September Report

Our purpose.

To create a place where we can facilitate our people’s growth.

To create a place where we can facilitate our people’s growth.

Family.

Our colleagues are our broader family, assist when needed and when in need.

Mutuality. Respect our colleagues and our clients as you would like to be respected.

Realising potential. Unlock your full potential, encourage and support your colleagues.

Embrace change. Strive for excellence; be open minded and willing to embrace change.

Health and energy. Work towards being well balanced within yourself.

Here's a summary of the key points for the September update:

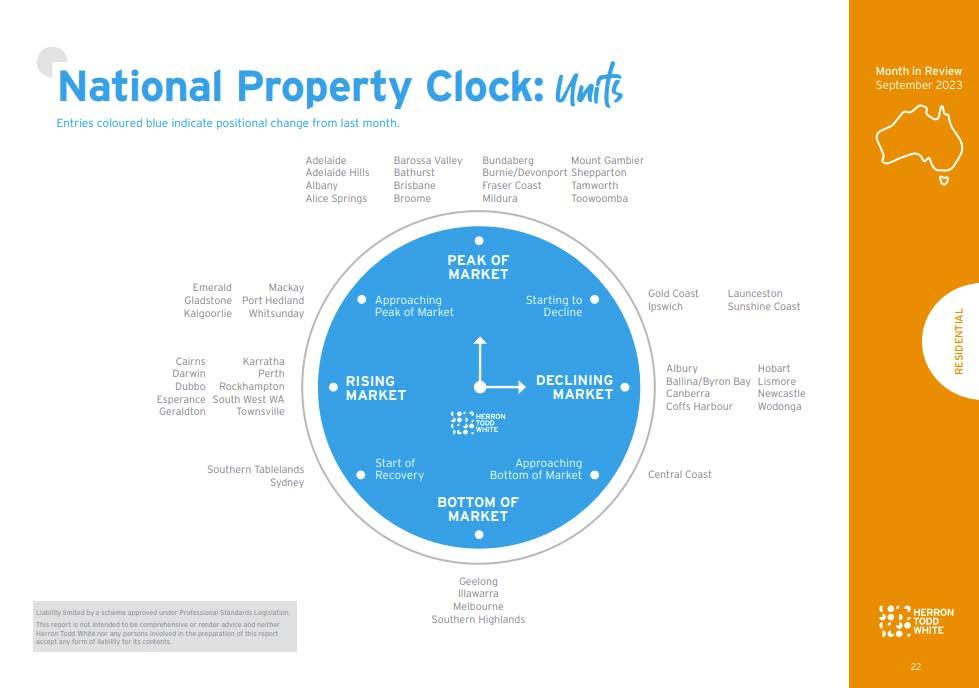

1. Melbourne Home Prices: Melbourne has experienced seven consecutive months of home price increases, with a modest 0.4% increase in September. However, it lags behind other major Australian cities like Brisbane, Adelaide, Perth, and Sydney in terms of price growth. Over the first quarter of the financial year, Melbourne's home prices have grown by 1.3%.

2. Comparison with Pre-COVID Levels: When compared to home values in March 2020, Melbourne has seen only a 3.6% growth over the last 3.5 years, while other cities like Adelaide, Brisbane, Perth, and Sydney have recorded much higher growth rates.

3. Inflation Data: In August, overall inflation increased slightly, but annual core inflation (excluding volatile items) decreased from 5.8% to 5.5% in July. Economists expect the Reserve Bank of Australia (RBA) to keep the cash rate unchanged during its upcoming meeting in October, with some predicting rates to remain stable until mid-2024.

4. Mortgage Cliff: Around 155,000 mortgage holders are expected to face the "mortgage cliff" by the end of the year, with an additional 450,000 fixed-rate mortgages due to expire in 2024. This trend poses challenges for borrowers and the housing market.

5. Chinese Home Buyers: Australia has become the top destination for Chinese home buyers, followed by Canada, the United Kingdom, and the United States, according to Juwai.com. Inquiries from China to Australia have surged by 76% in quarter 3 of FY23 compared to quarter 2, indicating strong interest from Chinese investors.

6. Corelogic Home Index: In September, median house prices in Melbourne Metro increased by 0.3%, while units saw a 0.6% increase. The top three areas in Metro Melbourne for capital growth over the past year were Whitehorse, Monash, and Manningham. In Regional Victoria, Mildura, Wellington, and Baw Baw were the topperforming regions, although overall regional prices remained flat in September.

7. Rental Market: After 36 consecutive months of rent increases, rental rates retracted in September. However, vacancy rates dropped to a low of 1%, well below the 10-year average of 2.8% for combined capital cities. The report suggests that the housing undersupply situation is expected to worsen, as total dwelling building approvals for August declined by 8.1%.

Thank You

Dean O’Brien Director & Co Founder

Applying for a home loan is a big financial decision, but there are simple hacks to make the process as smooth and quick as possible.

Experts say long wait times for home loans to be approved have been slashed since the pandemic, with most lenders and banks turning around applications in less than two weeks

The time it takes to secure a home loan depends on how busy the lender is at any given time, said Brisbane-based mortgage broker Ian Cook.

“On average, 14 days for finance but many lenders can do it more quickly,” he said. “From as little as two or three days if you have to, and a further two weeks for settlement. A one-month settlement is quite common.

“The better organised you are, the more likely you are to go to a lender with the best rate.”

The application process is usually drawn out and arduous when prospective buyers come to the table unprepared for the reality of a bank poring over every transaction on a 90-day bank statement.

“It’s a really good idea to have an initial meeting with your broker or bank as soon as possible,” Cook said. “So that you can start doing things like keeping your accounts in good order, making sure you don’t overspend in the three months prior to the application, making sure all your bills are absolutely paid on time.”

“And then have a meeting in order to understand, ‘Can I get equity? Where do I get the money from? What are the costs? What would the stamp duty be?’

“The earlier you have that knowledge, the better. If necessary, you can do a budget.”

This has become particularly prudent because prospective buyers’ borrowing capacity has been heavily reduced in the wake of recent interest rate rises, said Sydney-based mortgage broker Keegan Rezek, from The Lending Alliance.

Sixteen months ago, a single professional earning $100,000 excluding super, and with no debts, could typically borrow $700,000, according to Rezek.

“That same customer can barely get $475,000 now because of the interest rate environment. But property prices have not dropped 30 or 40 per cent like borrowing capacity.”

Preparing application documents in advance – such as copies of payslips, birth certificates and passports – will speed up the loan process. “Some people are ultraprepared and some people are more laissez-faire,” Rezek said.

Once all application documents are submitted, the turnaround to secure pre-approval is usually between two to eight days, according to Rezek.

“At the moment, I don’t know how much banks want to talk about it, but volumes are down,” he said. “Currently, turnaround times for applications are pretty good.”

Pre-approval gives buyers confidence to start taking the property search seriously.

“Getting a pre-approval is definitely a hack,” Cook said. “It makes the home loan process so much smoother –not so much faster – but much smoother. I also believe you’re in a better bargaining position with the seller or the real estate agent.”

While pre-approvals typically last for 90 days, Cook said it was important to remember they weren’t guarantees and things could change, such as bank policy or government schemes.

Once a purchaser has their offer accepted and signs a contract that is subject to finance, the bank will conduct a valuation of the property before formally approving the loan. Rezek said a four to six-week settlement was “more than enough time to convert that pre-approval into a formal approval”.

Home owners looking to refinance will also have to submit extensive documentation and undergo the same financial checks as they would for a new home loan.

“Refinance, in reality, shouldn’t be anything different but you get a greater choice of lenders because you don’t have that urgency,” Cook said.

“The hardest part is getting people to send us their documents. People are pretty good when purchasing because they want the property. Refinancing should be just as important because you are about to save quite a lot of money.”

The quality of our service stems from the importance we place on the people behind our network.