REACHING NET ZERO

HOW CAN PACKAGING HELP BRANDS MEET THEIR CLIMATE COMMITMENTS?

Packaging Europe Ltd

HOW CAN PACKAGING HELP BRANDS MEET THEIR CLIMATE COMMITMENTS?

ASyou read this, many of you will be getting ready for interpack, or already be at interpack. The Packaging Europe team will be at the event in Düsseldorf for the entire week, and we will be scouring the trade show aisles to report on all the new developments and trends, conducting interviews and filming short videos. We also have our own stand at North Entrance 1/.16, so make sure you stop by and say hello.

Submissions to our 2023 Sustainability Awards have just closed and judging is underway. We will be announcing the finalists on May 29th – watch this space! The winners will be revealed at our combined Sustainable Packaging Summit and AIPIA super-event in Amsterdam on November 14th and 15th. We’re looking forward to seeing many of you there.

The effects of climate breakdown and global heating are becoming ever more apparent, and reaching net zero goals is becoming more vital as time progresses. Major beverage brands have set themselves ambitious targets to reach net zero by 2040. In this edition of the magazine, Frances Butler speaks to PepsiCo and Coca-Cola Europacific Partners to find out how the companies are tackling their emissions, what role packaging plays in their net zero strategies, and to learn about the progress being made towards these goals.

Victoria Hattersley takes an in-depth look at advances in digital print, asks the question: ‘Are we there yet?’ when it comes to market saturation, and explores four key drivers in digital printing, speaking with Advisory4Pack’s Patrick Poitevin and Landa Digital Printing.

In the wake of the upcoming proposed revisions to the European Commission’s Packaging and Packaging Waste Directive, reducing empty space in commercial packaging has shifted into focus. To gain a clearer picture of the new legislation's implications for the sector, Emma Liggins speaks with representatives from H.B. Fuller and Mondi Group.

AIPIA’s Andrew Manly makes the case for antimicrobial films and explores how innovative antimicrobial and antibacterial materials can be commercialised in a cost effective, viable way.

Coming back full circle back to the topic of carbon, food waste is a major contributor to carbon emissions, and the SAVE FOOD initiative was set up to combat the global food waste crisis. At interpack, a new pilot project that sets out to produce food packaging from food waste will be presented. I speak with the project's coordinator from Istanbul's Bahcesehir University as well as Messe Düsseldorf's Executive Director to learn more about the project. Staying with interpack, you’ll find a round-up of just some of the new products you will be able to see at the event

That just leaves me to say we hope you enjoy the latest issue of Packaging Europe magazine, and we look forward to seeing many of you at interpack in Düsseldorf! n

Elisabeth SkodaThe winners of our 2023 Sustainability Awards will be revealed at our combined Sustainable Packaging Summit and AIPIA super-event in Amsterdam on November 14th and 15th. We’re looking forward to seeing many of you there.

With the effects of global heating becoming ever more apparent, and the European Union aiming to be climate-neutral by 2050, companies’ net zero strategies are more important than ever. Frances Butler takes a closer look at how beverage brand owners PepsiCo and Coca-Cola Europacific Partners (CCEP) are tackling their emissions, what role packaging plays in their net zero strategies, and the progress being made towards these goals.

In January 2021, PepsiCo pledged to reach net zero emissions by 2040. To find out what progress PepsiCo is making towards its net zero targets, we heard from chief sustainability officer Katharina Stenholm.

“Packaging counts for approximately 20% of our GHG emissions, with PET being the biggest contributor,” said Stenholm, emphasising that circular, non-fossil-based packaging will play a vital role in achieving PepsiCo’s net zero emissions goals.

Stenholm highlighted packaging design as a key element of this, such as the brand’s aims to design 100% of packaging to be recyclable, compostable, biodegradable or reusable by 2025; cut virgin plastic from non-renewable sources per serving across food and beverage portfolios by 50% by 2030; and scale new business models that avoid or minimise single-use packaging materials.

She also mentioned its goal to achieve 50% recycled plastic (rPET) by 2030 across Europe, and consumer trials of 100% recyclable or renewable snack packaging which began in 2022 “in line with our new goal of eliminating virgin fossil-based plastic in crisp and chip bags by 2030”.

Stenholm underlined Pepsi Co’s support for ambitious recycling targets, increased recycled content targets and deployment of Deposit Return Schemes (DRS), saying:

rPET for its 500ml and 600ml bottles, but the use of 100% rPET bottles was scaled back for some UK brands in July 2022, citing supply issues.

When we asked Stenholm how this issue was overcome, she explained that whilst 11 markets across Europe have 100% rPET Pepsi bottles (excluding cap and label) already, “we are struggling to enough rPET to continue the roll out at this pace.”

One the reasons Stenholm cites for this is less advanced return systems in some European countries. However, she points out that in Slovakia “return rates have reached over 80%” which has increased the rPET supply, and the company is going ahead with DRS in many countries.

Following on from the difficulties with rPET availability, we asked Stenholm for her opinion on the main packaging challenges that need to be tackled to achieve net zero.

She stated that PepsiCo is focusing on business models requiring little or no single-use packaging ahead of various reusable bottle schemes due for rollout this year, with SodaStream “expected to eliminate the need for nearly 200 million virgin plastic bottles globally by 2025”.

Stenholm says that in 2022, PepsiCo Labs (which works with tech start ups to test industry needs and scale ideas) identified 12 start-ups which may unlock potential solutions to help PepsiCo’s sustainability agenda across its supply chain, including “a physical and digital tracking system for sorting and recycling of waste, a

In January 2021, the company stated its plan to reduce Scope 1 and 2 absolute GHG emissions across its value chain by 75% and Scope 3 by 40% by 2030 (against a 2015 baseline). We wanted to know what progress has been made with this so far.

In 2022, PepsiCo Labs (which works with tech start ups to test industry needs and scale ideas) identified 12 start-ups which may unlock potential solutions to help PepsiCo’s sustainability agenda across its supply chain.

Katharina Stenholm, Chief Sustainability Officer at PepsiCo

Stenholm said that 12 European markets eliminated Scope 2 emissions by transitioning to 100% renewable electricity for their own manufacturing operations, and with the reduction of Scope 1 emissions is being tackled through piloting new technologies like “biomass, biogas, renewable natural gas, electrification, and hydrogen opportunities, as well as investing in capability-building and knowledge-sharing internally to quickly identify and deploy low-carbon solutions.”

She underlined the importance of reducing Scope 3 emissions in the food industry, saying: “our efforts to reduce value chain emissions focus on our three largest emissions drivers: agriculture, packaging, and third-party transportation and distribution. Meeting our net-zero goals requires that we move quickly and significantly on these, in collaboration with our upstream and downstream partners from whom these emissions originate.”

Another brand owner aiming for net zero is CCEP, who have set sciencebased targets to reduce absolute emissions by 25% by 2030 against a 2015 baseline and achieve net zero by 2040.

As part of its World Without Waste campaign Coca-Cola is planning to make 100% of packaging recyclable globally by 2025, and use at least 50% recycled material in its packaging and collect and recycle a bottle or can for each one it sells by 2030. It also claims that 90% of its packaging is recyclable globally.

To learn more about the progress the company is making towards these goals, we spoke to Joe Frances, vice president of sustainability at CCEP. He outlined plans to make sure all packaging is recyclable; using as much

In Europe, “around 53% of all the plastic we used at the end of 2021 was recycled PET,” he said, with around 60% in Australia and 40% in New Zealand. Between 75%-80% of packaging in Europe is being collected for recycling, which differs by market, with Great Britain and France being lower and some markets with DRS being much higher.

According to Franses, the company’s science-based targets and climate strategy is value chain based, with estimates of around 20-25% of total value chain emissions being ingredients; 40% being packaging; 10% from all of its operations in commercial sites; 10% for transportation; and about 10-15% for cold drinks equipment.

He noted that markets will make a difference here, too – “in a market where the carbon footprint of the local grid is higher than the proportion of the value chain emissions attributed, our cold drinks equipment will be higher – simply because it’s using higher carbon intensive electricity.”

CCEP has its own goal to achieve net zero by 2040, with around 90% of the bottler’s GHG emissions coming from the supply chain. We asked Franses to explain what steps are being taken towards this goal, and how packaging can play a role in achieving it.

Franses stated: “Supplier engagement is a fundamental part of how we will proceed on our journey to net zero. We will not be able to reduce our emissions unless we can reduce our Scope 3 emissions”.

He set out three things CCEP has asked suppliers to do: set their own

Sharing data is a key point for Franses. “If you’ve got a can supplier doing excellent work to reduce the carbon footprint of the can, we need to be as close to their data as possible so we can incorporate that into our carbon footprint numbers.

Most big companies will use average data for the entire sector or for a reason. We want to move to using supplier specific data that will help reflect the carbon reductions our suppliers are engaged with.”

In addition, he mentioned CCEP’s sustainability linked finance chain with Rabobank, which will incentivise and reward suppliers for improving their performance in this area, as well as the Supplier LoCTS programme run by the consultancy Guidehouse (which the bottler and many of its packaging suppliers are involved in) which helps to “upscale and upskill supplier activity on carbon reduction.”

In 2021, 98%.3 percent of CCEP’s primary packaging in Europe was recyclable, and the company aims to ensure that 100% of packaging is recyclable by 2025. Franses said that in Europe, there are still some elements that don’t meet the requirements, such as some of the pouches used for Capri Sun, which are not always easily collected for recycling.

Investing in PET recycling plants has taken place in France, Australia and Indonesia, and there is a single-use plastic directive in Europe that requires 90% collection of plastic bottles by 2029.

There is also Packaging and Packaging Waste regulation which will introduce minimum requirements for DRS and make them mandatory across EU member states. Franses underlined CCEP’s support for this infra structure “as long as it’s well designed because it will help because it will help us to get in excess of 90% of our packaging back.”

In terms of collection, he stated that as a global Coke system, CCEP has a commitment to collect a bottle or can for every one it sells, and while “we can’t possibly collect every single pack we put onto the market, we will be looking at equivalents. That depends upon not just recyclability, but the collection functioning really well across all of those markets.”

Joe Franses, Vice President of Sustainability at CCEP

CCEP has asked its suppliers to do three things: set their own sciencebased targets; shift to using renewable energy; and share their data with CCEP, for example, making sure the electricity a PET producer is using to make a can is coming from renewable sources.

Digital technologies for track & trace. Inline inspection for security in the circular economy. Foreign object detection for product safety. Smart image processing for efficient resource management: HEUFT has the right solutions.

Digital technologies for the bi-unique identification, tracking, serialization and aggregation of the most varied packs will be presented at Stand A43 in Hall 13. From proof of origin to the documentation of the whole packaging process they generate "Big Data" for traceable production.

Right up to the archiving of the detection images this also applies to all the data of network-capable HEUFT systems for the inspection of empties for safely reusable packaging in the circular economy and for the examination of full containers for high product safety.

A highlight is the HEUFT eXaminer II XT. With optimized pulsed X-rays and a revised mechanical design it offers more detection accuracy during the inspection of still unpackaged product mass and more flexibility for space-saving integration.

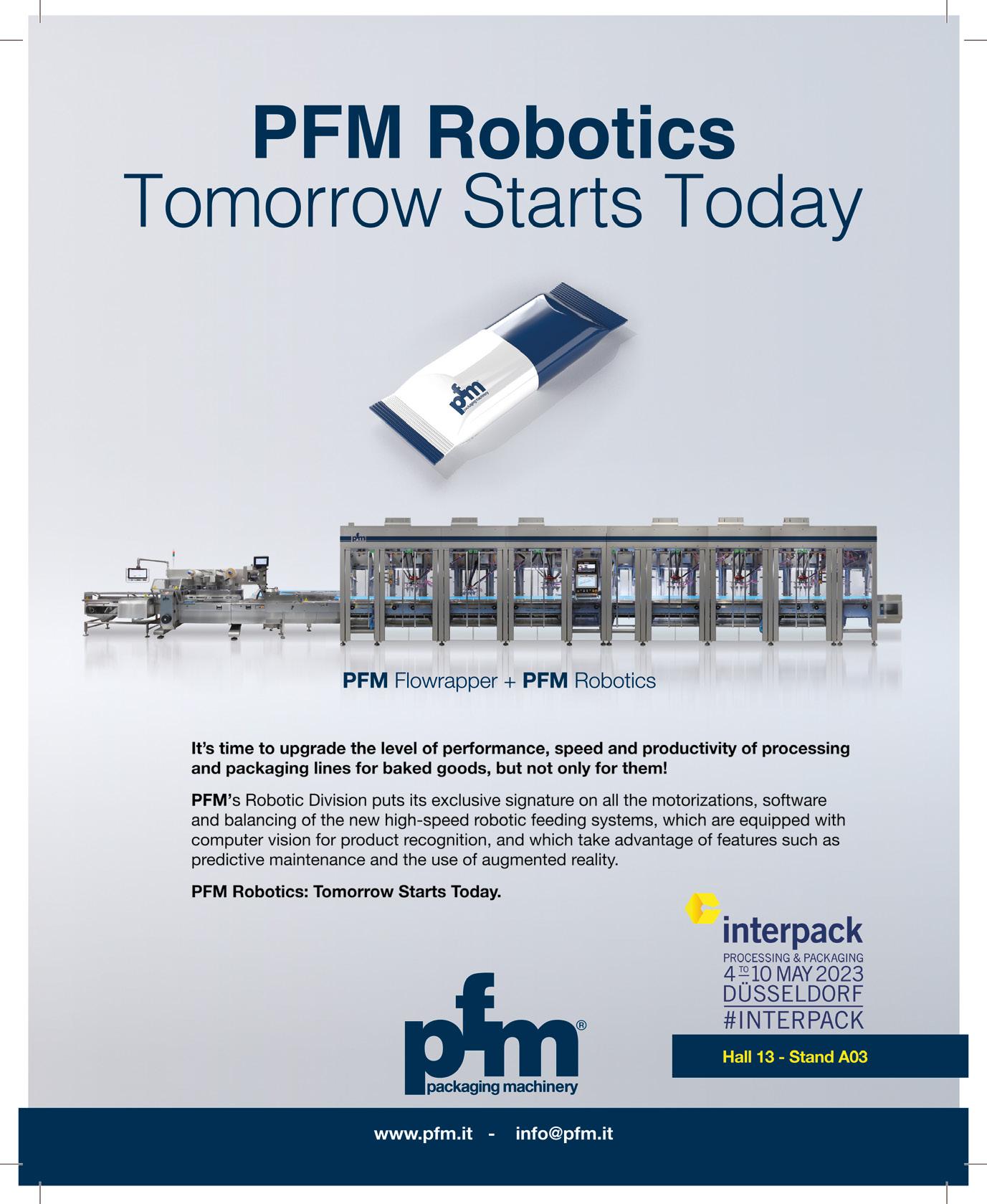

PFM Packaging Machinery, a leader in the production of automatic and robotic systems for flexible packaging, will be showcasing technological innovations at interpack in hall 13 / A03.

Among the new products on display at the event, visitors will be able to see the D-400 EPT Series Horizontal Stand-up Pouch and the RQ700/800 Series Vertical Stand-Up Pouch.

The D-400 EPT Series is equipped with an electronic pouch transport system with magnetic carriages, adding further benefits to the D-Series:

Innovative image processing combines artificial intelligence with human expertise to clearly distinguish harmless objects from critical ones, so that resources are no longer wasted and only truly unmarketable products and packaging are rejected.

The magnetic carriages group the pouches together, thus doubling the filling time compared to traditional systems. The machine can switch from Duplex to Triplex configuration in 20 minutes with increased bag output and width format changeover. and can produce up to 200 stand-up pouches per minute.

The RQ700/800 is the VFFS intermittent motion packaging machine that can produce pillow bags, block bottom packs and doy-style packs, also with zip. The innovation lies in the new sealing unit concept, i.e. the QRM, which can be pulled out with a special carriage and replaced in a few minutes with a second unit to switch from a pillow or block-bottom pack to a doy-style pack. The format changeover takes place without the need for further adjustment, and the sealing control system allows the sealing force applied to each side of the pack to be set, managed, measured and stored independently.

ELBA S.p.A. has recently launched an innovation around the modular structure of its SA-V pouch making machine.

Despite its compactness, this updated model can preserve high levels of productivity and efficiency for the manufacture of retort pouches with bottom inserted gussets.

Customization is one of the features that distinguish ELBA in the pouch making machines market, indeed the SA-V can be designed for two or four-lane production.

Automation is another essential characteristic of ELBA’s machines: the automated collecting table allows to reduce time and effort as pouches are piled up automatically at the end of the process.

This compact SA-V has been engineered to make machine management easier in every respect, from setup to maintenance, and is equipped with new design components. The latter guarantees maximum reliability, regarding speed and sealing quality, and minimize maintenance downtime, limited only to wear and tear parts.

Find Elba in Hall 12 / D54.

Contact the company at sales@elba-spa.it

More information: www.elba-spa.it

Armed with some of the world’s most highly skilled permeation experts, the team at Industrial Physics – a global packaging, product, and material test and inspection partner – are here to provide highquality, cost-effective permeation solutions.

The OxySense® 8101e Oxygen Transmission Rate Analyzer from Systech Illinois incorporates the latest in coulometric sensor technology with high sensitivity and the widest test range. The instrument is simple to operate, designed to lower testing costs, and increase productivity. Ensuring both accurate and repeatable results!

Our Systech Illinois permeation solutions have been designed to provide the most accurate solutions in a way that keeps the costs down –with our instruments, you’ll be able to benefit from a significantly reduced cost of ownership when compared to market expectations.

But permeation test solutions are just one part of what we do. Industrial Physics boasts a wealth of package test solutions across a variety of applications. From burst testing to leak test ing to tear testing and so much more, we’re here to ensure the integrity of your packaging. Learn more about Industrial Physics here: www.industrialphysics.com

KIEFEL GmbH, a market leader in the design and manufacture of polymer and natural fiber processing machines, automation and tools, will mainly be digitally exhibiting its exten

sive portfolio of cutting-edge and sustainable solutions for various industries in Hall 8a / C57. Product samples such as cups, trays, bowls or coffee capsules made of natural fibers, recycled and recyclable polymers or bio-based material will be on display too.

“At interpack 2023, one focus will be on the machine series for the production of biodegradable natural fiber packaging. We are delighted to receive the WorldStar Award 2023 for our NATUREFORMER KFT 90 machine at this trade fair as recognition of Kiefel’s commitment to

sustainable packaging solutions,” says Cornelia Frank, Global Director of Fiber Packaging at Kiefel. Kiefel Fiber Thermoforming allows the manufacture of sustainable packaging such as bowls, cups, lids, coffee capsules and packaging for frozen food, among others.

Additionally, Kiefel’s SPEEDFORMER KMD 78.2 SPEED and SPEEDFORMER KTR 5.2 machines for the efficient production of polymer trays and cups, respectively, are being displayed. Visit Kiefel at the Brückner Group booth Hall 8a / C57.

ATinterpack, the MBP 12C4 will be presented, designed to minimize impact and eliminate the risk of product breakage during weighing phases.

The strength of the 12C4 multi-head weigher’s design concept is to reduce the product's falling height as much as possible and with it the impact against rigid surfaces.

The multi-head weigher is characterized by 12 weighing buckets fed directly from the vibrating channels, excluding the pre-dosing buckets. Furthermore, the central vibrating plate, used for distributing the product on the radial channels, has a flat horizontal shape, which improves the

product's distribution on the channels and minimizes the product's falling height.

The product's impact in the buckets is reduced to a minimum thanks to the degree of inclination of the bucket walls.

The falling height from the pans to the belts is only a few centimeters, as is the distance between the belts and the discharge point.

All maintenance and cleaning operations of the multi-head weigher are made easy: the four main belts rotate 90° downwards, and the carpets are easily removable.

The MBP 12C4 is integrable with an inclined vertical packaging form fill and seal machine,

specific for fragile products, or it can feed an output conveyor belt that, in turn, can feed different types of packaging machines.

ProAmpac, a leader in flexible packaging and material science, presents its ProActive Sustainability Portfolio at interpack featuring two new products: ProActive Recyclable® R-2050 and ProActive Post Industrial Recycled Content (PIR). ProAmpac will also showcase its RAP product solutions that meet the 90/10 ratio of fibre to film target which allows for OPRL labelling as Recyclable.

ProAmpac continues to build on its patentpending high-performance mono-material ProActive Recyclable® R Serieswith ProActive Recyclable R-2050. The newest member of the ProActive Sustainability family, R-2050, is available in reel stock and pre-made pouches, with standard and high-barrier options.

In addition, ProAmpac will have ProActive PIR on display. Containing 30% polyethylene-based PIR, ProActive PIR reel stock film meets UK Plastic Packaging Tax guidelines for tax exemption and is OPRL compliant for front-of-store drop-off. All virgin material and film used to produce ProActive PIR film are EU food contact grade materials. Finally, ProAmpac will show its RAP Packaging solutions including Sandwich Packs, HandRaps, SoftPacks and Trays. The modern format keeps food fresh and offers an elevated appearance in either a hot cabinet or a chiller. By weight, the largest component of ProAmpac’s food to-go packaging is paperboard and paper sourced from well-managed forests, which is widely recyclable in fibre streams.

ProAmpac’s food to-go packaging solutions are 2023 OPRL 90/10 compliant.

Visit ProAmpac in Hall 10 D1.

The company’s portfolio of innovative solutions includes Omya Smartfill, functionalized Calcium Carbonate for usage in biopolymers, and in particular for Polylactic Acid (PLA) and PolyHydroxyAlkanoate (PHA).

It will provide stable processing conditions and improved performance as a natural biopolymer enhancer while also contributing to a decrease in overall formulation cost.

The Omyaloop family is committed to helping transform the polymer industry into a more circular economy. Omyaloop FC is a fully recycled product portfolio composed of selected recovered material from various sectors that would

otherwise be disposed of as waste. It is certified as 100% recycled by Bureau Veritas. Omyaloop MIX is used in the recycling, and it improves the mechanical performance of recycled polyolefin blends, such as Polyethylene and Polypropylene. OmyaPET provides strong UV protection for white opaque PET in example UHT milk bottles and BOPET films replacing other opacifying additives. OmyaPET r100 provides more heat stability to PET products enabling the use of recycled PET in pasteurized and microwavable packaging and vending cups. Find Omya at stand C12 in Hall 8a, or go to polymers.omya.com, or email info.polymers@ omya.com

KOCH Industrieanlagen GmbH is a specialized robot system house and develops intelligent automation solutions for packaging, palletizing and order picking according to customer-specific requirements. The company provides professional support throughout the entire project - from planning to implementation and servicefor the sustainable implementation of complete turnkey systems and also of integrable individual systems that can be integrated into any production environment for all factory areas.

Customers also benefit from the flexible, highly available and powerful KOCH in-house developments: With the KOCH PalletSystemMove, the KOCH RobotApplicationCenter or the intelligent KOCHNectivity platform, any production can be automated and efficiency significantly increased to secure a decisive competitive edge. Find out more about innovative and sustainable KOCH automation solutions and visit the company in hall 12 at Stand C17.

PFM Packaging Machinery will showcase a number of innovations at interpack, among these, the RQ550 Nano packaging machine. RQ550 Nano is a lowered VFFS with reciprocating motion, which can produce pillow, square bottom, 4-seal and doy style bags; its compact design also involves a height of 1200 mm, which makes the machine ideal for operations in small spaces and for the packaging of fragile products.

The sealing concept of the RQ550 Nano involves the removal and the replacement of one QRM unit with another in a few minutes, so that it is possible to switch easily from

pillow/square bottom bags to doy-style bags. Format changeover is carried out with no need for further adjustments, because the QRMs feature all necessary tools to produce the different types of bags.

Up to 150 pillow bags and up to 60 square bottom bags (standard and 4-seal on sides) or doy bags (also with zip) can be processed per minute. There also is an easily removable forming tube and exit belt both on the back and on the side, to simplify operations as much as possible.

All PFM Group’s companies develop machines that use sustainable, 100% recyclable wrapping materials such as paper and mono-material

plastics. After many years of research and testing, all PFM machines can operate with these materials without performance being affected.

When visiting interpack this year, find out how to do more with less in packaging board and flexible paper packaging by working with Omya, a natural minerals and specialty materials expert.

In containerboard and folding carton grades, Omya Aqurate can offer more printing flexibility and coverage while fully replacing white fibers with Calcium Carbonate based coating pigments. Board surfaces can be tuned to meet your quality and profitability goals. For containerboard manufacturers, Omyaboard can provide more productivity and efficiency while reducing drying and energy costs.

For flexible packaging papers and quick-service-restaurant grades, Omya offers a portfolio

of ready-to-use, water-based functional coatings. The Extomine, EarthGuard, and EarthWrap product ranges provide functional barriers to mineral oil, oil & grease, and water vapor, as well as sealing properties. These products can offer more food safety, recyclability, and convenience with less environmental impact and hazardous chemicals compared with alternative technologies available today.

Visit the company at booth C12 in hall 8a where Omya will be presenting its natural, renewable, recyclable, and bioavailable (ecofriendly) calcium carbonate solutions with a low carbon footprint, or go to paper-board. omya.com to learn more.

ATinterpack, The Navigator Company will be present innovations along the entire value chain.

By participating with its most recent packaging rangegKRAFT, the company aims to present its answer to the plastic crisis: a kraft paper solution that accelerates the transition to the use of natural, sustainable, recyclable, and biodegradable fibres.

Capitalising on its knowledge of the advantages of Eucalyptus globulus, The Navigator Company introduced gKRAFT in three sub-brands, FLEX, BAG and BOX, covering a wide range of business needs.

Due to the virgin fibres used, this high-quality packaging solution offers an extra smooth finish and superior printing quality, while being a safer

and more hygienic option compared to recycled paper, as the latter can contain harmful quantities of chemicals. However, even among its virgin fibre peers, gKRAFT has leverage, since it has more recycling potential, while using less wood volume per tonne of paper.

All in all, gKRAFT is a clear asset for brands wanting to show their consumers a clear commitment to the environment.

Find out about the company’s gKRAFT solutions in Hall 8A/C31.

PFM will present a packaging line produced by SPS that features a robotic feeding system with computer vision for product recognition at interpack.

The line can manage the mixed-up bars on the exit belt: the robots recognize them, pick them up and deposit them on the feeding belt of the first high-speed horizontal packaging machine.

The first part of the line wraps the bars in a primary flexible packaging; the packaged product is then rotated before coming out, to feed the second packaging machine; eventually, this will create multipacks of bars thanks to iTRAK, the intelligent feeding system by Rockwell.

The line offers an increase in production rates: the automatic line for bars can reach a speed of

up to 1000 pieces per minute, while ensuring a consistent quality of the final product. Furthermore, it offers reduced downtime. The automatic line for bars is equipped with a system that allows a fast and easy format changeover.

Furthermore, the automatic line for bars features a smaller footprint.

At interpack, visitors will be able to see the whole line running with its predictive maintenance system and augmented reality for technical assistance, which allows monitoring of the machine’s status in real-time and to take prompt action in case of anomalies or faults.

Find PFM in Hall 13, Booth A03.

Greif subsidiary Tri-Sure will be showcasing its EcoBalance™ caps for steel and plastic containers at this year’s interpack in Hall 10, Booth 7.

The EcoBalance caps are made from 100% post-consumer recycled (PCR) resin from recycled containers, further expanding the EcoBalance product portfolio of sustainable packaging and accessories for Greif®. When compared to standard plastic caps, internal analysis from the Green Tool by Greif shows a potential reduction of carbon emissions by up to 45%.

Easy to apply and remove, the closures come in two varieties - the SambaCap™ for steel drums and the Push-Lock™ cap for fibre and plastic drums. Both caps are also complementary to the Tri-Sure Metal and Plastiplug™ Closure Systems, respectively.

“EcoBalance caps support sustainability goals of reducing carbon emissions, minimizing energy consumption and diverting waste from landfills.” explains Dale Taylor, Global Product Development Manager Closures at Greif. “They signify our commitment to making sustainable

improvements across our product lines that support a closed-loop system for recycling material and reducing waste, whilst maintaining the high levels of quality our customers expect.”

More info: www.tri-sure.com

Packaging and film manufacturer Bischof+Klein has relaunched its brand with a new slogan: “Packed with innovation.”

CSO Erik Edelmann: “We are the partner for

implementing the requirements of tomorrow’s product protection today. This is how we ensure that our customers have a crucial market lead.”

The innovation center at the company’s headquarters in Lengerich serves as a development platform for customers, suppliers, and machine manufacturers, combining cutting edge technologies with know-how.

“Sustainable protection of the environment and climate remains the central issue,” explains Erik Edelmann. Bischof+Klein has set itself the goal of offering all of its packaging solutions in recyclable form and with recycled material content. In recent years, multiple successful developments have been presented with the German

Packaging Award and the WorldStar Packaging Award, the most recent prize-winner being the “U-Pack® – recyclable” side gusseted bag.

Industrial packaging from Bischof+Klein is manufactured from pure PE and is fully recyclable. Packaging solutions such as PowFlex® for finely powdered and moisture-sensitive products can also be produced with 50% recycled material.

Demand for high-purity packaging is enjoying strong growth. Bischof+Klein is one of a small number of companies in Europe to produce packaging and films in the encapsulated class 5 clean room “at rest” in accordance with DIN EN ISO 14644-1.

Find out more at www.bischof-klein.com.

BERICAP, a global manufacturer of plastic and aluminium closures, is offering interpack visitors a tour of Captown at stand E67 in hall 10. Environment and health are important in the ‘Industrial District’ with a focus on resource conservation with new lightweight agricultural and DIN closures. Like all closures for industrial applications, they can be manufactured with up to 50% PCR. BERICAP has a comprehensive range of anticounterfeiting safeguards, such as printing, embossing and special labels.

Tethered caps, which become mandatory in 2024, are on show in ‘Beverage Hills’. Many BERICAP customers are already using the sustainable ClipAside closures that are available across Europe for all relevant neck finishes. Consumers appreciate BERICAP ClipAside’s 180° opening and intuitive handling.

BERICAP sports caps include ‘Mayence’ and ‘Biarritz’, as well as new premium closure ‘Monet’ for dry and wet aseptic filling processes. Consumer-friendly features include an integrated TE ring, mono-material design, and one-hand opening.

In ‘Foodville’ the new HC SK 31/19 closure system for ketchup, mayonnaise and honey can be found, a lightweight closure with a large opening angle for precise dispensing, It is also available with a silicone-free valve for better recyclability.

The new range of edible oils combines user convenience with sustainability. These closures can be opened with one hand and have TE components that stay on the closure after opening.

Plastic solution expert Braskem is supporting the transition of the packaging industry towards a carbon neutral circular industry.

Braskem believes the future of both plastic and packaging relies on the development of low carbon, circular solutions together with stakeholders. Over a decade ago, Braskem launched I’m Green™ Polyethylene and EVA, a premium biobased plastic solution. Braskem is supporting the growing demand for more sustainable packaging by expanding production of sustainably sourced bio-based plastics from currently 260kt

to 1Mt in 2030. Each ton of green polyethylene used avoids 5 tons of GHG emissions and is 100% recyclable. This contributes to achieving a carbonneutral circular economy and to decoupling from fossil feedstock. More recently, Braskem launched Wenew, a portfolio of chemically and mechanically recycled resins, to support the transition to a circular plastics chain. Braskem is committed to expanding the recycling portfolio to include 300kt of products by 2025 and 1MMt by 2030.

“At Braskem we are focused on supporting converters and brand-owners to achieve their

sustainability goals in packaging and at this year’s interpack, our goal is to show the various examples of how we can help the packaging industry to achieve those goals.”,

Marco Jansen,Business Director Biopolymers EMEA / Advocacy & Sustainability director Europe & Asia. n

the Packaging and Packaging Waste Directive. For grouped and transport packaging applications, the amount of empty space in a pack – which includes room left for filling materials – should correspond with the total volume of the product(s) and their sales packaging, and it is up to the economic operators facilitating these kinds of packaging to ensure that the space-to-product ratio should only ever reach a maximum of 40%.

This approach has come under fire by key players in the packaging industry at large, some of whom have argued that an absence of scientific or empirical evidence, combined with a lack of consideration for the range of properties that come with packaged products, has resulted in ‘arbitrary’ restrictions. Even so, consumer demand for less, more spaceefficient packaging remains on the rise.

In search of a clearer picture of the new legislation’s implications for the e-commerce sector, Emma Liggins consulted Nedim Nisic, e-commerce director at Mondi Group, and Tania Montesi, global e-commerce manager at H.B. Fuller, about their respective takes on the situation.

Broadly speaking, what impact could a mandated reduction of space in e-commerce packaging have on the e-commerce sector?

TM: We believe it would have a positive impact on the e-commerce packaging market. According to our consumer surveys, right-size packaging is desired by consumers. Yes, the reduction of space will require packaging designers to adapt their designs to be regulation compliant, but this process will drive the creation of new innovative packaging designs that reduce empty space and design out waste. We believe it is possible to achieve this reduction in space without compromising product protection and stability during transit.

Of course, there are other benefits associated with a reduction of packaging: right-sized packaging should result in a reduction of carbon emissions, as it allows more packages to be loaded onto a delivery vehicle and logistics optimisation across the supply chain. It should also enable energy savings and cost-effective solutions, as less materials will be required to manufacture the package.

thirds (67%) of respondents said they would avoid shopping with an online retailer that sent orders in oversized packaging, while almost as many (62%) said they would also avoid shopping with a retailer that used excess internal packaging material.

With the growth of online shopping, packaging has become a crucial aspect of the brand experience. To strengthen customer loyalty, brands need to consider consumer packaging demands for sustainable materials, convenient returns and recycling, and right-sized packaging.

TM: This gives full clarity on where the accountability sits. The proposed date of 2030 is a target, and we believe that economic operators should start working towards the

innovative package redesign with less ecological impact.

We believe that the 40% target is realistic. That is not to undermine the challenges it presents to e-commerce packaging – the supply chain has many obstacles to overcome in achieving this space reduction target. For example, fragile items, such as glass drinkware, need to be suspended away from the outside of the packaging, with added packaging components to fill the space between to

Certainly, meeting the empty space ratio of 40% will require some innovative design thinking but we believe it is possible. This being said, many e-tailers will look to invest in automated right-sizing equipment to achieve this goal, assuming the volumes and financials justify the investment. This investment will help them achieve the directive’s goal and reduce their packaging and overall freight costs, as calculated by Dimension and Weight Ratio (DIM), through the elimination of protective components or void fillers.

NN: Mondi is committed to making packaging that is sustainable by design, and for e-commerce minimising the amount of packaging required is a key consideration. We offer a multi-material portfolio, including kraft and functional barrier paper, paper bags, and corrugated solutions. With a broad product portfolio, deep technical expertise, and an integrated value chain, we can help customers to make the best packaging choices. Partnering with customers provides an opportunity to innovate and create fit-for-purpose solutions that contribute to a circular economy.

TM: Yes, and we all should see a positive effect on costs. The reduction of space in e-commerce packaging has an overarching goal to reduce packaging waste and the amount of materials used. The reduction of the empty space will decrease or eliminate the need for void fillers, like air cushions, polystyrene, paper fillers, or bubble wrap, which can reduce the overall packaging cost.

Optimised packaging should also provide a reduction in freight costs that have been calculated by the major companies using DIM since 2015. Time will tell if the transportation industry updates the DIM costing approach, as the size and weight of packaging reduce and potentially bring down their revenue stream.

NN: We believe that overpackaging is neither sustainable nor cost-effective. A reduction of space will have an impact on the whole supply chain: less empty space means more cost-effective transport, lower material usage, and lower material cost. Furthermore, better product safety – thanks to a better packaging fit – will minimise product loss, lower stocking costs, and reduce the overall Total Cost of Ownership. Our latest annual e-commerce consumer research also shows that overpackaging can negatively influence buying decisions. Customers prefer not to support retailers that use too much or improperly sized packaging, which could lead to online retailers losing money from potential customers.

TM: No, and it is time to redesign packaging and get creative. Many companies are already embracing the challenge and have launched some excellent innovative solutions. For example, the tableware brand Lenox redesigned the packaging for its red wine glasses, which enhanced sustainability and greater product protection for Amazon’s Frustration-Free Packaging program requirements.

using the right materials. By ensuring a good fit between the product and its packaging, the product is less likely to move inside the package, providing stability and protection.

Do you feel that the Packaging and Packaging Waste Directive addresses the biggest challenges to sustainability that the e-commerce industry is facing?

NN: We support the European Commission’s ambitions for making packaging part of the solution in a circular economy. Our experience shows that sustainability needs to be considered from a holistic perspective, considering all the potential trade-offs. This means considering the environmental impacts of our products at each stage of the value chain, from sourcing raw materials to product design and end-of-life, to drive progress towards a circular economy and eliminate unsustainable packaging.

TM: Every step forward matters and while PPWD may not solve all of the sustainability challenges faced by the e-commerce indus try, it is a big step in the right direction. The focus to reduce space in e-commerce packaging most likely received extra atten-

tion due to the fast growth experienced over the last couple of years. In 2021, European e-commerce grew by 13% to €718 billion according to industry figures. Even though some innovations have already focused on lightweighting e-commerce packaging, the amount of waste packaging generated has continued to grow significantly. Also, the responsibility for correct end-of-life packaging disposal, i.e., recycling, shifted more to the consumers.

Regulations generate innovation – and as the packaging industry finds the answers, we may well see the introduction of alternative fibres as another advanced step on

In our experience, the key to effective packaging is clever design using the right materials. By ensuring a good fit between the product and its packaging, the product is less likely to move inside the package, providing stability and protection.

Nedim Nisic, Mondi Group

the sustainability journey. For example, the Ukrainian green tech company Releaf is using their patented technology to turn leaves collected by city authorities, which would normally be burnt or left to decompose, into cel-

Empty space is a key area of consideration for the industry, as it is a loss for all parties, including customers, online retailers, and suppliers. We expect that the industry will continue working to reduce the amount of unused space in e-commerce packaging with more innovative and functional designs that deliver on sustainability goals and product requirements.

I believe we’ll see multiple strategies that will ensure the e-commerce industry is able to comply with these new regulations. There will be a shift for smaller items to be shipped in flexible, paper-based mailers instead of rigid corrugated boxes to reduce empty space. These mailers are lightweight and cost-effective. We are already seeing many innovative, 100% fibre-based designs entering the market, including paper bubble mailers that are constructed with kraft paper to mimic plastic bubble padding. Others use honeycomb to provide cushioning and protective functionality

We know the packaging industry is both highly innovative and motivated to develop new packaging formats and materials that not only comply with PPWD requirements but also support the circular economy journey. For sure we’ll see new designs that minimise the amount of empty space and packaging required and are easy to recycle at end of life. But we’ll also see new packaging designs that enable different ways of consumer use such

Regulations generate innovation – and as the packaging industry finds the answers, we may well see the introduction of alternative fibres as another advanced step on the sustainability journey.

Tania Montesi, H.B. Fuller

In the latest of our Wider View series, we turn our attention to the subject of adhesive tapes. Longstanding industry expert monta discusses how the sector can reduce its environmental impact and increase efficiency and product security along the supply chain.

The importance of adhesive tapes as a key driver of green innovation across the packaging industry should not be overlooked. Packaging tapes are a small yet vital component of the whole packaging concept. The right choice of tapes can save a lot of resources, material and time and also enable packages to be manufactured from more recyclable materials – and this is just the start. They can also increase the pack’s ability to withstand tough conditions during transit, reducing product waste and therefore enhancing resource efficiency. And no damaged goods, of course, also equates to greater customer satisfaction.

monta Klebebandwerk GmbH, the subject of this article, is well aware of the many possibilities for this sector: monta tapes are used for box and bag sealing, carry handles, strapping, surface protection and splicing.

Its product range – which we will discuss in more detail – includes the carbon-neutral Greenline tapes, namely paper-based tapes, biodegradable tapes and tapes that eliminate the need for virgin, fossil based raw material, to name just a few.

monta focuses on natural rubber based adhesives which it develops and manufactures in-house, as opposed to acrylics or hotmelt, which are the other alternatives for this segment. Sylvia Di Felice, Head of Product Management & Marketing, explains why.

“Natural rubber adhesive has the benefit of naturally having a relatively high biobased content of around 50% (whereas acrylic and hotmelt typically are of 100% petrochemical origin). It is suitable for many demanding applications, such as below zero temperatures or high humidity, and

thanks to its unique flowing properties is great for even adhering to recycled cartons and other difficult surfaces. Another plus is that with natural rubber, one layer of tape is (almost) always sufficient to achieve the desired bond. This means minimal material input is required.”

According to monta, the global market for packaging tapes is estimated at 30 billion square metres per annum. The majority of this comprises tapes with a plastic-based backing, with paper backing taking up a smaller – albeit growing – part of the market. The biggest application is carton sealing, in which the tape is applied to close the box. In most cases, says the company, at the end of life, the adhesive tape enters the cardboard recycling stream, where it’s usually separated from the carton and incinerated for energy recovery or heating.

Sustainable innovation in the adhesives sector is today focused on several different areas. For example, on the raw materials side the tapes themselves can be manufactured using ever-more environmentally responsible chemical formulations, while substrates can also be made from more eco-efficient, recyclable or circular materials.

A different, possible future end-of-life solution might be pyrolysis: instead of incinerating it, the tape is converted into liquid oil or gas as a basis for new raw materials, thus closing the loop.

“As a result of choosing a low-quality tape or one that isn’t well suited for the application, we often see that far too much tape is applied to achieve a secure seal. This is neither costeffective nor sustainable, as unnecessary material and time is wasted. Often the user is not aware of the fact that if using the appropriate tape technology for their specific carton quality, a single layer application and short strip of tape is sufficient Put in other words: the less tape you require for the desired result (e.g. closing a shipping carton), the more economical and sustainable your packaging. In addition, a neatly sealed carton, without excessive packaging material, leaves a positive impression on the customer. And with an individual print on the tape, companies can convey their brand message in an easy and sustainable manner, another value-added adhesive tapes offer.”

But while progress is continuous, the industry also has many ongoing obstacles to overcome. New or revised regulations and initiatives – among them the European Green Deal, the Circular Economy Action Plan, the updated Packaging and Packaging Waste Directive, the Chemicals Strategy for Sustainability, the SUP Directive – all demand greener packaging solutions.

“Sustainability has been an integral pillar of our corporate strategy for many years, enabling monta to anticipate the current trend – which translated into our monta Greenline range to offer products that fulfil sustainable market requirements,” says CEO Daniel Lückfeldt. “The challenge in some cases is the price of new raw materials! Everyone wants to have green packaging, but if the price premium compared to the ‘conventional, fossil based’ tape is perceived as too high, the green intentions often subside. But the price gap is getting smaller, and availability of alternative raw materials is also improving, so we see a positive development.”

Another challenge the company mentions when it comes to using sustainable packing tape alternatives is technical performance: “They must perform equally well [as existing products] if not better. The box must stay closed during transportation to ensure the packaged goods reach their destination safely and intact. Before launching eco-friendly alternatives, extensive research & development work and practical testing is mandatory to achieve the required technical specification.”

One of the primary goals of the European Green Deal is to make Europe climate-neutral by 2050, and the adhesives industry is supporting this in various ways. For its focus on sustainable responsibility, monta has been awarded the silver medal for sustainability by international ratings platform EcoVadis multiple times – most recently in 2022. The company’s Greenline tapes are a key part of its carbon neutral strategy.

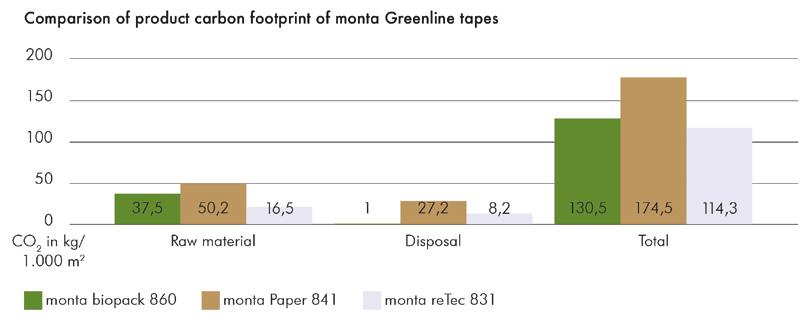

“We calculated the product carbon footprint based on the GHG protocol (Greenhouse Gas Protocol Product Life Cycle Accounting and Reporting Standard) for all our Greenline tapes with great results: monta biopack® & monta reTec offer lower carbon footprints than conventional polypropylene tapes. To go one step further, we decided to offset all unavoidable CO2 emissions by investing in certified climate protection projects. Some call this greenwashing; we don’t. monta has established an Environmental ManagementSystem to EN ISO 14001 in 1999 and has been energy certified to EN ISO 50001 since 2015. Part of this certification is setting an annual target to lower our energy consumption. We report regularly and also get audited on our progress annually.” (See Figure 1)

monta biopack®, incidentally, was a finalist in our 2020 Sustainability Awards. Aside from having a high biobased content (around 90% based on dry weight) the product is also compostable under industrial conditions –certified by TÜV Austria with the OK COMPOST Industrial mark. While, as mentioned above, many self-adhesive packaging tapes have a fossil-based plastic backing and are often coated with an acrylic or hotmelt adhesive, monta biopack® uses a biobased PLA film and a natural rubber adhesive.

It should be pointed out here that while biodegradability has come a long way and shows strong promise, there are still some question-marks surrounding it that the packaging industry as a whole is attempting to address. For example, there is an important difference between home compostability and industrial compostability – something that can still be confusing to consumers, which may be in part a labelling issue.

“It is true that the infrastructure for compostable products is not widely established yet and there is room for improvement,” says Daniel Lückfeldt. “And there are voices that therefore don’t like packaging alternatives made from biobased plastic, like monta biopack®, which is made from PLA film. The perfect ‘green’ packaging solution has not been invented yet but biobased plastics have huge potential to replace fossil based plastics, with lower carbon footprint and potential to be able to move away from dependence on fossil based materials. Depending on the product and application they can also successfully be recycled, e.g. as a mono-material solution where monta biopack® is used for sealing PLA bags. Furthermore, part of

the TÜV OK COMPOST certification also tests on eco-toxicity, which our tape passed, so another benefit there. As to the marketing of compostable packaging materials, clear communication is important, so as not to confuse or even mislead the consumer.”

Across the packaging value chain, products that were traditionally plasticbased are increasingly being replaced with fibre-based solutions. But how does this apply to adhesive tapes, where strength and durability are so vital? Are paper-based tapes always sufficient?

“We offer a paper-based tape that is silicone free and perfect for light to medium heavy boxes. It adds a more natural look and is popular where a mono-material tape solution is desired. It also offers stunning print results,” says Sylvia Di Felice.

“A drawback is that most paper tapes may not be strong enough for heavier cartons or harsher conditions, and the CO2 footprint of paper tapes compared to other conventional tapes (PP) and other sustainable tape options (biobased) unfortunately is much higher. Also, not all paper tapes stay in the cardboard recycling stream and get incinerated instead of recycled at the end of life.”

monta says its “eco-friendly answer for heavier boxes or more demanding applications is using a filmic tape with either a high renewable raw material content (like monta biopack®) or one that significantly reduces the

need for virgin fossil-based raw materials, like the above-mentioned monta reTec, a tape manufactured with a film backing made from reprocessed polypropylene, which eliminates the need for virgin fossil based raw material by over 99%. For both products CO2 emissions (cradle to gate plus waste) are lower than with other tapes.”

Looking ahead at the bigger picture, monta sees strong prospects for ‘greener’ alternatives across the wider adhesive tapes sector. In order to get the most from this, says Daniel Lückfeldt, “Staying flexible, ideally anticipating the direction the market will take and responding quickly to demand are the main ingredients for continued success.”

And monta itself has some exciting products in its R&D pipeline, some of which may be revealed at this year’s interpack in May. To find out more, come and talk to the team at Hall 7, stand 70C20 (where they will be serving some local specialties!).

We have heard a lot in this article about the benefits of working with the right adhesive tape producer.

We were interested to delve a little deeper into this by getting the perspective from monta’s customers themselves. We therefore put some questions to Cameron Bell, General Manager of Australia-based Stylus Tapes International:

PE: Why is the correct choice of adhesives tapes essential to help you meet your sustainability goals and ensure product security?

CB: It is our opinion that for the Australian market it has to be truly sustainable. That means certified compostable or recyclable. If recyclable, the process of material collection and recycling has to be viable and accessible for both domestic and commercial use. If compostable, the process of collection has to be available and composting facilities must be accessible. The tape should also perform according to consumer expectations and be suitable to the packaging application. Another aspect is the continuity of supply of the sustainable material.

PE: What are the biggest challenges you face in this regard?

CB: Consumer and industry awareness of the need for sustainability is a big challenge, as is recycling collection accessibility and viability. There is also the question of whether consumers and the industry will accept the need to pay a premium for sustainability, as prices for sustainable raw materials are higher.

We also spoke with Thilo Simon, Lead Buyer (paper, wood, plastics) at the Industrial and Packaging Division at Germany-based TAKKT Group, about the impact of the e-commerce sector:

PE: Has the recent e-commerce boom increased the importance of efficient and sustainable bonding solutions?

ST: We have been experiencing an increased demand for sustainable products for some time now. The recent e-commerce boom has reinforced once again the importance of efficient and sustainable bonding solutions because packaging is a critical component of the supply chain, and online shopping has significantly increased the volume of packages being shipped. Efficient and sustainable bonding solutions, such as the monta paper packaging tape or monta biopack®, can help reduce waste, improve the packaging process, and create a more sustainable supply chain.

Coming soon! Hive is a brand-new set of tools created by Packaging Europe that aims to help packaging professionals know more about the industry they work in, offering briefings, reports, digital live events and a cutting-edge data tool.

To give our readers a flavour of what to expect from Hive, we are sharing some statistics insights in Packaging Europe magazine.

Recovery rates and recycling rates by material (2019) These two charts give a comparison of recovery rates versus recycling rates for different, commonly used packaging materials, from paper and cardboard, plastic, wood, metallic and glass, showing noteworthy discrepancies and overlaps between recovered and recycled waste.

For this edition of the Wider View, Victoria Hattersley speaks to PakTech about our collective attitude to plastics and how the industry is – or should be – addressing the plastic waste problem.

INthis article, we’re going to talk about plastics. Because while there are many recognized benefits to these materials – they are strong, lightweight, durable, reusable, aseptic, help prevent food waste, etc. – we know that they have also garnered a lot of negative press. And yes, it’s fair to say there is a good reason for this. According to the UN, today we produce around 400 million tonnes of plastic waste each year. (I say ‘we’, but as we know the largest percentage of plastics are produced by first-world nations.)

But these perceptions are only part of the story, and to get a balanced viewpoint we need to know the whole story. We certainly have much to do to address plastic pollution so that the above-mentioned benefits of these

materials can outweigh their drawbacks. So that plastics never reach landfill or incinerators but are instead recycled or reused. And indeed, many would argue that is exactly what governments, industries and individual companies around the world are doing. To name just a few, we have: the Ellen MacArthur Foundation’s (EMF) Global Commitment which has united more than 500 signatories; the posited UN Treaty on Plastic Pollution; and the Alliance to End Plastic Waste. There will be more on these later.

Then, of course, there are the many, many single organizations signing up to global commitments or looking at how they can individually tackle plastic waste. PakTech, a producer of 100% recycled HDPE handles and handle applicators, is one such company. Throughout this article, PakTech Sustainability Officer Gary Panknin will give us his viewpoint on the steps the industry needs to take, collectively and individually, to ensure plastics are not always seen as the ‘enemy’.

“There is no question that plastic packaging and its impact on the environment is under scrutiny,” says Gary Panknin. “This has led to a public backlash on all things plastic.”

And one problem is, this ‘backlash’ can have its own unintended consequences if plastics are widely replaced with other materials without thinking about other factors such as carbon footprint or resource efficiency.

“We have seen knee-jerk reactions to this negative consumer perception of plastic – retailers and brands have been quick to switch to paperbased materials without reflecting on the low level of durability of paper, the fact that it can only be recycled a handful of times and that paperbased packaging often contains a lot of toxic chemicals and additives. Simply switching plastics to alternatives can lead to increased food waste, emissions and energy consumption.”

Before we go on, let’s acknowledge what the problem is and where the specific issues lie. PakTech sees three major challenges that the industry must address.

First and foremost, not all plastics are equal: Some types – such as PP no-bottle, PS or PET thermoforms – are not recyclable in practice and there are calls to reduce or cut their use entirely. Flexibles are also currently not recyclable, although as we know this is something the industry is working on, not least through the CEFLEX consortium.

“A lot of plastic packaging is not designed for recycling,” says Gary Panknin. “Some packaging uses two or more different types of plastic that make it difficult to recycle. Further, some types of plastic are much more difficult to recycle within the currently available infrastructure.”

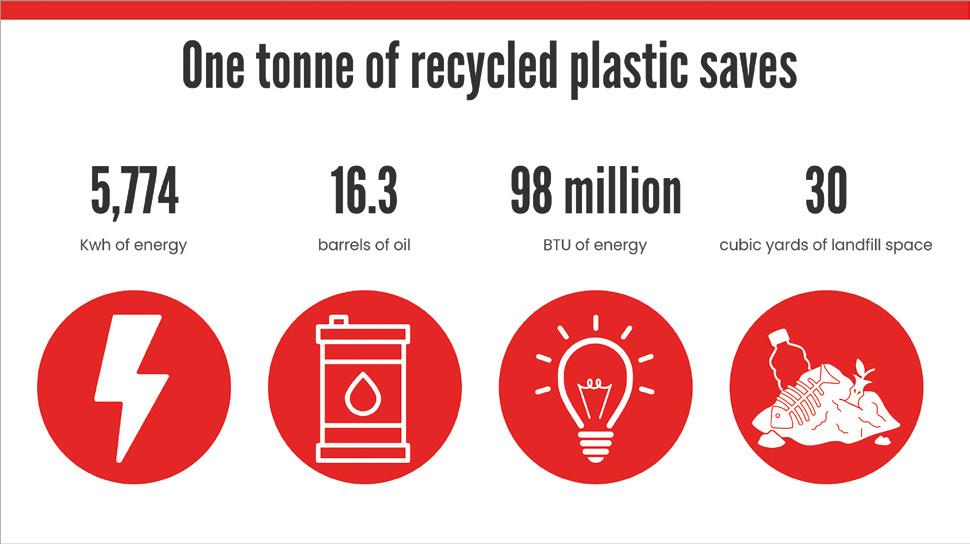

For PakTech, it is also important to acknowledge that there is a big difference between ‘manufacturing with virgin petroleum vs using recycled plastic’.

The second major challenge for plastics identified by PakTech comes down not to the materials themselves so much as the wider infrastructure surrounding them. Plastic waste, to many, is a waste management problem. As Gary

Panknin says, there is a ‘clear mismatch’ between the demand for recycling and the current infrastructure available to support the industry and “many materials recovery facilities are lacking innovation to evolve with the demands of recycling. We are dedicated to pursing improvements in the recycling infrastructure to achieve improved collections and recycling of materials.”

Among other things, the industry needs to implement best practices when it comes to securing a steadier supply of PCR content, such as through long-term contracts. Alongside this, more viable reuse models need to be developed at scale through cross-industry collaboration on ambitious pilot projects.

And third, says Gary, “toxic chemicals or additives also pose a hindrance to recycling by reintroducing harmful substances to recycled products, and thus to the circular economy, or compromising the level of recyclability of a plastic material.”

“Toxic chemicals or additives also pose a hindrance to recycling by reintroducing harmful substances to recycled products, and thus to the circular economy, or compromising the level of recyclability of a plastic material.”

PakTech itself has attempted to address these three challenges through its own product design. It believes there should be more focus on the plastics that are widely recycled rather than attempting to create ways for more challenging plastics to be recycled.

“PakTech handles are mono-material as they are made from 100% recycled HDPE (#2 plastic). The material choice was deliberate as HDPE is one of the easiest plastics to recycle and also widely collected by kerbside collection. They are also toxic free, containing neither bisphenol-A (BPA) nor phthalates nor any other harmful chemicals.”

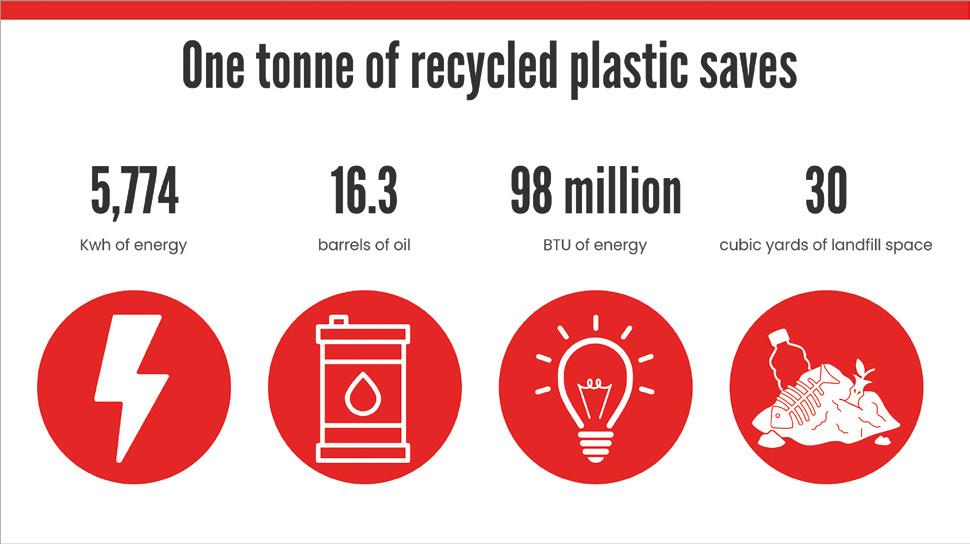

How, then, can the above challenges be addressed? One fundamental step to improve supplies of recyclates would be, as Gary says, “for the consumer-facing part of the value chain (such as retailers and brands) to commit to using more recycled material. This will help to drive more demand for recycled material, which would incentivize the improvement of recycling rates which in turn would make recycled plastic material more competitive compared to raw feedstock from fossil fuels.” The following infographic illustrates just how much we can save through improved recycling rates.

On a granular level, he feels there is plenty of promise and scope for innovation in the area of waste collection, sorting and separation. “For example, recently we have seen the integration of Artificial Intelligence to accelerate plastic waste classification in processing sites. This will allow the industry to work with secondary raw materials of higher quality. Also, automated recycling, which accepts, classifies and digitally bills for waste without the use of manual labour, could also benefit from AI solutions to address the worker scarcity plastic recyclers are often facing.” He adds that chemical recycling is likely to play an increasing role, but stresses the question marks that exist over the carbon footprint and chemicals required in the process.

We are seeing an increasing focus on the shift away from single-use to reusable packaging (as exemplified, for example in the EU’s Single-Use Plastic Directive as well as the key focus areas outlined in the recent EMF 2022 Global Commitment Report). PakTech believes this is an important goal – indeed, its own products are reusable – but cautions that we should not lose sight of the need to improve recycling processes.

“When it comes to reuse, it would be good to see requirements that are practical and without compromising on ambitions to build more recycling infrastructures. Our products provide a reusable alternative to single use and hard-to-recycling packaging such as plastic rings, plastic film or shrink-wrap.”

While the industry must play its part through innovation and fundamental systems change, this has to be backed up by concrete laws and regulations. There are calls on governments – again, for example, through the above-mentioned EMF Global Commitment – to create legally binding plastic waste targets. It is of course a huge challenge to enshrine ambitious targets into law.

“For instance, in the EU, changing the legal basis of the Plastic Packaging Waste Directive to a Regulation is a very ambitious move as it means that the forthcoming legislation will apply equally to all Member States and also come into force at the same time for all Member States. However, this level of ambition is necessary to ensure that rules are harmonized everywhere at the EU level and circularity ambitions remain high for all Member States.”

With the global initiatives and treaties such as those mentioned at the start of this article, as well as ongoing policy and legislative updates, can we at least be hopeful that we are moving in the right direction on plastics?

Regarding the UN Treaty on Plastic Pollution, Gary Panknin says, “PakTech is glad to see partners joining the fight against the use of single-

use plastics, whether those partners are of a commercial nature like the businesses we work with or of a political or policy nature. The Treaty, which is expected to result into a legally binding agreement by the end of 2024, is expected to reflect diverse alternatives to address the full lifecycle of plastics, focusing on reusability and recyclability.”

The company is also a signatory of the US Plastics Pact, launched as part of EMF’s global plastics network (of which PakTech is a signatory). Many in the industry will already be familiar with the main goals of this, but just to briefly recap, the pact aims to: eliminate problematic plastic packaging by 2025; ensure 100% of plastic packaging is reusable, recyclable or compostable by 2025; achieve an average 30% recycled content or responsibly sourced bio-based content in plastic packaging by 2025; and undertake actions to effectively recycle or compost 50% or plastic packaging by 2025.

All these goals are vital and it has been encouraging to see such impetus behind systemic change. However, as outlined in the recent EMF 2022 Global Commitment Progress Report, it is becoming increasingly likely that these targets will not be reached. This, says the Foundation, only ‘reinforces the urgency for businesses to accelerate action, particularly around reuse, flexible packaging, and decoupling business growth from packaging use’.

This signals that, while individual signatories may be on track to meet the targets, as a collective, the industry and governments need to do better. I was interested to know where PakTech feels some of the issues may lie, and how the agreement may perhaps be modified to ensure a more positive outcome. For Gary Panknin, it comes down partially to a recognition that in some ways we are not all equal and that perhaps goals should reflect this (not, admittedly, an easy to thing to accomplish when taking into account the amount of work it takes to bring such a global commitment into being in the first place).

“We need to look at sustainability holistically, and at the same time, we have to take into consideration the specific requirements of individual companies in a flexible way. There is no one-size-fits-all solution in existence. It is mandatory to constantly evaluate which activities make sense for a certain company to achieve concrete, significant, and noticeable sustainability improvements in the best way. Increasing the use of recycled plastic can be a great lever for one company to increase sustainability. In contrast, for another company, this can be irrelevant because of constraints in terms of technology or restrictions from the products that will be packed (e.g. food contact packaging).”

Are plastics the enemy? It may sometimes appear that way but, as with many if not all problems, small or (in the case of climate change and plastics waste) unfathomably large, failure to move is the real enemy. Given their relatively low carbon footprint in terms of production, plastics can indeed be part of the solution to our current climate crisis, if we can move away from petroleum-based materials and reduce reliance on virgin plastic, while simultaneously boosting reuse and dramatically increasing recycling rates. And it’s also worth pointing out, as many have, that the need to reduce CO2 and tackle plastic waste do not have to be mutually exclusive goals.

There is certainly reason to hope when it comes to achieving a circular economy for plastics, but as they say, hope can be cheap. It is actions that propel us forward. n

• The recycled HDPE PakTech uses to manufacture its handles is made from products such as milk, water, juice, and other unpigmented household containers.

• Production of PCR plastic material compared to virgin plastic material requires 90% less energy, 100% less petroleum and produces 78% less GHG at the processing facility.

• PakTech handles are designed for recycling and once recycled, they are given a third life as composite lumber, park benches, planter pots and more.

• 907,164,295 recycled milk jugs have been collected, shredded and extruded into pellets to create PakTech products.

• 54,429,858 kilograms of plastic has been rescued from landfills and oceans and used to make PakTech products.

• The equivalent of 25 soccer fields were saved from landfill by repurposing recycled containers into PakTech products.

When it comes to digital printing, how far have we come and what can the industry do to take advantage of the many benefits these technologies offer? Victoria Hattersley reports.

Anyone who has driven a child on a long journey will no doubt be all-too familiar with the question. When we apply this question to digital printing, as in, have we reached the stage where it accounts for the largest percentage of the market, the answer really depends on what ‘there’ means.

According to the Smithers Pira report, ‘The Future of Digital Printing to 2032’, by 2032 digital print will account for almost a quarter of the global value of all print and printed packaging by value, so we’re certainly not looking at total market saturation. In short, it appears we’ve still got a way to go (sorry, little one).

Then again, perhaps the child-on-journey scenario is not the best analogy at all. Perhaps we need to think of the road to digitalization of printing as not so much as one with a finite end, as a series of stops – a gradual progression of technological breakthroughs in print machines, workflow and finishing systems that bring us further along the road to mass digital adoption.

In the following, I will highlight four key drivers for progress in digital printing: sustainability, easing supply chain pressures, meeting consumer needs and meeting brand owner needs. I will look at how digital print can help to address, these including some recent examples on the market –and then, perhaps more importantly, how far there is still to go.

Sustainability – or lack thereof – is the biggest concern for every aspect of the value chain. There are several ways in which digital already has an environmental advantage over analogue. Patrick Poitevin, former Principal Scientist at Mondelez International and founder of Advisory4Pack, mentions just a few of these.

“Inventory reduction is an important factor: Instead of eg. 60 SKUs with digital you would only need one for each brand. There is also no obsoles-

cence: you only print what you need, when you need, for where you need; this is the case not only for packaging materials, but also when there are changes to the finished product due to overstock; changing legislations or ingredient changes can be factored in. Finally, digital print engines also use less energy than their conventional print processes, as well as well less ink.” We can add to this the fact that a significant amount of energy is required to produce offset plates, whereas with digital, no plates are required.

A recent example of the impact innovative digital technologies can have on brand owners’ environmental footprints can be found in the finalist list of our very own 2022 Sustainability Awards. CCL Label’s Hybrid ASD Technology enables printing embellishments to be produced with digital hybrid inkjet technology. According to CCL, it provides ‘”all the embellishments of conventional printing with digital hybrid inkjet technology. It is designed to reduce waste, reduce CO2 footprint, and use less material and solvents whilst using less energy during the print process. This ensures brand owners still have the freedom to design without limitations.”

In today’s global marketplace, changes in consumer expectations have vastly increased the pressures on the packaging supply chain. Digital print can play its part by, among other things, offering a quicker response to the market, shorter lead times, inventory reduction, increased efficiency and minimum order quantities (MOQs).

Sealed Air, for example, has launched a digital packaging brand, prismiq, which has a portfolio of solutions for design services, digital printing and smart packaging. Through this, systems can run multiple designs on a single order, print serialized/digitized codes and images that are packagespecific and allow customers to have flexible order quantities, as well as, it claims, faster turnaround times.

“Our world is constantly changing and evolving,” says Amir Shalev, Director of Market Development at Landa Digital printing, “and our printed products need to be able to change with it and keep up with the pace. Digital printing enables service providers to cut down their response time for their customers. On top of that, the reduction in setup times and make ready means that we can take away the inefficient pieces of the production schedule and release tremendous capacity to let the conventional, analogue presses become more productive – and overall, increase plant yield.”

The key goal of brand owners – apart from sustainability – is to meet consumers’ evolving demands. Increased interest in personalization and customization are central here, as Patrick illustrates: “More and more brands utilize digital print for unique individual customization for events - eg. Cadbury’s Dairy Milk associated with football tournaments, Toblerone’s continuous personalization which can be done in store, in airports where growth and market increase is obvious. The HP Mosaic is well known and used quite often for customization.

Sustainability – or lack thereof – is the biggest concern for every aspect of the value chain and digital print is not exception. There are several ways in which digital already has an environmental advantage over analogue.

Also, brands such as Mondelez International’s Milka have enabled the possibility for consumers to individually colour or create their own design and have their packaging (product) printed.”

Furthermore, as consumers are much more concerned with both the provenance of the products they buy and what they contain, it is also important that brand owners can communicate information to them in the most efficient way. This includes personalized ingredients and wellbeing information, sustainability messaging and communication. All of this is a substantial improvement on offset if there are ingredient or legislation changes that need to be incorporated on the packaging at a late stage.

For brand owners, the onus is very much on factors such as security, brand protection and image. Digital presses such as HP’s Indigo 6K Secure Press can address the first of these. The machine was designed specifically for the security printing market, delivering end-to-end security solutions featuring multi-security layers printed in one pass.

When it comes to the look of the pack, digital print also opens up opportunities for more higher-resolution graphics than was formerly possible, helping ensure brand stand-out.

“Digital vendors are constantly improving their systems to address a larger piece of the addressable market,” say Amir Shalev. “Landa Digital Printing’s Nanography® is a platform that allows endless upgrades for productivity, print quality and application span.”

All of the above shows us what is currently possible. But it is fair to say that the market has not yet fully embraced the opportunities offered by digital printing technologies. So where are the missed opportunities, what can the industry do better and what are some of the challenges to overcome?