Director for Financial and Enterprise Affairs

OECD

Launch event

March 7th 2024

Paris, France

Both sovereign and corporate bond market borrowing have grown significantly around the world

Source: OECD Global Debt Report 2024. OECD Global Debt Report 2024 Launch event March 7th 2024 Sovereign bonds 0 10 20 30 40 50 60 70 80 2008 '12 '16 '20 '23 2023 USD, trillions USA EU Japan Other OECD Other Corporate bonds 0 5 10 15 20 25 30 35 40 2000 '05 '10 '15 '23 2023 USD, trillions Financial Non-financial Sustainable bonds 0 1 2 3 4 5 2014 '16 '18 '20 '23 2023 USD, trillions Official sector Corporate sector

Bond issuance

sovereigns Source: OECD Global Debt Report 2024. OECD Global Debt Report 2024 Launch event March 7th 2024 Sovereign bonds 0 5 10 15 20 25 2008 '12 '16 '20 '23 2023 USD, trillions OECD Corporate bonds 0 2 4 6 8 10 2000 '05 '10 '15 '20 '23 2023 USD, trillions Financial Nonfinancial NonOECD

reached record levels during the pandemic and remains elevated for

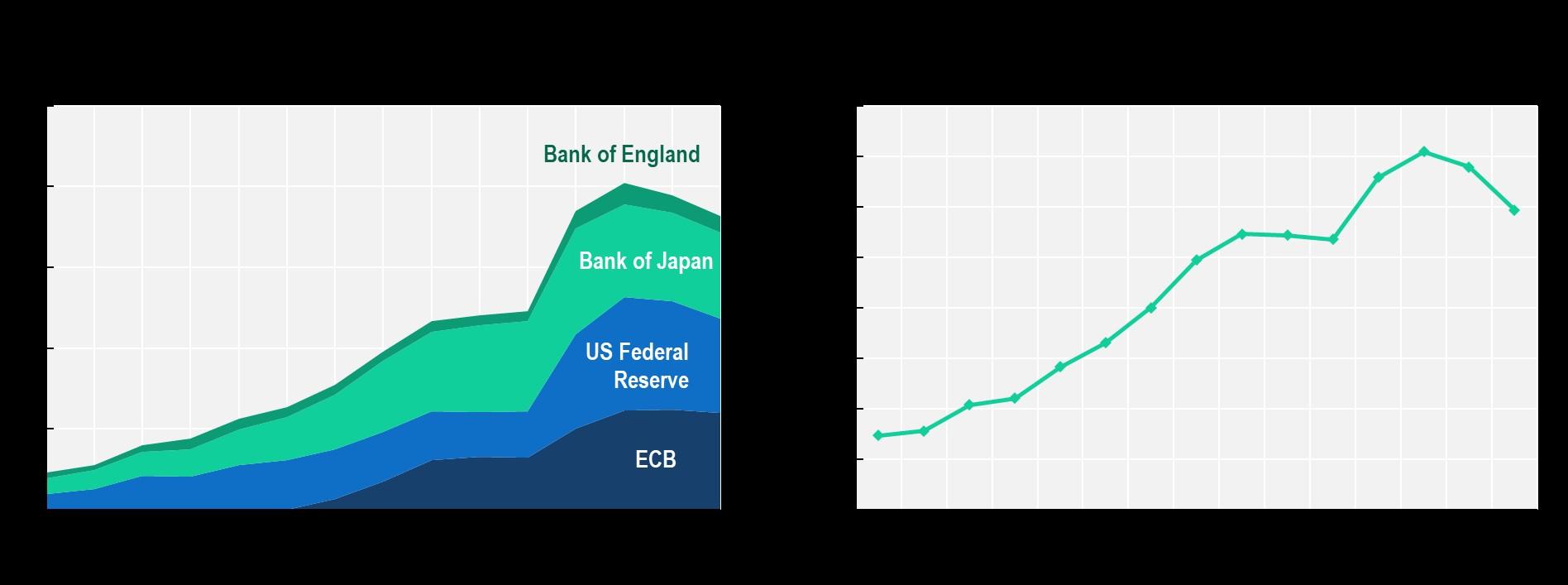

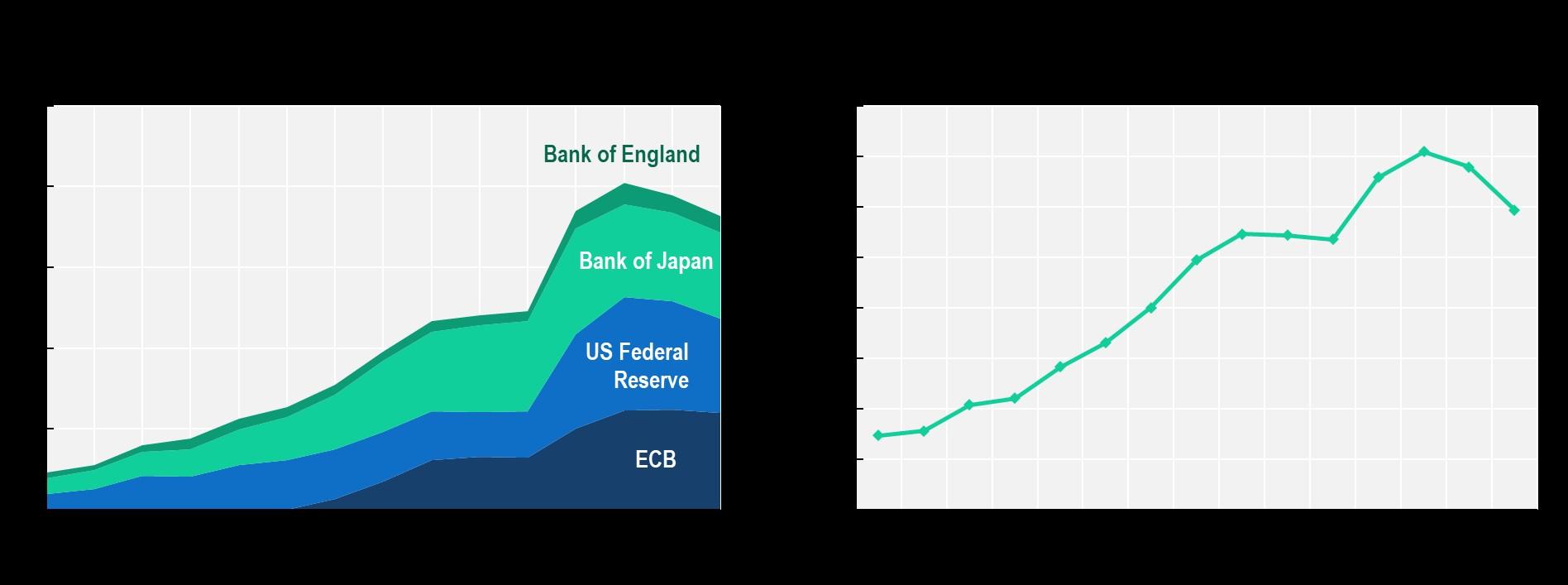

have absorbed large parts of the increases in borrowing

Central banks

but have begun withdrawing from bond markets

OECD Global Debt Report 2024 Launch event March 7th 2024

Source: OECD Global Debt Report 2024.

Favourable funding conditions have enabled high-grade issuers to extend the maturities of their borrowing

Note: Left panel shows the ICE BofA Global Government Index and ICE BofA Global Corporate Index. OECD sovereign maturities are equal-weighted, all other maturities are value-weighted. Source: OECD Global Debt Report 2024; LSEG.

Corporate IG: non-financial (global)

Corporate IG: financial (global)

OECD Global Debt Report 2024 Launch event March 7th 2024 Yield to maturity,

3 6 9 12 15 2000 '05 '10 '15 '23 Years

global

3 4 5 6 7 8 9 10 2008 '12 '16 '20 '23 Years Average maturity at issuance 0% 2% 4% 6% 8% 10% 2000 2003 2006 2010 2013 2016 2020 2023 Corporate Sovereign Sovereign:

OECD Sovereign: Emerging markets and developing economies

Considerable amounts of debt will need to be refinanced in the near-term Source: OECD Global Debt Report 2024. OECD Global Debt Report 2024 Launch event March 7th 2024 Debt coming due in the next 3 years 0% 10% 20% 30% 40% 50% 0 5 10 15 20 25 OECD EMDEs Sovereign USD, trillions 0% 10% 20% 30% 40% 50% 0 2 4 6 8 10 Non-financial Financial Corporate USD, trillions 0% 10% 20% 30% 40% 50% 0 105 15 20 25 OECD EMDEs Non-financial Financial Sovereign Corporate 2024 2025 2026 % of 2023 outstanding (RHS) USD, trillions

Key risks are currently concentrated in some market segments

Source: OECD Global Debt Report 2024. OECD Global Debt Report 2024 Launch event March 7th 2024 Sovereign bond debt as % of GDP, OECD countries 40% 60% 80% 100% 2008 '10 '12 '14 '16 '18 '20 '22 2024p EMDE sovereign credit rating changes -100 -80 -60 -40 -20 0 20 40 60 2015 2017 2019 2021 2023 Real estate company leverage 0x 5x 10x 15x Average, other industries Real estate Debt to EBITDA Downgrades Upgrades 2022 2011 2022 2011

Risk-taking has increased substantially in the non-financial corporate sector

Global corporate bond rating index Composition of investment grade issuance, global

20 (AA+)

18 (AA-)

16 (A)

14 (BBB+)

12 (BBB-)

Note: Middle and right panels show three-year rolling averages. Source: OECD Global Debt Report 2024.

Share of BBB issuance by high-debt companies (debt to EBITDA > 4)

OECD Global Debt Report 2024 Launch event March 7th 2024

0% 10% 20% 30% 40% 50% 60% 2000 '05 '10 '15 '23 0% 10% 20% 30% 40% 50% 2000 '05 '10 '15 '23

BBB, % of IG 12 14 16 18 20 1980 '85 '90 '95 2000 '05 '10 '15 '23

Following rapid growth, market practices and regulation for the sustainable bond market need to improve

Global sustainable bond issuance by type

2023 USD, billions

Sustainabilitylinked

Sustainability

Companies do not systematically benefit from lower yields for issuing a sustainable bond.

Green, social, and sustainability (GSS) bonds typically allow the refinancing of concluded eligible projects with the proceeds.

GSS bond issuers are not penalised for not using all proceeds to finance eligible projects.

One-fourth of issuance in 2023 was not assuredbysecond-partyopinionproviders.

Source: OECD Global Debt Report 2024. OECD Global Debt Report 2024 Launch event March 7th 2024 0 200 400 600 800 1 000 1 200 1 400 2014 '15 '16 '17 '18 '19 '20 '21 '22 '23

Green Social

Global Debt Report 2024

event

7th 2024

France

OECD

Launch

March

Paris,