+ Cybersecurity Risks & Regulations in On- & Off-Highway Connectivity PAGE 10 + Autonomous Technologies: Where Are We Now? Examining market demands, product innovations & component testing imperatives POWERTRAIN MARCH/APRIL 2024 oemoffhighway.com PRIORITIES

•

•

Vision 3 Series Display

•

•

•

HYDAC Ethernet Cameras

•

• Reliable image display, even under extreme conditions

• Best image quality and a broad selection of fields of vision

HYDAC Position Sensors

•

HYD2402-2441 Lifting mobile machinery to the next technological level

Multi-Purpose Computing Unit

Fusion

• AI accelerator to enable edge AI applications

Connect up to four displays simultaneously

Possible use as central machine gateway

High computational and graphical multimedia processing power

Customizability and clear data visualization for advanced usability

Slim and flexible design suitable for modern operator cabins

Enhanced safety with HYDAC assistance systems

Vision 3 Series Display Fusion Computing Platform Ethernet Camera HVT1000

Linear, angle and inclination – are key components in machine automation HYDAC.com/en-us ttcontrol.com

EDITOR'S NOTE

4 Work Truck Week & OEM Off-Highway's 2024 Engine Spec Guide

NEWS BRIEF

5 4 new partnerships bringing technology integration to the forefront

EQUIPMENT MARKET OUTLOOK

6 US mining production is up year over year, rising at a slowing pace

NEW PRODUCTS

32 8 innovative new releases hitting the OEM market now

OFF-HIGHWAY HEROES

34 Stroud Road Machinery Company's 1931 conveyor design components & complications

WEB EXCLUSIVES

Video Network

oemoffhighway.com/videos

OEM Industry Update

oemoffhighway.com/podcasts

Premium Content

oemoffhighway.com/premium-content

FEATURE SERIES: POWERTRAINS

18 Powertrain Priorities

Inside off-highway power trends & the shape of the market today

20 Exploring the ICE Age

Alternative fuels, emissions & the future of the internal combustion engine

22 4 Keys to Efficient Driveline & Component Testing

Hybrid & EV powertrains & the testing tech designed to improve performance

CONSULTANT CORNER

10 The Road to Autonomy

Market conditions & the path forward for on- & off-road driverless technologies

ELECTRONICS & ELECTRIFICATION

14 Agriculture’s Merge Into the New Road Safety

Connected capabilities of V2X technologies & the need for standardization

TECHNOLOGY NEWS

16 For HD Hyundai, the Future Is in Xite

A glimpse into construction jobsite transformation with XiteSolution President & CEO Youngcheul Cho

CAMERA SYSTEMS

26 What’s Next for Advanced Vehicle Safety Solutions?

The challenges of AI in onboard cameras, object detection & risk reduction

CONNECTIVITY

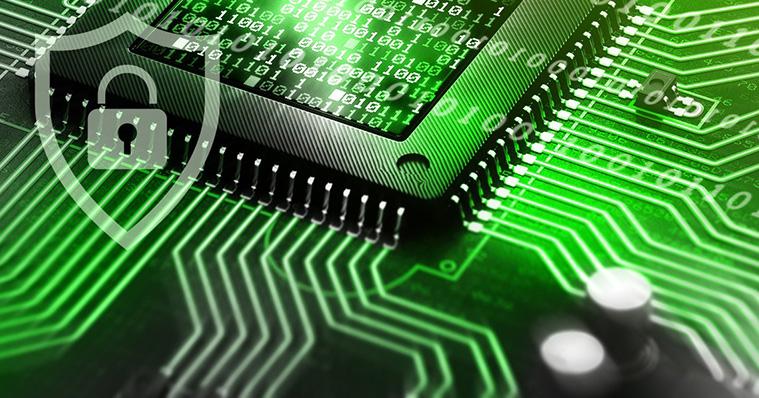

28 Cybersecurity Challenges for Connected Vehicles

Trends, risks & regulatory environments in both on- & off-highway connectivity

TRENDS IN THE CAB

30 Operator Cockpit Designs Impact End-User Efficiency

From comfort and ergonomics to cutting-edge technology, the cab is becoming a key differentiator

3 OEM Off-Highway | MARCH/APRIL 2024 CONTENTS VOLUME 42, NO. 02 | MARCH/APRIL 2024 10 26 30 18 14

As this issue goes to print, the OEM Off-Highway team is returning from Indianapolis, Indiana, where we spent the week tracking commercial truck trends at Work Truck Week 2024.

The event provides commercial vehicle industry professionals with access to the latest trucks, components and attachments alongside some of the industry’s newest technologies and solutions.

In our time there, we not only met with truck OEMs, component manufacturers and industry players, but also attended the Green Truck Summit, the event’s advanced vehicle and fuel technology conference. This portion of the week highlighted the commercial vehicle advancements that are driving the industry toward greater sustainability, productivity and efficiency on both the enduser and manufacturer fronts. For a recap of what we saw on-site and a look at the latest releases from the exhibition hall, visit oemoh.co/wtw2024.

EDITORIAL

Editor Kathy Wells kwells@iron.markets

AUDIENCE

Audience Development Manager Angela Franks

PRODUCTION

Senior Production Manager Cindy Rusch crusch@iron.markets

Art Director Kimberly Fleming kfleming@iron.markets

ADVERTISING/SALES

Brand Director Sean Dunphy sdunphy@iron.markets

Brand Manager, OEM & Construction................Nikki Lawson nlawson@iron.markets

Sales Representative Kris Flitcroft kflitcroft@iron.markets

Sales Representative Craig Rohde crohde@iron.markets

IRONMARKETS

Chief Executive Officer Ron Spink

Chief Financial Officer JoAnn Breuchel

Chief Revenue Officer Amy Schwandt

Corporate Director of Sales Jason DeSarle

Brand Director, Construction, OEM & IRONPROS Sean Dunphy

VP, Audience Development Ronda Hughes

VP, Operations & IT Nick Raether

Content Director Marina Mayer

Director, Online & Marketing Services Bethany Chambers

Director, Demand Generation & Education Jim Bagan

Content Director, Marketing Services Jess Lombardo

CIRCULATION & SUBSCRIPTIONS

P.O. Box 3605 Northbrook, IL 60065-3605, Phone: 877-201-3915 Fax: 847-291-4816

circ.oemoff-highway@omeda.com

Take care,

LIST RENTAL

Looking ahead to our next issue, our May/June installment will feature the return of OEM Off-Highway’s Engine Spec Guide, a special supplement designed to provide engineers with the specs of hundreds of gas and diesel engine systems from major engine OEMs. We hope this guide, packed with pages of detailed spec information available both in print and online, can serve as your go-to resource throughout the year.

EDITORIAL ADVISORY BOARD

Craig Callewaert, PE, Chief Project Manager, Volvo Construction Equipment

Roy Chidgey, Business Segment Head, Minerals Projects and Global Mobile Mining, Siemens Large Drives US

Andrew Halonen , President, Mayflower Consulting, LLC

Terry Hershberger, Director, Sales Product Management, Mobile Hydraulics, Bosch Rexroth Corp.

Steven Nendick, Marketing Communications Director, Cummins Inc.

John Madsen, Director Engineering & Product Management, GKN Wheels & Structures

Doug Meyer, Global Director of Construction Engineering, John Deere

Andy Noble, Head of Heavy Duty Engines, Ricardo

Daniel Reibscheid, Business Development Manager, MNP Corporation

Matt Rushing, Vice President, Product Line, Global Crop Care, AGCO Corp.

Allen Schaeffer, Executive Director, Diesel Technology Forum

Keith T. Simons, President – Controls Products, OEM Controls, Inc.

Alexandra Nolde , Senior Communication & Media Specialist, Liebherr-Components AG

Bob Straka, General Manager, Transportation SBU, Southco, Inc.

Luka Korzeniowski, Global Market Segment Leader, Mobile Hydraulics, MTS Sensors

Chris Williamson, PhD, Senior Systems Engineer Global Research & Development, Danfoss Power Solutions Company

Sr. Account Manager Bart Piccirillo, Data Axle 402-836-2768 | bart.piccirillo@data-axle.com

REPRINTS & LICENSING

Brand Manager, OEM & Construction Nikki Lawson 920-542-1239 | nlawson@iron.markets

SUBSCRIPTION

Published and copyrighted 2024 by IRONMARKETS. All rights reserved. No part of this publication shall be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage or

OEMOff-Highway (USPS 752-770, ISSN 1048-3039 (print); ISSN 2158-7094 (online) is published 6 times a year: January/February, March/April, May/ June, July/August, September/October and November/December by IRONMARKETS, 201 N. Main Street, 3rd Fl., Fort Atkinson, WI 53538. Periodicals Postage paid at Fort Atkinson, WI and additional entry offices. POSTMASTER: Send address changes to: OEMOff-Highway, P.O. Box 3605 Northbrook, IL 60065-3605. Printed in the U.S.A.

@oemoffhighway @oemoffhighway @oem-off-highway @oemoffhighway

Published by IRONMARKETS

201 N. Main Street, Fort Atkinson, WI 53538 800-538-5544 iron.markets oemoffhighway.com ironpros.com

retrieval

without written

from the publisher.

system,

permission

Individual print subscriptions are available without charge in the United States to original equipment

Digital subscriptions are available without charge to all geographic locations. Publisher reserves the right to reject nonqualified subscribers. Subscription Prices: U.S. $35 One Year, $70 Two Years; Canada and Mexico $60 One

$105 Two Years; all other countries, payable in U.S. funds, drawn on U.S.

$85 One

Two Years.

POLICY:

manufacturers.

Year,

bank,

Year, $160

EDITOR’S NOTE 4 MARCH/APRIL 2024 | OEM Off-Highway

The IRONMARKETS team joined more than 500 exhibitors and several thousand industry professionals at Work Truck Week 2024. The event took place March 5-8, at the Indiana Convention Center.

Cummins, Daimler Truck, PACCAR to Produce Batteries in Mississippi

The 21-gigawatt hour (GWh) factory is expected to begin producing battery cells in 2027.

Cummins’ Accelera division, Daimler Trucks and PACCAR have selected Marshall County in Mississippi for a new battery production factory. The factory will produce batteries for commercial electric medium- and heavy-duty trucks. The joint venture will localize battery cell production for commercial electric vehicles and is expected to create more than 2,000 U.S. manufacturing jobs, with the option for further expansion as demand grows. The 21-gigawatt hour (GWh) factory is expected to begin producing battery cells in 2027. The joint venture will create scale to deliver cost effective and differentiated battery cell technology that supports the adoption of electric vehicles for medium- and heavy-duty commercial transportation.

Accelera, Daimler Truck and PACCAR will each own 30% of, and jointly control, the business, which will focus on lithiumiron-phosphate battery technology for commercial battery-electric trucks. EVE Energy will serve as the technology partner in the joint venture with 10% ownership and will contribute its battery cell design and manufacturing expertise to the future cell manufacturing plant. The transaction is subject to customary closing conditions and receipt of applicable merger control and regulatory approvals, including the submission of a voluntary notice to the Committee on Foreign Investment in the United States.

Read More oemoh.co/s5ibw7573

Deere, Leica Collaborate on Digital Construction

The strategic partnership aims to help accelerate the digital transformation of the heavy construction industry. By combining the manufacturing expertise of John Deere with Leica Geosystems’ leadership in positioning and sensor technology, the two organizations will work together to develop and deliver solutions that improve productivity, reduce material costs and the number of passes required, which can help improve safety by minimizing traffic on construction sites. The pair hope to bring new levels of accuracy, productivity, and accelerate the implementation of safe and sustainable workflows to the construction industry, helping its customers succeed.

Leica Geosystems technology, software and services will be available for purchase on select John Deere construction equipment models starting in 2024.

Read More oemoh.co/bz94tugc

HD Hyundai Teams Up With Google Cloud

The move introduces generative AI in Hyundai’s core businesses. Google Cloud will provide enterprise solutions like its Vertex AI platform to develop industry-specific AI applications. The company will prioritize high-impact tasks like building AI solutions tailored to each industry’s needs; creating AI-based platforms to enhance customer digital experiences; and training AI experts.

HD Hyundai has already piloted a Generative AI service for after-sales calls at its construction equipment division. The collaboration with Google Cloud commenced in July 2024. It plans to establish a long-term AI roadmap to lead digital and business innovation.

Read More oemoh.co/570xs671

Technotrade Partners With Hainzl Group

The company becomes part of Hainzl Motion & Drives, a division of Hainzl Group, expanding its international presence.

Technotrade has become a part of Hainzl Motion & Drives, a division of the Austria-based Hainzl Group. Through acquiring a 50% share in Technotrade and establishing a joint venture with the Kejduš family, founders of the company, Hainzl expands its international market presence and adds a strong technology partner to its international company group.

Read More oemoh.co/ol940qxt

OEM Off-Highway | MARCH/APRIL 2024 5 NEWS BRIEF

MINING PRODUCTION UP

PACE

Industry-leading economic firm ITR Economics provides heavy-duty equipment market trends to help OEMs stay up to date on top industry information and insights, which can help them make better decisions in 2024. In our continued analysis, recent data shows last year’s U.S. mining production was 4.9% higher than in 2022, with annual production continuing to rise at a slowing pace.

Economists suggest that an overall weakening in the macroeconomy will result in less demand for goods and thus less demand for mined raw materials in the quarters ahead. However, the oil and gas sector remains on a growth trajectory. The following provides a summary of key observations across 13 indicators and areas of industry that contribute to today’s global economic conditions.

• The monthly rate-of-change for the U.S. OECD Leading Indicator continued rising in December.

• While this indicator is signaling an earlier industrial production low, a broader mix of economic evidence still suggests further decline.

Editor’s Note: Please note that this chart has been modified on the Y-axis to show the trend more easily. All data for charts are supplied by ITR Economics. Annual % change in 12 month moving totals Monthly index Europe Leading Indicator -0.3 0.0 0.3 0.6 0.9 1.2 1.5 -0.3 0.2 0.6 0.9 1.2 1.3 1.3 1.2 Dec Nov Oct Sep Aug Jul Jun May '23 MARCH/APRIL 2024 | OEM Off-Highway 6 oemoffhighway.com/economics EQUIPMENT MARKET OUTLOOK Sponsored by Eberspächer US Leading Indicator Editor’s Note: Please note that this chart has been modified on the Y-axis to show the trend more easily.

Economics is an independent economic research and consulting firm with 75+ years of experience. @PARILOV – STOCK.ADOBE.COM Visit oemoffhighway.com to sign up for our monthly ECONOMIC NEWSLETTER.

YOY, RISING

SLOWING

ITR

US

AT

US Industrial Production

• Industrial Production in the fourth quarter was 0.2% below the fourth quarter of 2022. Production trended flat for much of 2023.

• Downside pressures are likely to linger and potentially intensify in 2024 as the lagged effects of contractionary monetary policy unfold. A weaker consumer will dampen demand for goods, negatively impacting the manufacturing sector.

US Private Nonresidential New Construction

• U.S. Private Nonresidential Construction in the three months through November 2023 came in 22.5% above the same year-ago level.

• The quarterly growth rate ticked down slightly and macro trends suggest slowing growth is likely ahead. Trends in U.S. Corporate Profits and U.S. Commercial and Industrial Sector Architecture Billings Index signal further downward pressure ahead.

US Total Public New Construction

• Annual U.S. Total Public Construction in November totaled $429.7 billion, 14.9% above the year-ago level.

• One of the largest components of Public Construction is US Public Highway, Street and Infrastructure Construction, which is at a recordhigh level and accelerating.

A WORLD OF COMFORT

Airtronic and Hydronic Heaters

Eberspächer offers a diverse selection of fuel-operated heaters, including the high-performance Airtronic S3 Commercial/M air heater and the innovative Hydronic S3 Commercial water heater, ensuring driver/operator comfort in any environment.

Annual % change in 12 month moving totals -25 -20 -15 -10 -5 0 -9.1 -12.3 -15.5 -18 -20.6 -20.7 -21.3 -21.4 Nov Oct Sep Aug Jul Jun May Apr '23 US Farm Machinery and Equipment Supplies Annual % change in 12 month moving totals 0 3 6 9 12 15 8 9.3 10.5 11.4 12.4 13.4 14.3 14.9 Nov Oct Sep Aug Jul Jun May Apr '23 US Total Public New Construction Annual % change in 12 month moving totals 0 1 2 3 4 5 6 7 8 1.1 1.6 1.9 2.9 4 4.8 6.1 7.4 Dec Nov Oct Sep Aug Jul Jun May '23 US Mining & Oil Feild Machinery Production Index

MORE

OEM Off-Highway | MARCH/APRIL 2024 7

|

AT EBERSPAECHER-OFF-HIGHWAY.COM

US Farm Machinery Production

• Annual US Farm Machinery and Equipment Shipments through November were 21.4% below the year-ago level.

• Lower commodity prices in 2023 likely cut into farmers’ income, suggesting downward pressure on Shipments. While we will likely see interest rates go down in 2024, providing some relief, the negative impact on this market could linger.

Europe Ag & Forestry Machinery Production

• Annual Europe Agricultural and Forestry Machinery Production in November, although declining, is 2.9% above the year-ago level.

• The European Central Bank recently announced they are keeping key interest rates unchanged; persistent and elevated interest rates will likely continue to damper demand for and reduce Production.

Europe Leading Indicator

• The Four Big European Nations Leading Indicator monthly rate-of-change ticked down but has been in a general rising trend since late 2022.

• Annual Europe Industrial Production in November 2023 was 2.3% below the year-ago level and will likely continue to decline in at least the near term given contractionary monetary policy.

US HeavyDuty Truck Production

• U.S. Heavy-Duty Truck Production declined in late 2023, with the year coming in 3.5% higher than 2022.

• Expect further decline in the near term given the suppressed freight market.

US Mining Production Germany Industrial Production

• U.S. Mining Production in 2023 was 4.9% higher than in 2022. Annual Production is rising at a slowing pace.

• Overall weakening in the macroeconomy will result in less demand for goods and thus less demand for mined raw materials in the quarters ahead. However, the oil and gas sector remains on a growth trajectory.

• Germany Industrial Production in the three months through November was 4.3% below the same three months one year earlier.

• The Germany Manufacturing Purchasing Managers Index, which leads Production by nearly a year, is signaling further decline ahead.

Annual % change in 12 month moving totals 0 5 10 15 20 15.3 13.8 12.8 12.8 8.5 4.6 3.4 3.5 Dec Nov Oct Sep Aug Jul Jun May '23 US Heavy-Duty Truck Production Annual % change in 12 month moving totals # $% # $$ & $$ & $% # # ) US OECD Leading Indicator -1.2 -1.0 -0.8 -0.6 -0.4 -0.2 0.0 0.2 0.4 0.6 0.8 -1.1 -0.7 -0.3 0 0.3 0.5 0.7 0.8 Dec Nov Oct Sep Aug Jul Jun May '23 Annual % change in 12 month moving totals 0 3 6 9 12 15 12.8 13.2 12.8 12 11.4 14.8 13.7 12.7 Nov Oct Sep Aug Jul Jun May Apr '23 US Construction Machinery New Orders Annual % change in 12 month moving totals 0 5 10 15 20 25 18.2 19.5 20.2 19.3 14.7 14.7 16.7 15.3 Nov Oct Sep Aug Jul Jun May Apr '23 US Defense Capital Goods New Orders Annual % change in 3 month moving totals -0.6 -0.5 -0.4 -0.3 -0.2 -0.1 0.0 0.1 0.2 0.3 0.4 0.4 0.2 -0.1 0 0.1 -0.3 -0.6 -0.2 Dec Nov Oct Sep Aug Jul Jun May '23 US Industrial Production 0 2 4 6 8 10 12 10.7 11.2 11.2 10.6 8.7 7.4 5.1 2.9 Nov Oct Sep Aug Jul Jun May Apr '23 Europe Agriculture Machinery Production Annual % change in 12 month moving totals MARCH/APRIL 2024 | OEM Off-Highway 8 oemoffhighway.com/economics EQUIPMENT MARKET OUTLOOK Sponsored by Eberspächer

Editor’s Note: Please note that this chart has been modified on the Y-axis to show the trend more easily.

US Construction Machinery, New Orders

• Annual U.S. Construction Machinery New Orders in November 2023 were 12.7% above the yearago level.

• New Orders will likely soften in the near term due to elevated interest rates and stagnant corporate profits, although opportunities exist in sectors benefiting from government assistance, such as infrastructure and data centers.

US Mining & Oil Field Machinery Production Index

• Though average Production in 2023 was 1.1% above 2022, Production is declining and will likely continue to do so in the near term.

• Compared to 2021 and 2022 levels, commodity prices are generally lower, dampening the incentive to mine. Expect further downside pressure in the mining machinery market in at least the near term.

US Defense Industry, New Orders

• Annual U.S. Defense Capital Goods New Orders in November totaled $169.6 billion which is 15.3% above the year-ago level. Expect New Orders to generally rise in the near term.

• While the defense budget could cap investment in 2024, continuing conflicts in Ukraine and Israel could result in additional aid funding which would positively impact New Orders.

0 1 2 3 4 5 6 7 8 7.1 7 6.7 6.4 5.8 5.3 4.9 4.9 Dec Nov Oct Sep Aug Jul Jun May '23 US Mining Production Annual % change in 12 month moving totals -5 -4 -3 -2 -1 0 -0.2 -1.1 -1.3 -1.2 -0.7 -4.2 -3.5 -4.3 Nov Oct Sep Aug Jul Jun May Apr '23 Annual % change in 3 month moving totals Germany Industrial Production Annual % change in 12 month moving totals 0 5 10 15 20 25 21.1 21.7 21.8 21.7 22 22.7 23.6 22.5 Nov Oct Sep Aug Jul Jun May Apr '23 US Private Nonresidential New Construction DualSync® with CVT functionality PLANETARY RIGID AXLES optional with electric drive HydroSync® shiftable while driving HEAVY DUTY HIGH TORQUE PLANETARY RIGID AXLES NAF AG BUILDS MODULAR DRIVELINES FOR CONSTRUCTION, FORESTRY, MATERIAL HANDLING AND AGRICULTURE APPLICATIONS. OUR DRIVELINES ARE COVERING A WIDE RANGE OF OFF ROAD APPLICATIONS WITH PROVEN RELIABLE DESIGN FOR MORE THAN 60 YEARS. REALISING YOUR REQUIREMENTS WITH NAF’S MODULAR DESIGN IS OUR GOAL. FOR YOUR HEAVY DUTY PLAYGROUNDS BOGIE AXLES MADE IN GERMANY MODULARMINDED AXLES Permanent ® Bogie Balancing System NAF Neunkirchener Achsenfabrik AG OEM Off-Highway | MARCH/APRIL 2024 9

THE ROAD TO AUTONOMY

Market conditions & the path forward for the development, adoption & delivery of on- & off-road driverless technologies

by Wilfried Aulbur, Giovanni Schelfi, Walter Rentzsch

The last 12 to 18 months have been challenging for the autonomous industry.

Disturbing news seemed to chase each other as Waymo seemed to go back on their commitment to drive L4 truck autonomous uses cases, TuSimple focused on its China business and is in the process of delisting from Nasdaq, Cruze is facing cash flow challenges and companies such as Argo. AI and Embark are no more. An overall volatile environment and high interest rates made funding rounds challenging for startups as well as OEM-affiliated entities. Valuations of listed companies tanked.

Given this upheaval, some industry observers may be tempted to think that the future of autonomy is shaky or that, at the very least, we are solidly in the trough of disillusionment of the high-tech hype cycle. Yet, this would not adequately reflect realities on the ground.

In the agricultural space, autonomous tractors are providing tillage on demand in real-life applications. Farmers can book autonomous services on a

per-hectare basis, while watching the equipment work on their iPhone as they have dinner at home. Countless autonomous robots are providing crucial pre-harvest and harvest assist activities in specialty crop applications. Farmers bank on these robots to address critical labor shortages in the industry and are increasing investments in these new technologies on a year-over-year basis. With autonomous tractors being feasible, the race is on to automate the work functions of implements such that labor intensity and agricultural efficiency can be further improved.

Mining is another area in which autonomous trucks are evermore present. Leading mining truck companies such as Caterpillar and Komatsu have hundreds of mining trucks in operation across dozens of sites. Safety and total cost of ownership are major drivers for adoption. Not having to deploy human drivers in barren and remote mining environments is a plus, as are the reduced maintenance costs that result from operating trucks within design parameters. Staying within

design parameters is by design in autonomous trucks, yet not necessarily the case with human drivers. These benefits overcompensate investments in better-maintained roads, support crews that need to intervene should an autonomous truck get stuck, etc. The case for autonomy is so compelling that companies are actively mapping and investing in other use cases for automation such as semi-autonomous loading.

On-road applications with restricted operational design domains (ODDs) are successful as well and improve modern lives, particularly in rural areas. At a recent panel at CES 2024, one of the speakers discussed the positive impact that shared taxi operations and last-mile distribution solutions can have on the livelihoods of rural populations, as well as underserved populations in urban environments. Together with Laura Chace (CEO, Intelligent Transportation Society of America), Edwin Olson (CEO, May Mobility) and Richard Steiner (vice president of Government Relations and Public Affairs, Gatik) the panel clearly demonstrated that autonomy is crucial

MARCH/APRIL 2024 | OEM Off-Highway 10 CONSULTANT CORNER

ADOBE STOCK | GORODENKOFF OEM Off-Highway | MARCH/APRIL 2024 11 The CANbus Collection CAN Joysticks CAN Rocker CAN Keypad Now Featuring: www.otto-controls.com | Scan to view the complete CANbus collection here Powerhouse Lineup OTTO Controls’

to not only address labor shortage, but also to enable access to vital resources such as employment opportunities, schools, government offices, etc., for weaker sections of society.

It enables a larger section of society to lead productive lives and does so in a safer manner than what we experience with human drivers.

Plus, even in on-road applications, clearly identifiable use cases exist in which deploying autonomous solutions are commercially attractive.

On-road, L4 long-distance trucking is hence one of the applications that has not quite been solved yet. However, after being delayed several times, the timeline of autonomous trucks is now becoming clearer. Autonomous trucks have gone through a classical hype cycle. After some bullish announcements early on and inflated expectations regarding the timing, players have changed their view on what is feasible in the mid-term. Slower-than-expected technology progress and safety issues have further pushed back these timelines. Now, the fog is clearing and the roadmap, at least for the coming years, feels more stable.

unexpected cut-ins, merges, night driving, further levels of inclement weather, and even construction sites. Many autonomous truck players are close to having implemented the full set of capabilities that the autonomous

The road to autonomy isn’t easy and its timeline strongly depends on the industry and the use cases that we are considering. However, across the board, the glass of autonomy is rather more than half full.

With players working on safety cases, “driver out” autonomous-driving technology is the next milestone within reach. Autonomous truck players have come a long way in training their systems on increasingly complex driving scenarios. Just five years back, autonomous drivers were capable of performing only simple capabilities, such as maintaining lane position and performing lane changes; systems have since been developed to handle

driver requires or are currently solving the last remaining challenges, such as pulling over to the road shoulder or inspections.

The focus of most players is now shifting from expanding the capability set and the ODD of the vehicle to validating and improving their systems. Players have used 2023 to prove the safety capabilities of their technology. Safety incidences, like those seen in 2022, may impact this overall delivery timeline, but if things run smoothly, driver-out operations can be expected in 2024.

While the ability to handle edge cases is critical for driver-out operation, having a safe action as fallback, where the vehicle comes to a controlled stop in a safe location, is equally critical. In the early phase of adoption, we will

see autonomous trucks sitting in a safe mode on the road shoulder while a remote operator on an on-ground support team takes over. While this will be feasible as long as the numbers of autonomous trucks in operation are small, the support needed, and thus the operating cost, must come down eventually. Including the cost of human support, driver out autonomous trucks will not immediately be cost competitive to conventional trucks. This proves that the driver out milestone is important, but theoretical. It determines the starting point of the market adoption curve, but the speed of adoption will be determined by both technological advancements and consumer behavior. While driver-out is an important technology milestone, large-scale commercial adoption is still far from realization. Parallel to technology development, autonomous truck players are working on commercializing their autonomous drivers. To accelerate market adoption, several players have chosen a business model in which they act as autonomous truck carriers hauling freight for customers with their own fleet of autonomous trucks. The number of loads handled is still very low today but will grow as more customers sign on and routes are expanded. In the mid-term, autonomous truck players will additionally make their technology available to traditional truck carriers, likely through a pay-per-use subscription model.

Once the technology is commercially available, a large market potential can be tapped. From a total addressable market perspective, about 40% of all on-road freight traffic could be handled by autonomous trucks.

CONSULTANT CORNER MARCH/APRIL 2024 | OEM Off-Highway 12

This is the share of freight traffic that, today, is handled by combination trucks and travels a distance of at least 200 miles. Shorter routes will, at least initially, not be economical while trucks still operate in a transfer hub model with costly first- and last-mile drays.

Savings from autonomous trucking will be significant, but market adoption will still not happen overnight. Several near- and mid-term constraints will determine the speed of market adoption. While driver-out operation is possible from a regulatory perspective in the vast majority of U.S. states, including Texas, where freight volumes are concentrated, some states, especially California, specifically prohibit autonomous trucking, limiting short-term adoption potential. Also, as OEMs and technology players do not all operate on the same timeline, different levels of OEM readiness will result in staggered market entry, limiting vehicle supply.

Toward the end of the decade, market adoption will be determined more by the operational readiness of fleets and their risk profile. In general, truck carriers are slow adopters of new technologies. This has been the case in the past with both telematics and lower-level advanced driver assistance systems (ADAS), and will likely be the case with autonomous technology.

Unionized fleets will face additional resistance. In addition, fleets need to change their operating model and integrate drayage runs into their operations to support the transfer hub model of autonomous trucking. While players will focus on high-density routes, such as the Texas Triangle, at the beginning, routes with lower freight density will eventually need to be unlocked. To operate on these routes with the same ROI that players are used to from high-density routes, technology cost must continue to be reduced. Finally, carrier consolidation is needed to drive market adoption beyond the large fleets/players of the industry.

Reaching full market penetration requires “unlocking” many capillary routes and eventually technology that is capable of handling dock-to-dock operations. Accounting for a quarter of the freight traffic by the mid-2030s would still mean rapid adoption, especially when compared to other similarly disruptive automotive innovations, such as electric powertrains. It took almost three decades between the release of the first purpose-built electric cars in the mid1990s and today’s full-scale production.

In summary, the road to autonomy isn’t easy and its timeline strongly depends on the industry and the use cases that we are considering. However, across the board, the glass of autonomy is rather more than half full.

At international management consultancy firm Roland Berger, Wilfried Aulbur is a senior partner, Giovanni Schelfi is a partner, and Walter Rentzsch is a director. Visit rolandberger.com.

OEM Off-Highway | MARCH/APRIL 2024 13 The power behind it all.™ WWW.ISUZUENGINES.COM * WARRANTY 1 4LE2 Engine2 2.2L | 40-66 HP (30–49 kW) LIMITED5-year / 5,000-hour is the standard limited warranty. 3C models and power unit components offer a 2-year / 2,000-hour limited warranty. Warranty is based on years or hours of service, whichever comes first. See your authorized Isuzu Distributor or dealer for warranty and other details. 4LE2 engine shown. See your authorized Isuzu representative for performance info and specifications. 1 2 GENUINE PARTS DIAGNOSTIC TOOLS TRAINING & SUPPORT DEDICATED SERVICE NETWORK INDUSTRY-LEADING WARRANTIES1

AGRICULTURE’S MERGE Into the New Road Safety

Understanding the connected capabilities of V2X technologies & the need for standardization

by Ryan Milligan

The United States Department of Transportation (USDOT) has a draft plan for road safety, which took years — decades, even — to develop. During that time, technologies evolved, varying interests competed for bandwidth, politics changed, and the government found it must juggle the diverse needs of multiple stakeholders in order to achieve its ultimate mission: the eventual elimination of crashes on American roadways. Its draft plan, published in 2023, seeks to enable a safe, efficient, equitable and sustainable transportation system through the national, widespread deployment of interoperable vehicle-to-everything (V2X) technologies. “The U.S. has the technology and the resources to make its roadways substantially safer,” said Austin Gellings, director, Agriculture Services, Association of Equipment Manufacturers (AEM). “The USDOT’s plan is an important first step. From the agricultural safety standpoint, this is our opportunity to collectively begin to perfect connected communication.”

“There’s a high risk coming from agriculture machinery driving on roads, and although the number of accidents between agriculture machines and passenger cars is not that great, when they do happen, they typically have serious consequences,” said Johann Witte, head of Advanced Development Electronics, CLAAS.

Whether it’s a grain cart, multiple combines, or a variety of ag machinery, each piece of equipment will know where the other one has been, and where it is going. And it’s not just equipment that will be connected; it’s the equipment’s connection to everything.

V2X

V2X is the all-encompassing term for a vehicle’s connected communications, or the idea that a vehicle will be able to use its on-board communication tools to deliver real-time traffic information, react to changing road conditions, recognize road signs and warnings, and more. This interconnected system depends on the exchange of real-time information to improve traffic efficiency, enhance safety, and enable autonomous driving. According to the USDOT’s plan to accelerate V2X, achieving and sustaining interoperability is necessary to fully realize the benefits across the nation. Interoperable V2X deployments will rely upon standards and wireless

technologies that must work together to function effectively. V2X is fundamentally a cooperative technology where the benefits on a large scale are many times greater than the benefits of individual systems. “We are appreciative of the accelerated rollout of V2X technology in the U.S. and the stable framework set in place,” said Tobias Nothdurft, manager of Research and Advanced Engineering, AGCO. “This gives companies a solid foundation for series introductions.”

The On-Ramp to the Next Level

Part of the USDOT’s road safety plan for V2X is the “Safety Band,” a band of wireless spectrum at 5.9 GHz reserved for transportation-related communications among the devices that support connected and automated vehicles. The ag industry is awaiting the next level of connectivity: Wireless-InfieldCommunication (WIC). The evolving digitalization of agriculture will require WIC between agricultural machines. According to the Agricultural Industry

ELECTRONICS & ELECTRIFICATION MARCH/APRIL 2024 | OEM Off-Highway 14

@ROSTODRIVER – STOCK.ADOBE.COM

Electronics Foundation (AEF), WIC serves as a facilitator for seamless and interoperable collaborative fieldwork, playing a pivotal role in addressing road safety concerns during transit to and from the field. AEF, a global industry organization, is working behind the scenes on interoperable technologies like WIC to provide the protocols for ag machinery OEMs to make safe, precise and smart vehicles that communicate in real time in the field. AEF consists of almost 300 ag business-related companies and universities from around the world. These groups provide the technical methods and procedures to enable open communication and interfacing between electronic systems of different ag machinery from independent manufacturers. The role of the organization is to make technology available across the agriculture industry, and one of its goals is to increase safety and decrease accidents between ag machinery and passenger vehicles.

AEF’s WIC team is focused on allowing machines from different manufacturers working in the same field, or on the same operation, to communicate wirelessly. WIC technology will allow tractor and implement combinations from different OEMs to work together cooperatively in the same field to make the infield activities more efficient where multiple machines are used simultaneously. “We started in 2018 with the first rough pilot technology, and over the last few years we have had demo events with real machines,” said Norbert Schlingmann, general manager, AEF. They have chosen an existing radio standard according to requirements like range, data rate, latency and availability that will work in most parts of the world, including North America and Europe.

This will be combined with a communication middleware provider, to enable manufacturers of ag machines to integrate a brand interoperable, machineto-machine, in-field communication channel, similar to a Bluetooth standard for tractors. This will enable coverage map sharing between machines of different colors, camera (on one machine) and remote display (on another machine),

even platooning (one machine controlling another) will be possible. In addition, this type of communication can be used to communicate to road users (cars and trucks) when there is an ag machine entering the road. This interoperability between machine brands will allow customers to benefit from reduced operator strain and fatigue (e.g. automated procedure for offloading grains to a trailer).

Different Paths to Road Safety

While ag equipment is used around the globe, the geography, standards and technology are all different country to country, and continent to continent.

“The safety band in the U.S. can be used for road safety use cases only, and this band should support the use cases AEF has shown in our road safety demos during 2023,” said Nothdurft. “However, this band wouldn’t be sufficient from a throughput perspective for in-field communication use cases, and it is not permitted to be used for non-safety applications like process data exchange. So, we would need to use other frequency bands and wireless technologies like Wi-Fi for this.”

“Looking at the amount of ag equipment produced, you can see it is a niche application compared to passenger cars or even trucks,” said Witte.

Automaker Volkswagen, for example, has already begun deployment of this technology in Europe and now has more than one million passenger cars equipped with radio technology, enabling them to talk to other vehicles similarly equipped with this technology. AEF is in close contact with Volkswagen, as all new models in the EU will be equipped with this technology.

“In the U.S., the goal of road safety is possible. There is a single channel, which is a sufficient amount, at least for a lot of these day one use cases,” said Witte. “In Europe, it’s a bit different. There’s more space allocated for the [Cooperative Intelligent Transport Systems] C-ITS systems, not only for road safety, but also efficiency topics.” According to Nothdurft, most of the learnings AEF has gathered

from prototypes and initial tests can be transferred to the U.S. market. “The vehicle ISOBUS interface can stay the same. There are chipsets and communication stacks available covering both markets and radio communication requirements,” he said.

“A certain amount of spectrum is available for doing wireless communication. And when we are talking about C-ITS today, available chip sets are capable for working in different areas of the spectrum and supporting different radio protocols,” said Witte. “I’m not afraid of supporting both in the end. It’s more about the decision of the car manufacturers, which technology will be introduced in which market, and then [adopting] it within our machinery.”

Driving the Industry Forward

As things progress, existing standards will need to grow and be adapted, but right now, the agricultural industry has come together to collaborate on these efforts. Accelerating V2X deployment is an important step toward saving lives through connectivity. V2X, WIC and autonomy are transformational technologies that will not only advance safety, but also enhance efficiency and reduce negative environmental impacts.

“We are all pushing toward zero accidents and zero accident-related deaths. If it saves one life, it’s worth it,” said Gellings. “But how we get there, and what that road looks like, will require collaboration within the industry and with our external stakeholders.”

“Autonomy is going to play a piece in that effort, but I don’t know if that’s going to be the only answer. That’s why it’s so important that we work together, both within our industry, with other industries, with government and other external stakeholders; we need to find ways that work for everybody.”

Ryan Milligan is director of business development at Powell Electronics’ Powell Agricultural Solutions and deputy team leader for communications and marketing for the Agricultural Industry Electronics Foundation (AEF). Visit powell.com.

OEM Off-Highway | MARCH/APRIL 2024 15

For HD Hyundai, THE FUTURE IS IN XITE

A glimpse into construction jobsite transformation with XiteSolution President & CEO Youngcheul Cho

by Kathy Wells

At the Consumer Electronic Show (CES) 2024 in January, HD Hyundai revealed its vision for the future of construction. Packaged under the theme “Xite Transformation” (pronounced ‘site’), HD Hyundai aims to develop solutions for the sustainability of humanity. Xite, as HD Hyundai refers to it, is an expanded concept for construction jobsites, and incorporates the company’s goal to deliver “innovation in building smart construction sites with autonomous, digital twin, ecofriendly, electrification and more future construction equipment technologies.”

A keynote speech delivered by HD Hyundai Vice Chairman and CEO Kisun Chung revealed the company’s latest technology, X-Wise and X-Wise Xite, both of which will play a key role in

the company’s journey toward Xite Transformation.

According to the company, X-Wise is an AI platform designed to maximize safety and efficiency in fleet management, with the ultimate goal of reaching site autonomy. X-Wise will be applied to all HD Hyundai’s industrial solutions as a base technology going forward. X-Wise Xite is an intelligent site management solution developed for optimal production of infrastructure by connecting all construction equipment applied with X-Wise in real time.

In addition to realizing site autonomy with these two innovative technologies, HD Hyundai plans to become the leader in open innovation by partnering with global top players in the industry to build a new global ecosystem.

If that’s not enough, HD Hyundai XiteSolution, the controlling company of HD Hyundai Construction Equipment and HD Hyundai Infracore, is also setting ambitious goals for the future of construction. XiteSolution aims to not only build synergy across the company’s subsidiaries, but also shape

its own industrial vehicle and hydraulic component business.

Encompassing offerings from HD Hyundai Infracore and HD Hyundai Construction Equipment and HD Hyundai XiteSolution at the show, HD Hyundai showcased its vision for the future of construction jobsite at CES, highlighting three main areas:

• Future Xite - Advanced construction technologies for safer jobsites

• Twin Xite - Improved productivity and efficient in site operations

• Zero Xite - Decarbonized construction sites utilizing renewable energy sources

Future Xite presented what the future of next-generation construction machines will look like when utilizing advanced unmanned and automation technologies. Twin Xite introduced sitecontrol solutions and remote-control technologies based on digital twins. Zero Xite focused on exhibiting the company’s experience and technological capabilities for green energy value chains. Armed with a comprehensive

MARCH/APRIL 2024 | OEM Off-Highway 16 TECHNOLOGY NEWS

HD HYUNDAI

strategy and this vision for the future of construction, HD Hyundai aims to become a leading global player in the construction equipment industry. XiteSolution President and CEO Youngcheul Cho plays a key role in driving this vision forward.

Since joining the company in 1988, Cho has seen the company adapt through different phases of change and iterations of innovation — each more intelligent than the next.

According to Cho, the most recent shifts toward greater integration of technology and stronger drive to innovate have been the most notable.

“[At CES, HD Hyundai Vice Chairman and CEO Kisun Chung] announced the focus on all-new technologies designed to improve jobsite safety, environment and productivity,” said Cho. “Without a focus on technology — without any of these things — we cannot work forward, so that is that a target.”

At the show, the Twin Xite concept showcased X-Wise Xite as it assessed fleet and site productivity through task and production tracking, providing recommendations to improve efficiency, including adjustments to fleet positions and routes. In this construction site of the future, solutions are no longer restricted by time and space, utilizing remote-control and site simulations created with digital twin technology.

While tech advancements like Twin Xite are certainly a target, Cho says other priorities include a focus on research and development (R&D) and product development and design — areas in which the company is dedicating resources both now and in the coming years.

“Here at CES, we’re showing the newest type of machine, and soon you’ll see this scale of technology come through across different types of machines,” said Cho. The Future Xite concept showcased a 15-foot-tall electric-powered autonomous excavator, equipped with perception/safety sensor system. The equipment can be upgraded by software update. Additionally, it can be built with various upper body and undercarriage (track and battery) depending on its purpose and task.

According to Cho, at the close of

2022, the company shaped longterm manufacturing strategies for its construction equipment divisions, with the main priority being the development of new machines. “Secondarily, we are focused on being the best in the market — for example, in the North American and European markets, to be the best, we have to focus on different types of machines,” said Cho. “Currently, we are focused on medium- to large-scale [machines] at the heart of the largerscale machines in the mining sector. Last year, we did some motors and two different types of machines, and this year will be the compact track loaders.”

“At the close of 2022, the company shaped long-term manufacturing strategies for its construction equipment divisions, with the main priority being the development of new machines.”

All of this is a step in XiteSolution’s greater path toward growth. In terms of market share, the company is looking increase its footprint. “We are not covering 100% of the North American market, but we are ready to invest in that with our partners. With the compact machines, we’ll be able to cover more and offer a full lineup to increase our market share,” said Cho.

Ultimately, Cho sees an opportunity to take the company further and plans to pursue a spot in the top five construction machinery companies globally. “I think product-wise and pricewise, we have a competitive business,” said Cho. “As the new type of machine is introduced, [there is a need for] upgrading the sales channels and the lineup. And increasing the production volume will provide a benefit when it comes to cost-effective releases,

and getting more customers than the competition,” said Cho.

With regard to safety, the future construction site is focused on autonomous equipment to reduce operators’ exposure to dangerous conditions. “In the mining environment, sites are not close, and this work requires working across long distances in rough conditions. For example, mining materials from a mountainous site. Some of these sites are dangerous, so who will do this work? People cannot do this, but machines can go out — operated autonomously — for long periods and long distances and safely do this work,” said Cho. “These machines are really changing things, removing the threats from the operator, and adapting to different site situations.”

On the Zero Xite front, HD Hyundai shared a glimpse into its potential technological capabilities for green energy value chains. When it comes to climate concerns and carbon neutrality, the company is focused on alternative energy production and transportation solutions using both electric and hydrogen sources. Representing HD Hyundai’s efforts to realize an era of zero carbon emissions, the Zero Xite concept shows an eco-friendly energy value chain depicting how HD Hyundai produces, supplies and utilizes energy, shown through the process of how hydrogen and electric energy is produced, shipped and utilized from ocean to land.

According to HD Hyundai, the company is committed to being a “Future Builder” and “will continue to lead technological innovation to build infrastructure that will shape a more sustainable future for humanity.” Laid forth at the show in impressive fashion, this vision to solve the pressing challenges faced by humanity, such as safety, security, supply chain issues, climate change and more, is an ambitious one. But according to Cho, he’s all in: “We have a responsibility, not only to our clients, but to all people globally.

Kathy Wells is editor of OEM Off-Highway magazine. Visit oemoffhighway.com.

OEM Off-Highway | MARCH/APRIL 2024 17

POWERTRAIN PRIORITIES

Inside on- & off-highway power trends & the shape of the market today

by Kathy Wells

As original equipment manufacturers (OEMs) continue to work toward meeting regulatory changes and pinpointing new sustainability goals, the name of the game is emissions reduction. While electrification is leading the way today, fuel efficiency remains key to traditional powertrain success, and product diversification is the future.

Vehicles within the automotive, on-highway and commercial markets have seen the most engaged transition toward powertrain electrification. Particularly in the automotive market, powertrain suppliers are electrifying rapidly, creating both pressure and opportunity for suppliers. According to McKinsey & Company, electric vehicle sales between 2020 and 2022 grew by more than 90% in both the U.S. and Europe and by more than 300% in China.

In the commercial truck space, major players have begun to join forces in the hopes of taking the lead in electrification. Partnership acceleration is also a critical step in solving current electric charging infrastructure problems. According to Tim Campbell, managing director at Campbells Electric Vehicle Consultancy, “Partnership is the key. Not one manufacturer can do it alone. Whether it’s Cummins, Daimler

Truck and PACCAR producing batteries in Mississippi, or Daimler Truck, Volvo Group and TRATON Group, which is Scania and Navistar, building an infrastructure of 1,700 high-powered chargers across Europe — if we don’t get the infrastructure right, we don’t get the trucks on the road, the customer doesn’t buy them, you don’t engage with them. So that’s an important part of the game.”

In electrification within the offhighway realm, OEMs are challenged with more demanding power requirements and more diverse end-user needs, applications and equipment sizes across various industries. And while electrifying larger equipment is a tougher challenge due to demanding duty cycles and high power consumption and weight considerations, great opportunity remains in the electrification of smaller equipment. Successful launches in smaller electric equipment categories such as excavators, scissor lifts, compact wheel loaders, etc., from names like Volvo Construction Equipment, JLG, Caterpillar and others, provide good examples.

John Deere Power Systems Director, Global Marketing and Sales Nick Block says battery-electric offerings will play a key role for applications such as turf equipment, compact utility tractors,

small tractors, compact construction equipment, and some road-building equipment.

According to Interact Analysis

Principal Analyst James Fox, “Electrification of smaller off-road machines is flourishing. Forklifts were already 64% electric in 2022 (including a small amount with fuel cells), scissor lifts were 89%, and boom lifts 25%. Largely, as a result of this, 1.5 million or 27% of off-highway vehicles/machines covered by this report were already electric in 2022. However, if we exclude these categories, fully electric vehicles did not even reach 0.1% in off-road during 2022, with 2027 forecast to be just under 1% and 2030 about 5%. This is a much slower pace of growth than the truck and bus market.”

And while the electrification trend will continue to buzz, many OEMs have begun to emphasize the need for powertrain diversification, offering multiple solutions to both meet customer needs and offer loweremissions products. This conversation surrounding the future of powertrain technology is focused on balancing emissions reduction with efficiency gains, the importance of natural gas, hydrogen and renewable energy, as well as emerging emissions regulations.

MARCH/APRIL 2024 | OEM Off-Highway 18 FEATURE SERIES: POWERTRAINS

ADOBE STOCK PERYTSKYY

Although, as OEMs continue to diversify and develop alternatives, many remain in support of a future for more traditional power options like the internal combustion engine (ICE), powered by petroleum-based fuels like gasoline, diesel and natural gas and renewable bio-based fuels.

According to Statista, ICE offerings were the dominant powertrain in off-highway equipment worldwide in 2021, accounting for about 95% of the value of total sales that year, while sales of off-highway equipment with electric and hybrid powertrains made up only 5% of the total sales value. This data indicates that ICE is projected to retain its dominance in the offhighway equipment market in the coming years.

For many, environmental regulations will be top of mind as the industry looks to future emissions requirements, which

will be significantly more stringent and demanding in the development of new technologies in both the on- and offhighway segments.

Block says that by 2026, John Deere aims to offer customers a variety of electric equipment solutions, including more than 20 electric and hybrid models designed to reduce the carbon footprint of the off-highway industry.

“For heavy-duty applications like those found in the construction industry, we believe there is still a long lifetime ahead for compression ignition engine technology and we are investing in it accordingly with product advancements like [John Deere Power Systems’] nextgeneration engine lineup,” said Block.

As OEMs and product teams to look toward the future, emissions reduction and sustainability will continue to factor into decision-making, research and future product development.

For example, in 2023, Cummins invested $1.5 billion in the research and development of new engine platforms and technologies. The company also funded $1 billion in upgrades to two of its engine plants to enable the production of fuel-agnostic platforms.

“We ultimately believe that there will be a place for more efficient diesel, natural gas and hydrogen internal combustion engines for many years in the commercial vehicle markets we serve,” said Brett Merritt, vice president and president, Engine Business, Cummins.

“These products, together with Accelera by Cummins zero-emission products, will help our customers of all shapes and sizes, reduce emissions today and well into the future.”

Kathy Wells is editor of OEM Off-Highway magazine. Visit oemoffhighway.com.

A powerful positioner from ALM delivers up to 40%+ increased welding and assembly manufacturing productivity. You’ll also gain increased safety, quality and ergonomics to ensure maximized throughput is always within reach.

OEM Off-Highway | MARCH/APRIL 2024 19

GET YOUR QUOTE AT ALMMH.COM

ALM positioners

Exploring the ICE Age

Scania’s Henrik Nilsson offers insight into alternative fuels, emissions reduction & what the future holds for the internal combustion engine

by Kathy Wells

As the mobile equipment industry continues to explore alternatives to traditional powertrain options, the internal combustion engine (ICE) remains a core product offering for many original equipment manufacturers (OEMs). To discuss the ways in which this classic engine is evolving, OEM Off-Highway spoke with Henrick Nilsson, director product management at Scania, Power Solutions. Operating in over 100 countries, transport solutions provider Scania is increasing its focus on sustainable transport systems. In 2023, the company delivered 91,652 trucks, 5,075 buses as well as 13,871 industrial and marine power systems to customers across the globe. Founded in 1891, Scania continues to invest in the research and development of new engine platforms and believes the internal combustion engine will be a staple for years into the future. Read on for Nilsson’s insights.

1. How has the equipment electrification trend affected the future of internal combustion engines platforms in mobile off-highway equipment?

Nilsson: First of all, we see great interest and potential in electrification of mobile off-highway equipment, which is why we are investing in modular hybrid and fully battery electric power solutions. At the same time, we are launching our nextgeneration inline internal combustion engine platform, pushing the limits of performance, reliability and fuel efficiency. We truly believe that the internal combustion engine plays an important role in powering offhighway equipment for years to come, and improving its fuel efficiency will be crucial in combination with the implementation of electrification to meet the demands of more energy efficient equipment and to reduce CO2 emissions.

2. How have you seen the balance shift regarding ICE versus EV? Will ICE still be a player in 10 years? 20 years?

Nilsson: In the power range in which we offer our combustion engines, there is great interest from equipment manufacturers in learning more about electrification in general and in specific niches there is a more concrete demand already here and now. As an example of this, we currently have a hybrid solution project in an airport firefighting vehicle. With that said, we believe that the combustion engine still will play a key role in the mentioned time period, although with more focus on the combination with electrification solutions and on alternative fuels. Again, this is why we are investing in our next generation inline engine platform, to enable real CO2 emission reductions, lower operating cost and better performance in off-highway equipment already now.

MARCH/APRIL 2024 | OEM Off-Highway 20 FEATURE SERIES: POWERTRAINS

Offering lower CO2 emissions, Scania’s DC13 next-generation engine is compatible with renewable 100% HVO fuel.

SCANIA

3. What are the market opportunities for ICE moving forward? Conversely, what are the limitations?

Nilsson: There is a lot to be done when it comes to optimizing combustion engine-powered off-highway equipment now and moving forward and we see great market opportunity in that. We believe in electrification of off-highway equipment, but it will not happen overnight in all types of equipment, which is why we advocate for choosing the most fuel-efficient combustion engine solution here and now. If operated on HVO fuel it is possible to substantially reduce the CO2 footprint with existing technology. The combustion engine technology as such is great in terms of the flexibility it offers both equipment manufacturers and operators, and it is also a technology that can offer market opportunities for many years to come even if it is not with diesel but with alternative green fuels.

4. What are Scania’s goals to support the longevity of its ICE products?

Nilsson: First and foremost, Scania’s purpose is to drive the shift toward a sustainable transport system, creating a world of mobility that is better for business, society and the environment. In this, our approach to sustainable transport rests on three pillars: energy efficiency, renewable fuels and electrification and smart and safe transport. These pillars also apply to our power solutions for off-highway equipment, and they enable us to make our customers’ operations cleaner and more efficient. The next generation inline engine platform is key for the company to meet the science-based targets related to decarbonization that Scania has committed to.

5. How do sustainability and carbon emissions play into this plan?

Nilsson: Sustainability and carbon emissions play a significant part,

and there is no doubt that we need to offer solutions that enable significant reductions in carbon emissions. There is nothing stopping equipment manufacturers from starting right now by selecting the most fuel-efficient solutions available and thereby take the first step on the road toward emission-free solutions. In combination with electrified solutions and more sustainable fuels, such as hydrotreated vegetable oil (HVO), the combustion engine can play a significant role.

6. What next-generation offerings are coming down the pipeline from Scania? What makes them stand apart from offerings from other ICE OEMs?

Nilsson: Scania is both here and now, and for the future. With industry-leading fuel efficiency, we have a great starting point. Fuel efficiency is in our DNA and our next-generation inline engine platform is truly the result of this. While offering this here and now, we invest heavily into electrification, and we conduct research within the field of hydrogen combustion engines as well as hydrogen fuel cells.

7. What challenges will ICE manufacturers face in the engine environment of the future?

Nilsson: We are used to a stable environment in terms of diesel being the dominant fuel and in that we have faced the emission legislation challenge, which for sure will continue. However, with the changing technology landscape, we believe that there will be a bigger variation of preferred fuels and technologies depending on industry and equipment type. For example, equipment operating with high energy demand in rural areas will be challenging to electrify, paving the way for alternative fuel combustion engines. On the other hand, equipment operating with low energy demand in urban areas will be suitable for electrification. To navigate this, still uncertain, future environment will be one of the biggest challenges, making

sure we invest in the right technologies at the right time.

8. Are alternative fuels a viable option for the future for ICE products? If so, which ones are currently leading the pack?

Nilsson: Alternative fuels are definitely a viable option for combustion engines. Here and now, all our engines run on HVO, and there is significant savings to be made by switching from diesel. The benefit of HVO is that no changes have to be made to the powertrain, you simply change the fuel and you will get the same performance as with diesel without having to refuel more often.

Looking a bit further ahead, hydrogen is an interesting option, although it comes with new challenges such as fuel supply logistics, equipment design changes and changed refueling intervals. Also, for it to be more sustainable than HVO and even diesel, it requires green hydrogen, which at the moment is supplied in very limited quantities. With increasing green electricity supply as a source for green hydrogen, this could however be a game-changer in equipment, which is hard to electrify for reasons mentioned earlier.

9. What’s next for ICE platforms?

Nilsson: Our first step is the launch of our next-generation inline engine platform based on the Scania Super engine for on-highway trucks and adapted for off-highway purposes. The 11- and 13-liter engines are the most advanced combustion engines we have ever built, setting a new standard for performance, reliability and fuel efficiency. We are, for example, increasing power output by 11% and torque by 21% while improving fuel efficiency by up to 7%, compared to our current inline engines. This is an opportunity for OEMs to reduce the carbon footprint substantially here and now by making use of existing technology and infrastructure.

OEM Off-Highway | MARCH/APRIL 2024 21

Kathy Wells is editor of OEM Off-Highway magazine. Visit oemoffhighway.com.

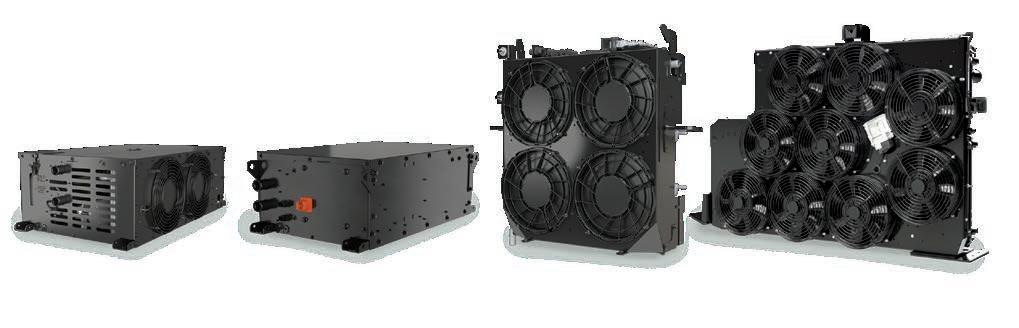

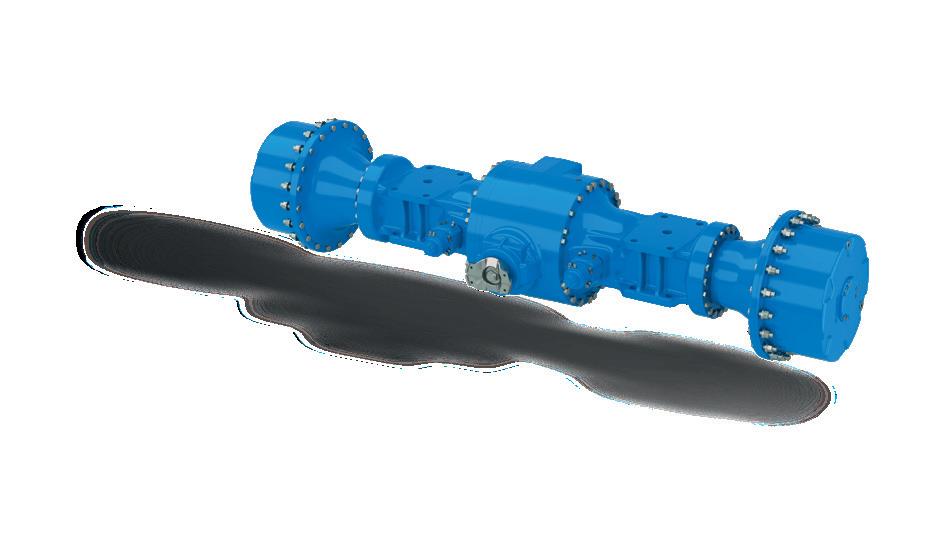

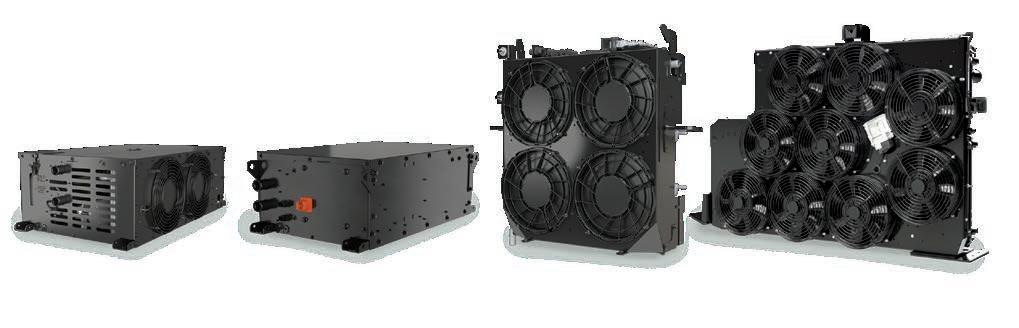

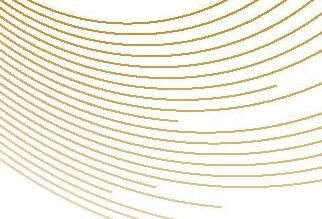

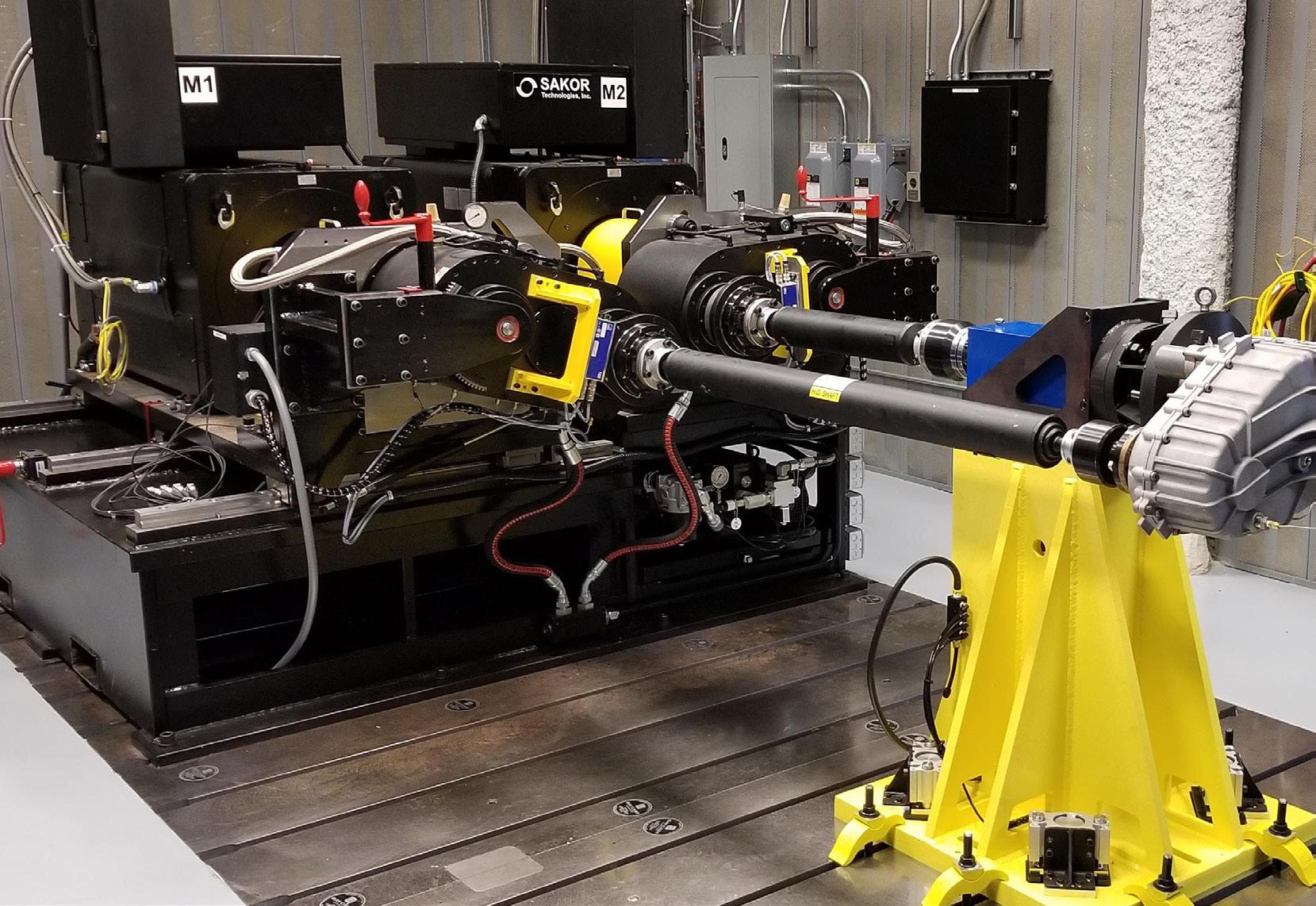

4 KEYS to the Most Efficient Driveline & Component Testing

Understanding the features of hybrid & electrical vehicles & the powertrain testing technologies designed to improve their performance

by Randal Beattie

Over the past decade there has been a tremendous surge of interest in hybrid and electric vehicle (HEV) technology in the off-road heavy vehicle market, including construction and mining vehicles.

To gain promised efficiency benefits and green profile from these vehicles, driveline and component testing conducted during design and manufacturing must be specially adapted to the particular nature of HEVs.

Hybrid and electric drivetrains have several features that make testing them very different from the standard testing conducted on internal combustion (IC) only systems.

First of all, HEV systems use regenerative braking, in which braking actually generates power that is returned to and stored in the vehicle’s battery for later use. This typically requires addition of fairly complex AC inverter technology, and often more complex transmissions.

These vehicles also often have several module control units (MCUs), essentially small onboard computers, which control the functions of such major subsystems as the engine, transmission, and charging system, among others.

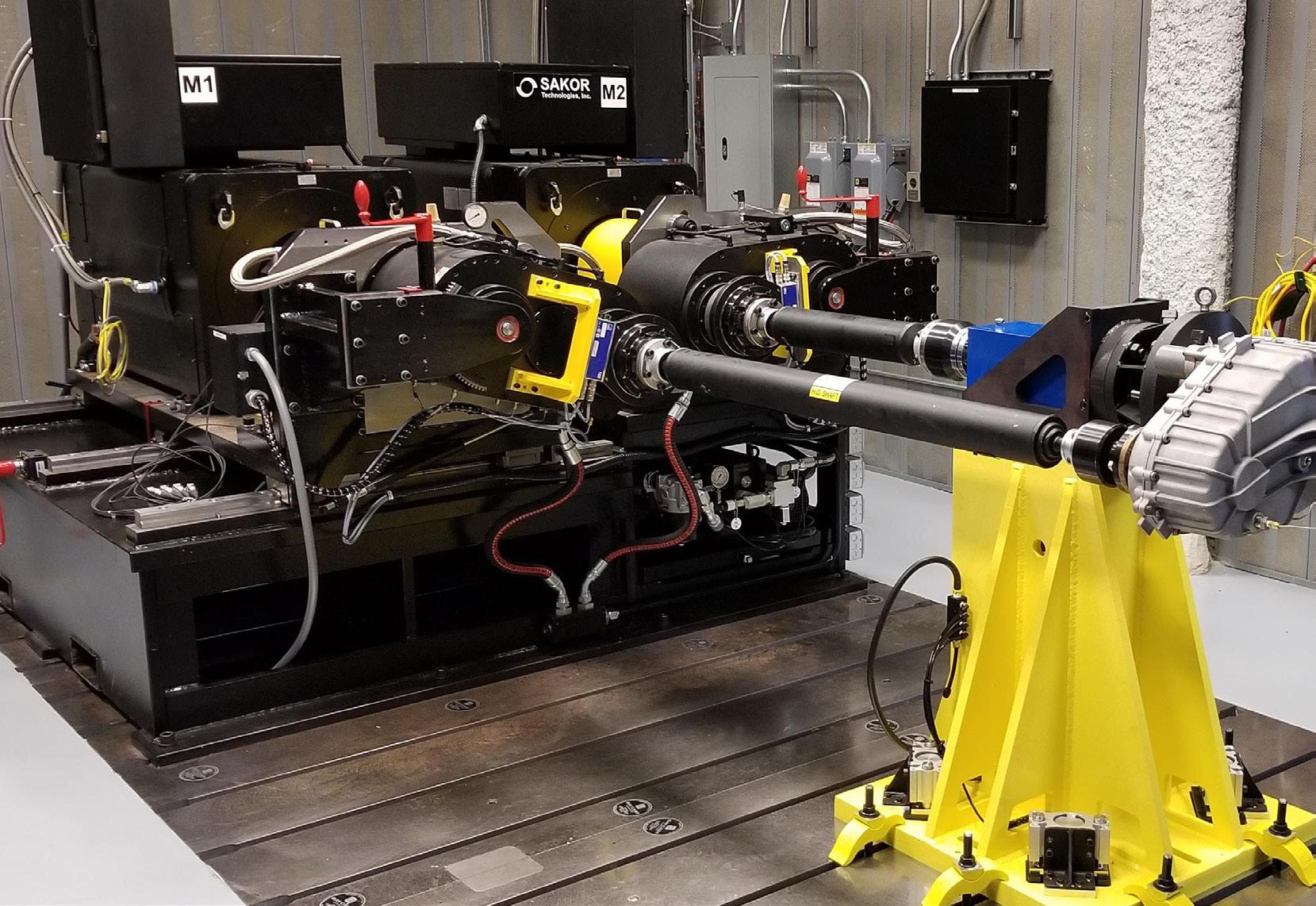

FEATURE SERIES: POWERTRAINS MARCH/APRIL 2024 | OEM Off-Highway 22

SAKOR

TECHNOLOGIES

TECHNOLOGIES

SAKOR

Proper testing of these components requires the test system to communicate with one or more of these units via a high speed in-vehicle network, requiring a far more complex system than those used in IC-only systems.

Fortunately, the technology is out there to ensure proper testing and realization of the energy efficiency benefits. What’s more, the testing technology is itself energy efficient, reducing operations and maintenance costs and contributing to the vehicle’s overall environmental performance.

1. HEV Driveline Testing at Several Vehicle Development stages

HEV driveline testing is conducted at several vehicle development stages, and each has an important role to play. Consider the following stages:

• Engineering testing to provide precise measurements — Design engineers

need accurate measurements to extract every bit of efficiency from their designs and gain the advantages of using hybrid/electric technology. Most vehicles use 3-phase AC motors driven by inverter technology, so testing systems need sophisticated power analyzers to properly measure 3-phase AC power with a large amount of harmonic content. These test systems tend to be rather complex and more sophisticated, with many elements to be tested and coordinated.

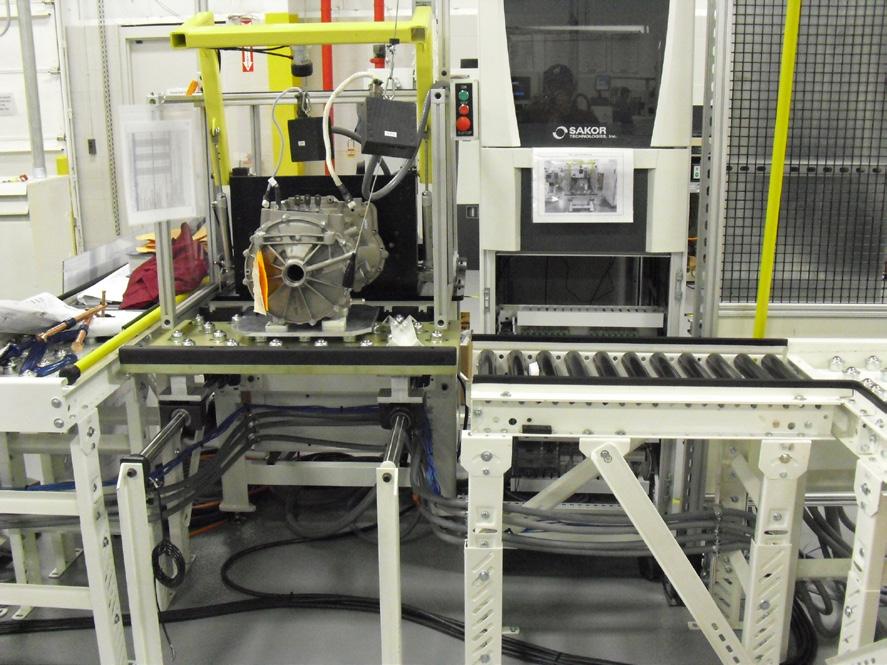

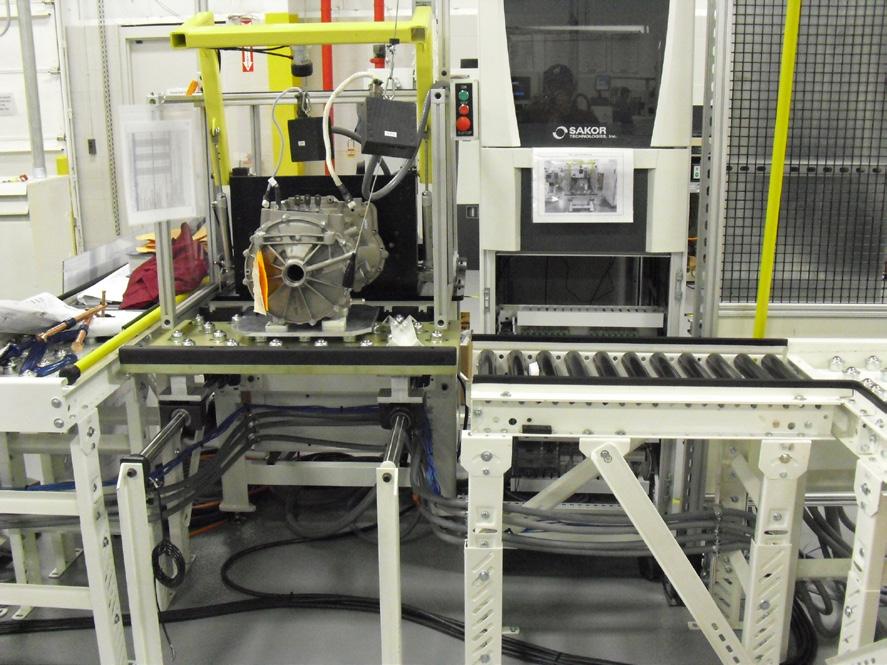

• In-process and end-of-line testing to verify performance and safety — Manufacturing end-of-line testing is usually performed to verify that no defects were introduced in the manufacturing process, and that the components will perform to specifications. Typical tests include operational validation, quick

performance testing, as well as rigorous testing to validate that highvoltage electrical systems are properly isolated and are therefore safe to use in vehicles. In-process testing may also be conducted to test partial assemblies along the production line. This improves manufacturing efficiency and significantly reduces the chance that faulty components will find their way into the finished product.

• Quality control testing can help detect many defects in incoming product — Quality control (QC) testing is usually done on a percentage of the components to verify that that they perform over the specified range and are relatively free of defects. For example, a fork lift company may conduct QC testing on a shipment of imported electric motors that are scheduled to be placed inside their

THE BRIGHTEST DESIGNS IN OEM LIGHTING

Specializing in LED lighting for agriculture, mining, & construction vehicles, J.W. Speaker lights the way to success for industrial OEMs.

Replace standard headlights with industrydefining performance. Choose the Model 93 5-in-1 LED headlight as the new drop-in replacement standard for 90mm LED lights — or as the latest breakthrough for your next custom vehicle OEM project.

OEM Off-Highway | MARCH/APRIL 2024 23

DRL,

Front Position, Turn Signal, High and Low Beam

forklifts to verify that the shipment will not experience high failure rates in the field. This type of test system is typically less complex because it does not have to measure as many items, nor to the degree of accuracy, as those tested in engineering systems.

2. Regenerative Braking Results in Fuel Economy Improvements

Hybrid or electric vehicles use fourquadrant motor/inverter technology to either assist the engine (hybrid) or as the prime mover (electric vehicle). During deceleration, the system uses regenerative braking, so the electric motor is used to slow the vehicle, and in the process becomes a generator, partially recapturing the energy of motion in the vehicle and restoring it to the battery.

In hybrid systems, the engine is typically shut off and not burning fuel when stopping, slowing down or idling and the electric motor again becomes a generator, partially recouping energy and storing it back in the battery. The engine is switched back to keep the vehicle moving, or to accelerate and the electric motor uses some of the recaptured electrical energy to assists in accelerating while reducing the load on the engine, and therefore reducing fuel consumption.

Since using this recaptured power is the key to the sought after fuel economy improvements, it is essential that the testing program used ensure that the powertrain is making the best use of this regenerative power.

3. Testing Systems Must Be Able to Handle Regenerative Drives, High Voltage Batteries & Multiple MCUs

Testing hybrid and electric vehicles is worlds apart from traditional internal combustion engine testing, which typically measures speed, torque, and a few temperatures, pressures and flows. Very precise control of speed and torque is typically not required in testing internal combustion engines, so dynamometers used for standard

combustion engine testing were never designed to handle the types of precision required by hybrid or electric powertrains, nor can they test the regenerative (motoring) modes of operation.

Modern HEV test systems must provide all of the functionality of traditional systems, with the added ability to test high-power regenerative electrical drives, high voltage battery and charging systems, and communicating with any number of MCUs.

Electrical System Testing

For many larger hybrid/electric drivetrains, such as those used in offroad heavy vehicles, there is a strong trend toward using higher voltage, higher efficiency drive systems. Going from the traditional 12/24-volt DC electric system to one using 240 volts AC will typically require one-eighth or less of the current to deliver the same power. This is more efficient and also requires much smaller/lighter wiring and smaller components to transfer the energy, leading to smaller, lighter, more energy efficient vehicles. Many current designs operate at 1,000 volts or more, making the vehicles even more efficient.

To conduct this type of testing, it is essential to use a 4-quadrant motoring dynamometer, which can simulate/test all modes of operation in a hybrid or electric vehicle. The ability to drive or load in either direction is exactly what is needed to test a system that itself operates in this manner. A standard dynamometer is just not capable of testing the system during braking, when it is in regenerative mode.

Creation of high-efficiency, AC powered systems typically involves the use of three-phase, inverter based technology to precisely control the electric motor(s) in the system. These systems tend to be very efficient, but also generate a great deal of harmonic distortion in the power output. So, in addition to the motoring dynamometer, a modern hybrid/EV test system typically includes a rather sophisticated three-

phase power analyzer. This unit must be specifically designed to accurately measure high-power electrical values with a great deal of harmonic distortion present.

For example, some companies have developed one comprehensive test system for determining the performance, efficiency and durability of all aspects of hybrid drivetrain systems, including electrical assist (parallel hybrid), diesel electric (serial hybrid) and fully-electric vehicle systems.

The system can integrate components of powertrain and electric motor data acquisition and control systems. Coupled with one or more AC dynamometers, and one or more precision power analyzers, the modular system can test individual mechanical and/or electrical components, integrated sub-assemblies and complete drivetrains with a single system.

High-Voltage Battery Simulation & Testing

The high-voltage battery and charging system is a critical element of modern hybrid or electrical vehicles. Accurate high voltage hybrid or electric drivetrain testing requires precise, repeatable high-voltage DC power. Batteries are not acceptable for powering the DC components of a hybrid/EV test system because battery performance changes over time, depending upon charge state, ambient conditions, and age. A standard off-the-shelf power supply will not work, because it cannot absorb power from the regenerative system. In fact, a standard power supply used with a regenerative system may be damaged or destroyed.

This problem can be solved with a solid state battery simulator/test system developed specifically to test highvoltage hybrid vehicle batteries and simulate these batteries in an electric drivetrain environment.

At the heart of the system lies a high-efficiency, line-regenerative DC power source. During regenerative modes, absorbed power is regenerated back to the AC mains instead of being dissipated as waste heat, a customary

MARCH/APRIL 2024 | OEM Off-Highway 24 FEATURE SERIES: POWERTRAINS

practice in previous generation testing systems. This innovative method provides far greater power efficiency and measurably reduces overall operating costs.

Coupled with a a comprehensive test system, the solid state battery simulator/ tester accurately simulates the response of the high-voltage battery in realworld conditions. However, since it is not subject to a variable charge state, it provides repeatable results, test after test. This same unit, when operated as a battery tester, subjects the battery to the same charge/discharge profile as it would encounter in an actual vehicle on an actual road course.

One of the advantages of using the AC dynamometer with a regenerative DC power source is that, when coupled together, the power absorbed by one unit can be re-circulated back to the other unit within the test system. This reduces the power drawn from the AC mains by as much as 85% to 90%, significantly reducing total operation cost. This energy efficient configuration easily pays for itself, often many times over, during the life of the test system. Low maintenance requirements also contribute significantly to lowering operating costs.

4. Communication With Control Modules

Communication with MCUs is another feature that has to be built in to testing systems for hybrid or electric vehicles. Whereas engines used to be controlled primarily by the throttle and ignition, HEV engines have an engine control unit (ECU), as well as a separate MCU to control the electric drive.