Items

Features:

+ 3 MIG torches (steel, aluminum, silicon bronze)

+ Automative torch detection by pressing trigger

+ XL color screen to configure and precisely control the welding cycle.

+ 3 electronically regulated wire feeders with 2 driver rollers

+ Welding processes: Standard, Pulse, Double Pulse, and Cold Pulse.

+ 68 synergic curves for exceptional welding. Wire Spool

1.2mm Aluminum

5554 - 2 kg (5lbs)

Spool 0.8mm CuSi3

Bronze2kg (5lbs)

Spool 0.8mm / .030" Steel ER70S4kg (11lbs)

MIG Welder Nozzle 3 Packs: + 150A (steel, silicon bronze) + 250A (Aluminum) + M6 - 0.6MM / 0.023" + M6 - 1.2MM / 0.045" Single-Phase Welding Plug

Includes The Apollo Welding Helmet 068681

Purchase the GYS M3 Pulse MIG Welder (ref: 062481) with these accessories and receive a free Apollo MIG Welding Helmet (ref: 068681, valued at $208.00). The Apollo features super-fast .08ms darkening speed and has TRUE COLOR technology, providing more realistic and detailed color during each use.

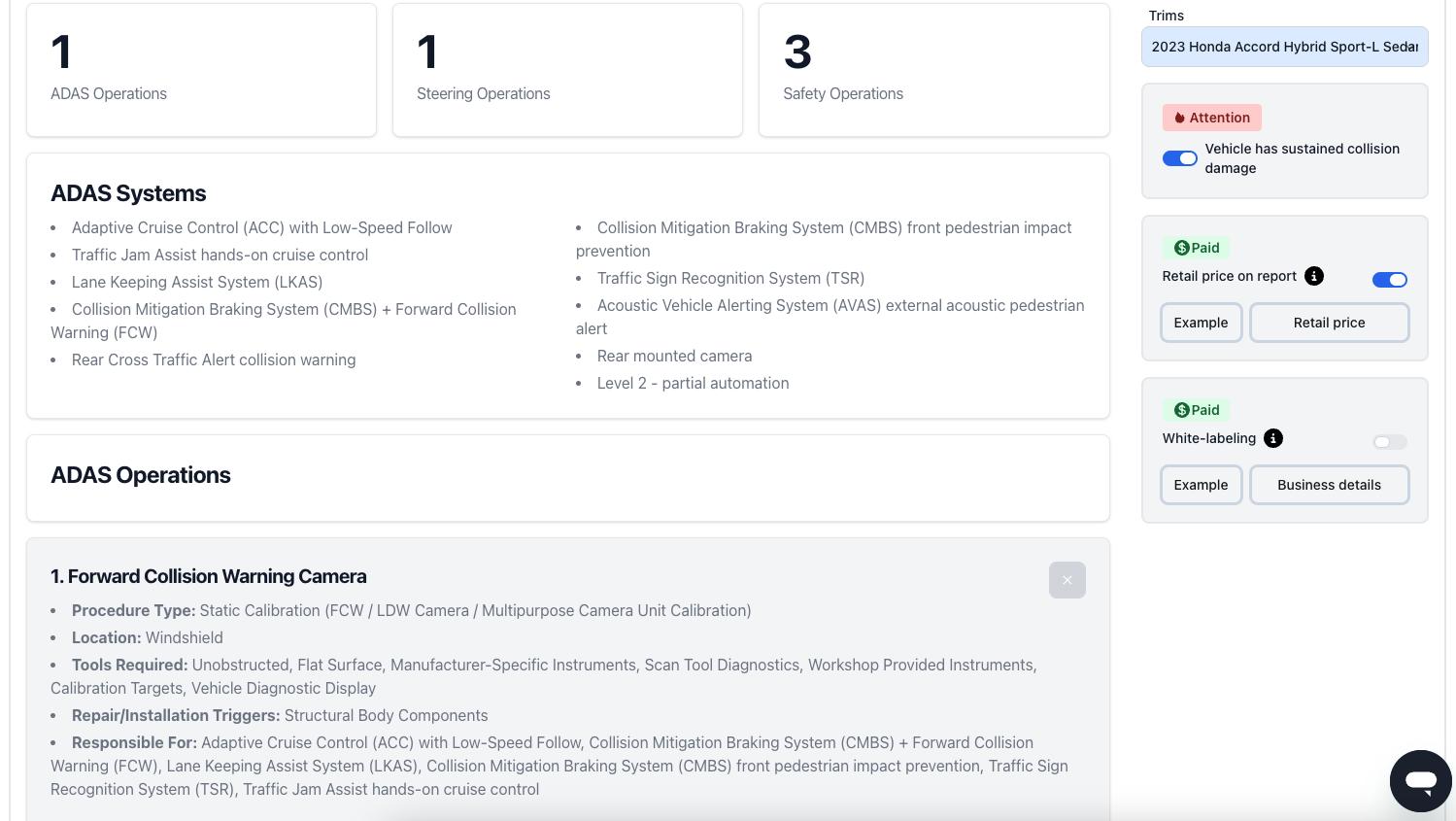

Revv identifies every required ADAS calibration with supporting documentation

Revv is an end to end solution for ADAS calibration shops

• Precise Calibration Identification

• Seamless Integration

• Custom Invoicing

Our flagship dealerships are pleased to offer a wide selection of authentic genuine parts so you can repair your customer’s luxury car to the highest quality.

We not only sell WHOLESALE GENUINE PARTS across the tri-state area, but we also offer a knowledgeable team of parts specialists who will find the component you need for a seamless vehicle repair. WE WILL GO THE EXTRA MILE FOR YOU!

AUDI QUEENS

30-35 College Point Blvd. Flushing, NY 11354

Wholesale Direct: 929.297.0788

parts@audiqueens.com audiqueens.com

MERCEDES-BENZ OF BROOKLYN 1800 Shore Pkwy. Brooklyn, NY 11214

Wholesale Direct: 718.258.7055

parts@mbofbrooklyn.com mbofbrooklyn.com

MERCEDES-BENZ OF CALDWELL 1220 Bloomfield Ave. Caldwell, NJ 07006

Wholesale Direct: 973.808.0204

Parts@mbofcaldwell.com mbofcaldwell.com

JAGUAR BROOKLYN 809 Neptune Ave. Brooklyn, NY 11224

Wholesale Direct: 929.583.6492

parts@jlrbrooklyn.com jaguarbrooklyn.com

LAND ROVER BROOKLYN 809 Neptune Ave. Brooklyn, NY 11224

Wholesale Direct: 929.583.6492

parts@jlrbrooklyn.com landroverbrooklyn.com

LEXUS OF BRIDGEWATER 1550 US-22 Bridgewater, NJ 08807

Wholesale Direct: 866.679.7054

parts@lexusbridgewater.com lexusofbridgewater.com

LEXUS OF EDISON 711 US Highway 1 Edison, NJ 08817

Wholesale Direct: 732.593.6860

parts@lexusedison.com lexusofedison.com

P.O. Box 734 Neptune, NJ 07753

EXECUTIVE DIRECTOR

Charles Bryant 732-922-8909 / setlit4u@msn.com

2023-2025 OFFICERS

PRESIDENT

Ken Miller, 821 Collision, LLC (973) 949-3733 / kmiller@821collision.com

COLLISION CHAIRMAN/

PAST PRESIDENT ATTENDING

Jerry McNee, Ultimate Collision Repair, Inc. 732-494-1900 / ultimatecollision@att.net

MECHANICAL CHAIRMAN

Keith Krehel, Krehel Automotive Repair, Inc. 973-546-2828 / krehelauto@aol.com

TREASURER

Tom Elder, Compact Kars, Inc. 609-259-6373 / compactkars@aol.com

SECRETARY

Thomas Greco, Thomas Greco Publishing, Inc. 973-667-6922 / thomas@grecopublishing.com

BOARD

Nick Barbera, Union Collision 908-964-1212 / nick@unioncollision.com

Dennis Cataldo, Jr., D&M Auto Body 732-251-4313 / jr@dnmautobody.com

Brad Crawford, Livingston Collision, Inc. 973-992-5274 / livingston.collision@gmail.com

Todd Fontana, Proline Body & Chassis 201-398-1512 / todd@prolinebody.com

Gary Gardella, Jr., County Line Auto Body 732-363-5904 / countylineautobody@gmail.com

Dean Massimini, Autotech Collision Service, Inc. 856-232-1822 / autotechnj@comcast.net

Jeff McDowell, Leslie’s Auto Body 732-738-1948 / chacki@aol.com

Danielle Molina, 821 Collision (973) 949-3733 / dmolina@821collision.com

Ted Rainer, Ocean Bay Auto Body 732-899-7900 / ted@oceanbayautobody.com

Anthony Trama 973-818-9739 / anthonytrama@aol.com

BOARD ALLIED

Joe Amato, The Amato Agency 732-530-6740 / joesr@amatoagency.com

Mike Kaufmann, Mike Kaufmann Dealer Group 973-332-7014 / mkaufmann@adps.com

PRESIDENT/PUBLISHER

Thomas Greco / thomas@grecopublishing.com

VICE PRESIDENT/SALES DIRECTOR

Alicia Figurelli / alicia@grecopublishing.com

EDITORIAL DIRECTOR

Alana Quartuccio / alana@grecopublishing.com

SENIOR CONTRIBUTING EDITOR

Chasidy Rae Sisk / chasidy@grecopublishing.com

OFFICE MANAGER

Donna Greco / donna@grecopublishing.com

PRODUCTION COORDINATOR

Joe Greco / joe@grecopublishing.com

CONTRIBUTING

Published by: Thomas Greco Publishing, Inc.

244 Chestnut Street, Suite 202, Nutley, NJ 07110

Corporate: (973) 667-6922 / FAX: (973) 235-1963

www.grecopublishing.com @grecopublishing

Mike Anderson & Friends Share Insight with AASP/NJ by Alana Quartuccio

Like Father, Like Son: Ultimate Collision Repair’s Anthony and Jerry McNee Both Earn Recognition by Alana Quartuccio

AASP/NJ Recognizes DJ’s Restoration as 2024 Body Shop of the Year by Chasidy Rae Sisk

Auto Body Distributing Co. Holiday Party Highlights

Get Connected: Experience It All at NORTHEAST® by Alana Quartuccio

People, Process and Passion: Collision Restoration Joins VIVE Collision Family by Chasidy Rae Sisk

BROKE? Just How Much Do Insurance Company CEOs Make? by Chasidy Rae Sisk & Alana Quartuccio

Wharton Insurance Briefs by Mario DeFilippis

Ron Ananian

Jim Bowers

Charles Bryant

Don Chard

Guy Citro

Dave Demarest

Thomas Greco

Dan Hawtin

Rich Johnson

Mike Kaufmann

Wes Kearney

Nick Kostakis

Jim Kowalak

Keith Krehel

Joe Lubrano

Phil Dolcemascolo

Tom Elder

Bob Everett

Alicia Figurelli

Michael Lovullo

Jeff McDowell

Jerry McNee

Sam Mikhail

Ron Mucklow

George Petrask

Russ Robson

Jerry Russomano

George Threlfall

Anthony Trama

Cynthia Tursi

Lee Vetland

Paul Vigilant

Rich Weber

Brian Vesley

Glenn Villacari

Stan Wilson

I’m sure you’ve all heard about the tragic murder of the CEO of a major health insurer in early December. And it truly is a tragedy. No one should be shot in the back and killed in cold blood because of their profession. Of course, like all of you reading this (I hope), I would never condone anything like that. BUT I do understand it. Let me explain.

I’ve written several times about my many experiences with the health care industry. I’ve had phenomenal doctors, and some really bad ones. I’ve been to several really wonderful hospitals, and stayed in some really crappy ones. I have experienced the nicest nurses as well as those who were just flat-out evil. So like many industries, there is always the good with the bad. EXCEPT ONE: the health insurance industry.

In fact, do you know who the insurance companies are now? They’re the Mafia. And not because the poor guy who got shot was murdered on a New York City sidewalk just like the old Mafia Don Paul Castellano in the ’80s. It’s because they play the same rackets the mob did. They are the only industry endorsed and unregulated (look up the McCarran–Ferguson Act) by the government. That’s crazy, you say? Maybe. But isn’t health insurance just another word for “protection”? The mob used to shake down businesses to pay them for “protection,” or else they would let their businesses fade away or blow up and die. We pay for health insurance to cover our doctor visits, hospital stays and prescriptions. They set their rates, and we pay them in order to “protect” ourselves and our businesses from dying.

Of course, prescriptions are the equivalent of the cocaine and heroin the mob would sell. The pharmaceutical companies are the drug dealers. The doctors are the drug runners. The insurance companies dictate who gets the drugs and how much they will pay for them. If you can’t afford the “vig,” screw you – go away and die. And every year, the “vig” goes up, and the drugs become harder to get. I am telling you, they’re the Mafia.

Why this rant? Over the last six months, I have spent more time on the phone with my insurance company than I have with my cumare! (Mob joke for levity!) Honestly, every damn month, I get 16 letters from my insurance company telling me how their “expert” has determined that a prescription my doctor has prescribed is not approved. When I call to ask who this “expert” is, how can I speak to him and how it’s possible that he knows what I

by THOMAS GRECO, PUBLISHER

need better than my own doctor, I get passed on from one operator to another until eventually they either disconnect me or I hang up. I have literally been taking this one medication for two decades, and now they tell me they need more proof that I need it. Are you f$%king kidding me?

How about this one? I need to lose weight. I feel like shit. I look like shit. Both my general practitioner and my cardiologist think a weight loss drug like Ozempic or Wegovy will not only help me drop pounds, but studies have shown both of these drugs to have heart-healthy benefits. Could a drug be more perfect for me? We submitted the Ozempic first. Denied. We submitted Wegovy. Denied.

“If you want to dispute this ruling, fill out these 16 forms…” Screw that. I called them. Again, after four different operators, someone asked what the problem was.

“I want to know why I was denied these drugs that were prescribed by TWO of MY doctors.”

“Are you diabetic?”

“No, but I’m pre-diabetic.”

“Sorry, you have to be diabetic.”

“Wait, so I have to get sicker before I can get the drug that prevents me from getting sicker?”

“That’s the policy, sir.”

“Are you fu…..”

Click.

I tried everything possible to get one of these drugs. My doctor offered to do a peer-to-peer call with the insurance company. They said they’d agree to the call only after they got 16 more pages from him. Oh, and he’d have to mark “urgent” on the documentation. Keep in mind that these drugs cost $1,200 per month. No lie.

I finally gave up. I found a coupon online that got the price down to $600 and bought a month’s worth of Wegovy. My hope is that it works so well, I will not be a complete idiot and realize I feel so much better from the weight loss that I can be disciplined enough to continue on my own. (Don’t laugh! I have done it in the past.)

They are the Mafia. In fact, they are worse than the Mafia. After all, the Mafia may have killed junkies looking to score some heroin, but they never killed little old ladies looking to score some insulin.

The shocking December murder of UnitedHealth Group’s CEO sparked a national conversation about the role of insurance companies and their practices. Early reports suggest this may have been a targeted attack, possibly tied to an insurance issue. Investigators discovered shell casings at the scene inscribed with the chilling words “delay, deny, defend” – a phrase many recognize as the title of a 2010 book by Rutgers law professor Jay Feinman.

Feinman’s book is a must-read for anyone seeking to understand the tactics insurers use to withhold payment on legitimate claims. It exposes strategies designed to protect corporate profits at the expense of policyholders. Although the book was written nearly 15 years ago, the troubling reality is that these practices have only intensified since its publication.

If these early theories about the crime prove accurate, it raises a profound and uncomfortable question: Have insurers pushed their cost-cutting measures too far? For decades, insurers have prioritized shareholder returns

by KEN MILLER

over policyholder obligations, often at the cost of fair and timely settlements. But this tragic event may force us to confront the darker implications of these priorities.

Tragic events often have a way of illuminating systemic failures that otherwise go unnoticed or are willfully ignored. Consider the landmark John Eagle Collision case, which exposed the dangers of repairers deviating from OEM repair procedures. That lawsuit didn’t just hold one shop accountable; it reshaped how the entire industry views liability and the critical importance of following manufacturer guidelines.

Similarly, this case – if tied to insurance practices –may serve as a wake-up call for an industry plagued by dysfunction. The current system is not just broken; it is actively harmful to the very people it is meant to protect. Policyholders are not just numbers on a balance sheet; they are individuals and families who purchase insurance to safeguard against life’s uncertainties. Yet, they often find themselves trapped in a game designed to minimize payouts rather than provide the promised safety net.

WIN offers education, mentoring and leadership development opportunities to build critical skills for success in the collision repair market.

• Local/Regional Networking Events

• Annual Education Conference

• Educational Webinars

• Mentoring Opportunities

womensindustrynetwork.com

• Scholarship Program

• School Outreach Program

• Most Influential Women (MIW) Award

Behind every claim denied, delayed or underpaid is a person in crisis. These are people who have suffered losses, whether due to car accidents, natural disasters or health emergencies, and who turn to their insurer for the support they have paid for through premiums. Instead, many find themselves battling a system engineered to protect profits, not people.

This is not just a matter of inconvenience; it’s a matter of justice. Insurers’ refusal to meet their obligations creates ripple effects – financial strain, emotional distress and in some cases, life-altering consequences. While most policyholders don’t resort to violence, this tragic event underscores the frustration and desperation felt by many. The insurance industry’s commitment to profit over policyholders has been an open secret for years. But this is an inflection point. Will this horrific event finally force the industry to confront the ethical and human costs of its practices? Or will it simply reinforce the status quo, with insurers doubling down on their tactics while regulators and lawmakers look the other way?

One thing is clear: the insurance system must change. Policyholders deserve better than a system that views them as adversaries. They deserve prompt, fair and equitable treatment – not gamesmanship designed to maximize corporate profits. We can only hope that this tragedy compels meaningful reform in an industry long overdue for accountability. Because the stakes couldn’t be higher – not just for those seeking justice, but for the future integrity of the system itself.

Certain cars are now capable of driving themselves. You look up outside, and drones are moving around unattended…or in a manner that appears that way. Computers can prepare reports and articles on any subject based on minimal information – and they can write what you say as you speak!

Now, I know some will likely say, “Get with the times, Charles.” Well, to prevent any misunderstandings, let me make myself clear right from the start. I’m not saying there is anything wrong with where we are today or that I disagree with anything. What I am saying is that I am fascinated with it, and I never thought such things would occur in my lifetime!

I try to stay up on the new things that get introduced in the collision industry because I run a hotline where I assist members of the industry when something goes wrong or when they have a problem they are unable to resolve on their own. It is common for someone to call me and ask a question like, “Is there a law, rule or regulation that prevents an insurer from refusing to pay for a particular operation or procedure?” My many years of experience has allowed me to gather information on issues such as this or to know where to find the answer to such questions.

As a result, I have gathered a wealth of information that has been extremely valuable to members of the collision industry. Over the years, I can’t even begin to tell you how many of these types of questions I have been asked and answered.

However, looking at the industry today, one might

by CHARLES BRYANT

as well throw out most of the information that has been gathered over the years because it simply doesn’t pertain to the ultra-modern vehicles that are on the roads today or to the vehicles that are on the way. I should call them something other than vehicles, as what we are finding on the roads today are more like rolling computers.

I recently got in a new vehicle, and while driving down the road, the vehicle suddenly corrected itself by pulling itself to the left just a bit because it apparently felt it was too close to the lane line on the road I was traveling on. Well, to put it politely, it scared the daylights out of me! I immediately thought someone had run into the side of the vehicle and pushed it to the left; instead, it was simply the vehicle correcting itself by automatically staying in the correct lane.

The next thing I noticed that I wasn’t accustomed to was the headlights changing from high beam to low beams without any assistance or request from me. I know these are simple issues, but they certainly are not ones I was familiar with. However, these issues triggered me to wake up and start watching what is coming and looking at what is already here. Although these new and unique features fascinate me, I am no longer involved with the repair of damaged vehicles.

However, it triggered me to wonder about just how many older, long time repair technicians are aware of these features vehicles are equipped with today. I am quite sure some of the older repair technicians are out there repairing these vehicles on a regular basis.

So, I am now making a plea to members of the collision industry to reach out to me and share your experiences with some of the new modern vehicle issues that you have run into. I can be reached on the AASP/NJ Hotline at (732) 922-8909 or via email at Setlit4u@msn.com. I await your response. Thank you, and I look forward to hearing from you.

Offer your employees quality health insurance at an affordable price. The Alliance of Automotive Service Providers has partnered with World Insurance Associates to bring you the AASP Health Plan for members only. Now you can offer your employees quality health insurance at exclusive rates. And it’s fast and easy to enroll!

• Any size business is eligible

• National network of doctors

• Multiple plan designs

• Members-only health plan

• Potentially great premium savings

CONTACT: Joe Amato, Jr. Principal

World Insurance Associates 4900 Route 33, Suite 103 Neptune, NJ 07753

O: 732-530-6740 x412

joeamatojr@worldinsurance.com

Terence

terencegorman@worldinsurance.com Call or email us

x162 | M: 646-438-4959

Navigating this continuouslyevolving industry often leaves repairers feeling as though they’re constantly “running the gauntlet” as they are forced to jump, duck and tackle the obstacles that arise in their path. As a result, many become so focused on the challenges that they fail to see the opportunities that exist. But this does not have to be the case at all, according to the one and only Mike Anderson (Collision Advice).

Noted as one of the most influential speakers in the collision repair world, Anderson shared his insight and expertise with the AASP/ NJ community during a full-day workshop on November 21 at the Courtyard Lincroft in Red Bank. He and his crew of industry professionals demonstrated how “Obstacles are Opportunities in Work Clothes.”

“Lots of sales cover lots of sins,” he cautioned, addressing the false belief that dollar signs are not a true indication of success. Severity is up – along with the price of just about everything – therefore, if “you want to grow your sales in 2025, you need to get more cars in the door and write better estimates.

“You can’t just look at your sales

in dollars,” Anderson insisted. “You have to look at your labor hours because labor is where you make your gross profit.” He suggested that shops assess their mechanical labor rate as well because “this one will grow in the future, and if the industry doesn’t right size this now, we’ll lose the opportunity.

“When you get certified with an OEM, you have to be smart about it. You have to be intentional. Are you marketing your certifications? Are you building relationships with dealerships?” he asked. He brought up Matt Ritzer of Enterprise Rent-aCar to inform all about resources like Entegral.

OEM subscription-based services are something Anderson believes will “change the collision repair industry.” The customer experience is changing, and vehicle owners will want a personalized experience. AI can be of assistance to body shops by helping improve their capture rate. According to Anderson, 43 percent of accidents happen when a body shop is closed, and AI can provide ways for consumers to make a first contact.

“ChatGTP is getting smarter and smarter and smarter. Look at it as a way to handle some communication to your customers or insurance companies.”

Craig Stevens of CCC Intelligent Solutions believes that AI is an opportunity repairers should embrace as it can be a marketing or triage tool. AI will never eliminate human interaction completely as this technology is designed for human interaction. A shop can notify customers that they won’t be able to write an estimate based on the photos, but they can use them to get an idea of the damage and get their car to the shop sooner. Anderson noted it as a marketing strategy.

“When customers have the ability to send photos, it eases their anxiety. Whoever responds to them first gets the customer.”

Deric Krist and Larry Grossaint of Kritech Solutions showed the audience various automation tools that are designed to help estimators get time back. They set out to build a system “that works while one is writing an estimate so it gives them guidance and advice,” according to Krist. Reports from their systems also help in educating customers.

“Customers don’t know how to read estimates. This is a great report to hand them as it itemizes where the shortpays are.”

Many items can easily get lost in the area of estimating for paint and materials. Anderson spoke of static removal which is a not-included operation as per all the IPs. Tools like the Static Solutions Pro-stat gun can remove static and ultimately improve the paint process, saving time and cutting down on resources.

Addressing proper invoicing for paint and materials, Ben Stephens of Matthew’s Auto Supplies asserted, “Anything you consume, you should bill out. There is no such thing as ‘the cost of doing business.’ Everything

has a sale associated with it.”

Negotiating with insurers sure has its challenges, but the future is taking a turn in a different direction. Reports say 40 percent of drivers would rather pay out of pocket for repairs, while more than a third of drivers have said they would rather not file claims with their insurance company. As claim trends continue to plummet, Anderson says now is the time to start thinking about customer financing. The audience weighed in on the possibilities customer pay could bring, creating a list of benefits that included everything from “less bullshit” in not dealing with third-party payers to faster cycle time, higher

To achieve success by doing so, shops will have to educate their consumers but also “teach our front estimating staff how to upsell.”

Anderson shared his predictions surrounding electric vehicles, which won’t be adopted in the US as quickly as other parts of the world where gasoline is much more expensive. Infrastructure is key, and there’s much to consider – especially when it comes to road repairs, not to mention what is to be done with fuel tax. “If everything goes electric, how do we fund work on roads and bridges?”

EVs weigh more than ICE vehicles, so there’s much to consider in the adoption of EVs. He believes they will remain in the fleet space like Rivian’s partnership with Amazon delivery vehicles; therefore, there’s opportunity in large-sized paint booths.

Anderson left the audience with so much to think about, including the importance of investing in one’s local politicians to get them to understand how the insurance industry works, how Hyundai could easily surpass Tesla in the US EV space and that OEMs will begin to sell recycled and refurbished parts.

AASP/NJ is grateful to Matthew’s Auto Supplies for sponsoring this

The Ultimate Collision Repair (Edison) team has had lots to celebrate in recent months!

AASP/NJ’s Immediate Past President and current Collision Chairman Jerry McNee (owner of Ultimate Collision) learned he was inducted into the association’s Hall of Fame during their October Annual Meeting. Just two weeks later during SEMA week in Las Vegas, he watched his son Anthony be recognized with the FenderBender Best Repair Planner/Estimator Award during the Collision Industry Red Carpet Awards.

“There is not a guy out there who is more passionate about this industry than Jerry,” AASP/NJ President Ken Miller said upon accepting the award on his predecessor’s behalf during the Annual Meeting. Miller noted Jerry’s commitment to the industry which includes national-level outreach and his willingness to help others.

“I was honestly flattered,” shares Jerry about being inducted into AASP/NJ’s Hall of Fame.

“I was just happy to see what was happening in the industry,” he says of the early days of working with the Board. “I really didn’t think I had anything to add, but I guess others felt I offered something that would benefit the members and the association.

I’m grateful someone somewhere thought enough of me to think ‘we need a guy like this on the Board.’ I’m happy to help out in any way shape or form that I can or to offer any suggestion I may have based on my own personal experience to help the industry overall.”

things correctly be treated and looked at as the ‘big bad wolf?’ That is a problem.”

It all comes down to making sure things are being repaired properly, which is why he makes sure his staff is trained and educated to be at the top of their game.

His son Anthony surely shares that same work ethic and passion for education as is proven by him taking home the inaugural Best Repair Planner/Estimator Award. “The goal was to refer to OEM repair guidelines and not-included repair operations,” expressed Jay Sicht (FenderBender) as he explained to the SEMA audience how Mike Anderson (Collision Advice) and his team worked with the panel of judges on the estimate exercise. “The competition and estimate exercise was close, but what made our winners stand out was the critical safety related inspection items. Our winner has been tireless in his efforts to keep the shop up to date with researching OEM repair procedures and processes and has multiple OEM certifications.”

Getting this recognition was a huge honor for Anthony, who took his first estimating class with Anderson. “To be nominated to participate in this competition and be chosen winner was very special for me.” Growing up around the family business, Anthony would work at the shop during the summer. He started sweeping floors and moved into invoicing for parts and later began writing estimates. He’s now consistently worked at Ultimate Collision Repair for the past 10 years.

Being involved at the Board level helped him see the challenges that exist out there. He strongly believes a lack of knowledge is the problem, and that’s why he is so hellbent on education. “My goal has always been to help educate the industry. I know what shops need. I am a shop owner; I have been living, eating and breathing this stuff my whole life.

“We’ve all heard ‘you’re the only one,’ but I know I’m not the only one,” he laments about the common pushback from insurers. “I don’t make the repair procedures. I’m not an engineer, so who am I to question what the OEM says needs to be done? If eight out of 10 shops are not doing things properly because they are uneducated and don’t understand that proper repairs need to be done, why should those two shops doing

He fully recognizes the importance of writing and documenting every single detail of the repair process, and that is required on every single vehicle. “I document everything I do, and I do it in an organized fashion.”

Jerry points out that it wasn’t the final value of the repair bill that made Anthony stand out as winner in this competition. It all came down to the accuracy of the estimate. “Anthony was able to hit every single mark of what was required to repair that car properly with every safety feature, with notes and explanations. I’m happy to have him on my team doing what he is doing.”

AASP/NJ is only as strong as its members, and during its Annual Meeting each year, the association acknowledges the value that individual members contribute to the association and the industry atlarge by recognizing an outstanding member shop with the Stan Wilson/ New Jersey Automotive Body Shop of the Year Award.

This year’s honoree was DJ’s Restoration (Ewing), an association member whose involvement began decades ago – before AASP/NJ even existed! “I originally got involved with the Garden State Automotive Federation,” shares Daniel Brandt, Jr., owner of DJ’s Restoration.

Brandt’s passion for auto body work began when he was a teenager, but cars are in his blood; his grandfather owned Perry Auto (Trenton), and his father operated a mechanical shop, so Brandt was basically “born and raised in a garage.” While he was still in high school, he got his start painting cars in his father’s shop, and after graduation, his love for creating

something beautiful led him to go to work at a local collision repair shop.

After nearly a decade working for someone else, Brandt decided to branch out on his own in 1992. “When I opened the business, I was 26 years old,” he recalls. “My father thought I was crazy when I made that decision, but I was convinced it was what was right for me, so I put everything on the line and worked crazy hours. It was stressful at times, but 33 years later, DJ’s Restoration is a wellestablished, high-quality full collision and restoration shop that is very well known in our community.”

The I-CAR Gold certified facility employs five collision professionals who work on everything from small dents to major collision repairs. DJ’s Restoration also performs complete auto restorations and custom paint and vinyl wrap on cars, trucks and motorcycle tanks. To perform the quality work his customers have come to expect, Brandt invests in the most up-to-date tools, equipment and materials to restore each vehicle to its pre-collision condition; he treats every

customer’s car as if it were his own. That also requires a commitment to training and ongoing education for himself and his entire team. “DJ’s Restoration has only done high quality work – no cutting corners. That means we’re constantly investing in the latest and greatest equipment and training for our staff,” Brandt asserts.

His need to maintain a high level of knowledge about the field to which he has devoted his life led to getting reacquainted with AASP/NJ several years ago. Although he has remained a member throughout his career, running a busy shop sometimes gets in the way of anyone’s best intentions, so “my participation in the association dwindled a bit over the years” as he became preoccupied with his business’ day-to-day operations.

But with technology changing so rapidly these days, Brandt recognized the need to keep a close pulse on current trends as well as environmental concerns and safety requirements, and he knew the best way to do that was to recommit to his local association. “About five years ago, I started attending AASP/NJ events and meetings again to further my education as well as to help educate others,” he shares.

A major benefit of his closer involvement with the association is the sense of community garnered from collaborating with other Garden State collision repairers and shop owners. He feels sorry for the shops that miss out on the camaraderie that exists among the group. “It’s a shame not every shop in the state is a member! I hope that more shops will become involved with AASP/NJ in the future.”

Belonging to a supportive organization like AASP/NJ creates a feeling of unity and solidarity within the local industry that is much needed, especially as interactions with insurers often leave shops feeling

like they’re stuck on an island by themselves, repeatedly told “you’re the only one;” however, Brandt has no tolerance for that behavior from carriers. “We restore customers’ cars to factory specifications, period. Any shop can provide a lower estimate by leaving something out or overlooking parts, but that’s not how we operate. We put the customer first, and we take no nonsense from insurance companies.”

Still, Brandt recognizes the obstacles that can arise when interacting with insurers, especially when it comes to negotiating repair plans, processes and procedures that are required to safely restore vehicles. He identifies the biggest challenge faced by New Jersey shops as “simply dealing with the insurance companies and their lack of agreement to repair our mutual

customers’ cars properly” and notes that a lot of the contention boils down to “the archaic labor rates.

“What’s a mechanic’s labor rate?” he asks. “What is a plumber’s labor rate? How about an electrician? Are we any less skilled/qualified for the work we do? Absolutely not. And that means that we should be able to collect a fair and reasonable amount without fighting tooth and nail.”

Brandt’s passion and dedication to this industry for the past 40-plus years indicates exactly why AASP/NJ named DJ’s Restoration as the 2024 Stan Wilson/New Jersey Automotive Body Shop of the Year Award recipient. Originally known solely as the New Jersey Automotive Body Shop of the Year Award, the honor was rebranded in memory of the late AASP/NJ Board member who was known for his dedication

to the association and played an instrumental role in its early days.

“I don’t feel like I deserve this,” Brandt humbly says when asked about his reaction to the honor. “There are many good shops in this state, especially the ones associated with AASP/NJ. I am very grateful for the recognition, but DJ’s Restoration would not be as successful without the support and hard work of my entire team, so this honor belongs to all of us.”

Held at Gran Centurions in Clark in late October, the Annual Meeting also featured the presentation of two Russ Robson Scholarships, AASP/ NJ Hall of Fame induction and the election of three new AASP/NJ Board members. Full coverage of the event is available at grecopublishing.com/ nja1124localnews

The InvertaSpot NexGen, featuring advanced press-and-go technology, is the ideal choice for customers seeking a cutting-edge automated spot-welding solution. Developed to meet car manufacturer specifications, it offers both automatic and manual operation modes.

Now equipped with a lightweight gun for improved handling, the InvertaSpot NG also features trigger controls for seamless operation and an easy-to-navigate touchscreen display that enhances user experience. The new lightweight c-arms upgraded technology ensure precise regulation of pressure, amperage, and timing, delivering optimal performance for a variety of sheet metal configurations.

Acme Nissan Aeromotive

Bridgewater & Edison Lexus

Conicelli Genesis

Conicelli Nissan

Conicelli Toyota

Dover Dodge

Douglas Auto Group (Infiniti & Volkswagen)

Gerber RV

Hackensack Toyota

Hummel & Associates

INDASA

Malouf

Manhattan Mini

Maxon Auto Group (Buick / GMC / Hyundai / Mazda)

Mercedes Benz of Newton Nielson

NUCAR

Paul Miller Parsippany Jaguar

Roberlo

Sussex Honda

Sherwin Williams

• Our expert parts staff is ready to serve you with over $500,000 in inventory and a fleet of trucks to help ensure same-day delivery on most orders

• We respect your time, and offer a quick and accurate order process to help meet your needs

• Proudly serving the Tri-State area with Audi Genuine Parts since 1970

• Same-day delivery on stocked items, next-day availability on most non-stocked items

400 South Dean Street Englewood, NJ 07631

Parts Direct: 888.779.6792

F ax: 201.541.0314 E mail: audiparts@townmotors.com

Hours: Monday-Friday 7am-7pm Saturday: 8am-5pm

BMW of Springfield

391-399 Route 22 E. Springfield, NJ 07081

Toll Free: 800-648-0053

Fax: 973-467-2185

bmwofspringfieldnj.com

BMW of Bridgewater

655 Route 202/206

Bridgewater, NJ 08807

PH: 908-287-1800

FAX:908-722-1729

bridgewaterbmw.com

©️2025

Circle BMW

500 Route 36

Eatontown, NJ 07724

Parts Direct: 732-440-1235

Fax: 732-440-1239

wholesale@circlebmw.com circlebmw.com

Park Ave BMW

530 Huyler Street

South Hackensack, NJ 07606

PH: 201-843-8112

FAX:201-291-2376

parkavebmw.com

Paul Miller BMW 1515 Route 23 South Wayne, NJ 07470

PH: 973-696-6060

Fax: 973-696-8274 paulmillerbmw.com

BMW of Bloomfield

425 Bloomfield Avenue Bloomfield, NJ 07003

Parts Direct: 973-748-8373

psantos@dchusa.com

• Audi Parts Professionals are your subject matter experts on collision parts, replacement components and mechanical items.

• Many Audi dealers offer technical service support hotline access that can reduce your repair times and help you meet an on-time promised delivery.

• Installing Audi Genuine Parts contributes towards improved cycle time that makes both your customer and their insurance company happier.

Helping you do business is our business. Order Audi Genuine Parts from these select dealers.

Paul Miller Audi

179 Route 46 East

Parsippany, NJ 07054

Toll Free: 800.35.MILLER

Parts Direct: 973.575.7793

Fax: 973.575.5911 www.paulmiller.com

Bell Audi

782 Route 1

Edison, NJ 08817

732.396.9360

Fax: 732.396.9090 www.bellaudi.com

Town Motors Audi

400 South Dean Street

Englewood, NJ 07631

201.227.6506/6536

Fax: 201.541.0314 www.townmotors.com

Jack Daniels Audi of Upper Saddle River

243 Route 17

Upper Saddle River, NJ 07458

201.252.1500

Fax: 201.254.1552

tbabcock@jackdanielsmotors.com www.jackdanielsmotors.com

Audi Bridgewater 701 Route 202-206 N Bridgewater, NJ 08807

929.600.9156

Fax: 908.595.0237 parts@audibridgewater.com www.audibridgewater.com

14-16, 2025

Secaucus, NJ

A new year is here, and that means the NORTHEAST 2025 Automotive Services Show is just two months away. Every informed automotive professional up and down the East Coast and beyond knows that AASP/NJ’s flagship show is where the industry connects and plans to head to New Jersey this March 14-16 when it all goes down at the Meadowlands Exposition Center (MEC) in Secaucus.

2025 marks the 48th year AASP/NJ will present this show, which is noted as the largest and fastest-growing event of its kind. Elite educational presentations in the classrooms, innovations, products and equipment on the show floor, plus non-stop activities on and off the show floor is what brings people to New Jersey year after year to experience this one-of-a-kind premiere industry weekend.

“We are gearing up for another action-packed weekend,” boasts AASP/NJ President Ken Miller. “Repair professionals travel from all over to take part in the

NORTHEAST experience, so we set out to never fall short in offering the best of the best. I have no doubt that all we have in store this year will make for another recordbreaking event. Can’t wait to see everyone in March!”

Details are still rolling in, but attendees can rest assured the sky is the limit once again when it comes to the NORTHEAST show as it sets out to bring everything together under one roof. Attendees can expect more than 150 exhibitors to line the aisles of the MEC. The Body Work Bowl will return for the third consecutive year, giving repairers an opportunity to showcase their skills in welding, painting and estimating. Winners in each category will take home big prizes! The show offers repair professionals a shot at winning some NORTHEAST Dollars toward purchases at the show – plus there’ll be chances to meet celebrity guests!

All that is just what will take place on the show floor. There’s also the education component (once again sponsored by AirPro Diagnostics) that NORTHEAST is so well recognized for – featuring some of the industry’s most recognizable faces.

In fact, the most recognizable face in the industry – Mike Anderson (Collision Advice) – will return to NORTHEAST this March. One of the most dynamic speakers around, Anderson is known for his engaging presentations designed to inspire and enlighten repairers to be their best selves in and out of the body shop.

Last year, Anderson wowed the NORTHEAST audience with a full-day Collision Advice workshop focused on completing a 100-percent disassembly and offering an extraordinary customer service experience. This year, he will team up with Craig Stevens of CCC Intelligent Solutions to offer an exclusive, in-depth, one-day workshop to kick off the NORTHEAST weekend.

“Unleashing the Full Power of CCC One” will be held on Friday, March 14 from 8am to 4pm featuring “all things related to CCC One, whether you are a CCC estimating customer or a body shop management customer.” The course is designed for shop owners, operators and managers who want to take full advantage of CCC One’s capabilities. Repairers will walk away from the workshop with a deep understanding of pre-repair, repair and postrepair processes.

This will be an opportunity for repairers to optimize CCC One to improve their body shop’s performance. Anderson and company intend to cover estimating, repair tracking, parts management, invoicing and customer communication. The Collision Advice team will also be on hand all weekend during NORTHEAST.

The conclusion of the Friday workshop will mark the official start to NORTHEAST 2025 when the doors open at 5pm.

Once again, NORTHEAST educational offerings will extend beyond the three-day weekend. Following in the success of last year’s pre-show workshop debut, Dave Luehr (Elite Body Shop Solutions) returns to offer another full-day of education set for Thursday, March 13.

“My Elite team and I are very excited to be invited back to NORTHEAST,” exclaims Luehr. “To me, it is one of the very top events in North America.”

by ALANA QUARTUCCIO

have studied the effects of a few high-leverage actions that eliminate most of the stressors. “In other words, if you do these few things, you work less and accomplish more!” according to Luehr.

His workshop will dive into transforming the atmosphere of one’s shop in the areas of work in process (WIP), repair planning accuracy and parts management. It’s recommended the entire team attend the course in order to learn and build an action plan together.

Later in the NORTHEAST weekend, Luehr will return to the classrooms to present “REV UP Your Business,” where he plans to share the secrets of the world’s best body shops while helping repair professionals build a strategy to take advantage of the incredible opportunities coming their way.

“There’s incredible opportunity in the collision repair industry right now,” Luehr believes. “I’m finding that many collision repairers feel overwhelmed and they aren’t seeing these opportunities because they are feeling the grind instead. This program will give them clarity toward the freedom and prosperity they seek, helping them identify the opportunities they should take advantage of. There’s a false impression that new opportunities will result in more work but that is only the case if people go about things the wrong way. My mission is to help them find the clarity they need so they don’t have to work harder, but work smarter on the high leverage activities that are really going to move their businesses forward.”

The AASP/NJ team is gearing up for another successful year at Meadowlands.

Luehr intends to show audience members how to not only increase productivity and profit, but also how to reduce stress with his “Fundamentals of Operational Success” workshop. Most body shop chaos is avoidable by consistently doing the basics well. Luehr and his team

“It’s nearly time for the industry to return to the Meadowlands for the largest automotive services trade show of its kind,” says AASP/NJ Executive Director Charles Bryant. “When repairers invest in their businesses, our industry can reach new heights and achieve great things –and this is the opportunity to do just that. We can’t wait to see everyone on the show floor this coming March!”

NORTHEAST 2025 show hours are 5pm to 10pm on Friday, March 14, 10am to 5pm on Saturday, March 15 and 10am to 3pm on Sunday, March 16.

Whether you’ve been attending for decades or will be a first-timer this year, be sure to secure your spot at the show. Don’t miss this great opportunity to connect with your peers, grab hold of new knowledge and experience the best innovations the industry has to offer.

Pre-register now for your free admission, make accommodations and get the latest updates by visiting aaspnjnortheast.com

You’ve got the right tools, staff, technology and procedures to give your customers the best repair possible. The missing piece of the puzzle? Genuine Volkswagen Collision Parts. Contact an authorized dealer today and find your perfect fit.

Paul Miller Volkswagen 118 Morristown Road

Bernardsville, NJ 07924

TOLL FREE: 877-318-6557

LOCAL: 908-766-1600

FAX: 908-766-6171

Email: aaitchison@paulmiller.com www.paulmillervw.com

Douglas Motors 491 MORRIS AVE.

SUMMIT, NJ 07901

PHONE: 908-277-1100

FAX: 908-273-6196

TOLL FREE: 800-672-1172

Email: douglasparts@douglasautonet.com www.douglasvw.com

Trend Motors 221 Route 46 West Rockaway, NJ 07866

TOLL FREE: 888-267-2821

FAX: 973-625-4985

Email: dreinacher@trendmotors.com www.trendmotors.com

Crestmont Volkswagen 730 ROUTE 23 NORTH

POMPTON PLAINS, NJ 07444

TOLL FREE: 800-839-6444

FAX: 973-839-8146

Email: vwparts@crestmont23.com www.crestmontvw.com

Refinish+ is AkzoNobel’s digital platform for vehicle refinish businesses to help optimize business performance.

Via single sign on you can access all AkzoNobel’s digital solutions, with the option to integrate third party software for a seamless digital experience. Set KPIs, track business performance, and benchmark your bodyshops, Refinish+ transforms data into insights.

Ready for digital transformation? Find out more at www.refinishplus.com

Nearly four decades after its doors first opened in 1986, Collision Restoration (Fairfield) has begun a brandnew journey as a member of the VIVE Collision family of auto body repair facilities!

Garden State collision repairers were stunned last year when Eddie Day, a prominent and respected figure in the industry, decided to retire and sold the shop he founded so many years ago (read Day’s interview at grecopublishing.com/nja0924coverstory). But the legacy he created made the facility an ideal addition for VIVE Collision’s growing organization, which is dedicated to “redefin[ing] the collision repair industry by focusing on three core principles: People, Process and Passion,” according to VIVE CEO Vartan Jerian.

VIVE Collision was founded in 2021 by a group of collision industry professionals who were passionate about fixing what they saw as broken. “We saw an industry often burdened with outdated processes, high turnover and inconsistent service quality,” Jerian explains. “Rather than accept that as the norm, we set out to challenge the status quo with the goal of creating a world-class collision repair experience for our customers, teammates and stakeholders. We believe that by prioritizing our people, streamlining our processes and fostering a culture fueled by passion, we can deliver better outcomes for everyone involved.”

The MSO now consists of 52 collision repair shops in nine states within the Northeast region, located as far south as New Jersey and Pennsylvania and running up through New England to Maine. Collision Restoration is the ninth New Jersey shop to join the VIVE Collision family –but VIVE isn’t willing to invest in just any shop; it seeks out facilities that are already dedicated to performing highquality repairs per OEM requirements.

“Collision Restoration stands out from other shops in the area due to its extensive OEM certifications and commitment to manufacturer-approved repair standards,” Jerian notes, pointing out that the shop has certifications from JLR, Mercedes Benz, Porsche, Tesla and Maserati. “These certifications ensure our technicians are trained, equipped and qualified to repair vehicles to factory specifications, using the right tools, parts and procedures. This gives customers the confidence that their cars are being restored with precision, safety and long-term

performance in mind. Our focus on OEM-certified repairs and cutting-edge technology positions us as a leader in the market, delivering the highest standards of service to every customer.

“Backed by Eddie Day’s strong foundation, Collision Restoration has established a reputation for quality, trust and excellence,” Jerian continues. “Adding a shop with a strong reputation like Collision Restoration to the VIVE family brings immediate credibility, trusted customer relationships and a solid foundation of operational excellence. It allows us to build on their strengths while enhancing performance with VIVE’s systems, tools and leadership development.”

Of course, adding a new shop to a large organization such as VIVE’s will always include some growing pains. “The biggest challenge [when we acquire a new facility] is cultural alignment and change management,” Jerian acknowledges. “Anytime you integrate two teams, there’s an adjustment period, but we focus on clear communication, leadership development and ensuring everyone understands how VIVE’s ‘People, Process and Passion’ approach creates new growth opportunities.”

Embracing that approach while integrating Collision Restoration’s 28 employees into the VIVE family required a proven approach. “The journey of Collision Restoration becoming a VIVE shop was all about alignment, integration and growth. Our goal was to maintain what made Collision Restoration successful while enhancing it with VIVE’s approach to ‘People, Process and Passion,’” Jerian stresses. “The process started with thoroughly evaluating their people, processes and performance metrics to ensure alignment with VIVE’s vision. We wanted to understand their strengths, spot gaps and ensure our cultures aligned.”

After finalizing the acquisition, VIVE “implemented a 90-day plan to maintain continuity while driving improvement. This involved open teammate communication, leadership assessments and operational support. It’s all about clarity and communication. People need to know the ‘why’ behind the change and how it benefits them,” Jerian insists, clarifying, “For me, the ‘why’ behind VIVE Collision has always been simple – investing in people leads to better results. We know that developing

our teammates, empowering them with clear processes and inspiring them with a shared purpose drives success across the board.”

Collision Restoration’s journey to becoming a VIVE facility continued with operational integration – focusing on optimizing throughput, quality of estimate and overall efficiency while maintaining OEM procedures and continuity. VIVE introduced tools, technology and new processes to ensure consistency and performance. “Our goal is simple: make a great shop even better than before with simple changes to a great business,” Jerian says.

“VIVE continues to invest in the already robust training and equipment necessary to continue with the many OEM programs, and the process doesn’t end at 90 days; we follow up post-close with senior leaders and the team to review what’s working and what needs to change. These calls focus on ‘People, Process and Passion’ to ensure lasting success. Collision Restoration was already a great shop, but with VIVE’s playbook, we’ve set it up to be even better.”

VIVE’s efforts focus on “disrupting the collision repair industry” to overcome its challenges, but what are those challenges? “The biggest challenges facing New Jersey repairers are the technician shortage and the rapid evolution of vehicle technology,” Jerian believes. “The shortage of skilled technicians is a nationwide issue, but it’s even more difficult in a competitive market like New Jersey. Shops must prioritize attracting, developing and

“Another major challenge is keeping up with advancements in ADAS and EV technology. As vehicles become more complex, repairers must invest in continuous training, updated equipment and new processes. These investments are necessary for shops to stay caught up in their ability to service modern vehicles effectively,” he continues, adding, “Addressing these challenges requires focusing on workforce development, technology investment and ongoing training to ensure repair teams are equipped for the industry’s future.”

VIVE’s devotion to improving the industry starts at home with an emphasis on the first “P” of their principled approach: “We are here to support and work for our teammates because the real key is people. If you get the people part right, everything else works.”

Implementing the right processes is a vital step for any successful collision repair establishment, but none of it matters unless one possesses an enthusiasm and love for the industry that keeps them going when things get tough. “Passion fuels everything we do, from approaching customer service to handling growth and expansion,” Jerian professes. “Our combination of ‘People, Process and Passion’ has become the DNA of VIVE Collision and the foundation for everything we strive to achieve.”

Up and up and UP! From east to west and north to south, drivers all over the country have seen significant increases in their auto insurance policies.

According to the US Bureau of Labor Statistics’ Consumer Price Index (CPI), the cost of motor vehicle insurance in the first half of 2024 rose by nearly 21 percent compared to the first half of 2023, an annual trend that has intensified since the pandemic. The average cost of premiums in the first half of 2019 saw an increase of just 1.6 percent compared to the previous year, yet from the first half of 2020 through the first half of 2024, auto insurance premiums increased by 51.7 percent – an average of nearly 13 percent per year! And an additional spike of 12.6 percent nationwide is predicted for 2025.

But some states have likely seen an even larger adjustment to their premiums. Insurify.com projected a 22 percent increase in 2024 nationally, but the insurance shopping comparison website also provided a breakdown by state, indicating that some states could see a rate hike of up to 61 percent! Compared to other states like Massachusetts and Connecticut, which have predicted high increases of 40 percent and 35 percent respectively, New Jersey is below the national average at nine percent, while New Hampshire and New York were expected to experience one of the least significant increases at an estimated four percent.

In some states, a huge jump has made a major dent in consumers’ pockets, so insurers and news outlets have sought to justify these increases by blaming inflation, the cost of repairs and claim frequency and severity. While there is some

validity to these explanations, it seems worthwhile to dissect each culprit identified by carriers.

The annual inflation rate for 2023 was 4.1 percent with the current year’s rate hovering near 2.5 percent and experts predicting a continued decline in 2025. With rising inflation impacting the cost of – well, everything, it’s not exactly surprising that repair costs have increased. Examining the first half of 2024 compared to the same period in 2023, CCC Intelligent Solutions’ Crash Course Q3 2024 reports a 3.7 percent growth in the total cost of repair, driven largely by labor and parts costs…actually being paid by insurers!

Exploring the growth of severity and frequency is a little more complex. CCC Intelligent Solutions’ Crash Course Q1 2024 indicates that severity has outpaced general inflation, largely due to the higher cost associated with medical bills, reflecting an increase of 6.7 percent since 2022. Although the report

asserts that auto collision frequency flattened out in the first half of 2023, it acknowledges, “Comprehensive paid claim frequency has continued to rise in recent quarters and appears to be at or near historic levels, likely a result of the storm activity.”

These factors are corroborated by the 2024 LexisNexis Auto Trends Report: “Both the severity and frequency of claims, including severe auto physical damage and bodily injury, have increased since 2020. Bodily injury severity has increased 20 percent in the post-pandemic years.”

While the fact that advancing technology has led to higher severity is apparent, many shops report that insurers object to paying for certain processes and procedures. At the same time, these same technological advances have largely mitigated some risky driving occurrences, with safety systems like lane departure warning and automatic braking, which would appear to reduce the frequency of claims.

Although the Insurance Information Institute (III) claims that auto insurers paid out 112 percent of premium dollars collected in claims in 2022, they also report a 2023 net written premium growth of 14.3 percent, “the highest in over 15 years and six points higher than the nexthighest, reflecting rate increases to offset inflation-related loss costs.”

Yet, even as insurance carriers cry broke based on these figures, other numbers tell a different story.

III’s website identifies the top 10 writers of private passenger auto insurance in 2023 by direct premiums written as State Farm, Progressive, Berkshire Hathaway (GEICO), Allstate, USAA, Liberty Mutual, Farmers Insurance, American Family, Travelers and Nationwide. These premiums total over $243 million and account for 76.7 percent of written premiums in this category.

A look at annual and quarterly financial results for these insurers reveals varying tales; some acknowledge high earnings, while others share a sob story of their losses, but in either case, these insurance companies do not seem to be suffering from a major budgetary deficit based on what they’re paying their CEOs – these same 10 companies paid over a quarter billion dollars to their CEOs over the past two years!

Data for 2023 wasn’t readily available at the time of this writing, but New Jersey Automotive was able to find estimated compensations for eight of these companies, which has been used in the following discussion.

Although State Farm reported a $13.2 billion underwriting loss in 2023, the company issued a record $118 billion in new policy volume and boasted a $3.5 billion increase in net worth (from $131.2 billion in 2022 to $134.8 billion in 2023). CEO Michael Tipsord’s 2022 compensation was $24.4 million, and while that reportedly dropped to just $17.6 million in 2023, that amount still reflects a 76 percent increase over his 2019 salary of $10

million. According to Payscale.com, the average State Farm employee earns $56,000 per year, which means Tipsord earned over 314 times more than the company’s average worker last year (which we’ll identify as “pay ratio” going forward).

Progressive’s 2023 net income was $3.86 billion, a 456.4 percent increase over 2022, and the insurer net worth is estimated at $93 billion.

During an earnings call in October, Progressive reported a Q3 profit of $2.33 billion – more than double its net income of $1.12 billion for the same period in 2023. CEO Susan Patricia Griffith’s 22.7 percent compensation increase in 2023 took her earnings from $12.7 million (2022) to $15.6 million with a 218:1 pay ratio. by

Kemperle represents hundreds of the industry’s top manufacturers and stocks thousands of their superior products. With more than 50,000 products available to our customers, Kemperle’s locations are uniquely equipped to find the products you need.

KEMPERLE PERFORMANCE DRIVEN PRODUCTS

Abrasives | Adhesives | Body Fillers & Polyester Putty | Clearcoats Detailing Products | Hardware | Masking Products | Prep Solvents/Cleaners Primers/Sealers | Reducers | Spray Suits | ...and more

PINNACLE EQUIPMENT

U.S. Importer for Car Bench International

NJ TRAINING CENTER

• Hands-on technical training

Instagram.com/albertkemperleinc

• Classroom seminars Facebook.com/albertkemperleinc

626 E. Elizabeth Ave

Linden, NJ 07036

P: (908) 925-6133

F: (908) 925-4344

414-416 Madison Ave Paterson, NJ 07524

P: (973) 279-8300

F: (973) 279-9030

100 Melrich Rd Cranbury, NJ 08512

P: (609) 860-2800

F: (609) 860-2801

631 Clifton Ave Toms River, NJ 08753

P: (732) 797-3942

F: (732) 797-0774

Linkedin.com/company/albertkemperleinc

Careers

4 Emery Ave Randolph, NJ 07869

P: (862) 244-4818

F: (862) 244-4822

After reducing its staffing by 20 percent and increasing premiums by an average of 17 percent per policy in 2023, GEICO generated an underwriting profit of $3.6 billion last year, compared with a loss of $1.9 billion in 2022. The company suffered the highest loss in market share of these organizations, and that was reflected in CEO Todd Combs’ salary cut from $13.6 million in 2022 to just $10 million last year (cue world’s smallest violin), with a pay ratio of 130:1.

While Allstate’s 2023 Financial Report indicated a $316 million loss, a net worth of over $50 billion allowed the insurer to pay CEO Thomas Wilson $16.5 million last year, a decrease from his 2022 compensation of $18.9 million, though it still results in a 240:1 pay ratio.

According to USAA’s 2023 Annual Report, its net income of $1.2 billion helped increase its net worth by $1.7 billion, ending the year at $29.1 billion, though its assets total $212 billion. As a result, Steven Wayne Peacock walked away with $8.1 million, a 426.3 percent increase over his starting CEO salary of $1.9 million in 2020 and a pay ratio of 137:1.

Liberty Mutual’s new CEO Timothy Sweeney earned an estimated $15.5 million (a 187:1 pay ratio) in 2023 after his company hiked premiums across the country, including a 25 percent rate increase in California.

In 2022, Farmers Insurance CEO Jeff Dailey received $1.8 million more than he had the previous year, following the layoff of 11 percent of the company’s workforce and huge jumps in homeowners insurance premiums (more than $575 million across 42 states). He earned almost 136 times the average employee’s salary.

After reporting an underwriting loss of $1.7 billion in 2023, American Family reduced CEO Jeff Salzwedel’s salary from $6.7 million (2022) to $3.4 million; last year, he made just over a quarter of his 2020 earnings of $12.4 million. As a result, this company has the lowest pay ratio of just 33:1.

Travelers’ Allan Schnitzer received $22 million in compensation last year, an increase of 136.65 percent compared to $16.1 million in 2019, and a pay ratio of 378:1.

Last year, Nationwide reported its third consecutive year of “record sales” with $1.3 billion in net operating income and total adjusted capital of $25 billion, up nearly five percent from 2022. CEO Kirt Walker received $3.5 million in 2022, an estimated pay ratio of 43:1.

So, where does all this money come from when insurers keep claiming losses year after year?

Michael DeLong, research and advocacy association for the Consumer Federation of America, seems to have

hit the nail on the head in an October 2023 statement: “CEOs are living high on the hog while increasing insurance premiums for people living paycheck to paycheck. Insurers are telling regulators that ordinary consumers have to pay much more for auto and home insurance because the companies are struggling with inflation and climate change, but they are quietly handing CEOs gigantic bonuses. Drivers are required to buy auto insurance and homeowners have to buy coverage to satisfy their loan requirements, so there needs to be more scrutiny of the rate hikes companies are demanding and the huge CEO paydays that are funded with customer premiums.”

So, while many consumers struggle to buy groceries, their insurance premiums continue to increase, lining the pockets of these executives while the companies they work for keep crying that they can’t afford to pay out claims.

As AASP/NJ President Ken Miller points out, these practices threaten public safety. “This information reveals a troubling reality: despite claiming financial struggles, insurers continue raising premiums while failing to cover the full cost of repairs.CEOs walk away with millions, while the companies undercut reimbursements needed for safe and proper repairs. These tactics not only harm repair shops but also jeopardize the safety of consumers who

rely on quality repairs.

“Insurers continue to unjustly enrich themselves while collision repair shops and policyholders are left fighting for fair reimbursement,” Miller stresses. “Insurers routinely deny or underpay for essential repairs, expecting repairers to absorb the costs or compromise on quality. This behavior prioritizes corporate profits over public safety, putting both repairers and policyholders at risk. Simultaneously, insurers delay inspections, reject supplements and impose unnecessary obstacles that increase frustration for both repairers and customers.

“By using cost-cutting measures to boost profits, and making the claims process overly difficult, insurers are leaving repairers and policyholders to bear the burden,” he adds. “As repair professionals, we are committed to performing proper repairs, but we cannot do so without fair reimbursements. It is crucial that we continue exposing these practices to ensure insurers are held accountable for their refusal to pay for safe, complete repairs – repairs that are vital for the safety of the consumers who depend on us to do the right thing for their families and their vehicles.”

David Yeager - EL & M Auto (800) 624-2266 / elandmauto@aol.com

Ed Silipena - American II Autos (609) 965-0987 / esilipena@yahoo.com

Norm Vachon - Port Murray Auto (908) 689-3152 / portmurrayauto@yahoo.com

Dillon Rinkens - East Brunswick Auto (732) 254-6501 / ebautonj@comcast.net

President - Rodney Krawczyk Ace Auto Wreckers (732) 254-9816 / aceautonj@comcast.net

1st Vice President - Daryl Carman Lentini Auto Salvage (908) 782-4440 / darryl@las-parts.coms

2nd Vice President - Mike Ronayne Tilghmans Auto Parts (609) 723-7469 / tilghmans@snip.net

Past President - Bob Dirkes Dirkes Used Auto Parts (609) 625-1718 / dirkesauto@gmail.com

The Automotive Recyclers Association of New Jersey

OSHA unveiled the 2024 list of its 10 most frequently cited safety violations. For the 14th consecutive year, Fall Protection came in at number one with 6,307 violations – the most commonly cited standard following inspections of worksites for all industries. Hazard Communication was next at 2,888, followed by Ladders and Respiratory Protection.

Below is the full list, plus some resources to help you maintain a safe workplace and stay compliant.

OSHA’s 2024 Top 10 Safety Violations:

1. Fall Protection – General Requirements (1926.501) – 6,307 violations

2. Hazard Communication (1910.1200) – 2,888 violations

3. Ladders (1926.1053) – 2,573 violations

4. Respiratory Protection (1910.134) – 2,859 violations

5. Lockout/Tagout (1910.147) – 2,443 violations

6. Powered Industrial Trucks (1910.178) – 2,248 violations

7. Fall Protection – Training Requirements (1926.503) – 2,050 violations

8. Scaffolding (1926.451) – 1,873 violations

9. Personal Protective and Lifesaving Equipment – Eye and Face Protection (1926.102) – 1,814 violations

10. Machine Guarding (1910.212) – 1,541 violations

As always, if you have any questions, please contact me.

800-221-0003 (ext. 1320) (908) 513-8588 (cell) mdefilippis@whartoninsurance.com

1839 Central Park Avenue Yonkers, NY 10710 Order Hot Line: (800) 967-5298 Fax: (914) 361-1508 www.centralave.com COLLISION LINK, REPAIR LINK AND PARTS TRADER

Optimal performance, accessibility and cutting-edge precision come standard with the NEW InvertaSpot NexGen Spot Welder.

The InvertaSpot NG has been developed to meet car manufacturer specifications and offers both automatic and manual operation modes for ease of use. Among its many standout features is an intuitive digital interface, including Bluetooth trigger controls for seamless operation and an easy-to-navigate touchscreen display that enhances each user’s experience. The lightweight gun and c-arms combine with upgraded technology to ensure improved handling as well as precise pressure regulation, amperage, and timing for top-notch performance with a variety of sheet metal configurations.

The InvertaSpot NG’s inverter technology ensures consistent welds every time and helps to minimize energy consumption, keeping operational costs

down and efficiency high. Its compact, portable design allows repairers to position the welder wherever needed, enabling it to take on projects of any size.

The InvertaSpot NG is perfect for both entry-level and expert welders, with pre-set parameters for a variety of materials and thicknesses. Repairers can begin working quickly without having to spend time on complex adjustments; more experienced users can manually fine-tune settings, allowing for precise welds to meet industry standards. Whatever a repairer’s skill level and scope of repair job, the InvertaSpot NG will help in streamlining the repair process and furthering productivity.

To learn more about the InvertaSpot NG or to view Reliable Automotive Equipment’s full offering of products, services and support, visit raeservice. com

1953

Delivering to the New Jersey/New York area.

Genuine Nissan parts are built to the same standards as Nissan vehicles. It’s no wonder they’re the driving force behind the most exhilarating vehicle on the road.

7 experienced countermen and 12 drivers ready to serve

Parts: 800-782-7597

E-mail: John@lynnes.com www.lynnesnissan.com

Hours: M-F 7:30am - 6pm, Sat 7:30am - 2pm

5 Alva Street | Bloomfield, NJ 07003

The RAE InvertaSpot NG combines accuracy with a user-friendly interface for increased efficiency and precise welding solutions.

Our wholesale parts team is here to make sure you find the exact Genuine Subaru Parts you need for every repair.

•Competitive prices

•Fast, accurate deliveries

•Genuine Subaru Parts that drive your business

Fax: 973-402-9591

mdaltilio@paulmiller.com www.paulmillersubaru.com/parts