November report.

To create a place where we can facilitate our people’s growth.

Family. Our colleagues are our broader family, assist when needed and when in need.

Mutuality. Respect our colleagues and our clients as you would like to be respected.

Realising potential. Unlock your full potential, encourage and support your colleagues.

Embrace change. Strive for excellence; be open minded and willing to embrace change.

Health and energy. Work towards being well balanced within yourself.

DearReaders,

Dataisshowingthattheheatintheeconomyiseasing, whichcouldmeantheflatteningofthemarketisnear.The ABShasjustreportedinflationdroppedfrom7.3%to6.9%in OctoberandbuildingapprovalsfordwellingsAustralia-wide dropped6%inOctoberonthebackofan8.1%dropin Septemberandretailtradeturnoverfellforthefirsttimeover thiscalendaryear.

Wearenow6.9%belowtheDecember2021peakinhome prices,butMelbournehadthemostmodesthomeprice increasesoverthe2-yearpandemicofallcapitalcitiesand nowsitsonlyat2.8%abovethepre-covidperiod,basedon ourcurrentrateoffallsinhomepricesitmeansthatbyMarch 2023allpre-covidgainswillbeerased. Interestraterises haveincreasedthefastestsince1994,andtheReserveBank GovernorPhilipLoweapologisedthisweektoallhomeloan borrowersforthereservebank'sfailedguidancethatinterest rateswereunlikelytoriseuntil2024.ButifAustralia’slargest bank,theCommonwealthbankiscorrectthecashratetoset topeakwithonlyonemoreraterise.

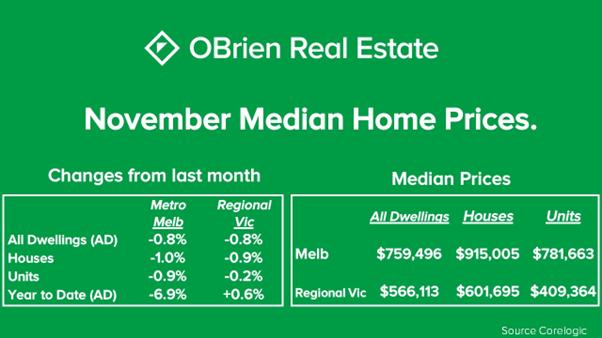

MelbourneMetrodeclinesintheHomeValueIndex

overNovemberfell0.8%foralldwellingtypes,whichisthe samerateofdeclinefromlastmonth.Ona12monthrolling averageMelbournepricesforhousesarenowdownalittle over$82,000howeverhousepricesinRegionalVictoriaare upalittleover$18,000.UnitsarealsofairingwellinRegional Victoriawitha2.9%increaseinpricesoverthelast12 months.

Regards, DeanO’Brien

Number of suburbs sold in.

Sale Price Suburb Address

5WarangaRoad 14FairfordCourt 18/1-3ConnollyCrescent 19LydiaMaryDrive 68StBoswellsAvenue 1/7-8HarmonClose 20DahlenPlace 6TurellaClose 10GolfLinksRoad 2EarlstonSquare 27MeadowlandsWay 8GrandArchWay 8BreeCourt 21AJerichoCourt 12HeronClose 8/162AlbertAvenue 4/6TunstallAvenue 3/51WesternRoad

Bayswater BayswaterNorth BayswaterNorth Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick BlindBight Boronia Boronia Boronia

4 2 2 4 2 6 3 1 1 3 2 2 3 2 2 2 1 1 3 2 2 4 2 1 4 2 2 4 2 4 4 2 3 4 2 2 3 2 4 3 2 1 3 2 0 3 2 2 2 1 1 3 2 2

$1,074,500 $940,000 $635,000 $801,500 $870,000 $522,500 $730,000 $740,000 $672,500 $920,000 $1,180,000 $725,000 $720,000 $558,000 $526,000 $771,525 $609,000 $816,000

Address

48MaintopRidge 104/3MortonAvenue 80ManksRoad 26CradleAvenue 15YandraStreet 7HoosierRoad 3KinrossParade 9KinrossParade 117SelandraBoulevard 7WatervilleVista 11GlenwoodCourt 15SneadBoulevard 39VillagerStreet 12CloverbankDrive 8CriterionWay 44MerrowlandAvenue 7FraserCourt 84CourtenayAvenue 20KiboCourt 2AtbaraLane

Carnegie Clyde Clyde ClydeNorth ClydeNorth ClydeNorth ClydeNorth ClydeNorth Cranbourne Cranbourne Cranbourne

CranbourneEast

CranbourneEast CranbourneEast

CranbourneNorth

CranbourneNorth

CranbourneNorth CranbourneNorth CranbourneSouth

4 2 2 2 1 1 4 2 2 3 2 2 4 3 2 Land 4 2 2 4 2 2 3 2 1 6 3 2 3 1 6 4 2 2 2 1 2 3 2 2 3 2 2 3 2 4 3 2 2 5 3 2 3 2 2 4 2 2

$915,000 $380,000 $1,470,000 $633,000 $1,245,000 $460,000 $675,000 $675,000 $603,000 $910,000 $613,000 $875,000 $505,000 $625,000 $600,000 $705,000 $590,000 $790,000 $610,000 $810,000

Address

41TaplanCrescent 41ButtonwoodWay 11LegendCourt 21CraigRoad 123MoodyStreet 13NellieStreet 5ColeAvenue 9BoldrewoodPlace 4DibaRise 5/138FleetwoodDrive 2StewartAvenue 17GlenwoodRoad 18KarrumKarrumCourt 19CrystalBrookCourt 110SeebeckDrive 6LicodiaDrive 139SouthGippslandHighway 43BayviewRoad 36WondaleaCrescent 4JeanbartCourt

CranbourneWest

Grantville Hallam JunctionVillage KooWeeRup LangLang LangLang Lynbrook NarreWarren NarreWarren NarreWarren NarreWarrenNorth NarreWarrenSouth NarreWarrenSouth NarreWarrenSouth Pakenham Tooradin Tooradin Wantirna WantirnaSouth

4 2 2 4 2 6 4 2 1 4 2 2 3 2 2 3 2 2 Land 3 2 2 3 2 2 2 1 1 3 2 2 4 3 2 4 2 3 3 2 2 4 2 2 4 2 2 3 2 2 4 3 4 5 2 2 3 2 2

$645,000 $1,500,000 $780,000 $640,000 $575,000 $585,000 $415,000 $675,000 $650,000 $560,000 $635,000 $1,900,000 $685,000 $750,000 $845,000 $710,000 $810,000 $1,081,000 $1,147,000 $1,190,000

Address

31SusanStreet 15/241SoldiersRoad 21HudsonStreet 2/15MarynClose 74PositanoCircuit 1/26CaraCrescent 27ChaseBoulevard 3KurnwillPlace 21KurandaCrescent 12EdgbastonCircuit 54InnesCourt 3BayleafPlace 76HomesteadRoad 7/40-44WarrawongDrive 3PetrelPlace 129MelzakWay 46AllungaParade Unit2/1135WhitehorseRoad 17FooteWay 33NunkeriCourt

Suburb

Bayswater Beaconsfield Beaconsfiled Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick BoxHill Clyde ClydeNorth

4 2 2 4 3 2 4 2 2 2 1 1 3 2 1 3 2 2 3 2 2 4 2 2 4 2 2 4 2 3 3 2 2 4 2 2 4 2 2 3 2 2 4 2 2 2 1 1 3 2 2 2 1 1 3 2 2 3 2 2

$550 $500 $480 $330 $445 $425 $540 $510 $570 $580 $460 $570 $530 $440 $600 $390 $480 $510 $440 $440

$2,389 $2,172 $2,085 $1,434 $1,933 $1,846 $2,346 $2,216 $2,476 $2,520 $1,998 $2,476 $2,302 $1,911 $2,607 $1,694 $2,085 $2,216 $1,911 $1,911

Leased price p/m Address Suburb 23SloaneDrive 5FaveroStreet 26aSelandra 6FleuveRise 30HarryStreet 57FloydCircuit 4/106ClairmontAvenue 24FerniskyDrive 9RannochStreet 106SabelDrive 11OtteliaStreet 46BroomeCrescent 57RenlikCircuit 12WhiteGumWay 21DellineaStreet 12LanossoAvenue 28HikariCrescent 17ScottRoad 60MiralieWay 24BarbaraAvenue 7/6ByronStreet 40AldridgeStreet 26ManuscriptDrive 10ArnicaClose

ClydeNorth ClydeNorth ClydeNorth ClydeNorth Cranbourne Cranbourne Cranbourne CranbourneEast CranbourneEast CranbourneNorth CranbourneNorth CranbourneNorth CranbourneNorth CranbourneNorth CranbourneNorth CranbourneSouth CranbourneSouth CranbourneSouth CranbourneWest DandenongNorth Elwood EndeavourHills EndeavourHills HamptonPark

3 2 1 3 2 2 2 2 1 3 2 2 3 1 1 4 2 2 4 2 2 3 2 2 3 2 2 4 2 2 4 2 2 3 1 1 2 1 1 3 2 2 3 2 2 3 2 2 4 2 2 3 1 4 4 2 2 3 1 1 1 1 1 4 1 2 3 2 2 3 2 2

Leased price p/w

$480 $465 $410 $450 $440 $500 $480 $430 $475 $550 $570 $450 $435 $460 $440 $540 $625 $650 $550 $410 $360 $465 $450 $430

$2,085 $2,020 $1,781 $1,955 $1,911 $2,172 $2,085 $1,868 $2,063 $2,389 $2,476 $1,955 $1,890 $1,998 $1,911 $2,346 $2,715 $2,824 $2,389 $1,781 $1,564 $2,020 $1,955 $1,868

Leased price p/w Leased price p/m Address Suburb

4ConstantineWay 40LindheLane 17ParslowCrescent 112HutchinsonDrive 125MontbraeCircuit 25DunkinsonStreet 28WesleyDrive 2TopazPlace 4Clarrisacourt 3/105SpringfieldDrive 18CulcairnCourt 6/13JoyParade 1FernStreet 7AddisonClose 14FairchildPlace 27HarlesdenCircuit 23EverlyCircuit 7/137AhernRoad 119GeorgeStreet 105/85MarketStreet 2HarewoodStreet 41ABayviewRoad 54KidderminsterDrive

Hastings LangLang Lynbrook Lynbrook NarreWarren NarreWarren NarreWarren NarreWarren NarreWarren NarreWarren NarreWarrenSouth NoblePark Officer Officer Pakenham Pakenham Pakenham Pakenham Scoresby SouthMelbourne Tooradin Tooradin Wantirna

4 2 2 3 2 2 5 2 2 3 2 2 3 2 2 3 2 0 3 2 2 3 1 2 3 2 2 3 1 4 3 2 1 2 1 1 4 2 2 4 2 2 3 2 1 2 1 1 4 2 2 3 2 2 3 1 3 1 1 1 3 2 1 3 1 0 4 2 2

$600 $850 $540 $530 $580 $490 $450 $420 $500 $430 $425 $275 $520 $500 $450 $395 $450 $420 $440 $400 $520 $520 $550

$2,607 $3,693 $2,346 $2,302 $2,520 $2,129 $1,955 $1,825 $2,172 $1,868 $1,846 $1,195 $2,259 $2,172 $1,955 $1,716 $1,955 $1,825 $1,911 $1,738 $2,259 $2,259 $2,389

Fivekeyfactsyouneedtoknowabouttheproperty marketrightnow Australia'smedianhousepricehasfallenatitsfastest rateonrecord,butitisstillwellabovepre-pandemic levels.

A bidding frenzy has begun in earnest as lenders trip over themselves to secure new business from home owners. In the past few weeks, some of the nation’s biggest lenders have announced they will fork out up to $4000 cash in exchange for your business.

More than 20 different banks and lenders are putting cash on the table if you refinance, which is an enticing offer in anyone’s books.

Westpac, St George, HSBC, Commonwealth Bank, Bankwest and AMP are among lenders literally throwing money at home owners willing to refinance.

The slew of cashback deals coincides with cost of living pressures reaching fever pitch in the lead-up to Christmas, with switching no doubt already top of mind for stretched home owners hoping to shave thousands a year off their mortgage repayments

It’s a tough time for over-stretched home owners. Just this week, the Reserve Bank of Australia Governor Philip Lowe apologised to the thousands of Australians who took out mortgages with the expectation that interest rates would stay unchanged until 2024.

His comments related to the RBA failing to make it clear that its commentary about steady interest rates was heavily conditional on the state of the economy.

Sign-up incentives for new customers are rolled out from time to time by lenders. The current official cash rate is 2.85 per cent, but we are days away from the next Reserve Bank Board meeting, where monetary policy decisions are on the agenda.

In reality, the cashback deals are a sign that lenders are starting to concede that the new year could start with a recession due to a further slowing of the economy and a spike in unemployment.

Bank of Melbourne has settled on $4000 refinance cash back, while Ubank is offering $5000 for your business.

St George Bank has put in place a $4000 cashback offer, while the CommBank is offering $2000. HSBC is offering a cashback of $3288, while Westpac will fork out $2000.

While you’ll, of course, need to read the fine print to see which deal works best for your circumstances, it’s another sign that being loyal to your bank – often called the “loyalty tax” – doesn’t pay off these days, Natalie Abel of Domain Home Loans says

“The bank wants to see you make your first loan repayment, forking out the refinance cash bank amount around six weeks after settlement,” Natalie Abel says.

“The minimum amount to be eligible to refinance with most banks now is $250,000, and the Loan To Value (LVR) mustn’t exceed 80 per cent. The security also needs to be a residential property that is used as an investment or is owner-occupied.

“Just remember that anyone that has to go back into LMI territory with their mortgage will not get a refinance rebate,” Abel says “They need to be 80 per cent and under to obtain this offer in all cases.”

But read the fine print. There are a number of hidden costs involved in refinancing, from mortgage discount fees, mortgage registration fees, new application fees and even Lender’s Mortgage Insurance, Abel warns.

In most cases, the refinancing process could take a few weeks to complete, depending on the complexity of the loan. “If you do decide to refinance, be quick, with most of these deals off the table by April 2023,” Abel says.

your lunch break: The banks now paying you thousands to switch to a cheaper home loan