Vienna 8 July oe.cd/Austria

Note: GDP refers to nominal GDP in USD based on current purchasing power parity. Source: OECD (2024), OECD Economic Outlook: Statistics and Projections (database).

Vienna 8 July oe.cd/Austria

Note: GDP refers to nominal GDP in USD based on current purchasing power parity. Source: OECD (2024), OECD Economic Outlook: Statistics and Projections (database).

Source: OECD (2024), OECD Economic Outlook: Statistics and Projections (database). Real GDP: Actual and pre-COVID-19 trend

Note: First quarter of 2016 = 100. The trend is calculated based on the period between the first quarter of 2015 and the fourth quarter of 2019.

Note: Data are based on harmonised consumer and core price indices. The June 2024 headline number is a flash estimate.

Government fiscal balance, % of GDP

Note: Projections for 2024 and 2025. Consumer price inflation refers to the harmonised index of consumer prices published by Eurostat.

Source: OECD Economic Outlook 115: Statistics and Projections (database).

Note: Data refer to general government net lending.

Source: OECD (2024), OECD Economic Outlook: Statistics and Projections (database). Budget balance in % of GDP

Note: The scenario is based on the OECD Economic Outlook 115 projections from 2023 to 2025, the OECD long-term model thereafter. The scenario assumes a continuation of the policy stance with a constant structural primary balance deficit of 1.1% of GDP from 2026 and increased spending on health care, long-term care and pensions, which will add on average an additional 0.1 % of GDP to annual government spending assuming no-policy change in line with the European Commission Ageing Report.

Source: OECD calculations based on OECD Economic Outlook: Statistics and Projections (database); Guillemette, Y. and D. Turner (2018), “The Long View: Scenarios for the World Economy to 2060”, OECD Economic Policy Paper No. 22; and European Commission (2024), “The 2024 Ageing Report - Economic and budgetary projections for the 28 EU Member States (2022-2070)”, Directorate-General for Economic and Financial Affairs.

Note: Labour taxation includes taxation of individual income, social security contributions, payroll and workforce. Corporate income also includes unallocable taxes on income, which refer to receipts that cannot be identified appropriately as income taxes from individuals and corporate enterprises. The OECD aggregate is an unweighted average of OECD countries excluding Australia, for which data are unavailable in 2022.

Source: OECD (2024), OECD Revenue Statistics, OECD countries: Comparative tables (database).

Newly established enterprises in % of all active enterprises, 2019

Note: 2019 data are shown to avoid patterns being influenced by the COVID-19 pandemic. According to 2021 data, Austria also has the second lowest share of newly established enterprises.

Source: Eurostat (2023), Business demography by size class and NACE Rev. 2 activity (2004-2020).

Occupational entry regulations indicator

Scale from 0 (no regulations) to 6 (strict regulations)

Personal services Professional services

Note: The indicator value of 0 indicates the absence of regulations, 6 reflects a strictly regulated market. Regulations for Canada and the United States represent the unweighted average of province/state-level regulations. Personal services include aestheticians, bakers, butchers, driving instructors, electricians, hairdressers, painters, plumbers and taxi drivers; professional services include accountants, architects, civil engineers, lawyers and real-estate agents.

Source: Von Rueden, C. and I. Bambalaite (2020), “Measuring occupational entry regulations: A new OECD approach”, OECD Economics Department Working Papers, No. 1606.

Source: OECD Broadband Portal (www.oecd.org/sti/broadband/oecdbroadbandportal.htm). Fixed broadband subscriptions with contracted speed of 100Mbps and above % of total subscriptions, December 2022

Note: Unweighted average of available data for 35 countries (excluding Israel, New Zealand and the United Kingdom) for the OECD aggregate.

Source: OECD (2023), OECD Enterprise Statistics (database). Venture capital investments

Note: Venture capital is private equity capital provided to young enterprises not quoted on a stock market. Unweighted average of available data for 32 countries (excluding Chile, Colombia, Costa Rica, Iceland, Mexico, and Türkiye) for the OECD aggregate.

Gender gap in the average usual weekly hours worked on the main job

Total employment, 15-64 year-olds

Source: OECD (2023), Education at a Glance 2023: OECD Indicators. Enrolment rates (%) in early childhood education and care services

Difference in PISA mathematics performance between socio-economically advantaged and disadvantaged students

Note: PISA is the OECD’s Programme for International Student Assessment. A socio-economically advantaged (disadvantaged) student is a student in the top (bottom) quarter of ESCS (the PISA index of economic, social and cultural status) in his or her country. Source: OECD (2023), PISA 2022

(Volume I):

Greenhouse gas emissions per capita

Tonnes of CO2 equivalent

Note: The 2030 target for total greenhouse gas emissions including land use, land-use change and forestry is based on IMF estimates and presented for illustrative purposes, as the Nationally Determined Contribution in the framework of the Paris Agreement is submitted for the European Union as a whole.

Source: OECD calculations based on IMF (2024), IMF Climate Change Dashboard; OECD (2024), Demography and Population Statistics (database); Austrian greenhouse gas emissions from 1990 to 2022, by CRF sector (UNFCCC).

Note: Effective carbon rates for total excluding biofuels CO2, average in EUR (real 2021 base) per tonne of CO2 equivalent. The shown rates refer to 2021, so they do not reflect the consequences of the implementation of the eco-social tax reform, which imposes a tax on carbon in

Tax burden difference between petrol and battery-electric cars, in EUR, 2024

Note: Calculations based on tax burden data over ten years of private ownership. The total tax burden includes taxation of car acquisition (net of purchase grants) and ownership, a standard value-added tax rate, and excise duties on energy use. The average is calculated as an unweighted average of countries with available data.

Source: Transport & Environment (2024).

Barrier index on grid regulation and infrastructure for wind and solar photovoltaics deployment

Index, scale from 0 (lowest) to 1 (highest)

Note: The barrier index on grid regulation and infrastructure considers, among others, the cost and duration of grid access for renewable energy sources, the foreseeability and transparency of grid development, and the complexity of the connection procedures. The index is computed on the maximum of assessed severity and spread values for all affected technologies. The EU aggregate refers to the average of EU countries plus the United Kingdom. For more details, see https://resmonitor.eu/en.

Source: RES Policy Monitoring Database.

Share of population exposed to river flooding % of population, 2020

Note: River flooding with a 10-year return period. A return period is the average or estimated time that a flood event is likely to recur.

Source: IEA/OECD (2023), “Climate-related hazards: River flooding”, Environment Statistics (database), https://oe.cd/dx/58w.

Rebuild fiscal space to strengthen the resilience of Austria’s economy. Reduce the deficit via expenditure cuts and efficiency gains, and increase the retirement age.

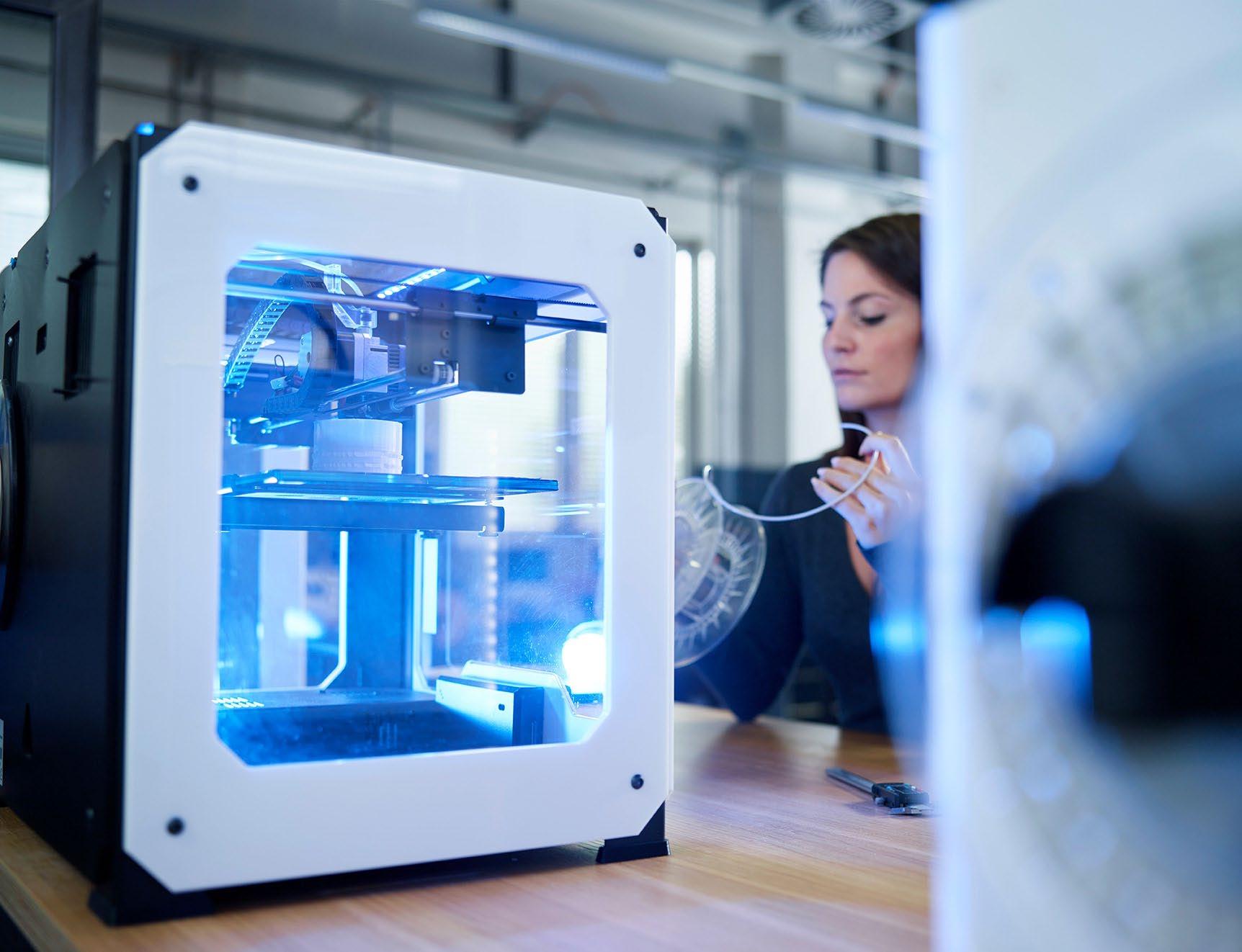

Reduce barriers to business dynamism and support equity financing to bolster innovation.

Improve access to the labour market for all groups. Support high-quality childcare and well-designed parental leave and further expand language classes for immigrants.

Increase effective carbon prices through higher taxes and the withdrawal of inefficient subsidies. Reduce administrative constraints that hamper green investments.

Disclaimers:

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law. This document and any map included herein are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area.