TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 1 PRSRT STD U.S. POSTAGE PAID TRAVERSE CITY, MI PERMIT NO. 7 $3 DECEMBER 2022 • VOLUME 27 • NUMBER 05 MOVING THE NEEDLE FOR GOOD Ten emerging nonprofit leaders already transforming the region Jill Sill Stephanie Rustem Bekah TenBrink Michelle Bien

Brandstatter Yarrow Brown Elizabeth Calcutt

Early Megan Holtrey Katie Jones ⚪ Changes throughout the latest bank market share numbers ⚪ A shortage of attorneys? ⚪ Realtors leading the affordable housing charge

Lauren

Caitlin

2 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS

Zhang - Michigan’s #1 Financial Advisor by both Barron’s* and Forbes** A Fee-Only Wealth Management Group

on assets under management, revenue produced for the firm, regulatory record, quality of practices, and other factors.

Research, are based on an algorithm of qualitative criteria, mostly gained through telephone

minimum of seven years experience, and the algorithm weighs factors like revenue trends,

records, industry

and those that encompass best practices in their practices and approach to working with clients.

ranking criteria. Fee-Only Unbiased Investment Advice • We uphold a Fiduciary Standard and work with clients on a fee-only basis. • We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest. Credibility & Professionalism • Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD. • Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from Western Michigan University, and Executive Education from Harvard Business School and Columbia University.

CFP®, MBA, MSFS, ChFC • Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.* • Ranked #6 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.** www.zhangfinancial.com Serving the Entire Traverse City Area Our Office is Located at: 236 1/2 E. Front Street, # 26 Traverse City, MI 49684 231-943-6988 or 888-777-0126 Our Zhang Financial Team Founder and President Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial, TD Ameritrade, and Charles Schwab.

Charles

*As reported in Barron’s March 12, 2022 and September 17, 2021. Based

For fee-only status see NAPFA.org. **As reported in Forbes April 7, 2022 and August 24, 2022. The Forbes rankings, developed by SHOOK

and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a

assets under management, compliance

experience

See zhangfinancial.com/disclosure for full

Charles Zhang

SWEET PEA OWNERS

RECOGNIZED

Michele and Jeff Joubran, owners of Sweet Pea, are the recipients of this year’s Lyle DeYoung Award. The Downtown Traverse City Association’s award is given annually to a community member or members who have made a significant contribution to the vitality of downtown. It is named in honor of long-time busi ness owner and downtown leader Lyle DeYoung, who passed away in 1992. The Joubrans, both natives of Traverse City, opened the children’s clothing and accessories store on Front Street in 2009.

Schmuckal, vice president; Christie Dompierre, secretary; Chet Simonelli, treasurer; and Randy Sprague, past president. It also honored the following members: Mike Brown, corporate duck race sales; Keith Bonomo, yellow duck race sales; Chet Simonelli, length of service and treasurer services for the club; and Randy Sprague, past president recognition.

SUN COUNTRY COMES TO TVC

Sun Country Airlines is coming to Cherry Capital Airport (TVC). The low-cost air carrier will fly a Boeing 737800 aircraft with 186 passenger seats on direct flights between Traverse City and the Minneapolis-St Paul International Airport starting in June.The seasonal ser vice will operate on Friday and Monday every week through September 1. Sun Country has previously provided charter service for Operation Northern Strike, Camp Grayling, and the Detroit Red Wings Prospect Camp.

NEW TC OFFICE FOR STATE SAVINGS

State Savings Bank has broken ground on a new Traverse City office at the corner of Garfield Avenue and Centre Street. The 17,575-square-foot, three-level facility will serve as the bank’s principal office and will be home to more than 50 employees. “We’ve always been a commu nity bank,” said Dan Druskovich, regional president. “While we continue to invest in the digital banking solutions customers expect, we know a lot of our customers still want a physical location.”

GRANT SUPPORTS SAFER

MED DISPENSING

The Grand Traverse Regional Community Foundation’s Anchor and Heart Endowment recently awarded a $101,890 grant to Munson Healthcare Paul Oliver Memorial Hospital in Frankfort. The grant supports a transition to a new medication dispensing system, which will help doctors and nurses dispense the right medications to the right patients at the right time. These platforms will also help reduce the risk of potential errors from its previous manual sign-out process.

TC OPTIMISTS NAME OFFICERS

The Traverse City Optimist Club recently announced the new year’s officers. They are: Gail Chambers, president; Don

LOCAL HOTEL EMPLOYEES RECOGNIZED BY STATE

Two Traverse City hotel employees were recently honored with “Stars of the Indus try” awards by the Michigan Restaurant & Lodging Association. Scott Firman, direc tor of rooms administration at the Grand Traverse Resort and Spa, was awarded the North Star: Employee of the Year. Firman started at the resort as an intern and 14 years later has filled a variety of positions, including overseeing five associations connected to the resort. Frank Silsbee of Sleep Inn & Suites received the Guest Relations Hotel Star of the Year. Silsbee was praised for stepping up during the peak of the pandemic when the Sleep Inn hosted first responders as well as homeless individuals.

SEASONAL POPULATION STUDY AVAILABLE

Networks Northwest has released the 2022 Northwest Michigan Seasonal Population, Seasonal Workforce, and Short-Term Rental study. The large fluctuations in the population depending on the season bring challenging questions and tasks for the

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 3

BRIEFLY FOR MORE INFO VISIT WWW.THESHAWNSCHMIDTGROUP.COM 6819 S M-37 | MAYFIELD CONDO BARNS • 5 Minutes from Chums Corner on M-37 • High Quality Construction Storage Units, Workshop or Work Space. 714 sqft , 1000 sqft, and 2000 sqft units available 522 E FRONT STREET TRAVERSE CITY, MI SHAWN SCHMIDT SMITH ASSOCIATE BROKER 231.499.1990 shawn@shawnschmidtsmith.com CARLY SMITH REALTOR 231.649.3137 carly.cbrealtor@gmail.com

4 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS of small-business owners are counting on the sale of their business as a major source of retirement income.1 Creating Solutions. Empowering People. Enhancing Lives. 42% We can help! Since 1992 we’ve helped small businesses plan and maintain a comfortable lifestyle in retirement. Give us a call. have saved nothing for retirement.2 34% Mental Health Care for the Whole Family PSYCHIATRY | THERAPY | COUNSELING | ADDICTION PINEREST.ORG/TRAVERSE-CITY 866.852.4001 402 EAST FRONT STREET TRAVERSE CITY, MI 49686 Ann Porter ASSOCIATE BROKER Ann@AnnPorterTC.com 231.944.4959 Best wishes for a wonderful holiday season and happiness in the year ahead. Happy Holidays

region’s local units of government, business es, schools, and the general population. The study provides accurate and recent data to help inform community decision-makers, business owners and developers. Find it here: nwm.org/SeasonalPopulation.

SURGERY CENTER TOPS IN STATE

Copper Ridge Surgery Center (CRSC) was recently selected by News week for the 2023 Best Ambulatory Sur gery Center (ASC) award in Michigan. Ten ASCs in Michigan were considered and Copper Ridge Surgery Center earned the top coveted designation in the state for the second year in a row and was one of the top three ASCs rec ognized for the past three years. There are more than 5,000 Medicare-certified ambulatory surgery centers in the Unit ed States and Statista Inc. partnered with Newsweek to analyze the data for this award based on the 25 states with the highest number of ambulatory surgery centers (ASCs). The award is based on the quality of care, perfor mance data, and peer recommendations relative to the in-state competition.

ECONOMIC CLUB OPEN TO NEW MEMBERS

The Economic Club of Traverse City (ECTC) is now accepting members for the 2023 season. In previous years, there has been a waiting list to join the club but due to the disruption of the pandemic there are now openings. Club mem bers meet at the Traverse City Golf & Country Club for lunch and a speaker program, and hold an annual dinner in September. The ECTC mission is to encourage discussion and understanding of economic issues. Past speakers have addressed the economic aspects of energy and climate change, the growing influ ence of China, the national debt, and crypto currency. Memberships will be accepted into January; tceconclub.com.

COMMON GOOD’S 2ND LOCATION OPENING SOON

Common Good Bakery is putting the final touches on its second location (1115 E. Eighth) in Traverse City, with a grand opening anticipated in early January. In addition to offering the same menu as its original location on Fourteenth Street, the bakery will also offer weekend brunch and a pizza & pasta wine bar menu to go along with its liquor license allowing for take-out alcoholic beverages.

COLLABORATION HELPS WITH CAREER EXPLORATION

Northwest Michigan Works! in Traverse City is adopting Newton’s Road Career Investigator as its primary career pathway exploration platform to support individuals as they learn about in-demand careers across the region. This collaboration creates one regional tool supporting youth and adults in exploring careers and reduces cost and confusion caused by duplicative efforts. The platform also allows local business es to reach students and adults, and possibly identify strong candidates they could eventually hire. Lean more and check out the platform here: nwm.org/ careerinvestigator.

$10M FACELIFT FOR RESORT UNDERWAY

Work has begun on a $10 million renovation of the Grand Traverse Resort and Spa’s original six-story hotel, following the completion of a $3 million renovation of the resort’s meeting space. The hotel renovation includes transformation of 242 guest rooms, including two junior suites, four hospitality suites, and all corridors. The interior will be modern and all rooms filled with updat ed amenities. The resort has partnered with several local companies on the project, including Bouma Corporation, D&W Mechanical, Denoyer Brothers Moving, Northern Michigan Glass, and TC Millworks. The renovation is expected to be complete in spring 2023.

NOMI POLICY CONFERENCE: JAN. 20

The 2023 Northern Michigan Policy Conference will be held January 20 at the Grand Traverse Resort & Spa in Acme. Now in its fifth year, the regional economic development conference is led by the Northern Michigan Chamber Alliance - a coalition of 16 chambers and economic development organizations, along with more than 7,000 member businesses, from across northern Michigan. This year’s conference will address chronic issues surrounding business de velopment, talent, housing and childcare, and discuss innovative approaches to these challenges. Lean more and register at traverseconnect.com.

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 5

BRIEFLY SHOP SHOP LOCAL LOCAL FOR THE HOLIDAYS FOR THE HOLIDAYS Events, deals and more at: downtowntc.com HUMANS FIRST Does local matter to you? 231.944.1100 • safetynet-inc.com For Traverse City area news and events, visit TraverseTicker.com

“Bay Area Contracting has developed a strong team of pro fessionals who allow us to exceed our customer expectations. Old Mission Windows plays a key role on our team providing years of experience, knowledge and a never-ending desire to create a once in a lifetime experience for our clients. It is a true partnership built on trust and respect”

-Dean Adams, President Bay Area Contracting

-Dean Adams, President Bay Area Contracting

6 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS www.oldmissionwindows.com/tcbn 231.947.2120 395 Hughes Drive Traverse

MI 49696

City,

Philanthropia

Since the Grand Traverse Regional Community Foundation’s start in 1992, we’ve been committed to investing in the people and places of Antrim, Benzie, Grand Traverse, Kalkaska and Leelanau counties, stewarding community assets for lasting impact.

But our work today looks different from what it was in the early ‘90s, in large part because of the generosity of our com munity, the dedication of our nonprofit partners, and the thriving vision many of us hold for this region.

For many years, the Community Foun dation was focused on donor service – doing what we could to match an individual’s passion for a particular cause or project with a philanthropic, namely financial, purpose. This approach has supported many wonderful community projects and improvements, from the Benzie Shores District Library and the Grand Traverse Bay YMCA to Herman Community Park in Suttons Bay and Rail road Square in Kalkaska.

Yet over time, as our region has grown and evolved, so too have we as an organization.

Over the last few years, several trends have emerged in the ways that community foundations function, including:

1. Maximizing impact through col laborative leadership, bringing partners and resources together to address complex issues and emerging opportunities.

2. Reckoning with long-embedded inequities and how to uplift diversity, equity and inclusion efforts.

3. Being more flexible, responsive and

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

ON THE WEB tcbusinessnews.com

PUBLISHER

Luke W. Haase lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu gneu@tcbusinessnews.com

MAXIMUM IMPACT

strategic in addressing community needs.

While our organization is still proud to support the passions of our donor part ners, we’re progressively moving into these dynamic roles. In doing so, we are working toward filling gaps that have existed in funding and in addressing pressing community needs, both emergent and ongoing.

Convening the Northwest Michigan Community Development Coalition, for example, is one way we are flexing our collaborative leadership muscle. Com posed of more than 30 partners from the business, nonprofit and governmental sectors, together we are aiming for trans formational change across the region in the areas of economic, societal and environmental improvements.

As a coalition, we are chasing this bold vision by organizing advocacy efforts around core policy issues, pursuing funding resources from outside the region and building partnerships among cross-sector organizations. Our most recent efforts have included advocating for early childhood ed ucation, workforce housing and child care bills in the Michigan legislature; supporting BATA and the Grand Traverse Housing Commission’s innovative transportation and housing project, Flats at Carriage Commons; and helping to raise funds for a consultant to develop a business plan for a new mental health crisis center.

In addition to these efforts, the Community Foundation is committing our resources to advancing diversity, equity and inclusion both internally as an orga

nization and across the region. One way we’re doing this is through our Diversity Equity Inclusion (DEI) Fund, which we established last summer.

To date, our DEI Fund has awarded more than $58,000 to 30 organizations, including Autism Alliance of Michigan, Discovery Center Great Lakes, Michigan Indian Legal Services, Northwest Michi gan Arts and Culture Network, Up North Pride and Women’s Resource Center. Projects supported have ranged from Anishinaabe culture educational programs to artist stipends for Black, Indigenous and people of color artists.

In conjunction, we’re dedicated to our own internal DEI learning journey. This has included becoming the first community foundation in Michigan to sign onto the Disability Inclusion Pledge, which has us pursuing action steps such as examining our grant-making process to be more inclusive of people with disabilities and improving accessibility options at hosted events.

In addition, we’re reviewing our in ternal policies through a DEI lens and are involved in a DEI audit – both of which are helping us reduce inequities in everything we do, from our hiring practices to our own personal interactions. We have a long road ahead, but we’re committed to this critical work and being here to support a thriving region for all, now and forever.

Our DEI efforts are developing along side our increased focus on growing commu nity fund assets. As I mentioned before, the

SERVING:

AD SALES

Lisa Gillespie lisa@northernexpress.com Jill Hayes jill@northernexpress.com

Kathy Johnson kathy@northernexpress.com Kaitlyn Nance knance@northernexpress.com Todd Norris tnorris@tcbusinessnews.com

Michele Young myoung@tcbusinessnews.com

Community Foundation has long supported specific causes and organizations.

While we continue to hold this im portant role, we also see that flexible funding is needed to help develop solutions for myriad community issues – from the lack of available and attainable housing to gaps in early childhood supports.

That’s where our community funds can come in.

Community funds are a collection of funds that are not designated for a specific organization or cause, provide grants di rected by the foundation’s board and staff, and allow us to be flexible and responsive to local needs and opportunities as they emerge over time.

These funds also help us address complex problems, which may need multi-year and multi-partner solutions, that many of our other funds cannot. Already this year –through $111,000 in community fund grants – we’ve supported efforts to increase access to housing solutions in Leelanau County; an ambitious project to make barrier-free access to our Great Lakes a reality; and start-up costs for a community-centric early childhood program, among other partners and initiatives. There’s so much potential in our community funds to help transform our five-county region forever and for everyone.

While we’re leaning into our evolu tion as a community foundation, we are doing this work in collaboration with our donor and community partners. We’re grateful to supporters like you that are pushing us to grow for the benefit of our local communities.

Thank you.

The Traverse City Business News

Published monthly by Eyes Only Media, LLC

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2022 Eyes Only Media, LLC. All rights reserved.

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 7

theTCBN

COPY EDITOR Becky Kalajian CONTRIBUTING WRITERS Ross Boissoneau Rick Haglund Megan Kelto Clark Miller WEB PRODUCTION Byte Productions MAILING/FULFILLMENT Village Press DISTRIBUTION Gary Twardowski

HEAD WRITER Craig Manning CREATIVE DIRECTOR Kyra Cross Poehlman

Grand Traverse, Kalkaska, Leelanau and Benzie counties

EYES ONLY MEDIA, LLC

is an ancient Greek word meaning “love of mankind.” This idea inspires us to make a difference, whether by giving our time, expertise, or a financial gift.

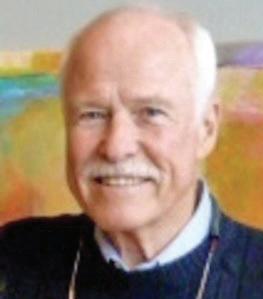

David Mengebier is the president and CEO of the Grand Traverse Regional Community Foun dation, a role he’s held since January 2018.

COMMENTARY BY DAVID MENGEBIER

The evolution of your regional community foundation

reviewing our internal policies through a DEI lens

in a DEI audit –

which are helping us

thing

hiring practices

We’re

and are involved

both of

reduce inequities in every

we do, from our

to our own personal interactions.

8 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS professional pumping Much More than Pumping Extensive fleet of tanker trucks and professional technicians • Septic Assessments • On Time • Satisfaction Guarantee 231-228-7499 williamspumping.com septicyear-round services Louis A. Rodriguez 231.943.1326 ThirdCoastIns.com Proud partners with You know your business. We know your business insurance.

‘Moving the Needle for Good’

10 nonprofit leaders on benefits, challenges of their work

By Ross Boissoneau

This region is known for many things. Clean, bountiful waters. The appeal of the cities and towns that dot the countryside. Its rolling hills and opportunities for recreation. Its culture. Last but not least: Its giving spirit. That last is engendered in large part by the many people working in the nonprof

JILL SILL Executive director, Norte Youth Cycling

I have the privilege of leading our growing staff using the Norte mission as our guide: to help build a stronger, better con nected and more walk/bike-friendly Traverse City by inspiring the young and young-at-heart through bicycles. I’m also responsi ble for empowering and engaging people of all ages and abilities in our region to be physically active and connected to their communities. This is a col laborative effort that requires several hundred volunteers and coaches, a steady staff and board, and the generosity of individuals and business owners in our region. As we look toward 2023, our partnerships with partner nonprofits are promising achievements. Happy, healthy, strong communities are intentional, and we each have an opportunity to play an important role.

Other work inside/outside the nonprofit world:

My professional positions have been within environmental education centers, public schools and charter schools. As a former at-risk high school teacher, I know the value and potential for inclusive programming. We are striving to make Norte’s programs more inclusive every season. The Norte ‘Bikes For All’ program provides opportunities for people with physical and cognitive differences to enjoy the benefits of riding a bicy cle using our growing adaptive bike fleet. In addition, our scholarship program ensures Norte camps are accessible for those regardless of financial status. Finally, our bike library guarantees children access to bicycles within our programs or at home at no cost to the family. We check them out just like books!

Why nonprofits?

I am drawn to the nonprofit world because nonprofits are essential to supporting healthy communities, and I find great value in contributing to that work. In addi tion, nonprofits naturally attract people who enjoy collaboration, innovation, and personal connections — traits that fuel my drive. Finally, although nonprofit work is not always easy or clear-cut, working alongside others with shared values and visions and placing those at the center of everything we do is quite empowering. I want to live in a community that is thriving.

Best part of the job:

On the surface, Norte Youth Cycling may appear merely about bicycles. But bicycles are a vehicle to independence, community connections, confidence, physical activity, adventure, friendships and joy. The best part of my job is helping create the platform for these intangibles to flourish. I have a front-row seat to watch the flash of pride when our littlest riders master balancing on a bike. I see new friend ships form during summer camp. I witness the sense of empowerment and accom plishment when Norte summer campers realize they can ride to numerous city and county parks under their own power. We have named these ‘Norte magic moments’ and they occur daily. The pandemic illuminated the need for social connections and the importance of physical activity – and Norte provides both.

it world, from food banks to tech, from foundations to the arts, from the outdoors to serving and protecting our youth. Numerous people of talent and drive commit ted to helping those in need buoy nonprofit organizations across the region and across virtually all walks of life.

We spoke with some of the leaders who are up and coming and asked them to tell us about their responsibilities and achievements, as well as their other work, what attracts them to working with nonprofits, and why they enjoy their jobs.

BEKAH TENBRINK

Founder and executive director, LIFT Teen Center and The Center of Suttons Bay

This was never on my radar. My degree is in social work and I thought I’d be working in an agency. LIFT dates back to 2011, when my hus band Gerald saw some teens playing ice hockey at the local rink down the road and asked if they needed an extra player. After a few hours on the ice, he invited them back to our house for some pizza. That started the ball rolling, and we incorporated the organization in 2017. We are in the business of building relationships with teens and providing connections where they can be seen, heard and loved. I became executive director of The Center (formerly the Friendship Community Center) in 2020. It provides a gathering space that enriches and strengthens multi-generational and multicultural relationships in the community. Lots of different organi zations use it for Pilates, tai chi, art classes. We merge different generations together.

Other work inside/outside the nonprofit world:

I am a photographer for families and seniors; photography was my original major in college. I found out that social work and photography fit nicely together. I use my time with each client to get to know them, hear their stories, and find the best way to capture them. It’s always a bonus when I capture keepsake senior pictures for my high school teens because as I already know them, I get to celebrate this remarkable new chapter of life with them.

Why nonprofits?

Nonprofits are fundamentally about moving the needle for good. Areas of society that are often overlooked and neglected are generally at the core of the mission of nonprofits. Through the diligent work of those working in this sector, this life-changing work would otherwise go unaddressed.

Best part of the job:

Every day has a purpose and every day is different. My schedule never looks the same from week to week. I find it thrilling to be able to have a job that is moving forward and is constantly shifting. Working to en hance other people’s lives does not allow you to stay stagnant. I would be remiss if I didn’t also say I work with the absolute best people! Their hearts for others and the mission of our work is humbling and the stuff of heroes’ tales.

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 9

THE PHILANTHROPY ISSUE

MEGAN HOLTREY Operations manager, Dennos Museum Center

I manage the budget for the museum, coordinate the volunteers, maintain memberships, and manage museum and rental events. I was a member of the 2019-20 Michigan Arts & Culture Council Rising Leaders cohort and recently co-presented at the 2022 Association of Academ ic Museums & Galleries conference.

Other work inside/outside the nonprofit world:

I’m currently the vice president of the Northwest Michigan Arts & Culture Network board, the treasurer for the Friends of the Traverse Area District Library, and serve on the Community Advisory Council for Interlochen Public Radio. I enjoy serving on committees at NMC, such as some of the various search committees, as well as the Commencement Planning Committee. I also review grants every year for the Michigan Arts & Culture Council.

Why nonprofits?

I really enjoy using my time and expertise to further the arts in the community. I’m not an artist or creative myself, so I love being able to use my skills as an admin to help facilitate art and the connections it fosters in our region.

Best part of the job:

The best part of my job is getting to do something different every day. Being a part of a small museum team and being on NMC’s campus presents tons of opportunities for learning new skills and exploring new collaborations with the campus and greater community.

CAITLIN EARLY Campaign and development officer, TART Trails

At TART I focus on fundraising strategies, donor relations, and managing our Art on the TART program. My daily work supports linking philanthropically minded individuals and organizations to our non-motorized infrastructure projects, with the goal of making our region happier, healthier and more connected. Recently we celebrated the opening of the Acme Connector, a two-mile trail that connects the eastern side of TART Trail and Acme, providing safe access to businesses, existing trails and recreation opportunities. I had the privilege of managing the public phase of the capital campaign, successfully securing funds for trail construction. This season we also cut the ribbon on three separate art installations along the Boardman Lake Loop, including sculptures by Lois Teicher and TJ Carroll, and a mural by Rufus Snoddy, Glenn Wolff, Kiah Ander son and Logan Hudson.

Other work inside/outside the nonprofit world:

I spent the better part of a decade working in arts and culture-based nonprofit organi zations before I joined the team at TART Trails. I worked primarily in fundraising and communications, and learned the critical importance of building relationships and focusing on interaction rather than transaction. In addition to my responsibilities at TART, I am a member of the Traverse City Arts Commission and volunteer at the Old Town Playhouse.

Why nonprofits?

At this point in my career, I can’t imagine not working in the nonprofit sector. The why, which also happens to be the best part, is two-fold: collaboration and impact. I have the opportunity every day to work with my team to make a positive, tangible impact. In addition to working with a strong team at TART, I frequently get to engage with a wide range of partners who offer important varying perspectives on projects. Ultimately, these diverse perspectives consistently lead to a more successful end result for all. We have so many nonprofit organi zations doing good work in our region, making it a more vibrant place, and I’m fortunate to reap the rewards, both professionally and as a community member, of the fruits of our labor.

Best part of the job:

The best part of my job is getting to do something different every day. Being a part of a small museum team and being on NMC’s campus presents tons of opportunities for learn ing new skills and exploring new collaborations with the campus and greater community.

10 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS servprograndtraversearea.com MORE impact on people, LESS impact on the environment. env-arch.com 231.946.1234 10241 E. Cherry Bend Rd. Traverse City > We design the circumstances, objects and conditions that surround you. © Environment Achitects

City

Best community

KATIE Executive

The but well. relations, round and director the from Other Prior next This ty, and Why Transitioning tivated others. ed to Best The es. We those the stories STEPHANIE Program Discovery many working Great ing for Great Pier barrier-free and There and Other ilege ties.

Why up a would do to know

recreation campaign, on by Ander focusing Playhouse. why, opaddition to partners perspectives organi fortunate to labor. a learn

KATIE JONES

KATIE JONES

Executive director, Friends of the Garden Theater

The Garden Theater was once just a single-screen movie house, but we have now expanded into hosting performing arts events as well. My role consists of ongoing fundraising, donor and patron relations, overseeing operations of the theater, and scheduling yearround programming. Every day is different for a small nonprofit, and my job consists of wearing many hats. One day I act as creative director for a holiday concert, the next I scoop popcorn for weekend shows. We recently were the recipient of one of the Traverse City Impact 100 grants as well as two substantial grants from Michigan Arts and Culture Council.

Other work inside/outside the nonprofit world:

Prior to my role at The Garden I worked in film production. I was looking for that next step that would require me to travel less and provide more stability for my family. This position blends so many of my passions: film and all other forms of art, community, and my favorite place on Earth, Frankfort.

Why nonprofits?

Transitioning to work in the nonprofit world for me was the best decision. I am mo tivated not only for myself or by my own creativity, but for a cause that benefits many others. I love working for a nonprofit that gives back to a community that has contributed to the betterment of my life.

Best part of the job:

The best part of my job is uniting community members through artistic experienc es. We often divide ourselves from one another and The Garden tries to break down those barriers by creating events that might allow for a little vulnerability. Watching the theater empty out and everyone leave with a smile on their face while sharing stories with one another is a moment I hope to create time and time again.

STEPHANIE RUSTEM Program and fundraising coordinator, Discovery Center & Pier

I have been in this position for just over a year. As with many small nonprofits, I wear many different hats, including working with local youth-centered organizations to provide Great Lakes-based opportunities, writing grants, and developing new programs. I feel incredibly proud and lucky to work for an organization that’s striving for equitable access to the Great Lakes. On Nov. 7, we broke ground on the Discovery Pier Project – a $2.2 million project to transform Traverse City’s old coal dock into a barrier-free public park. I feel so lucky to play a small role in making this dream a reality, and seeing it come to fruition is incredibly exciting.

Being recognized on this year’s TCBN 40Under40 list was incredibly humbling. There are so many amazing people that work to make our community a better place and I feel so honored to have received that recognition.

Other work inside/outside the nonprofit world:

In addition to my work at Discovery Center & Pier, I have the honor and privilege of serving on the board of the Groundwork Center for Resilient Communi ties. I am also a member of two service organizations: the Zonta Club of Traverse City and Traverse City Rotary Club, where I spend my time volunteering.

Why nonprofits?

I have spent my entire working career in the nonprofit sector. Each day, I wake up and feel like I’m playing a small part in making our community and the world a better place because of the work I do. Nonprofits provide many services that would otherwise be unavailable in communities across the country. Nonprofits do everything from protecting the environment to providing youth programming to offering social services and beyond. Without nonprofits, many of the things we know and love in our community wouldn’t exist.

Best part of the job:

The best part of my job is seeing the direct impact the work we’re doing has on our community and knowing that I’ve played a small part in making it happen.

TRAVERSE NEWS DECEMBER 2022 11 with E L E V A T E Y O U R E V E N T t h e d e l a m a r c o m | 2 3 1 9 4 7 3 7 0 0 | d t c s a l e s @ t h e d e l a m a r c o m It has been our pleasure to serve our valued clients for more than 49 years. We look forward to many more. DENNIS,GARTLAND & NIERGARTH CPAs BUSINESS ADVISORS Your Success is Our Business TRAVERSE CITY PETOSKEY 231.946.1722 • www.dgncpa.com WE’RE HONORED AGAIN! TCBN Qtr 2021 INDUCTEE THE PHILANTHROPY ISSUE

search

12 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS Sometimes life goes downhill & WE’RE HERE FOR IT! We’re into getting our clients comprehensive coverage, so they can rest assured when the unexpected goes down. Sometimes life isn’t perfect. We’ll take care of that. OUR AGENTS PROTECT YOUR NORTHERN MICHIGAN LIFESTYLE. HOME | AUTO | LIFE | COMMERCIAL | HEALTH | MEDICARE 231.941.0450 | FORDINSURANCE.NET | TRAVERSE CITY

LAUREN BRANDSTATTER Director of community engagement, Traverse Bay Children’s Advocacy Center

I have been with TBCAC since March of 2021 when my family and I moved to Traverse City from Indianapolis. I began as the community outreach coordinator and transitioned to the director of community engagement in September of 2021. My role is to cultivate relationships in the community with both donors and other organizations, create and implement fundraising campaigns and strategies, and research and write grants that support our organization’s mission.

Other work inside/outside the nonprofit world:

This is my first position in the nonprofit sector, but it has been a goal of mine since I graduated from DePauw University with an edu cation degree. I taught for a few years, and then my path took me back to my first love: soccer. I have played my whole life, including college, and I was not ready to give it up, so I decided to coach collegiately. After a number of years doing so, I landed in the healthcare sector as a project manager for the innovation department of a hospital network in Indianapolis. My role was to scale ideas from inkling to implementation. I loved the fast-paced tech environment, so that took me to my working for a startup company, Upper Hand, on the implementation team. Fi nally, after a big leap of faith, my husband and I bought a house sight unseen and moved our two young kids to Traverse City. We have not looked back for a second. We love this city and this tightknit, innovative community.

Why nonprofits?

The answer here is simple: They make our community a better place for all. We are so fortu nate to have so many INCREDIBLE nonprofits in our region. The best part is they are all doing so much for our communities. The passion, the drive, the can-do attitudes are absolutely inspir ing. Not to mention, there are some super rad humans in this sector. I have learned so much about our community and myself as a person just from listening to the work that is being done right here in northwest Michigan. We are so lucky.

Best part of the job:

Truthfully, the best part of my job is working with true heroes on the front lines. It often makes me tear up hearing the stories that come through our center. Not the stories of child hood trauma, but the stories of resilience, hope, healing and justice. Listening to how passionate and incredible our staff and partners are, day in and day out, makes me have so much hope for our world. Being able to communicate that to our community, donors and grant reviewers is just the cherry on top. Not all heroes wear capes, and I truly believe that about our staff at TBCAC. I am in awe each and every day.

MICHELLE BIEN Executive director of art and connection, Elk Rapids

We just opened our doors this summer, so my responsibilities in clude planning our programs and growing them over time, ensuring that everything runs smoothly and consistently, assigning tasks to staff, recruiting teachers to lead workshops, networking with other organizations and local businesses, spreading the word about who we are and what we do, and assisting visitors, event guests, and work shop participants.

Other work inside/outside the nonprofit world:

I run the French language and culture group of Traverse City. We usually meet once or twice a month at a local café or restaurant to practice our French language skills, discuss French culture, and share updates with each other. I am also in this year’s Leadership Grand Traverse program and I feel very fortunate to be participating with a fantastic group of people. Previous ly I was the program manager at Arts for All of Northern Michigan.

Why nonprofits?

I find fulfillment in contributing to our communities in ways that are valuable, lasting and innovative. Being involved in a nonprofit is one of the best ways to make a direct impact where there is a specific need, with the potential for lasting change. I feel that the world will always need nonprofits, and the ways we can help our world through them are endless.

Best part of the job:

The best part of what I do is when I witness my work changing someone’s life for the better. When someone walks up to me at the end of one of our events and tells me how thankful they are that our space exists, or that one of our art workshops gave them something they needed at an important time in their life, this can make my day or even my week. I am also very grateful to work with a wonderful team in a beautiful space.

YARROW BROWN Executive director, Housing North

Housing North was formed in 2018 to address the barriers to housing through communications/ awareness, policy/ advocacy and capacity-building. We have expanded our programs over the last two years to include four housing-ready program staff in four of our 10 counties (Emmet, Charlevoix, Leelanau and Manistee). We launched a deed restric tion program in partnership with the City of Charlevoix to preserve year-round housing and an accessory dwelling unit program and are hoping to expand this to more communities. We recently received a $100,000 matching challenge grant from Consumers Energy Foun dation for a pilot rental preservation program where we hope to help local organizations such as Peninsula Housing preserve year-round rentals and build more housing.

Other work inside/outside the nonprofit world:

My background is in conservation biology. Prior to this job I worked at the Leelanau Con servancy, managing their conservation easement program and doing land protection and water shed planning. Many of the earlier years in my career outside of college were as a biological technician for the U.S. Forest Service, looking for rare plants, fungi or mushrooms in Oregon, California and Washington. I also spent two and a half years working for a small conservation district in Crook County (Devil’s Tower National Monument) in the Black Hills of Wyoming. I have also been on the planning commission for Cleveland Township in Leelanau County for two-and-a-half years. I am on the board of the Fair Housing Center for West Michigan, the Peninsula Housing board of directors and participate in the executive committee for the Northwest Coalition to End Homelessness.

Why nonprofits?

Good question. I have worked for nonprofits for over 15 years now and truly see the impact and value in the community. They are focused on the mission and are very community-driven. I feel fortunate to have learned so much from my years at the Leelanau Conservancy.

Best part of the job:

The best part of the job is working with all the various communities and the people, building relationships and collaborations. We could not have an impact without our connections in our communities and these relationships are invaluable. We rely on our local advocates and experts to make an impact. I love that we are a 10-county organization and we are having an impact both regionally and statewide, yet a lot of our work is very grassroots and locally making a difference.

ELIZABETH CALCUTT

Trail development director, TART Trails

I support trail planning and development with project man agement; coordinate and oversee work plans and budgets; develop strategies and tools to advance our short- and long-term trail develop ment and maintenance goals; and work with the TART team, local partners, and members of the com munity to advance TART Trails’ mission. My core active projects are the Nakwema Trailway, Sleeping Bear Heritage Trail and Three Mile Trail Extension.

Other work inside/outside the nonprofit world:

I’ve had the honor of serving on the board of the Northwest Michigan Arts & Culture Network since it was formed in 2018 as an arts and cultur al services organization dedicated to connecting, promoting and supporting the individuals, organizations and creative projects that create and further arts and culture in Northern Lower Michigan. During the winter months, I am a ski coach for the Holiday Race Team, a communi ty-based ski racing program operating at Mt. Holiday.

Why nonprofits?

I get to be part of solving local and regional problems, and while it takes years to implement proj ects that offer solutions, it’s very motivating to work hard and work strategically in order to someday see results. It’s more than just passion for the mission that makes the work interesting and motivating. I appreciate the variety in the work, the communication and ne gotiation, the opportunity to take on challenges and collaborate on innovative solutions. And I work alongside great people.

Best part of the job:

The people and places. I get to connect with individuals and communities across northwest lower Michigan. And can I add the Boardman Lake Loop? Every walk on that trail is rewarding and motivating.

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 13 THE PHILANTHROPY ISSUE

14 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS 3 I am Grateful this Holiday Season! I welcome future opportunities to assist you

your Real Estate! I Wish You and Yours Good Health and

Thank You! SAM ABOOD 231-218-5130 sam@samabood.com 402 E. Front Street Traverse City, MI 49686 Sam Happy Holidays! I am Grateful this Holiday Season! I welcome future I Wish You and Yours Good Health and Spirits in

Thank You! SAM ABOOD 231-218-5130 www.samabood.com 402 E. Front Street Traverse City, MI 49686 Sam Please Call if I Can Help You Buy or Sell Your Home or Property. With Gratitude I Wish You and Yours Good Health and Spirits in 2023. Local. Wise. Nimble. Your Insurance is Changing. Your needs are changing. GROUP BENEFITS • INDIVIDUAL COVERAGE • MEDICARE Here to Serve and Support Northern Michigan’s Business Community and Individuals with Tailored Insurance Solutions. When you live and work in Northern Michigan you should expect more from your locally owned insurance agency. Visit Us At: traversebenefits.com Call Today: 231.640.0022 Locally yours, Andi Dolan May your sleighs travel safely this season. Happy holidays from your friends at Nicolet Bank. NicoletBank.com Member FDIC | Equal Houseing Lender | NMLS ID #411069 800.369.0026

with

Spirits in 2020.

2015.

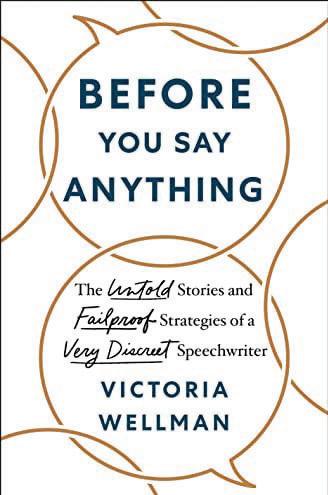

By Eric Braund, columnist

If you’re like many of our clients, you want to secure a comfortable retirement – and give back to the community around you.

There are many ways to give back during retirement, but one way is to donate your required minimum distributions (RMDs) directly to a charity.

Let’s look at some benefits of donating your RMDs and why you might consider this charitable giving option.

Benefits of qualified charitable distributions

While removing yourself as a middle man saves you a lot of time, that’s not where the greatest benefit of a qualified charitable distribution (QCD) lies. If the distribution is donated directly to the nonprofit without you collecting it first and then donating it, you’ll also save a lot of money on taxes.

When you make a QCD, it is excluded from your taxable income because the amount you donate never shows up on your tax return. This leaves you with a lower taxable income and, therefore, a lower tax bill. And you don’t even have to itemize your deductions to get this tax break.

QCD eligibility

Not all retirement accounts are eligible to use the funds as a QCD. The funds need to be in a traditional IRA, rollover, inherited, inactive SEP, or inactive SIM PLE plan to be eligible. A SEP or SIMPLE plan is considered inactive if no employer contribution was made during the plan year ending during the tax year that the charitable contribution is made.

In addition to having the right kind of account, other requirements must be met:

• You must be age 70½ or older.

• To count toward the RMD for the year, the funds must come out of the IRA account by the RMD deadline, which is usually Dec. 31. Excess donations cannot count toward future-year RMDs.

• QCDs cannot be greater than the

GIVING BACK

amount that would otherwise be taxed as ordinary income (excluding non-deduct ible contributions).

• Total QCDs cannot exceed $100,000 per calendar year per taxpayer, regardless of the number of charities to receive donations.

• Funds must be distributed directly to the charity. If you take a distribution and then give it to charity, it does not count as a QCD.

Charitable eligibility

After establishing your eligibility, you need to ensure that your charity is eligible to receive a QCD. It must be a 501(c) (3) organization that is eligible to receive tax-deductible contributions.

On top of that, certain types of organi zations are not eligible to receive QCDs. They are:

• Private foundations

• Supporting organizations (charities that only exist to help other exempt organizations, usually public charities)

• Donor-advised funds managed by public charities on behalf of individuals, families or organizations

Reporting a QCD

Unless it is an inherited IRA, QCDs are reported as normal distributions on Form 1099-R. For inherited IRAs, they are reported as death distributions. Therefore, it is critical to ensure your accountant is aware of your QCDs. If they are unaware, you may miss out on substantial tax ben efits! Though state rules vary, QCDs are not subject to federal tax withholding.

Keep this in your records to document that the QCD was qualified.

Plan for your retirement income

Qualified charitable distributions are a tax-efficient way to take advantage of your RMDs and give back to a charity that’s near and dear to your heart. There are some specific rules and requirements to consider, so it’s always best to run your dis tribution plan by a qualified professional.

Eric Braund, CFP®, CRPC®, is the founder and CFO at Black Walnut Wealth Man agement, a financial advisory firm providing counsel and fiduciary investment services to individuals, families and private foundations throughout Traverse City and northern Mich igan. Contact him at (231) 421-7711 or visit BlackWalnutWM.com.

Because it is already tax-free, you may not claim the QCD as a charitable tax deduction. You need the same acknowledgment of the donation you would need if you claimed it as a deduction.

Braund is an investment advisor representative with Dynamic Wealth Advisors d.b.a. Black Walnut Wealth Management; all invest ment advisory services are offered through Dynamic Wealth Advisors. This material is not intended to be used as tax advice. Each taxpayer should seek independent advice from a tax professional.

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 15 THE PHILANTHROPY ISSUE

Know the benefits of sending your RMDs straight to a charity

Not all retirement accounts are eligible to use the funds as a QCD. The funds need to be in a traditional IRA, rollover, inherited, inactive SEP, or inactive SIMPLE plan to be eligible.

DISCOVER NEW POSSIBILITIES FOR YOUR BUSINESS.

No matter what stage your business is in, the Michigan Economic Development Corporation is here to help you succeed. By connecting you to the resources your business needs, granting access to necessary capital and introducing you to the right partners, the MEDC helps your business reach new potential.

Find out how we can help propel your business forward with customized support at michiganbusiness.org/pure-partnership

16 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS

T:10.25" T:12.875"

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 17 GIVE YOURSELF of a tuition-free* EDUCATION THE GIFT Get ahead with Today! Are you 25 years or older? *As an in-district student or at a reduced rate if out of district. TR A VERSE CITY 231.94 7 .2700 SBOURGEOIS.COM SARAH BOURGEOIS ARCHITECTS

LAW, INSURANCE ACCOUNTING

WHERE HAVE ALL THE LAWYERS GONE?

Inside northern Michigan’s growing dearth of legal professionals

By Craig Manning

Employers in the legal profession are struggling to fill positions almost across the board.

“I just got my license renewal for the Michigan State Bar for next year, and the paperwork said, ‘Serving over 46,000 at torneys,” said Anna Fiorvento, owner and founder of the Cadillac-based Fiorvento Law PLLC.

Michigan is a mandatory bar state, so to practice law in Michigan, attorneys have to be a part of the Michigan State Bar. Seeing those numbers gave Fiorvento pause.

“I thought, ‘Wait, there are only 46,000 attorneys in the state of Michigan?’” she said. “I know that number might seem like a lot, but you have to remember that a huge chunk of those lawyers are probably corporate, where their only client is the corporation they work for. And then another huge chunk of them are retired or semi-retired. And then we’ve also got a ton of patent attorneys in Michigan.”

Fiorvento estimates that the 46,000 breaks down to “...something like one attorney per 200 people.”

“I wonder what the actual numbers are if you take out all the people who you couldn’t actually walk into their office and hire them,” she said.

Local law offices are seeing just how small a number 46,000 really is when they try to hire new attorneys. Especially when it comes to recent law school grads and other younger attorneys, most of Michigan’s lawyers seem to be clustered downstate.

According to Ed Price, managing partner for Traverse City’s Alward Fisher Attorneys at Law, the primary issue there is that north ern Michigan’s lofty cost of living is a poor match for recent graduates who already have a mountain of student loan debt.

“It’s difficult to get young lawyers to relocate to Traverse City unless they have specific ties here,” Price explained. “If they grew up here and went to law school but want to move back home, that’s one thing.

But as the costs of college and law schools have increased, the amount of student loans that people have is through the roof.”

Price reports that younger lawyers feel like they need to work at larger firms in Detroit, Grand Rapids or Chicago for a few years to make some money to be able to pay off some of those loans.

“As a result, we’ve had trouble finding attorneys to relocate,” he said.

The expense of a legal degree, combined with the cost of living in northern Michi gan, is why Fiorvento says she chose Cadil-

factor behind a nationwide decline in the number of people pursuing legal degrees.

“It’s just it’s a lot different than when I went to law school,” she said. “When I went, you came out with debt, but it felt manageable.”

She says the amount of debt she sees re cent graduates emerging with is “incredible.”

“And maybe we’ll see some change with forgiveness on student loans and things like that, but right now, law school is just prohibitively expensive for a lot of people,” she said.

buy houses, start families, or pursue other major life milestones due to the career setbacks they saw because of the recession.

The wrinkle to that narrative in this particular case is that, for many years, the law profession was thought to be insulated from economic shifts, characterized as it was by extremely high salaries. Even with sub stantial debt, surely lawyers making the big bucks could pay off all that debt in no time?

But the story around lawyer salaries might actually be more complicated than most people think. It’s true that lawyers can make big money. According to ZipRecruiter, lawyers in New York earn an average of $123,571 per year. Other states have lower averages, though, and one of the lowest is Michigan, where the typical lawyer earns $86,429. Even within states, the numbers can fluctuate quite a bit, with rural areas (like northern Michigan) often trailing behind more urban spots (such as Detroit or Grand Rapids).

lac as the home base for her business.

“I was originally practicing and living in Traverse City,” she said. “But I made the move over to Cadillac because we could get triple the house for the same price that we were looking at in Traverse City. And I’m an attorney, and my husband is an engi neer. So we’re a dual-income professional household, and there’s still that struggle (to afford the local cost of living).”

According to the American Bar Associ ation (ABA), the average law student graduates from law school with $130,000 in student loan debt. That number has more than doubled since 2000, when average cumulative debt for loan school graduates was $57,500. Even figuring in inflation, today’s debt figure is dramatically higher than it was in the past. Adjusted for infla tion, $57,500 in 2000 would be $99,500 in 2022 dollars.

Noelle Moeggenberg, prosecuting attorney for Grand Traverse County, thinks the cost of law school – and the massive amount of debt that students must typically take on to become lawyers – is the primary

There’s no doubt that American law schools are producing fewer lawyers these days. Ever since the Great Recession, law school enrollment in the United States has been in a nosedive. Per ABA data, there were 147,525 students enrolled at Amer ican law schools and seeking a JD (Juris Doctor, the most common type of law degree) in 2010 – an all-time high.

That number dropped every year through 2017, when just 110,183 students were seeking JD degrees; you’d have to go all the way back to 1974 to find a year where fewer American students were pursu ing that particular credential. Things have rebounded slightly since the 2017 nadir –total JD enrollment at U.S. law schools was 117,305 last year – but the recession clearly dealt the legal profession a hefty blow.

Exorbitant education expenses and clouds of student debt are familiar road blocks to most people who came of age in the era of the Great Recession, regardless of profession. An oft-repeated part of the millennial story is that members of that generational cohort have been slower to

“When I moved to Traverse City in 2015, I was quickly informed of the saying in town of, ‘Half the pay for a view of the bay,’” says Agnes Jury, president of the Grand Traverse-Leelanau-Antrim Bar As sociation. “The truth is that the wages are ridiculously low for most of the attorneys here, so it’s hard for northern Michigan to compete with the salaries that attorneys get paid in bigger cities.”

Perhaps it’s no surprise that, statistical ly, northern Michigan is lagging behind downstate areas when it comes to attracting younger lawyers.

Each year, the State Bar of Michigan conducts a survey of the lawyers practicing law in the state. 2022 data shows that there are 7,524 members of the bar who would be classified as “young lawyers” – which is to say, they have joined the legal profession in the past 10 years. Only 74 of those, or 1.2%, are working in Grand Traverse County, while another 20 are practicing in the other parts of the five-county region (Antrim, Benzie, Leelanau, and Kalkaska). Comparatively, Oakland County is home to 2,058 young lawyers, or about a third

18 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS

“It’s just it’s a lot different than when I went to law school. When I went, you came out with debt, but it felt manageable.”

- Noelle Moeggenberg, prosecuting attorney for Grand Traverse County

of the state’s total, while Wayne County boasts another 1,323.

Drawing younger attorneys – or any attorneys, for that matter – is especially hard for segments of the law that tend to pay on the lower end of the legal salary spectrum. According to a Reuters article from this past spring, district attorneys’ of fices throughout the U.S. are “experiencing vacancies of up to 16%.”

Moeggenberg said that trend is at play in Grand Traverse County and throughout Michigan as a whole.

“The Prosecuting Attorneys Association of Michigan has a website where, each month, they put out all of the openings at different offices,” Moeggenberg said. “It used to be you’d see maybe three to four openings around the state at any given time. Now, it’s close to four pages of jobs for attorneys.”

When Moeggenberg started as chief assistant prosecutor (in Grand Traverse County) in 2013, the county would receive more than 100 applicants for one attorney opening.

“Right now, I have a position that’s opening up in January, and I put the application out at the end of September, and I’ve had two people apply so far,” she said. “It’s just super-hard to find people. And while I know it’s a statewide issue,

becoming palpable in more niche areas of legal practice. Her firm works in some of those niche areas, including criminal record expungements and court-appointed probate or family law work. In both of those areas, Fiorvento thinks northern Michigan already has fewer attorneys than it needs – an issue that could get worse if the area can’t draw younger lawyers to replace aging or retiring legal professionals.

On the expungement front, for instance, Fiorvento works with Networks Northwest to help people throughout the 10-county northwest Michigan region pursue expungements of certain non-violent criminal offenses. Michigan has seen a notable uptick in expungement petitions over the past few years, due largely to the legalization of marijuana. Networks Northwest is dealing with those increases in real time.

“We hit four times our anticipated num bers for the entire year by June,” Fiorvento said of the program. “And at that point we just had to cut it off, because we didn’t have the resources to service the number of people coming through the door.”

So, what does the lawyer shortage mean for northern Michigan in the long term? Fiorvento anticipates that rates for legal services in the region will increase, that more niche types of legal expertise will become more difficult to find, and that courts will

Jury, president, Grand Traverse-Leelanau-Antrim

Fiorvento also predicts some bigger transformations throughout the profession as a whole. Could those transformations help bring more lawyers back to northern Michigan? Only time will tell.

“For years, you’ve had a lot of cultural

tion in a lot of places that associate attorneys are going to work these insane 80-hour weeks. I think that part of the shift we’re seeing is that this newer generation of lawyers are saying, ‘No, I’m going to emphasize mental health. I’m going to emphasize my

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 19

LAW, INSURANCE & ACCOUNTING

“The truth is that the wages are ridiculously low for most of the attorneys here, so it’s hard for northern Michigan to compete with the salaries that attorneys get paid in bigger cities.”

- Agnes

Bar Association

Moeggenberg

LOWER TEMPS SHOULDN’T MEAN LOWER SAVINGS When temperatures drop, increase your energy efficiency efforts. DTE can help, with tools and tips to save. Like having your HVAC system serviced and tuned up. Seal air leaks that can cost you money, and make sure your thermostats and lighting line up with winter hours. DTE can help your business with both comfort and savings. Visit dteenergy.com/savenow.

Fiorvento

The team at McLaren Healthcare learned that inefficient lighting in their 14 hospitals was costing them. The incandescent and fluorescent bulbs were using far more energy and lasting a fraction as long as efficient LEDs. This meant wasted energy, frequent purchases of replacement bulbs, and a negative impact on staff and patient experience.

To find a way to reduce costs and create a brighter, more productive environment, they turned to our energy experts. Working together, McLaren earned $230,106 in rebates to change their lightbulbs to LED and install advanced lighting controls. These upgrades improved the healthcare experience of their patients and staff — all while saving $1.6M* in annual energy costs.

Are you ready to brighten up your energy budget? Learn more at ConsumersEnergy.com/startsaving

20 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS

Inefficient lighting can leave you burnt out on energy costs.

$1.6 million in savings each year? That’ll brighten things up.

product

* Savings will vary based on customer energy use and

specifications. Annual energy savings are estimated.

WITH A GRATEFUL HEART cele ating the season

231.883.3273 | shellykleinrealtor.com

Put your party planning in our hands and celebrate in grand style. With accommodations for groups of 50 or more, we’ll create a party that is effortless, elegant and best of all, memorable. Guestrooms start at only $129* for party attendees.

a party: 231-534-6212

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 21 FOLLOW ME! 630 E Front Street, Unit 200, Traverse City, MI 49686

Owned & Operated by the Grand Traverse Band of Ottawa & Chippewa Indians

* Plus tax and fees. Some restrictions may apply. Book

Representing Northridge Commons, Traverse City’s Newest Affordable Luxury Development LOTS STARTING AT $50K grandtraverseresort.com

Celebrate in Grand Style

LEGAL BRIEFS

Seven local law firms share their biggest 2022 news

By Craig Manning

Major cases, office relocations, succession plans and big growth: These are a few of the new developments currently playing out in Traverse City’s legal scene. We touched base with seven local law firms to get their biggest news from the past year or two.

The firm: Revision Legal is a multi-ju risdictional international law practice with three main business arms: intellectual property matters, mergers and acquisitions, and legal advice and services for businesses or individuals that make money online.

Biggest 2022 headline: Unsurprisingly for a firm whose “bread and butter” revolves around helping clients that do business on the internet, the past few years have been exceptionally busy for Revision Legal.

“We’ve always taken a bit of a re mote-first approach to being a law firm,” said Revision Legal Attorney Christo pher Carol, noting that firm co-found ers – John Di Giacomo and Eric Misterovich – have always operated the business from their respective homes in Traverse City and the Kalamazoo area.

That structure meant Revision Legal was not only ready for remote opera tions when the pandemic hit, but it also made the firm well-positioned to help clients who suddenly found themselves doing business online.

“The internet became a pretty big lifeline for people when they couldn’t necessarily leave their houses,” Carol said. “And then a lot of people also had to figure out what they might need to do differently for a living, so they’d form internet-based businesses and try to get those off the ground.”

Revision Legal became a go-to partner for those new entrepreneurs using the internet to start fledgling businesses, as well as for established businesses that suddenly wanted to diversify into more

web-centric lanes.

“We definitely saw a big influx of gen eral M&A and transactional work happening through those pandemic years,” Carol added. “Companies started to recognize that, ‘Hey, there’s several people making good livings selling through channels like Amazon or Shopify, and we could buy those businesses and add them to our portfolio.’”

As a result, Carol says that Revision Legal has handled over $100 million of M&A transactional work in 2022 alone.

Other notable news: In March, Revi sion Legal launched a new podcast, ti tled “May It Please the Internet,” which covers a variety of legal matters pertain ing to intellectual property, ecommerce, M&A, and more. While the podcast

sometimes works in an FAQ mode, answering common questions about, say, doing business on Amazon, it also engages with splashier topics of the moment, such as the 2022 fad of NFTs (non-fungible tokens) or the IP law dynamics of Taylor Swift re-recording her albums.

The firm: Jay Zelenock Law describes itself as “a civil justice law firm helping clients with wrongful death, personal injury, automobile accidents, insurance issues, employment issues, employee rights, wrongful termination, contract, property, and probate issues.”

Biggest 2022 headline: If you’ve read much local news lately, you’ve probably seen Jay Zelenock’s name. That’s due in large part to his role as counsel for Save Our Downtown, the nonprofit group at the center of numerous legal battles around building heights in Traverse City.

Mostly recently, Zelenock has been representing Save Our Downtown and Albert T. Quick as plaintiffs in a lawsuit against the City of Traverse City and development group Innovo over how building height is measured within city limits.

Save Our Downtown was instrumental in the 2016 passage of Proposal 3,

which amended the city charter to trig ger a public vote before the city commis sion can approve any new building with a height above 60 feet. The Innovo/ City of Traverse City lawsuit, in turn, emerged in relation to a new apartment complex that Innovo is seeking to build on Hall Street.

In March of 2022, city planning commissioners approved an 88-unit, six-story design for the Innovo Hall Street complex, including rooftop mechanical equipment that would put the building over the city’s 60-foot maximum. City Attorney Lauren Trible-Laucht argued at the time that city zoning code does not count rooftop mechanical equipment and that the Innovo project therefore did not require a public vote.

Zelenock, on behalf of his clients, countered that Proposal 3 had overruled the city’s existing zoning ordinance and that rooftop features do count toward

building height, which would put the Hall Street project up for a public vote to move forward as designed.

13th Circuit Court Judge Thomas Power ultimately sided with Save Our Downtown on the matter, but his ruling was later overruled by the Michigan Court of Appeals, which stated that Pro posal 3 “does not expressly address how to measure the height of a building.”

Zelenock and his clients have ap pealed that ruling with the state, em boldened by the fact that city residents voted this November to reject a proposal from Innovo to build the project as initially designed.

Other notable news: Zelenock says his firm is eyeing growth plans for 2023.

“We plan to expand and strengthen key relationships in the coming year to increase our ability to meet the needs of our clients, and help them solve their problems and meet their needs,” he said.

22 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS LAW, INSURANCE & ACCOUNTING

Jay Zelenock Law Firm

Revision Legal

Christopher Carol

Jay Zelenock

The firm: Previously affiliated with the Grand Rapids-based law firm Smith Haughey Rice & Roegge, Parker Harvey was born five years ago when the down state firm decided to close its satellite office in Traverse City. The TC office became Parker Harvey, which continues to offer legal service in northern Mich igan covering multiple areas of legal practice, including property and real estate, litigation, nonprofit, insurance, construction, business law, taxation, and more.

Biggest 2022 headline: According to Managing Partner Pete Boyles, one of the biggest priorities on the Parker Harvey todo list in 2022 was succession planning.

“We’re not necessarily looking to grow by adding lateral hires,” Boyles said. “What we’re really looking to do is fill in with younger attorneys and to get them ready to take over practices and clients for our attorneys that are nearing kind of the end of their careers. We want to have that plan in place.”

The challenge there, Boyles noted, is finding younger lawyers who want to relocate to Traverse City, work for Traverse City firms, and make Traverse City salaries.

“Even before the pandemic, I remem

ber interviewing a young lawyer from a big Chicago firm that was paying big Chicago salaries,” Boyles said. “He was looking to relocate, and we were talking to him, and I ended up telling him, ‘If I were you, I would see if that Chicago firm would let you work remotely.’ And they did. So, he was able to relocate here, continue to work for the big Chicago firm, and – I presume – continue at that very high salary.”

That trend – of big-city lawyers working remotely from places like Traverse City –has become more common since COVID, and Boyles thinks the situation is making it even harder for firms like Parker Harvey to recruit and hire younger attorneys.

“It used to be that in order to live in Traverse City and be a lawyer in Traverse City, you had to be with the Traverse City

firm. And clearly that is no longer the case.” Boyles said.

Parker Harvey is trying to stay competi tive by offering things that remote lawyers working for major big-city firms might not be getting – such as direct mentorship from experienced attorneys, face time with clients, and actual courtroom experience.

“It’s hard to compete with dollars, so we have to find other things that resonate with young attorneys,” he said.

Other notable news: Speaking of the pandemic, Boyles noted that Parker Har vey has dedicated itself this year to putting failsafe measures in place should future COVID shutdowns or other circumstances require law firms to pivot back to remote work.

“Everybody is on premises at this point, but we’re also prepared (to go remote) if

need be,” he explained. “We’ve invested quite a bit in hardware and technologies for everyone, including legal assistants, to be able to work remotely if we ever have to go that route again.”

Time for an upgrade?

TRAVERSE CITY BUSINESS NEWS DECEMBER 2022 23

Free Estimate | | | Don’t be

(231) 947-0100 precisiontc.com LAW, INSURANCE & ACCOUNTING

left out in the

Parker Harvey

Peter Boyles

“It used to be that in order to live in Traverse City and be a lawyer in Traverse City, you had to be with the Traverse City firm. And clearly that is no longer the case.” – Peter Boyles

The firm: A general practice law firm founded in Traverse City in 1974, Smith & Johnson describes itself as “one of the largest and most diversified” law firms in northern Michigan. The firm’s list of legal services includes municipal law, busi ness and corporate services, commercial litigation, criminal defense, family law, maritime law, and more.

Biggest 2022 headline: Tim Smith, a partner at Smith & Johnson, P.C., described 2022 as a big year in general for the business, thanks in large part to some major strides for a landmark opioid lawsuit the firm has been working on since 2017.

“The biggest litigation we’ve ever worked on has been this federal opioid litigation,” Smith explained.

The lawsuit, which has been brewing for five years, pitted counties and mu nicipalities from throughout the country against pharmaceutical manufacturers, dis tributors, and retailers. Plaintiffs argued that players at every level of the pharmaceutical helped create the opioid epidem ic, which in turn has ravaged communities throughout the United States.

Per Smith, Smith & Johnson was the counsel of record for 36 municipalities north of Clare and across the U.P., including Grand Traverse County and the City of Traverse City. This year, four of the de fendants in the case settled for $26 billion nationwide, with nearly $800 million of that money coming to Michigan. Smith &

“And it’s a huge, broad range of potential uses (of the money) for those counties, from addiction treatment services, to pub lic health departments, to court systems, to Narcan pens for the sheriff’s office,” Smith explained. “So, it’s a ton of money coming in for our clients here in north ern Michigan, including Grand Traverse County and the City of Traverse City.”

Smith added that, since several defen dants have yet to settle, this settlement should be “just the beginning of monies that will be coming into these munici palities that have been damaged by the opioid epidemic.”

Other notable news: Smith & John son bought the Northwestern Mutual building on East Front Street in the summer of 2021 and moved into the new space in August of this year. Smith told the TCBN that he and his partners were ready “to own a building and not be a tenant anymore.”

The firm: Alward Fisher works in a va riety of practice areas, including banking, business and corporate law, civil litigation, criminal defense, estate planning and probate, family law and real estate.

Biggest 2022 headline: According to Managing Partner Edward Price, Alward Fisher was just one of many Traverse City law firms involved in a “musical chairs” game of office relocations in 2022.

Alward Fisher is now doing business out of an office located at 412 South Union, where Kuhn Rogers used to be.

“It was one of those years where several of the larger firms in town were moving around and getting adjusted,” Price added.

Price said that these moves were largely out of necessity, due to the additional attorneys that have been hired in the past few years to accommodate the increase of legal work in the area.

“And that was definitely true for us,” he said.

In 2013, the firm started with about seven attorneys, but since then, Alward Fisher has been growing.

“We’re up to 11 attorneys now, and I just had an interview to hopefully add one more,” he said. “It’s just been a busy time for lawyers in town.”

Other notable news: On the subject of firm growth, Price told the TCBN that Alward Fisher has made two major addi tions to its legal practice team this year. The first is Anca Pop, who relocated to Traverse City and joined Alward Fisher as a partner after leaving her job as an assis tant prosecutor for the United States Attorney’s Office in Bay City. The second is Melissa Whitman, a local divorce attorney who joined Alward Fisher after nearly a decade as the owner and solo practitioner of her own firm, Whitman Family Law.

24 DECEMBER 2022 TRAVERSE CITY BUSINESS NEWS Why choose Bonek? For over 85 years, Bonek Insurance has provided personal and commercial insurance protection. We form strong relationships with our clients – keeping their best interests in mind. Let us customize your coverage. Call us today! (231) 271-3623 www.bonek.com Business2018oftheYear–LeelanauCounty “RedHotBest” Winnerfor2020

Alward Fisher

Johnson clients in northern Michigan will receive some $26 million.

LAW, INSURANCE & ACCOUNTING

Smith & Johnson