A deep dive into the performance and size of the wholesale industry, and an overview of AI within the sector

A deep dive into the performance and size of the wholesale industry, and an overview of AI within the sector

Paul Hill

Editor

Whether companies like it or not, 2025 is shaping up to be the year that the wholesale channel finally begins to embrace AI. No longer just a buzzword, it’s proving to be a transformative tool that is offering wholesalers a competitive edge, improving efficiencies and customer satisfaction while – most importantly – reducing costs and increasing sales.

For example, research from Proton.ai shows it can boost revenue

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Head of design

Anne-Claire Pickard

Production editor Ryan Cooper

Sub editors Jim Findlay, Robin Jarossi

Senior designer Jody Cooke

Junior designer Lauren Jackson

Contributors Tamara Birch, David Gilroy, Tom Gockelen-Kozlowski, Simon Hannah, Rob Mannion, Tim Murray

Production coordinator

Chris Gardner

by identifying wallet-share gaps and predicting reorder needs. It then suggests additional products to customers, leading to sales increases. Proton.ai is just one of many companies working in wholesale, with the firm providing pricing optimisation software using machine learning algorithms.

Deloitte’s AI wholesale report, meanwhile, mentions ‘insight mining’ – the ability to process customer meeting notes to identify next actions, generate inputs into customer relationship management tools, and identify patterns and insight for the entire sales force.

As Simon Hannah points out in his piece in this issue: “Would we employ someone today in our sales or commercial teams who couldn’t use the internet or send an email? How long will that remain the case for being able to use AI?”

Wholesale was late to catch up with digital, and it took the Covid-19 pandemic to force the channel’s hand. Now is the time for wholesalers to move forward with AI as a focal point of their operations.

Head of commercial

Natalie Reeve 020 7689 3367

Associate director

Charlotte Jesson 020 7689 3389

Account director

Lindsay Hudson 020 7689 3366

Account managers

Megan Byrne 020 7689 3372

Lisa Martin 020 7689 3364

Commerical project manager

Ifzal Afzal 020 7689 3382

Printed by Acorn Web Offset Ltd, Loscoe Close, Normanton Industrial Estate, Normanton, West Yorkshire, WF6 1TW

Distributor Seymour Distribution, 2 East Poultry Avenue, London, EC1A 9PT

Newtrade Media Limited, 11 Angel Gate, City Road, London EC1V 2SD Tel 020 7689 0600

Better Wholesaling Insight is published by Newtrade Media Limited, which is wholly owned by NFRN Holdings Ltd, which is wholly owned by the Benefits Fund of the National Federation of Retail Newsagents. Reproduction or transmission in part or whole of any item from Better Wholesaling may only be undertaken with the prior written agreement of the Editor. Contributions are welcomed and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information.

REPORT

P4-5: Viewpoint

David Gilroy investigates the pros and cons of buying groups

P6-9: Overview

A deep dive into the economics, employment and value of the channel

P10-11: In-depth

Simon Hannah looks at how AI can become a competitive advantage for wholesalers

P12-13: Opinion

Rob Mannion on why wholesalers need to take the plunge with AI

P14-15: Spotlight

The team at Caterfood (SW) reveal how it’s maintained growth for five decades

P16-17: Profile

How a Belgium fruit and veg wholesaler goes from ‘field to fork’

P18-19: Interview

Calsa explains how the UK market continues to be a key export focus for the wholesaler

P20-23: Buying Group Briefing

This brand-new regular section takes a deep dive into buying groups and their members

P24-27: Foodservice Focus

Tim Murray reports on the latest trends and developments in the culinary world

CATEGORY ADVICE

P28-32: Sector review

The latest opportunities within breakfast, lunch and dinner occasions

P33-36: Sector review

Finding out about all the trends and developments in soft drinks

P37-39: Sector review

A look at the tobacco, vaping and nextgen category ahead of the June disposablevapes ban

Gilroy’s viewpoint: What is the purpose of buying groups, and do they add any value?

The city break market is booming. And why not?

Cities are great places to visit. Culture, hospitality, social events and the buzz. Cities are for the most part safe and civilised, but those old city walls and ramparts were built for a reason. Size, scale and security. In times gone by, they were anything but great places to visit. Yuval Noah Harari’s seminal work, Sapiens: A Brief History of Humankind, provides a compelling narrative that traces the human journey, the Cognitive Revolution, the Agricultural Revolution, and culminating in the modern era of urbanisation and globalisation. Until around 10,000 years ago, humans were foragers living in egalitarian bands. Then came farming and the domestication of plants and animals. Trade networks were set up, and law, money and politics developed. This is when human settlements came to the fore. The

advent of the industrial revolution from the 18th century supercharged technical innovation, ambitious transport and global trade. Cities grew exponentially. Size, economic power and security were prime. When it comes to trade, size and scale really matters.

The UK grocery market is estimated to be worth £240bn in value. Supermarkets are dominant at around £192bn turnover. Tesco is the market leader with sales of £62bn, of which Booker Wholesale accounts for £9bn. The wholesale food and drinks market is worth £37bn – 15% of the total market. The top 30 wholesalers account for £32bn of turnover, which equates to 85% of the total wholesale market. Number 30 in the list turns over £113m per annum. Equivalent to one large multiple superstore. And there is a long tail of wholesalers selling way below this level. Tiny in comparison to the total market, and tiny in comparison when lined up against the top suppliers such as Coca-Cola, Diageo and Unilever.

When it comes to buying power even some of the top 30 wholesalers lack scale. Enter buying groups (BGs). They represent around £18bn of annual turnover. That word ‘represent’ is carefully chosen. A search through their accounts reveals a gulf between the turnover they represent and the value of stock they actually buy. In other words, the BGs don’t buy anything like billions

of pounds of stock. What purpose do they serve?

The wholesale sector is a delicately balanced ecosystem comprising suppliers, wholesalers and their customers. Relationships are the lubrication that makes this work effectively and BGs operate inside this set-up, offering size, scale and security to the smaller wholesalers. They also offer considerable efficiencies for suppliers, routes to market to a plethora of wholesalers, one point of communication, one promotion programme (rather than many), and a conduit to share brand planning and the vision.

The term ‘buying group’ is misleading and would probably be better labelled a ‘purchasing consortium’. An organisation that works collaboratively to leverage collective purchasing power. Potential BG members should be asking, ‘How will joining this group help make my business develop sales, operate more efficiently, be more sustainable and more profitable?’

BGs negotiate terms, deals and promotions with suppliers on behalf of their wholesaler members. Most tend to put this first on their list of selling points. They underpin it with ‘collaboration’ and ‘relationships’. This is important because they are service providers. They also offer a range of added-value services that small resource-constrained wholesalers would not be able to access.

The list is long and impressive, including access to hundreds of suppliers, promotional programmes, new product development, ranging and category expertise, marketing collateral materials, product file maintenance support, invoicing efficiencies, goods not for resale pricing, utilities and services pricing, and sharing of best practices.

All the above form a baseline standard and should be the minimum provided. What marks out the great from the good? The supplier portfolio is number one. How many active suppliers does the BG have trading relationships with, how effective are they and is there open access to suppliers for members? What do the range, brand plans, promotional programmes and trading terms look like? This sits right at the centre of trading profitability. Minimum order

quantities (MOQs) are a real problem for smaller wholesalers and are often a barrier to trade. Suppliers are understandably working hard on supply-chain efficiencies and imposing MOQs is one way of securing improvements.

MOQs can effectively rule out stocking for wholesalers, putting them at a disadvantage. BGs that offer solutions to resolve MOQs add serious value. A credible own-label range is very important in today’s trading landscape. Particularly with the emphasis on value for money, differentiation and innovation. The range must be backed up with verifiable quality control and resonate with business customers and consumers. Chilled food, obviously a strength of the supermarkets and the discounters, is highly important to hospitality outlets, making the fresh-food assortment a key ingredient. A reliable chilled-food solution that includes regular deliveries of short- and longer-life goods is vital to the range.

How good is the BG’s technology? The need for efficient, frictionless and reliable systems cannot be overstated. Can the BG’s technology integrate effectively and painlessly with the wholesalers? Can it facilitate an accurate, smooth back-end operation without excessive management intervention, providing management reports and good visibility of the relevant business metrics? Does the BG offer an electronic and digital marketing capability? On-

line, email, app, WhatsApp and social media coverage define excellence. In a rapidly changing world, does the BG provide any market intelligence, analysis tools, insight and trend support? These are the kind of resources that small cash-constrained wholesalers are often unable to access, yet are important to help stay up to date with the market and to predict future outcomes. And does the BG offer updates on the many (and increasing) legal requirements that the trade needs to activate?

Despite their numerous benefits, BGs face challenges that can hinder their effectiveness. Balancing the varying requirements and priorities of their members can be complex. Maintaining transparency in pricing, decision-making and operations is essential to building trust among members. Managing a large and diverse membership base requires significant administrative resources and coordination efforts. Some suppliers may be reluctant to work with BGs due to concerns about reduced margins or loss of direct relationships with customers. Despite aggregated scale, the BGs sometimes struggle with negotiating manageable MOQs. There is also an ongoing industry issue with price-marked packs (PMPs). Suppliers are squeezing PMP margins, and the BGs seem to be powerless to deal with this. Small retailers are

demanding straight packs, but this is not the solution. BGs should be ensuring that suppliers are offering fair margins for all parties. A key challenge for BGs is that of execution and activation.

The basic premise of buying from manufacturers is quid pro quo. Suppliers need to know that agreements and monies invested will manifest in the designated outlets and that the negotiated plan is being executed. This is why they like dealing with supermarkets and edge-to-edge operators. The relationships between BGs and their members are predicated on cooperation. The BGs are not in a position to instruct wholesalers to implement activations. This puts them in a weaker position than competitors and can be a bone of contention internally.

On balance, buying groups play an important role in the wholesale industry by empowering all parties to compete effectively in a dynamic and competitive marketplace where size and scale can dominate. Through cost savings, enhanced competitiveness, access to resources and risk mitigation, these groups contribute to the sustainability and growth of their members. While challenges exist, the benefits of buying groups far outweigh their drawbacks, making them an indispensable component of the wholesale industry. l Check out Better Wholesaling Insight’s new Buying Group Briefing section on page 20

The Covid-19 pandemic brought into sharp focus how significant the wholesale channel is to the UK, and it has grown in importance as the new Labour government looks to increase economic growth.

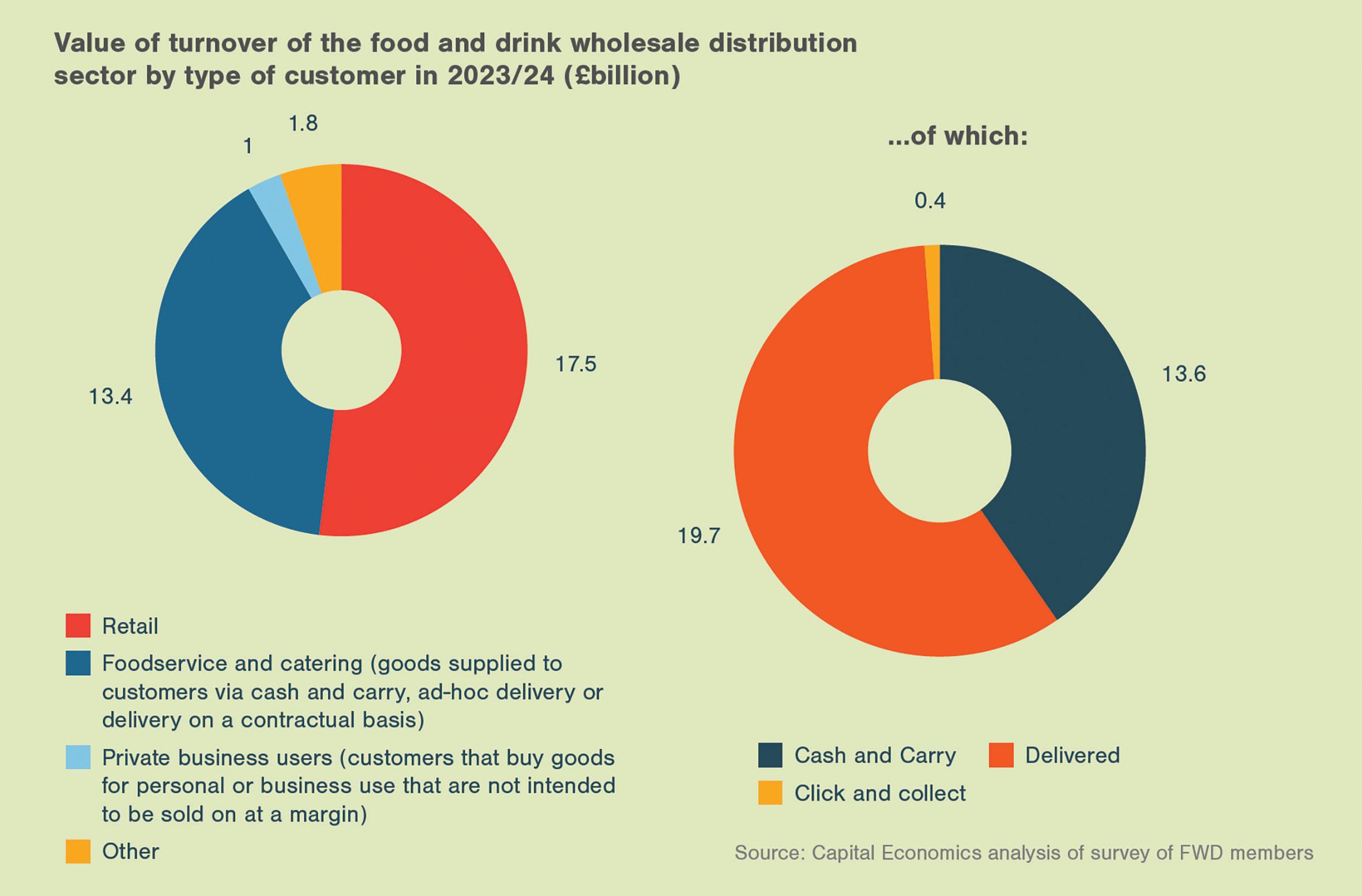

Overall, the sector generated £33.6bn turnover in 2023/24, with £17.5bn coming from sales to small independent retailers and £13.4bn to foodservice providers and caterers.

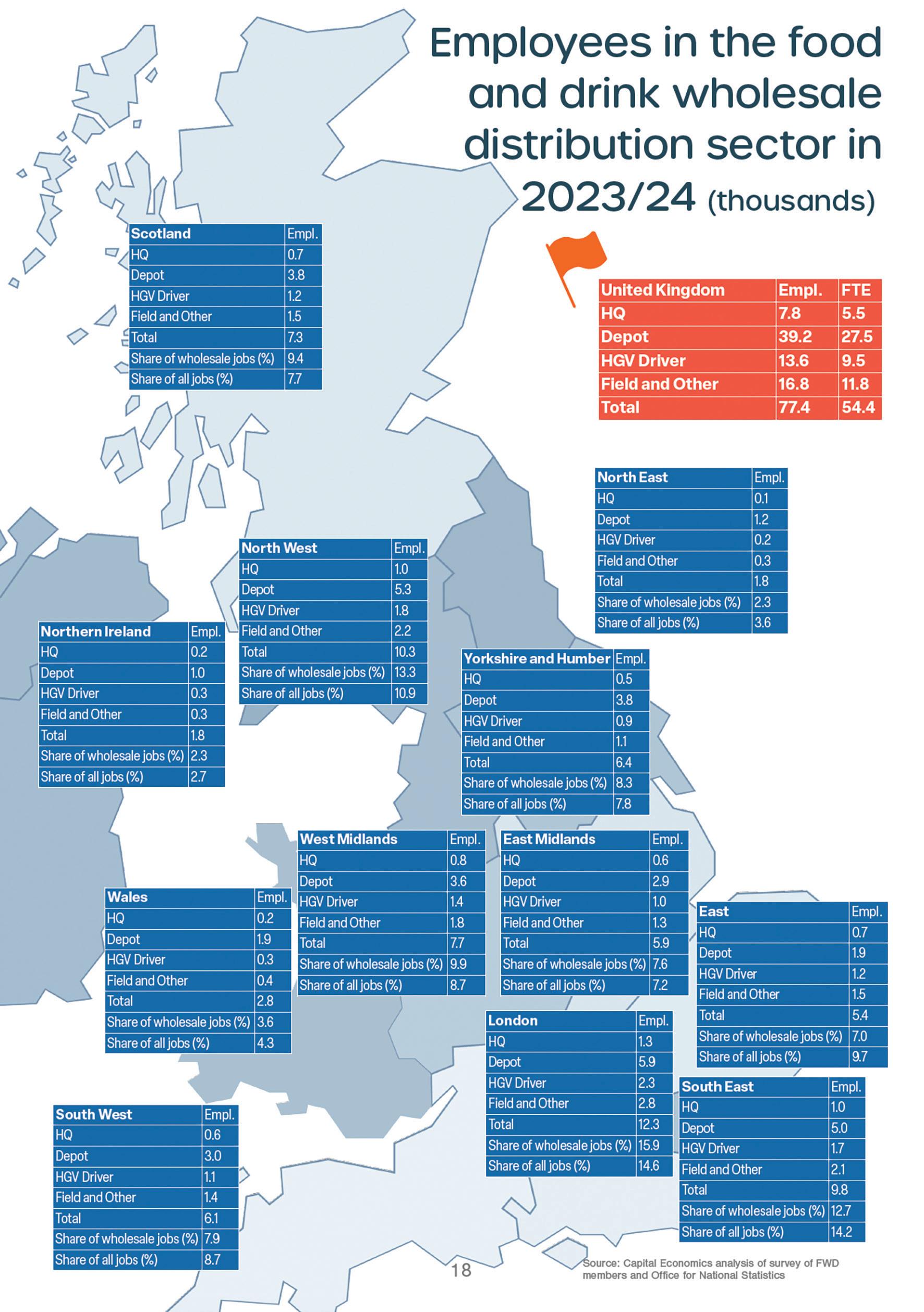

With regard to national output in terms of gross value added, £3.5bn was added in the same period, with around 77,000 people employed in the sector.

These figures come from a recent FWD report called ‘Going for Gold: The Impact of Food and

Wholesale is fairly unique in that it’s not disproportionately concentrated in any particular region of the UK

Drink Wholesale Distributors’.

Conducted by Capital Economics, the research provides a comprehensive look at the economic significance of UK wholesale.

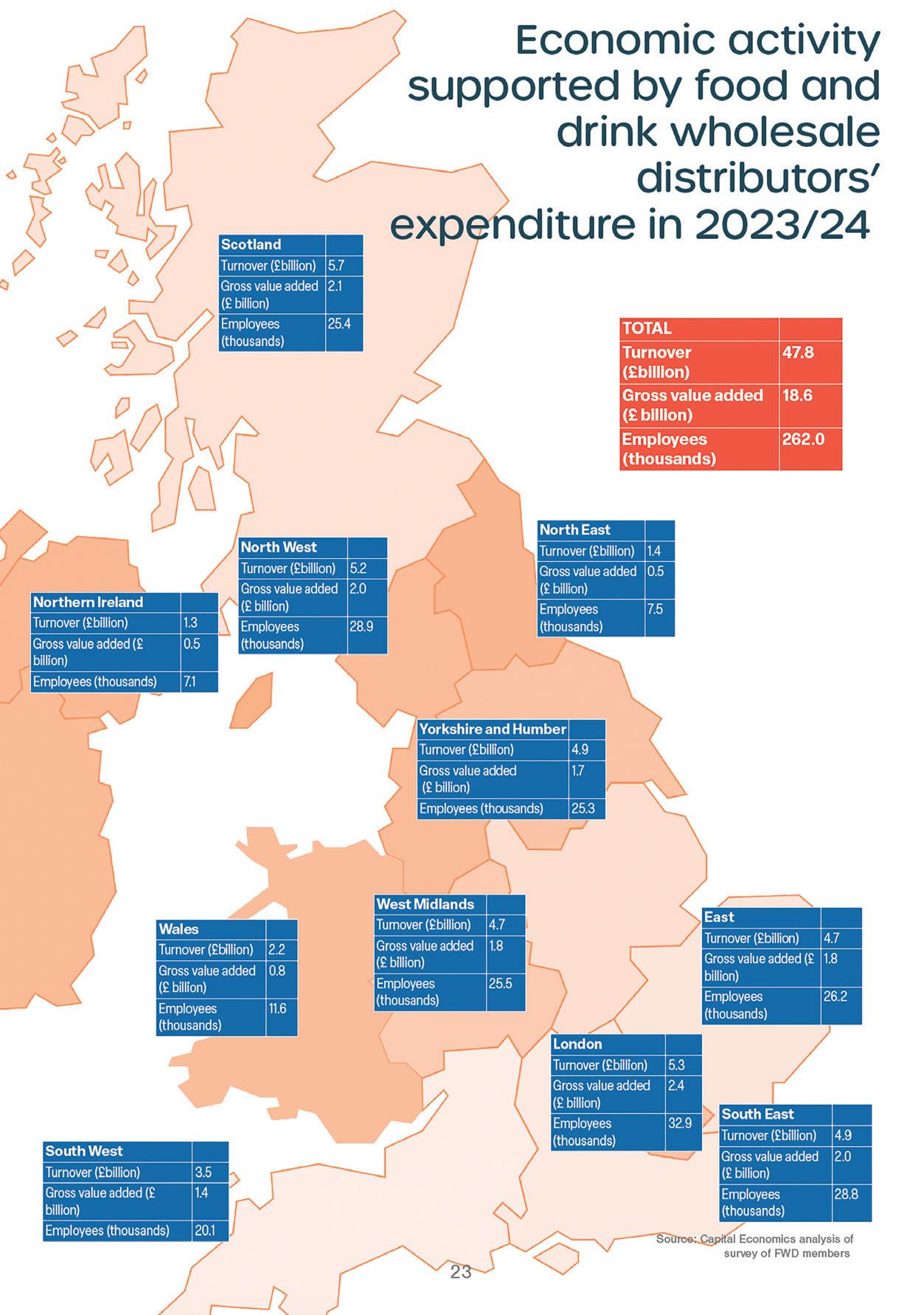

Further insight shows that wholesale is fairly unique in that it’s not disproportionately concentrated in any particular region of the UK, with more than 5,000 jobs supported in nine out of the 12 regions and devolved nations.

It also shows that more than a quarter of a million jobs are

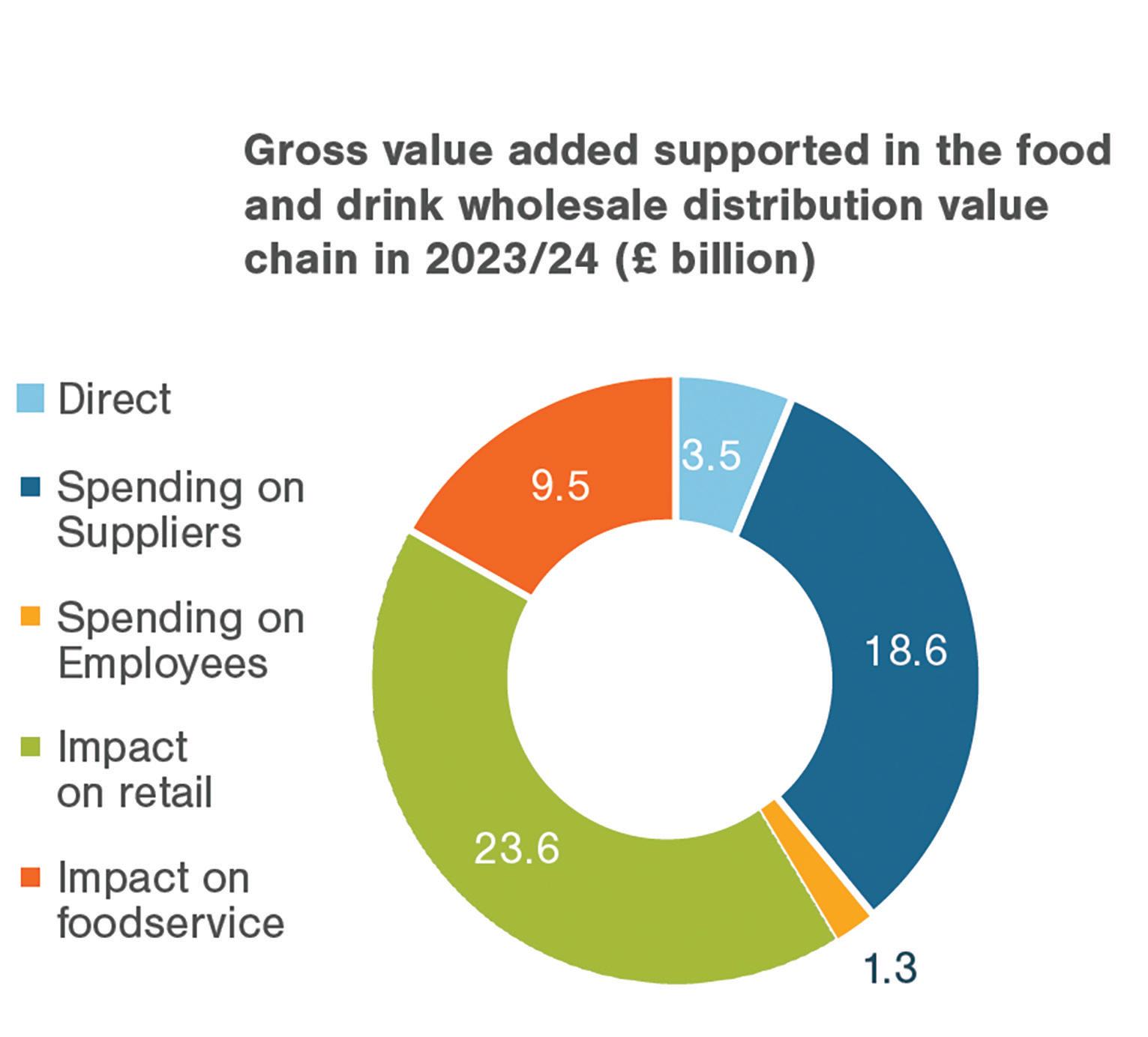

supported by spending on foodand-drink manufacturers and other businesses in the supply chain, with this associated with £18.6bn of gross value added.

When considering the entire value chain, it is estimated the food-and-drink wholesale distribution sector supports almost 1.5 million jobs across the UK, adding £57bn of value to the economy annually, which equates to more than the GDP of Northern Ireland, which was £56.7bn last year.

To add detail, employees working for food-and-drink wholesalers spend £1.6bn annually on goods and services from businesses across the country. This supports a further 17,800 jobs and £1.3bn of gross value added.

Delivery (58%) is the most-common route to fulfilling sales of wholesale customers, while cash and carry accounts for 40% of sales revenue, and a small proportion is generated through click & collect services.

Now in sharing bars.

• Top sellers, profit margin and products on promotion are key purchase decision factors for retailers and foodservice operators. Wholesalers should focus on offering products with clear profitability benefits and communicating proven sales performance. Suppliers should increase customer demand and profit-on-return (POR) messaging on online ads to influence purchase decisions.

• Mobile is the most important device to secure advertising and influence shopping journeys. Mobile has the highest share of sessions (52%) and a 33% add-to-basket rate from retailers. Wholesalers including Sugro, Bestway and Parfetts have been investing in optimising the app and mobile experience.

• Email notifications should be prioritised as the preferred method of communication of foodservice operators and retailers. Foodservice operators (76%) and retailers (77%) prefer to receive notifications and information via email. Wholesalers and suppliers should prioritise engaging with customers through this format to maximise engagement and return on investment of any personalised advertisements or offers.

• More than a quarter (28%) of search terms retailers used on wholesaler websites include brand names – brand filters are essential taxonomy. Suppliers should focus on ensuring that wholesale partner websites feature brand filters and brand content including clear product descriptions and pictures on online platforms. Five per cent of retail searches currently do not return results, highlighting that search algorithms need improvement.

• Wholesalers should focus on customer support and loyalty schemes to drive satisfaction and boost engagement. Foodservice operators and retailers rank customer support as the most useful service provided by wholesalers, signalling a clear opportunity for wholesalers to stand out from competition. Wholesalers and suppliers must collaborate, using data to meet evolving needs across both channels. l

figures in this stat box are from Lumina Intelligence’s UK Wholesale Online Report.

Paul Hill speaks to Filshill chief executive and AI trainer Simon Hannah about what the technology can bring to the channel

For Simon Hannah, there is a “real and genuine buzz” around AI across all sectors globally, with every article leading us to believe that AI is going to disrupt all our industries.

However, he accepts that it is a “highly emotional subject matter for leaders and employees”, adding: “Are we late to the game? Do we have the right skill sets across the business to implement AI? Is AI going to replace all our

jobs? Where do we start?”

He explains: “The wholesale sector, as we are all fully aware, is a low-margin, high-turnover business, and marginal gains and increased efficiency are the difference between turning a fair profit and washing our faces.”

Meanwhile, government policy changes have put serious pressure on all sectors in terms of the cost of running a business. Hannah says: “The forthcoming hike in employer National Insurance

contributions and national living wage will have a significant impact if we just keep doing the same thing.”

This is where AI can be a real opportunity for our sector, he believes. “As a collective, we are more data-focused,” he points out. “Our alignment with our suppliers is very much based on data sharing and optimising the output of what that data is telling us – we use that data to ultimately create excellence in front of

the shopper, working with our retail customers.

“AI can generate greater efficiency, higher productivity and, ultimately, give us a fighting chance of mitigating some of these significant cost increases while remaining relevant in the future.”

But how is he qualified to talk on this subject?

Hannah, an active member of global leadership organisation YPO, explains: “In October 2024, I had very little knowledge of AI, but was incredibly curious. I decided to do something about that curiosity and flew to Dubai to be trained on AI through a retail lens with the VJAL Institute [which works with global business leaders to harness the transformative power of AI].

“Through my membership of YPO, I then committed to a further visit to Dubai to become at AI trainer for the YPO Retail Network – training YPO CEOs

and their executive teams on the journey of going from ‘AI curious to AI Serious’.”

Hannah, who believes that he is currently the only person in UK wholesale who runs a wholesale business and is a formal AI trainer, too, cautions that “AI is not an IT project”, adding: “It is a tool to support and enable the implementation of a strategy – it is not the strategy.

“Implementation of AI in any business is a culture shift towards a digitised world, bringing everyone in the company on that cultural journey shift.”

To that end, Hannah believes that accountability for AI implementation in any business, given that it is about a culture shift, sits firmly within the chief executive’s remit.

“It should be led by them and should be at the heart of any business strategy as an enabler,” he says. “Upskilling all colleagues is essential and, if being realistic, will take three-to-five years to start having a company structure

where daily use of AI is the norm.

“Would we employ someone today into our sales or commercial teams who couldn’t use the internet or send an email? How long will that remain the case for being able to use AI? Those who embrace AI early will win.”

From Hannah’s perspective, AI is not something to fear, and he points to ChatGPT and other large language models (LLM) that are simple to use once you know how to structure your prompts.

He adds: “This is the starting point for anyone. Create clarity on the expertise and the experience that you are seeking help on, articulate who you are and who your business services, upload relevant data and be clear on what your enquiry is seeking to achieve. Importantly, ask ChatGPT for any clarifying questions.”

According to Hannah, there are “almost unlimited” uses for

AI using LLMs in wholesale if businesses can embrace the culture shift.

From accelerating HR functions on recruitment and policy reviews, creating marketing strategies and implementation plans by social media platforms, predicting more accurate forecasting for procurement and sales, aligning multi-company joint business plans in order to achieve category growth for customers, to analysing company performance using large data sets to help identify areas for improvement – the list goes on.

“We need to be very clear, of course, about how we protect our company data, and make sure that we have policies and processes in place to ensure our sensitive data is not going into the public domain via free LLMs,” Hannah cautions.

“But the upside to using AI freely across our businesses will be game-changing in time.”

And his advice to anyone who is AI-curious? “FAFO (fool around and find out), get onto ChatGPT, run some prompts and witness the power of what is at our fingertips.”

Hannah has allocated 10 days of his time in 2025 to take 10 suppliers on the ‘AI Curious to AI Serious’ journey for up to 40 of their colleagues in return for a contribution to the Filshill 150th Anniversary charity fund.

He says: “Please do reach out if you are interested. These newfound skills I have will not only be used to take my business, our colleagues’ and our customers’ businesses to the next level – but that of key stakeholders in the spirit of co-prosperity and delivering success.” l

Rob Mannion Chief executive, b2b.store

It will hardly come as much of a surprise that we’re embracing AI at b2b.store. But this shouldn’t exclusively be the arena of digital experts like ourselves. Every business should be doing the same – and that goes for wholesalers, too.

There’s understandably some reticence for some companies to jump headfirst into AI, especially with talk of newfangled tech coming in to replace human jobs. But this isn’t the reality of what AI is out there to achieve – its function is intended to help humans do their jobs rather than take over.

AI is a powerful tool that can help individuals and businesses in hosts of ways that stretch beyond simply visions of robots carrying out tasks around a warehouse. The technology can help in ways many wholesalers wouldn’t even consider, with

business functions that don’t cross the minds of most people.

We’ve been dabbling with a variety of new AI technologies and have identified a raft of tools that help transform productivity, aid with creative output, and can be a great sounding board for business decisions. That knowledge has been value in arming us

with the understanding of AI that help with our wholesale customers’ challenges.

Some of the best solutions are not necessarily in the most obvious places, though. One of the most powerful is AI’s work with data, with several tools out there that

provide high-quality data analysis – turning large datasets into detailed reports that offer up a series of smart recommendations within a matter of seconds. These reports may need some polishing up before they can be presented, but as a usable insight provider, it’s a great free resource for time- and cash-poor wholesal-

ers to make data-driven decisions simply by uploading documents and asking it to analyse or summarise them, or by posing specific questions.

AI doesn’t need to stop at simply creating reports. Its ability to apply the use of insight and recommend actions is also a big asset, with the right tools able to

provide guidance to help with a host of business decisions.

Using AI-powered forecasting, algorithms can analyse sales data, market trends and several other factors to help predict future demand and make suggestions for planning stock levels. This can even reach into competitive analysis to give wholesalers a market view versus other businesses within their sphere.

Bigger businesses may already have employees or agencies that already do this for them, but for those leaner operations, it’s as good as an extra specialist – or independent opinion – to call upon. Among the AI assistants we’ve tested for reporting like this are DeepSeek, Copilot and ChatGPT, with each having different strengths, so we recommend wholesalers try out queries on each to see which works best for them.

There is also a range of other time-saving tasks that different AI software can support with, such as writing and updating business policies. These are espe-

cially important for wholesalers when they are tendering for new business with large or publicsector organisations.

When those policies are in place to help you win the business, the aforementioned AI tools – such as Pitch Power or the AI assistants – will help with writing the tenders or pitches you need. It’s not just the times these tools save, it is also the observations they make that are so worth using.

The best thing is that these examples are just a few of the ways AI could be integrated into a wholesaler’s business and quickly make a tangible difference at very low cost. Many of these tools are flexible and can be used in several other ways: analysing customer behaviour, price management and customer service. The list goes on.

For many, the term AI has been met with cynicism.

The truth, however, is that many wholesalers have already

been using AI tools without even considering them to be that before now. It’s simply technology with a different label, but now it’s making headlines, where previously there wasn’t the emotion-inducing label to go with it.

We know some wholesalers use software or online resources to help with route planning when making deliveries to plot out the most energy-efficient way to make drop-offs. This is just AI logistics, but used by many.

Similarly, pre-populated lists or search suggestions on wholesalers’ online-ordering platforms are pretty common practice for customers using e-commerce – and much of that is also powered by AI.

My point is that technology is everywhere, and most wholesalers wouldn’t pause to try something out that was available and low cost (and effort), so using anything branded as AI should be the same.

Remove the stigma and what you’ll see is a series of online tools that can make tangible differences to the productivity and success of a business.

Wholesalers willing to harness what’s out there have a big opportunity to tap into a major upgrade of business skills that will help drive their performance forward

There’s nothing out there that’s big or scary, just ways to help wholesalers be more efficient and bring in larger revenues. The ones that aren’t too afraid to try things out for themselves are the ones that will gain an edge over their competition. Just ask an AI assistant – they’re bound to tell you the same thing. l

Paul Hill visited Torbay to see how Caterfood (SW) has maintained growth since its formation in the 1970s

What does your customer base and product range entail?

We’re an independently run foodservice company with a heritage in frozen food, catering and distribution and cover all of Devon, Cornwall, south-west England and Wales.

In terms of our product range, we supply fresh, chilled, frozen and ambient foods as well nonfood supplies for the wholesale catering industry. One of our USPs is that we can essentially sell anything and consistently partner with local businesses – butchers, cider farms, beer producers and so on – to get their products out in the local area.

Our range is about 60% ambient, chilled and non-food consumables, and 40% frozen, but this figure changes depending on the season. It has also evolved over the years as we’ve expand-

ed into new sectors. However, some of our focal-point lines will continue to be in frozen, such as chips and baguettes.

What customer frameworks do you have in place?

We offer deliveries six days a week with no minimum order, and we take these the night before. However, in the Torbay area, we offer chefs a same-day delivery service. We’re currently going through a digital upgrade that will include a new ordering platform and online B2B shop. The plan is for this to be launched in the first quarter of 2025, and we’re doing

it through a Bidcorp-owned software company called QNetex.

What are your future plans?

We are very hospitality-led due to being in south-west England, and this means we’re very seasonal, so to flatten the curve we are trying to grow in new markets such as the cost sector and education, as well as hospitals and care homes. We’ve had to invest in new units as we’ve grown and added different divisions, but it gets to the point when it’s a chicken-andegg situation, and we must ask if certain growth areas are worth the operational investment.

Nevertheless, we continue to look for opportunities, and a good example is Tamar Valley Ice Cream (now known as Yard Farm Ice Cream). This business now sits under Bidfood, but was originally bought by our grandfather in 2008, around the time of the financial crisis when banks were reluctant to lend money, so he made the deal with an old-school handshake with the owner.

How has the Bidcorp acquisition helped you grow?

Bidcorp purchased us in 2016, as it saw an opportunity in the south-west, and it’s been a fantastic partnership ever since. At the time, our grandfather, the original Caterfood owner, had just passed away, and it felt like the right opportunity.

Along with South Lincs Foodservice, we were one of the first acquisitions Bidcorp made, and it’s great that we’re now part of the Caterfood Buying Group (CFBG).

The benefits of the buying group have been brilliant, with a central function structure in place as well as an own-label range that is already at 150 products. I believe the aim is to get this number to 1,000 within five years.

We’re also on a trading panel with a buyer and salesperson from each CFBG wholesaler that has a say in the development of the range.

The vision of the buying group

is to achieve national coverage and not just to be known as ‘box movers’, but also to have a reputation as product experts in the field as well as providing great-quality food.

Another bonus of being owned by Bidcorp is that we have a close working relationship with local Bidfood depots.

Our product ranges may differ to theirs, but we’re able to call on each other if needed. This means we have the heritage and power of being a trusted independent wholesaler, plus the strength of Bidfood to call upon, if required.

What are the biggest challenges the business faces?

Last year’s budget, especially the National Insurance increases, has put massive pressure on us. The economic environment we’re in means biggest companies will be hit hard, but business rates will hit the smaller ones.

Costs are also going up all over the place, with customers having less money to spend.

Where do you see the business in five years’ time?

When we are in our peak trading months, we find ourselves near to capacity, so we are always on the lookout for the right opportunity for expansion. However, in our area, good-sized commercial property or land to fulfil our requirements is extremely rare.

We also have to keep our team

in mind when we are making any decisions, as we have very good longevity within our workforce, and we know opportunities have to be right.

Should we not be able to find what we require locally, there is

also the option to look further afield to a hub depot within our current delivery area.

Overall, we will continue to expand and grow over the coming years to continue Caterfood’s proud history. l

Year founded 1970 (Bidcorp acquisition – 2016)

Fleet size

48 (58 during peak season)

Employees 120 (150 during peak season)

Turnover £29m

Target £35-£40m in the next five years

Paul Hill visited Belgium to find out how one of Europe’s leading fruit-and-vegetable cooperatives takes its product range from ‘field to fork’

BelOrta, headquartered in Sint-KatelijneWaver, Belgium, is one of Europe’s leading fruit-and-vegetable cooperatives and represents more than 1,000 member-growers.

The company plays a key role in the European fresh-produce market, with nearly 40% of all Belgian fruit-and-vegetable products passing through its auctions.

The company’s modern auction room houses six digital auction clocks, with real-time and worldwide connections enabling the selling of products in uniform quality blocks, as well as digital buying via home auction systems.

On any given day, 450 buyers from across the world could be in attendance in person or online, and the prices set at these auctions are used as price guides across the EU.

Using what the company calls a “360° marketing approach that combines B2C, B2B and B2B2C”, it has more than 1,250 growers,

with 770 million units sold each year, and then sold to more than 75 countries.

The company’s unique proposition means its takes care of almost all the processes within the supply chain in what it classes as five key stages – cultivation, control, storage, sales and transport.

Within this, BelOrta’s harvests, sorts and packages produce on the morning of day one.

Later in the afternoon, products arrive at BelOrta’s facilities for quality control and are then stored under specific conditions.

Sales occur on the morning of day two, with products remaining in cold storage until delivery to clients.

By the afternoon, the produce is transported to buyers’ wholesale depots or retail outlets.

With exports making up 65% of the company’s business, and the UK accounting for 6% of that operation, the country is classed as a significant market for BelOrta and continues to grow year on year.

BelOrta’s produce is prominently featured in UK’s wholesale markets, including London’s New Covent Garden and Spitalfields, and across the broader UK wholesale market, with this presence largely facilitated by export companies partnering with BelOrta.

The quality-control room of an apple-and-pear production line

In recent years, BelOrta has observed a growing interest from UK clients seeking its products. To strengthen its brand presence and support its UK partners, it has actively participated in events like the IFE, as well as collaborating with The Chefs’ Forum to promote the versatility and superior taste of its Ruby Red tomatoes,

highlighting their appeal to the UK foodservice wholesalers. As the demand for fresh, sustainably produced fruits and vegetables continues to rise in the UK, BelOrta is well positioned to meet these needs, fostering a healthy and fruitful partnership between Belgian growers and UK wholesale operations. l

Paul Hill visited Ardooie to discover how a Belgian fruit-and-veg wholesaler’s UK export operation works

Established in 1939 and headquartered in Ardooie, Belgium, Calsa has solidified its reputation in recent years as an exporter of Belgian fresh fruits and vegetables to the UK, with this market continuing to play a big role in its operations despite Brexit.

The family business offers a diverse range of fresh Flemish produce, including field- and greenhouse-grown vegetables, as well as a variety of fruits. The company strategically

sources its products from local Belgian growers and auctions, with these auctions unique to Belgium and serving as critical hubs in the country’s agricultural supply chain.

Auction houses

Using advanced cooperative systems where growers bring their produce to be sold through auctions, they ensure fair pricing and transparency for farmers and buyers. Known for high-quality produce, these facilities also integrate modern logistics, enabling

5am: First contact with market information

9am-10am: Rounding up of orders

10am-12pm: Preparing export documents

12pm-4pm: Preparing goods for Belgian and UK customs

4pm: Truck leaves Belgium

11pm: Truck arrives in London area for the next day of business

Jeroen Buyckpol, chief executive

swift distribution and sustainable practices as the company exports to international markets such as the UK.

With regards to these sustainable practices, green politics are ingrained in Calsa’s corporate philosophy, according to Jeroen Buyckpol, chief executive of the wholesaler.

He described the installation of 576 solar panels on the company’s facilities, which generate approximately 100,000 kWh annually, accounting for more than a quarter of Calsa’s energy consumption. Additionally, residual heat from refrigeration units is repurposed to heat parts of the facility, further enhancing energy efficiency.

Furthermore, Calsa prioritises eco-friendly packaging, such as IFCO and EPS containers, over

conventional plastic. For wooden crates, the company opts for poplar wood, a rapidly growing species known for its efficient CO2 absorption and oxygen production. Alongside this, a fleet of 14 Euro V standard trucks allows the business to focus on optimal loading and route planning.

With exports making up 96.4% of its operation and wholesalers making up 73.5% of its customer base, the Flanders region’s proximity to Calais means the UK plays a huge role at Calsa.

Still, it’s the fourth-biggest export market across the world, the UK’s south-east region is the main focal point of activity and Calsa is able to transport its products to its UK customers’ destination within 16 hours of the order being made. l

Welcome to the new Buying Group Briefing – a quarterly dedicated section in Better Wholesaling Insight that highlights the latest trends, insight and best practices within the world of wholesale buying groups. This section will dive deep into the dynamics of group purchasing, offering exclusive case studies from successful buying groups as well as all the latest changes in an area of the wholesale industry that continues to innovate.

Yulia Petitt, head of commercial and marketing, Sugro

Sugro has revealed a year of growth, finishing 2024 12% up year on year. This is on the back of 18 consecutive years of improvements, with the soft drinks, confectionery, crisps and snacks, grocery and non-food categories all contributing positively to this.

The buying group is owned by its 90-plus independent wholesale members, with a combined turnover of more than £2.5bn, and welcomed 19 new wholesalers in 2024. “We are continuing recruitment this year with four new members having already joined

us in January, adding £62m of incremental turnover to the group,” says Yulia Petitt, head of commercial and marketing at Sugro.

Sugro recently celebrated its 40th anniversary, and it proved to be a landmark year for the business, which was marked by transformative digital changes including a launch of the E-Loyalty Reward and Recognition Scheme, the integration of new capabilities with b2b.store and Vision33, as well as the rollout of digital screens across member stores.

It took this even further at the start of the year with the launch of a WhatsApp channel for members.

“The E-Loyalty and Rewards Scheme has been a game-changer both for members and their customers,” says Petitt

“This initiative empowers members to offer tailored promotions and rewards, foster customer retention and increase e-commerce traffic.

“Feedback from members has been overwhelmingly positive, with many reporting measurable increases in customer engagement and sales volumes.”

Furthermore, with a view to saving costs for members and suppliers, Sugro delivers a central invoicing facility that enables one point of contact for invoicing, queries and payments.

“In addition to a central invoicing facility, we offer central distribution option to the members who are unable to meet minimum order quantity directly with the manufacturers. The benefit of this is that members can purchase products at group promotional prices, which enables them to be competitive in the marketplace,” continues Petitt.

“However, the main achievement of the group was its tremendous recognition in the wholesale

sector for the second year in a row. The group was voted number one across all buying groups in the industry in the Advantage Group Survey for a second consecutive year. This prestigious recognition reflects our unwavering commitment to excellence and innovation in the wholesale sector.

“This accolade, based on feedback from a wide array of our valued supply partners, highlights Sugro’s industry-leading performance across key benchmarks.

“This achievement is a testament to the strength of our collaborative partnerships, the trust we have cultivated, and the tangible results we deliver for our members and suppliers.”

• Member-Owned Buying Group with Diversity and Focus on Growth at it’s Heart

• Industry Leading Promotions across all Impulse, Grocery, Food Service and Non-Food Categories

• Central Distribution and Central Invoicing Services

• Dedicated Business Development Support

• Events Calendar including two Annual Trade Shows and Overseas Convention

• Personalised Marketing Leaflets

• Excellent Digital Solutions: All-in-One Ecommerce Solution with Personalised App and Web Development, Open Banking and WhatsApp for Business Capabilities

• Full Category Support via Sugro Digital Drive Your Sales Magazine and Online Portal

• Opportunity to Join Sugro Insight Service (SIS)

• Digital Signage and Procurement Services

The business has introduced a centralised pricing and promotions platform for its nine wholesalers that aims to streamline pricing and promotions management across the membership. Developed in partnership with TWC and rolled out in December 2024, Price Hub is a custom-built solution that is claimed to remove the administrative burden of managing pricing and promotions, by removing workloads and minimises the risk of errors.

Elsewhere at Caterforce, Peter Saunders has been promoted to head of buying, while Joanna Halucha has been appointed head of own-brand buying and technical at the buying group. Prior to joining Caterforce, Saunders served as trading and marketing controller at AF Blakemore Foodservice and foodservice controller at Landmark Wholesale, where he developed a range of own-brand foodservice products for members.

Savona Foodservice picked up the Member of the Year and Best Branded Performance gongs at the annual Country Range Group ‘An Evening With’ awards in London in December last year.

Following this, Jersey-based Valley Foods joined the group as its 15th member, with the arrival now allowing the buying group to cover the UK, Ireland, Spain, Portugal and Jersey. Set up in Trinity, Jersey, in 1981, the business has an annual turnover of £14m and more than 5,500 products in its portfolio, with an employee base of 50 people and 17 vans in its fleet. Valley Foods director Helen Clackett said: “We’re incredibly excited to be joining.”

The company has appointed Clare Spindler as business development manager as it looks towards a strategy of developing and delivering commercial relationships between its members and suppliers. Speaking at the buying group’s November AGM, managing director David Lunt said the business had delivered more than £8m growth year on year, with the group distributing more than £12m in member terms since its formation.

At the AGM, one of the topics for discussion was the status of consolidation plans by its supplier partners and how this would affect independents. “Our members provide a service to suppliers so consumers can access brands at the point of purchase or consumption,” said Lunt.

Northern Ireland-based Golden Glen has joined the membership, with the Belfast business adding to the group’s buying power with immediate effect. Over the past four decades, the company has grown its product range to more than 1,000, with customers now based throughout Ireland. This follows Sterling appointing Daniel Larkin to the position of chief commercial officer, while Jodie Garnham has been promoted to head of finance and operations.

The company is looking to become the biggest buying group in the UK by implementing a “powerful and defined vision, mission and strategy for the future of the group”. Revealing this at the company’s annual conference, it also discussed the 120-strong Caterfood Collection range, as well as the growth in its central team personnel, which now help service eight members, following Turner Price joining this year.

The Bidcorp-owned buying group also announced an updated Meet the Buyer format that will feature a new extended setup that will enable foodservice suppliers to engage with 40 representatives from across the group’s eight member businesses and central team.

The newly formed buying group recently hosted 50 channel directors and 150 representatives from FMCG suppliers to introduce the group, outline the rationale for its creation its USP. “We all know the wholesale landscape is changing and we recognise the need to change with it to ensure we provide the best support and value for independent wholesalers and our supplier partners,” said joint managing director Jess Douglas.

“As a result, The Wholesale Group has been created to provide the home for independent wholesalers, of all sizes, with extensive retail and foodservice expertise and support. This also provides our supplier partners with a highly-effective, cost-efficient route to market for independent caterers and retailers.

“Of course, our major USP is there is no charge to join the group as a member, and all members receive a share of the profits.”

The group also held its first foodservice event in Nottingham in January.

The business has finalised its new-look executive team with the appointment of Nick Shaw as finance director. This follows the hiring of retail director Victoria Lockie.

Meanwhile, the company’s procurement service to its wholesalers has collectively saved the buying group’s membership almost £3m in non-resale purchases such as stationery, energy, packaging and payment solutions.

The service, in partnership with Auditel, saw member Direct Line Supplies save more than £18,000 within just three weeks, negotiate preferential rates and service levels on purchases, and reduce the time members’ teams spend on sourcing deals.

This preceded managing director John Kinney announcing a £2m bonus fund to reward its members for engagement and compliance in group-wide promotions, materials and events that has been designed to add further value to suppliers’ investment. l

Sustainability is still key in the foodservice sector, alongside health and wellness. Tim Murray reports on these and other key trends and developments

Health and wellness and sustainability continue to be among the key trends in the foodservice industry.

Despite rising costs putting pressure on pricing and continued uncertainty among operators, consumer confidence in eating out continues to grow, with the overall market set to grow by 2.4% in the three years to 2027.

According to Lumina’s Intelligence Menu & Food Trends report, menu prices have risen by 4.5% for pubs and bars, and just above 5% for chain restau-

rants. Kitwave-owned Creed Foodservice, which highlighted the 2.4% growth projection, has noted that food and energy prices are still worrying for operators, while government policies, not least tax rises that could cost the industry £3bn, have put further pressure on hospitality.

Lumina says “elevated classics, aspirational offerings and globally inspired flavours” are all on trend in the sector, with premium and sharing dishes coming to the fore.

It also notes that health and wellness are increasingly important for consumers, while more than half of businesses are now

putting sustainable practices first, cutting waste, sourcing more locally and being open about its work in this arena.

As well as the increasing focus on health and wellness, with less processed food, more nutrients and plant-based dishes coming to the fore, “entertainment” –immersive experiences with pop-culture-inspired menus –is increasingly prominent.

Trends in flavours include “whipped feta, kimchi and hot honey”, which are all becoming staples as part of a wider move towards fresh flavours and premium ingredients.

Lumina Insight lead Katie Gallagher says: “The UK eating-out market is projected to grow at a compound annual rate of 2.4% through 2027, reaching an estimated £105bn. We anticipate continued focus on digitalisation, streamlined menus and sustainable practices as key drivers of success in a competitive landscape.”

Meanwhile, the company’s operator data index has some more interesting thoughts on trends in hospitality, with the latest insight suggesting that pressure on consumers and businesses – encompassing inflation, wages and interest rate falls – is easing.

The quick-service restaurant market is benefiting the most – its growth was set to outpace the full-service sector in 2024, increasing by 3.3% year on year to £17bn.

“While challenges remain for the hospitality sector, particularly in the restaurant market, the easing of economic pressures and the continued dynamism of the QSR market highlight opportunities for growth and innovation in 2025,” says Lumina insight manager Maggie Davis.

Creed Foodservice is more cautious, noting that uncertainty remains for the sector. The

wholesaler’s insights manager, Anna Clapson, says: “It’s an interesting period. We’re seeing glimmers of hope as consumer confidence slowly starts to return, but operators are still facing economic and operational challenges. That’s why we have anchored around the core macro trend of ‘adapt to survive’ as everything stems from this.”

Creed identifies ‘adapt to survive’ as the key trend for the year ahead, breaking it down into six related sub-strands.

These include ‘consistent quality’, with consumers, especially older ones, willing to pay more as long as the quality is there (this includes everything from fresh ingredients clearly stated in menus through to prep, such as hand-stretched dough on pizzas); ‘personalised experiences’, with social media-savvy experiences and elevated offerings; ‘reshaping value’, as perception of what value for money means and deals and perceived value becoming more important; and ‘harnessing digital’, with more than a third of business prioritising digitalisation, and AI and robotic systems becoming increasingly significant.

At its annual conference, the Caterfood Buying Group has signalled its intention to become the biggest buying group in the UK, by putting in place a “powerful and defined vision, mission and strategy for the future”.

Speaking at the two-day event, which saw the company highlighting its growing personnel and its

120-strong Caterfood Collection, recently appointed commercial director Tom Workman said: “We still have highly ambitious and exciting plans to continue our growth trajectory: to become the biggest buying group in the UK, to acquire new members, and to reach even more customers.”

Woods Foodservice, meanwhile, is replacing a third of

its fleet of delivery vans with electric vehicles in the shape of custom-built ones made from recyclable materials, with solar panels and the ability to save almost two tonnes of carbon emissions per vehicle annually.

“We’re still on our sustainability journey, but we are passionate about minimising our environmental impact,” says managing director Darren Labett.

“These upgrades demonstrate our commitment to promoting greener practices across all aspects of our operations.”

JJ Foodservice has revealed plans to open a new resource, The Kitchen, to promote its cost-saving products, including its own-brand range and supplier collaborations.

It is aiming to inspire chefs and customers with new recipe ideas. The company has also announced plans to expand its Mix & Save promotion. The scheme, which is aimed at helping restaurants save money by buying in bulk, will include branded drinks, and fresh

fruit and vegetables.

The wholesaler’s chief sales officer, Baris Kacar, says: “We know value and menu innovation are key for our customers, and we’re committed to supporting them with solutions like Mix & Save and inspiration through The Kitchen.”

In the West Midlands and Wales, Harlech Foodservice has secured a five-year education contract to deliver to schools across the region after inking the deal with the catering arm of Shropshire County Council, Shire Services.

It’ll be serviced in partnership with Harlech’s new depot near

Telford. “We aim to use suppliers local to the client wherever possible as that cuts food miles and ensures the benefits of the contract are shared with the local community,” says Harlech regional account manager David Roberts.

Savona Foodservice, meanwhile, has opened a new depot in London and created a development kitchen in Oxford, with the wholesaler aiming to maintain its upwards growth trajectory.

The brand-new premises in Barking, east London, is said to be modern with room to expand as the business grows and offer access to offer flexible delivery to south-east England. l

• Pan’Artisan has added to its premium dough range with the launch of a Detroit Style Pizza Base, which features handstretched focaccia-style dough to appeal to pizza connoisseurs.

• Family-owned Phat Pasty has been awarded B Corp certification, the status signifying its efforts to benefit people, communities and the planet. The certification recognises its work with the World Forest Organisation and other sustainable and charitable efforts.

• Délice de France’s new range includes a Breakfast Sausage Patty and Sausage & Cheesy Bean Slice. They are available for foodservice outlets in units of 40.

• Asahi and LWC are partnering in a bid to reduce CO2 in deliveries by encouraging LWC depots to order fewer but bigger orders to bring down emissions. Successful depots will be rewarded with trees being planted in a firth partnership with environmental charity Thames21. The target is to plant more than 3,700 trees in total.

• With consumers increasingly considering protein intake as part of their diets, Quorn is pushing its products containing mycoprotein. These include Veggie Mince, Vegan Beef Pieces, Veggie Pieces, Vegan Burgers, Vegan Nuggets and Sausages, as well as its ChiQin range. Quorn is also highlighting the launch of its “mouth-watering” thick-cut vegan Beef Burger.

• Central Foods has added Peach Bellini Meringue Roulade flavour to its Menuserve range. The roulades are hand-rolled and finished, filled with peach curd and a prosecco-infused dairy cream, and topped with honeycomb pieces.

• Bang! Curry has entered the foodservice and hospitality space after experiencing success in retail. Designed for caterers working across education and healthcare who are looking for an easy way to bring authentic Bangladeshi flavour to their menus, the product has achieved a listing at Bidfood depots and contracts across the UK, and the brand hopes to expand further.

In breakfast, cereal and bars continue to play an important role. They are cupboard staples and will often be purchased as part of a shopper’s regular grocery needs. According to the latest Mintel UK Breakfast Cereals Market Report 2024, value sales in the UK cereal market are expected to exceed £2bn by 2026.

What’s popular will differ based on customer habits, but health and taste are important within the cereal and cereal bar categories, and the wider breakfast category. Therefore, lines such as Bio&Me cereal bars and Hollie’s Granola and cereal are viable options for wholesalers.

Shoppers are also looking for products that offer additional benefits. These can be found in the majority of brands, including Cheerios by Cereal Partners UK.

The range, which includes Multigrain and Honey varieties, is free-from artificial colours and flavours, with both products containing oats, wheat and barley. They also feature seven vitamins and two minerals, calcium and iron to support immunity and help give energy for the day.

In September last year, the range underwent a redesign to highlight these added benefits to consumers. For wholesalers, these can be highlighted in depot through PoS for any retail customers capitalising on health missions.

Not all shoppers want cereal for breakfast, and prefer some-

George Tuck Head of sales – impulse, Tropicana

“There are several trends that are driving sales across breakfast, lunch and dinner opportunities, not least the rising consumer demand for health and well-being. Consumers are looking for on-the-go meal options that are nutritious, made from natural ingredients, low in sugar and free from artificial additives.

“These are the products that will not only satisfy their taste preferences, but also support their health goals.

“Research shows shoppers are searching for healthier alternatives in soft drinks – 58% say they want to see healthier soft drinks in retailers’ ranges. This is why Tropicana is highly

valuable to wholesalers, retailers and consumers. Made from pure, not-from-concentrate fruit juice of natural origin, it is ideal for meal deals and on-the-go consumption.

“For wholesalers’ convenience retail customers, fruit-juice shoppers are a valuable demographic so it is critical that wholesalers stock the right range. On average, fruit-juice shoppers spend 25% more per shop when compared to non-fruit-juice shoppers.

“Fruit juice also adds three more items to shoppers’ baskets, on average, compared with total convenience, so ensuring you can meet consumer demand will unlock a huge opportunity.”

thing small to consume on the go, which is where bars, like Bio&Me, or even breakfast biscuits, such as Belvita, can help.

“For bars, it’s all about the commuter routes and giving retailers the option of stocking these for their busy customers who want to consume something on the go,” explains Jon Walsh, co-founder and chief executive of Bio&Me.

Walsh says there are three key times of the year when consumers are more engaged in improving themselves – January, April and September.

“By tying into seasonal themes, such as the January reset, wholesalers can create gut-healthy destinations for their customers,” he says.

“Cross-merchandise these products near other complementary health products.”

While the category is very value-focused, Walsh says cereal bars are an area where price is

Cheerios packaging – Cereal Partners UK has launched new Cheerios packaging to showcase its key nutritional attributes, such as its multigrains and high-fibre content.

The Hungry Boar meat snacks – Gold Acre Foods is launching The Hungry Boar meat snacks into Booker with four varieties: Flamin’ Piri, Loaded Cheese, Chicken and Pork.

less of an issue, providing an opportunity for wholesalers to offer their retail customers a product outside of value trends. “Shoppers are less price-conscious in certain retail establishments, so this is a great opportunity for wholesalers to encourage their customers to trade up to more premium products,” he adds.

Fresh and chilled is an area of focus for breakfast, too. While there are shorter shelf lives on these products, many shoppers are willing to spend more on these products, such as eggs, bacon and sausages.

As we transition into hotter weather, product demand will change. The summer is the perfect time for lighter pastries or fresh fruit. Within drinks, wholesalers should focus on colder options, such as iced cof-

Caramelised Biscuit – The new line is available and being supported with shopper activations, paid media and influencer campaigns between March and April.

The Guv’nor RTD coffee – Tom Parker Creamery’s The Guv’nor range are RTD iced coffees, available in 500ml and 250ml Original, Mocha and Caramel varieties.

fee, which continues to thrive as a breakfast option due to the quality and brand engagement of coffee drinkers.

This also applies to lunch. In fact, the total coffee market in the UK, including coffee sold in cafés, coffee-to-go and consumed at home, is worth £6bn.

Put another way, the UK consumes 98 million cups of coffee a day. Due to more consumers than ever being short on time, more are transitioning towards takeaway coffee.

Wholesalers also have an opportunity to cross-merchandise in depot, too.

Most retailers claim their customers will buy a coffee and pastry, sandwich or a cereal or protein bar together, so by merchandising these options close by, you’ve created a meal option for people in store.

This makes it easier to nav-

Holie’s cereal gets UK launch – The Dutch cereal brand plans to launch in wholesalers later this year. It has Protein Crunch, Low Carb Crunch and Protein Peanut Butter granola lines.

Starbucks Skinny Latte Grande Cup – The new variety is currently available in Booker, but Arla Drinks has confirmed it will expand from April. It comes in a 330ml format.

igate what they need quickly and swiftly.

Lunchtime is a versatile meal time, but food to go is the strongest opportunity for wholesalers. In fact, in 2024, more than £8.3bn was spent on food to go, an increase of 26% year on year. By 2028, the market is expected to increase in value by almost 40% on 2019 levels.

This can be attributed to the transition towards hybrid working where the Agriculture and Horticulture Development Board say 71% of food-to-go customers specifically purchased lunch items. Consumers tend to spend less on lunch compared with breakfast and dinner, but they’re still looking for enjoyment with their choices.

Meat food-to-go options continue to grow due to the rise in demand for protein. As of June 2024, pork accounted for almost three-quarters of food-to-go growth. In the same period, sandwiches accounted for 41% of all pork-based food-to-go purchases.

Elsewhere, beef pasties are seen as a popular food-to-go option, accounting for almost 13% of volumes purchased.

As the cost-of-living crisis continues, more shoppers are leaving restaurants and takeaways in favour of cooking from scratch.

Canned goods can help cater to this trend, as they tend to be cheaper, but have similar health qualities as fresh foods.

“Making meals healthier is the top reason for cooking meals from scratch, with 57% of home cooks listing this reason,” says Carmen Ferguson, brand manager at Windmill Organics.

The right products to stock will be the traditional canned fruit and vegetables, as well as including fresh ingredients to offer a choice. For a more premium option, include organic options.

“I recommend wholesalers stock a range of core organic food and drink products, as up to 67% of UK consumers state they have purchased organic in the past 12 months,” Ferguson adds.

1. Offer a breadth of range with breakfast – On the go is becoming increasingly important to the breakfast category as fewer people work from home full-time and more commute to their offices. As a result, wholesalers need to include a selection of cereal for at-home missions, as well as cereal or protein bars for shoppers buying on the go. Health is also playing a strong role in the breakfast category, including added-benefit cereal.

2. Food to go is important – Lunch is a mission where shoppers tend to spend less, especially if buying on the go. As a result, wholesalers can thrive with meal deals and strong food-to-go offers. Meat options, such as pork, beef and lamb, are in growth. As of June 2024, pork accounted for three-quarters of the food-to-go growth. Sandwiches accounted for 41% of all pork-based food-togo purchases. Pasties are a popular choice for food-to-go ranges.

3. Cooking from scratch – Shoppers increasingly can’t afford to eat out at restaurants or order takeaways as often as they did prior to Covid-19, and many are now cooking meals at home from scratch. Canned goods are a way of helping shoppers meet this mission, so wholesalers should include a range of canned veg, fruit, beans and lentils for their retail customers. For a more premium option and to cater to health trends, consider including organic options, as shoppers are less likely to be concerned on price with organic. Organic foods have now become commonplace in the UK market as consumers strive to purchase products that are perceived to be both better for them and the environment, with the £3.2bn organics sector now in its 12th year of consistent growth. l

Tom Gockelen-Kozlowski

With the days getting longer and the temperatures creeping up, the soft drinks category is about to hit its annual sales peak.

“Retailers need to make sure their shoppers are spending when the sun is out, so it’s important that wholesalers are there to support them,” says Louisa Newlove, head of field sales at Suntory Beverage & Food GB&I (SBF GB&I).

A crucial footfall driver

One point upon which suppliers, wholesalers and retailers are united is the continued importance of soft drinks to independents. “Of all the categories in this channel, soft drinks is the biggest contributor to generating store footfall and sales as they were purchased in more than a quarter of visits to UK convenience stores in 2023 and appear in more than twice as many baskets than alcohol,” says Ben Parker, vice-president of sales (off-trade) at Carlsberg Britvic.

“It is fundamental for retailers to maintain varied soft drinks offerings that include core, triedand-trusted brands alongside new, trending flavours.”

Simon Knight, managing director at Radnor Hills, adds: “We’re seeing soft drinks dominating when it comes to pulling in shoppers at symbols and independents, driving a third of all foot traffic.”

In response, suppliers are adjusting their approach and continuing to innovate to help both c-stores and wholesalers take full advantage, with Radnor Splash introducing a new range of price-marked packs (PMPs) in April to expand its presence in

the convenience sector.

“It’s the first time we’ve launched a PMP, and we’re excited to see how it performs in convenience – offering great margins for wholesalers and independent retailers,” says Knight.

“Over the past few years, we have seen consumers become increasingly interested in health and wellness, a trend which has transferred into the types of soft drinks they are choosing to purchase,” says Parker. “This has been amplified by the introduction of HFSS regulations, a topic that continues to gain traction.”

Over the past decade, this transition has caused a game-changing shift in the activity of major brands such as Carlsberg Britvic, with 85% of its portfolio now represented by low- or no-calorie products.

“Our innovation pipeline continues to centre around low- and no-sugar products which meet

Louisa Newlove Head of field sales, Suntory Beverage & Food GB&I

“Seasonal trends remain absolutely key for soft drinks and there is a very clear correlation between warmer weather and an uptick in soft drinks sales, with summer remaining the biggest selling period.

“It’s important that wholesalers are prepared to take advantage of any upcoming sunny spells by stocking segments such as sports drinks, which have a key focus on hydration.

“International sporting competitions in the summer months are also a key driver for sports drinks, as well as for brands that sponsor these big events.

“Wholesalers can capitalise on this by working with businesses to create displays that

inspire their retailer customers to create excitement for their shoppers in store around these key calendar dates.

“Wholesalers should always keep in mind the brands that are currently in growth, making sure they have a comprehensive range of bestselling formats and flavours.

“The sports drink segment has been affected by Prime’s decline in the past year, but Lucozade Sport continues to lead the way ahead of competitors.

“Shopper desire for low- and no-sugar soft drinks shows no sign of slowing down. The low/ no-calorie share of the soft drinks market is almost three times that of regular drinks.”

Galaxy Milk Drinks – Mars Chocolate, Drinks and Treats will switch Galaxy Milk Drink’s bottles from a traditional sports cap to a flat cap from April, following consumer feedback.

HFSS regulations and offer consumers better-for-you options as part of our strategy,” says Parker. A recent example of this is the launch of sugar-free Pepsi Max Mango and Tango Mango.

Energy (still) powers growth

After more than a decade transforming the soft drinks market, wholesalers would be forgiven for expecting sales in this crucial sector to start plateauing, yet the data suggests the market is going from strength to strength.

“The energy drinks market remains one of the most profitable for retailers, driving nearly half of all ‘drink now’ soft drinks growth,” says an AG Barr spokesperson.

To capitalise on this, AG Barr launched two limited-edition flavours for its Rubicon Raw brand. Available in its 500ml

Radnor Splash – With flavours including Lemon & Lime, Strawberry and Apple & Raspberry, Radnor Splash is now available in a new 85p PMP sports cap bottle format.

Rubicon Raw Berry & Grape – AG Barr’s limited-edition range arrives in a 500ml ‘big can’. Also available in Peach & Apricot flavour, it taps into the growth in mixed-flavour energy drinks.

Tropicana Sparkling – Made with 25% real fruit, Tropicana Sparkling is available in two flavours: Zesty Orange and Tropical Twist. Both are available in 250ml cans.

big-can format, the new flavours include Berry & Grape and Peach & Apricot.

“There’s still a huge opportunity for growth, as 60% of shoppers still don’t buy into the energy category and traditional energy drinks aren’t always seen as appealing for new shoppers,” the company added.

“Our two new flavours, alongside our core five, offer something truly different as we appeal to a much broader base of consumers.”

Key trends

Trends continue to drive sales across the soft drinks industry and when it comes to taste, tropical flavours continue to reign supreme.

One supplier to fully embrace this trend is SBF GB&I with Lucozade Alert’s Mango Peachade Zero and two Ribena

Jimmy’s Myprotein Iced Coffee – Carlsberg Britvic’s new collaboration contains 5.6g of protein per 100ml and is available in Original and Caramel flavours, and is HFSS-compliant.

Yazoo Inspirations – This new milkshake range comes in Birthday Cake and Caramel Blondie varieties and has been developed to capitalise on growing consumer demand for indulgent treats.

SKUs – Pineapple & Passionfruit as well as Mango & Lime.

It’s not alone. Carlsberg Britvic has launched two tropical-inspired flavours for its Tango brand in recent times, including Mango and Paradise Punch.

Fruit-juice brands are also jumping on this opportunity, according to George Tuck, head of sales (impulse) at Tropicana. “Tropicana Sparkling satisfies demand for products containing natural ingredients as it contains 30% fruit juice, which is 2.5 times more than competitors, infused with sparkling water and containing less than 65 calories per serve,” he says.

Alongside Zesty Orange, Tropicana Sparkling is available in a Tropical Twist flavour – both available in a 250ml can format.

Chocolate-flavoured milk is another sector that continues to perform strongly, growing by 17.6% to £150.1m, with more than 108 million units sold annually, according to Mars Chocolate Drinks & Treats (MCD&T).

“Our success in convenience highlights the growing demand for flavoured milk as a quick and easy on-the-go option,” says Kerry Cavanaugh, general manager at MCD&T, who points to a 39.4% year-on-year sales leap for its flavoured-milk range.

“We’re confident that our continued innovation in flavours and packaging will attract even more consumers and help retailers drive further growth.”

The MCD&T range – featuring Mars, Mars Caramel, Maltesers, Milky Way, Twix, Snickers, M&M’s Brownie and Galaxy – contains no added sugar, meeting the growing demand for healthier options.

Finally, protein drinks are another area of continued success. Jimmy’s Iced Coffee recently collaborated with Myprotein on a new HFSS-compliant range available in Original and Caramel flavours, and will help brand owner Carlsberg Britvic capitalise on the $1.56bn global market in protein beverages. l

1. A major footfall driver – Research from suppliers such as Radnor Hills is seeing soft drinks dominate when it comes to bringing shoppers into symbols and independents as well as other types of wholesale customer, driving a third of all foot traffic into store. In response, suppliers are redoubling their efforts to help c-stores and wholesalers take full advantage through innovation, category management advice and more.

Simon Knight points to Radnor Splash introducing a new range of PMPs in April to expand its presence in the convenience sector: “It’s the first time we’ve launched a PMP, and we’re excited to see how it performs in the convenience sector – offering great margins for wholesalers and independent retailers.”

2. Energy still growing – There’s still a huge opportunity for growth, with 60% of shoppers still not buying into the energy category, and traditional energy drinks not always appealing to new shoppers.

This highlights how much effort and ambition suppliers are placing in this sector, which has driven so much growth for well over a decade. To capitalise on this, AG Barr has launched two limited-edition flavours for its Rubicon Raw brand, including Berry & Grape and Peach & Apricot. “Our two new flavours offer something truly different as we appeal to a much broader base of consumers,” says a spokesperson for the supplier.

3. Tropical tastes and protein drinks – Trends continue to drive sales across the soft drinks industry and when it comes to taste, tropical flavours reign supreme. One supplier to fully embrace this trend is Suntory Beverage & Food with Lucozade Alert’s Mango Peachade Zero and two Ribena lines – Pineapple & Passionfruit as well as Mango & Lime.

Carlsberg Britvic, meanwhile, has launched two tropical-inspired flavours for its Tango brand in recent times including Mango and Paradise Punch. Protein drinks are another area of continued success. Jimmy’s Iced Coffee recently launched a collaboration with Myprotein on an HFSS-compliant range.

Tamara Birch

Disposables currently account for 36% of the vape market, while cigarette sales have declined by 34% in two years, and with the upcoming disposables ban that comes into effect on 1 June, the biggest concern is maintaining sales and avoiding shoppers transitioning back to tobacco and cigarettes.

The key is ensuring a suitable and strong range of alternatives are available.

Pod-based and reusable devices are swiftly becoming the subcategory of choice for both wholesalers and retailers.

New pod sales – specifically closed systems – have grown 161% since the beginning of 2024, with next-gen products accounting for 48% of all sales value of all closed systems.

What’s more, 75% of consumers intend to switch to a new

pod system alternative because of the ban.

A spokesperson for IVG says it expects 2ml and 10ml formats to surge in demand.

“Wholesalers that stock a strong selection of pod kits and replacement pods will be well prepared to meet this and any other demand from their retail customers,” they add.

Pods that offer a similar flavour range, such as the Blu Bar Kit, should be an avenue for wholesalers to consider. This is, according to Andrew Malm, UK market manager for Imperial Brands, because shoppers have become used to a wide range of flavours that disposables offer.

Malm also adds that if wholesalers can ensure this demand continues to be satisfied, they can help retailers protect their sales post-ban. It can also help facilitate any attempts for quitting smoking.

Prianka Jhingan Head of marketing, Scandinavian Tobacco Group UK

“With the upcoming disposable-vapes ban arriving in June, this is likely to mean many will be looking for alternative next-gen products, so nicotine pouches, like our own XQS, should see a further surge in sales. This is because they offer a very credible and attractive alternative due to the flavours available, discreet nature and ease of use.

“With overall traditional tobacco sales in decline and with the impact of the upcoming legislation on the vape category now a few months away, wholesalers need to fully embrace all aspects of the next-gen nicotine

category, otherwise they risk missing out with lost sales.

“We offer wholesalers products that meet current trends and what consumers want, but we also regularly have meetings with our wholesale partners, discussing the market dynamics and ensuring their product mix is what the consumers and retailers are asking for. We also support wholesaler-to-retail purchases of new products through promotions and money-off incentives. As we know, this can improve footfall into the wholesaler and potentially influence other purchases in depot, so a ‘win-win’ for both parties.”