CENTRAL FLORIDA

GOLF

FRIDAY, OCTOBER 11

GOLF

FRIDAY, OCTOBER 11

P.O. Box 941125

Maitland, FL 32794

www.caicf.org

407-913-3777

Reini Marsh, CED exdir@caicf.org

Membership Manager

Tara Ruch membershipmanager@caicf.org

2024 BOARD OF DIRECTORS!

Brian Jones, President

Stefanie Nicholson, CMCA, AMS, Vice President

Tracy Durham, CMCA, AMS, CFCAM, PCAM, PresidentElect

Leslie Ellis, CPA, MSA, CGMA, Treasurer

Jessica Cox, CMCA, AMS, Secretary

Patrick Burton

Stacey Loureiro, CMCA, AMS

Jarad Pizzuti, Past-President

Jackie Swisher

Tom Wheir

Advocate for the cause! Get involved! Become a volunteer! Start today! Join our journey to sustain our mission. The growth of our organization is measured through engagement. Engagement is stated eloquently in our Chapter Mission Statement.

“Our mission is to become the foundation for the advancement and betterment of Central Florida communities by bringing together community leaders with those who serve their communities through education, community resources, and leadership.”

As a volunteer leader in Avalon Park Orlando, I am proud to be part of a community that thrives on learning and engagement. Our mission below, as quoted by CAI National, focuses on identifying and meeting the evolving needs of leadership in associations. Together, we work towards exceeding expectations and contributing to community initiatives.

“We believe homeowner and condominium associations should strive to exceed the expectations of their residents. We work toward this goal by identifying and meeting the evolving needs of the professionals and volunteers who serve associations, by being a trusted forum for the collaborative exchange of knowledge and information, and by helping our members learn, achieve and excel. Our mission is to inspire professionalism, effective leadership and responsible citizenship— ideals reflected in associations that are preferred places to call home.”

As Board President, my goal is to exceed your expectations and inspire you to do the same, following in the footsteps of past leaders. Continuous improvement is paramount, and with your support, volunteering, and engagement, we will deliver results. Register and save the dates for our upcoming annual events: the Golf Tournament on October 11 and the Annual Meeting & 007 Gala on December 5. The Golf Tournament is a key fundraising opportunity, while the Gala celebrates our 2024 accomplishments. Join us at both events and let’s continue our success together.

Thank you for backing our Central Florida Chapter. Share your CAI experience with others and invite them to our next luncheon. Your feedback is crucial, so let’s connect soon to shape our future.

Wishing you good health, prosperity, and success!

Sincerely,

Brian Brian Jones Vice President, Hotwire Communications 2024 President, Central Florida Chapter CAI

If you are interested in getting more involved in the chapter, joining a committee is a great thing to consider. Below are the different committees that we currently have active. Please feel free to contact any of the following committee chairs:

CA Day/Trade Show Committee

Christy Raymon

Don Asher & Associates christy@donasher.com

Communications Committee

Benjamin Isip

Towers Property Management, Inc. ben@towerspropertymgmt.com

Education Committee

Suzan Kearns

Premier Association Management suzan.kearns@premiermgmtcfl.com

Meet the Managers Committee

Angela Timmons Greystone Management angela@greystone-mgmt.com

Annual Meeting/Gala Committee

Jackie Swisher EmpireWorks Reconstruction jswisher@empireworks.com

Golf Tournament Committee

Seamus Devlin

RL James sdevlin@rljames.com

Legislative Committee

Tom Slaten Larsen and Associates tslaten@larsenandassociates.com

Shayla Mount Arias Bosinger sjmount@ablawfl.com

Membership & Registration Committee

Mary Ann Sheriff One Florida Bank msheriff@onelforidabank.com

Social Committee

David Cofressi Behr Paint dcofressie@behr.com

Cares Committee

John M. Calpey One Florida Bank jcalpey@onefloridabank.com

Finance Committee

Leslie Ellis Glickstein Laval Carris LEllis@glccpa.com

BY REINI MARSH, CHAPTER EXECUTIVE DIRECTOR

Hello CAICF Members! It is officially fall and we will be heading into the holidays before you know it. And, how about those Seahawks?

Our chapter continues to grow and our events are growing along with it. There are new things on the horizon starting with the rollout of the new website for CAI National - www.caionline.org. Remember that your sign-in credentials are different for the National website than they are for our local site. Additionally, the new website for the Florida Legislative Action Committee is also up at www.caionline. org/advocacy/florida-legislative-resources as well as the DBPR’s new website (in English and Spanish) to help condo owners at condos. myfloridalicense.com

Our Cares Committee has scheduled a Volunteer Day on October 25 at The Mustard Seed to help straighten their dish room and linen room from 1:30 until 3:30 pm. We have volunteer T-shirts to

give everyone. The Mustard Seed is so thankful for our help, not only with the Volunteer Day but also our year-long undergarment collection. They will come out to our Golf Tournament on October 11 for pictures and the big check presentation of $5,000, which will help 10 families. We hope to see you there for the presentation.

Don’t forget to register for our Annual Meeting & 007 Gala on December 5. Visit our chapter website to register. We also want to remind everyone to mark your calendars for May 7-10 when the 2025 CAI Annual Conference & Exposition: Community NOW will once again come to Orlando. There are will be a lot of opportunities to be a part of it. To learn more, visit www.caionline.org/events/ annual-conference

We would like to congratulate Tony Burtrum from Napoleon Tree Service and Maddy Osman from Vice Painting on their recent engagements! Congratulations! We wish you the best.

More details regarding upcoming events will be posted to caicf.org under the “Events” tab. Check back regularly for the most up-to-date information. CAICF Board Meetings will be held before or after each of the Monthly Meetings. Please be sure to register for all events in advance, as we need an accurate head count for space and food purposes prior to the event. Thank you for your help!

• October 3: Monthly Meeting Luncheon at Azalea Lodge at Mead Botanical Garden for the CEU presentation, “Legal Fundamentals – Board Meetings: Scheduling, Noticing, and Conducting Organized, Drama Free Board Meetings” by Patrick Burton of DiMasi Burton. Registration begins at 11:30 am and the program begins at 12:00 pm. Manager Members & Homeowner Leaders (HOA Board Members) are FREE and Business Partners cost $37. Sponsorships available for $300. Please click here to register.

• October 11: 14th Annual Golf Tournament at Rio Pinar Golf Club in Orlando. Join us for an exciting golfing experience! Registration is at 7:00 am and Shotgun Start at 8:30 am. A portion of the proceeds will benefit the local charity, The Mustard Seed of Central Florida. You could win a CAR in the Hole In One Contest, $5,000 in the Putting Contest, and loads of raffle prizes! There will be Track Man, Golf Ball Cannon and more fun! Become a sponsor of this awesome event (all the details are on the chapter website) or register to play! A few foursomes are still available for $600. Please click here for more information and to register.

• October 25: Volunteer Opportunity at The Mustard Seed of Central Florida from 1:30 - 3:30 pm. Please wear closed-toe shoes. Kindly RSVP so we can gather a head count (click here) and fill out the Volunteer Application. Please click here to download the PDF of the Volunteer Application.

• November 7: Monthly Meeting Luncheon at Azalea Lodge at Mead Botanical Garden for “Legal Update” by Shayla Mount

Johnson with Arias Bosinger. Registration begins at 11:30 am and the program begins at 12:00 pm. Manager Members & Homeowner Leaders (HOA Board Members) are FREE and Business Partners cost $37. Sponsorships available for $300. Please click here to register.

• December 5: Annual Meeting & 007 Gala at the Winter Park Events Center for an evening of casino games, music and dancing from 6:00 - 9:00 pm. Dress in cocktail attire. The cost is $55 for Business Partners and $35 for CAMs and HOA Board Members (Homeowner Leaders). Tickets include dinner and a drink ticket. There are sponsorship opportunities available. We will also have the Giving Tree again this year! Buy a ticket for a grab and pull gift card for $20. Each prize is valued at $25-$100. We need your help for this mini-fundraiser! We’re asking for gift card donations valued between $25-$100. If you would like to donate a gift card, please contact Reini Marsh at exdir@caicf. org or mail it to CAI Central Florida, P.O. Box 941125, Maitland, FL 32794. Click here for more information and to register.

SPONSOR AN UPCOMING CHAPTER

Each sponsor for the Chapter Meetings receive face time in front of the membership with the microphone to talk about your company. You will also be able to put give-away items and collateral on all the tables. Space is also provided for our sponsors to display their marketing materials. Every sponsor is important to our chapter and your generous donation goes directly to off set the costs of the program. Only three sponsors are permitted per program. Please consider sponsoring today!

CONTACT REINI MARSH AT EXDIR@CAICF.ORG OR 407-913-7777

CAI Central Florida has a list of great service providers in most every industry a Community Association could need! The best part is, they are members! Check it out at: caicf.org/directory.

This series is hosted in partnership by Orange County Neighborhood Services Division and the City of Orlando Office of Communications & Neighborhood Relations. The workshops are free to all and offered monthly. Please note, there are no workshops in December.

2024 Orange County Community Conference

Saturday, October 12 from 7:30 am - 2:00 pm

Orange County Multicultural Center: 7149 W. Colonial Drive

The annual Orange County Community Conference provides Orange County residents an opportunity to learn about innovative ways to improve neighborhoods. Workshops offer a well-rounded blend of topics for individual citizens, voluntary neighborhood organizations, homeowners associations and other community groups. Click here for more information.

Neighborhood Crime Prevention

Saturday, November 9 from 9:00 am - 11:00 am

Internal Operations Center 1: 450 E. South Street, Orlando

Want to make your neighborhood a safer place to live, work, and play? This workshop will focus on the top crime and safety issues that adversely affect neighborhoods. It will also help you identify the best resources available that can help your organization reduce crime and promote safer neighborhoods. Click here to register on Eventbrite.

Wednesday, November 6 | 2:00 - 3:15 pm Live Virtual connections. Informed communities.

New Guidance, Support and Resources for Homeowners, Managers, and Business Partners. Get to the heart of the matter about current news, issues, and trends we have in common. CAI’s Community Conversations happen quarterly in collaboration with CAI chapters. Each conversation is led by community association leaders and

industry experts. Join us and find solutions to create a powerful and positive impact on the community associations we serve. Registration: FREE to all CAI members (advanced registration required); Non-members: $25 each. Click here to register

CAI offers many online learning opportunities (click on the dates below to register or obtain more information on these Live Virtual Courses) that lead to professional credentials. View the 2024 Education Catalog for additional resources.

» October 9-10: M-205 - Risk Management (Live Virtual Class)

» October 16-17: M-310 - Management Company Administration (Live Onsite Course before the CEO-MC Retreat in Tucson, AZ)

» October 24-25: M-206 - Financial Management (Live Virtual Class)

» November 7-8: M-100 - The Essentials of Community Association Management (Live Virtual Class)

» November 14-15: M-330 - Advanced Insurance and Risk Management (Live Virtual Class)

» November 21-22: M-202 - Association Communications (Live Virtual Class)

» December 5-6: M-203 - Community Leadership (Live Virtual Class)

» December 12-13: M-100 - The Essentials of Community Association Management (Live Virtual Class)

» January 16-17: M-100 - The Essentials of Community Association Management (Live Virtual Class)

» January 23-24: M-201 - Facilities Management (Live Virtual Class)

» February 6-7: M-360 - Leadership Practices in Building Community (Live Virtual Class)

» February 13-14: M-202 - Association Communications (Live Virtual Class)

BUSINESS PARTNER MEMBERS

Block & Scarpa

Marlene Kirtland-Kirian, Esq.

CJ2 Roofing

Joe Tamburino

DMI Paving & Sealcoating

Bailey Bailey Morgan

HOA Mailers

Josh Minton

Orange County Construction 911

Debbie Morlock

TechFense Solutions LLC

Lavinash Basdeo

TEKWave Solutions

John Hayde

Triple C Security Consulting

Chad Chaney

NATIONAL BUSINESS PARTNER MEMBER

eUnify, Inc.

Sarah Sukta

MANAGER MEMBERS

James Roy Biggs, III

Artemis Lifestyle Services, Inc.

MANAGER MEMBERS CONT.

Robert Rice, II

Artemis Lifestyles Services, Inc.

Mr. Jordan Jimerson Community Management Professionals, Inc.

Jacquelin Rothwell Community Management Professionals, Inc.

Austin Mitchell Edison Association Management

Melissa Bello Leland Management, Inc.

Krystal Soto RealManage

Michael E. Barber, CMCA

Deanna Lynn Campos, CMCA

Daniel Mandracken

Gina Kaye Mckinney

Joseph Louis Miller

VOLUNTEER LEADERS

Thomas Masella Vista Gardens

VOLUNTEER LEADERS

Dean Vigliano Vista Gardens

Dan Barnes Great Outdoors Premier RV Community Services, Inc.

Robert Fraser Great Outdoors Premier RV Community Services, Inc.

Terry Manchick Great Outdoors Premier RV Community Services, Inc.

Ron Wagner Great Outdoors Premier RV Community Services, Inc.

Join THE CHAPTER!

Homeowners, Managers, and Business Partners can become members. If you provide products or services to community associations, CAI can give you direct access to thousands of potential customers and provide unique opportunities through networking luncheons, socials, and other great events. Visit caicf.org/resources/ membership to learn more!

MEET

MANAGERS - JULY 11, 2024

BY THOMAS M. SKIBA, CAE, CHIEF EXECUTIVE OFFICER, COMMUNITY ASSOCIATION INSTITUTE

CAI has filed a lawsuit against the U.S. Department of the Treasury, Secretary Janet Yellen, and the director of the Financial Crimes Enforcement Network. This action is being taken to protect our members from the burdensome and unnecessary requirements of the Corporate Transparency Act.

The act imposes new reporting requirements on many entities, including community associations. Under the law, volunteer board members of condominiums, homeowners associations, and housing cooperatives will be required to provide sensitive personal information to the federal government. These requirements were designed to combat illegal activities including terrorism financing and money laundering. The Treasury Department has taken a very broad approach to implementing this law, impacting organizations like community associations that are extremely unlikely to be engaged in such activities. We believe the application of the Corporate Transparency Act to community associations is an overreach and potentially unconstitutional.

CAI has worked with the Treasury Department for over a year to pursue a regulatory exemption for community associations but has been unsuccessful. Since the law’s implementation date for existing associations is rapidly approaching on Jan. 1, we determined that a lawsuit was necessary to protect community association rights and ensure they are exempt from the act.

Along with the full complaint (lawsuit), CAI is filing a motion for preliminary injunction. A preliminary injunction is temporary relief that maintains the status quo until the court decides the merits of the case.

In the lawsuit, we seek to:

» Obtain a declaration that the Corporate Transparency Act does not apply to community associations, including condominiums, homeowners associations, and housing cooperatives.

» Challenge FinCEN’s decision not to exempt our members from the act.

» Request judicial review of the denial of exemptions, which we believe is both unlawful and unconstitutional.

CAI is committed to protecting our members from regulations that threaten privacy and discourage volunteerism within community associations. We are pursuing this lawsuit to ensure that communities can continue to operate without unnecessary and burdensome regulations.

I would like to recognize the leadership and commitment of Brendan Bunn, Esq., CCAL fellow, President of the College of Community Association Lawyers and Shareholder, Chadwick, Washington, Moriarty, Elmore & Bunn (Fairfax, Va.) and Ed Allcock, Esq., CCAL fellow, Past President, College of Community Association Lawyers and Shareholder, Allcock & Marcus (Braintree, Mass.) for their tremendous efforts in moving this initiative forward.

What can you do to support the efforts?

» Maintain your CAI membership to stay informed about the case’s progress.

» Encourage other associations in your local area to join as CAI members.

» Bookmark www.caionline.org/CTA to keep up with developments.

» Donate to CAI’s legal fund to help cover litigation costs.

» Contact your Congressional representatives to express support for H.R. 9045 to exempt community associations from the Corporate Transparency Act.

The National Small Business Association filed a lawsuit over the act and was successful in getting its members exempted from the requirements. CAI learned from that effort that “association standing” protects all members of the organization. If our lawsuit is successful, it is very possible exemptions will only apply to community associations that are members of CAI. We encourage you keep your membership in good standing.

We will keep you informed of any updates as this lawsuit progresses. In the meantime, please visit www.caionline.org/CTA to find answers to frequently asked questions.

Thank you for your continued support as we work to protect the interests of our members and communities nationwide.

CAI is thrilled to announce the launch of the Florida Chapters Community on the CAI Exchange, a dedicated space for Florida members to connect, share, and learn from each other. This community is designed to help you:

» Connect with others in the state: Network with colleagues and professionals across Florida.

» Ask questions and get feedback: Receive insights and answers from fellow members on various topics.

» Stay informed on hot topics and legislation: Get the latest information on issues specific to Florida.

Whether you have something successful to share from your community, or you’re seeking feedback and advice, the CAI Exchange is for you! Before you get started:

» Daily Digest Email: FL CAI members will receive a daily email summarizing the latest discussions. You can adjust the frequency of these digests to weekly, or opt out if you prefer. Simply log in to the Exchange, click your profile picture in the upper right corner, choose My Account and Community Notifications

» Community Rules: Please take a moment to review our Community Rules to help maintain a positive and productive environment.

We encourage you to dive in, start connecting, and make the most of this valuable resource. Get started at exchange.caionline.org/home. Click Communities in the top toolbar, choose My Communities, and click on Florida Chapters Community. Let’s work together to make this community the best it can be!

Florida’s DBPR has launched a new website for condominium information and resources, which is accessible in both English and Spanish at condos.myfloridalicense.com.

Three legislative bills impacting the rights and obligations of Florida condominium unit owners, board members, community association managers (CAM), and other stakeholders have been enacted since 2022. Given these many changes, this website was created to provide transparency about the new laws and serve as a resource to help you understand them.

House Bill (HB) 1021 became law on July 1, 2024. This bill was the third of a series of laws passed since 2022 that seeks to improve the lives of Floridians living in and managing condominium communities. The new law prioritizes safety, expands accountability, increases transparency, and educates Floridians about responsible condominium management. The goals of these laws include protecting Floridian life safety, requiring sound management of condominium associations, fostering transparency regarding the governance of condominium associations, and expanding the Florida Department of Business and Professional Regulation’s (DBPR) role in serving and protecting the public.

DBPR’s Division of Condominiums, Timeshares, and Mobile Homes (CTMH) offers a variety of educational resources to assist condominium residents, boards, and CAMs in understanding their rights and responsibilities. These resources include in-person and virtual meetings, in both English and Spanish, where our experts provide guidance on statutory compliance, financial management, and dispute resolution. Additionally, we offer a wealth of resources covering topics that range from maintenance standards to election procedures. Tailored presentations specifically focused on the needs of your community may also be requested.

BY HEATHER KARAMITSOS, SENIOR VP/DIR. OF ASSOC. BANKING, AMERICAN MOMENTUM BANK

Cybersecurity threats and internet fraud are on the rise. While it’s the large-scale cyberattacks that make news headlines, in reality, according to Accenture’s 2023 Cost of Cybercrime Study, 43% of cyberattacks are aimed at small businesses.

Homeowners’ personal and financial data are especially vulnerable in today’s high-threat cyber environment. Community association management companies and self-managed associations cannot be too careful when protecting themselves and their homeowners from theft and fraud.

Below are a few potential theft and fraud risks associations and management companies should be aware of, as well as tips for mitigating them.

Some management companies are outsourcing accounting services to countries outside of the U.S. in an effort to significantly reduce payroll expenses. These overseas companies and individuals have

access to associations’ financial information, including homeowners’ personal data and bank accounts.

Association boards should ask whether their management company is outsourcing work to organizations outside of the U.S. and, if so, ask additional questions to help ensure their association and homeowners are protected from potential security and fraud risks.

Examples of questions to ask community association management companies outsourcing their accounting services overseas include, “What legal protections roll down to homeowners in the event of fraud or identity theft?” “What protections are in place for associations if funds disappear?” and “What cyber insurance coverages may be applicable in various theft or fraud circumstances?”

Any organization that collects Personally Identifiable Information (PII)—names, social security numbers, driver’s license numbers,

Continued on page 22

ensure your community’s goals are met and resident satisfaction is high.

Sherwin-Williams understands the needs of HOAs and has the products and services to ensure long-lasting curb appeal and easy maintenance. From premium paints that provide performance and protection to color design services, on-site assistance, maintenance manuals and more — we’re here to help throughout the state of Florida.

addresses, birthdates, etc.—is at risk of a data breach. That includes associations and CAMs that collect this type of information from homeowners.

The costs of a data breach can be steep. Expenses can include, but are not limited to, hiring attorneys, computer security experts and PCI forensic investigators; providing credit monitoring to victims; and fines and penalties issued by regulatory agencies.

Community association management companies and self-managed associations can protect homeowners from a data breach by having a layered cybersecurity program in place that includes monitoring, detecting and preventing data breaches.

When criminals send someone a fraudulent email that appears to be from a trusted sender to induce them to reveal confidential information or perform an action that seems legitimate, this is considered spear-phishing.

For example, a CAM employee or association board member receives an email that looks like it came from a colleague. The email asks the recipient for a list of homeowners’ personal information, such as names, account numbers and access codes. Thinking this is a valid request, the recipient sends the requested information, which then results in fraud or theft for the homeowners.

Training CAM employees and association board members on detecting fraudulent emails is critical to protecting homeowners’ PII. Various organizations offer cybersecurity awareness training to help

people identify fraudulent emails, prevent potential cybersecurity attacks and protect sensitive information.

Malware is malicious software designed to infiltrate, damage or disrupt computer systems. It can pose a significant threat to associations and homeowners by stealing sensitive data, compromising operations and causing financial losses.

One type of malware is spyware, which is unwanted software that infiltrates a computer and allows the criminal to secretly monitor and collect user data. CAMs and associations are at risk of cybercriminals using spyware to collect information that will allow them to access PII and bank accounts.

Again, training employees and association board members on detecting fraudulent emails and potentially malicious files can offer stronger protection against a cyberattack. Remember, spyware and spear-phishing attempts are only successful if an unsuspecting employee or board member follows through on the cybercriminal’s request.

In addition, it is vital to have a solid IT security infrastructure and processes in place – including IT detection software, content filtering and web blocking – to help block fraudulent emails and malicious files or sites.

CAMs and self-managed associations can also help protect themselves and their homeowners against cybersecurity risks by:

» Working with their bank to implement a system of checks and balances to protect against fraudulent activity. For example, before completing large transactions, perhaps the bank requires call-backs or codes for approval.

» Investing in cyber insurance, which is protection from financial losses caused by cyberattacks, data breaches and other cyber-related incidents. Cyber insurance helps organizations mitigate their exposure to risks by transferring financial liability related to cybersecurity and privacy events.

Heather J. Karamitsos

is

Senior VP/ Director of Association Banking

at American Momentum Bank. She can be reached at hkaramitsos@americanmomentum. bank and 941-806-0755.

BY LAUREN WHEELER, LCAM, CMCA, AMS, ACCESS MANAGEMENT

In the world of community association management, having a strong and capable team is crucial. While onboarding and training are essential for setting the foundation for new employees, the next step is to transition toward coaching and professional development. But what’s the difference between the two, and how can we shift our mindset to create a culture of growth?

Training is typically task-oriented. It focuses on teaching specific skills, processes, and knowledge needed to perform day-today responsibilities. Think of onboarding—a structured, often standardized approach to get new employees up to speed. Training is critical for providing employees with the essential tools and understanding needed to succeed in their roles.

Coaching, on the other hand, goes beyond the basics. It’s an ongoing, collaborative process where coaches and supervisors guide employees toward reaching their full potential. While training provides the “how-to,” coaching is more about unlocking individual talents, encouraging self-reflection, and fostering continuous improvement. Coaching isn’t just about fixing weaknesses; it’s about nurturing strengths, offering feedback, and supporting long-term professional growth.

Shifting from a training-focused approach to a coaching culture requires intentional effort. Start by reframing the role of trainers.

Instead of merely being instructors, they should become mentors who invest in their teams’ development. This shift involves regular check-ins, creating personalized development plans, and encouraging employees to take ownership of their growth. By focusing on professional development, we can create a culture where employees are not only trained but coached to thrive.

Additionally, foster an environment of feedback. Constructive conversations and open dialogues can help employees feel valued and supported, which in turn drives engagement and retention. Ultimately, embracing a coaching mindset transforms your company into a place where employees are empowered to continuously learn, grow, and excel in their roles. The result? A more motivated, capable, and loyal workforce ready to navigate the complex landscape of community association management.

Lauren Wheeler is a seasoned professional in the community association management industry, with 17 years of experience and 14 years as a licensed CAM. She also holds the designation of Certified Manager of Community Associations (CMCA) and Association Management Specialist (AMS). For the past four years, she has been a dedicated team member at Access Management. For more information, visit accessdifference.com.

BY NICK BRENNEMAN, SOUTHEAST REGIONAL ACCOUNT MANAGER, RESERVE ADVISORS

It begins with piggy banks. As children, birthday money, allowance, and loose coins from the floor of dad’s car were placed for safekeeping in the small slit on top of a ceramic animal until it was time to smash it open, meaning enough had been saved to buy the coveted toy or electronic. As teenagers, bank accounts held the wages from after-school jobs, some saved for a car or college, and some used at the mall on weekends because mom no longer fell for the “I really need $20” act. In college, saving money was often put on the backburner, as getting through with as little debt as possible was what mattered. As adults with retirement accounts, investments, and savings accounts serving different purposes, it seems that saving money was much simpler with one goal and one piggy bank. However, at the end of each life phase or savings goal, the money is used for its intended purpose.

Reserve funds are no different – they are saved to be spent. In the simplest terms, reserve funds are used to replace the reserve components in a community association. These funds, made up of the monthly dues paid by each unit owner, fund the replacement of components that the association owns, such as roofs or amenities, or the non-routine maintenance of components, such as re-paving streets. These components’ upkeep or replacement are generally

expensive, which is why reserves are built up over many years. However, because maintenance or replacement schedules are predictable, reserve funds should not be looked at as a rainy-day fund – they are meant to be saved and spent on a timeline.

Reserves, like any other savings fund, often have too little money at any given time, leading to issues such as special assessments or deferred maintenance. But unlike retirement accounts, which benefit from having as much cushion as possible, it is possible that reserve funds contain too much money. It is understandable for board members to see reserve funds as any old savings account, not wanting to spend the money and just aiming to watch it grow. However, this is not their purpose.

While a healthy reserve balance is obviously desirable, 100 percent funded reserves are not generally necessary nor an indicator of health. The truth is, the amount an HOA should have in reserves differs year to year, and there isn’t a specific percentage at which reserves need to be consistently funded. Targeting an arbitrary balance relative to the fully funded balance does not offer a complete picture of overall

financial health. While maintaining a 100 percent funded balance is generally a safe strategy, it typically results in over-funded reserves as it is incredibly rare that all projects would need to be completed at the same time.

Let us take it back to the piggy bank. To be fully funded, or 100 percent funded, you would need to have enough money for the new toy, a car, college, a house, retirement, and all of life’s other major expenses before breaking it open. First, there would simply not be enough room in the piggy bank for that amount of money. Second, you would eventually be doing yourself a disfavor. If you waited until you had enough money for everything before spending anything, you would be 60 years old and have never owned a toy or car, been to college, or bought a house. That money would still be sitting in the piggy bank, useless and waiting.

Similarly, an association does not necessarily need to have funds in reserves for all its expenditures at the same time, because each reserve component has a different lifecycle. It would be incredibly uncommon for every reserve component to need replacement simultaneously. Instead, associations need to look at the cash flow. Expenses should be covered over time through stable and adequate reserve contributions that consider these lifecycles.

If reserve funds were meant to sit in an account forever, communities would suffer. Potholes would expand, shingles would fall, and structures would deteriorate. Your community is a living, breathing entity that ebbs and flows, and your reserve funds should be too –don’t be scared to use them!

As the Southeast Regional Account Manager at Reserve Advisors, Nick is responsible for developing long-term client relationships and providing industry-leading reserve study consulting services. Since joining Reserve Advisors in 2010, he has worked with hundreds of management companies throughout the Southeastern United States, ensuring that their associations receive comprehensive reserve studies, customized funding solutions, and consultative support allowing community leaders to understand and implement their plan for long-term financial sustainability. For more information, visit www.reserveadvisors.com.

BY CHRISTOPHER ERSSON, PRESIDENT & BOARD CHAIRMAN, DEBARY PLANTATION

Assomeone deeply involved in community management, both as a Licensed Community Association Manager (LCAM) and in my role as President of a homeowners’ association, I’ve seen firsthand how rapidly the landscape of managing associations is changing. With new state legislation coming into play, particularly in Florida with HB 1203 and HB 1021, and skyrocketing insurance costs, it’s more important than ever to stay informed and adaptable.

In this article, I want to share some insights on how community managers, board members, and homeowners can navigate these shifts while ensuring the continued well-being of their communities.

Recent laws, such as Florida’s HB 1203 for HOAs and HB 1021 for condominiums, are driving significant operational changes for community associations. These laws put more responsibility on association boards and management, especially around compliance, transparency, and long-term planning. For example, some communities that previously relied on portfolio management may now require full-time, on-site managers to handle the increased workload and complexity.

These changes mean that volunteer boards, who are already dedicating their time to improving their communities, must now juggle even more responsibility. As someone who’s both worked as a community manager and currently serves as an association president, I understand the pressure this can place on volunteers and professionals alike. That’s why collaboration between boards and management professionals is critical.

Along with new legislation, another pressing challenge is the surge in insurance premiums. Whether your community is dealing with wind, flood, or liability insurance, the cost of keeping a property insured can be overwhelming. This is particularly true in areas prone to natural disasters, such as Florida, where hurricanes and floods make adequate coverage non-negotiable.

For community associations, it’s essential to take a proactive approach to managing these costs. Regularly review your insurance policies, explore competitive rates, and look for ways to mitigate

Continued on page 32

nviro Tree Service is a full-service provider of commercial and residential tree care as well as preconstruction activities such as land clearing, tree protection, arborist consulting and biological assessments.

We are a privately-owned, certi ed Majority Woman-Owned Business and have been serving central Florida for over 9 years. Enviro Tree Service has over 100 combined years of professional tree care

experience between our 6 ISA Certi ed Arborists on sta . Our biologist has 13 years of agency experience and spent over two years providing commercial environmental consulting services. We currently employ over 60 tree care professionals, heavy equipment operators as well as our biologist and Commercial Applicator.

Our scope of work includes tree removals, tree pruning, root pruning & control, palm pruning and planting, cabling and bracing, storm and emergency work, tree surveys, environmental consulting, tree health care services and site clearing and mowing.

Enviro Tree Service prides itself in having the most specialized equipment and certi cations to complete your job in a safe and e cient manner. Our land clear-

ing division is equipped with a horizontal grinder, excavator and

loader. We also have three grapple trucks to assist in debris removal.

Managers on sta are all ISA Certi ed Arborists. Other certi cations include TCIA Certi ed Tree Care Safety Professional, Advanced Mitigation of Tra c (MOT), Aerial Rescue, First Aid and CPR, Gopher Tortoise Agent, OSHA 30, and Florida Commercial Applicator for aquatic environments, roadways and natural areas.

risks within your community. Partnering with a knowledgeable broker who understands your unique needs is also key to securing the best possible coverage while controlling expenses.

1. Educate and Empower Board Members: One of the most important steps is ensuring that board members are wellinformed about legislative changes and how they affect dayto-day operations. Hosting workshops, attending educational events, and working closely with legal advisors can help everyone get up to speed.

2. Rethink Management Structures: With the increased demands placed on boards, it might be time to reconsider your community’s management setup. While portfolio managers have been an efficient solution for some, the new laws may require a shift to full-time, on-site management, even in smaller communities. It’s crucial to evaluate what works best for your association in this new climate.

3. Focus on Risk Mitigation: Rising insurance premiums don’t have to be a financial burden if you actively work to reduce risks. Proper maintenance, regular inspections, and improvements

like upgraded roofing or flood prevention measures can not only protect your community but also result in lower premiums.

4. Collaborate with Experts: Now more than ever, it’s essential to rely on industry experts—whether it’s legal counsel, insurance brokers, or community management professionals. These advisors can help ensure your community remains compliant and financially stable amid the changing regulations and economic conditions.

The future of community management may seem uncertain, but with the right strategies and mindset, we can successfully adapt to these new challenges. The key is to remain proactive, informed, and willing to make the necessary adjustments to protect our communities. As someone who’s dedicated to both managing and supporting associations, I’ve found that fostering strong relationships between board members, homeowners, and management professionals is crucial. Together, we can navigate these changes and ensure that our communities thrive. If you’re facing similar challenges or need guidance on how to manage your community during these changing times, feel free to reach out. I’m always happy to connect and share my experiences.

BY UROS VASILJEVIC, CMO, STONE BUILDING SOLUTIONS

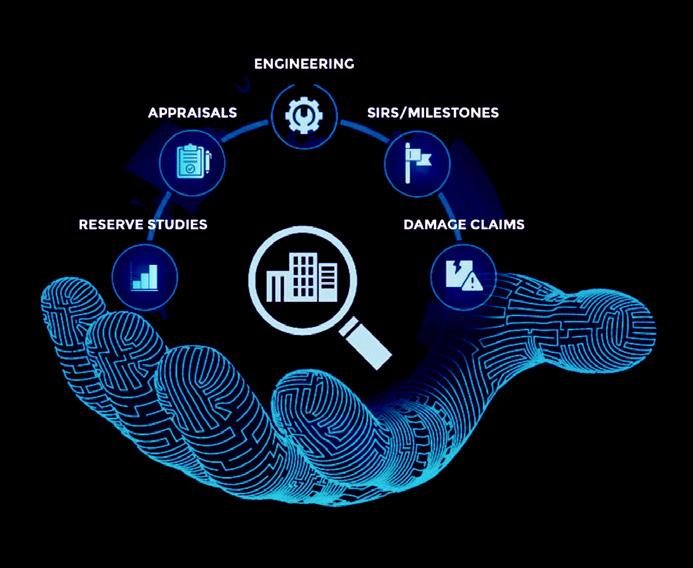

Asthe clock ticks down to the end of this 2024 deadline for 3+ story condos, Stone Building Solutions would like to remind you: don’t get stuck between a rock and a hard place! Time is running out for condo associations to complete Milestone/Recertification & SIRS reports.

If you haven’t done it yet, it’s the final hour to roll up your sleeves, urgently.

Why the rush, you ask? Let’s face it—condos aren’t meant to be overpenalized, but that’s the only talk coming back from Tallahassee. SB154 is not only NOT changing, but it’s also not getting extended,

nor is it getting publicly funded through any kind of low-interest, government backed loans.

The Senate just issued another memorandum confirming that, on August 16th.

Condos are investments, homes, and above all, structures that should stand the test of time (and weather). But they also are entities cancered by a strong lack of legacy-thinking over the past 40 years. If your condo is caught napping on these crucial assessments, you

Continued on page 38

could find yourself in quite a rocky situation. The cost of inaction isn’t just measured in dollars and cents—it’s measured in cracks, leaks, and way worse, red flags from banks and insurance companies; and black marks on your associations.

The financial world is starting to wise up to condo safety. Banks and insurers are now asking the multimillion-dollar question: “Has your condo passed its structural safety inspections?” If the answer is “no,” or even worse, “I don’t know,” you could find yourselves in the stone-cold grip of denied loans, inflated premiums, or the dreaded “no coverage for you!” No inspection, no protection.

Let’s not forget the structural integrity reserve studies (SIRS)— those little gems that ensure your condo association isn’t caught flat-footed (or flat broke) when it comes to future repairs. Think of these studies as the financial bedrock for your condo. Without them, you’re setting yourself up for a financial landslide.

Surprise expenses, anyone? They’re like stepping on a Lego barefoot. Painful, unexpected, and a quick way to ruin a good day and get scape-goated.

So, what’s the rock-bottom line? As 2024 draws to a close, make sure you’ve got your structural safety inspections and reserve studies locked, loaded, and ready to roll.

Trust us, the cost of doing nothing will only leave you stoned— without a place to turn for help or support.

At Stone Building Solutions, we’ve helped thousands of Associations over the last decade, and are geared to help you rock these deadlines and keep your community safe, secure, and financially sound. Don’t wait until it’s too late—because when it comes to condo safety, you can’t afford to take it for granite!

BY JAVI MURILLO, NEW BUSINESS DEVELOPMENT ASSOCIATE, ET&T DISTRIBUTORS, INC.

Asa furniture sales rep, I’ve been studying the hype behind fast furniture. It’s affordable and readily available - making it an attractive option for community managers and board members. Websites have great pictures and pricing – but what’s behind the veil? Fast furniture may seem like a quick fix for your needs, but there are significant downsides that can cost a property much more over time.

Fast furniture refers to mass-produced, inexpensive furniture designed to meet current trends at a low cost. It’s often made with low-quality materials and is not built to last. The hype comes from its accessibility and trendy designs, but there’s a hidden cost to choosing fast furniture over commercial grade options.

1. Durability: Materials used in fast furniture, such as particleboard, plastic, and low-grade fabric, aren’t made to withstand everyday wear and tear (especially in the multifamily industry). What might seem like a great deal at the store can quickly become a source of frustration as pieces begin to warp, chip, fade, tear or break. Over time, you will replace items more frequently, which can end up

costing more than investing in quality furniture from the start.

2. Environmental Impact: Fast furniture contributes to a significant amount of waste. These items have built-in obsolescence. They often end up in landfills within a few years. The production processes for fast furniture also often involve harmful chemicals and unsustainable practices. Choosing quality, commercial grade furniture made from sustainable materials can help reduce your environmental footprint.

3. Comfort and Aesthetics: While fast furniture might look good initially, it often sacrifices comfort and long-term aesthetic appeal for the sake of following trends. The cushions may flatten, and the finish might wear off quickly, leaving you with furniture that’s uncomfortable and ugly.

4. Non-Replaceable Parts: Many times, when buying an overseas product, replacement parts are not readily available to extend product life.

5. Warranty issues: Hard to find customer service.

Continued on page 42

When purchasing quality commercial grade furniture, you’re not just purchasing an item—your property is making an investment into your space and lifestyle. Why?

1. Longevity: Quality furniture is built to last. It’s made with durable materials like solid wood, aluminum, high-density foam, and top-grade upholstery. These materials are not only more resilient but also age gracefully.

2. Sustainability: Many quality furniture manufacturers prioritize sustainability. They use responsibly sourced materials, ecofriendly production processes, and offer fair warranties to extend the life of their products. By choosing these brands, you’re supporting a more sustainable industry and reducing waste.

3. Replaceable Parts: When components are modular and manufactured by USA suppliers, parts can be acquired to extend the life of the product.

4. Long-Term Savings: While the initial cost of quality furniture may be higher, the long-term savings are significant. You won’t need to replace items frequently.

5. Warranties Honored: One stop shopping with a reputable distributor who follows through on warranty claims in house.

Fast furniture might seem convenient, but the drawbacks far outweigh the benefits. When investing in quality, you’re choosing durability, sustainability, and timeless style. It is an investment that saves money, reduces environmental impact, and enhances the comfort and beauty of your community. Next time you’re in the market for furniture–give your friends at ET&T Distributors a call to assist you in your site amenities selections.

Your community deserves the best—don’t settle for anything less.

Javi is a supplier with ET&T Distributors serving the Space Coast/Southeast Florida market. While at UCF, he was introduced to working in student housing as a leasing agent. He worked his way up to Assistant Manager at a conventional community and helped with a lease up in Palm Bay before moving to Daytona and transitioning into the supplier world. For more information, contact Javi at javi.murillo@ettflorida.com or 561-486-8380.

Be sure to update your board’s member names, titles (President, Vice President, Treasurer, Secretary, and Board Member), and contact information to ensure your board members receive all the latest CAI member benefits!

As a CAI member, you’ll unlock access to exclusive benefits— resources and services designed to help you and your communities thrive. You’ll also be able to enroll in career-enhancing CAI education and connect with nearby CAI members through your local chapter, where you can network and learn with peers and meet potential new clients.

❚ Automatic membership in your local CAI chapter

❚ Members-only, how-to resources at www.caionline.org

❚ Exchange, CAI’s online members-only forum to ask questions, get answers, and share your expertise

❚ Legislative, regulatory, and media advocacy at national and local levels

❚ Free subscription to Common Ground, ™ CAI’s bimonthly, award-winning magazine

❚ E-newsletters, including the personalized CAI@Home with content tailored to your preferences

❚ Member rates for CAI education courses and certification opportunities

❚ 40% off for members on all books and merchandise from CAI Press

❚ Member discount programs on D&O insurance, energy solutions, and rental car service

❚ Member registration rates for national and chapter events

❚ CAI Job Market, the industry’s leading online recruitment service

❚ Free listing on CAI’s online Professional Services Directory

❚ The Directory of Credentialed Professionals, CAI’s online database of trusted companies and individuals who have earned industry designations and certifications

Juniper

Kipcon

M2E

Premier

SmartStreet