to think of something else to put in that space because every square inch in retail is worth a fortune. It’s about creating a different purchasing experience as well because re�illables have a higher price, so is more of an informed choice than an impulse buy.”

In the next issue, the Retail Express team nds out how retailers are increasing footfall in their stores. If you have any problems you’d like us to explore, please email