by Chasidy Rae Sisk

PRESIDENT’S MESSAGE by Burl Richards Think RTA Doesn’t Affect You? Wrong!

ABAT MEMBER APPLICATION

EXECUTIVE DIRECTOR’S MESSAGE by Jill Tuggle ABAT Members - Mount UP!

LADIES OF COLLISION by Alana Quartuccio Susan Schulz, English Collision Equipment, Inc. NATIONAL NEWS

CREF’s 2025 School Benchmark Grants and Student Scholarship Applications Open

ASK THE EXPERT by Robert L. McDorman TDIs Appraisal Experience Data Call Report Supports the Need for Mandatory Appraisal Rights

Official publication of the Auto Body Association of Texas

(903)

Larry Cernosek Deer Park Paint & Body lcwrecker@comcast.net (281) 930-1539

Chevy Corn Corn’s Collision chevy@cornscollisioncenter.com (979) 279-3310

Kevin Ellison Westway Ford kellison@vtaig.com (972) 584-9033

Brandon Gillespy Park Place BodyWerks bgillespy@parkplace.com 214-443-8250

Chad Kiffe Berli's Body & Fine Finishes chadk@berlisbody.com (512) 251-6136

Greg Luther Helfman Collision gluther@helfman.com (713) 574-5060

Chad Neal Innovative Collision Equipment Chadwneal@yahoo.com (817) 527-2143

Payne Payne & Sons Paint & Body logan@paynescollision.com (214) 321-4362 Anthony Palomo West Texas Auto Color japalomo3@yahoo.com (806) 831-7765 Corey Pigg S&W Expert Collision Repair coreyp@swcollision.com (936) 634-8361

Manuel Rubio Miracle Body & Paint manuelr@miraclebp.com (210) 843-9564

Albert Salinas South Houston Nissan asalinas@southhoustonnissan.com 833-856-7871

Published by: Thomas Greco Publishing, Inc. 244 Chestnut Street, Suite 202, Nutley, NJ 07110

Corporate: (973) 667-6922 / FAX: (973) 235-1963

PRESIDENT/PUBLISHER

Thomas Greco / thomas@grecopublishing.com

VICE PRESIDENT/SALES DIRECTOR Alicia Figurelli / alicia@grecopublishing.com

EDITORIAL DIRECTOR Alana Quartuccio / alana@grecopublishing.com

SR. CONTRIBUTING EDITOR Chasidy Rae Sisk / chasidy@grecopublishing.com

PRODUCTION COORDINATOR Joe Greco / joe@grecopublishing.com

OFFICE MANAGER Donna Greco / donna@grecopublishing.com

SPECIAL CONTRIBUTORS: Burl Richards / Jill Tuggle Robert L. McDorman / Mike Anderson

www.grecopublishing.com

WWe spend a lot of time around here talking about Right to Appraisal (RTA), and lots of shops get it – and then some don’t. I’ve heard plenty of folks claim that RTA doesn’t affect them, and although I respect your right to be wrong, education is a vital part of what we do here at ABAT, so let me break it down for you.

First off, if you believe that you never use RTA, you’re technically correct; shops cannot invoke the Appraisal Clause. A policyholder can invoke their RTA when there’s a discrepancy between the repair cost and the amount the insurance company is willing to pay, but as shops, our job is to educate the customer and help them understand that they have this right so they aren’t being taken advantage of by carriers that are only concerned with profits.

A common situation you might see: A customer brings in a vehicle, along with a photo estimate from their insurer. It’s pretty likely that estimate comes nowhere near the amount needed to actually make the repair. In fact, when ABAT did an analysis of photo estimates a few years ago, we found that a true repair plan costs 10 times more than a photo estimate on average.

So, maybe the insurer’s estimate comes in at $1,500, and after you disassemble the vehicle and submit your blueprint to

the insurance company, they’ll send something back that accounts for 30 to 40 percent of what you wrote. Perhaps you try for another supplement, or maybe you explain to the customer that the insurer is objecting to paying for OEM procedures and safety items associated with the repair. It’s likely the insurance company is going to tell you and your customer that no one else asks for those items, that your shop is too expensive.

Now, we can provide OEM documentation to demonstrate why these repairs are needed, and the insurer may ultimately agree to properly indemnify their policyholder…and they may not. If that’s the case, a shop that cares about their customers (like I know you do) will take time to educate the customer about their options, and while pursuing the short pay in court is a possibility, the Texas Department of Insurance (TDI) recommends that policyholders invoke RTA before reaching out to an attorney. In my experience,

continued on pg. 14

AABAT members, it’s 2025!! And there’s a good chance that by the time this issue hits your desk, the 89th legislative session will have started. I can’t even believe that! It seems like it was just a few months ago when we were making our last legislative push, but it was, in fact, two years ago! This time, we need you more than we ever have. This year, it is absolutely crucial that we pass legislation to address many issues in Texas but especially SB 369 – the Right to Appraisal bill. And we need heroes.

We need you to donate, make phone calls, show up to the Capitol, and for heaven’s sake, if you are not a member – join ABAT. Here’s what we specifically need from our members in the coming weeks:

• Donations: We need 75 more shops to step up and be Political Champions for us. ABAT needs to raise $82,000 for our share of the costs to afford the team of folks it will take to pass this bill. These

funds will go directly to the staff in charge of lobbying, our legal team and campaigning for these bills. While we like for these champions to come in at the $1000 level, any donation amount is helpful.

• Membership: The number of members in our organization tells lawmakers how seriously to take us. We need to look strong and be strong. Membership dues also help us cover operating costs for the year.

• Show up: We will be asking you to make phone calls, send emails and even show up to the Capitol to spread awareness about the struggles we face as collision repairers. While this may seem intimidating for many, I promise you this will be one of the easiest things you can do. It’s all about honesty and speaking from your heart. Most lawmakers have no idea how much of a struggle it is to get the carriers to properly compensate for a safe and proper repair. They just need to hear from the shops in their markets about the problems that you face day to day. A casual conversation about your struggles is all that’s needed, and we even have email templates you can use. Please make 2025 the year that you resolve to be a changemaker in our industry.

You can donate, join and read more about our proposed legislation on our ALLNEW website: abat.us.

Have a blessed year – love you all!!

Although it may appear as though collision repair is a man’s world, it most certainly is not. There are so many amazing ladies who help make this industry shine, especially here in the Lone Star State. This month, we feature Susan Schulz of English Collision Equipment, Inc. who has been an active participant in this industry for more than two decades. An accountant by trade, she initially set out to work in that field, but as it turns out, she also has a knack for equipment and really knows her stuff!

Texas Automotive: How did you get your start in this industry, and what role do you play?

Susan Schulz: This May, I will be with English Collision Equipment for 24 years. I’m a CPA on paper and was offered a job as the senior accountant for English, and I took on the opportunity. One day, I answered a call from a customer who was in need of a welder ASAP. I blindly walked through talking to this customer about a welder. When I got home that night, I watched some post-op videos so I could learn what the equipment was and could do. The next day, I called the customer back and sold the welder over the phone. My boss’ reaction was, ‘If she can do that over the phone, I wonder what she can do in the shop,’ so he sent me out into the field. When I originally started, I thought I’d only be involved in sales, but as it turned out, I found myself learning about all the different parts of the industry, seeing what our customers deal with on a day to day basis. When I go into a shop, I evaluate what they need and don’t need. I guide them through their needs and work on their wants from there.

TXA: Sounds like it was just meant to be. What about this industry keeps you inspired?

SS: I lost a husband in a car wreck. There were several factors that led to this tragedy, but the repair that was done to the truck he was driving wasn’t done properly, and the door flew open. So, when I go into shops, I want to be sure that they have everything they need to ensure that the vehicle is safe when it leaves their shop, so hopefully, someone else won't get that call because a shop did not do what it was supposed to do.

TXA: Can you tell our readers a little bit about what you and your company offer?

SS: We offer resistance welders, rivet guns and dent pulling systems and filter service on paint booths. I will visit a body shop and observe what they're in need of, and work on providing them with a solution and we get them set up. I provide training to make sure they understand how to use the equipment. When I go into a shop that already has equipment, I’ll observe their use of it, and if there’s something they aren’t doing, I’ll make sure they are aware of all the things the machinery is capable of doing, such as making sure they are getting the best weld, for example.

TXA: What would you say are some of the biggest challenges that women in the industry face?

I really think women in this industry are underestimated. I can walk into a shop to troubleshoot/repair a piece of equipment or paint booth and get ‘the look’ until they see me fix their issue and their equipment is up and running again. I have been very lucky as my customers know me and never once thought I couldn’t handle the job. We just have to be prepared for the job and walk in knowing what we are doing and show them how it’s done!

TXA: What about this industry do you love the most?

by Alana Quartuccio

SS: First, the people are awesome. I like knowing that I'm going in and making somebody's vehicle a little bit safer. I also like to learn the different aspects of the whole business; having a part in that car going out the door of that shop and knowing the car was fixed correctly is important to me.

TXA: So what's life like outside the body shop? Do you have any interesting hobbies that you'd like to share?

SS: I travel a lot for work, but when I can, I like to run, ride my motorcycle, deer hunt, read and love visiting libraries when in different cities

TXA: What encouraging words would you give other women interested in entering this profession?

SS: Make a plan and follow it. Learn everything you can, go in there with your head up like you own that business, and show them what you’ve got! TXA

Optimal performance, accessibility and cutting-edge precision come standard with the NEW InvertaSpot NexGen Spot Welder.

The InvertaSpot NG has been developed to meet car manufacturer specifications and offers both automatic and manual operation modes for ease of use. Among its many standout features is an intuitive digital interface, including Bluetooth trigger controls for seamless operation and an easy-to-navigate touchscreen display that enhances each user’s experience. The lightweight gun and c-arms combine with upgraded technology to ensure improved handling as well as precise pressure regulation, amperage, and timing for top-notch performance with a variety of sheet metal configurations.

The InvertaSpot NG’s inverter technology ensures consistent welds every time and helps to minimize energy

consumption, keeping operational costs down and efficiency high. Its compact, portable design allows repairers to position the welder wherever needed, enabling it to take on projects of any size.

The InvertaSpot NG is perfect for both entry-level and expert welders, with pre-set parameters for a variety of materials and thicknesses. Repairers can begin working quickly without having to spend time on complex adjustments; more experienced users can manually fine-tune settings, allowing for precise welds to meet industry standards. Whatever a repairer’s skill level and scope of repair job, the InvertaSpot NG will help in streamlining the repair process and furthering productivity.

To learn more about the InvertaSpot NG or to view Reliable Automotive Equipment’s full offering of products, services and support, visit raeservice.com.

The RAE InvertaSpot NG combines accuracy with a user-friendly interface for increased efficiency and precise welding solutions.

The InvertaSpot NexGen, featuring advanced press-and-go technology, is the ideal choice for customers seeking a cutting-edge automated spot-welding solution. Developed to meet car manufacturer specifications, it offers both automatic and manual operation modes.

Now equipped with a lightweight gun for improved handling, the InvertaSpot NG also features trigger controls for seamless operation and an easy-to-navigate touchscreen display that enhances user experience. The new lightweight c-arms upgraded technology ensure precise regulation of pressure, amperage, and timing, delivering optimal performance for a variety of sheet metal configurations.

Collision repair facilities around the country desperately need talented workers to address the ongoing workforce shortage, yet a lack of qualified young professionals are entering the industry for various reasons. Many schools’ collision programs are underfunded, and post-secondary students seeking to enhance their skills and knowledge often struggle to afford tuition and tools.

The Collision Repair Education Foundation (CREF) addresses these needs through its Collision School Career Readiness Benchmark Grants and Student Scholarship awards, thanks to support from many generous industry donors and sponsors.

In 2024, CREF awarded $536,000 in grants to 80 schools, benefitting over 4,000 students training in these programs this year alone. The Benchmark Grants recognize those programs that excel at educating students but which require additional financial assistance due to constrained school budgets, providing funds to

continued from pg. 4

my shops typically collect within five percent of our repair plan when a customer invokes RTA.

Feel like RTA is the policyholder’s problem, not yours? Okay, let me explain why this still affects your shop. Take that same photo estimate and repair plan, but this time, the customer doesn’t invoke the Appraisal Clause. Instead, they pay the difference. Now, the next time you submit a repair plan that includes a test drive, checking for wind noise, correcting a water leak or cleaning the vehicle, that carrier can legitimately say “we don’t pay for that!” Because they didn’t pay for it; the customer did. And while that may seem trivial on one car, when it happens repeatedly over time, it becomes the prevailing competitive practice, which is what the vast majority of insurance policies – if not ALL – obligate them to pay for.

In contrast, when they DO pay for those items through the RTA process, that becomes the prevailing competitive practice and empowers you with the documentation to show that they have paid it in the past, making it less of a fight in the future. So many shops are told they’re “the only one,” but that’s simply not true. Every operation that your shop performs should be included on your invoice for the customer to see, and you deserve to be paid for what you’re doing. By educating customers on RTA, we help them, but we also help ourselves and our industry.

Still not convinced that RTA affects you?! Let’s break it down even simpler. Do you…

purchase the tools, equipment and supplies necessary to enhance their students’ learning experience and elevate the caliber of their graduates.

The 2024 Student Scholarships benefitted 90 students with over $235,000 awarded in financial assistance to ensure those students were able to continue their education, preparing them to pursue a successful career in body shops around the country.

Applications for CREF’s 2025 Student Scholarships open on January 8, with a deadline of March 6, 2025.

Applications for CREF’s 2025 School Benchmark Grants open January 22 through June 27, 2025.

To apply for a Benchmark Grant or Student Scholarship – or to learn more about supporting CREF’s efforts to promote the industry to future generations – visit CollisionRepairEducationFoundation.org.

• Want to ensure customers’ vehicles are safely repaired?

• Find that photo estimates often fall short of predicting the actual work needed?

• Get tired of assuring customers that you’re not overcharging them because your invoice is so much higher than the insurer’s “guestimate?”

• Deserve to be fairly compensated for the high-quality repairs you perform?

• Worry about charging customers a copay (or shorting yourself) because insurance companies constantly under-indemnify their policyholders?

• Get sick of being told you’re “the only one” who performs certain repairs?

• Want to be part of the solution in establishing realistic “prevailing competitive practices?”

If any of the previous circumstances apply to you and your business, RTA does affect you, and it’s time to acknowledge it and get involved with our legislative battle to mandate the Appraisal Clause be included in all Texas automotive insurance policies.

(Learn more about the RTA process and ABAT’s ongoing legislation on page 16.)

Buying a paint booth is a huge investment, and there are many factors to carefully consider before selecting one Will the booth work well in a region where there’s a ton of humidity and with drastic changes in the weather? How long do you think the booth will last and will it require a lot of maintenance? Will your painters be comfortable using it ever y day and finally, will the company making the booth provide solid training and reliable customer ser vice?

To answer these questions before acquiring two Chronotech spray booths and a prep deck from USI ITALIA back in 2004, Collision Center Manager Kevin McIllveen at Russell & Smith Body Shop in Houston, TX spent six months studying the market He was looking for the best booths that matched his needs to use in a brand-new 36,000 sq ft facility that the company built from the ground up

Mcllveen, age 56, entered the industr y more than three decades ago as an estimator and has worked for Russell & Smith Body Shop since 1993 His goal with his new spray booths was to improve the efficiencies in his paint department and to accommodate his production, he said, while simultaneously saving time and energy if possible

The vetting process was arduous but worth it in the end. "We did our research so that we could make an educated decision," he said "I went to NACE two years in a row and talked to literally ever yone and asked a lot of questions We knew that this was going to be a ver y significant investment, so we took the time to perform our due diligence to cover all our bases We invested in their prep stations as well, which was another good decision, because my guys can work so much faster and effectively with five different places where we can spray We put a curtain up in the prep booth that provides us two additional spaces that are heated and properly ventilated So, when we are really jammed, we can handle the workload and maintain our cycle time without interrupting or slowing down our production "

After using them for a ver y short time, Mcllveen could clearly see that his Chronotechs were more than capable as they quickly became a centerpiece in his new, high-end, modern shop

"We have four paint teams here, consisting of a painter and a painter’s helper and we consistently log approximately 600-700 paint hours weekly,” he said “We switched to waterborne paint when we opened this facility because we want to provide a healthier climate for our employees and the community as a whole ”

we push these booths and they never let us down ”

Any issues that Russell & Smith Body Shop have encountered with their USI ITALIA booths have been rare and far between But Mcllveen feels good knowing that if called upon, the company will respond and find solutions promptly “If you do your scheduled maintenance and keep ever ything clean, these booths will last you 30 years and maybe even longer The issues that we have encountered with the Chronotechs have been minor and quickly solved, which is impressive when you think that we have been using these booths daily for the last 16 years. I tell people that these booths will be here long after I’ve retired!”

Why was Mcllveen able to improve his numbers by simply adding two USI booths? “In the end, it all comes down to their airflow because we never need blowers or additional air to cure these vehicles The fans in these Chronotechs are exceptional because they feature variable speeds, so we can switch depending on the parameters of each job. Our painters are producing an impressive product day after day, so these booths are saving us both time and money We paint an average of 400 cars ever y month, so

After training provided by USI ITALIA, Mcllveen’s painters were able to start spraying after one day, he said "The Chronotechs are designed to work with waterborne paint, which makes it easier for our painters to do their work After a ver y short time, all of our guys were comfortable and the results were consistently exceptional.”

Mcllveen is also impressed by the Chronotech's sturdy construction and durability "Some booths are just a box, but these are wellbuilt," he said “I know, because I've seen them all and there isn't anything like a USI ITALIA booth "

His career in collision repair industr y has been a great experience and products like his USI ITALIA spray booths and prep station are a part of that, he said “We haven’t had to furlough anybody here and that’s because we value our people and, in the end, our Chronotechs are part of the team ”

With 2025 underway, businesses around the country are examining their budgets and determining which investments to undertake. To deal with ongoing challenges related to advancing technology, Texas collision repair shops likely plan to allocate funding to a number of important business needs, such as tooling, equipment, training, certifications, employee benefits and so forth.

But what about the challenges related to shops’ continuous struggles with insurance companies – how can repairers budget for ways to address confrontations with appraisers who underindemnify claims or refuse to pay for the parts and procedures necessary to safely and properly repair customers’ vehicles? By joining ABAT and getting involved with its legislative efforts calling for safe repairs and mandatory Right to Appraisal (RTA), initiatives which will be the association’s focus as the 89th legislative session opens up on January 14!

“We are going to throw everything we have at passing some laws that address safe and proper repairs and the consumers’

Right to Appraisal in Texas,” says ABAT Executive Director Jill Tuggle. “To make this happen, ABAT will need to increase its membership and legislative funds exponentially. We need YOU!”

And by “you,” ABAT means ALL of you…shop owners, managers, repairers, technicians, estimators, painters, instructors, auto body students and everyone in between. In addition to launching its new website last month, the association began offering new membership levels to encourage participation from more industry professionals throughout the Lone Star State.

“Our offer of these new membership levels comes in response to hearing from repairers who see value in membership and want to be part of something bigger, even though the owners of the shops where they work have not yet joined the association,” Tuggle explains. “We talk a lot about investing in our businesses, but individuals also need to invest in themselves, so we’re providing new ways for Texas auto body professionals to do exactly that.”

It’s also important to recognize that there are many ways to

by Chasidy Rae Sisk

be an auto body professional, Tuggle points out, as she recalls recently attending a local tech school’s advisory board luncheon where she met a young lady whose parents have coerced her into obtaining a four-year degree. “She plans to come back to work in a body shop after graduating with a political science degree, but I encouraged her to follow along with what we’re doing legislatively because there’s a crossover there between what she’s studying and her ultimate career goals. I’m hoping she’ll attend our Capitol Day event later this year. The conversation was a really cool reminder that there are many ways to be involved in this industry, and it’s important that we highlight how many opportunities exist outside of the shops as well.”

ABAT’s new membership levels grant individuals access to the plethora of information the association provides through the information hub on its website, inclusion on its mailing lists and opportunities to attend training events. The cost of an individual membership begins at just $25 per year; those interested can register at members.abat.us/application-to-join.

“Getting involved as a member also allows you to stay updated on the legislative efforts ABAT is undertaking to improve the industry for all Texas shops and repairers,” Tuggle adds.

During this legislative session, the association will continue “beating the drum” for safe repairs as it has since 2017 (as discussed in last month’s Texas Automotive cover story, available at grecopublishing.com/txa1224coverstory); however, while details related to that proposed legislation is still forthcoming, ABAT is putting its support behind mandatory RTA for the third time. Its first attempt at an appraisal rights bill in 2021 passed the House of Representatives with a vote of 91-50 and progressed to the Senate, but as the session winded down, it never made it out of committee. The 2023 iteration of the bill requiring the Appraisal Clause be included in all Texas automotive insurance policies passed the House of Representatives and was awaiting a final vote by the Senate when the session ended.

Senate Bill 369, pre-filed on November 14 by Senator Charles Schwertner (R-District 5), includes similar goals and language as the bills proposed in the last two legislative sessions. First and foremost, it would mandate that all personal automobile insurance policies written in Texas “contain an appraisal procedure that complies with this subchapter.”

That procedure would permit the insured or insurer to demand an appraisal within 90 days from when “the insurer accepts liability and issues the insurer's undisputed liability offer,” at which point, both parties would have 15 days to appoint an unbiased appraiser and share that appraiser’s identity with the other party. Those appraisers would collaboratively determine the true amount of the loss, but if they fail to agree upon the amount of loss, they would select an umpire to determine the true cost of repairs. (The bill is available in its entirety at bit.ly/RTA-SB369.)

The need for this type of legislation became apparent in recent years. Although insurance policies have historically included the Appraisal Clause, the Texas Department of Insurance (TDI) permitted State Farm to eliminate the Appraisal

Clause from its Texas policies in 2015, and since then, several additional carriers have submitted policy change applications requesting approval from TDI to remove the RTA for repair procedure disputes from their policies.

“If insurers are permitted to remove the Appraisal Clause from their policies, it could have a ripple effect that will negatively impact the industry,” Tuggle fears. “When we allow insurance companies to self-police and manipulate the system, their accountability wanes, and shops are put under even more pressure to cut corners.”

But she’s convinced that most shops want to do the right thing for their customers, so it’s important to recognize that the “ripple effect” she mentions can work in both directions. “We need more shops, more repairers, more instructors to step up to the plate. A lot of times, people don’t get involved because they’re convinced that other people are handling these matters on their behalf, but that weight is heavy when it’s distributed among a few people; it gets lighter when we spread it out among the masses. And there are a massive number of Texas shops. Working together, we can accomplish what we’ve set out to do!”

Getting legislation passed is hard work, requiring a team of experts – and that experience comes at a cost. ABAT is looking to raise $82,000 for its share of the funds required and has asked for shops to become Political Champions to aid these efforts.

“We can raise the funds needed if 82 shops each donate $1,000, but that’s asking less than two percent of Texas shops

continued on pg. 18

While ABAT remains focused on its local initiatives for Texas legislation, the association still keeps an eye on national legislation that impacts Texas repairers, including federal efforts happening in Washington, DC. “ABAT takes an opposing stance to some of the initiatives that are posing as the ‘Right to Repair,’ such as the REPAIR Act,” Tuggle says. “The concept sounds appealing, but at its core, this legislation is being used by aftermarket providers to convince lawmakers that body shops don’t have access to the information and parts they need to properly repair cars. They are pushing to gain access to this information so they can create more aftermarket parts and positioning the fight as though it’s for repair shops’ benefit when it is not.”

Several national organizations, including the Society of Collision Repair Specialists, have been at the forefront of the conversation in DC, addressing the actual challenges being faced in the field by collision repair professionals, and ABAT intends to lend its support to such initiatives that are championed by actual repairers who understand actual repairers’ challenges. Stay tuned to Texas Automotive for more information as it becomes available.

continued from pg. 17

to do something for everyone’s benefit. If we spread that out amongst the vast number of shops and repairers in our state, each contribution would become less burdensome. Our association is strong, but our membership is not as deep and wide as many believe, and a small minority of people actually step up to the plate; we need everyone to step up and help make a difference.”

Several Political Champions share their reasons for stepping up.

“As a small town auto body repair shop, we are dealing with our community, so making sure they get safe and proper repairs is our highest priority,” Ed and Crystal Griffin (Griffin’s Paint & Body; Winnsboro) say. “We donated to ABAT in order to help ensure that our community members are treated fairly by their insurance companies and that donation is a sacrifice worth making. If we don’t all take a stand and fight to be treated fairly, then we will have nothing but unsafe or diminished vehicles on Texas roads. We stand for the truth…what do you stand for? Make a donation and help your community stay safe!”

“More than 90 percent of our customers have to use the Appraisal Clause,” acknowledges Steven Stringer (Reno Paint & Body; Paris). “Insurance companies like State Farm that do not offer RTA in their policies create a power imbalance between consumers and insurers. Customers may only have the option

WIN offers education, mentoring and leadership development opportunities to build critical skills for success in the collision repair market.

• Local/Regional Networking Events

• Annual Education Conference

• Educational Webinars

• Mentoring Opportunities

womensindustrynetwork.com

• Scholarship Program

• School Outreach Program

• Most Influential Women (MIW) Award

to take legal action to resolve disputes, which is costly, timeconsuming and burdensome. Supporting ABAT will help level the playing field by ensuring that all consumers have access to the same rights when it comes to auto repair appraisals.”

“As shop owners, we need to do what’s right for our customers and this industry,” offers Brian Buson (Auto Tech Services; Mansfield). “We will never get this done without supporting this legislation. It’s critical work that can make a world of improvement for all, including our customers and the profitability of businesses! Doing safe repairs with OEM parts and getting paid for the work required to be done! It’s time to put your money and your efforts toward making a difference!”

Although Political Champions are encouraged to donate $1,000, Tuggle recognizes that such a large contribution may not be possible for every shop. Raising the necessary funds could be achieved in a number of ways that would require less effort from each individual repairer or shop while still adding up to effect the impact desired. If just 10 percent of Texas shops contributed $183, ABAT will have raised enough money; if 25 percent of shops make a $73 donation, sufficient funds will be available. And shop owners can involve the entire team as well.

“Maybe your shop cannot afford to donate a large amount of money, but if you educate your technicians about what we’re doing and how it affects them, they might be interested in contributing as well,” Tuggle suggests. “If four technicians give $25 each and you match it, that’s a $200 donation and helps us move the needle. This legislation doesn’t just affect shop owners; it affects everyone in the shop, and it also impacts all Texas policyholders, so it’s going to take all of us investing in our industry to make a difference.”

Along those same lines, it’s also important to spread awareness about what ABAT is doing. The association encourages members to educate their customers and their legislative representatives, but it’s just as vital to educate industry peers. “Talk to the other shop owners, technicians and estimators you know about joining ABAT,” Tuggle urges. “The more of us there are, the louder our voices become!”

ABAT President Burl Richards agrees, stressing “the importance of passing collision repair legislation that protects the consumers of Texas. We need our members more than ever right now.”

And small efforts by many individuals add up to large results. As author Robin Dance says, "Some of us will make tiny ripples and others will send waves crashing, but each one will change the surface of the water forever." Participating in ABAT’s efforts to mandate RTA is an easy way to collectively make a big splash on the Texas collision repair industry!

Stay current with ABAT’s ongoing legislative initiatives and calls to action by continuing to read Texas Automotive each month as we provide updates on these efforts or by visiting abat.us/current-initiatives-legislation TXA

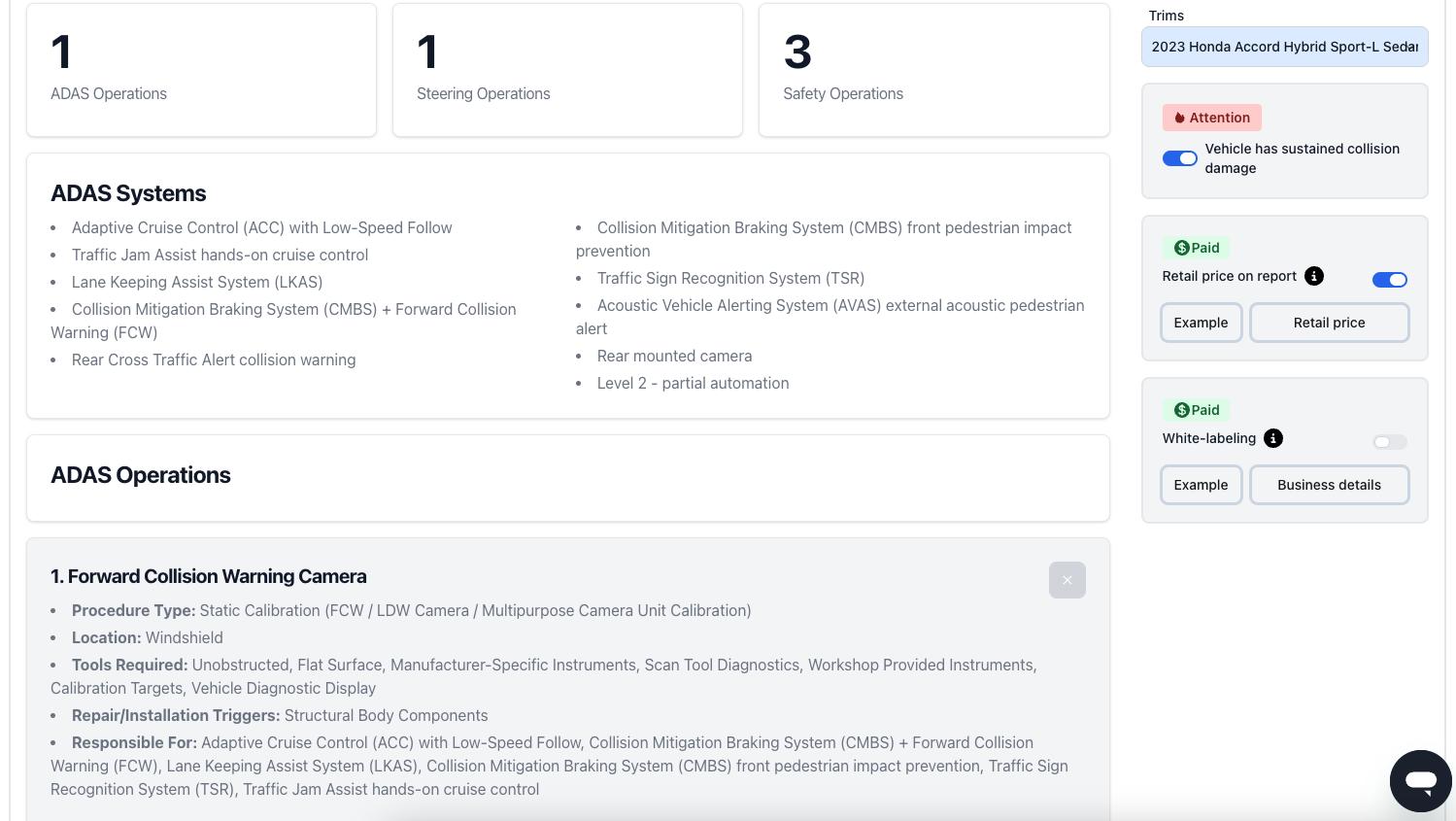

Revv identifies every required ADAS calibration with supporting documentation

Revv is an end to end solution for ADAS calibration shops

• Precise Calibration Identification

• Seamless Integration

• Custom Invoicing

by Robert L. McDorman

Dear Mr. McDorman,

Thank you for your comments and question. Let me start by stating that I commend the Texas Department of Insurance (TDI) for stepping forward, requesting this data on appraisal and releasing it for public view. As you point out, their report states that only 0.02 percent of reported claims went through the appraisal process. This is particularly concerning and reflects the alarming unawareness of policyholders when it comes to their Right to Appraisal when the proposed offer to settle is low. The report then shows that only a small fraction of those – just 14 auto claims – reportedly moved to litigation. I am confident the TDI understands that without the contractual Right to Appraisal, the number of claims going to litigation would have been much greater. There is no information on litigation costs in the report, but it states that appraisal costs for auto claims are less than two percent of the average appraisal award, which demonstrates just how cost effective the appraisal process is as a means of resolving disputed settlement offers.

With only 0.02 percent of reported claims going to appraisal, one would wonder why the carriers have been attempting to remove the Right to Appraisal from their policies in the first place. Why is it a big deal? What they fear is that information on the policy Right to Appraisal and the typical significant appraisal awards is starting to spread, and they want to quietly and underhandedly remove this right before it starts to cost them significant money. They know they aren’t really making fair offers for 99.8 percent of claims and that their scheme is finally becoming exposed. With the Right to Appraisal removed from Texas policies, it wouldn’t really matter that the scheme is exposed because there wouldn’t be any fast and cost effective way for insureds to push back and get fairly compensated for their loss.

This data call report sounds the alarm on the systematic underindemnification scheme I have spoken about for years and the need for mandatory appraisal rights. With mandatory appraisal rights in Texas, the TDI website can state, “Your policy includes an appraisal process to resolve complaints,” instead of the current, “Your policy may include an appraisal process to resolve complaints.”

Now getting directly to your question, our data shows (for

2017 through June of 2024) the average negotiated increase on total loss claims above the carrier final offer for 0-2-year-old vehicles is $4,387; for 3-5-year-old vehicles, it is $3,908; for 6-8 years old, it is $3,617; for 9-11 years old, it is $3,555; for 12-14 years old, it is $3,483; and over 14 years old, it is $5,009. The average settlement increase for all years combined is $3,965. On the repair procedure disputes we have handled for the insured for the same period, the average settlement increase from the carrier final supplement to the signed agreement between the independent appraiser is $5,981. Our combined average increase is $4,973.

We should also take note of the March 2023 Texas Watch Impact of Auto Appraisal Report. This report shows that of the 166 repair claims analyzed, the average increase between the appraisal award and the insurance offer was $5,307.35. It was also reported that for 1,080 total loss claims analyzed, the average difference between the appraisal award and the insurance offer was $3,889.27. The combined average increase on the 1,246 claims analyzed was $4,078.20.

Clearly, with the Texas Department of Insurance Appraisal Experience Data Call Report noting an average increase between $2,100 and $5,900, the Texas Watch Impact of Auto Appraisal Report noting an average increase of $4,078.20 and our average increase of $4,973, we can see that Right to Appraisal is critical, and making these rights mandatory before they are deviously removed from Texas auto policies is vital. As insured citizens of Texas, we need our lawmakers to pass the mandatory Right-to-Appraisal bill this upcoming session. Without the passing of this bill, this injustice will not only continue but likely grow even worse.

As I have written many times, we at Auto Claim Specialists understand your concerns about under-indemnification. Our position is that the Right to Appraisal should be a mandatory contractual right in every policy. For the 89th Texas Legislative session, we have teamed up with lobbyist Andrew “Drew” Graham to educate lawmakers and help secure mandatory contractual appraisal rights for all insured Texans. We, the insureds, are many, and I am confident that if we join forces and all do what we can, we can be successful in securing our rights and our children’s rights to contest insurance settlement offers that would result in underpayment of losses and/or shoddy and dangerous repairs.

As shown above, the under-indemnification in repair procedure claims in Texas is rampant. What we have found extremely

I own and operate a collision facility in North Texas. In my opinion, the release of the Texas Department of Insurance Appraisal Experience Data Call Report outlines and supports the need for mandatory appraisal rights in Texas. I was surprised that less than 0.02 percent of payable personal auto claims used the Appraisal Clause. I was also disappointed that the report had the total loss and repair procedure appraisal results combined, as these are very different claims. The report stated that about half of the personal auto appraisal awards were between $13,000 and $38,000, resulting in a $2,100-$5,900 increase above the insurer’s initial offer. How does the data call report compare to what you see in your office from the handling of personal auto claims? Robert is a recognized Public Insurance Adjuster and Certified Vehicle Value Expert specializing in motor vehicle-related insurance claim resolution. Robert can be reached by phone at (800) 736-6816, (817) 756-5482 or via email at

continued from pg. 20

concerning is that most of the estimates and supplements for repair claims had many overlooked (by design) safety and OEM-required operations needed to restore the loss vehicle to its pre-loss condition to the best of one's human ability. I believe limiting or removing the insured’s right to appraise a repair procedure is a serious safety issue. The limiting or eliminating the Right to Appraisal by the insurance carrier in a repair procedure dispute will be the nail in the coffin for safe roadways in Texas.

The spirit of the Appraisal Clause is to resolve loss disputes fairly and to do so in a timely and cost-effective manner. Invoking the Appraisal Clause removes inexperienced and biased carrier appraisers and claims handlers from the process, undermining their management’s many tricks to undervalue the loss settlement and under-indemnify the insured. Through the Appraisal Clause, loss disputes can be resolved relatively quickly, economically, equitably and amicably by unbiased, experienced, independent third-party appraisers as opposed to more costly and time-consuming methods such as mediation, arbitration and litigation.

In today’s world, regarding motor vehicle insurance policies, frequent changes in claim management and claim handling policies and non-standardized GAP Addendums, we have found it is always in the best interest of the insured or claimant to have their proposed insurance settlement reviewed by an expert before accepting. There is never an upfront fee for Auto Claim Specialists to review a motor vehicle claim or proposed settlement and give their professional

opinion as to the fairness of the offer.

Please call me should you have any questions relating to the policy or covered loss. We have most insurance policies in our library. Always remember that a safe repair is a quality repair and quality equates to value. I thank you for your question and look forward to any follow-up questions that may arise.

Sincerely,

Robert L. McDorman TXA

Designed for high production, the Italia comes with the Timeless Series Direct Drive Air Make Up Unit, completely integrated intake, heat, and exhaust system.

The Italia includes (2) 10hp VFDs, digital PLC control panel, full lower LED lighting package (every wall), and SmartPad digital control panel with EnergySmart Package, which automatically drops to idle when no spraying is detected.

The exterior of Accudraft’s Dual Skin Finishing Equipment is available in FOUR colors: