Foreign Wave

As labor shortage deepens, seasonal businesses call foreign workers “critical” to their success

As labor shortage deepens, seasonal businesses call foreign workers “critical” to their success

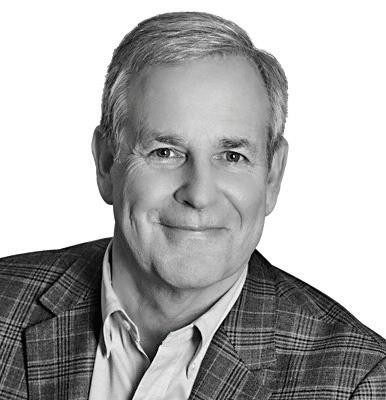

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University.

Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.**

investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial, TD Ameritrade, and Charles Schwab.

Red Spire Brunch House owners Chad Hall and Joshua Anderson have purchased the former Green House Cafe building at 115 East Front St. The partners both worked at Green House Cafe before leaving in 2016 to open Red Spire at The Village at Grand Traverse Commons. Hall says the duo had been looking for a building to purchase – not necessarily to open a restaurant, but as an investment in downtown Traverse City –when the Front Street building came on the market. Hall and Anderson are making renovations, modernizing the space, and working to obtain a liquor license with the goal of opening a new restaurant this fall. Red Spire will remain open as a separate business in Building 50.

Commongrounds Cooperative , the community-owned building on Traverse City’s Eighth Street, recently caught the attention of the The New York Times . The article, “Priced Out of Housing, Communities Take Development Into Their Own Hands,” highlighted the co-op as part of a growing trend of innovative community-funded development. The 47,000 square-foot, mixeduse community center features a mix of commercial and residential floors, including 18 long-term, income-based apartments. Rents are subsidized by five short-term units, utilized by visiting guests, including musicians and artists traveling to The Alluvion, the cooperative’s performing & visual arts venue.

Munson Healthcare was recently among five hospitals nationwide presented with the American Hospital Association (AHA) Dick Davidson NOVA Award for hospital-led collaborative efforts to improve community health. Munson Healthcare was recognized for the Street Medicine program done in collaboration with Traverse Health Clinic and Goodwill Northern Michigan. The partnership launched in 2020 and has provided care to more than 1,000 people experiencing homelessness in the Traverse City area. Munson Healthcare also recently announced a commitment to donate $300,000 to Traverse Health Clinic over the next two years to support expansion of the program.

ATHENA LEADERSHIP RECIPIENT ANNOUNCED

Judy Harrison, founder of Community Impact Partners, president and founder of High Impact Productions, and co-owner of Flat Cap Ventures in Traverse City, is the recipient of the 2024 Athena Leadership Award for the Grand Traverse area. The annual award honors an individual whose work exemplifies collaborative leadership and community impact. Through Harrison’s 15-season fundraiser, Swingshift and the Stars, more than $4.3 million was raised for 122 nonprofits.

INSURANCE AGENCY RECEIVES “SAPPHIRE”

Fischer Insurance has been named a Sapphire Agency by Auto Owners Insurance Group. The award is given to the top 3 out of 160 agencies in the Traverse City region. Fischer Insurance, established in 1969 with offices in Elk Rapids and Bellaire, provides personal, commercial and life insurance across Michigan.

STARTUP FOCUSES ON ‘LOCAL’

We Heart Local is now operating in Traverse City. Founded by Brett and Katharine Sigworth, the startup is focused on

www.goldencircleadvisors.com info@goldencircleadvisors.com

TRAVERSE CITY Curtis D. Kuttnauer (231) 922-9380

PLYMOUTH Fred Manuel (734) 320-6667

community engagement and connection as a way to support local business owners in the Grand Traverse area. Joining is free and members enjoy discounts, activities, exclusive deals and more at area restaurants, wineries, breweries and other businesses. More at weheartlocal.co.

Artful Interiors is now open at 714 Randolph St., Suite 101, in Traverse City. The boutique features furnishings and décor pieces in addition to comprehensive interior design services. The business is owned by Laura Millar. Learn more at artfulinteriors.com.

City is under new ownership. Amy and Lee Goldberg recently sold the restaurant to business partners Matthew and Cheryl Caplan, and Bruce Kaye. The Goldbergs opened the Traverse City store in Septem ber 2022. The Traverse City location is one of 230 stores nationwide and one of seven in Michigan.

Northwest Michigan annual Parade of Homes June 13-16. Builders from the area will unveil nine homes, showcasing the latest trends in home design, technology, outdoor living spaces, and landscaping. More info and tickets available at hbagta.com. Tickets can also be purchased at any of the homes on the tour.

western Michigan new website – Bigsupnorth.org – for its youth mentoring program. The new site serves as a hub for information about how to get involved as a mentor, men tee, or supporter, and learn more about the organization.

Action Water Sports, a boat dealership with locations throughout Michigan including Traverse City, has opened a satellite location at Sommerset Pointe Yacht Club on Lake Charlevoix. The dealer carries MasterCraft, Cobalt, Crest and Barletta brands. Find the new location at 00970 Marina Dr. in Boyne City.

River Club Glen Arbor (RCGA), located on the Crystal River, will host a grand opening this month. RCGA will offer Mexican-inspired eats, signature drinks, riverfront and deck seating, a concert stage, an 18-hole mini-golf course, and a gift shop. Founders are Mike and Gina Sheldon, joined by

Welcome to June and the kickoff of the Pure Michigan Summer Season.

The return of summer always reminds me of my hometown of Beulah. I grew up on a family cherry farm on the bluff between Crystal Lake and Platte Lake.

Summers brought a lot of work on the farm, the neighbor’s U-pick operation, and the Cherry Hut, as well as sunsets at Point Betsie and unbeatable days on the boat.

The influx of visitors and summer residents from around the world not only meant much-needed economic activity but also the return of music performances, art exhibitions and other cultural events at venues like the Christian Summer Assembly, Crystal Downs, Interlochen Center for the Arts and the Michigan Legacy Art Park. It was clear from a young age that we were lucky from both a natural and cultural resource perspective.

As the summer tourism season dawns upon us, northern Michigan stands at the threshold of new opportunities for economic diversification and growth based on our fortunate combination of outdoor beauty, cultural amenities and enterprising businesses. Recent developments, including the Agritourism Summit presented by MSU Extension, the Outdoor Recreation Economic Impact Study from Networks Northwest, and the Northwest Michigan Arts and Culture Summit, point toward a transformative phase in the region’s tourism and larger economy.

Agritourism, a fusion of agriculture and tourism, encompasses farming, entertainment and leisure experiences that contribute to a healthy lifestyle, strong family

values and a rich quality of life. Agritourism also focuses on finding the best route to encourage rural entrepreneurship and regional economic development while preserving the landscape and character of an area.

Tourism and agriculture each contribute significant revenue and jobs to

activities like boating, golfing, biking and skiing. The COVID-19 pandemic made clear that our abundance of outdoor adventure activity is a key driver of both quality of life for our existing residents and a draw for talented people from elsewhere. Our population growth is a rare bright spot for a state experiencing overall

By leveraging the synergies between agritourism, outdoor recreation, and arts and culture, the region can chart a path toward sustainable development and prosperity.

Michigan’s economy. Still, farmers often struggle financially and encounter resistance from neighbors and elected officials when they attempt to add farm markets, food and drink operations, or other onfarm revenue streams to their operations. Success lies in finding the right balance between helping our farmers and economies thrive while preserving our rural and agricultural character. The recent Agritourism Summit, held in Traverse City, focused on the potential for farm families to combine agriculture and tourism while also educating the larger public on the need to support farmers as they diversify into agritourism to sustain their farms –and our region’s farming heritage.

Similarly, northern Michigan’s outdoor economy presents a wealth of diversification opportunities beyond traditional

population decline. Meanwhile, the surge in consumer spending since the pandemic on recreational vehicles, sports equipment, and watercraft underscores the growing demand for unique outdoor experiences.

Networks Northwest’s recent Outdoor Recreation study points to these attributes as building blocks for economic growth. Our region’s abundance of forestry, fishing and hunting employment – combined with higher-than-average concentrations in manufacturing and arts, entertainment, and recreation jobs – is a very strong foundation for entrepreneurial ventures catering to outdoor enthusiasts. Initiatives such as the Fresh Coast Maritime Challenge and the rise of electric-powered boats and off-road vehicles are just a few examples of what the Outdoor Recreation Technology sector could mean for our region.

EDITORIAL

ON THE WEB

tcbusinessnews.com

PUBLISHER

Luke W. Haase

lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu

gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

COPY EDITOR

Becky Kalajian

As we think about our traditional economic drivers of agriculture and tourism, it is also important to pay attention to the economic significance of a thriving arts and cultural sector. Economies with thriving creative industries do not just perform well; they outshine their peers economically. Arts and creative industries not only contribute creative goods and services but also nurture a skilled and innovative workforce, boost consumer spending, and create an environment conducive to economic and population growth.

Arts and culture serve as a cornerstone of northern Michigan’s economic vitality, contributing more than $15 billion to the state’s economy. From independent artists to renowned institutions like Interlochen Center for the Arts, the region boasts a vibrant cultural landscape that attracts residents and visitors alike. Championing our arts sector through investment, patronage and promotion serves to both enhance our quality of life but also drive economic growth by nurturing creativity and innovation.

As northern Michigan embraces these new opportunities, the tourism economy stands poised for unprecedented growth and resilience. By leveraging the synergies between agritourism, outdoor recreation, and arts and culture, the region can chart a path toward sustainable development and prosperity. As we enjoy another perfect northern Michigan summer, the possibilities for economic diversification and community enrichment are boundless.

Warren Call is the president and CEO of Traverse Connect.

CREATIVE DIRECTOR

Kyra Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Art Bukowski

Kierstin Gunsberg

Rick Haglund

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Gerald Morris

SERVING:

Grand Traverse, Kalkaska, Leelanau and Benzie counties

AD SALES

Caroline Bloemer

cbloemer@tcbusinessnews.com

Lisa Gillespie

lisa@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris

tnorris@tcbusinessnews.com

Michele Young myoung@tcbusinessnews.com

4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions. Content ©2024 Eyes Only Media, LLC. All rights reserved.

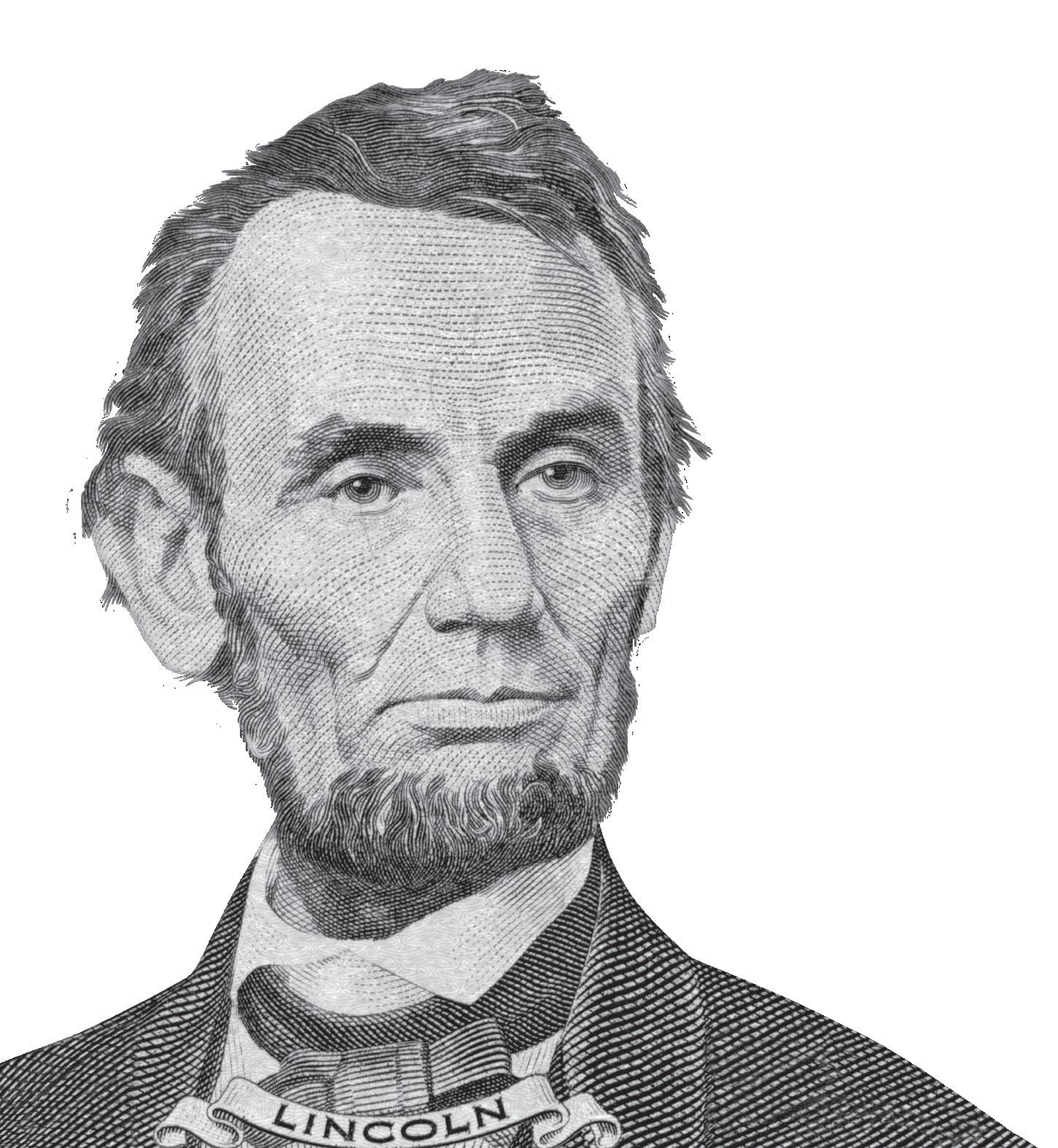

Norm Plumstead heads up Honor Bank, a community-based operation with eight branches, 75 employees and about $390 million in assets. He was kind enough to show us around his space in Traverse City, where the bank recently built a building along the Boardman River. Have an idea for a future “From the Desk Of” feature? Email Art Bukowski at abukowski@tcbusinessnews.com.

1. One of my favorite books is ‘Endurance,’ the story of Antarctic explorer Ernest Shackelton. (The above text) is purportedly the ad that he ran when he was recruiting people for his voyage. I like it because it speaks to the people we are trying to find here, people who believe in what we’re trying to accomplish as a community bank.

2. Here’s some running swag. I kind of graduated from the marathon distance (26.2 miles) as I got older and slower, and I also wanted a bit more of a challenge, so I began running 50 mile races and then ultimately a few 100 mile races. I attempted three and completed two. I think it’s reflective of my personality. Steady and persistent, maybe a little bit stubborn.

3. Isle Royale map (on wall): That’s a map of Isle Royale. I’ve gone there a number of times, and it’s

probably my favorite place to be. I’ve backpacked and paddled all over there.

4. When I need a little bit of a break, it’s great to mess around with the Rubik’s cube. It gives my mind something else to concentrate on.

5. Seat not in use, under desk: I stuff my chair under there because I sit as little as I can. It’s a health thing, and we’ve also invested in these great standing desks.

6. I’ve always liked elephants. I can’t really explain it. I think it’s their purported long memory span or the family structure. These have all been gifts from people along the way. My wife brought me one from Malawi.

7. These are our five core values: ‘Pull up a chair, we’ve got your back, be a neighbor, let’s be real and find the opportunities.’

A federal program that allows local businesses to use foreign workers is arguably more important than ever as businesses of all stripes desperately struggle to find staff.

There are more than 40 types of visas that foreign workers can secure to work in the United States. These visas cover a wide variety of job types and intent –some cover workers who seek permanent citizenship, others those who plan to return home after working – and they help fill tens of thousands of employment gaps across the country.

Several are used in our region in a variety of applications. Many who toil in local farm fields participate in the H-2A program, for instance, which is specifically for temporary agricultural workers.

And while H-2A has been of considerable importance to local farmers, you’d be hard pressed to find a program more impactful to the local economy than H-2B. This program is focused on sea-

sonal, non-agricultural work and is used heavily by the local hospitality industry to plug holes in housekeeping, food service and much more.

Hundreds of these workers from dozens of countries (more than 80 countries are eligible, according to federal guidelines)

workers are to their operations.

“Over the last 10 years, this has become mission critical. For many positions, if we didn’t have (H-2B workers), we would be limited in what we could offer in terms of our business,” said Tim Norman, general manager of the Grand Traverse Resort.

“There’s this perception that we’re taking away American jobs. We work really, really hard to dispel that perception, because it’s absolutely not the case, but unfortunately it’s something that’s out there.”

- Jennifer King, senior vice president of human resources, Crystal Mountain

are employed in the region during the peak season. And while they work at a variety of businesses, the majority are at local hotels and resorts. Leaders there can’t say enough about how vital these

“We’d be offering less, be it in rooms or food and beverage or other services because we simply wouldn’t have the personnel.”

And while it provides a huge boost to local businesses, the program is expensive,

time-consuming, and wrought with uncertainty, particularly because businesses sometimes wait until the last minute before finding out how many workers they’ll receive – or if they’ll get any at all.

“It’s extremely stressful,” said Jennifer King, senior vice president of human resources at Crystal Mountain. “It makes it very, very difficult to plan from one season to the next, not knowing if you are going to have your staff.”

The Grand Traverse Resort aims to fill about 100 H-2B slots per year, with a lesser amount of J-1s mixed in. The latter is for workers in programs that promote cultural exchange, with many J-1 workers being students.

That’s a big chunk of the 600-plus workers the resort needs during the peak season. But it’s necessary, Norman says, because finding local workers to fill those positions has proven to be quite literally impossible.

“We would much prefer to have fulltime, year-round, local people working in these positions, but we just can’t find the numbers we used to have,” he said. It’s the same story wherever you go, particularly in the hospitality industry. And it’s getting worse, with hundreds of additional hotel rooms coming online over the next year or so.

“There’s just not enough local people to do all of the work, and not just in hospitality, but all of the work in this area in general. It’s just a fact,” Crystal Mountain’s King says. “We will hire every single domestic applicant that we get, and we still will not fill the need. And that’s what this program was made for, to help employers fill the need.”

King uses both H-2Bs and J-1s, with perhaps 20 of the former and 40 of the latter. Over at the Delamar in Traverse City, they also make use of both, but general manager Jordan Berkowitz much prefers the H-2Bs, which he calls a “godsend.” That’s in large part because the H-2B workers usually stay twice as long as J-1s, and he says the H-2Bs have outstanding work ethic.

“The J-1 program is great and all, just the only problem is the stay-dates, because they’re all students. So we only get them from June 15th to, let’s say, September 1st,” he said. “May, June, and

especially September are still extremely busy still up here.”

Berkowitz says H-2B workers are “the most grateful, hardworking people you’ve ever seen in your life,” and said he’d have to close portions of his hotel – or otherwise reduce service – without them.

“You just wouldn’t be able to operate in northern Michigan without H-2Bs. There just isn’t a talent pool up here big enough,” he said. “There’s no big metropolitan area, and on top of that there’s just too many hotels, too many restaurants, too many of everything, to the point

where we’re fighting for a talent pool that’s already only probably 60 percent of what we need.”

It’s not just for hotels and resorts.

Restaurants use these workers, as do certain small businesses that can show a seasonal need. At Anderson’s Glen Arbor Market, owner Brad Anderson had two H-2B workers last year and hopes for five this year.

For Anderson, the program delivers quality and consistency of labor on a regular basis, something that he’s struggled to find with the local talent pool alone.

This is especially true for a business that’s open seven days a week with extended hours.

“A lot of times when you hire locally, there’s a lot of conflicts with camps and family reunions and all the different things that people want to do in the summer,” he said. “By investing in foreign labor, we have the employee willing to work five or six days a week, every single week… You’d rather hire local, but you just cannot get local labor that’s willing to work efficiently and consistently in the high season.”

Employers of H-2B workers are used to fighting misconceptions and misinformation about the program, much of it steeped in the often-inflamed rhetoric tied to immigration and anything that might impact American jobs.

“Often this subject gets lumped in with immigration, and it really shouldn’t, because it really has nothing to do with immigration,” King says. “This is 100% about employers and employment.”

King points out that unlike other types of visas, the H-2B program is specifically a nonimmigrant program that sets time limits on how long workers can be in America.

“They’re here to do a job and support their families. They’re not looking for an opportunity to stay in America forever. They’re not looking for a path to citizenship,” King says. “They’re looking to come here, work their season, support their family, and then go back home to their family.”

That said, workers can and do return year after year after time back in their home country, giving employers some valuable institutional knowledge.

“We’re very blessed in that we’ve been doing this for so long that over 50 percent of our H-2B workers, particularly for the summer, have five plus years of service with us, and some have as many as 15,”

said the Grand Traverse Resort’s Norman. “We specifically ask for them and they specifically ask for us.”

Among the biggest misconceptions with the H-2B and other visa programs are that these workers are providing cheap labor or taking American jobs. Everyone involved strongly dismisses both suggestions.

“No one’s saving money by doing H-2B workers. It’s a very, very expensive endeavor,” said Trevor Tkach of Traverse City Tourism, which represents the local hospitality industry. “So when people talk about taking jobs or it being a cheaper alternative, that’s just not the case.”

Employers have to cover housing costs for H-2B workers, along with transportation to and from their home country. That’s in addition to application and other fees paid to the government and considerable in-house and contracted costs (most large employers use an attorney) to navigate the program.

“At the end of the day, it’s thousands of dollars per employee that you’re investing to get them here, and that’s in addition to what you have to then pay them (to work),” Norman said. “We love our foreign workers, a lot of them are like family, but I would love to get rid of the thousands of dollars I’m spending to get them here and have them work here.”

King says it’s “infuriating” to hear

people assume that employers are saving money by using foreign workers when the cost data shows an entirely different story.

“By no means whatsoever is this an opportunity for cheap labor,” she said.

As far as taking American jobs, King goes back to the point made by her and others – there aren’t enough willing American workers to fill those jobs in the first place.

“There’s this perception that we’re

taking away American jobs. We work really, really hard to dispel that perception, because it’s absolutely not the case, but unfortunately it’s something that’s out there,” she says.

Employers of H-2B workers first have to post the jobs and prove they can’t fill them locally, said Jim Aldrich, a downstate attorney who specializes in the program. The government reviews those postings to make sure the offered wage is fair. Employers are even required to

At its heart, a business is about people. A group of people coming together to create something bigger than themselves. To create a solution or a product or an experience in the service of other people. At Huntington, it’s our belief that running a business is about more than making money, it’s about making people’s lives better. So let’s roll up our sleeves and get to work, together.

“You wouldn’t be able to operate in northern Michigan without H-2Bs. There just isn’t a talent pool up here big enough. There’s no big metropolitan area, and on top of that there’s just too many hotels, too many restaurants, too many of everything, to the point where we’re fighting for a talent pool that’s already only probably 60 percent of what we need.”

- Jordan Berkowitz, general manager, Delamar Traverse Citycontact past domestic employees to see if they can come back to work. All of this is designed to make sure that employers truly can’t find domestic workers for these positions, Aldrich says.

“Basically, the process is intended to protect U.S. workers,” he said. “That’s the whole reason for all of the hoops that these employers have to jump through.”

Those in the industry say that rather than harming the American worker, a regular influx of foreign support can help domestic employees by ensuring the health of their employers.

“Something that has been recognized nationally is that there are many people who work in the hospitality and tourism industry year-round, and if we don’t secure additional workers in some of these markets, those full-time jobs go away, too,” Tkach said. “Because this could be the difference between a business staying open and having to shut their doors. It’s that real.”

The bottom line? Bringing in workers from anywhere is important for an area that needs them, local leaders say.

“(The H-2B program) helps with our overall compression in the workforce by making people available to work other places and for other businesses to be able to find somebody locally,” said Whitney Waara, COO of Traverse City Tourism. “It gives us a little bit less pressure on the system. We need that support here in the overall economy or we’re just going to get crushed.”

The federal government caps the number of workers allowed under the H-2B program to 66,000, split evenly between those who start around April and those who start in November. The cap has remained unchanged for decades, despite pressure from industry groups to raise it.

“The numbers allowed through the cap are just not sufficient, and they have not been sufficient since the 1980s,” King said. “When there’s 130,000 applications for 33,000 visas, it’s really telling, in my opinion.”

Norman said the Grand Traverse Resort is effectively limited from asking for more H-2B workers due to housing constraints, but he knows the demand is there.

“I can speak for other hoteliers that I’ve talked to, be it from Mackinac Island all the way down to Grand Rapids who use these programs, and there’s no doubt we would ask for more between us all if they were available,” he said.

There is at least one bill that was recently introduced in an effort to increase the cap. Aldrich, who has seen many similar bills die on the vine, isn’t holding his breath.

“There’s always talk of legislation going through and a lot of people do propose bills that just seem to go nowhere,” Aldrich says. “Nothing ever happens with the cap.”

Aldrich and King both believe the issue is a tough one from a political standpoint, due to the faulty misconception that H-2B workers will take American jobs.

Functionally speaking, the cap means not all requests can be filled. The government handles requests via lottery, meaning an uncomfortably degree of uncertainty year after year.

“The greatest challenge with the program is there’s no guarantee…that we will fill all our positions,” Norman said. “Even if you fill out all the documentation properly, do everything correct, it’s a massive unknown. You just don’t know what you will or won’t get. You follow the steps and you hope for the best.”

Compounding the problem is the fact that the government also isn’t great about informing employers about the status of their requests in a timely manner.

“Even right now, we still don’t know if we’re going to get all of our requested staff members for this season,” Norman said.

Over in Glen Arbor, Anderson was unimpressed – to say the least – at communication from the feds about his application process.

“Last year, we had people arriving and they gave us basically 48 hours’ notice,” he said. “It was like OK, you’ve been approved, they’ll be here in two days.”

By Craig Manning

By Craig Manning

Toll roads in Michigan; a new shortterm rental excise tax that could funnel more money back to local communities; a bill that would restrict boat speeds on Michigan water bodies; a piece of legislation that would prioritize in-state residents in the queue for state park campsites. These four ideas are all things that have generated discussion on the state level in the past two years, and all four have the potential to cause significant impact on Traverse City’s tourism-centric economy. Ahead of the 2024 summer tourism season, the TCBN takes a closer look at each of these proposals and what they could mean for the future.

The scoop: Experts say “Michigan roads are underfunded by $4 billion per year,” per a Bridge Michigan report, and that the state doesn’t have the money to make good on Gov. Gretchen Whitmer’s “fix the damn roads” pledge. Last year, feasibility and implementation studies commissioned by the Michigan Department

of Transportation (MDOT) showed that the state could make up at least $1 billion per year of that funding gap by converting nearly 1,200 miles of state highways into toll roads.

The scope: Currently 38 states have some form of toll roads, toll bridges, express lanes, or other toll facilities, per TollGuru.com. Michigan is technically one of them, but only because it charges tolls for use of its major bridges (like the Mackinac Bridge or the Ambassador Bridge) and tunnels (the Detroit-Windsor Tunnel). Unlike nearby states like Ohio and Illinois, Michigan does not have any toll highways. After analyzing all 31 Michigan highways, last year’s studies determined that 14 could feasibly become toll roads, including sizable segments of major thoroughfares like I-75, I-94 and I-96. The good news for northern Michiganders is that one of the area’s main entry points –US-131 – is not on the toll road list.

The status: “We haven’t followed that too closely,” said Trevor Tkach, president and CEO of Traverse City Tourism (TCT), when asked about the toll road issue. As Tkach notes, the state legislature has yet to develop any kind of bill based on last year’s feasibility and implementa-

tion studies.

“These conversations (around tolls in Michigan) have been going for more than a year, but that doesn’t mean they’ve gotten enough momentum,” he added. “We tend to pay more attention when things get to more of a fever pitch.”

The impact: While Tkach isn’t overly concerned about the toll road issue at the moment, he does think it could deter some traffic to northern Michigan – all without necessarily helping the state relieve its taxpayers of the road repair cost burden.

“I think part of the challenge is a lot of Michiganders travel inside of Michigan,” he said. “We’re a bit of a cul-de-sac, in that a lot of the people driving to destinations like Traverse City are people who live elsewhere in the state. So, us Michigan residents would probably be picking up the tab (for the road repairs) one way or another.”

The scoop: State Rep. Joey Andrews (D-St. Joseph) is pushing a 10-bill package that would create a variety of new mech-

anisms for local governments to regulate and benefit from short-term rentals in their communities. Andrews argues that the state’s lack of regulatory framework for STRs has led to a crisis where Michigan towns – particularly those along the lakeshore – are being overrun by Airbnbs.

“It’s long past time we put some reasonable guardrails in place to allow local governments to address STRs, respect the needs of permanent residents, and bolster our tourism economy,” Andrews states in support of his legislation.

The scope: The 10-bill package, which is tie-barred together, would effectively create a new “Short-Term Rental Regulation Act.” Perhaps the biggest impact of that legislation is that it would levy a 6% excise tax on all properties rented for 15 days or more each year, on top of the 6% use tax that already exists for STRs. The legislative package would also institute a $1 million liability insurance requirement for STRs, enshrine the ability for municipalities to limit how many STRs can operate in their jurisdictions, and direct the Michigan Department of Licensing and Regulatory Affairs to create a statewide database of STRs, including information like location, owner and emergency contact.

The status: The bill package headed to the House committee on Local Government and Municipal Finance in February after it was introduced. Speaking to Bridge Michigan in early May, Andrews said it was “still alive” after a few legislative hearings, but did not yet have the support to win a full House vote and that he did not expect the bill would see any real movement ahead of the 2024 summer tourism season.

The impact: According to a House Fiscal Agency review, a 6% STR excise tax could generate anywhere from $35 million to $75 million, with most of the money going back to the municipalities in which the STRs are located. Supporters of the legislation say it would help curb adverse effects of STRs, such as their impact on local housing markets, while also providing a stimulus for municipal budgets. Critics, including companies like Airbnb and VRBO, say the legislation would be bad for tourism, bad for homeowners who rely on rental revenues to pay their bills, and unfair in that it would actually require STR guests to pay higher taxes than they would for a hotel stay.

In the past, Tkach has pushed for Traverse City’s STRs to pay assessments to TCT, arguing that STR owners benefit from the work TCT does in promoting the region without paying their fair share. When asked about the new package of bills, though, Tkach says he agrees with

the STR companies, at least with regards to the excise tax.

“We haven’t supported (that proposed tax) because we believe it would tip the scales too far in the opposite direction,” Tkach said. “All we were ever looking to do is find balance, and make sure that anyone who’s working in the business of accommodations is following the same rules and regulations and paying the same taxes and assessments. This excise tax adds an additional 6% just to those doing STR business, and I don’t think that’s fair or justified. I understand that most municipalities want more money, but I don’t know if it’s fair to put so much extra burden on the STR market and those owners and guests.”

Despite his opposition to the excise tax, Tkach says he does see value in some of the items in Andrews’ bill package.

“We do support the idea of a statewide registry,” he said. “I think the registry would help provide a platform to support local governments, so that the burden wouldn’t be entirely on them to track down all of these businesses.”

The scoop: Introduced in February by State Rep. Julie Rogers (D-Kalamazoo), House Bill 5532 would significantly limit the ability of Michigan boaters to par-

You’ve sacrificed so much to build a successful business. Don’t risk losing it all because of someone else’s subpar performance.

With a focus on security, Safety Net offers fullservice IT management and custom IT solutions for organizations with 20-200 employees. You deserve an experienced IT partner who will protect what you’ve worked tirelessly to build.

ticipate in wake sports, particularly on inland lakes. Specifically, the bill would require watercraft in “wake sport mode” to be at least 500 feet from a shore or dock and at a water depth of 20 feet or more. Wake sport mode refers to boats operating with any form of wake-boosting features engaged – common for activities like wakeboarding and wake surfing. The bill has garnered bipartisan support from other Michigan lawmakers, including northern Michigan’s own John Roth (R-Interlochen).

The scope: Earlier this year, Vermont became the first state in the country to

adopt a significant wake boat rule. That law includes the same 500-foot shore buffer and 20-foot depth rule being proposed in Michigan. Here, the law would apply to both inland lakes and the Great Lakes, though it would be most impactful for smaller water bodies. The Michigan Lakes & Streams Association has endorsed the legislation, arguing that it recognizes “the impact that wakes from such vessels have on shoreline erosion, damage to shoreline structures, bottomland/vegetation degradation, and destruction of fisheries.”

The status: House Bill 5532 is currently awaiting a hearing from the House Nat-

what you’ve created – and save

– with IT support from

ural Resources, Environment, Tourism, and Outdoor Recreation Committee.

The impact: Wake boat enthusiastsargue that House Bill 5532 is too restrictive and would cause significant harm to the recreational boating economy throughout the state.

“This bill will effectively kill most wake sports on all but the largest inland lakes,” one user wrote on the forums for MasterCraft, a popular wake and ski boat manufacturer. “Even Lake Erie…is quite shallow. I have to be over 1,000 feet from shore in many places to get to 15 feet (deep). This bill was clearly written by someone with no clue about the lakes in Michigan, or more likely someone looking to shut down all wake boat activity.”

Tkach says TCT will take more of a stance on the bill and its potential tourism implications if/when the legislation gains more momentum in the House. For now, he’s mostly concerned that the new rules won’t be legible to the average boater. Currently, state law – and boater safety classes – demand that boaters be 100 feet from any shoreline, dock, raft, moored or anchored vessel, or buoyed swimming area before traveling at a speed that creates a wake.

“500 feet is a lot tougher to judge than 100 feet,” Tkach said. “So, my initial reaction to this legislation is that I don’t know if the general consumer can actually understand what’s going on (with those proposed rules). It seems a bit over the top to me.”

The scoop: In March, State Rep. Cam Cavitt (R-Cheboygan) introduced House Bill 5597, which would give Michigan residents a two-week head-start in making state campground reservations each year. As things stand, Michigan’s state parks open up reservations for their campgrounds six months in advance. Cavitt has argued that slots book up too quickly, and that Michiganders should get first dibs on

reservations in the state where they live, work and pay taxes.

The scope: Per Cavitt’s office, one in three campsites in Michigan were already booked for the 2024 summer season by January 8 of this year.

“It’s great to see so many people interested in camping in Michigan,” Cavitt said in a statement. “But some of our most popular parks fill up so quickly that state residents have less than 20 minutes to get a spot before they’re gone. There should be perks to living in Michigan. People who pay taxes that contribute directly to the quality of the parks should be able to get first dibs in vacationing to those parks. Camping is supposed to be relaxing. Michigan families shouldn’t have to plan their vacations by huddling around a computer in December and praying for a nice campsite.”

The status: In March, Cavitt’s bill was referred to the Committee on Natural Resources, Environment, Tourism and Outdoor Recreation.

The impact: When asked whether he’s worried about the potential of House Bill 5597 to hinder out-of-state tourism, Cavitt has argued that his concerns lie with his in-state constituents and not out-of-state tourists.

For his part, Tkach says he isn’t worried about this piece of legislation hurting tourism, either.

“A lot of the campsite bookings in Michigan are by people in-state already, so I don’t know that this bill would change much,” he said. “And I’ll also say that the Traverse City and Interlochen state park campgrounds are always two of the most popular campgrounds in the entire state anyway. That’ll never change, no matter what they do with the rules.”

Indeed, the lion’s share of campground bookings in Michigan are already coming from Michiganders: Ron Olson, chief of the Michigan Department of Natural Resource’s parks and recreation division, recently told Bridge Michigan that state residents have accounted for 87% of state park campground reservations over the past five years.

At Nicolet Bank, we believe every great success story starts with a conversation. Look to your local, experienced commercial banking team, who work and live here, and understand our local economy is built on shared success.

Michael Caruso

SVP Commercial Banking

231.941.6303

mcaruso@nicoletbank.com

John Galbraith

VP Commercial Banking

231.632.9331

jgalbraith@nicoletbank.com

Jeremy Harnish

SVP Commercial Banking Manager

231.941.6306

jharnish@nicoletbank.com

Andrew Sabatine

SVP Commercial Banking

231.941.6301

asabatine@nicoletbank.com

Whether they handed off icy concession treats or greeted travel-weary hotel guests, most people born and raised in northern Michigan’s coastal towns welcomed tourists as their first job.

For brother/sister duo Quinn and Alexandra Wuerfel, hospitality wasn’t just a fleeting introduction to the workforce, it’s been their family business since the 1970s.

That’s when their grandparents John and Leslye Wuerfel began developing and purchasing Traverse City hotel properties. Eventually John and Leslye passed the baton to their son, Josh, and his wife Tonya who are now president and VP, respectively, of Wuerfel Resorts, an LLC that has developed and managed more than a handful of hospitality staples throughout the area.

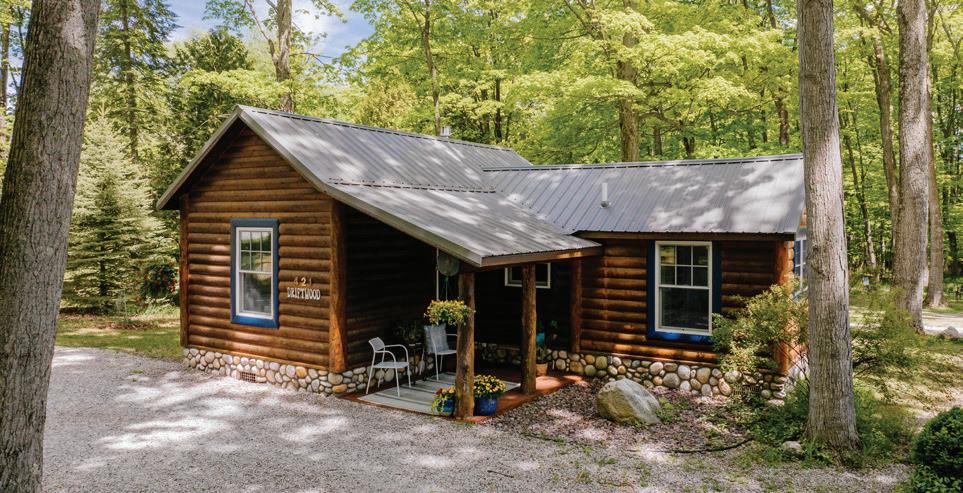

Three generations in, Quinn and Alexandra, two of Josh and Tonya’s kids, are stepping up and into leading roles at Wuerfel Resorts. The company portfolio currently includes Tamarack Lodge, adjacent event center Harbor Brook Hall, and the newly developed Alexandra Inn on East Bay.

Building 31’s resort retreats

Growing up, Quinn and Alexandra were surrounded by the NoMi hospitality and tourism scene.

“Some of my favorite childhood memo-

ries include playing catch with my siblings and the (Beach) Bums players before a game,” recalled Alexandra of her summers spent working at Wuerfel Park near Chums Corners. The 26-acre baseball stadium known these days as Turtle Creek Stadium was built by her grandparents in 2006 and run by the family for 12 years.

By the time Alexandra graduated from high school in 2015, she was getting ready to attend Cornell University’s school of hotel administration and working the night desk of the Beach Haus Resort. Owned and operated at the time by her parents, the Beach Haus is just a stone’s throw from several other Wuerfel properties including past developments Sugar Beach Resort and Grand Beach Resort.

In fact, look up and down either direction along U.S. 31’s East Bay end and sprinkled amongst the ice cream shops, souvenir stops, and Tripadvisor must-sees, are most of the hotels, resorts, and inns once owned or developed by the Wuerfel family. Even if it no longer carries the original name or facade, chances are that a Wuerfel broke ground or at least had some input in what’s there today.

“My grandpa (John) always says they were the first hotels to have color TVs in Traverse City,” said Alexandra of her family’s impact on the TC hospitality and tourism scene, which recently saw a major boost in numbers.

Traverse City Tourism reported an 11%

increase in visitors for 2022 compared to pre-pandemic statistics, translating to more than $423 million spent on lodging alone. It’s no surprise then that hundreds of new hotel rooms are going up throughout the county.

Born-and-raised northern Michiganders, the Wuerfels say that being locally raised and locally focused gives them an edge against national competition. As Alexandra points out, Wuerfel Resorts is fully independent, giving them the freedom to design and brand their properties to highlight the landscape and serene ambience of the area without franchise limitations.

With Wuerfel Resorts founders John and Leslye now retired and Josh and Tonya at the helm, they’ve niched down their active portfolio to just three properties and spent the last two years delegating to Alexandra and Quinn as the third generation of Wuerfel Resorts’ leadership.

As the general manager of Harbor Brook Hall, their beachfront event venue, Quinn says that studying hospitality at Michigan State helped prepare him for the role but also emphasizes the opportunities he had growing up in the industry.

“My family taught me from a young age the time commitment you need to (give) to a business and the versatility you need to

work the day-to-day operations,” he said. Meanwhile, Alexandra transitioned out of her role as an analyst for a Pennsylvania-based firm to take her place in the family business at the start of 2022.

She’s now Wuerfel Resorts’ director of operations and namesake of its latest resort development, a boutique hotel on TC’s East Bay called the Alexandra Inn.

“My parents actually purchased the domain thealexandrainn.com the year I was born,” said Alexandra of the four-story hotel that opened in June of 2023. “My dad is a bit proactive and every time he thinks of a good hotel name he purchases the domain…I think he has a list of over 50 domains and endless ideas for future projects.”

The 32-room, marine blue Alexandra Inn has been an all-hands-on-deck family project from the start.

After purchasing the East Bay beachfront property two and a half years ago, the Wuerfels set to work clearing the lot, which was originally residential, and worked alongside contractors to do everything from hanging walls to installing drywall. Alexandra and Tonya even designed the guest room furniture together before sending their sketches to a manufacturer in North Carolina.

“We wanted the property to feel almost like a renovated home turned Inn,” said Alexandra, who is on site every day to run operations.

Despite the concerns voiced by northern Michigan locals about obstructed bay views and increased summer traffic caused by the growing number of hotels along U.S. 31, the Wuerfels say that at the heart of their branding they’ve embraced not just the locale but locals too.

“We knew from the start of designing Alexandra Inn that we wanted the rooftop level to be an outdoor space for guests and locals to enjoy,” said Alexandra.

“It was a very long process to get us to where we are today,” she said.

After the inn’s site plan was approved in the spring of 2022, they were restricted by East Bay Township to only allowing Alexandra Inn guests to visit the restaurant.

“We fought tirelessly for 15 months to get Blush open to the public,” said Alexandra.

“We have a wonderful group of regulars from Holiday Hills, Acme, Elk Rapids and Rapid City,” she said, noting that last year Blush hosted everything from book clubs to adoption parties. This summer, they’re welcoming diners for live music and events along with a menu emphasizing NoMisourced brands and ingredients from places like Ebels and Traverse City Whiskey Co.

taneously growing the Wuerfel brand.

“I think one of the things that is fun to see coming full circle is that when Josh and I joined John and Leslye, we had ideas,” she said.

Ideas that included implementing unfamiliar technologies and fresh marketing strategies. “

That rooftop level is home to Traverse City’s only rooftop bar and restaurant, Blush, an endeavor that Alexandra admits became quite challenging.

Shortly after the hotel opened in the summer of 2023, the family finally received approval to open Blush to the public. Since then, Alexandra said that the restaurant has become a “strong place of community” for the East side.

As another season of festivals, fireworks, and bumper-to-bumper traffic swings into action, Tonya reflects on the next chapter of Wuerfel Resorts and the excitement her and Josh feel watching their kids grow into their new roles while simul-

And then we get to Alexandra and Quinn…(we’re) bringing in the next generation, and seeing things from a new perspective is just invaluable,” she said.

“It’s unlimited.

“And, we’ll see about that 4th generation eventually.”

design/build to construct a new, larger medical office that enhances patient experience, improves efficiency and meets HIPAA regulations.

Burdco didn’t cut corners.They always did quality work and actually went above and beyond. That gave me a lot of peace. I think Burdco, especially since Mike Brown is at the helm of this, really exudes character and quality in the facilities they build and stand by.

By Craig Manning

By Craig Manning

Live in Traverse City long enough and the summer tourism cycle starts to seem like a well-established routine: the same festivals and events, the same gridlocked streets, the same hotels flashing “no vacancy” signs. Ten years ago, though, you might find that Traverse City and its tourism landscape has transformed to a surprising degree.

With another peak tourism season rolling in, the TCBN journeys back to 2014 to find out what has changed – and what’s stayed the same.

In 2014, the tourism scene started in a more combative place than normal. While there has long been a clash between those who see tourism as the core element of Traverse City’s economy and those who would rather keep the so called “fudgies” out of their backyard, 2014 was unique given the then-recent attempt by a 75-year-old TC resident named Lou Colombo to reserve the Open Space for the entirety of the summer.

Colombo’s move was a form of protest: His summer-long reservation would have been called “The Quiet Festival,” and would have kept the Open Space, well… open for locals to enjoy during the warmer months.

Of course, Colombo didn’t exactly get his way: The Traverse City Commission opted not to approve his stunt permit for The Quiet Festival, and events like the National Cherry Festival and the

Traverse City Film Festival ended up getting dibs on the Open Space for their usual engagements in early July and early August, respectively.

However, Colombo’s proposal did kick off a controversial conversation in town about “festival fatigue,” and about just how much major events should be allowed to monopolize Traverse City’s prime spaces during the summer months. Inspired in part by Colombo’s proposal, the city commission voted in December 2013 to reduce the maximum number of festivals that could take place at the Open Space each summer from six to four. The new policy also banned festivals at the Open Space on Memorial Day and Labor Day weekends.

Despite the headline-grabbing protest, and despite the new limit on festival permits for TC’s most desirable festival location, summer 2014 ended up being anything but a quiet time for local tourism. The Bayshore Marathon kicked off the season on Memorial Day weekend, drawing nearly 5,800 runners across its three main races – the 10K, half marathon and full marathon. The Bayshore’s numbers were only slightly higher nine years later, with 6,168 runners participating in those three races.

A big-as-ever version of the National Cherry Festival followed in July, kicking off on July 6 with a performance by the U.S. Navy Blue Angels and a Blues, Brews & BBQ festival at the Hagerty Center. Other highlights of the 88th Cherry Festival included musical performances from country star Justin Moore and a quadruple bill of ‘90s throwback bands – Sugar Ray, Smash Mouth, Blues Traveler and

“TCT is also prepared to support and partner with anyone who is willing and able to develop a new event for the future that will help sustain the visitor economy here in town. We’d love to have that conversation, because as we’re reflecting on 10 years ago, I would say there was far more interest and energy in the event space in 2014, and that has waned.”

–Trevor Tkach, President/CEO, Traverse City Tourism

Uncle Kracker – along with the typical parades, carnival rides and beer tent shenanigans.

One big milestone from the summer of 2014: The 10th annual Traverse City Film Festival, which spanned some 230 screenings of more than 200 different films, tal-

lying a reported 131,000 admissions along the way. That year of the festival included Open Space showings of beloved classics like Jaws, Star Wars, Jurassic Park and Casablanca, featured guests like Borat director Larry Charles, and even offered opportunities for film-goers to watch mov-

ies aboard a boat in the middle of Grand Traverse Bay.

The other festivals filling out the new four-event Open Space rule: Paella in the Park, hosted by the now-defunct Porterhouse Presents on August 15; and the Michigan Schooner Festival, a maritime-focused event held in September. The new rule forced the relocation of several TC events – such as the Epicurean-focused Taste of Traverse City festival, which swapped its Open Space berth from the year before for Grand Traverse Resort and Spa.

Outside of Traverse City proper, locals could catch other popular events such as the Interlochen Arts Festival (performers included Sheryl Crow, Gordon Lightfoot, Lynyrd Skynyrd, Bonnie Raitt, Nickel Creek, Darius Rucker, Jackson Brown, Willie Nelson, Five for Fighting, Ray LaMontagne, and Steely Dan) and Horse Shows by the Bay (which ran from July 2-27).

Looking ahead to summer 2024, can you spot the differences in the picture between now and 10 years ago?

Many of the starkest contrasts between 2024 and 2014 can be found by looking at the event calendar. While both the Bayshore Marathon and the National Cherry Festival hit snags this spring – the

former around a controversial per-participant fee increase from Peninsula Township, the latter in the form of a contentious debate with Cherry Capital Airport that threatened the future of the air show – both events are back this year in similar formats to 10 years ago.

Beyond those two flagships, many of Traverse City’s big celebrations and gatherings have shifted. Most notably, TCFF is no more – at least in the week-long summer festival format that marked its 10th incarnation back in 2014. Instead, festival founder and leader Michael Moore announced last year that TCFF would be rebranding as a yearround arthouse movie series called TCFF Tuesdays, which is currently in its second season at the Traverse City State Theatre. No major event has yet taken TCFF’s place during the prime end of July/beginning of August slot in the calendar.

Most of the other events mentioned above – Paella in the Park, the Michigan Schooner Festival, Taste of Traverse City – also didn’t make it to 2024, nor did other 2014 fixtures like the Traverse City Wine & Art Festival or the Traverse City Microbrew and Music Festival – headlined in 2014 by singer-songwriter Brandi Carlile.

Trevor Tkach, the current president and CEO of Traverse City Tourism (TCT) – and the executive director of the National Cherry Festival back in 2014 – points

to the loss of local events as one of the biggest contrasts between tourism 10 years ago and tourism now. The pandemic, he notes, dealt the region’s events sector a blow that it never fully recovered from. Add in the departure of events-organizing heavyweights like Porterhouse Presents, and there’s a yet-to-be-filled void in the local tourism ecosystem.

“Once we lost some of those events during COVID, it’s been near-impossible to bring them back online,” Tkach said. “You lost your business, you lost your customer base, you lost your volunteer base. So, we’re still recovering from that. And

then on top of that, it’s just been hard to find new people who are willing to put in the time and energy to produce events. It’s a lot of work. One of the few bigger event producers left in Traverse City, Troy Daily, I think has done a nice job of keeping his portfolio stable and even growing it. But on the whole, we’ve seen fewer independent entrepreneurs working in this space, and we don’t see the nonprofits as engaged in hosting events as they were 10 years ago.”

In fact, of the few new local events that have come online and become annual traditions in the past 10 years, TCT has

• The largest number of experienced and board certified surgeons with 13 surgeons, and a team of PAs and Physical Therapy providers focused solely on Orthopaedics

• We can get you in the same day with a single phone call when you get injured

• GLOC has served Northern Michigan for over 30 years

• No Urgent Care or ER deductibles at GLOC

• 2 locations to serve you

With premium technology, the best wakes and waves, and top notch reliability and quality... MasterCraft is pushing the boundaries to deliver moments that make life extraordinary. Find your families MasterCraft at Action Water Sports of Traverse City or shop online at actionwater.com.

been behind arguably the two biggest: the IRONMAN 70.3 Michigan in Frankfort and the International Fireworks Championship at Turtle Creek Stadium. TCT worked to bring the IRONMAN to Traverse City in 2019 – though the event moved to its new home in Frankfort after the pandemic. The International Fireworks Championship, meanwhile, drew strong reception during its inaugural 2023 event and will be back this September 6-7 with pyrotechnic teams competing from Australia, the United Kingdom, India, the Philippines, Finland and the United States.

“Our objective is to create something that’ll draw people from outside the market to get them to spend their dollars here, and hopefully spend the night,” Tkach said. “So, we’ve started creating our own events to do that. But TCT is also prepared to support and partner with anyone who is willing and able to develop a new event for the future that will help sustain the visitor economy here in town. We’d love to have that conversation, because as we’re reflecting on 10 years ago, I would say there was far more interest and energy in the event space in 2014, and that has waned.”

There is at least one local summer event that is exponentially bigger now than it was in 2014: Traverse City Horse Shows. What 10 years ago spanned just four weeks of competition in July has become a behemoth in the equestrian world that boasts a 13-week circuit of events and draws horses and riders from all over the world. This year’s festival kicks off with a June 5-9 series and concludes with a September 18-22 tournament of champions.

Beyond events, Tkach points to one other aspect of Traverse City’s tourism scene that has changed dramatically in the past 10 years: lodging. One of the area’s newest hotels in 2014 was the Cambria Suites on Munson Avenue, which had opened five years prior.

In the decade since, a slew of new hotels have sprung up and opened their doors: the Hotel Indigo in downtown Traverse City in 2016; the Tru by Hilton near

the Grand Traverse Mall and the Alexandra Inn in East Bay Township, both last year; the newly opened Avid hotel, also in East Bay Township. In addition, at least half a dozen other hotels are either under construction or in the development pipeline, including another downtown hotel from the developers that built the Indigo, a second hotel next door to the Tru by Hilton, and several other properties in East Bay Township.

The short-term rental (STR) industry has grown exponentially in the past 10 years. Back then, Tkach says, Traverse City’s STR landscape was mostly an informal system of homeowners who would rent their properties directly to visitors during Cherry Festival week. The rise of Airbnb and other platforms formalized the rental system and grew it dramatically, with Tkach now estimating that Grand Traverse County has some 2,000 STR listings during the peak summer travel season.

“Clearly, there’s way more inventory now,” Tkach said. “There are far more STR opportunities documented in Traverse City today than there were back then, and there are a few more hotels, too.”

This all leads us to the million-dollar question: Is tourism in northern Michigan significantly bigger in 2024 than it was 10 years ago?

“It’s a different world,” Tkach admitted. “Looking back at 2014, five years prior to that was when the Pure Michigan campaign was starting to kick off. And TCT had also recently shifted its local hotel assessment from 2% to 5%, which greatly increased the marketing budget. So even in 2014, we were starting to see the payoffs of multiple years of marketing. But it still wasn’t like it is now. I would say that, 10 years ago, there was still a lot of reliance on the Cherry Festival and TCFF to lead the way on local tourism. Those were significant peaks in our market. Now, I just see more consistent demand throughout the summer. The Cherry Festival still draws an immense amount of attention, but the summer as a whole is bigger.

From mid-June to about mid-August, it’s always busy.”

In terms of geographic borders, there is little overlap between Traverse City and Leelanau County. When it comes to northern Michigan’s local brand as a tourism destination, Traverse City and Leelanau County are deeply intertwined – and arguably becoming more so by the year.

Indeed, from Pure Michigan promotional campaigns that spotlight the Sleeping Bear Dunes National Lakeshore to endorsements from national publications that repeatedly call out Leelanau businesses like Farm Club or The Mill Glen Arbor, Leelanau County is increasingly looking like Traverse City’s ace in the hole when it comes to tourism branding.

Local tourism leaders see the relationship as a rising-tide-lifts-all-boats situation, arguing that visitors flocking to the region means traffic, dollars, jobs and increasing year-round economic viability for the entire region. Meanwhile, Leland Township Supervisor Susan Och told the TCBN there is a growing feeling among Leelanau residents that the county is “bearing the brunt of regional tourism” without getting either a seat at the table for local tourism planning, or a fair share

of the profits.

Leelanau’s stock as a tourism destination has been on the rise for years, particularly since Good Morning America dubbed Sleeping Bear Dunes as the “Most Beautiful Place in America” back in 2011. The park’s numbers have increased substantially since then. In the 2000s, the average annual visitor total for Sleeping Bear Dunes was 1,153,146. Fast-forward to now and the number has exceeded 1,500,000 visitors every year since 2015, including an all-time record of 1,722,955 visitors in 2021.

It’s not just Sleeping Bear Dune that’s seen its shine increase thanks to Leelanau’s steady trickle of national attention. In 2018, Time Money named Glen Arbor number four on its list of 20 best affordable places to visit around the world, highlighting Cherry Republic, Blu and nearby wineries as key draws.

In December 2022, when Conde Nast Traveler touted northern Michigan as one of its “23 best places to go in 2023,” Leelanau favorites like Farm Club, Dune Bird Winery and The Mill Glen Arbor were all name-checked. And in 2023, Leland landed on Travel and Leisure’s list of the 20 most beautiful small towns in America, while Wall Street Journalpraised

“(There’s a) strain that comes from being a day destination and having to provide parking, trash removal, public restrooms, public safety and so forth for day trippers who are attracted to this area by all of the hype.”

– Susan Och, township supervisor, Leland

Traverse City “and its bustling peninsulas” as “summer’s best beach vacation.” The latter feature recommended Leelanau spots like The Mill, the Village Cheese Shanty in Leland, and Suttons Bay’s Tandem Ciders and Poppy Things.

Between the press coverage and a recent string of milder-than-typical winters, Och says small Leelanau towns like Leland have seen a noticeable shift in

their patterns of tourism traffic. It used to be that Leland, Northport, Empire, Suttons Bay and other Leelanau towns would do bustling summertime business but then mostly go into hibernation during the winter.

Now, those towns are becoming yearround destinations, and, according to Och, it’s causing some growing pains. For instance, Leland’s only public restrooms

are located at the local harbor, and Och says they aren’t built for four-season operations.

“I’m amazed to go out in February and see people out hunting for Leland blue stones on the beach,” Och said. “That’s something you did not see 20 years ago. I think this climate disruption is changing people’s expectations of when they should visit and what’s going to be here when they get here. And because of that, we’re getting calls to keep the restrooms at the harbor open through the winter.”

Those calls have pushed Leland Township to explore options for expanding restroom access. In the immediate future, Och said, the township will be relying on portable toilets to fill the public restroom gap. Building a more permanent facility – or retrofitting the harbor restrooms for wintertime use – isn’t off the table, but Och says she thinks it might be “hard to justify” to taxpayers, given the expense.

tion where they are unfairly “bearing the brunt for regional tourism.” In the past few years, she’s clocked an increase in the amount of anti-tourism and anti-development sentiment from her constituents.

One recent example? A post on the Overheard in Leelanau Facebook community page, “where someone, maybe a bot, asks where everyone’s favorite beaches (in Leelanau County).”

“So perhaps Leelanau County, or even just Leland, could consider establishing an assessment district and partnering up with (Traverse City Tourism). I know that we would certainly welcome that, and I think then we could address some of these issues around infrastructure.”

Trevor Tkach, president and CEO, Traverse City Tourism

“It already seems like Leland Township taxpayers are paying for regional tourism in the form of these restrooms,” Och said. “Out of our $123,000 parks budget – which is for the entire township – we already spend $41,000 on maintenance of that one public restroom. I think it would be very difficult to get our taxpayers to support paying even more for a restroom that a lot of them might never use.”

Och says she is worried that all the growth is forcing Leelanau’s small towns and their taxpaying residents into a situa-

“Most of the people (in the comments to that post) are complaining that this is a person looking to write an article promoting our area, and they are not happy about it,” Och said.

Och says part of the challenge is that while Leelanau small towns are popular destinations, they don’t have much in the way of hotels. Plenty of visitors to the county stay in nearby short-term rentals, but many book hotel rooms in Traverse City and then plot day trips out to Leland or other Leelanau towns.

“(There’s a) strain that comes from being a day destination and having to provide parking, trash removal, public restrooms, public safety and so forth for day trippers who are attracted to this area by all of the hype,” Och said. “We can’t prove where these people are staying, but it does seem like Leelanau County destinations are being used to fill Traverse City hotel rooms.”

The tourism situation has left Och wondering: “When have we promoted this area enough?”

For his part, Trevor Tkach – president and CEO of Traverse City Tourism (TCT)

Great investment property

Zoned for short term rentals

Fully furnished and turnkey

Beautiful 1 BR, 1.5 BA Boardman Ridge Condo overlooking Boardman Lake, directly on the TART Trail. Walk or bike to beaches and downtown. Premier finishes throughout including stainless kitchen appliances. Includes extensive outdoor deck, one covered parking space, and flex room in basement.

$519,900 • 225 E Seventeeth St, #2-B • MLS# 1919564

MIKE ANNELIN

Enthusiastic & Experienced 231-499-4249 | 231-929-7900

Atlanta- ATL

Boston- BOS

Charlotte- CLT

Chicago- ORD

Dallas/Fort Worth- DFW

Denver- DEN

Detroit- DTW

Fort Lauderdale- FLL

Houston- IAH

Minneapolis- MSP

Newark- EWR

New Haven- HVN

New York-LaGuardia- LGA

Orlando/Sanford- SFB

Philadelphia- PHL

Phoenix/Mesa- AZA

Punta Gorda- PGD

Tampa/St. Pete- PIE

Washington DC-Dulles- IAD

Washington DC-Reagan- DCA

– sees Leelanau County as both an important asset and an important partner in his organization’s efforts to promote the northern Michigan region to visitors.

“Leelanau has definitely grown their collection of assets over the past many years, and they’ve done an especially phenomenal job of developing their wine region,” Tkach said. “And the average consumer doesn’t see borders. When you’re talking about coming to Traverse City from downstate or out of state, you’re not thinking just of Traverse City. You’re thinking more about the experience of coming north, and one of the great things about Traverse City is that it’s a wonderful hub-and-spoke experience. You’re going to have a nice centralized downtown space, but you’re also going to have outlying areas where you can go and explore a lot of really cool experiences. And Leelanau never disappoints on that front.”

Tkach also says it’s not easy to “turn on and off the faucet” of tourism marketing based on which areas feel like they have the bandwidth or infrastructure to manage the flow of visitors, and which ones don’t.

“You do your best job of telling stories about the region and trying to fit to what the market will bear, but it’s hard to match the marketing strategy of the entire region to the specific needs of each

smaller community,” he explained. “Especially when the alternative complaint, if desired visitor numbers aren’t met, the question typically becomes ‘Why aren’t you marketing more?’ We’re getting that feedback this year more than ever, because we just went through a very, very challenging winter. So, I don’t know that there’s a perfect number or a silver bullet.”

What Leelanau County could do, Tkach says, is get more involved with TCT as it plots out its approach for future tourism marketing. Right now, Leelanau is not a part of TCT’s assessment district, which means that most of the hotels that fund TCT’s existence – and that therefore have a voice in guiding its strategy – are not in Leelanau County. Instead, TCT is largely governed by the lodging properties in Grand Traverse County, though Benzie County also joined the organization’s fold back in 2020.

“They could establish a district,” Tkach said of Leelanau’s lodging properties. “I think if they were more organized in that way, we’d love to see that and I think we could provide even more support.”

Currently, Tkach notes, Leelanau has a single assessment district: the Sleeping Bear Dunes Visitors Bureau in Glen Arbor, which was formed by The Homestead, itself the county’s biggest resort hotel.

“Comparatively, in Grand Traverse

County and Benzie County, you have multiple fully established assessment districts which then feed into TCT,” he said.

Those partnerships mean pooled financial resources across the districts, as well as a shared “commitment from those who work in the travel and tourism space to come together and work together to solve issues or challenges.”

“So perhaps Leelanau County, or even just Leland, could consider establishing an assessment district and partnering up with TCT,” Tkach said. “I know that

we would certainly welcome that, and I think then we could address some of these issues around infrastructure. Right now, in Benzie County, we’re putting money into the Frankfort bathrooms down by the beach. That’s been a little bit of a challenge for them to figure out, but at the end of the day, there’s going to be a new resource in that community, partly because the tourism group there is partnered with us. So, I think there are more opportunities for Leelanau to take advantage of.”

Immaculate Waterfront Home! Spectacular Sunsets & Westerly Views Over Grand Traverse Bay! Custom Built Contemporary Home. Parcel is Elevated & Wooded to Ensure Privacy. Only Steps down to the Sandy Beach! This 3 BD - 2.5 BA Home Constructed in 2006 to be Maintenance Free. Features Include In-Floor Radiant Heat –Central AC – Whole House Generator – Whole Home Air Exchange - Main Level Living w/ Walkout Lower Level w/Views of Bay – Large Natural Fireplace – Chefs Kitchen – First Class Finishes/ Woodwork – Built In Hot-Tub/Huge Recreation Room/ Custom Wet Bar – Den could be Guest Rm - Screened In Porch – Oversized 3 Car Garage – etc. Virtual Tour Online. MLS# 1920907 $1,729,900.

Medical Office Building For Sale! - 11,486 Sq/ Ft. Main Level is 6,187 Sq/Ft. Walkout Lower Level is 5,299 Sq/Ft and Features a Large Open Area w/ Picture Windows providing lots of natural light. Excellent for Physical Therapy, Patient Assessments, Gym Related Activities! Current tenant (month to month) is utilizing the lower level (some lab space), and approx. 2/3's of the main floor. The owner is using approx. 1/3 of the main floor & shared common areas. Owner leaseback is negotiable or buyer could use the entire building if needed. Many individual offices of various sizes. Close to Munson Hospital surrounded by a variety of Medical Practices. Virtual tour Online – MLS# 1919691 - $1,595,000.

RETAIL SPACE FOR LEASE! Large Picture Windows - High Ceilings - Wide Open Space Ready for New Tenant to Design it w/Personal Touches! Double Doors in the rear allow for Great Delivery Options. Appox 350 SQ FT of Upper Floor Storage Space. Busy Garfield Rd just South of Major Intersection w/Airport Rd. Lots of Traffic - Great Signage & Ingress/Egress for this Corner property. Front & Back Drives to Lots of Parking, & Easy Truck Access. Modified Gross Lease. Tenant to pay Rent, Electric, Nat Gas, Trash, Internet/Phone. Great Space for Retail, Insurance, Finance, Real Estate, Salon, etc. MLS# 1918610 $1600/month

Twelve banks serve the Grand Traverse region, but none of them are headquartered in Traverse City.

That could soon change.

Gregg Bigger, a former California banker and business executive who announced plans last year to start a new bank in Traverse City, has filed an application with the Federal Reserve Bank of Chicago to create a holding company that, if approved, would allow him to open Grand Traverse State Bank by around the end of the year.

Initially, the bank would be a loan production office, but plans to become a full-service bank in 2025. Grand Traverse State Bank would be headquartered in downtown Traverse City, the only bank based in the city.

“Things are going well, but it’s not an expeditious process,” he said.

Bigger filed an application with the Chicago Fed in April to create GTSB Financial Inc., a bank holding company that would acquire First State Bank of Decatur, a tiny Southwest Michigan bank with assets of $53 million. It’s the third-smallest bank in Michigan, according to iBanknet.com.

The transaction price would be roughly $13 million, including payment of a special dividend to First State Bank shareholders, according to GTSB Financial’s application.

Bigger, chairman and CEO of GTSB Financial, said he has raised more than $14 million in capital from more than 125 investors.

GTSB Financial would establish the Grand Traverse State Bank and another bank located in metro Detroit as subsidiaries with First State Bank of Decatur. Rob Farr, a veteran Oakland County banker who recently moved to Traverse City and is the president of GTSB Financial, calls the proposed Detroit-area bank “bank313” on his LinkedIn page.

Bigger says bank313 is a “concept” and has been testing the market in meetings with potential investors and customers.

Farr founded the Bank of Birmingham, which was acquired by the Bank of Ann Arbor in 2017. He then founded Mi BANK in Bloomfield Hills but left in November to join GTSB Financial. He moved to Traverse City in 2020 and commuted to Bloomfield Hills.

“I love to build things, particularly

banks,” Farr said. “The community bank is a great model.”

Farr said he met Bigger two years ago when Bigger was attempting to create Sovereign Bank, a de novo, or bank which has not been acquired through purchase and is newly chartered by the FDIC, that would have served Grand Traverse, Leelanau and Benzie counties.

But Bigger scrapped that plan when he learned that First State Bank of Decatur, founded in 1870 and said to be Michigan’s oldest bank, was up for sale.

“We pivoted to an acquisition,” he said, adding it was a less expensive way to get into the banking business and presented fewer barriers to entry than starting a bank from scratch.

Bigger has assembled a nine-member board of directors that includes Vice Chair Connie Deneweth, the former CEO of Traverse City State Bank, which was acquired by Independent Bank in 2018.

Deneweth says she was happily retired and wasn’t looking to get back into banking, but is worried that that the area has become increasingly dominated by big banks that “don’t understand the needs of small businesses.”

Large, mostly out-of-state banks control about 80% of bank deposits in Benzie, Grand Traverse, Kalkaska and Leelanau counties. None of the 12 banks serving the area are headquartered in Grand Traverse County. The only banks based in the region are Honor Bank and State Savings Bank, both of Benzie County.

Large banks tend to make loan decisions based on a credit scoring model, Deneweth says, with little regard for the “character and experience” of small business borrowers.

“Banks servicing small businesses are becoming fewer,” she said. “The future is collapsing for small businesses seeking banking alternatives.”