EXECUTIVE COMMITTEE

Jon Syre, Chairman Cascade Hardwood, LLC

Bucky Pescaglia, Vice Chairman Missouri-Pacific Lumber Co., Inc.

Jeff Wirkkala, Past Chairman 2020-2022 Hardwood Industries, Inc.

MISSION LEADERS

Sam Glidden, ITS and ITSEF GMC Hardwoods, Inc.

Ray White, Lumber Services Harold White Lumber, Inc.

Joe Pryor, Education Services Oaks Unlimited

Rich Solano, Convention Pike Lumber Company, Inc.

Stephanie VanDystadt, Membership & Networking DV Hardwoods, Inc.

Rob Cabral, Market Impacts Upper Canada Forest Products, Ltd.

DEPUTY MISSION LEADERS

Burt Craig, Membership & Networking Matson Lumber Company

Tom Coble, Market Impacts Hartzell Hardwoods, Inc.

Dennis Mann, Convention Baillie Lumber Co.

Tom Oiler, Lumber Services Cole Hardwood, Inc.

Brant Forcey, ITS and ITSEF Forcey Lumber Company

George Swaner, Education Services Swaner Hardwood Co., Inc.

COMMITTEE CHAIRMAN

Sam Glidden, Rules GMC Hardwoods, Inc.

THE VOICE OF THE HARDWOOD INDUSTRY

National Hardwood Lumber Association PO Box 34518 • Memphis, TN 38184-0518 901-377-1818 • 901-382-6419 (fax) info@nhla.com • www.nhla.com

To serve NHLA Members engaged in the commerce of North American hardwood lumber by: maintaining order, structure and ethics in the changing global hardwood marketplace; providing unique member services; promoting North American hardwood lumber and advocating the interest of the hardwood community in public/private policy issues; and providing a platform for networking opportunities.

For advertising contact: John Hester j.hester@nhla.com or 901-399-7558

NHLA STAFF

Dallin Brooks, Executive Director dallin@nhla.com

John Hester, Chief Development Officer j.hester@nhla.com

Renee Hornsby, Chief Operating Officer r.hornsby@nhla.com

Dana Spessert, Chief Inspector d.spessert@nhla.com

ACCOUNTING

Desiree Freeman, Controller d.freeman@nhla.com

Ashley Johnson, Office Administrator a.johnson@nhla.com

Jens Lodholm, Database Manager j.lodholm@nhla.com

INDUSTRY SERVICES

Mark Bear, National Inspector m.bear@nhla.com

Tom Byers, National Inspector t.byers@nhla.com

Kevin Evilsizer, National Inspector k.evilsizer@nhla.com

Simon Larocque, National Inspector s.larocque@nha.com

Benji Richards, Industry Services Sales Manager b.richards@nhla.com

INSPECTOR TRAINING SCHOOL

Roman Matyushchenko, Instructor of the Inspector Training School r.matyushchenko@nhla.com

MARKETING/COMMUNICATIONS

Melissa Ellis Smith, Creative Director m.ellis@nhla.com

Brennah Hutchison, Junior Copywriter b.hutchison@nhla.com

Darci Shannon, Communication & Outreach Specialist d.shannon@nhla.com

MEMBERSHIP

Julia Ganey, Member Relations Manager j.ganey@nhla.com

Welcome to Member Insights, a new section in Hardwood Matters for sharing your thoughts and experiences on the hardwood industry. We invite you to contribute!

Submission by BRUCE NESMITH

New Red Oak markets require it to be cheaper and more desirable than competing products. The availability and cost of those competing products drive demand.

First, let’s take a look at historic hardwood lumber markets. Until the last third of the twentieth century, wood was the construction material of choice for everything. It was the cheapest, most versatile raw material available for many uses. Hardwood was used in everything from automobile parts to waste bins.

When manufacturers of other products looked for markets, they tried to take market share from the most significant competitors, wood products. This cutthroat competition targeted paper products, building materials, and hardwood users. It came from many different industries. Over the past one hundred years, the paper industry has been decimated by plastics and computers, the softwood industry has had to reinvent itself to stay cost-competitive over alternative products, and the hardwood industry has tried to ignore the fact that it’s dying.

The simple fact is that hardwoods are a commodity product, and cost is the driving market factor. There are many wood substitutes on the market today. I’m sure that if you look, your house is full of them. You bought them because they were cheaper or required less upkeep. Look around at them. This is the competition, not the sawmill in the next county.

Every plastic bag, every plastic rifle stock, every steel stud, and everything you touch that used to be wood drives a nail in the wood industry’s coffin. This is a worldwide phenomenon. Hardwoods lost their protected markets with the free trade treaties of the 1980s and

— continued on page 11

Share Your Voice in Hardwood Matters!

Send your submissions to NHLA at info@nhla.com and join the conversation shaping our industry's future.

Premier Sponsor

OCTOBER 2-4, 2024

Don't miss this must-attend event! Join us to celebrate the best in the lumber industry!

Please note that while we value all submissions, we cannot accept all pieces. Thank you for understanding and for your consideration. THE 2024 NHLA ANNUAL CONVENTION IS ONLY 2 MONTHS AWAY!

Our annual convention features an incredible lineup of speakers, industry education, networking, cutting-edge technology, and special events. Don’t miss the excitement and insights!

www.nhla.com

Arriving at Reagan International Airport in late May for my second Hardwood Federation fly-in, I knew just enough to have a little confidence and to be very bold! This famous quote was undoubtedly at the top of my mind: “If you are not at the table, you are on the menu.” In years past, the grading rules and the school were the most critical action items; now, it is advocacy and promotion. It’s time to engage, get involved, and have your voice heard! So, I was enthusiastic as I reviewed the well-prepared issues we, as a lobbying group for the hardwood industry, would focus on this year.

Approximately 60 people from our industry went to the Hill for the fly-in. For 18 of those people, this was their first time. Together, we completed 109 meetings and had 40 members of Congress at our receptions. This is all very impressive! However, as I walked up the Hill to another building to meet with another member of Congress, I couldn’t help but fantasize about what could be. I kept passing other lobbying groups, all dressed in coordinating t-shirts. Specifically, the first responders’ group was everywhere that day. They were on the sidewalks, in the halls, in the offices. I am considering having a Hardwood Federation fly-in with attendance numbers similar to the annual conventions. A thousand people on the Hill, lobbying issues critical to our industry’s viability and future. That is how we will create change and make ourselves heard!

Just as in advocacy, the promotion of our products and industry is of critical importance. We will only be impactful if we have significant involvement from our entire industry. Think about a thousand of us all roaming the halls of Congress and meeting with our representatives. Think of the impact if we got involved in promoting hardwood by leveraging social media sites, appearing on home improvement TV channels, and engaging with architects to explain our true and honest environmental story of carbon sequestration and carbon storage! We would be shaping our industry for the better and increasing demand.

It is hard to define success in promotion and advocacy. Did our promotional efforts change how an architect specified a university’s flooring? Did my efforts during the fly-in help change a member of Congress’s opinion on equipment depreciation for tax purposes? While it is difficult to measure success directly, I know with absolute certainty that these efforts are essential. If we don’t advocate for and promote our industry, then those two questions become moot, and we never even had a chance. I always wonder why somebody doesn’t do something about that, and then I realize I am somebody!

As someone once said, “I am somebody. You are somebody. We all are somebody.” Let’s get with it. Please get involved!

Together, we can grow and stabilize the hardwood industry!

Contact Dana Cole at the Hardwood Federation (202) 463-2705.

Contact Dallin Brooks for the Real American Hardwood Coalition at (901) 377-0182.

Contact John Hester at the National Hardwood Lumber Association (901) 399-7558.

Thank you, as always, for taking the time to read my letter; I hope it has spurred in you a need to get involved. I look forward to seeing you at the next Hardwood Federation fly-in!

Jon Syre NHLA Chairman | Cascade Hardwood

The RossiGroup has been helping customers navigate the global hardwoods industry for almost a century.

We have raised the bar with our new state-of-the-art Emporium Mill and kiln facilities, our long-term supply agreements, and our uniquely personal brand of customer service.

We deliver a world class selection of hardwoods – including the gold standard in cherry – all sorted, milled and dried to tolerances, consistencies, and yields that were not even possible five years ago. Visit us www.rossilumber.com or call 860-632-3505

What issues do our hardwood products have? Solid hardwood faces scrutiny over price, longevity, maintenance, acclimatization, and labor. Concerns for the environment, sustainability, and safety also come to mind.

Interestingly, the approach the NHLA took with their recent computer purchase mirrors some of the challenges and opportunities faced by the hardwood industry. The NHLA just purchased a new computer; rather than selling Microsoft Office as a one-time software program that needs occasional maintenance, they now sell it as a subscription that you renew every year. Even though I still want the physical disk in my hand, I can get an ROI by keeping it for more than four years. Buying something without a subscription is getting harder and harder to do. They know that the better business model is to keep you coming back. So they sell you on always having the newest updates at optimal performance, and a low annual fee is more accessible on the books than the larger one-time cost.

Hardwood flooring, cabinets, furniture, ties, matting, pallets, and other products aren’t software, but we must understand that we are not just selling products. We sell products that need installation, maintenance, removal, etc. We must start offering more services that maintain our products at their best performance and highest aesthetics and ensure hardwood replacement at the end of its service life.

Goods and services have long been the backbone of the global economy. Goods are always needed, but services impact our future more heavily than we think. If people don’t know how to design or maintain hardwood, they won’t use it. We need to ensure services are provided for our products, but we sell the lumber and let everyone else figure it out. Supporting our customer’s complaints seems like barking up the wrong tree. But it is the future of hardwood as

much as it is for software or softwood. We have to compete against alternative materials that are much more vertically integrated. Partnerships with our customers, their installers, and others to provide services are new opportunities to help them sell more hardwood and help us maintain and grow our market share.

A service partnership is part of the holistic approach to the hardwood life cycle. We want to know when its service life ends and that we are willing to take it and replace it. It has a cost but can be passed on over time, just like buying software. Start paying and keep them paying monthly to maximize your profits and their loyalty.

Selling services is just as crucial as the hardwood of sale; that is one common ground we have with software.

Dallin Brooks NHLA Executive Director

dallin@nhla.com | 901-377-0182

Some see wood, we see purpose.

With hardwood lumber, we enhance our customers' business's and the health of the planet. From responsible harvest to fabrication and installation, from use and re-use, hardwood lumber enriches and sustains the places we live, work, and play. As North America's leading distributor of hardwood lumber, we are proud to partner with you to bring unique products to the market through the untold possibilities of hardwood lumber.

What you need. When you need it. By people that know and care.

We are excited to welcome Darci Shannon to the NHLA team as our new Communication & Outreach Specialist. In this role, Darci will lead member outreach efforts, promote events and programs, and champion the Association’s initiatives. Her work will be crucial in enhancing member engagement and advancing NHLA’s mission through effective communication strategies and content management. We look forward to the positive impact she will bring to our organization. Darci can be reached by email at d.shannon@nhla.com and by phone at 901-399-7567.

We are delighted to welcome Brennah Hutchison to the NHLA team as our new Junior Copywriter. In this role, Brennah will be responsible for conducting research, crafting, and refining a variety of written communications, including promotional materials, marketing collateral, website content, email campaigns, ad copy, video scripts, recruitment publications, social media content, and other essential materials. Working within the NHLA marketing team, Brennah will ensure that all messaging aligns seamlessly with the Association's brand and voice. We look forward to her contributions in promoting and enhancing the NHLA brand. Brennah can be reached by email at b.hutchison@nhla.com and by phone at 901-399-7580.

Please join us in extending a warm welcome to both Brennah and Darci as they begin their respective roles. They are committed to advancing our mission and enhancing our services.

Darci M. Shannon has always excelled at building relationships, a skill she honed in the close-knit community of Kahoka, MO. Influenced by her mother’s role as a funeral director, Darci understood the importance of connection and community from a young age. Darci attended Missouri Baptist University in St Louis. After graduating in 2009 with a Bachelor of Science degree, Darci taught math, behaviors and Title reading as well as coached track and was an assistant softball coach. After her teaching career, she joined Yoder Saws Inc. as an office manager, advancing quickly to sales and significantly boosting the com pany’s success through her customer-focused approach. Here, Darci’s connection to NHLA began, where she made valuable connections and demonstrated her proficiency in sales and customer relations.

Her dedication to communication and community engagement naturally led her to the Communication and Outreach Specialist role at NHLA. Darci’s love for hardwoods is deeply rooted in her family history; her father, known for his meticulous craftsmanship, built their home, and her grandparents owned a lumberyard.

Darci lives in the countryside outside Kahoka with her children, Mason, Dane, and Evan Marie, her boyfriend Chris (a Locomotive Engineer for BNSF), two chocolate labs, and three European basset hounds. The family enjoys attending sporting events, fishing, hunting, and spending time together. Fun fact: Darci was an extra in the movie Up in the Air with George Clooney.

When I was a kid, I went car shopping with my parents. I grew up in a small town in Missouri, so you had to go to the big city of Jonesboro, AR, if you wanted any selection. The one memory I have from that trip was going into the showroom with a brand-new Jaguar on the floor. It was a V12, deep purple, with crystal clear windows and sparkling chrome. I had never encountered a Jaguar before, but it was the most beautiful thing I had ever seen. There was no price on the car, and my dad, in all his redneck glory, asked a sales guy, “What’s something like that cost?” The guy looked at my dad and said, “If you have to ask, you can’t afford it.” At 9 or 10 years old, I didn’t know how offensive that was. I heard, “It’s beautiful, fast and expensive.” Needless to say, that dealership didn’t earn our business that day.

I found out later in life that even though the “sticker price” for a new Jaguar is higher than that of many luxury cars, it drastically loses its value faster than most other vehicles in its class. It’s considered mechanically unreliable, the maintenance is expensive, and they’re seen as not keeping pace with technology . . . among other reasons.

Just like the allure of a beautiful car, the NHLA Convention and Exhibit Showcase offers a luxurious experience—but unlike the fast-depreciating Jaguar, the NHLA Convention holds its value, providing unmatched benefits that make it an indispensable event for industry professionals.

At the NHLA Convention, the educational seminars are like getting the latest model with all the advanced features. These sessions offer cutting-edge insights and knowledge, ensuring attendees stay ahead of industry trends. The information gained here is invaluable and contributes significantly to professional growth and business advancement.

The exhibit hall is a marketplace filled with diverse and top-quality suppliers, like a showroom with the best luxury cars. Here, you can meet suppliers from across the globe, evaluate new products, and establish vital business connections. The variety and quality of suppliers present are unparalleled, providing a unique opportunity to explore a wide range of offerings in one place.

Networking at the NHLA Convention is not just about mingling; it’s about forging strong, lasting connections. These sessions offer the chance to meet domestic and international contacts you wouldn’t find elsewhere. The relationships built here can lead to significant business opportunities and collaborations, like finding a rare, high-performing vehicle that stands the test of time.

A common misconception is that attending the NHLA Convention is expensive. However, this is far from the truth. The NHLA Convention offers exceptional value for money, often costing less than comparable conventions while providing much more content and amenities. Don’t believe me? Compare sticker prices. Attendees also enjoy complimentary breakfast, lunch, evening receptions, and an abundance of beverages throughout the event. This level of hospitality ensures you

can focus on making the most of your experience without worrying about additional costs, making it the best value in its class.

The NHLA Convention boasts keynote speakers who are not just experts in their field but are also recognizable names. These speakers provide transformative insights and strategies that can drive your business forward, similar to a luxury car offering performance and prestige.

The NHLA Convention and Exhibit Showcase epitomize luxury and value in the world of conventions. It combines top-tier educational content, diverse supplier interactions, unrivaled networking opportunities, and high-profile keynote speakers—all at a cost that provides exceptional value. Unlike the fleeting allure of a fast-depreciating luxury car, the benefits of attending the NHLA Convention are long-lasting and impactful.

What do I need to do to put you in the Convention today?

John Hester NHLA Chief Development Officer

j.hester@nhla.com | 901-399-7558

— Member Insights continued from page 3

90s. American hardwoods have to be cheaper than competitive products to compete in world markets. It is more affordable than wood from Africa or South America. It is more inexpensive than plastics from Asia. Cheaper than ceramics from Spain. Not prettier, more nostalgic, or more “green.” It is more affordable to use and maintain. Period!

All hardwood-using markets are under attack. No one is exempt. Pallets, railroad ties, cabinets, flooring, furniture, and accessories are all targeted by other nonwood competitors. And COST is the driving force. Not appearance or tradition or nostalgia.

As computers and the internet destroyed the paper industry, cheaper alternatives are destroying the traditional hardwood industry. There has to be a need or demand. Just as buggy whips are no longer necessary, natural hardwood is no longer required.

Surviving hardwood producers will have the lowest manufacturing costs in areas with abundant cheap timber or those in a specialty market. Or those under-the-radar micro-producers who are unregulated. This is true for the hardwood supply chain, from landowners to retailers.

Finding new markets for Red Oak will require that it be cheaper than competing products. Cheaper Red Oak has to come from lower timber prices and efficient manufacturing. Both are necessary; neither alone will be sufficient.

By DANA COLE, Executive Director of the Hardwood Federation

he November elections are rapidly approaching, summer is waning in D.C., and political pundits are busy analyzing what can be done in the few legislative days left on the calendar before the people head to the voting booth.

In the handful of weeks between now and the election, one or both Houses of Congress will be in session for only about half of them. Both Chambers scheduled recess for August as is tradition. Less traditional and more political are plans to also be on recess for October, the run-up to the November election.

The top priority for legislators in the days they spend in D.C. will be moving the appropriations bills that fund government operations before they expire in October. Bills of this nature start in the House and move to the Senate for consideration before going on for Presidential signature. The annual defense policy bill, the National Defense Authorization Act, will likely be acted on before the end of the year. Reauthorization of the Farm Bill, which has already been extended for one year past its deadline, is less likely, but still possible. While a bipartisan House bill has moved forward, the Senate is still working to develop final language. Democrats in the Senate released their framework and some initial language a few months ago. The Republicans recently released their priorities framework, indicating that negotiations between the two sides may begin soon.

Moving a tax bill reinstating many of the provisions of the Trumpera Tax Cuts and Jobs Act while boosting child tax credits seems unlikely, but key players, including Senator Ron Wyden (D-OR) and Congressman Jason Smith (R-MO), continue to push forward.

For those operating outside the Beltway, it is unfathomable why these issues cannot be resolved promptly and

orderly. If a business permit or license expires, you renew it. If there are bills to be paid, you cut the check. Unfortunately, while Congress is good at imposing rules for others to follow, it is also very good at delaying action that is, by most standards, essential. Why?

First, it is important to remember that our system of government was not created to be quick. The three branches of government were designed to slow things down, allow for dissenting options, and force policy debate. It works. The ever-growing tensions between the two main political parties act as a further drag on agreement and action.

Most, if not all, of the action on the bills noted above will be delayed until the “lame duck” session, between the election and the swearing-in of the new Congress and President. At that point, the table will be set for the next Congressional session, and current leaders will understand exactly what leverage they have at the end of 2024 compared to early 2025. Both parties will strategize how to maximize their priorities . . . whether that means taking action before Christmas or delaying so that legislation can be dealt with in the new year.

The bottom line for the Hardwood Federation team is that we must keep working on both sides of the aisle to ensure everyone understands OUR priorities, and try to get the best result from whatever the eventual election outcome. This is also what makes our unified voice so crucial. Hearing the same message from our association members and their company members under the Hardwood Federation banner strengthens our action case. And louder.

Candidates will be out in full force this fall. Look for talking points and helpful hints about how you can spread the Hardwood Federation message for federal action that helps support our outstanding industry.

By ANNETTE FERRI, NWPCA Vice President, Communications

The importance of hardwood markets cannot be overstated, especially considering that nearly a billion new wooden pallets are manufactured annually. The pallet industry consumes roughly 40% of all hardwood lumber production - or about 3.5 billion board feet of hardwood lumber annually. The durability, reliability, safety, and sustainability of hardwood pallets are essential to global logistics.

Softwood has gained substantial ground in wooden pallet manufacturing, accounting for 80% of the material now used and equivalent to 30% of all softwood lumber production, according to Forisk. Hardwood remains vitally important, and hardwood market supplies remain essential as partnerships and agreements help shape the future of our crucial sectors.

Hardwood: The Backbone of Wood Packaging

Wooden pallets play a crucial role in global logistics. Of all the materials used, wood stands out for its exceptional strength, sustainability, and ease of configuration. This is why, according to Modern Materials Handling, wood continues to dominate the pallet market at over 90% year after year.

Despite the rise of softwood alternatives, hardwood maintains a strong foothold in the market. This enduring preference underscores the significance of hardwood markets to the wood packaging industry, driving demand for species like oak, maple, and cherry.

Ensuring the sustainability of hardwood resources is a priority and a responsibility that we share. Recognizing this, stakeholders in the wood packaging sector work closely with allied partners such as the NHLA to promote responsible forestry practices and forest management and collaborate on challenges and opportunities.

NWPCA President Brent McClendon recently joined a strategic planning session in Memphis with sixty hardwood industry leaders, association executives, and government representatives. The goal was to address sector challenges and opportunities through enhanced wood utilization, product innovation, and market development. Collaborating with organizations like NHLA, industry

players work together to maintain healthy forests, balancing conservation efforts with sustainable wood sourcing

One noteworthy development is the Memorandum of Agreement (MOA) between the US Forest Service and key industry representatives, including the National Wooden Pallet & Container Association (NWPCA) and the Hardwood Federation. Central to the MOA is creating an online carbon data platform to better understand and manage carbon sequestration in forests.

Over the last five years, the NWPCA has prioritized acquiring verifiable data on the sustainability of wood pallets. The NWPCA and the Pallet Foundation received funding to conduct a new lifecycle assessment and advance those efforts. The grant will help the NWPCA deliver a custom carbon calculator tool for businesses later this year.

In a policy-driven global supply chain, industry cooperation and engagement are vital for thriving wood markets. Domestic and international policies can threaten the industry unexpectedly. NWPCA’s consultancy in Brussels secured policy wins in the new Packaging and Packaging Waste Regulation, preventing disruptions to the international flow of wood pallets and crates into the EU and protecting the entire supply chain, including hardwood providers.

Through collaboration and partnerships, stakeholders are safeguarding hardwood resources and driving innovation and sustainability. By working together from forest to factory, the wood packaging sector can ensure a future where sustainability, economic viability, and stewardship go hand-in-hand.

Annette Ferri, NWPCA Vice President, Communications

By BRENNAH HUTCHISON, Junior Copywriter

“I believe this is like an elegant story—easy to follow—but I don’t want to get caught up in the dream . . . I don’t want to be greenwashed.”

Outsiders often assume the hardwood industry is merely spinning a “greenwashed” narrative to appear more environmentally conscious than we are. And how can you blame them? As an average consumer, it is challenging to discern which eco-conscious products are worth investing in. Americans are constantly inundated with dire news about climate change and global warming, creating a sense of urgency to purchase products that claim they are “eco-friendly,” “green,” or “produced with renewable energy.” However, what do these terms genuinely signify? While they all seem positive and “sustainable,” such blanket statements often obscure the reality of what is being produced.

Upon examining the Federal Trade Commission’s (FTC) “Guides for the Use of Environmental Marketing Claims,” or “Green Guides” (which have not been amended since 2012), it becomes clear that the average citizen has minimal knowledge of how companies can market their services and products as “recyclable” or “net zero” without making substantial efforts toward genuine

environmental change. This lack of transparency is intentional. For instance, under the “Green Guides” section: “260.16 Renewable Materials Claims,” the FTC states:

Research suggests that reasonable consumers may interpret renewable material claims differently than marketers may intend.

Example 1: A marketer makes the unqualified claim that its flooring is ‘made with renewable materials.’ Reasonable consumers likely interpret this claim to mean that the flooring also is made with recycled content, recyclable, and biodegradable. Unless the marketer has substantiation for these implied claims, the unqualified ‘made with renewable materials’ claim is deceptive.

As a hardwood industry trade association, NHLA knows that examples like the above are all too common. Greenwashing is any communication that misleads people into adopting overly optimistic

beliefs about an organization’s environmental performance, practices, or products. It was only last year that the Decorative Hardwoods Association (DHA) challenged Mohawk Industries for using the slogans “Wood Without Compromise” and “The Perfect Wood for Your Home” for its RevWood laminate flooring. These slogans are misleading because RevWood does not have a wood-wearable surface. The slogans implied that the product was genuine hardwood, thereby deceiving consumers about the nature of the product. The National Advertising Division (NAD) of the Better Business Bureau (BBB) ruled the slogans deceptive, recommending their discontinuation as RevWood does not have a genuine wood surface (WoodWorkingNetwork). By suggesting that RevWood’s surface is authentic hardwood, Mohawk Industries created a false impression of the product’s environmental benefits and sustainability. The company selectively disclosed information that would lead consumers to believe the product is more environmentally friendly than it is.

Expectedly, this is something that NHLA’s Executive Director,

“The sheer volume of fake wood at NeoCon was astonishing. Everything seemed to have a printed wood grain pattern. This trend reveals a desire for the aesthetic of wood, but people are being misled by imitations that are environmentally harmful and undermine the principles of biophilic design.”

Dallin Brooks, encountered at this year’s NeoCon convention in Chicago. “The sheer volume of fake wood at NeoCon was astonishing. Everything seemed to have a printed wood grain pattern. This trend reveals a desire for the aesthetic of wood, but people are being misled by imitations that are environmentally harmful and undermine the principles of biophilic design.” NeoCon serves as the world’s leading platform for the commercial interior design industry. At this convention, the Real American Hardwood® Coalition (RAHC), in collaboration with the National Hardwood Lumber Association (NHLA), curated an informational booth and launched its newest website, realamericanhardwood.pro. This website showcases innovative and sustainable hardwood solutions tailored for commercial design and architecture. Users can explore American hardwoods’ unmatched durability, versatility, and environmental benefits. The new website educates users on the industry’s sustainability practices and design options, as well as features projects using mass timber and hardwoods. It provides comprehensive information on NHLA’s efforts to promote ethical forestry and the environmental benefits of using hardwood. Additionally, it offers expert insights into the hardwood industry’s latest trends and best practices. The site also serves as a community showcase, offering networking opportunities where users can display their hardwood projects, fostering a sense of community and shared creativity.

Building on this engagement with the design community, NHLA’s marketing team sought to gain further perspective and educate commercial designers and architects at the convention. In December of last year, in preparation for NeoCon and the launch of realamericanhardwood.pro, NHLA formed a focus group with commercial designers and architects to discuss the value of hardwoods and sustainable forestry. Given the opening quote of this article, which was coined by one of our focus group members, participants in these

discussions articulated the confusion that is being a responsible consumer. For example, consider the complexity of understanding that deforestation is not occurring in the United States bearing in mind the rhetoric on deforestation that is often circulated: “But I think it’s also hard to really wrap your head around just the magnitude, right? We picture cutting down trees, and these deforested areas in the Amazon. But we don’t necessarily associate healthy forestry in North America.” These insights highlighted a common knowledge gap; many outside the hardwood industry are unfamiliar with terms or concepts that clarify the hardwood lifecycle and its sustainable possibilities. Participants often voiced misunderstandings when differentiating management practices between boreal and tropical forests. This is why it was unsurprising when another participant stated, “I think there’s a lack of education, and maybe through advertising, or articles, or publications, or print, or social media or all of the above. Rather than just telling the story [of hardwood], make it a little more educational and informal. Like, here’s your little guide that you can screenshot and keep on your phone and star as a favorite.”

While most Americans are willing to pay more for sustainable products (PolitiFact), as of 2023, 54% of U.S. consumers have yet to immediately trust brands that claim to be sustainable (YouGov), and firms have developed more complex relationships with suppliers and stakeholders. Supplier relationships are often political, meaning power dynamics, mutual interests, and strategic negotiations influence them. In this era of information silos, targeted messaging is calculated. This targeted messaging often exploits homophilic information, where people prefer to consume information confirming their beliefs rather than engaging with diverse or contradictory perspectives. Social media significantly influences the spread of such targeted messaging, and intermediaries such as government and certifying bodies help proliferate these messages.

While most Americans are willing to pay more for sustainable products (PolitiFact), as of 2023, 54% of U.S. consumers have yet to immediately trust brands that claim to be sustainable (YouGov), and firms have developed more complex relationships with suppliers and stakeholders.

Consequently, the intended audience often doesn’t realize that the message is only part of the truth—just what they wanted to hear—leading them deeper into information silos where conflicting communication can coexist without scrutiny. This manipulation capitalizes on confirmation bias, reinforcing pre-existing notions. For example, IKEA was considered a beacon of sustainability until June 2020, when the furniture retailer was linked with illegal logging in Russia. A report by the NGO Earthsight revealed that some of IKEA’s most popular children’s furniture was likely made from wood linked to unlawful logging in Siberia. The Forest Stewardship Council (FSC) was criticized for missing this illegal activity. “FSC is aware of the devastating impacts that illegal sanitary logging has on the environment, economy and local communities in Russia, and we certainly do not support it,” it said. IKEA acknowledged using wood from logging companies associated with illegal practices and announced they had cut ties with those suppliers. They also banned the use of timber from sanitary logging in the Russian Far East

and Siberia and committed to improving their oversight of supply chains. However, this incident exemplifies how even companies with solid sustainability reputations can engage in greenwashing, misleading consumers about the true environmental impact of their products (NBC News).

So, what can we do as stewards of the hardwood industry to prevent greenwashing and ensure consumers are investing in hardwood products that are genuinely environmentally conscious?

1. First, we can lobby for stricter enforcement of the FTC Green Guides and advocate for increased penalties for deceptive advertising and amendments that cater to the hardwood industry.

2. Collaborating with environmental and consumer groups for joint campaigns and shared resources can amplify our efforts.

The Real American Hardwood Coalition has launched its Build Your World™ campaign in partnership with Magnolia Network. The ads are inspiring a national audience by educating them on the benefits of Real American Hardwood® products. The campaign was made possible thanks to voluntary contributions from the hardwood industry. Your continued support is critical to advance the initiative and reclaim market share for the benefit of all industry stakeholders.

Help Build Your World. Learn more about the RAHC’s promotion efforts, see a list of supporters, and make a voluntary, tax-deductible contribution at RealAmericanHardwood.com/industry or scan the QR code.

3. To further enhance our communication, we should develop consistent and straightforward communication strategies by incorporating accessible language and imagery, ensuring our messages resonate with diverse groups. For instance, we have been brainstorming ways to simplify concepts like “carbon sequestration” into more understandable terms like “carbon banking.”

4. Additionally, creating a consumer guide or checklist can help identify and avoid greenwashing, empowering consumers to make informed and responsible choices.

5. Finally, NHLA members can actively engage in community outreach and educational initiatives, such as industry adjacent conventions, to spread awareness about the genuine environmental benefits of hardwood.

By doing so, we can position ourselves as credible industry ambassadors who advocate for transparency and sustainability, ultimately restoring trust in our industry and promoting a truly green future.

Canup, B. (2023, July 17). Red light on ‘greenwashing’? US regulatory agency takes fresh look at deceptive climate claims. PolitiFact, https://www.politifact.com/article/2023/ jul/17/red-light-on-greenwashing-us-regulatory-agency-tak/ Federal Trade Commission. Green guides, https://www.ftc.gov/news-events/topics/ truth-advertising/green-guides

Montgomery, A. W., Lyon, T. P., & Barg, J. (2023). No end in sight? A greenwash review and research agenda. Organization & Environment, 1-36. https://doi. org/10.1177/10860266231168905

Nast, C. (2021, July 15). Ikea likely sold furniture linked to illegal logging in forests crucial to Earth’s climate. NBC News, https://www.nbcnews.com/science/environment/ikealikely-sold-furniture-linked-illegal-logging-forests-crucial-earth-n1273745

Supran, G., & Oreskes, N. (2017). Assessing ExxonMobil’s Climate Change Communications (1977-2014). Environmental Research Letters, 12(8).

Supran, G., Rahmstorf, S., & Oreskes, N. (2023). Assessing ExxonMobil’s global warming projections. Science, 379(6628).

van Halderen, M., Bhatt, M., Berens, G. A. J. M. J., Brown, T, & van Riel, C. B. M. (2016). Managing impressions in the face of rising stakeholder pressures: Examinine oil companies’ shifting stances in the climate change debate. Journal of Business Ethics, 133(3), 649-674.

Adams, L. (2023, June 10). Advertising watchdog wants Mohawk to discontinue some RevWood flooring. Woodworking Network, https://www.woodworkingnetwork.com/ news/woodworking-industry-news/advertising-watchdog-wants-mohawk-discontinuesome-revwood-flooring

Fernandes, J. (2023, April 25). Are consumers mistrustful of brands’ green claims? YouGov, https://business.yougov.com/content/46193-global-are-consumers-mistrustfulof-brands-green-claims

By DANA SPESSERT, Chief Inspector

Over the past ten years, the NHLA has become more of a partner for our membership and industry. Evolution has been possible through the very experienced and talented team of the NHLA.

The National Inspectors have experience in this industry that goes far beyond the scope of inspecting hardwoods, including sawmills, dry kilns, machine operation, management, and many other areas of the hardwood industry.

One area that has been growing in popularity is yield analysis of the sawmills. This type of program is nothing new in the hardwood industry; we have reinvigorated it to ensure the value of the logs is known and that every penny is accounted for.

The Yield Analysis program is part of a much bigger program of Quality Control that I learned through my career as a Quality Control Manager at a large hardwood company, where we tested everything from debarkers to ready-to-ship kiln-dried lumber. The rationale behind all the testing was to maximize the raw material and produce the best possible product.

Yield analysis testing is a straightforward concept that requires many different levels of knowledge. First, we gather information from the sawmill owner/manager about species, number of employees, current average log costs, operating costs per thousand, number of running hours, etc. We will then set up a schedule to begin the 2-day test.

The first day begins with grading and measuring the logs for the test. These logs are divided into Forest Service log grades and diameter classes. There can be as many as 16 or more groups that are tested depending on species and diameters. Each group is run through the sawmill as a batch, and the National Inspector grades and tallies all the lumber produced. Each group will be included in the final report and combined to show an average.

Some of the main features of the report generated after testing are its vital pieces of information. The report’s first page highlights critical areas for improvement, such as downtime, production per

person-day, and lumber recovery factor, among others. The following page provides a detailed breakdown of logs grouped by diameter class and grade.

The results of the tests show the break-even log value for each batch run through the sawmill to assist the company in determining how much the logs are worth when they are on the ground in the log yard. This value determination helps to manage the raw material costs and decisions regarding purchasing or selling logs.

The logs can be shown in Doyle, International ¼” and Scribner Decimal C at this time, and more can be added; we can also weigh each sort if scales are provided, as we are processing to determine break-even when buying by the ton.

Today, with higher log costs, higher freight rates, and lower lumber prices in a lousy economy, it is even more important to do these tests to ensure that your company’s future is in the best possible condition.

We are here to help; contact the National Inspector in your area or the NHLA Headquarters if you have any questions or want to participate in our programs.

August 6-8

3-Day Walnut

Lumber Grading

A 3-day course focused on Walnut, a high value species with several Grading Rules exceptions. Attend and learn how to get the most value out of your walnut production.

The course is designed for experienced Hardwood Lumber Inspectors who need to have a more in-depth knowledge of Walnut lumber grading.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor: Benji Richards, NHLA Industry Services Sales Manager

August 12-23

Inspector Training School Online Training Program

MODULE 1

Two weeks of hands-on training.

Venue: NHLA Headquarters Location: Memphis, TN

Module 2: Online study Module 3: Three weeks hands-on training and final testing at NHLA headquarters.

Instructor: Roman Matyushchenko, NHLA ITS Instructor

August 27-29

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Host: Forcey Lumber & Veneer

Venue: YMCA Bigler Location: Bigler, PA

Instructor: Tom Byers, National Inspector

August 28-30

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor:

Roman Matyushchenko, NHLA ITS Instructor

September 9-13

Intro to Hardwood Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Host: Indiana Hardwood Lumbermen's Association

Venue: Wood-Mizer, LLC

Location: Indianapolis, IN

Instructor: Kevin Evilsizer, National Inspector

September 9-Nov 1

Inspector Training

School 207th Class

Traditional 8-week hands-on training to achieve a certificate of completion in Hardwood Lumber Inspection.

Venue: NHLA Headquarters Location: Memphis, TN

Instructor:

Roman Matyushchenko, NHLA ITS Instructor

October 15-17

Intro to Hardwood

Lumber Grading

Intro class to gain a basic understanding of the NHLA hardwood lumber grading rules and how the rules affect the value of lumber.

Host: New Hampshire Timberland Owners Association

Venue: UNH Sawmill

Location: Durham, NH

Instructor: Tom Byers, National Inspector

October 21-24

Effective Safety Management & Leadership Strategies

A 3-day safety leadership course focusing on safety and creating a culture of safety at your site. The seminar will be taught by EHS Support LLC, a new NHLA member company. EHS Support is a US company that originated in 2005 and has expanded globally. The trainers have over 25 years of experience in environmental, health and safety training.

Venue: NHLA Headquarters

Location: Memphis, TN

Hardwood Markets Matter, and it is important for NHLA to share market details of the entire Hardwood Industry. We appreciate the support of allied associations and publishers in gathering and sharing this important market information that can help you understand the complete hardwood industry picture.

www.hardwoodreview.com

U.S. Walnut lumber exports were up 10% yearover-year through May, supported by growth to China and Vietnam and healthy gains to secondary Asian markets South Korea, Indonesia, Malaysia and Taiwan. Over the last decade, however, less Walnut lumber has shipped globally in the second half of the year than the first. Coupled with the broader overall decline in exports that shippers reported in June, a month earlier than usual, second-half Walnut shipments could be considerably slower.

That said, March-May Walnut lumber shipments were the strongest for any three-month period in two years, and exporters also reported decent demand in June, despite some price pushback, which potentially signals a stronger-than-usual second half. Walnut log exports did fall slightly in May from April’s record high, but were still the second-strongest on record. Through May of this year, 70% as much Walnut log volume was exported as was exported during all of 2023. While Walnut log exports tend to slow in Q3, any “slowdown”—if it occurs at all—will be from record levels.

Logs

Lumber

The prevailing Appalachian KD 4/4 FAS/1F Walnut price fell slightly in late-June, ending a slow-but-steady price runup from late-September 2023 through mid-June. Northern KD 4/4 Sel/Btr Walnut prices also appear to be leveling off after slowly rising most of the year. Kiln-dried 4/4 #1 Common Walnut prices have been steady in both regions over the last month, coming off springtime gains. With log exports elevated, increases in Walnut lumber production will be small, limiting further #2/Btr price declines.

www.hmr.com

The HMR Demand Index (HDI) is a feature in HMR Executive® that illustrates monthly trends in reported demand from 10 major domestic markets for hardwood lumber. Components of the index are color coded with various shades of blue when demand is slow, they transition to gray when demand is fair, and then to light red and deep red when demand moves from good to strong.

Index for June, which is published the first week of July.

Upholst.

Wood Components

Board Road

Pallets

Railroad Ties

www.rta.org

By Petr Ledvina

Recent economic developments have led the markets to anticipate higher interest rates for a longer period, as indicated by the minutes from the May Federal Open Market Committee (FOMC) meeting. The expectation of three rate cuts this year has shifted, with the Federal Reserve’s (FED) dot plot now suggesting only two cuts, possibly starting later in the summer. Despite signs of weakening in consumer spending, government fiscal policies continue to stimulate economic growth, especially in the industrial sector. Amidst this backdrop, industrial hardwood market developments deserve some attention.

Elevated inflation does not seem to be a large concern for Class I railroads (RR), as it was mentioned only a few times on RR’s earnings calls for Q1 of this year. However, the year started very slowly for several companies, as winter weather reduced January shipments. Some carriers were affected by the Port of Baltimore closure due to a bridge collapse, but most utilized nearby ports (Norfolk and Philadelphia) as a workaround.

Overall, revenue ton-miles (RTM) were down in the first quarter, primarily due to lower volumes of coal and fracking sand shipments. However, shipments with higher-margin cargo, such as automobiles and containers, were up. Additional headwinds for the RRs included a lower fuel surcharge and intense competition from the trucking industry. Despite this, the financial results were not as bad as it might seem.

Consequently, the RRs intend to spend more on CapEx this year than last, even though in real terms, the planned increase is less significant: about 0.5 percent. Of the total CapEX, track maintenance represents, on average, about 65 percent. Most railroads expect freight to grow by mid-single-digit percentage points.

However, softness creeps into the tie market after several years of rising nominal tie prices. Following a few months of flat data, the Hardwood Market Report (HMR) suggests that prices in the Southeast and Appalachian Northern regions have started to decline.

This should not come as a surprise. The supply of ties has outperformed demand for many months now, and as a result, the inventory-to-sales ratio (ISR) has been above 0.9 since January. The last time the ratio was above 0.9 was at the beginning of 2017. From RTA’s Tie Pricing Report, the reader may be familiar with the graph showing a moderate correlation between ISR and the sixmonth lag in tie prices adjusted by the producer price index. This means that if the supply outperforms demand for an extended period, indicated by a rising ISR, there is a measurable increase in the probability that the tie prices will soften in six months. This poses potential issues for sawmills, depending on the demand side of the equation.

The tie demand forecast for 2024 was revised up by 254,000 ties, to a total of 18.8 million. Major drivers for the upward revision include the revised forecast for GDP growth. The economy is expected to grow by 2.5 percent instead of 1.5 percent (S&P March vs November forecast), as the triple windfall of fiscal stimulus— the Inflation Reduction Act, the Infrastructure Act, and the CHIPS Act—boosts economic activity in the industrial sector, particularly non-residential construction. Consumer spending has been revised higher as well with a growth rate roughly the same as last year. Adjustments were made for the coal production forecast, and instead of declining 16 percent in 2024 it is now expected to decline about 14 percent from 2023 levels (EIA).

Allocated CapEx by the RRs points to higher spending on track maintenance. However, more recent economic data casts doubt on the predicted level of consumer spending. Hence a meaningful increase in intermodal traffic is in question beyond seasonal vari-

ance. Given these events, there is an increased uncertainty about the tie demand, especially looking into 2025. With this in mind, RTA presents the tie demand forecast in Table 1.

Note: Breakdown of total purchases for 2023 was not possible at the time of the forecast. Therefore, Class I and Small Market purchases are still from the January forecast and do not add up to the total number.

WHAT IS YOUR VIEW OF CROSSTIE COMPETITIVE POSITION RELATIVE TO OTHER HARDWOOD PRODUCTS?

REGARDING YOUR ABOVE ANSWER, PLEASE PROVIDE CONTEXT FOR MARKET, WEATHER OR OTHER CONDITIONS.

Minnesota, Iowa, Wisconsin, Michigan, N Indiana, N Illinois: Rain, flooding, and more rain in the forecast. Mills are running out of logs. Several mills are shutting down the entire week for the 4th of July vacations.

West Virginia: Lumber markets are sluggish and not much good news going forward.

Virginia: Flooring, pallet,v poplar and ties are slow to move. Quotas and shutdowns are in place.

NEW ENGLAND

New England 1: Weather conditions have been good for logging but most mills have their loggers on quotas to keep inventories low. Markets are stable but with very low pricing. Tie production is continuing to slow.

Pennsylvania: Log supply continues to vary greatly around the area. Struggles for mills persist across the area. Upper grade lumber in some species are doing okay. Chip supplies are lower and increasing demand at some end users facilities.

E Texas, NW Louisiana: Pallet is a big problem and with this Hurricane coming thru east texas could put logging on hold for some time so we just have to wait and see with this being a election year. Not looking good!

Mississippi: Crossties hold a strong competitive advantage in the market. Lack of pallet & lumber orders coupled with terrible residual markets have forced many mills to restrict overall production.

www.nwfa.org

According to Hardwood Floors magazine’s 2024 Industry Outlook, competition from wood-look products such as LVT, WPC, and laminate continue to have a negative effect on real wood product sales for 67 percent of NWFA members. Higher-end wood flooring products don’t appear to be as negatively affected by wood-look products as those with a lower cost of entry

www.ahec.org

By Tripp Pryor, AHEC International Program Manager

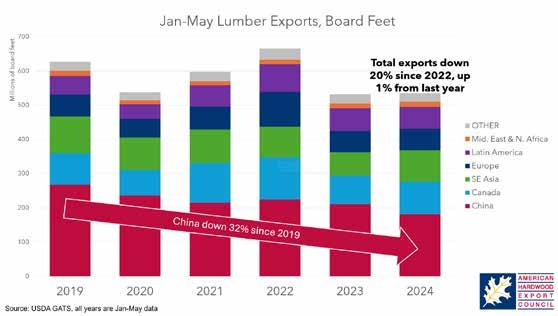

Exports of US hardwood lumber have remained level from last year through the first 5 months of 2024, despite another down year in China. Over 535 million board feet of lumber were exported to all markets through May of this year, a 1% increase by volume from last year, but a 15% decrease from 2019, and a 20% drop from 2022.

The Chinese market has steadily decreased since the US-China trade war in 2017, and this year is no exception. By volume, the Chinese market is down 14% through May 2024 from the same period last year. That’s a drop of 28.5 million board feet in the first five months of the year. However, based on monthly data, US lumber exports to China started historically slow through March but picked up to match last year’s trade level in April and May. During the AHEC US Hardwood Pavilion at SylvaWood 2024 in Shanghai this June, feedback was cautiously optimistic, as many reported that the show was better than expected with a strong level of interest from Chinese buyers. This is an encouraging sign for an upward trend in the Chinese market.

At the SylvaWood show, several representatives from Chinese companies were concerned about potential tariffs and a future escalation of the US-China trade war. Interestingly, multiple Chinese representatives also discussed their concerns about US tariffs on products coming from Vietnam, so many Chinese companies are working to “de-risk” their supply chain and expand operations in

countries that are more politically friendly with the United States. As these trade patterns shift and global demand comes back, Chinese-led demand may not result in the historic, 1 billion board feet level of direct exports to China that we saw in 2017, but instead to a growth in exports to Southeast Asia and even Mexico.

Even with another drop in exports to China, total exports have managed to increase by 1% so far in 2024. This is largely driven by lumber exports to Canada and SE Asia, which have bounced back from a rough 2023 to a strong start this year. By volume, lumber exports to Canada are up 12% (Jan-May total 95 million board feet), and exports to SE Asia are up 36% (Jan-May total 92 million board feet) compared to last year. Elsewhere, lumber exports to Australia have nearly doubled (2.8 million bf in 2023 to 5.5 million bf in 2024), and the Middle East remains on pace for the best year since before COVID (14.6 million board feet so far in 2024, best start since 15 million bf in 2019).

Our remaining AHEC pavilions for 2024 will cover Mexico, China, and Southeast Asia at the Technomueble show in Guadalajara (August), the FMC Premium furniture show in Shanghai (September), and the TIWF wood show in Bangkok (September). We will also be hosting educational seminars throughout Europe and Asia, and design events in China and at the London Design Festival. For more information on export markets and upcoming AHEC events, please visit www.ahec.org.

Here, you will find our current job listings. To see more details of the job or to post a job, visit www.nhla.com/resources/careers-center

HARDWOOD LUMBER INSPECTOR

PIQUA, OHIO

Basic Function: Inspects incoming and outgoing lumber according to NHLA rules at the assigned grading deck. The grading deck sits on the Lumber Handling Machine.

Please send all resumes, applications, and questions to Brian Wombold at bwombold@hartzell.com.

Hartzell Hardwoods 1025 S Roosevelt Ave. | Piqua, OH 45356 937-773-7054

HARDWOOD LUMBER INSPECTOR

KIRKVILLE, MISSOURI

Basic Function: Inspects incoming and outgoing lumber according to NHLA rules at the assigned grading deck. The grading deck sits on the Lumber Handling Machine.

HOW TO APPLY

Please send all resumes, applications, and questions to Brian Wombold at bwombold@hartzell.com.

Hartzell Hardwoods 3310 Industrial Rd. | Kirksville, MO 63501 660-665-3006

HARDWOOD LUMBER INSPECTOR

ALTENBURG, MISSOURI

Altenburg Hardwood Lumber Company is seeking a lumber inspector to grade green and kiln dried lumber. Must be a NHLA graduate.

For all questions and applications, contact James Schlimpert by phone at (573)-450-6573 or via email at jamesschlimpert@att.net

Altenburg Hardwood Lumber Company 10220 Main St. | Altenburg, MO 63732 573-824-5265

J. Gibson McIlvain Company has been providing high quality wood products since 1798 and is a trusted and well-known name and hardwood authority in the lumber business. Job Responsibilities:

• Consistent and accurate grading of kiln dried hardwood lumber to meet NHLA rules and regulations.

• Grade at production speed, while maintaining grading accuracy.

• Work safely and help maintain a safe work environment.

• Read and understand production schedules.

• Work closely with operations to maintain lumber quality.

Please send all questions, applications, and resumes to Bryony SySantos at bsysantos@mcilvain.com.

J. Gibson McIlvain 10701 Philadelphia Rd. | White Marsh, MD 21162 410-335-9600

eLIMBS | Agility | TallyExpress | Neural Grader

Ease the pain of staffing shortages with inventory management solutions made for hardwoods. DMSi is your one software partner from timber to consumer.

FRANK MILLER

LUMBER CO