• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University. Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.**

investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan.

under custody of LPL Financial, TD Ameritrade, and Charles Schwab.

NET NOW PART OF THRIVE Safety Net , an IT services firm with offices in Traverse City and Detroit, has been acquired by Thrive, a global technology outsourcing provider for cybersecurity, cloud and IT managed services. With the acquisition, Thrive expands its reach to the Midwest, enabling Safety Net’s existing and new customers to have access to Thrive’s global security operation center and hybrid cloud solutions. “With over two decades of providing strategic IT solutions to Michigan businesses, our team is excited to accept the challenge of accelerating our growth to become the premier managed services provider in the Midwest,” said Tim Cerny, CEO of Safety Net.

Traverse Connect, Munson Healthcare, DroneUp, blueflite, and Central Michigan University’s Rural Health Equity Institute have announced plans for an upcoming aerial medical delivery project. The project will consist of test flights to deliver medical supplies between Munson Healthcare facilities in Traverse City, Garfield Township and East Bay Township. Test flights will be conducted between November 2024 and May 2025. This is the first uncrewed medical delivery project in the Grand Traverse region and the first funded by the State of Michigan.

The Bay Area Transportation Authority (BATA) has received a $795,673 grant from the Michigan Public Service Commission (MPSC) to install more than 650 solar panels on the roof of BATA’s new 80,000 square-foot headquarters at the corner of LaFranier and Hammond roads in Traverse City. BATA was one of 19 different projects selected out of 52 applications. Benefits of the solar project include 650 rooftop solar modules that will offset nearly all the facility’s daily electrical usage; $63,000 in annual estimated recurring electrical utility savings; 260 tons of estimated carbon dioxide and one ton of sulfur dioxide removed from Michigan’s air, land and water. The installation is planned for next spring.

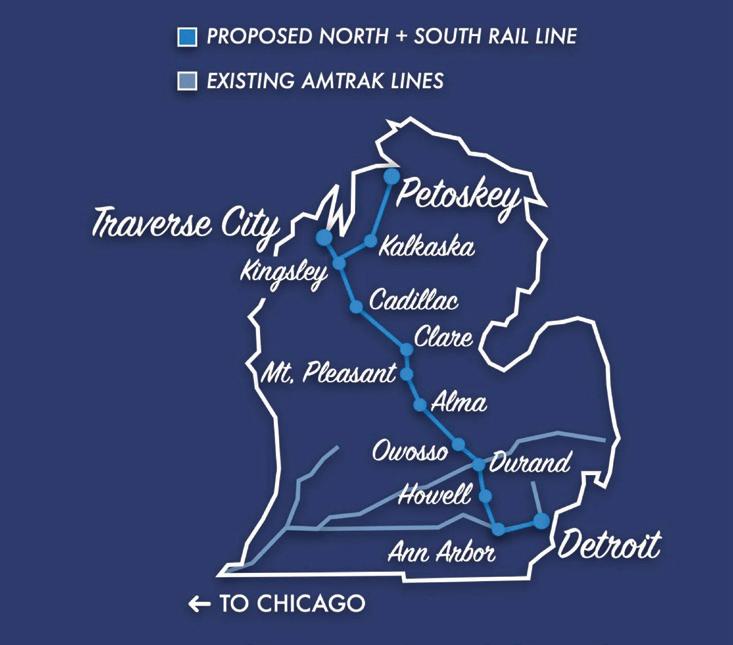

NEXT STEP FOR PASSENGER RAIL

Groundwork Center for Resilient Communities has hired engineering and professional services firm WSP to serve as the rail consultant for the “Phase II study” for the proposed Michigan North-South Passenger Rail Project. Groundwork and its partner, the Cadillac/Wexford Transit Authority, will now work alongside WSP to establish a roadmap for how project players can move forward with fixing the railways, establishing passenger rail stations, and ultimately getting rail service up and running.

A $5 million-plus expansion is underway at Traverse City’s Historic Barns Park at the Grand Traverse Commons, with the now-vacant Barn 206 to be transformed into a new Botanic Garden education center. The adjacent Cathedral Barn improvements, a new two-story connecting tower that will join the two barns with common lobbies and universal elevator access, and water infrastructure upgrades are also planned for the property. Architect Ray Kendra of Environment Architects and construction contractor Eckler Building Solutions are overseeing the renovation project, with the barn’s upper level to become the Botanic Garden’s new Debra J. Edson Family Education Center. The center will feature classroom and event space, a demonstration teaching kitchen, a gallery, and office space.

In observation of Veterans Day, the Grand Traverse-Leelanau-Antrim Bar Association is offering free wills and durable powers of attorney for estate planning to veterans on Thursday, Nov. 11, 12pm4pm at the Traverse Area District Library.

Services will be provided free of charge to any veteran by volunteer licensed attorneys from the local area. No registration required, but an RSVP is appreciated by emailing admin@gtlaba.org. Bring a valid ID and proof of military service.

The Festival Foundation – which manages events including the National Cherry Festival, Iceman Cometh Challenge, Cherry-T Ball Drop, and the Leapin’ Leprechaun 5K Race – recently appointed its 2024/’25 board of directors: Max Anderson, president; Kelli Mengebier, president-elect; Mike Meindertsma, immediate past president; Ian Hollands, treasurer; and Nikki Schweitzer, secretary. The Foundation also welcomed new board member Peg Jonkhoff.

Interlochen Public Radio’s “Points North” podcast recently won a national Edward R. Murrow award from the Radio Television Digital News Association. The podcast was honored in the Excellence in Diversity, Equity and Inclusion category for the episode “Complete With His Language: Kenny Pheasant and the Great Lakes’ Original Tongue.” Executive producer and host Dan Wanschura accepted the award at the Edward R. Murrow Awards Gala last month at Gotham Hall in New York City.

The Grand Traverse Regional Community Foundation’s Anchor and Heart Endowment has awarded a $110,325 grant to Munson Healthcare Paul Oliver Memorial Hospital, supporting the Paul Oliver Living and Rehabilitation Center (POLAR). As a long-term care community located within the hospital, POLAR aims to promote a sense of peace and healing and cultivates independence and social, emotional, and mental well-being of its

long-term residents. The Anchor and Heart Endowment grant will be used to support POLAR’s mission, allowing for the purchase of a long-term care resident transport van, long-term care mattresses, and parallel bars for therapy.

Traverse City Light & Power recently opened its second customer service center at 130 Hall St. in downtown Traverse City. “As we continue to enhance our services, we’re excited to open our new customer service center on Hall Street,” said TCLP Executive Director Brandie Ekren. “This new location underscores our ongoing commitment to making it easier for our customers to connect with us and access the reliable service they expect.” The new location is open from 8am-4:30pm, Monday through Friday. Customers can also continue to visit the 1131 Hastings St. location during the same hours.

Impact100 Traverse City recently announced the three area nonprofits that will share $348,000 in grants. The Northwestern Michigan College Foundation, Thompsonville Area Revitalization Proj ect, and Friendship Community Center were each awarded $116,000 after being selected by membership rank vote. The NMC Foundation will use the funding to purchase a 3D printing arm. This 3D printer will revolutionize the construc tion industry in our region by leveraging cutting-edge technologies to construct homes, while also helping students acquire specialized technical skills that will set them apart in the job market. Thompson ville Area Revitalization Project will utilize the grant to construct its keystone project – a bicycle trailhead and an ADA com pliant visitor’s pavilion and campground. And Friendship Community Center hosts Leelanau Investing For Teens (LIFT), a no-cost, out-of-school program for 6th-12th graders in Leelanau County that connects teens with community mentors and offers activities that support their development and mental health. LIFT will utilize the funding to update its classrooms and pur chase a 12-passenger vehicle.

Rain, shine, wind or snow, count on us to help you reach your goals.

Our Demand Response Program rewards businesses for shifting when they use energy. In 2023, participants earned over $7.3 million in incentives to reinvest in their operations, just for the summer. Beginning in summer 2025, Demand Response will be available year-round, with incentives paid at the end of each season. That means more opportunities to boost reliability — and your bottom line.

There’s no better season than now to be part of something bigger for your business and Michigan. Space is limited. Scan the QR code or go to ConsumersEnergy.com/goals today to learn more and enroll for summer 2025 and beyond.

Between the imminent holiday parties, buying presents, decorating, and various other activities, one can get lost in how busy this time of year feels.

At the same time, there are a lot of people and organizations in our community that need our support. For many years, serving on the Advancement Committee of Father Fred, I saw firsthand the needs in our community as staff and volunteers worked tirelessly to make sure families had food on their tables and young kids had warm clothes, especially going into the cold winter months.

Currently serving as the board president of Traverse City Philharmonic and board member of TC Tritons rowing, I have seen the needs of these organizations. At TC Phil, as we playfully say to our friends, we are growing into our new music school where no child will be turned away due to financial constraints.

At the TC Tritons, we provide amazing opportunities for middle and high school students to learn the importance of teamwork and dedication through rowing. Many students additionally receive scholarships that allow them to further their journey after high school. There are so many great local organizations, and they rely on us in one way or another for support.

One thing I have found is that no matter how busy I am, or what other things

I am working through, time invested helping other people and organizations always leaves me feeling uplifted, even on the busiest of days. At the same time, I learn and grow through the process. In talking to others this past year, many have said that they just don’t have time to get involved: “Maybe one day when I retire,” or “Maybe when I reach a certain financial level.” We all have varying degrees of time and resources, many even less than me, but one thing I always reply is that often there are

include in shopping bags to customers to raise awareness. Both ideas are low-time and low-cost, and we hope they can make a small difference and be a win-win.

I have friends who organize golf outings. Not only is this a great win for the charities they sponsor, it also helps them meet new people and show how much they care about our community, all while doing something they love. I personally have enjoyed serving on boards as I learn a lot and get to meet many interesting people. While this can potentially be a

We all have varying degrees of time and resources, but often there are creative ways to help, no matter what the circumstance.

creative ways to help, no matter what the circumstance.

What are some good solutions to help our community even if you are still getting established, investing in a business, or busy with family? Perhaps find ways to partner with organizations.

For example, at Blue Goat Wine & Provisions we are trying something new this fall: We are purchasing TC Philharmonic tickets up front to use in holiday gift baskets. Also, we are handing out flyers with upcoming concerts that we can

EDITORIAL

tcbusinessnews.com

PUBLISHER

Luke W. Haase

lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu

gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

STAFF WRITER

Art Bukowski

CREATIVE DIRECTOR

Kyra Cross Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau Kierstin Gunsberg Rick Haglund

COPY EDITOR Becky Kalajian

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT Village Press

DISTRIBUTION Gerald Morris

SERVING:

Grand Traverse, Kalkaska, Leelanau and Benzie counties

bit more of a time commitment, the right organizations value their volunteers and board members and are very respectful to leverage their skills and knowledge as best as possible.

I sat down with Executive Director Dr. Kedrik Merwin of the Traverse City Philharmonic for some ideas, and he mentioned how even small gifts of $100 or less provide students with scholarships for music lessons. He said some people also sponsor instruments for students, because even if we provide the lessons, they still

need an instrument of their own to play.

On the other hand, other individuals offer rides to a lesson instead of a monetary donation, giving just a little bit of their time to help others in need. At TC Tritons, volunteers help us coach our kids, get meals lined up, and help put workout programs together. Most nonprofits have a lot of things they can use help with – filling envelopes, running quick errands and such – so it’s relatively easy to find an organization whose needs align with something you already enjoy doing. If we all came together to do some of these little things, the cumulative effect would be gigantic.

I hope everyone has a wonderful holiday season and feels the love of all of those around them. Let’s see what good we can do in our amazing community during a time where we often get busy otherwise. Cheers!

Sebastian Garbsch founded Formative Fitness after graduating from Ferris State University with his bachelor’s in business. He is the owner of Blue Goat Wine & Provisions and is currently serving as president of the Traverse City Philharmonic, as well as on the board of TC Tritons Rowing and Downtown Traverse City Association. In his free time, he enjoys spending time with his family, being outdoors and seeking new opportunities that align with his passion for business growth and community engagement.

AD SALES

Caroline Bloemer cbloemer@tcbusinessnews.com

Lisa Gillespie lisa@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris tnorris@tcbusinessnews.com

Michele Young myoung@tcbusinessnews.com

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810. The Traverse City Business News is not responsible for unsolicited contributions.

©2024 Eyes Only Media,

By Art Bukowski

Brandie Ekren is the executive director of Traverse City Light & Power, a post she assumed in March of 2022 after spending 18 years in various roles at the Lansing Board of Water & Light. The Detroit native and Michigan State University graduate is thrilled to be “Up North,” and was glad to show the TCBN around her workspace. If you have an idea for a future From the Desk Of feature, please email Art Bukowski at abukowski@tcbusinessnews.com.

1. I’ve been into Legos probably since I was a kid, and now my sons have really been into Legos. I love planting and gardening, and I recently got turned on to these Lego plants. One of my employees gave me this Lego orchid for Christmas.

2. I am a chronic reader. I love books, I love leadership books, anything that’s about self-improvement or growing as a person. I absolutely love Brené Brown, who is all about resilience and leading with vulnerability, and how that’s actually a strength.

3. This little sign says ‘Trust in the Lord.’ My faith is really important to me. And when I say my faith, it’s more than just religion. I’m a Catholic, but I’d like to say I’m probably a little bit more spiritual than I am religious, and I take my faith and spirituality everywhere with me.

4. We just updated our strategic plan, which is very exciting to me. We’ve refreshed our mission, we did our vision, our values, established new priorities. And it’s all about leading with positivity and being powered by positive energy.

5. I’ve been a Kiwanis member since I was in Lansing. I joined in 2009, probably. I was the

president of that club and was on the endowment board. And then when I got offered the job to come to Traverse City, the local Kiwanis club here reached out to me and invited me to join. The local club is celebrating 100 years this year.

6. This is a calendar called Good Vibes. In essence, it’s daily motivations or affirmations. Today’s is: ‘Success and happiness are side effects of your daily rituals. They’re a natural result of moment to moment decisions.’ It just gives me something to think about.

7. These are called Team Tactics and Workshop Tactics. Obviously, energy and meetings are not the most exciting thing for everybody. So, I try to get all the help I can. These cards guide you through whatever it is that you’re trying to work through in an entertaining and engaging way.

8. I grew up in the inner city of Detroit. And in most of our neighborhoods, you don’t have a lot of forestry or plants. My grandmother was heavily into gardening within the house and within the backyard. Whenever you went into her home or in the backyard, it was comforting. It was like you went into a mini forest, and it was so tranquil. So plants have been my comfort my whole life.

By Art Bukowski

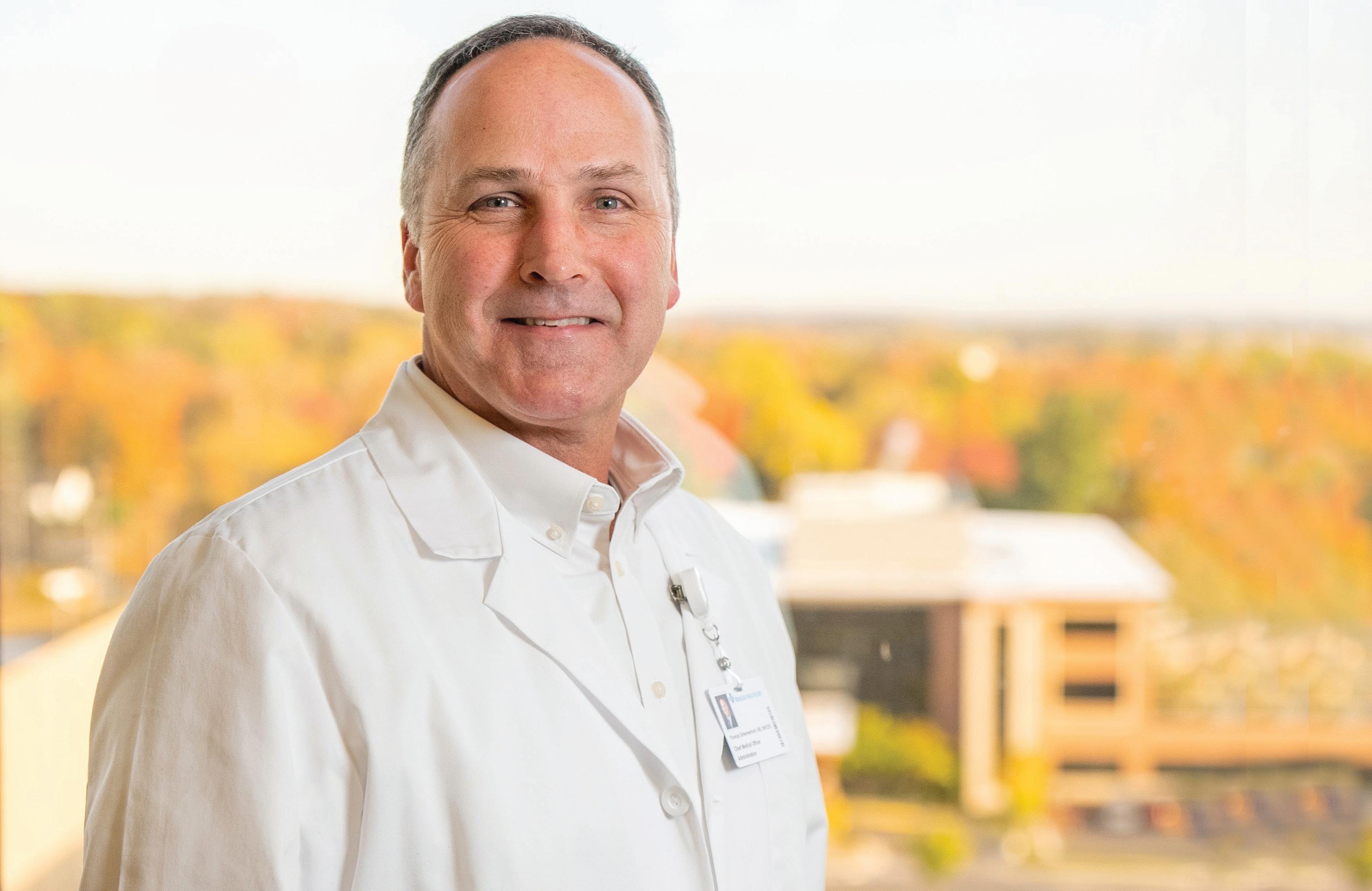

Dr. Tom Schermerhorn wants to be the voice of his fellow soldiers in the halls of leadership.

While he does indeed have a military background, the soldiers in this instance aren’t wearing combat uniforms. They’re in scrubs and face masks. They’re wearing stethoscopes or pushing gurneys. They are the men and women at Munson Medical Center who care for patients week in and week out.

Many things pile up on the plate of Munson’s chief medical officer (Schermerhorn assumed the role in August, replacing retiring Dr. Walt Noble), but Schermerhorn won’t soon waver in his desire to advocate for those out there on the front lines.

“I serve between the Munson administration and Munson medical staff, hopefully to communicate the interests and needs of that staff – not just their

neurosurgeon and is surgical director for Munson Neurosciences. This and his previous decades of experience mean he knows all too well the challenges faced by

“Medicine is hard. Healthcare is a difficult career to be in, and there are days that are physically, emotionally or intellectually demanding that push you to your edge in any one or all three of those realms. I want to serve my colleagues and partners and help them accomplish goals and elimi- nate the barriers and difficulties they’re experiencing.”

– Dr. Tom Schermerhorn, Chief Medical Officer, Munson Medical Center

daily needs, but their strategic interests,” he said.

Schermerhorn, 56, is still “elbow-to-elbow” with his colleagues as a practicing

those in his line of work.

“Medicine is hard. Healthcare is a difficult career to be in, and there are days that are physically, emotionally or

intellectually demanding that push you to your edge in any one or all three of those realms,” he said. “I want to serve my colleagues and partners and help them accomplish goals and eliminate the barriers and difficulties they’re experiencing.”

Schermerhorn is a Kalamazoo native who went to the United States Military Academy (commonly referred to as West Point) right out of high school, intending to head to medical school in short order.

“I was dissuaded by some of the folks I met along that process,” he said. “They said, ‘If you really think a medical career is the route you want to go, West Point’s probably not the right path for you. We send 2% of each graduating class on to

medical school, but that’s not our goal –our goal is to graduate combat leaders.’”

He bucked the trend and did end up in medical school, but only after he “drank the Kool-Aid” and dove head first into U.S. Army service. He was stationed in Europe and served as a platoon leader before heading to medical school after his honorable discharge.

To this day, he draws on the themes and values instilled during his military service. Things like paying attention to details, leading by example and putting nothing above the mission.

“Military service is a servant role. You’re subjugating your own interest for the good of the team, the betterment of the team,” he said. “And medicine is also the ultimate team sport. You put your patients’ interests ahead of your own, and as you evolve into other positions, especially leadership positions, it’s your patients’ interests and those of your team.”

He also sees a lot of similarities between the small-unit leadership he experienced as a platoon leader and now as a respected neurosurgeon.

“When I’m in the operating room, I may have an assistant across from me, a co-surgeon who’s been to medical school and is highly trained. And then I’ll have a nurse in the room, surgical technician, and anesthesiologist,” he said. “But we’ll also have entry-level folks: technicians and aides. So it’s a true team that’s assembled; each person critical to the outcome of that patient.”

After the Army, he went on to Wayne State University for medical school, then to the prestigious Mayo Clinic in Minnesota for his residency and a stop at Wake Forest for a spine fellowship. He also recently obtained a master’s in Healthcare Delivery Service from Dartmouth College.

“I loved my time at Wayne State. It was perfect for somebody that was a little bit older, like I was, because it wasn’t sitting in a classroom. We were in the wards, we were contributing to patient care and patient outcomes,” he said. “It was very hands-on and really a great place to train.”

Schermerhorn arrived at Munson

in 2003 and has been there ever since, raising three children in Traverse City and providing care (surgical or otherwise) for hundreds of patients over the years.

All systems go

Schermerhorn has been closely involved in several initiatives that have ramped up Munson’s care in recent years, including work to establish the hospital as northern Michigan’s only comprehensive stroke center.

Among the goals of that program was enabling local patients to stay in Traverse City for high-level care instead of seeking it out downstate. As CMO, Schermerhorn wants to push the envelope with this line of thinking.

“Our goal is to be able to provide the right care at the right place so that folks don’t have to leave home,” Schermerhorn said. “Considering the impact we were able to make with the growth of the neuroscience program, I want to have that same impact in the growth of other programs and the growth of our health system.”

While he’s all about supporting patients and coworkers, Schermerhorn’s new role will undoubtedly see him tugged in different directions as pressure from inflation, staffing and other business concerns have led to struggles for both patients and providers.

“We try to avoid thinking of medicine as a business, but there are bottom-line interests that we need to keep in mind,” he said. “We have no mission without a margin, so we need to act in a way that still puts the patients’ and our colleagues’ interests first while still being a good steward of our resources and delivering the best care in the most efficient manner.”

While they have enough to cover baseline staffing needs, Munson still needs to hire hundreds of people. Schermerhorn tips his hat to existing employees who have been grinding it out over the past five or so years in unprecedented times. This “particularly dedicated workforce” has been prepared for any challenges ahead, he believes.

“We went from pandemic right into a staffing or workforce crisis, and just as we started to emerge from the staffing crisis, now we have some financial constraints (with rising costs),” he said. “It’s been a trying time, but we were bumped and bruised and accumulated scar tissue in each of those events, and we’ve demonstrated resiliency and grit.”

Munson Healthcare is an independent nonprofit, and for years some people have wondered about its ability to remain independent in a sea of mergers and acquisitions. For his part, Schermerhorn isn’t worried about Munson getting swallowed up. He points to MHC’s regionalization efforts and expansions as evidence of a healthy system.

“I don’t feel like we’re vulnerable,” he said. “We’re doing good things financially…and we have significant plans for additional projects we plan to undertake.”

He’s also aware of (but not overly threatened by) independent radiology centers like Novello Imaging that are nipping at Munson’s heels from a business standpoint.

“Competition’s a good thing. Competition keeps us sharp on our game,” he said. “If we’re not delivering the most efficient, cost-effective care, then somebody’s going to come in and try to do that. So this will keep us focused.”

‘WE’VE

Supreme Court deals a blow to agencies that regulate health care, finance and more

By Rick Haglund

For the past 40 years federal agencies, including the Food and Drug Administration, the Environmental Protection Agency and dozens of others, have exercised broad powers in regulating most industries providing goods and services to consumers.

Consumer advocates say the work of these agencies has been critical in protecting the nation’s food supply, the environment, the financial system and consumer safety. Businesses, however, have long complained the rules have become increasingly onerous, amounting to government overreach.

But a landmark U.S. Supreme Court ruling in June dealt a severe blow to the agencies’ regulatory power, establishing that courts no longer must defer to federal agencies in interpreting ambiguous laws.

Local attorneys and business leaders say it’s too early to gauge the impact of the ruling but say it will likely be significant with positive and negative implications.

“We’ve been watching that case very closely,” said John Lynch, a Traverse City business law attorney who specializes in representing business startups. “It’s going to be very interesting as it impacts almost every facet of executive and administrative agencies.”

In 1984, the Supreme Court ruled against oil company giant Chevron USA Inc., in a case involving the EPA’s definition of a term in the Clean Air Act. It said courts must defer to the judgment of agencies in carrying out laws that are unclear. The concept is commonly known as “Chevron deference.”

Since then, thousands of lower court rulings have upheld the Chevron deference. But in a major reversal in June, the Supreme Court said courts can no longer be

required to defer to federal agencies in interpreting ambiguous laws. They must do it themselves.

The ruling came in a case involving a group of New England commercial fishing businesses known as Loper Bright Enterprises that sued the U.S. Commerce Department over a rule requiring them pay on-board government monitors an estimated $710 a day. Justices voted 6-3 in favor of Loper Bright, with all three liberal judges voting against the fishing businesses.

“The gates are now open” to challenge federal agency rules “because the bar has been lowered,” Lynch said.

One of the major industries already challenging those rules is the highly regulated health care business.

Just days after the Supreme Court ended Chevron deference, Hackensack Meridian Health in New Jersey sued the Centers for Medicare and Medicaid Services over what the hospital system said were too-low reimbursements.

A spokeswoman for Munson Healthcare in Traverse City says the Loper Bright ruling will likely result in significant rule-making changes affecting hospital systems.

“While the decision by the Supreme Court does not immediately change any specific health care policy, we are likely to see its impact through scaled back federal rule making in areas where federal law is

“We’ve been watching that case very closely. It’s going to be very interesting as it impacts almost every facet of executive and administrative agencies.”

– John Lynch, Lynch Law Firm

silent or unclear and Congress having to be more specific in its legislative efforts, ultimately shifting many policy decisions from agency technical experts to federal judges,” said Megan Brown, Munson Healthcare’s chief marketing and communications officer in a statement.

Local banks and credit unions deal daily with regulations promulgated by a variety of federal agencies, including the Federal Deposit Insurance Corp., the National Credit Union Administration and the Consumer Financial Protection Bureau.

Honor Bank President and CEO Nor-

Expand

Even before shovel hit dirt, Mike and his team navigated the complex township permit process, engineering hurdles, etc. — working closely with us to truly build our vision.

We’ve worked with Burdco on multiple projects over the last five years for a reason.

– Josh Manthei

President, Manthei Supply

man Plumstead says he thinks the Loper Bright decision could cause more regulatory uncertainty for financial institutions.

“My perspective is that the decision will change how banking regulators write their rules because of the increased legal challenges they may face,” he said. “While it’ll take time to see the full effects, we’ll likely see more lawsuits about banking regulations in the short term. Down the road, this could make the regulatory environment more complicated.”

Andrew Kempf, president and CEO of 4Front Credit Union, says the end of

Chevron deference could slow the deluge of rule-making that often occurs near the end of a presidential administration.

“Every four years things change, which confuses consumers and business,” he said. “It’s untenable.”

For example, Kempf says he’s seeing a “rush” of agency rules coming forward that could get overturned if Republican Donald Trump wins the November presidential election.

But a potential flood of lawsuits challenging agency rules citing the Loper Bright decision could take years to resolve,

“My perspective is that the decision will change how banking regulators write their rules because of the increased legal challenges they may face. While it’ll take time to see the full effects, we’ll likely see more lawsuits about banking regulations in the short term. Down the road, this could make the regulatory environment more complicated.”

– Norman Plumstead, President and CEO, Honor Bank

creating “a very confusing environment for all of us in the financial institution space, as well as our members as we navigate our new reality,” he said.

Advocates for people with disabilities fear the end of Chevron deference will lead to rulings by conservative judges that could gut the Americans with Disabilities Act. The landmark 1990 law prevents discrimination against those with disabilities in a wide range of areas, including employment, health care, transportation and government services.

But Brandon Dornbusch, a Traverse City attorney whose practice encompasses elder law and representing families with special needs, said the Loper Bright decision might also result in the removal of overly restrictive rules that prevent

certainty in the regulatory landscape in general,” Dornbusch said, “it opens up a lot of opportunities for disability advocates to push back (against rules) that unduly restrict the ability of individuals and families to plan for their future and qualify for benefits.”

For example, the state’s interpretation of asset limitations to qualify for some Medicaid-paid care under federal law is often so strict “that it’s impossible for an applicant to qualify,” said Dornbusch, who’s on the board of directors of the Disability Network of Northern Michigan.

Legal experts say stiff new Environmental Protection Agency pollution rules for power plants are also likely to be chal-

said the Loper Bright ruling “is certainly significant in terms of altering a 40-year precedent.”

But she also says the decision should have little short-term impact on the municipal utility, because it doesn’t generate its own power. Light & Power jointly owns a power plant and purchased power contracts with other utilities.

Lynch says the significance of the Loper Bright decision for businesses, and state and local governments could

rule-making agencies, such as the Michigan Liquor Control Commission and the Michigan Department of Environment, Great Lakes and Energy.

A 2018 Michigan Supreme Court ruling ended Chevron-style deference for state agencies and said courts must decide the meanings of ambiguous state statutes. But the decision also allowed for the “respectful consideration” of agency rulings, which has muddied its enforcement.

By Art Bukowski

Health insurance is big. It’s rigid and established. There’s simply not a lot of room to reinvent things.

That’s not going to stop Rick Abbott from trying.

Abbott is the (relatively) new senior vice president of employer solutions at Priority Health, one of the biggest players on the Michigan health insurance scene. He’s spent about half of his career in health insurance and half in small startups, where rocking the boat is not only common, but necessary.

His goal at Priority is to show that the status quo isn’t sacred, even if change seems overwhelming or impossible in a relatively static industry. Throw a little of that startup mindset in there, he says, and watch the magic happen.

“What we’re trying to accomplish here at a high level is to make healthcare far more affordable and better from an experience perspective, but at a more specific level, I want to demonstrate that health plans that have been around for 30 years can actually disrupt the healthcare ecosystem from the inside,” he said. “We can make a difference.”

In his role, Abbott leads Priority’s commercial business, serving companies large and small across Michigan. He oversees a market-focused team that includes product innovation, wellness, underwriting, sales and client services, sales operations and marketing.

“It’s a pretty broad role that gives our team the ability to really impact change, and do so in a way that is far more quick than others across the country,” he said.

He came to Priority in June 2023 after most recently serving as co-founder and CEO of Lyn Health, a startup that provided clinical, advocacy and care coordination services for people with multiple chronic conditions.

Prior to that, the Chicago-area native and father of five spent several years in various roles at Blue Cross Blue Shield and Aetna, along with several years playing key roles in healthcare startups. Time in “both worlds” provided various important lessons, but the hustle of startup culture is something that still gives him energy and guidance.

“The trait of scrappiness inherent in

“What we’re trying to accomplish here at a high level is to make healthcare far more affordable and better from an experience perspective, but at a more specific level, I want to demonstrate that health plans that have been around for 30 years can actually disrupt the healthcare ecosystem from the inside. We can make a difference.”

- Rick Abbott, Senior Vice President of Employer Solutions, Priority Health

startups is invaluable,” he said. “The ability to say, ‘I’m going to have resilience and I’m going to focus on the solution and work through every single barrier that I can to get to what I need.”

Abbott also has experience being uninsured (he was part-time at his first stint at Blue Cross Blue Shield), which motivates him to make such a vital benefit more accessible.

“So here I was working at Blue Cross and I was uninsured, which is kind of crazy to think about,” he said. “And I remember that time how scared I was to go to a doctor because I had to pay the whole bill. You kind of walk on eggshells because if you break an arm or something catastrophic happens, that’s your bill, and you’ll be scared about where you can go (for care).”

A company like Priority is in an ideal position to drive change, Abbott says, especially when you look at it from a purely resource standpoint.

“I think there are things we are able to do here that any startup or progressive company would love to be able to do but just can’t because they don’t have the financial or technological assets,” he said. “We have an abundance of resources here to tackle really big problems, so I’ve challenged our product team: How do we look at the resources we have and use them to be innovative and pioneering?”

Idealism is also not lost on Abbott, who pushes his team to remember that the mission of a health insurance company is first and foremost to help people get the care they need.

“We want to…lift up our communities,” he said. “We really want to impact the vulnerable population.”

Thus came several initiatives designed to boost accessibility to (and affordability of) services, a general theme of programs begun under Abbott’s watch.

“We’ve launched programs that give people access to physical therapy through artificial intelligence in the comfort of their own home so they can actually go through those treatments and do it when

it’s convenient for them. It’s highly accessible and it’s completely free to them,” he said. “We’ve also made fertility benefits and adoption and menopause benefits infinitely more affordable and accessible by how we contract with startups that actually do those services really, really well.”

A few months ago, Priority launched a program with virtual care provider Curai

are,” Abbott said. “Can we solve all of the health problems that everyone might have? No, but at least we can give them a starting point and point them in the right direction to resources that might be available to them.”

The startup junkie in Abbott wants to not only bring more services like these online, but to get them spreading throughout the healthcare industry.

“Most people who carry health insurance with any company view their health insurer as a financial company, and I think that’s what fundamentally has to change. I want people to view their health insurer as an advocate for them that helps them navigate the entire health care ecosystem… to know that your health insurer is constantly thinking about you and your needs and doing things proactively to make your life easier.”

- Rick Abbott, Senior Vice President

of Employer Solutions, Priority Health

Health that provides free virtual visits to Michigan residents 18 and older who don’t have health insurance. While virtual care has some drawbacks, it’s a huge jump in the right direction, Abbott says.

“You can live in a very rural community with no provider access at all or in downtown Detroit, and either way we’re going to be able to bring access to you right where you

“(The startup mentality is to) demonstrate that you can solve a very specific need and do it better than anybody else, and then take that core concept and expand it to more populations,” Abbott said. “Get something out that we know is high quality, has been tested and will impact the lives of the members we serve, and once we prove it does, then let’s scale and expand it.”

That requires cooperation between providers and insurance companies, something Abbott says is vital to future innovation in the industry.

“A health system has to make sure they’re being reasonably compensated for the services they provide and a health plan has to make sure that compensation isn’t higher than it needs to be to be able to keep health care affordable. That can create a lot of friction between the two most dominant players in the health care system,” he said. “The more we can find partnerships and collaborations between health systems and health plans, the better we can work together to make sure that people…have a great experience.”

Ultimately, Abbott’s goal is to change the way people think about health insurance. It’s not going to happen overnight, but it can happen one step at a time with programs like those described above, he believes.

“Most people who carry health insurance with any company view their health insurer as a financial company, and I think that’s what fundamentally has to change,” he said. “I want people to view their health insurer as an advocate for them that helps them navigate the entire health care ecosystem… to know that your health insurer is constantly thinking about you and your needs and doing things proactively to make your life easier.”

By Michael Corby, columnist

As we enter the holiday season and begin looking ahead to the New Year, it’s a time that is accompanied by a sense of new hope, which is something we are seeing tangibly take form at 410 Brook St. Thanks to significant investment over the last year by Grand Traverse County, state and federal government, Munson

By Terri Lacroix-Kelty, columnist

Healthcare (MHC) and Northern Lakes Community Mental Health Authority (NLCMHA), our community now has the resources to establish the Grand Traverse Mental Health Crisis and Access Center (GTMHCAC).

With The Center set to open Jan. 5, we are in the final stages of constructing,

staffing and operationalizing the project that when complete will provide care to patients at any age, regardless of their ability to pay.

Michigan is among the most under-served in the country when it comes to the accessibility of mental health resources, and this is especially true in rural areas of the state like northern Michigan. This will change for us in the coming year as The Center provides expanded access to this care and brings mental healthcare services under one roof in a physically, psychologically and emotionally safe environment that promotes healing and growth.

Led by a director and leadership team of community mental health partners, The Center will be subject to the same staffing and operational complexities as any other non-profit healthcare organization. However, a shared staffing model between NLMCHA and Munson is designed to gain efficiencies that will aid in providing timely access to care and help reduce strain on other community

resources such as emergency departments and jails.

To meet the needs of the community, we will incrementally add services and increase hours of operations as we ramp up staffing in four phases between January and fall 2025.

In Phase One, the center will open its doors on Jan. 5, 2025, initially operating Sunday through Thursday from 8am-8pm with NLCMHA providing:

• A Welcoming Center where patients can receive behavioral health assessments as well as information and referrals connecting them to resources in the community and to outpatient therapy

• Crisis phone screening

• Mobile crisis and peer support services

Phase Two is anticipated to begin July 1, 2025, at which time the facility will be open 24 hours a day, seven days a week. This phase will include the addition of psychiatric urgent care operated by Munson and a “Living Room” model of care

facilitated by Northern Lakes.

Psychiatric urgent care is an intermediate level of care between community-based services and acute care services, such as an emergency department or inpatient care. This level of care can often prevent urgent situations from escalating while also providing a broad range of mental health services that include:

• Medication management

• Crisis intervention

• Stabilization

• Counseling

• Social work and psychiatric assessment

• Illness education

• After-care plan

The Living Room model of mental health care is based on the idea that people experiencing a mental health crisis want a safe, home-like place to go that isn’t a hospital or emergency department. In this more comfortable, non-clinical setting, people will be able to receive crisis intervention, stabilization services and support from staff who have their own experience with mental illness or substance use disorder.

Phase Three will include nine NLCMHA adult residential beds slated for summer 2025, with Munson Healthcare’s six pediatric residential beds scheduled to come online during the final phase sometime in fall 2025. The timing of the

final two phases will be dependent on the licensing process.

Even more important than the brick and mortar of the center is the team we are building to provide support and care for our patients. Healthcare overall is experiencing nationwide staffing shortages which can be even more prevalent within mental health services. According to Mental Health America, only one mental

region will have a determining role in setting the dates to opening residential care units.

When we look back a year from now, we will see benefits from putting this crisis services continuum in place. Research tells us that:

• Eighty percent of those using hotline services will resolve their crisis over

The model is designed to provide multiple options for those in mental health crisis with the ultimate goal to provide care upstream, before someone reaches a point of crisis.

health care provider is available for every 350 people in the U.S.

We are well into the process of recruiting and hiring more than a dozen master’s degree, bachelor’s degree, and registered nurse positions to staff the center. While the quality of life in northern Michigan coupled with the opportunity presented by this new program makes it an attractive prospect for job candidates, their availability to relocate to the Grand Traverse

the phone.

• More than 70% receiving care from mobile teams will resolve their crisis in the field.

• Nearly 70% of those who come to the GTMHCAC will be discharged to the community.

• Eighty-five percent of those receiving care in any of these three venues will remain stable through community-based care.

The model is designed to provide mul-

tiple options for those in mental health crisis with the ultimate goal to provide care upstream, before someone reaches a point of crisis. Doing so will help prevent overburdening law enforcement and emergency medical staff, reduce demand for inpatient behavioral health beds and most importantly, ensure people are receiving care in a setting that is most conducive to helping them heal.

An open house is being scheduled for December to introduce the center to the public and celebrate this far-reaching collaboration between community mental health partners and non-profits; Grand Traverse County; local, state and federal elected officials; the Community Advisory Group; CHIR Behavioral Health Initiative and the United Way.

This project truly reflects the strength and compassion of our community. We should not only be proud of the new path we are helping to forge for other rural areas like our own but optimistic about taking this step toward greater mental health and well-being for our friends, neighbors and loved ones.

Michael Corby is the behavioral health director for Grand Traverse Mental Health Crisis and Access Center. Terri Lacroix-Kelty is executive director of behavioral health at Munson Healthcare.

Health care careers start at NMC

Nursing: Practical nurses (PNs) Licensed practical nurses (LPNs) Associate degree (ADNs) Bachelor of science (BSNs) (through Davenport University)

Medical billers and coders Physician Assistants (through GVSU at the University Center) Surgical Technologists

By Andi Dolan, columnist

Operating a business in northern Michigan requires the delicate balance of both grit and grace.

Our beyond-stunning, four-season landscapes and vibrant festival-filled shorelines present unique challenges for business owners, especially when it comes to recruiting and retaining skilled employees.

Attracting seasonal workers while also engaging and keeping current hires happy is vital for developing a successful and sustainable workforce. Identifying the right talent is just one aspect…determining which benefits to offer and managing them within a budget demands a thoughtful and ongoing strategy.

Implementing impactful programs that are both cost-effective and enhance employee satisfaction doesn’t have to break the bank. Here are a few budget-friendly items to add to your annual open enrollment offerings.

One of the least expensive, yet highly valued benefits, is group life insurance. Typically, these employer-paid policies are guaranteed issue, meaning employees receive coverage regardless of any pre-existing conditions – no awkward medical questions are asked. Offering a group life plan not only shows that you care about your employees, but it can also positively influence your recruitment efforts.

For approximately $10 per employee per month (PEPM), employers can provide a solid, basic life insurance plan that offers priceless peace of mind for employees and their families. Knowing their loved ones are financially protected in the event of an unexpected loss creates a supportive workplace atmosphere. This is one mighty way to invest in your employees and strengthen their loyalty to your organization.

Another wise and very timely enhancement for your menu: offering an Employ -

ee Assistance Program (EAP). EAPs deliver confidential counseling and support services to help employees tackle personal and professional challenges. This low-expense and highly valued resource averages $25 to $30 per employee, per year (PEPY). Providing employees and their families access to mental health support, financial counseling and legal advice fosters an environment that prioritizes their overall wellness. EAPs can significantly improve productivity, reduce absenteeism and contribute to a more positive work culture and climate.

Employer-paid group accident plans are an inexpensive and valuable investment that offers financial safeguards for employees facing accidental injuries, on and off the job. By providing assistance for unexpected medical expenses, hospital stays and emergency room visits, these plans help alleviate financial stress for your hard-working crew. Ranging from $8-$25 PEPM, employers can show a strong commitment to their team’s financial fitness when unforeseen mishaps occur.

Flexible Spending Accounts (FSAs)

Flexible Spending Accounts (FSAs)

are another cost-effective benefit to add to your menu. With a low start-up price tag and small admin fees, $60 PEPY is a bargain considering the significant tax savings this vehicle provides.

Employees may allocate more than $3,000 pre-tax dollars from their paychecks to an FSA to offset their ongoing annual medical, dental, vision expenses. This benefit may also allow for $5,000 of pre-tax dollars to be used for dependent daycare expenses. Bonus feature: employers may make tax-free contributions of up to $500 to eligible employees’ accounts, offering extra financial support (and further tax savings).

FSAs encourage employees to plan for their annual expenses, in turn easing financial burdens and promoting better financial management. A key advantage: employees may access their full contribution at the beginning of the year, allowing for immediate use for eligible expenses.

A frequently overlooked feature of employee benefits is the importance of clear and comprehensive compensation statements. These annual summaries outline total rewards, not just including salary, but also Medicare, Social Security payments, employer contributions for

health premiums, 401K, paid time off and all other perks in-between. By providing this transparency, employees can better understand the full value of their compensation package. This clarity not only enhances their appreciation but also strengthens their connection to their employer’s commitment to their financial and personal health.

Enhancing your benefits menu doesn’t have to be costly. Affordable options are not only achievable but essential. With group programs such as life insurance, EAPs, accident plans and flexible spending accounts, employers can provide valuable support to their workforce without straining their budgets.

Regularly reviewing and communicating this information not only helps employees feel valued but also plays a crucial role in building a motivated and satisfied team, ultimately contributing to longterm success for both the employees and the organization. In northern Michigan we work hard and play hard! Protecting your team’s well-being today will yield lasting results.

Andi Dolan is the owner of Traverse Benefits, a local independent insurance agency advocating and providing health, life and disability solutions for employers, individuals and Medicare beneficiaries across northern Michigan.

Medical Office Building For Sale! - 11,486

Sq/Ft. Main Level is 6,187 Sq/Ft. Walkout Lower Level is 5,299 Sq/Ft and Features a Large Open Area w/Picture Windows providing lots of natural light. Excellent for Physical Therapy, Patient Assessments, Gym Related Activities! Current tenant (month to month) is utilizing the lower level (some lab space), and approx. 2/3's of the main floor. The owner is using approx. 1/3 of the main floor & shared common areas. Owner leaseback is negotiable or buyer could use the entire building if needed. Many individual offices of various sizes. Close to Munson Hospital surrounded by a variety of Medical Practices. Virtual tour Online –MLS# 1919691 - $1,499,000.

MIXED USE COMMERCIAL - Great Opportunity - One Building a Large (40x44) Insulated Warehouse -15 ft Sidewalls -14x20 Sliding Doors for Large StorageSecond Building has a Reception - Office - Restroom Area and a Unique Building Attached with 11 ft Sidewalls - Epoxy Floors - Steel Ceilings - 3 Sink Stainless - Double Doors for Deliveries in Main Workspace w/4 Individual Work Rooms. Could be Opened up for One Large Space. Light Manufacturing could be a great Contractor or Woodworking Workshop! Rental or Cleaning Business, etc. etc. US-31 Highway Frontage & Exposure for Signage on Building. Improvements include 3 phase electric in both buildings - Paved & Plumbed w/ New Drainfield, & Security System. MLS# 1922900 $459,900.

By Kierstin Gunsberg

Northern Michigan dentists are dropping dental insurance carriers because of stagnant reimbursement rates and increasing operational costs.

Consequently, patients paying premiums for their employer-provided dental coverage are finding that their dentist no longer accepts their insurance, most notably Delta Dental, which is offered by some of northern Michigan’s largest employers such as Munson Medical Center.

Delta – which currently participates with thousands of dental offices across Michigan – appears to be the most commonly dropped carrier, purely based on numbers. But many dentists that are dropping Delta say they are simultaneously dropping other insurers too, or will soon.

That’s because “the reimbursement rates are not increasing with the cost of doing business,” said Dr. Hayley Popp of Associates in Family Dentistry.

“Dentistry

is an investment, not an expense. It’s still healthcare that everyone needs to live a healthy life.”

– Dr. Hayley Popp, Associates in Family Dentistry

Some insurance companies haven’t raised their reimbursement rates in a decade, says Dr. Ryan Paulson of Grand Traverse Smile Center, who adds his practice continues to accept dental insurance but understands why it’s becoming unsustainable for others.

Some insurers like Delta Dental of Michigan claim to have paid an additional $184 million to providers over the last three years by raising reimbursement rates. Dentists argue that these rates remain outdated and say that the

compensation fails to cover the rising costs of running a practice and keep pace with inflation.

According to a 2024 American Dental Association report, earnings for general practice dentists have declined slightly over the past decade, with the average general practice dentist netting just over $218,000 annually. In Michigan, that figure is even lower – around $166,000, according to ZipRecruiter.

“We all know everything costs more. That isn’t any different for dentists,” added Paulson, noting that labor shortages in the hygienist and assistant pool and the need for competitive wages further drive up expenses.

In addition to rising labor costs, dental practices – most of which are run by sole proprietors or small partnerships – have to account for growing behind-thescenes expenses like equipment depreciation and office management software fees.

“Inflation has affected everything,” said Paulson.

Both Popp and Paulson note that the function of dental insurance has historically confused patients, who often assume it works the same way as health insurance. It turns out that’s not the case.

While dental insurance typically has lower premiums than health insurance, it also comes with annual coverage caps and only covers a percentage of most procedures. In contrast, health insurance has higher premiums and outof-pocket costs but no annual cap on coverage. Navigating this confusion has long been part of handling the billing side of the business, but it’s the increasing difficulty of getting paid by insurance companies that’s becoming the real deal-breaker for dentists.

The real hidden cost of running a dental practice isn’t just overhead—it’s the revenue lost from insurance companies capping reimbursements. To minimize their own expenses, insurers often limit reimbursement rates or require dentists

to write off portions of their services.

For example, if a patient with a $0 copay comes in for a basic dental cleaning and the office charges $112 for the service, the dentist would expect the insurance company to reimburse the full amount. However, if the insurance company only reimburses $78, the $34 difference falls on the dentist. That $78 might have covered all the supplies and labor for a basic cleaning a couple of decades ago, but not these days, say dentists.

In most businesses, price points would just increase to keep up, but dentistry is different, since most dentists base their pricing on guidelines set by their regional American Dental Association chapters. In northern Michigan, that’s the Resort District Dental Society.

Another challenge is the treatment guidelines imposed by insurance companies, says Popp.

She thinks that insurers are too quick to deem treatments unnecessary, basing their decisions solely on paperwork and predetermined policies instead of considering the patient’s long-term needs.

If an insurer doesn’t see a treatment or part of a treatment (say, nitrous oxide for a pediatric extraction) necessary, they won’t cover it. In turn, patients are hesitant to follow through on treatment plans.

“If the insurance believes a tooth doesn’t need a specific treatment based on the X-ray, it creates tension with the patient, who might ask, ‘Why does my insurance say I don’t need it, but you do?’” Popp said. “They’ve never met the patient or seen their entire mouth, nor do they understand the individual characteristics we consider when making treatment decisions. When they refuse reimbursement, they essentially tell us that because we’re in-network, we can’t bill the patient and must write off the costs.”

Shifting models and the perks of going out-of-network

That red tape, combined with the financial impact, is why some practices are choosing to go out-of-network or be-

“Dentists leaving insurance networks have determined that reimbursement rates don’t work for their practice for various reasons.”

– Dr. Ryan Paulson, Grand Traverse Smile Center

come “non-participating.” Popp’s group, Associates in Family Dentistry, is one of them. After the New Year, they’ll transition to non-participating status with all dental insurance.

For insured patients whose dentists go out-of-network, Popp explained that they’ll still have coverage, because dental insurance continues to cover portions of treatments and procedures regardless of a dentist’s participation status. But things will look different at the check-out counter. Instead of patients handing over their usual copay, they’ll now need to pay the full cost of treatment upfront, then wait on their insurance to reimburse them for the covered portion.

And that covered portion may be less than they’re expecting, since out-of-network dentists will be passing the cost that they used to write-off directly to the patient in addition to their copay. As for what the extra cost will look like, there’s no solid answer since treatment costs vary, but patients can expect to pay anywhere from an extra $30 to $300 or more per visit.

Stagnating reimbursement rates aren’t unique to Michigan. A 2023 American Dental Association report revealed that while private practice revenues rose by 2.2% nationally, expenses increased by

7.7%, resulting in lower profits across the country. In response, some urban dentists are turning to membership models similar to direct primary care (DPC), but Popp thinks it will take time for that trend to reach northern Michigan.

For now, she hopes her patients will recognize the value of maintaining oral health through preventive care, even if it costs more out-of-pocket.

“Dentistry is an investment, not an expense,” she said. “It’s still healthcare that everyone needs to live a healthy life.”

Meanwhile, some patients wonder if dentists are being greedy by going out-ofnetwork, but Paulson says that it’s not a decision made out of greed.

“Dentists leaving insurance networks have determined that reimbursement rates don’t work for their practice for various reasons,” he said. “It isn’t anyone being greedy or uncaring about patients. It’s just a personal and business decision that each individual dentist or group practice has to make.”

As for why so many dentists are making that decision now, Paulson says the challenges of working with dental insurance have been building over the last several years and have finally hit a tipping point.

“Some have just finally had it,” he said.

Open enrollment a busy time for HR professionals, insurance brokers

By Art Bukowski

It’s that time of the year again. Human resources professionals and benefits providers are in the thick of open enrollment. This is the designated (and often only) time employees can make important, sometimes life-altering changes to their health, vision and dental insurance or other benefits. Miss out now, and with the exception of a qualifying event (divorce, birth of a child, etc.), they’ll have to wait another year to make changes.

While some businesses that operate on a fiscal year go through this process in spring or summer, most businesses operate on a calendar year and are in the open enrollment window from October into early December to get the following year’s benefits in place.

The TCBN connected with HR folks and benefits professionals to talk about the importance, evolution and current state of this critically important practice.

The basics

Employees at most businesses and organizations now complete open enrollment online via various software programs, replacing the stacks of paperwork that were until a decade or so ago inseparable from this process. This makes the situation for both employees and employers faster, easier and less prone to error.

“If the enrollment process is…complicated or confusing, that definitely adds to difficulties,” said Hollie DeWalt, asso-

ciate vice president of human resources at Northwestern Michigan College.

“When you have software that works well, and we’ve used it consistently year over year, it becomes a much smoother process.”

There are other benefits inherent in such programs. Jennifer Ewing provides part-time HR services to several local organizations via Traverse City-based Human Resource Partners. She said the use of artificial intelligence in these (and many other) software programs leads to a very intuitive experience for employees.

“A lot of these platforms now have AI that will help, using things like chat boxes that will prompt questions and help them walk through the decision-making process,” she said. “That’s kind of a cool new use of AI.”

Before employees settle into the process, however, they need to know it’s coming, so HR folks like to hammer them pretty hard ahead of time to make sure this open enrollment window is on their radar. Although it’s different with every employer, most will set a limited window (usually no shorter than 10 days, often in November) in which employees can make changes to all available benefits.

“We do lots of communication in many different formats. Email, internal newsletters, things like that, and we have benefit guides that we send out,” DeWalt said. “We schedule Zoom meetings to go over all of the benefit information for the new year...I send calendar invitations to every person.”

Those helpful online systems also add an extra boost in this regard, DeWalt said, by making it harder for open enrollment to slip through the cracks.

“In our software system, if you haven’t gone in and made your elections, the system will send you a reminder,” she said. “So that helps to keep track of all of that.”

All things combined create a relatively “well-oiled machine” in which few people miss the open enrollment window at NMC, DeWalt said. But it happens.

“If someone comes after the window’s closed, then we’re going to look at that on a case-by-case basis,” she said. “If someone doesn’t get enrolled in a benefit before the new benefit year begins in January, however, then there does have to be a qualifying event in order to make a change.”

While representatives from the insurance companies or other benefits providers are sometimes involved, it’s far more often that employers bring in folks from their insurance brokers to educate employees and answer questions before and during the open enrollment period.

“A strong, well-rounded agent broker will be fully participating in that open enrollment process. They may be on site doing large group meetings or one-on-one meetings to explain the new benefits package. They’re creating handout materials that you can share with employees,” Ewing said. “A good agent broker can really make or break the enrollment process.”

That’s in part because what seems like a straightforward process can often be a true struggle for many employees trying

“We focus a lot of attention on building that understanding of what generates rate increases and ways they as a consumer can help mitigate that. So not to take anything away from our local hospitals, but if we’re trying to contain and flatten our renewal rates year over year and save the individual some out of pocket money, we are going to educate and make sure that they’re aware of these other outlets.”

- Kurt Swartz, managing partner, Michigan Planners

to make the best and most cost-effective decisions about coverage, and the brokers are intimately familiar with the plans they lined up for their clients.

“If my spouse works in company A and I work in company B, how much would my spouse pay for an individual plan? Is it cheaper for them to be on my plan? Should my children be on one plan or the other?” Ewing said. “People can really struggle with decision-making and what’s best for the family for that year.”

Kurt Swartz is managing partner at Michigan Planners, a broker that through its Traverse City office coordinates the benefits for the City of Traverse City, Goodwill Industries, Shoreline Fruit and many other private and public organizations in northern Michigan.

“We focus a lot of attention on not only servicing the C-suite decision makers at the employer, but also on the employees and being there as a resource for them and their insured dependents as they navigate insurance,” he said. “So that really alleviates a lot of the revolving door noise that comes to the HR professionals.”

During open enrollment (and indeed throughout the year), Swartz’s goal is to keep as much work as possible off the HR department’s plate.

“We funnel all of that through our agency so that it frees up the HR folks to do what they do best, which isn’t administering the benefits, but focusing on their employees, recruiting, retention

and overall culture at their company,” he said.

Aside from getting people into the right plans and benefits by asking good questions, Swartz said his firm works hard to keep costs down for employees during the upcoming year and over time, and a lot of that is done through education. An MRI at an independent imaging center might cost a fraction of what it does at the hospital, for example, but people can’t take advantage of that if they don’t know about it.

“We focus a lot of attention on building that understanding of what generates rate increases and ways they as a consumer can help mitigate that,” he said. “So not to take anything away from our local hospitals, but if we’re trying to contain and flatten our renewal rates year over year and save the individual some out-ofpocket money, we are going to educate and make sure that they’re aware of these other outlets.”

Finally, a good agent can help you avoid overpaying for the plan itself, Swartz said.

“The struggle that we have that’s happening more often is individuals who are relatively healthy will allow themselves to be talked into a more expensive insurance plan by their co-workers and peers versus listening to an insurance professional,” he said. “And they’ll spend years in these plans overpaying for insurance that they may only use for preventive care or maybe not even use at all.”

Certified WOC nurse, specially trained at the prestigious Cleveland Clinic. Holistic,

Wound Care Expertise

Ostomy Support Continence Care/Resolution

For compassionate in-home care for your loved one, lean on us.

By Craig Manning

More than $1 million of donated dental health services, impacting 1,700 patients across 2,400 patient visits.

That’s a quick rundown of the first 365 days at United We Smile, the first-ofits-kind charity dental clinic United Way of Northwest Michigan (UWNWMI) launched one year ago.

Speaking to TCBN sister publication

The Ticker last spring, UWNWMI Executive Director Seth Johnson said his team had spent much of the pandemic looking “at how we can better serve the community.” As he explained it, the community impacts of UWNWMI – and other United Way branches across the country – have historically “been a lot around fundraising and grant-making.”

COVID-19 got the organization thinking about how it might be more hands-on in meeting local needs, with UWNWMI ultimately landing on dental care as an

area where it could orchestrate some much-needed change.

“We realized that there’s just a massive lack of dental care for children in our region, as well as for pregnant women, for

“I’ve

School of Dentistry and Traverse City’s Resort District Dental Society (RDDS) to treat patients who might not otherwise be able to afford dental care. The clinic opened its doors at Copper Ridge in

definitely had a lot of calls from other United Ways. They’re saying, ‘How did you do this? Dental care is an issue in my community, too. How could we structure something like this?’ No one’s done it yet, but we’re happy to help if they do.”

–

Seth Johnson, Executive Director, United Way of Northwest Michigan

veterans, and for those with developmental and cognitive disabilities,” Johnson said. “It got us thinking about what we could do to address those problems.”

That thought process led to United We Smile, which harnesses donated services from the University of Michigan

September 2023, making UWNWMI the first of the more than 1,100 United Ways around the world to operate its own dental clinic.

A year later, Johnson says UWNWMI might have actually underestimated how much northern Michigan needed a free-

of-charge dental clinic.

“We have a big waitlist of veterans who are interested in becoming patients,” Johnson said. “We have people who are traveling long, long distances to get here. We have families coming from far south of Cadillac, or from the U.P., just to receive care. I think that shows how wide of a need there is for dental care. It’s quite striking and stark – and daunting.”

“Daunting” might be an understatement given how demand at United We Smile still far outstrips the clinic’s capabilities. One of the big goals for year two, Johnson says, is to shorten that gap.

“We want to be able to serve more patients,” Johnson said. “We want to make sure we are continuing to offer a high level of care, but we’re absolutely looking at ways to increase accessibility of care as well. To do that, we need to become more solvent. The program really operates at a deficit at this point, because we’re seeing so many uninsured

individuals coming through; we were not anticipating the sheer level of patients who don’t have any insurance but need care. Of the veterans that we’ve seen, for instance, none have had insurance. That means that we have been doing all our work for the veteran community at no cost to them, and purely on philanthropic support.”

That’s where UWNWMI’s history as a fundraising powerhouse will come in handy. With a year’s worth of cases under their belts, Johnson says the United We Smile team plans on getting more aggressive about telling the story of the clinic to “the giving community” locally and beyond.

Case studies shared with the TCBN include helping a three-year-old boy whose dental issues were so severe that he stopped eating, or treating a Purple Heart veteran who had teeth problems from when a mortar shell exploded near his face during the Vietnam War. Whether it’s private donations, nonprofit support, or government grants, Johnson feels confident United We Smile will be able to up its fundraising game significantly now that it has a track record.

One area where United We Smile won’t be expanding is in the demographics it serves. When the clinic opened, UWNWMI limited its services to the groups it believed were most underserved by northern Michigan’s existing dental

The clinic opened its doors at Copper Ridge in September 2023, making UWNWMI the first of the more than 1,100 United Ways around the world to operate its own dental clinic.

benefits other parts of the population.

infrastructure: veterans, pregnant and nursing women, young children, HIV and AIDS patients, and people with cognitive disabilities. With demand across those groups already so high, Johnson says it’s unlikely United We Smile would ever be able to serve a broader clientele. Still, he’s hopeful the work the clinic is doing will have a domino effect that

“We want to do the best job that we can serving the patients in those targeted demographics that we already serve,” Johnson said. “I think there will always be a need for more dental care in this region, but I hope that, by us doing this, our other partners can be able to do more dental work for other patients.”

And speaking of domino effects, John-

son shares that the successful first year at United We Smile hasn’t gone unnoticed by other United Ways around the world.

“I’ve definitely had a lot of calls from other United Ways,” Johnson said. “They’re saying, ‘How did you do this? Dental care is an issue in my community, too. How could we structure something like this?’ No one’s done it yet, but we’re happy to help if they do.”

From proposal to installation to servicing, KEEN surpasses expectations! Our K1 Speed project was managed and implemented with impressive technical knowledge, careful attention, and timeliness. The installation team even worked around and alongside several other building projects to get us up and running on time. Their highly skilled team is amiable and always available to answer any questions we may have about our new system. It may be the go -karts, but the guys from KEEN even stop by from time -to-time to make sure everything is running smoothly!

~ Traverse Racing

By Rob Hanel, columnist

As the holiday season unfolds, businesses face a unique set of challenges and opportunities.

While this time of year can be synonymous with festivities and joy, it also presents potential dips in employee engagement and overall mental health. High levels of engagement are essential for productivity in any organization, but the chaos of the holiday season can make it easy to forget that employees are at the center of any organization’s success. And what those employees feel about the companies they work for, their leaders, their teams, and themselves, ultimately provides the fuel for high performance. Bottom line, leveraging the holiday season to boost employee engagement can be critical for organizations aiming to finish the year strong.

It is unclear which term gets thrown around more these days, “culture” or “employee engagement,” but there is an undeniable correlation. Company culture is a shared set of workplace beliefs, values, attitudes, purposes and behaviors, and reflects both the written and unwritten standards that people in an organization follow. Employee engagement, on the other hand, is the alignment between the company culture and the employees’ individual cultural compass, which equates to the emotional commitment employees have to their organization.

During the holiday season, various factors, such as increased workloads, holiday stress, and personal matters, can impact engagement levels. Hence, it’s vital for organizations to remain proactive in fostering a supportive and engaging environment. The holiday season isn’t just a time for festivities, it’s also an opportunity to reflect on progress and build momentum for the upcoming year. So how do we as business leaders focus on engagement during the holiday season? News flash, it’s not buying your employees the latest trendy brandable item (I’m looking at you, Yeti and Stanley) or throwing swanky office Christmas parties. Rather, we should shift our focus to creating opportunities for personal connections amongst our teams.

Being inclusive, sharing traditions and staying flexible can deepen connections with your team