Goodwill Northern Michigan’s Dan Buron has a big resume and an even more ambitious list of goals for the region

A good professional fundraiser is harder than ever to find. For those still looking, experts say a lack of experience is no concern

Goodwill Northern Michigan’s Dan Buron has a big resume and an even more ambitious list of goals for the region

A good professional fundraiser is harder than ever to find. For those still looking, experts say a lack of experience is no concern

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University.

Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.**

Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial, TD Ameritrade, and Charles Schwab.

TentCraft , a U.S. manufacturer of custom tents, structures, and event solutions in Traverse City, has acquired World Class Displays, an Iowa-based, full-service custom exhibit company with more than 40 years of expertise in creating custom trade show booths. The acquisition bolsters TentCraft’s capabilities in the indoor event space. World Class Displays will retain its name and operate within the TentCraft family of companies, alongside PrintCraft On Demand and PrintCraftSend. Its existing facilities in Marion, Iowa, will continue production, with TentCraft’s headquarters set to handle overflow production during peak trade show season.

Life of Riley Meadows (formerly Ritters Assisted Care Facility) in Traverse City has expanded with the acquisition of two additional facilities: Life of Riley Maples (formerly Woodside Assisted Living) and Life of Riley Oaks (formerly Southridge Assisted Living). Also, Jessi Rokos has been hired as executive administrator. Rokos spent more than two decades at the Grand Traverse Pavilions. All three facilities are owned by Cole Riley.

20Fathoms recently announced new no cost, one-on-one startup coaching opportunities are now available on a recurring basis for entrepreneurs in Traverse City and Benzie County. Coaching is available on a drop-in basis (no appointment needed) at 20Fathoms in Traverse City every Thursday, 1pm4pm, and at Grow Benzie in Benzonia on the third Thursday of each month, 12:30pm-2:30pm. In addition to coaching, 20Fathoms is also providing startup boot camps in these communities. Dates for the next boot camp cohorts will be announced in early 2025. More info at 20fathoms.org/coaching.

Aspire North REALTORS , under the leadership of President Jessica Brutzman, has chosen Alan Jeffries to succeed Kimberly Pontius as its CEO in 2025. Pontius, who led the organization since 2007, announced in May that he would not seek renewal of his contract. Jeffries is a seasoned CEO/ association executive, serving in the role at the Southwestern Michigan Association of Realtors and Real Estate Systems since May 2017. He has also been a licensed real estate broker for 31 years and previously owned his own brokerage in Kalamazoo.

Craig W. Elhart, PC in Traverse City is now Elhart & Kreinbrink, PLLC (eklawtc.com), with attorney Lauren R.P. Kreinbrink joining Elhart and the firm as partner. Kreinbrink is the former prosecuting attorney for Mason County. Elhart has practiced law in Traverse City for 50 years.

Kelly Dunham, executive director of the Bay Area Transportation Authority (BATA) since 2016, is leaving the organization this month. She first joined BATA in 2009 as human resources manager and also served as the transit agency’s director of human resources and operations before being named executive director. Dunham helped revolutionize BATA by reinventing its brand, finding and hiring new personnel and transforming its service delivery model from a traditional dial-a-ride service to a hybrid fixed route and on-demand transportation system. She and her team also planned the building of BATA’s new headquarters by securing more than $23 million in federal and state grant funds. Dunham has joined 4Front Credit Union as chief culture officer.

Fractional Insights , a Traverse Citybased research and advisory firm revolutionizing the future of work, won the $5,000 first place prize at last month’s TCNewTech pitch competition hosted by 20Fathoms . The firm “bridges the

CLIENT: Gauthier Family Property (former Big Top property)

PROJECT: Multi-family Development Sale

SERVICES: Rezoning, Listing & Selling Broker

Colleen Smith Kevin endres principal, three west commercial Ernie Gauthier

Talk about challenging. Our 19-acre family homestead had 10 heirs. It encompassed our childhood home, our businesses, agriculture, you name it.

Kevin navigated the complexities of this sale brilliantly. From complex zoning issues to family dynamics, Kevin was able to finesse the best deal while managing to ensure our family legacy – the buyer plans workforce housing (160 units), desperately needed in our community.

Our parents would’ve been delighted. We sure are!

gap between cutting-edge AI technology and human-centric workplace design,” according to a news release announcing the winner. Fractional Insights was founded by Shonna Waters and Erin Eatough. The $2,000 second place award went to Blooma, an all-in-one garden app that unites Gen-Z and Millennial gardeners through social connections and offers easy-to-use resources. Blooma, founded by Erin Blohm, is based in Leelanau County.

United Way of Northwest Michigan has announced new members on its board of directors. They include Laura Matchett, director of extended education and training at Northwestern Michigan College (Grand Traverse County), and Abigail Ellsworth, a naturopathic doctor and founder of Freshwater Wellness (Benzie County). In addition, Deon Vaughan, current board chair from Leelanau County, was re-elected to a second term.

TC Adventure Bike , a new business offering guided motorcycle adventures on the area’s roads and trails, is now open. “Our goal is to share the experience of northern Michigan, and to encourage people to get into the sport,” said Dan Gray, who owns the business along with Brian Allen and Luke Reneaud. “Riders also can try out various models if considering buying a bike.” Riders must be at least 21 years of age and have a valid motorcycle endorsement, with the business offering tours on KTM 390, 690 and 890 adventure models. Learn more at tcadventurebike.com.

The annual Northern Michigan Policy Conference will be held January 31 at the Grand Traverse Resort and Spa. Now in its seventh year, the conference is designed to leverage diverse strategies to enhance the region’s standing as a world class place for business, residents, visitors, and students. Speakers will address chronic issues surrounding business development, talent, housing,

and childcare. More info and tickets at traverseconnect.com.

Venture North in Traverse City recently received a $50,000 grant from the DTE Energy Foundation to support small business growth in northern Michigan. The grant will enable Venture North, a U.S. Treasury-certified Community Development Financial Institution, to provide low-cost loans and no-cost consulting services. The focus will be on aiding small businesses, particularly in underserved areas of northwest Michigan.

Harmony Estate Wineries of Leelanau has acquired Dune Bird Winery , a Northport establishment founded by Nicole and Bo White. The winery joins the Harmony Estate Wineries of Leelanau family of wineries, alongside Bel Lago Vineyard & Winery and French Valley . “We are so proud of our new association with Dune Bird,” said John Heekin, owner and CEO of Harmony Estate Wineries of Leelanau.

“The culture that Nicole, Bo, and the Dune Bird team have created is awe-inspiring. We promise to continue what the Whites and their team have started and preserve the Dune Bird legacy for years to come.” Dune Bird launched in 2021 after the Whites transformed a former ranch into a winery. As part of the transition, Sarah Peschel will take over operations of the winery.

Traverse City Light and Power (TCLP) has earned a Smart Energy Provider (SEP) designation from the American Public Power Association for demonstrating a commitment to and proficiency in energy efficiency, distributed generation, and environmental initiatives that support the goal of providing safe, reliable, low-cost, and sustainable electric service. Of Michigan’s roughly 42 municipal utilities, TCLP is one of eight to carry this designation.

What is worse than bad government policy? Answer: confusing bad government policy.

This summer, the Michigan Supreme Court made headlines by ruling that the Michigan legislature had violated the state constitution in its “adopt and amend” approach to two ballot measures related to minimum wage and paid leave.

The court’s ruling has sparked both confusion and concern as businesses attempt to understand the implications and prepare for possible changes.

These ballot measures were initiated by an out-of-state special interest group and intended to increase the minimum wage, eliminate the tip-credit calculation for servers, and require that employers provide paid sick leave. While this may not sound alarming, the actual language to implement these programs is fraught with unworkable provisions, confusing rules and contradictory regulations.

To avoid the ballot process, the Michigan legislature adopted both initiatives into law in September 2018. Following the election, lawmakers moved to amend both laws. This “adopt and amend” approach allowed legislators to modify and scale back the original proposals to a more workable version that preserved the tipped wage credit and exempted smaller businesses with fewer than 50 employees from the sick leave requirements.

This legislative approach sparked considerable debate and legal action, leading to a complex battle over the constitutionality of the “adopt and amend” method. This ultimately resulted in the landmark July 2024 ruling from the Michigan Supreme Court.

Unless further legislative action is taken, the tipped minimum wage will be eliminated, and an unworkable set of paid sick leave provisions will be instated, applying to all businesses with one or more employees and nonprofit employers, including schools, hospitals, and local governments.

Traverse Connect and the Northern Michigan Chamber Alliance have closely followed these issues for more than six years, given their impact on our local economy. While we support fair labor practices, these laws as currently written will have significant negative implications for all businesses in our region, and they pose dire risks to our small businesses and the hospitality industry.

Unfortunately, many in Lansing are more focused on political games, and legislators have yet to address this issue. This is not a partisan issue or political game. It is a very serious across-the-board employer and employee problem that legislators need to fix.

Members of the Northern Michigan Chamber Alliance have been proactive in advocating for balanced solutions that ad-

EDITORIAL

PUBLISHER

Luke W. Haase

lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

STAFF WRITER

Art Bukowski

CREATIVE DIRECTOR

Kyra Cross Poehlman

dress the need to attract and retain talent without overburdening businesses. We have called on legislators to enact several amendments that will provide a more sustainable path forward for both workers and employers.

Paid sick leave provisions, as currently written, are vague and difficult to implement, leading to challenges for employers and employees. Michigan lawmakers need to ensure that the law protects employees while being practical for businesses to follow.

It is important the legislation recognizes that many employers already provide the required 72 hours or more of paid time off (PTO) and should be exempt from the new rules. This approach could be more flexible and manageable for businesses while also ensuring that employees receive time off.

Employers with fewer than 50 employees and seasonal businesses, such as those in tourism-driven regions of northern Michigan, should be exempted from paid sick leave requirements. This is in keeping with federal guidelines under the Family and Medical Leave Act and the Affordable Care Act. Such exemptions recognize the resource limitations of small and seasonal businesses and prevent them from facing disproportionate compliance challenges.

The minimum wage increases in the legislation are largely irrelevant, given our region’s relatively high entry-level wages,

but maintaining the tip credit is particularly important for our service industry. Surveys indicate that more than 80% of servers prefer to keep this system. By preserving the tip credit, legislators can safeguard jobs and prevent unintended consequences for workers and employers alike.

Given the economic pressures facing northern Michigan businesses, we are urging lawmakers to enact these amendments before the end of 2024. Immediate action will provide businesses with much-needed clarity and stability, allowing them to prepare for and comply with any new requirements while maintaining jobs.

The Michigan Supreme Court’s July 2024 decision underscores the need for a balanced approach to labor reform in Michigan. The court’s ruling creates new challenges for businesses, particularly small and seasonal employers. We have outlined common-sense reforms that protect workers while recognizing the unique needs of employers.

As the state moves forward, it will be essential to find a middle ground that respects constitutional processes, supports workers and promotes business growth in Michigan. If you have not already engaged your legislators on this issue, please take action now and get others involved.

Warren Call is CEO and president of Traverse Connect.

CONTRIBUTING

Ross Boissoneau

Kierstin Gunsberg

Rick Haglund

COPY EDITOR

Becky Kalajian

WEB

Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Gerald Morris

SERVING:

Grand Traverse, Kalkaska, Leelanau and Benzie counties

Caroline Bloemer

cbloemer@tcbusinessnews.com

Lisa Gillespie

lisa@northernexpress.com

Abby Walton Porter

aporter@northernexpress.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris

tnorris@tcbusinessnews.com

Michele Young myoung@tcbusinessnews.com

Editor’s note: This letter is in response to the November article “Out of Network: Why dentists are ditching Delta Dental, and dropping other carriers, too.”

I am a dentist in the Traverse City area and am seeing a lot of new patients in my practice because their providers have stopped participating with dental benefits plans. These patients are scrambling to find someone who does. They’re justifiably feeling angry, abandoned and inconvenienced by having to wait to get into a new practice.

Access to affordable oral healthcare is essential for the overall health of a community. Dental benefits do more to get people to the dentist, especially for preventative care, than anything else, according to the American Dental Association. That’s why I continue to work collaboratively with dental benefits companies, and so do many of my colleagues in the Traverse City area. I am particularly proud to partner with Delta Dental, whose mission to improve oral health aligns with mine. Delta Dental has always been and is still today by far the easiest dental benefits company to work with.

The dentists who believe they can fix their finances by walking away from dental benefits partnerships are building a different kind of practice than I and many of my colleagues; they’re faulting the dental benefits companies for their woes.

The root of the problem is the high cost of doing business in a post-Covid world. Inflation has driven up our

overhead and expenses by nearly 40%. A stubborn national hygienist shortage has crippled our ability to consistently and affordably staff our offices. That shortage is even worse in a resort community like Traverse City where the cost of living, particularly the cost of housing, is out of reach for working- and middle-class families.

Over the past couple of years, Delta Dental of Michigan, Ohio, and Indiana has paid us more – $184 million more in reimbursements across its network. The company and the Delta Dental Foundation (DDF) are also offering scholarships starting in 2025 to attract more hygienists and a student loan repayment plan to new dentists who work in communities with shortages, like northern Michigan. No other dental benefits company that I am aware of does anything like this.

And it’s not like Delta Dental is immune to inflation. As their costs go up, surely they must pass some increases on to their customers. When employers cut or reduce dental benefits, or an individual decides they can no longer afford coverage, that means fewer people will go to the dentist. That isn’t a solution.

My practice and others in the region remain steadfast in our commitment to improving oral health in our community. Our doors are open to you. We just ask that new patients bring a little patience. We will take care of your emergencies and work you into our hygiene and cleaning schedules.

- Dennis T. Spillane, DDS, Bellaire

Mengebier, President

By Art Bukowski

CEO

The first thing Dave Mengebier will tell you about his desk is that he doesn’t like to be at it all that much. Mengebier is president and CEO of the Grand Traverse Regional Community Foundation, and he’d much rather be out interfacing with donors or community partners. But there are times when we’re all stuck behind the desk, and we’re grateful to Dave for showing us around his space at the foundation’s offices in the beautiful Village at Grand Traverse Commons. If you have an idea for a future From the Desk of Feature, please email Art Bukowski at abukowski@tcbusinessnews.com

1. This level is from Peace Ranch, one of our grant partners that does equine therapy. They give this to their staff and ask each other, ‘Where’s your bubble today? Is it centered? A little off?’ They gave me one during a site visit, which the foundation conducts to help measure the impact of our partners (grant recipients) on the community. These visits are important to us as a foundation, and I liked the sentiment behind this gift.

2. I did my undergraduate at Michigan State and then I got an MBA from Michigan. People ask me all the time who I cheer for, and I say Michigan in every game but three: The two basketball games and the football game against MSU.

3. My phone is my real computer. People talk about having a work-life balance, and some people like to have a firewall between their personal and their professional lives, but I don’t do that. I’m always accessible, and I think part of it is I don’t consider this work in some respects. I really enjoy it, and I love the people I work with. So even when I’m out of the office I’m going to be connected. I’m happy to respond.

4. When I first took this job, I was really working hard to reach out to members of the community, who would ask what I do and what exactly the Community Foundation is. It was one of the areas of focus of the board, to increase our visibility. Now, after doing a lot of that sort of outreach, I don’t need my name tag as much. We’ve also increased our assets (for grantmaking) and strengthened our community collaborations, which also increases visibility.

5. This is “I Have Something to Tell You” by Traverse City native Chasten Buttigieg, and it’s about his experiences being a gay man in a pretty conservative area. We are very focused as an organization on diversity, equity and inclusion. That includes people of color, indigenous people, people from the LGBTQ+ community, but also people with disabilities, veterans and people from lower socioeconomic levels. This is a book we read together as a staff (we do that regularly) that speaks to our efforts in this area.

6. These are mailings asking supporters to make a contribution, and I’m working through a pile now to personalize them. What we found when we’re reaching out to donors and inviting them to make a contribution is that writing personalized notes on there to people we have a relationship with makes a huge difference.

7. These are files tied to initiatives that I’m spending a lot of time on. Things like the Coalition to End Homelessness, Press Forward (a national organization that supports local journalism) and the Community Development Coalition, which is made up of more than 40 nonprofit organizations.

8. This painting was a gift from a cultural organization associated with the Grand Traverse Band of Ottawa and Chippewa Indians. We received this because we’ve been working really hard to strengthen our trust relationship with the tribe. For me, this painting was validation and some affirmation of our work to build that relationship, which is very important to us.

Here’s what eight local nonprofits are asking for this year

By Craig Manning

Everyone has a wish or two around the holidays, whether it’s dreams for a visit from Santa Claus or hopes for a rejuvenating season spent with loved ones. Northern Michigan’s many nonprofits have wish lists, too, and each year, the TCBN asks a handful of them to share those lists with our readers.

If you remember this feature from past years, you know the drill: We encourage local orgs to think about their needs in small (less than $100), bigger (less than $500), and biggest (sky’s the limit) categories, with the caveat that they can’t just wish for cash. With all that said, here are the eight area nonprofits we asked to provide wish lists this year:

Once the working farm for the State Hospital, the Botanic Garden seeks to be “a yearround sanctuary of environmental preservation, recreation, and education.” Per organization leaders, the Garden’s 26-acre campus is designed to “nurture the soul, enliven our history, and promote Michigan’s natural beauty.” In particular, the Botanic Garden emphasizes plant species that are native to northwest Michigan, not just providing a tranquil space for human visitors to spend time, but also offering ideal habitats for numerous types of local wildlife.

Less than $100: “Get to know us!” the Botanic Garden urges. “Surveys suggest that many locals only have vague knowledge that we exist. Visit the Garden at 1490 Red Drive; become a member; sign up for the Botanic Garden newsletter at www.thebotanicgarden. org; or join the organization’s volunteer family.” Volunteer opportunities include gardening, small engine repair, tractor driving, and social media oversight.

Less than $500: “Garden is Open” feather flags for the entrance; safety supplies, such as industrial first aid kits; gift cards from Menards, Home Depot and Lowes’ to purchase materials as needed.

Sky’s the limit: Glass block windows –fourteen of them, approximately 30 inches by 30 inches, to weather-proof the historical cellar under the pavilion. Per organizational leaders, weather-proofing of the cellar “will protect our visitor center inventory and allow the room to be used for training and events.” Other bigger-picture asks include a six-seater golf cart for offering accessible tours of the garden, sponsorships for future Botanic Garden interns, and a website overhaul.

The Father Fred Foundation serves individuals and families across the five-county northwest Lower Michigan region by providing food, clothing, and financial assistance. The organization’s mission is to “offer help, hope, and compassion to anyone with essential needs,” whether it’s help with rent and utilities or filling the refrigerator with fresh food.

Less Than $100: Cold weather gear for Father Fred’s clothing and household department; needs there include donations of coats, boots, heavy socks, hats, and gloves, which “are always in need during the winter months.” Father Fred also urges supporters to volunteer, whether it’s for an hour, a day, or a year. “We welcome extra help at any time to keep our costs down and to serve as many people as possible,” said Executive Director Candice Hamel.

Less Than $500: A new smart TV for Father Fred’s guest lobby, “to share information about services, upcoming events, and resources” with visitors.

Sky’s the Limit: A complete software systems upgrade, to streamline real-time data entry of guest services and “reduce paper and post-services data entry.”

Described as a “rural prosperity incubator,” Grow Benzie “accelerates the impact of grassroots projects, small-scale nonprofits, and food and farming enterprises.” Launched in 2008 at a then-abandoned four-acre plant nursery in Benzie County, Grow Benzie functions by inviting local residents, organizations, and volunteers to its campus to utilize its incubator farm, community gardens, event center, commercial kitchen, co-working office spaces, sewing studio, bee apiary, and more. The organization also provides a variety of other services, such as bookkeeping, grant writing, and volunteer management. The goal is to help lift up volunteer-driven organizations, which often struggle in small rural areas.

Less than $100: “Subscribe, like, follow, and click Grow Benzie posts on Facebook, Instagram, and YouTube for one month,” Executive Director Josh Stoltz said. “In addition, subscribe to our monthly newsletter on our website, or visit GrowBenzie.org and click around our updated pages, infographics, and photos to gain clarity about the organization.”

Less than $500: New, comfortable and ergonomic office chairs; a gift certificate to purchase annuals (flowers) in the spring for campus beautification; a light for the Grow Benzie roadside marquee; metal signage for wayfinding and plant identification throughout the nonprofit’s four-acre campus; excavator work to help alleviate runoff damage in the parking lot.

Sky’s the limit: “Someone paying off the remaining $83,000 balance of our mortgage would allow us to immediately redirect those payments toward increased staffing, which in turn would enable us to expand services and rental revenue,” Stoltz told the TCBN

Our Missio

Since 1941, Young Life have been showing up basketball games, han the local lunch spot, an friendships, family, co and church bonds, and pursue the world thou of God Young Life Lea been in Grand Traverse actively sharing their m introducing adolescent christ and helping them their faith

Who We Serve

Young Life (High Scho WyldLife (Middle Scho YoungLives (Teen Mom

Based in Suttons Bay, the Inland Seas Education Association (ISEA) allows learners of all ages to get hands-on learning experiences aboard traditionally-rigged tall ship schooners. The organization carries a mission “to inspire a lifetime of Great Lakes curiosity, stewardship, and passion in people of all ages.” “We are convinced that the scientists and citizens who will solve the Great Lakes’ problems of the future will sail aboard Inland Seas’ ships today,” ISEA proclaims on its website. Since it was founded in 1989, the nonprofit has tallied more than 165,000 program participants.

Less than $100: Replacement motors, fittings, and batteries to support ISEA’s popular underwater remotely operated vehicle (ROV) challenge.

Less than $500: A dock box for storing underwater ROV materials at Discovery Pier; larger dissection trays with foam pads for pinning sea lampreys as part of ISEA’s lamprey dissection program; a replacement Manta Trawl filter for conducting microplastics research; replacement equipment for the Benthos station, which teaches learners about the bottom-of-the-lake ecosystem.

Sky’s the limit: 15 new mattresses to support overnight programs on the schooner Inland Seas – an approximately $7,000 value, according to ISEA Executive Director Fred Sitkins; new electrical and replacement decking for the schooner dock in Suttons Bay.

Started in 2017, LIFT is an out-of-schooltime mentorship program that “empowers Leelanau County’s youth to discover and embrace their strengths.” The organization seeks to “provide a safe environment for local teens, where they can develop social and emotional skills through enriching activities and the support of caring community members.”

Though LIFT began with an exclusive focus on Suttons Bay, the nonprofit now has an affiliation within three Leelanau school districts (Suttons Bay, Glen Lake, and Northport) and is in the midst of an “exploratory year” with Leland that could add a fourth district to the list. LIFT currently serves over 600 teens per year.

Less than $100: Snacks; gas cards; board games or card games; puzzles; yard games; art supplies; sports equipment.

Less than $500: Desk chairs; coolers; new printers; a Nintendo Switch; noise-canceling headphones; smart TVs.

Sky’s the limit: A trailer and a fleet of mountain bikes with helmets, all for LIFT’s summertime biking adventures.

The Northwest Michigan Coalition to End Homelessness is a collaborative group of dozens of local stakeholders – including shelters, health care providers, nonprofits, social services agencies, and government entities – that work together to make homelessness “rare, brief and one-time across northwest Michigan.” The collective’s major goal is to end chronic homelessness in the region by 2028.

Less than $100: Basic needs items for people experiencing homelessness – which, in the winter, includes cold weather gear like coats, snowpants, winter boots, hand warmers, hats, and gloves, along with always-needed items like backpacks, toothbrushes and toothpaste, or deodorant. “Basic needs items can provide some immediate relief, ensuring that people experiencing homelessness have essentials like food, hygiene supplies, and warm clothing to survive daily challenges,” said Executive Director Ashley Halladay-Schmandt. “These items not only meet urgent physical needs but also offer dignity and stability, supporting individuals on their path toward housing.”

Less than $500: Supplies for “welcome home baskets,” which the Coalition provides to individuals and families who are moving from homelessness into new homes. “When you’re starting with nothing, a basket full of essential items can make a new place feel like home and support long-term housing stability,” Halladay-Schmandt explains. Each basket contains roughly $160 worth of items, including toilet paper and paper towels, cleaning products, shower curtains, and more.

Sky’s the Limit: Rental assistance for people experiencing homelessness. According to Halladay-Schmandt, it costs around $13,500 per year to pay rent and provide supportive services to maintain someone in their housing. “Conversely, it costs around $35,000 per person, per year to maintain a person in homelessness,” she added.

TC Paw Cat Rescue seeks to “provide a second chance to cats that have been abandoned, found as strays, or surrendered by their owners.” In addition, the organization works with local veterinarians to “create the best outcome for all animals and nurture the human-animal bond through careful placements, assessing and thoughtfully addressing animal needs, and considering the health and safety of both animals and our communities.“ The organization helps cats and kittens in the greater Traverse City area through spay/neuter, fostering, adoption, education, and community collaboration.

Less than $100: Cattery cleaning supplies, including 13-gallon trash bags, dish soap, and disinfectant wipes; dry kitten food (Purina One Healthy Kitten), wet kitten food (Purina One or Fancy Feast), dry cat food (Purina One Indoor Advantage), and adult wet food (Purina One, Fancy Feast, or Friskies); unscented Tidy Cats litter; litter boxes and scoops; cat toys; cat beds; scratch pads; gift cards to Amazon.com or Chewy, a popular online retailer for pet-related products.

Less than $500: Annual subscriptions for Constant Contact (TC Paw’s email newsletter platform) or Square Plus (its payment processing account); a Square Terminal all-in-one credit card reader; cat towers; microchip scanners; a digital photo frame to display all cats and kittens available for adoption; True Catch cat traps and Wi-Fi enabled outdoor motion sensor cameras for locating missing cats or TNR (trap-neuter-return) operations.

Sky’s the limit: A shelter location and building with vet care facilities for vaccinations, spay/ neuter and surgical services; a Cat Cafe where TC Paw could showcase its cats and have a way to bring in more funds; permit costs for food/alcohol at annual spring fundraising event.

The Women’s Resource Center (WRC) works “to protect, shelter, and empower people impacted by domestic and sexual violence.” The nonprofit offers free and confidential services to all survivors of such situations.

Less than $100: Welcome packages for survivors coming to stay in the WRC shelter, which could include shampoo, toothpaste, toothbrush, socks, deodorant, and other basic needs items; cleaning supplies and laundry soap; diapers of all sizes; hygiene products; snacks that are simple for school lunches; small new toys for kids that can be given as gifts when they leave; businesses in the community hanging WRC posters, so the organization can reach more people.

Less than $500: A new quality vacuum for the WRC transitional house; new comfortable chairs and coffee table for the organization’s waiting room, or “uplifting artwork” for the lobby.

Sky’s the limit: An update to the WRC playroom, which Director of Donor Engagement Jamie Bell said “is used frequently when parents are in appointments.” Per Bell, “everything in there is a little worn” and in need of replacement. “An upgrade of toys, changing table, and storage would be appreciated,” she said. “We would love to add a TV where we can show cartoons, and a privacy screen for nursing moms.”

By Kierstin Gunsberg

Women-founded businesses in the U.S. drive an impressive $2.7 trillion in revenue annually, yet capture less than 3% of the country’s venture capital funding.

It’s a major gap that the Traverse Citybased Boundless Futures Foundation (BFF) wants to close. Started in 2023 by Good Bowl founder and entrepreneur Soon Hagerty and her husband McKeel, BFF awards grants and mentorships to help female-led businesses overcome barriers – financial and otherwise – that stymie growth.

“There are uphill battles when it comes to being a female founder,” said Soon Hagerty, pointing to a lack of early-stage capital as one of the largest hurdles. “Talent is distributed equally, but opportunities are not.”

BFF’s EmpowHer grant, which awards up to $25,000, was created to address those early funding needs and has so far been awarded to over a dozen startups

across the country including Traverse City’s own Archie’s Dog Co., an all-natural dog treat brand.

When choosing BFF’s grant recipients,

northern Michigan community, she’s familiar with the challenges women face navigating success both in their business and outside of it.

“It’s just fantastic when people who don’t always feel like they’re making a difference on their own are able to join their contribution with all these other women.”

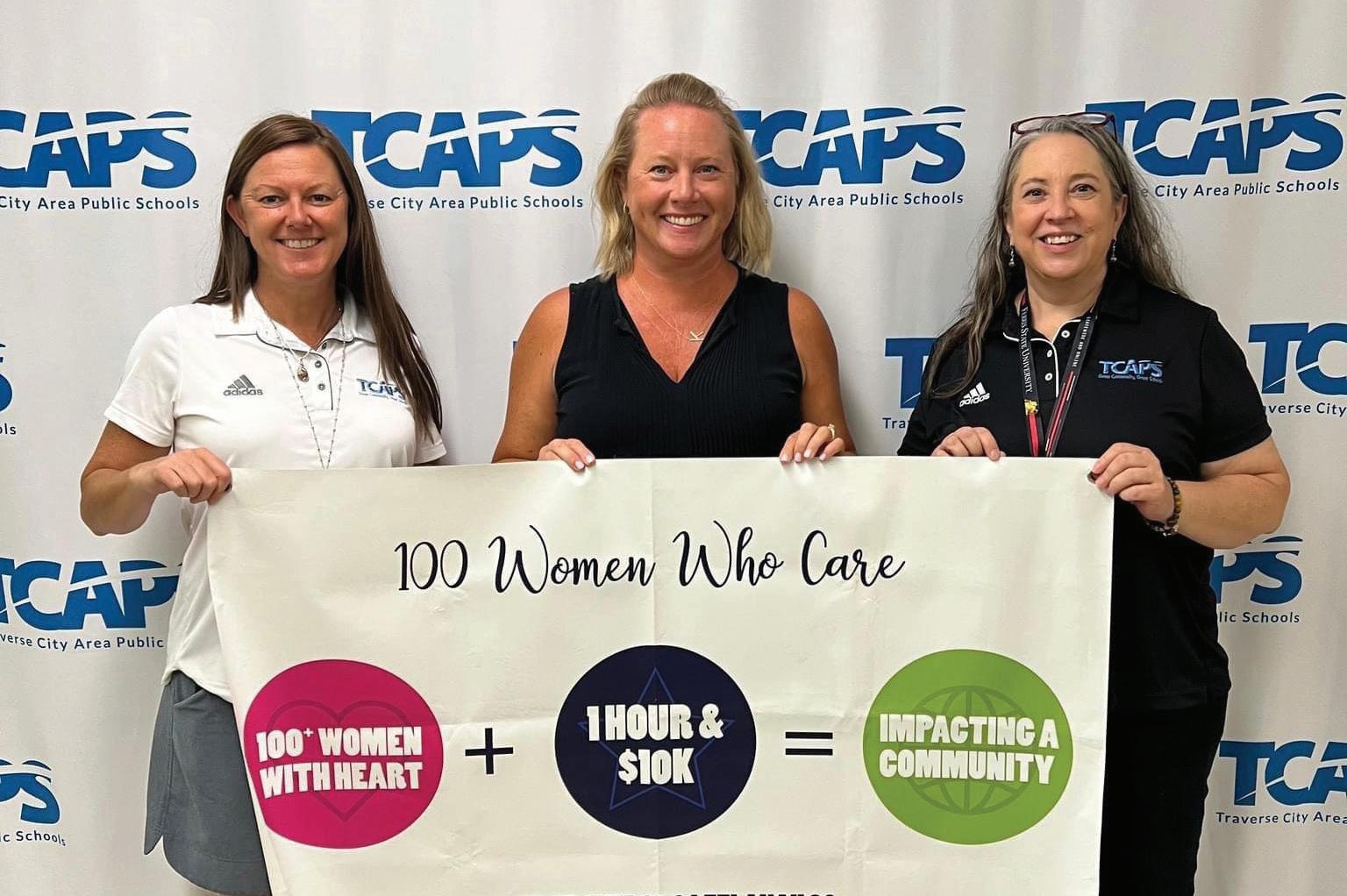

Kristin Marinoff, co-founder, 100 Women Who Care Grand Traverse and Leelanau County

“we look at their business plan, we look at their critical thinking,” said Hagerty, adding that the foundation requires recipients to make a positive social impact, whether in their product, service, or a charitable pledge of their profits.

Capital isn’t the only obstacle when it comes to entrepreneurship, says Hagerty. As a wife, mother and member of the

“We’re in a special, really positive time where women can be all things,” she said. “But with that comes a lot of pressure.”

Access to mentorship connections, which the foundation also provides, and early-stage capital, are critical to long-term entrepreneurial success when balancing those roles.

“You need both of those things from a

technical standpoint to really have a great chance,” she said.

Like Hagerty, more and more of northern Michigan’s female leaders are looking for ways to spread capital. At Impact100 Traverse City, capital is going right back to local nonprofits in the form of grants.

“It’s regular women who have planned and set aside funds,” explained Lindsay Raymond, president of Impact100 Traverse City.

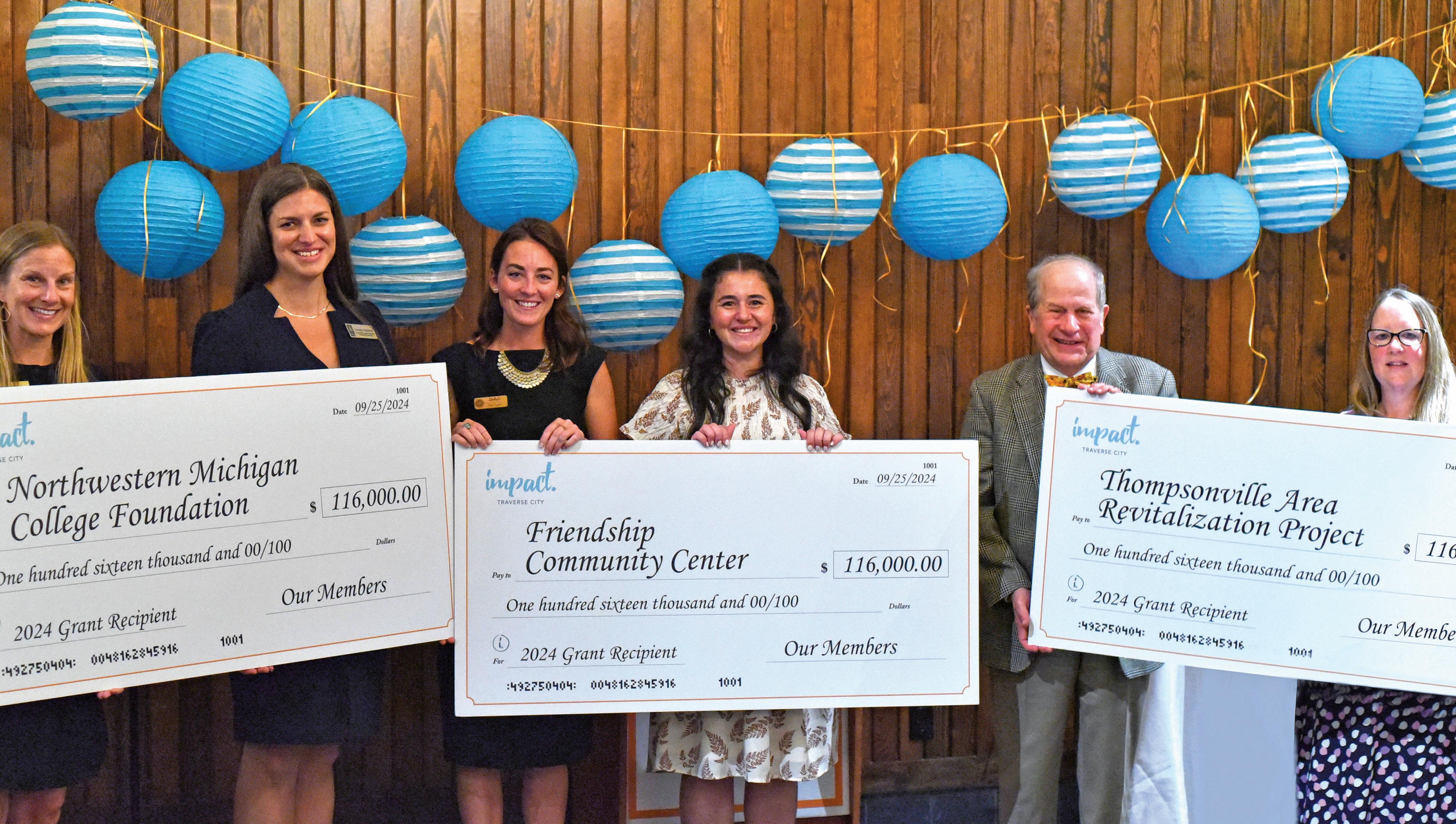

Raymond emphasized “regular” because Impact100’s funding model is anything but. One hundred women pay a $1,000 annual membership fee to the organization. Multiply all of those zeros and the total annual membership revenue comes out to a hefty $100,000 which is pooled and awarded to a local nonprofit or organization. Since launching in 2017, Impact100 Traverse City has awarded more than $2 million.

“We get a lot of applications every year,” said Raymond, who said that grant recipients are chosen by the membership via a vote at their annual meeting,

where finalists present their causes and initiative plans. “We want them to dream big. They need to spend the entire grant amount within a 12- to 18-month window.”

While smaller-scale grants from other sources help fund the day-to-day operations at nonprofits, Raymond says Impact100’s six-figure grants enable organizations to scale their goals.

“People are reaching out to us to really grow and breathe life into a specific initiative or project,” she said.

With a current membership of 348, the woman raised $348,000 in 2024. Looking toward 2025, they’ve set a goal of reaching 400 members by April, with an anonymous donor pledging an additional $100,000 to the funding pool if that target is met. If achieved, it would mean northern Michigan philanthropies could see a combined $500,000 boost later next year.

This year’s grants were split evenly among three recipients: Leelanau’s Friendship Community Center, the Thompsonville Area Revitalization Project, and the Northwestern Michigan College Foundation.

At NMC, the $116,000 grant will support the purchase of a 3D printing arm for the college’s Construction Technol-

“We’re

– Soon Hagerty,

co-founder, Boundless Futures Foundation

the new equipment and resources could attract more students, including female learners who currently represent only 10% of NMC’s construction students.

With the increase in cost of living expenses, Impact100’s $1,000 annual membership isn’t an easy amount of money for most women to part with, admits Ray

Yet, despite the dollar amount and the rural membership area, the group’s numbers have only grown since its debut-year headcount of 255.

“It speaks a lot about the women in our community,” she said.

Meanwhile, when TCAPS’ Student Support Network (SSN) saw a need to

bers of 100 Women Who Care Grand Traverse and Leelanau County pulled out their checkbooks.

The group is another giving collective that pools their funds to support local causes. Members gather quarterly at Traverse City’s Country Club, where they hear pitches from three local charitable

$100 to. With a membership goal of 100, their current membership stands at 115.

The giving strategy is straightforward, explains Kristin Marinoff, who established the chapter with her mother, Renie Cutler, in late 2011.

“The women who are part of the group write their $100 check directly to that winning organization,” said Marinoff. “It’s super efficient. We meet for one hour from start to finish and at the end of one hour $10,000 (or more) is given.”

When she started the chapter, Ma-

rinoff was a mom with young kids who knew she wanted to give back to her community but didn’t know where or how to find the time.

After learning about 100 Women Who Care – which was founded in Jackson by Karen Dunigan in 2006 before expanding nationally – she knew it was the right fit for her schedule and budget.

Marinoff says there are some members of the group she’s never met because their own busy schedules resign them to voting absentee and mailing in their donation.

“It’s just fantastic when people who don’t always feel like they’re making a difference on their own are able to join their contribution with all these other women,” she said. “What might have been $100 is then $10,000 very easily.”

So far, the group’s funding has totaled close to $500,000.

To amplify its impact, 100 Women Who Care – Grand Traverse and Leelanau County recently partnered with the Richard M. Schulze Family Foundation, which matches some quarterly donations up to $5,000, increasing $10,000 dona-

tions by 50% to $15,000.

“I like to say we’re for the little people,” said Marinoff, explaining that her organization’s small scale funding model requires less vetting and opens the grant process up to more grassroots causes that might otherwise not qualify for larger grants.

“That $10,000 has allowed an organization to just get up on their feet or maybe keep their lights on and keep their doors open until other funding comes through,” she said. “So, you know, we’re a much smaller giving organization, but I still think equally as impactful.”

By Art Bukowski

The hiring pinch is real.

From full time to part time and white collar to blue collar, employers of all stripes have struggled since the pandemic to find the right people for various openings. While there are signs that this trend is starting to soften, it’s still very much forcing employers to think outside the box when it comes to attracting and selecting talent as 2025 approaches.

Nonprofits are not immune to this trend, and may be in an even tougher spot due to salary or other constraints. As many of these nonprofits are donor funded, there’s a very heavy focus on making sure they have the right people on their fundraising team. Without money coming in for operations, things can get tough in a hurry.

While it’s natural for employers of all kinds to seek candidates with direct experience, fundraising experts strongly encourage managers to not be blinded by resumes. This is arguably more important than ever, as candidates with experience might be harder to find anyway.

“If you’re filtering or removing people as possibilities because they don’t meet fund development experience qualifications, you’re really missing out,” said

Anthony Rupard, a Traverse City-based consultant who works with local nonprofits and those across the country. “I understand why you’d be more attracted to people who have experience, but if you’re insisting on qualifications based on it, there are some talented people who aren’t getting in the door.”

Rupard spent many years heading local fundraising teams before forming the Solvent Group, which (among other services) helps nonprofits with their fundraising efforts. He started his career as a counselor and educator before one of his bosses noticed his knack for relationship building, leading to his career as a fundraiser.

“People kind of fall into fundraising; it’s not something that most people grew up wanting to do,” he said. “Early in their career or in the middle of their career, someone else encourages them to consider it.”

What that means, Rupard says, is that some of the best fundraisers around came from entirely different careers anyway, making their lack of direct experience irrelevant. Rupard works with clients (his firm conducts searches) to

look for the type of people who have the personality and skill set to build real, genuine relationships. Experience in fundraising is a welcome (but not necessary) bonus.

“Emotional intelligence is really critical,” he said. “We want people that have really strong soft skills that can build relationships through conversation. They have to be really good listeners…develop rapport and consistently stay engaged with folks in the way you’d do with friends and family.”

Rupard recalled observing a friend at

a social gathering and marveling at her interpersonal communication skills. As was the case with Rupard’s boss all those years ago, he suggested that she enter the fundraising field.

“I said ‘You’re full of open-ended questions and you’re constantly getting people talking. You’re not dominating any conversation; you’re reading the room. You’re very observant. You bring energy,’” he said. “These are all of the characteristics that make a good fundraiser.”

But nonprofits, especially small ones,

can still be “seduced by resumes” and be very hesitant to hire people without experience, Rupard said. Aside from potentially missing out on good hires, there are other pitfalls in sticking to experience alone, including a glut of ineffective fundraisers that have built experience without being all that good at their job.

“Those folks can talk the talk. They can tell you how to fundraise. But because you can’t see them in action, there’s a lot of misses on hiring people just based on resumes,” he said. “A lot of nonprofits also don’t have strong major gift fundraising experience in-house, so they don’t know what to look for in interviews.”

Rupard’s team also coaches nonprofits to look for passion. While there are “parallels and overlaps” with sales positions, he says, fundraising is far less transactional and more mission-driven and idealistic.

“It’s critical to be passionate about the non-profit you’re raising money for so you can better tell that story and connect with philanthropists,” he said. “Most people in sales are probably more driven by the idea to make money and have a career, and I think typically you see a little bit more altruistic folks involved in fundraising.”

Ultimately, Rupard says, fundraising comes down to the art of developing meaningful relationships and the science of fundraising itself (knowing the various mechanisms in which donors can convey money, etc.). When it comes to the former, most candidates either have it or they don’t.

that she was the director of development at Northwestern Michigan College and spent time in the development office at the University of Michigan.

She echoes Rupard’s sentiments about what can be taught and what is arguably innate.

“I have seen folks who have been very successful in fundraising who have come from communications, hospitality, even theater. It’s not like there’s only one alternate (career) that translates. It’s all of those positions where you are using skills to connect with people and meet goals simultaneously.”

- Paris Morse, Director of Development, The Leelanau Conservancy

“You can teach the science of fundraising, but the art is harder to teach,” he said. “Those natural instincts and soft skill sets go a long way.”

Paris Morse is the director of development at the Leelanau Conservancy, which works to permanently protect natural land and farmland from development in Leelanau County. Prior to

“Somebody can learn information about the programs (we’re fundraising for) and information about the nonprofit. That and the actual science of fundraising are all things that I can coach and train people on,” she said. “The key thing is that they’re able to make those personal connections and are truly interested in learning and connecting with people.”

Morse recently hired two people for

her fundraising team who rose to the top of the candidate pool despite not having traditional fundraising experience. It’s not the first time that happened, and probably won’t be the last.

“I have seen folks who have been very successful in fundraising who have come from communications, hospitality, even theater,” she said. “It’s not like there’s only one alternate (career) that translates. It’s all of those positions where you are using skills to connect with people and meet goals simultaneously.”

She cited a lot of the same “soft skills” Rupard mentioned as being key to success.

“I think a true interest in learning is key,” she said. “And those strong interpersonal skills like listening are also very important. Because what you’re doing (in fundraising) is connecting the work of the organization to the donor’s interests and truly making that bridge.”

Rupard and Morse also speak of the importance of being self-driven and working independently as they cultivate these relationships.

“One of the things that nonprofits sadly face a lot of times is they hire somebody who really doesn’t have that drive … and they get kind of stuck in the office trying to raise money behind the computer, and you can only go so far doing that,” Rupard said.

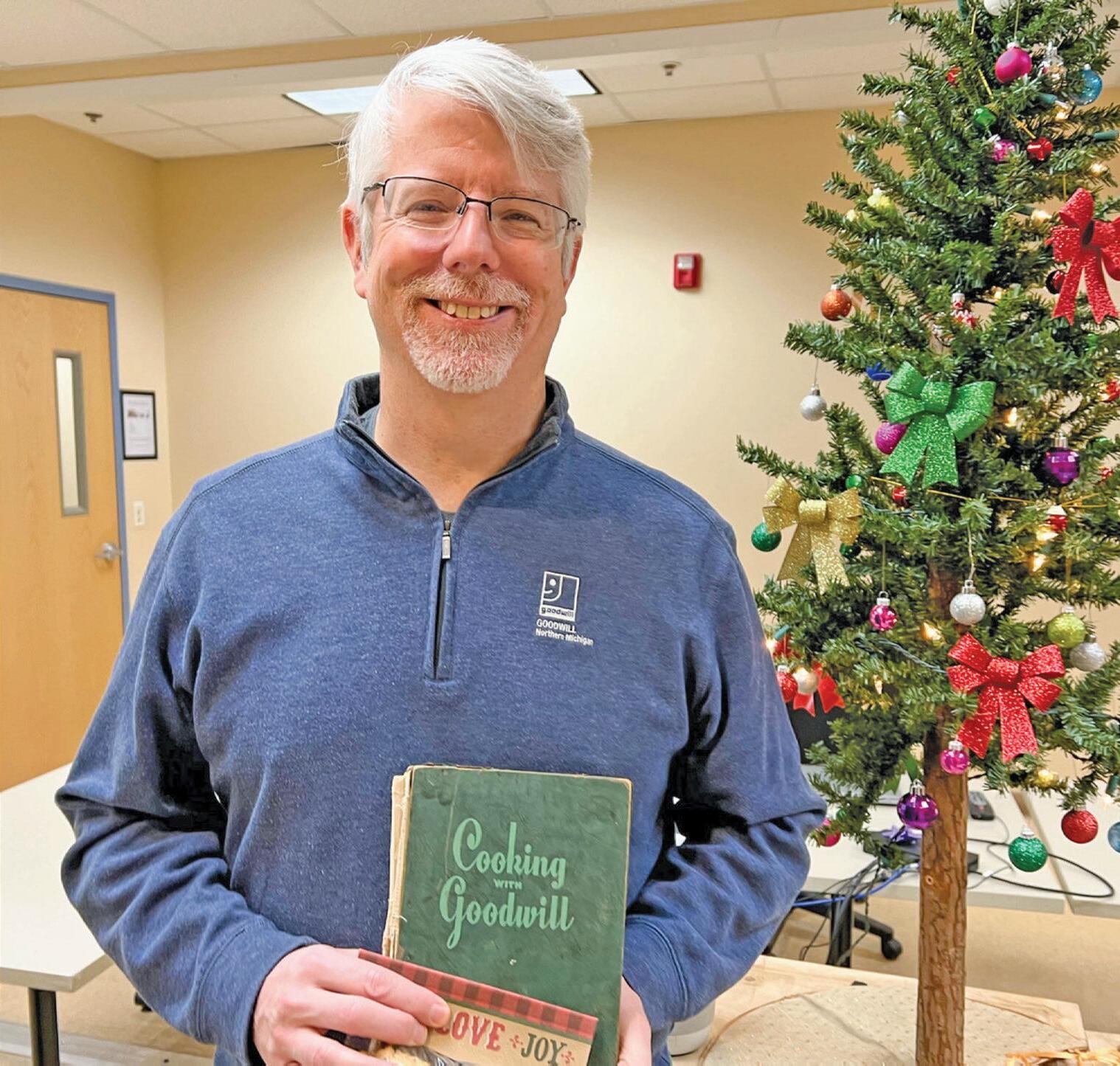

By Craig Manning

If you know Dan Buron, you know he’s a man with big goals.

At the helm of Goodwill Northern Michigan since July 2016, Buron’s aims for the organization are daunting things, like solving local hunger and ending chronic homelessness. Working with organizations like Safe Harbor and the entirety of the Northwest Michigan Coalition to End Homelessness, Goodwill is making significant strides on both counts.

One recent victory: getting the Traverse City City Commission to support a variety of initiatives to address local homelessness, like giving Safe Harbor the green light to pursue becoming a year-round shelter, or committing $40,000 annually for the next two years to support day shelter services at Jubilee House.

Even before Buron was a key player in Traverse City’s conversation about poverty and homelessness, he was a veteran of this type of work. In fact, Buron has been working for Goodwill, in some capacity, for 25 years.

Before moving to Traverse City in 2016, he was the executive director for Goodwill Industries of Southeastern Michigan, based in Adrian. Prior to that, he was the chief workforce development officer for Goodwill Grand Rapids. His resume also includes stints at Goodwill’s national office in Washington, D.C. and at Goodwill Hawaii. And nowadays, he even sits on both the board of directors and the council of executives for Goodwill International. It’s an impressive resume, and none of it would exist had it not been for Buron’s sister.

Goodwill Northern Michigan leader

Buron has big goals and big challenges

“What got me into this field as a whole was the fact that my sister was developmentally disabled,” Buron said. “She was about 11 years old when I was born, so we kind of grew up together. She was at home, and I got to know her and all her friends quite well. And what I came to recognize, as I grew up, is how fortunate she was to be in a very supportive family. My parents did a lot to make sure that she had the best that she could have in terms of developing her full capacity and becoming as independent as she could possibly become. She was never going to be fully independent, but she was able to work, and she could live outside of the home with some supports. I always wondered: What if she grew up in a different environment, or a different family situation where they might not have had as many resources?”

Karen Buron, Dan’s sister, grew up to compete in the Special Olympics, winning two gold medals in cross country skiing at the 1985 World Winter Games in Park City, Utah. Karen passed away in 2001, but Buron says he carries her legacy forward every day in his work with Goodwill.

“Because of her, I’ve always wanted everyone, regardless of the circumstance, to have the opportunity and capacity to fully explore who they are and what they could become,” Buron said. “From a very young age, I was leaning toward working with populations that might be less fortunate or disadvantaged in some ways.”

While Buron’s work with Goodwill has taken him to a variety of different places, he’s found that the unique attributes of northern Michigan have made

this particular Goodwill an especially rewarding one to lead.

“What’s really nice about Traverse City is that the people here really like to work together; they don’t necessarily agree, but they collaborate,” Buron said. “On top of that, we are a little bit geographically isolated, and that makes it a really great place to try new and innovative ways of getting at a problem. Traverse City is a small enough community for it to be possible to do things that are really complicated. But, as the regional hub for northern Michigan, it’s also large enough to have some of the complexities that you have with other larger-population areas. As a result, we have an opportunity here to do things in really innovative ways that can then become a model for other rural communities.”

If Goodwill Northern Michigan does become a recognized innovator, it will likely be in one of two areas: the fight to end homelessness or the fight to end food insecurity.

On the homelessness front, Buron notes that Goodwill Northern Michigan is currently working to get more involved in housing development and housing access. Using funds from the American Rescue Plan Act, the local Goodwill helped developer Woda Cooper close a funding gap for Annika Place II, a 52-unit housing project on Hastings Street that will include 19 Permanent Supportive Housing units set aside for individuals or families transitioning out of homelessness. Goodwill hopes to leverage the visibility and success of that project to tackle similar projects in the future.

As for food insecurity, Buron says

Goodwill leans on its partnerships with other members of the Northwest Food Coalition to tackle things like curbing food waste in the region and distributing “healthy, nutritious food” to the people who need it most. Key to that mission is Food Rescue, a program within Goodwill Northern Michigan that “rescues, harvests, repacks, and distributes 2 million pounds of food annually,” per its website. Even with Food Rescue, though, Buron stresses that Goodwill can’t fight northern Michigan’s food access issues on its own.

“One of the things you’ll hear about any Goodwill organization is that we work very closely with our partners,” Buron explained. “And there’s no way we could do the work that we do if it wasn’t for the Food Coalition. We distribute food to the different pantries, but the pantries make sure it gets to the individuals. If they weren’t doing what they’re doing, we couldn’t do what we’re doing. In a nutshell, that’s really how I see our responsibility: It’s about making sure that we do things that we’re good at, and support people doing things that they’re good at. Because then we’re not trying to compete; we’re just working together to build a bigger pie.”

Sitting on a variety of high-profile boards helps give Buron that big-picture attitude. At the national level, he serves on the Goodwill Board of Directors, which puts him in regular communication and collaboration with the leaders of other local Goodwills.

“One of the advantages (of having that board seat) is that I certainly become more aware of the some of the challenges

that all Goodwills are facing,” Buron said. “Some of the things we’re experiencing (at Goodwill Northern Michigan) are more local issues, but some of the things we experience are larger trends. Talking with leaders from the other 150 Goodwills, I do have a firsthand look at things that might impact our organization in the future.”

One challenge hitting every local Goodwill right now: the shifting tides of donation-based resale. Historically, the operating budgets of all Goodwills have been heavily supported by the revenues from Goodwill retail stores, which in turn depend on the clothes, toys, and other belongings that people decide to donate to the organization.

“Seven percent of our total budget comes from the stores, and about 50% of the budget for our individual programming comes from the donated goods, so it’s quite significant for us and the community,” Buron said. “The challenge is that we don’t know whether we’re going to be able to continue growing our donations of items for our stores, because a lot of things have changed in that market.”

One factor at work is the simple shift away from brick-and-mortar shopping and toward online buying. Another is the rise of Facebook Marketplace and other channels that have made it “much easier than it used to be for people to sell things on their own.” Finally, even if someone is set on donating unneeded possessions,

Buron says there is simply “a lot more competition now for donations than there was before,” both from other nonprofits with resale shops – Traverse City has a few of those, like Women’s Resource Center and Habitat for Humanity – and from for-profit entities.

“We have to be responding to this new landscape and making sure that people can see the value of donating to us when

national Goodwill board means valuable bridges between Goodwill Northern Michigan and other Goodwills across the country, the Traverse Connect board provides a similarly important link between the organization and the local business community.

“I see our role with Traverse Connect as being very much aligned,” Buron said. “They want to create a stronger, more

“We have to be responding to this new landscape and making sure that people can see the value of donating to us when they have a lot more very easy options than they did before. And to do that, I think we have to make sure that Goodwill is still seen as something they want to contribute to.”

–Dan Buron, Executive Director/CEO, Goodwill Northern Michigan

they have a lot more very easy options than they did before,” Buron said. “And to do that, I think we have to make sure that Goodwill is still seen as something they want to contribute to. We need to do more to stay relevant in people’s lives and in the community, so that people want to support us.”

One way that Buron himself tries to stay present and relevant in the community is through his participation on another board: the Traverse Connect Board of Directors. Where Buron’s role on the

vibrant community. We want to create a stronger, more vibrant community. Now, our roles are going to be a little different. Their focus is going to be more around economic development. Ours is going to be on ensuring that all people have an opportunity to be part of that vibrant community. But it’s all a part of that same pie, and I think it’s really important that both of us are engaging with each other, and that the business community is engaging with this nonprofit community. Connecting all those pieces is what’s going to

make this community stronger.”

For his part, Buron is confident that just about everyone who lives in the Grand Traverse region “really does want a community where everyone has an opportunity to be fully engaged with work, housing, and the food that they need.” He’s so confident, in fact, that he’s not worried when the public pushes back against some of the work that his organization and its partners are doing.

Case-in-point? The backlash that occurred earlier this year around the idea of a year-round Safe Harbor. While many acknowledged the need to do something to help the people experiencing homelessness in the community – particularly those at the homeless encampment popularly known as “The Pines” – some questioned the impact a year-round Safe Harbor would have on nearby residential neighborhoods.

“In a lot of ways, I think this attention has been really good,” Buron said when asked about the opposition to expanding Safe Harbor’s operations outside of the winter months. “The idea that now we’re all thinking about what we should do in order to provide better services to people who are experiencing homelessness? That’s a good thing. People have different views of what that might look like, but we’re all at the table and we’re having a conversation, and that has been very meaningful.”

By Renee Sovis, columnist

Many philanthropic families face a common question: How can we get the kids involved?

It’s striking that each preceding generation expects young people to take charge and create positive change, yet often fails to offer guidance on effective engagement in the charitable sector. This disconnect creates a frustrating dynamic, as the older generation wonders why younger individuals appear indifferent, while younger individuals feel excluded from the conversation.

After decades of decline in the rate of giving, the future of philanthropy requires a collaborative approach that acknowledges both the expectations and limitations present in intergenerational relationships.

The next generation — primarily millennials and Gen Z — will soon inherit an unprecedented wealth transfer of nearly $60 trillion in the U.S. However, this wealth is only one aspect of young philanthropists’ potential impact. Younger generations also bring unique perspectives, motivations and resources to charitable giving. Even so, it’s unrealistic to expect them to engage meaningfully without mentorship and support from their elders. Older generations must share their knowledge and embrace new trends in philanthropy that reflect the evolving social consciousness of today’s youth. Trust, after all, is a two-way street.

When considering the next generation, it’s important to recognize that engage-

ment isn’t limited to those with significant financial resources. In philanthropy, we often refer to the “Five Ts”: time, talent, ties, testimony and treasure. While the emphasis often rests on treasure, the other four resources are crucial for fostering engagement. To mobilize the next generation effectively, we must understand their motivations and leverage these resources to create meaningful change.

Motivation for charitable giving among young people can stem from personal experiences, community needs, faith or the values learned in childhood. When working with philanthropic families to bridge the generational gap, we begin by examining assumptions around giving, money and identity.

Key questions arise: When did you first begin volunteering? What behaviors did your parents model regarding generosity? What personal values do you hold? What legacy do you wish to create? These inquiries clarify individual motivations and create a roadmap for a fulfilling philanthropic journey.

Acknowledging areas of contention is equally important. Many young people feel disconnected from their parents’ values or are unsure of their own beliefs about giving. Understanding these barriers is critical to fostering a more inclusive environment for charitable engagement. Common sentiments include, “I don’t feel like I can contribute meaningfully,” or “I don’t have the same priorities as my parents.” Open conversations about these barriers can foster a more inclusive environment for charitable engagement.

The Generosity Commission’s recent report likens charitable giving to exercise: It’s easier to cultivate the habit from an early age than to start later in life. To instill generosity as a family value, several strategies can be effective:

• Discuss your current giving practices with your family.

• Share your future plans and hopes for impact.

• Model the behaviors you wish to see, such as volunteering, mentoring, or serving on boards.

• Let your children observe these actions, as this can lay the foundation for a lifetime of engaged giving.

As children grow, so should their autonomy in philanthropy. The world is rapidly evolving and the next generation may prioritize different causes or methods of engagement. Giving Tuesday is an example of this shift. Now the single highest day of charitable giving by individual donors, it’s almost entirely driven by social media. Encouraging young people to engage in their way is more important than ensuring they mirror previous generations. Provide them with support, encouragement and guidance, but allow them the freedom to give confidently.

As young people mature, the importance of individual and family legacy becomes clearer, allowing them to step into philanthropic spaces — such as youth advisory councils, internships and grantmaking organizations — ready, prepared and with enthusiasm. If philanthropy is a family endeavor, particularly when managing substantial resources like a family foundation, bridging generational gaps becomes essential. Families with significant wealth carry a heightened responsibility to give effectively.

Engaging younger generations in philanthropy requires effort from both older and younger family members. By encouraging open communication, sharing knowledge and embracing new perspectives, we can cultivate a culture of philanthropy that’s inclusive, innovative and impactful.

The responsibility of building a better future doesn’t rest solely on the shoulders of the next generation; it’s a shared journey that calls for collaboration, understanding and a commitment to nurturing generosity. Together, we can bridge generational divides and empower the next generation to drive meaningful change in the world.

Renee Sovis is vice president of Detroit- and Traverse City-based Neithercut Philanthropy Advisors and a certified consultant working with multi-generational family foundations.

By David Mengebier, columnist

Giving is integral to a thriving community. By giving your time, talent, connections, voice or monetary contributions to a cause, you become part of a larger movement, striving alongside others to make a difference for the people and places you care about. Through giving, we can make the impossible feel possible because there is power and hope in working together toward positive change.

At the Community Foundation, giving is central to everything we do. We believe in the power of generosity to do great things. As your local giving partner, we’re committed to being a good steward of the assets in our care to support making life better for everyone in our region. Partnerships are key to putting our giving philosophy into action, because without them, we simply wouldn’t exist, nor would we see positive outcomes happen in our broader community.

Partnering with local people and organizations allows us to make thoughtful strides toward our ultimate goal: creating a region of healthy, resilient, thriving communities for all.

The solutions to community problems can often be found directly in our local communities. This is why it’s critical to connect with local people to not only understand their needs but also to engage them in supporting local solutions.

As your Community Foundation, we are firmly rooted in supporting this region of Antrim, Benzie, Grand Traverse, Kalkaska and Leelanau counties and the Grand Traverse Band of Ottawa and Chippewa Indians. We work with individual donors who come to us with giving capacities of all sizes to fund local needs, from new housing developments and addiction treatment services to preserving natural areas and supporting youth programs. We partner with donors who give $10 monthly to donors who leave an estate gift – both making a meaningful difference supporting the needs of our region.

A recent example of our donor partnerships in action is the story of our new endowment for diversity, equity and

Community Foundation partners with people, organizations to uplift community

inclusion. Established this year, the endowment will continue our work funding local organizations supporting marginalized populations, including individuals and families experiencing homelessness and poverty, and organizations led by community members of color, including Black and Indigenous people, as well as LGBTQ+, immigrant, neurodiverse, veteran, and disability community members. It was our dream to create an endowment so that equity and inclusion work across the region could receive ongoing, sustainable support in perpetuity. One of our donor partners approached us to explore an opportunity to make a bigger impact together.

This donor partner contributed a generous gift to establish the endowment for diversity, equity and inclusion, and he wanted to ensure that his gift worked alongside others’ giving. So, we got to work. We built out a campaign to engage our community of givers.

The results of the campaign blew us away: We raised nearly $170,000, with gifts ranging from $10 to $5,000. We also welcomed five new monthly donors and 22 donor partners who gave to us for the first time. While the positive results of this giving partnership are clear, what is perhaps even more meaningful to us is how partnering with a single individual turned into a collective partnership of 85 community members. That’s the power of giving together.

Donor partners come to us in many ways – by reaching out to us directly or by indirectly finding us through referrals from other supporters or local advisors. Referrals are an under-recognized form of giving. They allow you to tap into your connections to create a pathway to additional giving opportunities. By working with local advisors, including estate attorneys, financial planners, accountants and others, we help link a client’s giving

interests with ways they can make a difference locally.

This year, referrals resulted in the creation of our animal welfare endowment, jointly established by two donors. What’s interesting here is that these two donor partners did not know each other before establishing this endowment; rather, it was their shared giving interests that brought them together. Each donor came to us through referrals from their respective advisors.

After meeting with them and building a relationship over time to better understand their giving interests and how to align those with local needs, our team worked with them to launch the animal welfare endowment. The endowment is aimed at reducing animal suffering and building community awareness by supporting smaller, grassroots animal welfare organizations, which have been underfunded in our region.

This is a perfect example of how referrals can open the door to new connections and positive change.

In addition to partnering with individuals and their advisors, we often collaborate with community organizations. One way we do this is through the Northwest Michigan Community Development Coalition. As convener and member of the coalition, we work alongside more than 40 business, governmental and nonprofit partners to share information, align and leverage resources, and coordinate advocacy actions to drive economic, societal and environmental improvements for our rural communities. This collaborative spirit has led to several efforts in support of advancing shared goals.

This spring, for example, 10 coalition members representing our region’s nonprofit, public and private sectors headed to Lansing for our inaugural lobby day.

Together, we met with a variety of leaders in state government, advocating for funding for the Office of Rural Prosperity, recommending funding and policy reforms to make it easier for communities to build affordable housing, requesting full funding for grants through the Michigan Arts and Culture Council, and raising awareness about the challenges our region’s farmers are facing.

We also recently convened – alongside Rotary Charities of Traverse City –community partners working to identify supports and solutions for the chronically homeless in our community. This resulted in safety and sanitation facilities for individuals sheltering in the Pines, strategic discussions about transitioning Safe Harbor to a year-round emergency shelter, and a future task force that would continue developing long-term solutions to support our neighbors experiencing homelessness.

In addition, earlier this year, our region was selected as a local Press Forward chapter, which will create new opportunities and funding resources to support collaboration to strengthen our local news sector, which is critical to a vibrant, thriving community.

Taken together, each of these efforts – from working with individual donors and advisors to community organizations – showcase what is necessary for positive community change to happen. Partnerships of all shapes and sizes are integral to strengthening our region, now and forever.

David Mengebier is the president and CEO of the Grand Traverse Regional Community Foundation. He formerly served for 17 years as senior vice president of governmental, regulatory and public affairs for Consumers Energy, and president of the Consumers Energy Foundation. He serves on the boards of Munson Healthcare, the Council of Michigan Foundations, and Northwest Michigan’s regional economic development organization, Traverse Connect.

Holly Hack EXIT Realty Paramount, Traverse City

Kevin Endres Three West Commercial, Traverse City

Jonathan Oltersdorf Oltersdorf Realty, Suttons Bay

Ann Porter Real Estate One, Traverse City

City

By Art Bukowski

It’s December, and that means it’s time for the TCBN’s annual real estate outlook. We connected with agents and brokers throughout the region to see what’s on their mind as the calendar turns to 2025.

What trends or developments (in sale prices, volume, demand, etc.) do you expect to see in local real estate in 2025?

Oltersdorf: Affordability challenges and rising living costs in 2024 should have slowed the real estate market, but we just didn’t see that in any significant way. Inventory remains historically low, with Leelanau County still at 1/3 of pre-Covid levels. Year-to-date our median price has increased by 5-6% and the average price has increased 6-8%. Looking ahead to 2025, volume may dip slightly, but I’d expect prices to grow modestly at a lower rate, aligning with inflation. Nationwide, the average homebuyer age has risen by seven years, a trend I also see locally. Homes with main-floor primary bedrooms are in high demand, driven by an aging buyer demographic. Notably, 47% of this year’s sales in Leelanau were cash purchases, compared to 35% in GT County. Our market has remained resilient, and

I expect more of the same in 2025 with moderate price growth and strong cash purchases offering continued stability.

Hack: Interest rates and demand will continue to play a pivotal role in shaping the housing market in 2025, both nationally and locally. Nationally, existing home sales are projected to rise by over 9% yearover-year, with new home sales expected to jump by 11%. Locally, I anticipate a similar trend as home prices continue to soften, particularly in more affordable price ranges. This shift will likely create increased opportunities for first-time homebuyers, who have faced significant challenges over the past few years, especially those relying on government loans. Interest rates are expected to stabilize, likely settling in the low 6% range, which should further support affordability and demand. In Traverse City, we’re seeing a noticeable cooling in the Airbnb market, especially downtown, where saturation levels appear to have been reached. This

cooling may redirect investment attention back toward long-term housing options, further impacting local demand positively.

Endres: According to the trajectory we have seen through the third quarter of 2024 vs. the third quarter of 2023, the commercial market is trending upward across the board as it relates to total square footage sold (up 144%), total volume sold (up 95%) and average transaction sales price (up 35%). We expect to see continued activity and interest in the commercial market in the Grand Traverse region in 2025. We are seeing a strong demand in our market from national businesses looking to locate in our region, which includes anywhere from small retailers, quick service restaurants or suppliers and regional distribution companies like Amazon. While we only handle commercial real estate and development land, we do see a continued strength and demand for land for future multi-family developments.

Shimek: Sale prices have started to

level off the last six months of 2024. Homes are sitting for longer and that is okay, as inventory levels have come up significantly from last year. I expect inventory levels to continue to creep up a bit in 2025, making it an even more balanced market for buyers and sellers. The market we were in the last four years was not sustainable, and we are in a much more “healthy” market currently. I expect prices to stay pretty flat in 2025, but we do always see an uptick in prices in the spring and a more competitive buying market as a lot of buyers come out of hibernation after the winter, ready to look for a home again. This creates a higher demand, therefore you see more multiple offer situations in the spring typically. This is what happened in 2024 after the market hit a wall in October of 2023 then it came back like gangbusters around March of this year.

Zickert: Demand has declined across all segments relative to 2023, but in historical

terms, demand still exceeds supply across all price ranges. The condo market seems to be the most active segment in the last few months, but in most areas, although multiple offers are not as plentiful, they are still happening. Sellers do need to be aware that because demand has slowed, many homes will be overpriced for the current market. Next year, we expect the number of homes for sale to rise 5-10%, the number of home sales to also rise 3-5% and home values follow the same 3-5%.

Porter: We are so fortunate to live in such a beautiful area full of natural resources, community amenities and local pride, and I expect our amazing region to continue to be a popular landing place for both out-of-towners as well as current residents upsizing or downsizing. Based on this, 2025 should offer a steady real estate market, with water-

front always being the most sought-after property type. With interest rates expected to remain level and sellers wanting to capitalize on their equity, inventory and pricing will increase to a healthy balance. We are seeing a lot of climate migration, where purchasers are leaving an area of more drastic climate swings and effects than typical, which will continue to increase demand. This will continue on the trend of a seller’s market, but at a much healthier definition than what we saw during Covid.