From our corporate director

Dean O’Brien

Hi All,

In February, the National Home Price Index, as reported by CoreLogic, saw a notable 0 6 percent increase, marking the most substantial monthly rise since October 2023 This upswing in early 2024 is particularly encouraging for homeowners nationwide, especially following a 0 4 percent uptick the previous month Across capital cities, Perth continues to stand out, boasting a remarkable 1 8 percent growth rate over the month Additionally, Adelaide and Brisbane demonstrated robust performance with growth rates of 1 1 percent and 0 9 percent respectively Despite this, Melbourne lagged behind with a modest 0 1 percent growth rate, yet it remains a prime location for advantageous property acquisitions

The upcoming weekend in Melbourne anticipates 1300 homes scheduled for auction, representing a 40.2 percent increase from the same period last year. Last weekend saw an even larger auction turnout with 1457 properties, achieving a respectable clearance rate of 64.7 percent. This surge in listing and sales volumes, notably attributed to the early Easter holidays, underscores heightened market activity compared to typical seasonal trends.

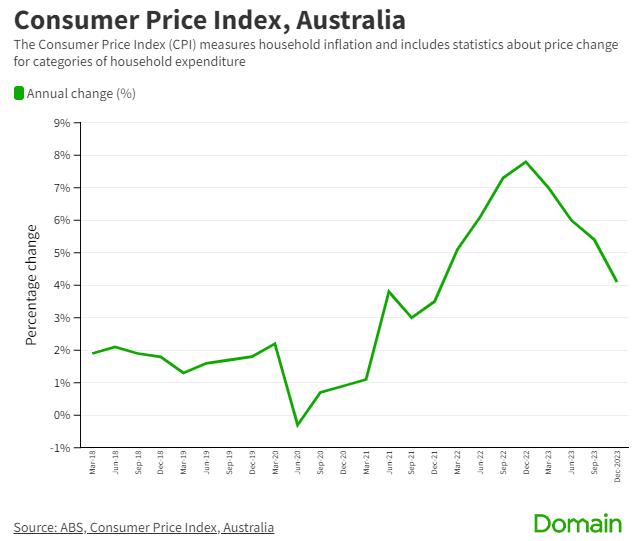

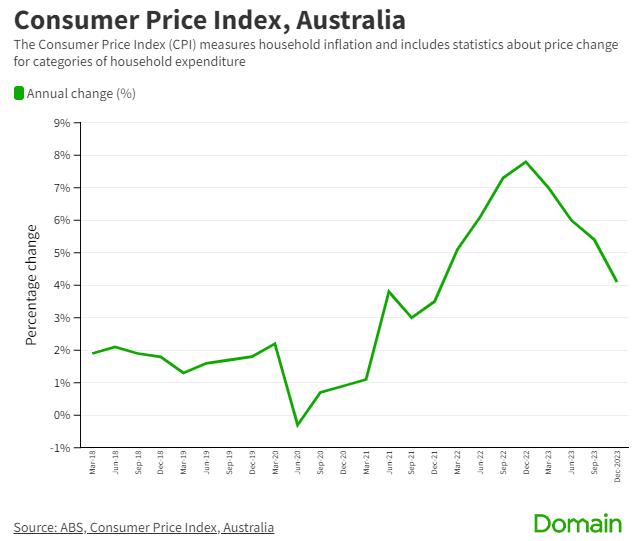

Economically, there's a noticeable deceleration, which bodes well for both investors and mortgage holders The January Consumer Price Index (CPI) released on February 28 revealed a drop in the annual inflation rate to 3 4 percent, likely eliciting satisfaction from the new Reserve Bank Governor Moreover, recent consumer spending figures indicate a decrease of 2 7 percent in December, signaling restrained expenditure Employment data released this week shows a slight uptick in unemployment to 4 1 percent, marking the first time in two years that the rate has exceeded 4 percent

Similar to the real estate market, the Australian stock market has experienced a strong start to 2024, surpassing previous all-time highs in January and again in February's closing days

Regional Victoria has also witnessed growth in both housing and unit prices during February, hinting at a potential uptick in growth for regional cities throughout 2024

Traditionally, rental prices observe an upsurge in the first quarter of each new calendar year, driven by factors such as job relocations, cadetships, internships, university placements, and fresh starts, which elevate demand in the rental sector. Consequently, it's expected that this heightened demand will translate into rental price increases over the next 2 to 3 months.

As we conclude this March update, it's essential to note that the information provided is of a general nature. For personalized advice tailored to your specific circumstances, it's advisable to seek independent legal, financial, taxation, or other professional advice Regards,

Dean O'Brien Corporate Director

February report

Interest rates: RBA holds the cash rate at 4 35 per cent as inflation slows

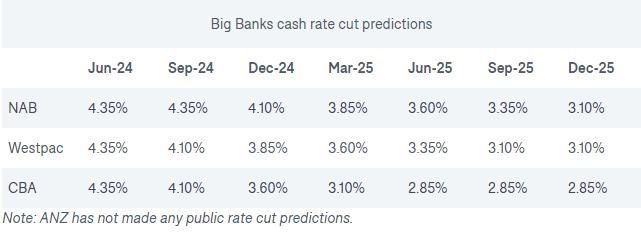

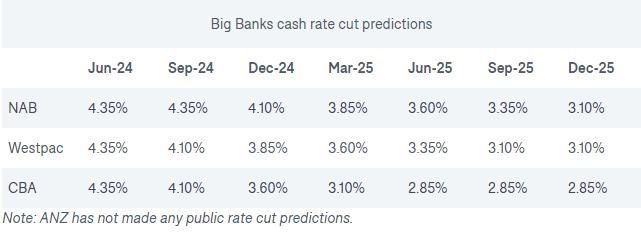

he Reserve Bank of Australia (RBA) has held the cash rate at 4 35 per cent during its first meeting of the year, in line with market expectations, following last week’s consumer price index (CPI) figures which showed annual inflation had plunged to a two-year low “This is the peak for the cash rate, and I actually think everyday Australians will assume that too,” says Domain chief of research and economics Dr Nicola Powell

“What Australians will be looking forward to is when the cash rate is cut, because many mortgage holders are struggling People want that break; they want a little bit of relief, and that’s very likely to come [at] some point this year ”

Centre for Independent Studies chief economist Peter Tulip says “most people in the market are expecting rates to stay on hold for a few meetings and then fall in the next few months – and fall relatively substantially over the next year or two”

He believes rates will have declined by 3 5 per cent by next year if inflation continues to decrease, which is good news for anyone feeling the cash-rate pinch

The quarterly CPI, an indicator of inflation, rose by 0 6 per cent in the December 2023 quarter – the smallest quarterly rise since the March 2021 quarter Annual inflation fell to 4 1 per cent, still above the RBA’s 2-3 per cent target, but back at its lowest level since 2021

“While prices continued to rise for most goods and services, annual CPI inflation has fallen from a peak of 7 8 per cent in December 2022, to 4 1 per cent in December 2023,” says Australian Bureau of Statistics head of prices statistics Michelle Marquardt

Although annual inflation is falling faster than the Reserve Bank expected – it was tipped to finish the year at 4 5 per cent – Tulip says it’s too soon to celebrate the low CPI numbers

“A lot of it reflected on one-off temporary factors that are not going to keep cutting inflation,” he says “For example, government measures; their cost-ofliving relief like rental relief and the electricity rebates took about half a percentage point off the inflation growth

“I don’t think the government will repeat that and, in fact, some of those things were temporary, and they will go away We’ll see a rebound from that in the CPI over the next year ”

University of Sydney macroeconomics professor Dr Mariano Kulish says the annual inflation of 4 1 per cent is still too high, and the upcoming stage three tax cuts might further increase prices

“They should increase interest rates again,” he says “And the reason is that inflation is still very high ”

However, Powell believes the tax cuts won’t affect inflation as many economists fear

“Australians will be very mindful of how much they flex this additional cash because I think that people have really tightened their belts There’ll be some element where some people will want to save any spare cash they have to keep it for a rainy day,” she says

Mozo finance expert Rachel Wastell welcomes the hold

“It looks like the inflation figures and everything [are] heading in the right direction,” she says “We are achieving what [former RBA governor Phillip Lowe] said: ‘A narrow path to a soft landing ’

“It looks like it is the peak of the rate-hiking cycle, but what I think is interesting is watching the big banks be split on how soon the rate cuts will come ”

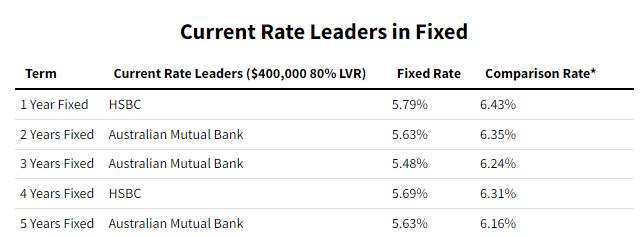

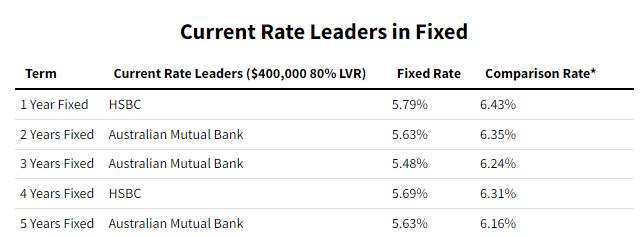

Many potential home buyers may now be waiting for interest rate cuts before they enter the property market, but Wastell says banks are constantly moving their rates

“There are moves happening behind closed doors that don’t make the news,” she says “It’s really important that mortgage holders keep an eye on their rate and don’t stick their head in the sand, essentially, and make sure they know what they are paying to see if they could get a better deal somewhere else

article source : www domain com au

Step 1: Assessment

Simply call and speak to our experienced Growth Specialist who will review and assess, collecting some information to commence the hand over process

Step 2: Authorise

At this stage, we will gather all required documentation authorising our team to take over the file and begin an in depth analysis of your property

Step 3:

OBrien Real Estate hand over We take it from here, managing contacts, assessments, and file transfers We'll also liaise with your tenant for inspections or introductions

have

investment property?

management to us ... it's easy.

Do you

an

Transfer

Josh Barbut 0439 782 898 Property Management Growth Specialist

Rental review

23

Rental providers/ property owners have chosen us

$538

Average median rent per week

7,799 Renter enquiries

112,948 Property views

131

Leasing inspections conducted

62

Properties leased

16

Average days on market

2,886

Renter applications received

6,651

360 degree tour viewed

0.61%

Vacancy rate

A snapshot of last months leases

We lease more.

January-February 2024 Review Address Suburb Price per week Price per month 17 Yarran Grove 23 Birch Street 1/13 Church Street 4 Fairlawn Place Unit 5/12-14 Elmhurst Road 1 Hartville Place 16 Bewley Way 2 Marija Crescent 19 Charles Conder Place 21 Fairground Promenade Unit 2/12-14 Harkaway Road 15 Stradbroke Close 37 Lemongrove Way 8 Sing Crescent 1 Konac Court 46 Allunga Parade 14 Dixon Grove 40A Tormore Road 240 Scoresby Road 3/37 Chandler Road 20 Rothan Avenue 11 Ridgeline Drive 38 Athletic Circuit 11 Milford Street 30 Mattamber Street 1 Pamplona Way 6 Hyde Avenue 50 Elmtree Crescent 21 Ventasso Street Bayswater Bayswater Bayswater Bayswater Bayswater North Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Berwick Blackburn Boronia Boronia Boronia Boronia Botanic Ridge Clyde Clyde Clyde Clyde North Clyde North Clyde North Clyde North 3 4 3 3 2 4 3 4 4 4 3 4 4 3 3 3 3 3 3 2 3 6 4 4 3 4 4 4 3 2 3 2 2 1 3 1 2 2 3 2 2 2 2 2 2 1 2 1 1 2 2 2 2 2 2 2 2 2 2 2 2 1 1 2 1 2 2 2 1 2 2 2 2 2 1 2 2 1 3 2 2 2 1 2 2 2 2 $600 $850 $630 $560 $430 $600 $450 $600 $570 $580 $550 $600 $650 $550 $560 $550 $500 $530 $500 $450 $625 $780 $560 $580 $480 $575 $650 $550 $500 $2,607 $3,693 $2,737 $2,433 $1,868 $2,607 $1,955 $2,607 $2,476 $2,520 $2,389 $2,607 $2,824 $2,389 $2,433 $2,389 $2,172 $2,302 $2,172 $1,955 $2,715 $3,388 $2,433 $2,520 $2,085 $2,498 $2,824 $2,389 $2,172

A snapshot of last months leases

We lease more.

January-February 2024 Review Address Suburb Price per week Price per month 10 Serengeti Street 35 Mortdale Lane 8 Rawls Street 22 Virginia Street 9 Evelyne Avenue 8 Haines Street 5 Mercury Road 70 Huon Park Drive 14 Epsom Lane Unit 14/10-20 Mickleham 9 Hunter Court 1/56 Elizabeth Street 49 Diplomat Crescent 21 Ottawa Walk 13 Forton Crescent 51 Raisell Road 40 Jupiter Crescent 5/9 Humber Road 9a Shetland 7a Nadia 2 Rossiter Avenue 6 Homewood Close 76 Helen Road 14 Virginia Way 13 Tiarne Crescent 9 Contata Grove 8 Sybella Avenue 34 Station Street 6 Glenbrook Crescent Clyde North Clyde North Cranbourne Cranbourne Cranbourne Cranbourne East Cranbourne East Cranbourne North Cranbourne North Cranbourne North Cranbourne North Cranbourne North Cranbourne South Cranbourne West Cranbourne West Cranbourne West Cranbourne West Croydon North Endeavour Hills Endeavour Hills Endeavour Hills Ferntree Gully Ferntree Gully Ferntree Gully Hampton Park Junction Village Koo Wee Rup Lang Lang Lynbrook 4 4 4 3 3 4 4 3 4 3 3 3 3 4 3 3 3 2 2 3 3 3 3 3 3 4 3 6 4 2 2 2 1 2 2 2 1 2 1 1 2 2 2 2 2 2 1 1 2 1 1 1 1 2 2 1 3 2 2 2 2 1 3 2 2 2 2 2 1 1 1 2 1 2 1 1 1 1 2 1 2 2 1 1 2 6 2 $570 $550 $575 $500 $495 $550 $550 $530 $590 $460 $515 $440 $500 $580 $550 $510 $480 $500 $420 $460 $500 $490 $550 $590 $480 $550 $550 $800 $630 $2,476 $2,389 $2,498 $2,172 $2,150 $2,389 $2,389 $2,302 $2,563 $1,998 $2,237 $1,911 $2,172 $2,520 $2,389 $2,216 $2,085 $2,172 $1,825 $1,998 $2,172 $2,129 $2,389 $2,563 $2,085 $2,389 $2,389 $3,475 $2,737

A snapshot of last months leases

We lease more.

January-February 2024 Review Address Suburb Price per week Price per month 15 Bulga Wattle Circuit 12/12-16 Carrum Street 101 Saffron Drive Unit 7/31-45 Vimini Drive 3 Warren Close 53 Upton Crescent 25 Kent Road 7/31-45 Vimini Drive 11 Beverly Court 4 Rosaleen Court 34 Abeckett Road 109A A\'beckett Road 23 Ernest Crescent 10 Sneddon Drive 4 Lighthorse Crescent 43 Sneddon Drive 12 Celestine Drive 2 Finch Court 8 Pinot Way 27 Harlesden Circuit 11 Stanhope Place 4/35 Sunbeam Avenue 11 Karabil Close 1 Ingrid Street 2 Harewood Street 41A Bayview 82 Coleman Road 37 Reita Avenue 55 Tate Avenue Lyndhurst Malvern East Narre Warren Narre Warren Narre Warren Narre Warren Narre Warren Narre Warren Narre Warren Narre Warren Narre Warren North Narre Warren North Narre Warren South Narre Warren South Narre Warren South Narre Warren South Officer Pakenham Pakenham Pakenham Pakenham Ringwood East Scoresby Scoresby Tooradin Tooradin Wantirna South Wantirna South Wantirna South 4 2 2 3 2 3 5 3 3 3 3 3 4 3 3 4 5 3 3 2 4 2 3 3 3 3 5 4 3 2 2 2 1 1 2 2 1 1 2 2 1 2 2 1 2 2 1 2 1 2 2 2 1 2 1 2 2 2 2 1 2 2 1 4 2 2 2 2 4 1 2 4 1 1 4 2 2 1 2 1 4 1 1 0 2 2 2 $690 $580 $480 $490 $420 $530 $630 $490 $495 $450 $650 $520 $640 $530 $460 $550 $550 $480 $450 $410 $550 $500 $510 $480 $560 $520 $680 $670 $540 $2,997 $2,520 $2,085 $2,129 $1,825 $2,302 $2,737 $2,129 $2,150 $1,955 $2,824 $2,259 $2,780 $2,302 $1,998 $2,389 $2,389 $2,085 $1,955 $1,781 $2,389 $2,172 $2,216 $2,085 $2,433 $2,259 $2,954 $2,911 $2,346

5 reasons why OBrien

Reason #1

Access to more renters

Inter-office promotion and selling increasing your property’s exposure. Latest prospective renter database

Reason #2

Local area specialists, highly skilled and trained property managers across all offices

Reason #4

Constant improvement.

Experience, integrity and knowledge Specialised

All property managers receive specialist industry training and have regular meetings

Reason #3

Faster leasing time.

Our low days on market can translate into marketing savings. Less time on market ensures you receive the best possible price

Reason #5

Professional photography and lease boards, utilising Australia’s premier real estate websites

marketing.

Josh Barbut 0439 782 898 Property Management Growth Specialist

Our property management team Currently for lease Berwick Cranbourne Narre Warren Berwick 9707 0556 56-58 High Street, Berwick berwick@obre com au Cranbourne 5995 0500 Cranbourne Park Shopping Centre FS005/125 S Gippsland Hwy, Cranbourne cranbourne@obre com au Narre Warren 8794 0500 Suite 3, Ground Floor/58 Victor Crescent, Narre Warren narrewarren@obre com au Rental Market Update

The quality of our service stems from the importance we place on the people behind our network.

offices

Our network 40

and growing

Torquay Northern Victoria Melton Alexandra Werribee Deer Park Wodonga Wangaratta Sydenham Rye Eastern Victoria Drouin Warragul Corporate Brighton Hastings Mentone Preston / Reservoir Mornington Somerville Bairnsdale Frankston Oakleigh Cowes Croydon Ringwood Blackburn Vermont Wantirna Far North Queensland San Remo Endeavour Hills

Warren Keysborough Berwick Chelsea Carrum Downs Cranbourne Langwar r i n Cairns & Beaches Pake n h am Wonthaggi Tecoma / Belgrave / Olinda obre.com.au

Narre