Whether your machinery is crushing, drilling, excavating, earthmoving, material handling, transporting or trenching, finding the right thermal management system to deliver exceptional performance in challenging conditions is critical.

From shock and vibration to dust, debris and extreme temperatures, Grayson has been developing advanced heating and cooling systems that conquer the thermal challenges of leading global OEMs for over four decades.

From liquid chillers for battery temperature regulation and coolers for electric traction and hydrogen fuel cells, to HVAC solutions using the latest, ultra-efficient heat pump technology, Grayson are here to support you create the next-generation of emission-free off-highway vehicles and machinery.

Contact Grayson to conquer your thermal challenges today

4 MINExpo 2024, OEM Industry Summit 2024 & OEM Off-Highway’s new editor

BRIEF

5 6 acquisitions & sales that are moving mobile equipment markets forward EQUIPMENT MARKET OUTLOOK

6 With an eye on interest rates, record-high construction machinery orders in recent months signal slow growth to come

32 4 innovative new releases hitting the OEM market now

34 How elevating graders experienced a revival as the concept was adapted to motor graders

Video Network

oemoffhighway.com/videos OEM Industry Update

oemoffhighway.com/podcasts Premium Content

oemoffhighway.com/premium-content

oemoh.co/subscribe-enl

Hydrogen Ahead

As OEMs zero in on the future of engine technology, hydrogen solutions become contenders amid the energy transition 30 Can Battery Swapping Make a Success of Off-Highway Electrification?

Inside the potential for widespread applications at construction sites, quarries & farms

The Chinese Challenge

3 factors driving Chinese players’ competitive advantage & how U.S. OEMs can successfully navigate this landscape

The Digital Revolution in the Off-Highway Industry

How integrating machines, cloud technology & data opens new possibilities for improving efficiency & pioneering new ways of working ENGINEERING & MANUFACTURING

Empowering Engineers on the Road to a More Sustainable Future Methods for finding innovative solutions that are not only sustainable, but also meet industry requirements & positively impact an OEM’s bottom line

20 OEM Off-Highway's 2024

New Products

This year’s winners highlight the ingenuity & innovation behind some of today’s best product offerings

As this issue reaches readers, the OEM OffHighway team prepares to explore latest mining equipment and technologies at MINExpo 2024. Taking place Sept. 24-26 in Las Vegas, Nevada, the trade show connects mining industry experts from every corner of the globe.

In August, the OEM Off-Highway team tackled the latest off-highway vehicle technologies and trends at iVT Expo 2024. For trade show insights and more on what’s leading the next generation of off-highway equipment, visit oemoh.co/ivtexpo2024.

The event, held every four years, draws thousands of OEMs, executives, engineers, environmental professionals and suppliers. If you’re attending the show, we encourage you to stop by the North Hall, Booth 225, to visit our team. If not, keep up with our coverage at oemoffhighway.com/ minexpo-2024, where we’ll highlight breaking news, announcements, interviews and insights, both before and after the show.

With this print edition, I will hand off editorial direction to the new editor of OEM Off-Highway. And while I won’t be going far — to OEM Off-Highway’s sister publication, Equipment Today — I will carry with me the spirit of innovation embodied by so many throughout this industry. I have valued my time here with you and will forever appreciate the dedication and zeal that you bring to your work.

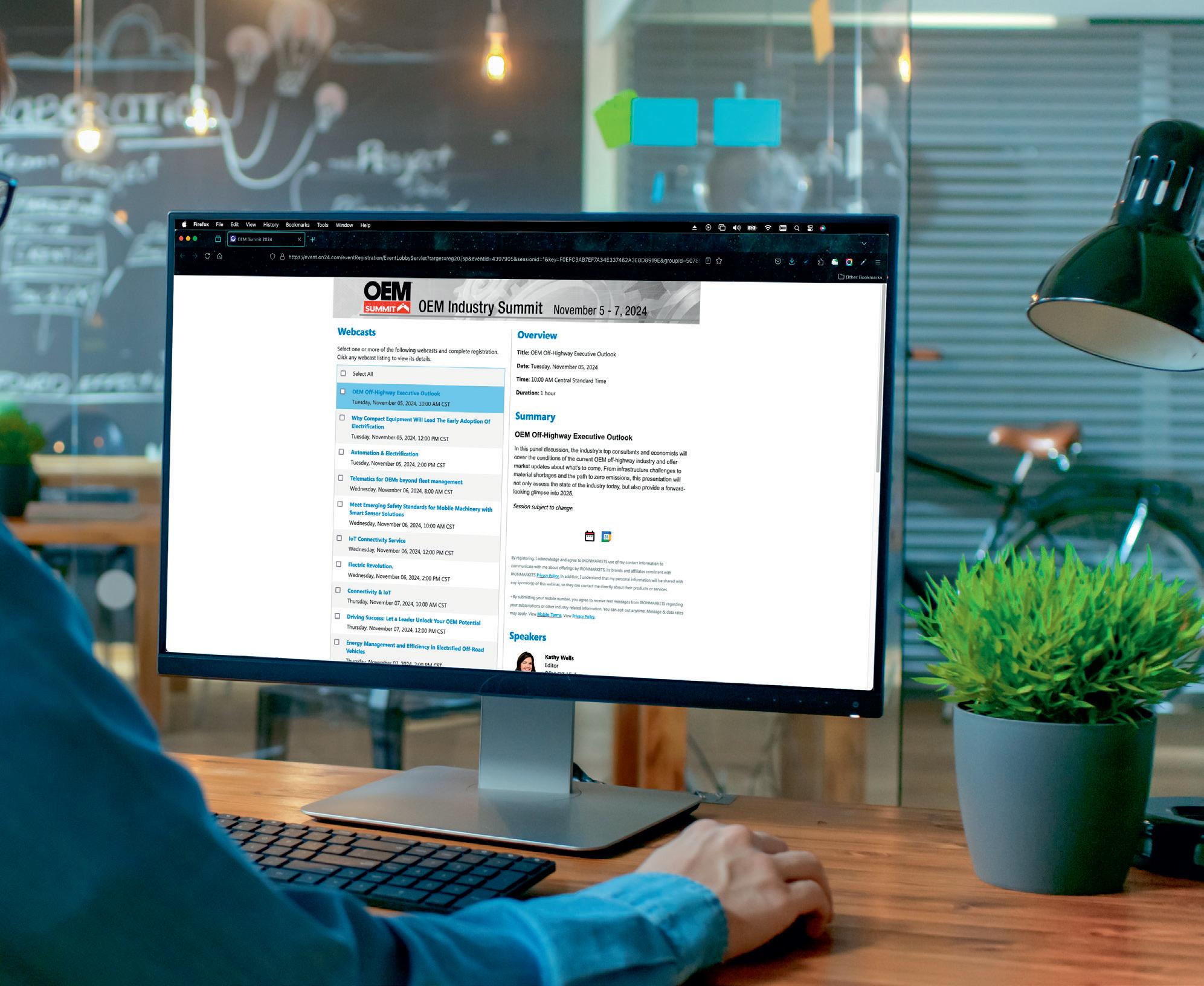

Catch up with our new editor and the latest trends at the OEM Industry Summit 2024, taking place Nov. 5-7. Tune in to hear OEM Off-Highway and its experts address some of the industry’s toughest challenges, covering topics from electrification to automation to operator environment. Register at oemsummit.com.

Take care,

Craig Callewaert, PE, Chief Project Manager, Volvo Construction Equipment

Roy Chidgey, Business Segment Head, Minerals Projects and Global Mobile Mining, Siemens Large Drives US

Andrew Halonen , President, Mayflower Consulting, LLC

Terry Hershberger, Director, Sales Product Management, Mobile Hydraulics, Bosch Rexroth Corp.

Steven Nendick, Marketing Communications Director, Cummins Inc.

John Madsen, Director Engineering & Product Management, GKN Wheels & Structures

Doug Meyer, Global Director of Construction Engineering, John Deere

Andy Noble, Head of Heavy Duty Engines, Ricardo

Daniel Reibscheid, Business Development Manager, MNP Corporation

Matt Rushing, Vice President, Product Line, Global Crop Care, AGCO Corp.

Allen Schaeffer, Executive Director, Diesel Technology Forum

Keith T. Simons, President – Controls Products, OEM Controls, Inc.

Alexandra Nolde , Senior Communication & Media Specialist, Liebherr-Components AG

Bob Straka, General Manager, Transportation SBU, Southco, Inc.

Luka Korzeniowski, Global Market Segment Leader, Mobile Hydraulics, MTS Sensors

Chris Williamson, PhD, Senior Systems Engineer Global Research & Development, Danfoss Power Solutions Company

EDITORIAL

Editor Kathy Wells kwells@iron.markets

AUDIENCE

Audience Development Manager Angela Franks

PRODUCTION

Senior Production Manager Cindy Rusch crusch@iron.markets

Art Director Kimberly Fleming kfleming@iron.markets

ADVERTISING/SALES

Brand Director Sean Dunphy sdunphy@iron.markets

Brand Manager, OEM & Construction Nikki Lawson nlawson@iron.markets

Sales Representative Kris Flitcroft kflitcroft@iron.markets

Sales Representative Craig Rohde crohde@iron.markets

IRONMARKETS

Chief Executive Officer Ron Spink

Chief Revenue Officer Amy Schwandt VP, Finance Greta Teter VP, Audience Development Ronda Hughes VP, Operations & IT Nick Raether VP, Demand Generation & Education Jim Bagan

Corporate Director of Sales Jason DeSarle

Brand Director, Construction, OEM & IRONPROS Sean Dunphy

Content Director Marina Mayer

Director, Online & Marketing Services Bethany Chambers

Director, Event Content & Programming Jess Lombardo CIRCULATION & SUBSCRIPTIONS

PO Box 3605 Northbrook, IL 60065-3605, Phone: 877-201-3915 Fax: 847-291-4816 circ.oemoff-highway@omeda.com

LIST RENTAL

Sr. Account Manager Bart Piccirillo, Data Axle 402-836-2768 | bart.piccirillo@data-axle.com

REPRINTS & LICENSING

Brand Manager, OEM & Construction Nikki Lawson 920-542-1239 | nlawson@iron.markets

Published and copyrighted 2024 by IRONMARKETS. All rights reserved. No part of this publication shall be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage or retrieval system, without written permission from the publisher.

SUBSCRIPTION POLICY: Individual print subscriptions are available without charge in the United States to original equipment manufacturers. Digital subscriptions are available without charge to all geographic locations. Publisher reserves the right to reject nonqualified subscribers. Subscription Prices: U.S. $35 One Year, $70 Two Years; Canada and Mexico $60 One Year, $105 Two Years; all other countries, payable in U.S. funds, drawn on U.S. bank, $85 One Year, $160 Two Years. OEMOff-Highway (USPS 752-770, ISSN 1048-3039 (print); ISSN 2158-7094 (online) is published 6 times a year: January/February, March/April, Month, July/August, September/October and November/December by IRONMARKETS, 201 N. Main Street, 3rd Fl., Fort Atkinson, WI 53538. Periodicals Postage paid at Fort Atkinson, WI and additional entry offices. POSTMASTER:

@oemoffhighway @oemoffhighway @oem-off-highway @oemoffhighway

Published by IRONMARKETS

201 N. Main Street, Fort Atkinson, WI 53538 800-538-5544 iron.markets oemoffhighway.com ironpros.com

The move broadens the company’s global reach and adds offerings in the industrial, marine and hybrid/ electrification space.

Twin Disc, Inc has completed its approximately $23 million acquisition of Katsa Oy, a Finland-based, designer and manufacturer of gearboxes and power transmission components for industrial and marine end markets.

The acquisition broadens Twin Disc’s global reach through further expansion into growing European markets, while also adding products to diversify and enhance its offerings in the industrial, marine and hybrid/ electrification space.

The recent steam of acquisitions is designed to bolster different areas of the business.

• ASI Mining — Epiroc already owns 34% of U.S.-based autonomous mining solutions company ASI Mining, which it acquired in 2018. The acquisition regards the remaining 66% of the company. The Utah-based company is a subsidiary of Autonomous Solutions, Inc., a provider of mining automation systems, such as remote control, teleoperation and fully autonomous solutions.

• Yieldpoint — Epiroc agreed to acquire the business of Yieldpoint Inc., a Canadian company that provides advanced ground support solutions that strengthen safety for mining and civil engineering applications. The company designs, manufactures and sells advanced digital geotechnical instruments.

Katsa’s after-sales services and in-house capabilities for engineering, development, manufacturing and heat treatment strengthen Twin Disc’s global sales and service network.

Read More oemoh.co/cvcnv620

• ACB+ — Epiroc agreed to acquire ACB+, a manufacturer of attachments and related couplers used by the construction industry. ACB+ is based in Saint Lager, France, and has several production facilities in the country.

• Weco Proprietary Limited — Epiroc completed the acquisition of the business of Weco Proprietary Limited, a South African manufacturer of precisionengineered rock drilling parts and provider of related repairs and services.

Read More oemoh.co/6z1m3y4y

Komatsu aims to strengthen its position in underground mining with the addition of GHH’s range of equipment, focused on loaders and articulated dump trucks.

Komatsu has completed its acquisition of GHH Group GmbH (GHH), a manufacturer of underground mining, tunneling and special civil engineering equipment headquartered in Gelsenkirchen, Germany. GHH’s range of equipment, focused on loaders (LHDs) and articulated dump trucks, will enhance Komatsu’s growing underground mining product offerings. This includes aftermarket parts and service support through the entire lifetime of the equipment. According to Komatsu’s president of Mining Business Division, Peter Salditt, the GHH staff will be retained as employees of Komatsu and the combined team plans to expand both product offerings and access to products in new territories. The company notes that adding GHH’s factories and rebuilding facilities in key markets in Europe, Southern Africa, India and Chile will strengthen production and service capabilities for customers.

Read More oemoh.co/br1u4jz8

Industry-leading economic firm ITR Economics provides heavy-duty equipment market trends to help OEMs stay up to date on top industry information and insights, which can help them make better decisions in 2024.

With an eye on elevated interest rates and U.S. Steel Scrap Prices, third-quarter 2024 data suggests slowing

growth for new orders of construction machinery, despite this area having experienced a record-high $51.4 billion in May 2024, which positioned this market 8.4% above the year-over-year level.

The following provides a summary of key observations across 13 indicators and areas of industry that contribute to today’s global economic conditions.

• Following a rising trend, the monthly rate-ofchange for the U.S. OECD Leading Indicator moved horizontally in recent months.

• The Indicator suggests near-term upward momentum for the industrial sector, followed by steadying growth late this year. However, analysis of a broader range of evidence suggests a plateau for the industrial sector through the end of this year.

• U.S. Industrial Production in the three months through June was roughly even with the year-ago level.

• We anticipate that Production will generally plateau rather than decline outright. Consumers face some financial pressures from prolonged high inflation, but rising incomes and labor market dynamics suggest that this is temporary.

• U.S. Private Nonresidential Construction rose in the three months through May to 5.2% higher than the year-ago level. Historical data was revised by the U.S. Census Bureau.

• Previous negativity in residential construction and decline in the U.S. Architectural Billings Index suggest a transition to general decline for Construction in the latter half of 2024.

• U.S. Total Public Construction in the 12 months through May totaled $471.2 billion, 16.3% above the year-ago level. Historical data was revised by the U.S. Census Bureau.

• The annual growth rate ticked down in May. Growth will likely continue to slow this year as signaled by prior slowdown in U.S. State and Local Tax Revenue.

• Annual U.S. Farm Machinery Shipments rose in May and were 6.6% below the year-ago level.

• Shipments have risen 3.8% since the start of 2024 and rise is likely to persist; however, elevated interest rates pose a downside risk.

• Annual Europe Agricultural and Forestry Machinery Production in May was 13.2% below the year-ago level.

• ITR Checking Points suggest further decline in the near term for Production, although r ecent ECB rate cuts pose an upside in the medium term.

• The Four Big European Nations Leading Indicator monthly rate-of-change ticked up from May to June. The Indicator rate-of-change has been generally moving horizontally with a slight downward bias.

• Europe Industrial Production has declined 3.5% since early 2023. Leading indicator evidence still suggests that Production will decline into late 2024.

• Annual U.S. Heavy-Duty Truck Production declined in June but remains above the year-ago level by 1.4%.

• Production will decline in the coming quarters following slowing macroeconomic activity. Upward rate-of-change movement in per-mile truckload pricing suggests demand is nearing an inflection point toward recovery, though the positive impact on Production may take time to develop.

• Annual U.S. Mining Production through June was 1.0% above the year-ago level.

• The oil and gas sector is rising as the non-oil segment contracts. Leading indicators suggest improved conditions on the horizon in 2025.

• Germany Industrial Production in the three months through May was 6.3% below the year-ago level.

• Markit Economics’ Eurozone Manufacturing Purchasing Managers Index signals a potential inflection point in the near term. Downside pressures may not worsen for much longer, but they will likely linger in the coming quarters.

• Annual U.S. Construction Machinery New Orders were at a record-high $51.4 billion in May and were 8.4% above the year-ago level.

• Growth is slowing for New Orders and U.S. Steel Scrap Prices suggest some near-term downward pressure. Elevated interest rates are also applying downside pressure on this market, given that large machinery purchases are interest-rate sensitive.

• U.S. Mining and Oil Field Machinery Production in the 12 months through June was 3.6% below the year-ago level.

• Recession will continue in at least the near term given mild downward pressure on the macroeconomy.

• U.S. Defense Capital Goods New Orders in the 12 months through May totaled $155.9 billion, 6.9% below the year-ago level.

• Trends in the Geopolitical Risk Index, a measure of news sentiment toward global geopolitical risk, suggest that rate-of-change rise in New Orders will occur in the near term.

Specializing in LED lighting for agriculture, mining, & construction vehicles, J.W. Speaker lights the way to success for industrial OEMs.

Focus on the big picture. Leave the lighting details to us. Choose the Model 93 5-in-1 LED headlight as the new drop-in replacement standard for 90mm LED lights — or the new Model 795 dual function work light as the latest breakthrough for your next custom vehicle OEM project.

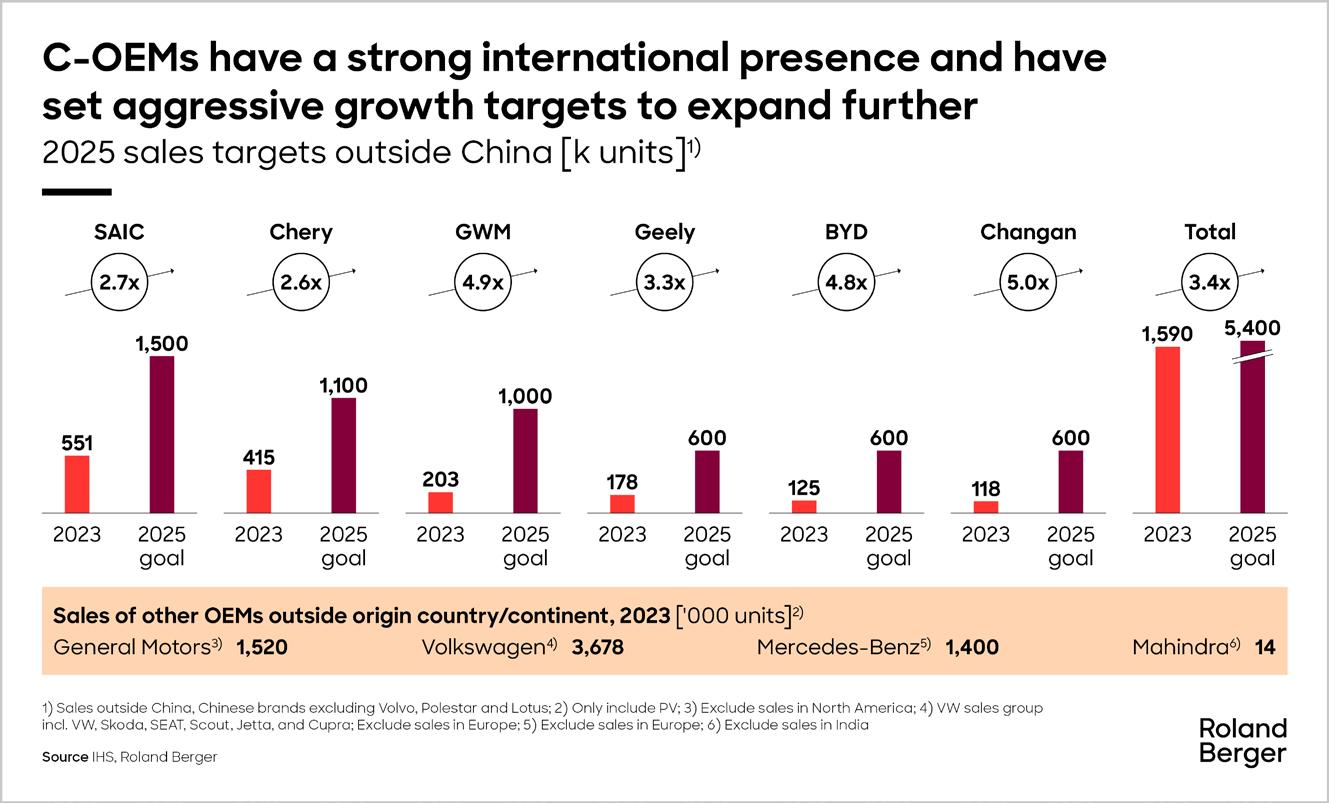

Inside 3 factors driving Chinese players’ competitive advantage & how U.S. OEMs can successfully navigate this landscape

by Wilfried Aulbur

China’s challenge to the West is multifaceted and plays out across geopolitical and industrial domains. Few industrial domains are as much in the public eye as the passenger vehicle industry. Given its importance for the economies of North America, Europe and China, as well as its visibility to end customers, this industry can be seen as a bellwether of the relationships between the West and China. We believe that the lessons and insights from the passenger car industry are applicable to other automotive and industrial sectors as well.

The current understanding of many Western observers is that the West is at a risk of being flooded by highly subsidized Chinese vehicles with corresponding negative implications for local employment, value creation and industrial ecosystems.

China, so the charge, is trying to export its way out of a difficult economic situation at home where the lifting of COVID restrictions has not unleashed the forces of the market and driven up growth and consumption sufficiently. This view has merit, as we will further explain in this article.

However, we will also highlight the inherent strength that the Chinese automotive ecosystem has developed and suggest that a full decoupling from the Chinese market may be less-thanoptimal from a technology, competition, ecological and consumer point-ofview. Three factors drive competitive advantage for Chinese players and will be discussed in this article: China cost, China speed and China tech.

From an economic point of view, the last decade has been a decade of normalization for China. Coming from breakneck speeds of double-digit growth, the country’s gross domestic product (GDP) is projected to grow by about 4.6% in 2024 and 4.1% in 2025. Clearly, as the economy is now the second largest in the world in nominal terms, this slowdown was to be expected.

However, the continued confrontation with the West has taken its toll as well and amplified economic challenges. Global economic risks such as softer and volatile global demand, exchange rate fluctuations and a foreign investment slump have been headwinds. Geopolitical risks around tariffs, sanctions, supply chain de-risking and technology decoupling have been negatives for the Chinese economy. In addition, the politicization of business and changed administrative approach to the economy have increased uncertainty and driven consumer confidence down to record lows.

Overall unemployment rates have stabilized at 5%, yet youth unemployment remains stubbornly high at 14% to 15%.

In this environment, the government, as well as entrepreneurs, need to take action. One area of activity is the automotive industry, especially in the light of the energy transition. Over the last decade, the Chinese government subsidized the development of its electric vehicle (EV) industry with incentives to the tune of $250 billion.

Support included tax exemptions, purchase incentives and subsidized access to raw materials and capital. Direct subsidies to key industry players amounted to several billion dollars over the last five to six years.

Given a soft market at home, both government and companies are also pushing hard to conquer export opportunities. As Figure 1 shows, the export aspirations of Chinese passenger vehicle OEMs are substantial and will catapult these companies to worldleading exporters in the space.

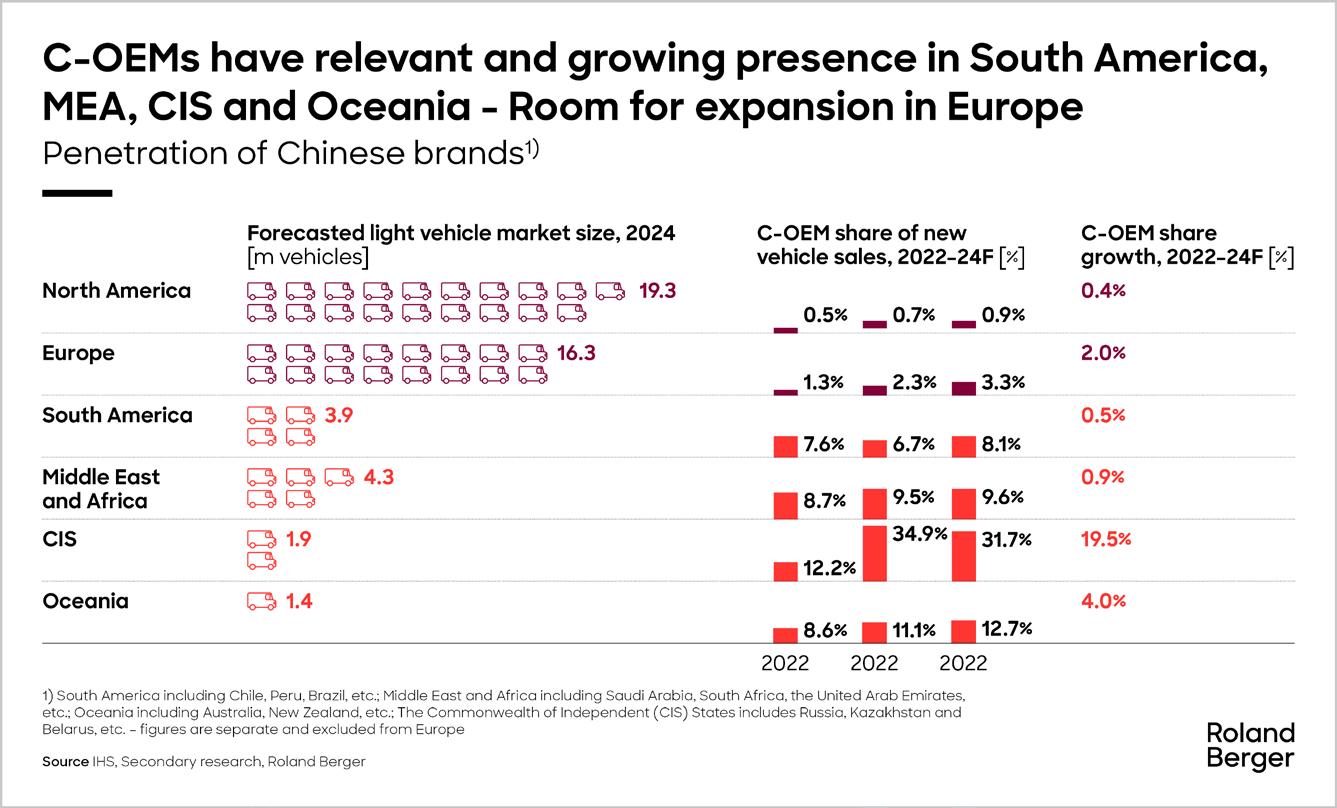

These growth ambitions come on the back of a solid market share gain in key regions globally. While entry into North America seems unlikely and building a presence in Europe not straightforward, Chinese players are visible in many emerging markets such

as South America, Middle East and Africa and Oceania. In the Commonwealth of Independent States (CIS), they command a share of more than 30% taking advantage of Western sanctions against Russia (see Figure 2).

Yet, the success of Chinese OEMs abroad is not only driven by geopolitics and subsidies. As mentioned earlier, China cost, China speed and China tech are important contributors to the expansion of Chinese players. From a cost perspective, scale plays a major role. The passenger vehicle market in China is expected to be 40% larger than that in the U.S. in 2024, while labor costs are still at least 40% cheaper. Rather than just relying on these factor cost advantages, Chinese companies are aggressively investing in process automation driving further cost and quality advantages. The old ways of competing — based on low labor cost, lax environmental regulation, high capital and low total factor cost productivity — seem to be a thing of the past.

China speed is driven by several factors, one of them being reduced platform development cycles. Current Chinese OEMs are operating at 30- to 36-month platform development cycles and are working actively to further shorten the time it takes to bring new vehicles to the market.

With shorter development processes, it is easier to react to new technology developments in the market or innovations by competition moving the vehicle closer to “a smartphone on wheels.” Speed in the form of optimized processes, e.g., regarding testing and electrical/ electronic (E/E) and software (SW) development for high-voltage batteries, translates into significant cost savings as well, as can be seen in Figure 3. Lastly, China tech is an area of competitive advantage for Chinese

OEMs. For example, the number of global EV patents filed by Chinese players has increased steadily, so much so that at the beginning of 2024, about 34% of global patent filings were Chinese compared with 27% for U.S. players.

Combined with a strong xEV battery supply chain in country, this drives a need for Western players to understand what is happening in China. In addition, in the area of infotainment, China’s OEMs are catering to a much younger, more digitally savvy audience. Understanding

the needs of the target group is an advantage, especially when building up export presence in key young and emerging markets.

Countering the Chinese challenge by import duties, as has been the case of the U.S. and Europe, certainly helps mitigate some of the advantages that Chinese OEMs have due to strong state support and subsidies. Given the complexity of the situation, especially for European OEMs with large Chinese exposures and in part large Chinese shareholdings, tariffs are only part of the solution. Similar to the challenge posed by Japanese and Korean OEMs in the past, Western OEMs and suppliers will have to learn how to tackle the Chinese players head on. The speed of development will have to increase, and organizational complexity must be reduced, e.g., via the intelligent use of artificial intelligence (AI) in research and development (R&D), procurement, supply chain, etc. Efficiency and cost must be at the center of organizations after a prolonged, COVID-induced period of passing cost increases through to the customer. Local manufacturing and technology ecosystems need to be strengthened, e.g., via the Inflation Reduction Act in the U.S., to build local competencies. Strategies for emerging markets need to be revisited to ensure success in these growth markets and ward off Chinese dominance. Partnership with Chinese players should be explored to get access to capabilities. The to-do list is long and unlikely to subside any time soon.

In addition, global volatility requires a constant reflection and adjustment of China-related strategies. The road that executives have to navigate is likely to be windy — flexibility, speed and diligence of execution and the capability to create win-win partnerships will be key to navigate through these challenges successfully.

Wilfried Aulbur is a senior partner at international management consultancy firm Roland Berger. Visit rolandberger.com.

Discover the new enGage® NX7 with Connectivity at its Core.

The Curtis NX7 represents a state-of-the-art 7-inch touchscreen display, designed to enhance the user experiences across a wide array of applications. Seamlessly integrating with the Curtis Mobile Application and Curtis Cloud, it ensures your equipment remains up-to-date and accessible at all times. Learn more at: www.curtisinstruments.com/GetConnected

Amazing Viewing Conditions

· 1024x600 High-resolution Display

Capacitive touch-screen

1000 nit brightness

Advanced Performance

i.Mx8 MPU

· 8GB Flash, 1GB RAM

Analog and Digital Video

Connectivity Made Easy

· Wifi

Bluetooth

RFID

· CAN-FD

Ethernet

How integrating machines, cloud technology & data opens new possibilities for improving efficiency & pioneering new ways of working

by Philipp Maul

The off-highway industry faces a rising wave of digitalization. While other sectors have already made significant strides toward digital transformation, machine manufacturers often need to catch up due to a lack of knowledge about digital technologies and their potential within many companies. Despite this, the off-highway industry has immense opportunities to boost efficiency and establish innovative work methods.

Integrating machines, cloud technology and data opens new possibilities for improving efficiency and pioneering new ways of working. Standardizing and analyzing collected data play a pivotal role in this evolution, which is growing increasingly important as the industry advances. The importance of data standardization and analysis cannot be overstated in this context.

A key area of development is telematics. Advanced telematics solutions, built directly into the heart of machinery, offer original equipment manufacturers (OEMs) and machine owners real-time data insights into their equipment, pushing the digital transformation of numerous processes. These systems provide valuable information on machine performance, usage patterns and potential issues, allowing for proactive maintenance and efficient operation. Telematics can significantly enhance machine lifespan and efficiency. By monitoring vital signs and usage patterns, operators can ensure that machines are used optimally and serviced before major issues arise.

This proactive approach to maintenance reduces downtime and repair costs, leading to more reliable operations and improved productivity.

Adopting new technologies is often a daunting task for machine manufacturers. It involves not just implementing cutting-edge tools but also convincing and engaging employees in the process. Success in these areas means that both manufacturers and employees can reap the benefits that digital solutions bring to daily operations. Training and support are crucial for employees to adapt to new technologies and workflows, ensuring a smooth transition and maximizing the benefits of digitalization.

The service sector is already experiencing a dramatic shift due to digitalization, presenting numerous opportunities to automate processes and enhance customer relationships. This shift allows for the provision of new and improved services, fostering closer connections with customers. Digital tools enable more personalized and responsive service offerings. By leveraging real-time data and analytics, businesses can proactively address customer needs and increase customer satisfaction and loyalty.

Moreover, remote services and diagnostics are becoming increasingly important for efficient and swift fault resolution and significantly reducing downtime. By accessing machine data in real-time, service technicians can identify and fix issues early without needing to be on-site. Another emerging trend in the construction industry is the implementation of

firmware over-the-air updates. These updates enable remote updates of machine software and systems without physical access. This capability allows manufacturers and operators to respond to new requirements, close security gaps quickly and introduce new functions without taking the machines out of service.

Digital transformation also drives efficiency improvements, cost savings and reduces environmental impact. Utilizing remote services and diagnostics minimizes site visits and fuel consumption, leading to lower CO2 emissions. Additionally, digital processes optimize resource use and reduce material waste, offering both ecological and economic benefits. These advancements benefit not only customers and the environment, but also employees. Increased options for remote work enhance worker flexibility and mobility, making jobs more attractive and addressing future labor shortages. Furthermore, adopting digital tools and processes can lead to upskilling opportunities for employees, equipping them with valuable technical expertise and increasing job satisfaction.

Digital technologies can also streamline operations by automating routine tasks and providing real-time insights into performance and efficiency. Automated systems can manage inventory, track equipment usage, and monitor environmental conditions, ensuring that resources are used effectively and efficiently. This leads to better planning, reduced waste and more sustainable practices.

For digitalization to take root sustainably in the off-highway industry, active involvement from machine manufacturers is crucial. To achieve long-term effects, they must prioritize digitalization as a core project rather than a peripheral issue. Many companies already have specialized positions, such as “Head of Digitalization,” dedicated to this effort. These roles are essential for driving digital initiatives and ensuring digital transformation is integrated into the company’s strategy and operations.

Additionally, having digitally savvy employees, particularly service technicians, who are open to new processes is highly beneficial. Companies should actively engage their employees in the digitalization process and offer training to enhance their digital skills. A culture of change is vital, as digitalization brings both technological and workplace transformations. Employees who are comfortable with digital tools and processes can contribute more effectively to the company’s goals and adapt more readily to new challenges.

While some fear that digital technologies might lead to job losses, experiences from other industries show that digitalization often creates new opportunities and perspectives. Automating routine tasks can relieve employees, allowing them to focus on more demanding and creative activities. Moreover, with demographic shifts, younger workers tend to be more techoriented, fostering a positive attitude toward digital innovations.

Digitalization is not just a passing trend; it is a long-term goal of reshaping industries globally. This shift is a golden opportunity for the off-highway OEM sector to lay the groundwork for future advancements. Given the long lifespan of heavy machinery, addressing digitalization challenges sooner rather than later is crucial for seizing future opportunities. Many manufacturers are already transforming or leading this change by actively promoting digitalization within their companies and equipment.

Recognizing these developments, engaging actively with the digital revolution in the construction industry, and responding innovatively to new challenges to remain competitive in the long run is essential. The off-highway industry must embrace digitalization as a strategic priority to tackle these challenges head-on and secure future success. Companies that invest early in digital technologies and involve their employees in the process will significantly shape the future of the industry.

By proactively engaging with digitalization and involving employees in the process, companies can ensure they are wellprepared for the future. Embracing digitalization will not only help companies remain competitive but also allow them to take full advantage of the numerous opportunities that digital solutions offer. The future belongs to those who adapt and innovate, and digitalization is the key to unlocking that potential.

87 Switchable High Amp Circuit Breaker from Mechanical Products is an innovative heavyduty, ignition protected solution ideal for use in DC power systems as a main or branch circuit breaker. It is designed as a cross to industry-standard circuit breakers.

www.waytekwire.com/Series87

How OEM leaders can build a sustainability strategy that meets industry requirements & positively impacts the bottom line

by Lisa Miller

The race is on to a more sustainable future in the truck and off-highway industries. Hybrid and electric vehicles are becoming more prevalent as companies develop more sustainable products. On the manufacturing side, a greener, more efficient approach is in demand. Having a sustainability strategy in place is no longer a bonus, but an essential aspect of business decisions. It is also often the deciding factor for not only awarding business, but also winning talent.

According to TE’s 2024 Industrial Technology Index, 87% of engineers say that it is personally important to them to support climate change solutions in their work, and 34% report they would leave their job if their company did not provide opportunities to support sustainable initiatives.

This begs the question: What can leaders do to empower their employees to find innovative solutions that are not only sustainable, but also ones that meet industry requirements and positively impact the bottom line?

A true sustainability mindset drives behaviors and decisions across every inch of an organization. Many engineers are joining organizations where sustainability is front and center, and

According to TE’s 2024 Industrial Technology Index, 87% of engineers say that it is personally important to them to support climate change solutions in their work.”

they are coming to the table eager to learn more about how they can make an impact. It is not just about creating an interest in sustainability, but creating the desire to innovate with purpose. Over the last few decades, the landscape of product design and development has shifted in favor of a more sustainable future, driven mostly by government regulations. Couple that with technological advancements and heightened consumer awareness, and you have the perfect environment for creating measurable change. Within

your own teams, it is critical to build a sustainability roadmap that outlines clear, concise goals over the next five to 10 years. Start by ensuring your teams understand where your organization stands in terms of energy and water consumption, emissions, and hazardous and nonhazardous waste. From there, look at materials used and their impact, and begin to identify alternatives.

Meeting sustainability goals in the off-highway industries is more complex than other industries, given the harsh environments in which these products operate. Many components are exposed to dust, dirt, moisture, vibration and more, so it is imperative that the materials used are rugged and able to withstand these climates. The good

No matter how challenging your needs, BKT is with you offering a wide range of OTR tires specifically designed for the toughest operating conditions: from mining to construction sites. Sturdy and resistant, reliable and safe, able to combine comfort and high performance. BKT is with you, even when work gets tough.

Office: (+1) 330-836-1090

news is there are tools available to understand the impact various products and materials used in the off-highway industry have on the environment.

As you travel down the road to sustainability, one of the first steps is to perform a life-cycle analysis of the current products in your portfolio. Interpret the results in the context of your goals. Identify hotspots or stages with significant environmental impacts. Based on the findings, look for opportunities to reduce those impacts, improve efficiency, or make other improvements. Ask yourself, “What products are exceeding market needs?” and “What do we believe the life of these products to be?” If a product has the potential to be relevant in the market for quite some time, adapting that product to be more sustainable will be beneficial long-term.

For example, using sealing plugs that contain bio-based polymers instead of fossil-based PBT plastics in connectors has allowed TE Connectivity to reduce its related greenhouse gas emissions by 20%. What’s more, making the switch to using a bio-based DRB flange in connectors has also allowed an estimated reduction of CO2 emissions by 45% and a 30% cost savings.

Encouraging a sustainability mindset from concept to development through

to production is key. In today’s market, there are more sustainable materials available than there were years ago, but it’s easy to get stuck in the cycle of using the same materials because we know they work. It is important to challenge your engineers to seek new ways of thinking and develop more innovative solutions that not only meet customer and regulation requirements, but also reduce environmental impact. For instance, if a product uses less material, will it still meet the regulation and performance requirements for the component with confidence? If the answer is no, it is time to go back to the

drawing board. The goal is optimally engineered solutions – designing products with engineering expertise to validate the minimum technical solution resulting in zero waste.

Using recyclable, biodegradable packaging materials also plays into the big picture. A product needs to arrive at a destination the same way it left the factory, so protection of components is critical. Thanks to advancements in packaging, finding a sustainable solution that maintains product quality is not only doable, but also worthwhile. Finally, where a product is made is just as important as how it’s made.

Position sensors for stroke measurement in hydraulic cylinders

Compact safety rotary encoders for position and speed measurement

Dynamically compensated inclination sensors for precise angle measurement

As part of its sustainability journey, TE conducted an energy audit across six Industrial and Commercial Transportation manufacturing plants, which uncovered opportunities to improve sustainability. For example, after observing excessive energy consumption coming from the compressed air system at its facility in Tangier, Morocco, TE discovered this was likely due to undetected air leaks. Measuring and analyzing critical indicators enabled TE to identify these and other opportunities and work toward rectifying them. TE also installed solar panels at the same plant, which now allow the plant to generate approximately 20% of the energy it consumes from renewable sources.

Infusing sustainability into company culture is necessary for driving meaningful change. This extends to external stakeholders. TE works closely with its raw materials vendors to evaluate materials in its components in trial samples and provide formulation results. The goal is to help material vendors evolve their formulation to meet TE’s needs, which in turn will allow TE to drive a more sustainable, costeffective product to market.

On the supplier side, it is important to encourage your product development teams to have open conversations with suppliers about your organization’s sustainability goals. You might consider offering training to suppliers to further encourage their own sustainability goals.

Additionally, seek opportunities to stand alongside your customers and educate them on your sustainability progress. With more collaboration and commitment across all areas of the supply chain, there is greater possibility for a larger impact. Today, sustainability is front and center in corporate strategy, driving innovation, operational efficiency and long-term growth while addressing environmental and social responsibilities. For engineers, there is a personal stake in doing meaningful

work and creating products with a reduced carbon footprint. As that notion grows, schools have begun embedding sustainability into curriculum, so engineers can enter the workforce with knowledge of eco-friendly design. By defining clear sustainability goals, evaluating products against those goals, and being transparent in your

objectives, both leaders and engineers can be confident that they are doing their part in creating a greener future.

Lisa Miller is vice president and chief technology officer, Industrial and Commercial Transportation, at TE Connectivity. Visit te.com.

This year’s winners highlight the ingenuity & innovation behind some of today’s best product offerings

by Kathy Wells

For more than 40 years, OEM Off-Highway has worked with manufacturers across to globe to identify today’s top product introductions and upgrades and share them with our readers.

Our Top New Products award, returning for its 16th year, is designed to highlight the ingenuity of today’s design teams and showcase the innovation behind some of the latest product launches in the mobile on- and off-road equipment manufacturing space. Read on for the latest information behind several of the industry’s top new releases, including product features, specs and more.

The winners highlighted in the following pages have been selected from the best in a global submission process and represent OEMs offering exciting new products in each of the following categories:

• Engines

• Drivetrains

• Fluid Power

• Electrical & Electronics

Operator Cab

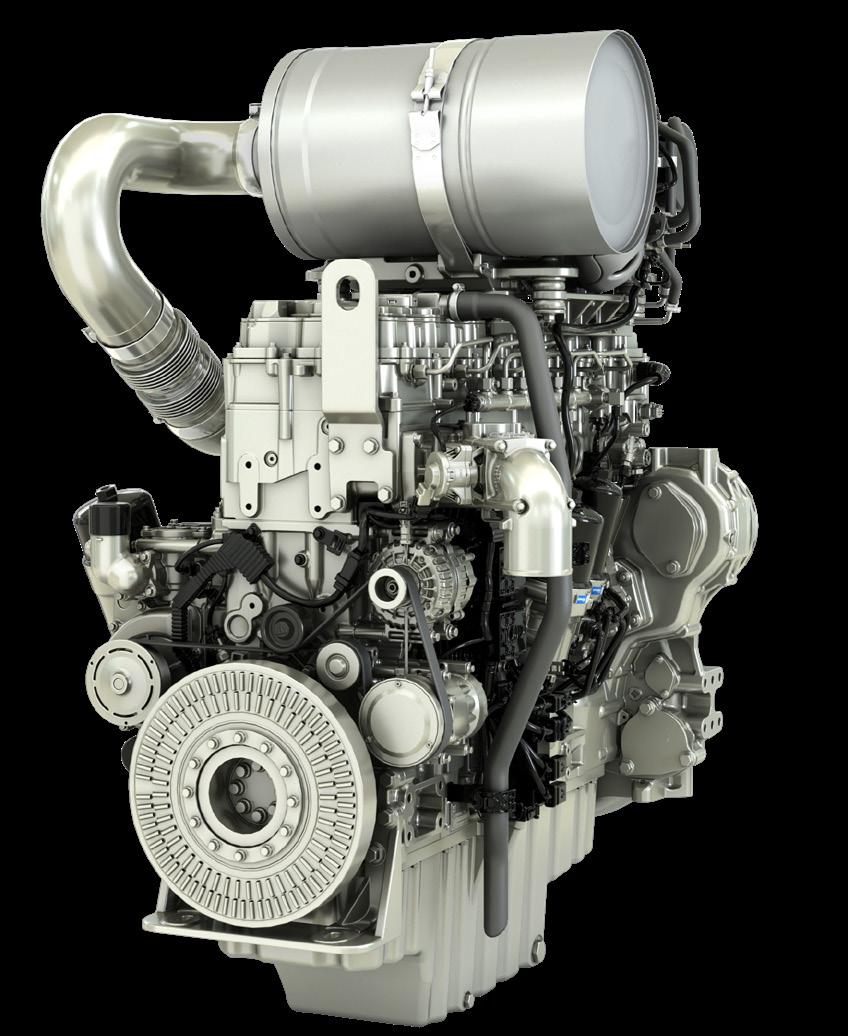

PERKINS 2600 SERIES FROM PERKINS ENGINES COMPANY LIMITED

The new 13-liter diesel engine platform is designed to achieve bestin-class power density, torque and fuel efficiency for heavy duty offhighway applications. Targeting applications in agriculture, construction and numerous other sectors, the platform offers eight power ratings from 340 to 515 kW (456 to 690 hp) offering up to 3,200 Nm of peak torque. Industrial open power units configured with engine-mounted aftertreatment and cooling packs will also be available. The engines are compatible with renewable liquid fuels such as 100% hydrotreated vegetable oils (HVO), B100 distilled Biodiesel, and up to B100 fatty acid methyl ester (FAME) standard biodiesel. Its core architecture also supports the future development of spark-ignited natural-gas and hydrogen fuel capabilities. Design enhancements include the integration of components as well as a reduction in the number of leak joints by more than 45%. The upgrades result in lower fluids consumption and extended oil and fuel filter service intervals as long as 1,000 hours, reducing operating costs and downtime. 2600 Series engines will also offer telematics solutions. By modularizing and eliminating components, its architecture is spaceprotected to accommodate configuration adjustments anticipated for future tiers of emission standards in the U.S. and EU without relocating customer connection points. The combination of the all-new rear gear train, stiffer core architecture and common rail fuel system reduces noise by up to 3 dB when compared with Perkins current 13-, 15- and single-turbo 18-liter engines. To date, engineers have completed more than 30,000 hours of design validation on the 13-liter engine platform. It will be available for early OEM pilots in 2025, with commercial production scheduled to begin in 2026.

CORE50 OFF-ROAD COMBUSTION ENGINE FROM AGCO POWER OY

The 4-cylinder CORE50 engine size saves space for installation and offers better fuel economy, even in low engine loads. Features: 165 kW maximum power at 1900 rpm; 950 Nm maximum torque at 1400-1600 rpm; Fuel consumption: 190 g/kWh- EGR-free design; 4-cylinder design, 5-liter displacement; Emission level: EU Stage V/U.S. Tier 4 Final. Excellent fuel economy (190 g/kWh) thanks to the low-speed concept and extensive and comprehensive base engine simulation (CFD, FEA, MBD) together with precise combustion and EAT system optimization in the development phase. The low-speed concept results in lower engine drag losses, lower piston speeds and less ignitions. Runs optimally with both HVO and diesel without any adjustment to the engine. Service points are on the cold side of the engine and the engine uses simple, robust parts, such as a single turbo with an e-wastegate, EGR-free design and hydraulic lash adjustment system. CORE50 engine has all major off-road application emission certificates for the Western world. It has been designed for future emission legislation (CARB Tier 5).

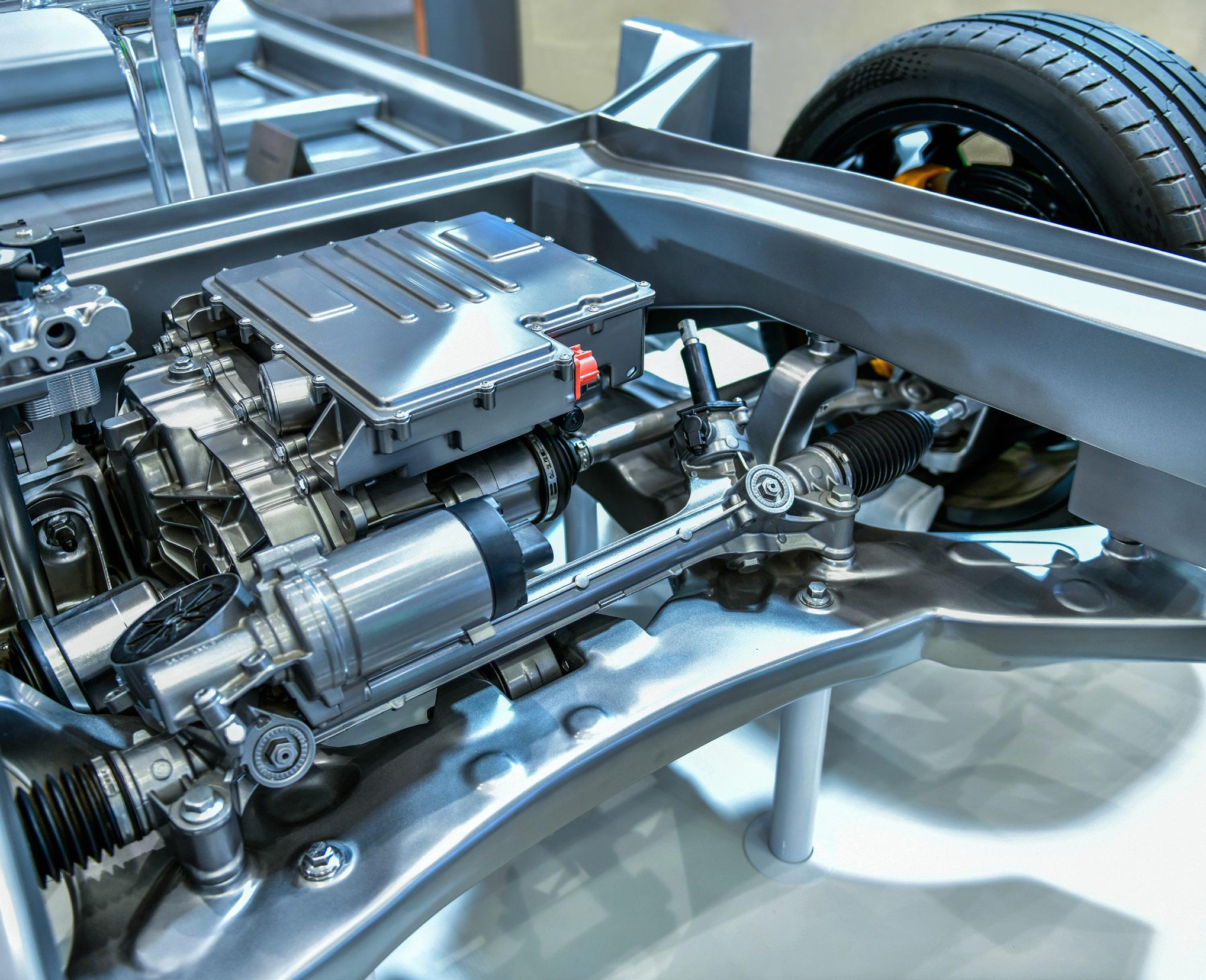

CNX TRIFUSION SERIES FROM CANIMEX

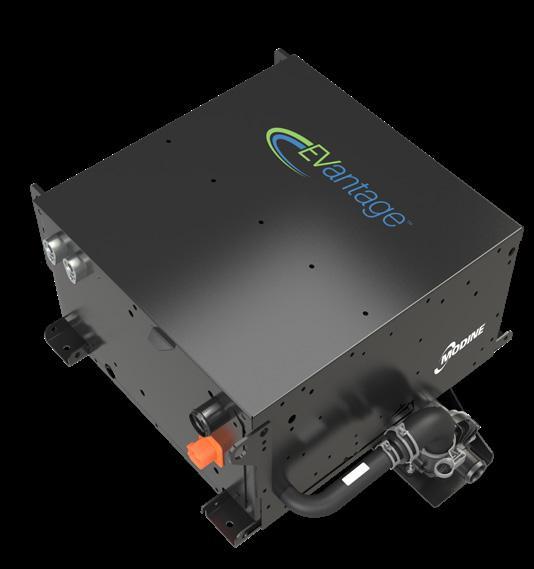

The CNX TriFusion Series of electric powertrains consolidates three essential components — gearbox, electric motor and controller — into a single package. The CNX TriFusion Series utilizes advanced vector control and high voltage technology to provide exceptional power while facilitating equipment integration, making it adaptable to a wide range of applications. Whether for off-highway use, industrial, agriculture or construction applications, this series aims to revolutionize the electrification market by enabling equipment manufacturers to simplify their product development and reduce time to market, thanks to its ultra-compact, reliable and affordable design. One of the standout features of the CNX TriFusion is its advanced thermal management system. This innovation significantly extends the motor’s lifespan and enhances performance under high-load conditions. Unlike standard electric motors, the TriFusion’s thermal efficiency ensures optimal operation even in demanding environments, reducing downtime and maintenance costs.

ZF ETRAC ECD60 ELECTRIC CENTRAL DRIVE

FROM ZF FRIEDRICHSHAFEN AG

ZF Friedrichshafen has developed a new type of electric motor that does not require rare earths because it does not use permanent magnets and therefore also the important magnet raw material. This saves considerable costs and reduces ecological consequences caused by the CO2-intensive mining of rare earths. Based on the modular axle system for vehicles with an operating weight of up to 10 tons, the ZF concept comprises a two-stage spur gear unit, electric motors in four power stages and power electronics adapted to these. The Electronical Driveline Control Unit (eDCU) networks all components to form an intelligent and interacting drive system. The travel and work commands are synchronized and optimized in real time with the power requirements of all components and the state of charge of the battery. The ZF eTRAC eCD60 places the e-motor in the same installation space. To fulfill the installation space requirements in bigger machines, also a remote mounted solution with the drive unit installed between the axles is now realized. As the whole drive family of e-motors uses the same interface, the remote mounted solution is also ready to produce for the eCD20 and 30 applications. The compact dimensions result in easier integration in the vehicle. At the same time, this arrangement reduces the length of the power cables and thus the line losses. The electric motor is directly attached to a two-stage transmission. Power is distributed to the drive axles in the proven manner via the permanent all-wheel drive system. With the start of series production of the eCD60, ZF offers a powerful all-electric solution for compact work machines. With the other performance levels from the modular system presented, the entire vehicle segment can be served. Four motor sizes are currently defined, creating synergies through common parts.

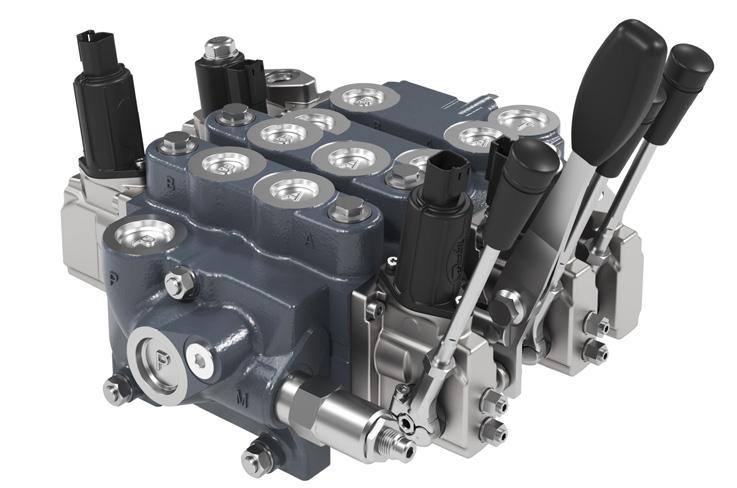

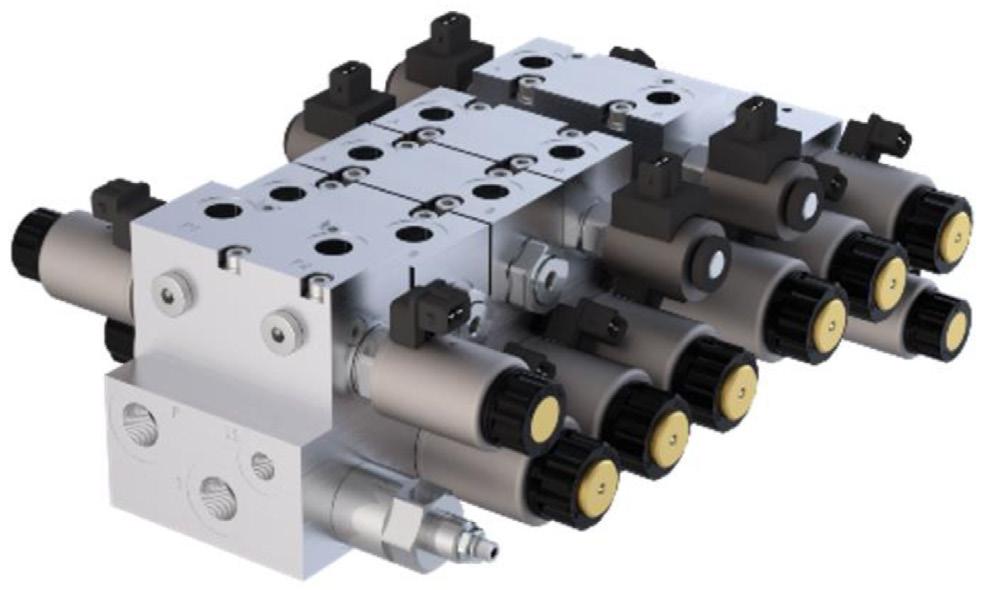

CMV(A) - COMPACT MOBILE VALVE (ALUMINUM) FROM WANDFLUH AG

The Compact Mobile Valve (Aluminum) or CMV(A) flexible, modular system solutions for mobile applications. The differentiation by design of these building-block solutions makes a decisive contribution to a cleaner machine layout, easier machine integration, higher level functionality and significant weight reduction for mobile machines. The entire CMV(A) program is available as sectional modules or as customer-specific monoblocks. The focus of the CMV(A) program is on weight optimization, energy efficiency, space-saving footprint, reduced installation cost/effort, long life with high reliability, and functional adaptability, while showcasing the high power density of hydraulics through precise operator control. The initial CMV(A) launch solutions target the common place needs in the four key market sectors of municipal machines, conveyor technology, agricultural and forestry machinery, and construction machinery. Mobile work machines, whether selfpropelled, or towed, must offer operational dependability, consistency for the operator, and precision performance in harsh conditions, and despite increasing electrification, the hydraulics system remain essential for these machines. The CMV(A) puts a spotlight on specific application needs and electro-hydraulic functions, eliminating the need for compromises. Key advantages of the CMV(A) include: Significant weight reduction of the hydraulic equipment thanks to the lightweight design; Increased flexibility offering multiple options, enabling the fastest possible adaptation to changing customer requirements thanks to the modular system design, consisting of monoblocks and sectional blocks; Improved energy efficiency through optimum design and "tuning" of the valve technology; Shortening of the time-to-market period through product availability and rapid support.

With the launch of the Directional Valve Group (DVG) Open Center Valves, Danfoss brings to the market a reliable, non-compensated valve solution with a best-in-class market pressure drop. True to its origin, DVG represents the valuable and well-known Danfoss quality. With DVG adding to our extensive valve’s portfolio, it is designed to meet the needs of various applications and projects and guarantee flawless operations under all conditions. With Danfoss DVG, your operational efficiency is enhanced without any compromise on features or cost along with remarkably short lead times. Flexibility of design The Danfoss directional control valves are designed to give customers flexibility over a broad range of flow and pressure capabilities. The DVG valve design is based on a modular concept that enables machine designers to specify a valve solution suitable for multiple market segments across multiple applications. Actuator options include a range of levers, cable actuators, hydraulic and pneumatic pilot controls, and electrohydraulic proportional solenoids. Danfoss DVG valves offer several class-leading performance attributes, including return flow rate, pressure drop, and active spool stroke resolution. DVG valves are designed with meter-out flow 75% higher than meter-in flow at 15 bar pressure drop. This enables fast cylinder retraction to meet desired cycle times, eliminating the need for complex or oversized systems. Pressure drop from the valve inlet to the work port is 33% lower in a DVG 60 valve and 7% lower in a DVG 100 valve compared to the next best alternative. This pressure drop reduces power losses and heat generation, enabling customers to reduce fuel consumption and cooling needs while optimizing the energy efficiency of the machine. With 4.2 millimeters of active spool stroke resolution on proportional electrohydraulic controls, DVG 60 and DVG 100 valves provide better application controllability than other open-center valves on the market.

The Danfoss Editron ED3 is a bidirectional onboard charger and electric power supply that offers high charging power and distributes energy to a vehicle’s auxiliary functions. Designed for on-highway commercial trucks as well as off-highway machinery, the ED3 enables rapid overnight and opportunity charging for vehicles using readily available utility outlets. The charger can deliver up to 43 kilowatts to the main high-voltage battery and up to 44 kW of AC or DC power as needed to other subsystems. The ED3 can deliver nearly double the charging power of the market standard 22 kW onboard charger. The ED3 enables charging to full capacity overnight (8 to 9 hours) using AC chargers. The ED3’s high-power AC and DC electric power take-off simplifies integration for OEMs. The product pulls power directly from the main high-voltage battery to support up to 44 kW of DC power to auxiliaries, such as high-voltage compressors, pumps, and motor controllers. ED3 can also convert power and deliver up to 43.6 kVA of single or three-phase AC current, which makes the device particularly well suited for refrigerated trucks. The ED3 gives OEMs flexibility in designing the vehicle’s system architecture and enables standardization of components across platforms. With an electrified PTO, the auxiliary functions are no longer connected mechanically to the driveshaft as they are in a traditional PTO. By decoupling from the main driveline, the vehicle chassis has more available space for batteries and other components. As a three-in-one unit (AC charger; DC ePTO; and AC ePTO, which can be used to create an AC microgrid), the ED3 reduces the number of high-voltage components and cables needed, which has direct benefits when it comes to cost, weight and space. There are also advantages in terms of vehicle integration, as the OEM only needs to mount a single component to the chassis. At 43 kW, the ED3 onboard charger provides nearly double the charging power of the market standard, decreasing charging time and enabling overnight charging of heavy-duty vehicles using AC chargers.

HMU-3640LB INDUSTRIAL GATEWAY FROM CALAMP

The HMU-3640LB is a hardened, next-generation Industrial IoT gateway for OEMs in construction, agriculture, mining and related industries. The technology exchanges critical data with remote equipment operating in harsh environments. By capturing GNSS, accelerometer, bus, controller and peripheral data, and enabling over-the-air equipment firmware updates and device management, the HMU-3630LB solves challenges for OEMs. Features include: Global connectivity: LTE CAT-1 with 3G/2G fallback; Extremely rugged design: IP66 and 67 ratings, US MIL-STD 202G & 810F, SAE J1455, IEC 61000-4-2; Wide operating temperature range: -30 degrees Celsius to +75 degrees Celsius (connected to primary power); Comprehensive I/O: upgraded Bluetooth 5.x and extensive wired connectivity options (via 12-pin connector) to capture more data; Built-in 3-axis accelerometer; J1939 and Modbus interface support; Software development kit (SDK) to streamline application development; Flexible application options: Integrate telematics data into your internal systems and mobile app. Inform design and testing decisions. Avoid guesswork by analyzing real world utilization, location, maintenance, diagnostics and warranty-related details. Amplify data by integrating third-party sensors with Bluetooth 5.x and wired connectivity options. Bolster maintenance: Employ preventive maintenance, remote troubleshooting and over-the-air firmware updates to avoid downtime and minimize cost. Prevent theft: Rely on precision location tracking with GNSS capability, reverse geocoding and geofence support with alerts. Derate stolen equipment, rendering it useless for thieves. Impact revenue and cash flow: Trigger timely customer offers based on specific usage and maintenance events. Map functionality to tiered pricing. Derate systems to compel payment for equipment used by delinquent accounts. Boost asset utilization: Enable customers to track hours of operation, distance traveled, idle time and more to avoid underutilization and unnecessary equipment rentals. Improve efficiency: Give customers precision location tracking with GNSS capability, reverse geocoding and geofence support with alerts for proof of equipment delivery, increased productivity and proof of service. Document performance indicators to identify training and coaching needs.

SAFETY TOUCH

FROM RAFI GMBH & CO. KG

SAFETY TOUCH is a technology platform designed for safetycritical touchscreen functions, achieving compliance with Performance Level d (PL d). This platform offers a robust solution for mobile agricultural, construction and forestry machinery, enhancing safety and operational efficiency. Features capacitive touchscreen systems that allow for customizable display of functions, input fields and status indications, providing versatile and intuitive operation. By minimizing the need for traditional key switches, it leads to more streamlined and user-friendly control systems. Integrated safety features include touch buttons, sliders and tactile key switches directly on the touch display. Key features and benefits include: Redundant safety CPU, an additional safety controller with independent logic ensures continuous monitoring and high diagnostic coverage, enhancing overall system reliability. Patent-pending display monitoring offering real-time views of the graphical user interface ensures error-free display and recognition of safety-critical functions, crucial for operations like activating attachments or unhitching loads. Unintentional input filtering offering advanced filter functions reject accidental touches and unwanted effects from fluids or contaminants, maintaining accurate input detection. Objectives and unique aspects include: Compliance with PL d: Meets stringent safety standards, suitable for safety-critical applications. Enhanced user interface: Combines display and input systems for efficient and error-free machine control, reducing the need for physical switches. Customizable and scalable solutions: Tailored for diverse applications using RAFI’s touchscreen technology. Integrated force detection: Optional TwinTouch technology prevents accidental operations by detecting input force.

SERIES 09 IN-CABIN ROTARY CURSOR CONTROLLER FROM EAO CORPORATION

The Series 09 Rotary Cursor Controller (RCC) and Rotary Pushbutton Modules (RPB) are designed for advanced use in special vehicles, trucks, and buses. These cutting-edge modules integrate the functionalities of a rotary control, pushbutton, and, in the case of the RCC, a digital joystick, making them indispensable for control and selection within vehicle displays or navigating user menus. One of the most noteworthy aspects of the Series 09 Rotary Cursor Controller and Rotary Pushbutton Modules is their advanced customization and safety features. The programmable RGB HALO ring and symbol illumination allow users to tailor the controls to their specific needs, making it easier to identify functions at a glance. This level of personalization is a standout feature in the market, providing a unique user experience that enhances both aesthetics and functionality. Additionally, the joystick function’s integrated protection against unintentional contact and actuation is a game-changer for safety. In environments where strong movements are common, such as off-road vehicles or buses navigating through uneven terrain, this feature ensures that the controls remain reliable and prevent accidental commands. This high level of safety, combined with intuitive operation, makes the Series 09 modules a preferred choice for vehicle manufacturers and operators looking to improve both usability and reliability.

CL-715/716 FROM HED, INC.

Designed for rugged mobile applications, HED’s newest lineup of digital displays offer highperformance processing, widescreen functionality ranging from 12.3- to 15-inches, and multiple options to enable connectivity. The CL-715 (12.3 inches) and CL-716 (15 inches) provide consistent speed for programming and digital video streaming. Standard features include NVMe drive, NPU and horsepower from the newest quad core iMX 8 processor. Multivideo display capability with 1920x720 resolution enables full 720P camera support, enhances safe vehicle operation and provides a superior operator interface with an optional PCAP touchscreen for navigation and control. Split screen views allow operators to monitor multiple camera views and vehicle information together. The versatility of these displays enables OEMs to consolidate multiple applications into a single processing unit. This allows designers to reduce the number of displays needed in vehicles, resulting in a lower total vehicle cost and an improved user experience. Enable high bandwidth connectivity with automotive Ethernet, create full 360 camera views with interface to multiple Ethernet cameras, optional connectivity options enable features such as data logging, operator connectivity and digital video streaming. These displays are highly configurable with inputs and outputs, multiple CAN bus ports, PCAP touchscreens, USB, video inputs, Ethernet, wireless communication, portrait orientation and audio input/output for hands-free commands. Programming options such as Crank, Qt, and more through Yocto containers. A top differentiator is the NPU (up to 2.3 TOPS), enabling AI and machine learning algorithms with its ability to process and perform trillions of operations per second.

ULTRASONIC SENSOR UF401V FOR MOBILE MACHINES FROM BAUMER

The sensor design is engineered for maximum reliability under wet, dusty, chemical and extreme temperature conditions, and has been tested to the highest standards of the off-highway industry. The proven impermeability exceeding IP68/IP69K is unique for ultrasonic sensors. Ideal for harsh outdoor use in agricultural machinery, construction machinery, working platforms and other mobile machines. The “automotive grade” design spares OEMs the need of their own complex service life tests and minimizes the time to market. To ensure this, UF401V is compliant to several industry standards such as ISO14982, EN13309, ISO13766, ISO15003, EN60947-5-2/-5-7. For measuring track width, floor clearance and level detection. The UF401V plays to its strengths particularly in agricultural applications. Thanks to short response times, the sensor is ideal for agile applications, such as presence monitoring of bales, bale film and distance measurements. UF401V can also be deployed at all hydraulically actuated machine parts that require position feedback. Thanks to its flat back, the compact short-range ultrasonic sensor is easy to integrate. Smart distance measurement ignores plant parts. A major benefit of the UF401V is the specialized feature for interference compensation: the smart ultrasonic sensor is capable of suppressing temporary interference in distance measurement to ensure consistent measurement data, even in the event of short interruptions by plants coming in between sensor and measurement surface. This will ease integration at the control level. The new ultrasonic sensor was proven in tests, including the particularly demanding endurance test of “thermal shock dunk.” The UF401V is further immune to shocks and vibrations, dust and dirt, moisture, condensation and salt spray. The non-contact ultrasonic sensing principle eliminates any wear and tear and ensures reliable operation at temperatures ranging from -25 degrees Celsius to 70 degrees Celsius.

by Kathy Wells

As original equipment manufacturers (OEMs) continue to explore power alternatives amid the energy transition, one emerging solution is the use of hydrogen in internal combustion engines (H2-ICE) and its applications within the on- and off-highway markets.

“Combustion engine power remains the preferred choice for many leading OEMs, and this will likely continue to be the case for years to come as wider

technologies and accompanying infrastructure grow,” said Jeremy Harsin, global director, Cummins OffHighway Engine Business. “However, combustion technology is continuously evolving to meet new emissions regulations and achieve lower emissions, including the ability to use hydrogen as a fuel,” Harsin said.

According to Alan Schaffer, executive director of the Engine Technology Forum, the concept of hydrogen-fueled internal combustion engines are a key part of the energy future. “As we look at the energy future,” Schaffer said, “we see one of a great mix of fuels and technologies certainly more diversified than today, using electricity, hydrogen, biofuels and advanced internal combustion engines — those powered by gasoline, diesel, natural gas and propane. Those are tightly woven into the fabric of our global economy in many ways, in many different sectors, and today, we find ourselves in the midst of an energy transition.”

Schaffer and the

Engine Technology Forum recently hosted “Exploring the Future for H2ICE as a Decarbonization Strategy,” a webinar addressing the challenges that hydrogen technologies will need to overcome in the future. “On the one hand, we have an energy system that relies heavily on fossil fuels,” said Schaffer. “On the other hand, we are working toward a system of reduced carbon emissions and energy systems reliant wholly on renewable energy. Internal combustion engines uniquely have one foot in both of those worlds, and that is one of the incredible advantages I think we have going forward.”

On the engineering front, many see a blended future for off-highway mobile equipment power. According to Preston Oihus, product engineer, special technology, at Bosch Rexroth, “Mobile equipment in the future will have multiple fuel options and/or hybridized motion systems. Gasoline, hydrogen and other combustibles will continue to power primary power sources, but secondary sources will be powered by solar, wind, electrification, etc.,” said Oihus.

As Dr. Ameya Joshi of MobilityNotes and vice president

of product at ClearFlame Engine Technologies has observed, “Almost all major manufacturers have some level of effort going on in hydrogen internal combustion engines at various stages of development,” noting several engines in development at this time are being designed for both on- and off-highway applications with a range of engine displacements.

One such example is from Cummins, introducing its next generation of versatile internal combustion engines that can run on low- and zero-carbon fuels like clean diesel, biofuels and hydrogen. According to the company, these engines are more efficient than previous generations, with reduced environmental impact. “The need to reduce greenhouse gas emissions (GHGs) from off-road machinery is driving interest among OEMs and end users in both hydrogen fueled engines

and hydrogen fuel cells,” said Cummins’ Harsin. “Hydrogen fuel is a promising non-fossil fuel and provides a viable solution for reducing emissions. Used in either solution, it offers zero carbon capability when using green hydrogen produced using renewable energy.”

“The first thing that drives this industry is regulations and policies,” Joshi said. “Whether it’s reducing GHGs or reducing criteria pollutants, that is one of the key drivers for hydrogen use. The engine technology has advanced quite a bit, but there’s also a lot of work still being done on improving the efficiency of the hydrogen. Ice injection, fuel injection strategies are a critical part of this.”

In late 2023, Caterpillar announced the launch of a three-year program to demonstrate an advanced hydrogenhybrid power solution built on its new Cat C13D engine platform.

The program aims to have Caterpillar develop a transient-capable system for off-highway applications and demonstrate how state-of-the-art control systems and electric-hybrid components can help hydrogen-fueled engines meet or exceed the power density and transient performance of traditional diesel engines. With research planned to commence in 2024, the project is supported and partially funded by the U.S. Department of Energy’s (DOE) Vehicle Technologies Office (VTO) through the Office of Energy Efficiency and Renewable Energy (EERE). It is included among 45 projects across 18 states and Washington, D.C., receiving funding to advance research, development, demonstration and deployment in several areas critical to reducing GHG emissions in the transportation sector.

“Every off-highway application has its own unique duty cycles, life-cycle demands and performance expectations, and this complexity is driving the development of a wide range of power solutions for the energy transition,” said Steve Ferguson, senior vice president Caterpillar Industrial Power Systems. “One size does not fit all, which is why we’ve engineered flexibility into the C13D engine to serve as our platform of the future.”

Also represented in the Engine Technology Forum’s discussion was Ivan Tate, head of product engineering and Technical Center at FPT Industrial, who highlighted FPT’s commitment to maintaining diesel engine production while exploring alternative fuels like natural gas and hydrogen. “We’re committed to [maintaining diesel engine production], both from a vertically integrated point of view and from a market point of view,” he said. “We also keep a strong focus on alternative fuels that started 35 years ago with natural gas. We sell a full range of natural gas engines on-highway in Europe. This gives a second string to our engine development. It’s also very forward thinking from an off-highway point of view. H2-ICE is a natural step forward from the natural gas engine in particular, but certainly a very efficient way to have zero emissions at the tailpipe with any hydrogen and overall net-zero depending on the source.”

As is the case with other manufacturers in the same position, Tate said the company has also had to diversify increased investment in alternative parts of the vehicle that will support expansion. “We’re looking heavily into axles control systems, making batteries and researching the benefits and capabilities of fuel cells for our market”, said Tate. “In some regions, we are also looking at the practical applications of H2 across a number of highway applications. We’re running these engines. We want to get feedback servicing, life cycle, even operator experience. The only way we can do that is starting very early, building that convenience into that product.”

Cummins’ next-gen fuel agnostic B6.7 engine is designed to have hydrogen-fueled power capabilities. Part of Cummins’ HELM range, it maintains the familiarity of diesel technology without changing the structure of the engine block. Designed to use the same transmission, cooling and hydraulic systems as today’s modern diesel engines, it reduces complexity for equipment manufacturers and customers.

As the industry continues down the road toward a more sustainable future, it’s clear that OEMs are committed to finding the right fit. “For construction and aggregates, no single approach will effectively cut emissions and decarbonize the entire industry, due to varied duty cycle requirements and operational needs” said Cummins’ Harsin. “Any solution must balance productivity with reduced operating costs and reliability.” Harsin notes that as the off-highway industry evolves, so will combustion engine power to play a significant role.

As it stands, OEMs and industry partners continue to embrace fuel-flexible engines capable of operating on low and zero-carbon fuels like clean diesel, biofuels and hydrogen.

Kathy Wells is editor of OEM Off-Highway.

Inside this emerging solution for the electrification of off-highway machines & its potential for widespread applications at construction sites, quarries & farms

by Alastair Hayfield

Battery swapping is being touted as a potential solution to the problems associated with electrification of large and hard to reach off-highway machines. But does it really offer the answer to creating zerocarbon equipment such as tractors, mining machines and excavators?

These machines are some of the largest in the world, demanding huge amounts of power and generating substantial volumes of pollution. Essential to food production and major infrastructure projects, electrification of large offhighway machines offers the opportunity to dramatically reduce greenhouse gases and pollution.

— particularly for hard-to-electrify applications such as tractors — and it offers potential new business models for equipment hire companies and OEMs.

However, they are notoriously difficult to electrify because of their power demands and lack of access to the grid. They require large, expensive batteries and access to charging stations, which can often prove unaffordable even with the lower cost of electricity in comparison with diesel.

Battery swapping could provide one answer to problems around the electrification of off-highway machines

Although slower to electrify than on-highway vehicles, we are seeing emerging solutions for off-highway electrification. However, adoption rates and emissions reduction have been low, even in relatively progressive markets.

There are specific challenges in relation to hard-to-reach applications, such as agriculture, mining and construction, and very large machines. Part of this problem stems from the continuous usage of off-highway applications, which,

unlike passenger cars, may be in use for eight hours or more per day. In such cases, a very large, expensive battery is required to provide the power and performance needed, making machines prohibitively expensive. Additionally, designing machines with very large batteries is a challenge and recharging takes a long time, taking the machine out of operation at a significant financial cost and adding potential delays to projects.

Having additional batteries that can easily be swapped in and out of vehicles enables one to charge while another is in use, considerably cutting downtime. In addition, the battery itself does not

have to be so large as batteries can be swapped in and out during operation without significantly disrupting operations.

Battery swapping for electric vehicles, at least in the passenger car market, is not a new concept. Indeed, there have been numerous projects over the decades, including its use in the Electrobat electric taxicabs in New York in the 1890s. Batteries could be replaced within seconds and the taxis could be operated all day.

However, the Electrobats only flourished for a few years before poorly run operations outside New York caused the model to collapse. In the 2000s, Israeli startup Better Place failed, despite its initial promise. There is now some progress being made in China, where several thousand heavy-duty trucks support battery swapping and a number of car brands are working together to create an ecosystem.

In the off-highway sector, we are also seeing the launch of machines that support battery swapping, such as Sandvik’s battery electric underground loader, with a battery pack that can be swapped in as little as five minutes while the operator is still in the vehicle. The PC05E-1 micro-excavator, developed jointly by Komatsu and Honda is an expanded version of the PC01E-1 and is powered by a small 1 kWh Honda Mobile Power Pack, allowing the battery to be easily exchanged by hand. Its small size and weight make it highly maneuverable and suitable for small groundworks.

Developed by the Traktorarvid Arvid Örde and RISE Research Institutes of Sweden, the Drever 120 is an autonomous tractor that features a modular battery swapping system. Furthermore, a 2020 collaboration between Webasto and Dutch company Electric Construction Equipment (E.C.E), the latter a part of Doosan distributor Staad, converted Doosan excavators to operate with modular swappable Webasto battery packs. Each excavator is fitted with two swappable “powerboxes” with 140 kWh of capacity.

Also utilizing 140 kWh E.C.E/Webasto swappable battery packs is a battery swapping solution for agricultural tractors developed by AGROMEC in the Netherlands that can be fitted to the front of the machines to provide a boost to its 70 kWh on-board battery and enable longer field operation. Several of these tractors are already in operation in the Netherlands.

Each of these models provides longer field operation and, although electrification of agricultural equipment is challenging, it is possible that a standardized battery swapping solution could provide the impetus needed to convince farmers of the benefits of electrified machines and drive-up adoption rates.

Offering a slightly different sustainable solution, ZQuip, a subsidiary of Moog, has developed a machine and industry-agnostic battery swap conversion solution to be retrofitted to existing diesel machines so they can run on electricity. The ZQuip energy modules can also be used at jobsites as both a zero-emission powertrain for machinery and a modular energy storage system, discharging electricity to other machinery and equipment on construction sites.

Given that 38% of the cost of an electrified off-highway machine is in the battery, building machines with swappable batteries enables battery packs to made smaller or even eliminated completely from the machine. This substantially drives down the upfront cost and could lead to widespread adoption as operators are able to select the number of packs required for a job, rather than purchasing a machine with a very large battery when they might rarely need all the stored energy.

The problem with machine downtime while it is charging is eliminated as batteries can be swapped within minutes. Batteries can also be used for grid storage when not in machines (both overnight and during off-seasons) to provide operators with an additional revenue stream.

In addition, the obvious benefits of battery swapping for end users and the solutions it provides to the electrification of large and hard to reach off-road applications, it also supports new business models.

This opens up new opportunities and potential revenue streams for OEMs and rental and plant hire companies, which could develop a lucrative source of income from end users requiring additional capacity.

With the growing focus on sustainability and the drive to reduce greenhouse gas emissions and other pollutants, incentives for electric vehicles are increasing. Concerns about the availability of biofuels and eFuels mean that low and zero-emission off-highway machines may need to become electric in order to meet strict emissions targets and comply with legislation.