The unusual products that put more cash in your till BACK PAGE

The unusual products that put more cash in your till BACK PAGE

Alex Yau, editor

THIS month, I heard many shocking accounts about the impact of escalating the and violence against retailers at the ACS Safe and Responsible Retailing Conference, and the Scottish Grocers’ Federation’s annual Crime Seminar.

A retailer at the SGF event told attendees how his wife, who was 26-weeks pregnant at the time, had been purposely targeted a er confronting a shopli er. He described how the attacker kicked her in the stomach multiple times during the horri c incident. Thankfully, she and the baby are okay.

Another retailer recently posted on social media about being spat at and having a bottle of wine thrown at her a er chasing the thief, who ran out of the store.

These are just some examples of a growing number of confrontations where female shopworkers are being abused. You can read about these accounts in our cover story (p3).

Although not as severe as these examples, I can remember my mother receiving verbal abuse from customers when she ran a takeaway. Working front of house, she o en bore the brunt of the insults.

These instances would be mainly from drunk customers or teenagers, and her loneliness and frustration in the a ermath of these incidents was obvious.

I KNOW HOW LONELY THE AFTERMATH CAN FEEL

I’d like to stress that, regardless of the abuse you may face while running your shops, you are not alone.

Please don’t hesitate to get in touch with any issues, as Retail Express will always be here to back you.

@retailexpress betterretailing.com facebook.com/betterretailing

Editor Alex Yau alex.yau@ newtrade.co.uk

020 7689 3358

News editor

Editor – news Jack Courtez jack.courtez@ newtrade.co.uk 020 7689 3371

Features editor Charles Whitting charles.whitting@ newtrade.co.uk 020 7689 3350

Kwame Boakye

kwame.boakye@ newtrade.co.uk

Production editor

Ryan Cooper 020 7689 3354

Sub editors

Jim Findlay

020 7689 3373

Robin Jarossi

Head of design

Anne-Claire Pickard 020 7689 3391

Senior designer Jody Cooke 020 7689 3380

Designer Lauren Jackson

Production coordinator

Chris Gardner 020 7689 3368

Head of marketing

Kate Daw 020 7689 3363

Head of commercial

Natalie Reeve 07856 475 788

Associate director Charlotte Jesson 07807 287 607

Commercial project manager I y Afzal 07538 299 205

Account director

Lindsay Hudson 07749 416 544

Specialist reporter Dia Stronach

dia.stronach@ newtrade.co.uk 020 7689 3375

Editor in chief Louise Banham louise.banham@ newtrade.co.uk

Features writer Jasper Hart jasper.hart@ newtrade.co.uk 020 7689 3384

Account managers Megan Byrne 07530 834 009

Lisa Martin 07951 461 146

Finance manager Magdalena Kalasiuniene 020 7689 0600

Managing director Parin Gohil 020 7689 3388

Head of digital

Luthfa Begum 07909 254 949

ALEX YAU

RETAILERS have been given advice on how to ensure they are stocking compliant vape devices after the 1 June disposable-vapes ban, following confusion over whether certain lines will be legal.

Several retailers told Retail Express they were unsure if some products would re-

main compliant, with uncertainty caused by the design and branding of certain lines.

“I’ve seen some describing their devices as disposable, despite claims they will be legal,” said one retailer.

Advising on how retailers can check compliance at the ACS Safe and Responsible Retailing Conference this month, the trade body’s public affairs manager, Daniel Askew, said

retailers can check the Medicines and Healthcare products Regulatory Agency’s (MHRA) database.

Askew added: “[The MHRA] is currently removing non-compliant disposable vape products and it is stopping applications for new products.

“Once the ban comes into effect, those products shouldn’t be on there.

“If that fails, and if you’ve

got a good relationship with trading standards, please get in touch with them.”

Major wholesalers such as Booker have also released guides, advising retailers on what lines will be compliant after the ban, alongside a timeline to help with preparation.

Compliant reusable devices must have a rechargeable USB port, replaceable coil and re�illable liquids.

COCA-COLA Europaci�ic Partners (CCEP) is upping the prices on full-sugar Monster lines but maintaining the PMP, a move that wholesalers warn will squeeze store margins.

Ciarán Donnelly ciaran.donnelly@ newtrade.co.uk 07743 936703 For the full story, go to

The changes to £1.65

PAYZONE is to increase its weekly fees, meaning some stores will pay �ive times more than they were two years ago.

A letter sent to stores stated the fee charged would be £5.54 from 5 April, or £8.85 with card processing.

Payzone parent company

Post Of�ice said the changes will simplify its pricing structure, adding: “The price remains great value against our nearest competitor.”

and search ‘Payzone’

/£1.75 single can and £5.49 four-packs coincide with the sugar tax increase from 1 April.

A CCEP spokesperson said the PMPs were “intended as a guide, and there are plain packs available as well”.

EVRI retailers are to see cuts to their weekly volume bonuses from 6 April, potentially costing shops hundreds of pounds a year.

Explaining its decision for the cuts, an Evri spokesperson told Retail Express:

“This change only affects the weekly volume bonus, which is paid only when a shop reaches an agreed parcel volume �igure, and we’re pleased to continue to offer a bonus, on top of standard per-parcel rates.”

BOOKER customer director

Martin Swadling has left the wholesaler, with a further restructure across the group to come.

Several sources revealed Swadling’s departure to Retail Express, adding more changes were expected from April. One retailer said he had “helped greatly” in the development of his store. Swadling held several senior roles at Booker, notably leading the development of Premier and Londis.

from a shoplifting incident.

ASSAULTS on pregnant retailers and other female shopworkers are becoming more common in the growing wave of shoplifting and violent incidents.

Speaking at the Scottish Grocers’ Federation’s (SGF) annual Crime Seminar this month, Dan Brown, of Pinkie Farm Stores in Musselburgh, Edinburgh, highlighted an incident where his pregnant partner had been attacked after confronting a shoplifter.

He said: “We had a shoplifter in the store. My partner Nicole asked them to pay for the stuff, and they took offence at that.

“She was 26-weeks pregnant and ended up getting battered by the woman. She was repeatedly kicked in the stomach, and we had to go to hospital.

“Nicole is okay, thankfully, but that’s the kind of level of crime we’re dealing with. They saw she was pregnant, and the �irst thing they did was kick her in the stomach, all over trying to get some Easter eggs.

“There are very limited deterrents. These people are coming in daily, and I’m at a stage where I don’t know what to do.”

Mohammed Rajak, of Day-Today Dalmarnock Road in Glasgow, recalled how a fellow retailer had recently lost a baby due to the stress she experienced

“I’VE

He added: “Politicians may only listen when a death occurs and a retailer loses their life.”

Co-op has also highlighted how the stress of shoplifting and violence on female retailers in small shops has reached a national scale.

Speaking at a House of Lords committee meeting in September last year, the supermarket’s campaigns, public affairs and policy director, Paul Gerrard, said: “If one of my colleagues gets in the way, they won’t say sorry and walk out.

“There will be assault, there will be a violent threat, there might be a knife and there might be a syringe. One colleague was attacked with a medieval mace; a colleague has lost an eye and another has miscarried.

“There’s a level of violence, abuse and threat nobody who works in retail has seen before.”

Elsewhere, Fiona Malone, of Tenby Stores & Post Of�ice in Pembrokeshire, was spat at recently after confronting a shoplifter.

Posting about the incident on social media this month, Malone said: “Tonight, I got spat at. My crime was to apprehend a teenage shop thief.

“Our cameras picked up the crime and I was in quick pursuit.

“I caught up with the teenager about 500 yards

ve varieties available to customers. Our rst order was for 20, and we were a bit cautious about it. Now, we sell 100 a week. We have always increased things slowly, I’d rather create a demand. We’re in contact with the butcher daily and I’d be surprised if we weren’t doing 200 a week within a month.”

Goran Raven, Raven’s Budgens, Abridge, Essex

from the shop. After a brief exchange of words, he decided to spit at me and throw the bottle of wine towards me.

“Why is this deemed as acceptable and when will this be stopped? Will it be when I am killed due to running after shoplifters?

“Why do people not understand right from wrong? Shop theft is not a victimless crime.”

According to ACS research published in 2022, 70% of small-shop workers were female.

These incidents against

female staff come as the ACS and SGF released their annual crime reports this month.

The ACS said more than 59,000 estimated incidents of violence occurred in the convenience sector over the past year, with 1.2 million incidents of verbal abuse over the same period.

Meanwhile, the SGF’s report claimed the average store in Scotland lost £5,000 to shoplifting in the past year.

Nearly all stores had reported that violence against staff had occurred at least

once a month, while weekly incidents of abuse were sparked by refusing sales or asking for proof of age.

ACS chief executive James Lowman said: “The levels of theft, abuse and violence experienced by retailers over the past year makes for shocking reading, but it will not surprise our members who are living it daily.

“Criminals targeting local shops without fear of reproach cannot be allowed to continue, which is why we’re fully supportive of the government’s Crime and Policing Bill.”

“WE can do jacket potatoes all year round, and in the summer period, we will do more because people will want lighter meals or snacks. We get the potatoes from a local farm. There’s not a lot of waste to it. The machine we use costs £1,000 – it’s not a big investment overall, and we o er customers a variety of options, such as cheese, cheese & beans and tuna & mayo. The idea is to keep it simple.” Dee Sedani, One Stop Packmoor, Sta ordshire

“WE invested in some new refrigeration at the front of the shop in July last year. Starbucks iced co ee is prominent, and shoppers pick these drinks up as they walk in. We also have a hot-pizza case by the counter with Chicago Town slices, which can be an impulse line. Sometimes, when customers are standing in the queue, the smell of the pizzas makes them want to buy while they’re waiting.”

BESTWAY: The wholesaler has launched a scheme to help retailers improve their social media pages. The pilot, which is being trialled with a select group of retailers, enables store owners to create and schedule posts for multiple social accounts from one platform. A wider rollout is expected after the three-month trial.

For the full story, go to betterretailing.com and search ‘Bestway’

BOOKER: A WhatsApp messaging service has been launched by the company to provide retailers with instant updates on new products and promotions. Other wholesalers have launched similar services, enabling their customers to make orders and ask for support from the instant-messaging app.

For the full story, go to betterretailing.com and search ‘Booker’ 25

COUNTERFEIT CASH: Retailers are still using detector pens on fake notes, despite the Bank of England warning they no longer work. The government-owned organisation’s banknote engagement and communications lead, Stuart Cooper, said: “Detector pens don’t work anymore. They were made for paper notes, so the pen showed up on them. They won’t work on counterfeits, where most of them are plastic.”

CO-OP: The convenience chain has been found guilty of blocking rivals from opening stores near its branches. The Competition and Markets Authority said Co-op had admitted 107 breaches of the Groceries Market Investigation (Controlled Land) Order of 2010, which is designed to stop supermarkets imposing restrictions that block rivals from opening competing stores nearby.

KWAME BOAKYE

THE Post Office (PO) hosted an all-female subpostmaster panel for the first time, as part of a wider strategy to improve representation across the network.

The event this month had four subpostmasters on the panel, sharing insights on their leadership experiences, offering advice to their

ing the contributions they make to their communities.

The panellists were Sara Barlow, Gurpreet Dhillon, Ying Shi and Fiona Malone.

Barlow, of Rainhill Post Office in Prescot, near Liverpool, was also the first woman to join the PO board as a non-executive director at the start of the year.

The move comes as part of the PO’s five-year strategy

Postmasters’, which aims to create a greater role for postmasters in the running and operations of the business, and strengthen their voices across the organisation.

Commenting on her particpation in the event, Malone told Retail Express: “When you talk about PO, people have a bit of a negative view, so it was nice to talk about some positive things.

difficult situations, and that’s why we shared our stories, as a kind of inspiration that you can get through things, and you can get over things.”

Malone added that the panellists were chosen for the event not solely on their gender, but also because they were “experienced subpostmasters”.

“We’ve got a good story to tell, male or female,” she

CONCERNS have been sparked over future access to cash, after one in 20 free ATMs and one in 10 payto-use ATMs disappeared last year.

released figures from Link revealed the number of free ATMs dropped by 1,831 machines to 44,569, while pay-to-use machines dropped by 1,311 machines to 9,101. The drop in cash machines has been blamed on cuts by banks in the fees they pay to ATM operators in 2019.

Tech has produced a machine designed to help small shops comply with the Deposit Return Scheme from October 2027.

Called the Trovr Qube, the machine can be attached to the top of a wheelie bin, or a specially designed compartment for an additional fee.

When the machine is fully assembled, the Qube is of similar to size to a conveni-

BOOKER has revealed more details about its newly launched home delivery platform, Scoot.

Details given out at its two annual tradeshows in Doncaster and Sandown this month revealed retailers joining the service will pay a £395 set-up fee, with support, such as marketing and point-of-sale material, given in return.

Booker’s head of home delivery, Damian Sanderson, told Retail Express that Scoot has received “such positive feedback” as well as “many

retailers enquiring how they can join Scoot, with most not currently offering delivery services”.

MCCOY’S turns up the heat with the new Hot ’n’ Spicy flavour and exciting ‘Bank of McCoy’s’ promotion to boost sales

MCCOY’S launched the huge ‘Bank of McCoy’s’ on-pack promotion at the start of the year.

Available across McCoy’s grab bag and price-marked-pack (PMP) formats, the new incentive gives consumers the chance to unlock a £100,000 prize vault to win instant cash prizes of up to £1,000 or free crisps. Retailers are also in with the chance to unlock a £50,000 prize vault featured across the brand’s PMPs.

Alongside this, McCoy’s also expanded its range with the launch of a Hot ’n’ Spicy flavour with a bold flavour pro le to appeal to shoppers. It delivers full-on flavour with a perfect blend of spice and seasoning to ignite taste buds and elevate consumers’ snacking experiences. With spicy being the third-largest flavour partition in crisps, snacks and nuts, the launch debuts in this popular format to meet consumer demand and drive sales.

Stuart Graham, head of convenience and impulse, KP Snacks

“MCCOY’S is a key crisps, snacks and nuts brand to back in 2025, starting the year with a huge on-pack promotion that engages shoppers and retailers, and an exciting new flavour. Growing in value at 6.2% year on year3, McCoy’s is introducing innovative products and creative incentives designed to disrupt the category and drive brand and category growth.”

JASPER HART

MONDELEZ International has announced its latest Cadbury Dairy Milk innovation: Cadbury Dairy Milk Biscoff.

The partnership between Mondelez International and Lotus Biscoff aims to tap into consumer interest in new �lavours and textures, as well as drive cross-brand excitement and incremental growth.

To support retailers with the launch, Mondelez and Lotus Biscoff will be running a campaign that includes a range of eye-catching, co-branded PoS materials to show both brands. The design will include the purple synonymous with the Cad-

bury brand, alongside the red Biscoff branding.

The campaign will also span social, in�luencer and seasonal content, and the product is available now in 105g non-price-marked pack (PMP), and 95g non-PMP and PMP formats.

Connor Gould, brand manager for Cadbury Dairy Milk, said: “Combining two delicious �lavours is a great way to give consumers the best of both, creating the perfect pairing for them to enjoy the smooth taste of Cadbury Dairy Milk mixed with the classic crunch and unique �lavour of Biscoff that consumers love.

“As a result, the new Cadbury Dairy Milk Biscoff is

LIPTON has entered the kombucha drinks segment with the launch of the Lipton Kombucha range in three varieties: Strawberry Mint, Raspberry and Mango Passionfruit.

The supplier will support the launch with the ‘Kombucha-cha-cha’ campaign across outdoor and in-store advertising, social media and sampling.

Ben Parker, vicepresident sales off-trade at Carlsberg Britvic, said: “As a brand, we are looking forward to shoppers being able to try the �lavours and for retailers to reap the current untapped rewards of stocking it.”

sure to utilise consumer demand for unique �lavours to help drive category growth.”

DIAGEO is expanding its Cîroc ready-to-drink (RTD) vodka range with a new Colada variety, which contains 5% ABV and has a £2.75 RRP.

It is a sparkling drink made with vodka, pineapple and coconut �lavours, mixed with lemonade, in a 250ml format.

It is the fourth addition to the brand’s RTD range, joining Red Berry, Summer Citrus and Tropical Passion.

Cîroc Coconut vodka is also making a comeback, relaunching on shelves with a £35 RRP.

Cîroc Coconut can be used to make a piña colada or as part of a martini cocktail.

RETAILERS can now stock Inch’s Cider Cloudy and 0.0 in multipack formats. Cloudy is available in four- and 10-packs of 440ml cans, while 0.0 is available in 4x440ml.

YOPLAIT has redesigned its Frubes packaging to highlight its health credentials.

On pack, consumers will be able to see the product uses only natural �lavours and no added colours.

Children will also be able to �ind a new game on pack, which features QR codes that unlock new characters and skills.

There is also £1,000worth of gaming vouchers

up for grabs every month.

The relaunch is being supported by a £1.5m marketing investment, which includes online video, video on demand, digital outdoor advertising, and social and in�luencer campaigns.

Both will be supported with a nationwide campaign across TV, social media, digital and outdoor advertising from April to September.

Heineken claims Inch’s 0.0 is the �irst de-alcoholised cider in the UK.

Amalka Woodall, quality technologist at Hereford Ciderie, said: “This process of de-alcoholisation has ensured that Inch’s 0.0 retains the �lavour that our Medium Apple cider has become so well-known for.”

WORLD of Sweets will launch Bluey Freeze-atHome Ice Pops, made in collaboration with the popular children’s franchise of the same name.

The frozen treat range comes in four varieties: Pineapple, Strawberry, Apple and Blackcurrant, in packs of 12.

They are also non-HFSS, with 25% real fruit juice and no added sugar. They will be available from World of Sweets on 25 April ahead of the summer. This launch follows in the footsteps of other successful licensed products, such as its Paw Patrol Freeze Pops, which launched in May last year.

SWIZZELS has launched a limited-edition Squashies line, Drumchick, to drive sales during the Easter season. The new product features chick-shaped gummy sweets in an orange & pineapple �lavour.

This marks the latest seasonal launch from Swizzels, following Halloween-, Christmas- and Valentine’s-themed products in the past year.

Clare Newton, trade marketing manager, Swizzels, said: “While Easter is usually associated with chocolate, we’ve noted rising demand for alternative sweet treats.

“Squashies Drumchick play into the popularity of

fruity �lavours, and limitededition seasonal treats are ideal for retailers looking to diversify their Easter range.”

YAZOO has launched Inspirations in Birthday Cake and Caramel Blondie varieties, aiming to inspire incremental growth. The range is available now and has been developed to capitalise on growing consumer demand for indulgent on-the-go treats. Additionally, sales of dairy drinks are up by 28.4% year on year, while Yazoo sells two bottles every second across the UK. Each variety carries a £1.50 RRP and is available in cases of 12. They are packaged 100% in recycled rPET and have peelable sleeves and tethered caps for easy recycling.

How to

How to find profitable products

How to buy a convenience store

How to list your business on Google

How to attract customers to your store

How to write a stand-out job advert x

TAMARA BIRCH

RETAILERS that prioritise premium cider products and strategic ranging will be best placed to drive category sales in 2025, according to the 2025 Westons Cider Report.

An example cited in the report was the rise of crafted apple cider, which has experienced a 14.6% sales growth in convenience stores.

This is compared with total cider sales, which have only increased by 0.1% year on year.

Apple cider currently accounts for 63.7% of market value, while pear has just a 4% share overall.

Darryl

Hinksman, head

of business development at Westons Cider, said retailers who dedicated “adequate facings” for crafted apple cider can help maximise sales.

“We believe stocking the right mix of single-serve formats for impulse purchases and larger multipacks for

planned consumption will help capitalise on both shopper missions,” he added.

The report also found that younger shoppers are actively trading up to premium drinks, with crafted cider having the highest proportion of shoppers aged under 45.

KELLANOVA has expanded its Cheez-It range with the Snap’d Cheese Sour Cream & Onion variety.

The product is listed in one major wholesaler’s new product brochure.

The �lavour was part of the initial UK launch in July 2024, but only to multiples.

It marks Cheez-It’s �irst non-price-marked sharing bag in convenience stores.

Available at an RRP of £1.99, it offers a PoR up to 21.4% on promotion, according to its listing with the wholesaler.

SUNTORY Beverage & Food GB&I (SBF GB&I) has launched Lucozade Sport Ice Kick as part of a new collaboration with Real Madrid and England footballer Jude Bellingham.

The drink features citrus �lavours, with Bellingham on pack to drive standout and appeal to football fans.

It is available now in 500ml plain (RRP £1.75) and £1.50 price-marked bottles, as well as a 4x500ml multipack (RRP £4).

SBF GB&I is supporting the launch with a suite of PoS. There will also be marketing content featuring Bellingham across his and Lucozade Sport’s social media channel.

HEINEKEN UK has revamped its Star Retailer loyalty programme with a new participation and rewards framework for retailers.

The loyalty scheme will provide three reward levels: Star Retailer, Star Plus and Star Platinum. From April, retailers can unlock a tiered set of exclusive bene�its and

PEPSICO has launched a range of Walkers crisps that have combined two popular sauces with its crisp base.

Walkers Heinz Tomato Ketchup and Walkers Lea & Perrins Worcestershire Sauce have been listed in one major wholesaler’s newest product brochure.

cash incentives, worth up to £100 per bimonthly cycle, achieved by stocking and promoting Heineken brands. Retailers will qualify for different levels depending on a set criteria, including how many Heineken products they stock and how often they post about them on social media.

CAMPARI has rolled out a uni�ied label design for Magnum Tonic Wine in the UK and Jamaica, available now.

According to Campari, the standardisation of the product’s packaging across the two markets aims to address consumer misconceptions about there being differences in the product.

The new look is inspired by the original green-label design sold in Jamaica and it’s hoped the colour scheme will help the product stand out more on UK shelves.

Cash-and-carry stockists will have orders ful�illed with the new-label stock automatically.

This marks Walkers’ latest collaborative launch, following combinations with other popular PepsiCo crisp brands.

Available in £1.25 pricemarked packs, they offer a PoR of 42.1% on a promotional price, according to their listings with the wholesaler.

MÁS+ by Messi, a new energy drink co-founded by footballer Lionel Messi, has launched in the UK exclusively through Spar, The drink will be available from the symbol group in Miami Punch, Limon Lime League, Berry Copa Crush and Orange d’Or varieties.

Each �lavour is inspired

by different milestones in Messi’s career, such as his current club, Inter Miami CF, and his trophy wins. The range is designed for hydration and has no arti�icial colours, sweeteners or caffeine.

PRAGUE beer Staropramen is now available in a 440mlcan 10-pack in response to rising demand for multipack formats in world beer.

open fold.

The packs launched in stores nationwide on 17 March and are encased in a new recyclable cardboard sleeve and include an easyto-carry handle and tear-

The launch is being supported by a new marketing campaign, including in-store PoS, digital assets and a paid social media programme. Each can and outer sleeve will include a scannable QR code, giving consumers access to exclusive Staropramen content.

brand Nurishment has launched a £1.39 pricemarked pack (PMP) across its core �lavour range.

The brand’s four original varieties – Vanilla, Banana, Strawberry and Chocolate –are now available in the pricemarked format.

Dorota Dzerdzic, brand manager at Nurishment’s owner, Grace Foods UK, said: “Nurishment milk drinks are a great source of protein and calcium, and contain 13 vitamins and minerals.

“We wanted to add more value to Nurishment by introducing a PMP of £1.39 for our four original �lavours.”

MARS Chocolate Drinks & Treats has given its Galaxy Milk Drink range a packaging update that aims to bring it in line with Galaxy Chocolate.

The bottles will also switch from a traditional sports cap to a �lat cap from April.

MAGNUM has introduced a new recipe for its vegan ice cream range, including Magnum Vegan Almond.

The supplier says the new soy-protein recipe offers consumers a more velvety taste and texture.

The plant-based segment has continued to grow, with

10% of households containing someone following a vegan or vegetarian diet. Daniel Lytho, brand manager for Magnum UK at Unilever, said: “This soy-based recipe presents a signi�icant opportunity for retailers to help drive incremental ice cream sales.”

This follows consumer feedback from a survey conducted by Mortar Research, which revealed that almost three-quarters (73%) of people who have drunk chocolate milk prefer to do so from a �lat-cap bottle.

This change also comes as Galaxy confectionery sales are in growth, having seen a year-on-year sales increase of 7.2%.

ALPEN has launched a consumer £2m campaign across TV, video on demand and social media following packaging and recipe updates. The campaign features a mascot called Ralph who recognises the importance of starting the day with breakfast, concluding that choosing muesli is ‘The Grown Up

Thing To Do’.

Louise Vickers, head of brand at Alpen, said: “Armed with new branding and packaging, we want to show shoppers that choosing a healthier, more complete breakfast option is far from boring.”

I ALWAYS dread having a di cult conversation with a member of sta , but it is about having the courage to tell them that something isn’t working, and then discussing how you can work together to resolve the issue.

A lot of people will skirt around the edges of a difcult conversation, but it helps to be more direct. You get better results when you’re clear.

I’m always talking to my team and making sure I understand when they’re upset about something.

CARLSBERG Britvic aims to tap into growing consumer demand for caffeine-free options with the launch of Pepsi Max Caffeine Free in a 500ml bottle.

The supplier aims to expand the reach of the variety, which is the leading sugar and caffeine-free cola, worth £20m in retail sales and growing by 47% annually.

Pepsi is also bringing back its ‘Thirsty for More’ campaign, giving shoppers a chance to win exclusive Pepsi merchandise, live across all Pepsi packs until 30 April.

DELICE de France is launching Cafe Delice, a coffee-to-go concept that earns margins of 40% for outlets selling 35 cups a day.

Cafe Delice is a monthly rental, which includes a fully automatic bean-to-cup machine, linked meal cooler, branded housing unit and

We recently introduced an iSqueeze orange juice machine to the store and some members of sta are complaining about cleaning it, but we haven’t brought it in to make life di cult. I’ve been explaining the additional costs we have coming up, such as the rise in minimum wages and business rates, and how we need to make sure we can secure their jobs for the future.

The machine is bringing more people into the business and making the business more sustainable.

The same goes for dealing with di cult conversations with customers. Nine out of 10 times I can get the customer back on side.

You have to be con dent in your approach. And fake the con dence if you need to. The more you try these things, the more con dent you become in dealing with them.

menu, as well as product and storage areas.

Full servicing and cleaning packs for the agreement period are provided.

Monthly options start from £360. Outlets could make more than £10,000 a year based on a forecast of 35 cups a day.

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

CRIME: What measures are you taking to tackle rising crime levels?

“WE support our colleagues by prioritising their safety and streamlining the way we record crime. Colleagues log incidents of theft, abuse or violence onto a tablet, with the ability to upload reports to the police. We can backdate paper records to gain insight into crime trends.”

Chloe Taylor-Green, Spar Linford, Stafford

“ SHOPLIFTING remains a near-daily issue. While our colleagues are trained to spot potential thieves, it can be isolating to handle a situation alone on the shop floor. Our colleague headsets have helped to provide a sense of connection and support.”

Shoplifting remains a near-daily issue

STORE DEVELOPMENT: How have you revamped your business?

“WE’VE rebranded our food-to-go counter as Carla’s Kitchen and added an extensive range of healthier options focusing on giving customers more protein. Options include macaroni & cheese, barbecue chicken, noodles and curries, which are all made in the store.”

Dan Brown, Pinkie Farm Stores, Musselburgh

“I WANTED to create a store that truly meets our customers’ needs. We’ve expanded our chilled and fresh product range, particularly our fresh produce, which has already had a positive impact on sales. We’re now seeing an uplift in fresh sales by approximately 50%.”

Malik Zameer, Nisa Uxbridge Road, west London

COSTS: What pressures are you facing in your business?

“WAGE increases, retail crime and a poor trading period since the Christmas season are issues I’ve been hearing about from independent retailers. Other challenges, such as upcoming legislation on vapes, are also likely to have a significant impact.”

Ramesh Shingadia, Londis Caterways, Sussex

We’ve added an extensive range of healthier options I’ve worked with Booker to look at technology

“THE decrease in the National Insurance threshold from £9,100 to £5,000 in April will certainly have an impact on staffing for us. I may look to employ fewer staff, get rid of staff or take on more hours myself. If I do take on any staff, I’ll be taking their age more into consideration.”

Anonymous retailer

AGE VERIFICATION: How are you checking customers?

“FOR my new Premier store in Sheffield, I have worked with Booker to add one of the industry’s first vape vaults. It’s a 250sq ft room with space for 500 individual lines. There’s always a member of staff there and we’re looking at how we can use technology to verify someone’s age.”

Seelan Thambirajah, multi-site operator, Derbyshire

“I’M working with a company called Innovative Technology for age-restricted sales on my beer cave. We’ve been looking at adding automated doors with a camera on them. The camera will use AI to identify a customer’s facial features and will only let them in if they are over 18.”

Girish Jeeva, Girish’s Premier, Glasgow

I’VE had an issue since January with Mondelez. Despite doing all the necessary steps, I’ve been unable to get it resolved.

Like nearly all symbol groups, there’s a policy that notice of defective stock and damages must be raised within 48 hours to qualify for returns and refund. The problem is, what

happens when the defect is inside the packaging? That’s what I’ve experienced with Mondelez and Maynard Bassetts Sports Mix.

A shopper returned a bag that was un�it for consumption. I sent images and details in, noti�ied my rep and took all manner of other actions, only to be told I should seek a refund from

my point of purchase, even when I informed them of the standard 48-hour terms.

I’m signed up for Mondelez’s rewards scheme and am one of its top performers, so it seems petty it is refusing to rectify such a small problem.

Hitesh Modi, Londis BWS, Chesham, Buckinghamshire

A Mondelez spokesperson con�irmed it had been speaking to Modi to resolve his issue with the return. Retail Express understands a rep visited his store the day after Retail Express contacted Mondelez to provide Modi with a free case of the affected line to “make up for the inconvenience he’s experienced”.

IT’S hard to quantify exactly what impact social media has on sales, but it de nitely provides an upward trend, and these days, with inflation, if you’re not growing sales, you’re falling back.

The more people your store and your products are exposed to, the likelier shoppers are to see something they either haven’t ever seen before or they want.

We sell packaged products that people like, and are sold everywhere, but the way we’ve built our social media platforms gives people that reason to come and shop with us rather than anyone else.

For us, that’s the new product we’ve got before everyone else – for another store, it might be food to go. I can put a post up about a new product, and someone will order it on Snappy Shopper from us within 20 minutes.

People won’t see what you’ve got if they don’t follow your Facebook, Instagram or TikTok pages, however. I bought 1,200 packs of a disposable vape I’d not had before and heavily discounted them. I only advertised it on Facebook and TikTok, and now only have 40 le . It’s a free marketing tool.

We get the best results from Facebook, which has transformed our business. My husband went for golf lessons in East Kilbride and discovered that his teacher’s wife followed us on Facebook.

“AFTER 45 years, I have decided to retire. The shop has been more than just a convenience store, it has been a cornerstone of the community, a place where friendships were formed and countless memories have been made. It took me a long time to get to know people and their faces, and I suppose it took them a long time to get to know me, too. I had taken over the shop in 1978 and spent a year renovating it before opening in 1979. Over the years, the store has had di erent fascias before joining Nisa, but my commitment to the community has never wavered.”

You can make it work by doing the same things that everyone is doing, but if you really want to stand out, you’ve got to be doing something di erent and thinking outside the box. On top of that, you need to be consistent. Online competitions are a great way to boost your followers and they don’t have to cost anything. Talk to your reps and work with brands to see if they can pull together some prizes for you or free merchandise. I’ve got a competition ongoing with Bacardi Breezer that’s already reached 50,000 people.

DATA: This feature is created by Newtrade Insight. Data is gratefully received from the retailers who participated in a four-week trial of Maryland. Any data from other sources is cited.

Newtrade Insight partnered with FBC UK to trial three MARYLAND varieties in one independent retailer’s store. Here’s how he got on

THE trial’s aims were to learn with retailers how to activate sales of Maryland Minis and Maryland 200g Cookies, and how to best use in-store PoS to make the most of these moments and opportunities.

Other aims included increasing penetration and value sales across Maryland Minis and Maryland 200g packs during key occasions.

Over four weeks, Neil Godhania’s Premier store in Bretton, Peterborough, was supplied with ve cases each of Maryland Minis £1.59 pricemarked pack (PMP), Maryland

Choc Chip £1.59 PMP and Maryland White Choc Chip £1.59 PMP. Sales of the products were recorded as well as overall biscuit category sales compared to the same fourweek period last year, and the two weeks prior to the start of the trial.

A brand representative was also on hand to help Godhania with advice about positioning to increase visibility and purchase opportunities with dual displays. There were seven pieces of PoS used during the trial: aisle ns, till mats, wobblers, shelf strips, posters, a

fully branded FSDU and floor stickers directing shoppers to the products.

As a suburban retailer with a dedicated customer base, Godhania was interested to see how stocking the Maryland PMPs influenced his shoppers’ behaviour and approach towards the biscuits category, building upon the Maryland lines he stocked pre-trial. PMPs are particularly important for influencing shopper decisions, identi ed as one of the six core drivers behind brand growth in the convenience channel1

189%

The total increase in Maryland unit sales compared with the same period in 2024

OVERALL, the trial was a success, leading to a considerable uplift in Maryland unit sales in Godhania’s store.

He sold 78 Maryland units during the trial period, compared with 27 during the same period in 2024, equating to a 189% total increase.

Maryland also increased its share of the biscuit category in the store from 3% in the two weeks before the trial to 10%, based on a comparison of average weekly sales during those two periods.

The new promotional products led this sales growth:

Maryland Minis £1.59 PMP was the top-selling line from the brand, with 26 units sold, followed by Maryland Choc Chip £1.59 PMP with 24 units and Maryland White Choc Chip £1.59 PMP with 11 units.

The combined sales of these three units (61), accounted for 78% of the total Maryland sales in Godhania’s store during the trial period.

Dual-siting and PoS were crucial in driving shoppers towards the products. “The FSDU we positioned next to the till has really enhanced impulse purchases and given the Min-

is even more prominence,” said Godhania. “I think the PMP has influenced shoppers across all the products, along with the high-impact, shiny red packaging and the positioning in store.” Additionally, the floor stickers provided a fun factor that played well with Godhania’s younger shoppers.

“We have two schools, one next door and one opposite, and parents are nipping in to buy the Minis for lunchbox top-ups, as are the students who love the ‘stepping stone’ floor stickers,” he added.

The category share increase of Maryland products compared to the two weeks prior

PROVOKING impulse purchases by dual-siting products, with one position close to the till, was cited by Godhania as a key reason for the increased sales during the trial. Additionally, spotlighting the products as part of an occasion or mission, such as lunchtime, reinforced the brand to shoppers, providing another avenue for impulse purchases. Meanwhile, the use of a

variety of PoS and planogram advice which made the trial products more prominent and visible had a direct impact on customers choosing them more. Moreover, this positioning was coupled with an attractive PMP proposition, which communicated a strong perception of value to consumers and influenced their decision to opt for Maryland over nonPMP competitor brands.

The £89.14 average increase in category sales per month, if maintained, could translate to an extra £1,070 sales per year. The shop’s customer demographics also played an important role in the trial’s outcome: Godhania’s shoppers are overwhelmingly local and regular, such as the schoolchildren, so they were able to notice the changes to his ranging and the use of PoS throughout the

THE trial shows there are ways for retailers to increase their biscuit category sales through a proactive approach, even if they think the category is already pulling its weight instore. “In 2024, 98% of British households bought sweet biscuits, which equates to £3.1bn in sales2, and this presents retailers with a big opportunity to capitalise on the category’s success,” said Robin Norton,

head of category insights at Fox’s Burton’s Companies UK (FBC UK), who helped Godhania with the trial.

A key part of doing so beyond second-siting top lines and use of PoS is looking at category segments which may have previously been ignored – with mini biscuits an important one to consider. Their successful role in the trial, as the top-selling line during

the period, is demonstrative of their overall growth nationwide, which many convenience stores are missing out on.

“Independent retailers tend to under-trade on mini biscuits, despite this being the fastest-growing segment of the category over the past ve years3,” said Norton.

“We added Maryland Minis PMPs to Neil’s o ering to help him make the most of this

Neil Godhania, JS Premier Neil’s, Peterborough RETAILER

“I’VE learned that visibility on-shelf and stocking di erent varieties are really important. I’d tell store owners to look at their category, merchandising, and speak to their eld sales rep and supplier. It’s de nitely helped my store.”

Robin Norton, head of category insights, Fox’s Burton’s Companies UK

“WE felt we could optimise Neil’s xture by making it easier for shoppers to nd what they want. At FBC, working closely with retailers is incredibly important to us, so we want to thank Neil for allowing us to run the trial in his store.”

store from repeat visits.

“We have temporary accommodation above the store, so the people who stay there tend to be regular impulse buyers, popping in every day for something, with snacking products being their go-to,” said Godhania. “We have de nitely seen a big uptake of the Maryland products with them since we implemented the category advice and PoS in the store.”

great sales opportunity.”

Given that so many retailers are proactively looking for ways to increase their pro ts, investing in growing segments such as mini biscuits is one way to do so. The fact that Maryland Minis are available as a PMP will help retailers to drive sales, especially when the format’s role in helping branded products increase sales is taken into account.

RETAIL EXPRESS gets the lowdown from top suppliers on how retailers can optimise their ranging across key convenience categories

IN the current trading environment, retailers need to ensure their ranging and merchandising are as e cient as possible.

The sheer variety of products available across so many categories means thinking carefully about every inch of space is more important than ever.

Retailers need to know what their customers like, and which products are best-placed to respond to their needs.

As a result, Retail Express has partnered with four leading suppliers to help retail-

ers optimise their ranges and make the most of their respective categories.

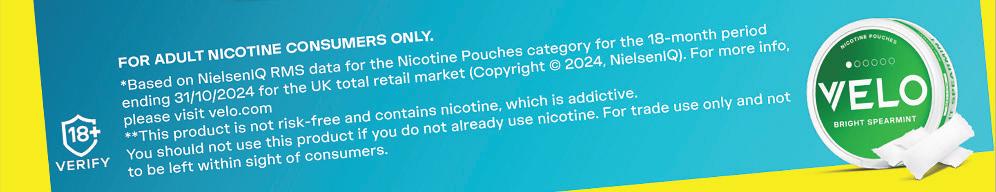

BAT UK emphasises the importance of considering the nicotine pouch category, ahead of the disposable vapes ban, and how its Velo range caters to a variety of consumer preferences.

The supplier also outlines the steps stores should be taking ahead of the ban regarding their vape ranges, by stocking compliant alternative products, such as Vuse Go Reload,

and being equipped to explain the upcoming changes to their customers.

Coca-Cola Europaci c Partners (CCEP), meanwhile, looks at the ongoing growth of the energy drinks category and how its Sales Supercharged online platform is helping retailers drive sales of key brands such as Monster.

Grenade highlights the growing stature of the protein market and the breadth of options its protein bars o er, as well as their high margins, as

more shoppers look for snacks that o er a functional bene t alongside an appealing taste.

Finally, Hell Energy examines the growth of the readyto-drink iced co ee segment and the need for retailers to attract shoppers’ attention with second sitings and PoS, as well as well as showcasing the brand’s range of lactose-free and no-added-sugar options.

Some of the suppliers have also provided planograms as a visual aid to help retailers reorganise their shelf space.

THE right display of nicotinepouch products can make the di erence when it comes to helping your adult nicotine consumers nd and purchase the products they want.

It will also mean your sta can help as e ciently as possible. It’s good practice to keep your brands visible and your ranges together.

It’s recommended to group by flavour, and a clear order of strength is important – from low nicotine strength up to high, from left to right.

The low-strength options in the Mellow range are key for new customers looking for an alternative to smoking and vaping.

It may be a challenge to know where best to stock and display your nicotine-pouch products. Ideally, they should sit with other smokeless alternatives and behind the counter, away from under-18s.

If that’s not achievable, BAT o ers some e ective countertop units to keep your range secure in one place.

Stock only reputable brands among the many new ones in the category. Working with trusted brands provides condence that your products comply with the right marketing code of conduct, including branding and flavour names.

2

O er lower-strength (4mg-6mg) products in your range. Nicotine pouches are meant for adult nicotine consumers only, who already smoke, vape or use alternative nicotine products. Our Mellow range is ideal for new entrants.

3

Work with your suppliers on display options for nicotine pouches in your store. Keep a tidy, organised category, with nicotine products together behind the point of sale and away from under-18s and theft.

VIEW Visit vapermarket.co.uk, get in touch with your local BAT representative or email batuk_customer_enquiries@bat.com

Hashim Tahir, B2B manager, BAT UK

“THE nicotine-pouch category has grown signi cantly in recent years, giving retailers a prime opportunity to drive sales and pro ts. Retailers also face the challenge of understanding what’s right for them, in terms of brands, flavours and strengths – as well as how to make the most of their category display. Keep close to reputable suppliers, and reps who will guide and educate retailers on the right choices, as well as o er competitive prices. We have a range of educational material and unitary solutions available, so please get in touch to make the most of these.”

A COMPETITIVE range is all about the right blend of brands, products, flavours and strengths for adult nicotine consumers. Then, it’s about understanding the best way to display those products so the right ones can be found easily. As the ban on disposable vapes gets closer, BAT believes that future-compliant products, including re llable and rechargeable devices, should start to take centre stage. Organise your available space by moving the disposable ranges

out of the prime line of sight. Rechargeable and re llable devices are available in various formats, usually in pen or box shape. You can begin to guide your adult nicotine consumers to a compliant alternative – then match their flavour pro les to what’s available within the range. Keep a good selection of flavours and nicotine strengths available within the key flavour groups – tobacco, mint and fruit – to allow you to o er like-for-like alternatives.

1

As adult nicotine consumers start to move away from disposables, make sure they can easily be o ered an alternative with a flavour they enjoy. Keep like-for-like flavours available in your re llable rechargeable devices range.

2

O er a range of re llable rechargeable device formats. Disposables come in di erent-shaped devices like a pen or box. Alternative product options will make it easier for adult nicotine consumers to choose and make purchases.

3

Move compliant vapes into the line of sight and disposables away from the centre of your display. It will drive conversations about alternative products and help you inform adult nicotine consumers about the disposables ban.

Hashim Tahir, B2B manager, BAT UK

“WHEN the disposables ban comes into force in June, we expect an increased demand for alternative products, such as the Vuse Go Reload, with its rechargeable and reusable pre- lled system. These products aim to o er consumers the same flavour sensation they would expect from disposable vapes. We understand many retailers will have questions about the impending ban. We recommend retailers with any concerns or questions to get in touch with their local BAT representative, who can o er helpful advice and guidance.”

In partnership with

ENERGY drinks are the number-one deliverer of value growth in soft drinks, worth more than £2.1bn1 to retailers. Monster is the fastestgrowing major energy brand in Britain1, worth more than £706m1, and delivering double-digit volume growth2

Monster has been helping independent convenience stores tap into this huge opportunity through its Sales Supercharged retailer support initiative, which has been refreshed for its fth year.

The SalesSupercharged. co.uk platform provides the lowdown on the latest trends within energy drinks, alongside tips and advice around ranging and execution in store. And it’s supported by retailer ambassadors who share how they’ve supercharged energy-drinks sales in their own stores. The platform also includes easy-to-follow tips, downloadable planograms, quarterly giveaways and links to PoS materials or chillers.

One in three on-the-go soft drinks sold is an energy drink3, so make plenty of space in your chilled soft drinks lineup for shoppers to pick up and enjoy straight away. You can also activate your meal-deal o ers with top sellers.

2

Group brands, and remove slow-selling lines, replacing them with double facings of bestsellers. Use launches such as Monster Juiced Rio Punch and PoS in store to catch customers’ eyes.

3

Have lots of choice in your energy-drinks lineup, ensuring you stock a range of options spanning the big four energy segments – traditional, zero sugar, flavoured and performance.

Helen Kerr, associate director of portfolio, Coca-Cola Europaci c Partners GB

“ENERGY drinks are an exciting growth opportunity for retailers. New products from Monster have driven more than half of energy drinks’ innovation sales in the past year1 and we’re con dent Rio Punch will continue this momentum. Ranging is all about getting the core right, at the same time as also o ering choice through the latest launches and making room for growing sub-segments like zero sugar and performance. Chilled is crucial, with 78% of consumers preferring to purchase energy drinks cold, so keep your chillers stocked up4.”

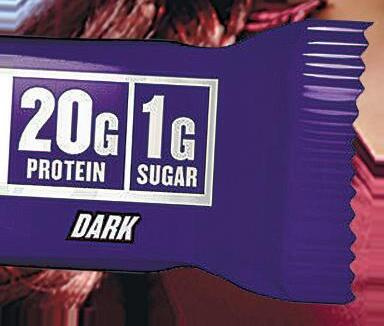

PROTEIN-PACKED snacks are no longer con ned to tness enthusiasts, they are now picked up by all kinds of shoppers.

As the UK’s bestselling protein-bar brand1, Grenade understands what these customers are looking for. Forty per cent of consumers now enjoy their protein bar as a snack between meals or on the go2. This means convenience retailers need to o er an easyto-shop protein range to cater to this demand.

As impulse purchases, like any other snack, protein bars belong in quick-to- nd locations within the store. A range of bestselling protein bars alongside confectionery provides the shopper with a lowsugar, guilt-free indulgent alternative. With competing cash rate of sale vs traditional confectionery singles, the Grenade protein-bar range o ers the retailer a lucrative return on shelf space, whilst meeting the shopper’s desire for a healthier alternative treat.

VIEW

1

Choose bestselling products to maximise the return on shelf space. Proven sellers such as Grenade Oreo and Chocolate Chip Salted Caramel are customer favourites and should be at the core of any protein range.

2

Choose the right location for your protein range to help shoppers nd what they’re looking for. As impulse snacks, protein bars belong alongside your wider snacking range, such as near your confectionery.

3

Help shoppers to nd your protein range easily using recognisable brands such as Grenade and strong PoS to clearly signpost where protein products can be found in your store.

Luke Morgan, head of convenience, Grenade

“IT’S vital for retailers to consider the importance of protein in their store. With all kinds of shoppers looking for high-protein, low-sugar snacks, retailers can bene t by simply ensuring they have a strong protein range that’s easy to nd. Ranging bestsellers such as Grenade Oreo alongside their traditional snacking will provide retailers with popular products that maximise the return on their shelf space. Grenade’s range typically generates a PoR of 40%, and with a strong rate of sale, will more than earn its space in store.”

THE iced co ee category continues to be buoyant. For retailers, it is important to have a varied range, focusing on a mix of exciting flavours and category leaders.

Hell Ice Co ee provides a strong range, including a lactose-free Salted Caramel, no-added-sugar Slim Vanilla Latte and higher-ca eine-content Double Espresso, o ering broad appeal at a very a ordable £1.25 per can.

The products contain quality ingredients, with a high

milk content and at least 40mg/100ml ca eine content.

With iced co ee projected to almost double in value by 20291, having products available in impulse locations with disruptive PoS is critical.

Hell Ice Co ee can be supported with PoS including branded FSDUs, shelf wobblers and shelf trays. It can also be merchandised in free-on-loan branded fridges, o ering unmissable standout and increasing the chance of impulse purchases.

1

2

3

O er the consumer choice with a great range at varying prices. A premium, mainstream and own-label/entry range gives the consumer the option to trade up for a treat while meeting that pick-me-up need state, too.

Keep the range exciting with new flavours. Ensure you are stocking unique flavours and lines that account for dietary requirements, for example Hell Ice Co ee Salted Caramel, which is lactose-free.

Make the products stand out with strong PoS – suppliers can support with disruption at both the point of purchase and o shelf, to drive that impulse purchase and add incremental sales to your store.

Andrew Pheasant, channel controller wholesale & convenience, Hell Energy

“ICED Co ee is currently seeing strong growth as consumers seek out new and exciting flavours in addition to their regular favourites. Having a good range of flavours, well merchandised and dual sited in highly disruptive locations is important for grabbing that impulse purchase.

“Hell Ice Co ee has a range of ve high-quality, a ordable drinks at only £1.25, o ering great value to consumers. Our eld teams are on hand to support in store with strong branded PoS to provide visibility.”

Sponsored by Velo

If the answer is YES, enter the Better Retailing Customer Engagement Award, and gain the recognition you, your store and your team deserve.

Don’t stop at Customer Engagement. Enter one (or more) of our other categories: Store Development

Merchandising & In-store

The protein category o ers retailers good margins and strong sales opportunities. TAMARA BIRCH nds out how retailers can stay ahead of the curve and drive sales

THE protein products category has been building over the past three years and momentum keeps growing. The protein-bar category alone is now worth £150.4m in the UK.

Brands such as GetPro, Myprotein and On have joined Grenade and Huel in the convenience market, with a growing crossover range of healthy lifestyle, energy and vitamin-enriched products also available.

“The protein category keeps broadening. It’s not just bars – there are protein yoghurts, porridges, milkshakes, snacks and more,” says Chloe TaylorGreen, of Spar in Newcastleunder-Lyme, Sta ordshire.

Product development is strong and new ranges in yoghurts and desserts are gaining traction alongside shakes, bars and balls.

Margins are satisfactory and suppliers o er good pro-

motional support.

While many retailers say the products are popular among gym-goers and teenage boys, Taylor-Green has been surprised at their broad appeal.

“You would not think our store would be in the right area, but even if you are elderly or in ill-health and trying to bulk, a protein shake gives flavours and options,” she says.

RETAILERS report that brands matter to customers buying protein products. Mike Nijjer, who operates the 24-hour Food & Liquor store in Birmingham’s Corporation Street, says protein accounts for 5% of his overall turnover.

“Customers are looking for the highest grams of protein and the best flavours, with brands preferred over own label,” he says.

He stocks Grenade, U t,

Arla, Snickers, Mars, On, and recently took on Starbucks’ new protein co ee product. He also sells pre-workout shots.

Taylor-Green has a wide protein range from brands such as Nocco, across bars, milkshakes and drinks, as well as Grenade, Barebells and Nomadic, and associated healthy lifestyle and vitamin-enriched lines from brands such as Vitamin Well and Celsius.

“A diverse selection of for-

mats and flavours keeps consumers engaged and helps justify the price,” adds Paul Sloane, UK and Ireland country manager at Yfood.

“Retailers can expand the category by o ering a mix of high-protein, ready-to-drink options, protein bars and snacks to cater to di erent preferences. Limited-edition flavours and seasonal rotations can also drive repeat purchases.”

Snickers

Snickers Low Sugar Dark and Low Sugar Hazelnut launched at the end of 2024, designed to appeal to Snickers fans and regular protein-bar users.

Huel

Huel is adding a Cookies & Cream flavour to its Black Edition ready-to-drink range. The drinks contain 35g of plant-based protein, 26 essential vitamins and minerals, 7g of bre and are glutenfree. They have an RRP of £3.80 for a 500ml bottle.

Trek

Last year, Trek launched the Power Bisco highprotein bar, with sales hitting £4.6m since launch. In February this year, Trek also introduced Bisco Protein Flapjacks.

Windmill Organics

Last year, Windmill Organics launched Profusion Organic Chickpea Cakes and Organic Red Lentil Cakes, which are both made of 100% extruded pulses. Windmill Organics has since added Protein Chickpea Cracker Bites and Protein Red Lentil Cracker Bites to the range.

Jimmy’s

Last March, Jimmy’s Iced Co ee collaborated with Myprotein to launch a new iced co ee. Available in Original and Caramel flavours, Jimmy’s Myprotein Iced Co ee contains protein-enriched milk and has 5.6g of protein per 100ml, and is HFSS-compliant.

“GREAT merchandising is key to great category visibility, which maximises sales,” says Shaun Whelan, Jack Links’ convenience, wholesale and out-of-home controller. “The unseen is unsold, so visibility of bestselling products is key.”

Taylor-Green has seen an impressive uplift in protein bar sales since she relocated them under the till with breakfast bars, six weeks ago.

Where one line, for example a Barebells bar, may have sold one or two a week, this is now up to nine or 10 a week.

“I’m really surprised by the sales data,” says TaylorGreen. “All our protein-bar sales are trending upwards in the past six weeks, since we relocated them.

“We tried a hanger option for display, which didn’t work, but grab-and-go with standard

breakfast bars is making people look.”

At the moment, protein shakes might be with chilled drinks or in the milk fridge, Taylor-Green says. Further planogramming is currently underway in the shop, and getting the location right for the typically more expensive and high-margin protein products will be of paramount importance.

Matt Stanton, Head of insight, DCS Group

“RETAILERS need to cater to multiple di erent shopper missions including impulse, planned and food to go. Protein bars, protein shakes and pre-workout shots are essential for stores near gyms or other sports facilities, as shoppers will plan to visit either before or a er their training sessions.

“High-protein foods are trending. Retailers with foodto-go o erings should include protein bars and shakes as part of their meal deals.

“Retailers should also consider stocking optimum nutrition pre-workout shots, especially stores located near to gyms and sports facilities. These are taken just before a workout or other sports activity and are best located at tills in their shelf-ready packaging to maximise visibility and drive impulse purchases.”

PROTEIN products o er a good margins. These higher margins also give leeway for retailers to build in promotions of their own.

Taylor-Green has included Nomadic protein yoghurt in a £4 meal deal.

The Nomadic yoghurt has nearly £2 RSP, but is being sold alongside a drink and a sandwich for £4, with a small reduction in margin.

Imityaz Mamode, of Premier Shop Wych Lane in Gosport, Hampshire, says promotions from suppliers help to make the protein category more appealing.

Mamode stocks eight fla-

vours of Grenade protein drinks, with Booker o ering a two-for-£3 promotion. The normal price is £2.49, so these sell well when on sale. There is a balancing act for retailers in getting a good margin and getting the price right so customers are tempted to buy, especially with shorter-shelf-life products.

“Margins are good on protein, but we don’t want product to be wasted, so if the margin is 47% we might reduce the price so that customers are tempted to try, and then hopefully they will want to come back for more,” Mamode says.

CHARLES WHITTING nds out what’s happening within the spirits category and how retailers can grow sales

RETAILERS looking at their spirits range need to consider their local customer base and also wider trends within the category.

For Suman Sarkar, from Cally News in north London, value is the most important factor.

“Vodka is our bestselling spirit and then whisky,” he says. “We don’t sell many high-end products, it’s a value

product for our customers, but it o ers steady sales. We sell products like Smirno , Captain Morgan and Jack Daniel’s.”

Imtiyaz Mamode, from Wych Lane Premier in Gosport, Hampshire, stockpiled 600 bottles of Smirno when they were on o er at Booker for £10+VAT, and now sees strong sales, pricing them at £14.99, lower than the price-marked

version.

Another trend that retailers should pay attention to is the growing number of people looking for non-alcoholic versions of their favourite spirits. While it’s not something that every store’s demographic is going to be heavily focused on, the number of people reducing their alcohol intake or cutting it out entirely is on the rise,

so it makes sense to cater for these customers.

“We stock 0% gins – Gordon’s mostly – even though it’s only select customers who buy that,” says Milan Vahanaka, from Heathcote Post O ce in Crawley, West Sussex. “In January, we sold a lot of 0% gins when people were doing Dry January, but they also buy it when they’re on a diet.”

• Are you struggling with household billsorfinancial commitments outside of your business?

• Have you experienced retail crime?

If you have experienced a drop in income as a result of unexpected change, disability bereavement or illness, we may be able to support you with a financialgrant as well as provide emotional support

WITH the cost-of-living crisis in full swing, many retailers are reporting a growing demand from customers for smaller bottles of spirits, with Vahanaka seeing people moving away from 70cl and 1l bottles to purchase 20cl or 35cl options instead.

“They prefer smaller options not just because they’re cheap, but it’s a way to ensure

they drink less,” he says. “There is a desire to reduce their alcohol consumption.”

Having a strong range of these smaller bottles can also add an impulsive element to your range, boosting basket spend at the till as people pick up a little treat for themselves at the end of the week.

“We have seen with Wray & Nephew that fractionals are a

key growth driver and should be a prominent part of independents’ ranges, not least because they’re an appealing solution while people’s disposable income is stretched,” says a Campari spokesperson.

“The impulse-led positioning of disposable-vapes displays would be a great opportunity for smaller bottles of popular spirits.”

John Parkinson, John’s Broadway News, Penrhyn Bay, Conwy

“THE spirits category is driven by brand and price. It’s a footfall driver and we try to be as competitive and fair as we can be. It’s all very well stocking products at the RRP or above, but it’s pointless if you’re only selling a bottle a week. And if you’re not competitive on something like spirits, people o en won’t come to you for anything else.

“We keep the spirits behind the counter and we sell quite a lot of the smaller bottles – especially in vodka. We’ve not seen much demand for flavoured spirits recently, although we have a 1l bottle of melonflavoured Robert Cavalli vodka, which we sell for £20 and that sells very well. Whisky is also a perennial favourite.”

BECAUSE spirits will usually be displayed behind the counter for security purposes, it’s important to make sure they are as visible, legible and attractive as possible for any customers standing at the till. Lighting is important in this regard as it helps customers see what you’ve got. Retailers should contact reps and suppliers for promotional support

either in the form of PoS or other merchandising advice to improve the display.

“It’s always a good idea to capitalise on brands that have a lot of marketing support,” says the Campari spokesperson. “Aperol, for instance, had a huge campaign over Christmas, and Wray & Nephew will be driving their rum punch serve through festival activa-

SPIRITS have real seasonality opportunities and retailers should make sure they are stocking up and getting their merchandising in place well ahead of schedule.

This is as important for speci c calendar days – like Mother’s and Father’s Day –when spirits will be purchased as a gift, as it is for wider seasons, as we leave winter with their darker spirits and move into the warmer months where

tion this summer.”

Stocking products by category allows for easy comprehension from customers, but it’s also important to make pricing clear and have an obvious progression from the most popular to the most expensive, premium options, so customers know where to look and aren’t surprised when they come to pay.

gins, rums and vodkas will be more prevalent.

“Dark spirits have clear overtrades over winter, with rums and cognac doing particularly well at Christmas,” says the spokesperson for Campari. “At these high-volume times of year, it’s best to avoid promoting di erent expressions of the same spirit at the same time (VS and VSOP cognac, for example) to ensure shoppers have that base price

in mind when they come back for the brand.”

Chris Seale, managing director of Speciality Brands, adds: “Retailers can make the most of seasonality and gifting occasions, such as Mother’s and Father’s Day, to help boost sales. In the rum category, for example, consumers will look at lighter rums in the summer as they make cocktails at home while seeking sipping options in winter.”

The RETAIL EXPRESS team nds out which unusual products and categories are driving sales for retailers

1

Sheraz Awan, Westerhope Convenience Store, Newcastle upon Tyne

“TRENDING items are always a good way to stand out, but you’ve got to be on the ball.

“The American pickles were a thing last year and then passed. Freeze-dried sweets came and went within three months, but it was important to get hold of them and get selling while they were big. Keep an eye on US candy and anything new happening in vapes.

“Dubai Chocolate is the big thing at the moment and I do think it will stick around. I can’t see that �inishing any time soon.

“We had three large versions and we’ve now cut that down to one. But we also have smaller bars that we’re selling for £3.99, rather than £7.99 for the bigger bars. Every other shop in our area is selling it for £10, but we take the approach of piling it high and selling it cheap. We want that footfall through the door, which these products can bring you.”

2

David Worsfold,

Farrants Newsagents, Cobham, Surrey

3

Andy Robinson, Summer Lane Stores, Wombwell, South Yorkshire

“I SPEND most of my time sourcing new, interesting and exciting products that I can put on my shelves to boost dwell time and basket spend. I’ve got a huge range at the moment of 24 bottles from Legami. They’re fancy bottles that will keep whatever’s inside them hot or cold for 24 hours. They retail for £30-40 a bottle, but if you display them nicely, then parents will pass them while their kids are looking at sweets and pick one up. I’ve just introduced a children’s version of them as well, so the parents might also get one for them as well.

“I’ve just taken up business with Lilalu, which is a company that does rubber ducks in a variety of costumes. There are 115 different types of duck and they sell for £10 a duck, as a gift. If someone comes in and buys a birthday card, they might just pick one up as well. Finding these products is one of my biggest challenges.”

“WE have a big toy section, which we put in after a re�it. It’s about 1x1 metres. It’s full of water pistols and soft play kits and more. It adds that point of difference to the store.

“We source it all from BJ Toys. They come in every two-tothree weeks and will put something different in there every time. They’ll often leave us a spare box as well so we don’t run out.

“You’ve got to be looking for new stuff all the time. If something’s not selling, then you can get rid of it and replace it with something else. You need to be keeping up with trends and looking for new ideas rather than sitting back and thinking the customers will come to you naturally. We’re not a massive shop, but we try to get everything people need, from sweets to a �ive-amp fuse. We’ve even got sherbet lemons and Murray Mints for the older generations, because if they can’t get them with us, they might do their whole shop elsewhere.”

In the next issue, the Retail Express team nds out how retailers are reducing crime in their stores. If you have any problems you’d like us to explore, please email