August Report

Our purpose.

To create a place where we can facilitate our people’s growth.

To create a place where we can facilitate our people’s growth.

Family.

Our colleagues are our broader family, assist when needed and when in need.

Mutuality. Respect our colleagues and our clients as you would like to be respected.

Realising potential. Unlock your full potential, encourage and support your colleagues.

Embrace change. Strive for excellence; be open minded and willing to embrace change.

Health and energy. Work towards being well balanced within yourself.

Selling a house in the spring is a strategic choice that offers several advantages to both sellers and buyers. As the cold winter months recede and nature awakens, the real estate market experiences a surge in activity during the spring. This season's attributes, such as improved weather, longer daylight hours, and vibrant landscapes, create an appealing atmosphereforshowcasingproperties.

One key benefit of selling a house in the spring is enhanced curb appeal. With flowers blooming and lawns regaining their lush green color, homes present themselves in their best possible light. The brighter, natural illumination that accompanies longer days accentuates the positive features of a property's interior, makingitmoreinvitingtopotentialbuyers.

The timing of the spring season also aligns favorably with various factors. Families often aim to relocate during the summer break to minimize disruption to their children's education. By listing homes in the spring, sellers cater to this demographic,potentiallyattractingalarger poolofinterestedbuyers.

Additionally, the optimism associated with spring can influence buyers' decisions. The season symbolizes renewal and positivity, creating a conducive atmosphere for making substantial commitments like purchasing a new home. Moreover, many individuals receive tax refunds during this time, providing them with the financial means necessary for down payments and other expenses associated with buying a house.

A higher inventory of homes on the market during the spring can foster a competitive environment, encouraging buyers to make quicker decisions and possibly leading to more favorable offers for sellers. The combination of increased buyer activity and a sense of urgency oftenresultsinefficientsalesprocesses.

While selling a house in the spring offers numerous advantages, local market conditions, economic factors, and individual circumstances should also be considered. Collaborating with a real estate professional who possesses a deep understanding of the local market dynamics can help sellers maximize the benefits of listing their homes during this season. In essence, spring's unique blend of weather, timing, and positive sentiment creates an opportune environment for both buyers and sellers in the real estate market.

DeanO’Brien Director&CoFounder

Australia isn’t building enough new homes to accommodate our booming population growth, which will have a massive flow-on effect for rents and house prices.

New home building has continued to languish amid higher interest rates and a backlog of homes already under construction, with new home approvals falling 8.1% nationally in July.

The low approval numbers are bad news for Australia’s housing crisis and will challenge policy makers who set an ambitious target earlier this month to build 1.2 million new homes in five years.

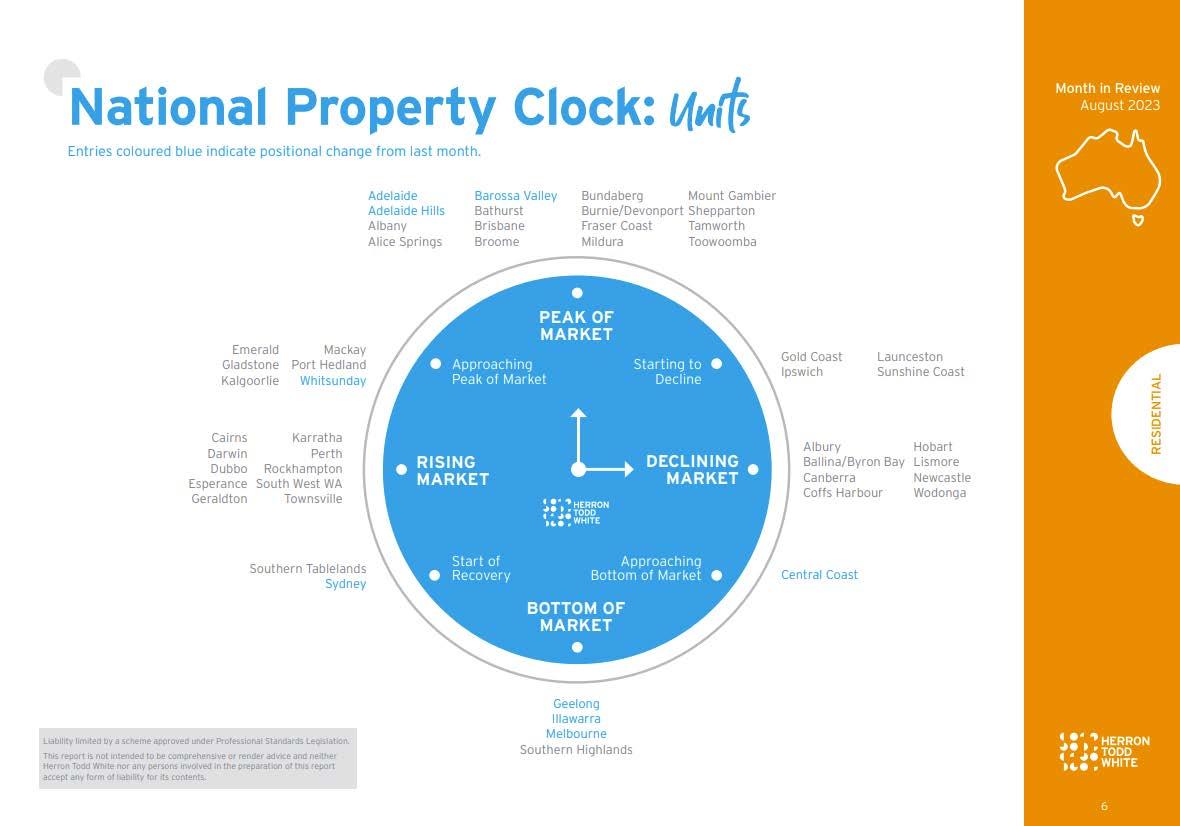

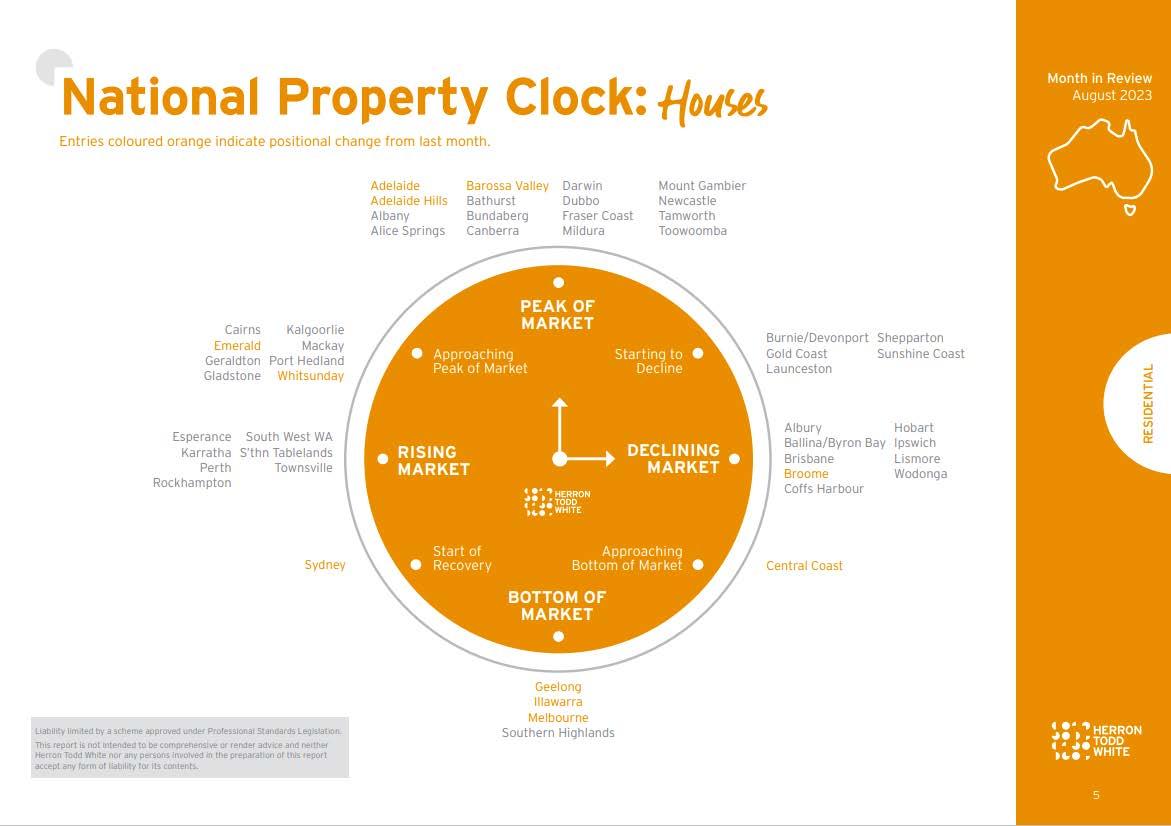

According to the Australian Bureau of Statistics, apartments and townhouses weighed heavily on the sector, with attached home approvals decreasing 15.8% month-on-month in July.

House, or detached home, approvals edged 0.1% higher during the month.

Proptrack Economist Angus Moore said the monthly figures were volatile, but the trend was clear that Australia wasn't commencing enough home building.

"New house and apartment building activity has been sitting around the lowest levels seen in a decade,” he said.

The recent interest rate rises and a glut of homes already under construction have been weighing on the home building industry.

Home builders have been working through a backlog of new homes that were stimulated during the pandemic, when interest rates were at record lows and the federal government launched its HomeBuilder grant.

e said the number of houses under construction was about 60% higher than the average volume seen prior to the pandemic.

At the same time, rapidly rising immigration and sluggish home building has pushed vacancy rates to extremely low levels and fuelled Australia’s rental crisis.

About 171,000 people migrated to Australia from overseas during the 2021-22 financial year, according to the ABS. .

Mr Moore said building more homes was the only way to make housing more affordable and accessible for everyone.

“It’s going to be challenging to build 1.2 million homes in five years, particularly if approvals stay at the current pace,” he said.

The Urban Development Institute of Australia predicted dwelling completions would be around 30% lower in 18 months' time compared to the long-term average if home building wasn’t ramped up immediately.

The time taken to build a home from the approval stage through to completion is typically about 18 months.

“UDIA National has been warning of a major contraction in new housing construction and productivity for some time, and that prediction is coming true just at the time when we need to be increasing new housing supply and re-stocking our pipeline,” said UDIA National President Max Shifman.

“The ever-worsening reduction in new housing supply is leading to skyrocketing house prices and rentals, and we predict this becoming much worse over the next 18 months.”

Home prices continue to march higher, with the PropTrack Home Price Index showing that national home prices jumped a further 0.28% in August.

August marked the eighth consecutive month of national home price growth, with national home prices having now regained the majority of the price falls seen in 2022.

eanwhile, renters are facing ever rising rents amid a lack of available rental homes across the country.

Recent PropTrack data showed that the national rental vacancy rate dipped 0.04 percentage points to 1.43% in July.

Annual rental inflation surged to 7.6% in July, its highest point in almost 15 years, according to the ABS.

Master Builders Australia CEO Denita Wawn said rental prices accelerated again in July amid plummeting approvals for new higher density homes.

“Being able to meet demand in the rental market relies on there being enough apartments and units available. In this area, we have been underbuilding since before the pandemic,” she said.

“[These] figures are showing that there are less – not more – new homes coming our way. It is hard to see how we can bring the rental market under control if this remains the case.”

The quality of our service stems from the importance we place on the people behind our network.