or 888-777-0216

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University.

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors and is the highest ranked NAPFA-Registered Fee-Only Advisor on the list.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the ONLY Independent Advisor in the top 10.**

Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial, TD Ameritrade, and Charles Schwab.

State Savings Bank’s new Traverse City office is now open at 862 Garfield Ave. The three-level, 17,575 square-foot facility serves as the bank’s principal office, including full-service banking, mortgage and consumer lending, and administration and operations teams totaling more than 50 employees. The bank is maintaining its current branch location on Front Street in downtown Traverse City. The new retail branch is run by Jim Richardson, who brings 27 years of management experience to his position. Richardson has also been promoted to regional manager for Traverse City and Suttons Bay.

Lucky Jack’s - previously Timber Lanes - has closed its doors after owner David Mohrhardt and family sold the property on Garfield Avenue to the Serra Automotive Group. Mohrhardt, who is retiring, and his family operated Timber Lanes Bowling for decades on U.S. 31 next to Meijer in Traverse City. After closing that site in 1998, the family purchased Wildwood Bowling Center on Garfield and reopened it as Timber Lanes, later rebranding to Lucky Jack’s.

Traverse City-headquartered ATLAS Space Operations, a provider of ground station services for satellite communications, recently announced it has raised $15 million in its latest growth investment round led by space-focused private equity firm, NewSpace Capital. ATLAS’ services support a range of missions across the commercial, civil and defense sectors. Company CEO John Williams said NewSpace Capital’s expertise in the space industry will accelerate the company’s expansion in the U.S. and internationally.

TileCraft, located on Trade Center Drive in Traverse City, is under new ownership. Kyle Fussman, owner of Kyle’s Custom Tiles in Petoskey, purchased the business from founder Dale Censer, who retired after 38 years. Censer grew the business from solely a tile-based operation to include natural stone, hardwood, luxury vinyl planks, countertops and more. Fussman said the entire team will remain on staff under the new ownership, with plans to incorporate new design ideas and products.

Earthly After, an innovator in eco-friendly memorialization and holistic grief support, recently announced the launch of its pet memorial service. The service allows owners to honor their companions in natural settings, including the Sleeping Bear Dunes National Lakeshore. Earthly After, founded by Jamie Kramer, also recently received $80,000 in resources, including a $20,000 cash investment, as part of its participation in Michigan State University’s Conquer Accelerator Program.

Nico’s Pizza & Grinders recently opened in the former Mancino’s West Bay location on West Bay Shore Drive in Greilickville, serving up pizza, grinders and more. The company also has a location in Kalkaska. Pizza franchise Cottage Inn Pizza – headquartered in Ann Arbor – is coming to northern Michigan with a new Traverse City location at 822 East Front St. Indoor go-kart racing center K1 Speed has started operating in the Cherryland Center, offering high-powered electric go-karts, an arcade, two private event rooms, and a café called the Paddock Lounge with food and drinks. Also in the Cherryland Center, the Traverse City Philharmonic – formerly the Traverse Symphony Orchestra – has officially moved into its new home in the former Kmart building.

Northwest Michigan Works!, in a partnership with Pro Image Design and World Magnetics in Traverse City, has launched four new apprenticeship

ELEV8 Climbing Gym is reaching new heights in sustainability with the addition of solar!

Customer Incentives Award:

40% USDA/REAP Grant

30% Tax Cradit

YEARLY KILOWATT HOURS AVOIDED:

34,387kWh annual production

SAVINGS EQUIVALENT TO:

2,742 gallons of gasoline consumed 24 Metric Tons of Carbon Dioxide (C02)

It was a great pleasure to work with KEEN on our solar project! They were informative, knowledgeable, respectful, interested and thorough. Their company culture shines through All of our interactions with their entire crew were positive and friendly. Navigating the entire process, from concept to completion, was a breeze, and they assisted with the grant application. We now get to enjoy lower energy bills and knowing that we are minimizing our carbon footprint!

~ Kevin Vlach

training programs. Pro Image Design’s sign erector apprenticeship program combines on-the-job learning along with instructional courses. World Magnetics is launching CNC, mold setter and drafter apprenticeships. The company will provide on-the-job learning with curriculum provided by Northwestern Michigan College. Registered apprenticeships are certified through a partnership with the U.S. Department of Labor and are a method for employers to build a talent pipeline of highly skilled, educated employees. Northwest Michigan Works! provides technical assistance and administrative support for registered apprenticeships, including development, implementation and program management.

The Great Lakes Children’s Museum (GLCM) recently announced its newest chapter: the opening of The Curiosity Place powered by GLCM at the Grand Traverse Mall in Traverse City. This move marks a significant step forward for the museum as it transitions from its longtime location in Elmwood Township to make room for the new Freshwater Research & Innovation Center. The Curiosity Place will have expanded gallery space, as well as doubled program spaces. The new location will be ready to welcome visitors this fall. The GLCM is still planning a permanent home.

Copper Ridge Surgery Center in Traverse City is expanding its services with the addition of comprehensive pain management solutions led by Dr. Richard Burke. The state-of-the-art procedures address a range of conditions, including diabetic foot neuropathy, spinal stenosis, and chronic pain.

The Huntington Bank Foundation has granted $20,000 to Venture North Funding and Development in Traverse City, continuing its support for the organization that has made 183 low-cost commercial loans and dedicated 9,300 hours to no-cost consulting to support the growth of the region’s small businesses. “We are so appreciative of our longstanding partnership with Huntington Bank,” said Venture North President Laura Galbraith.

The Grand Traverse Pavilions recently was honored with a Governor’s Award of Excellence for its achievements in improving the quality of healthcare at the facility. The staff achieved the milestones required for the award including increasing influenza vaccination rates and

increasing COVID resident vaccination up-to-date rates.

Northern Initiatives , a regional nonprofit lender, has been awarded $250,000 to help entrepreneurs throughout Michigan become more climate resilient.

The grant, from the Opportunity Finance Network’s Financial Justice Fund, is part of a drive to increase climate lending across the country, and Northern Initiatives is using the funds to create a climate lending strategy.

“We’re using the funds to learn, train and support our staff, and understand what our customers need to stay on top of climate-related changes to their businesses,” said Elissa Sangalli, president of Northern Initiatives.

The Association of Cancer Care Centers recently recognized Munson Healthcare’s Cowell Family Cancer Center (CFCC) with the Innovator Award for pioneering achievements in improving access, quality and value in cancer care delivery. The CFCC is being honored for implementation of a Bispecific T-Cell Engager Therapy Program. Bispecific therapy activates the immune system to recognize, target and attack cancer cells, reducing harm to surrounding tissue compared to traditional chemotherapy. This is currently FDA-approved for multiple myeloma, several types of non-Hodgkin’s lymphomas and select solid tumors. Other cancers appropriate for this treatment are currently in clinical trials.

BAR SERVICE LAUNCHES Mandy & Marlee Mobile Bars, northern Michigan’s newest mobile bar service, is now up and running. Founded by Sarah Boozer and Courtney Lorenz, Mandy & Marlee Mobile Bars is a dry hire (drink services hired separately) fleet of mobile bars, offering versatile and personalized mobile bar solutions for events. More information at mandyandmarlee.com.

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.” –Benjamin Franklin in a letter to Jean-Baptiste Le Roy, 1789

Certainty. From a business perspective, it is an essential element of good public policy. Can we have some assurance that the rules of the road are not going to change the moment a different political party is in control? Can we count on a law not changing in the next legislative session – or the one after that?

According to a recent survey by Business Leaders for Michigan of CEOs across Michigan, three-quarters of Michigan’s top executives expect Michigan’s economy to be stable over the next six months. However, they also feel that long-term growth, our economic future, will be hampered by barriers related to state policy. With the election right around the corner, business and community leaders need to focus on what is at stake, what policy decisions are being made and who is making them. Your vote matters to our economic future. That’s a certainty. So let’s cut through the ads, mailers and robo texts and focus on a few local, state and federal issues that will be decided this fall and how positions on these issues matter to our economic future.

Local (City of Traverse City Residents): Vote no on Proposals 1 & 2; we can’t afford it!

• What’s certain is that Tax Increment Financing (TIF) is a tool we cannot afford to lose.

• When we have utilized Brownfield TIF to redevelop the Commons or complete the Boardman Lake loop, we are making investments that have a 49:1 economic return and are fundamental to our economic future.

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020

Traverse City, MI 49685

231-947-8787

ON THE WEB

tcbusinessnews.com

PUBLISHER

Luke W. Haase

lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

COPY EDITOR

Becky Kalajian

• When we use Downtown Development Authority TIF to replace bridges, build a civic square or farmers market, we are using the regional tax base to pay for public infrastructure, again essential to our continued growth and prosperity.

• The Takeaway: Voting “No” on Proposals 1 & 2 provides certainty for TIF as the only regional tax tool we have and an essential element in our economic future.

of hours required under the Act.

•Add a small employer exemption.

•Require notice be made by an employee prior to a shift start.

•Leave enforcement and penalties to the state.

•Allow employers to frontload time off, maximizing employee flexibility.

•These policies are supported by a broad coalition of groups from across the

It is critical in the final month of this election season that we educate ourselves about these issues and call on policy makers to recognize the importance that certainty plays in public policy and the sustainability of our regional businesses.

State: Legislation is needed to provide certainty on The Earned Sick Time Act (ESTA)

• With the Michigan Supreme Court’s decision on mandatory paid sick leave, the state legislature has an opportunity to soften the blow to employers and workers before the law takes effect in February 2025.

• Without action, these government mandates would force employers of all sizes and types to rethink their existing paid leave policies.

• The act extends sick leave to all types of employees and contractors in addition to micromanaging leave policies and allowing for costly litigation against businesses for noncompliance.

• So, what can the legislature do?

•Exempt employers with paid sick leave policies that meet or exceed the number

CREATIVE DIRECTOR

Kyra Cross Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Art Bukowski

Kierstin Gunsberg

Rick Haglund

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Gerald Morris

SERVING:

Grand Traverse, Kalkaska, Leelanau and Benzie counties

state including the Michigan Retailers Association, Business Leaders for Michigan, Small Business Association of Michigan, Traverse Connect, Michigan Health and Hospital Association, Michigan Realtors, and many others.

The Takeaway: Michigan businesses need certainty that only the state legislature can provide, and we call on the legislature to make these changes to the Earned Sick Time Act before the end of the year.

Federal: Major policies are on the horizon - choose wisely

As we look to federal policy issues, ones with the biggest impact confront a new president and new members of the U.S. Senate and House.

• The Debt Limit: Suspended since 2023, the Debt Ceiling will be reinstated Jan. 1, 2025, at which point without Congressional action, the Department of the Treasury will have to implement a variety of accounting maneuvers to temporarily keep the government from defaulting on its debt.

AD SALES

Caroline Bloemer

cbloemer@tcbusinessnews.com

Lisa Gillespie

lisa@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris

tnorris@tcbusinessnews.com

Michele Young myoung@tcbusinessnews.com

• The Affordable Care Act Tax Credit subsidies: Following a three-year extension, the enhanced subsidies for people buying their own coverage on the marketplace will expire in December of 2025. There are currently 13 million subsidized enrollees who receive approximately $700/year in support for the purchase of their health insurance.

• Trump Tax Cuts: Passed in 2017, the 2017 Tax Cuts and Jobs Act includes tax cuts for corporations and business owners as well as individual tax payers. Many of these provisions will expire in December of 2025.

The Takeaway: Our federal elected officials will have a lot to tackle when they get to Washington in January and who we vote into office will matter.

It is critical in the final month of this election season that we educate ourselves about these issues and call on policy makers to recognize the importance that certainty plays in public policy and the sustainability of our regional businesses. Speak up, speak loudly and speak often. Our economic future is on the ballot and that’s a certainty.

Gabe Schneider is the principal at Northern Strategies 360, a government relations consulting firm founded in 2015. Northern Strategies 360 helps clients navigate local, state and federal legislative and regulatory issues and advocates on their behalf in Lansing and Washington, DC. Schneider was recently recognized by the Traverse City Record Eagle as a Leader of Northern Michigan 2024 and was previously recognized on the Traverse City Business News “40Under40” list of the most influential people in the region.

The Traverse City Business News

Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2024 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

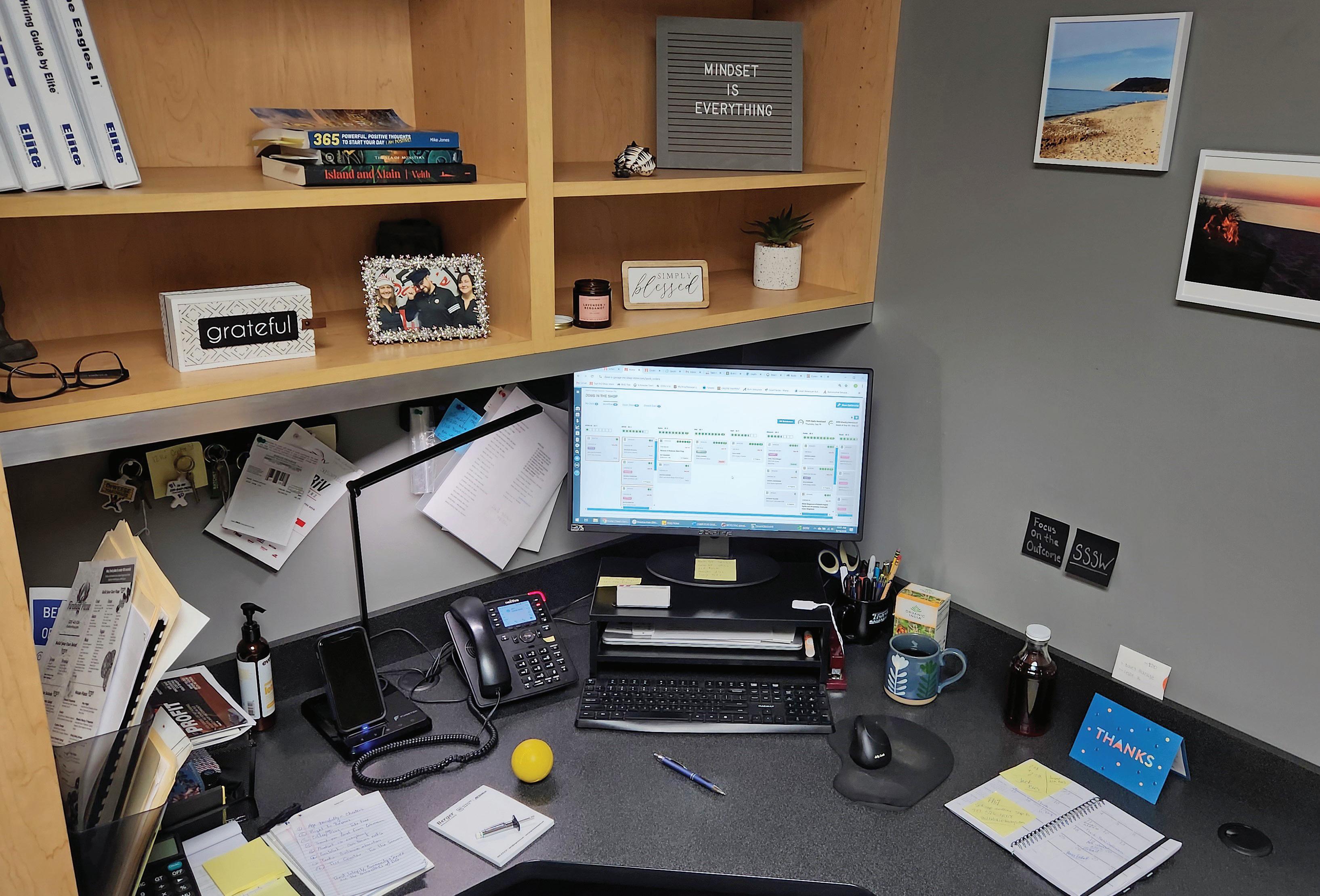

By Art Bukowski

Heather Smith is general manager of Dave’s Garage, an auto repair shop that specializes in imports (though they service domestic vehicles as well). We’re thankful to her for showing us around her desk! If you have an idea for a future From the Desk Of feature, please email abukowski@tcbusinessnews.com.

1. I use this lacrosse ball to relieve aches and tension. I sit here and get tense, and I get kinks in my shoulders all the time. So I rub up against the wall like a cat with the ball between me and the wall.

2. We get a lot of thank you cards from customers, and one even brought us this maple syrup. She’s done it twice now, and it’s wonderful. And we just got a thank you card and lunch from another customer. It’s a nice little reminder that even on the bad days, we are doing a lot of things right.

3. These say “Focus on the Outcome” and “SSSW” which means small steps, small wins. I’m always trying to remind my team to not get complacent. We do a lot of things well, but we always want to be doing better.

4. I’m an avid tea drinker. You will almost always find a cup of tea on my desk. I’ll make coffee at home, but it’s tea here.

5. This here is the motherboard. It’s a program called Shopware. I see all my technicians, what they’re working on, the customers’ information. It’s a pretty slick program.

6. It says ‘mindset is everything.’ My office assistant got me that board. It’s a good reminder. You come into the shop, and you have long days telling people what’s going on with their cars, and people can be stressed. So starting your day with the right mindset is really, really important. And I’ll change that every once in a while and put a different positive thing I want to say on there.

7. I’m always, always using my planner. I’ve got two sons, and while I’m a mom at home, everyone here also calls me mom. Two boys and eight kids out there, too. I keep everyone scheduled and on track.

8. This is a photo of me with coworkers Brandon and Danielle, who run the show up front. We’re always messing around and having fun. Being a small shop, this is family. We’re with each other sometimes more on average than we are with our family at home. It’s really important that we hire the right people.

By Craig Manning

Beaches, boats, golf, wine, sunshine. These are just a few of the draws that have helped make Traverse City and the broader Grand Traverse region the most popular destination for retirees in Michigan. While local retirees don’t necessarily live here year-round – often trading the area’s cold winter weather for the warmer climates of places like Florida or Arizona – they undoubtedly have a massive impact on the regional community, economy and environment. Some of those impacts are predictable, like the way retirees skew Traverse City’s demographic statistics. Others are less explored, like how thoroughly older adults dominate the local volunteer force.

This month, in honor of our area’s retirees, the TCBN takes a look at six distinct ways in which retirees are totally changing the narrative of how Traverse City operates.

They change our demographics

On average, the Grand Traverse region skews older than other parts of the state. According to 2022 Census Bureau data, the median age in Grand Traverse County is 43.1, compared to 40.1 for Michigan as a whole. Some local counties skew even older, like Leelanau County, which has a median age of 55.2.

Roughly 21,000 people, or 22% of Grand Traverse County’s 96,500-person population, is 65 or older, compared to just 18.7% for the state as a whole.

The region has also gotten dramatically older in the past decade: As of the 2010 Census, just 12,886 Grand Traverse County residents fell into the 65-and-over demographic – about 14.8% of the population at the time.

Local demographics are poised to skew older and older in the years to come, based on the number of people in the area who are nearing retirement

age. Per Census data, the three biggest five-year age ranges in the county, based on population, are 55-59 (7,336 people), 60-64 (7,057 people), and 65-69 (6,271 people).

Only one other age bracket tops 6,000 residents in Grand Traverse County: 30-34, which boasts 6,185 people.

2. They drive growing needs for in-home care and senior living

With northern Michigan’s population increasingly skewing toward older demographics, those working in the senior care industry have been fretting for years about whether the region has the infrastructure and services necessary to support the aging population. From senior living communities to in-home care providers, professionals in this space have repeatedly told the TCBN and its sister publications that they lack the space and/or staff to meet the

needs they expect the region will face in the coming decades.

In fact, according to Amy Northway, president and CEO of Traverse City’s Monarch Home Health Services, the situation is already reaching a fever pitch.

“Monarch has been in contact with significantly more older children who are involved in the long-term care of their parents and loved ones,” Northway said. “The children may be moving their loved ones into their homes, or into assisted living communities, but still want to travel and have the freedom to enjoy their retirement years. As a result, there are more and more requests for weekend caregivers and extended caregivers.”

The good news, Northway says, is that older adults and their families are starting to be more proactive when it comes to planning for senior care. All the discussion about worker and capacity shortages in recent years, she notes, has helped people recognize that

“there is a need for reliable relationships with in-home care companies to provide short and long-term care on an as-needed basis.” While Northway still doesn’t think the region has enough caregivers to keep up with demand, she sees the uptick in caregiver applications as a “positive” sign that families are planning ahead.

In particular, Northway says there has been a notably increase in families establishing relationships with companies like Monarch before they need care – not when the need arises.

“Monarch Home Health Services has been conducting more and more ‘reserved’ interviews, as we refer to them, to have paperwork and introductions in place, as caregiving services are often needed with little advance notice,” Northway explained. “This allows for on-demand types of services for those with the means to provide care for their loved ones while they enjoy their lives up north.”

3. They affect the region’s number of “dark” homes

“Older

adults are having a huge impact on helping us advance our mission. The numbers are large, but more importantly, the impact they make is very significant.”

– Glen Chown, Executive Director, Grand

Many of the region’s retirees are snowbirds, or people who own homes in northern Michigan, but only live here part-time. That part-time population – and the number of local homes they hold down as second or seasonal homes – means that Traverse City and its surrounding areas have a disproportionately high number of homes that sit empty and dark in the winter.

Speaking to TCBN sister publication the Traverse City Ticker in 2021, Polly Cairns, the then-city assessor for the City of Traverse City, said that “approximate-

Traverse Regional Land Conservancy

ly 55% of residential-classed property for the City of Traverse City Leelanau County portion and 42% for the City of Traverse City Grand Traverse County portion” have principal residence exemptions. In other words, roughly half of the homes in Traverse City are second homes, not primary residences.

Regional numbers are high, too. In 2022, Networks Northwest and Beckett & Raedar published a seasonal population study for northwest Lower Michigan, which found that the population for the 10-county region swells by 78% in the summer. That number does include tourism, with overnight

visitors making up 40% of the region’s total population during the peak month of July. However, the report also specifically tallied the region’s part-time/ second-home population, finding that some 96,566 part-time residents call the area home during the summer months.

The number of seasonal homes in the region has become a hot-button issue in recent years as demand for – and cost of – housing has skyrocketed.

Per a 2023 Housing Needs Assessment from Housing North, vacation rentals and seasonal housing now account for more than a quarter of the total housing in the 10-county region, ranging from as low as 9.8% in Grand Traverse County to 40.3% in Benzie County. The report stated that recent increases in seasonal and short-term rental housing were “chipping away” at permanent housing stock across northern Michigan, and advocated finding a way to address this market, “particularly given the lack of rental and for-sale housing product that is available.”

The Grand Traverse Regional Land Conservancy (GTRLC) relies on an army of some 350 volunteers to carry out its mission of environmental preservation and stewardship in northwest Lower Michigan. Across six local counties, the organization protects more than 47,000 acres of land and 155 miles of shoreline. Volunteers lend a hand by building and maintaining trails, leading community hikes, spearheading events, assisting with efforts to combat invasive species, and more.

According to GTRLC Volunteer Coordinator Erica DesJardins, approximately 75% of the organization’s volunteers are retirees.

“There are so many examples, from our volunteer base, of retirees really committing themselves to our mission and going above and beyond what would be expected of a volunteer,” DesJardins said, before listing a few standout examples. One is Paula Dreeszen, a 66-year-old retiree from Interlochen who will be celebrating her 20th year of volunteering for GTRLC in 2025.

“Paula is a lead volunteer in our southwest region – which includes Manistee and Benzie counties – and manages most of the communication with volunteers in that area,” DesJardins said. “She sends weekly regional emails to those volunteers to keep everyone in the loop, coordinates trail maintenance and chainsaw response when it’s needed down there, and even leads a series of invasive species removal workbees in the summer in the Arcadia area. Her knowledge of Arcadia Dunes is totally unmatched, and she keeps excellent records of her work and observations there from over the years.”

There are other examples, too. One is Anne Sutton, who coordinates a group of 30-40 volunteers for GTRLC’s Maple

Bay Farm, which last year donated more than 6,000 pounds of organic produce to local food pantries. Another is Rick Hager, who used to work as a land manager for the U.S. Fish and Wildlife Service in Iowa. Since retiring to northern Michigan, he’s put his technical skills to work for GTRLC, leading projects around seed collection, invasive species removal and prescribed burns.

“Older adults are having a huge impact on helping us advance our mission,” said GTRLC Executive Director Glen Chown. “The numbers are large, but more importantly, the impact they make is very significant.”

5. They fill seasonal, part-time and even full-time jobs

Even beyond volunteer capacities, “older workers and/or retirees are very prevalent in our workforce in our region,” according to Rob Dickinson, regional director of business services for Networks Northwest.

Networks Northwest offers a variety of workforce, business, community and economic development services throughout the 10-county region, often acting as a matchmaker to connect job seekers with employers, or vice versa.

While the organization serves all demographic ranges, Dickinson says older adults have become a bigger part of the equation over the past 10 years or so.

“This is all anecdotal, but retirees are coming into our offices looking for work for lots of reasons,” Dickinson shared. “The most often relayed message is that they cannot afford to simply not work at this point. There is also a segment of older workers that are let go from their long-time employer and are struggling to find new employment.”

What older adults are looking for

from Networks Northwest programs can vary. Dickinson says certain types of work and certain industry sectors tend to be more popular among older demographics than others.

“Some retirees are looking to work in less demanding positions – so, parttime, seasonal and gig work are appealing,” Dickinson shared. “We are also seeing more older job seekers take jobs at retail and hospitality establishments. Retirees are finding their way to us in hopes of being connected to their next job in many industries, though. Our job seeker side of the house tells us that the individuals they are working with are frequently inquiring about manufacturing jobs and even post office positions, both full-time and part-time.”

In recent years, as talent shortages have pushed employers throughout the region to get more creative in filling vacant positions, Dickinson says it’s become easier to find good job opportunities for retirees.

“Employers at this point in time are opening up who they are willing to hire, and some are even targeting retirees or older workers,” Dickinson noted.

One example he cites is Plato’s Closet, a chain retailer in Garfield Township that buys and sells secondhand clothing for teenagers and young adults.

“They were on radio wanting seniors to apply for their part time positions,” Dickinson said.

Statistically, employment among older demographics is on the rise. According to a 2023 analysis from the Pew Research Center, roughly 19% of the approximately 11 million Americans that slot into the 65-and-older demographic are employed – a significantly higher share than in past generations.

For instance, in 1987, only 11% of the country’s 65-and-over population

was working. The higher percentage, plus the fact that the 65-plus demographic is roughly four times bigger now than it was in the mid-to-late 1980s, shows the changing norms of employment among senior citizens.

6. They bring institutional knowledge and investment capital to the table

While some local retirees are filling their time with volunteer work or part-time jobs, others are injecting lifeblood into the region’s economic development scene. So says Warren Call, president and CEO of Traverse Connect. The region, Call notes, is a magnet for retirees who have had quite a bit of success in their careers and are looking to pay that success forward to the next generation.

Examples include Northern Michigan Angels, an angel investment group whose members invest in “scalable, early-stage companies” from throughout the state; a majority of that group’s members are retirees. It’s also common, Call notes, for retirees to act as business mentors through SCORE, to sit on local nonprofit boards, to serve businesses or organizations in advisory capacities and more.

“The institutional knowledge of our retirees and seasonal residents is immensely valuable, and one of the unique attributes of this area that is a positive differentiator for us,” Call said. “These are accomplished people that have done impressive things all over the world, and their engagement and sharing of experience benefits our region, community and economy in a number of ways. Not only do they serve on boards and committees, volunteer for nonprofits and provide expertise and funding to our companies, they also serve as direct mentors for business, nonprofit and community leaders. Their generosity and passion for making this a great place is truly appreciated.”

By Rebecca Teahen, columnist

You’ve read thousands of articles about personal finance. You listen to the news and follow the markets, but somehow, it lacks personal connection for you.

Maybe once in a while an article will offer a novel strategy to minimize taxes or maximize investment returns, but all these tactical strategies fail to consider the big picture. Your financial strategy has to be relevant to YOU.

Now, imagine you’re out taking a scenic drive to enjoy the fall colors. Maybe you are wine tasting along the way or stopping to buy some apples at a road side stand. Doesn’t that feel better?

Your financial journey doesn’t have to be mired in drab forms and irrelevant noise from the media, nor does it have to be overly complicated. Let’s take a more holistic view, taking inspiration from those beautiful farms along your drive. As you pull in the drive or pull up to the farm stand, you may wonder how this farm got started. Maybe the land has been in the family for generations, or maybe a scrappy young couple has just pulled it together with duct tape and twine. Maybe the owners are new to the area and just purchased the property.

No matter which of the scenarios is true, they all have one thing in common: This is part of a long-term plan; a dream for the future. Similarly, your dreams for the future will benefit from a plan.

1. Have you created a long-term financial plan?

2. Do you have your estate plans documented, and if appropriate, a plan for generational transfer of wealth?

3. What do you want to create, nurture, and grow for the future?

As you review the selection and choose the apples or peruse the tasting menu at a winery, you’re thinking about what products are best to suit your tastes and your goals. How did the farmer select the variety of grapes or apples you’re enjoying? In some cases, the best wines and ciders may come from a blend of grapes and apples. Some land may be perfect for growing one variety, and terrible for another.

Like you, farmers are constantly learn-

Are you providing sufficient care and feeding to grow your wealth?

ing and trying new practices to make their business more efficient and their products more marketable. Just like these farms, you must choose the right variety of assets and account types to meet your needs during a certain period. One asset class may do well while another lags; one account type may be better suited to a short term vs. long term goal. It’s critical to include a diverse set of assets in your financial plans.

1. Are your assets diversified to weather different market swings and to be well aligned with your goals?

2. Have you established the right mix of account types for your needs?

3. If part of your investment portfolio or savings plan isn’t working, what’s your plan to change it?

Once you’ve made your selection and bite into that sweet, juicy apple, or taste a crisp, refreshing sip of wine, you might wonder what it took to produce this treat. All agricultural production takes significant “inputs.” Beyond the initial planting or seeding, plants and animals require significant ongoing care and feeding. I’ve learned (and am still learning) this the hard way. My garden is suffering from terrible neglect. It turns out that a “set it and forget it” strategy does not work for growing vegetables.

Are you providing sufficient “care and feeding” to grow your wealth?

1. Are you consistently making deposits into your retirement and savings accounts?

2. If your assets have been growing for a while, take a look at what might need to be “pruned.”

3. Are there gains or losses to capture or accounts that could be consolidated to

provide some efficiency and simplification in your life?

The work of a farm revolves around the seasons and the weather. While this lends itself to a beautiful rhythm throughout the year, it can also be incredibly challenging when the weather doesn’t cooperate! We can take many lessons from this, some harder than others.

First, make hay while the sun shines. Be sure you’re saving while you can, and don’t let the natural rhythm of life throw you off course. When you get a good “harvest,” make a plan to “store” those earnings for the future.

Success in agriculture and in life requires patience, persistence and perseverance.

1. Are you taking advantage of your strongest earning years to save for the future?

2. Do you have a plan of where to “store” your money and how to steward it if you’ve had some strong earnings or perhaps received a gift or inheritance?

While I do enjoy the four distinct seasons in our region, some are more enjoyable and

productive than others. An unexpected storm can cost a farmer their entire crop for the year, but it doesn’t have to knock your financial plans off the map. Success in agriculture and in life requires patience, persistence and perseverance. Your hard work, consistent saving, and a long-term outlook on your investments will pay off.

1. Do you have a plan to weather a “drought” in earnings or an unexpected expense?

2. Are you prepared to be patient and let your savings grow long term, even when the market is volatile?

3. Are you in the season of life where you can relax a little and simply enjoy the harvest? If so, have you created a plan for efficient decumulation and enjoyment of your retirement years?

As you think about the future you’d like to create, perhaps you can draw some inspiration from your neighborhood farms. I’m grateful to have just a tiny bit of involvement with our local farm community. We provide ample “care and feeding” to three old horses and grow hay in Northport. We are fortunate to have amazing neighbors who help us whenever a piece of equipment breaks or when we just need a few extra hands. You can benefit from our connected community to help along your journey, too. Whether you need financial advice, or just want to know where to find the best apple pie, just ask.

Rebecca Teahen, CIMA® has a background in philanthropy and farming and is a Financial Advisor with Robert W. Baird & Co. Incorporated in Traverse City serving clients nationwide.

Northern Michigan bank heads on community investment, economic insulation and local control

By Craig Manning

Banks occupy a unique position in a community. On the one hand, banks are big businesses that have a direct impact on local communities through everything from mortgages to commercial lending to charitable activities. On the other hand, many banks are regional or even nationwide entities, beholden to major corporate interests or stakeholders that have very little to do with mid-sized towns like Traverse City.

It all begs the question: What does it take to be the local leader of a larger, out-of-townbased bank? To find out, we convened a panel of three local bank presidents to learn all about their day-to-day jobs, the things that make northern Michigan unique from a banking standpoint, and retaining local control even amidst a large corporate entity.

Nick Florian is the northern Michigan market president for Huntington Bank, which is a publicly traded Fortune 500 company based in Columbus, Ohio. Huntington has more than 1,000 banking offices in 10 different states, most of them in the Midwest.

Autumn Gillow is the vice president of commercial banking for Fifth Third Bank’s northern Michigan operations. Like Huntington, Fifth Third is a publicly traded Fortune 500 company. The bank operates more than 1,000 branches and more than 2,000 ATMs in 11 states. The business is based in Cincinnati, Ohio.

Sid Van Slyke is the senior vice president and market leader for West Shore Bank in Traverse City. Unlike Huntington and Fifth Third, West Shore bank is not a major publicly traded company, nor does it have operations in multiple states. However, the bank – which started in Scottville, Michigan in 1898 – remains based in Ludington and does

TCBN: Give us a general idea of what your job looks like on a day-to-day and week-to-week basis. How much of the role is on-the-ground stuff with local branches or local events, versus traveling for meetings/conferences or interfacing with corporate leadership from afar?

“Traverse City has grown a lot in the last 10-plus years, but it still has the heart of a small town – a ‘take care of your neighbor’ feel. I hope that doesn’t change.”

– Autumn Gillow, Vice President of Commercial Banking, Fifth Third Bank

business in six counties, in addition to Grand Traverse. Those counties are Benzie, Kent, Manistee, Mason, Muskegon and Oceana. The bank has 11 branches total.

Florian: It kind of ebbs and flows, but much of my time is spent in the local markets. Our northern Michigan territory is quite larger, covering some 37 counties and spanning 82 branches across the tip

of the mitt and the U.P. So, my job really is a regional role, and my responsibilities span that whole territory. But my time is predominantly spent in Traverse City; I have an office at our branch on Garfield. Huntington houses more branches in the state of Michigan than any other institution, and we have a pretty strong physical presence in northern Michigan. So, I am regularly visiting branches. I’m visiting customers. I’m attending community events – ribbon cuttings and groundbreakings, and what have you. I’ve been with the bank 31 years and have served on a variety of nonprofits in that time, as well as civic and charitable boards. I continue to do that work.

On top of all that, you just have your office days. And there are days every week when I’m just sitting down with customers. That’s the part of the job I love: It’s getting out in the marketplace, meeting with our customers, meeting with people who want to bank with us, and learning about their business, learning about what they do, learning about their nonprofit. We

even go out on tours of local businesses. I did one just a week ago, where I went out and toured the facility of a large-scale manufacturer that banks with us. Things like that are such a great opportunity to learn about what our customers can do, and what people are doing that provide jobs in our community. That’s the fun part of my job.

Gillow: My role is twofold: acting as market president and leading our commercial banking efforts in northern Michigan. The market is rather large geographically, stretching into the upper peninsula and down to Saginaw area. My role includes meeting with clients and attending events throughout the footprint, and while that does entail a fair amount of travel, I do spend much of my time in the Traverse City area.

Van Slyke: A day in the life for me is nearly all local. I am the market leader or community president for the Grand Traverse region, so nearly all of my time and effort is spent here. I do travel about once a month to our headquarters in Ludington, but that’s really it. The exception would be traveling to meet a client outside of this market, or the occasional conference that may be further away.

We just have the one branch in the Grand Traverse area, which is why we chose a centrally located spot for our forever home on Eight Street. The location, which opened in 2018, offers easy access from the east or west without feeling like

our clients have to go downtown and fight for parking to visit us.

On-the-ground work accounts for about 95% of my day-to-day. I’m still directly involved in many of our client relationships. In addition, I myself attend most of the local events I ask my team to attend. We’ve also hosted more than 100 events in our own community engagement room, located on the third floor of our Eighth Street building. Primarily, those events were for our local nonprofit community.

TCBN: Our area has a mix of more regionally based credit unions and then a bunch of branches for larger nationwide banks. How do you keep a local grounding here, so that the northern Michigan branches still feel like they are really rooted and involved in the community? What role do you as a leader play in that localization?

Florian: This summer, our CEO for Huntington Bank flew into Traverse City and spent a day with us, with our customers, with our colleagues, and went and visited some of our nonprofits. It was an absolute stellar day, and it’s important to do that kind of thing because then our national executive leadership team gets a very good, in-depth peek at our local market. Because our market is different. Traverse City is not Columbus. It’s not Denver. It’s not West Virginia. Huntington is in a lot of different areas across the country, but we’re pretty well-rooted here in northern Michigan.

A little over a year ago, Huntington shifted into a regional bank model, where we have 11 regions across our national footprint and we’ve established leadership teams within each region. The benefit of that model is it brings the bank as close to the customer as possible. We still have a corporate component, where we have the depth of resources of a national bank. That’s the luxury we have. But because of our regional model, we bring the resources as close to our customers and communities as we can.

We leverage those resources in the form of a lot of volunteerism and community involvement. We’re always working with local nonprofits, from the Northwest Michigan Community Action Agency, to Father Fred, to Child and Family Services. Just recently, we did a groundbreaking out at Corners Crossing, a new workforce housing development, because we participated in getting that project off the ground. And we did the same thing with developer Woda Cooper, right here near our office on Garfield, with the Annika Place affordable housing project.

Gillow: We have a team of professionals that are committed to the local market. Our team loves northern Michigan. They live here and raise families here. Hiring a team that is part of the community helps us care for our clients, participate on local boards, and support the nonprofit community.

On that front, there are approximately

15 local nonprofits that we partner with, either financially, with board involvement, or volunteer support. Staying connected to the needs and initiatives of our local nonprofits ensures our team is staying connected to the needs of the local community.

Speaking personally, I joined Fifth Third eight years ago because of their deep commitment to supporting local communities, at a level I hadn’t experienced at other large banks. Part of my role is to ensure we remain connected to the initiatives in the community that need our support.

Van Slyke: West Shore Bank turned 126 years old as an institution this year, but we’ve only been in Traverse City for a little more than six years. We had a small wealth management and mortgage presence, but I was hired to bring the full banking services to the community for West Shore in 2018. The bank’s board of directors had been looking at Traverse City for close to 10 years as the next place they wanted to grow.

Fortunately for me and the team, the CEO and board were aware that Ludington and Traverse City are two different communities. It’s most common for a bank that’s new to a community to send their team from somewhere else to get things rolling. Our board saw things differently, and made the decision that they wanted Traverse City people to run the Traverse City effort. As a result, everyone on our local team – now up to 28 people – are local people who were in banking

before West Shore arrived here. Being involved in the community we serve is embedded in the DNA of this bank. It’s rare you see a community effort we’re not involved in, and that would be true for every community we serve down the lakeshore. As far as my role goes in that, I’ve always been heavily involved in the community at a pretty high level. Part of the reason for that is I’ve always felt that, if I am going to ask my team to do this stuff, I need to lead by example. I can’t be at every single thing we do, but I definitely do as much as I can.

TCBN: What makes the northern Michigan region unique for banking? How do those unique attributes affect your work, versus bank leaders from other regions?

Florian: We are a little unique in that we have a large region, just from a geographic standpoint. At Huntington especially, we have a lot of offices spread out across northern Michigan. Whereas, if you think about one of our metro markets, the density is just totally different. We don’t have that density, which is why we are spread out a little bit. So, that’s a difference, but that’s also where we leverage our local branch managers, who have a tremendous amount of visibility into the local markets that they operate in. They live there. They work there. These branch managers are very connected to their community, and we give them quite a bit of empowerment there – to be engaged, to volunteer, to service in any way they can.

Gillow: I think people in this area want to work with people they know and trust. I certainly do! Traverse City has grown a lot in the last 10-plus years, but it still has the heart of a small town – a ‘take care of your neighbor’ feel. I hope that doesn’t change.

Van Slyke: I can’t speak for any other banks, but I do know why we love being here. I came to Traverse City back in 2000, and my wife and I fell in love with this

place immediately. Within six months, we were both looking for a way to stay here much longer than we planned to.

One thing I love about this area is that the entrepreneurial spirit here area is inspiring. So many small businesses are succeeding, and getting to know the founders of these businesses has been great work to me.

Some of the unique things about this region might be the seasonality of many of our businesses, or the higher-than-normal concentration of hospitality and service businesses. On a national scale, some of these industries fall in and out of favor for the larger financial institutions. That doesn’t work well for small business. They need a partner that understands there will be good times and bad, and you have to be there through both.

I still recall my time at a larger bank and bringing my first winery loan request through. (Headquarters) thought I was joking about there being a winery business in Traverse City!

TCBN: We’ve heard a lot of talk over the past decade or so about how this region and its desirability – as a place to live, as a place to visit, as a place to do business – insulates it a little bit from economic ebbs and flows. But then, obviously, there are certain things – like inflation and interest rates – that affect every area. How insulated is our economy, in your opinion, and what does that mean for the banks that operate here?

Florian: I think we can all agree we’re not immune totally, right? We still get exposed to certain aspects. So, the inflation, the rising costs, those things are no different for northwest Michigan than they are anywhere else. We’ve got to be prepared to help support our customers who are dealing with higher costs – whether it’s a business, whether it’s a consumer – and just trying to provide any products and

services we can to solve those issues. One thing that is unique about northern Michigan is that desirability factor. Thanks to social media, I think the awareness that people have regarding our climate, regarding our amenities, regarding our tourism attractions, it’s all caused an increased migration here. Simply put, northern Michigan is appealing, and we’re blessed that we get to work, live and play here. But we’re on the map, and we have been. Traverse City is going to grow, and we’re going to see commerce continue to grow, too. When that happens, it also raises prices. You see all these articles about the cost of housing, and it’s not getting any cheaper. We’re acknowledging that at Huntington, and we’re doing our part to help by leaning in on developments like Corners Crossing and Annika Place. Those projects are desperately needed, and while they’re not going to be built overnight, they are big projects that can make a difference.

Gillow: I do think we’ve been somewhat insulated in the past. However, I’m not sure past trends can predict the future, given how much Traverse City has changed in the last 10-plus years.

It’s important to be well diversified to operate through any cycle. A balance of consumer and commercial banking, diversification across industries, etc. Banks that maintain a disciplined approach to business will continue to do well.

Van Slyke: I do think the demand for what we are insulates us some. We’re not impervious to interest rates and inflation, but I do think people want to be here regardless of cost. That could be just visiting for a weekend, or moving here permanently. We saw the huge spike during and after COVID. When people became more able to live and work wherever they wanted, we benefited tremendously, and that plays out economically in all types of business; more people here simply means more demand for products and service. But it

also means we are hurting on the housing front, because the national housing issue is only exacerbated when everyone wants to live here.

TCBN: As a bank leader, do you think you have more or less local control over lending and overall operations than you did five years ago? To which factors do you attribute the shift?

Florian: I already mentioned our adjustment to our org structure a little over a year ago, where we went to a regional banking model. Our northern Michigan market runs from the mid-Michigan area – so, the Great Lakes Bay Area, Flint area – all the way north and into the entire U.P. So, that’s pretty expansive, geographically. But we do have a lot of local control, where we have this regional leadership team that represents all of those mini-markets throughout our territory. And I think the change has been hugely beneficial. We’re seeing really good growth because of our pivot to a regional model, and I think it’s because we are closer to the marketplace. It’s been very well received by our customers, and it is paying dividends for our bank.

Gillow: I’d say it’s about the same. Our industry is highly regulated, so it’s our job to deliver the best experience we can while adhering to the guidelines that are intended to protect our clients and the bank.

Van Slyke: No question, there is more control here in Traverse City five years later. We literally have half of our senior management team here in Traverse City now. Our heads of wealth management, treasury management and even our credit officer are all here in Traverse City. So yes, there is definitely more decision-making and control here than there was five years ago.

Operationally, that would be true as well. We have commercial credit underwriting here, as well as our consumer mortgage underwriting and processing. A lot of the operations for our entire bank happen right here on Eighth Street.

By Ross Boissoneau

Everybody wants to make money, then put it to work making more. But above all you want to keep it safe – safe from thieves, hackers and economic downturns.

There are numerous options and investments available. The best way to keep your money safe? That varies depending upon whom you ask, so we asked a number of people.

What about the time-honored tradition of holding onto cash? Stashing it under your mattress might keep it safe, as long as no one breaks into your home, but that doesn’t keep it safe from inflation. Though the rate of inflation is dropping, it’s likely there are other avenues to provide better results.

Instead of stuffing it under your bed, you could put that cash in a bank. Doug Zernow, the chief marketing officer at State Savings Bank, touts the safety of keeping your money in a bank, where it’s insured by the federal government up to $250,000.

“No one has lost money since the (inception of the) FDIC. I can’t see anything safer than that,” he said, referring to the Federal Deposit Insurance Corporation.

Keeping your money in a savings account that accrues interest also keeps it earning, rather than decreasing in value.

“The rates go up and down. You can always find a bank that competes on price. For some, that’s all that matters,” Zernow said.

For others, the bank’s service and place in the community are also important and helps them feel confident in where their

money is being put to use.

“Our customers … want to feel they’ve being treated fairly,” he said.

What about the wide, wild world of cryptocurrency? Cryptocurrencies have attracted a reputation as unstable investments due to investor losses from scams, hacks, bugs and volatility. Because of their technical complexity, using and storing crypto assets can be a challenge to new users.

Rick Stringer heads a local group of crypto investors, and he has a different view. While there are a dizzying number of cryptocurrencies available, he says sticking to Bitcoin is a sound and safe investment.

“All the others are a form of gambling. Bitcoin is decentralized. No one entity controls it,” he said.

So, he considers it much safer than banks.

“As long as you self-custody your Bitcoin instead of leaving it on an exchange, such as Coinbase and others,” said Stringer. “Any exchange can get hacked. Bitcoin is considered the most secure form of money you will find, as long as it is handled properly.”

He said when you self-custody Bitcoin, you have a passphrase of 12 to 24 to words. Those words are the key to your Bitcoin.

“Typically, when someone loses their Bitcoin, it’s for one of two reasons: They held it at a custodian that got hacked, or they lost access to their passphrase,” he said. “Bitcoin itself has never been hacked; however, companies that hold Bitcoin have been. That’s why self-custody is so crucial.”

For financial advisor Larry Avery,

Keeping your money productive and protected

“I believe in the market. The stock market is a creator of wealth. It always goes up, just not in a straight line.”

– Larry Avery, financial advisor

there’s safety in numbers. As in your money is safer if you spread it around in a number of ways.

“Diversity is the key,” he said.

First is how you make your money.

“If you own a business or have a good job, that’s a constant source of income,” he said.

Stocks and bonds offer a number of different investment opportunities, and that is an area he is always confident in.

“I believe in the market. The stock market is a creator of wealth. It always goes up, just not in a straight line,” he said.

Which for him means playing the long game. Buy low, sell high is not an investment strategy.

“In the long haul,” he said, “buy and stay the course.”

Annuities are also a popular choice

for retirement planning and long-term financial security, and Avery says they can be useful as well.

“There are some annuity products that are great for people with less pain tolerance,” he said, adding they are safer but cap the upside.

Finally, he recommends including real estate in one’s portfolio.

“Get a piece of the rock,” Avery said. Is real estate really a secure investment? Many investors jumped in immediately after the pandemic struck as the short-term rental market exploded. Katy Bertodatto of Golden Swan Management strikes a note of caution in terms of currently purchasing a home to cash in on that boom. She said short term rentals have largely plateaued and potential investors need to be aware of the market.

“Two years ago I would have said shortterm rentals are an excellent bet,” she said.

In fact, many of her clients who purchased properties to get in on the trend are money managers. Now, however, it’s a bit of a different story.

“Based on my experience the last couple of years, the market got flooded,” she said.

Add to that the increase in interest rates and the fact many communities are enacting rules to regulate the short-term rental market, and Bertodatto advises investors to tread cautiously.

New units are continuing to come on

the market, and some people still think it’s an easy way to make money, Bertodatto cautions.

“A lot of people are paying top dollar with the inventory low and prices high,” she said.

Beyond that, she said to make sure of the rules and zoning before buying.

“I get calls from somebody looking for a miracle. They ask me to manage a property that’s not zoned properly,” she said. “I can’t do that.”

Still, she’s optimistic as she looks down the road.

“I think it will settle down in years to

come,” she said.

But for now, it’s clear she doesn’t see spending money on a rental property as the best, safest use of your money.

That doesn’t mean that all real estate is a less than stellar choice for investment.

Dan Stiebel, a long-time commercial real estate consultant and sales person for Coldwell Banker Schmidt, says part of the appeal of owning real estate is that it is something you can actually see and touch.

“It’s local, it’s tangible, you can put your eyes on it. From a safety point of view, that is very reassuring,” he said.

He does say there is always exposure to

peril when investing.

“Nothing is risk-free,” he noted.

In the case of commercial property, there is always the possibility of tenant damage or natural disaster.

He said the biggest risk in real estate is wire fraud, when funds directed to a title company get intercepted by fraudsters masquerading as legitimate business.

Another is when someone tries to sell a piece of vacant land they don’t own. In both those cases, Stiebel said working with a legitimate Realtor and title company and checking with the property owners will eliminate any chances of theft.

By Art Bukowski

Stocks? Sure. Bonds? Alright, fine. Cash? Getting closer.

The yellow stuff? Now we’re talking.

For thousands of years, mankind has been fascinated with gold. And while the financial world of 2024 is a bit more sophisticated than it was in ancient Rome or Greece, there’s still plenty of investors and collectors who insist on having this legendary and universally revered metal in their holdings.

“They want it in their hands,” said Chris Guynn, owner of Chris’s Coins in Traverse City. “It’s a security thing. They have it, and they know it’s worth something no matter what, no matter where they go, at any given time. You could be in the middle of the rainforest and pull it out, and everyone there will know exactly what it is.”

And while there’s a segment of gold buyers who don’t trust banks or the government, plenty of mainstream investors also hold gold as part of a diversified portfolio, Guynn says. Unlike many other financial instruments, there’s no strings attached when trading.

“It’s as liquid as water, and there’s no fees. If you have a CD (certificate of deposit) and you need to pull some out, there’s five or ten percent in fees, and then you have to pay taxes on top of that,” he said. “But if you’ve got that met-

“It’s as liquid as water, and there’s no fees. If you have a (certificate of deposit) and you need to pull some out, there’s five or ten percent in fees, and then you have to pay taxes on top of that. But if you’ve got that metal in your hand, you can go in anywhere and sell it for no fee – it’s just a matter of what the price is.” – Chris Guynn, Owner, Chris’s Coins

al in your hand, you can go in anywhere and sell it for no fee – it’s just a matter of what the price is.”

As it sits right now, the price of gold is at an all-time high. At $2,560 per ounce

(at press time), gold is double what it was just five years ago and about six times the roughly $300-$400 it was for the 20 years prior to beginning a slow climb in 2006. That means a mixed bag for local gold

purveyors. More people are interested in selling, which still allows dealers to make a profit by turning around and selling to wholesalers. But while they’re readily available, these wholesale buyers

typically offer ultra-thin margins in the 1-2% range.

“There’s always a buyer, it’s just a matter of what their number is,” Guynn said. “And it’s a matter of how far I have to go and how quick I can get my money. I can drive south for four hours and make (more money than here), but then I’ll be gone all day to Detroit …and if I ship it, I might not get paid for two and a half weeks.”

The bottom line is the best margins (up to 5% for the pure, investment-grade bullion that Guynn deals in) are in retailing to customers, and record high prices simply mean less action on that front.

“It’s a little rougher, because when gold was $1,500 an ounce, for instance, more people were coming in and buying because they could afford it,” Guynn said. “Now, at $2,400 to $2,600, there’s just less people buying. When the prices are lower, you do more business.”

But people still buy, and for that, Guynn is thankful. Because whether gold is at $300 or $3,000 an ounce, those tight margins remain the same. The more transactions, the better.

“Gold and silver are all about volume,” Guynn said. “You don’t stay in business by making a bunch of money on 10 ounces.”

The impact of a record-high price isn’t all that different with jewelry and other

“We can’t stand over it and go, okay, gold went up. Let’s go through here and mark up everything. We just can’t do it. I’m not here to make a million dollars a day, I’m here for volume sales and (having people know) they can come in here and get something nice without having to go get financing.”

–

Vince Amroian, Owner, Vince’s Jewelers

gold that isn’t quite investment grade.

Vince Amroian owns Vince’s Jewelers in Logan’s Landing along the Boardman River south of Traverse City. He’s seen an uptick of people coming in to sell gold now that prices are high, though he’s always had a steady stream of people through his door regardless of price.

“It’s everything from broken promises

and broken dreams to heirloom jewelry that people have that they want to sell,” Amroian said. “We’ll advise on selling it or consigning, or other avenues.”

Record-high prices can sometimes impact sales, Amroian says, even if it’s indirectly. Some people simply assume they’re priced out.

“We sell gold chains, we sell gold rings, but people have this perception

that it’s unattainable,” he says. “They’ll come in and (assume they) can’t buy any gold because it’s too high…not so here because we’re buying it right and we’re rehabbing it right.”

Unlike with bullion, in which high purity means more price fluctuation, the various purity and ratios of gold found in jewelry makes pricing at a place like Amroian’s much less volatile. He’s not

On bright summer days and dark winter nights, Munson is at work. Whether you’re facing life’s toughest or most beautiful moments, we’re at your side through it all. Delivering expert care with kindness, courage, and resolve. And that commitment will never change.

“Yes, prices have gone up on things like gold chains, but it really doesn’t affect buying. Fashion trends are cyclical. Things that were popular in the eighties are popular again, and we sell a ton of yellow gold, a ton of those big chains.”

– Jeff Guntzviller, General Manager, Miner’s North

out to lose money, but says his far greater concern is building a good reputation for his business.

“We can’t stand over it and go, okay, gold went up. Let’s go through here and mark up everything. We just can’t do it,” Amroian said. “I’m not here to make a million dollars a day, I’m here for volume sales and (having people know) they can come in here and get something nice without having to go get financing.”

Over at Miner’s North in downtown Traverse City, General Manager Jeff Guntzviller recalls the 2008 economic downturn during which there was an intense blitz of gold-buying ads. Even though the price of gold is much higher now, he says they bought far more gold back then as consumers were whipped into a selling frenzy.

“There were a lot of places advertising that they buy gold, places popping up in the outlet mall, commercials and things like that. Jewelers were struggling at the time, and they were spending ad dollars,” he said. “We did a bit of that (advertising), but I’d rather spend our ad dollars on our true core business – engagement rings, jewelry and diamonds.”

Like Amroian, Guntzviller isn’t running around marking up prices as gold

gets higher, though certain single-metal items fluctuate based on spot prices. And while prices for those pure metal items are higher, it doesn’t seem to be fazing customers.

“Yes, prices have gone up on things like gold chains, but it really doesn’t affect buying,” he said. “Fashion trends are cyclical. Things that were popular in the eighties are popular again, and we sell a ton of yellow gold, a ton of those big chains.”

From a financial standpoint, Guntzviller says the high price of gold is advantageous because he can offload unused or scrap jewelry components that have piled up over the years for the most money. But the arguably biggest benefit is the chance to have a conversation with a newcomer who might later become a regular customer.

“A lot of times it’s people who inherited things and they’re trying to figure out what to do with it. Sometimes they end up selling it, of course, but you try to help them with all of the options. We can make it into something else, scrap it, take it to a place where they can sell it for you, or they can trade it in,” he said. “We want to be able to help everyone, and if we can help them, they’re going to remember it.”

NOW to enjoy all our

• Our 18-hole course • Renovated clubhouse • Two Indoor TrackMan Golf Simulators • Aquatics Center • Fitness Center

Tennis Courts • Children’s & Family Activities

Social Events

By

As investors approach their retirement years, they need to shift their vision from investing solely for the future and start strategizing on to how to pull from their investments to supplement their retirement income.

The bucket strategy is a popular approach widely used by financial professionals in designing an efficient and intentional retirement investment portfolio. This strategy typically utilizes three buckets, each serving a specific purpose based on when the investor might need access to funds. The buckets can be named a number of titles, but they have the same basic purpose: well-planned access to your hard-earned funds in retirement.

Everyone’s story is different and the bucket strategy is a flexible tool that can be crafted and tailored to each individual’s plan.

Today Bucket: The Today Bucket (or Now Bucket) is where investment options allow access to funds needed in the next two years. These investments would include conservative, low-risk investments. Money market funds, certificates of deposit and short-term treasuries are just a few types of investments that might be held in the Today Bucket. Emergency funds would be included in this bucket as well. By isolating funds in a low-risk investment that the investor knows they are going to need, volatility can be reduced. Distributions from this bucket would include a monthly withdrawal or lump sums for designated expenses (e.g., vacations, home improvements, etc.).

Tomorrow Bucket: The Tomorrow Bucket (or Soon Bucket) is designed for funds that may be needed in the next seven to 10 years. The Today Bucket can be refilled from this bucket as it is depleted, and the market indicates an optimal time for liquidation. The Tomorrow Bucket invests in a mixture of assets with conservative to moderate risk levels to take advantage of growth. In this bucket, you may find investments like annuities, mutual funds, stocks and bonds. The investor is targeting a moderate return with the flexibility to move funds to the Today Bucket as needed. If the investor has greater income than they need for their current daily expenses, they may add to this bucket as a savings vehicle for future big-ticket items, such as a new roof.

Beyond Money Bucket: The Beyond

Money Bucket (or Later Bucket) consists of funds that are not anticipated to be needed for 10 or more years. The purpose of this bucket is to build wealth over the long term. This money also works to replenish funds in the Today and Tomorrow buckets. Additional risk can be taken on in this bucket because the timeline allows liquidation to be timed with optimal market conditions. Stocks and mutual funds looking for growth are commonly found in this bucket. The Beyond Money Bucket often includes assets intended to be passed on to beneficiaries.

The bucket tool can also be used for phases of investment that are not strictly retirement, like the Accumulation Phase and Transition Phase. The Accumulation Phase of investment starts when you first begin saving and continues to five to seven years before you retire. The Transition Phase of investing is typically five to seven years before retirement. This phase incorporates a reassessment of investment risk and moving into new products and allocations in preparation for the Preservation Phase, or the retirement period itself. Working with a financial advisor can help you navigate the complexities of combining the bucket plan and the phases of investment.

By combining both the short-term needs of the investor with the long-term retirement timeline, investors can design a portfolio that helps navigate their retirement years. Everyone’s story is different and the bucket strategy is a flexible tool that can be crafted and tailored to each individual’s plan.

Heidi Cartwright, RICP®, has been in the financial retirement industry for more than 15 years. Heidi specializes in issues unique to women in retirement. Securities offered through LPL Financial, Member FINRA/SIPC.

Investment Advice offered through Capital Asset Advisory Services, LLC, dba CG Advisory Services, a registered investment advisor. Capital Asset Advisory Services, LLC, CG Advisory Services and Prout Financial Design are separate entities from LPL Financial. Intended for educational purposes only and not as investment advice.

At Nicolet Bank, we believe every great success story starts with a conversation. Look to your local, experienced commercial banking team, who work and live here, and understand our local economy is built on shared success.

Michael Caruso

SVP Commercial Banking

231.941.6303

mcaruso@nicoletbank.com

John Galbraith

VP Commercial Banking

231.632.9331

jgalbraith@nicoletbank.com

Jeremy Harnish

SVP Commercial Banking Manager

231.941.6306

jharnish@nicoletbank.com

By Eric Braund, columnist

The past few years have brought their fair share of stress, with worries about a potential recession and ongoing inflation leaving many feeling uncertain about what lies ahead in 2025.

While these concerns can feel overwhelming, your personal finances don’t have to mirror the challenges of recent times. There are plenty of strategies you can employ to regain control of your finances and pave the way for a brighter future. Take the time to prepare before the end of 2024 (it’ll be here before we know it!) by considering these five end-of-year financial actions to cover all your bases.

Now is the time to ensure that you have enough money set aside in your emergency fund or create a plan to build this up over the next year.

With all stock market uncertainty and recession fears, we suggest maintaining a larger emergency fund closer to six to 12 months of expenses for most individuals. However, if you are in or nearing retirement, it’s wise to consider having at least one to two years of cash reserves. This buffer can help you manage unforeseen market downturns or unexpected expenses, without the need to prematurely liquidate investments.

However much you save, be sure this money is held in a highly liquid account. It needs to be readily available and easily accessible, but it should also be in an account that offers a competitive interest rate so that you don’t lose out on potential growth.

The end of the year is also a great time to review your asset allocation strategy. Given the continued impact of market volatility and historic levels of inflation these past few years, it’s crucial that you evaluate your investments and make sure your portfolio is properly positioned. You should be earning enough returns to keep up with inflation, but not overexposing yourself to risk.

Charitable donations are an important strategy to consider as the year winds down. Instead of waiting until the last minute, we advise our clients to schedule their gifts in earlier in the year. This way, you can comfortably contribute to your favorite non-profits, churches and organizations and enjoy the benefits of giving – without the year-end rush.

Charitable donations can be used as part of your overall tax strategy, or as part of a comprehensive estate plan. Providing many potential benefits including supporting causes you care about, reducing your taxable income and reducing your taxable estate.

Early fall is an ideal time to review your tax strategy. Taking these steps can help you manage your tax liability effectively and keep more of your hard-earned money in your hands:

• Tax Loss Harvesting: If you have investments that have declined in value, now may be a good time to sell them to offset gains in other areas of your portfolio. This strategy – known as tax-loss harvesting – can help reduce your taxable income and potentially save on your annual tax bill. You’ll want to consult with a financial professional to see if this strategy fits your overall financial plan.

• Roth Conversions: Another effec-

tive strategy to consider is converting a portion of your traditional IRA to a Roth IRA. While you’ll pay taxes on the converted amount now, the funds can grow tax-free and qualified withdrawals in retirement will also be tax-free. As with tax-loss harvesting, be sure to discuss this with a financial professional to determine if a Roth conversion aligns with your long-term goals.