Market Update

May 2024 Review

Our purpose

To create a place where we can facilitate our people’s growth.

May 2024 Review

To create a place where we can facilitate our people’s growth.

Family.

Our colleagues are our broader family, assist when needed and when in need.

Mutuality.

Respect our colleagues and our clients as you would like to be respected.

Embrace change.

Strive for excellence; be open minded and willing to embrace change.

Realising potential. Unlock your full potential, encourage and support your colleagues.

Health and energy. Work towards being well balanced within yourself.

Hi All,

May 2024 Report: Melbourne Metropolitan Real Estate Market

Market Overview: In May 2024, the Melbourne metropolitan real estate market remains resilient amid economic uncertainties. This stability is significantly influenced by recent state and federal budget measures aimed at supporting the housing sector and stimulating economic growth.

State Budget Initiatives: The Victorian state budget for 2024 has introduced measures to bolster the real estate market. Key initiatives include increased investment in infrastructure projects, enhancing connectivity and making suburban areas more attractive to homebuyers. Additionally, the state government has expanded firsthome buyer grants and stamp duty concessions, benefiting young families and first-time buyers. These measures have led to increased property inquiries and transactions in outer suburbs.

Federal Budget Influence: The federal budget complements state efforts by addressing housing affordability and supply issues. A significant initiative is the Housing Affordability Fund, which allocates resources to build affordable housing units in metropolitan areas, including Melbourne. This initiative has eased rental market pressures and provided more opportunities for low to middle-income families to purchase homes. Federal tax incentives for property investors, such as negative gearing and capital gains tax discounts, remain intact, attracting investors to the Melbourne market and sustaining demand for residential and commercial properties.

Market Performance: These budgetary measures have resulted in a stable real estate market in Melbourne, with moderate property price growth. Expert forecasts for 2024 include:

ANZ: 3-4% rise

CBA: 5% rise

NAB: 5.5% rise

Westpac: 3% rise

PropTrack: 1-4% rise

SQM: up to -3% fall

Supply constraints, like other major Australian cities, continue to influence market dynamics.

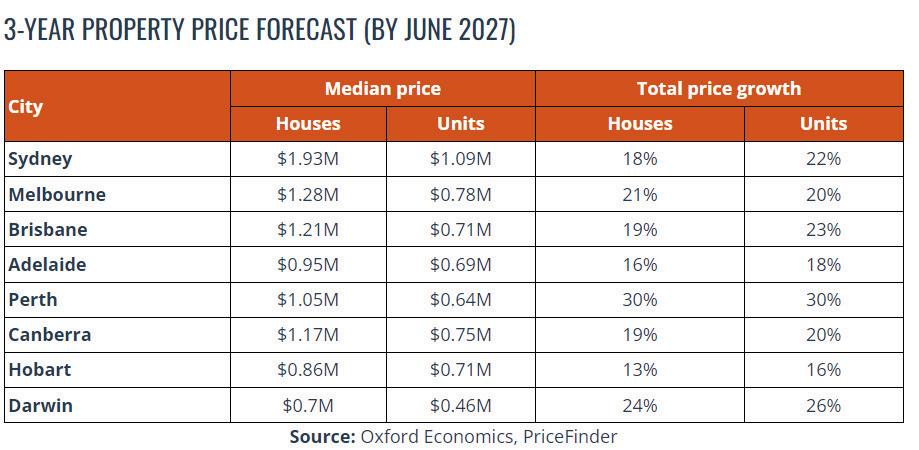

3-Year Property Price Forecast (By June 2027): Melbourne: (Source Oxford Economics, Pricefinder) Median Price: Houses $1.28M, Units $0.78M Total Price Growth: Houses 21%, Units 20%

Other cities also show varying growth forecasts, with Perth leading in projected growth at 30% for both houses and units.

Conclusion: The Melbourne metropolitan real estate market in May 2024 demonstrates steady growth and resilience, supported by strategic state and federal budget interventions. These measures have aided homebuyers and investors while contributing to the region's broader economic stability.

Regards,

Dean O'Brien Corporate Director

Do you have an investment property? Transfer management to us ... it's easy.

Step 1: Assessment

Simply call and speak to our experienced Growth Specialist who will review and assess, collecting some information to commence the hand over process.

Step 2: Authorise

At this stage, we will gather all required documentation authorising our team to take over the file and begin an in depth analysis of your property.

Step 3:

OBrien Real Estate hand over We take it from here, managing contacts, assessments, and file transfers. We'll also liaise with your tenant for inspections or introductions.

Reason #1

Inter-office promotion and selling increasing your property’s exposure. Latest prospective renter database.

Reason #2

Local area specialists, highly skilled and trained property managers across all offices.

Reason #3

time.

Our low days on market can translate into marketing savings. Less time on market ensures you receive the best possible price. Access

Reason #4

All property managers receive specialist industry training and have regular meetings.

Reason #5

- $671,000 $660,000 - $700,000

- $968,000 $550,000 - $600,000 $680,000 - $730,000 $630,000 - $690,000 $880,000 - $968,000

$750,000 - $825,000

$620,000 - $682,000

$880,000 - $940,000

$550,000 -$605,000

$585,000 - $640,000

$670,000 - $730,000

$860,000 - $920,000

$685,000 - $753,000

$800,000 - $860,000

$830,000 - $870,000

$699,000 - $759,000 $742,000 $765,000 $847,000 $1,102,500 $610,000 $1,800,000 $850,000 $885,000 $665,000 $690,000 $920,000 $590,000 $700,000 $660,000 $960,000 $766,000 $675,000 $912,000 $420,000 $595,000 $710,000 $865,000 $715,000 $810,000 $870,000 $728,000 $742,000

- $720,000

$620,000 - $660,000

$530,000 - $580,000

$1,150,000 - $1,250,000

$600,000 - $640,000

$500,000 - $550,000

$650,000 - $715,000 $1,100,000

$598,000 - $657,000

$1,220,000 - $1,190,000

$650,000 - $700,000

$890,000 - $950,000

$720,000 - $770,000

$770,000 - $840,000

$1,000,000 - $1,100,000

$630,000 - $690,000

$1,130,000 - $1,190,000

$380,000 - $410,000

$840,000 - $924,000

$980,000 - $1,078,000

$680,000 - $748,000 $800,000 $670,000 $590,000 $610,000 $820,000 $710,000 $630,000 $535,000 $1,225,000 $605,000 $535,000 $700,500 $1,100,000 $685,000 $1,165,000 $656,000 $930,000 $750,000 $787,000 $1,030,000 $655,000 $1,150,000 $380,000 $970,000 $1,080,000

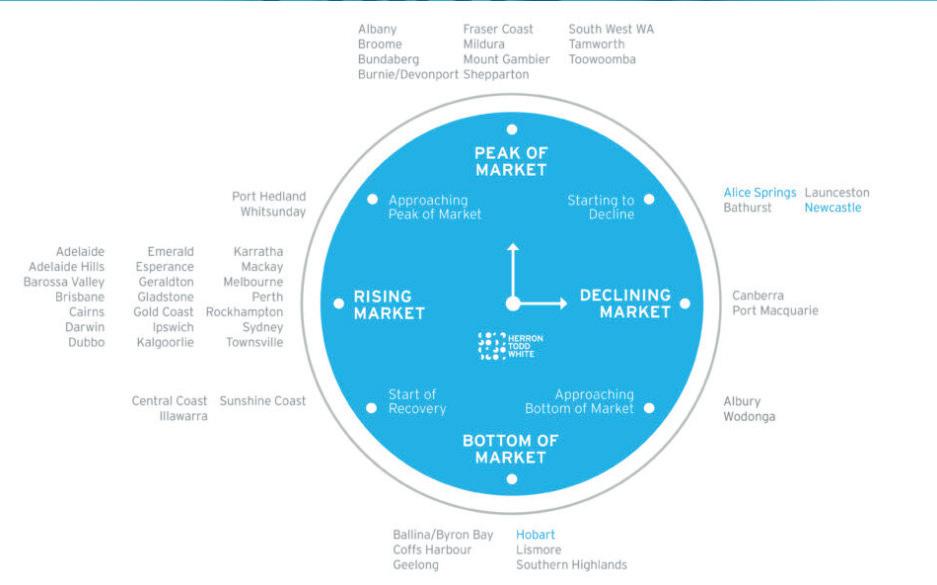

Why the underperformance of the Melbourne market?

Key takeaways

The Melbourne housing market has not performed as strongly as some other capitals over the last year, but Melbourne’s property values are expected to gain ground as we move through 2024.

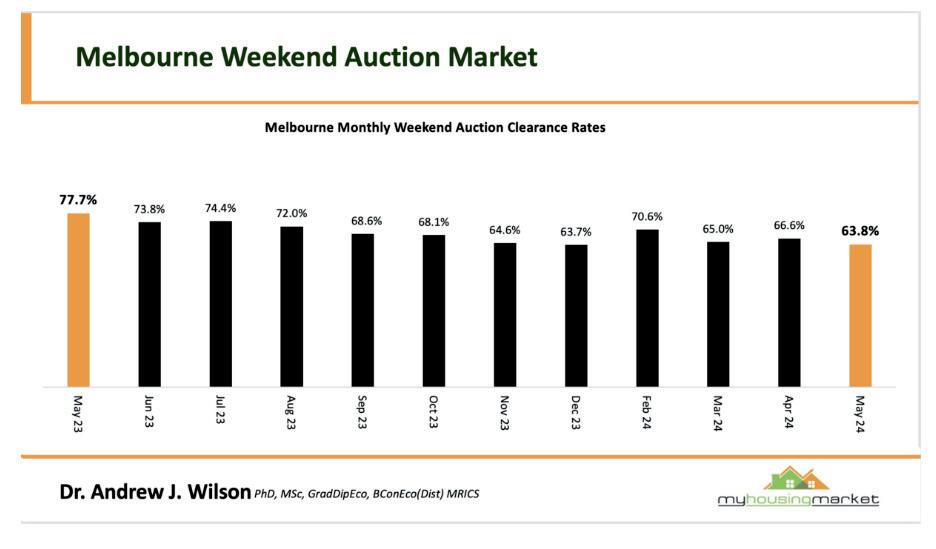

We are seeing some early signs of a boost in confidence in both buyers and sellers and auction clearance rates have remained strong showing a significant depth of buyers in the market.

There is significant "inbuilt equity" in the undervalued Melbourne housing market at present but not all Melbourne property is created equal - you need to know where to buy, what to buy and what suburb is ripe for investment.

One thing is becoming clear, if you wait around until interest rates fall, all you’re going to be doing is playing tug-of-war with owner occupiers over the best properties.

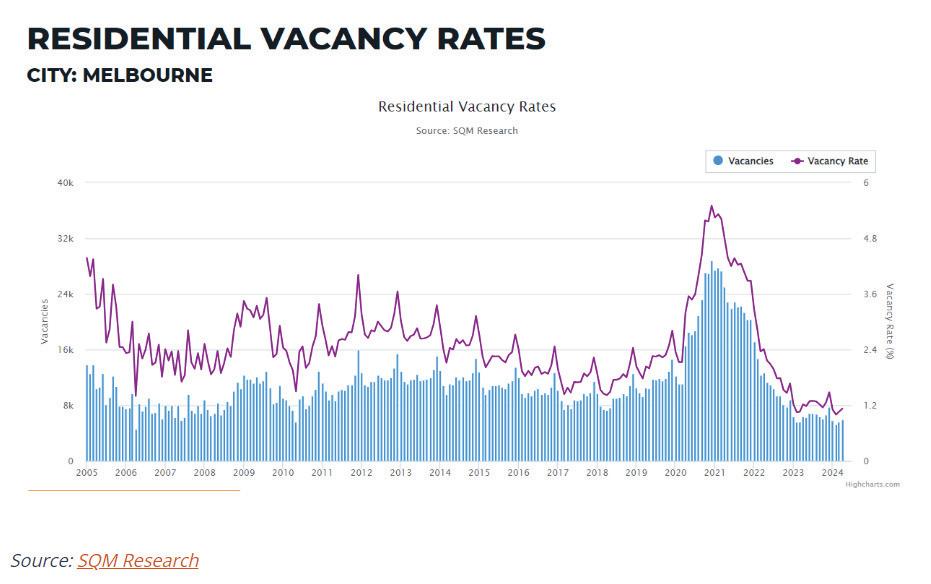

With vacancy rates at historic lows, rentals are skyrocketing in Melbourne

Are you wondering what will happen to the Melbourne property market in 2024?

Clearly, the Melbourne housing market has not performed as strongly as some other capitals over the last year, but Melbourne’s property values are expected to gain ground as we move through 2024.

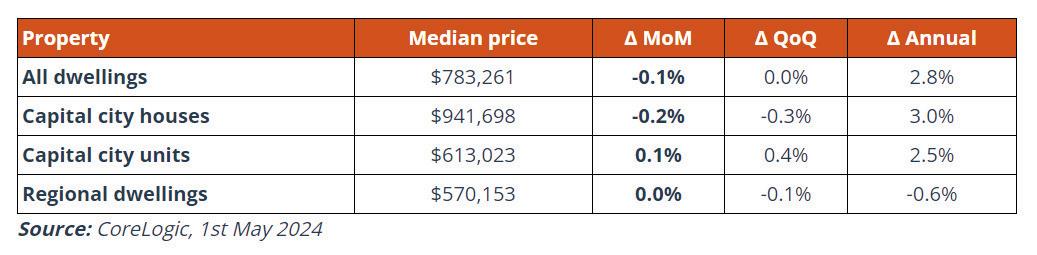

Melbourne home prices were flat in April growing 3% over the last year, while unit values grew 2.5% over the year. Melbourne's property values have risen 11% since the onset of Covid, but they are still -4.1% below their previous peak in March 2022.

Here is the latest data on the median property prices for Melbourne.

Clearly the Melbourne housing market has not performed as strongly as some other capitals over the last year. This creates a window of opportunity for strategic property investors as Melbourne property values significant upside potential.

The average price of a Melbourne standalone house is the lowest it has been against its Sydney equivalent in around twenty years. There is significant "inbuilt equity" in the undervalued Melbourne housing market at present, but not all Melbourne property is created equal - you need to know where to buy, what to buy and what suburb is ripe for investment.

One thing is becoming clear, if you wait around until interest rates fall, all you’re going to be doing is playing tug-of-war with owner occupiers over the best properties.

By buying the "right property" in the Melbourne market now you could lock down almost certain upside equity.

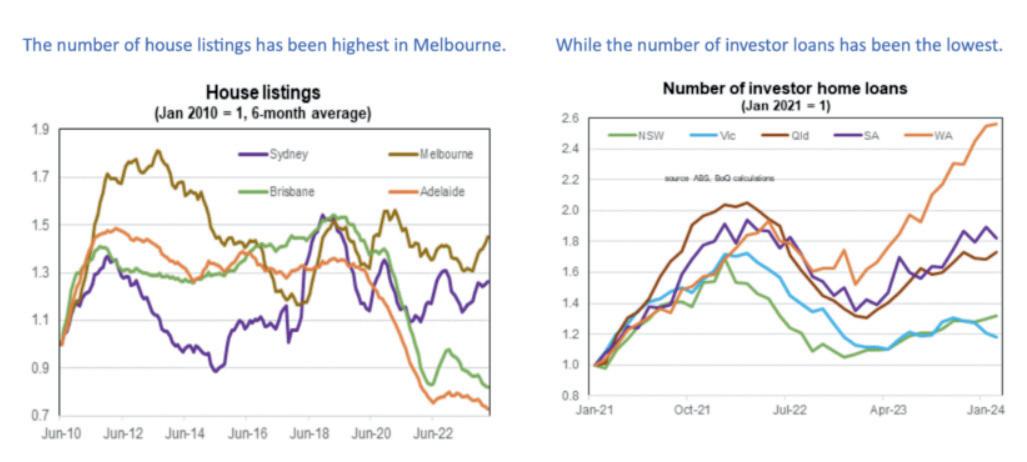

Partly it might reflect the greater stock of housing available for sale in the Melbourne market relative to other states. Also, investor demand has also been lower in Melbourne dues to discontent with the way the Victorian government is treating investors and favouring tenants.

Another possible reason the Melbourne market has underperformed is what has happened to the number of people per household.

While that number declined over COVID, particularly in Melbourne, the rise in rents at a time of the general high cost of living has lead to a number of people either having to move into a group house or move back home.

And that could be playing a role of reducing demand by more in Melbourne than in some of the other cities.

However the Melbourne housing markets are fragmented and more than 50 Victorian suburbs saw house price growth exceed the average national average house price growth in 2023.

At Metropole Melbourne we’re finding that strategic investors and homebuyers are back actively looking to upgrade, picking the eyes out of the market.

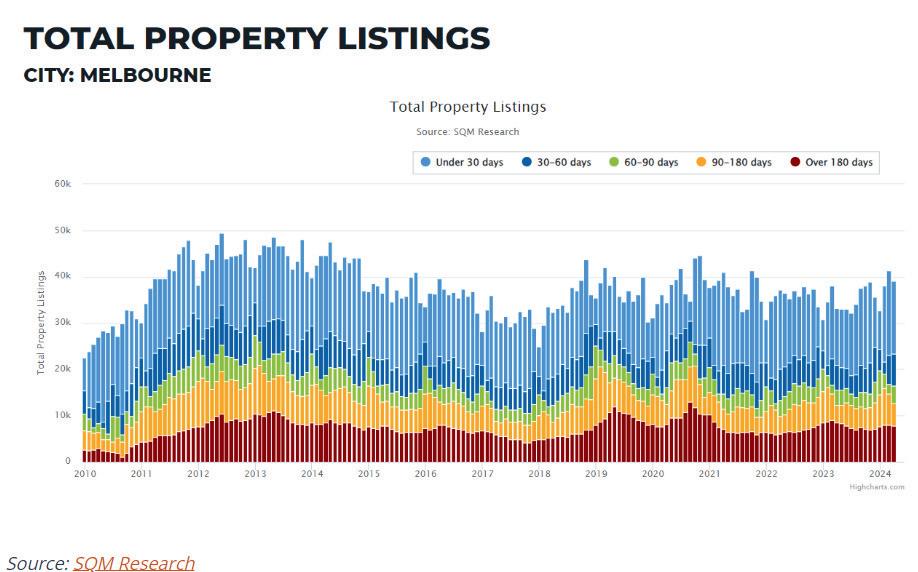

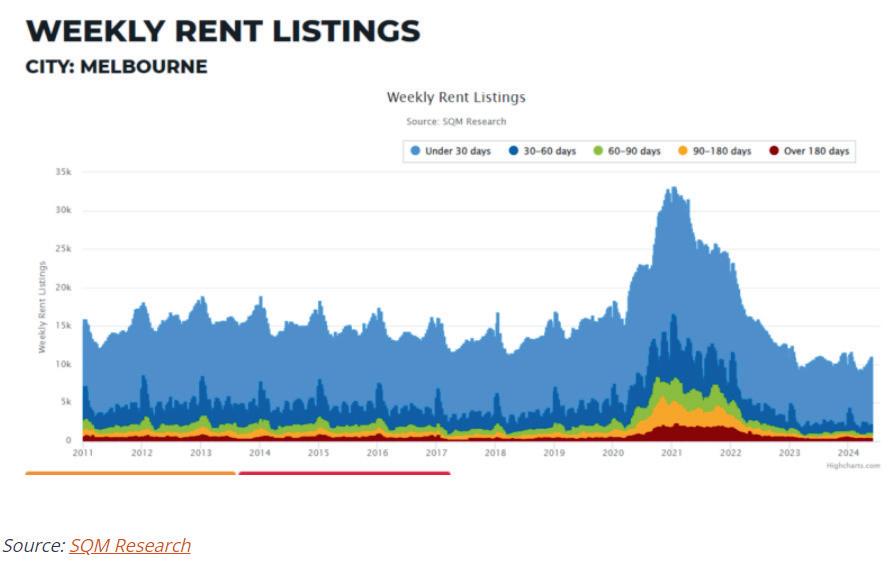

As you can see from the following chart, the number of properties listed for sale in Melbourne has not increased much since the market turned in early 2023.

On the other hand, the Melbourne auction market started the year strongly showing a significant depth of buyers in the market.

While the data is insightful, as we know, Melbourne’s market is not a one-size-fits-all property market and A-grade homes and investment-grade properties remain in strong demand and are likely to outperform, many holding their values well.

There is a clear flight to quality with A-grade homes and investment-grade properties still in short supply for the prevailing strong demand, but B-grade properties are taking longer to sell and informed buyers are avoiding C-grade properties.

This is creating a window of opportunity for homebuyers and property investors with a long-term perspective.

Sure, many discretionary buyers and sellers have left the market at present, but life will go on in the Victorian capital – people will get married, people will get divorced, families will have babies and many Melbournians are going to need to move house.

When they realise interest rate rises have stopped (and we're possibly there already) and that inflation is under control (and we're past the peak already) they will come back into the market with a vengeance.

MELBOURNE’SRENTALMARKETSREMAINEXCEPTIONALLY TIGHT

Vacancy rates in Melbourne’s rental market are usually very tight, often sitting below the national baseline.

And thanks to soaring demand and a severe undersupply across Victoria, and the rest of the country, the national vacancy rate is exceptionally low today by historical standards.

SQM Research reports Melbourne’s vacancy rate at 1.5%. By comparison, the vacancy rate which represents a balanced market, is around 2-2.5%.

Of course, this isn’t news.

As we know, Melbourne’s rental market, like most places across the country, has plunged into crisis.

Near-record-low vacancy rates, high rent prices, strong demand, and a rising population have combined to push the city’s market into a high-pressure cooker environment.

The data for vacancy rates and also weekly rent listings highlights that the distressing state of Melbourne’s rental market leads to a bleak outlook for renters.

Melbourne's decline in vacancy rates and number of rental listings can be attributed to two factors:

1.

One major factor is the city's strong economy and job market. Melbourne is home to a number of major industries, including finance, technology, and healthcare, which are driving the demand for housing.

2.

Another factor is the city's growing population. Melbourne's population has been growing steadily in recent years, with more people moving to the city to take advantage of its job opportunities and quality of life.

This increased demand for housing has led to competition among renters, driving down vacancy rates.

Overall, the decline in vacancy rates in Melbourne is a sign of the city's strong economy and growing population.

While it may be more difficult for renters to find a property, the city remains an attractive place to live and work.

The Melbourne property market has been one of the strongest and most consistent performers over the last four decades.

But the COVID-19 pandemic and numerous city lockdowns hit the city hard – many residents fled northwards to Queensland and closed borders halted migration from overseas.

From the economic fallout of the COVID-19 pandemic and being locked down for longer than any other city in the world, to 13 interest rate rises, the lowest level of consumer confidence in decades, and a continuous conveyor belt of negative messages in the media, tightening of lending restrictions, the Melbourne property markets have faced considerable headwinds.

After booming through 2020 and 2021 with prices rising by 15.8%, Melbourne housing values fell -7.9% from their peak in March 2022 through to the recent trough in January 2023.

While the Melbourne housing market turned the corner in early 2023, property price growth has been slower than in some other capital cities.

Any way that you look at it, Melbourne has now clearly passed the bottom of the downturn, and while Melbourne has not seen as sharp a recovery in prices this year as Sydney has, it also did not see as large a decline in 2022.

And there are firm indications that Melbourne property values and rents will keep rising in 2024.

Having said that, Melbourne’s housing markets were fragmented in 2023 with more than 50 Victorian suburbs seeing house prices exceed the average national house price growth for the year. Across sub–regions, Melbourne's Inner and Outer East are outperforming marginally while the North West and West are seeing prices stabilise rather than rise.

Conditions are notably softer outside the capital, with property prices in most regional centres in Victoria falling or at best only stabilising.

And it’s worth remembering that even though Melbourne’s property market underperformed in 2023, it has been one of the strongest and most consistent performers over the last four decades.

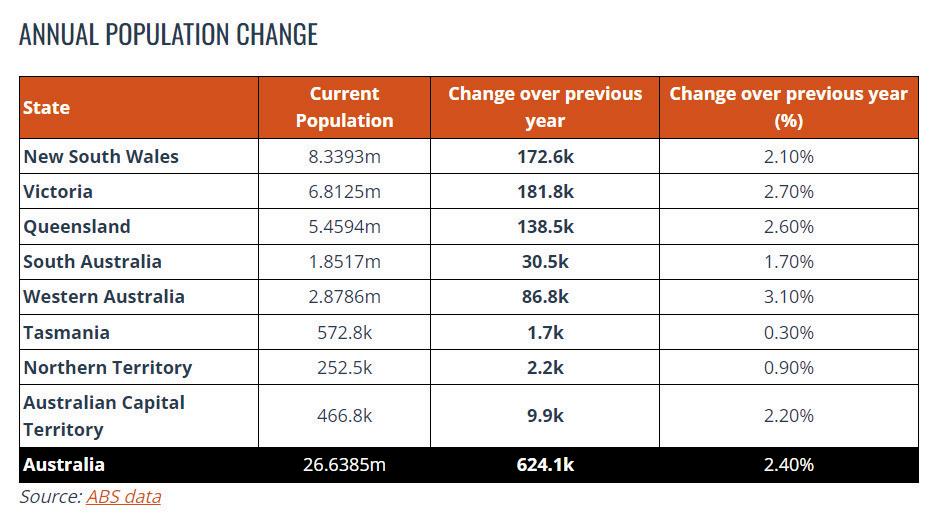

Currently, there are 5.8 million people living in Melbourne, and 6.8 million in Victoria.

Victoria experienced the biggest population increase over the year to June 2023.

This can mostly be accounted for by a steady inflow of interstate and international arrivals and a subdued number of Victorians leaving the state (compared to other states which have had higher arrivals but also higher departures).

And the population growth is expected to continue growing too. The Victorian government has a business plan to increase Melbourne's population by 2050 to 8 million people, which will put Victoria’s population at around 10 million people.

This means that over the next 30 years, Melbourne is likely to require 1.5 million more dwellings which will be made up of 530,000 detached houses, 480,000 apartments, and 560,000 townhouses.

While this increased demand is likely to translate to continued strong property price growth and a more robust economy, which is great news for investors, its infrastructure will struggle to keep up. However Melbourne's public transport system, in particular, is struggling to keep up with the increased demand, leading to overcrowding, delays, and other issues.

The city's roads are also becoming increasingly congested, making it difficult for people to get around.

To address these challenges, the Victorian government has committed to investing heavily in public transport infrastructure. The Metro Tunnel project, for example, will create a new underground rail line through the CBD, while the Suburban Rail Loop project will create a new orbital rail line connecting Melbourne's suburbs.

These projects will help to relieve congestion on Melbourne's roads and public transport system, providing much-needed relief to commuters.

The local government also has plans to invest in the city’s sustainable infrastructure and practices and is looking to develop new areas in surrounding suburbs to help facilitate the impending population boom.

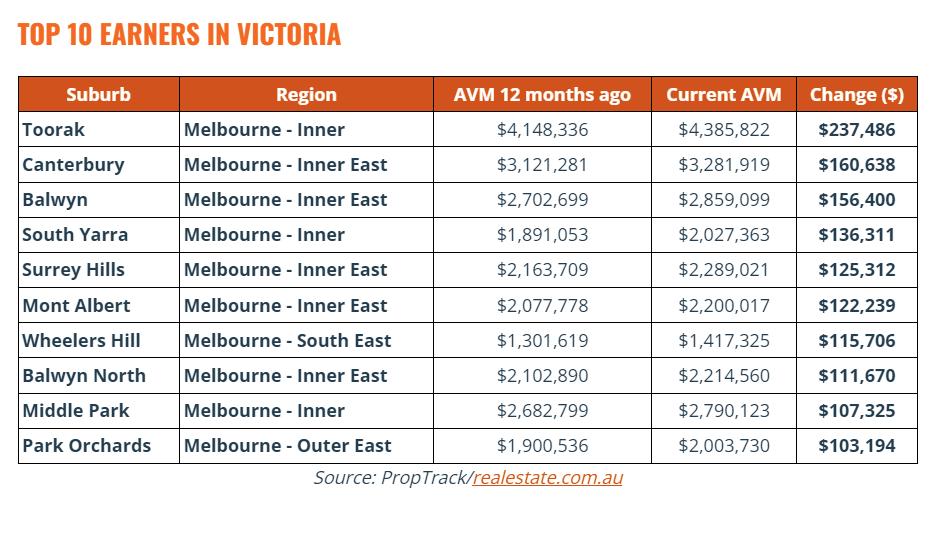

Top 10 Melbourne suburbs where property has earned more than the average worker

Overall Melbourne property prices grew by a relatively modest 1.33% over the year.

But in the exclusive inner-Melbourne suburbs of Toorak and South Yarra, houses still gained more than the average wage at $237,486 and $136,311 respectively.

Meanwhile, suburbs east of the city in Canterbury, Balwyn and Surrey Hills also saw house values jump by $160,638, $156,400 and $125,312 respectively.

Further east the data was also impressive. House prices in Wheelers Hill, Park Orchards, Lysterfield and Doncaster East increased $115,706, $103,194, $101,332 and $99,385 respectively over the year, all more than the average Australian wage.

Melbourne’s housing market - the forecast for 2024

Digging deeper into the stats, some Melbourne properties - bearing in mind there are multiple markets within markets - have far outperformed others.

But it seems that freestanding Melbourne houses within a close distance of the CBD or in good school catchment zones are the most stable.

It really is a tale of two cities - while some properties over-perform, others underperform.

But the expert consensus is that strong population growth and tight supply will continue to push property prices upwards as we move through this next stage of the property cycle.

And that is even in the face of the Reserve Bank continually hiking interest rates in order to get on top of Australia’s soaring inflation levels.

While Melbourne’s property market has lagged behind Sydney and Brisbane, there are clear indicators that it will continue on its upward trajectory.

Here are some of the most recent expert forecasts to take note of:

ANZ forecasts a 3-4% property price rise in Melbourne in 2024.

CBA forecasts a 5% property price rise in Melbourne in 2024.

NAB forecasts a 5.5% property price rise in Melbourne in 2024.

Westpac forecasts a 3% property price rise in Melbourne in 2024.

PropTrack forecasts a 1-4% property price rise in Melbourne in 2024.

SQM forecasts up to a -3% property price fall in Melbourne in 2024.

Overall though, supply remains constrained much like Australia’s other major cities.

Oxford Economics recently made the following forecasts of where house prices will be in 3 years time.

As you can see, they expect very strong property price growth for both houses and units in Melbourne over the next three years as Melbourne reverts back to mean long-term growth rates.

Are you wondering how you should invest in this interesting phase of the property cycle?

If you're like many property investors, you're probably wondering what's the right thing to do at present.

Should you buy, should you sell, or should you just wait?

You can trust the team at Metropole to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, at times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s exactly what you get from the multi-award-winning team at Metropole.

We help our clients grow, protect and pass on their wealth through a range of services including:

1.

Strategic property advice – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

2.

Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $4Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney, and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment-grade property. Click here to learn how we can help you.

3.

Property Development - We enable you to become an “armchair developer” and get all the benefits of property development without getting your hands dirty. We take the hassles out of your investment by assisting you with all the expertise you need, from concept to completion, including construction. Click here to see if it’s the right way for you to grow your portfolio.

4.

Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

5.

Property Management – Our stress-free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years, and our properties lease 10 days faster than the market average.