Case study

Curve now saves £60K a month with optimization

Above all, we are now able to serve our customers better, experience fewer declines, and offer greater customer satisfaction.

Lotan Ganot

VP Payment Solutions Curve

Lotan Ganot

VP Payment Solutions Curve

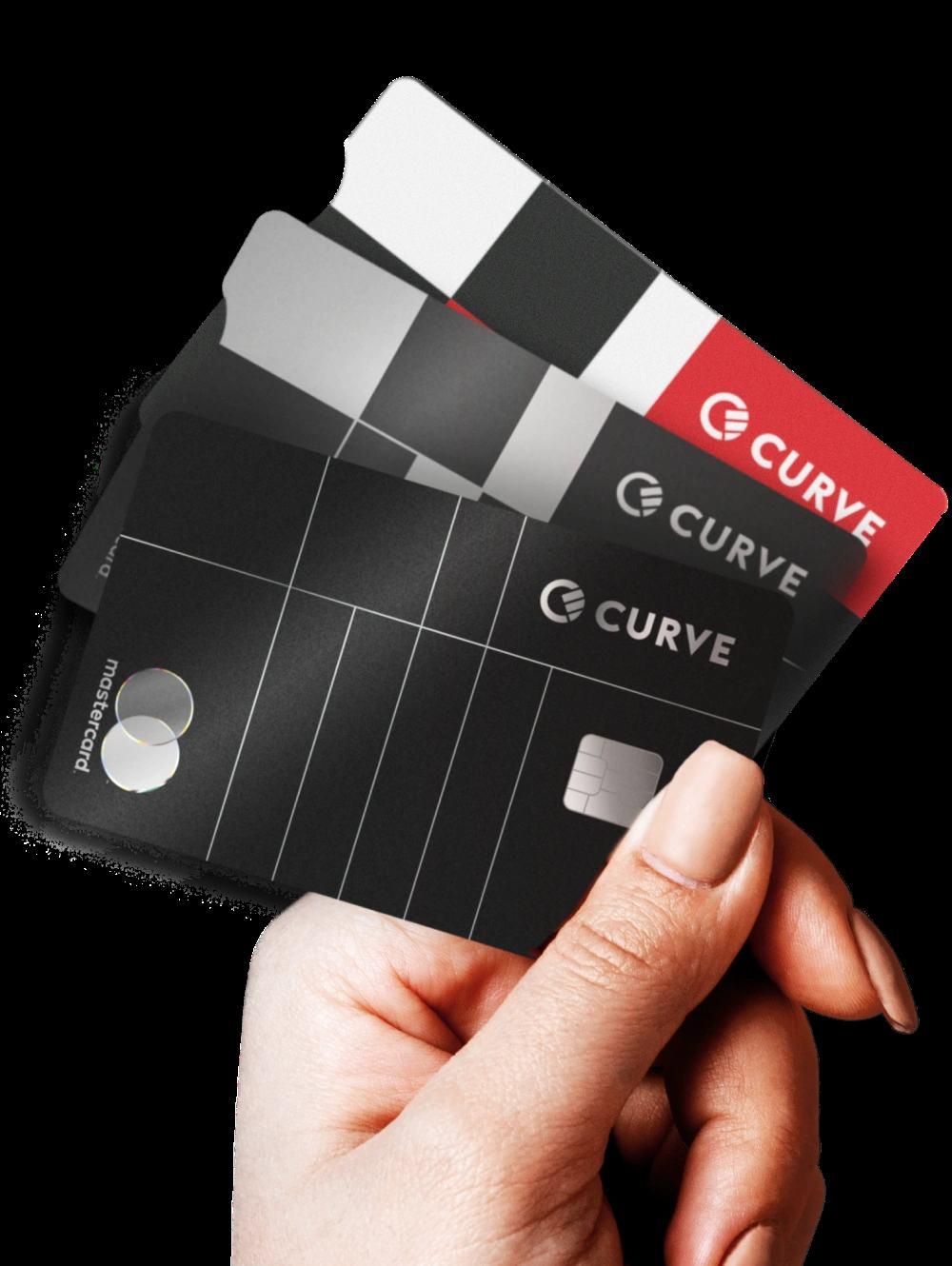

ABOUT CURVE

Literally one card to rule them all, Curve is

a hassle-free financial super app that connects all users' payment cards in one.

Curve aggregates multiple cards through its accompanying mobile app, allowing users to seamlessly make payments and withdrawals from a single location and to switch cards after each transaction is complete.

The Challenge

As a financial service provider that unites users’ card payments into one app, Curve needs instant processing to maintain its exceptional user experiences. Working with a sole acquirer meant an inflexible pricing strategy and limited scope for expansion. Furthermore, Curve faced challenges with reconciliation, settlement times, and limited cashflow management so it sought out an additional acquirer with a forwardthinking mindset and support strategy that matched its own.

The solution

By uniting Curve and Nuvei’s innovative, resultsfocused teams, the two companies implemented

a payments optimization strategy designed to improve acceptance rates, speed up settlement times, lower false declines, increase liquidity, and reduce Curve’s overall costs. As part of their partnership, Nuvei and Curve then mapped out

a geographical expansion plan that includes additional payment methods to facilitate

further growth.

Services used coverage EU,

Global acquiring

Fraud and risk management

Authorization optimization

more transactions a month

UK

The Results

With its original acquirer, Curve’s best month for processing cost was August 2023 at 0.47%. In March 2024, with 90% of its volume with Nuvei, Curve achieved a processing cost of 0.45%. A typical month at Curve will have approximately £300 million in processing volume, so that 0.02% reduction reflects approximately £60,000 per month, or £720,000 per annum, thanks to moving the lion’s share of its processing to Nuvei.

Between March 2023 and March 2024, Curve saw an approval rate improvement of 0.5%. in a typical month, Curve processes approximately 11 million transactions, so the 0.5% improvement reflects approximately 55,000 transactions per month that were authorized rather than declined.

Curve now approves

55K

£720K

Curve now saves a year with lower processing cost

£1.5M

Curve now processes more volume a month more transactions a month

Customer experience is essential to Curve and it is paramount to us at Nuvei, too. That's why human-led expertise and support is in our DNA. We've been delighted to help drive Curve's approval rates up and processing costs down, and it's down to the quality of our partnership as much as our technology. We continually strive to be a true payments partner, to accelerate Curve's revenue.

Jasper Goeman

SVP Sales, Europe, Nuvei

Jasper Goeman

SVP Sales, Europe, Nuvei

We’ve been able to accelerate our revenue organically and have approximately £1.5 million more in processing volume, at an average transaction value of £27, every month. Above all, we are now able to serve our customers better, experience fewer declines, and

offer greater customer satisfaction.

Lotan Ganot

VP Payment Solutions, Curve

Lotan Ganot

VP Payment Solutions, Curve

Payments designed to

accelerate your business

Lotan Ganot

VP Payment Solutions Curve

Lotan Ganot

VP Payment Solutions Curve

Jasper Goeman

SVP Sales, Europe, Nuvei

Jasper Goeman

SVP Sales, Europe, Nuvei